MEMBERS ONLY

Will Last Month's NYSE Breakout Hold?

by Martin Pring,

President, Pring Research

* McClellan Summation gives a sell for the Wilshire 5000.

* Bond confidence ratios turn positive.

* Inflation ratios break to the upside. Trick or treat?

* Bonds complete a head and shoulders top.

US Equities

The NYSE Composite ($NYA) has been doing its best to break to the upside but continues to vacillate...

READ MORE

MEMBERS ONLY

With Recent Breakouts Lacking Strong Conviction, "Sell in May?" Could Be A Legitimate Question

by Martin Pring,

President, Pring Research

* Global equities starting to get overbought.

* Dollar Index and related relationships break to new correction lows.

* Commodities tentatively break to the upside.

US Equities

From now until next Tuesday the market will be under the spell of the bullish end of the month seasonal. That condition, combined with the fact...

READ MORE

MEMBERS ONLY

Does Friday's Sell-off Negate the NYSE Upside Breakout?

by Martin Pring,

President, Pring Research

* -Some short-term momentum indicators weaken but are not yet bearish.

* -Dollar related relationships close to an upside breakout

* -Gold and silver under pressure

US Equities

They say that the most critical points of a flight are takeoff and landing. The same is true in technical analysis where the most critical...

READ MORE

MEMBERS ONLY

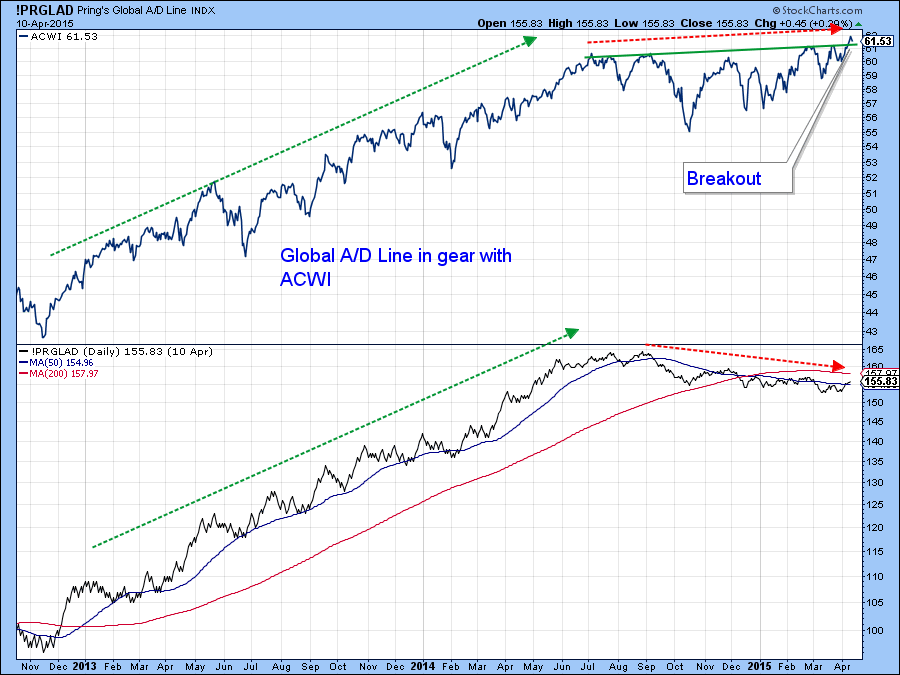

Global A/D Line Breaks above Key Resistance

by Martin Pring,

President, Pring Research

* - Confidence trying to improve in the bond market so that it can support higher equities.

* - Oil trying to form a base.

* - Declining peaks and troughs still in force for the Bloomberg Commodity ETN.

Global Equities

Throughout most of the bull market my Global A/D Line, comprising...

READ MORE

MEMBERS ONLY

US Equities are Very Close to an Upside Breakout. Can they do It?

by Martin Pring,

President, Pring Research

* World Stock ETF looks set for an upside breakout if it can get a small push in that direction

* Treasury yield curve begins to steepen

* Gold shares and silver caught in an important trading range.

Equities

Last week’s headline addressed the question of whether Chinese equities would drag US...

READ MORE

MEMBERS ONLY

Will Chinese Equities Drag up their US Counterparts?

by Martin Pring,

President, Pring Research

* Dow Jones Transports flirting with key support.

* Chinese ETF (FXI) experiences a long and short-term breakout.

* Emerging markets on the edge of a breakout.

US Equities

Since the middle of last year we have seen two different market characteristics develop. The first, as epitomized by the S&P 500...

READ MORE

MEMBERS ONLY

Global Stocks And The NYSE Composite Are In Focus At The Top Of A Major Trading Range

by Martin Pring,

President, Pring Research

* The NYSE Composite breaks out against the S&P 500.

* The SPY/EFA (US against the world) ratio completes a top.

* The S&P Europe 350 (IEV) breaks out against the S&P 500.

* The DB Commodity ETF is close to an important down trend line violation....

READ MORE

MEMBERS ONLY

Beneficiaries Of A Rising US Dollar Are Beginning To Look Tired

by Martin Pring,

President, Pring Research

* The RS between US equities and the rest of the world could be about to break against the US.

* The GLD breaks above its intermediate down trendline.

* Silver experiences a false move to the downside, thereby leaving it free to move higher.

The Dollar and Related Markets. Has the US...

READ MORE

MEMBERS ONLY

Stock Markets around the World Continue to Look Vulnerable

by Martin Pring,

President, Pring Research

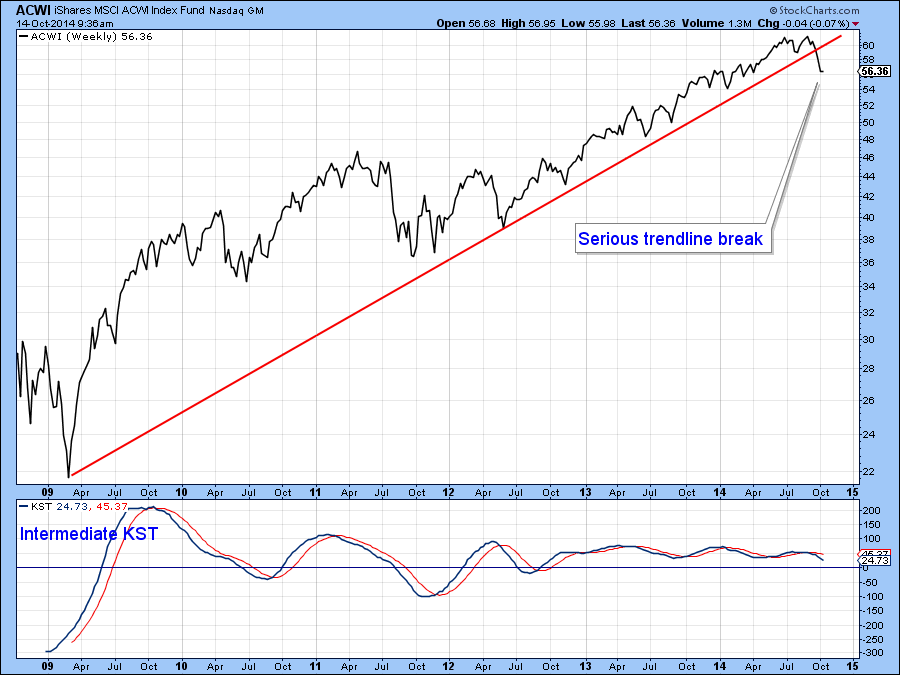

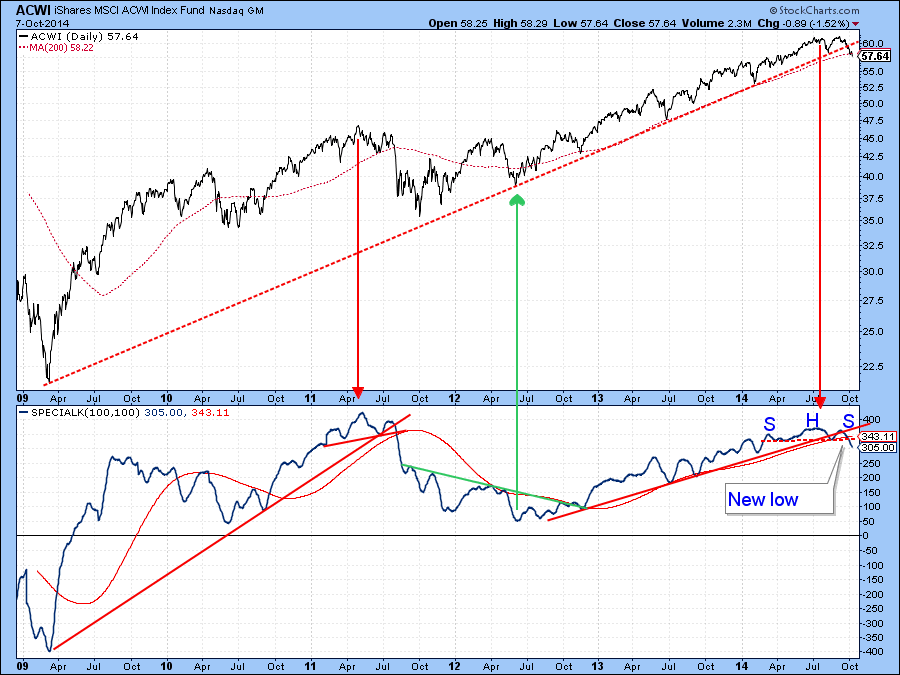

* World stock ETF may have experienced a false upside breakout.

* Bonds likely to out-perform stocks in the immediate future.

* Emerging markets ETF right at critical support.

Global Equities

Global equities are starting to look sick. Chart 1, for instance shows that the MSCI World Stock ETF, the ACWI, has recently...

READ MORE

MEMBERS ONLY

Can the Stock Market Hold its Breakout?

by Martin Pring,

President, Pring Research

* NYSE Composite and MSCI World Stock ETF could be in the process of cancelling their recent breakouts.

* Stock/bond ratio at a critical juncture.

* Junk bonds violate up trend line.

* Dollar Index breaks to the upside.

* Gold and gold shares face important technical test.

Equities

Chart 1 suggests that the...

READ MORE

MEMBERS ONLY

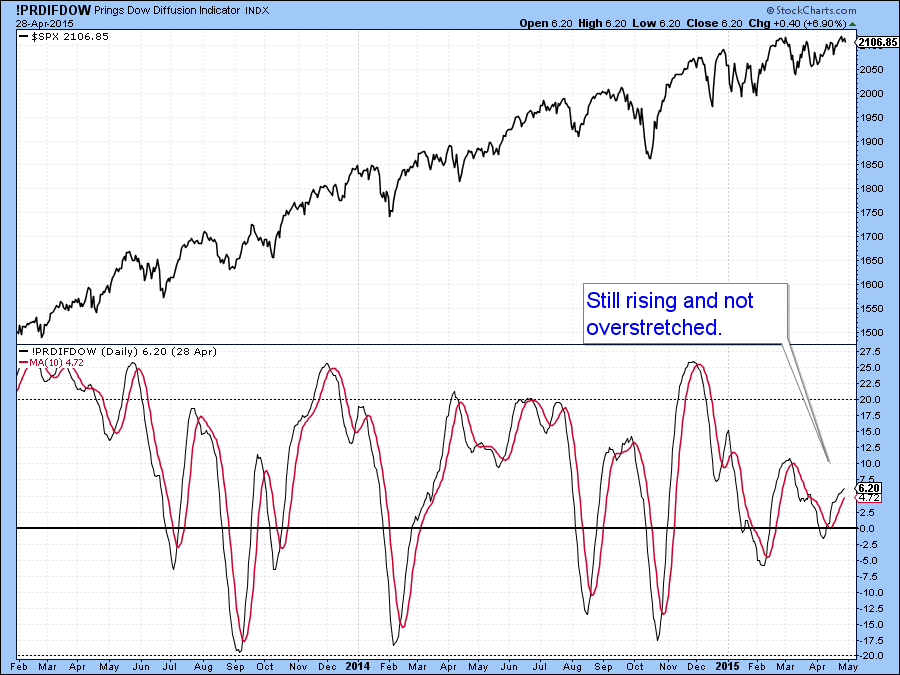

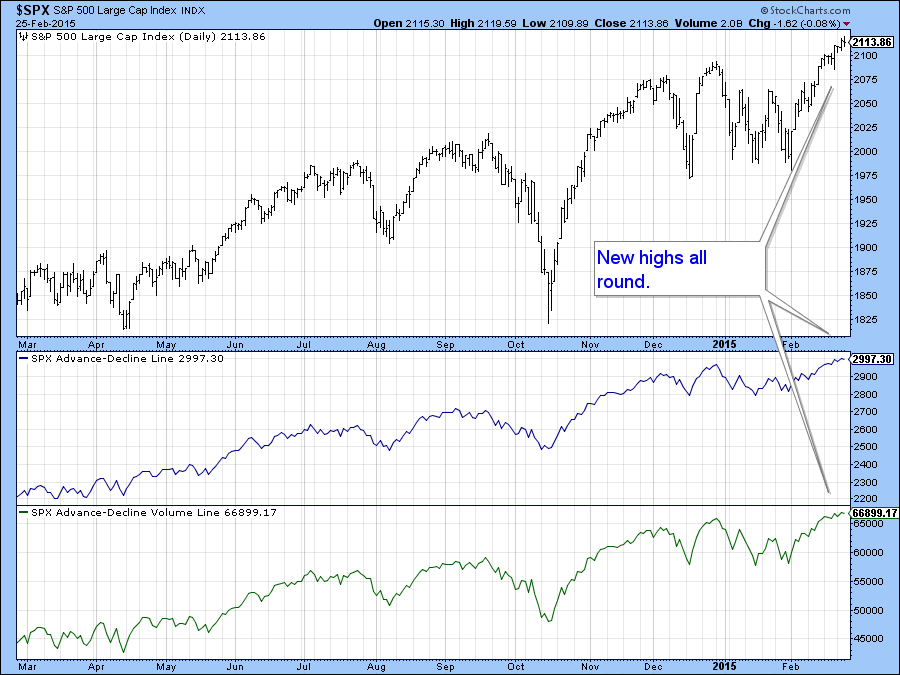

Equity Market Breakout is Broadly Based but Short-term Indicators are Becoming Overstretched

by Martin Pring,

President, Pring Research

* Emerging markets about to experience an important breakout.

* Yield curve continues to flatten.

* Confidence in the bond market faces an important technical test.

US Equities

We have seen some nice breakouts in the last few trading sessions, which have been pretty broadly based as you can see from Chart 1,...

READ MORE

MEMBERS ONLY

US Equity Upside Breakout So Far So Good

by Martin Pring,

President, Pring Research

* -NASDAQ Composite offers quality upside leadership.

* -Watch the 5-year yield for a clue as to future rate movements.

* -Gold starting to show bull market characteristics but can it confirm with some positive trend action?

In last week’s article I drew your attention to the fact that the technical picture...

READ MORE

MEMBERS ONLY

Forthcoming Big Move in Equities is Likely. The Question is Which Way will it Be?

by Martin Pring,

President, Pring Research

* The NYA starts to break down against the S&P again.

* Emerging markets ETF triggers some short-term sell signals.

* The EEM is resting above key long-term support.

US Equities

The market continues to frustrate both bull and bear alike as the major averages steadfastly refuse to break out from...

READ MORE

MEMBERS ONLY

Moment of Truth Approaching for US Equities

by Martin Pring,

President, Pring Research

* Short-term oscillators turn bullish for equities

* EFA breaks above significant down trend line

* Gold short-term momentum reverses to the downside

US Equities

Last week the headline of my Market Roundup article read as follows, ”Will the end-of the month bullish seasonal for equities be enough to avoid a downside domino...

READ MORE

MEMBERS ONLY

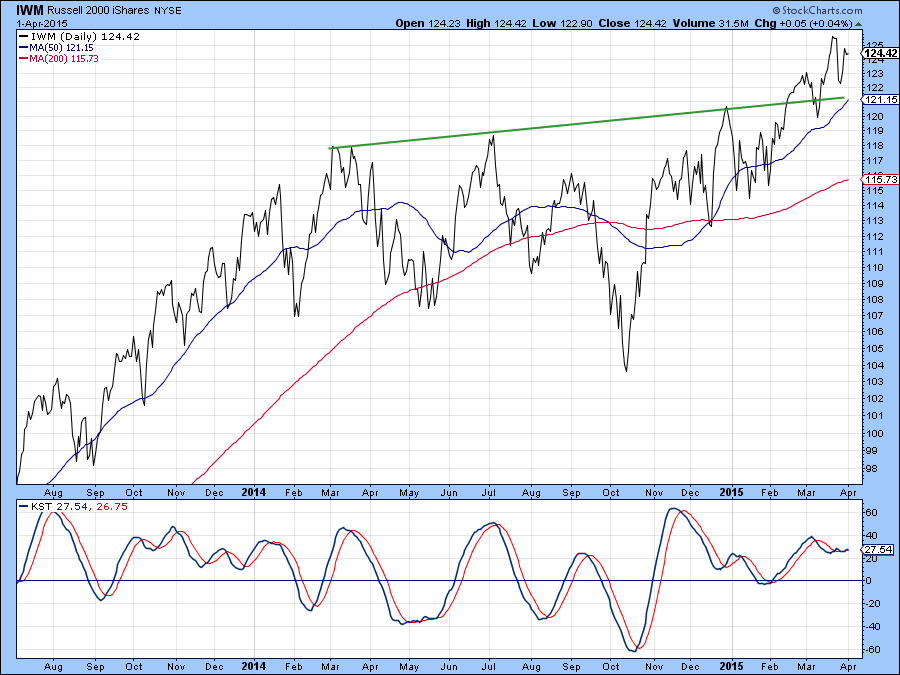

Will The End-Of-The-Month Bullish Seasonal for Equities Be Enough To Avoid A Downside Domino Effect?

by Martin Pring,

President, Pring Research

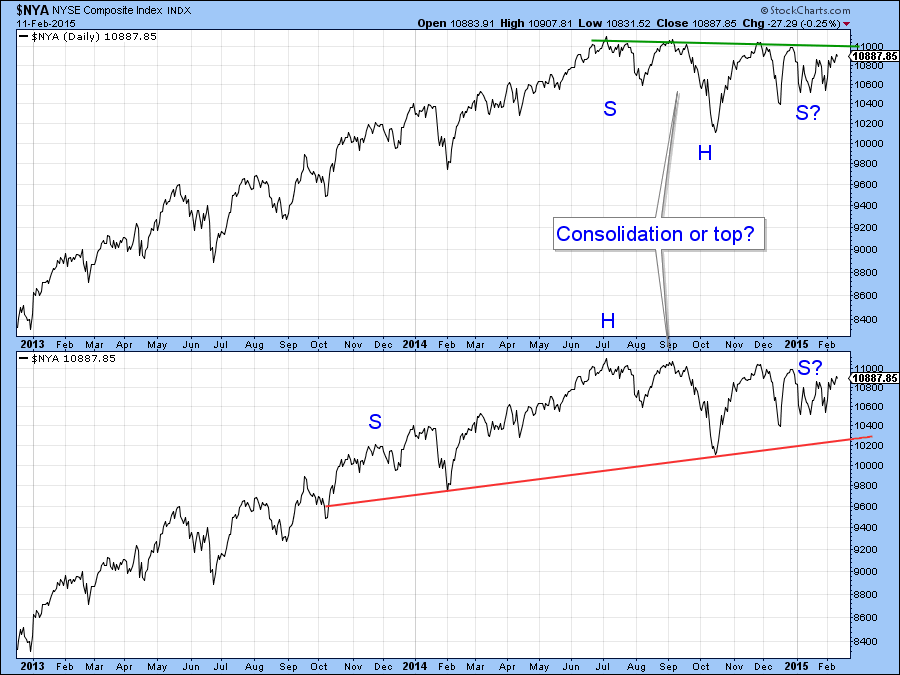

* NYSE Composite is forming a head and shoulders top or is it a bottom?

* IWM experiences false upside breakout

* SPY/EFA ratio is signaling a dollar correction. Will the Index take the bait?

* Wisdom Tree Yuan fund right on a key up trend line

I last wrote about the US...

READ MORE

MEMBERS ONLY

The Rest of the World May be About to Beat US Equities for a While

by Martin Pring,

President, Pring Research

* Europe and Emerging Market equities positioned to move higher.

* Philippine ETF breaks to the upside.

* Silver breaks convincingly to the upside.

* Gold breaks out against US equities.

US versus the World

The trend favoring US equities over most of the rest of the world, may be in the process of...

READ MORE

MEMBERS ONLY

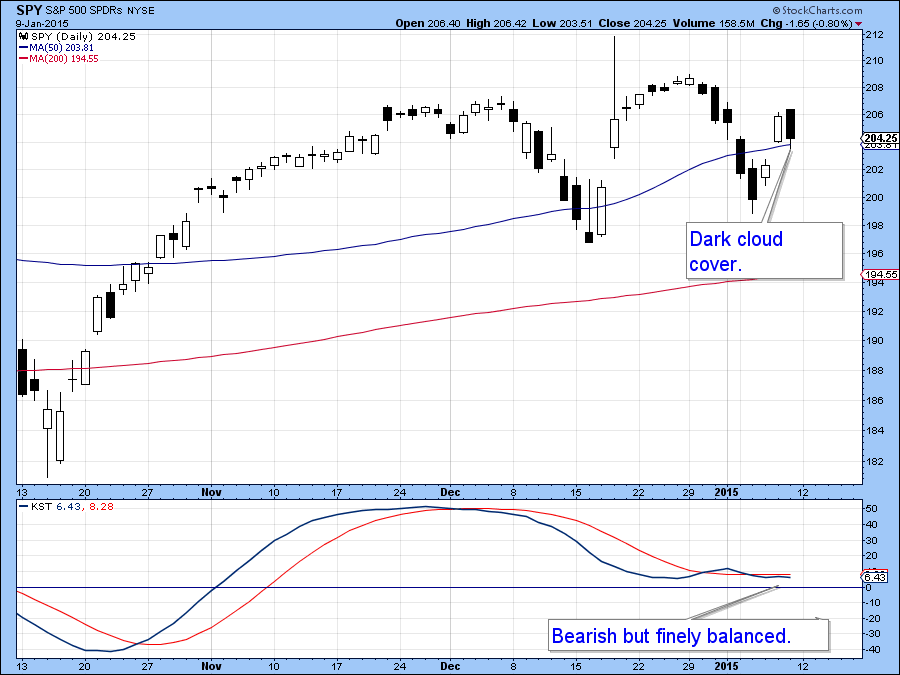

Friday's Stock Market Action Hints at Further Weakness to Come Near-term

by Martin Pring,

President, Pring Research

* World Stock ETF getting closer to completing a top.

* Gold in euro and yen build on recent breakouts.

* Dollar denominated gold close to an upside breakout.

US Equities

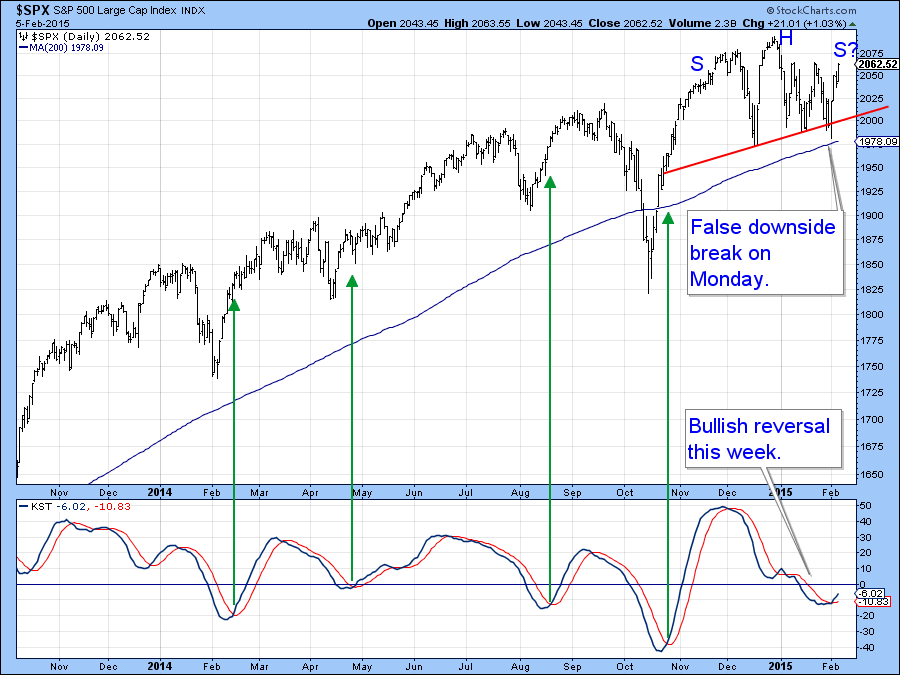

On Friday the S & P Composite ($SPX) experienced the second day of a dark cloud cover formation, a bearish candlestick pattern....

READ MORE

MEMBERS ONLY

MSCI World ETF and NYSE Composite Violate their 12-month Moving Averages. Is This the Start of a Primary Bear Market?

by Martin Pring,

President, Pring Research

* Much expected Santa Rally did not happen and that’s bearish.

* MSCI Europe Australia Far East ETF right on the brink of a major breakdown.

* Small caps may have experienced a false upside breakout.

* Chinese ETF breaks out big time on both an absolute and relative basis.

In my mid-December...

READ MORE

MEMBERS ONLY

An Important Move is Likely for Gold and Silver in Early 2015. Here are the Chart Points to Watch

by Martin Pring,

President, Pring Research

* Dollar based gold is in a bear market.

* Yen and euro denominated gold are in primary bull markets.

* Gold shares complete a massive top.

Last week we reviewed the technical picture of the major currencies. This week it is the turn of the precious metals because the finely balanced technical...

READ MORE

MEMBERS ONLY

End Of The Year Dollar Index Review

by Martin Pring,

President, Pring Research

* Long-term dollar rally likely to continue.

* Yuan on the edge of a breakdown.

* January is tied with November as the most bullish month for the dollar.

* Short-term dollar momentum overstretched but re-accelerating to the upside.

Currencies

At the end of August the US Dollar Index ($USD) broke out from a...

READ MORE

MEMBERS ONLY

Equities still Look Vulnerable Notwithstanding a Possible Reflexive Bounce

by Martin Pring,

President, Pring Research

* Dichotomy in the credit markets is extending.

* Dim Sum bonds at a critical juncture.

* Gold asset markets weakening again.

US Equities

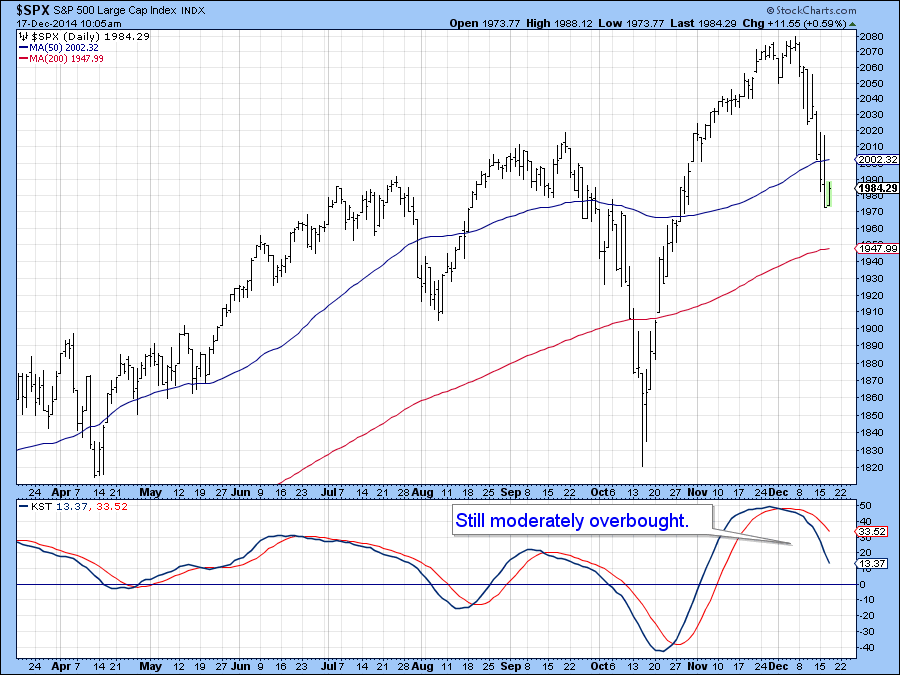

Statistics tell us that December is the most bullish month of the year for equities. Interestingly, the November-January period offers the best performing consecutive months of the year (S&...

READ MORE

MEMBERS ONLY

Two Benchmarks that will Likely Signal the Direction of the Next Major Equity Move

by Martin Pring,

President, Pring Research

* Stocks likely to resume their downtrend vis a vis bonds.

* Emerging Markets ETF resting on a key trend line.

* Different bond maturities moving in different directions.

US Equities

The battle lines are being drawn for the next major move in the equity market. For the NYSE Composite ($NYA) those lines...

READ MORE

MEMBERS ONLY

Global Equity Market Roundup

by Martin Pring,

President, Pring Research

* USA still leading the way on the upside.

* Russian and Mexican ETF’s break to the downside.

* EEM components offering a mixed picture.

* The two sides of Japan.

International Equities

With the US, German, Japanese, Indian, New Zealand, Pakistani and several other markets joining the US in new all-time high...

READ MORE

MEMBERS ONLY

Bullish Seasonals and Cycles Should Push Stocks to Significant Highs in 2015..but will they?

by Martin Pring,

President, Pring Research

* Bullish NYSE percent has likely peaked out. Indicates market will become more selective.

* You can’t keep a good dollar down!

* Emerging market currency fund breaks down. EM are likely to follow.

US Equities

I have always said that trend trumps everything. By that I mean that however bad the...

READ MORE

MEMBERS ONLY

A couple of Chinese Equity Sector ETF's break to the Upside

by Martin Pring,

President, Pring Research

* Stock/bond ratio challenges overhead resistance.

* Watch $120 on the GLD.

* Commodities may be set for short-term rally.

US Equities

For some time I have been pointing to several discrepancies in the market that have been troubling. My conclusion was that as long as the uptrend since mid-October was intact...

READ MORE

MEMBERS ONLY

Tuesday's NASDAQ High Was Accompanied By A Paltry 50 Net New Highs

by Martin Pring,

President, Pring Research

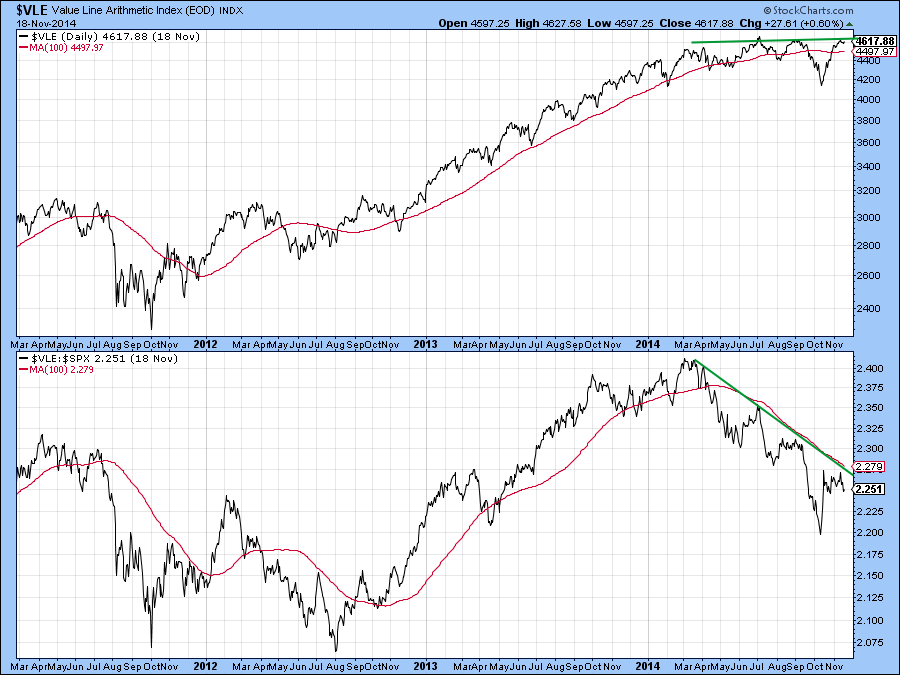

* Value Line Arithmetic is just below important resistance.

* 10-year bond price reacts to its recent breakout point.

* The GLD fails at resistance.

US Equities

The Value Line Arithmetic($VLE) monitors the price of the average stock. It has been one of the weakest areas of the market as demonstrated by...

READ MORE

MEMBERS ONLY

Gold in Yen Breaks to the Upside. Is this the Start of a Broader Trend Feeding Back to the US Dollar Gold Price?

by Martin Pring,

President, Pring Research

* IWM continues to rally but Relative Strength action still lags.

* Dollar diffusion indicator starting to turn down.

* The Gold (GLD) experiences a strong outside bar on heavy volume.

US Equities

Chart 1 shows the Coppock Curve for the S&P 500 ($SPX) . This indicator was designed to identify major...

READ MORE

MEMBERS ONLY

Gold Price in Yen Offers a Thumbs Down on the BOJ's latest Inflationary Moves

by Martin Pring,

President, Pring Research

* Short-term market indicators are still bullish.

* Stock/bond ratio reaches a critical point.

* Yen completes a 28-year top against the dollar.

US Equities

Throughout 2013 and for most of 2014 every peak in the S&P was confirmed by the NYSE Composite ($NYA) . You can see that from the...

READ MORE

MEMBERS ONLY

Inflation Hedge Assets Continue to Break to the Downside (Video)

by Martin Pring,

President, Pring Research

* Outside day hints that the short-term downtrend for bonds may be over.

* Dollar Index may be completing an inverse head and shoulders.

* Stronger dollar forces gold to test its lows.

* Stronger dollar causes gold to break down from a 2-year trading range.

Here is a link to the the text...

READ MORE

MEMBERS ONLY

Inflation Hedge Assets Continue to Break to the Downside

by Martin Pring,

President, Pring Research

* Outside day hints that the short-term downtrend for bonds may be over.

* Dollar Index may be completing an inverse head and shoulders.

* Stronger dollar forces gold to test its lows.

* Stronger dollar causes gold to break down from a 2-year trading range.

Here is a link to the video version...

READ MORE

MEMBERS ONLY

Bearish Candle Patterns Indicate a Test of Last Week's Lows are Likely

by Martin Pring,

President, Pring Research

* Short-term momentum is still oversold, so a rally is probable once the expected test is over.

* Any rally likely to be part of an overall topping out process.

* Europe experiences primary trend sell signal.

* Japanese and Asian Ex Japan ETF’s look vulnerable from a long-term aspect.

This week we...

READ MORE

MEMBERS ONLY

That Was Probably It....For The Time Being

by Martin Pring,

President, Pring Research

* Short-term indicators continue to decline, but Wednesday’s price action may cause them to go bullish.

* Small caps starting to emerge as leaders on the upside (At least for the short-term).

* Quality bonds experience probable upside blow-off and high yield exhaustion on the downside .

Earlier in the week I pointed...

READ MORE

MEMBERS ONLY

Shanghai Reverses Four -year Bear Market in Relative Action

by Martin Pring,

President, Pring Research

* Global equities experience long term technical damage.

* But short-term indicators are close to signaling a tradable rally.

* Bond market still looks strong.

* Gold experiences marginal upside breakout against stocks.

US Equities

Last week I described how some serious long-term technical damage had been done to global equities but that a...

READ MORE

MEMBERS ONLY

Stocks Break Down Against Bonds In A Major Way

by Martin Pring,

President, Pring Research

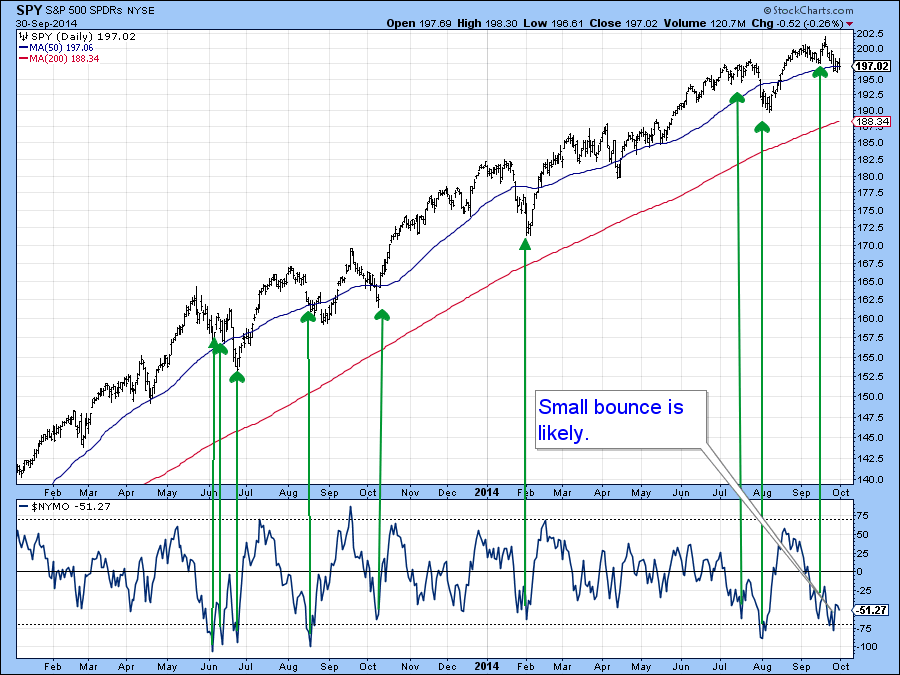

* Oversold short term condition could trigger a bounce... but remember this is October!

* Five year yield experiences false upside breakout. That signals lower yields

* Gold bounces from a must hold support level.

(Click here for the Video Version of this article.)

US Equities

In the last week some serious long-term...

READ MORE

MEMBERS ONLY

Stocks Break down Against Bonds in a Major Way - Video Version

by Martin Pring,

President, Pring Research

* Oversold short term condition could trigger a bounce... but remember this is October!

* Five year yield experiences false upside breakout. That signals lower yields.

* Gold bounces from a must hold support level.

Click here for the Print Version

Good luck and good charting,

Martin Pring...

READ MORE

MEMBERS ONLY

Silver Breaks to the Downside in a Big Way

by Martin Pring,

President, Pring Research

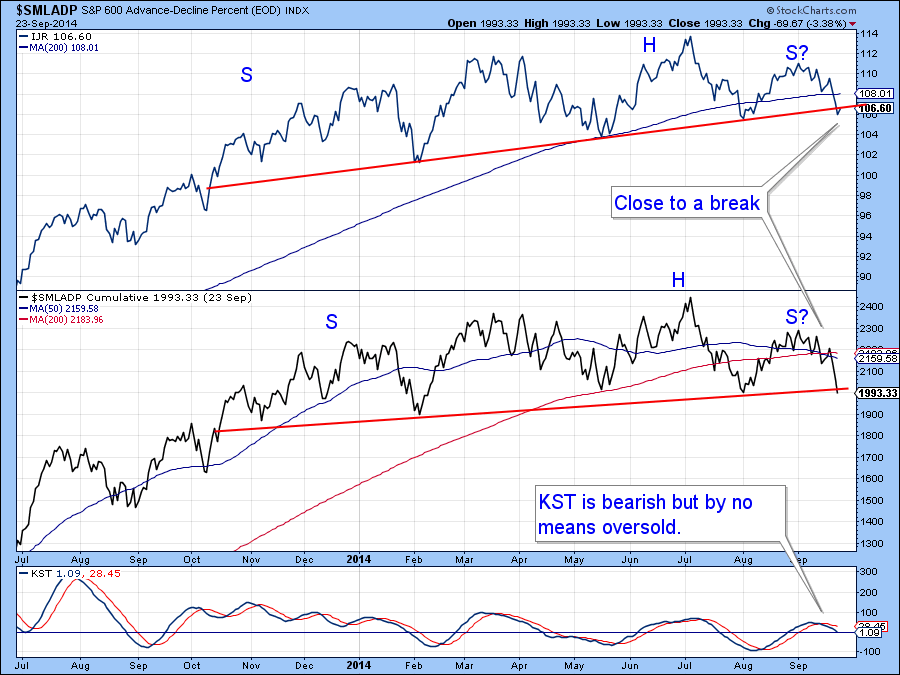

* Negative divergences in the equity market continue to build.

* The rest of the world (EFA) completes a head and shoulders top.

* Credit spreads continue to deteriorate.

* Some commodity indexes break down in a major way, others hold fast.

US Equities

In our last issue my basic conclusion on equities was...

READ MORE

MEMBERS ONLY

Global Equities and Some US Averages are Just Above Critical Support

by Martin Pring,

President, Pring Research

* Small cap stocks on the verge of a major breakdown.

* Gold shares violate important up trend line.

* Dollar Index due for a correction within a primary bull market.

Click here for the video version.

For the last few weeks I have been pointing out the gradually deteriorating technical position but...

READ MORE

MEMBERS ONLY

Global Equities and Some US Averages are Just Above Critical Support - Video Version

by Martin Pring,

President, Pring Research

This is the video version of the Market Roundup.

* Small cap stocks on the verge of a major breakdown.

* Gold shares violate important up trend line.

* Dollar Index due for a correction within a primary bull market.

Click here for the print version.

Good Luck and good charting,

Martin Pring...

READ MORE

MEMBERS ONLY

Five Year Yield Experiences Major Upside Breakout

by Martin Pring,

President, Pring Research

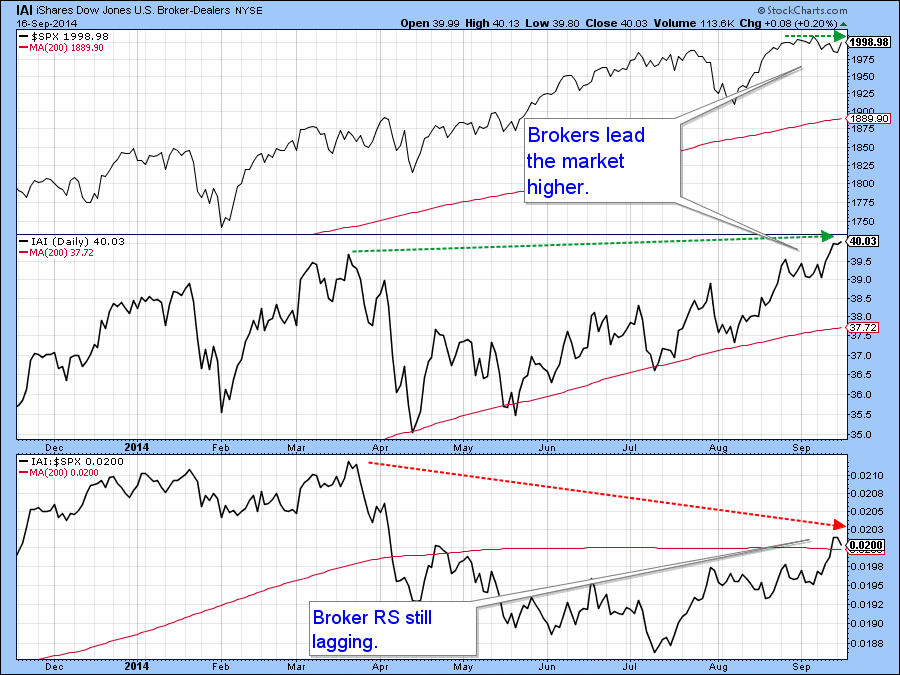

* - Brokers experience new bull market closing high.

* - NYSE stocks above their 200-day MA’s continue to shrink.

* - Canadian dollar experiences false break to the downside.

* - Commodities break to the downside. Could it be a whipsaw?

US Equities

Tuesday’s strong equity action could well be a...

READ MORE

MEMBERS ONLY

Interest Rates are Starting to Rally Across the Board (Video Version)

by Martin Pring,

President, Pring Research

Click here for a written version of this article...

READ MORE