MEMBERS ONLY

Momentum for This Interasset Relationship Just Reversed. What Are the Implications?

by Martin Pring,

President, Pring Research

Every business cycle has an inflationary and deflationary part to it. And if you know the prevailing phase, it can be enormously helpful. For example, when inflation is dominating, it's usually a favorable environment for commodities and commodity defensive sectors, such as mining and energy. At such times,...

READ MORE

MEMBERS ONLY

These Five Long-Term Indicators Are Signaling a Bull Market

by Martin Pring,

President, Pring Research

I have been negative on the market for some time. I believe that it's a wiser policy to wait for the long-term indicators to turn bullish, rather than trying to capture every twist and turn of those bear market rallies, pregnant as they are, with false breakouts and...

READ MORE

MEMBERS ONLY

Fourteen-Year Trend Favoring Relative Action of U.S. Equities May Be Over

by Martin Pring,

President, Pring Research

From the financial crisis in 2008 until October of last year, the U.S. stock market handsomely outperformed the Dow Jones Global Index ($DJW). However, recent price action suggests that this relationship may be about to change.

Stated more accurately, U.S. relative performance may have peaked last October, just...

READ MORE

MEMBERS ONLY

Selecting Sectors Using the Nirvana ChartStyle

by Martin Pring,

President, Pring Research

In the last couple of weeks, I've had a couple of conversations with clients asking how I go about selecting promising sectors, even when not much excites me at the moment.

To start with, I'm a believer in the principle that the character of short-term moves—...

READ MORE

MEMBERS ONLY

A Tale of Two Indexes

by Martin Pring,

President, Pring Research

Most of the time, the major indexes move in tandem. Occasionally, they'll throw up positive and negative divergences that technical analysts can use to better identify important trend reversals. Today, we will look at two market averages whose 2022 price action has resulted in completely different potential chart...

READ MORE

MEMBERS ONLY

Tesla's Bear Market Low: Are We There Yet?

by Martin Pring,

President, Pring Research

I don't usually get into individual stocks, but, back in August, I found Tesla's price action to be quite interesting. That's because I felt the stock, along with its fearless leader Elon Musk, were important icons of the 2020–2022 phase of the post-financial...

READ MORE

MEMBERS ONLY

Santa Comes Up Empty-Handed

by Martin Pring,

President, Pring Research

Statistically speaking, the last half of December is the best seasonal period of the year, part of which serves as what is popularly known as the Santa Claus rally. The first half of the month also has a slight edge to the upside, though that has not worked out so...

READ MORE

MEMBERS ONLY

The Business Cycle Is Poised for a Stage 1 Signal

by Martin Pring,

President, Pring Research

One of my favorite chart lists is one called Interasset Ratios. As the name implies, it contains a library of charts that plot various long-term relationships between asset classes, such as the stock/bond ratio, bond/commodity relationship, and so forth. It's not something you want to focus...

READ MORE

MEMBERS ONLY

Is Gold a Buy or a Sell?

by Martin Pring,

President, Pring Research

The price of gold has been on a tear recently, bouncing sharply from its October low. It could be a good time to see whether this is the start of a new bull market or just a flash in the pan. Let's begin with the big picture and...

READ MORE

MEMBERS ONLY

Three Indicators that Call Bear Market Bottoms Were AWOL at the October Lows

by Martin Pring,

President, Pring Research

To many, October represents the low for the 2022 bear market and what we are seeing today is the first leg of a new bull trend. After all, interest rates have probably peaked, inflation is dying, supply chain problems are over and so is the pandemic.

Looking Closely at the...

READ MORE

MEMBERS ONLY

What Does the Wall-to-Wall Media Coverage of the FTX Collapse Mean?

by Martin Pring,

President, Pring Research

Last May, I wrote an article entitled "Bitcoin Bubble Finally Bursts", where I laid out the technical case for substantially lower prices. It was partially based on the fact that the 18-month ROC had peaked from a level in excess of 200%. My research, featuring 26 case studies...

READ MORE

MEMBERS ONLY

Weakening Dollar Unleashes Non-U.S. Markets, or Does It?

by Martin Pring,

President, Pring Research

Last week, I wrote that the dollar and commodities were poised at inflection pointsand we should be on the lookout for an important move in both.

The U.S. Dollar Index ($USD) obliged with the completion of a head-and-shoulders top, as shown in chart 1. It's clearly overstretched...

READ MORE

MEMBERS ONLY

Dollar and Commodities Poised at Possible Inflection Points

by Martin Pring,

President, Pring Research

The Dollar Index has had a good run to the upside, but is starting to show some possible signs of fatigue. That potential weakness could take the form of an actual reversal in its primary uptrend, or an intermediate counter-correction. At the same time, commodities, which often (but certainly not...

READ MORE

MEMBERS ONLY

Signs the Bear Market Rally May Be Over

by Martin Pring,

President, Pring Research

Last time I reviewed the stock market, many of the Indexes had just experienced a bullish outside bar (see chart for the DIA). Since several of the oscillators had reached oversold readings, the idea of a rally seemed appropriate. By the same token, its important to remember that there is...

READ MORE

MEMBERS ONLY

Which Country ETFs Can Lead Us Out of the Bear Market and Which Ones Could Drag Us Deeper In?

by Martin Pring,

President, Pring Research

When I am looking at a downtrend of a specific market that has been in existence for a while, I often ask myself which components might be on the verge of an upside breakout and could therefore lead it higher. Conversely, I have to ask if there are any downside...

READ MORE

MEMBERS ONLY

Sectors to Avoid if the Market Declines and Worth Consideration if it Rallies

by Martin Pring,

President, Pring Research

Last week, I suggested that some unusually bullish outside bars, in conjunction with positive short-term momentum and a favorable seasonal going into year-end, could trigger a worthwhile rally. That does not make me wildly bullish, because I still think we are in a bear market. When my long-term indicators turn,...

READ MORE

MEMBERS ONLY

Giant Outside Days Spook the Bears

by Martin Pring,

President, Pring Research

Thursday's price action began bearishly with the probing of recent bear market lows. By the end of the session, the DJIA, along with several other markets, totally encompassed Tuesday's trading range and then some, in a one-day pattern known as an "outside day". To...

READ MORE

MEMBERS ONLY

The Oil Price Gets Resuscitated: Is it Enough to Keep the Bull Market Alive?

by Martin Pring,

President, Pring Research

Just when it seemed that oil was peaking, OPEC breathed new life into the commodity this week by threatening a sizeable production cut. That does not change the overextended nature of the longer-term indicators. Nevertheless, it does hint that oil prices and their related stocks may be on the verge...

READ MORE

MEMBERS ONLY

Inflation is All the Rage, but Many Market Signals are Pointing in a Different Direction

by Martin Pring,

President, Pring Research

Polls show that the number one issue with voters is inflation, but some intermarket relationships are signaling otherwise. I am not saying that inflation is about to be wrestled to the ground, but it goes in waves, as you can see from Chart 1. Also, once prices go up, they...

READ MORE

MEMBERS ONLY

This Chart Says the June Lows Will Not Hold

by Martin Pring,

President, Pring Research

The relationship between the stock market and money market interest rates is as old as the hills. The "hills," in this case, go back to 1900 and before.

The concept rests on the idea that, at the beginning of the cycle, when the economy is falling like a...

READ MORE

MEMBERS ONLY

Bearish Weekly Dollar Candles May Help Change the Energy Inflation Dynamic

by Martin Pring,

President, Pring Research

It is a well-established fact that the dollar and oil prices move in opposite directions, most of the time. Perhaps a more accurate way of saying the same thing is to observe that a rising dollar acts as a headwind for energy prices, while a falling one acts a tailwind...

READ MORE

MEMBERS ONLY

Preparing for an Upcoming Bond Mini-Bull Market

by Martin Pring,

President, Pring Research

This may seem like a foolish title, given that the Fed could be about to raise short-term interest rates by as much as 75 basis points in September with further, but smaller, hikes following that. However, bonds revolve around the business cycle in a chronological sequence, as do stocks and...

READ MORE

MEMBERS ONLY

The Direction of the Secular Trend Will Determine Whether the June Low Holds

by Martin Pring,

President, Pring Research

The big daddy of all market trends is the secular or very long-term one, and it's about to have a big influence as to whether the June low will hold, meaning prices are about to reach new all-time highs, or if we are going to return to a...

READ MORE

MEMBERS ONLY

Energy Gets a New Lease on Life

by Martin Pring,

President, Pring Research

Back in June, I wrote an article entitled Are Commodities Losing their Mojo?It drew attention to the fact that some long-term indicators were pointing to at least a temporarypull-back in prices. That process is already underway, but the article also pointed out that energy usually lags other industrial commodity...

READ MORE

MEMBERS ONLY

Dollar Bull Market Due for an Intermediate Correction, But It's Not an Easy Call

by Martin Pring,

President, Pring Research

It's a Primary Bull Market for the Dollar

Chart 1 shows that the US Dollar Index is very much in a primary bull market, having violated a (dashed) secular down trendline a few months ago and, more recently, completed a 7-year rectangle formation. The green-shaded areas identify those...

READ MORE

MEMBERS ONLY

Good Inflation News is Helping Stocks Move Through Resistance -- But is It Enough?

by Martin Pring,

President, Pring Research

The summer rally has enabled several indexes to push through important resistance, but, since there was a lot of backing and filling at higher levels earlier this year, there are several places where even more resistance is apparent.

If you want to be bullish, for instance, take a look at...

READ MORE

MEMBERS ONLY

Indexes Back to Their Breakdown Points; Should We Pop the Champagne If They Go Through?

by Martin Pring,

President, Pring Research

The rally since mid-June has taken several indexes back to their extended breakdown trendlines, which mark one demarcation point between bull and bear. Chart 1, for instance shows that the NASDAQ completed a top in May and then followed through with further weakness. By mid-June, the Index found a bottom...

READ MORE

MEMBERS ONLY

The Truth About Recessions

by Martin Pring,

President, Pring Research

This week, we diverge from our normal chart talk to focus on the economy, as the word "recession" is now on virtually every one's lips, provoked by a lot of misinformation.

First, there seems to be a general understanding in the media that the definition of...

READ MORE

MEMBERS ONLY

Housing Data Disappoints, But Housing ETFs Rally

by Martin Pring,

President, Pring Research

Due to its sensitivity to interest rates, housing has the greatest average lead time going into recessions than any other economic (as opposed to financial) indicator. For that reason alone, it is worth examining amid the constant talk of recession.

The HMI vs. Housing Starts

Earlier this week, two important...

READ MORE

MEMBERS ONLY

Will the Bond Market Surprise Us?

by Martin Pring,

President, Pring Research

In late April, I wrote that bond yields had run into resistance and a pause in the on-going uptrend was likely. Yields on longer-dated maturities initially moved slightly higher, but are now at approximately the same level as that April article. However, more corrective activity appears likely, as commodities (e....

READ MORE

MEMBERS ONLY

Credit Spreads May be the Canary in the Financial Mine

by Martin Pring,

President, Pring Research

Waterfall declines leading to capitulation are easy to observe and understand when we have the benefit of hindsight. However, they are almost impossible to identify ahead of time.

One characteristic often associated with such uncomfortable price moves is an unexpected weakening of economic activity, where confidence literally falls off a...

READ MORE

MEMBERS ONLY

The Rally Since Mid-June Leaves a Lot to be Desired

by Martin Pring,

President, Pring Research

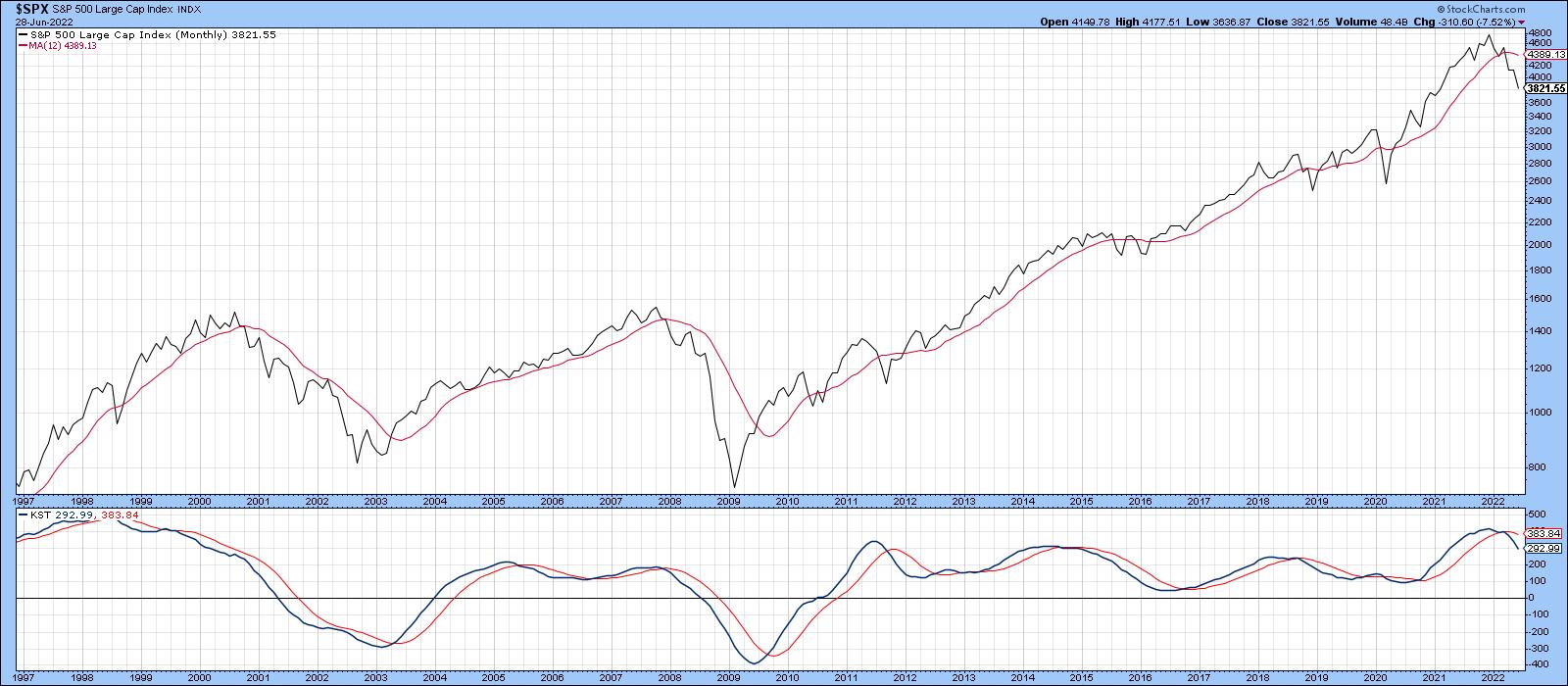

Long-term indicators, such as the KST and the S&P relative to its 12-month MA, remain in a bearish mode, but, that said, it would certainly be unusual to see them turn bullish immediately after the final low. Indeed, Chart 1 shows that the Index is currently well below...

READ MORE

MEMBERS ONLY

Are Commodities Losing their Mojo?

by Martin Pring,

President, Pring Research

Commodities have been on a tear since their lows set in the spring of 2020, but every news outlet you tune into these days is talking about inflation, gasoline in particular. That does not mean that prices cannot go higher. Over the long-term, that's probably a realistic scenario....

READ MORE

MEMBERS ONLY

Four Charts that are Acting in an Unintuitive Way

by Martin Pring,

President, Pring Research

Prices often move in the opposite direction to the expectations of most investors and traders. In many cases, that happens because the latest news has already been factored into prices and market participants have already begun to anticipate the next development. For example, a group of institutions might like the...

READ MORE

MEMBERS ONLY

This Sector Bucked Last Friday's Decline and Could Be Ready to Take Off

by Martin Pring,

President, Pring Research

A couple of weeks ago, I wrote about the fact that the technical position of gold was extremely finely balanced, and that it was "Either in a Hard Place or a Sweet Spot". My conclusion was that its short-term position was improving and that the sweet spot scenario...

READ MORE

MEMBERS ONLY

What Happens When Bonds Start to Outperform Stocks?

by Martin Pring,

President, Pring Research

It is possible for prices of individual asset classes to move in a linear up or down trend for an extended period. However, this rarely happens with inter-asset relationships, which rotate around the business cycle. As a result, it is helpful to monitor inter-asset relationships and their momentum to see...

READ MORE

MEMBERS ONLY

Gold: Either in a Hard Place or a Sweet Spot

by Martin Pring,

President, Pring Research

The long-term technical position of gold is extremely finely balanced and could easily tip into a full-fledged bear market, or start a new secular up leg to the bull trend that began in the opening years of this century.

Chart 1 really says it all. First, it expresses gold adjusted...

READ MORE

MEMBERS ONLY

It's Time for a Rally, But that Comes with a Catch

by Martin Pring,

President, Pring Research

The stock market's recent sell-off has made the front pages and top headlines in TV broadcasts, and CNN's famous Fear and Greed Index has fallen to an extreme level of fear. My contrarian bones say it's time for a rally. Is that right? Yes...

READ MORE

MEMBERS ONLY

Commodities on the Verge of an Upside Breakout, But Participation Will Likely Narrow

by Martin Pring,

President, Pring Research

Chart 1 shows that the Invesco DB Commodity Tracking Fund could be on the verge of breaking out from a 3-month consolidation pattern. It also points out that the number of commodities participating in the rally has been narrowing of late. That's because the indicator monitoring a universe...

READ MORE

MEMBERS ONLY

Bitcoin Bubble Finally Bursts

by Martin Pring,

President, Pring Research

I have written two articles about Bitcoin in recent months. The first,last December, concluded that "there are definitely some cracks appearing (in the technical structure), but a shrinking consensus of evidence continues to point to an uptrend." Thesecond, entitled "Has the Bitcoin Bubble Burst", noted...

READ MORE