MEMBERS ONLY

Post Tech Earnings & FOMC -- Give Retail Investors Credit

Although Microsoft and Alphabet, Inc. reported better-than-expected earnings after hours, and then with follow-up during the trading session, sellers came out to lock in gains or perhaps go short. After all, tech has done much of the market's heavy lifting to date. The earnings were already priced in....

READ MORE

MEMBERS ONLY

Higher Gold Price Coming, But Investors Must Be Patient

For today, I am reprinting an interview I did for Kitco News with Neils Christensen, written by Neils.

(Kitco News) - The gold market remains in a solid holding pattern as it waits for some direction from the Federal Reserve, and one market strategist is warning potential precious metals investors...

READ MORE

MEMBERS ONLY

A Word and A Chart About and On Alibaba

Alibaba.com is one of the world's largest wholesale marketplaces.

To be honest, I had never gone to their website until today, even though we bought shares in BABA 2 weeks ago. So, in case you are like me and have not checked them out, they sell a...

READ MORE

MEMBERS ONLY

Inflation Fell to the Fed's Target -- Or is That a Moving Target?

On Friday, the market woke up to great news. Mission accomplished on inflation.

Yahoo Finance reported: "The Fed's preferred inflation measure — a 'core' Personal Consumption Expenditures index that excludes volatile food and energy prices — clocked in at 2.9% for the month of December, beating...

READ MORE

MEMBERS ONLY

Remember Those 3 Signs of Inflation to Watch?

As a follow-up to a daily I wrote earlier in January called "Super Cycles Do Not Just Fade Away",yesterday'sJanuary 23rd dailywas all about one of the three indicators that can get us prepared for more inflation.

On January 5th, sugar was still trading under 22...

READ MORE

MEMBERS ONLY

Time for Sweet Talk: Sugar Futures

The biggest mover so far in one month's time is sugar futures, up over 16%.

As I am a big follower of weather patterns and have predicted weather could be a huge factor on several crops this year, one major concern for sugar is that the current El...

READ MORE

MEMBERS ONLY

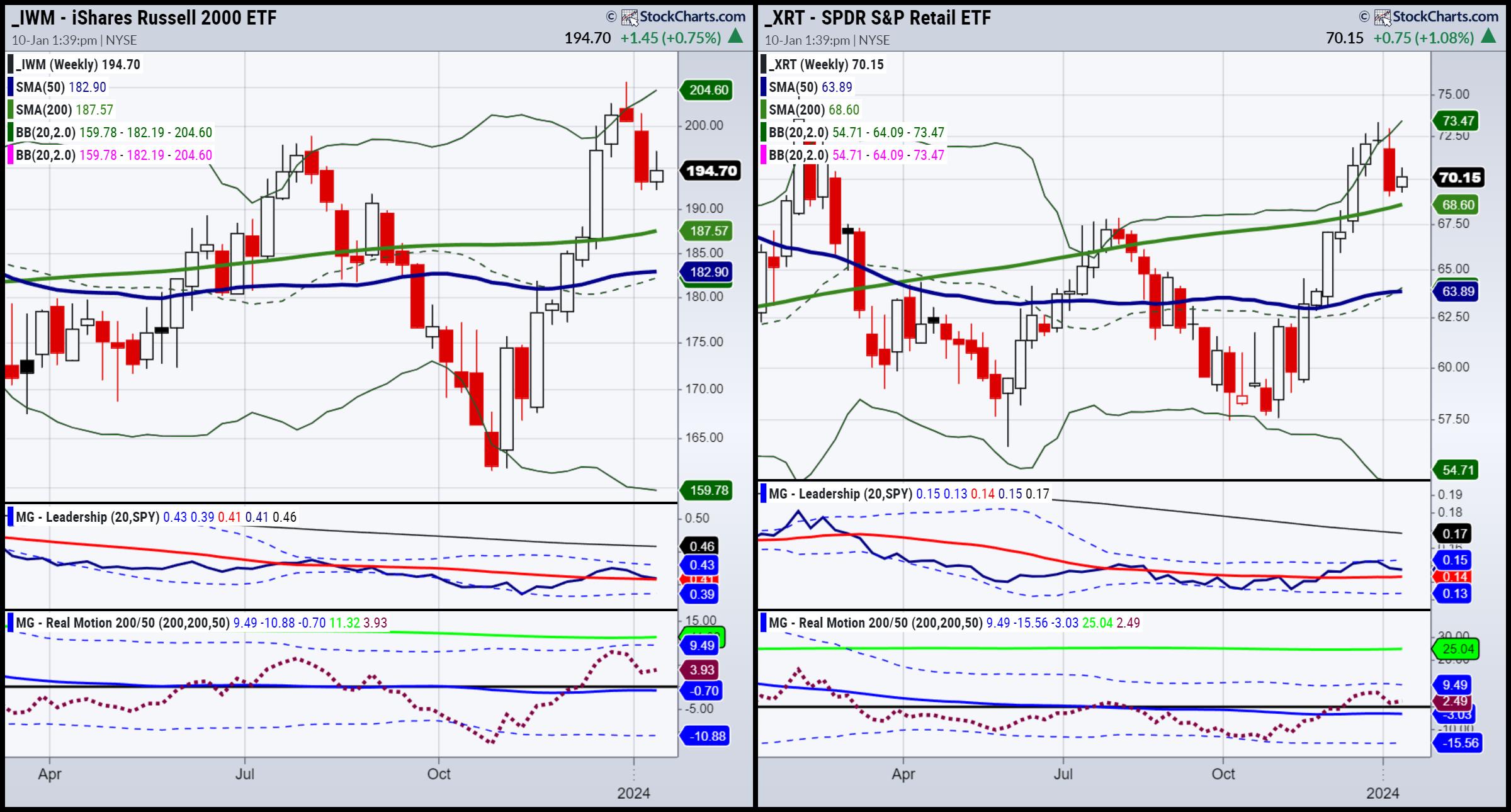

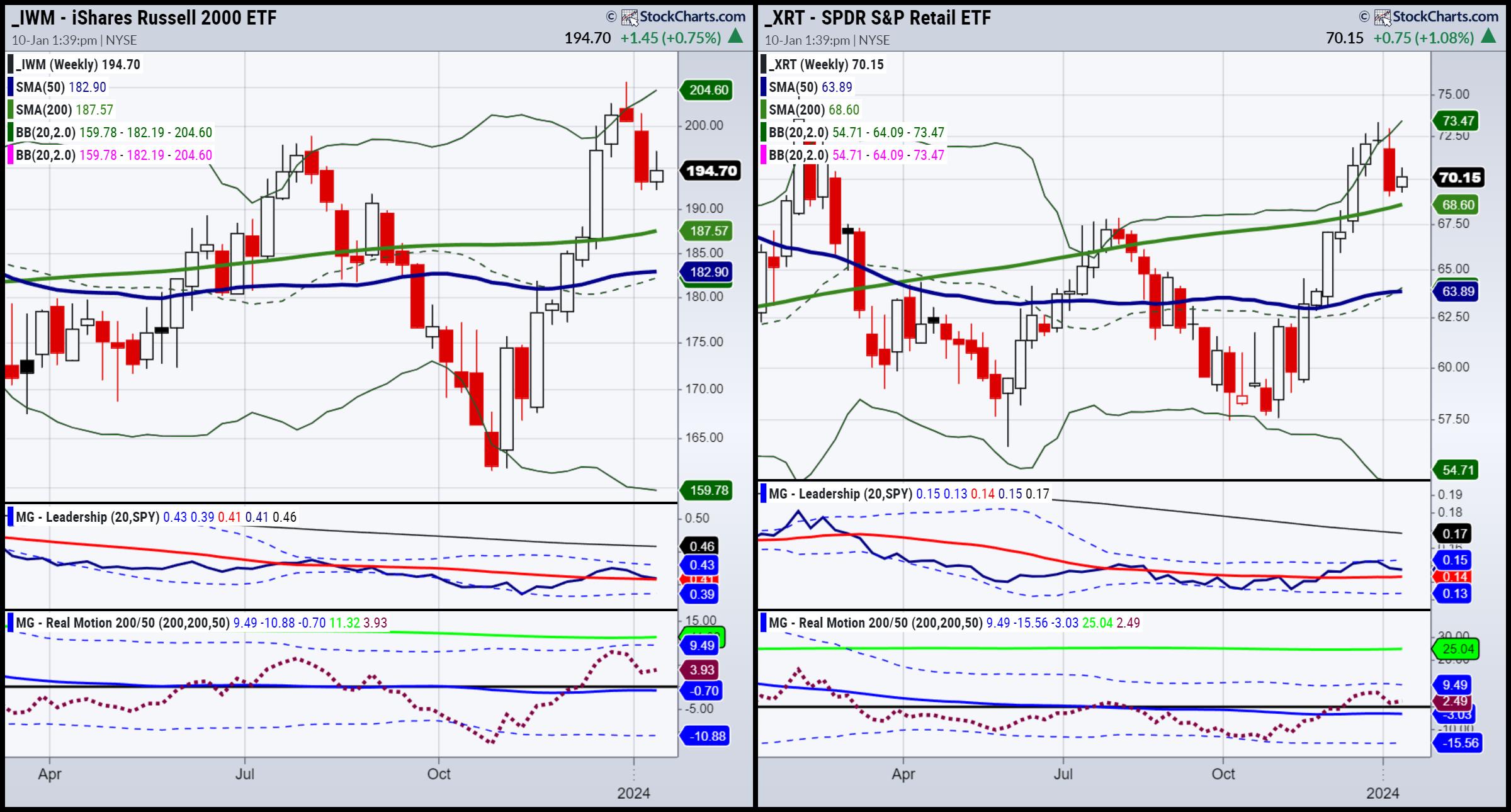

Economic Modern Family Has Divisive Weekly Charts

Over the weekend, I covered the daily charts on the Economic Modern Family, featuring the Russell 2000 (IWM) and Retail (XRT). Both are lagging the benchmark and in the middle of their January trend calendar ranges.

As Semiconductors, NASDAQ, the Dow, and S&P 500 continue to post new...

READ MORE

MEMBERS ONLY

Economic Modern Family's Engine Idles While Growth Goes Fast and Furious

Let's get right to it. The charts and our tools are telling.

To start, I always look at moving averages and phases. Then I look at Real Motion and momentum to see if there is a divergence to price. After that, I check out our Leadership indicator which...

READ MORE

MEMBERS ONLY

Trend Trade: January 6-Month Calendar Range Reset!

We are super excited to announce that today starts the official January 6-month calendar range!

As you can see in the chart for Apple, the small red and green horizontal lines have appeared on one of our favorite platforms at StockCharts.com. In fact, Geoff Bysshe and I recently did...

READ MORE

MEMBERS ONLY

Are Key Commodities Decoupling from Equities?

After a long weekend, the market action on January 16th held some surprises.

The Bullish Trends, or gainers, were the dollar and -- here is the surprise for some -- many different commodities. The Bearish Trends, or losers, were foreign currencies, long bonds, and (not shown on the chart) US...

READ MORE

MEMBERS ONLY

Drilling Down Into Gold and Silver

With the news on geopolitical escalation, soft versus hard landing, disinflation versus reinflation, growth versus value, and credit default versus available disposable income, gold and silver are even more interesting now.

Gold's behavior has been more of sell strength and buy weakness for some time. What has changed...

READ MORE

MEMBERS ONLY

Markets: Recap of This Week's Market Dailies

I began the week focused on bank earnings, which we will wake up to tomorrow. In that Daily, I wrote, "one can assume that bank stocks, which already started off the year extremely well, have potential to shine.

"However, we know that assumptions can be tricky. There are...

READ MORE

MEMBERS ONLY

Markets: Week 1, Week 2 -- What's Next in Week 3?

Looking at the Economic Modern Family (weekly charts), all of them, to date, peaked in December. The Russell 2000, Regional Banks, Transportation and Retail, as far as index and sectors go, backed off the most from their peaks. Semiconductors are more sideways since the peak, as well as Biotech (which...

READ MORE

MEMBERS ONLY

Commodities Trade Analysis: Aluminum

As a main aluminum producer, Alcoa (AA) announced cost-cutting measures, along with plans to curtail production at one Western Australian Refinery. But that is just one facility, and the company plans to continue to operate its port facilities located alongside the refinery. Plus, it will continue to import raw materials...

READ MORE

MEMBERS ONLY

Bank Earnings Up -- Time to Look at Regional Banks ETF

Starting with the Jeffries Group on January 9th, by Friday, we will see Bank of America (BAC), JP Morgan (JPM), Wells Fargo (WFC), and Citigroup (C), as well as a few other banks, all report earnings.

In my 2024 Outlook and this Year of the Dragon, Raymond Lo writes, "...

READ MORE

MEMBERS ONLY

Super Cycles Do Not Just Fade Away

On inflation

I like this quote-

"Goods deflation likely transitory as downward pressure on goods demand and input costs are fading. 1H24 global core inflation likely to settle near 3%, which won't resolve the immaculate disinflation debate."

And this quote does not include the steep rise...

READ MORE

MEMBERS ONLY

January: NASDAQ Has the Best Odds of Gains, BUT...

"January provides us with a wealth of information that gets our year off to a good start, financially and emotionally.

"The data is specifically chosen to begin in 2009 because that is the bottom of the most significant bear market prior to the 2022 bear market, and 2009...

READ MORE

MEMBERS ONLY

The Science and Art of Stock Market Predictions

Over the holiday, I thought a lot about predictions and how they are formed.

The dictionary meaning of prediction is a statement about a future eventor data.Many of the predictions for 2024 that I have seen are made by what we assume are knowledgeable people in the financial fields....

READ MORE

MEMBERS ONLY

Ready Yourself for 2024 With Macro to Micro Analysis

For the new year, we have given you an extensive 3-pronged look at the markets.

First, we have the general outlook for the economy and markets through the Outlook 2024. This is the general outlook for 2024, including the recap of 2023 and how the predictions I made then played...

READ MORE

MEMBERS ONLY

The Vanity Trade 2024: All About Me!

According to Wikipedia,

"Self-help or self-improvement is a self-directed improvement of oneself—economically, physically, intellectually, or emotionally—often with a substantial psychological basis."

In the Outlook 2024, I quote Raymond Lo yet again,

"The Dragon is considered a ‘Star of Arts.' The industries that will perform...

READ MORE

MEMBERS ONLY

More from Mish's Outlook 2024 -- 17 Predictions

One area I cover in the Outlook 2024 is the teachings of Raymond Lo and how he sees the upcoming Year of the Dragon. Part of my comments on his analysis is based on this statement by Lo:

"Many has the misunderstanding that the Dragon is glamorous auspicious animal...

READ MORE

MEMBERS ONLY

More from Mish's Outlook 2024 -- Gold and Silver

For last year's Outlook, I wrote:

Perhaps our biggest callout for a major rally in 2023 is in gold.

Here we are over $2000 and, although gold has not doubled in price, it did rise by 25%.

For 2024, we stay with our call for higher gold prices....

READ MORE

MEMBERS ONLY

More from Mish's Outlook 2024 -- S&P 500

A passage from the Outlook:

SPY's all-time high was made in January 2022 at $479.98.

For now, the chart looks clear. If SPY pushes over 460, we can expect more upside at least until we get near the ATHs.

Should those levels clear, then we are in...

READ MORE

MEMBERS ONLY

Mish's Outlook 2024 is Here -- Macro to Micro

Coming into 2023, we used the theme, "You can't hunt with the hounds and run with the rabbit." Those who stood back with the hounds, in search of a sure hit, were not only left behind, but missed the move higher as the rabbit got the...

READ MORE

MEMBERS ONLY

Stock(ing) Stuffers That Could Be Loving the High 2024

Just for the fun of it, and since we did not include it in our Outlook 2024, I decided to have a look at what experts are saying concerning mushrooms, cannabis, and hemp. After all, recreational and medical alternatives as investments, have been huge underperformers, and are a bit of...

READ MORE

MEMBERS ONLY

How is the Economic Modern Family Liking Santa Now?

This is a great time to examine the weekly charts of the Economic Modern Family. We like that timeframe for now, with only a short number of trading days left. And there's lots of news constantly unfolding:

1. Rate cuts/no rate cuts

2. Middle East heating up...

READ MORE

MEMBERS ONLY

Emerging Markets vs. U.S. Markets

While December 1st brought out the bulls in nearly EVERYTHING, one area caught our attention.

In December 2019, I saw a similar chart showing an unsustainable ratio between equities and commodities, which started me on the notion that something had to give. Now that I see this chart, with emerging...

READ MORE

MEMBERS ONLY

Skepticism Over the OPEC + Oil Cuts

Despite the total cuts by all countries added at the November 30th OPEC+ meeting, oil sold off, testing key support. Countries like Angola have threatened not to stick to the new quota, promising to produce above target. Meanwhile, Brazil confirmed it will join OPEC+. That means that some of the...

READ MORE

MEMBERS ONLY

Big View Slaps Bulls with Warnings

On Monday, after the close, some warning signs from our risk gauges popped up. These are especially interesting given the number of bulls and the amount of money coming into the market.

Technically, we still have the resistance that has not cleared in small caps, retail, or transportation. And this...

READ MORE

MEMBERS ONLY

Economic Modern Family -- Home for the Holidays, Part 2

Over the weekend, I covered small caps, retail, semiconductors and transportation. The conclusion was that "If you put these four charts all together, we get a reunion that is filled with the makings of a family breakdown. While Granny XRT and Sister Semiconductors SMH give us investors reasons to...

READ MORE

MEMBERS ONLY

Economic Modern Family -- Home for the Holidays

In the 1995 film, Home for the Holidays, family reunions are explored using both drama and comedy. The film illustrates how we outsiders looking in never really know the love and the madness that goes on inside any one family's home during Thanksgiving.

Happily, our Economic Modern Family...

READ MORE

MEMBERS ONLY

Equity and Inflation Outlook -- Watch These Videos!

On Monday the 20th, I gave 2 interviews. The first is the clip below is from Yahoo Finance where we focus on oil and agricultural commodities.

The second interview is the Daily Briefing with Maggie Lake on Real Vision. This chart above is featured, along with:

1. Inflation thesis

2....

READ MORE

MEMBERS ONLY

Recap and Action Plan: Small Caps, Beans, Oil

Since we came back from vacation, I've written 3 Dailys. The first of these was on the Economic Modern Family and how it opened its loving arms to the bulls.

I was particularly keen on small caps or the Russell 2000 (IWM). I wrote, "Beginning with Granddad...

READ MORE

MEMBERS ONLY

Oil the New Gold -- Buy When There's Blood in the Streets

A weaker labor market, manufacturing production slowing, new home prices falling and crude oil inventories rising more than expected are all to blame for the big drop in oil prices. US also eased sanctions on Venezuelan oil.

That's the nature of commodities; fresh news can supersede older headlines...

READ MORE

MEMBERS ONLY

Soybeans Could be the Next Parabolic Runner

Brazil planted a record soybean crop only to see unusually dry and hot weather create concerns for the harvest. Furthermore, Argentina had an extreme shortfall of soybean meal crops. Meanwhile, the USDA numbers were bearish for corn and soybeans, as U.S. crops came in larger than expected. However, China...

READ MORE

MEMBERS ONLY

Stock Market Welcomes Us Home in a Big Way

The Economic Modern Family has opened its loving arms to the bulls and to us after our 2 weeks away.

Beginning with Granddad Russell 2000 (IWM), Monday began with a gap up over the 50-DMA (blue). We will watch for a phase change confirmation. Furthermore, the monthly chart shows IWM...

READ MORE

MEMBERS ONLY

Key Market Relationships for the Next Big Move

First off, we are heading out of town to New York where I will be visiting in studio several media channels and hosts.

Then, we are off to Orlando for the MoneyShow.

On November 1st, Keith and I go on vacation until the middle of the month.

This is the...

READ MORE

MEMBERS ONLY

It's All About Risk and the Long Bonds

Monday, after a lot of spooky headlines, the SPDR S&P 500 ETF (SPY) touched its 23-month moving average (MA) or the two-year biz cycle breakout point right around 417.

Plus, the iShares 20+ Year Treasury Bond ETF (TLT)flashed green as didIWM,the small caps.

The big question...

READ MORE

MEMBERS ONLY

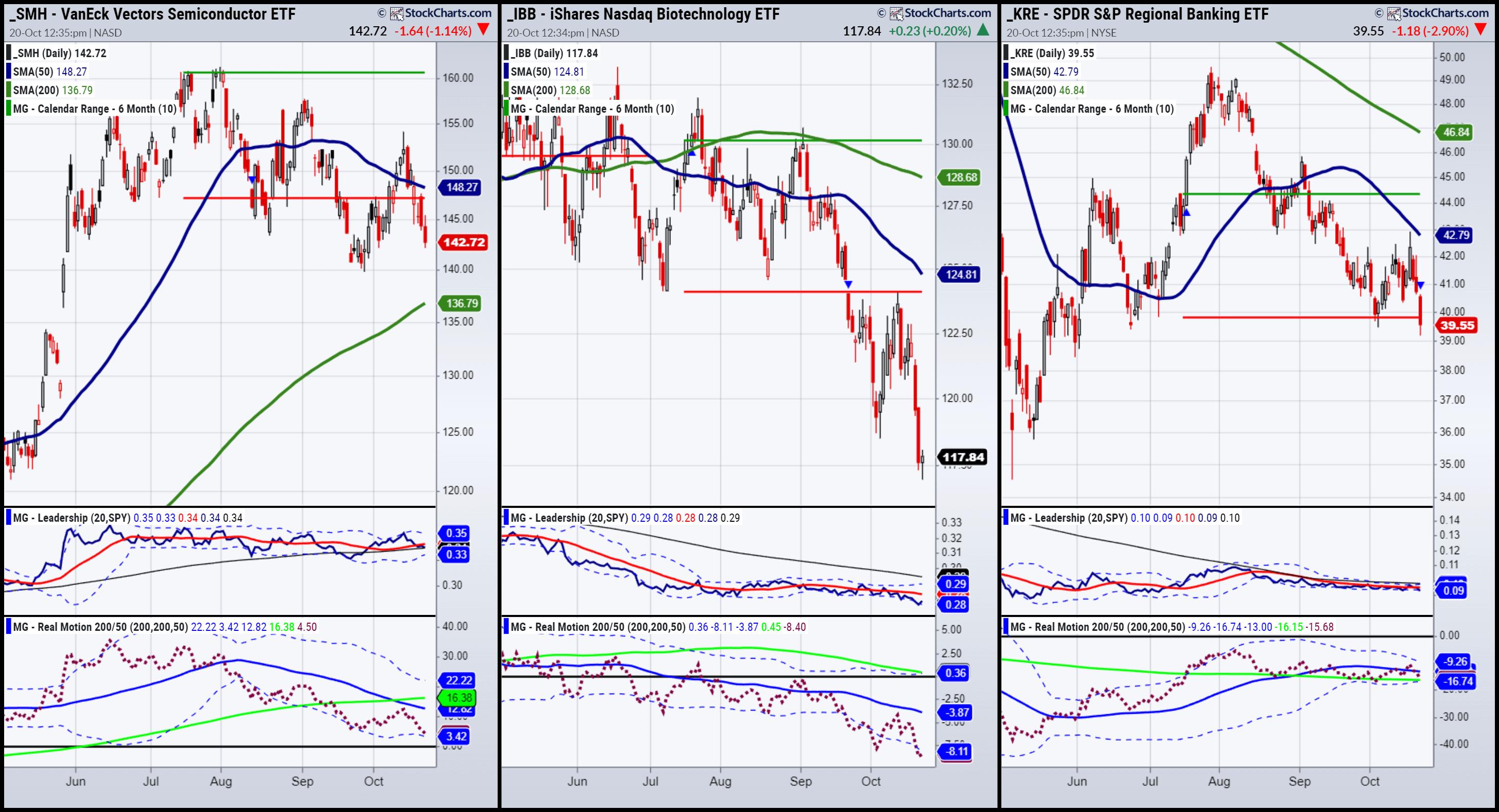

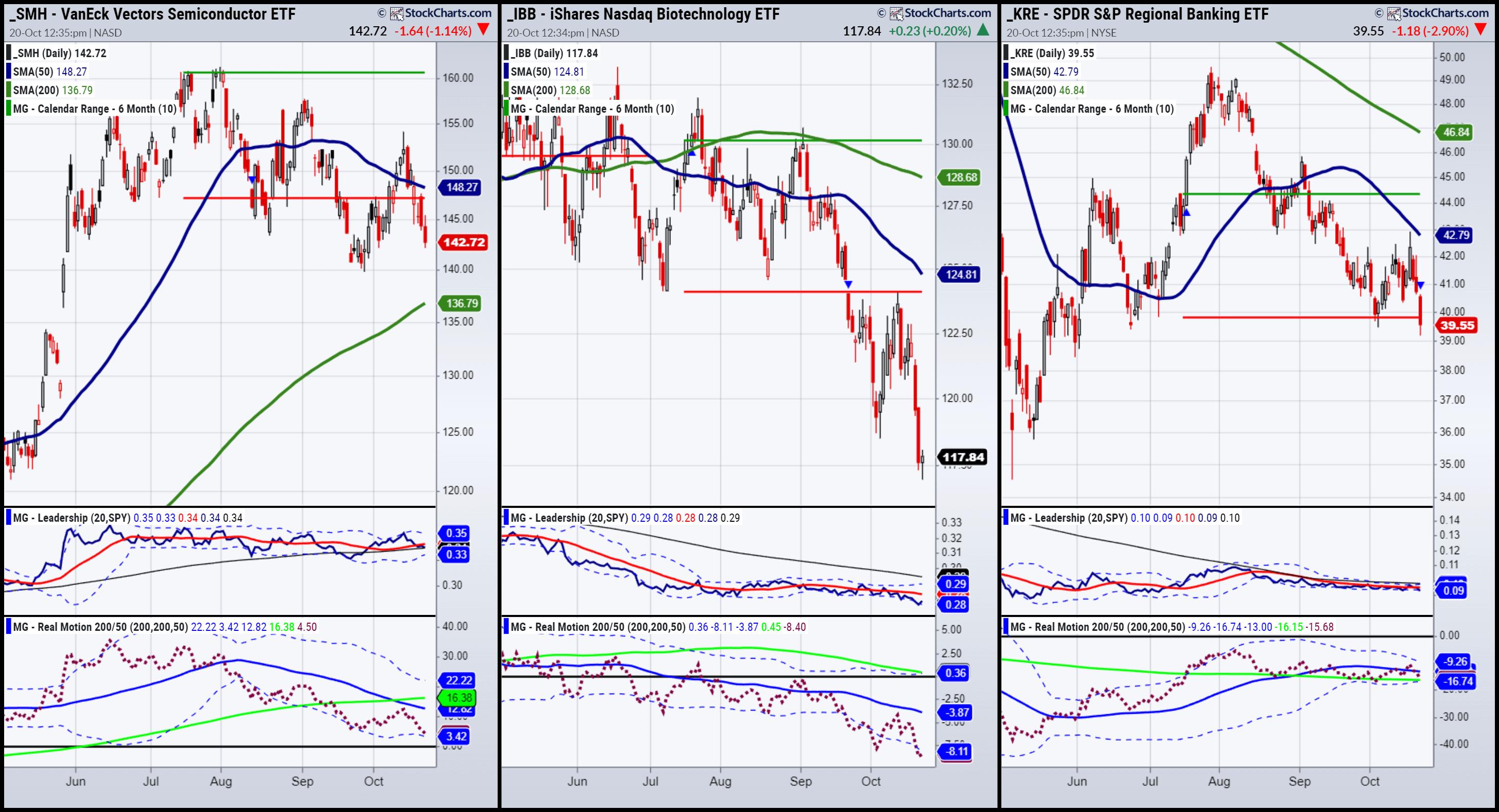

The Kids: Semiconductors, Biotechnology, Regional Banks

Most of you know our Big Viewproduct since I often discuss our risk gauges.

I can report to you that our risk gauges show three out of the five with risk off.

Most interestingly, the SPY continues to outperform the long bonds, risk-on.

And junk bonds continue to outperform long...

READ MORE

MEMBERS ONLY

Market Has Stress Fractures but No Clear Breaks

Considering everything:

1. Yields and mortgage rates

2. War

3. Inflation and rising commodity prices

4. Bank stocks falling

5. Risk Gauges: 2 out of 6 now risk-off

To name a few, why, then is the S&P 500 so strong?

Here are a few reasons:

1. Fed members...

READ MORE