MEMBERS ONLY

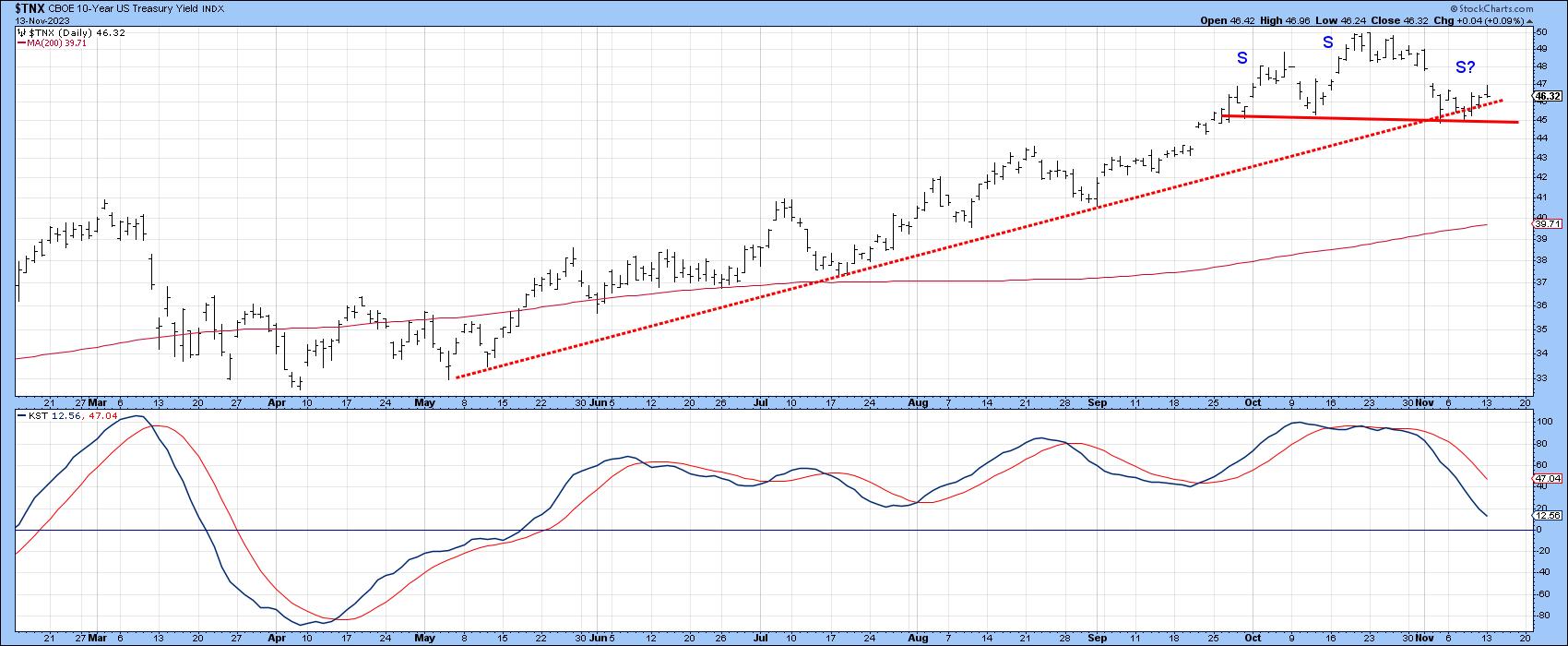

Is It Time for Interest Rates to Fall?

by Martin Pring,

President, Pring Research

I last wrote about bonds and interest rates in August, as they were in the process of challenging their October 2022 highs. My conclusion at the time was that they were likely to go through, but that upside potential would be limited due to what seemed at the time to...

READ MORE

MEMBERS ONLY

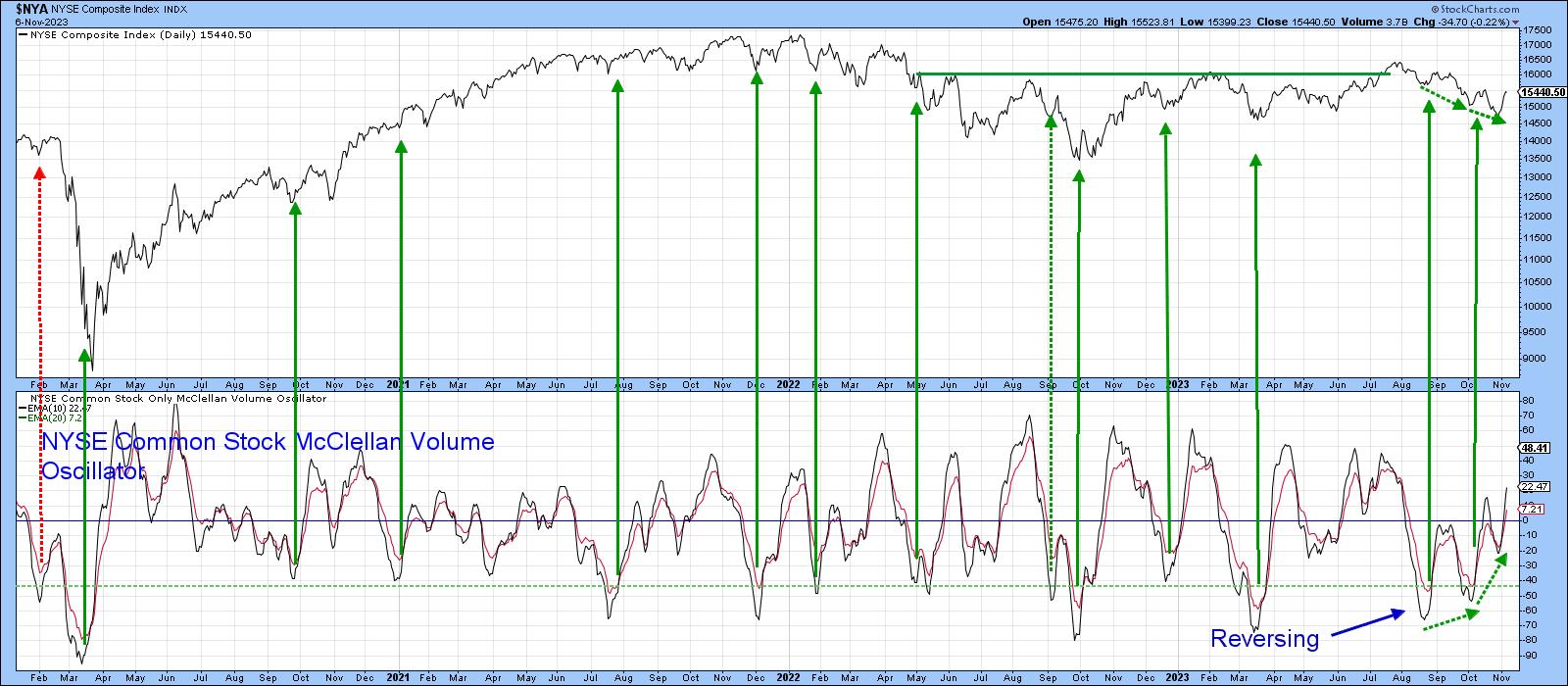

Benchmarks that Will Tell Us this Market Has Legs

by Martin Pring,

President, Pring Research

A couple of weeks ago, I wrote an upbeat article on the market, pointing out the fact that many short- and intermediate-term indicators were in a potentially bullish position at a time when stocks seemed impervious to bad news. I concluded "That does not mean the market will go...

READ MORE

MEMBERS ONLY

This Country ETF Rallies Sharply After War Breaks Out

by Martin Pring,

President, Pring Research

Understandably, most Middle Eastern country ETFs have performed poorly since the war broke out, but there is one noticeable exception, which I will get to later.

Israel

First, as might be expected, the iShares Israel ETF (EIS) has moved lower and completed what looks to be a massive top. The...

READ MORE

MEMBERS ONLY

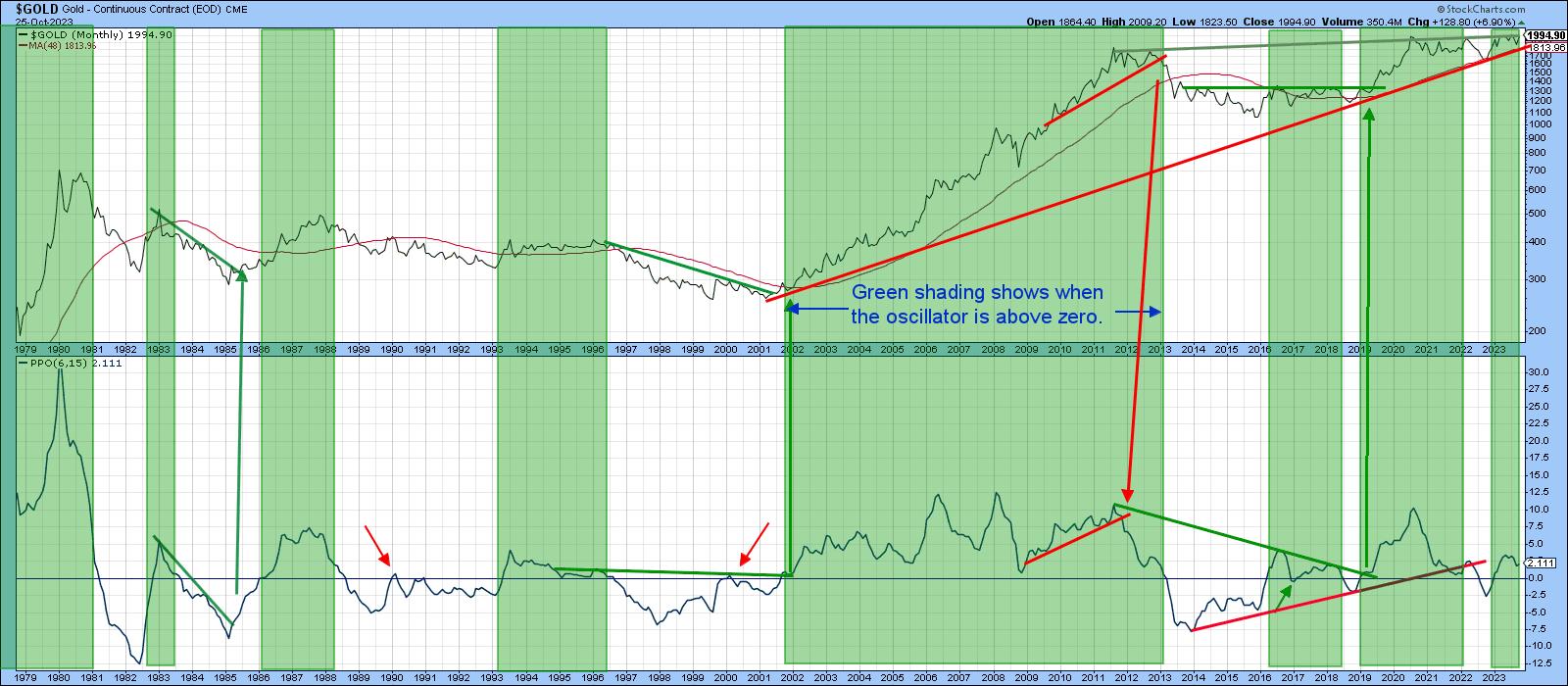

Some Gold Indicators Approach Critical Chart Points

by Martin Pring,

President, Pring Research

When Anwar Sadat, President of Egypt was assassinated in 1981, gold rallied sharply over the near-term, but the advance soon petered out. The reason was that gold was in a primary bear market, so the advance merely represented a counter-cyclical move. Gold has rallied sharply since the Middle East crisis...

READ MORE

MEMBERS ONLY

If War in the Middle East Won't Push this Market Down, What Will?

by Martin Pring,

President, Pring Research

I must say, I was surprised that the outbreak of war in the Middle East and a 4% rise in oil sent the market higher, not lower by the close of business last Monday. Typically, a market that does not respond to bad news in a negative way is one...

READ MORE

MEMBERS ONLY

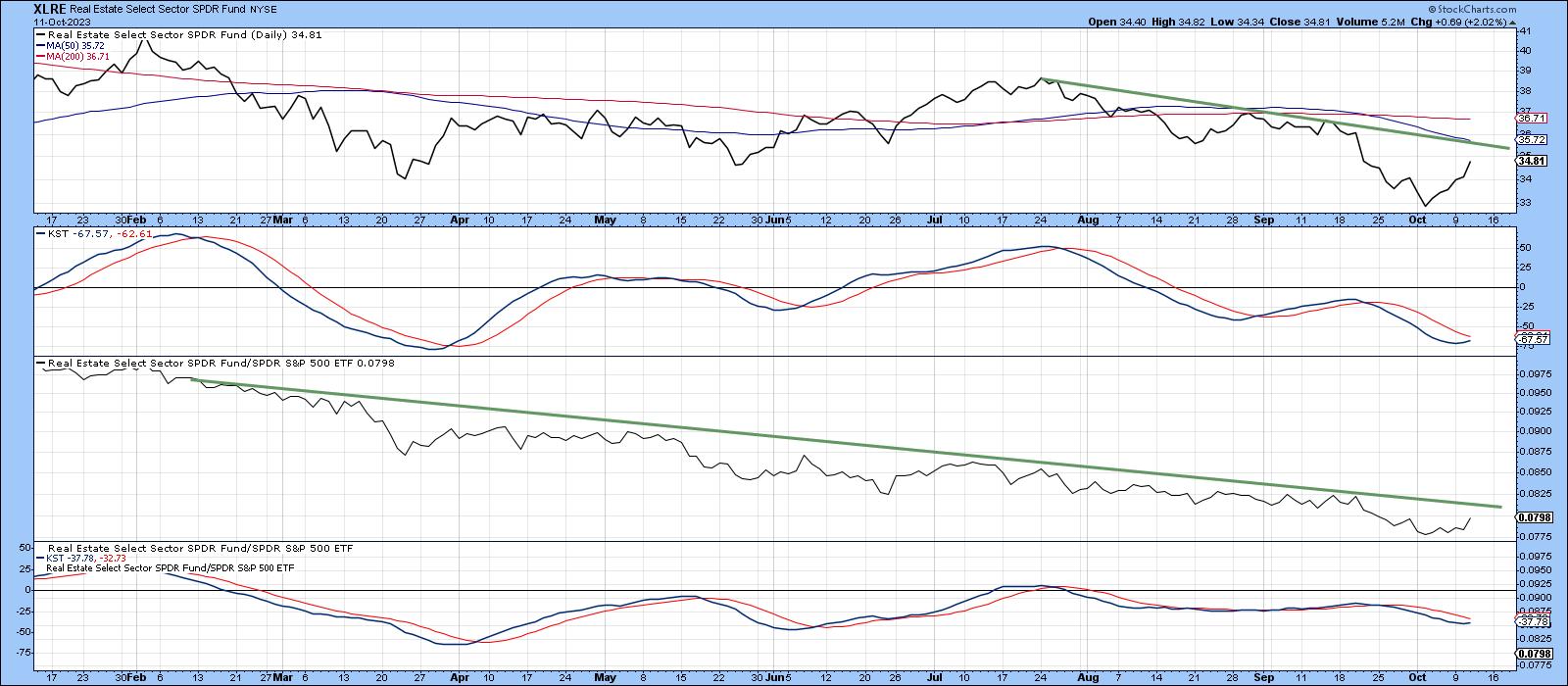

REITS Getting Ready to Rally, But What Happens After That?

by Martin Pring,

President, Pring Research

Several short-term charts suggest the SPDR Real Estate ETF (XLRE) is getting ready to rock and roll, thereby indicating an extension to this week's rebound is in the cards. It's possible that the expected rally could result in shifting some of the longer-term indicators towards a...

READ MORE

MEMBERS ONLY

When the Dollar Stops Going Up, Will These Markets Stop Going Down?

by Martin Pring,

President, Pring Research

The Dollar Index

I last wrote an article on the dollar in August, The Dollar Index Goes to Missouri. In it, I pointed out that the Index had reached crucial resistance, which, if surpassed, would signal a new primary bull market and a likely fourth up leg to the secular...

READ MORE

MEMBERS ONLY

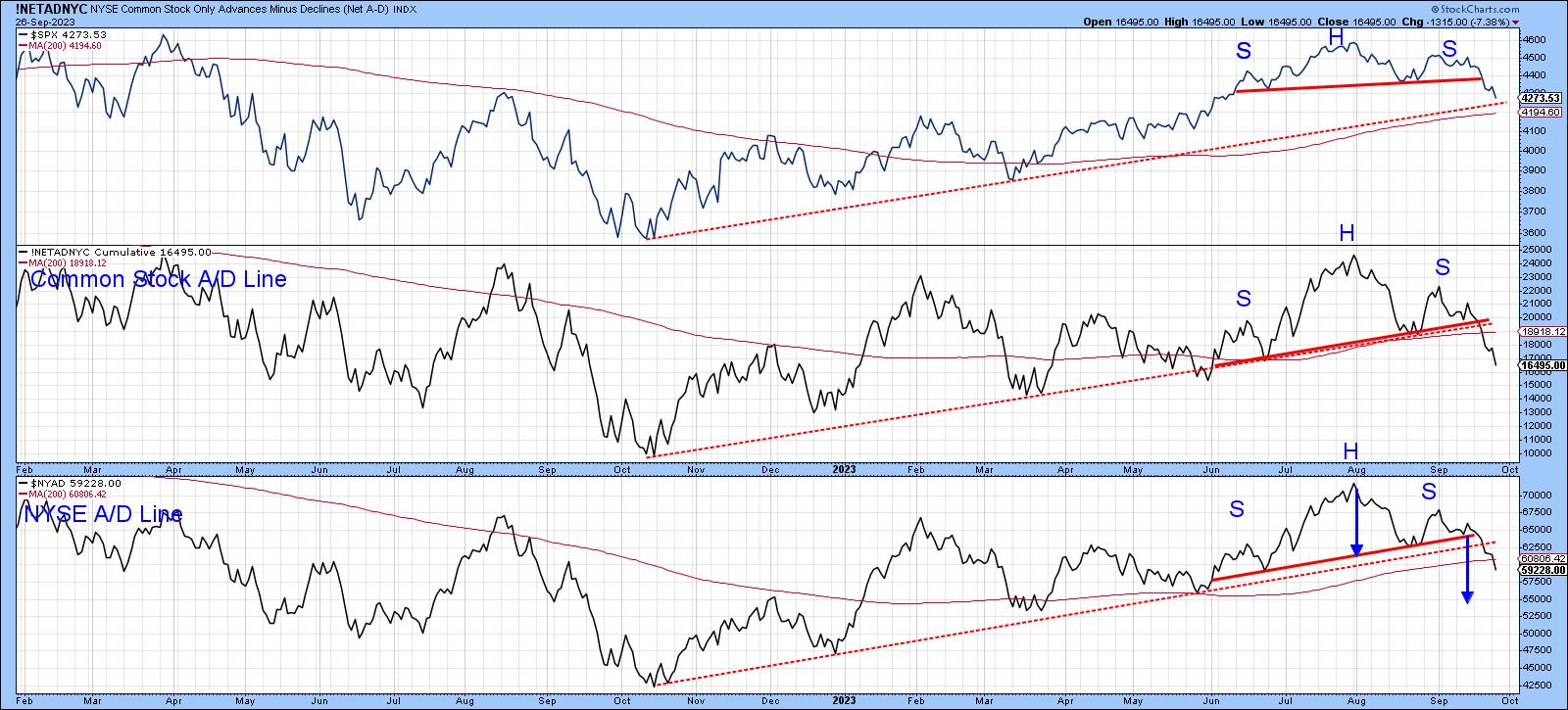

This Stock Market Looks Horrible... But...

by Martin Pring,

President, Pring Research

Chart 1 shows that the S&P Composite, like both A/D Lines, has completed and decisively broken down from a head-and-shoulders top. The two breadth indicators have also violated their bull market up trendlines. On the surface, things look pretty grim, with three seasonally weak September days left...

READ MORE

MEMBERS ONLY

Two Charts I'm Watching Closely for Potential Breakouts

by Martin Pring,

President, Pring Research

The title of this article should really be more in the vein of two technical situations I am watching, because the long-term forces look as if they may be converging with short-term ones to form a kind of potential bullish reverse domino effect. Let's consider our first candidate,...

READ MORE

MEMBERS ONLY

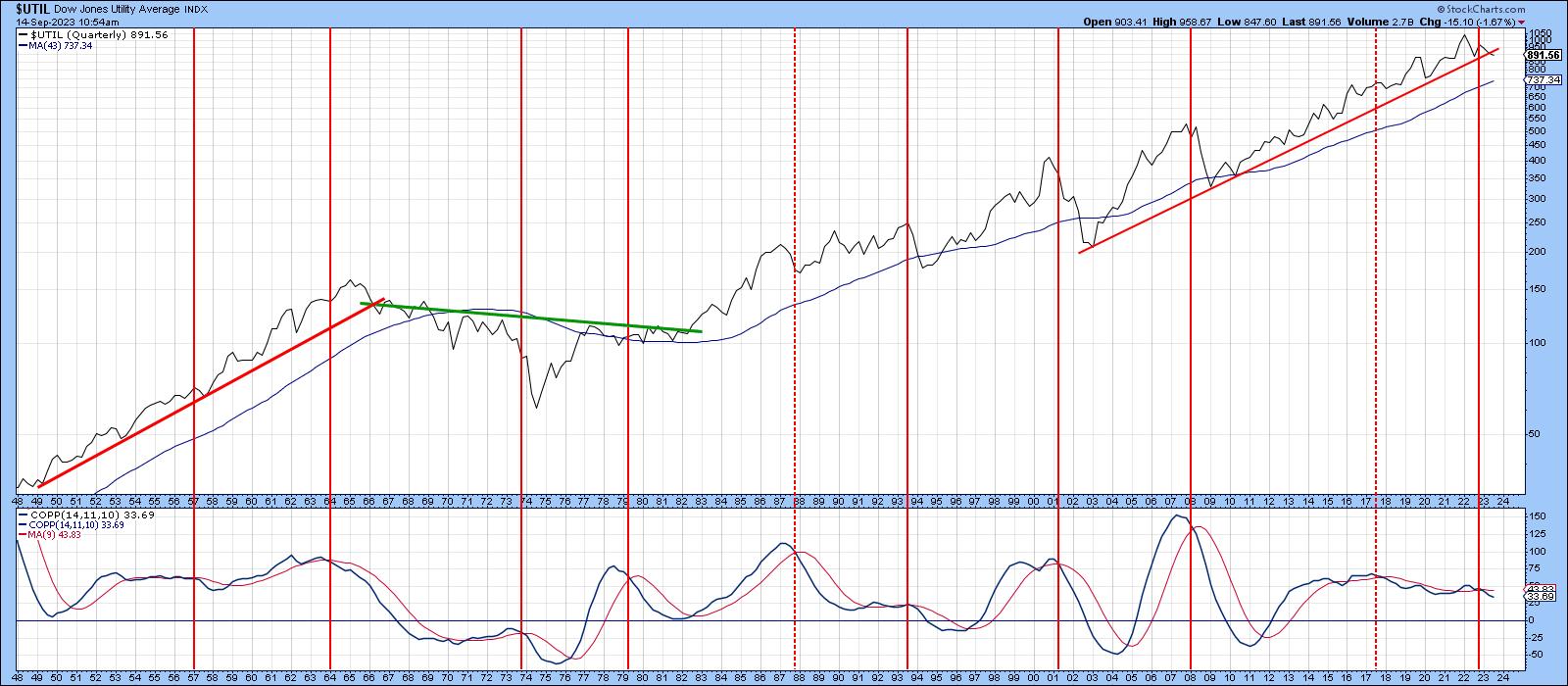

This Sector Looks Really Sick Long-Term

by Martin Pring,

President, Pring Research

The overall market has been rallying since registering its low last October. However, there is one sector which, in August, fell below its October low on a monthly closing basis. More serious is the fact that it recently violated a 23-year secular up trendline. Can you guess which sector I...

READ MORE

MEMBERS ONLY

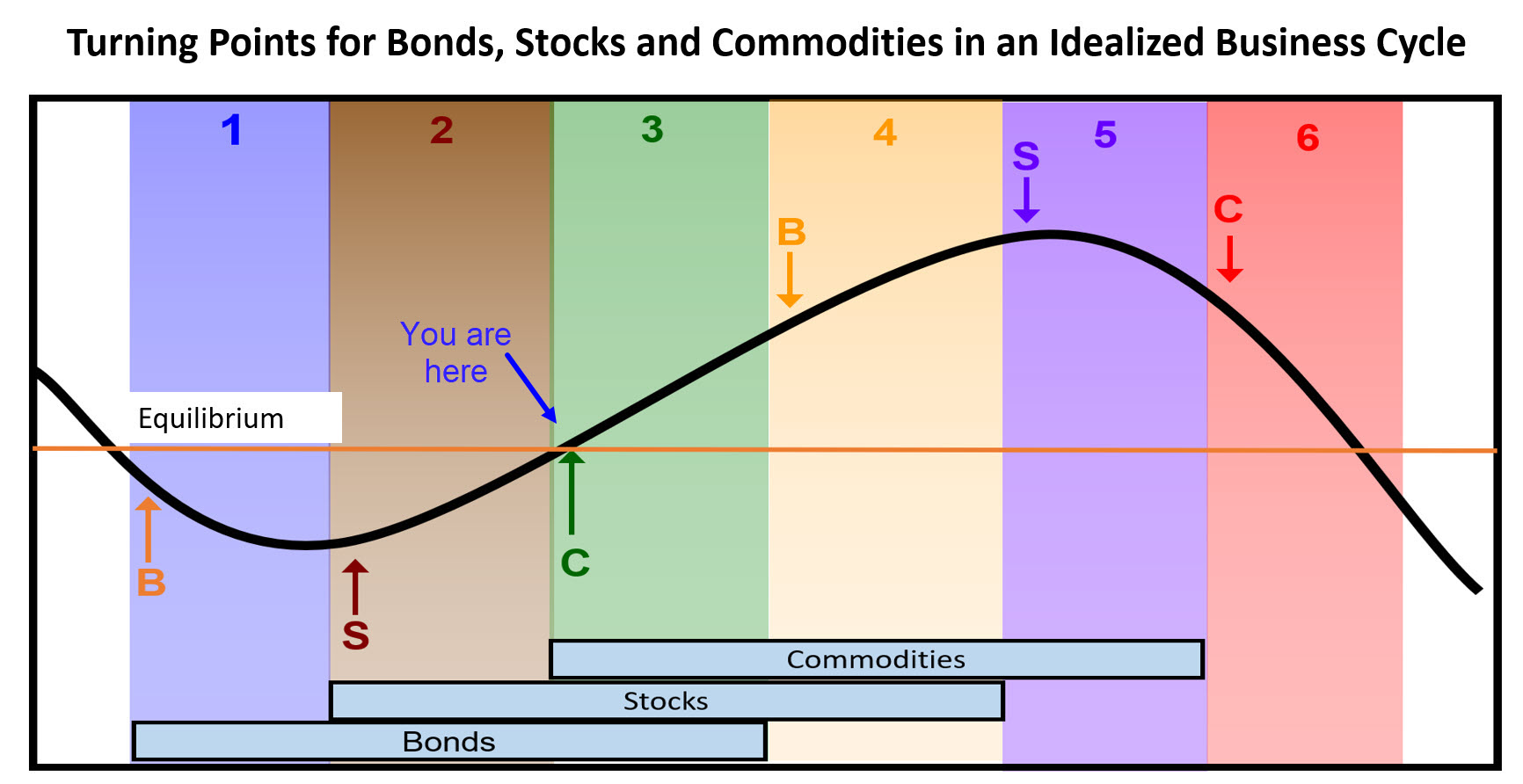

Some Investment Implications for Stage 3 of the Business Cycle

by Martin Pring,

President, Pring Research

The business cycle has been with us for as long as reliable financial records have been available, and that's at least 200 years. It may seem to be a mysterious force, but it is nothing more than a set sequence of chronological events that just keeps repeating. The...

READ MORE

MEMBERS ONLY

Positive Confidence Ratios Argue for Higher Stocks

by Martin Pring,

President, Pring Research

KEY TAKEAWAYS

* Comparing risky asskets with more conservative ones can reflect investor confidence

* Negative divergences offer subtle indications of a deterioration of a stock market rally

* An upward trend indicates that investor confidence is positive

Traders and investors pay a lot of attention to surveys to assess swings in sentiment,...

READ MORE

MEMBERS ONLY

The Dollar Index Goes to Missouri

by Martin Pring,

President, Pring Research

The Dollar Index has experienced a nice rally since mid-July and now reached important resistance. It's time to show us whether it can push through, thereby signaling an important extension to the recent advance. Before we examine that possibility, however, let's briefly take a step backwards...

READ MORE

MEMBERS ONLY

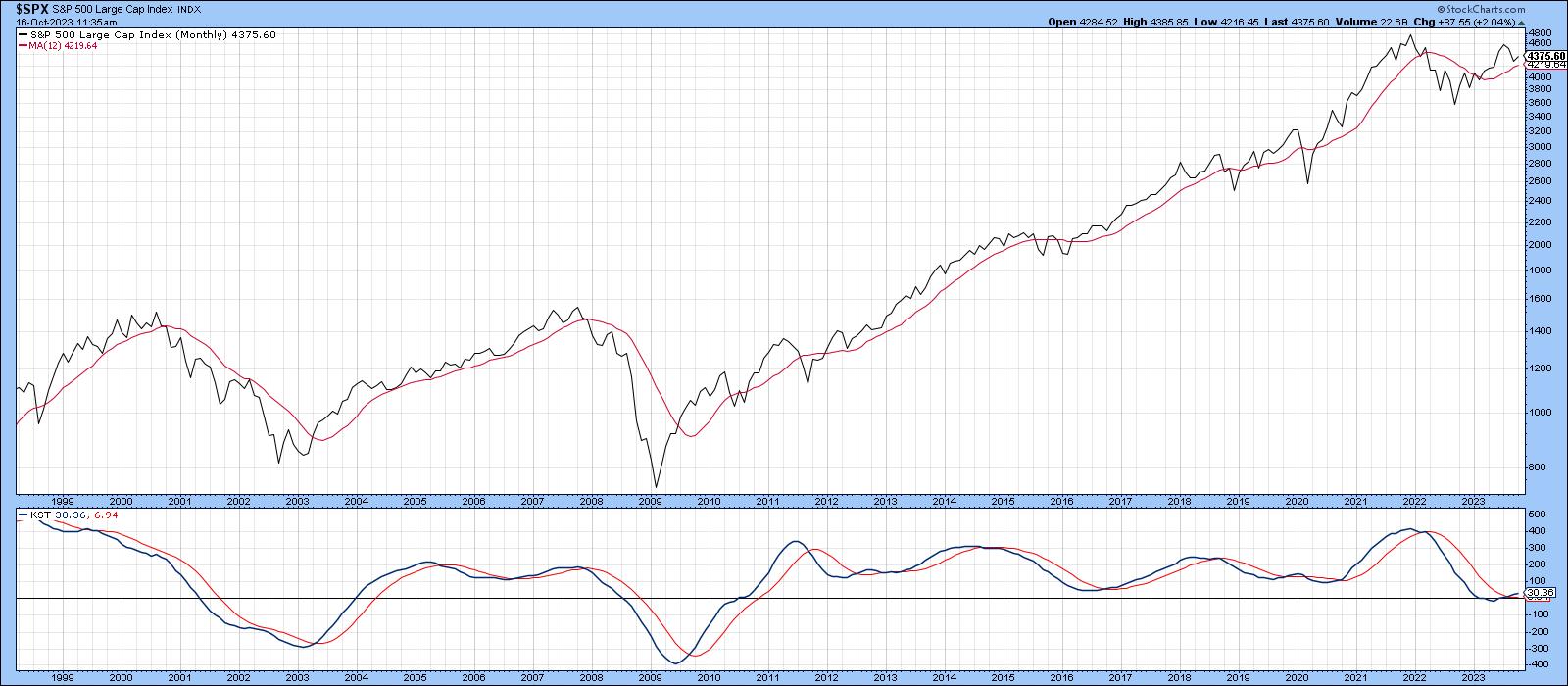

Is this a Normal Correction? Or Could It Be the Start of Something Much Bigger?

by Martin Pring,

President, Pring Research

The recent rise in interest rates and energy prices is certainly a cause for concern should these trends extend in any meaningful way over the next few months. After all, we are just about to enter September, which is seasonally the worst month of the year for stocks. Following that,...

READ MORE

MEMBERS ONLY

Will the Test of Last October's High for Bond Yields be Successful?

by Martin Pring,

President, Pring Research

The 30-year yield reached its high point last October and has been rangebound since December. Chart 1 shows that it began to break out of that trading range in late July, but has yet to succeed in taking out the October high. The 14-day RSI is currently correcting from an...

READ MORE

MEMBERS ONLY

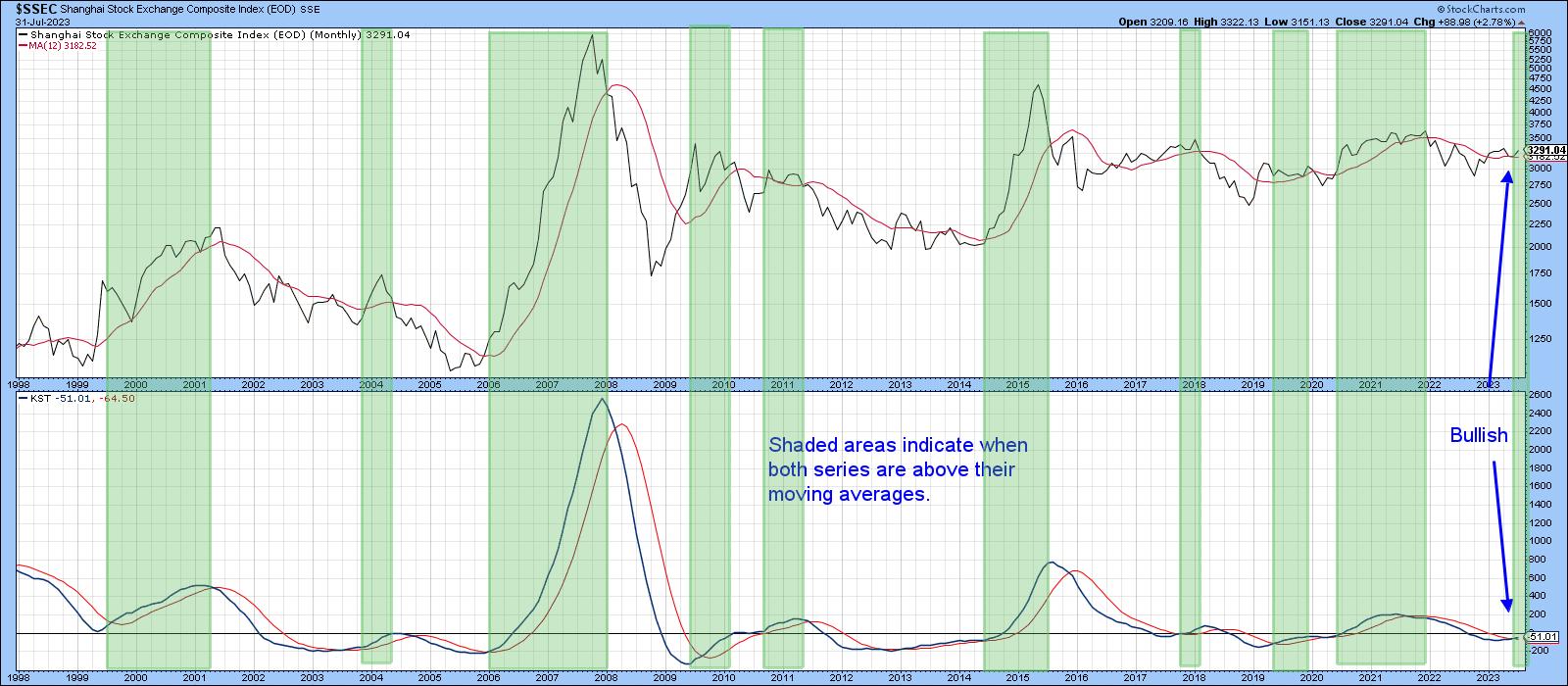

It's Time for These Chinese ETFs to Play Catch-Up

by Martin Pring,

President, Pring Research

There have recently been a lot of depressing stories concerning the state of the Chinese economy. Here are a spattering of headlines that appeared just today:

* China's Economic Recovery Weakens as Growth Concerns Linger (WSJ)

* China Manufacturing Keeps Shrinking, Weighing on Economic Recovery (Bloomberg)

* More Stimulus "Desperately...

READ MORE

MEMBERS ONLY

The Banking Crisis is Over... Or Is It?

by Martin Pring,

President, Pring Research

Last April, I wrote about the SVB (SVIB) banking crisis, using the KBW Regional Banking Index ($KRX) as a proxy, and suggested the price action in the right hand part of Chart 1 had the potential to be a double bottom formation. Double bottoms are characterized by heavy activity on...

READ MORE

MEMBERS ONLY

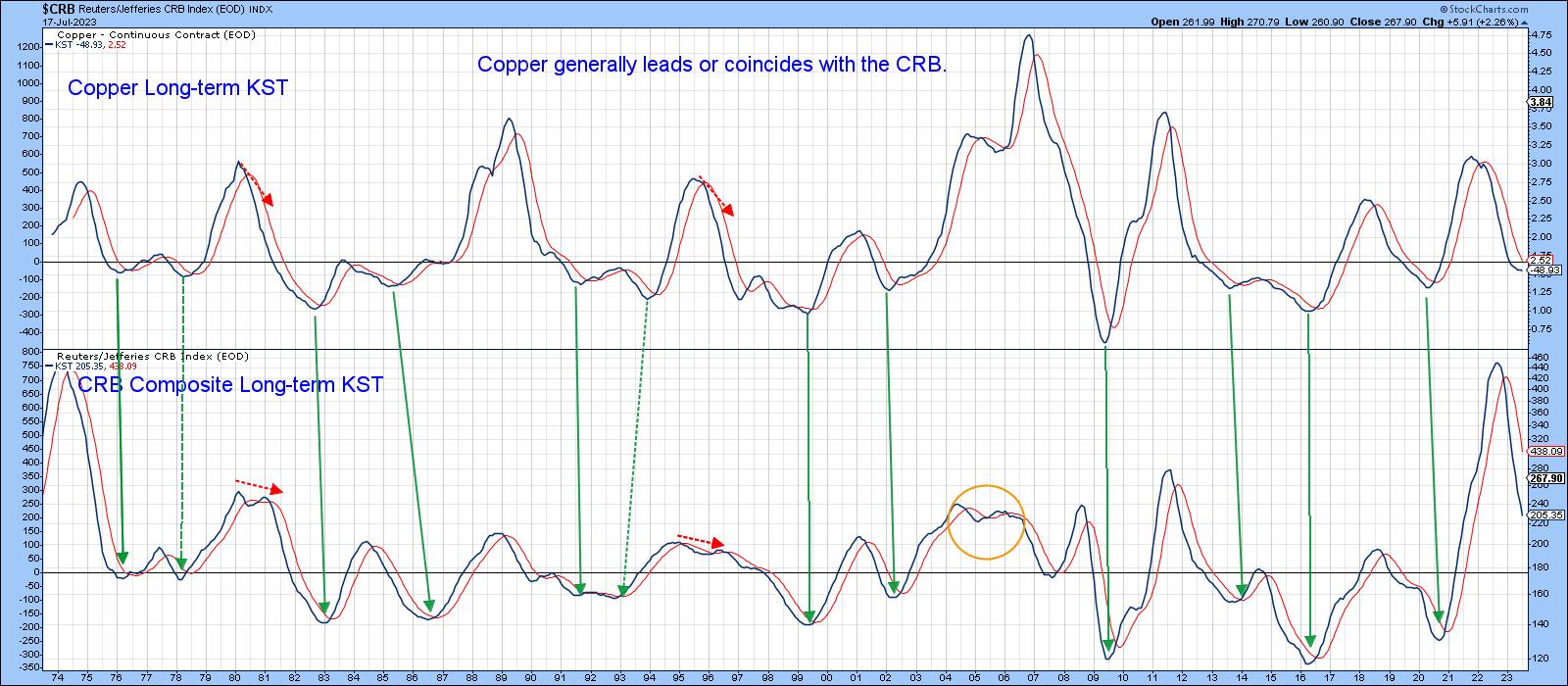

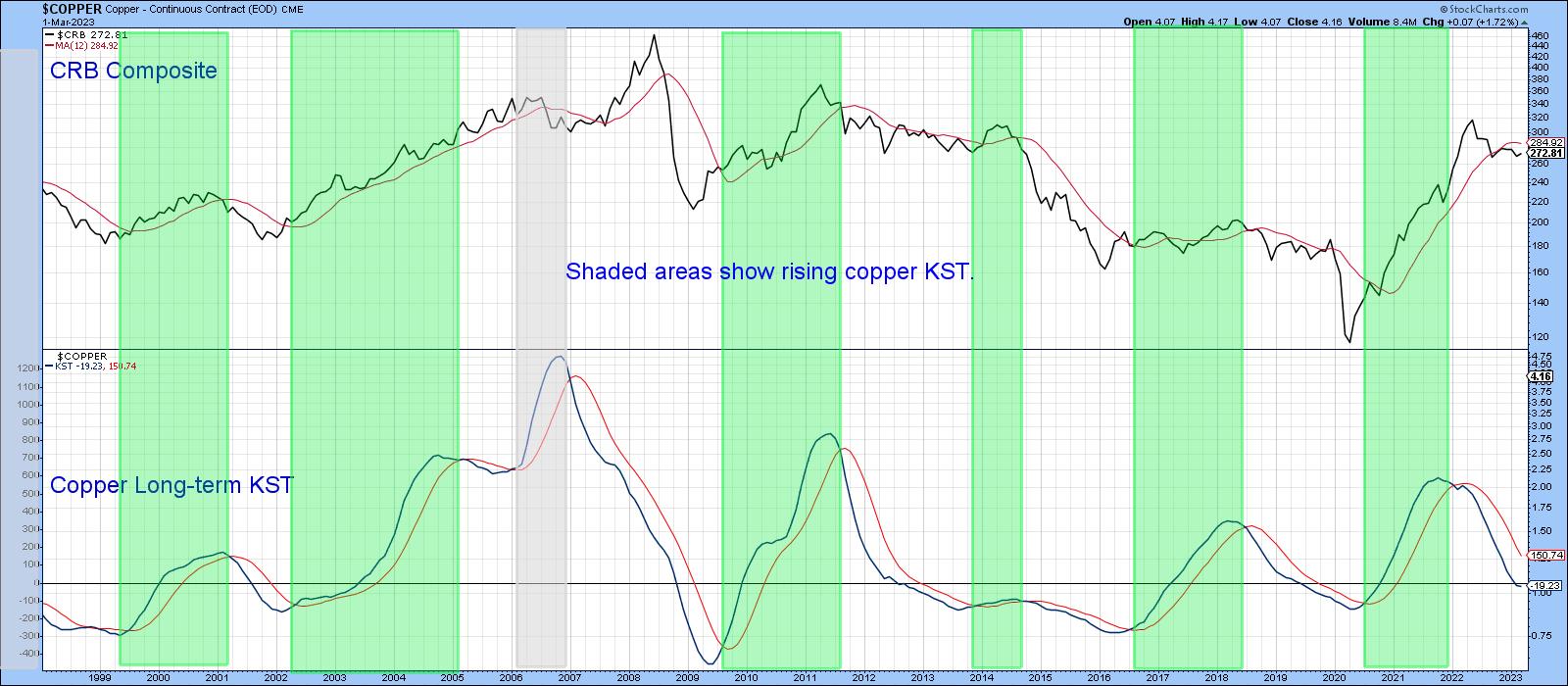

Taking a Deep Dive Into Dr. Copper and What it Means

by Martin Pring,

President, Pring Research

Last week, I pointed out that several indicators were close to triggering a bull market for commodities. Some of those benchmarks have since been met, but none have yet moved decisively in that direction. Now, it's time to take a deep dive into the copper price, as this...

READ MORE

MEMBERS ONLY

Commodities are in a Bear Market, But These Indicators Say That Could Soon Change

by Martin Pring,

President, Pring Research

I have been bearish on the primary trend of commodities for some time whilst still maintaining a bullish stance on their secular or very long-term trend. In other words, negative over a 9-month-to-2-year outlook, but constructive on a 10-to-20-year one. The secular aspect is important, because history shows primary bear...

READ MORE

MEMBERS ONLY

Why Rising Short Rates Could be Bullish for Stocks

by Martin Pring,

President, Pring Research

There has been a notable shift in expectations concerning rate hikes going forward, as several Fed spokesmen have floated the idea of additional hikes later in the year. Rising interest rates are generally seen as a negative factor for stocks, as they increase borrowing costs for companies, lowering their profitability...

READ MORE

MEMBERS ONLY

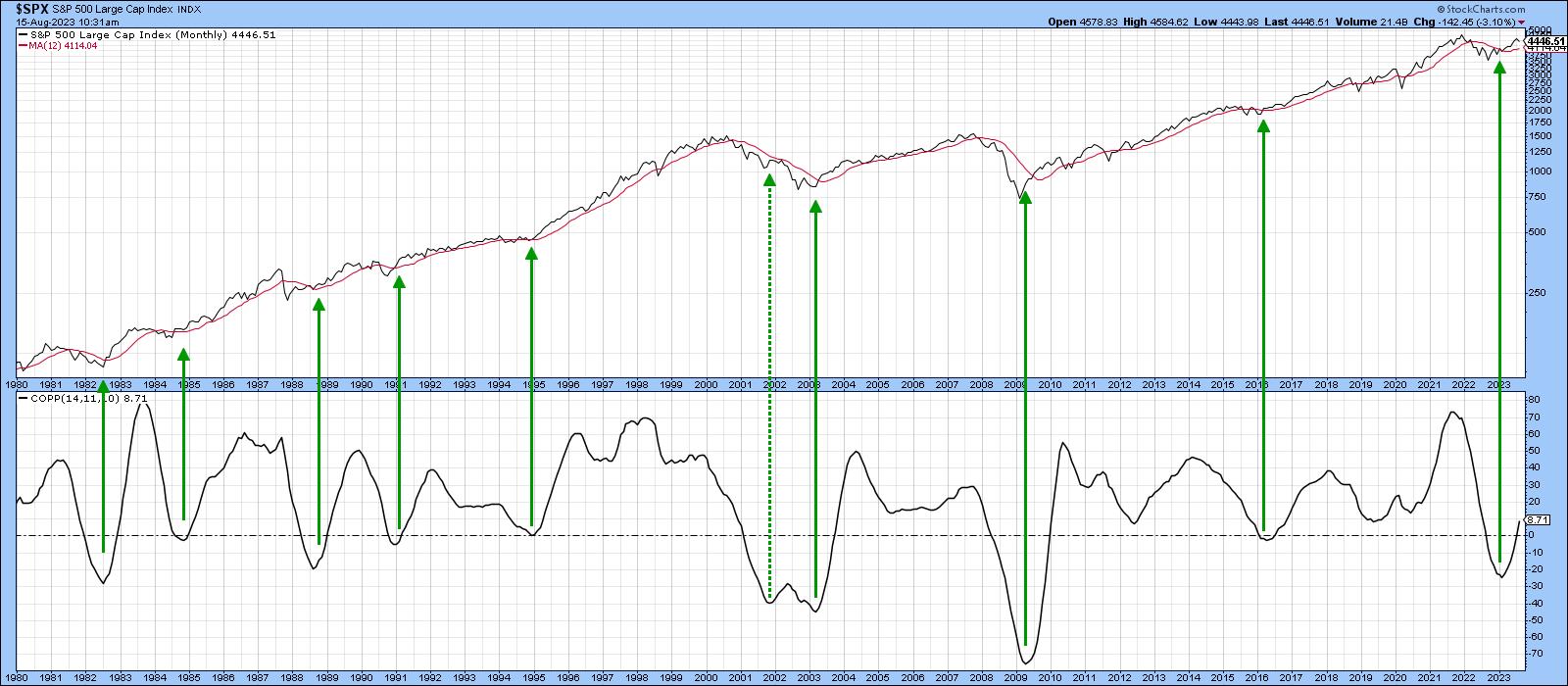

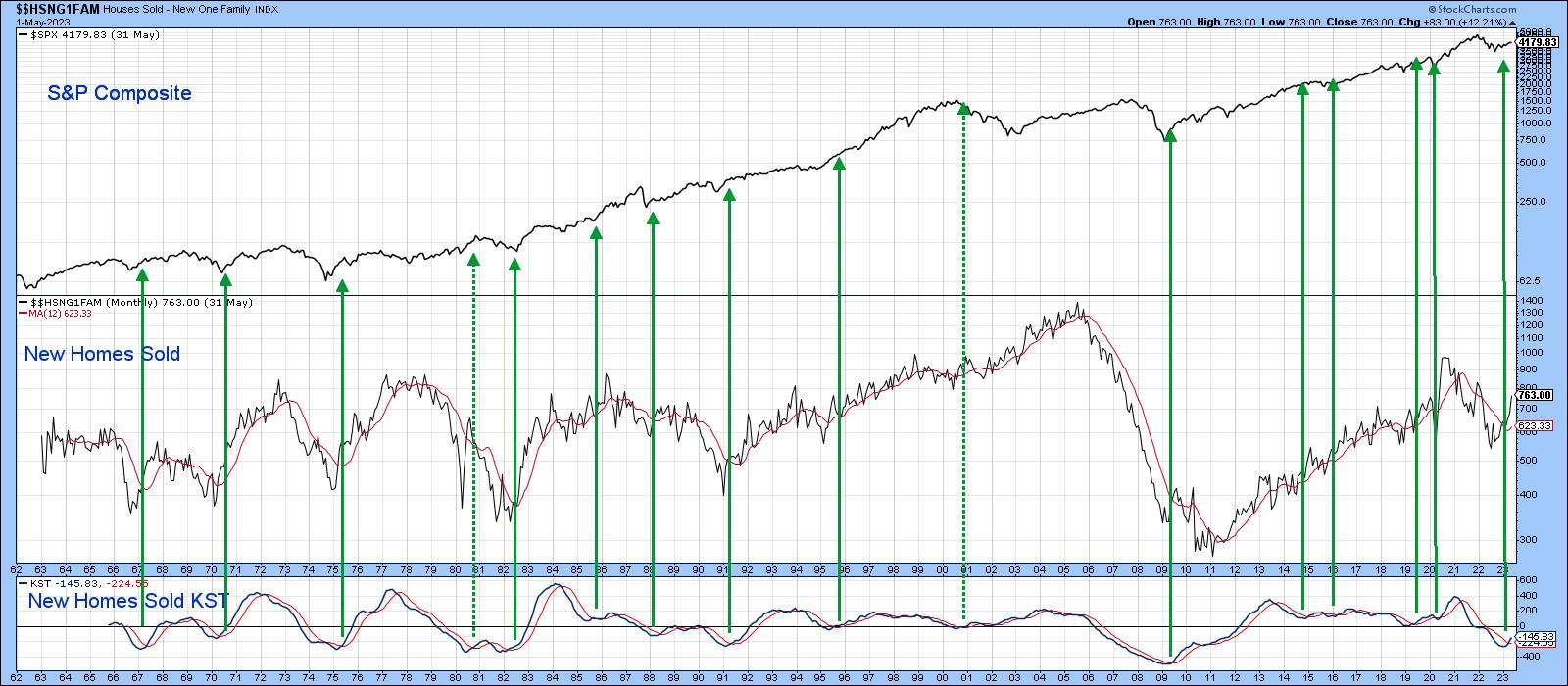

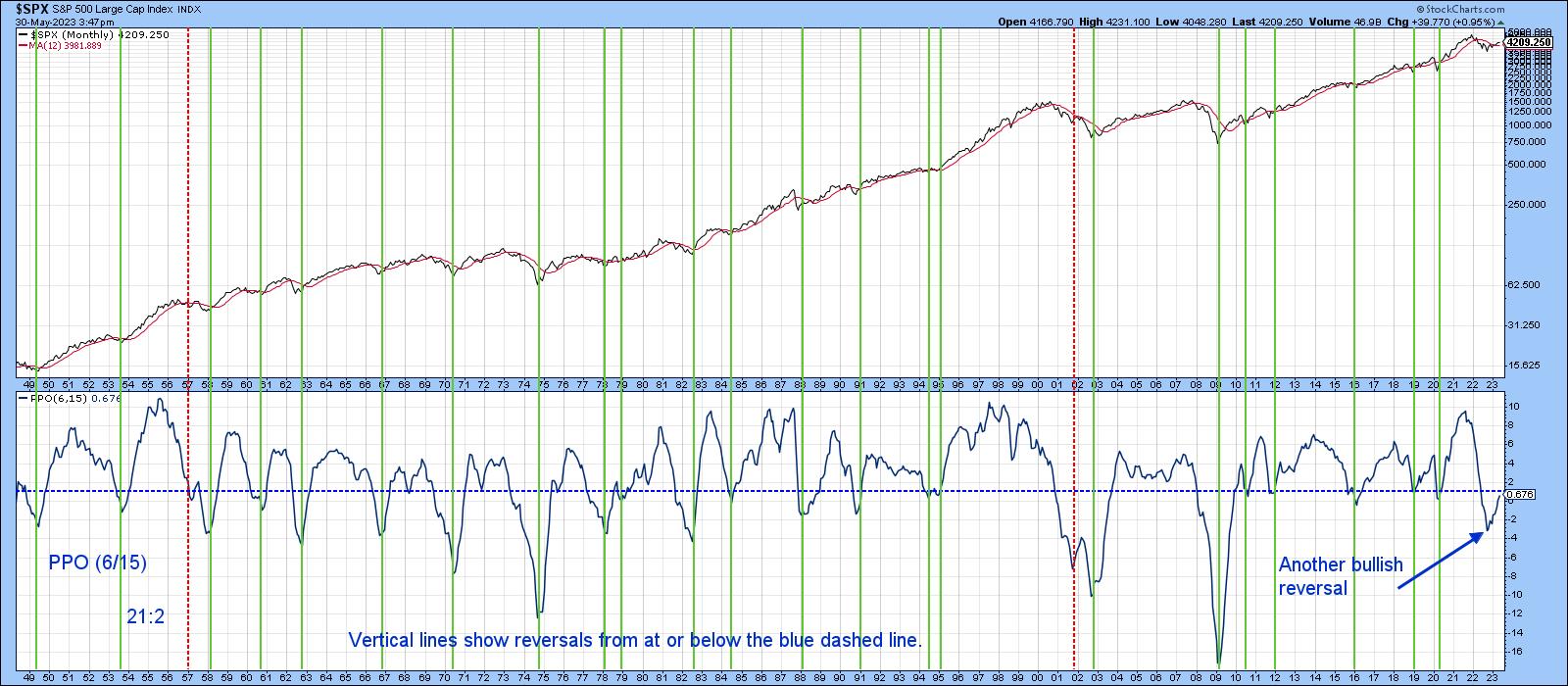

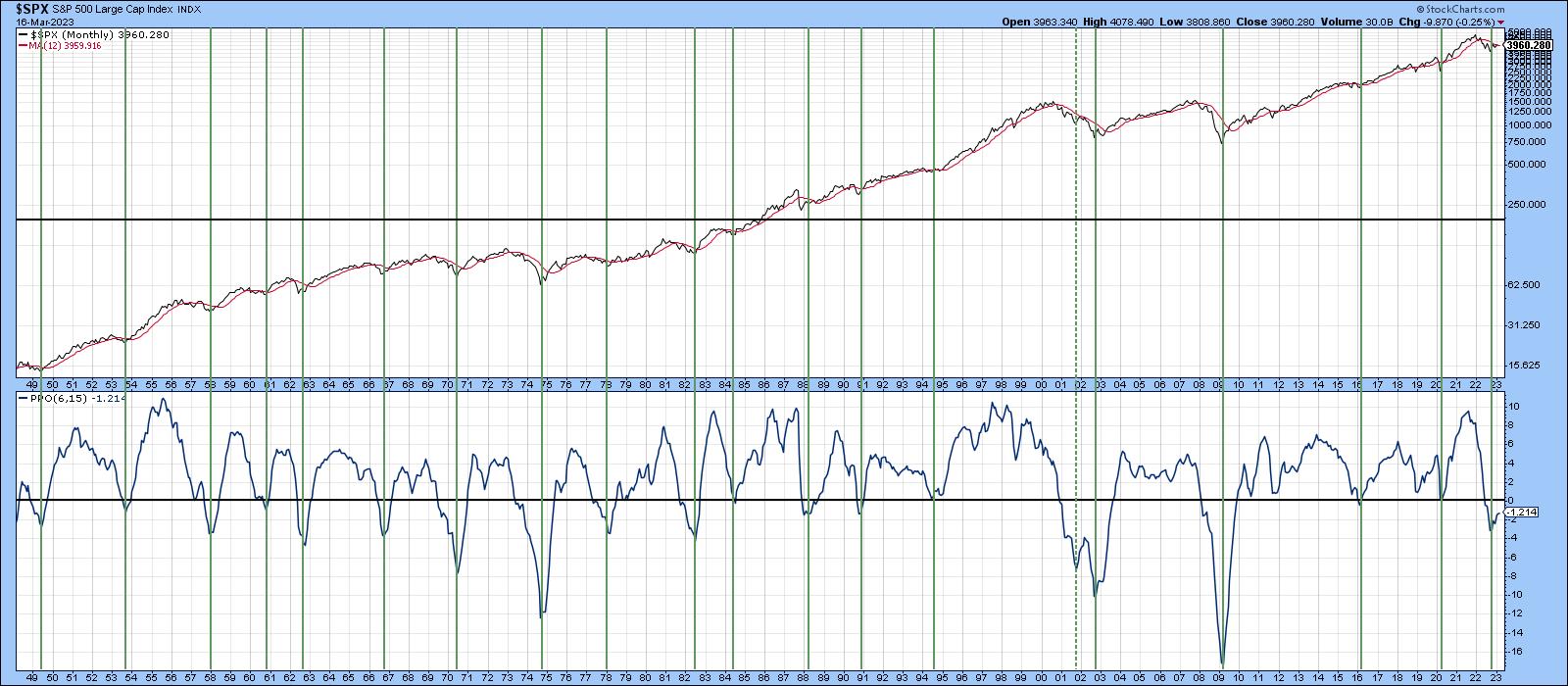

These Charts Explain Why Stocks Have Been Rallying Since October

by Martin Pring,

President, Pring Research

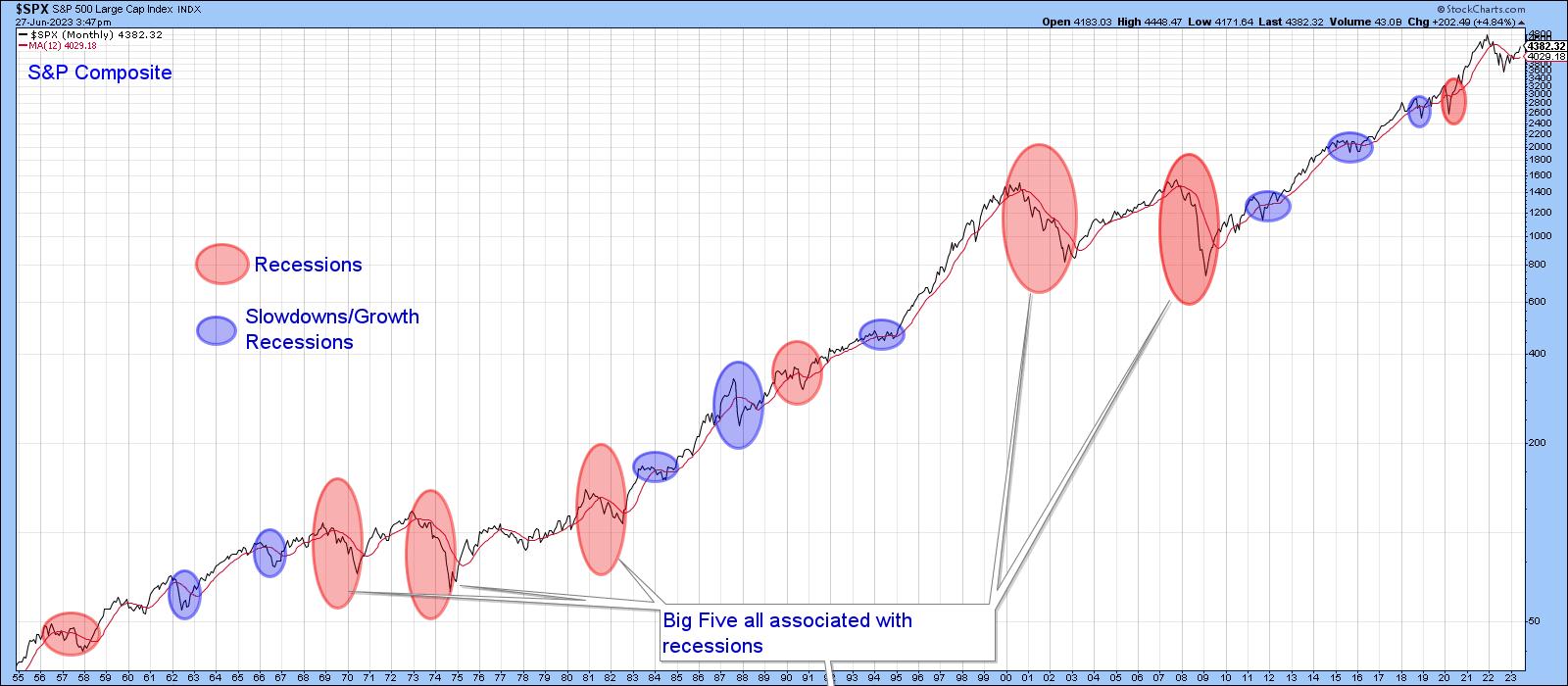

The ellipses in Chart 1 reflect economic events that have adversely affected the stock market since the 1950s. The pink ones reflect recessions, and those colored in blue indicate setbacks that anticipated economic slowdowns. Slowdowns develop when some economic sectors slip into recession, but that weakness is insufficient to push...

READ MORE

MEMBERS ONLY

Is the Tech Rally Overdone?

by Martin Pring,

President, Pring Research

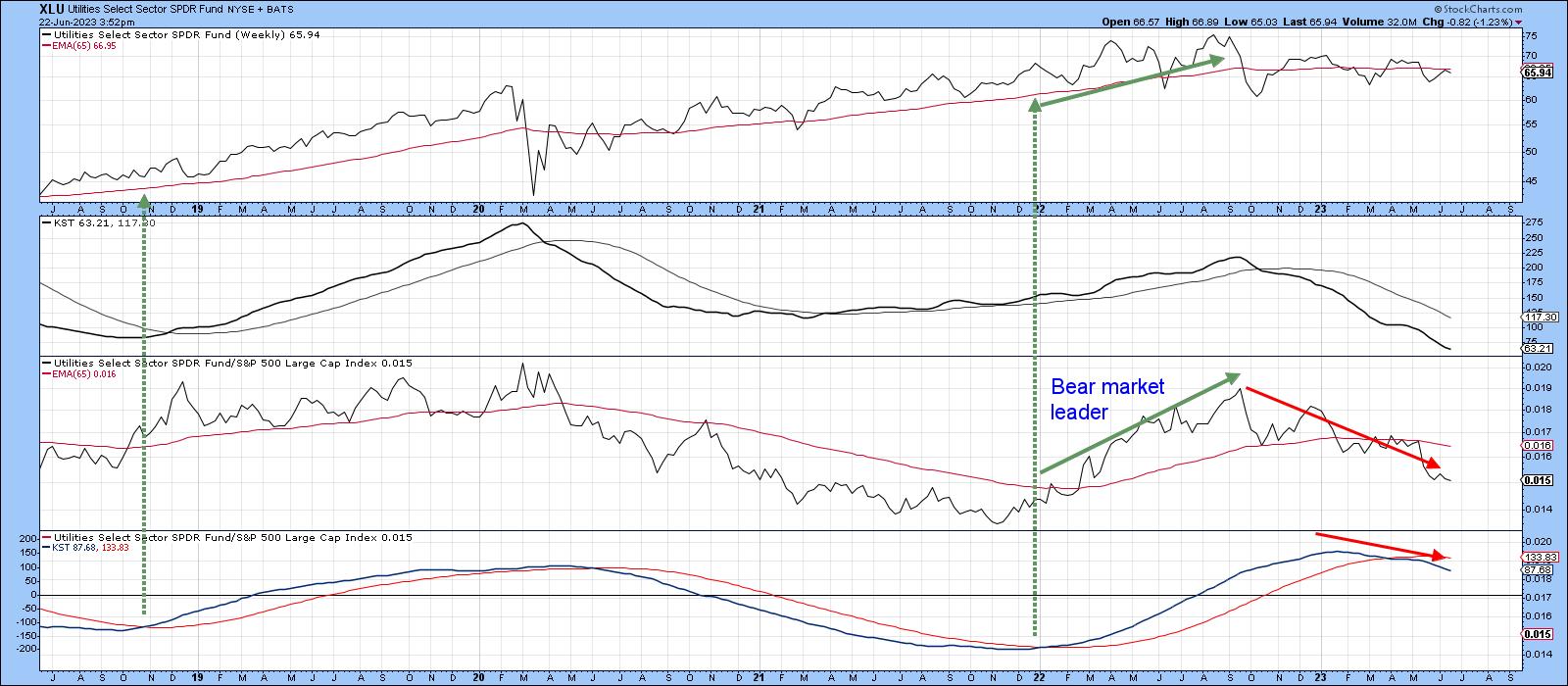

When the direction of the primary trend changes, it's usually because the business cycle is transitioning from a slowdown or recession to a recovery. That process usually results in a change in sector rotation, as defensive ones, such as utilities and consumer staples, come to the fore and...

READ MORE

MEMBERS ONLY

Can We Use Golf to Forecast Oil Prices?

by Martin Pring,

President, Pring Research

There used to be a rule of thumb on Wall Street that, whenever brokers upgraded to a new office after years of making do with smaller premises, it was the sign of market peak. Such behavior typically followed years of a bull market in which the investment houses had grown...

READ MORE

MEMBERS ONLY

Is Gold About to Explode or Crash?

by Martin Pring,

President, Pring Research

The price of gold was recently trading at an all-time monthly closing high. Since then, it has backed off, raising the question of whether that was "the" top or whether the subsequent short-term price decline represents a healthy digestion of previous price gains, which will serve as a...

READ MORE

MEMBERS ONLY

Perhaps It's Time for the Laggards to Catch Up?

by Martin Pring,

President, Pring Research

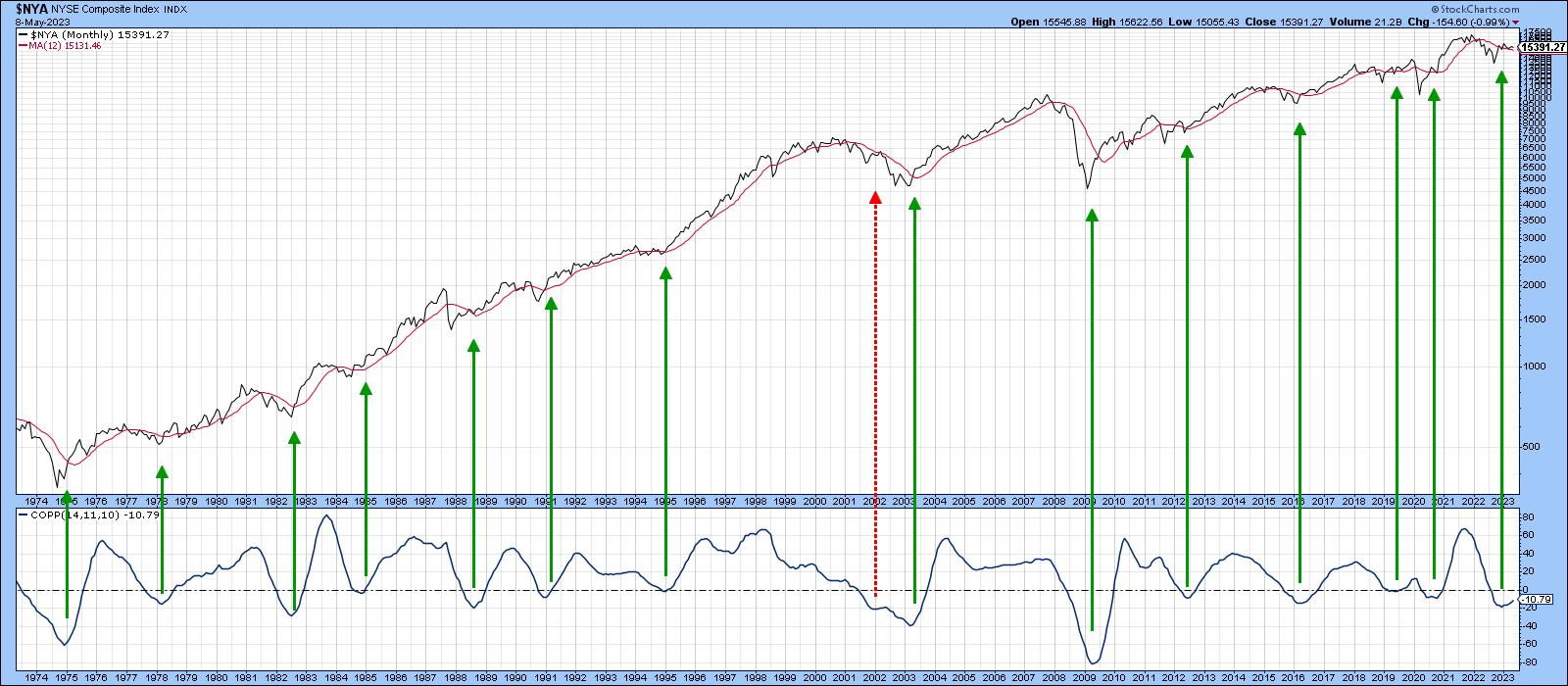

The recent strong performance by a few tech stocks has gained widespread attention, as has the disappointing market breadth. The result has been a soaring NASDAQ and a lagging NYSE Composite and Dow. Small cap stocks have also left a lot to be desired. The question is whether this divergence,...

READ MORE

MEMBERS ONLY

Does this Technology Rally Have Legs?

by Martin Pring,

President, Pring Research

In the last couple of months, we have seen a number of analysts and commentators point out that the current rally has been led by a handful of large-cap tech stocks and is therefore suspect. That observation suggests this week's extension to the advance is doomed. It'...

READ MORE

MEMBERS ONLY

The Long-term Trend of the US Dollar May Not Be as Bearish as You Think

by Martin Pring,

President, Pring Research

There has been a lot of talk recently about diversifying away from the dollar and it potentially losing its reserve status. The primary trend of the Dollar Index may be bearish, but the longer-term charts do not agree; they suggest that the dollar's death is greatly exaggerated. Let&...

READ MORE

MEMBERS ONLY

Could We See a Buy Signal for Stocks and Bonds Similar to 1982?

by Martin Pring,

President, Pring Research

The other day, I was looking at the charts of stocks, bonds, and gold and remembered that the lows of 1982 were preceded by a similar setup to what we see today. History rarely repeats exactly, and there are many differences between now and then. Still, I think it'...

READ MORE

MEMBERS ONLY

Europe and Japan to the Rescue?

by Martin Pring,

President, Pring Research

Most of the time, when looking at equity markets outside of the US, I focus on the various country ETFs, which are denominated in dollars rather than local currencies. In some ways, this limits my perspective, since currency fluctuations can change some of the outcomes--especially in countries experiencing a high...

READ MORE

MEMBERS ONLY

Three Charts I Am Watching Closely for a Verdict

by Martin Pring,

President, Pring Research

Charts have always fascinated me, so I plow through a lot of them in the course of a typical week. To me, breakouts hold a similar buzz as a striker scoring a great goal from the edge of the penalty box in soccer. To boot, I do not see any...

READ MORE

MEMBERS ONLY

What Are the Implications of Last Month's Gold Breakout for Commodities?

by Martin Pring,

President, Pring Research

Chart 1 below shows that, on a monthly close basis, gold broke out from a large consolidation formation in March. It has built on that move in the first part of April by moving slightly higher. The implication is obviously for higher gold prices, once the overbought condition laid out...

READ MORE

MEMBERS ONLY

Mr. Powell, Tear Down These Interest Rates

by Martin Pring,

President, Pring Research

These are not my words, but those of Mr. Market, who is doing his best to let the central bank know that rates are too high. Chart 1, for instance, compares the market-driven 5-year yield to that of the Effective Federal Funds. The dashed green arrows indicate that, in 2021,...

READ MORE

MEMBERS ONLY

Market Faces Key Test

by Martin Pring,

President, Pring Research

Global equities have risen for the last three weeks and now are at or just below key chart points. Chart 1, for instance, shows that the S&P 500 index ($SPX) is close to breaking above resistance in the form of its 2022–23 down trendline. In reality, that...

READ MORE

MEMBERS ONLY

Don't Let a Good Banking Crisis Go to Waste

by Martin Pring,

President, Pring Research

Remember the wall-to-wall coverage concerning the FTX crypto collapse? It's a great example of why conventional wisdom and groupthink are usually wrong.

The prevailing hysteria had most traders brainwashed into expecting further crypto collapses and price drops. The simple fact is that, the market had been anticipating trouble...

READ MORE

MEMBERS ONLY

Don't Be Surprised by a Pleasant Surprise

by Martin Pring,

President, Pring Research

In early February, I pointed out that five consistently correct long-term indicators had triggered primary bull trend buy signals. The article certainly did not represent good timing from a short-term point of view, as the market has been selling off ever since. Nevertheless, these indicators remain in the bullish camp....

READ MORE

MEMBERS ONLY

The Good News About SVB Bank They Are Not Telling You

by Martin Pring,

President, Pring Research

There is a well-known saying going around Wall Street that, when the Fed hits the brakes, someone inevitably crashes through the windscreen. That obviously applies to shareholders and directors of Silicon Valley Bank (SIVB), though depositors, following a nail-biting weekend, are apparently off the hook. It also warns the central...

READ MORE

MEMBERS ONLY

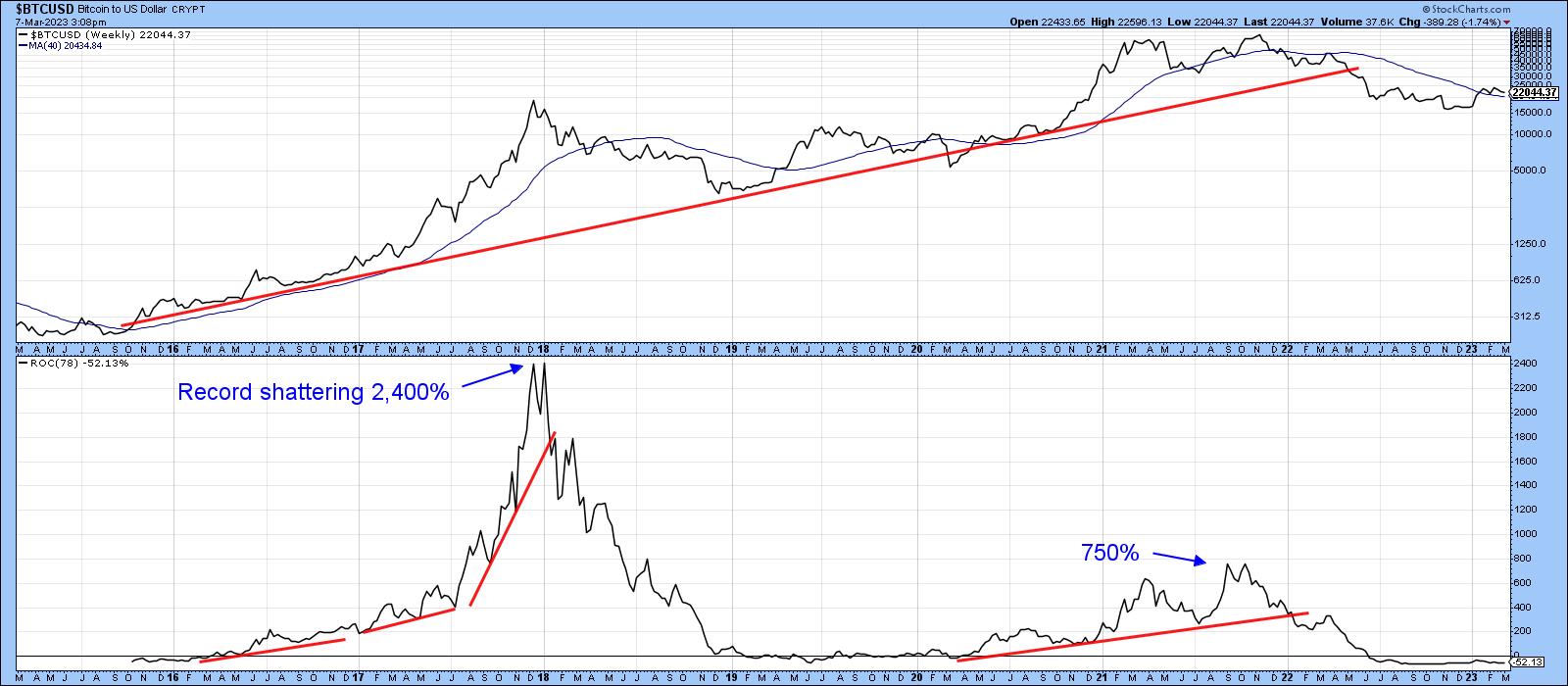

Is Bitcoin Ready for Prime Time Again?

by Martin Pring,

President, Pring Research

Last May, I wrote an article entitled "Bitcoin Bubble Finally Bursts", where I laid out the technical case for substantially lower prices. It was partially based on the fact that the 18-month ROC had peaked from a level in excess of 200%. My research, featuring 26 case studies...

READ MORE

MEMBERS ONLY

The Trend of This Metal Could Have Immense Consequences if It Breaks Out

by Martin Pring,

President, Pring Research

Commodity prices are an imperfect but useful forecaster of consumer price inflation. A key secular trend indicator that I use for industrial commodity prices went bullish last year. Since then, prices have corrected. However, it makes sense to take the pulse of the commodity markets from time to time, in...

READ MORE

MEMBERS ONLY

These Four "Basket Cases" Have Great Looking Charts

by Martin Pring,

President, Pring Research

We are all aware of the investment principle that it's time to buy when the news is blackest. Even knowing this, it's always difficult to step up and click on that buy button, because the problems seem unsolvable. Moreover, how do we know for sure that...

READ MORE

MEMBERS ONLY

Trying to Unravel the Enigma of the US Dollar

by Martin Pring,

President, Pring Research

The US Dollar Index ($USD) has taken a hit in the last few months, causing many commentators to cry "bear market." However, an examination of the long-term indicators doesn't indicate a consensus pointing in a southerly direction. Neither is there unanimity that the recent setback represents...

READ MORE