MEMBERS ONLY

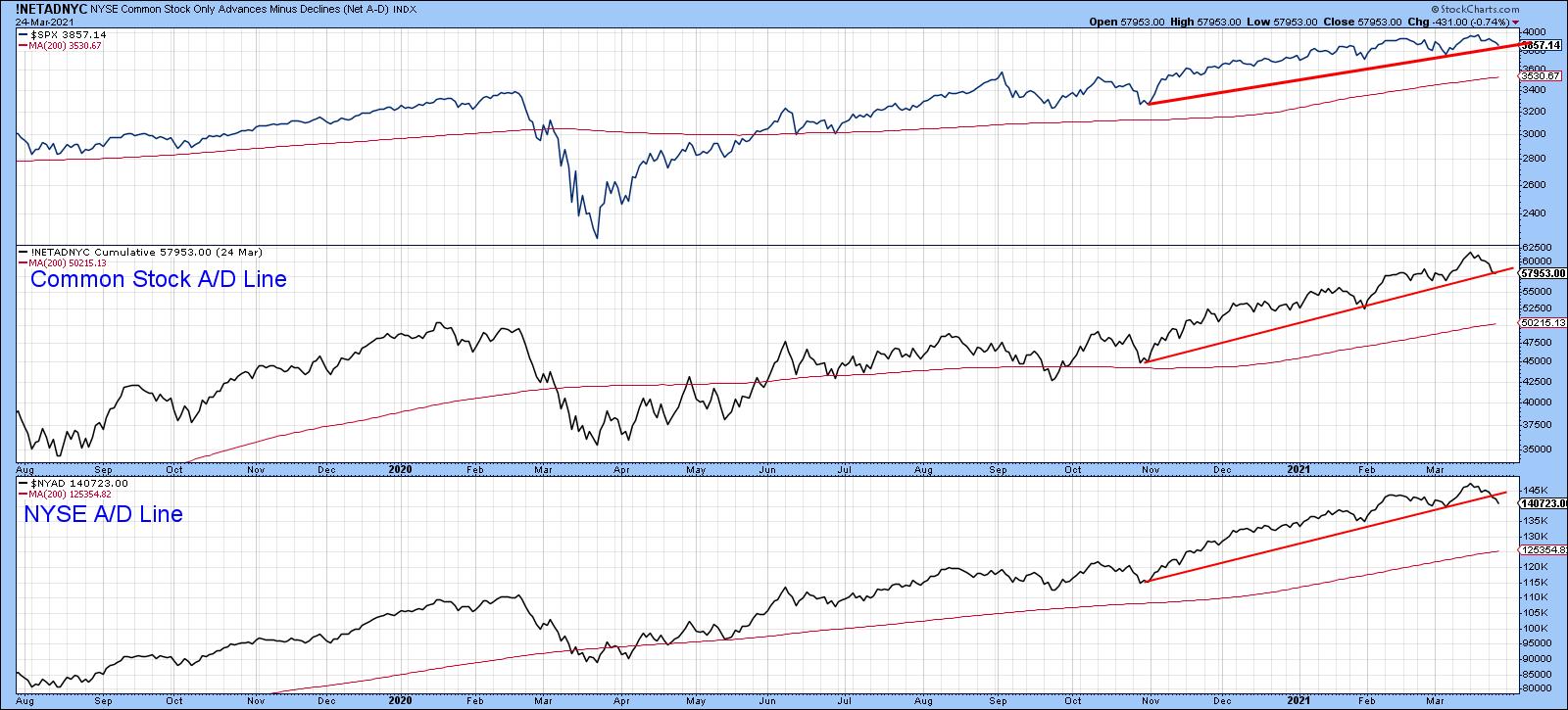

Several Key Indexes Testing Important Support

by Martin Pring,

President, Pring Research

It's never a good idea to try and predict contra-trend moves in a strong equity bull market, because the benefit of the doubt always goes with the prevailing trend. If false moves develop, they have a strong tendency to develop on the downside. That said, several key indexes...

READ MORE

MEMBERS ONLY

The Idea of Rising Bond Yields May be Getting Too Popular

by Martin Pring,

President, Pring Research

The longer-term indicators have been bullish on bond yields (bearish on prices) for a while now. However, they are now being joined by a number of commentators offering a similar view, which makes me uncomfortable. Don't get me wrong, the indicators are still pointing to a primary yield...

READ MORE

MEMBERS ONLY

US Breaking Out Against the World, But the Stocks Doing it May Surprise You!

by Martin Pring,

President, Pring Research

Back in the opening week of the yearl I wrote an article entitled Four Charts and Four Themes of the First Half of 2021. Three of them - higher stocks, higher commodities and value starting to outperform growth - are so far on track, but my negative analysis concerning US...

READ MORE

MEMBERS ONLY

After 13 Years, a Key Multi-Year Sector Relationship May be Reversing - and Could Have Enormous Implications

by Martin Pring,

President, Pring Research

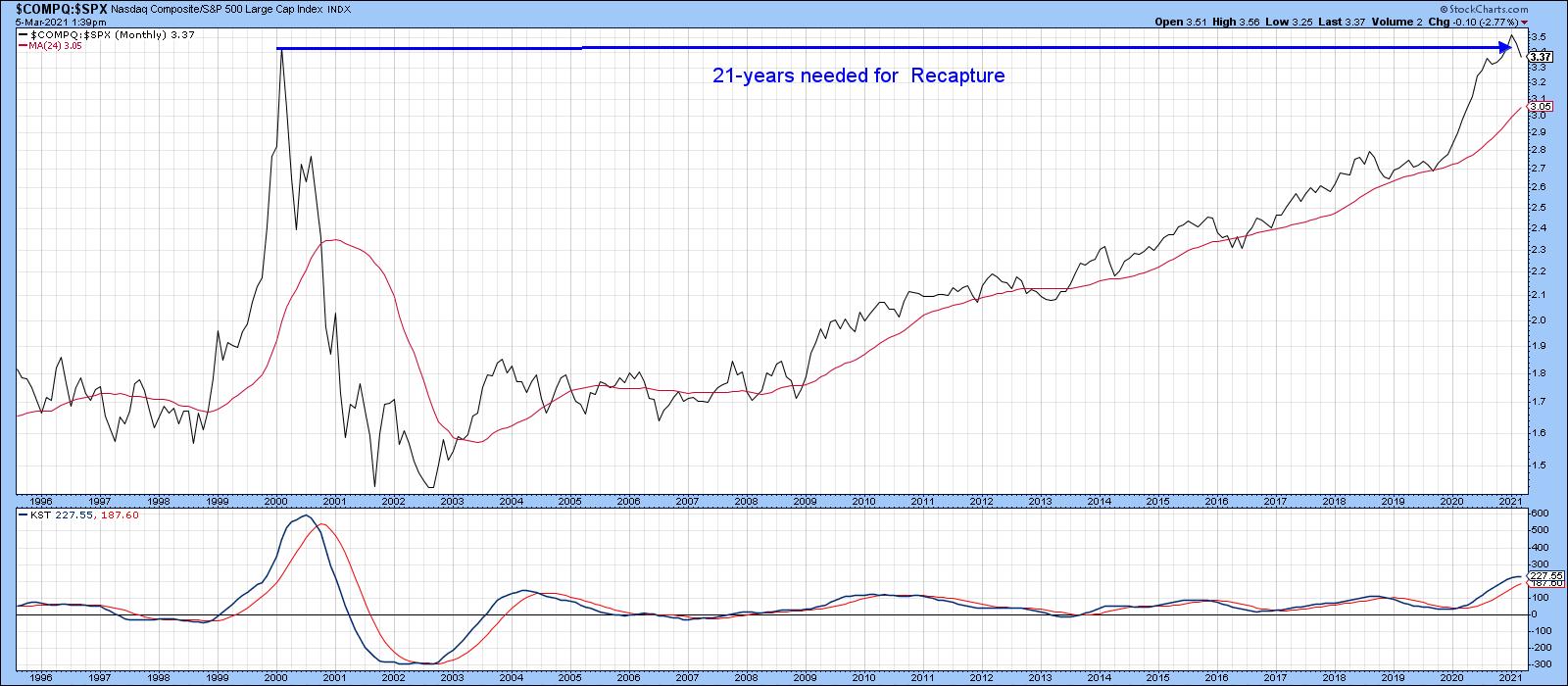

Technology, as reflected in the tech-dominated NASDAQ Composite, peaked as a group in 2000 and sank in popularity for the next 3 years. Since then, as shown by the relative graph in Chart 1, it has recaptured all of that lost ground. Now, its long-term KST may have started to...

READ MORE

MEMBERS ONLY

After 13 Years, a Key Multi-Year Sector Relationship May be Reversing - and Could Have Enormous Implications

by Martin Pring,

President, Pring Research

Technology, as reflected in the tech-dominated NASDAQ Composite, peaked as a group in 2000 and sank in popularity for the next 3 years. Since then, as shown by the relative graph in Chart 1, it has recaptured all of that lost ground. Now, its long-term KST may have started to...

READ MORE

MEMBERS ONLY

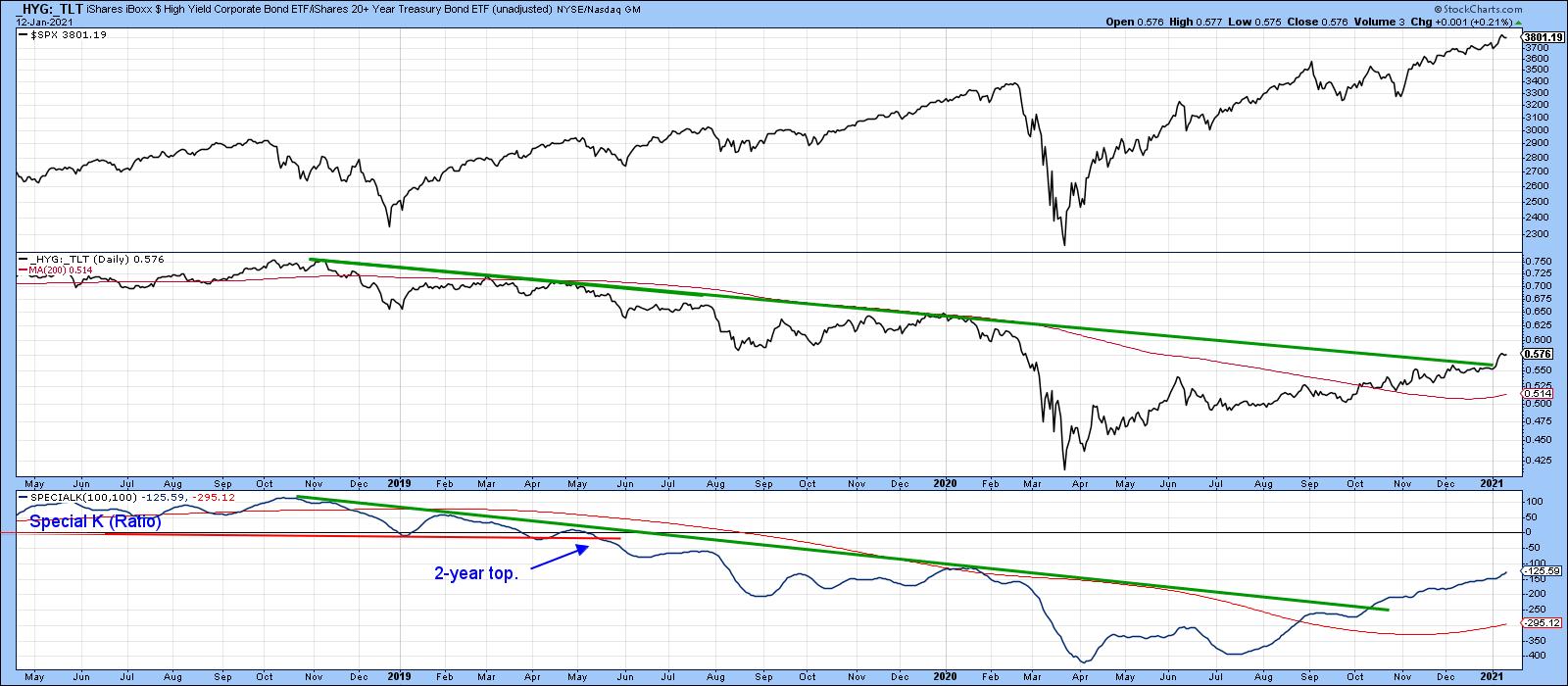

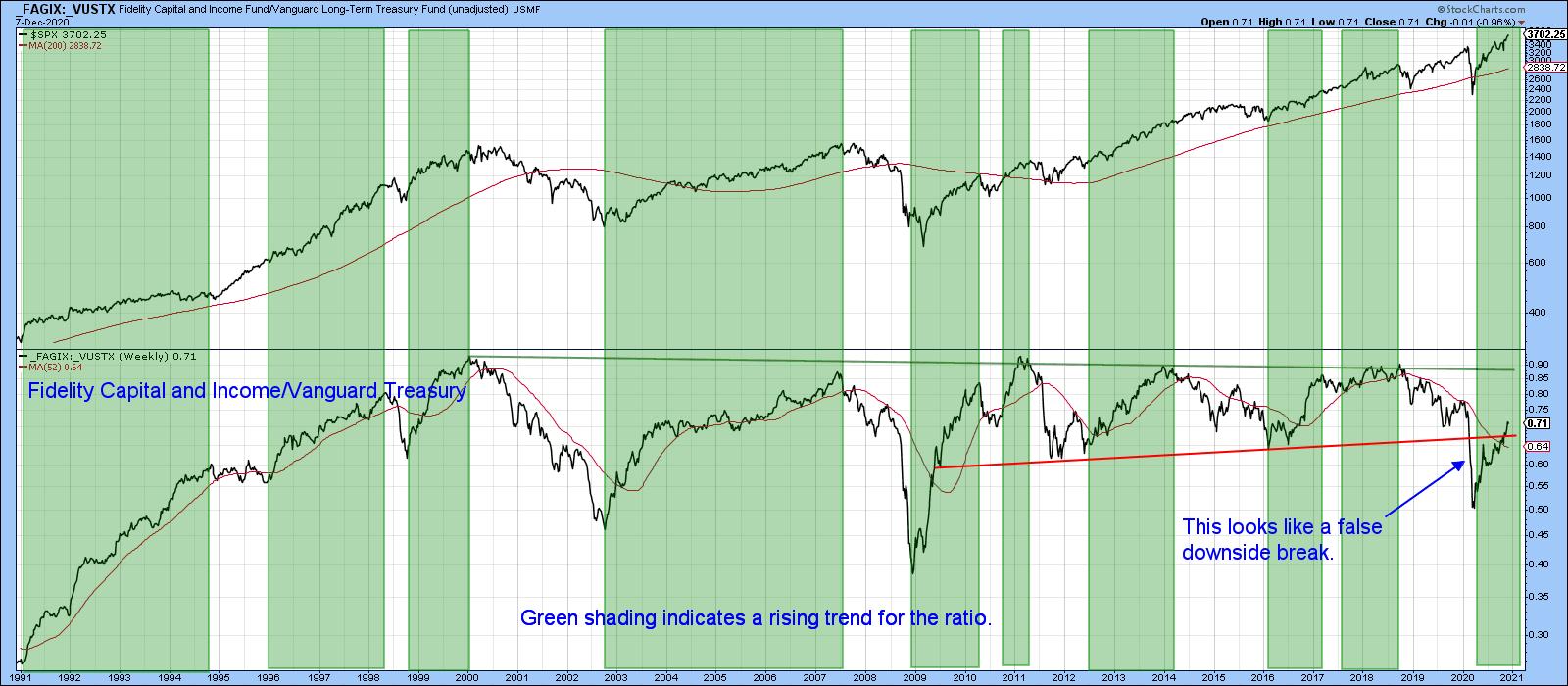

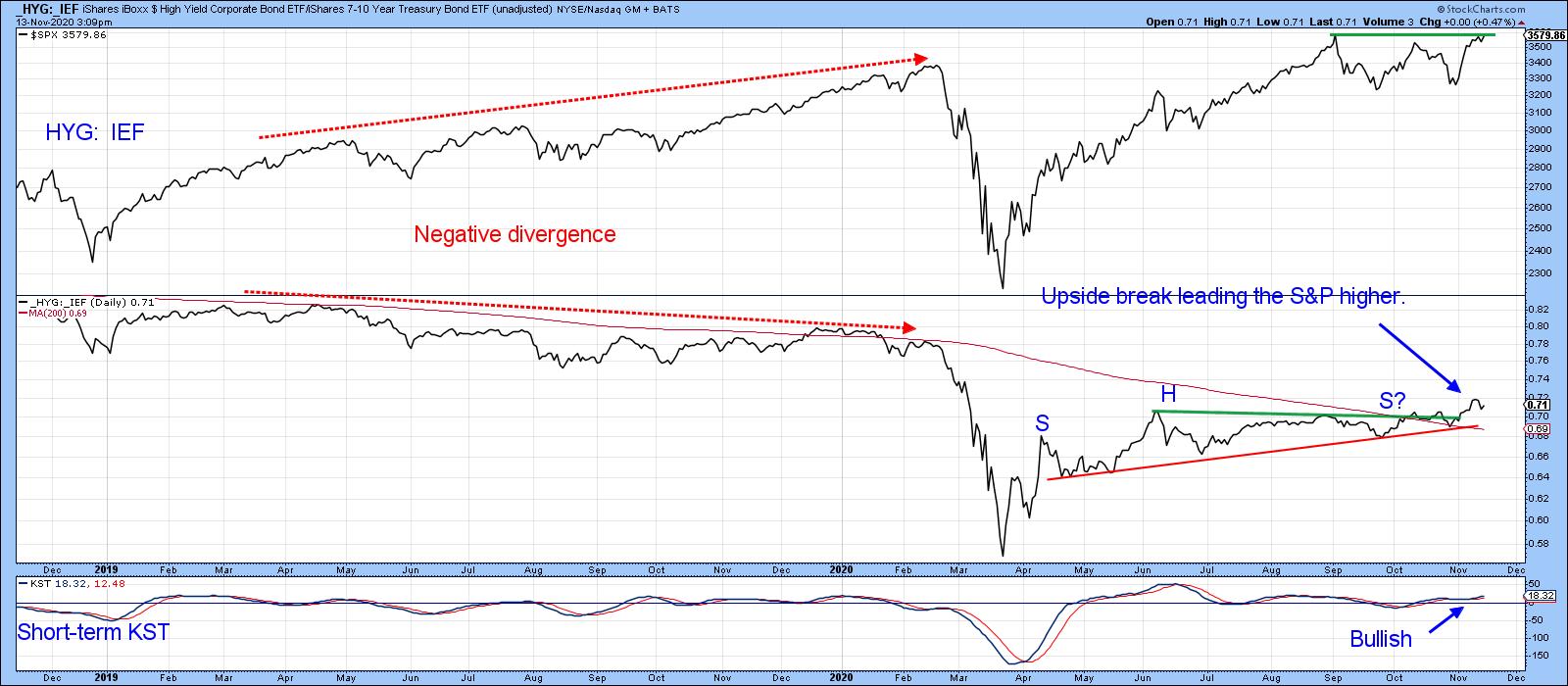

Five Confidence Relationships Hit Multi-Year Resistance; Breakout Would Signal Much Higher Stock Prices

by Martin Pring,

President, Pring Research

Many confidence relationships I follow have been confined to multi-year trading ranges, as investors have consistently swung between optimism and fear. The latest data show that many have rallied sharply and reached the upper region of this rangebound activity. That either means it's time to regroup and launch...

READ MORE

MEMBERS ONLY

Forget the Speculation and Uncertainty as these Short-Term Indicators are Bullish

by Martin Pring,

President, Pring Research

A few weeks ago I wrote an article entitled "Only a Fool Tries to Call a Correction in a Bull Market, So Here Goes!" Okay, so we did get a 4% drop in the Dow over a seven day period, but hardly anything worth worrying about. It reiterated...

READ MORE

MEMBERS ONLY

Using Short-Term Momentum to Define the Primary Trend Direction of Stocks, Bonds and the Dollar

by Martin Pring,

President, Pring Research

They say that a rising tide lifts all boats, and so it is with freely traded markets. In the boating world, you can spot a rising tide with a steadily rising boat, but, with markets, the simplest approach is to observe a series of rising peaks and troughs. However, there...

READ MORE

MEMBERS ONLY

Using Short-Term Momentum to Define the Primary Trend Direction of Stocks, Bonds and the Dollar

by Martin Pring,

President, Pring Research

They say that a rising tide lifts all boats, and so it is with freely traded markets. In the boating world, you can spot a rising tide with a steadily rising boat, but, with markets, the simplest approach is to observe a series of rising peaks and troughs. However, there...

READ MORE

MEMBERS ONLY

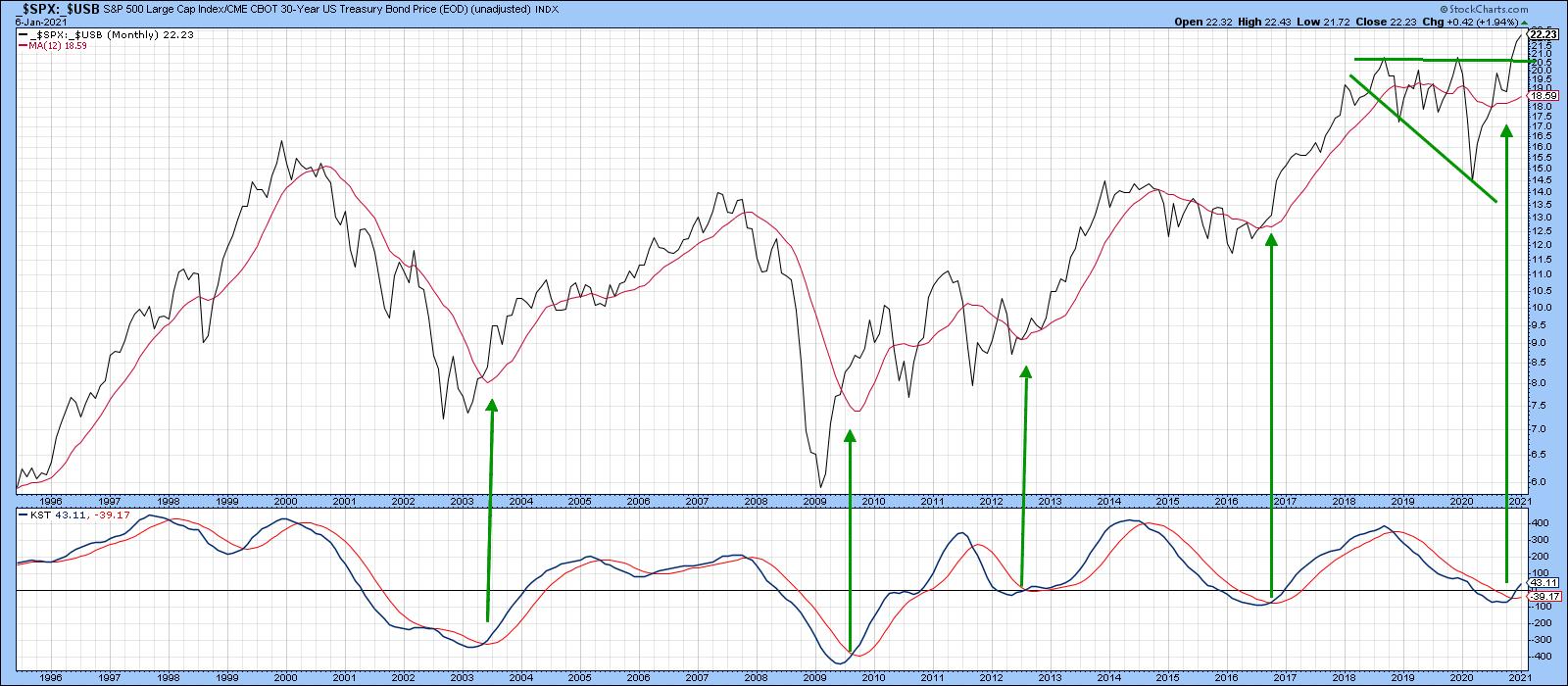

Key Interasset Relationships are Bullish for Stocks and Commodities but Bearish for Bonds

by Martin Pring,

President, Pring Research

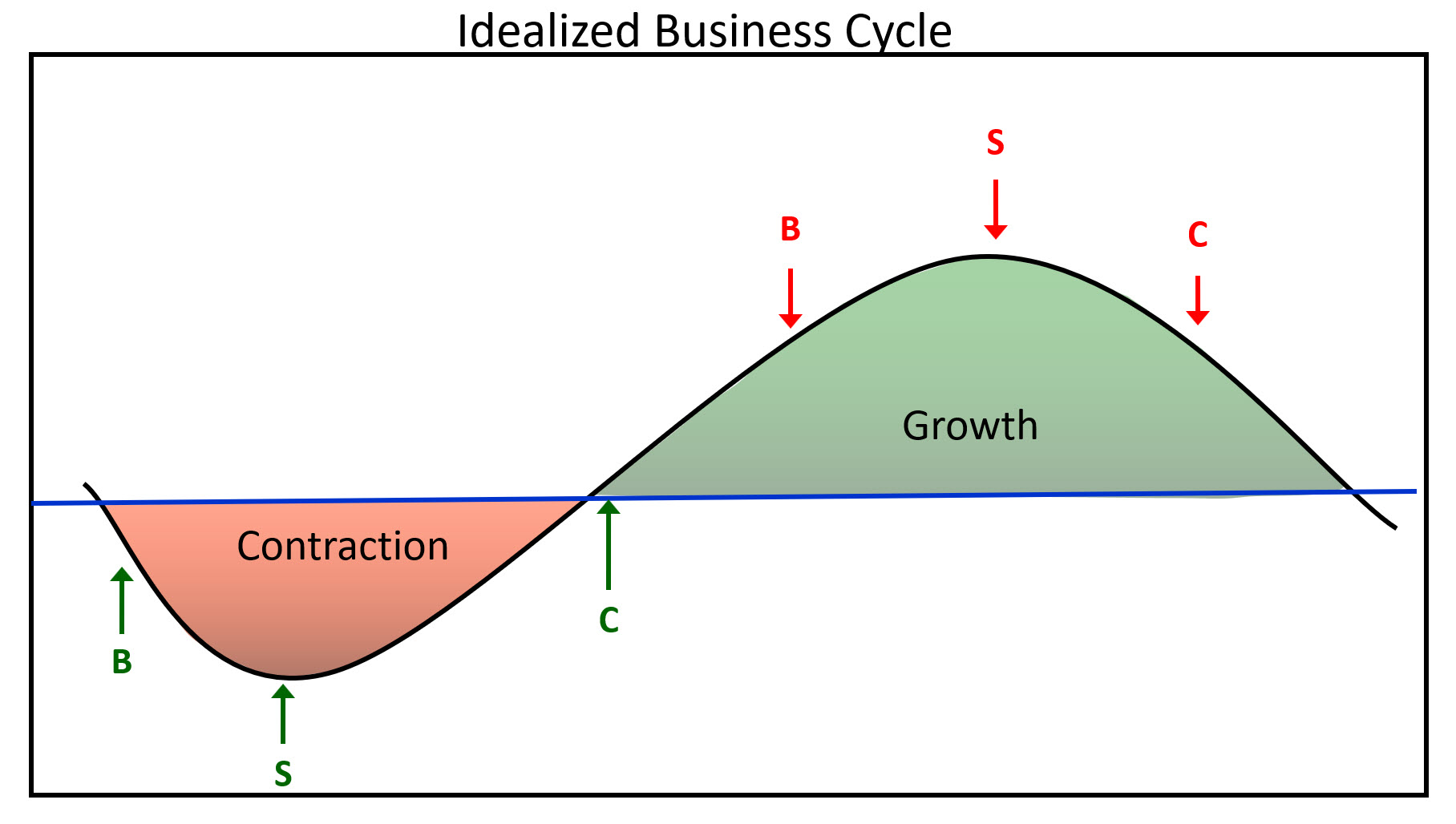

The business cycle approximates 41-months between the low points of slowdowns or recessions. For the record, a slowdown develops when the growth path of the economy declines, but not sufficiently to result in an actual recession, when economic momentum goes negative. The important point to bear in mind is that...

READ MORE

MEMBERS ONLY

Long-Term Interest Rates Getting Close to an Upside Breakout

by Martin Pring,

President, Pring Research

The Fed has pledged to keep short-term rates around zero for an extended period. That's certainly in their power, and Chart 1, which features the 3-month Libor, indicates no sign of life. There is also quite a distance between the latest plot and its 12-month MA. At this...

READ MORE

MEMBERS ONLY

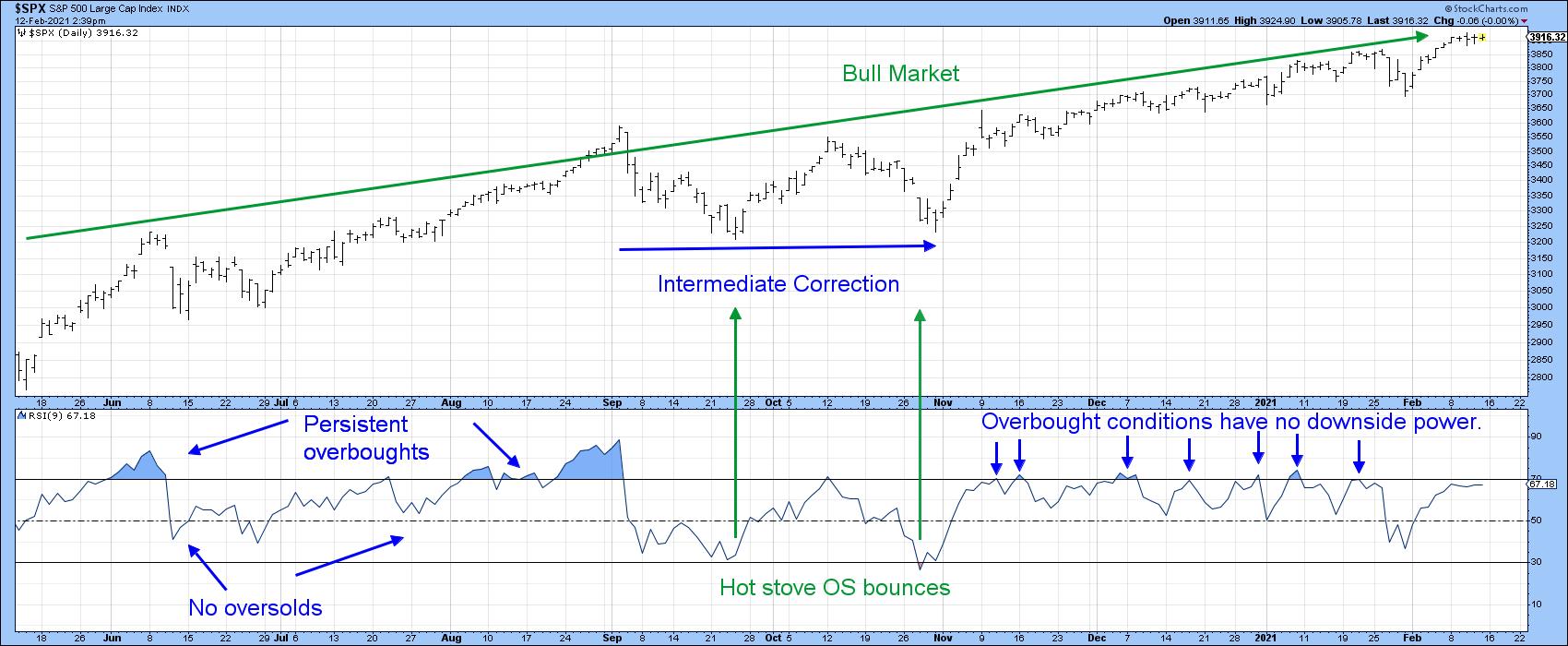

Only a Fool Tries to Call a Correction in a Bull Market, So Here Goes!

by Martin Pring,

President, Pring Research

Last week, I recorded a 40-minute presentation with my friend Bruce Fraser on the 2021 outlook. It's currently being featured on StockCharts TVand calls for a significant extension to the bull market. We present a number of long-term charts featuring several indicators whose bullish signals have consistently been...

READ MORE

MEMBERS ONLY

Only a Fool Tries to Call a Correction in a Bull Market, So Here Goes!

by Martin Pring,

President, Pring Research

Last week, I recorded a 40-minute presentation with my friend Bruce Fraser on the 2021 outlook. It's currently being featured on StockCharts TVand calls for a significant extension to the bull market. We present a number of long-term charts featuring several indicators whose bullish signals have consistently been...

READ MORE

MEMBERS ONLY

Green Light Still Flashing for Higher Bond Yields, Stock & Commodity Prices

by Martin Pring,

President, Pring Research

Back in early November, I wrote an article entitled,Confidence is Breaking Out all Over, Which is Bullish for Stocks/Commodities and Bond Yields, where I examined several intermarket relationships that monitor confidence. Since then, all three markets have rallied, but a further review of some of these relationships presents...

READ MORE

MEMBERS ONLY

Five Charts and Four Themes for the First Half of 2021

by Martin Pring,

President, Pring Research

Prices are determined by the attitude of market participants to the emerging fundamentals. Fortunately for us technicians, these attitudes move in trends, and once a trend gets underway it tends to perpetuate. Provided it is not overstretched, we can reasonably assume that that trend will continue. It's in...

READ MORE

MEMBERS ONLY

Four Charts and Four Themes for the First Half of 2021

by Martin Pring,

President, Pring Research

Prices are determined by the attitude of market participants to the emerging fundamentals. Fortunately for us technicians, these attitudes move in trends, and once a trend gets underway it tends to perpetuate. Provided it is not overstretched, we can reasonably assume that that trend will continue. It's in...

READ MORE

MEMBERS ONLY

Why Gold Bugs Should Be Praying for the Demise of Commodities

by Martin Pring,

President, Pring Research

Last month, the gold price slipped down very closely towards its 12-month MA. This is not a perfect indicator, but most downside penetrations are followed by bearish action, so you could say that gold is at the crossroads. Chart 1 tells us that prices have bounced a bit since then,...

READ MORE

MEMBERS ONLY

Bullish Commodities Run Into Resistance

by Martin Pring,

President, Pring Research

The global business cycle is nothing more than a chronological sequence of economic and financial market turning points. One of these involves a bottoming of commodity prices, as a new bull market gets underway. That reversal occurred several months ago and has recently been confirmed by numerous long-term indicators. That...

READ MORE

MEMBERS ONLY

Numerous International Multi-Year Trading Ranges are Reminiscent of the 1982 Dow 1,000 Breakout

by Martin Pring,

President, Pring Research

Years ago, before online charting platforms were widely available, technicians resorted to chartbooks published on a weekly or monthly basis and received days later in the snail mail. Using their long-term perspective helped a lot of us to appreciate that surpassing Dow 1,000 (see Chart 1) was a really...

READ MORE

MEMBERS ONLY

Numerous International Multi-Year Trading Ranges are Reminiscent of the 1982 Dow 1,000 Breakout

by Martin Pring,

President, Pring Research

Years ago, before online charting platforms were widely available, technicians resorted to chartbooks published on a weekly or monthly basis and received days later in the snail mail. Using their long-term perspective helped a lot of us to appreciate that surpassing Dow 1,000 (see Chart 1) was a really...

READ MORE

MEMBERS ONLY

Five Charts that are Pointing to Higher Stocks and Bond Yields

by Martin Pring,

President, Pring Research

Two Stock Market Relationships That Have Just Turned Positive

A few weeks ago, I wrote about some intermarket relationships pointing in the direction of higher stock prices. Picking through my StockCharts chart lists earlier in the week, I noticed a couple more that have only just moved into the bullish...

READ MORE

MEMBERS ONLY

Is it Time to Pull the Plug on the Gold Bull Market?

by Martin Pring,

President, Pring Research

Since its intraday high (set in August), the price of the SPDR Gold Trust, the GLD, has fallen close to 15%. That's not enough to qualify for a bear market under the media's arbitrary and totally useless 20% standard. However, it is enough for bulls like...

READ MORE

MEMBERS ONLY

Is it Time to Pull the Plug on the Gold Bull Market?

by Martin Pring,

President, Pring Research

Since its intraday high (set in August), the price of the SPDR Gold Trust, the GLD, has fallen close to 15%. That's not enough to qualify for a bear market under the media's arbitrary and totally useless 20% standard. However, it is enough for bulls like...

READ MORE

MEMBERS ONLY

S&P is Starting to Drag Against the World; Who's Going to Benefit?

by Martin Pring,

President, Pring Research

Last September, I pointed out herethat the ratio between the S&P Composite and the MSCI World Stock ETF (SPY/ACWI) had reached a critical juncture and needed an immediate rally in order to avoid an important sell signal. That point has been flagged with the green arrow. As...

READ MORE

MEMBERS ONLY

For the First Time in Three Years, Small Caps are Starting to Look Interesting

by Martin Pring,

President, Pring Research

* Russell 2K at a Record High

* Some Small-Cap Sector ETFs Breaking as Well

Russell 2K at a Record High

Small-caps have been underperforming since early 2018, but, in the last few weeks, have begun to emerge as relative outperformers. We can see this from Chart 1, where the iShares Russell...

READ MORE

MEMBERS ONLY

Confidence is Breaking Out All Over, Which is Bullish for Stocks/Commodities and Bond Yields

by Martin Pring,

President, Pring Research

Pfizer (PFE)'s announcement about a vaccine may have triggered a sharp rally on Monday, but its real effect was to boost confidence, which improved the status of a lot of different relationships that I follow, portending further gains for stocks and commodities down the road.

Swings in sentiment...

READ MORE

MEMBERS ONLY

Confidence is Breaking Out all Over, Which is Bullish for Stocks/Commodities and Bond Yields

by Martin Pring,

President, Pring Research

Pfizer (PFE)'s announcement about a vaccine may have triggered a sharp rally on Monday, but its real effect was to boost confidence, which improved the status of a lot of different relationships that I follow, portending further gains for stocks and commodities down the road.

Swings in sentiment...

READ MORE

MEMBERS ONLY

Chinese ETFs Break to the Upside

by Martin Pring,

President, Pring Research

They say that the Chinese economy has emerged from the pandemic quicker than the rest of the world. Recent action by Chinese ETFs certainly underscores such a possibility, as many have broken out from multi-week consolidation patterns. I last wrote about Chinese ETFs back in July,when we considered a...

READ MORE

MEMBERS ONLY

High Levels of Fear Argue for a Limited Decline Before a Big Move Higher

by Martin Pring,

President, Pring Research

This week's sell-off has been pretty scary. However, it has not yet ruptured the primary uptrend that began in March. In that respect, Chart 1 shows that the PPO for the S&P Composite, using 6- and 15-month EMAs as parameters, remains well above its equilibrium level....

READ MORE

MEMBERS ONLY

Upside Break by Copper also Has Implications for the CRB Composite and the Economy

by Martin Pring,

President, Pring Research

They say Copper is reputed to have a Ph.D. in economics because of its ability to predict turning points in the global economy. That arises because of copper's widespread applications in most sectors of the economy, from homes and factories to electronics and power generation. The implication...

READ MORE

MEMBERS ONLY

Upside Break by Copper also Has Implications for the CRB Composite and the Economy

by Martin Pring,

President, Pring Research

They say that Copper is reputed to have a Ph.D. in economics because of its ability to predict turning points in the global economy. That arises because of copper's widespread applications in most sectors of the economy, from homes and factories to electronics and power generation. The...

READ MORE

MEMBERS ONLY

Short-Term Indicators Argue for an Extension to the Recent Rally

by Martin Pring,

President, Pring Research

Last week, I pointed out that the long-term KST for the ratio between stocks and bonds was close to a buy signal, and that all such signals in the last 30-years had been followed by substantial advances in equity prices (Chart 1). We still don't have a signal...

READ MORE

MEMBERS ONLY

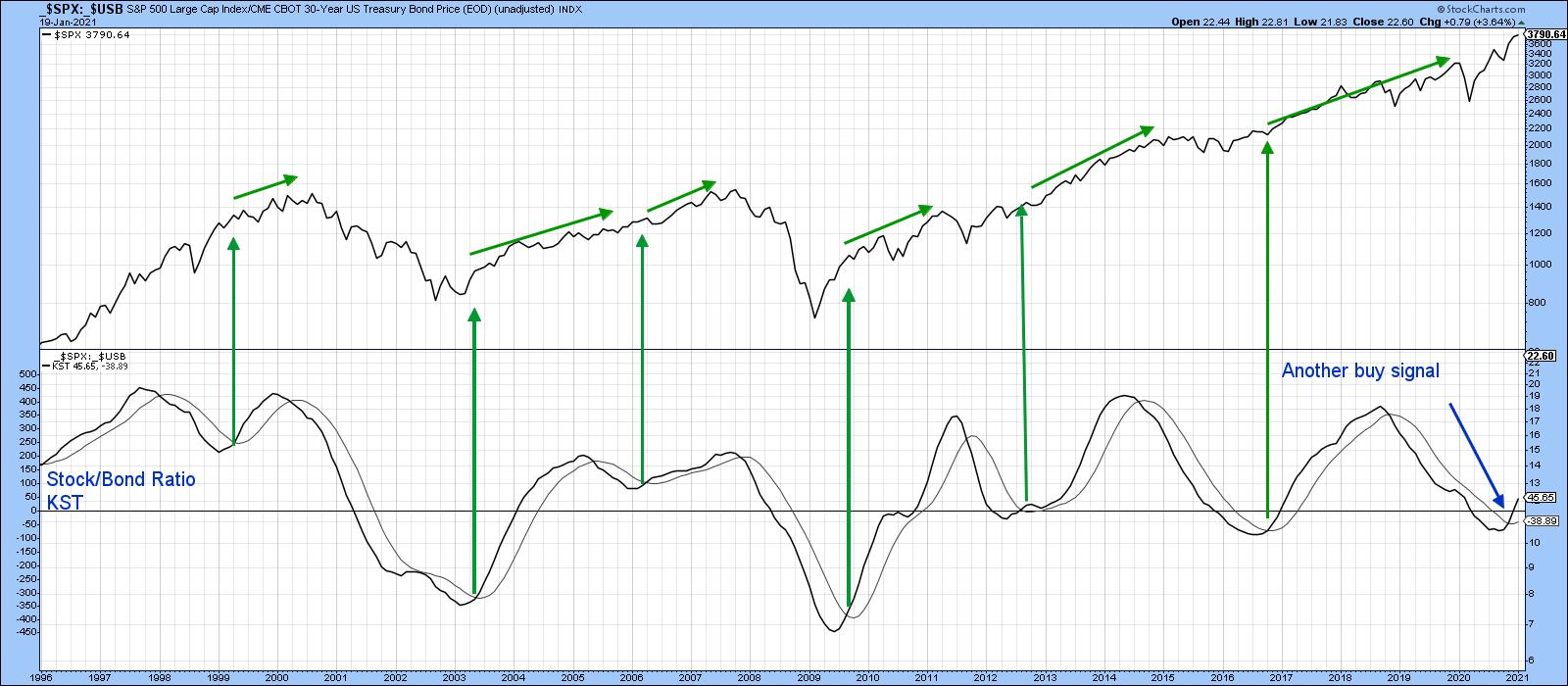

Reliable Long-Term Ratio May Be About to Trigger its Seventh Buy Signal for Stocks Since 1995

by Martin Pring,

President, Pring Research

Sometimes, it's a good idea to approach likely market action not so much from an analysis of the market itself, but substituting intermarket or inter-asset relationships to accomplish the same objective. It is a fact that each business cycle goes through a set series of chronological sequences. We...

READ MORE

MEMBERS ONLY

Reliable Long-Term Ratio May Be About to Trigger its Seventh Buy Signal for Stocks Since 1995

by Martin Pring,

President, Pring Research

Sometimes, it's a good idea to approach likely market action not so much from an analysis of the market itself, but substituting intermarket or interasset relationships to accomplish the same objective. It is a fact that each business cycle goes through a set series of chronological sequences. We...

READ MORE

MEMBERS ONLY

The Gold Bull Market is Likely to Extend Once the Correction Runs its Course

by Martin Pring,

President, Pring Research

Coppock Indicator Using Quarterly Data is Bullish

Long-term Charts show that gold is in a firm uptrend. Take Chart 1, for instance; it tracks the price of the yellow metal on a quarterly basis using a quarterly measure of the Coppock Curve, a momentum indicator originally devised by Edmund Coppock....

READ MORE

MEMBERS ONLY

The Gold Bull Market is Likely to Extend Once the Correction Runs its Course

by Martin Pring,

President, Pring Research

* Coppock Indicator Using Quarterly Data is Bullish

* Monthly-Based Gold Model is a Long Way from a Sell Signal

* Inflation-Adjusted Gold at Mega Resistance

* When Will the Correction Have Run its Course?

Coppock Indicator Using Quarterly Data is Bullish

Long-term Charts show that gold is in a firm uptrend. Take Chart...

READ MORE

MEMBERS ONLY

S&P Performance Relative to the World Reaches a Crucial Juncture

by Martin Pring,

President, Pring Research

For many years, the S&P Composite (SPY) has outperformed the MSCI World Stock ETF (ACWI). The benefit of the doubt continues to move in favor of the US, but this relationship has reached a crucial juncture point and needs to bounce; otherwise, some serious technical damage will transpire....

READ MORE

MEMBERS ONLY

Some Sectors Starting to Rotate from their Post-March Pattern

by Martin Pring,

President, Pring Research

From time to time, I like to review the various sectors to see which ones are in a positive or negative relative trend and which might be in a position to change. To do this, I use what I call my Nirvana Template or, in StockCharts-speak, Nirvana Chart Style. It...

READ MORE

MEMBERS ONLY

Is There More Corrective Activity Ahead?

by Martin Pring,

President, Pring Research

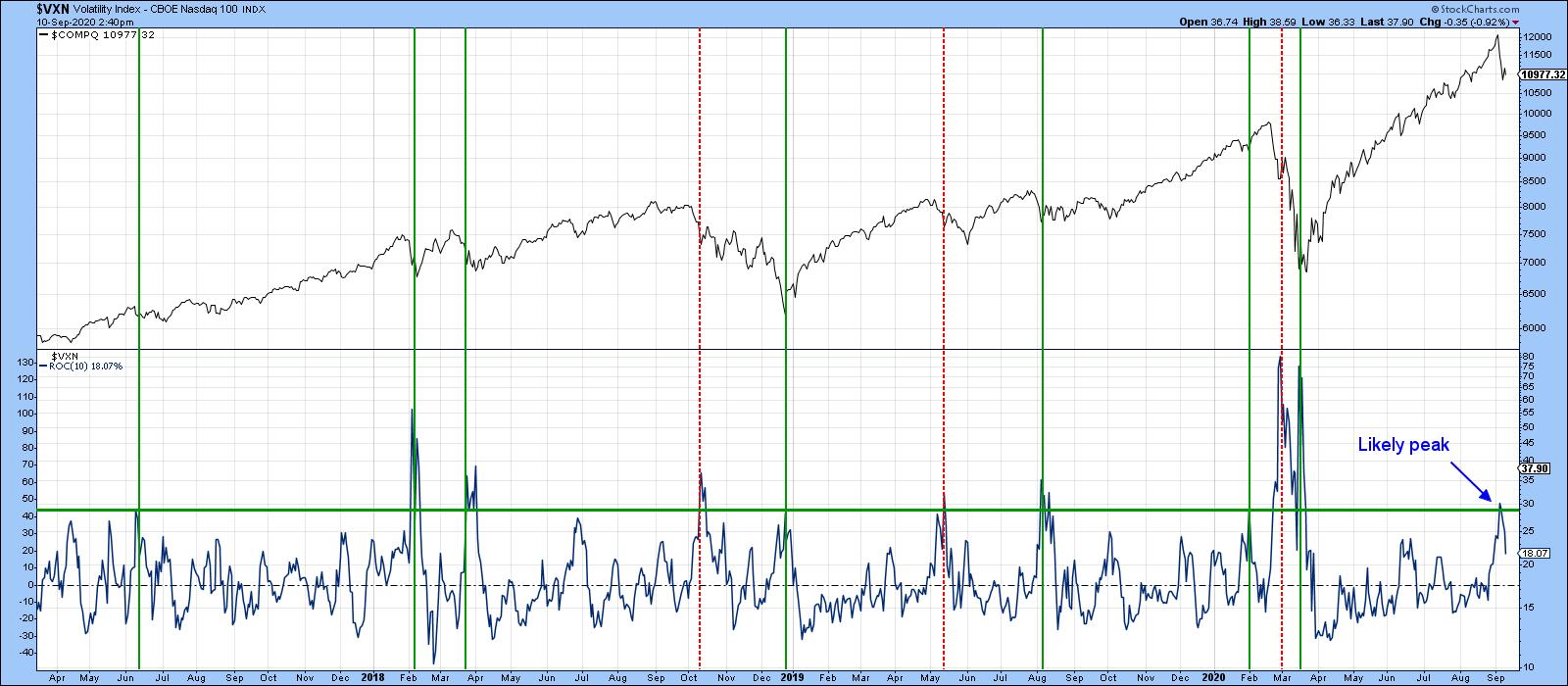

Some Indicators Have Moved to Levels Consistent with a Low

Most corrections in a bull market fall in the 5-10% range. On Thursday, the NASDAQ is down 10% intraday and the S&P Composite 7%, so it's not unrealistic to conclude that the correction might be over....

READ MORE

MEMBERS ONLY

If it's a Bull Market Correction, What Should We Look for to Signal the All-Clear?

by Martin Pring,

President, Pring Research

* Some Indicators Have Moved to Levels Consistent with a Low

* Others Suggest the Likelihood of More Corrective Activity

* Indicators that Should Be Monitored for a Possible Upside Reversal

Some Indicators Have Moved to Levels Consistent with a Low

Most corrections in a bull market fall in the 5-10% range. So...

READ MORE