MEMBERS ONLY

Is Stagflation Creeping Up?

After Wednesday's Fed announcement, the stock market has been sitting in an uneasy state. The U.S Dollar (UUP) has not only firmed, but pushed over resistance from its 200-day moving average at 24.69, confirming an accumulation phase. Additionally, the 20+ year treasury bond ETF (TLT) has...

READ MORE

MEMBERS ONLY

Can the Economic Modern Family Hold its Current Price Range?

After the FOMC minutes were released on Wednesday, the market responded with a sharp selloff. The Feds' underestimation of rising inflation pushed them to consider scheduling rate increases in 2023. While 2023 is still far in the future, the market responded with choppy price action.

This could be taken...

READ MORE

MEMBERS ONLY

The Hidden Opportunity in Soft Commodities

On Monday, we talked about transitory inflation and decided that, if general demand for goods was to continue with such strength, one of the best places to keep an eye on for investing opportunities could be in soft commodities. Not only must people eat, but, as travel picks up its...

READ MORE

MEMBERS ONLY

What is the Deal with Transitory Inflation?

The Federal Reserve has called inflation transitory as they look for the economy to continue to recover and for more people to enter the workforce. The Fed could be expecting inflation to settle down, not only from people returning to work but also with a decrease in programs, including the...

READ MORE

MEMBERS ONLY

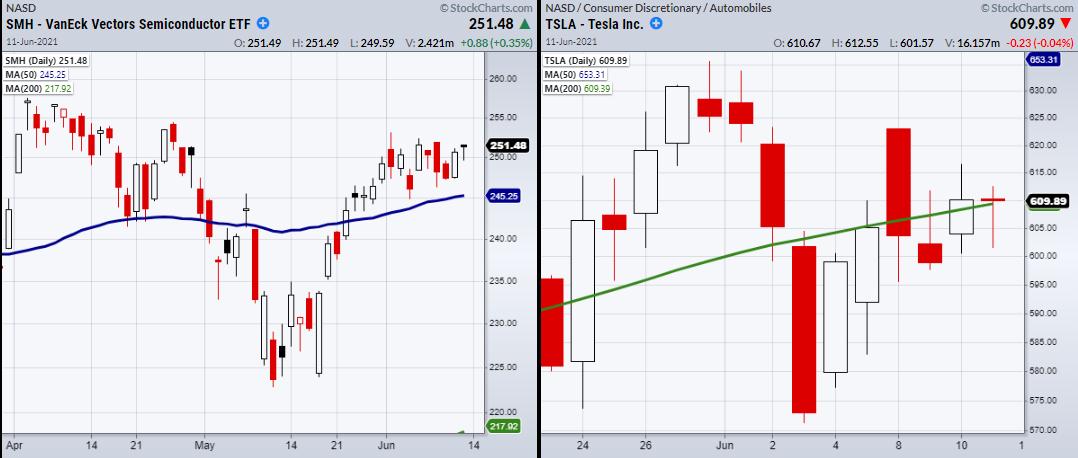

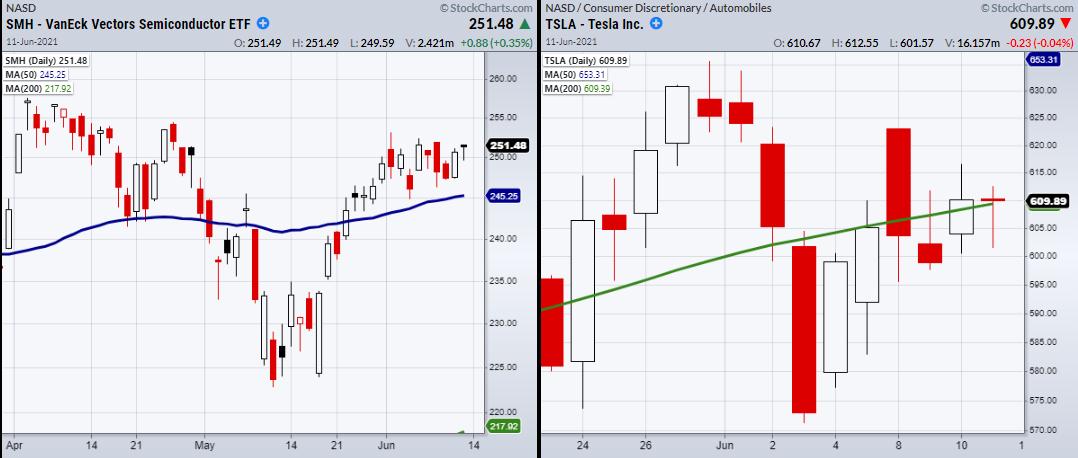

Will the Semiconductors Sector (SMH) Lead the EV Market Higher?

It is well known that supply chain disruptions in Taiwan and other leading countries, which produce semi-chips for computers/Electric Vehicles, have been struggling to keep up with demand. Therefore, if the EV space is looking to extend higher, it will need semiconductor supply companies to step up its game....

READ MORE

MEMBERS ONLY

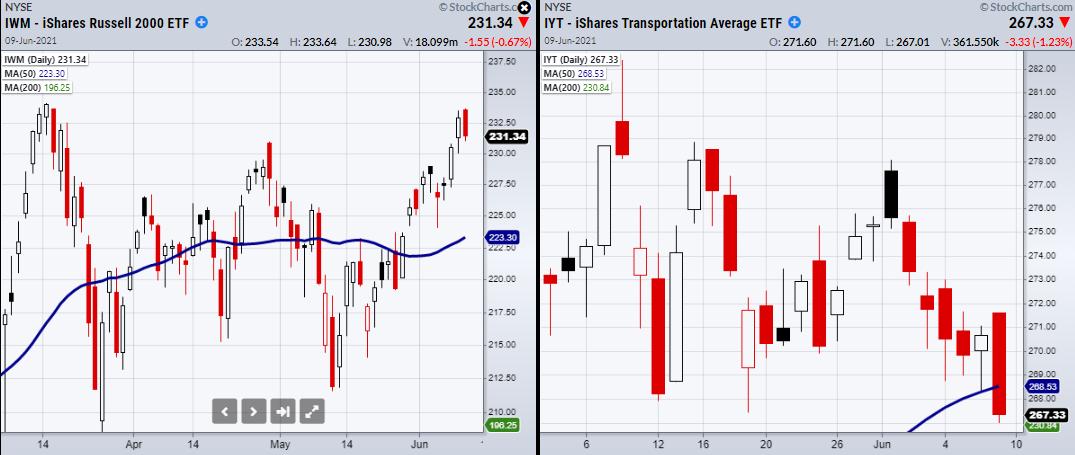

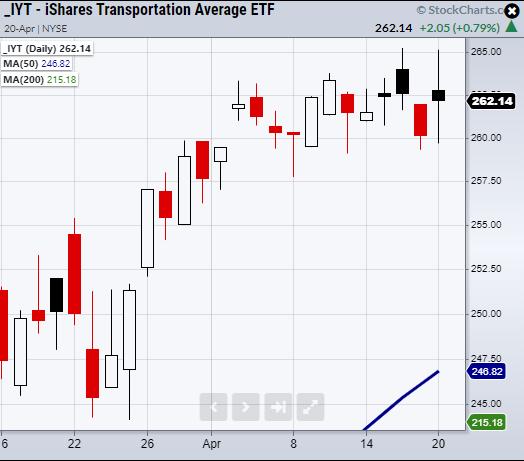

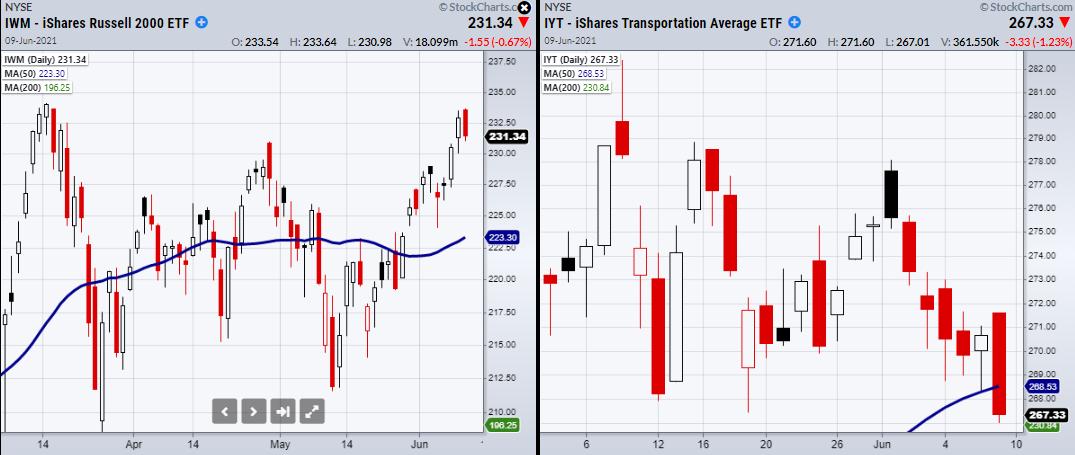

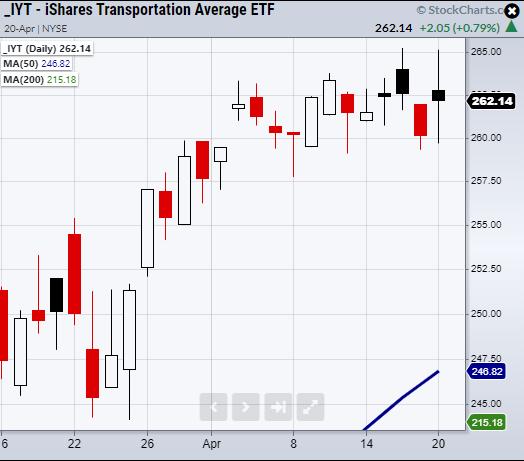

Is the Transportation Sector (IYT) Stifling a Major Market Breakout?

The S&P 500 (SPY) and the Small-caps Russell 2000 (IWM) linger near all-time highs. This looks like a great setup for a rally past resistance and into higher territory. However, there are two potential problems to consider.

The first is the Transportation sector (IYT), which has broken its...

READ MORE

MEMBERS ONLY

Why Transportation (IYT) Must Hold Over $268

The transportation sector (IYT) bounced off $268, closing +.32% on the day. This was a pivotal level to hold and becomes more important when compared to the rest of Mish's Economic Modern Family. Besides IYT, the Family consists of Retail (XRT) Regional Banking (KRE), Biotech (IBB), Semiconductors (SMH)...

READ MORE

MEMBERS ONLY

Small-Cap Growth Stocks

"A small-cap is generally a company with a market capitalization of between $300 million and $2 billion. The advantage of investing in small-cap stocks is the opportunity to beat institutional investors through growth opportunities. Small-cap stocks have historically outperformed large-cap stocks but have also been more volatile and riskier...

READ MORE

MEMBERS ONLY

Can the Small-Cap Index and the Transportation Sector Hold Key Support?

For the small-cap Russell 2000 (IWM), $226.69 is an important level to hold, as it shows the index can sustain itself over its main consolidation range dating back to early April. On the other hand, the Transportation sector (IYT), along with Retail (XRT), are not far from their 50-day...

READ MORE

MEMBERS ONLY

How to Use Simple Risk Control for Stocks Like AMC

Once a stock goes flying, it seems as though everyone wants a piece of the action.

Of course, it might be fun to be a part of a big move, but it can also be extremely dangerous to take a trade in something going parabolic. However, if you are late...

READ MORE

MEMBERS ONLY

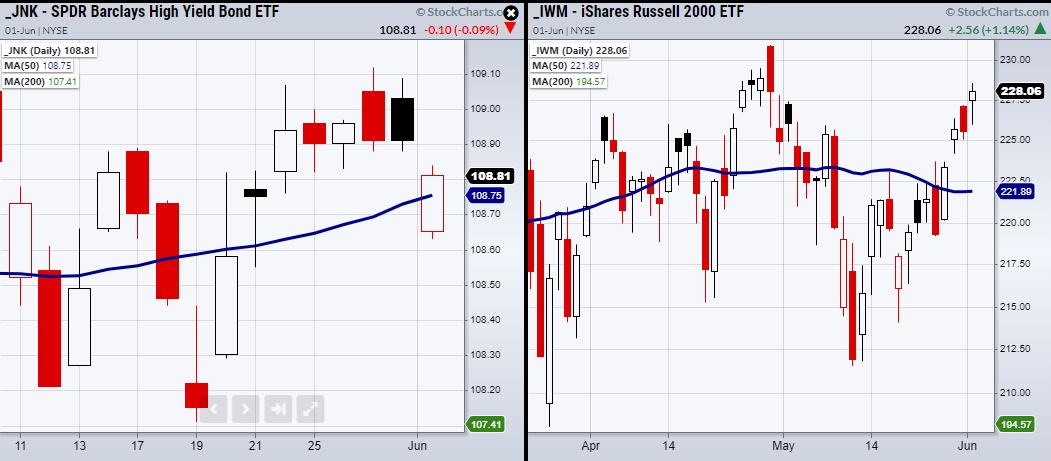

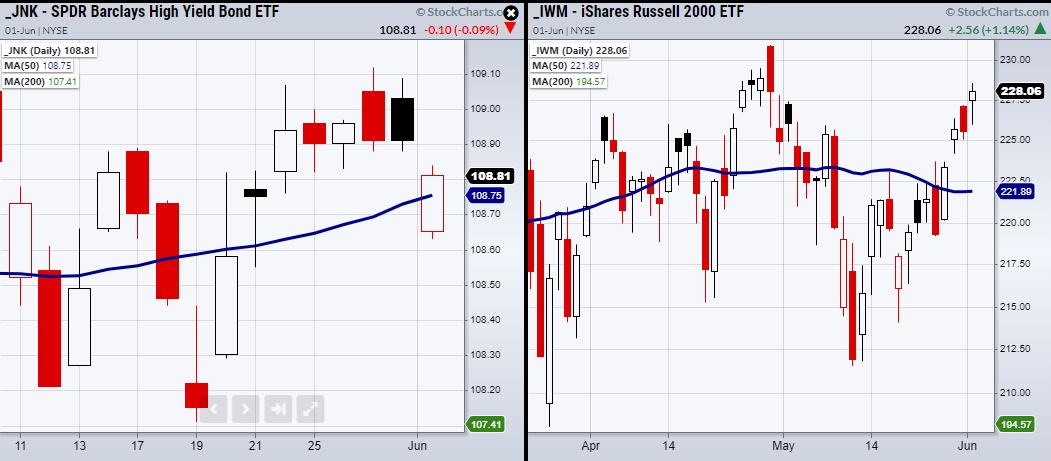

Can JNK and IWM Hold Their Key Price Levels?

On Tuesday, the Russell 2000 (IWM) closed over its pivotal price area of $226.69 from April 6th. Now it needs to hold over this price level as new support. However, the other major indices, including the S&P 500 (SPY) and Dow Jones (DIA), closed almost unchanged from...

READ MORE

MEMBERS ONLY

Cybersecurity - An Ever-Evolving Megatrend

The Biden administration is looking to increase spending on cybersecurity with the next round of stimulus. This comes after an increase in cyber-attacks across the world, which has targeted government agencies and groups. For the U.S, one of the most recent attack was a ransomware attack on the Colonial...

READ MORE

MEMBERS ONLY

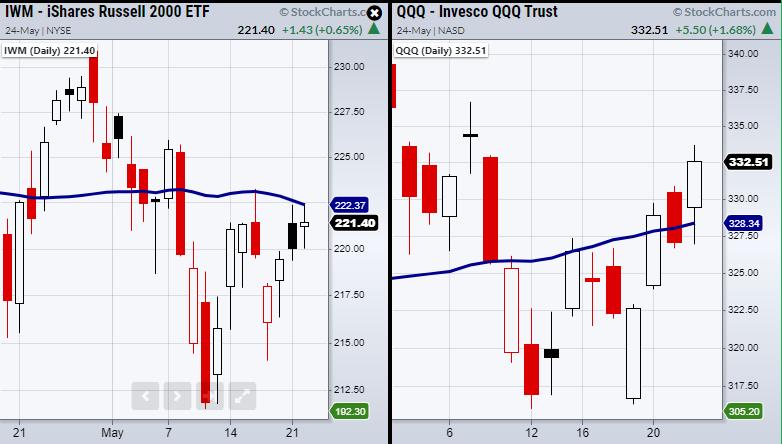

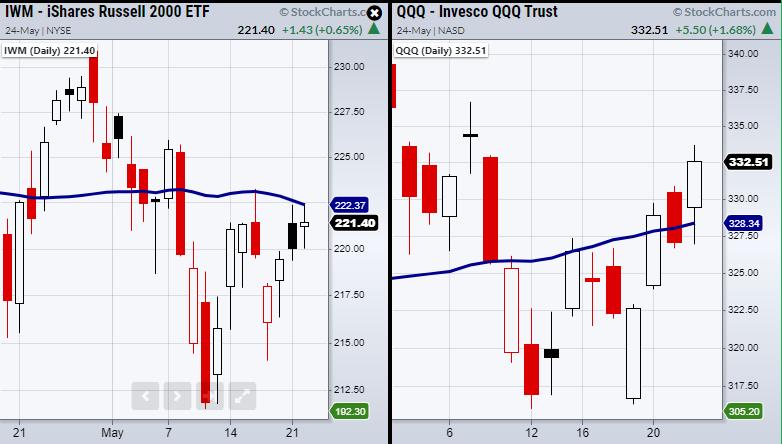

Finally Russell 2000 -- But Can You Confirm?

For the past couple of weeks, the Russell 2000 (IWM) has been a major focus for traders and investors that have been cautious, given the struggle IWM has gone through in its current trading range. Now it has cleared its pivotal 50-day moving average at $221.96 and looks to...

READ MORE

MEMBERS ONLY

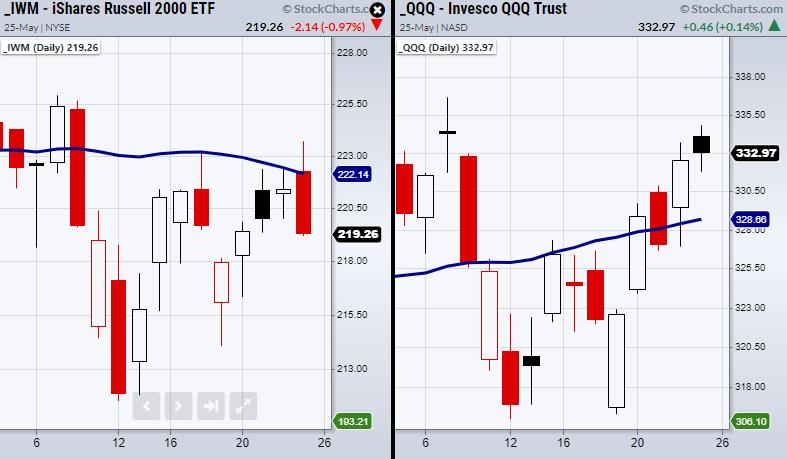

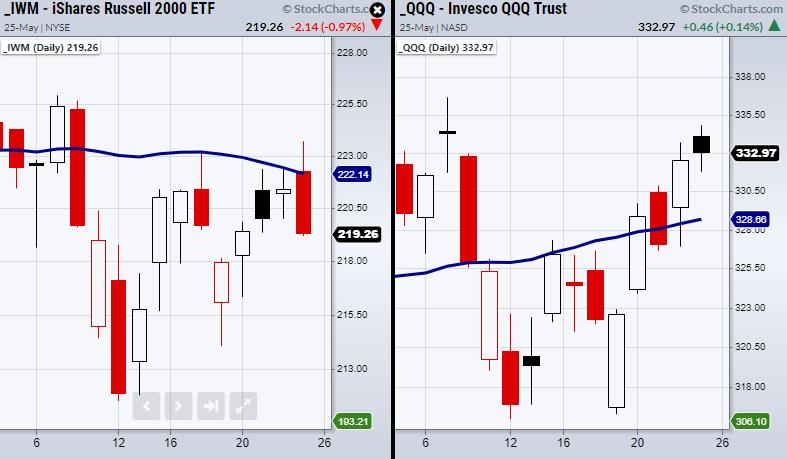

Why the Russell 2000 (IWM) Needs to Clear $222.14

For the third time, the small-cap index Russell 2000 (IWM) has failed to clear its 50-day moving average. It is the last of the four major indices to lag as, on Monday, the Nasdaq 100 (QQQ) cleared and has since held over its 50-DMA for a second day. This confirmed...

READ MORE

MEMBERS ONLY

Can Big Tech Lead the Market Higher?

On Monday, the Semiconductors ETF (SMH) cleared back over resistance from its 50-day moving average at $242.07. Additionally, the tech-heavy Nasdaq 100 (QQQ) cleared its 50-DMA. The next test is for both symbols to hold their MAs as support for Tuesday's trading session. Because both have consolidation...

READ MORE

MEMBERS ONLY

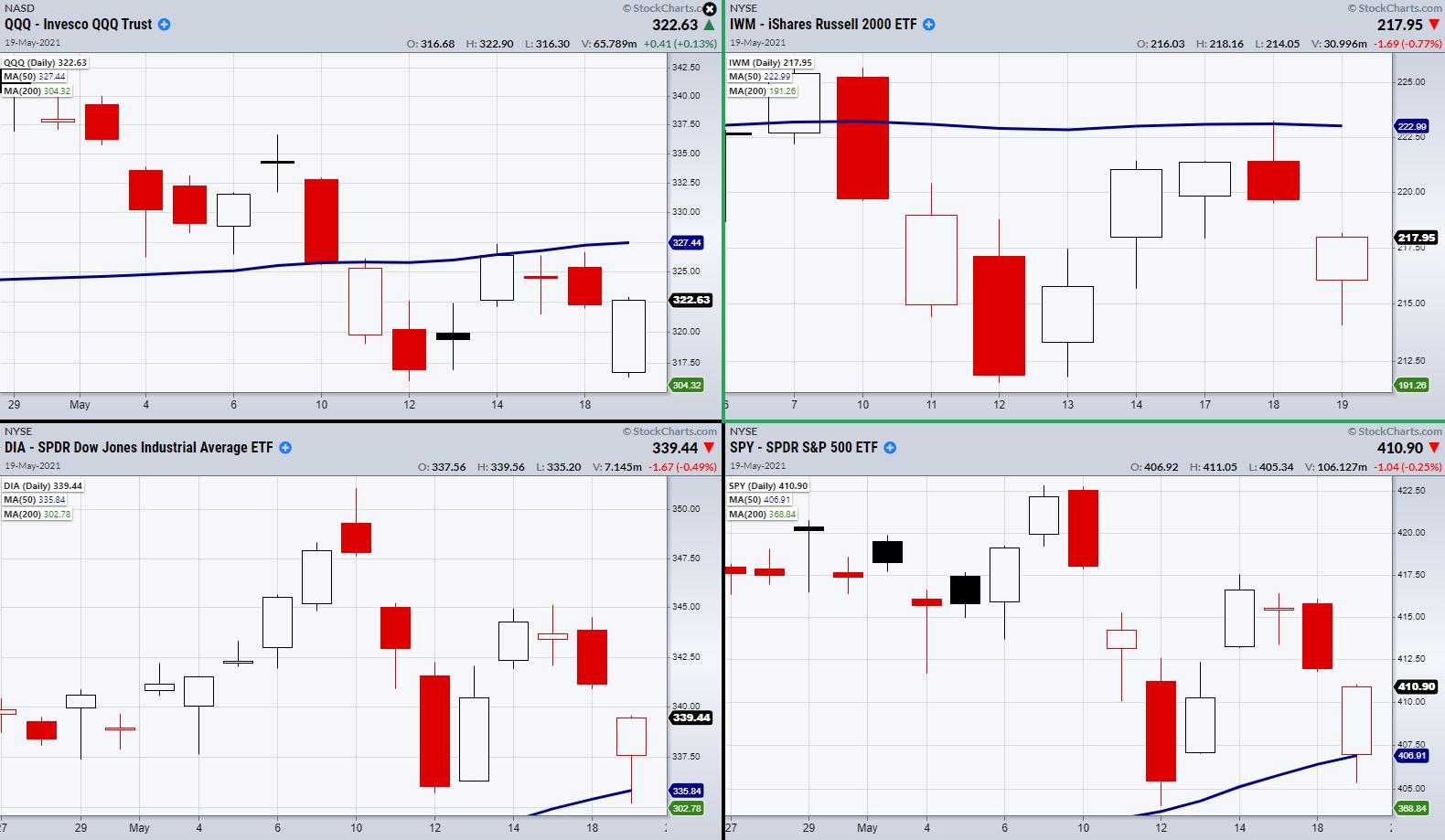

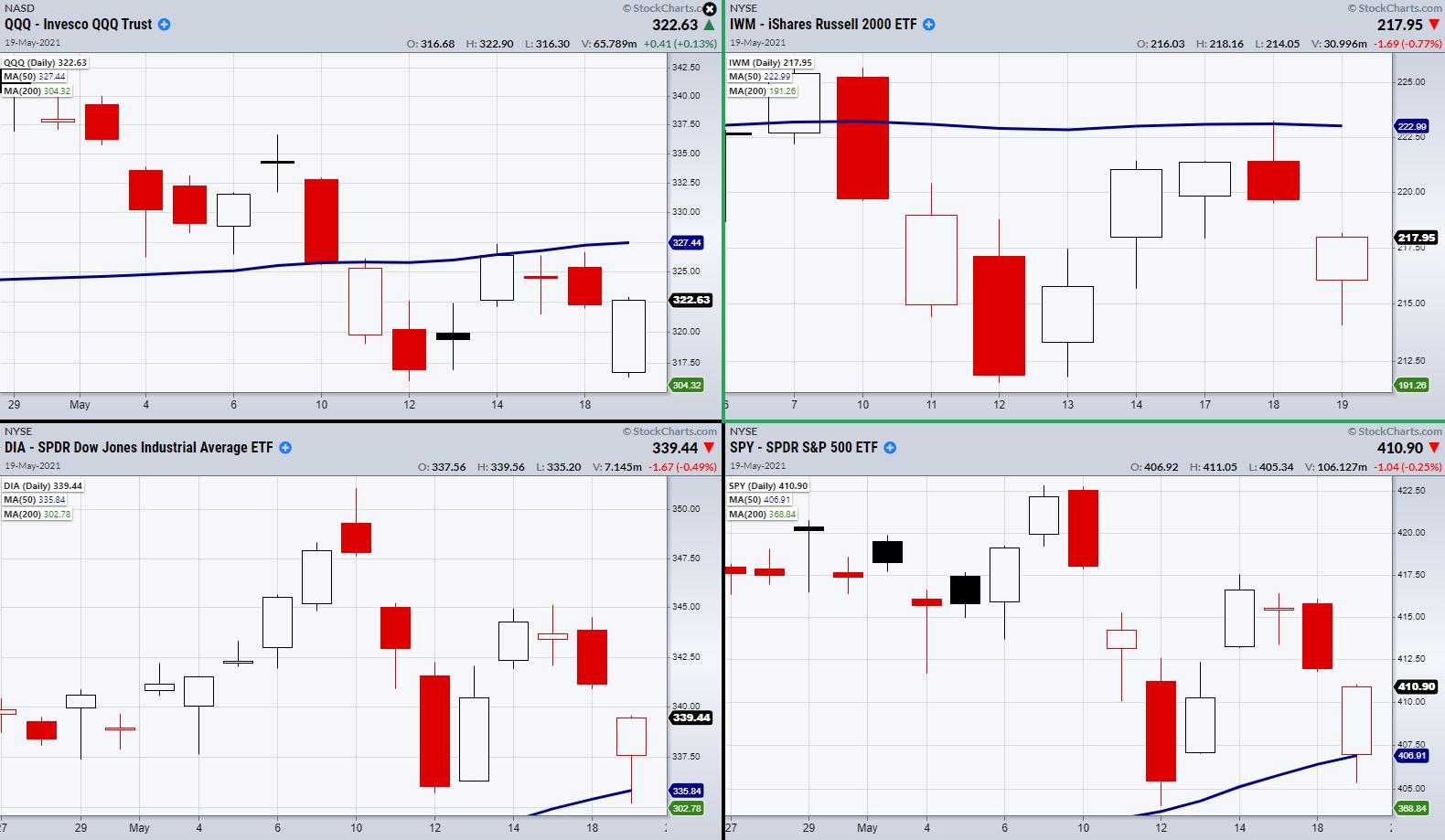

Will Monday Settle the Stock Market Divide?

The four major indices are split between two phases.

The first is a bullish phase. This is created when the price of a symbol is trading over its 50-day moving average, with the 50-DMA over the 200-DMA. Both the Dow Jones (DIA) and the S&P 500 (SPY) are...

READ MORE

MEMBERS ONLY

Can the Major Indices Stand Their Ground?

On Wednesday, the four major indices gapped lower based on the failure of the Russell 2000 (IWM) and the Nasdaq 100's (QQQ) ability to clear resistance from their 50-day moving averages. However, IWM did not reach its next support level at $211, and the QQQs were able to...

READ MORE

MEMBERS ONLY

All Eyes on the 50-Day Moving Average

The Russell 2000 (IWM) and Nasdaq 100 (QQQ) have yet to surpass their 50-day moving average, which has created a pivotal and psychological resistance level that bulls are looking to clear. Additionally, other key sectors and indices have been holding their breath in anticipation of a break over these specific...

READ MORE

MEMBERS ONLY

Why Tuesday is Pivotal for the Market

Last Friday, the market closed on a high note, with a rally off the lows of 05/12. This was a bullish sign, yet the rally also pushed prices into a resistance area. The mixed sentiment from traders can be seen in today's major indices, with an inside...

READ MORE

MEMBERS ONLY

Is the Current Market Rally Sustainable?

This past week, dip buyers saved the market from breaking lower.

The Retail (XRT) and Regional Banking (KRE) sectors have cleared back over resistance from their 50-day moving averages, followed by the Biotech (IBB) clearing back over its 200-DMA. However, the small-cap Russell 2000 (IWM) and Semiconductors (SMH) are still...

READ MORE

MEMBERS ONLY

Caution All Around with Transportation Market's Last Hope

On Wednesday, the market continued the prior days' sell-off. This has placed the overall market trend in a pivotal area as more sectors begin to look weak.

This can be seen in Mish's Economic Modern Family, which consists of one index and 5 important sectors. Currently, the...

READ MORE

MEMBERS ONLY

Why Big Tech is Tuesday's Main Focus

On Tuesday, the Nasdaq 100 (QQQ), Russell 2000 (IWM) and S&P 500 (SPY) gapped lower, followed by a rally.

One of the most important indices to gap lower was the teach-heavy index QQQ. This is important because big tech companies were the first to lead the rally created...

READ MORE

MEMBERS ONLY

What a Weakening Dollar Could Mean for the Market

The Russell 2000 (IWM) and the Nasdaq 100 (QQQ) both broke their 50-day moving averages. Meanwhile, Transportation (IYT) printed another new all-time high. This shows the market's current indecision and choppy nature.

The market's uncertainty may be related to inflation, which is set to increase beyond...

READ MORE

MEMBERS ONLY

Weekly Market Recap Based on 5 Key Sectors and 1 Index

On Friday, non-farm payrolls were announced, with a disappointing 266,000 jobs created compared to the roughly 1 million that economists had predicted. However, the gap in expectations did not result in a market selloff. This could be showing that investors are giving more weight to the Fed's...

READ MORE

MEMBERS ONLY

Which Commodities are the Safest Play to Combat Inflation?

Recently, there has been a surge of articles pertaining to rising inflation, as the Federal Government plans to add more debt with upcoming spending from the infrastructure bill and another stimulus package. Inflation has also become an increasingly touchy topic.

On Wednesday, Janet Yellen (Treasury Secretary) backtracked her recent comments...

READ MORE

MEMBERS ONLY

Can the Nasdaq 100 (QQQ) Hold its Main Support Area?

On Tuesday, Janet Yellen commented that "[i]t may be that interest rates will have to rise somewhat to make sure that our economy doesn't overheat." The market was already trending lower on the day after its recent teetering around new high territory. Clearly, Yellen did...

READ MORE

MEMBERS ONLY

Retail and Transportation Attempt to Lead the Market Higher

On Monday, the transportation sector (IYT) closed the day +1.4%, along with the Retail sector (XRT) also performing well, up +2.11%. These two sectors are currently attempting to lead the market higher, but are having trouble getting other members of the Economic Modern Family to join in.

The...

READ MORE

MEMBERS ONLY

Major Index Support and Resistance Levels

Last Thursday, the S&P 500 (SPY) and the Nasdaq 100 (QQQ) tested new highs and then gapped lower on Friday, showing that the market still had some overhead resistance. Driving reasons could be related to fears of inflation raising, as the U.S pushes to take on more...

READ MORE

MEMBERS ONLY

Has Earnings Season Slowed Market Volatility?

The first half of Wednesday saw minimal movement in the major indices, due in large part to the anticipation for the FOMC minutes that were later released at 2pm ET. However, like the prior FOMC report, it stuck to the same slate of ideas. Interest rates will stay near zero...

READ MORE

MEMBERS ONLY

Are Rising Commodities Causing Investors to Worry About Inflation?

This week, three of the major indices, including the Nasdaq 100 (QQQ), Dow Jones (DIA) and S&P 500 (SPY), have been lingering near highs without the ability to break out. However, food commodities, such as corn (CORN), sugar (CANE), soybeans (SOYB) and more, have seen a consistent rise...

READ MORE

MEMBERS ONLY

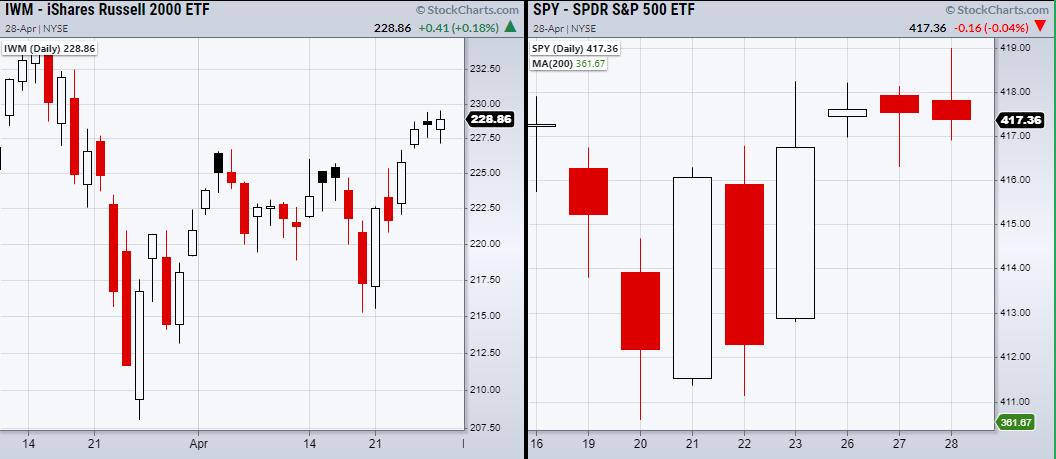

Is the Russell 2000 (IWM) Back on Track to New Highs?

On Sunday, we concluded that if most of the major indices could clear to new highs, along with the Russell 2000 (IWM) breaking out of resistance from $226.69, the market had the potential to make a powerful move up. However, while none of the indices broke out to new...

READ MORE

MEMBERS ONLY

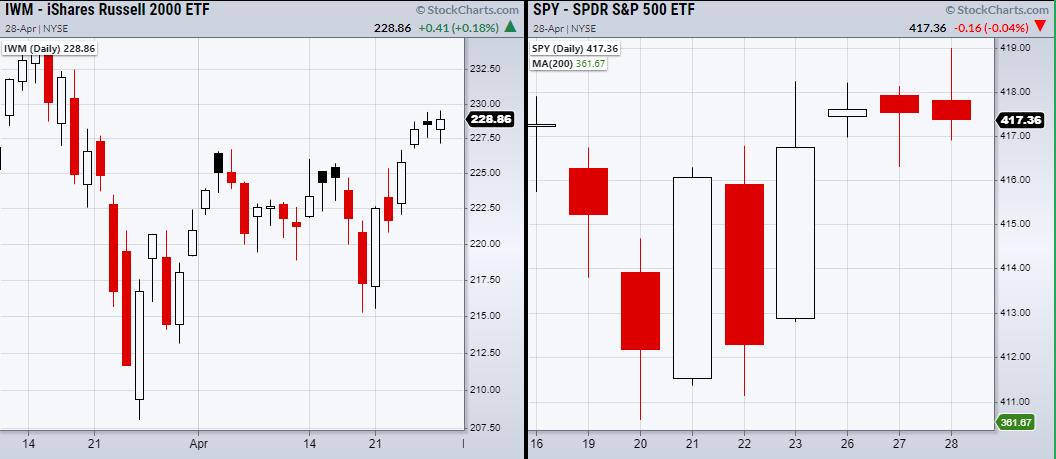

Are the Major Indices Poised for a Powerful Up Move Monday?

The Russell 2000 (IWM), Nasdaq 100 (QQQ), Dow Jones (DIA) and S&P 500 (SPY) all have the potential to make large moves Monday, if they clear their resistance levels together.

This month, the SPY, QQQ and DIA were able to make substantial gains. Currently, they sit close to...

READ MORE

MEMBERS ONLY

Saved By Hidden Support

On Wednesday, the major indices along with key sectors held pivotal support areas.

In the chart above, we can see that the small-cap index Russell 2000 (IWM) has put in some work to create a head-and-shoulders chart pattern. A head-and-shoulder pattern has 3 peaks, with the outside two being close...

READ MORE

MEMBERS ONLY

Is the Transportation Sector (IYT) the Market's Silver Lining?

On Tuesday, the transportation sector closed green on the day, while the rest of the Economic Modern Family closed red.

The most prominent break of support came from the Russell 2000 (IWM) and the Regional Banking sector (KRE). IWM fell under support at $218, while KRE fell below its 50-day...

READ MORE

MEMBERS ONLY

Key Support Levels That Need to Hold

Although every member of the Economic Modern Family closed down on Monday, none broke their major support areas. Here is a quick rundown of where each member's closest support level is.

First, we have the Russell 2000 (IWM), with support from the low of its current range at...

READ MORE

MEMBERS ONLY

Why We Bought Gold (GLD) Before Thursday's Gap Up

Last Wednesday, Mish went live on Fox Business' Making Money with Charles Payne and gave out a very bold pick. Or, at least bold in the eyes of the general populace, as most of the media's coverage has focused on big tech and the Crypto space.

Having...

READ MORE

MEMBERS ONLY

Why the Nasdaq 100 (QQQ) Needs to Hold Near Highs

On Tuesday, we talked about the Coinbase (COIN) public listing and how waiting for the dust to settle would be a good plan, as there is no prior price action or history to base projections from a technical standpoint. The plan turned out to be correct, as Coinbase's...

READ MORE

MEMBERS ONLY

How Does Coinbase Affect the Tech Sector?

The Nasdaq 100 (QQQ) has made new all-time highs on the heels of Coinbase's direct listing on April 14th.

Coinbase is currently the most popular exchange for buying crypto and has attracted a large amount of popularity and hype before it releases, as market analysts throw out wildly...

READ MORE

MEMBERS ONLY

How to Read the Mixed Market Picture

On Monday, the Economic Modern Family, which consists of 1 index and 5 key sectors, showed mixed signals as half of the Family closed down for the day. Currently, the Russell 2000 (IWM), Biotech (IBB) and Semiconductors (SMH) are down with Transportation (IYT), Retail (XRT) and Regional Banks (KRE) up...

READ MORE

MEMBERS ONLY

How to Navigate the Market with These 3 Symbols

Last week's focus was the Russell 2000 (IWM), Transportation ETF (IYT) and Semiconductors ETF (SMH). IWM has shown us general market direction and sentiment as it contains 2000 small-cap U.S companies. IYT is the backbone or demand side of the economy as the U.S opens with...

READ MORE