MEMBERS ONLY

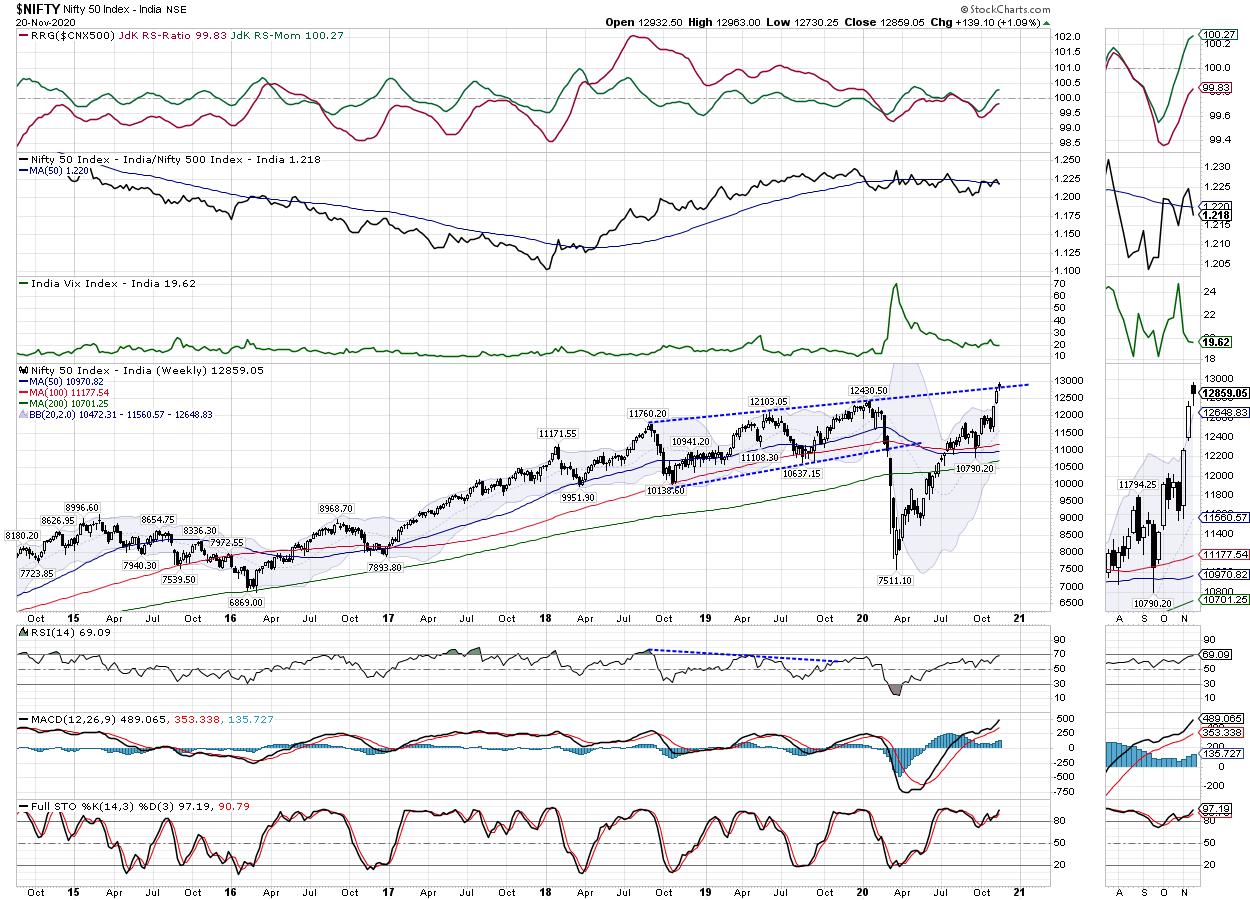

Week Ahead: Weak Dollar Index May Continue Fueling Liquidity in Markets Unless It Pulls Up; RRG Chart Shows Strong Sectoral Setups

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In a relatively very stable week, the Indian equity markets continued with their up move and have ended yet another week with gains. The volatility that was witnessed in the week before this one was absent. Instead of a wide 700-point wild move that was witnessed, the past five days...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Shows First Signs of Broad Consolidation, Even if it Shows Incremental Moves; These Sectors Poised for Strong Move

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In the recent weekly notes, we had mentioned the markets getting overstretched and overextended over the immediate short term. It was a matter of concern, as any form of a consolidation or corrective move stood imminent; the absence of either was making the present uptrend highly risky and unhealthy. On...

READ MORE

MEMBERS ONLY

Is This Stock In For A Major Trend Reversal?

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Take Solutions (TAKE.IN)

The study of both Daily and Weekly timeframes presents a few interesting insights.

The patterns appearing on both the timeframes are fractal. The area pattern that appears on the Daily timeframe is also present on the weekly charts. The RSI on the weekly chart has broken...

READ MORE

MEMBERS ONLY

Week Ahead: Markets See Sector Rotation; RRG Chart Tell Us to Focus Here as NIFTY Stays Prone to Consolidation

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Over the past five days, the Indian equities continued with their measured up move and went on to pile up some more incremental gains. After some brief consolidation in the beginning of the week, the NIFTY went on to mark fresh lifetime closing highs each day as the liquidity continued...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Strong, But Warrants Caution at These Levels; RRG Chart Shows Good Activity in These Sectors

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In what was a sixth consecutive week of gains, the Indian equities continued with their up move and extended their gains. It was a measured move ahead for the markets, which went on to close with fresh lifetime highs once again. The trading range over the past five days was...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Slightly Overstretched But Strong; RRG Chart Suggests These Sectors will Relatively Outperform

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In the week that went by, we saw the markets adding more strength and piling up some more incremental gains. The NIFTY has not only stayed above the crucial 2-year long pattern resistance trend line, but also added some directional bias to it by moving higher. The markets were much...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Hangs Just Above this Important Pattern Resistance Level; RRG Chart shows These Sectors Doing Well

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The equity markets are presently dealing with one of their most important pattern resistances over the previous days. In the previous note, we had mentioned the importance of this pattern resistance line; it was also mentioned that, unless the zone of 12960-13000 is taken out comprehensively, we may not see...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Flirts with an Important Pattern Resistance; RRG Chart Shows Good Activity in These Sectors

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In the previous weekly note, we mentioned that the NIFTY was testing its crucial pattern resistance. Over the past five trading sessions, the markets, in general, displayed some corrective tendencies, but continued to extend gains. As compared to the previous two weeks, which had a wide trading range of 723...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Meets This Important Pattern Resistance; RRG Chart Shows Isolated Performance From These Sectors

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In a yet another gainful week for the markets, the Indian equities extended their move on the upside and posted decent weekly gains. The past five days saw the NIFTY moving higher and closing at its lifetime high levels. As compared to the week before this one, the trading range...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Likely to Consolidate at Higher Levels; RRG Chart Point Towards These Sectoral Shifts

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In a week that saw wide-ranging moves and a rally that was fueled by US elections, the Indian equities went on to end on a strong note. The week's trading range not only wide that of 723 points, but the previous days also saw volatility declining to a...

READ MORE

MEMBERS ONLY

Week Ahead: Upsides in NIFTY To Stay Capped; RRG Chart Highlights Divergence Between These Two Banking Groups

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

After struggling near the 12000-12025 zones for two weeks, the Indian equities finally gave out following global weakness, ending the week on a negative note. In comparison to the week prior, the NIFTY had a wider trading range to deal with. In the previous weekly note, it was mentioned that,...

READ MORE

MEMBERS ONLY

Is the Indian Market Facing an End of the "Risk-On" Environment Along with Other Emerging Markets? These 3 Charts Tell a Story

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The first quarter of this CY 2020 was quite a disaster for the equity markets. The month of February saw the onset of the COVID-19 pandemic and the spread of coronavirus saw equity markets the world over witnessing a vertical crash everywhere, in the range of 35% to 45% across...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY to Have Difficult Time Moving Past This Zone; RRG Chart Paints a Tricky Picture

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

While trading on expected lines, the Indian equity markets did not make any major directional moves and consolidated in a defined range. The NIFTY did not move past the previous week's high point and consolidated while resisting to that level. The trading range also remained narrower than what...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY to Stay Largely Rangebound; RRG Charts Show No Improvement in This Group

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The market action in this week fared precisely on the anticipated lines. In the previous weekly outlook, we had mentioned the markets were firmly placed but, at the same time, staying overstretched on the short-term charts. It was also mentioned that any up moves will face stiff resistance at higher...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY at Crucial Resistance Zone; RRG Chart Suggests Staying Highly Sector-Specific

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The week that went by remained firmly on the expected lines. In the previous weekly note, we had mentioned that the markets may push themselves higher amid increased volatility. The NIFTY indeed closed higher following a strong move, while the volatility also spiked. The financial stocks were expected to perform...

READ MORE

MEMBERS ONLY

Time to Enjoy the Hospitality Of This Stock for the Medium Term

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The Indian Hotels Company Ltd (INDHOTEL.IN)

This hospitality stock has formed its bottom in June and is in the process of confirming it by moving past the crucial 200-DMA, to which it has presently resisted. If this level is taken out, we may see this stock extending its gains...

READ MORE

MEMBERS ONLY

Is This Sector Set to End its Underperformance?

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Nifty Financial Services Index ($CNXFIN)

The NIFTY Financial Services sector seem to have ended its short-term underperformance. The Index has broken out from a falling channel and has formed a gap, which indicates greater push to the upside.

The RSI has marked a fresh 14-period high, which is bullish. It...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY May Try to Push Higher Amid Increased Volatility; RRG Chart Says These Sectors May Start Making Moves

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The week before this one was quite eventful, as the NIFTY tested all its crucial supports on the daily and weekly charts. The past week saw the NIFTY respecting few crucial support levels on the higher timeframe charts and showing a technical pullback. The four-day trading week showed the headline...

READ MORE

MEMBERS ONLY

Crucial Week Ahead: NIFTY Set to Deal with Multiple Important Technical Setups; RRG Chart Points Towards Sector-Specific Moves

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Unlike the previous week that had stayed uneventful for the markets, the Indian equities witnessed an immensely volatile week that ended this Friday, September 25, 2020. The markets saw a good start to the week, but the second half of the week stayed terribly volatile, with the markets ending with...

READ MORE

MEMBERS ONLY

Week Ahead: Slippery Road Ahead for the NIFTY; RRG Charts Show No Major Shift on the Sectoral Front

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The week remained largely uneventful for the markets, as they traded in a narrow range and consolidated over the past five days. The trading range also remained very narrow compared to the earlier weeks. The NIFTY witnessed a movement in the band of just 235-odd point while avoiding taking any...

READ MORE

MEMBERS ONLY

Week Ahead: This Fractal Pattern is a Concerning Factor for Near Term; RRG Charts Warn to Stay Sector-Specific

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The Indian equities ended the week with modest gains, as they struggled to keep afloat when the global markets showed sharp corrective moves that led to the revision of means. In a trading range that stayed narrower compared to the week prior, the headline index ended with gains, while the...

READ MORE

MEMBERS ONLY

Week Ahead: Staying Above These Levels Crucial for NIFTY; RRG Chart Shows These Sectors Continuing to Outperform

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In a wide-ranging trading week, the Indian equity markets halted their four-month winning streak. The NIFTY met its important pattern resistance, from which it reacted. Over the past five trading sessions, the NIFTY saw a trading range of close to 500 points. Amid volatile moves, it was a time for...

READ MORE

MEMBERS ONLY

Week Ahead: Dollar Deluge May Push Markets Some More; RRG Chart Shows These Broader Indexes in the Leading Quadrant

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The Indian equity markets continued their unabated liquidity-driven up move and ended with yet another week with gains. The past five days remained less volatile than expected as the NIFTY remained in a defined range of 275-odd points. The directional move, however, remained unidirectional as the Index continued to move...

READ MORE

MEMBERS ONLY

Week Ahead: These Two Factors Will Affect NIFTY; RRG Chart Point Towards Broader Indexes Performing Well

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

After taking a breather in the week prior, this week the markets resumed their move higher and posted some incremental gains once again. Over past five days, the NIFTY has experienced range-bound oscillations, with the range still being close to its normal trading width. At the same time, the Index...

READ MORE

MEMBERS ONLY

Week Ahead: These are Two Concerning Factors for NIFTY; RRG Chart Shows Dearth of Sectors in Dominant Position

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

This was a week when the markets perfectly respected the technical levels; they took a breather and ended with a minor loss. Over the past five days, the NIFTY piled up incremental gains, but the last trading day reversed all those little gains. The NIFTY oscillated in a narrow 262-point...

READ MORE

MEMBERS ONLY

A Potential Breakout from a Bollinger Band Squeeze

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

SBIN.in (State Bank Of India)

SBI.in has seen a prolonged period of low volatility over the past several weeks, which has led to contraction of the Bollinger bands. Periods of low volatility are often followed by the periods of high volatility. The probability of the sharp move in...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Likely to Stay in a Range; RRG Chart Shows These Sectors Staying Resilient

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

After clocking robust gains in July, the NIFTY started off the first week of August on a positive note. Over the past five sessions, the markets traded in a 374-point range before closing the week with modest gains. The NIFTY stayed above its critical levels on both the daily and...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Makes Some Room for Consolidation at Higher Levels; Expect RRG Leadership From These Sectors

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

After testing a couple of important levels in the week before this one, the NIFTY took a breather and consolidated over the past five sessions. In the previous weekly note, we had highlighted that the momentum at higher levels is diminishing, which might lead to some consolidation at higher levels....

READ MORE

MEMBERS ONLY

This Telecom Stock Seems To Be Giving Up...

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The upper extended trend line shows that the Double Top breakout not only fizzled out, but the price action failed to move past that double top resistance several times. This has reinforced the credibility of this resistance.

Presently, the price has slipped below the 50-DMA.

The daily MACD has shown...

READ MORE

MEMBERS ONLY

Week Ahead: Chase Momentum Vigilantly If NIFTY Attempts Higher Levels; RRG Chart Show This Sector Taking a U-Turn

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The week before this one had seen the headline index testing a couple of important levels on daily and weekly timeframe charts. On the daily chart, the index had closed a notch above the 200-DMA; on the weekly chart, it had tested the 50-week MA. Over the past five session,...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY has Three Important Levels to Deal With; RRGs Clearly Show Change of Leadership

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In the previous weekly note, we had mentioned that the markets were losing momentum in general despite some measured incremental up moves. The week that went by traded much on the anticipated lines. The trading range increased over the past couple of days as the NIFTY continued to witness selling...

READ MORE

MEMBERS ONLY

This Health Care Stock is Poised for a Breakout

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Price action has seen an Ascending Triangle formation in APOLLOHOSP.IN over the past several weeks. In this classically bullish formation, the 200-DMA appears to be acting as a proxy trend line.

The prices have tested the 200-DMA five times; any strong move above this could lead to a breakout....

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Displays Diminishing Momentum; RRG Chart has Only One Sector Comfortably in Leading Quadrant

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The Indian equity markets went on to end their fourth week in a row with gains as the NIFTY extended its up move. However, unlike the previous week, the trading range narrowed down considerably and momentum appeared to be losing its strength as well. As compared to the 400-point trading...

READ MORE

MEMBERS ONLY

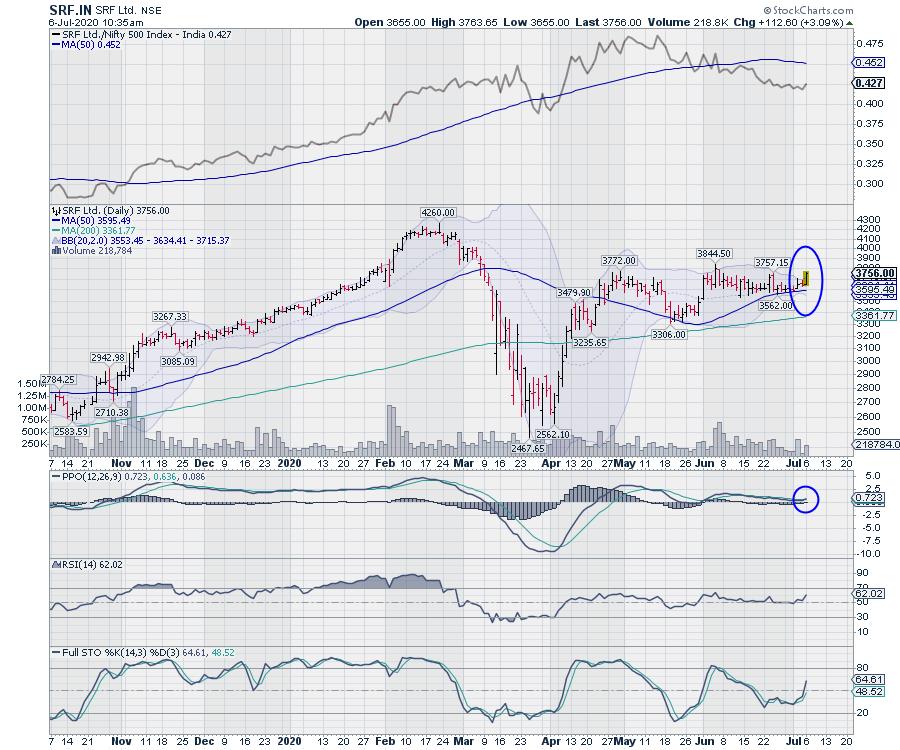

Probable Breakout From A Bollinger Band Squeeze

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

SRF Ltd - SRF.IN

Over the past several weeks, this stock moved in a capped range which has been getting narrower. The price action has formed a bullish ascending triangle and has also resulted in a classic Bollinger Band Squeeze.

Bollinger bands are over 60% narrower than normal. This...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY To Make Measured Moves; RRG Chart Show Sector Rotation on Expected Lines

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The NIFTY continued its surge for the third week in a row as it extended its gains. In the previous weekly note, we had mentioned the possibilities of the mild extension of the up move. In the week that went by, the NIFTY saw itself oscillating in a slightly expanded...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Crucially Poised Amid Mixed Signals; RRG Chart Shows This Sector Topping Out

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In a relatively less volatile week, the Indian equities continued to surge higher amid liquidity-driven rally. After gaining 2.72% in the week before this one, the NIFTY extended its up move this week as well. The index saw range-bound movement of just 359 points over the past five session,...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY in Striking Distance of this Critical Resistance; RRG Charts Sectors Moving on Expected Lines

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

After taking a breather during the week before this one, the Indian equity markets moved higher again and closed the week with decent gains. The trading range remained less wide than in the previous week. The earlier week had seen the NIFTY oscillating in a 784-point wide range; this time,...

READ MORE

MEMBERS ONLY

Why INR Is Resilient Against USD

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Despite rising over 20% from the low point seen in March 2020, the Indian equity markets have continued to underperform their global peers. The figures of the recent giant short-squeeze speak for itself. The headline index NIFTY50 has returned 12.99% over the past three months. However, on a year-to-date...

READ MORE

MEMBERS ONLY

Special Note: Why This Humble Indicator Should Not Be Ignored

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Moving Averages are one of the most simple and age-old tools within a technician's toolkit.

This humble indicator is nothing more than a smoothing tool, used for smoothing the price data to form a trend following indicator. It does not predict price direction, just the current trend and...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Likely to Struggle At Higher Levels; RRG Chart Shows Rotation Changing Hands

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

After a strong gain of 5.86% in the week prior to this past one, the NIFTY took a breather after rising nearly 1000 points over the past couple of days following a strong liquidity gush fueled by global risk-on environment. The past couple of days stayed volatile, especially the...

READ MORE