MEMBERS ONLY

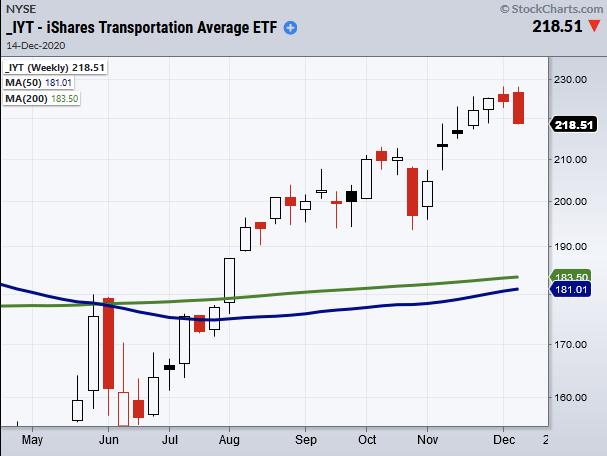

Is the Negative Momentum Divergence in Transportation a Warning Sign?

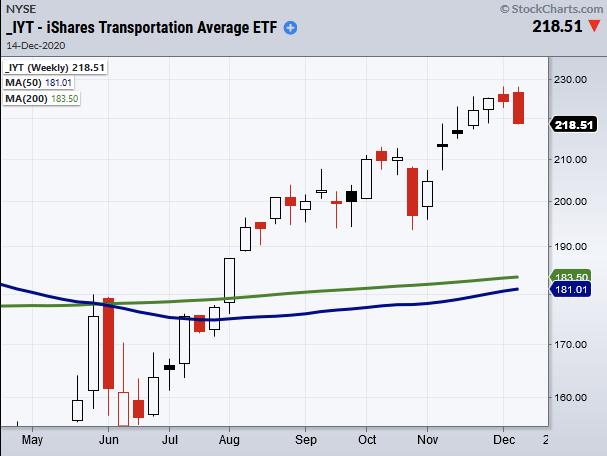

Recently, our proprietary momentum indicator RealMotion, seen in the chart above, has shown a divergence in momentum and price for the transportation sector (IYT).

While the price of IYT currently sits above the 50-day moving average, it has broken the 50-DMA on momentum. However, the warning only holds weight if...

READ MORE

MEMBERS ONLY

The Next Mega-Trend and What to Watch For in 2021

Wednesday's inauguration marks an interesting time for the economy.

The new administration has shown that clean energy tech is on the table as a way to push for new jobs in the industry, along with focusing on climate change policy going into the new year. The Nasdaq 100...

READ MORE

MEMBERS ONLY

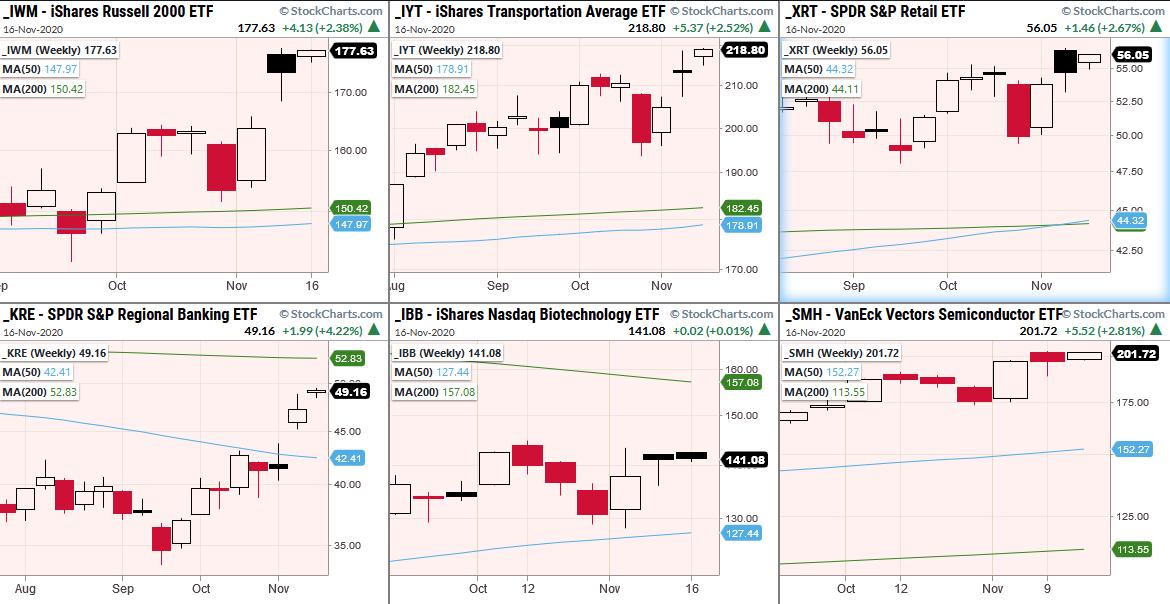

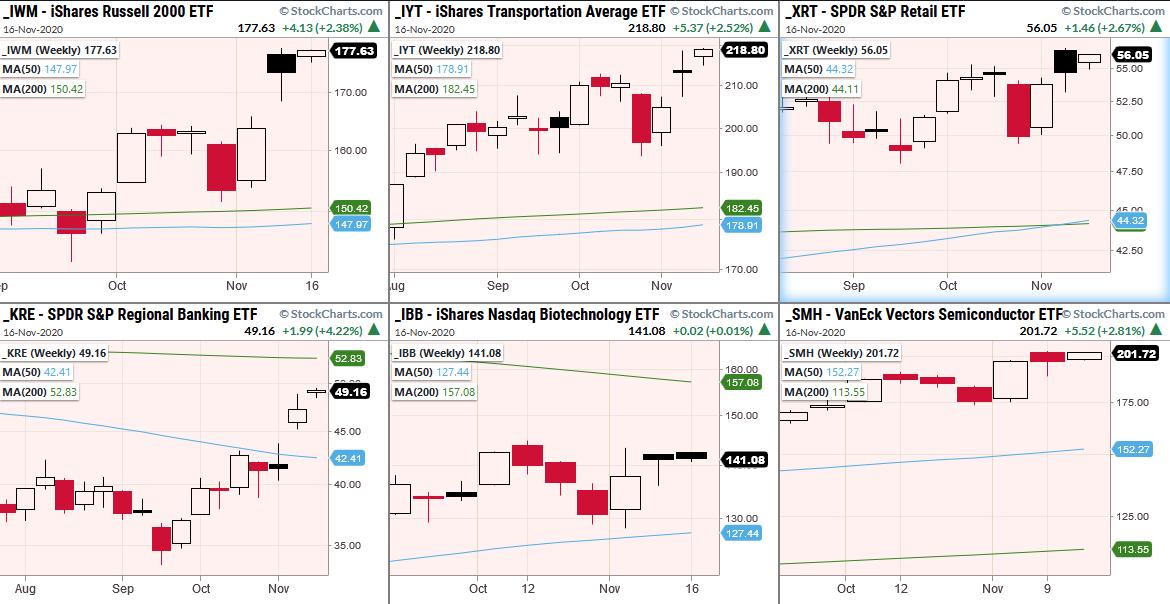

Momentum Divergences in Key Market Indicators

The transportation sector (IYT) closed .36% lower Tuesday. It was the only member of the Economic Modern Family to end the day red.

On the other hand, the retail sector (XRT) ended almost a half percent higher.

Because of how retail and transportation are interconnected via supply and demand, watching...

READ MORE

MEMBERS ONLY

Looking Back While the Market Drives Forward

On Friday, three of the major indices gapped lower, ultimately closing negative for the week. The Russell 2000, although down on Friday, closed up on the week.

With the media pointing to a slew of reasons for the price drop, like negative bank earnings, slow vaccination rates, fall in retail...

READ MORE

MEMBERS ONLY

The Market and Media Paint 2 Different Pictures

The market digests its recent highs amidst a rush of politically-charged news as more riots and a second impeachment dominate headlines.

We believe the market is more focused on the economic plans of the incoming administration and not as much on the politics at hand. The marijuana industry can attest...

READ MORE

MEMBERS ONLY

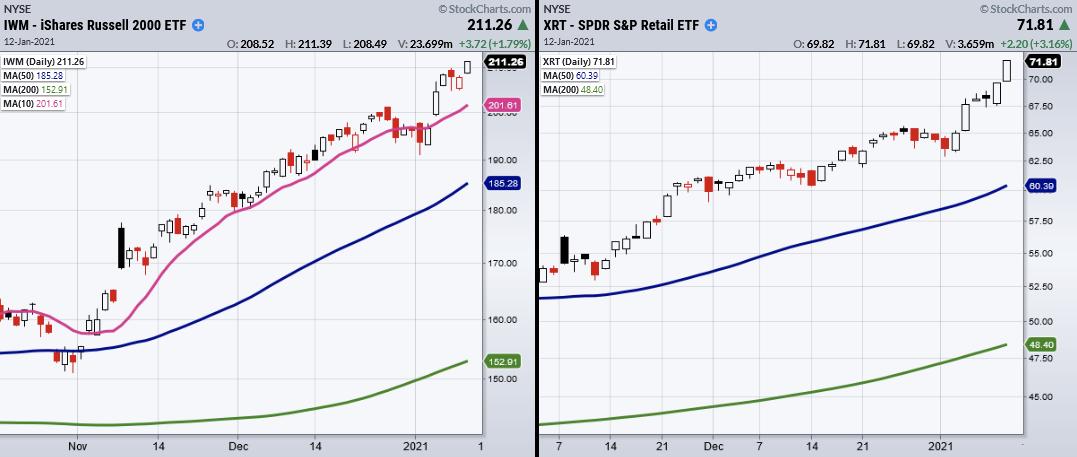

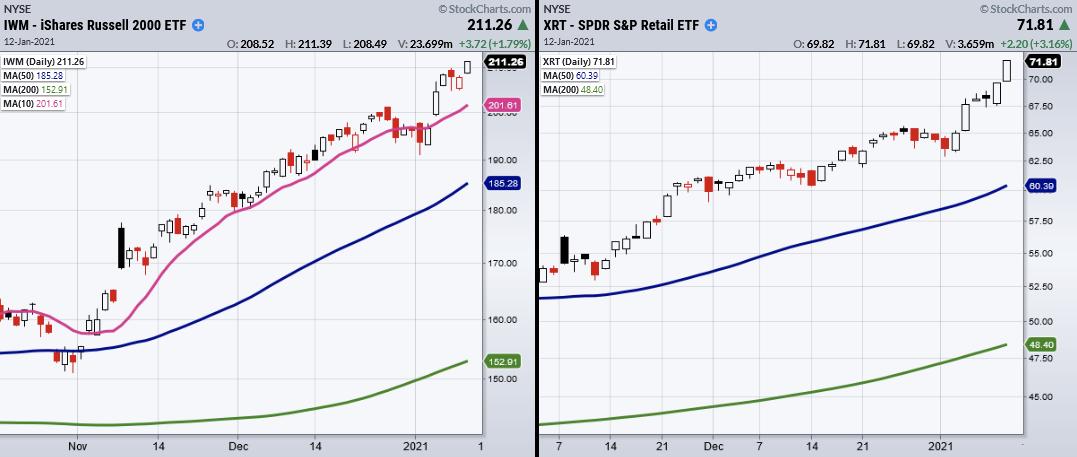

The Market's Power Couple

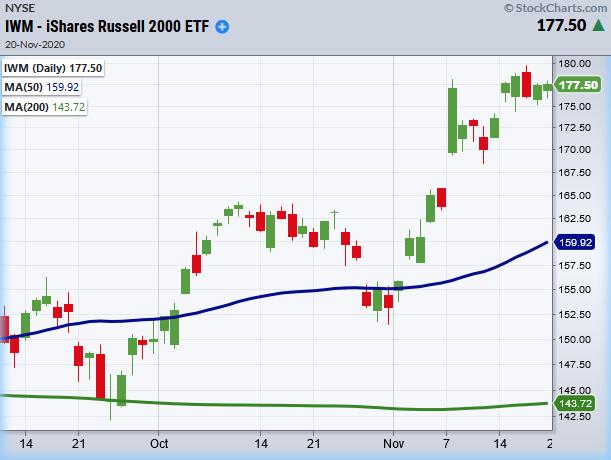

Grandad Russell 2000 (IWM) and Granny Retail (XRT) make the Perfect Power Couple.

The Russell 2000 (IWM) followed his wife (XRT) Retail, to new highs today while major indices sit under their recent highs. Granny's enthusiasm has not only encouraged Grandad to get back up since his recent...

READ MORE

MEMBERS ONLY

Where Have All the Silver Bulls Gone?

A week or so ago, silver was all the rage. The talk ranged from an inflation indicator, to the industrial usage to the outperformance to gold as key.

Then, last Friday, silver (and gold) tanked. Silver breached the 50-DMA but closed above it. Monday, it also declined, but not only...

READ MORE

MEMBERS ONLY

Adding Momentum to Our Top 2021 Picks

It is only the end of the first week of January, and already many of our picks in Mish's Outlook 2021 have made big money.

However, in Friday's StockCharts TV video, Mish picks out 17 of the 57 stock picks and showed you the charts along...

READ MORE

MEMBERS ONLY

3D Printing Rings in the New Year!

Mish's Market Minute Advantage members bought DDD on November 9th. Then, the service added to the position on Wednesday, January 6th. Furthermore, Mish went on Real Vision on the 5th and told those attendees that she believed the stock would double.

Who could have imagined the stock would...

READ MORE

MEMBERS ONLY

A Secret Setup Created by the Start of the New Year!

All the major indices closed with an inside day, meaning that today's price range fits completely inside the prior days price range. This can be seen in the above 4 charts.

Monday also brought us a new calendar range, as it was the first trading day of the...

READ MORE

MEMBERS ONLY

Market Wavers while Food Commodities Shine

Strength picks up in Food commodities as securities struggle amid final stimulus negotiations.

It is now in the Senate's hands to pass or decline the $2000 dollar stimulus checks; a large amount compared to the original $600 proposed in the bill. This looks to be the final hold-up...

READ MORE

MEMBERS ONLY

When Large-Caps Rally, Do Small-Caps Get Smaller?

With another short trading week, it's best to stay cautious, as price action can get wacky towards the year's end.

Fund managers will rebalance their portfolios by selling losers and replacing them with strong performers to spruce up the look of their portfolio before the fourth-quarter...

READ MORE

MEMBERS ONLY

Have The Banks Created An M2 Monster?

While Brexit settled, stimulus checks in the US were debated and Alibaba got their hand (stock) slapped, a few other events that did not make headlines occurred.

First, corn, soybean and sugar futures all advanced to new multi-month highs.

Secondly, as if without a care in the world, junk bonds...

READ MORE

MEMBERS ONLY

Investors Heed Granny Retail and Granddad Russell 2000

As the media focuses on a worsening situation with a new variant of the virus, Mish's Economic Modern Family shows that not all is doom and gloom.

Grandad Russell 2000 (IWM) is sitting right under all time highs of 197.83. The small cap sector continues to shine...

READ MORE

MEMBERS ONLY

What is Triple Witching Day - and Should You Worry About It?

Friday was triple witching day, meaning that stock options, stock index options and stock futures contracts were all due to expire. This happens four times a year and can lead to increased volume, as money is moved around resulting in sometimes unusual (or spooky) price action.

The S&P...

READ MORE

MEMBERS ONLY

When NASDAQ Leads, Bulls Worry

The FOMC reportcame out today, keeping rates unchanged as the Fed continues to buy into bonds, thus supporting the market going forward.

Both the S&P 500 (SPY) and the Nasdaq 100 (QQQ) closed green on the day, with the QQQs breaking new all time highs from their recent...

READ MORE

MEMBERS ONLY

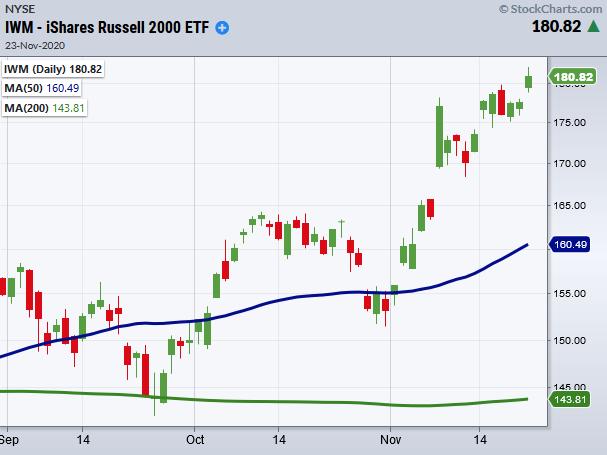

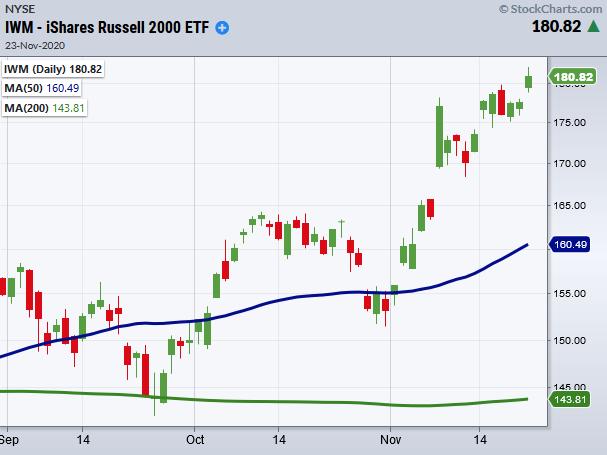

The Market Can Remain Irrational Longer Than You Can Remain Solvent

In the past month, we have written about the Russell 2000 (IWM) Index leading the market higher. Recently, IWM's stellar performance has revealed it as the new superhero of Mish's Economic Modern Family. Today was no exception, as Grandad IWM was able to make all-time highs,...

READ MORE

MEMBERS ONLY

Transportation/Retail Sectors - Correcting, Exhausted or Signalling Something Worse?

On Monday, the tech sector (SMH) and biotechnology sector (IBB) held as the other sectors of the Economic Modern Family failed to hold their gaps. Similarly to SMH, the only major index to close green today was the Nasdaq 100 (QQQ), which tends to have a high concentration of tech...

READ MORE

MEMBERS ONLY

The Agony and the Ecstasy of the Stock Market Outliers

This past week, we saw the market peak in some areas, while others look more like they have a healthy correction in the works. The weakest area, and one that we wrote about last Wednesday, is the reversal top in the Nasdaq 100 (QQQ).

The formation in the NASDAQ is...

READ MORE

MEMBERS ONLY

NASDAQ Dashes for the Exit Door - And Without Serving Food!

There have been many stimulus bills that have been denied, pushed off and almost forgotten about since the initial March selloff. This time was supposed to be different, since its key purpose was to be a condensed plan in order to keep small business loans and unemployment benefits extended past...

READ MORE

MEMBERS ONLY

Water Futures on the Chicago Mercantile Exchange

California Water futures have been added to the list of tradable commodities.

Historically, commodity futures contracts were first created as a way for farmers to hedge against fluctuating crop prices. If someone thought a drought might devastate their corn season, buying a corn futures contract would mitigate the loss. Conversely,...

READ MORE

MEMBERS ONLY

Is Gold Signaling Inflation?

The current market situation shows a quick attempt to push a smaller stimulus bill by the end of December before eviction protection and unemployment benefits end. If failed, it could potentially leave as many as 19 million people at risk of becoming evicted. This potential strain on the market could...

READ MORE

MEMBERS ONLY

Is There a Future for Oil and Gas Exploration?

In the past couple of weeks, we've talked about the rise of oil and gas exploration (XOP).

On Friday, XOP closed with just under an 8% gain for the day. Its recent break over the 200-day moving average gave a good area to risk from. Even with its...

READ MORE

MEMBERS ONLY

Is Junk Worth More than Gold?

In Santa Fe, New Mexico, we awoke with freezing temperatures and fresh snow.

This week, the state lifted the current lockdown, with restaurants now being able to serve at 25% occupancy outdoors. I can hardly wait to sit outside on a windy winter day!

The blatant disconnect between state orders...

READ MORE

MEMBERS ONLY

Can Tech and Biotech Continue to Break New Highs?

Those of you who are new to the Daily have probably noticed the references to the Economic Modern Family.

Mish developed one index and five sectors as the nucleus of the Family to help you and herself see the real economy, as portrayed through a combination of cyclicals and non...

READ MORE

MEMBERS ONLY

The Economic Modern Family Makes Way for Crypto

Today, Bitcoin (BTC) passed its record high as certain members of the Economic Moderns Family digest their recent gains.

Cryptocurrency as an alternative currency has pushed for widespread acceptance since the launch of the first Bitcoin in 2009. Even more so, it has become a movement for investors who see...

READ MORE

MEMBERS ONLY

Keeping You on the Right Side of the Market - Thanks Economic Modern Family!

As we head into the Thanksgiving holiday here in the U.S., we cannot help but think how grateful we are in the midst of so much stress.

For starters, we are grateful to you - our folks who publish and post our daily, plus our readers, members, followers and...

READ MORE

MEMBERS ONLY

Who is Guarding the Market's Galaxy?

Since the pandemic, the market has risen on stimulus. Then, the market bulls turned to vaccine news and hopes for a quick and effective release. Most recently, the market has a new guardian - a transition team taking shape with the market's favorite dove Janet Yellen as Treasury...

READ MORE

MEMBERS ONLY

Will Supply Disruptions be the New Market Bottleneck?

The Purchasing Managers Index (PMI) release came out today, giving insight into the economy's health as the market ramps up with increased consumer sales and all time highs for hiring. Additionally, the Economic Modern Family got another positive boost from Oxford and AstraZenica's vaccine.

Grandad Russell...

READ MORE

MEMBERS ONLY

Has Reality Hit the Stock Market?

On Monday, we talked about positive vaccine news from Pfizer (PFE) and Moderna (MRNA) holding up the market. Friday proved the market was able to hold up through the week. And yet, the same day, many articles surfaced about the market's health related to the increasing state lockdowns...

READ MORE

MEMBERS ONLY

Is it Time for the Oil and Gas Exploration Sector to Wake Up?

Today, Goldman Sachs (GS) announced that commodities were poised for a bull market. We have been taking advantage of that bull market for quite some time now.

We've seen nice moves from hard to soft commodities, which we are currently still holding. But what alerted us to this...

READ MORE

MEMBERS ONLY

Grandpa Russell 2000's Secret Identity!

The S&P 500 (SPY), Nasdaq 100 (QQQ) and Dow Jones (DIA) all closed under their recent highs, while Granddad Russell 2000 (IWM) was able to close over 178.10, making new all-time highs.

It's no easy feat for the small caps to outperform the major indices,...

READ MORE

MEMBERS ONLY

Can Positive Vaccine News Support the Economic Modern Family?

The Modern Family shows confidence as more positive vaccine news came out on Monday. This time, the positive news came from Moderna (MRNA). Hence, after last Monday's Pfizer (PFE) announcement, the market thrives on hope rather than fear, as COVID cases rise and areas of the country are...

READ MORE

MEMBERS ONLY

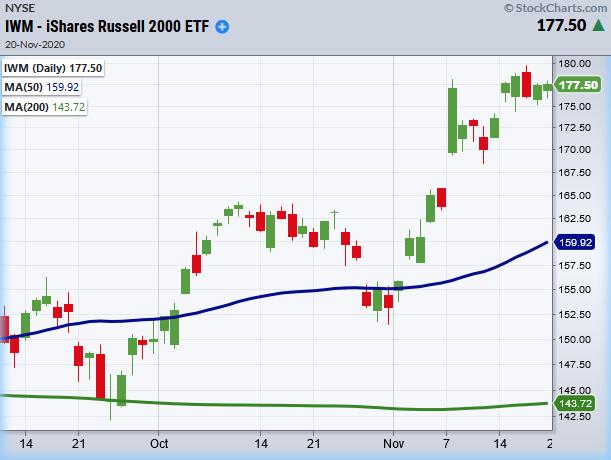

Will Small-Caps Hold Their Election Range?

Amid the news and initial reaction to this past Monday's selloff, we still need to take into account the week of the election range, or the range two weeks ago.

Created from Monday, Nov 2nd to Friday Nov 6th, the high and low from this period creates a...

READ MORE

MEMBERS ONLY

Will Regional Banking Continue to Grow as the Market Holds?

Yesterday, we looked at the Economic Modern Family as either hiding or holding their ground.

Today's price action shows that, at least for now, we are holding, as the Russell 2000 (IWM), Transportation (IYT), Regional Banks (KRE), Biotech (IBB), and Semiconductors (SMH) are currently trading inside the range...

READ MORE

MEMBERS ONLY

Market Euphoria with a Touch of Reality

Today, the market gapped up as news of Pfizer (PFE)'s Covid vaccine being 90% effective was released.

Last week, we talked about the Economic Modern Family's uncertainty over the election and potential gridlock over a Republican senate. The uncertainty looks to have followed into Monday, as...

READ MORE

MEMBERS ONLY

Does the Economic Modern Family Stand Divided?

The Economic Modern Family is holding onto the uncertainty of the election, with potential gridlock if Biden is elected and the Senate majority stays republican. As such, certain sectors of the modern family did very well, while others not so much.

Anticipating that taxes will not increase and interest rates...

READ MORE

MEMBERS ONLY

Are Media Companies the Real Winners of This Election?

Media companies stand to gain a large amount of income from this election, as both candidates have spent over $90 million in ads and that is just on Facebook (FB) alone.

Since 2018, Facebook has brought in more than $2.2 billion from political advertising. TV ads run in support...

READ MORE

MEMBERS ONLY

Does the Market Have FOMO?

A day before the election carries a lot of emotion and confusion for investors. You can see this in the market movement today, as the major indices did not align before the day's close.

The Nasdaq 100 (QQQ) closed down for the day while, both the S&...

READ MORE

MEMBERS ONLY

Will the Economy Hold Going Into this Holiday Season?

There are multiple reasons we could face a very tough holiday season.

For one, a second surge in COVID could tighten restrictions on brick-and-mortar businesses. Delayed financial aid can cause more business shutdowns as many businesses were expecting support through these slow months.

Delayed stimulus for individuals and decreased unemployment...

READ MORE