MEMBERS ONLY

Are Dip Buyers Ready for Thursday?

Over the past month, the four major indices have rallied to new highs. As seen in the above charts, this is our first pullback since the market cleared key resistance. Although the media has focused on rising inflation as a leading factor for investor worries, we can also learn a...

READ MORE

MEMBERS ONLY

Inflationary Trades Ripe and Ready

On Monday, we talked about watching High Yield Corporate Bonds (JNK) and 20+ Year Treasury bonds (TLT) ETF as risk-on or off indicator. With risky JNK moving lower and TLT pushing higher, this gave us more caution for trading on Tuesday.

It turns out being cautious was the right side...

READ MORE

MEMBERS ONLY

Is The Stock Market Looking to Consolidate Near Highs?

Inflation pressures take the media's focus this week. Nevertheless, we must remember the news does not always align with market price.

With that said, prices are holding near highs in the major indices. This is a positive sign as investors are looking for a continuation in trend or...

READ MORE

MEMBERS ONLY

These 7 Symbols Give a Complete Market Picture

Mish's Economic Modern Family consists of 5 key sectors, one major index and Bitcoin. Bring them all together and you have an easy and quick way to look at the market, grasp overall trends and see where potential pressure is leaning. Each symbol is meant to display a...

READ MORE

MEMBERS ONLY

How to Improve Your Profit-Taking Rules

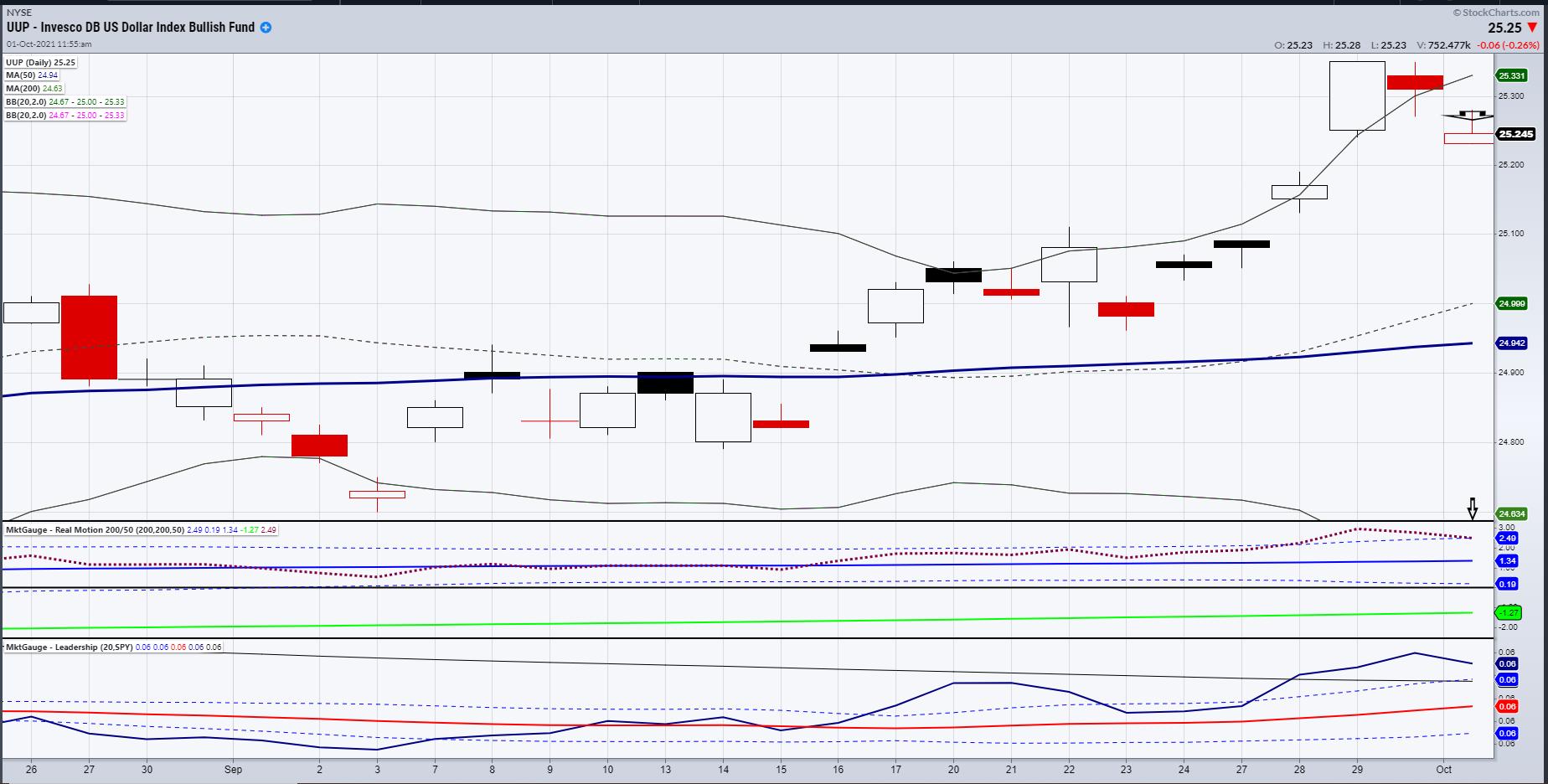

The S&P 500 (SPY) and the Nasdaq 100 (QQQ) both sit at highs, while the small-cap Russell 2000 (IWM) digests its recent breakout.

Triggered from Wednesday's bullish Fed meeting, the overall market has made a huge push Thursday. While many traders are loading up on positions,...

READ MORE

MEMBERS ONLY

Major Indices Create Important New Support Levels

The Fed has announced it will continue with its tapering plan. However, the Fed will decrease bond-buying by 10 billion per month, instead of the previously stated 15 billion. As of now, the program is set to buy 120 billion in bonds per month. This dovish sign creates an easier...

READ MORE

MEMBERS ONLY

Why You Should Be Watching Junk Bonds (JNK) This Week

This Tuesday and Wednesday, the Federal Reserve policy meeting will be held. Investors are expecting to hear a tapering announcement involving the monthly bond-buying program. This is the same program that has given the market its bullish gusto and is closely tied to the overall economic recovery throughout the pandemic....

READ MORE

MEMBERS ONLY

The Major Stock Indices Must Hold These Key Support Levels

Next week, investors are expecting the Fed to announce a reduction in the monthly bond-buying program. Jerome Powell, the Fed chair, has previously stated that he's looking to keep the original tapering schedule. This means there should not be any surprises investors need to worry about.

At least...

READ MORE

MEMBERS ONLY

Rotation Into Big Cap Stocks -- Will It Last?

Both the tech-heavy Nasdaq 100 (QQQ) and the S&P 500 (SPY) sit near their recent breakout levels. This is a pivotal place for large-cap companies, as the small-cap Russell 2000 (IWM) has already given up almost two weeks of progress. Now, IWM will look for support from both...

READ MORE

MEMBERS ONLY

Has the Housing Market Topped?

Tuesday's market shows mixed price action amid positive earnings reports and a 14% increase in home sales for September.

Focusing on the residential sector, many are looking for a top of the market, as home sales have skyrocketed since the pandemic began. Residential and Multisector Real Estate ETF...

READ MORE

MEMBERS ONLY

Why Is Consumer Staples (XLP) Outperforming the Season?

The Consumer Staples ETF (XLP) is known to be an area of focus through market downturns, as it offers exposure to companies that are historically safety plays. Some of XLP's biggest holdings include companies such as Walmart, Pepsi, Colgate and more. However, major indices are sitting at or...

READ MORE

MEMBERS ONLY

Did Jerome Powell Jump Scare the Major Stock Indices?

Friday, the chair of the Federal Reserve –Jerome Powell spooked the market when he announced that the Fed would keep rates near zero and continue with its tapering schedule. Though the market cannot blame Powell for stating already well-known information, it was enough to help create an intra-day selloff.

While...

READ MORE

MEMBERS ONLY

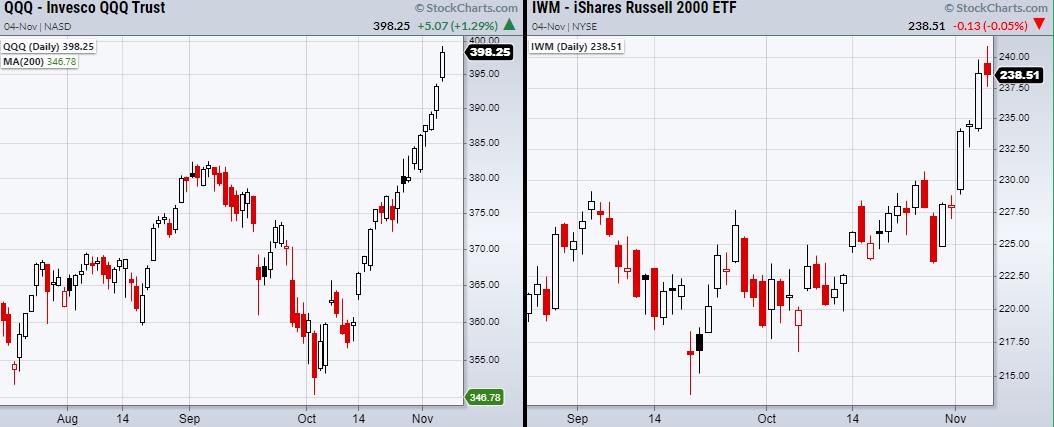

Can the Major Indices Clear Their Pivotal Resistance Levels?

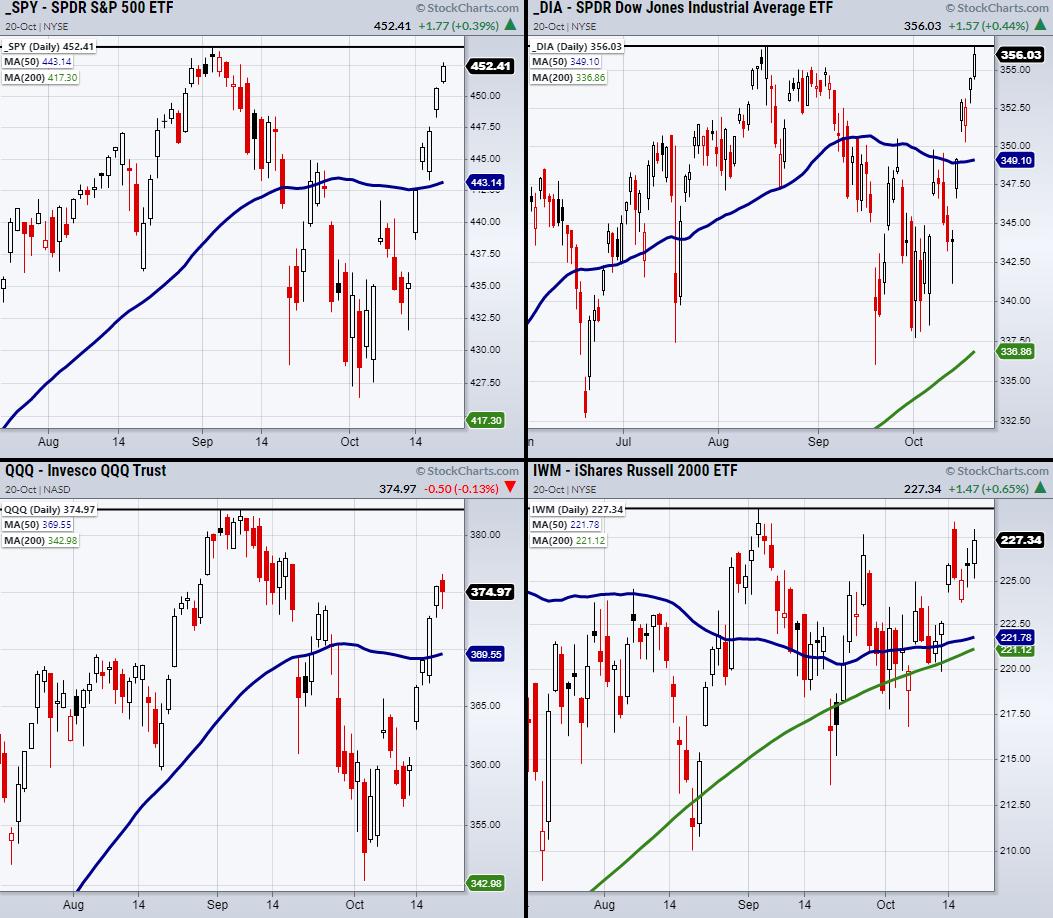

Both the S&P 500 (SPY) and the Dow Jones (DIA) are poised to hit new highs, while the Nasdaq 100 (QQQ) and the small-cap index Russell 2000 (IWM) have a bit more territory to clear. The above chart shows pivotal areas to clear in each index (Black Line)...

READ MORE

MEMBERS ONLY

Key Price Levels to Watch for an Active Netflix (NFLX) Trade

Netflix (NFLX) will report earnings after Tuesday's market close. Although previous earnings for the company have been dreary at best, with an average earnings surprise of less than half a percent for the past three quarters, investors are now looking for a major improvement.

The most common cause...

READ MORE

MEMBERS ONLY

Why We are Watching These Two Companies Through Thursday's Trading Session

Earnings season has taken the stage for the next couple of weeks as the market steadies itself for another move higher. Of course, another push higher means that companies will need to outperform or show signs of continued growth into the fourth quarter. So far, the financial sector has started...

READ MORE

MEMBERS ONLY

Are the Major Indices Geared for Another Move Up on Monday?

As seen on the above chart, two of the major indices, including the S&P 500 (SPY) and the Dow Jones (DIA) cleared prior resistance from their 50-day moving averages (DMA). On the other hand, the Russell 2000 (IWM) has resistance near $230 and the Nasdaq 100 (QQQ) has...

READ MORE

MEMBERS ONLY

Will the Fed Admit They are Wrong About Transitory Inflation?

For the past year, the Fed has stuck to its guns on the idea that supply-chain disruptions are causing a short-term increase in inflation and that, in 2022, inflation will decrease towards their 2% target. However, with continuous news of job shortages, shipping problems, rising food costs and more, it...

READ MORE

MEMBERS ONLY

Key Sectors Hover Over Support While the Major Indices Flounder

On Monday, we talked about specific sectors weakening as they teetered on the edge of support from their major moving averages. The main three were Transportation (IYT), Retail (XRT) and Semiconductors (SMH). It just so happens that these sectors perfectly align with the holiday season as people begin to do...

READ MORE

MEMBERS ONLY

Is the Market Ready to Take Another Step Lower?

On Monday, the major indices attempted a reversal of Friday's price action but failed. This created another late-day selloff. Does this mean we should prepare ourselves for another move lower, or does the market have support to lean on through the coming week?

To get a quick but...

READ MORE

MEMBERS ONLY

Are Investors Worried Over the Latest Jobs Report?

The recent jobs report came in less than expected, with analysts' estimates running anywhere from 250,000 to 500,000 new jobs created. Disappointingly, employers added only 194,000 jobs in September.

Although the numbers mean slower progress towards the 2-3% unemployment goal, will investors take a cautious note?...

READ MORE

MEMBERS ONLY

How to Predict Short-Term Price Direction With Two Special ETFs

On Tuesday, we talked about the 6-month calendar range as a support level to hold in both the S&P 500 (SPY) and the Nasdaq 100 (QQQ). On Wednesday, both indices were able to hold support from their calendar range lows around $427 (for the SPY) and $352 (for...

READ MORE

MEMBERS ONLY

The S&P 500 and the Nasdaq 100 Bounce Off Their 6-Month Calendar Range

Calendar ranges have been used for a long time in charting as important levels to clear or break down from. Investors can view price as bullish when over the range and bearish when trading under. We like to use the 6-month calendar range, as it shows long-term support or resistance...

READ MORE

MEMBERS ONLY

Which Commodities Are Countering the Market?

While the major indices continue to weaken, U.S factories have seen a 1.2% increase in orders in August. This shows that although equities are struggling, the demand for goods is steady. Therefore, now is the time to pay close attention to which spaces are holding up while the...

READ MORE

MEMBERS ONLY

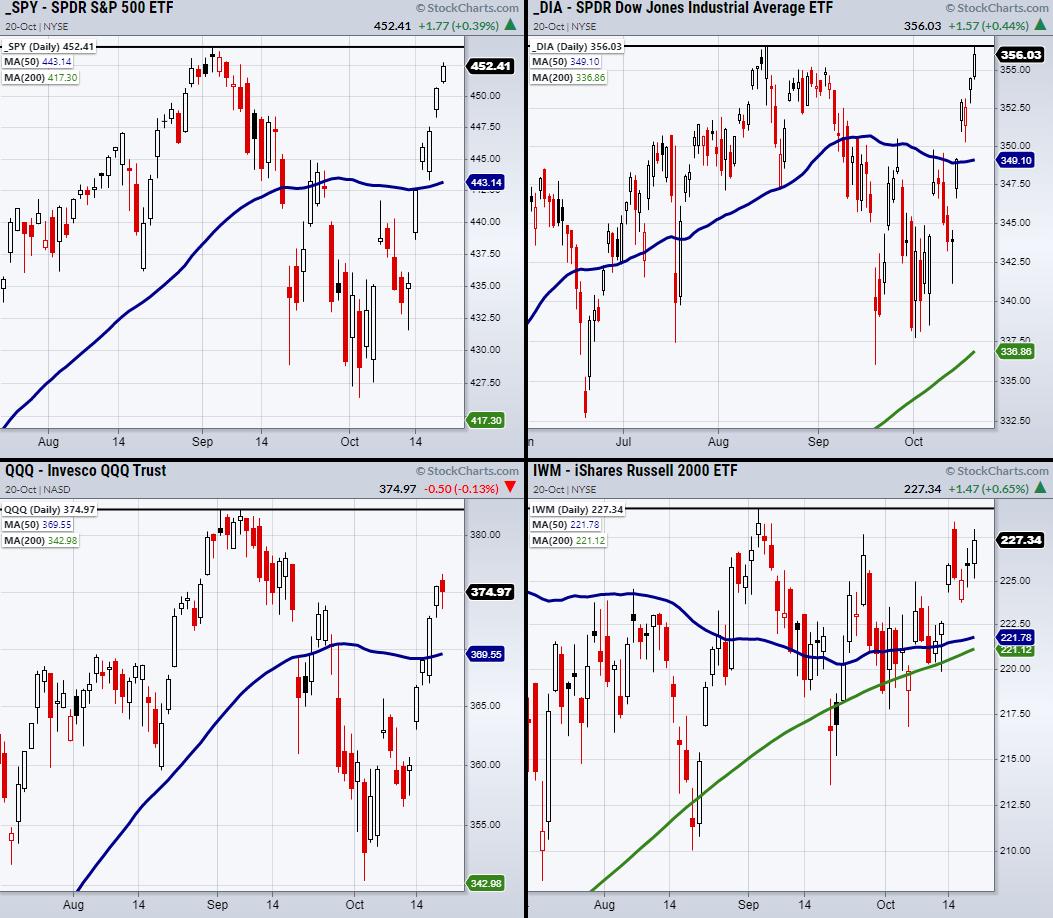

Mish: The U.S. Dollar Has Had Its Day

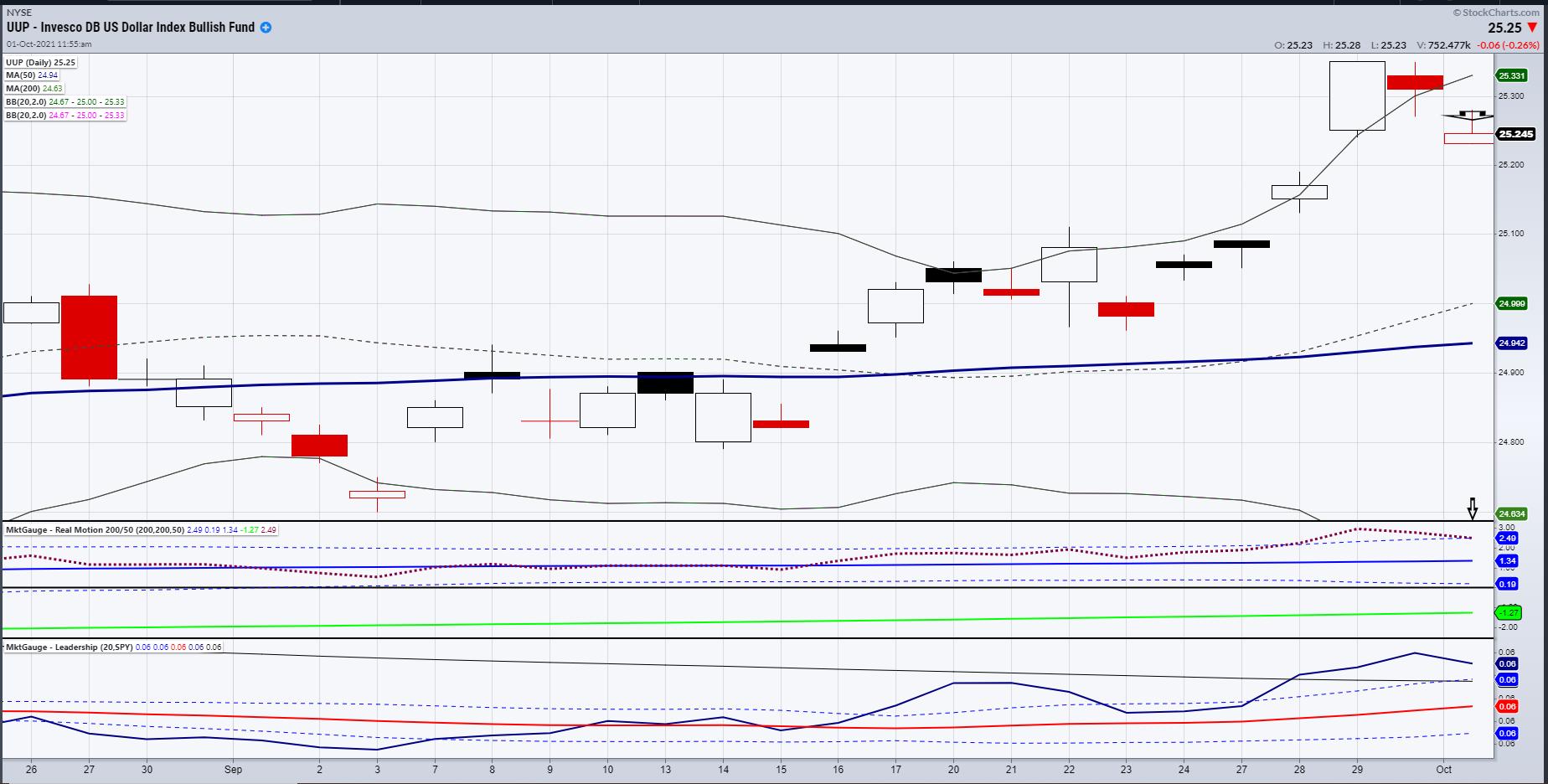

The U.S. Dollar chart, as represented by the Invesco DB US Dollar ETF (UUP), shows some classic signs of a top.

Before I delve deeper into the technicals though, let's look at the fundamental reasons for the dollar rally last week. For starters, China's slowing...

READ MORE

MEMBERS ONLY

Strength Rotates Into the Financial Sector

Wednesday showed weakness in key sectors, including biotech (IBB), semiconductor (SMH) and transportation (IYT). We have closely been watching the transportation sector for improving strength as it has attempted to clear its 50-day moving average (DMA). However, IYT has instead broken underneath the 200-DMA and, though it sits in a...

READ MORE

MEMBERS ONLY

Mish - Stock Traders: Buy the Dip or Buy Some Dip?

As many of you know, I am on many media outlets talking about the market, commodities, the state of the economy, and - yes - I was one of the first to talk about stagflation.

Oftentimes, I am joined by other investors, traders, analysts and financial consultants. What I and...

READ MORE

MEMBERS ONLY

Mish - Transportation Sector, Budgets, Debts and Stocks

The key sector to reflect optimism/pessimism about consumers, industrial demand, supply chain issues and the upcoming budget proposals is Transportation (IYT).

The Retail sector improved to start the week. As measured by XRT, we see an improved phase back to bullish, but still a very much rangebound sector. We...

READ MORE

MEMBERS ONLY

Are Transportation Stocks Setting up for Monday?

On Friday, the transportation (IYT) sector made a comeback from this week's lows, along with clearing resistance from its 200-day moving average (DMA) at $249.46. Next, it will need to clear its 50-DMA at $252.16.

A strong transportation sector is important because this sector helps show...

READ MORE

MEMBERS ONLY

The Market Fails to Clear Key Price Levels

On Wednesday, the Fed announcement continued past promises of reducing their bond-buying program and keeping interest rates low. The 120-billion-dollar bond-buying program will first look to reduce $15 billion per month beginning near the end of the year before it moves towards raising interest rates.

Looking through the eyes of...

READ MORE

MEMBERS ONLY

Is the Market Sending Mixed Signals to Dip Buyers?

On Tuesday, the Market attempted a recovery, with an initial gap higher followed by choppy price action throughout the day. Because the market is not selling off like it did early Monday, this is showing that the market is having trouble bouncing back quickly.

For the past week, the media...

READ MORE

MEMBERS ONLY

How to Create a Successful Trading Plan

Some people say that trading takes nerves of steel and insane willpower. Maybe people with these skills exist, but to become successful at trading you don't need to have such rare superpowers. What a successful trader needs, and what many traders fail to create, is a solid plan....

READ MORE

MEMBERS ONLY

Breaking Key Support in the S&P 500 (SPY) Could Be a Reversal Opportunity

On Friday, the S&P 500 (SPY) broke an important support level by closing under the 50-day moving average and this week's low. While this was an important level to break, it was also a very clean and obvious place for the SPY to fall through.

For...

READ MORE

MEMBERS ONLY

Are Traders Programmed to Buy Dips?

With the pandemic came a wave of new retail traders. Using apps that make trading as easy as swiping up on a phone to execute an order, millennials and more jumped on the bull train after the initial market selloff. This rapid bullish trend has made dip-buying (buying an upward...

READ MORE

MEMBERS ONLY

The Battle of Paid and Zero-Commission Trading Continues

On Tuesday, the chairman of the Securities and Exchange Commission, Gary Gensler, faced pushed back from senators about his recent ideas of adding cryptocurrency regulation, along with other topics such as meme stocks and zero-commission trading.

Specifically diving into zero-commission trading, Gensler believes that zero fees, while nice for the...

READ MORE

MEMBERS ONLY

Why Tuesday's Volume Patterns are So Important for the Major Indices

The major indices closed surprisingly well on Monday. Although the initial morning gap-up did not hold, the Dow Jones (DIA) and the Russell 2000 (IWM) were able to make a comeback, with support from IWM's 50-DMA at $221.58 and the low of 8/19 at $347.31...

READ MORE

MEMBERS ONLY

Does the Transportation Sector (IYT) Hold the Fate of the Market?

When the market struggles to decide which direction to travel in, we tend to see increased volatility. Throughout last week, the market was struggling to pick a direction until finally it threw in the towel and broke lower near the end of Friday. This is a considerable break in price...

READ MORE

MEMBERS ONLY

How Momentum Plays a Key Role in the Russell 2000 (IWM)

Representing 2000 small-cap companies, the Russell 2000 (IWM) gives a great view of the overall market picture.

Recently, we talked about watching our Real Motion momentum indicator to time a buy entry if it cleared its 50-day moving average in both price and momentum. However, momentum was unable to clear...

READ MORE

MEMBERS ONLY

Why Jobs Growth Could Make or Break the Current Market

The jobs market is growing, with more companies offering higher wages and increased benefits. For instance, Walmart (WMT) increased its average minimum wage to $16 an hour and has a program to pay for worker's tuition at a four-year college. Many other companies have followed suit with increasing...

READ MORE

MEMBERS ONLY

Bad Jobs Report Ahead of Labor Day

On Friday, the jobs report showed 235,000 new jobs reported for August. This was not good news since the estimate was roughly 500,000 higher. Ouch! However, the major indices did not take a large hit and closed roughly flat or a smidge down for the day.

So why...

READ MORE

MEMBERS ONLY

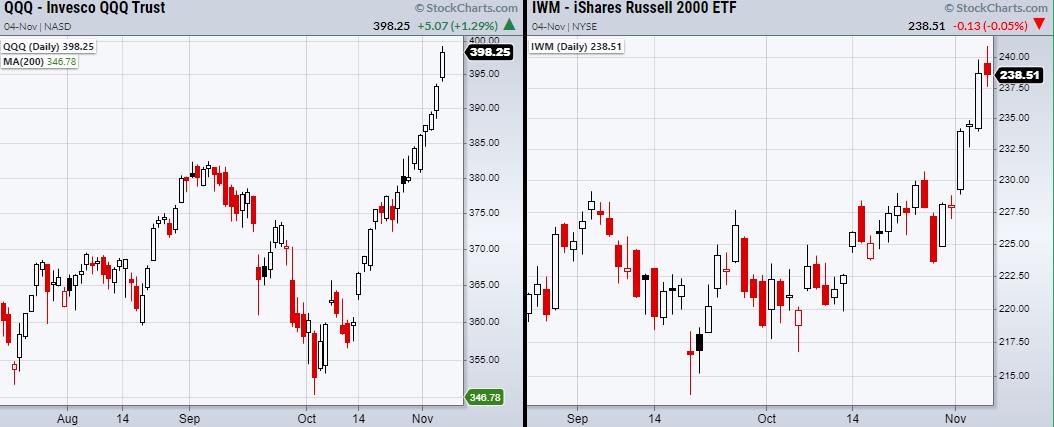

Will the Russell 2000 (IWM) Break to New Highs?

Recently, the small-cap index Russell 2000 (IWM) cleared $225. This was a main resistance level dating back to early August. Now that IWM had cleared resistance, will it make new highs?

One way we can judge the odds of IWM's continued rally is by checking its underlying momentum...

READ MORE