MEMBERS ONLY

Some Insights From The NIFTY Premiums

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

As we know, a futures instrument derives its value from its respective underlying asset. For example, the NIFTY futures instrument derives its value from the NIFTY's spot price. Though the futures price and the price of its underlying move in the same direction, they do not maintain the...

READ MORE

MEMBERS ONLY

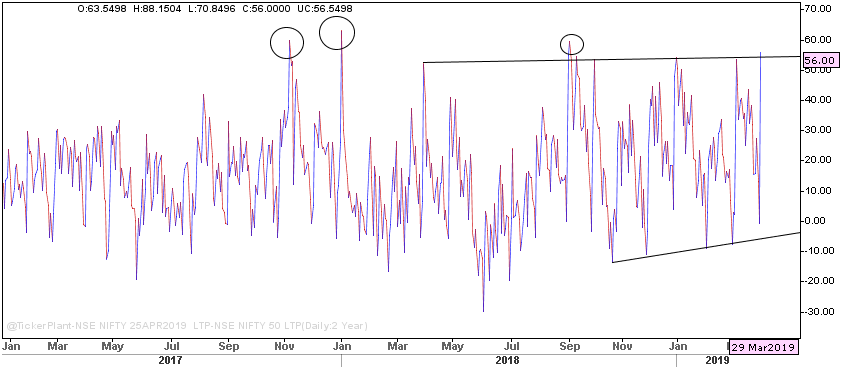

Week Ahead: Caution Advised for Momentum-Chasers; Stalling Of Up-Move Should Not Come As A Surprise

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

With the session that ended Friday, March 29, 2019, the markets ended a remarkable month which remained one of the best out of the past several quarters. NIFTY ended the month on a strong note, posting a monthly gain of 831.40 points (+7.70). After taking a breather in...

READ MORE

MEMBERS ONLY

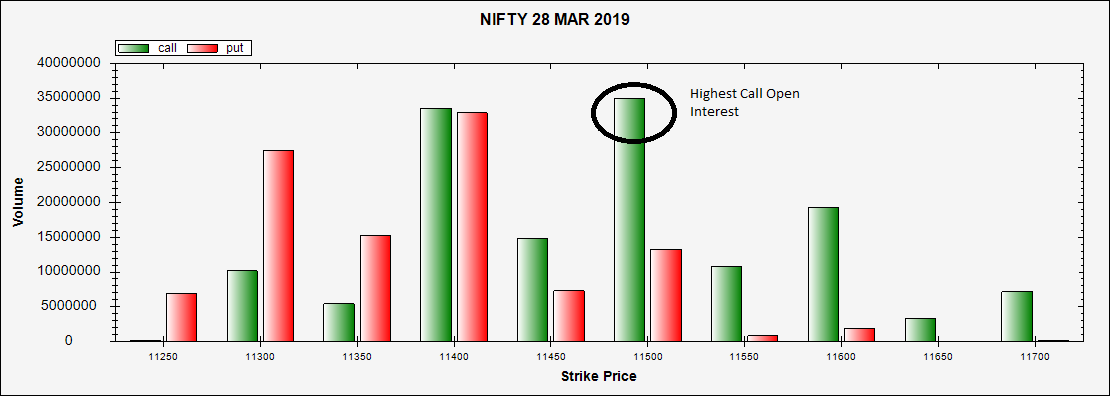

Derivative Expiry: Options Data Point Towards This Level Being An Inflection Point For The Markets

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The NIFTY50 ($NIFTY) saw an unexpected surge in trading on Tuesday, ultimately ending the session with decent gains. The expiry of the current derivative series is to come up on Thursday, March 28; the Options data on NIFTY throws up some useful insights.

Let's examine the 10 ATM...

READ MORE

MEMBERS ONLY

Week Ahead: Upsides May Remain Limited; Corrective Moves Likely From Higher Levels

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Following an unabated up move over the last several days, the markets finally took a breather on the last trading day of the week. After the session on Friday, the NIFTY has displayed visible signs of consolidation creeping in to the markets, which had become steeply overbought on the daily...

READ MORE

MEMBERS ONLY

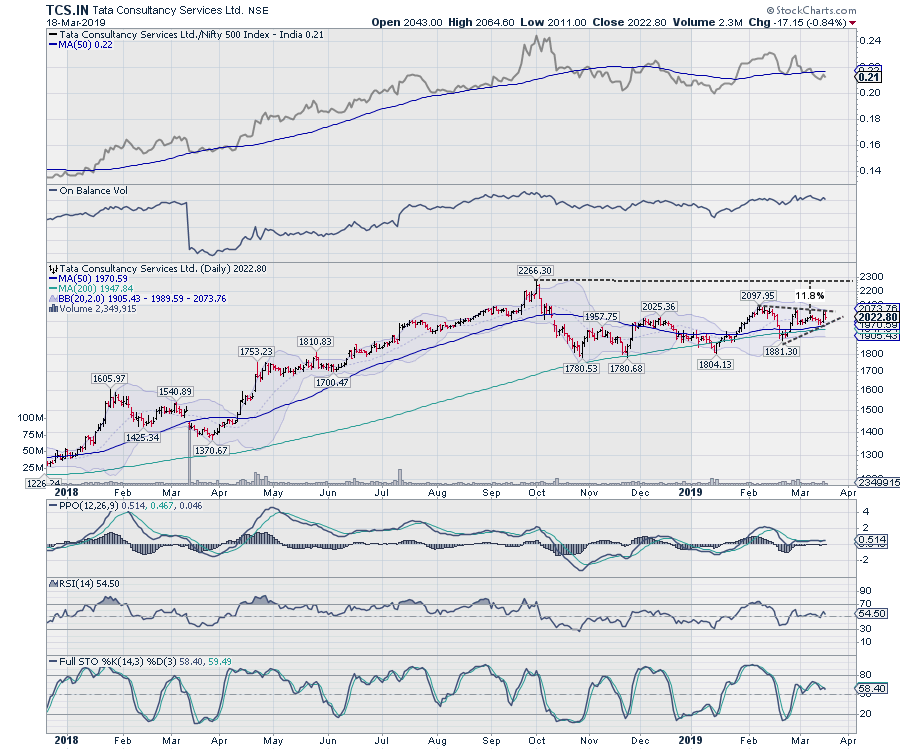

TCS: Likely Shift of Action to IT Pack May See This Stock Relatively Outperform

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The IT Pack remains firmly placed in the leading quadrant of the Relative Rotation Graph (RRG) as bench-marked against the broader CNX500 index. However, the IT index has relatively under-performed the front-line NIFTY over the past couple of days. With the NIFTY likely to take a breather and consolidate over...

READ MORE

MEMBERS ONLY

Time To Place Prudence Before Greed in the Coming Week

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Over the past week, the market performed in striking contrast to what had been expected. For nearly 15 weeks, the markets were consolidating near their 50-Week MA and, last week, were showing signs of further impending consolidation. In spite of this, the markets ended up putting up a very strong...

READ MORE

MEMBERS ONLY

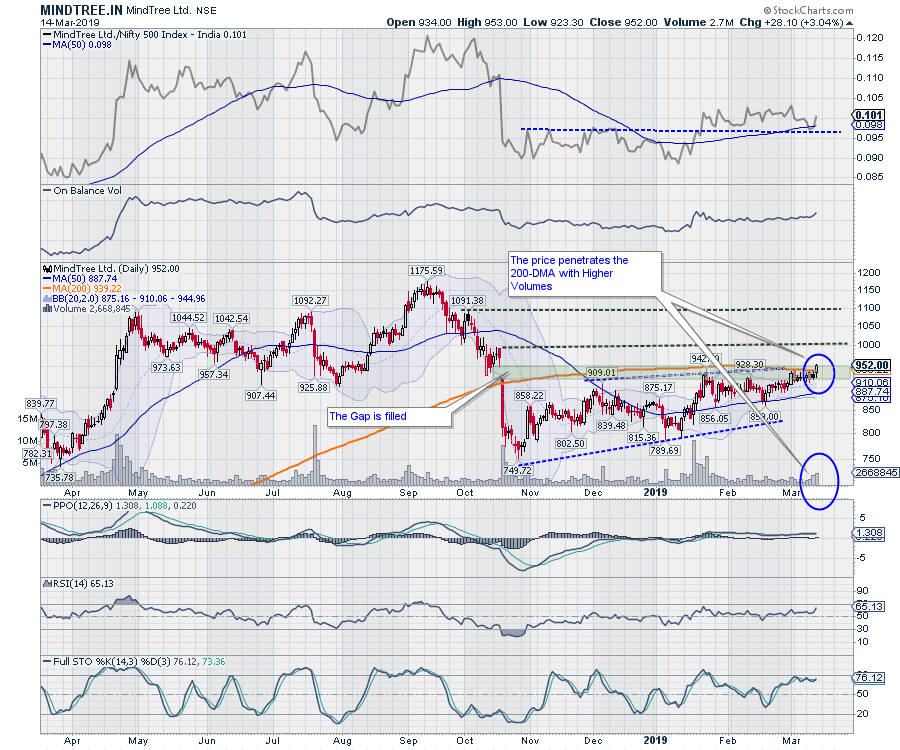

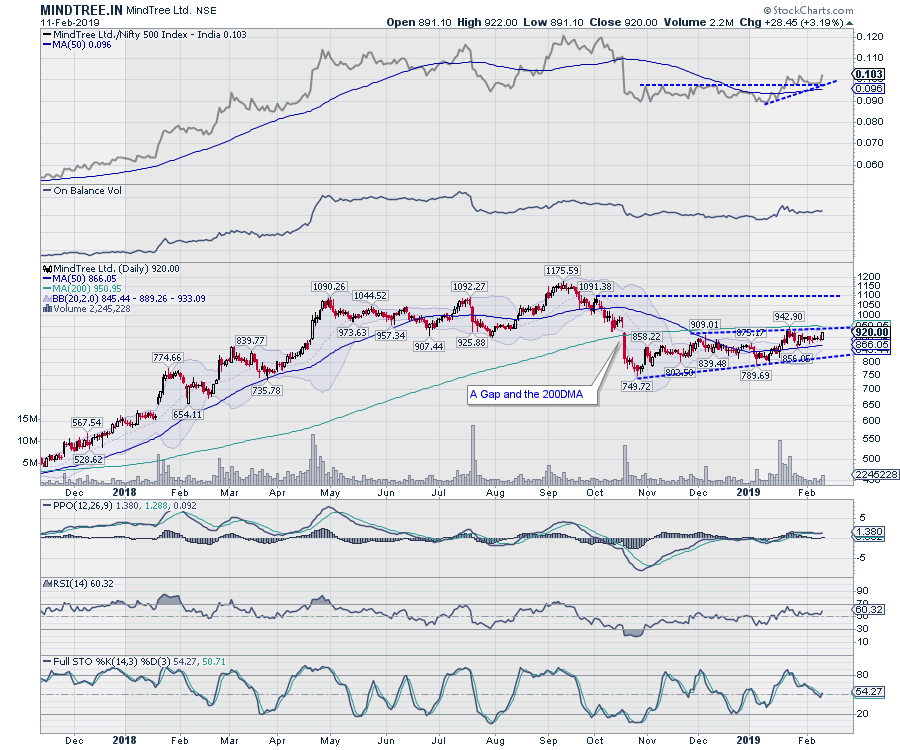

MINDTREE.in: Looking To Edge Higher

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

MindTree Limited's stock price ended with gains of Rs. 23.20 (+2.84%) in Wednesday's session on March 14, 2019. This price move appears very important from the technical perspective, as it has thrown up several signals that point towards MINDTREE.IN inching higher over the...

READ MORE

MEMBERS ONLY

Are We In For An Improved Market Breadth? The Level Of 9200 Holds The Key

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The Indian markets saw a strong start to the week as the headline index ended with a robust gain of 132.65 points (+1.20%). With this move, the index has once again begun to attempt a breakout. This being said, over the past several weeks, the market breadth has...

READ MORE

MEMBERS ONLY

Week Ahead: Markets May Remain Tentative; These Pockets Likely To Relatively Outperform

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The past week fared better than the one prior as the market added more to its gains. A major portion of the weekly gains was posted in the first half, while the last two sessions were spent amid consolidation. In a 4-day week, the headline index NIFTY50 ended with weekly...

READ MORE

MEMBERS ONLY

EMAMI Limited - Up for a Trend Reversal?

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Emami Limited is one of the leading and fastest growing personal and healthcare businesses in India, with an enviable portfolio of household brand names such as BoroPlus, Navratna, Fair and Handsome, Zandu Balm, Mentho Plus Balm, Fast Relief and Kesh King.

The stock price of EMAMILTD.IN has been under-performing...

READ MORE

MEMBERS ONLY

NIFTY Set-up For The Coming Week: Taking Out Imp Levels Necessary; These Pockets May Relatively Outperform

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

For yet another week, the markets took no directional call, going on to end the week with modest gains. The NIFTY remained within a broadly-defined range throughout the week, making some gains towards the end that halted near the 200-DMA. On the weekly charts, the index continued with its sideways...

READ MORE

MEMBERS ONLY

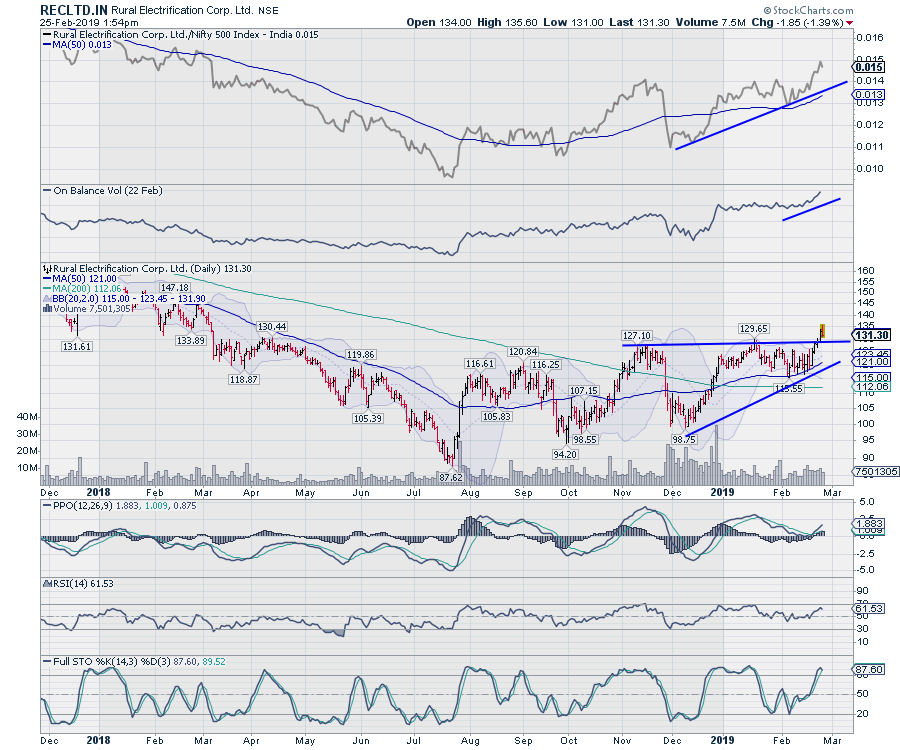

RECLTD: Breakout From An Ascending Triangle

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Rural Electrification Corporation Limited (RECLTD.IN)

* This stock has now witnessed a breakout from a bullish Ascending Triangle formation.

* The breakout occurred above 127.50, but the stock might still witness some pullback, with the zone of 127-130 potentially acting as support. Once the consolidation is out of way, there...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Hovers Around Important Levels; RRG Show These Sectors Likely Out-Performing The Broader Markets

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In our previous weekly note, we mentioned that the NIFTY was slipping below its 50-week moving average and highlighted the importance of this important weekly level. While the markets experienced continued weakness in the early part of the past week, the middle of the week saw the NIFTY rebounding following...

READ MORE

MEMBERS ONLY

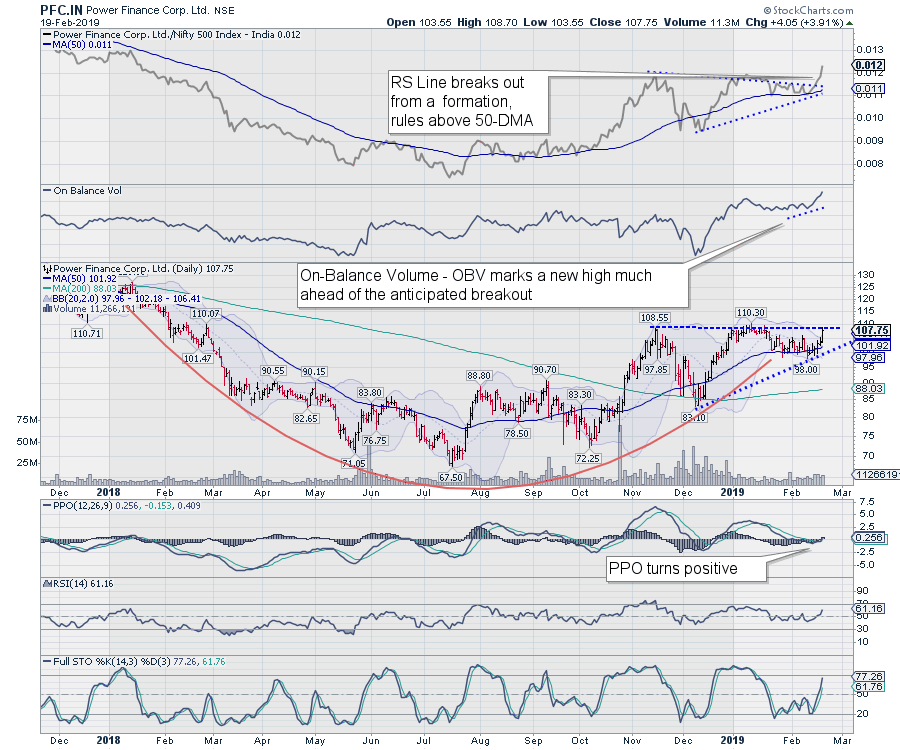

Greater Possibilities Of A Breakout In This Stock

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

With the session that ended on Tuesday, February 19, 2019, the Indian headline index NIFTY50 closed in the red for the eighth consecutive day. Amid such a weak environment, there are certain stocks which are showing great relative strength and are strongly outperforming the broader markets. Once such stock that...

READ MORE

MEMBERS ONLY

Week Ahead: Stable Start To The Week Expected; Cracks Might Appear If These Levels Are Not Defended

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The past week remained quite dismal for the market, which ended in the negative on all five days. After a failed breakout on the daily charts, the NIFTY returned inside the broad trading range and subsequently drifted even lower. The index has been defending the 50-Week Moving Average for over...

READ MORE

MEMBERS ONLY

MINDTREE.IN: Good Up-Move In The Offing If This Level Is Crossed

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

While the markets have been suffering from fractured breadth and the NIFTY moved below 10950 (its breakout level) following a strong throwback, the CNXIT index has crawled back into the leading quadrant of the Relative Rotation Graph (RRG). This means that the IT pack is likely to relatively out-perform the...

READ MORE

MEMBERS ONLY

This Stock May Out-Perform The Broader Markets

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The Indian market suffered a severe throwback, having broken out above the 10950 mark on Wednesday but returning all those gains by end of the week. The market breadth has not been healthy at all and remains a matter of concern. Amid such turbulence, this stock deserves some attention, as...

READ MORE

MEMBERS ONLY

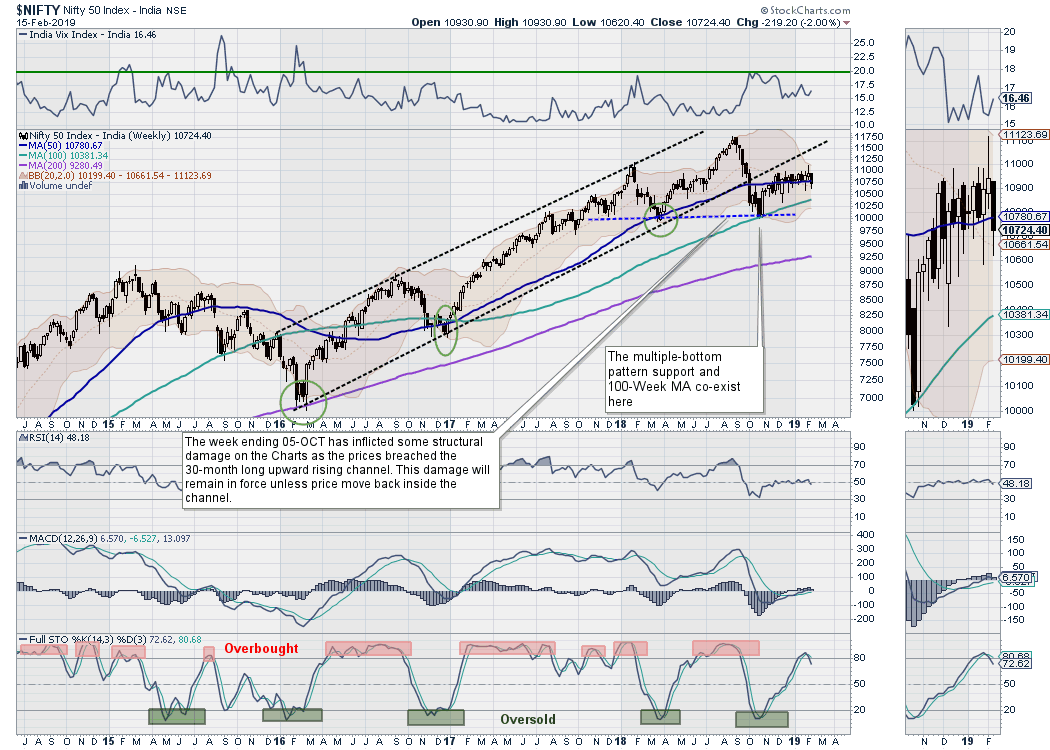

Week Ahead: Staying Afloat 50-Week MA Crucial; Market Breadth Remains A Concern

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

With the last day of the trading week remaining a drag, the NIFTY returned all its weekly gains and ended on a negative note. If we look at the daily charts, we can see the NIFTY achieved a breakout by moving past the 10950 level, but had returned all those...

READ MORE

MEMBERS ONLY

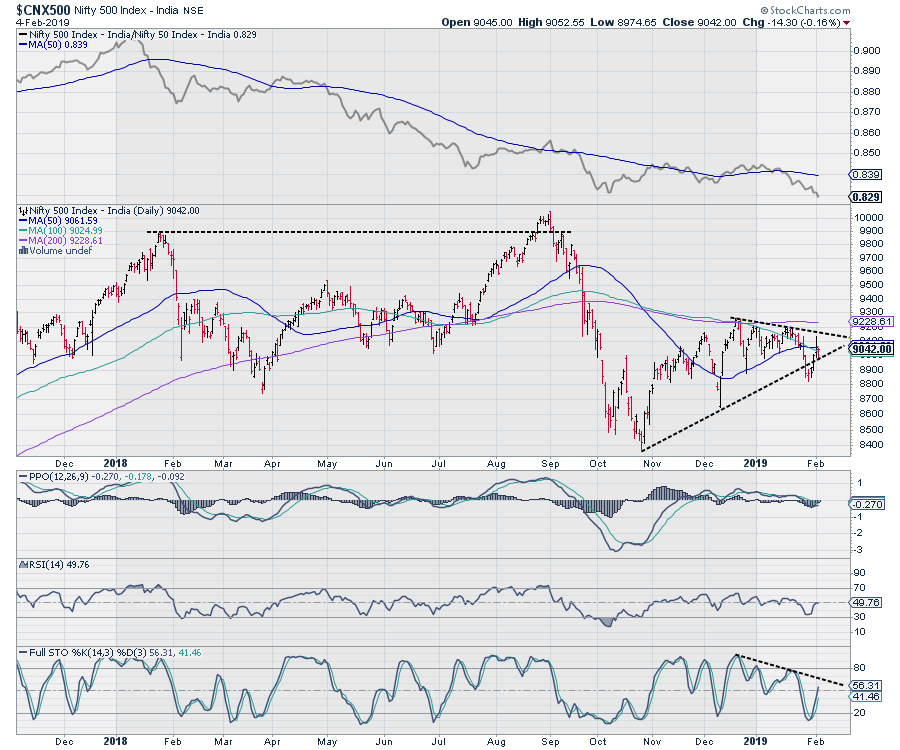

A Look At Broader Market Charts As Market Breadth Remains A Concern

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

After experiencing a brutal decline that began in September 2018, the NIFTY found support just below the 10000 mark and witnessed a technical pullback. This technical pullback halted near the 10950 level in early December 2018. Over the following two months, the index hit resistance multiple times and has remained...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Set To React On These Lines Post Interim Budget

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

We mentioned in our previous weekly note that, due to expiry of the January series and interim budget, the markets would remain more volatile than usual over the past week. While the expiry day did not bring in any volatility, the last session of the week remained immensely volatile on...

READ MORE

MEMBERS ONLY

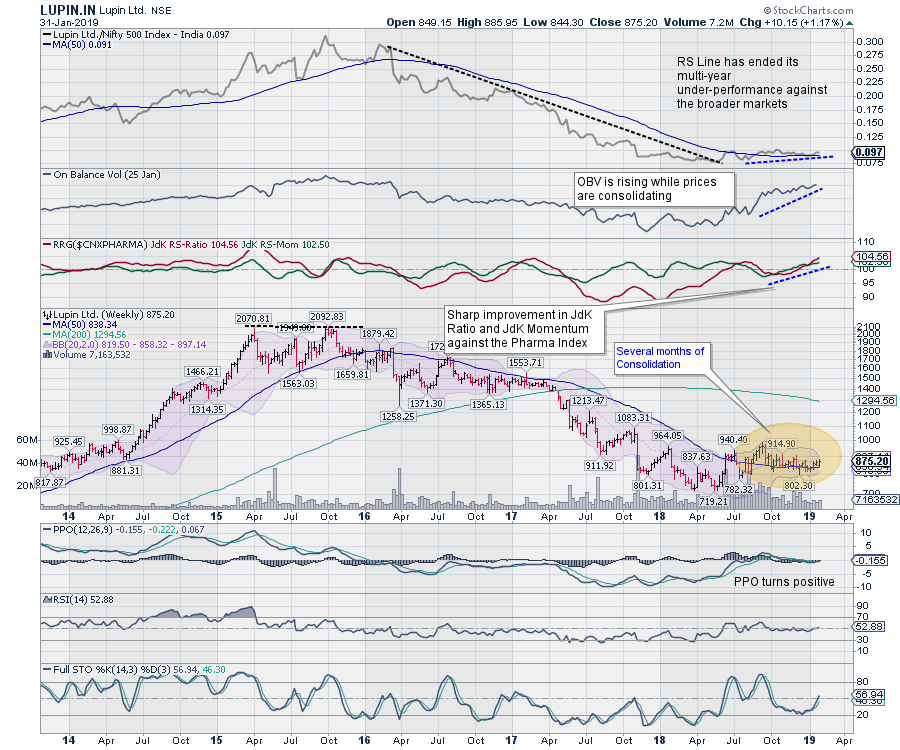

This Pharma Stock Is Set For A Good Move

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Lupin Limited (LUPIN.IN)

* LUPIN.IN marked a double top at the 2070-2092 level in October 2016 and has since remained in a corrective downtrend. After trading in a falling channel during this corrective phase and wiping out over 50% of its value, the stock has attempted to find a...

READ MORE

MEMBERS ONLY

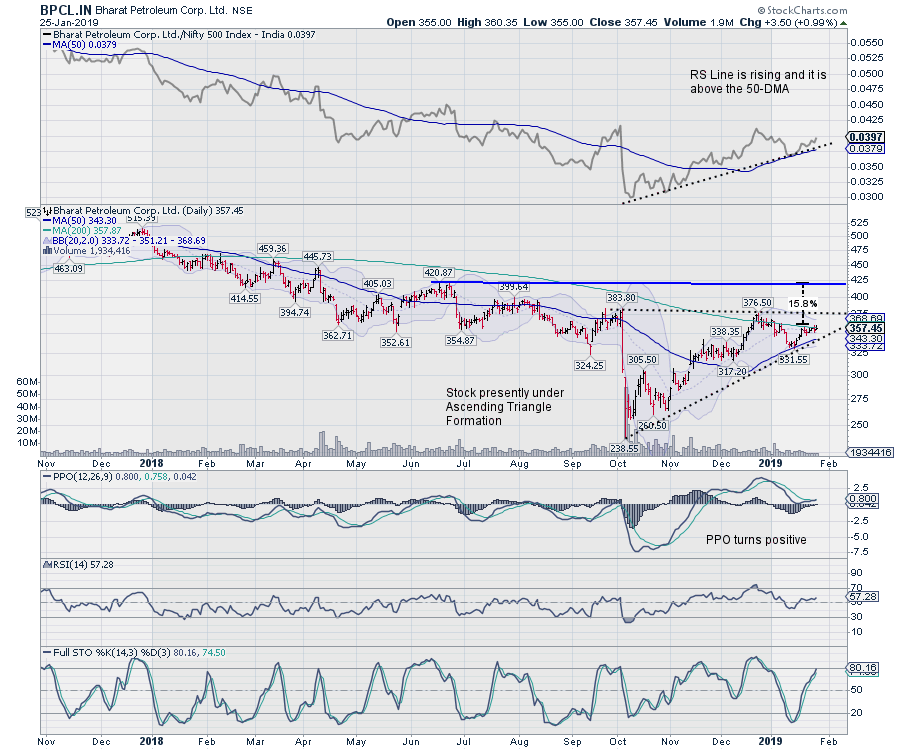

These Charts Show Some Likely Up-Moves Ahead

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Bharat Petroleum Ltd. (BPCL.IN)

* Having formed a bottom at 238.55 following a steep fall from 383.80, the stock has since formed gradual higher bottoms. Presently it remains in an Ascending Triangle pattern, which is a bullish formation.

* The RS Line, when compared against broader CNX500 is rising;...

READ MORE

MEMBERS ONLY

Week Ahead: With F&O Expiry and Interim Budget In The Tow, Markets Set To Remain Volatile

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In spite of all expectations, NIFTY remained volatile and did not make any directional call over the previous week, oscillating in a defined 230-point range throughout. However, on the weekly charts, the NIFTY has been able to keep its head above the 50-Week MA, which is 10757. Additionally, the market...

READ MORE

MEMBERS ONLY

NIFTY Energy Sector Looks Up

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

As the Indian equity markets remain under under an area formation, a clear breakout will continue to elude the NIFTY unless it can move past the 10950 level. With the markets still trapped in a range, the NIFTY Energy Index ($CNXNIFTY) provides some interesting observations.

The NIFTY Energy Index formed...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Looks At Taking A Decisive Directional Call In The Coming Week

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The past week saw the market remaining range-bound, oscillating inside a 250-point range and ultimately ending with a modest gain. Though the market did not take any directional call on either side, it saw significant amount of volatility within the defined range. While holding on to the 50-Week MA level,...

READ MORE

MEMBERS ONLY

ICICI Securities: Interesting Days Ahead

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

ICICI Securities Ltd. (ISEC.IN)

In addition to being the pioneers in the e-brokerage business in India, ICICI Securities is a technology-based firm offering a wide range of financial services including investment banking, institutional broking, retail broking, private wealth management and financial product distribution.

The stock has a short listing...

READ MORE

MEMBERS ONLY

NIFTY Mildly Penetrates The 50-Week MA; Moving Past These Levels is Necessary For A Sustained Up-Move

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

It was a volatile end to the week as the NIFTY index oscillated in a 100-point range on Friday, finally settling with a modest loss after rebounding from the lower levels. Just like the week before, no major downsides were seen. The NIFTY just barely managed to pierce the 50-Week...

READ MORE

MEMBERS ONLY

HDFC Standard Life - Preparing For A Move?

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

HDFC Standard Life Insurance Company Ltd. (HDFCLIFE.IN)

This stock has a rather short history. After listing in November 2017, it spent the first couple of months moving higher, then returned all those gains in the following months. It is said that chart patterns are fractal in nature; those patterns...

READ MORE

MEMBERS ONLY

Can the NIFTY Move Past its 50-Week MA in the Coming Week?

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Throughout the past week, the markets continued to follow the falling trend line pattern resistance. Though no major downsides were witnessed, the NIFTY did not make any major up moves either. The larger part of the previous week saw a significant number of shorts being added, but no short covering...

READ MORE

MEMBERS ONLY

Interesting Technical Set-Ups on Container Corp of India and SBI

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The PSUBank Index has a shown sharp surge in its relative momentum against the broader CNX500 index. This keeps this index firmly in the leading quadrant of the Relative Rotation Graph, where it accompanies the NIFTY Infrastructure Index. The Container Corporation of India (CONCOR.IN) from the Infrastructure index and...

READ MORE

MEMBERS ONLY

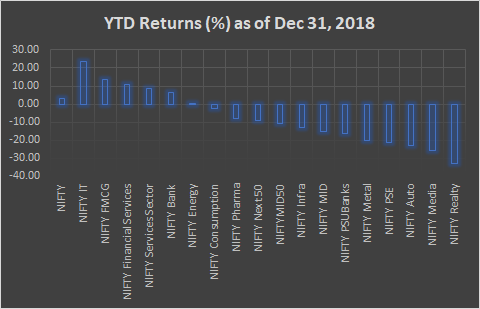

Special Note: The Year That Was & Sectors to Look At In 2019

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The last trading session of 2018 was rather dull, with the markets ending on a flat note. The year itself, however, stood in stark contrast to its last trading day. Throughout the previous year, the NIFTY was consistently affected by events both global and domestic in nature. These included, among...

READ MORE

MEMBERS ONLY

First Week Of 2019 To See NIFTY Remain Indecisively Bullish; Moving Past 10950 Still Important

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Over the past week, the markets continued to deal with overhead resistances on expected lines. Once again, it was a volatile week, with the NIFTY oscillating in a wide range as it dealt with a couple of important resistance levels on the charts. The benchmark index has attempted to penetrate...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY may relatively out-perform globally; upsides though, may remain capped

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Before the start of this week, we had highlighted the possibility of NIFTY facing overhead resistance as it was inching higher. We also expected the week to remain much more volatile than normal. In line with this forecast, the week that went by remained highly volatile, with the index oscillating...

READ MORE

MEMBERS ONLY

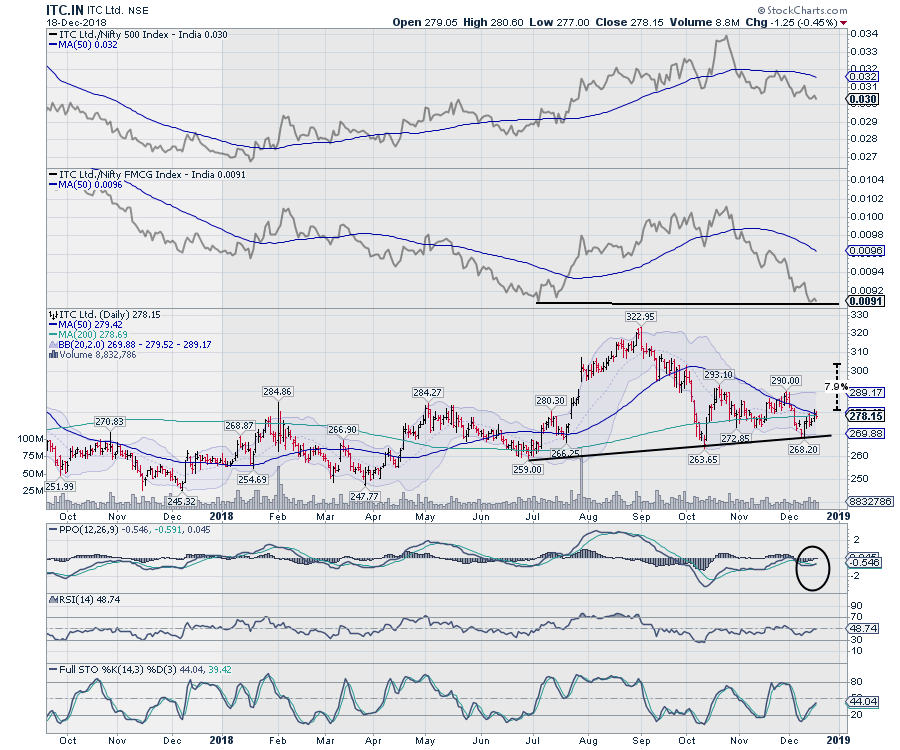

ITC and Adani Ports

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Before I begin, let me wish all our readers, friends and colleagues a very Happy Holidays and the best of times to come in 2019!

The Indian Equity markets have witnessed immense volatility over the past couple of days. Amid this volatile environment, it makes sense to adopt a stock-specific...

READ MORE

MEMBERS ONLY

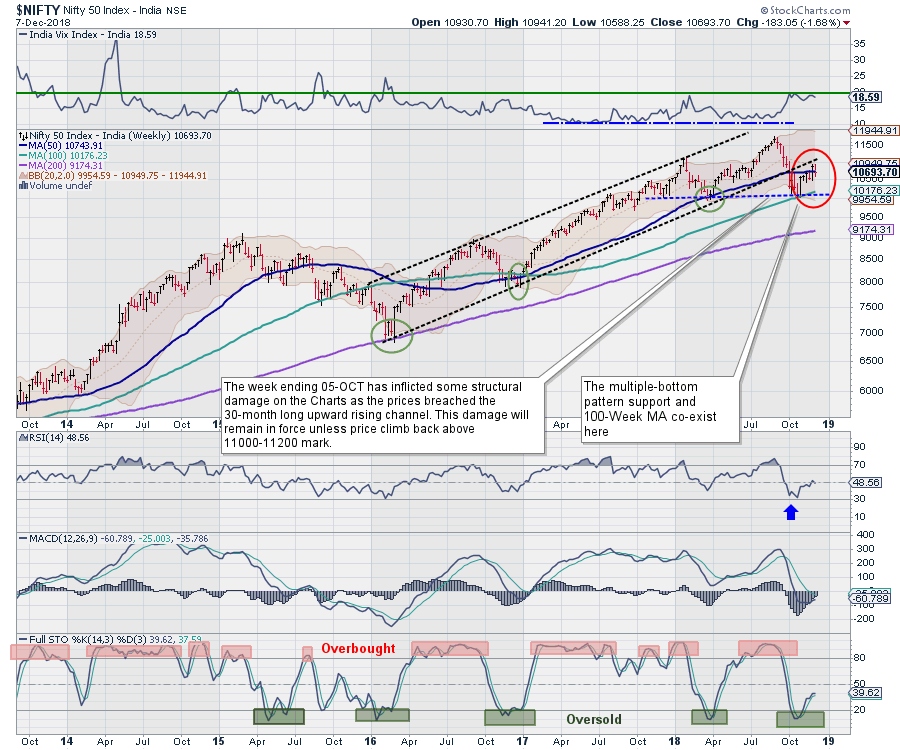

Week Ahead: Nifty continues to trade below key resistance levels despite strong pullback

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In our previous weekly note, we noted that we were expecting a rough ride for the Markets. Over the course of the last week, the markets dealt with the state election results and the sudden resignation of the RBI Governor. Volatility ruled the roost, with the NIFTY seeing swings in...

READ MORE

MEMBERS ONLY

Coming week to remain volatile for NIFTY; dealing with volatility infused by results of State Elections important

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

It wasn't smooth sailing for the equity markets as the previous week remained quite volatile, with the markets oscillating both ways to finally end the week in the red. The benchmark index NIFTY50 had moved past its 50-Week MA earlier, but it has failed to sustain that level....

READ MORE

MEMBERS ONLY

Kohinoor Foods and Godrej Agrovet

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Kohinoor Foods and Godrej Agrovet have under-performed the broader markets for quite some time. Presently, both of them are set to end their downward trajectory and look for some upward revision in prices over the coming days.

Kohinoor Foods Ltd (KOHINOOR.IN)

After hitting a high of 95.75 in...

READ MORE

MEMBERS ONLY

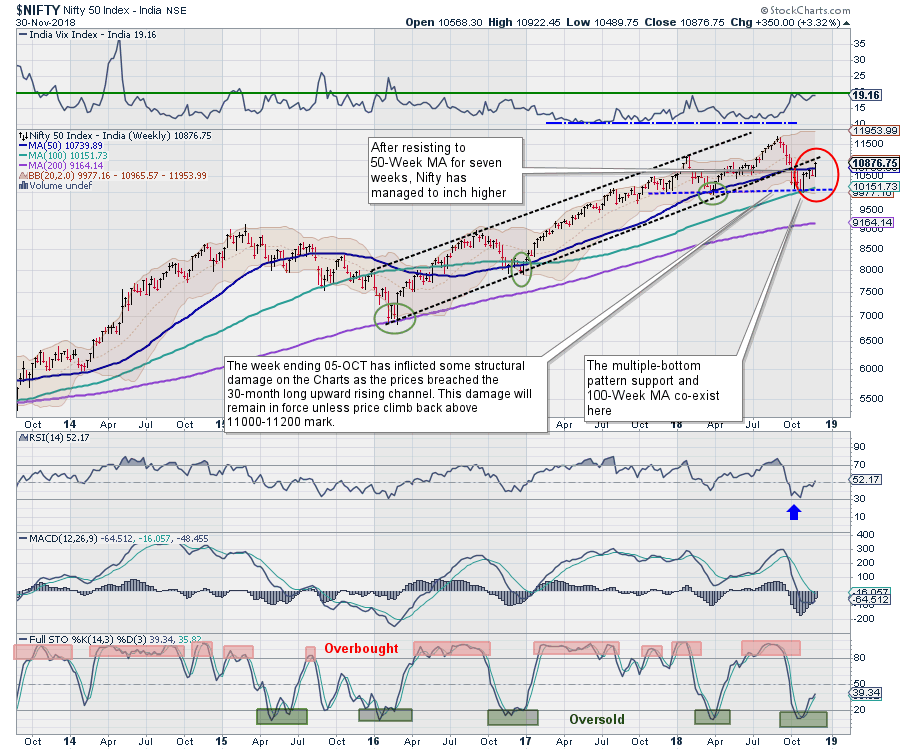

Weekly Outlook: NIFTY moves past 50-Week MA; sustenance above that may take Nifty higher

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The previous week remained much better than expected for the markets, as the benchmark Index NIFTY50 ended the week on a strong note. The week proved to be even more technically important as the NIFTY was able to move past its 50-Week MA, after having resisted that level for seven...

READ MORE

MEMBERS ONLY

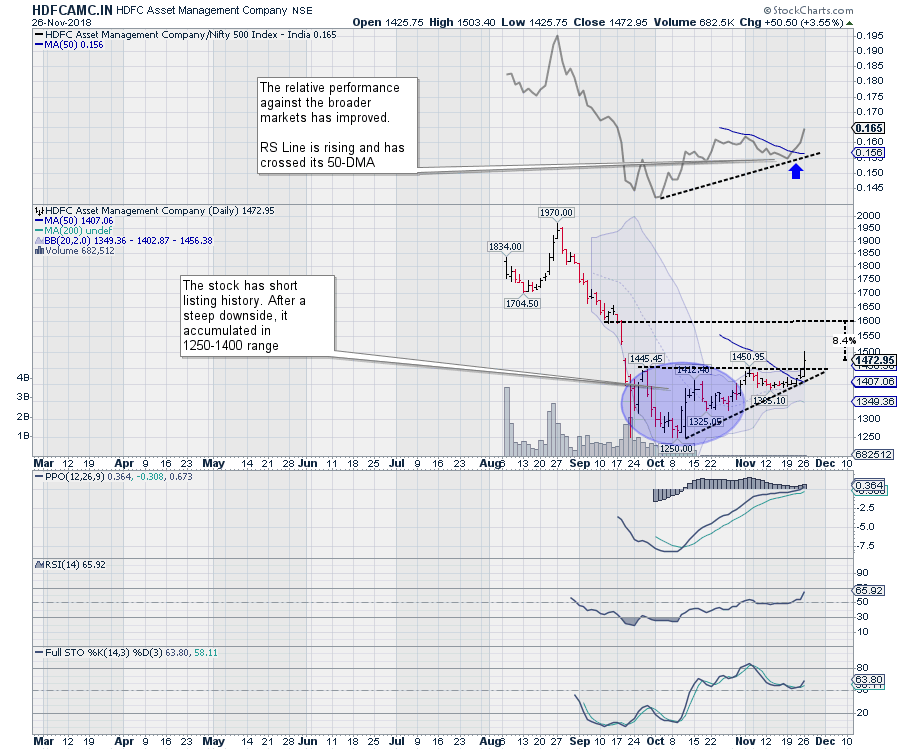

HDFC Asset Management and Adani Green Energy

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

As the broader and sector indexes continue to consolidate and remain in a broad range, it might be worthwhile to consider grabbing some opportunities outside the indexes. Scanning and looking for stock-specific opportunities is often very rewarding. Two stocks, both of which offer short term momentum and some possibilities of...

READ MORE

MEMBERS ONLY

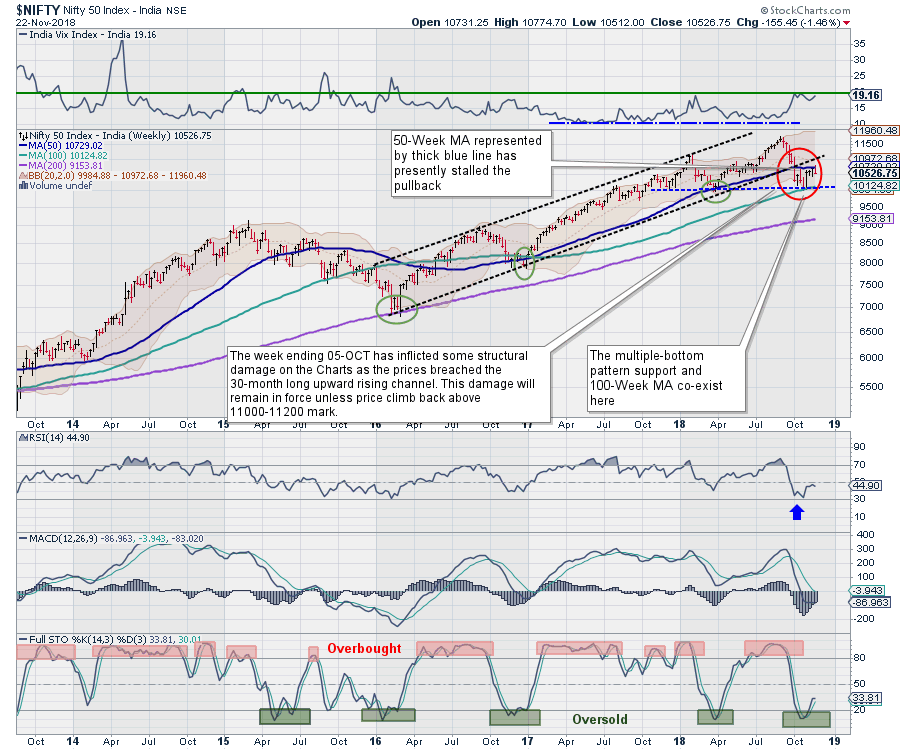

Expiry Week Ahead: NIFTY rules below 50-Week MA for seven weeks; up moves likely to remain capped

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In this short trading week, the equities ended the week on a negative note. In a week that saw the Markets moving in the 250-points range, the NIFTY ended the week near its lowest point. The benchmark Index lost 155.45 points (-1.46%) on weekly basis.

It was for...

READ MORE