MEMBERS ONLY

Can the Market Be Saved?

On Tuesday, we talked about an inside day pattern building consolidation for the next move. That pattern did not disappoint. QQQ and IWM gapped lower, closing in an unconfirmed caution phase, while the SPY and DIA have already confirmed a caution phase.

A caution phase is when the 50-day moving...

READ MORE

MEMBERS ONLY

Today's Technical Pattern Says it All

Today the market was indecisive.

The four major indices closed with an inside day pattern. An inside day is a two-day price pattern where the high and low from the second day doesn't extend past the price range of the first day. You can see this on all...

READ MORE

MEMBERS ONLY

Where and How to Go If the Market Ends

Before we talk about the recent rotation from growth into value and how that did relative to the phases, a note about managing large selloffs.

A while back, we talked about market timing based on the previous day's high and low. Watching for breakouts and breakdowns based off...

READ MORE

MEMBERS ONLY

The Election Nears and the Family Holds Strong

Friday gave the thrill of a roller coaster ride, as we watched major indices run up and down throughout the day. While it's not the ride most investors look for in the market, it's the best they can get, since most amusement parks have yet to...

READ MORE

MEMBERS ONLY

Can Cheap Money Entice Small Business Growth?

A growing worry of stagflation (high inflation followed by stagnant economic growth) is becoming more of a trending reality as the pandemic looks to continue into the next year. The March selloff affected major global supply chains and, if paired with rising inflation, could create an even tougher environment for...

READ MORE

MEMBERS ONLY

Is the Market Coming to a Head?

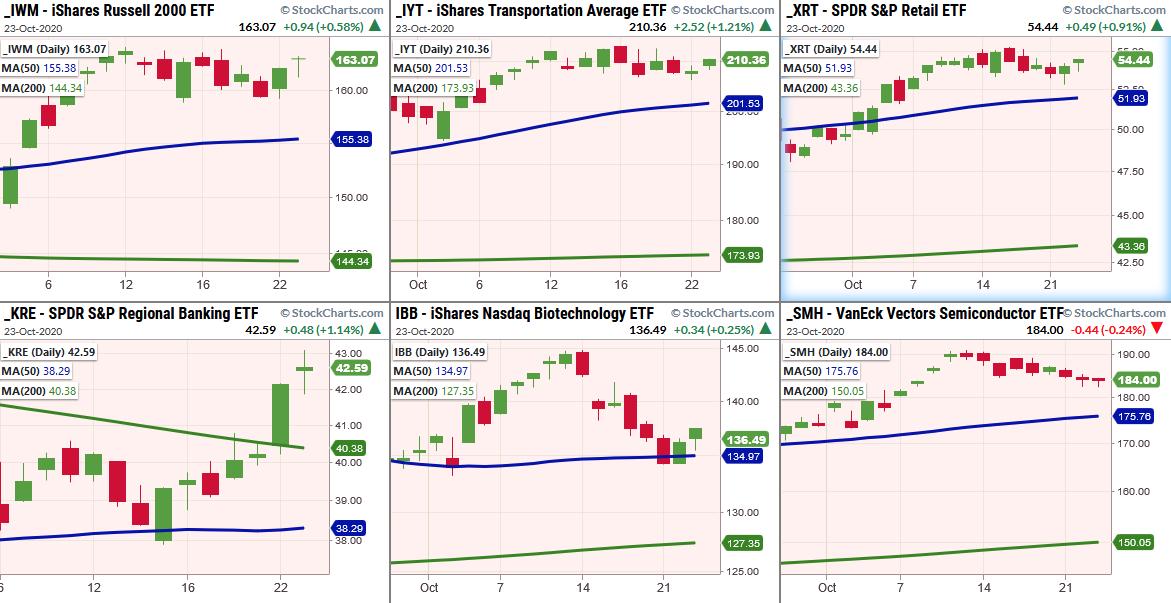

Today, the hope that the Economic Modern Family held onto coming into the week waned a bit, as the stimulus talks stalled once again.

After the close, more headlines emerged, as the Senate is back and both sides know that, politically, some stimulus package should be passed. And that is...

READ MORE

MEMBERS ONLY

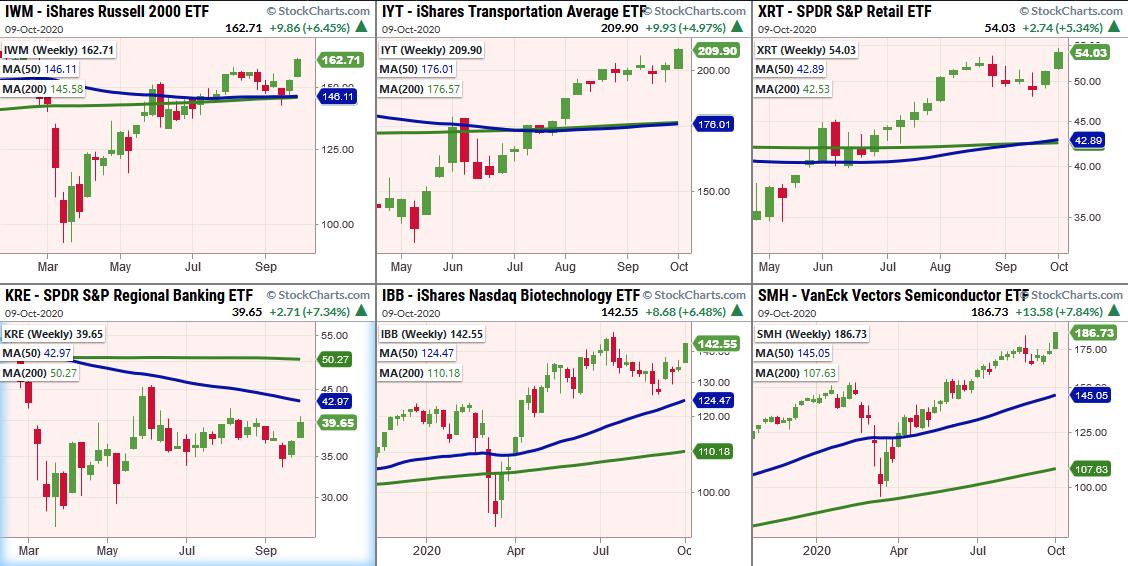

Who Rocks? The Economic Modern Family - That's Who!

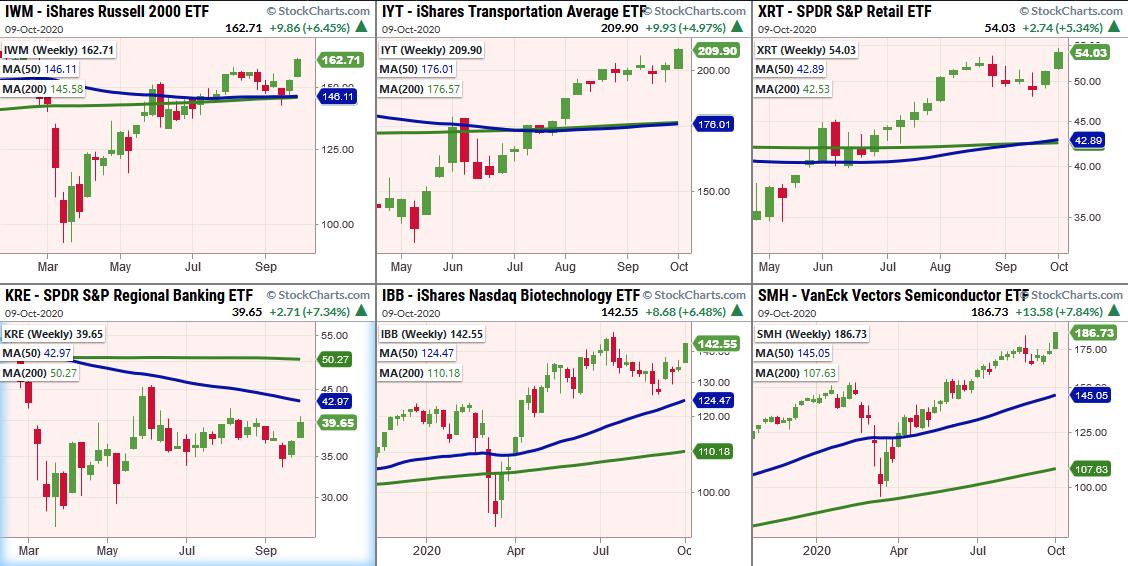

In spite of no passing stimulus, mixed economic data, rising COVID cases and a wild pre-election season, for the first time since we can remember, the Economic Family is brushing off most of the negativity.

For years, we would report on the health of the family with words like "...

READ MORE

MEMBERS ONLY

When Will the Financial Sector Stop Riding the Bear?

The banking sector has been put through the ringer since the March selloff. While the market has rallied since then, KRE (Regional Bank ETF) still looks in need of help.

One thing to note is that JPMorgan and Goldman Sachs reported Q3 earnings stronger than expectations. While JPM and GS...

READ MORE

MEMBERS ONLY

The Key to Your Success

I have been trading for many years. However, since I began working with MarketGauge, I have become a much better trader. The major reason, besides the awesome teachers (Mish, Keith, Geoff and James) is that they have taught me to think in terms of a rule-based trading system.

In today&...

READ MORE

MEMBERS ONLY

The Market Runs Rich

The market begins to show some overexuberance as we head into earning season and the election date closes in.

Amazon (AMZN)'s Prime Day and an Apple (AAPL) event are scheduled this week, with other companies, like Target (TGT) and Walmart (WMT) joining in with their own sale events...

READ MORE

MEMBERS ONLY

Happy Days for the Economic Modern Family

Friday showed us that, even with the insecurity of the stimulus package passing and tension from job loss, the Modern Family was still able to close strong for the week.

Grandpa Russell (IWM), which has been in a consolidation period for the last 6 weeks, has closed over resistance at...

READ MORE

MEMBERS ONLY

The Self-Fulfilling Prophecy

It's interesting how news affects the market. The negative information, paired with human emotion, sends the market frantically lower.

It is also interesting to watch how it creates a self-fulfilling prophecy. When people hear negative news, a common thought is "My goodness, I must sell before everyone...

READ MORE

MEMBERS ONLY

What Do the Technicals Show Us?

These past weeks, we've talked about the market's hopes of a quick stimulus package.

Today showed how easily the market can flip when stimulus hope fades. It also shows that the market can trade higher on expectations, even though it really didn't know what...

READ MORE

MEMBERS ONLY

Biggest Movers in the Modern Family

If the market could talk, it might say that the Economic Modern Family is happy. Perhaps happier than they have been in a long time.

Starting Friday, Forrest and I pointed out that the Russell 2000, Transportation and Retail all closed green in the face of the news on Trump...

READ MORE

MEMBERS ONLY

Making Better Trades with Market Timing

Our president and first lady contracted COVID. That yielded a morning gap down, followed by a rally; that rally was partially based on hope for the stimulus.

These are some of the biggest thoughts on trader's minds as of Friday. And, of course, on everyone's mind...

READ MORE

MEMBERS ONLY

How to React to a Choppy Market

We've recently talked about higher volatility in the market with the election date closing in. In these past couple of weeks, we've seen the market jump around quite a bit. We're in a choppy market environment, and while three of the 4 major indices...

READ MORE

MEMBERS ONLY

Time to Keep an Eye on Homebuilders

It's time to start watching the homebuilding sector. We can look at this using the symbol XHB, which is an ETF based off the SPY.

The reason that homebuilders are interesting right now is because they have been outperforming all the other sectors in the US economy based...

READ MORE

MEMBERS ONLY

Risk vs. Reward and The Never-Ending Battle

Today's large gap up in the indices can pose some great morning questions. The biggest one being, should I buy the gap, or should I wait to see where things go?

You don't want to chase the market, but you don't want to miss...

READ MORE

MEMBERS ONLY

Market Indices Phased and Confused

Coming into the weekend, we have more time to look over our charts, gather our thoughts and take a step back to grasp the larger picture. So, let's get right to it!

From bullish to caution. This is the current phase the major indices have recently switched to....

READ MORE

MEMBERS ONLY

Navigating Through the Market's Choppy Waters

Today the QQQs, SPY, and DIA, closed near the September 21st lows which we noted as possible support.

While we rallied intraday, we also sold off, giving back most of the days upward progress.

The VXX also failed to break through the 50-DMA to the upside, but It's...

READ MORE

MEMBERS ONLY

Junk Bonds Looking More Like Junk

Let's start with the 4 major indices, the SPY, QQQ, DIA and IWM. They all sold off today, breaking yesterday's lows. Besides IWM, they are still not below their recent low from September 21st. If the indices continue lower, we should keep an eye on those...

READ MORE

MEMBERS ONLY

How Long Will the Market Hold its Breath For?

Yesterday, Mish talked about watching junk bonds (JNK) to see if the Fed would continue supporting high risk companies.

Today, JNK had an inside day. This comes after a large red day where JNK gapped lower, breaking its 104.27-106 range. The break also happened to coincide with a major...

READ MORE

MEMBERS ONLY

Measured Moves in the Market

Coming into Monday, we wrote targets on the S&P 500 and NASDAQ 100. Based on the measured move from the all-time high and the ensuing gap lower (or topping pattern), we shared with you all that the SPY target was 322 and QQQs target was 260.

And wouldn&...

READ MORE

MEMBERS ONLY

Time for the Newer Biotech Companies to Wake Up?

With companies like Pfizer (PFE) giving possible hope for an end-of-year vaccine and a recent gap up in IBB (the Nasdaq Biotechnology ETF), now could be a good time to keep an eye on newer issues in this sector.

Large amounts of buying came into IBB on Friday. The price...

READ MORE

MEMBERS ONLY

Keeping Your Mind on the Right Side of the Market

Yesterday, we were watching the VXX to gauge fear in the market. Today, it gapped higher and then continued to sell off while the indices gapped lower and began to rise.

Now the QQQs, DIA and SPY, while selling off from the highs, had some end-of-day buying comeback, which pushed...

READ MORE

MEMBERS ONLY

Market Loves/Hates Fed Days

Last night we wondered, is the market correction was over? After all, both SPY and QQQs traded into resistance. For SPY, that number is 342; for the QQQs, it's 282. The DIA had to hold 28,000.

Today, SPY tried to clear 342, but wound up closing red...

READ MORE

MEMBERS ONLY

A Rally to Resistance

Is the market correction over?

Although a 10-15% correction is normal, the bigger question is whether the bounce we just saw from recent lows is a sell (rather than buy) opportunity. Both SPY and QQQs are trading into resistance. In SPY that number is 342; for the QQQs, we are...

READ MORE

MEMBERS ONLY

Mergers and Pfizer (PFE) Give the Market Hope

On Friday the 11th, the QQQs (Nasdaq) and IWM (Russell 2000) both closed under the 50-DMA. They were not followed by their friends the DIA (DowJones) and the SPY (S&P 500). The temporary divergence they were in has quickly been resolved because all four are now back over...

READ MORE

MEMBERS ONLY

Dominant Energy Supplier is Still Coal

Partly inspired by our recent trip throughout the West, and also partly inspired by our long position in Teck Resources Limit (TECK), which gained over 11% on Friday while the SPY closed basically flat, coal is the topic for the weekend.

Coal is the major supplier to steel and utilities....

READ MORE

MEMBERS ONLY

Taking a Temperature Check on the Modern Family

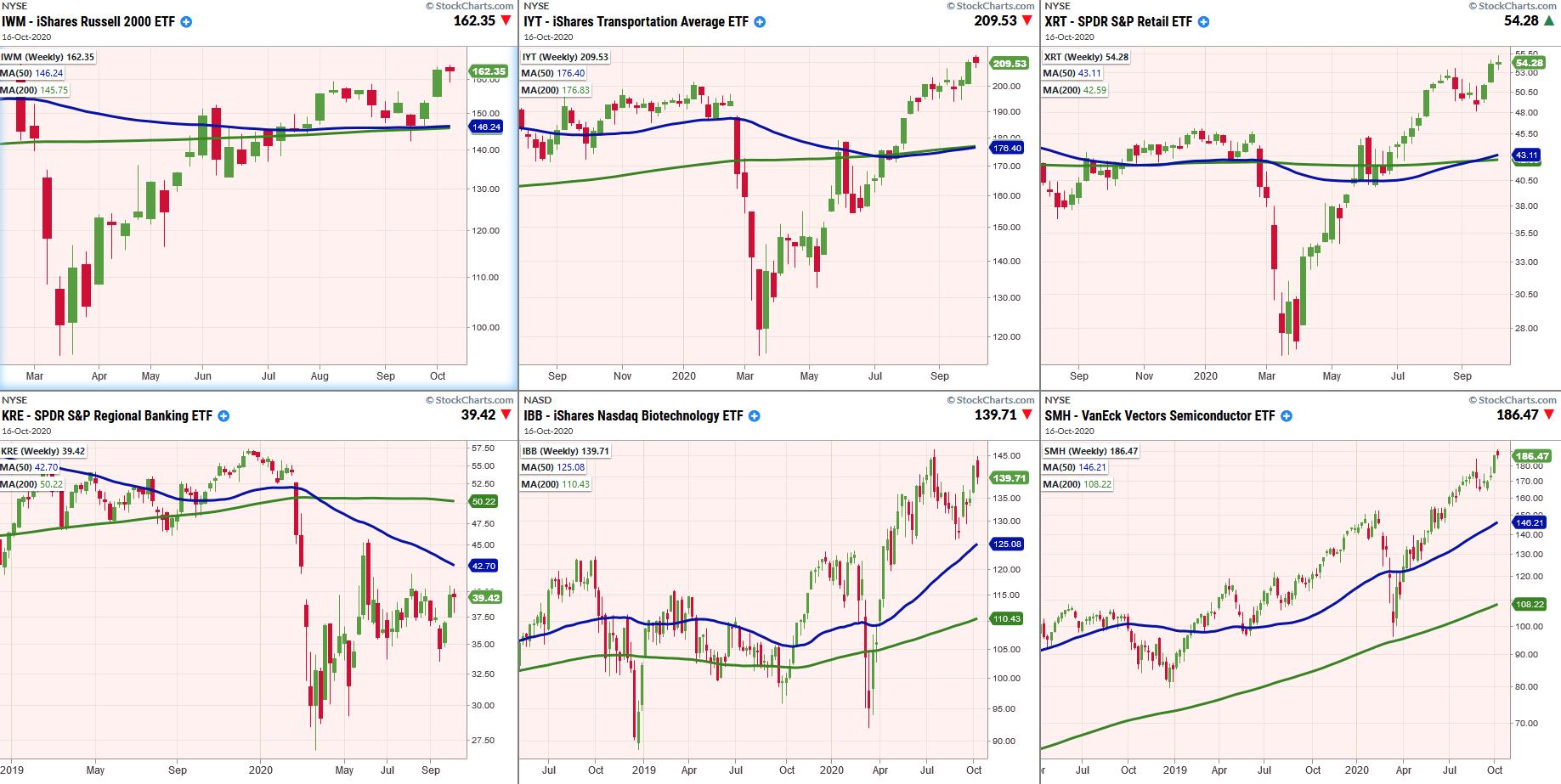

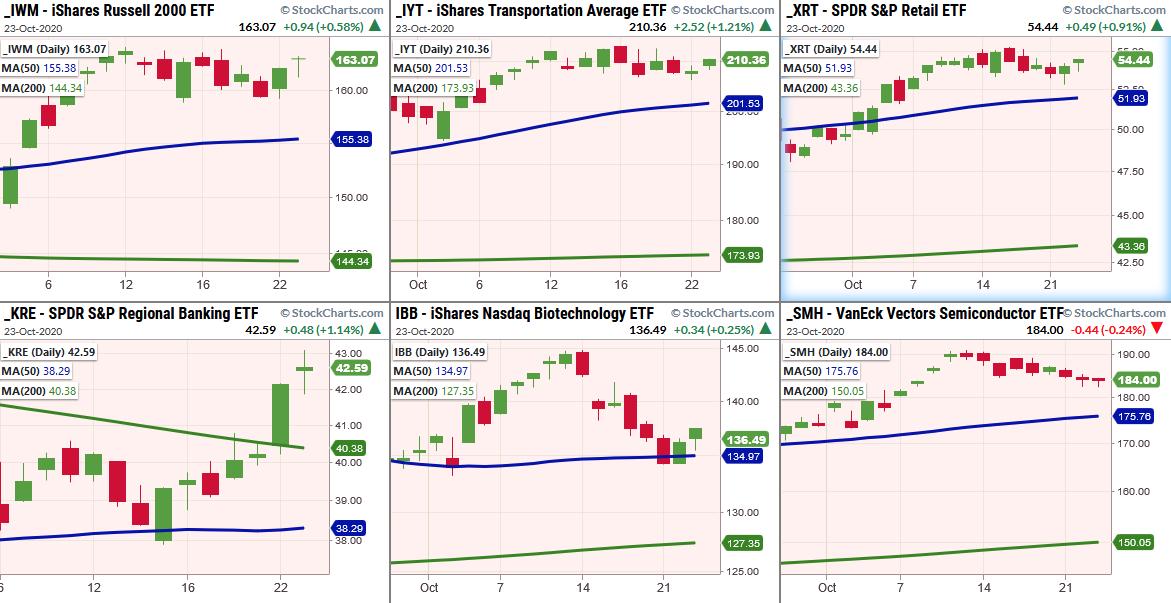

WIth the SPY, QQQ, DIA, and IWM closing down on the day, now it's a good time to check the health of the Modern Family to give us a bigger picture of the market.

Above, you can see the weekly charts for Modern Family (IWM, IYT, XRT, KRE,...

READ MORE

MEMBERS ONLY

Market Bears' Whitewater Raft Now Dry-Docked

The 50-DMA did its job! After a perfect touchdown in the NASDAQ QQQs to the 50-DMA at 270, today the NASDAQ gained 2.92%.

All the issues for the tech drop -- Softbank, overbought conditions, lack of a stimulus deal, China tensions, vaccine delays, etc. -- got the bears suited...

READ MORE

MEMBERS ONLY

A Potential Break in the 50-DMA and Where to Look Next

Last Friday, we noted how major symbols (QQQ, IWM, JNK, SMH) bounced off the 50-DMA. Now, with the market still undecided, we can build a plan on what to look for if we break under the 50-DMA.

Let's take a look at the QQQs and the SPYs on...

READ MORE

MEMBERS ONLY

Did the 50-Day Moving Average Stop the Bleed?

After 2 major sell-off days, the market bounced late Friday off the 50-day moving average. Coincidence?

First, why do we care about the 50-day moving average? The most common inputs for the Moving Average used by traders and market analysts are the 50-, 100- and the 200-DMAs. Knowing a large...

READ MORE

MEMBERS ONLY

A Rotation into Financials, But is KRE Biting?

As mentioned yesterday, the Big Banks ETF (XLF) and Regional Banks ETF (KRE) are two of the weaker sectors. However, today we saw some money rotate into those sectors, with XLF rising over 1% and KRE rising marginally at .4%. Goldman Sachs (GS) cleared a key moving average.

Now some...

READ MORE

MEMBERS ONLY

How Did the 3 Major Market Themes for August Do?

First off, a huge thank you to Geoff Bysshe for covering for me so I could have a vacation for 3 weeks!

Before I left, I wrote about 3 major themes to watch continue to emerge - or completely reverse. The first was the focus on the junk bonds and...

READ MORE

MEMBERS ONLY

3 Major Market Themes for the Rest of August

As Keith and I are heading on a vacation (with social distancing) starting Monday for 3 weeks, this is the last Daily that I will write until September 1st. Yet, not to worry, Geoff Bysshe will be taking over both my subscription service and the writing of the Daily blog....

READ MORE

MEMBERS ONLY

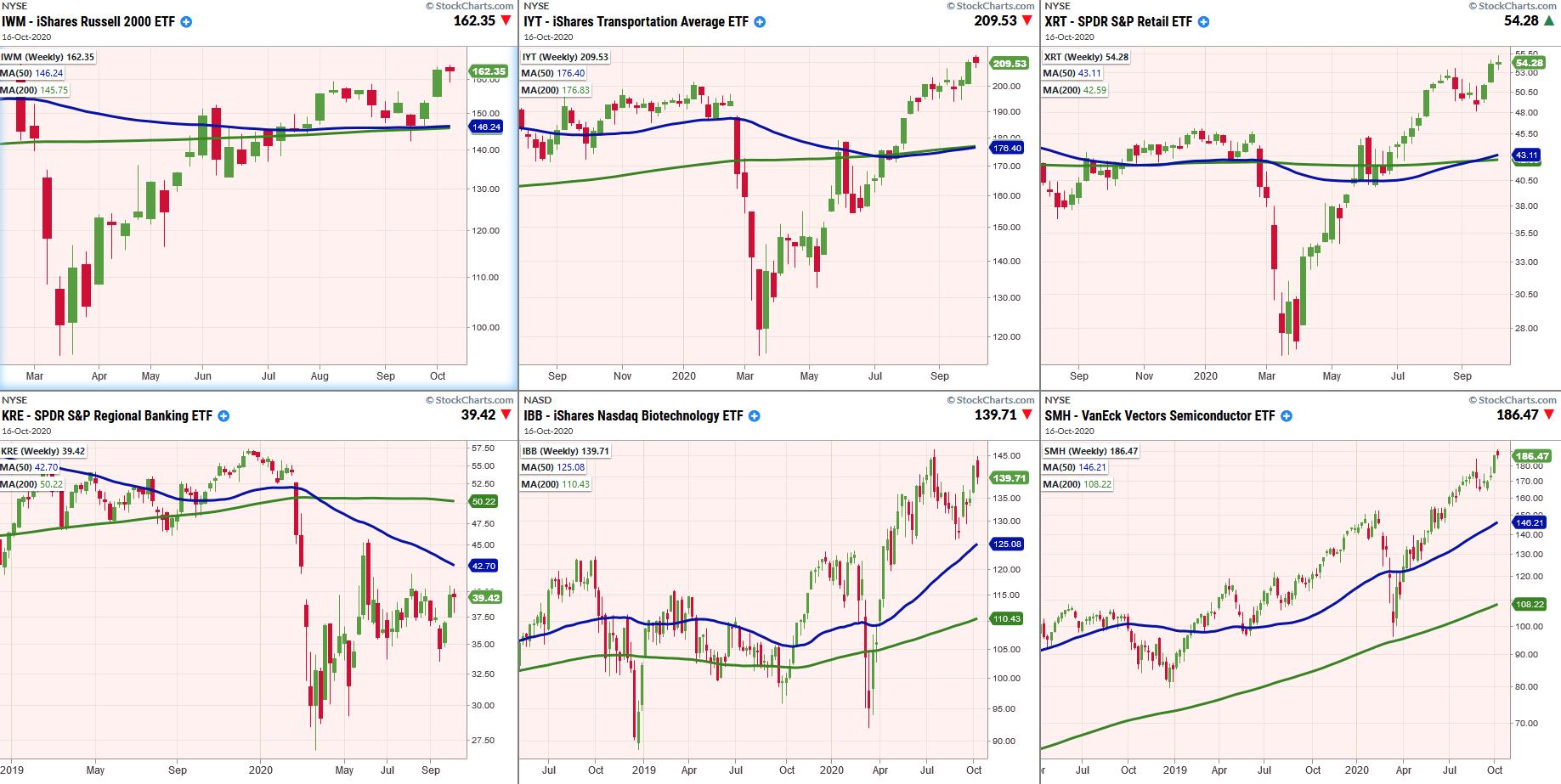

Regional Banks - The Prodigal Dunce

With the Russell 2000 breaking out over the 50 and 200-week moving averages, the market looks like blue skies, right?

Retail (XRT) ran to just over $50.00. Sister Semiconductors (SMH) rocked to another new all-time high. Transportation (IYT) passed the critical test at the 200-WMA. Biotechnology (IBB) consolidated over...

READ MORE

MEMBERS ONLY

Prodigal Son Regional Banks - A Ball and Chain

With the Russell 2000 breaking out over the 50- and 200-week moving averages, we should see nothing but blue skies, right? Maybe.

We have lots of positives based on hope, of course. Retail (XRT), as featured a while back, is doing well. Sister Semiconductors (SMH) is on the road less...

READ MORE

MEMBERS ONLY

Is NASDAQ Tiring?

A few cautious flags were thrown up today in spite of the new all-time highs in NASDAQ.

1. The volume was light. After Friday's spike in volume, Monday QQQssaw below-average daily volume.

2. The momentum indicators that we use to measure tops, bottoms, and big trends show a...

READ MORE

MEMBERS ONLY

A Summer Road Trip with the Economic Modern Family

Last week, Max Wiethe from Real Vision and I sat down for about an hour to discuss a myriad of timely and relevant market topics. (See the link at the end of the commentary).

So much happened in this past week. The short list:

* Blow-out Earnings of Apple (AAPL), Alphabet...

READ MORE