MEMBERS ONLY

It's Steady As She Goes For Global And US Equities

by Martin Pring,

President, Pring Research

* Many positive indicators

* Strong showing outside the US as well

The last time I focused on the US stock market I pointed out that I liked the fact that the market was shrugging off bad news in the form of numerous widely circulated articles calling for a correction. While not...

READ MORE

MEMBERS ONLY

Market Roundup Live With Martin Pring September 2017

by Martin Pring,

President, Pring Research

Here is the link to the Market Roundup Video Recording for September 2017.

Market Round Up Live With Martin Pring September 2017 from StockCharts.com on Vimeo.

Good luck and good charting,

Martin J. Pring

The views expressed in this article are those of the author and do not necessarily...

READ MORE

MEMBERS ONLY

Gold And Silver Getting Close To A Major Breakout

by Martin Pring,

President, Pring Research

* Long-term technical structure looks solid

* Gold shares are solid

* Hail silver!

Back at the end of July in an article entitled Has $GOLD Got What It Takes For A Major Rally? I pointed out that gold was sporting some bullish characteristics to the extent that we would probably see a...

READ MORE

MEMBERS ONLY

Growth Breaks Out Against Value As The NASDAQ Top Fails To Complete

by Martin Pring,

President, Pring Research

* NASDAQ is leading on the upside again

* The Technology/Staples ratio continues to signal the all-clear for the whole market

* Growth versus value is tipping towards growth

NASDAQ is leading on the upside again

Back in July the NASDAQ Composite was the epicenter for the coming market weakness, as it...

READ MORE

MEMBERS ONLY

Balance Of Equity Power Continues To Shift Away From The US

by Martin Pring,

President, Pring Research

* Contrary opinion argues against being too bearish on US equities

* US equities are breaking down against the world

* Emerging markets are emerging

* Metals driving north

Contrary opinion argues against being too bearish on US equities

The majority of the shorter-term indicators monitoring trends lasting between 4-6 weeks argue for an...

READ MORE

MEMBERS ONLY

Is Housing Headed Towards The Basement?

by Martin Pring,

President, Pring Research

* Housing and housing stocks are vulnerable

* Equal weight ETF’s are becoming less equal

* Gold short-term vulnerable

Housing and housing stocks are vulnerable

New data for residential new single family home sales ($$HSNG1FAM) was released this morning and it is starting to look a little shaky. Chart 1 does not...

READ MORE

MEMBERS ONLY

A Take On The Utilities In An On-going Correction

by Martin Pring,

President, Pring Research

* Bearish short-term charts suggest there is more to come on the downside

* Consumer Discretionary—not so discreet

* Energy—out of gas

* Utilities—a place to hide?

Bearish short-term charts suggest there is more to come on the downside

For the last two weeks, I have been zeroing in on a...

READ MORE

MEMBERS ONLY

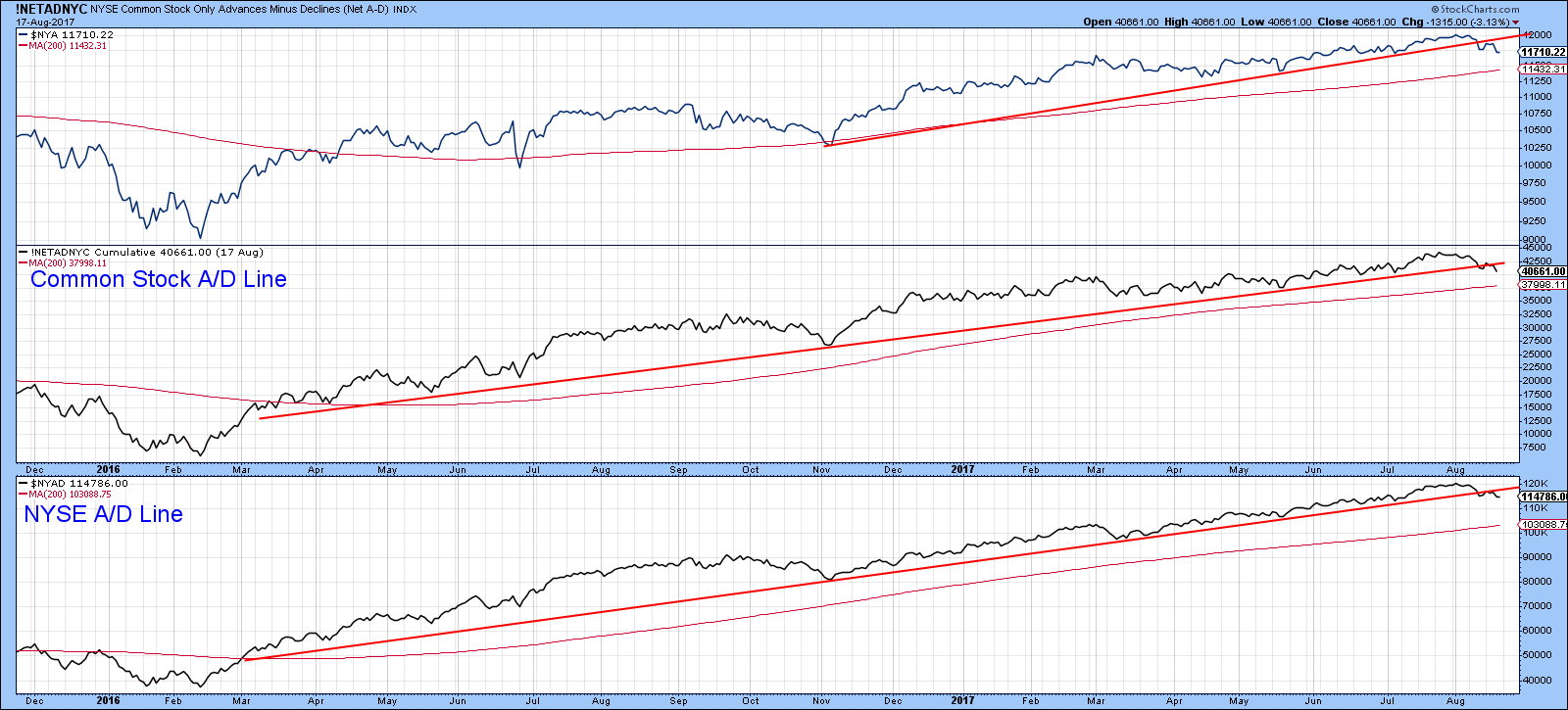

US Stock Market Showing More Near-term Weakness

by Martin Pring,

President, Pring Research

* More stock market indicators showing weakness

* Bonds close to a breakout

* Commodity rally over?

* Dollar bottoming or about to break down?

More stock market indicators showing weakness

Last week I made the case for a correction in the market based on some specific indicators that has started to flash some...

READ MORE

MEMBERS ONLY

Dow 22,000 Mission Accomplished. Oh Yeah?

by Martin Pring,

President, Pring Research

* Bullish percent indicators are starting to deteriorate

* Short-term confidence may be turning

* Small caps getting smaller?

* Oversold Dollar Index bounces from support

Bullish Percent Index indicators are starting to deteriorate

This week we saw the financial media and President Trump glorify the fact that the DJIA had exceeded 22,000...

READ MORE

MEMBERS ONLY

Market Round Up Video Recording With Martin Pring 2017-08-01

by Martin Pring,

President, Pring Research

The Market Round Up Video Recording for August is available. Use the HD button for better clarity when viewing.

Market Round Up Live With Martin Pring 2017-08-01 from StockCharts.com on Vimeo.

Good luck and good charting,

Martin J. Pring

The views expressed in this article are those of the...

READ MORE

MEMBERS ONLY

Has $GOLD Got What It Takes For A Major Rally?

by Martin Pring,

President, Pring Research

* The longer-term indicators very finely balanced

* The Gold/dollar ratio may be providing some leadership

* Gold shares may have something to say in the matter

The longer-term indicators very finely balanced

The price of Gold has been in a trading range since late 2013, and has traded even more narrowly...

READ MORE

MEMBERS ONLY

US Equities Reach Critical Point In Their Battle With The Rest Of The World

by Martin Pring,

President, Pring Research

* The US versus the world

* Two reasons why US equities are likely to underperform

* What does the rest of the world say?

I have been writing for some time that, notwithstanding the inevitable but unpredictable near-term correction, the US market is in good technical shape and likely to work its...

READ MORE

MEMBERS ONLY

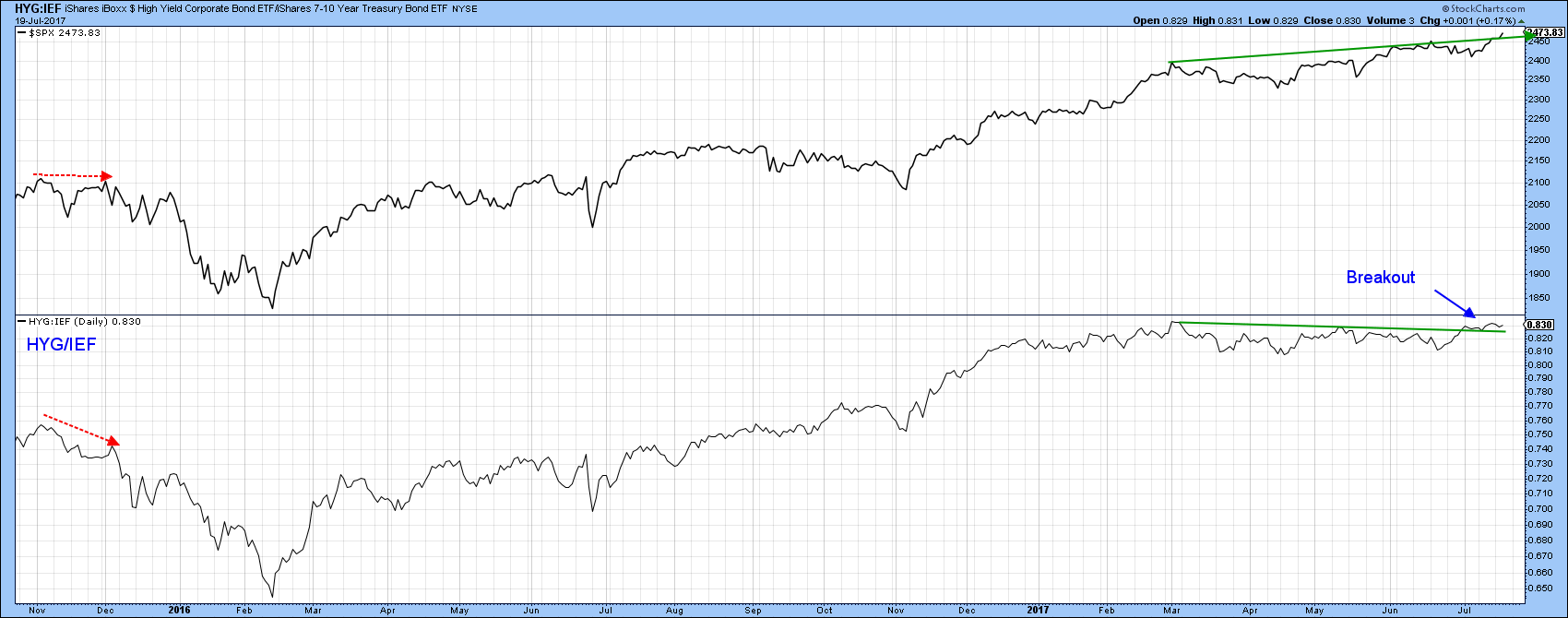

Confidence Indicators And Small Caps Point To Higher Stock Prices

by Martin Pring,

President, Pring Research

* What is a confidence indicator?

* Credit Spreads to the rescue

* Equity market spreads

* Growth versus Value

* Small caps: Are we there yet?

Washington may be suffering from acute dysfunction but Wall Street doesn’t seem to care, or perhaps knows something that we mere mortals do not. Failure to agree...

READ MORE

MEMBERS ONLY

Global Stocks Break To The Upside

by Martin Pring,

President, Pring Research

1. Some Global Equity Markets Getting Lift-off Again

2. US equities trying to follow the global lead

3. Relative trends favor emerging and Europe

4. Technology poised to move higher

In terms of price, global equities have been in a corrective mode since late May, but now appear to be...

READ MORE

MEMBERS ONLY

Are Precious Metals Likely To Get Less Precious?

by Martin Pring,

President, Pring Research

* The Long-term indicators

* Gold in Euro and Yen looking sick

* Dollar based Gold completes head and shoulders top gold shares not quite there yet

* Silver showing signs of tiredness

* Stocks breaking out against Gold

* The silver lining for Gold

Several articles I have written in the last few weeks have...

READ MORE

MEMBERS ONLY

July's Market Round Up Live Video Recording 2017-07-05

by Martin Pring,

President, Pring Research

Here is the July video recording for Market Round Up Live 2017-07-05.

2017-07-05 08.02 @Test Market Round Up Live With Martin Pring 2017-07-05 from StockCharts.com on Vimeo.

Good luck and good charting,

Martin J. Pring...

READ MORE

MEMBERS ONLY

Are Small Caps About To Come Alive?

by Martin Pring,

President, Pring Research

* Watch those small caps

* Dr. Copper about to get better?

* Wheat enters a primary bull market

* The yen is getting close to a downside breakout

* Gold is close to a breakdown

Watch those small caps

Chart 1 features the iShares Russell 2000 ETF, the IWM, together with its relative strength...

READ MORE

MEMBERS ONLY

Investment Implications From A Breakout In The Stock/Gold Ratio?

by Martin Pring,

President, Pring Research

* Technical condition poised for an upside breakout in the stock/Gold ratio

* The significance for equities and gold from an upside or downside breakout.

* Wither the tech stocks?

Technical condition poised for an upside breakout in the stock/Gold ratio

The ratio ($SPX:$GOLD) between the S&P 500...

READ MORE

MEMBERS ONLY

Is The Dollar Really In A Bear Market?

by Martin Pring,

President, Pring Research

* The long-term setting

* Short-term considerations

* Some individual currencies are vulnerable over the short-term

* Conclusion

The long-term setting

A few weeks ago I pointed out that the Dollar Index ($USD) had violated its bull market trendline, as well as the 65-week EMA and 12-month MA, two key long-term smoothings. That type...

READ MORE

MEMBERS ONLY

Is This The End Of The Game For Tech Stocks?

by Martin Pring,

President, Pring Research

* Widespread dissemination of tech sell-off

* Bears, not so fast

* Not all tech sub groups experienced Friday’s selling spree

* Commodities are down, but are they out?

Widespread dissemination of tech sell-off

In the last few days, we have seen a tremendous amount of financial media space alerting us to Friday&...

READ MORE

MEMBERS ONLY

Financials Break To The Upside And That's Good For The Market

by Martin Pring,

President, Pring Research

* The head and shoulders that did not “work”

* Inflation versus deflation sectors

* Which are the financial sector stars?

* Why financials matter

The head and shoulders that did not “work”

On this same date in May we published an article suggesting that financials could be an interesting area to monitor for...

READ MORE

MEMBERS ONLY

Market Round Up Video With Martin Pring 2017-06-02

by Martin Pring,

President, Pring Research

Here is the link to this months Market Round Up with Martin Pring for June 2017. Don't forget to use the HD button for better quality.

Market Round Up Live With Martin Pring 2017-06-02 from StockCharts.com on Vimeo.

Good luck and good trading,

Martin J. Pring...

READ MORE

MEMBERS ONLY

Perhaps The Fed Won't Raise Rates After All?

by Martin Pring,

President, Pring Research

* Long-term background for bonds

* Bond Prices at a critical short-term juncture point

* Is the 5-year yield forming a massive top?

* Utilities moving in sympathy with bonds

* Interest sensitive REITS starting to improve

* Follow the commodities

Long-term background for bonds

A lot of people are betting that stronger economic data will...

READ MORE

MEMBERS ONLY

Five Charts That Say Today's S&P Breakout Is For Real

by Martin Pring,

President, Pring Research

* Lots of supporting breakouts

* Confidence ratio on the verge of a major bullish breakout?

* Financials: trick or treat?

* The US is due for a bounce against the rest of the world

* Is it time to play the China card?

Lots of supporting breakouts

Last week I pointed out that the...

READ MORE

MEMBERS ONLY

Dollar Index Triggers Some Long-term Sell Signals

by Martin Pring,

President, Pring Research

* Dollar Index experiences major trendline breaks and MA crossovers

* Dollar sympathy relationships confirm a weaker dollar

* Emerging currencies are emerging

* Some currencies remain in bear market against the dollar

Dollar Index experiences major trendline breaks and MA crossovers

This week, the US Dollar Index ($USD) violated several key benchmarks, leading...

READ MORE

MEMBERS ONLY

Two Important Areas To Watch- $VIX and Financials

by Martin Pring,

President, Pring Research

* 10-day ROC for the VIX may have a message for traders

* Close that gap on your way out

* Financials, a canary in the coal line for stocks in general

Last week I wrote about the $VIX and concluded that a low reading, such as we recently saw, usually precedes a...

READ MORE

MEMBERS ONLY

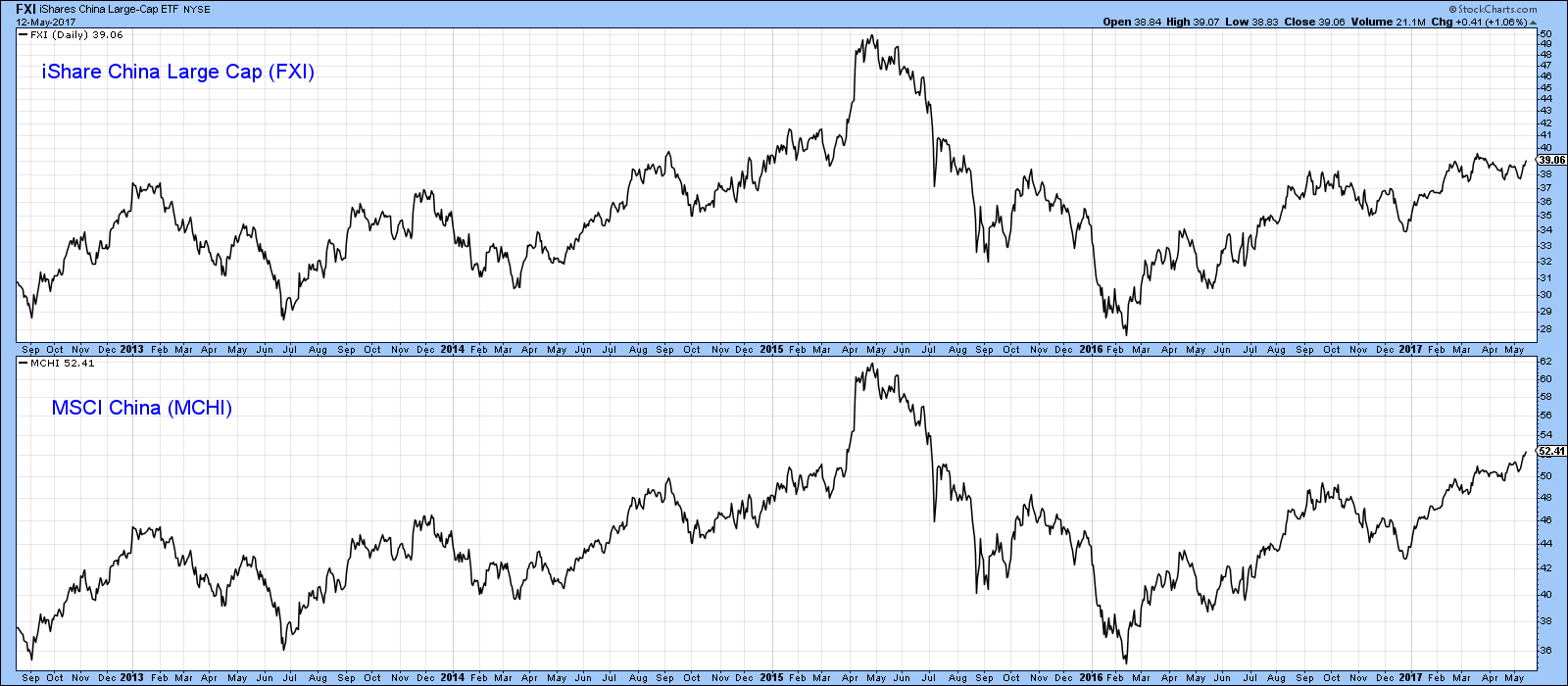

Chinese ETF's Are Playing Good Cop Bad Cop

by Martin Pring,

President, Pring Research

* Trying to replicate the Shanghai Composite with a Chinese ETF

* Global Update

Years ago, investing in China was a challenging proposition for US based investors. In recent years though, a number of ETF’s have been listed that embrace Chinese Indexes as well as specific sectors. The big daddy of...

READ MORE

MEMBERS ONLY

When Does A Low VIX Reading Matter?

by Martin Pring,

President, Pring Research

* The VIX

* The Dollar Index

* The Euro

* Swiss Franc

* Japanese Yen

The VIX

Most of this piece is devoted to the dollar and some interesting looking currencies. However, I have been intrigued by a couple of articles and news stories recently appearing in the general purpose media. They have pointed...

READ MORE

MEMBERS ONLY

Sell In May And Go Away? Forget Stocks But How About Commodities?

by Martin Pring,

President, Pring Research

* $CRB and oil break to the downside

* The stock market says commodities are headed lower

* Bond market participants leaning in a deflationary way

* Watch those commodity currencies

The usual “Sell in May and Go Away” articles are starting to appear bigly, and a case can indeed be made in that...

READ MORE

MEMBERS ONLY

Global Equities Trick or Treat?

by Martin Pring,

President, Pring Research

* A few words on long-term charts

* US equities starting a period of underperformance?

* Overcoming resistance

* Chinese equities look vulnerable

* Good looking country charts

A few words on long-term charts

I like looking at short-term charts because you can sometimes pick up some interesting psychological characteristics through divergences, candlesticks and one...

READ MORE

MEMBERS ONLY

Market Roundup Video For May 2017

by Martin Pring,

President, Pring Research

Here is the link to the Market Roundup Live by Martin Pring 2017-05-02.

Market Round Up Live With Martin Pring 2017-05-02 from StockCharts.com on Vimeo.

Good luck and good charting,

Martin J. Pring...

READ MORE

MEMBERS ONLY

Gold Faces A Critically Important Technical Test In The Weeks Ahead

by Martin Pring,

President, Pring Research

* Gold’s long term trading range

* Watch those Gold shares for clues about Gold

* Hail Silver?

Gold’s long term trading range

Gold is often regarded as a safe-haven investment, but is more normally held as a hedge against inflation. Chart 1 deflates the price by the CPI, so you...

READ MORE

MEMBERS ONLY

Some Markets And Key Ratios Are At The Brink, But At The Brink Of What?

by Martin Pring,

President, Pring Research

* Bond yields sending a deflationary message

* Intermarket signals from equities are close to deflationary signals

* So are similar measures for bonds

* More on confidence relationships

Wednesday’s close saw a lot of key ratios and some markets resting on key trendlines and moving averages. Since these benchmarks represent potential support,...

READ MORE

MEMBERS ONLY

Bull Market Correction Looks Likely To Continue

by Martin Pring,

President, Pring Research

* Recent technical deterioration

* Bonds and the recent false upside breakout

* Gold’s false breakout also turned out to be “false”

The long-term indicators for the equity market continue to look positive, as the major averages are comfortably above their key moving averages. Pretty well all measures of long-term smoothed momentum...

READ MORE

MEMBERS ONLY

Friday's Trading Action Offers More False Signals

by Martin Pring,

President, Pring Research

1. False moves in the precious metal pits

2. Outside day in silver tips the near-term balance to the bears

3. More false breaks in the bond pits

Late last week I wrote that several markets had recently experienced false moves, known as whipsaws. It seems that Friday saw this...

READ MORE

MEMBERS ONLY

Markets Have Experienced A Lot Of Fake Breakouts Recently

by Martin Pring,

President, Pring Research

* A few words on false moves

* US market experiences false upside breakout this week

* Whipsaws in the sectors

* European currency whipsaws

A few words on false moves

Prices in financial markets are driven principally by psychology. They effectively reflect people in action. The problem is, that people can and do...

READ MORE

MEMBERS ONLY

Market Round Up Video Recording 2017-04-04

by Martin Pring,

President, Pring Research

Here is a link to this week's video.

Market RoundUp With Martin Pring 2017-04-04 from StockCharts.com on Vimeo.

Good luck and good charting,

Martin J. Pring

The views expressed in this article are those of the author and do not necessarily reflect the position or opinion of...

READ MORE

MEMBERS ONLY

Monday Was A Very Important Inflexion Point For Several Markets

by Martin Pring,

President, Pring Research

* Two short-term indicators that can support higher prices

* Global equities ex the US are poised for a mega breakout

* Three markets poised for a major breakout

* Commodities coming to life?

It’s a well-known axiom on Wall Street that it’s not the news that is important but the market’...

READ MORE

MEMBERS ONLY

What Are Bond Market Intermarket Relationships Saying About Inflation?

by Martin Pring,

President, Pring Research

* The TIP/TLT Ratio reflects swings in commodity prices

* Watch that Technology/Staples ratio for a possible bullish breakout

* US breaking down against Global Equities

The TIP/TLT ratio reflects swings in commodity prices

When bond yields are compared to commodity prices there is definitely a connection, as we can...

READ MORE

MEMBERS ONLY

Five Markets That Are Approaching Critical Junctures

by Martin Pring,

President, Pring Research

* US Dollar completes a head and shoulders top

* Dollar right at key up trendline against the rest of the world

* Gold caught in a tight trading range

* West Texas oil also restrained in a tight trading range

* Mexico---a chance to jump over the wall?

* Emerging markets to the rescue

It...

READ MORE