MEMBERS ONLY

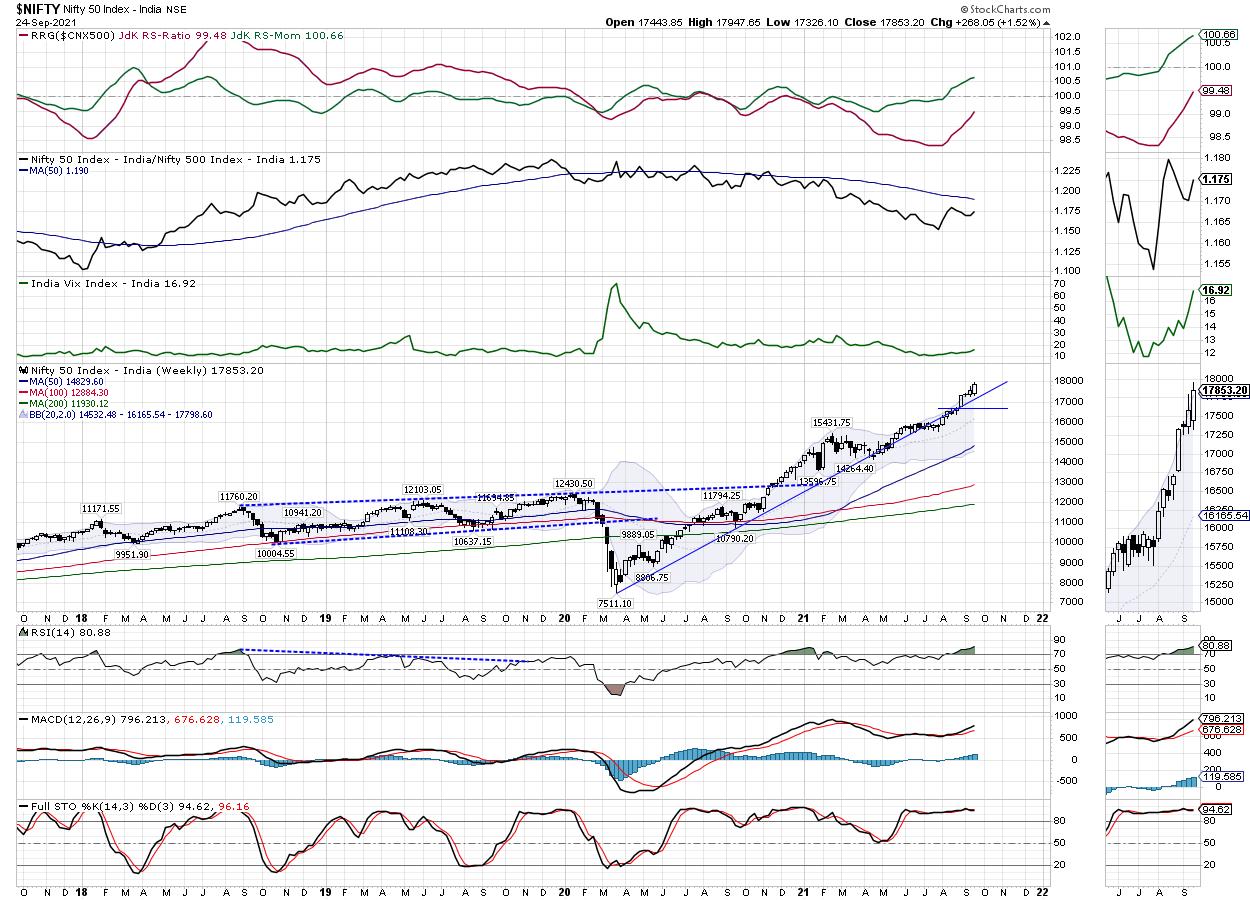

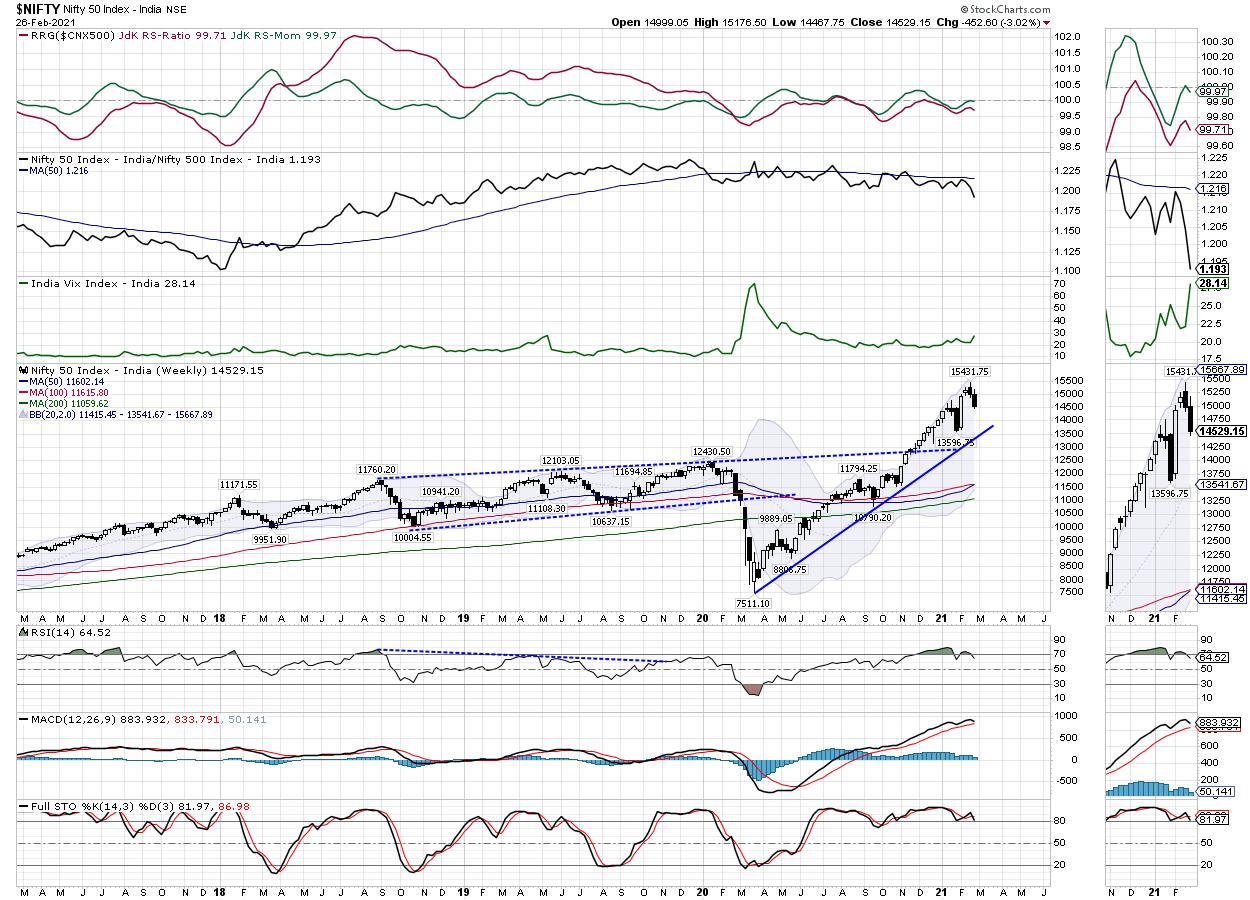

Week Ahead: NIFTY Stares at Important Support Levels; RRG Charts Show These Sectors Lending Inherent Strength to the Markets

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The week that went by remained on much of the analyzed lines. In the previous weekly note, it was mentioned that the NIFTY is unlikely to see any runaway rise as per the technical setup, as well as the Options data that point in time. It was also mentioned that...

READ MORE

MEMBERS ONLY

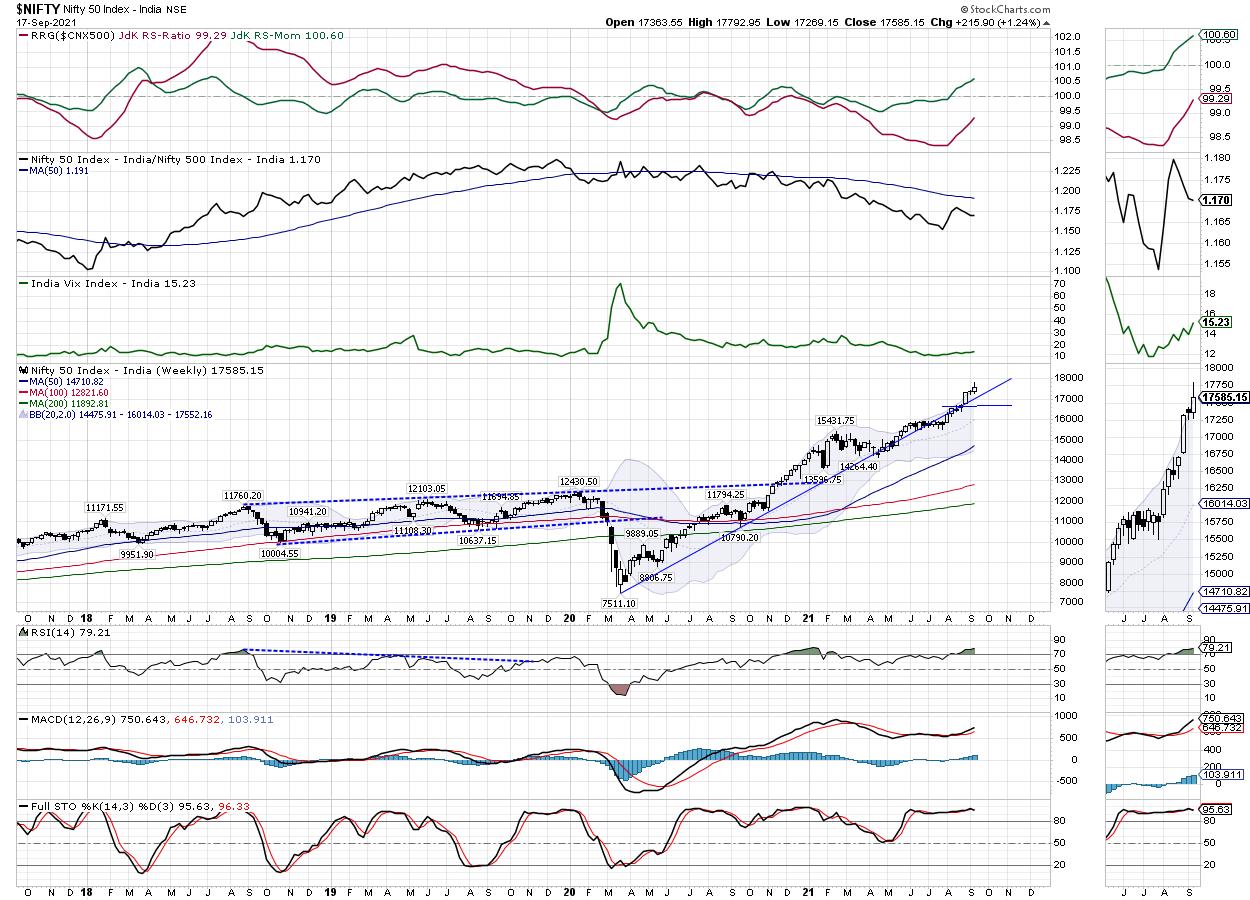

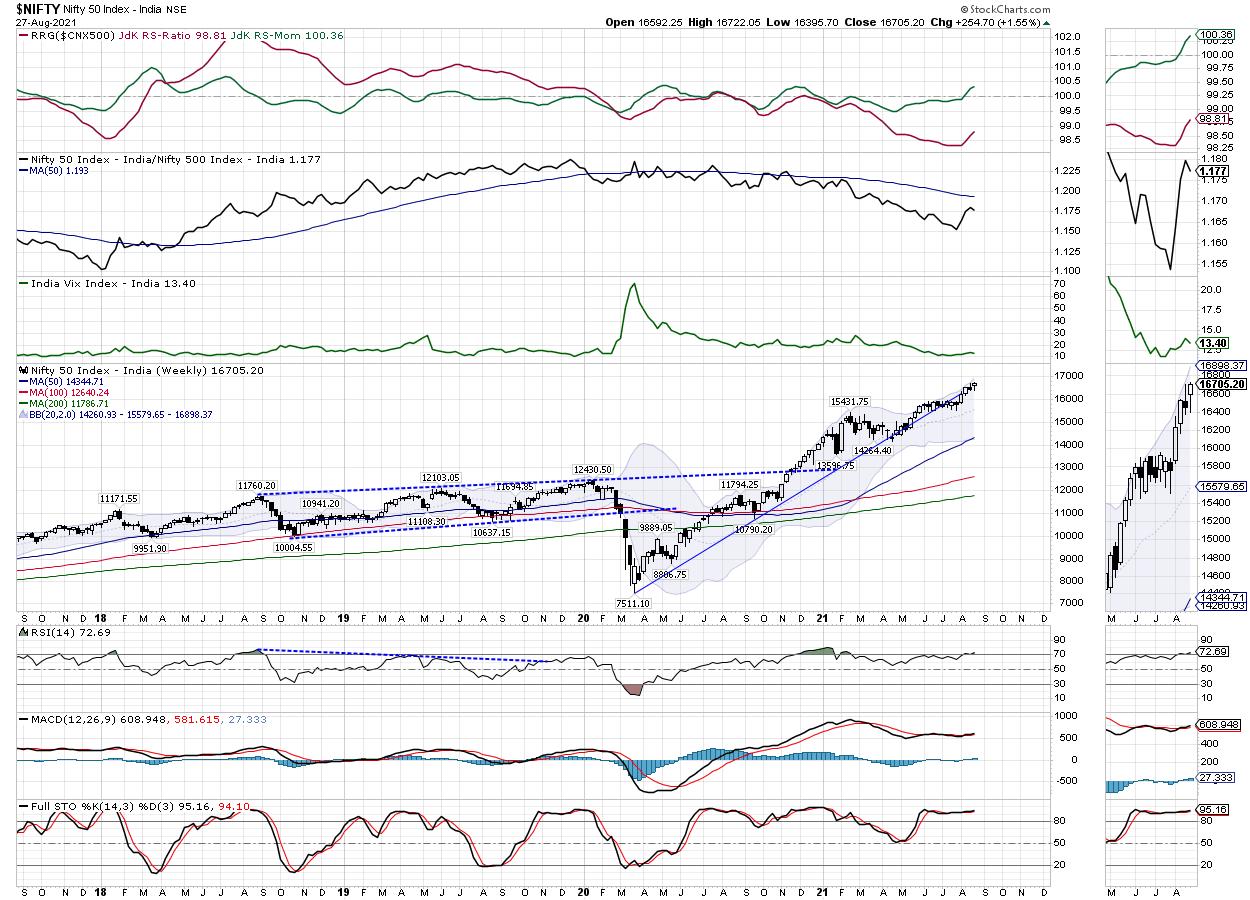

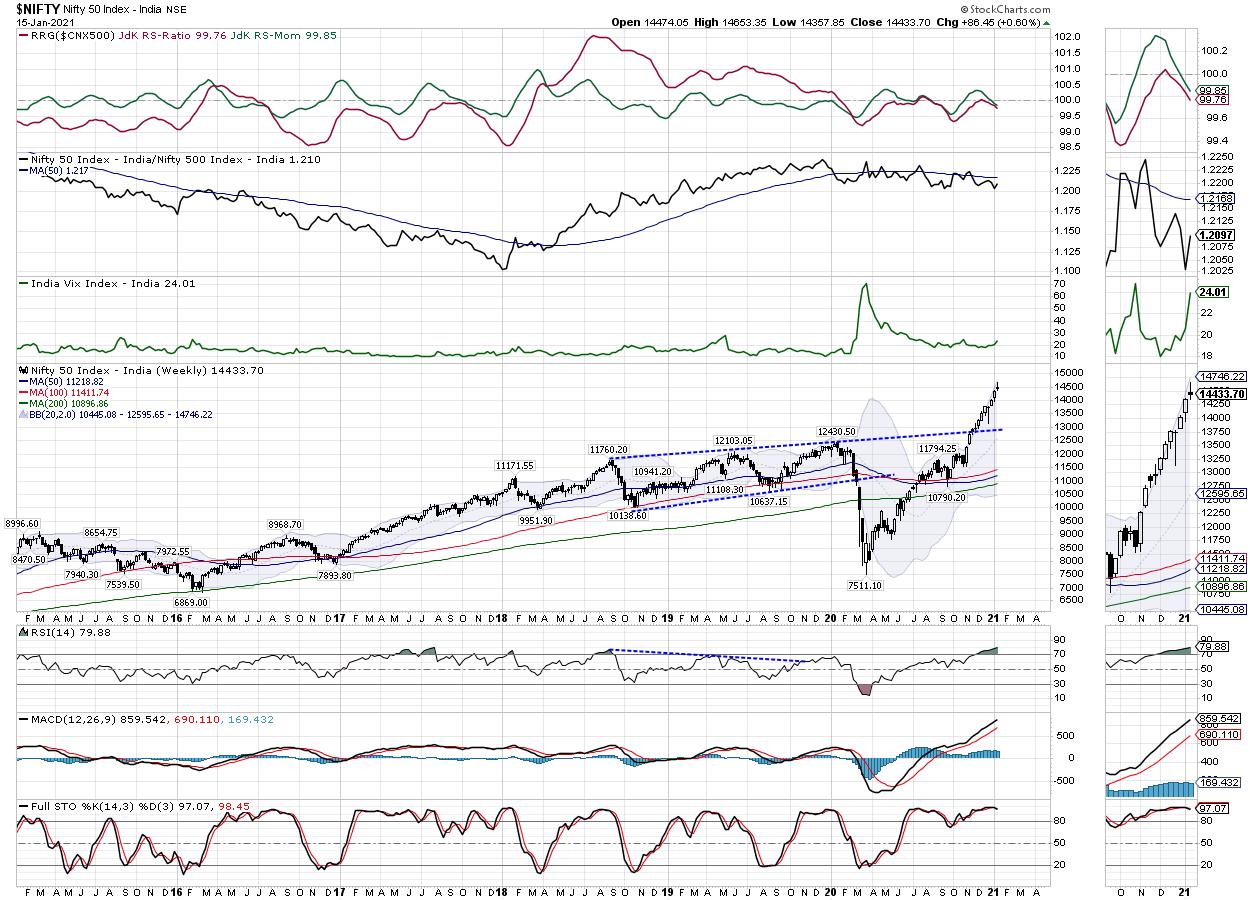

Week Ahead: Buoyant NIFTY May Face Consolidation at Higher Levels; Expect Outperformance from These Sectors

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Much on the expected lines, the Indian equity markets had a strong week. Despite being overbought and a bit overextended on the charts, the stocks put up a resilient show while the NIFTY tested and closed at a fresh lifetime high point. The Indian market was one of the most...

READ MORE

MEMBERS ONLY

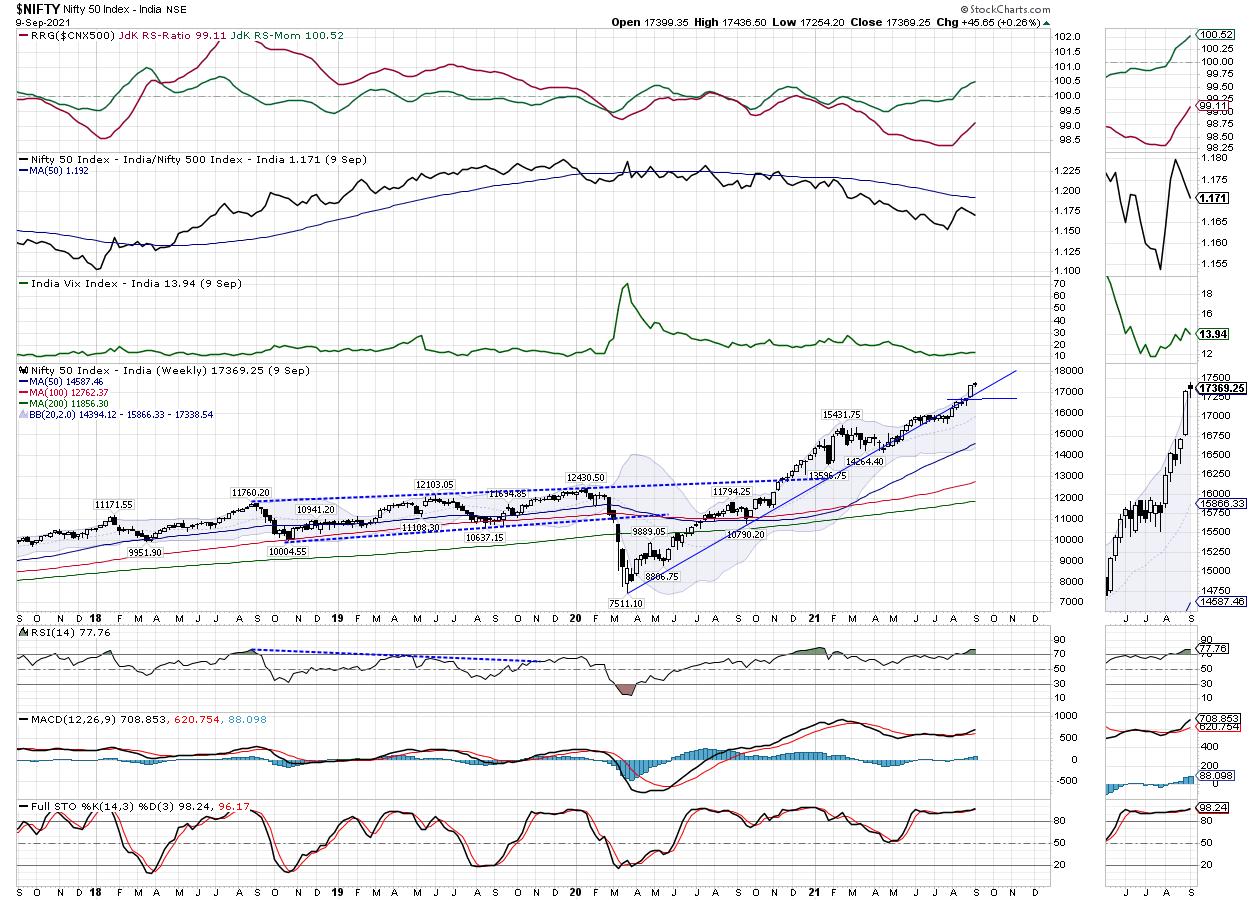

Week Ahead: NIFTY May Broadly Consolidate; RRG Chart Shows This Sector Ending Its Relative Underperformance

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

As discussed in an earlier technical note, the Indian equity markets were grossly overbought; as a result, they were largely expected to consolidate. However, in the first four days of the week, the NIFTY put up a very strong show as it kept marking incremental lifetime highs on a closing...

READ MORE

MEMBERS ONLY

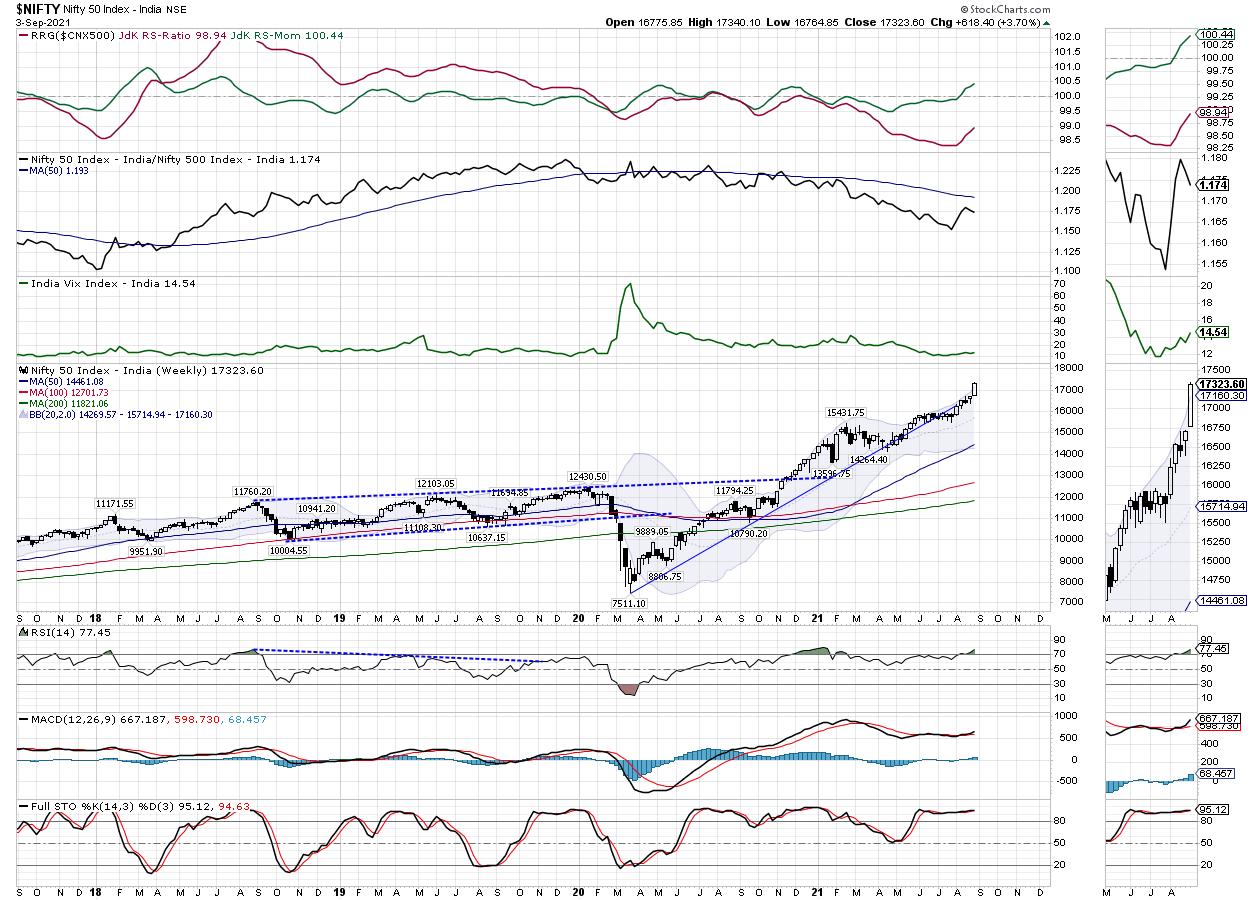

Week Ahead: NIFTY is Inherently Buoyant, But May Consolidate in a Broad Range; RRG Chart Shows a Good Setup

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In the previous weekly note, it was mentioned that even though the NIFTY and other key indexes are grossly overbought, the options data is continuing to show strength. This also meant that the supports were dragged higher by the NIFTY. While trading on the expected lines, the Indian equity markets...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Shows Internal Strength; RRG Chart Show These Sectors' Improving Relative Strength

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In a very strong surge to the up move, the Indian equity markets scaled greater heights, ending on a new lifetime high. In the previous edition of the weekly note, it was mentioned that, looking at the week's options data and the amount of PUT writing that was...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Makes Some More Room for Upside; Chase Momentum While Protecting Profits Vigilantly

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In the previous weekly note, it was mentioned that, although the markets are due for some range-bound consolidation, defending the zone of 16300-16450 will be crucial for the NIFTY. Over the past five days, the NIFTY kept marking intermittent highs with some consolidation in between. During some interim profit-taking pressure,...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY May Stay Ranged; Approach Markets in a Highly Stock-Specific Way

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In the previous weekly note, we had mentioned that the only trouble with the otherwise buoyant NIFTY is that it is overextended on the daily chart. The week that went by saw the markets consolidating at higher levels. On the global landscape, the "taper tantrums" from the Fed...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Edge Higher If Stays Above This Point; RRG Chart Hints At Leadership From These Sectors

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In the early weekly note, it was mentioned that the following eight weeks of consolidation, the NIFTY has finally staged a breakout while dragging its support levels considerably higher. Over the past five days, the NIFTY extended its gains while it closed at yet another lifetime high levels. The trading...

READ MORE

MEMBERS ONLY

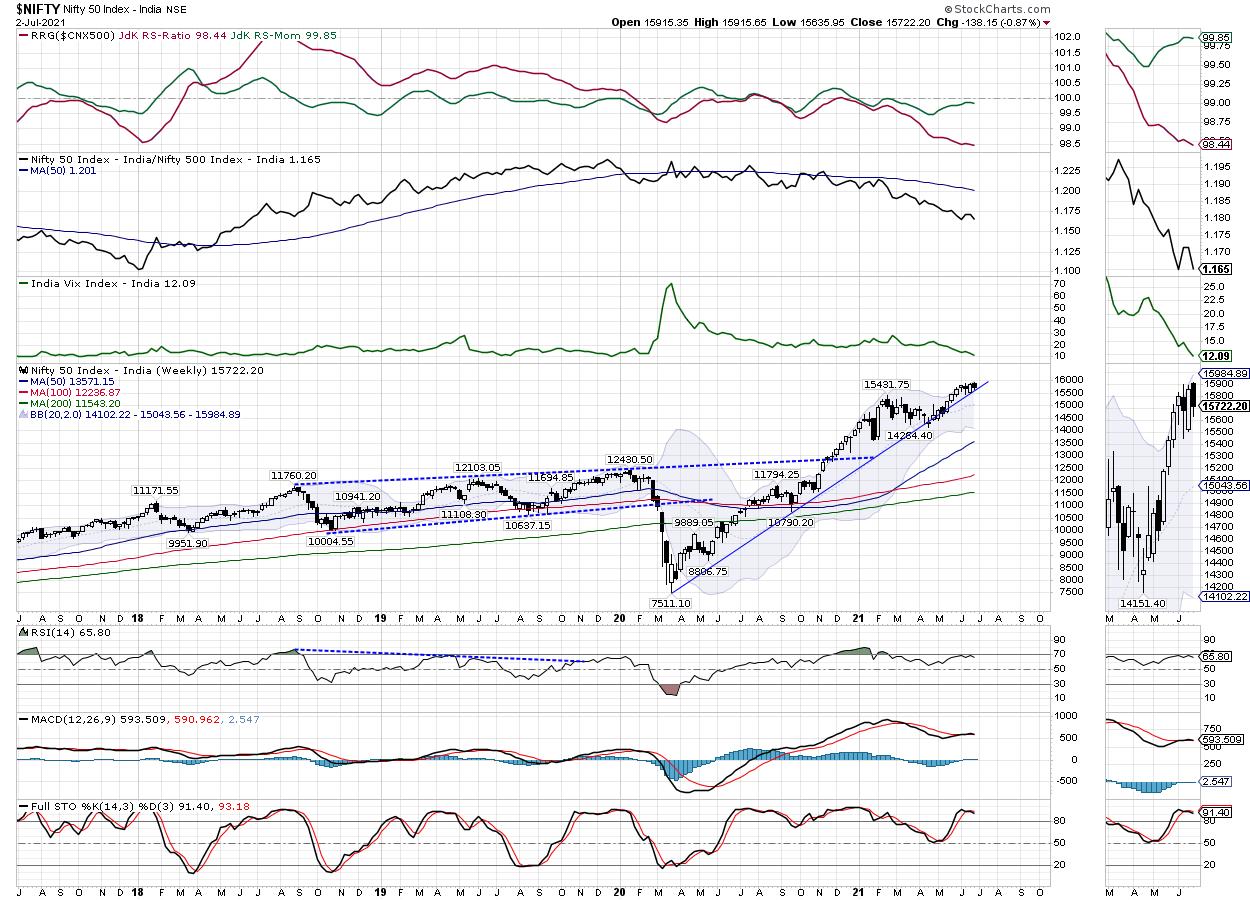

Week Ahead: NIFTY Likely To Positively Consolidate; These Sectors Are Likely To Put Up Resilient Show

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

After eight weeks of consolidation, the Indian markets gave yet another break out as it surged above the crucial 15900-15950 zone. The past four out of five saw the markets inching relentlessly higher as it not only demonstrated renewed strength but also made the present breakout sustainable. The markets saw...

READ MORE

MEMBERS ONLY

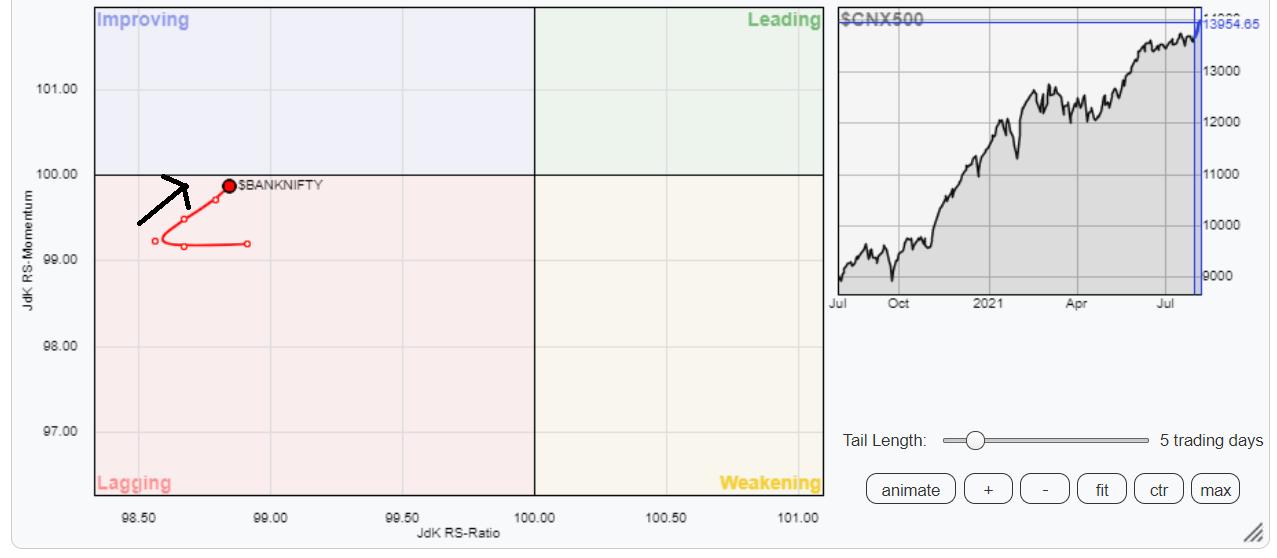

Is This Key Index Likely To Play A Catch-Up?

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The frontline NIFTY50 Index staged a strong breakout following eight weeks of strong consolidation. It has marked a fresh lifetime high and presently trades in uncharted territory.

For a bull run to sustain in a meaningful way, there has to be broad-based participation; especially from key sectors like banks and...

READ MORE

MEMBERS ONLY

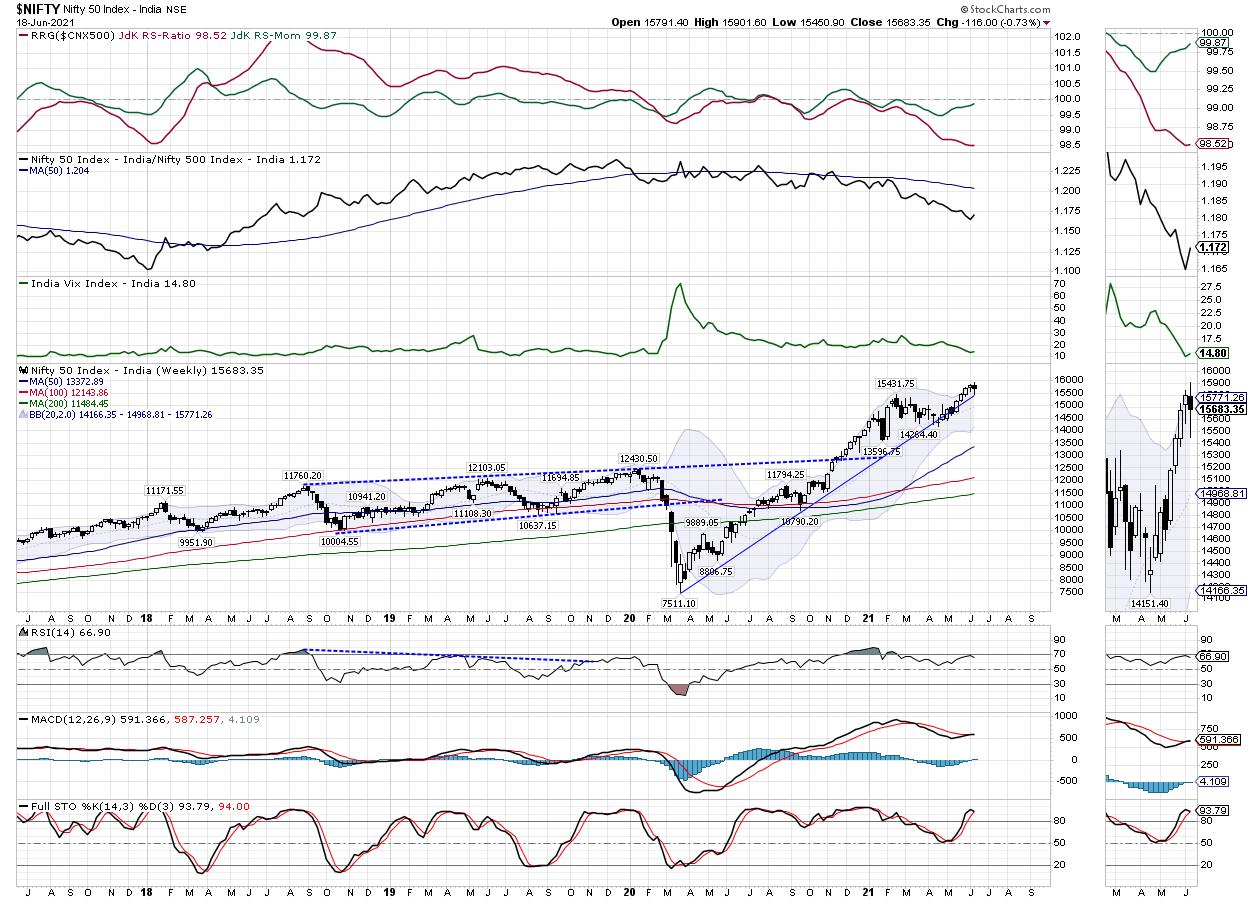

Week Ahead: NIFTY Stays Crucially Poised; RRG Charts Hints At Markets Turning Defensive

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

It was one more consolidating week for the Indian equity markets, as the NIFTY continued to consolidate over the past five days. Despite a couple of attempts, it failed to clear the important resistance zone of 15900-15950 and suffered violent profit-taking twice from those levels. On the short-term daily charts,...

READ MORE

MEMBERS ONLY

Week Ahead: Stay Alert as NIFTY Awaits a Breakout Amid Weak Technical Setup

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The Indian equities showed a lot of resilience throughout the past five trading days and managed to close on a fresh weekly near its fresh all-time high point. The markets stayed resilient to the downsides, but, at the same time, showed fierce consolidation at higher levels and did not make...

READ MORE

MEMBERS ONLY

Realty Space: Look What These Six Charts Are Saying!

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The NIFTY Realty Index is showing strong technical setup on both its Daily and Weekly charts. Some sector rotation is clearly evident and the sector is showing strong Relative Strength against the broader markets.

The Daily Chart of the NIFTY Realty Index show a strong breakout above 360. Even if...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Mildly Violates This Pattern Support; RRG Chart Shows Mixed Sectoral Trends

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Over the past five days, the Indian equity markets consolidated and traded in the limited range, ending the week with a modest loss. The NIFTY oscillated in the same range as the week before this one; though it ended on a negative note, it has also formed a parallel bar...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Stares at Crucial Support as it Rests on Major Pattern Support; RRG Chart Shows Mixed Sector Setup

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Following a buoyant performance in the week before this one, the Indian equities had a quiet show over the past five days. The trading range throughout the previous week was narrower and rested itself on key support. The NIFTY approached its lifetime high point and retraced from that level to...

READ MORE

MEMBERS ONLY

Interesting Price Pattern Develops on This General Insurance Stock

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

ICICI Lombard General Insurance Company Ltd -- ICICIGI.IN

The most recent price action in ICICIGI shows that it is likely to move past its multi-point resistance zone, existing between 1540-1560 levels. The stock has seen a broad range consolidation and the formation of higher bottoms after it took support...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY at New High But Weak Internal Strength; RRG Chart Shows Risk-on Setup in Place

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The stock markets once again had a buoyant week as the Indian Headline Index NIFTY50 closed at a fresh lifetime high. The Indian market had four consecutive weeks of gains, piling up over 1121 points and taking a breather after that. However, after pausing its up move for just one...

READ MORE

MEMBERS ONLY

Week Ahead: Technical Structure Shows NIFTY's Upside Capped Near This Point; RRG Chart Continues Throwing Mixed Cues

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The Indian equity markets took a breather in the week gone by as they halted four consecutive weeks of gains. Over the past month, the NIFTY had piled up 1121.55 points of gains. However, over the past five days, the NIFTY retraced after marking its fresh lifetime high at...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Has High Call Writing at These Levels; RRG Chart Continues Offering Mixed Cues

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

While trading on a narrower range, the NIFTY continued its up move and ended on a positive note for the fourth consecutive week. The NIFTY went on to mark its incremental fresh lifetime high as it continued trending higher on reduced and decelerating momentum. The trading range remained narrower at...

READ MORE

MEMBERS ONLY

Week Ahead: Buoyant NIFTY Has These Things to Guard Against; RRG Chart Shows Mixed Sectoral Setup

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

For the third week in a row, the Indian equity markets continued with their up move. The week that went by saw the NIFTY50 index scaling a fresh high and also ending at its new lifetime high point. The Indian headline index is now placed in uncharted territory. The NIFTY...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Stays Buoyant; Keeping Eye on Volatility Important Because of This

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The past week remained a trending one, as the NIFTY attempted to break out of the channel and, in the process, tested and marked a new lifetime high on the last trading day of the week. The trading range during the week remained narrower; the index moved in a 324-point...

READ MORE

MEMBERS ONLY

Week Ahead: Chase Momentum Selectively; RRG Chart Shows One More Defensive Sector Rolling Inside the Leading Quadrant

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Despite intermittent hiccups in between, the past week stayed much better than expected for the Indian markets. The NIFTY not only averted the bearish consequence of the violation of the rising trend line, but it also went on to end the week while posting decent gains. As compared to the...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Shows Weak Technical Setup; RRG Charts Shows These Sectors Making Strong Moves

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The truncated trading week stayed disappointing in more ways than one. Just when it appeared that the NIFTY had rectified its violation of the immediate and important trend line support, it has since violated it again while taking support on the short-term 20-week MA. The trading range remained a bit...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Within the Falling Channel; RRG Chart Show These Two Defensive Sectors Rolling Over to Improving Quadrant

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In a week that remained technically important, the markets pulled up from the lows that were marked in two previous weeks. The NIFTY saw a narrower trading range than the week prior. The index oscillated in a 446-point range over the past five sessions and remained largely trending on the...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Has a Challenging Phase To Navigate; RRG Points at Likely Relative Underperformance From These Sectors

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In a week where the trading range remained wider than usual, the Indian equities took a serious cut on the Friday's session; however, they managed to close the week on a positive note. In the previous weekly note, it was mentioned that the NIFTY was trading inside the...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Mildly Violates This Important Pattern Support; May Relatively Underperform Broader Indices

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In a week where the trading range stayed narrower than the earlier week, the Indian equities saw a corrective decline. The current week was also a truncated one with just four trading sessions. The headline index saw itself oscillating in a 375-point range. Though the range stayed less wide, the...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Almost Violated This Major Trend Line Support; RRG Chart Shows This Sector Rolling Inside the Lagging Quadrant

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Over the past four trading sessions, the Indian equities continued to relatively underperform their global peers and ended the week on a modestly negative note. The previous week was a truncated one, as Wednesday was a trading holiday. The NIFTY had a similarly wide trading range as it oscillated in...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Has This Pattern to Navigate to Move Higher; RRG Chart Shows These Sectors to Relatively Outperform

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In a trading range that was wider than the previous week, the Indian equities did not make any directional headway and ended on a flat note over the past five days. On the expected lines, the NIFTY oscillated in a wider range, but stayed within the falling channel that the...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Likely to See Incremental Gains; RRG Charts Show This Sector Ending Relative Outperformance

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The previous week was a short and truncated one with just three working days. The NIFTY stayed volatile on the expected lines and danced to yield and a stronger dollar on the expected lines, but continued to post some gains. On the weekly charts, the Index stayed much in a...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY to Stay Broadly Ranged in Truncated Week; This Zone Emerged as Strong Support Area for Markets

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The previous five days of the week were spent in a broad range, where the markets remained in wide-ranged consolidation and ended the week on a modestly negative note. The NIFTY oscillated in an over 600-point range just like the week before, staying predominantly in a corrective mode -- except...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY May Extend Technical Pullback to a Limited Extent; RRG Charts Show These Sectors May Stay Resilient

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

After being heavily spooked by rising bond yields and strengthening the US dollar in consequence, the Indian equity markets remained weak throughout the week, barring the last day where it saw some technical rebound from the short-term oversold levels. The NIFTY moved in a wide 700-point range and, if looked...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY to Stay Broadly Range-Bound; RRG Looks at These Sectors for Resilient Show

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In a truncated week, the Indian equities failed to take any directional cues and traded all over the places over for four trading sessions, before ultimately ending the week with a modest gain. The start of the week stayed volatile, with the NIFTY trading in a wide range. However, the...

READ MORE

MEMBERS ONLY

Week Ahead: These Signs Show Possibility of NIFTY Slipping in Broad Consolidation; This Index Moves Back Inside RRG Leading Quadrant

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Both the trend and the sentiment in the equity markets were affected due to a spike in the US Treasury Bond yields, which had its obvious effect on the emerging markets in general. The spikes and the strengthening US Dollar index caused some gap down opening and corrective moves in...

READ MORE

MEMBERS ONLY

Week Ahead: Technical Pullbacks Likely, But Upsides in NIFTY to Stay Capped; RRG Chart Shows This Sector Ending Relative Underperformance

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In the previous weekly note, we had expected the markets to show limited upsides and had also noted some possibility of the NIFTY slipping into some consolidation. The previous week remained quite volatile and the NIFTY oscillated in a violent and volatile way for the first four days of the...

READ MORE

MEMBERS ONLY

Week Ahead: Overstretched NIFTY Needs to Note These Technical Factors; RRG Charts Show These Sectors Favorably Placed

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Following a strong earlier week, the previous week saw some extension of the up move as the NIFTY ended on a positive note. Most of the past five sessions saw the index trading in a capped range with limited upsides. Unlike the earlier week, which had a very wide-ranging move,...

READ MORE

MEMBERS ONLY

Week Ahead: Markets Approaches Union Budget on a Relatively Lighter Note; Prefer These Sectors for a Better Risk-Reward Proposition

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In what remained one of the worst weekly and monthly performances in recent times, the Indian equity markets witnessed heavy profit-taking throughout the week. The markets had a phenomenal run over the previous months; however, over the past week, it had shown some signs of taking a breather. The past...

READ MORE

MEMBERS ONLY

Truncated Week Ahead: NIFTY to Continue Profit-Taking at Higher Levels; RRG Chart Shows Sectors Sharply Paring Relative Momentum

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In the previous week's note, it was mentioned that the markets have shown first signs of fatigue as they marked the high point of 14653. This was the point where profit-taking bouts emerged. Over the week that went by, the markets did make some incremental highs; however, they...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Eyes Some More Consolidation; RRG Chart Suggests This Group Likely Ending Relative Underperformance

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Although the Indian equity markets extended their weekly gains, they showed the first signs of impending broad consolidation, spending much of the last three days correcting from the higher levels. The start to the week was buoyant; however, after marking the week's high at 14653, the NIFTY continued...

READ MORE

MEMBERS ONLY

Week Ahead: Buoyant NIFTY Stays Prone to Profit-Taking Bouts; RRG Chart Highlights Importance of Staying Selective

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In a week that was a bit more volatile than the previous one, the Indian equities continued with their up move, ending once again on a lifetime high point. The trading range also widened over the past five sessions as the Index oscillated in the range of 414 points. On...

READ MORE

MEMBERS ONLY

A Classical Bottom Formation in Place for This Stock

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Chennai Petroleum Corp. Ltd -- CHENNPETRO.in

The long-term weekly chart of this stock offers some good classical ingredients in it: it hints at a potential bottom in place and a probable trend reversal going ahead from here.

The stock peaked near 480 in late 2017 and, ever since, has...

READ MORE