MEMBERS ONLY

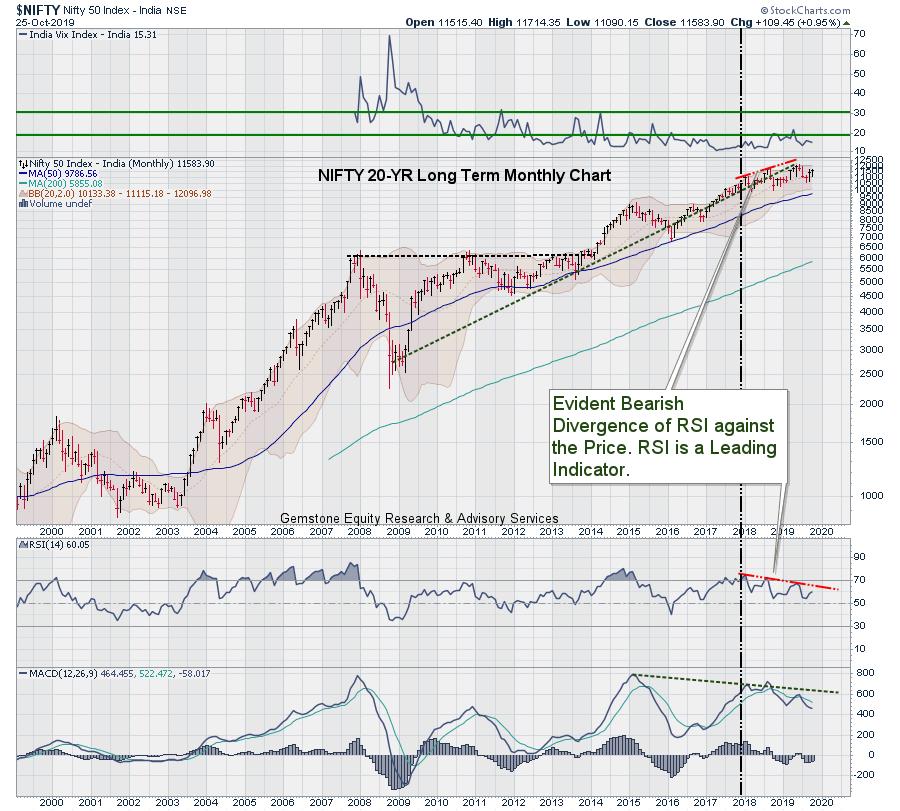

Week Ahead: Higher Levels Sustainable Only If This Bearish Divergence Is Corrected; Caution Advised

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The previous week played out very much on expected lines. In our last weekly note, we mentioned that NIFTY is facing stiff resistance in the 12000-12100 area and that the bearish divergences are not allowing a clean breakout on the charts. After staying buoyant for a significant part of the...

READ MORE

MEMBERS ONLY

Bearish Divergences Hindering A Clean Breakout; Fingers Crossed For The Coming Week

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

During a truncated week that began with a short Mahurut session, the markets ushered us into the new year on a buoyant note. In the previous weekly note, it was mentioned that the NIFTY's behavior against the price zone of 11700-11750 would be crucial to watch and that...

READ MORE

MEMBERS ONLY

Special Note: What To Expect In Samvat 2076

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The year that ended today, with NIFTY closing at 11583.90, remained quite eventful for the Indian equity markets.

We traditionally wish a "Happy and Prosperous New Year," and the current year remains prosperous in a literal sense. On the last trading day of the current Samvat on...

READ MORE

MEMBERS ONLY

Coming Week Likely To See Limited Upsides; Overhead Levels Continue To Remain A Concern

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In the previous weekly note, we had mentioned the possibility of the NIFTY consolidating in a defined range while having a limited upside. Though it traded in line as anticipated, the NIFTY spent a significant part of the week resisting and consolidating near the 11700-level. While continuing to stay above...

READ MORE

MEMBERS ONLY

Week Ahead: This Zone Crucial for NIFTY to Navigate; Rotation Evident in Certain Sectors

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The Indian equity markets had a strong week, making a steady upside move and ending the week with decent gains. In the week before this, the NIFTY had defended its crucial support levels of 200-DMA on the daily charts and the 50-Week MA on the weekly charts. After successfully defending...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY May Take A While To Establish A Confident Directional Bias; Upsides To Stay Capped

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

While trading in a broad range, the NIFTY struggled to find some base and managed to end the week with modest gains. The trading range of the NIFTY remained just moderately broad, but it oscillated quite a lot, infusing intraday volatility during the trading sessions. While holding on to its...

READ MORE

MEMBERS ONLY

The Coming Week May Attempt A Technical Rebound, But Broader Setup Remains Weak; Watch These Sectors

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In the previous weekly note, we had pointed out that the signs of exhaustion in the markets are visible; this week may see some profit-taking from higher levels. The past couple of days worked out much on the anticipated lines, but the profit-taking remained more intense than expected. The NIFTY...

READ MORE

MEMBERS ONLY

Coming Week May See Consolidation With A Corrective Bias; Upsides May Stay Capped At Higher Levels

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Following the announcement of fiscal stimulus on Friday, the market extended its gains in the following week, but, at the same time, also consolidated at higher levels. After some more follow-up up moves in the first half of the week, the second half was spent in some volatile consolidation and...

READ MORE

MEMBERS ONLY

A Weekly Special Note: Cooling Off Likely; Remain Selective A Vertical Rise May Make Risk-Reward Skewed

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In a week that turned dramatic on the last day, the markets that were over 3% down through the week pulled into positive territory in one single session. On Friday, the headline index saw its highest-ever single-day gain, ending 5.32% higher. The pronounced shift in the trend came in...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Holds The Crucial 100-Week MA; May Stay Vulnerable Unless It Moves Past This Zone

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The week remained positive for the Indian equities as the benchmark index closed with week with net gains. The markets witnessed up-moves over the past couple of days, but those were fueled mostly by short-covering, which was triggered from the lower levels. The NIFTY successfully defended the critical support levels...

READ MORE

MEMBERS ONLY

Truncated Week Ahead: NIFTY Likely To Remain In A Broad Range; Watching These Levels Continues To Remain Important

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In the week that went by, the Indian equity markets did not make any directional move on any side. The index oscillated back and forth in a defined range and ultimately ended the week on a flat note. The India Volatility Index (INDIAVIX) also remained flat, losing just 0.01...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Has A Treacherous Road Ahead; These Sectors To Relatively Out-Perform As Per RRG

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Throughout the past week, the Indian equity market struggled to keep its head above crucial levels and ended the week with modest gains. Keeping on anticipated lines, the week remained very volatile as the markets oscillated in a 385-point range. The week that went by digested the reforms initiated by...

READ MORE

MEMBERS ONLY

Week Ahead: Intermittent Pullbacks Likely; Broader Structure Continues To Remain Tentative

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The past week generally went along the anticipated lines. The broader structure of the markets continued to be weak; it faced severe volatility during the past trading days and faced heavy selling pressure at higher levels. After a thoroughly volatile week, the headline index ended with a net loss of...

READ MORE

MEMBERS ONLY

Week Ahead: With Nifty Vulnerable At Higher Levels, These Sectors May Act As Safe Havens

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

With a 3-day working week, the markets moved along expected lines and stayed within a limited range. As anticipated, the NIFTY did not make any directional move, remaining within the 50-Week MA and 100-Week MA (as mentioned in our previous weekly note). After flirting with the 50-Week MA, which stands...

READ MORE

MEMBERS ONLY

Week Ahead: Range-Bound Move Expected In The Truncated Week; These Sectors May Relatively Outperform

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

After bouncing off its 100-Week MA in the previous week, the markets attempted to take a breather and stabilize during the past week. The NIFTY was able to bounce back once again from the 100-Week MA; this pullback was aided by the oversold nature of the markets on the short-term...

READ MORE

MEMBERS ONLY

Week Ahead: Pullbacks May Occur, But These Signs Suggest Broader Technical Structure Damaged

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The end of the previous week saw the NIFTY taking support at its 50-Week MA but making a downward breach on the downside from the secondary channel, which was formed after the NIFTY breached the primary uptrend in October 2018. The week that went by saw the index extending its...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Critically Poised; Breaks Weekly Pattern Support, but Oversold on Short-Term Charts

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In the week before this past week, the NIFTY rested itself and took support on the lower rising trend line of the nine-month-long secondary channel that had been formed. This secondary channel was formed after the index breached its three-year-long upward rising channel in October 2018. In the previous weekly...

READ MORE

MEMBERS ONLY

Crucial Week Ahead For Markets; Need To Defend These Levels To Avoid More Weakness

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In the previous weekly note, we had raised concerns as the NIFTY had slipped below its 20-Week MA and the volatility index, VIX, traded at a multi-month low. It was expected that the volatility was likely to increase while there are chances of markets drifting lower. The week that went...

READ MORE

MEMBERS ONLY

Week Ahead: Mild Pullbacks Likely; NIFTY Continues To Remain Vulnerable To Sell-Offs At Higher Level

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

After meeting resistance around 11800-11840 for seven weeks, the markets loosened up a bit over the past week while ending with losses. NIFTY spent the previous couple of weeks in a defined range as it remained indecisive and did not make any convincing directional call. This week, the NIFTY witnessed...

READ MORE

MEMBERS ONLY

Week Ahead: Markets Have A Difficult Terrain To Negotiate; Will Continue To Resist At Higher Levels

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The markets were range-bound over the course of the week, but remained volatile on anticipated lines while digesting the Union Budget on Friday. As expected, the event failed to infuse any cheer in the markets, with the NIFTY remaining within a defined range and oscillating in a limited band. The...

READ MORE

MEMBERS ONLY

Investors' Expectations: Knee-Jerk Reactions And Volatile Oscillations Aside, Budget May Remain A Non-Event

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

After claiming an absolute majority again in the 2019 General Election, the Narendra Modi Government is slated to come up with their first budget of the second term on Friday, the 4th of July, 2019. Many expectations have been building up around this event, which has always been one of...

READ MORE

MEMBERS ONLY

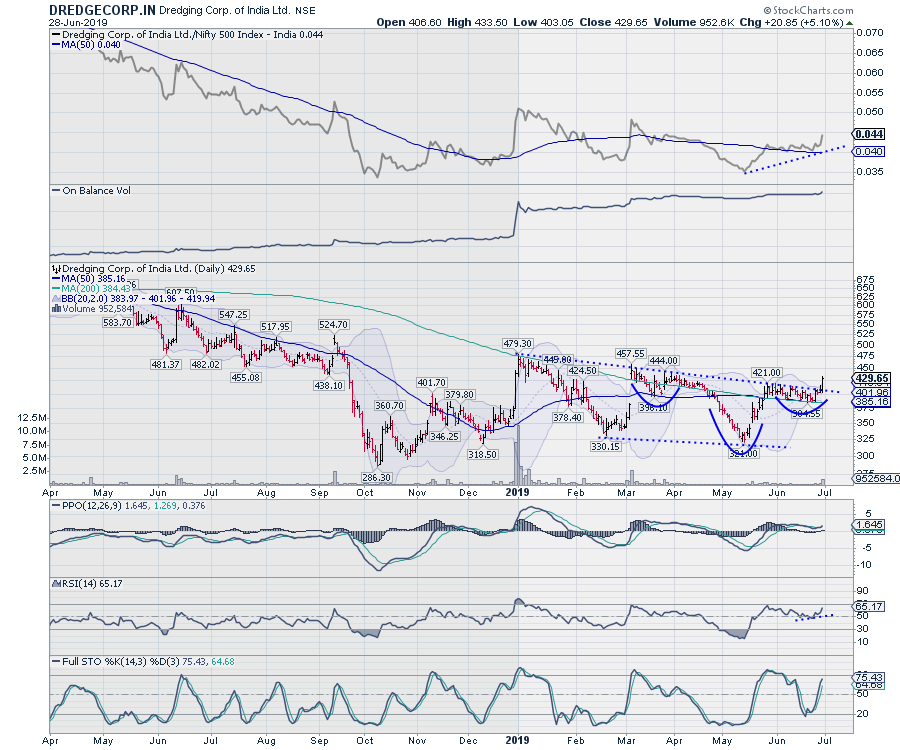

Bullish Setup On This Stock

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

DREDGING CORP. OF INDIA LTD -- DREDGECORP.IN

Following a prolonged down move and some subsequent bottom-finding, DREDGECORP is set to confirm its reversal. The stock is currently breaking out of a falling trend line resistance, which begins from 479 and joins the subsequent lower tops. In the process, the...

READ MORE

MEMBERS ONLY

Week Ahead: Larger Technical Setup Remains Challenging; Reaction To Budget May Increase Volatility

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In the previous week, the markets were expected to remain mostly volatile and to remain under range-bound oscillation without making any significant headway. In line with this analysis, the NIFTY headed nowhere, had a lackluster week and ended with mild gains on a weekly note. While the NIFTY continued to...

READ MORE

MEMBERS ONLY

Week Ahead: Mild Pullbacks Likely But Broader Technical Setup Remains Weak; Volatility May Increase

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In our previous weekly note, we had mentioned the possibility of the markets not giving any runaway moves on the higher side. The week that went by remained on expected lines as the headline index resisted to one of its significant double top resistance areas, which lies in the 11840-11880...

READ MORE

MEMBERS ONLY

Week Ahead: No Runaway Surge Expected; Markets May Continue Exhibiting Negative Bias

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In yet another wide-ranging week, the NIFTY oscillated in a 400-point range, ending the week with a modest cut. In our previous weekly note, we had raised concerns about the NIFTY failing to confirm the attempted breakout. In line with the our analysis, the index did not show any intention...

READ MORE

MEMBERS ONLY

Week Ahead: With Breakout Not Getting Confirmed, Chasing Technical Pullbacks Should Be Avoided

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Throughout the previous week, the Indian equity markets remained less volatile than expected, but, at the same time, marked some important technical events. After trading in a 350-point range, the index hit its key resistance zones, retraced and ended the week with a modest loss. The RBI Credit Policy largely...

READ MORE

MEMBERS ONLY

Week Ahead: Markets May Face Broader Technical Headwinds; Volatility Likely To Resurface

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In yet another fairly eventful week, the Indian equity markets continued to digest the general elections fully, ending with a violent reaction to the portfolio allocation of the new set of cabinet ministers. After witnessing a 420-point trading range while marking incremental highs on a closing basis, the headline index...

READ MORE

MEMBERS ONLY

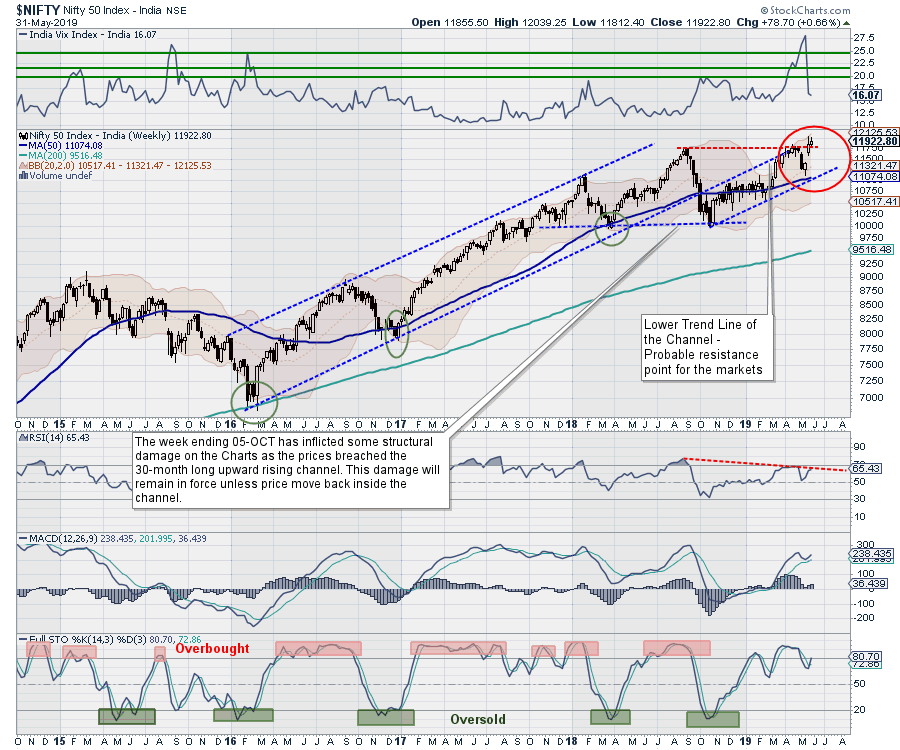

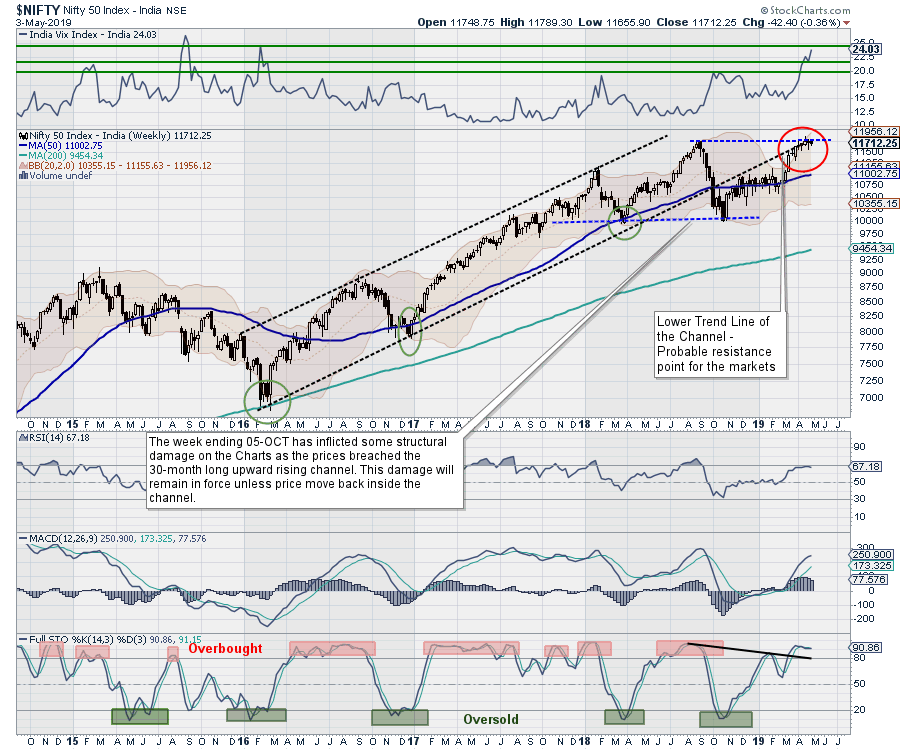

Week Ahead: Markets Set To See Wider Moves; Some Volatility May Resurface Again

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The Indian equity markets finished one their most eventful weeks as they faced the general election results. Though the move remained much on expected lines, the timing got little awry as the market finished the bulk of its reaction by rising after the exit polls rather than waiting for the...

READ MORE

MEMBERS ONLY

Special Weekly Note: Markets Set To Face A Volatile Week; Placed Differently Than In 2014

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The Indian equity markets witnessed one of their most volatile weeks in the recent past, oscillating back and forth in a relatively wider range before ending the week with a modest gain. After facing downward pressure in the initial days of the week, the NIFTY saw itself turning positive on...

READ MORE

MEMBERS ONLY

Week Ahead: Amid Feeble Attempts To Pullback, These Sectors May Relatively Out-perform

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

After having failed to give any sustainable breakout above the 11760 levels, as well as having resisted to the lower trend line of the upward rising channel (which was breached on the downside in October 2018), the NIFTY finally gave up and ended the week with a cut. The Indian...

READ MORE

MEMBERS ONLY

Week Ahead: This Zone Is Set To Act As Stiff Resistance Area For The Coming Week

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In a truncated 3-day working week, the Indian equity markets headed nowhere and ended the week on a flat note once again. In our previous weekly note, we had mentioned the possibility of the NIFTY failing to break resistance at 11760. In the week that went by, though the markets...

READ MORE

MEMBERS ONLY

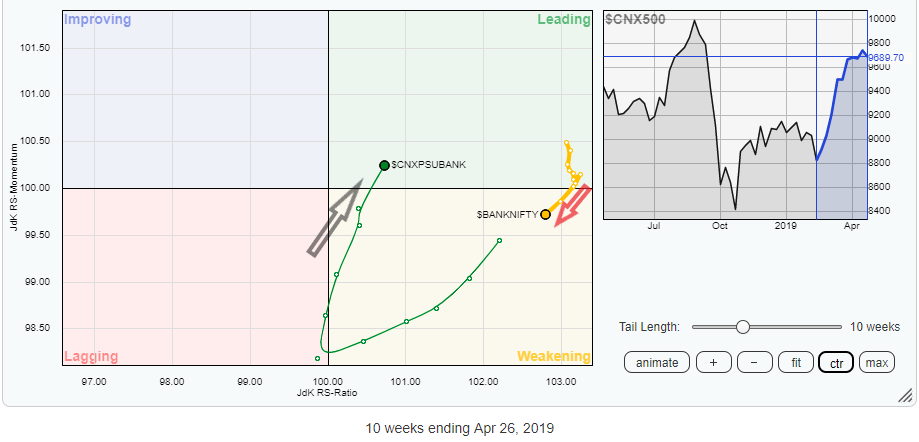

Are PSU Banks Likely to Outperform Private Banks? Answer Lies in the Relative Rotation Graph (RRG)

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

We head in to a month that is set to be among the most volatile and eventful as the market faces one of the most important domestic events – General Election Results.

The equity markets are currently hovering around their lifetime highs. On the one hand, they grapple with a not-so-favorable...

READ MORE

MEMBERS ONLY

Truncated Week May Offer Shallow But Volatile Moves; RRG Show These Sectors In Leading Quadrant

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The past week remained as flat as it can get. In our previous weekly note, we had expected the week to remain volatile and the level of 11760 continuing to pose stiff resistance to any up-moves. Hewing very close to expected lines, the Indian equity markets remained volatile, headed nowhere,...

READ MORE

MEMBERS ONLY

Week Ahead: Odds Stacked Against A Sustainable Breakout; 11760 Still Remains Important To Watch

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The past week was quite eventful for the Indian equity markets. The short 3-day working week saw the benchmark index NIFTY50 marking a fresh high and attempting a breakout. Along with that, it also saw the NIFTY not confirming this breakout, slipping below the all-important 11760 mark once again. This...

READ MORE

MEMBERS ONLY

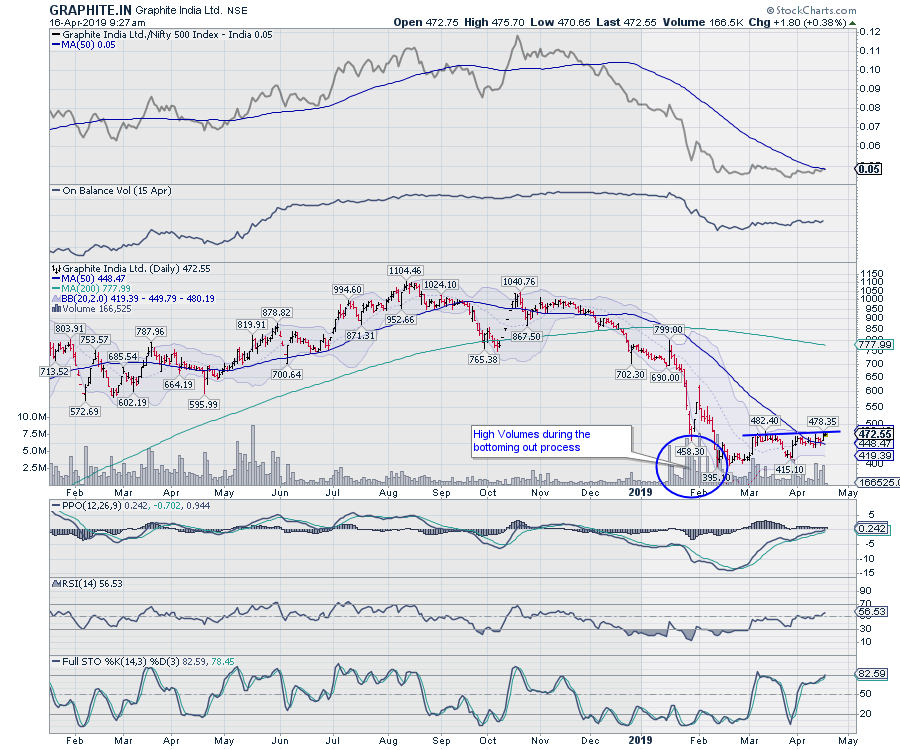

Graphite India - Showing Good Potential Among Non-Index Stocks

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Graphite India Limited - GRAPHITE.IN

GRAPHITE looks to be confirming its bottom in the 395-415 zone. After marking a low near 395, the stock has formed a base in the 395-415 zone; having experienced a sideways move over past couple of weeks, a breakout appears likely. The RSI, which...

READ MORE

MEMBERS ONLY

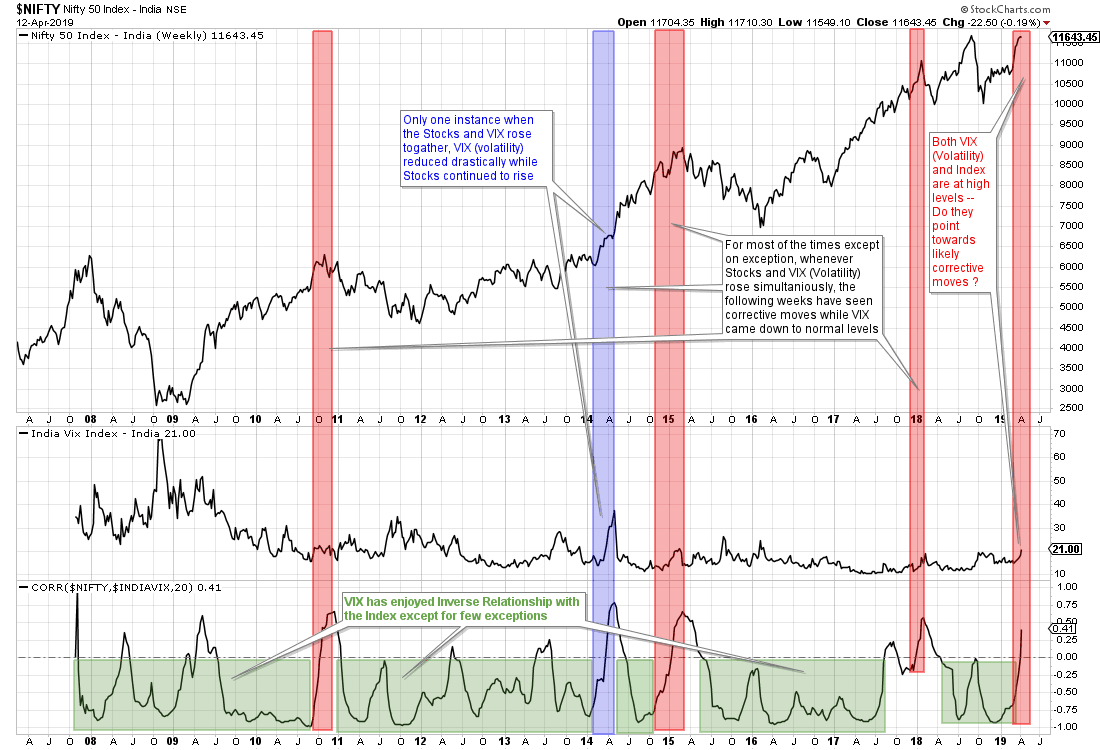

Special Note: When VIX Defies Its Inverse Relationship With NIFTY...

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The Volatility Index, more commonly known as the VIX, is a measurement of market's expected volatility in the future. Analysts and investors alike look at this tool to measure sentiment while making investment decisions. The VIX reflects the psychology of market participants' fear and greed and is...

READ MORE

MEMBERS ONLY

Week Ahead: Truncated Short Week To See Capped Upsides; Charts Offer Important Signals To Read

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

This was the second week in a row where the Indian equity markets did not make any significant directional move. The week that went by remained particularly volatile, as the market oscillated back and forth on each side in a defined range while continuing to resist to the lower trend...

READ MORE

MEMBERS ONLY

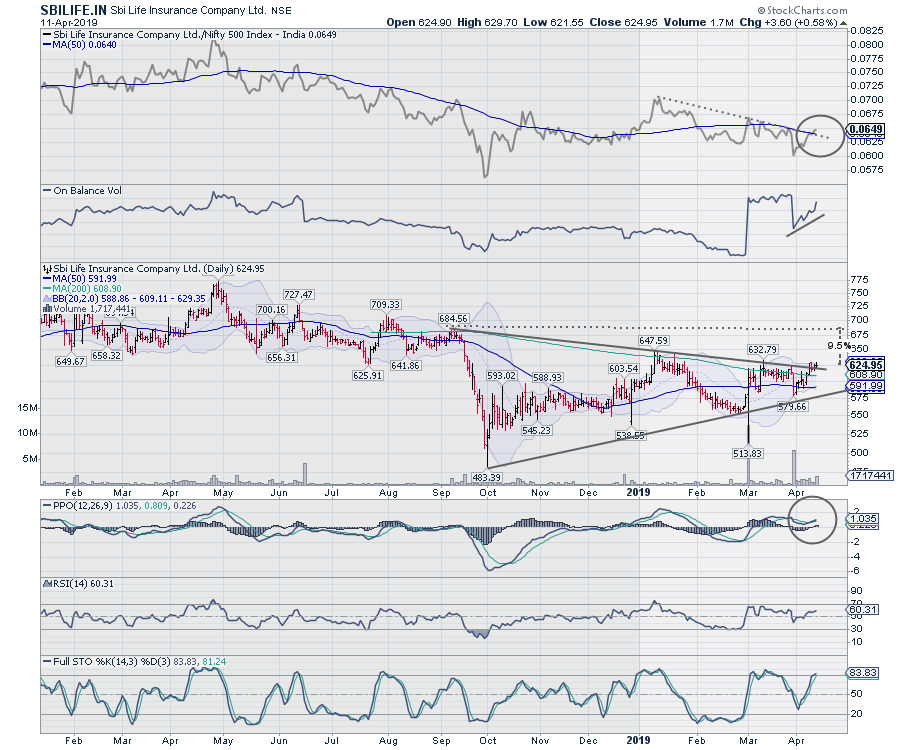

SBILIFE Offers Some Upside Potential

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

SBI Life Insurance Company Ltd (SBILIFE.IN)

This stock has a relatively short listing history. It originally listed in October 2017 and marked its high near 772 in middle of 2018, with a subsequent low near 483 in the corrective move that followed in late 2018. Presently, the stock is...

READ MORE

MEMBERS ONLY

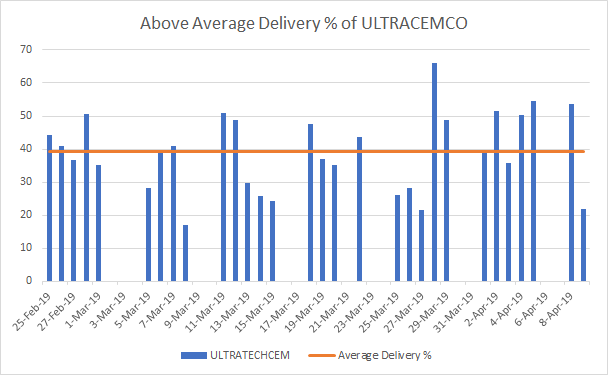

Complex Inverted H&S Formation on ULTRACEMCO; Higher Delivery Percentage May Give Directional Clues

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

A couple of days back, the NIFTY marked a classical Double Top at the 11760 level. The benchmark index has halted its up move and can be seen consolidating just below that level. Over the coming days, the markets are expected to remain highly stock-specific. Right now, ULTRACEMCO.IN deserves...

READ MORE

MEMBERS ONLY

Week Ahead: Markets Placed On Tricky Turf; Would Be Sensible To Stick To Defensive Stocks

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The Indian equity markets had a volatile week, ultimately ending on a flat note. In our previous weekly outlook, we had mentioned the possibility of the market stalling its up-move and showing some corrective intent. After volatile trading throughout the week, it was the last hour of trade on Friday...

READ MORE