MEMBERS ONLY

Interest Rates are Starting to Rally Across the Board

by Martin Pring,

President, Pring Research

* Equity market short-term momentum starting to roll over but not yet bearish.

* Dollar Index fails to respond to overbought short-term condition, which is a sign of a primary bull market.

* Gold experiencing very constructive sentiment but needs to confirm this with a break in the GLD above $130.

(Click here...

READ MORE

MEMBERS ONLY

Gold and Gold Shares Face an Important Test in the Next Few Days

by Martin Pring,

President, Pring Research

* Short-term equity rally is still intact.

* Dollar Index experiences major upside breakout.

* Commodities experience a very favorable divergence but the DJP needs to break above $37 to confirm.

US Equities

Last week we talked about the fact that the S&P had broken out to new highs but that,...

READ MORE

MEMBERS ONLY

US Dollar Index Tentatively Breaks Out from a Ten Year Base

by Martin Pring,

President, Pring Research

* Short-term indicators still bullish for stocks.

* Growth (IVE) about to break out against value (IVW).

* Commodity market experiences bullish short-term divergence.

(Click here for a video version of this commentary.)

US Equities

The short-term indicators i.e. those monitoring trends that range from 3-6-weeks remain in a bullish mode and...

READ MORE

MEMBERS ONLY

US Dollar Index Tentatively Breaks Out from a Ten Year Base (Video Version)

by Martin Pring,

President, Pring Research

Click here for a written version of this article....

READ MORE

MEMBERS ONLY

NASDAQ Breaks Out from a Broadening Formation

by Martin Pring,

President, Pring Research

* Bottom Fisher goes bullish.

* Bonds continue to break to the upside.

* Dollar Index due for a pause.

* Watch $27.50 and $130 on the GDX and the GLD.

US Equities

The Pring Bottom Fisher market indicator (!PRBFISH), shown in the lower window of Chart 1 (and discussed in more detail...

READ MORE

MEMBERS ONLY

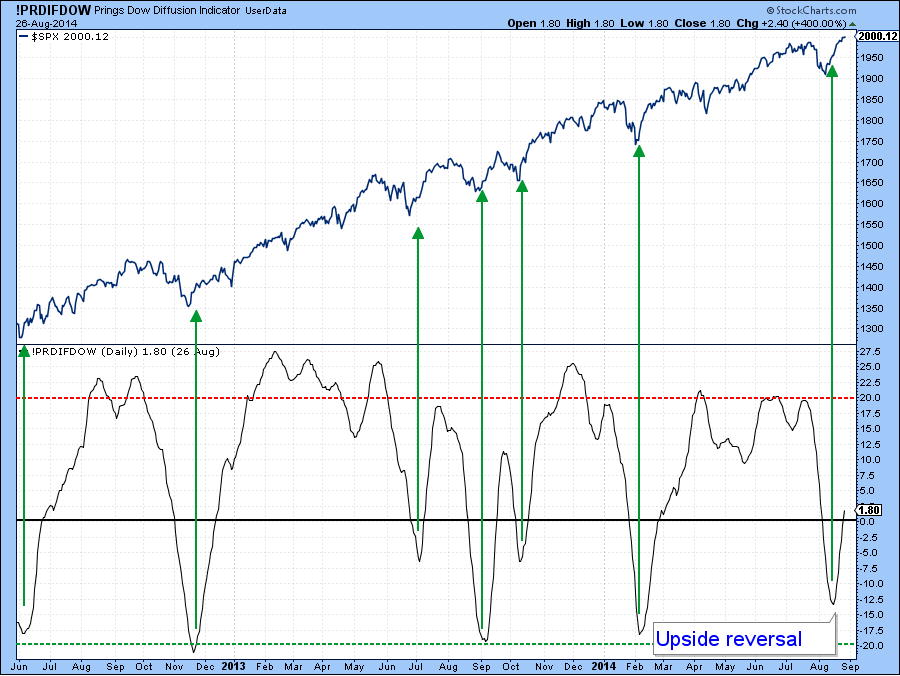

Oversold Condition Should generate a Short-term US Equity Rally as Part of an Overall Topping Process

by Martin Pring,

President, Pring Research

* Bottom Fisher indicator may be close to an upside reversal.

* If the rally develops watch the value Line Arithmetic for an indication of its resilience.

* Gold shares may be about to break to the upside.

(Click here for a video version of this article.)

US Equities

Last week the NYSE...

READ MORE

MEMBERS ONLY

Oversold Condition Should generate a Short-term US Equity Rally as Part of an Overall Topping Process (Video)

by Martin Pring,

President, Pring Research

(Click here for the written version of this article.)...

READ MORE

MEMBERS ONLY

Equities Continue to Show Long-term Deterioration

by Martin Pring,

President, Pring Research

* Value Line Arithmetic violates key uptrend line.

* Introducing the Bottom Fisher, but unfortunately not the bottom!

* Stock/bond ratio at the brink.

* 5-year yield between two key converging trend lines.

* Gold/stock ratio on the verge of an upside breakout.

US Equities

The bullish seasonal end of the month period...

READ MORE

MEMBERS ONLY

Can a Weakening Stock Market take Advantage of the Bullish End-of-the-month Seasonal? (video)

by Martin Pring,

President, Pring Research

Click here for the printed version of this article....

READ MORE

MEMBERS ONLY

Can a Weakening Stock Market Take Advantage of the Bullish End-of-the-month Seasonal?

by Martin Pring,

President, Pring Research

* Breadth continues to deteriorate following Special K sell signal for the NYSE Composite.

* Bonds are likely to violate an important up trendline.

* Gold and commodities may be about to reverse their recent declines.

(Click here for the video version of this article.)

US Equities

The US equity market has not...

READ MORE

MEMBERS ONLY

Birth of the Cool: A New Bull Market for Chinese Equities?

by Martin Pring,

President, Pring Research

* Shanghai breaks bear market trendline and takes the FXI with it.

* Long-term relative action suggests the FXI is no longer a world laggard, but a leader instead.

* Shanghai correlation with commodities argues for higher commodity prices in general.

* Chinese materials, real estate and energy ETF’s break to the upside....

READ MORE

MEMBERS ONLY

Homebuilders may be on the Verge of a Major Breakdown

by Martin Pring,

President, Pring Research

* General correction in US equities not over despite a higher S&P.

* Dollar Index breaks to the upside.

* Gold likely to experience more base building before moving higher.

* CRB meets downside objective, now we will see how it can handle a rally.

US Equities

Last week I pointed out...

READ MORE

MEMBERS ONLY

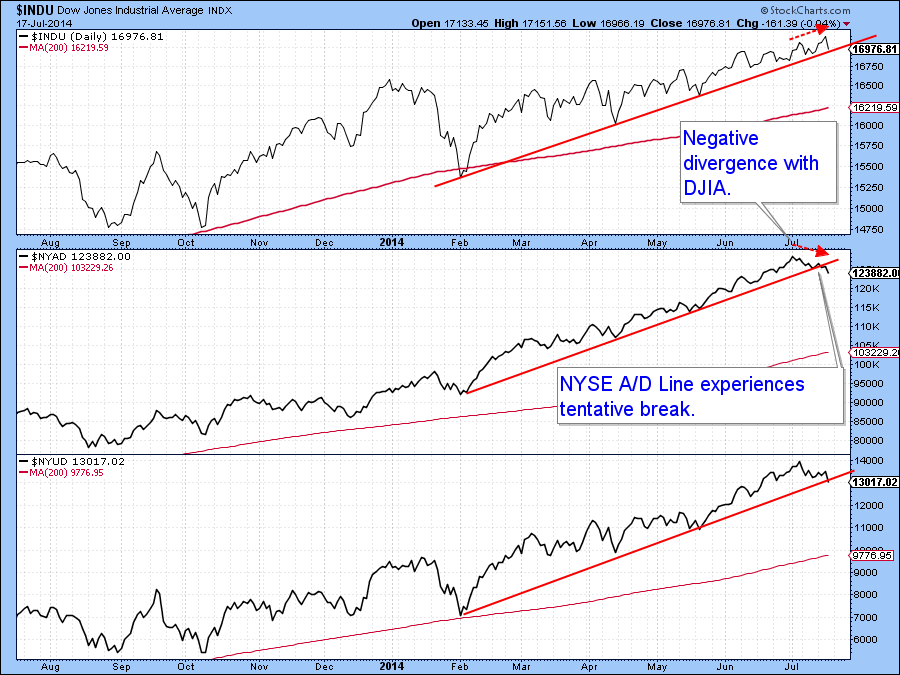

New Highs in the Dow Don't Translate Elsewhere

by Martin Pring,

President, Pring Research

* Less than 50% of NASDAQ stocks are above their 200-day MA’s.

* Bond market confidence ratio on the verge of a major breakdown.

* US Dollar Index could be about to break to the upside.

Click here for video version

US Equities

The Dow touched an all-time high this week but...

READ MORE

MEMBERS ONLY

Sectors and Industry Groups to Avoid or Embrace

by Martin Pring,

President, Pring Research

* Fading Sectors/Industries: Financial, Homebuilders, Consumer, Biotech, Small Cap, Industrial

* Emerging Sectors/Industries: Energy, Mines, Basic Materials, Gold Miners

Sector rotation is a continual process, but recently several old favorites have started to lose favor, and several previously discarded ones are coming to the fore. I am going to run...

READ MORE

MEMBERS ONLY

Gold Shares Break to the Upside

by Martin Pring,

President, Pring Research

* Brokers are leading the market lower

* NASDAQ Composite leaves a lot to be desired

* The balance of evidence suggests lower near-term bond prices

* Commodities complete a short-term top

US Equities

The correction we have been talking about in the last couple of Market Roundups is likely to continue.

As Art...

READ MORE

MEMBERS ONLY

Dollar Index Faces Important Technical Test

by Martin Pring,

President, Pring Research

Click here for a written version of this article....

READ MORE

MEMBERS ONLY

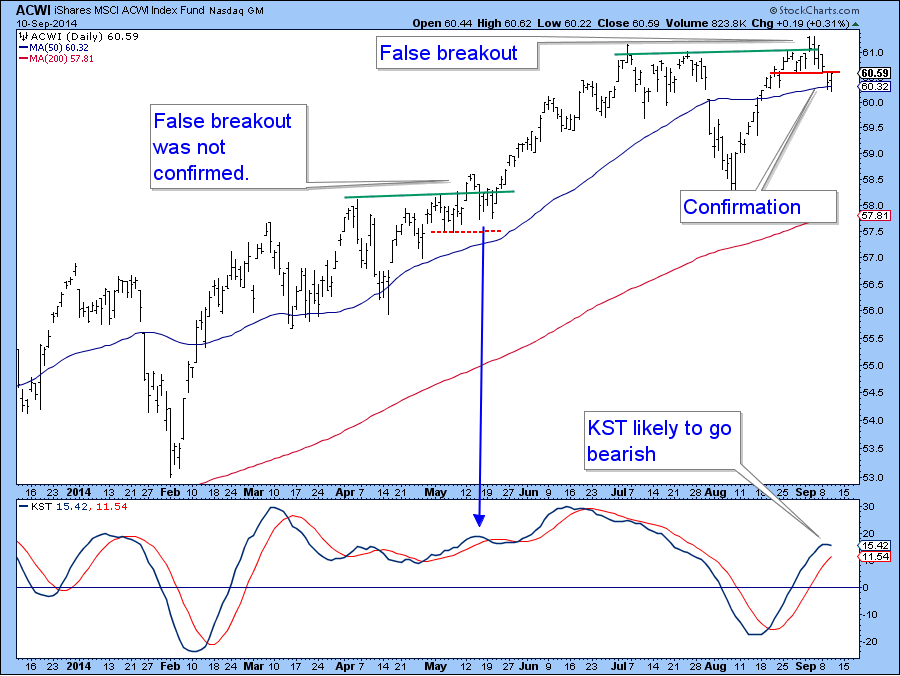

Bearish One Day Reversal and KST Argue for a Short-term Correction

by Martin Pring,

President, Pring Research

* Several market averages experience bearish outside days.

* NASDAQ Composite forms bearish Pinocchio bar

* Brokers leading the market lower

* Further dollar weakness anticipated

* Gold just below key resistance

* Commodities break out from a nice base

US Equities

I have been saying for several weeks that the market is overextended but that...

READ MORE

MEMBERS ONLY

Failure of Equities to Decline on Unexpected Bad News from Iraq is Bullish

by Martin Pring,

President, Pring Research

* Equities remain overstretched.

* Japanese ETF just below key resistance.

* Bonds look vulnerable as short-term rates break to the upside.

* Dollar Index triggers a sell signal.

* Gold is cloe to confirming a primary bull market.

* Commodities acting consistently with a primary bull market.

(Click here for the narrated video version of...

READ MORE

MEMBERS ONLY

The Equity Rally is Getting Overstretched on a Short-term Basis.

by Martin Pring,

President, Pring Research

* More signs of an intermediate peak in the bond market.

* Dollar Index is now overbought.

* Gold and gold shares are down, but not yet out.

* Commodities continue to struggle at key short-term support.

US Equities

The short-term uptrend remains intact but is becoming overextended. You can see this from the...

READ MORE

MEMBERS ONLY

Commodities Facing a Bull Market Test of their Manhood

by Martin Pring,

President, Pring Research

* US Equity market trend is still positive but more cracks appearing.

* Bond rally may well be over, but confirmation is needed.

* Dollar Index rally likely to extend.

* More base building in the gold market is likely.

(Click here for the narrated video version of this article)

US Equities

Last week...

READ MORE

MEMBERS ONLY

Will the Dollar Index Surprise on the Upside?

by Martin Pring,

President, Pring Research

* S&P Breaks to a new high, but leaves a lot to be desired.

* Bond rally intact but getting overstretched.

* Dollar Index is breaking to the upside.

* Euro experiences a double whipsaw breakout.

* Gold violates a key support trend line.

* Commodities face an important test of the bull market...

READ MORE

MEMBERS ONLY

No Sell Signal for Equities...Yet!

by Martin Pring,

President, Pring Research

* The line of least resistance for global and US equities looks to be an upward one.

* The overstretched short-term condition argues against taking undue risks.

* Bond rally is showing signs of tiredness.

* The commodity correction may be over.

(Click here for the video version of this article)

First, I would...

READ MORE

MEMBERS ONLY

Hello to all the StockCharts.com Subscribers!

by Martin Pring,

President, Pring Research

Hello Stockchart Subcribers!

My name is Martin Pring and I’m very excited to be joining the team at StockCharts.com! For those of you who may not be familiar with my work, I have been providing research to the international investment community since 1968. My professional analysis career was...

READ MORE

MEMBERS ONLY

Are Japanese Equities Topping Out? If so, Will US Equities be Far Behind?

by Martin Pring,

President, Pring Research

* Japanese Equities May be on the Verge of a Major Breakdown.

* Yen Close to an Unexpected Upside breakout?

* Nikkei has led Every US Stock Market Peak Since 1990.

Normally Martin Pring's Market Roundup, the PMR, will give you a short-term synopsis of the US equity and bond markets...

READ MORE

MEMBERS ONLY

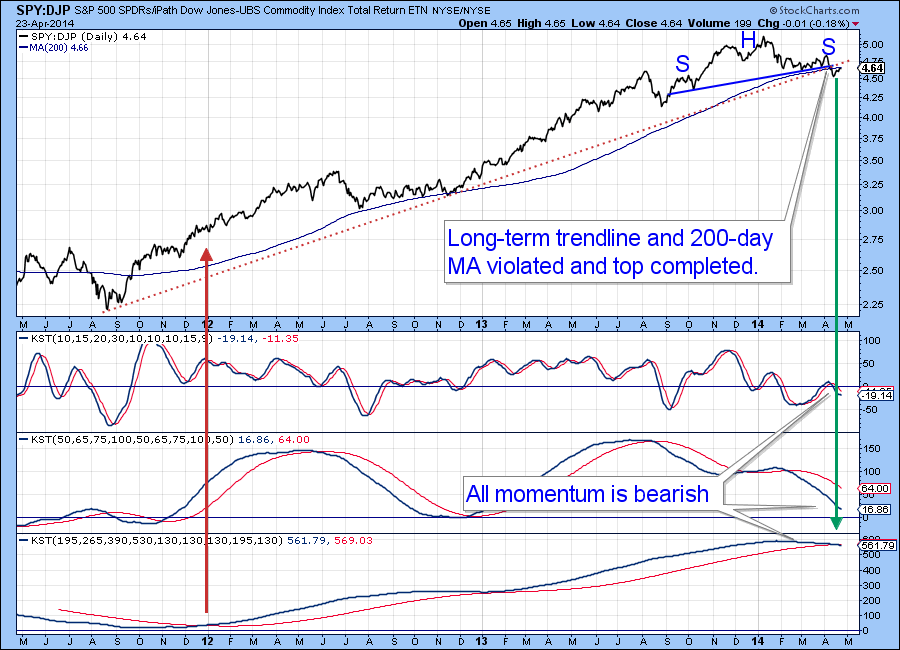

Stocks Breakdown Big Time vs Commodities

by Martin Pring,

President, Pring Research

Today's Market Roundup Headlines:

* Stocks break down big time against commodities

* IGE/XLP (Inflation/deflation ratio) breaks in favor of IGE

* Brent Crude close to a major breakout

* Industrial metals with the exception of copper break to the upside.

* Spider Metals and Mining (XME) close to major upside...

READ MORE