MEMBERS ONLY

What Does it Take to Build EV Charging Stations?

Headline over the weekend:

"GM, Other Big Automakers Form EV Charging Joint Venture"

Tesla (TSLA) is the dominant player in the EV space. As such, and with its supercharger network, several car companies have teamed up with Tesla for their charging stations.

To see more EV sales all...

READ MORE

MEMBERS ONLY

Macro to Micro -- Seasonals, Trends and Momentum

For the weekend, we invite you to listen to Mish's live coaching session, for Complete Trader members only.

During the 45-minute session, you will hear and see:

1. The Indices, along with Calendar Ranges and Momentum Indicators

2. The Economic Modern Family in 2 timeframes

3. The Outliers...

READ MORE

MEMBERS ONLY

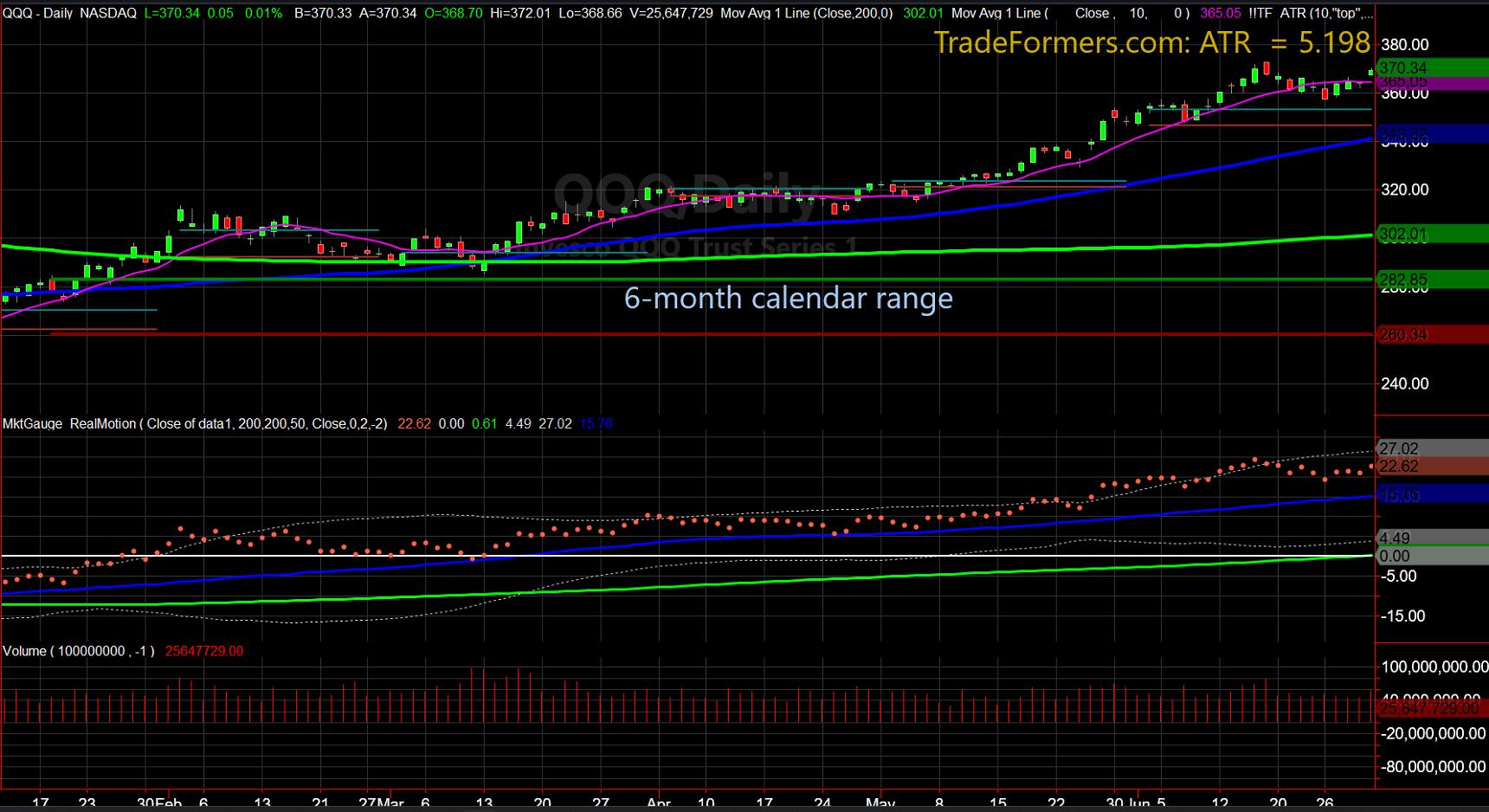

The July 6-Month Calendar Range -- SPY, QQQ, IWM, TLT

After the Fed meeting, we thought it would be useful to see the July calendar ranges and give you a brief lesson in how to use them. Who is this for?

The price levels defined by this trading method have proven to be insightful in all markets. Longer-term investors can...

READ MORE

MEMBERS ONLY

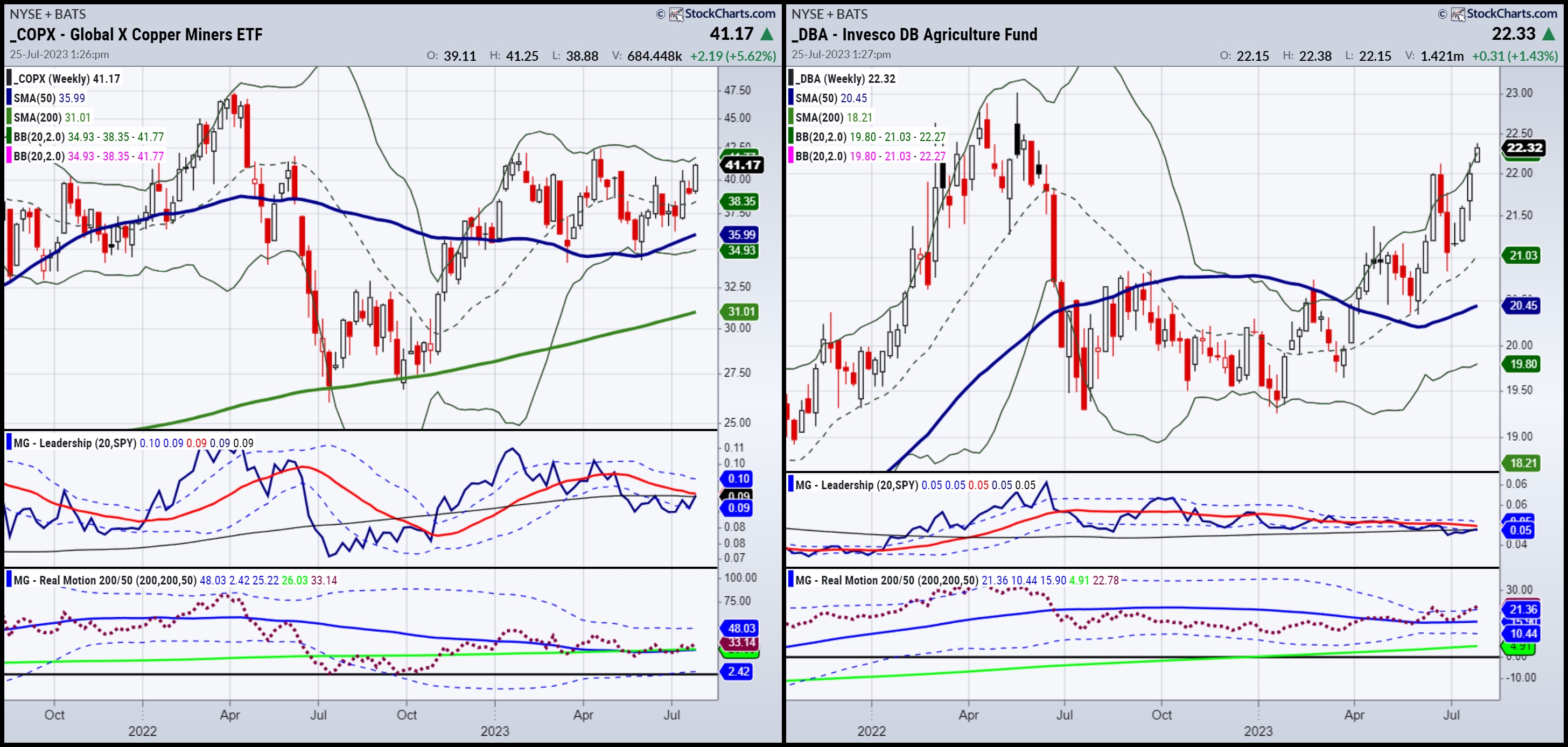

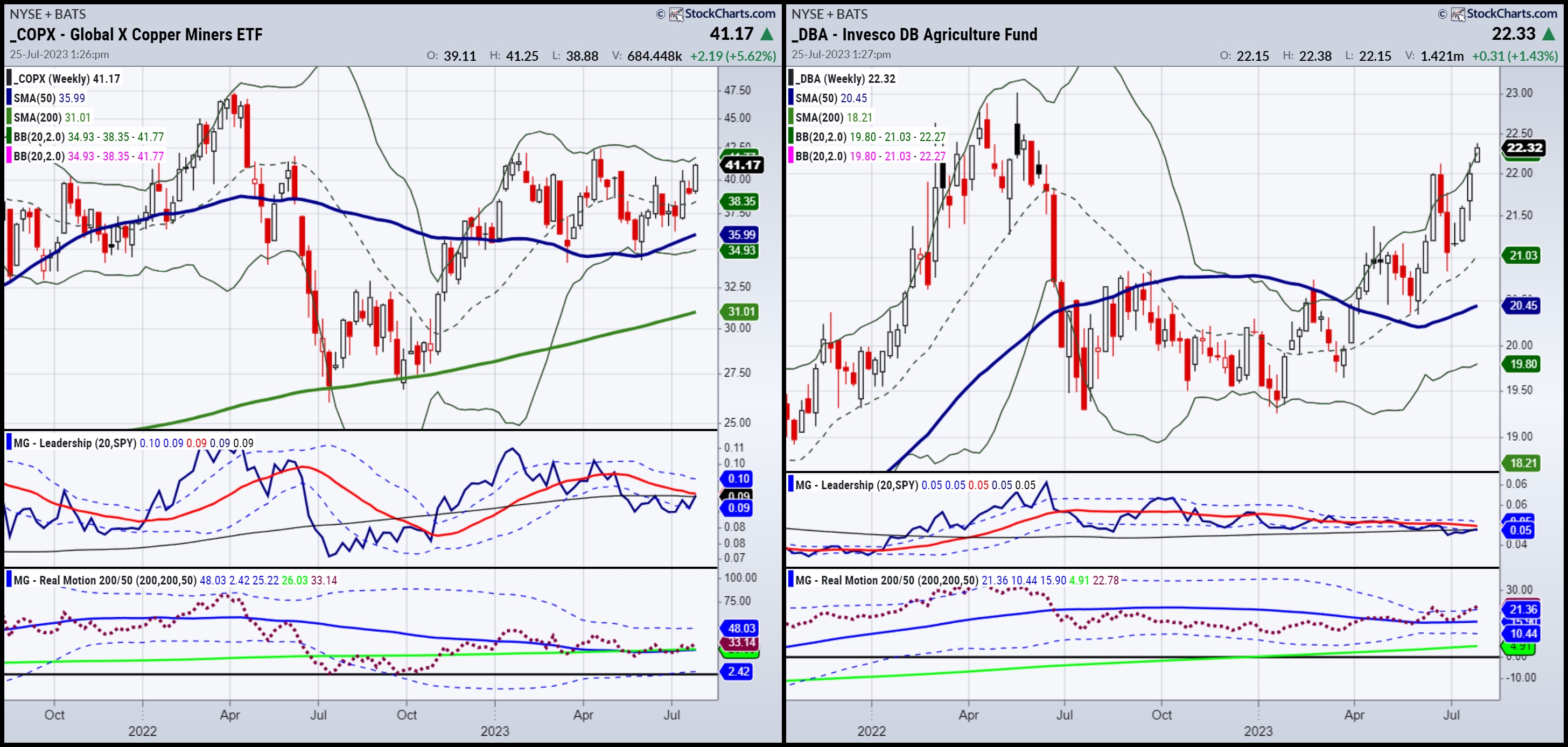

Commodities are the Best Investments

For today, I used ChatGPT to ask which companies store raw materials. After all, you cannot have capital investing in infrastructure without raw materials. You cannot have geopolitical issues without concerns about oil and energy. You cannot have weather issues without worrying about supply and supply chain.

How do we...

READ MORE

MEMBERS ONLY

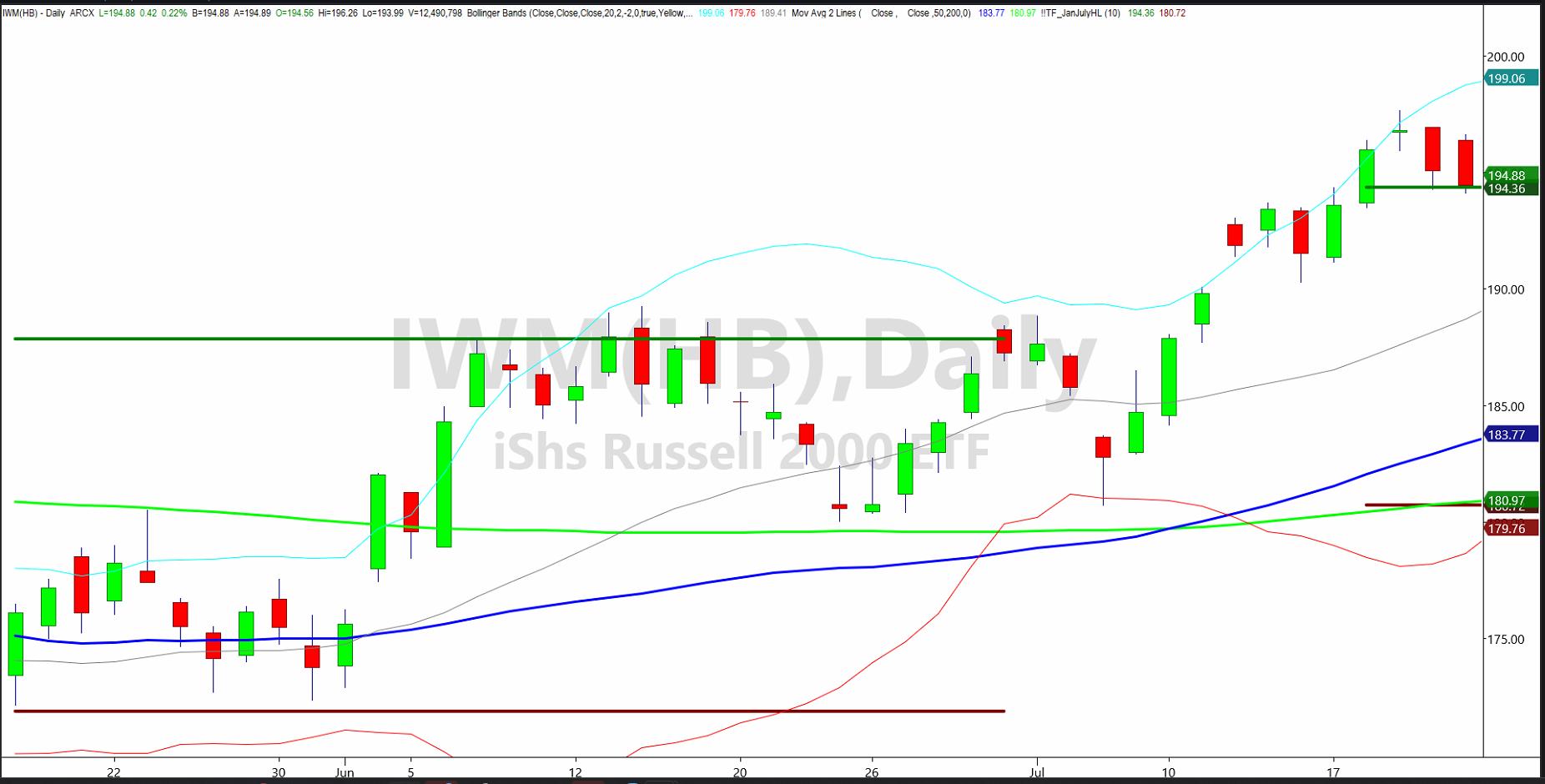

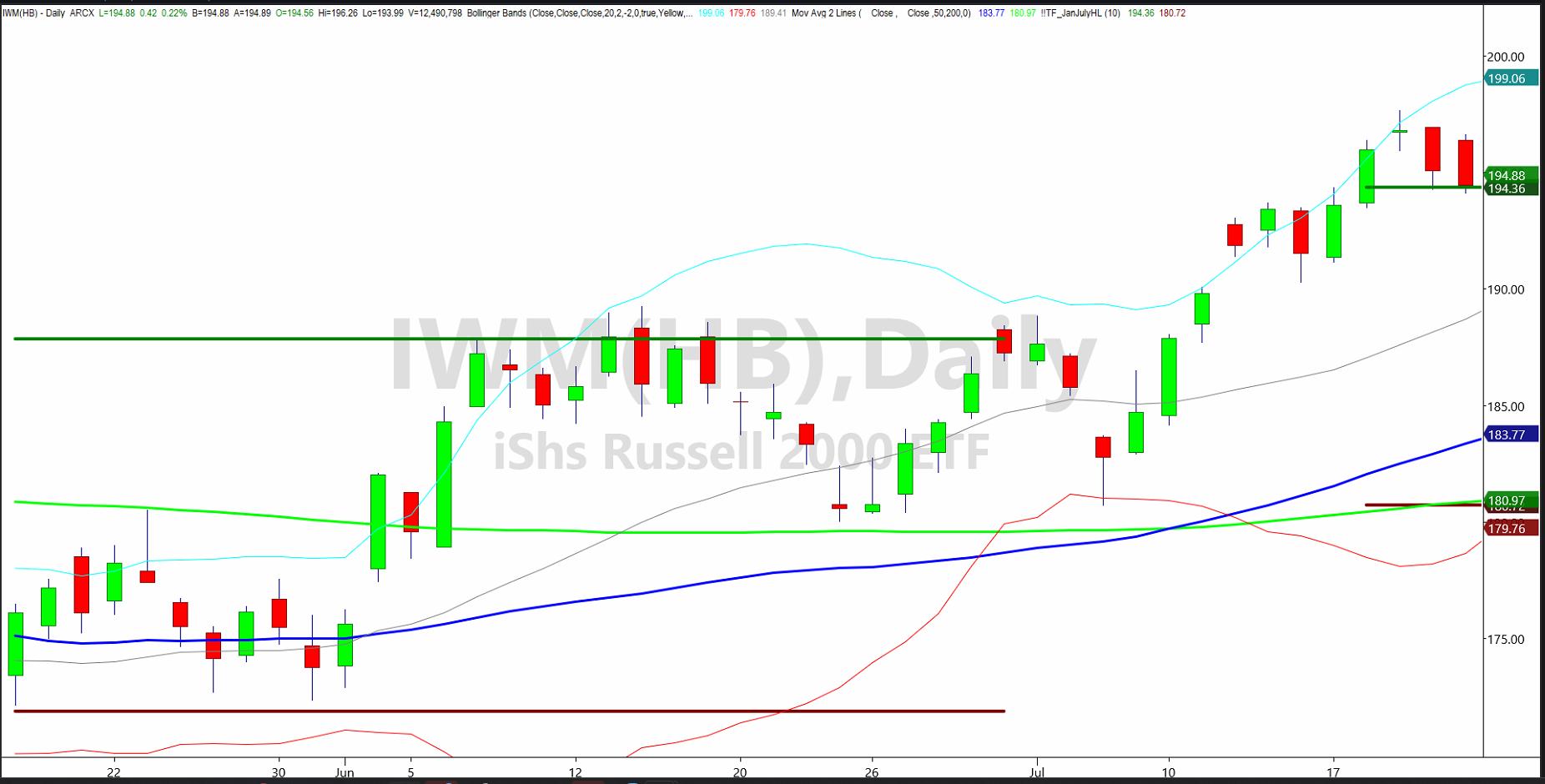

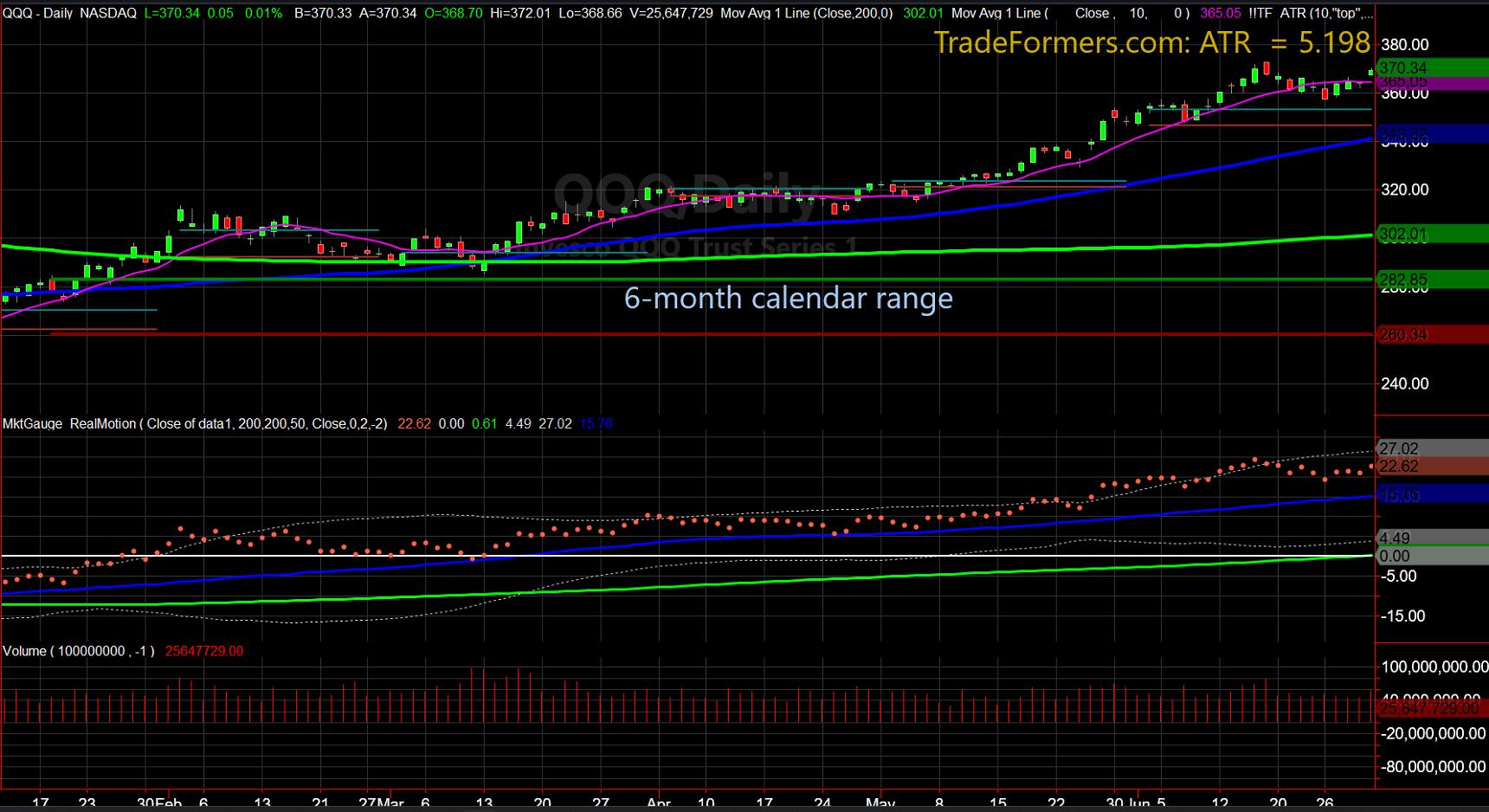

Now That The July 6-Month Calendar Range is Set

By now, you might have read either my or Geoff's articleon the July 6-month calendar range reset.If not, I highly recommend you click on Geoff's "Trades and Tutorials" above.

The chart of the Russell 2000 (IWM) shows a really wide July range. The...

READ MORE

MEMBERS ONLY

Economic Modern Family Reset in July -- Blueprint

This will be the only Daily for this week. (A new one will be available July 24th.)

As such, two key areas are in focus, both reliable in determining next moves in the market. First, we have the charts of the Economic Modern Family(Russell 2000, Retail, Transportation, Biotech, Semiconductors,...

READ MORE

MEMBERS ONLY

David and Goliath, or the Small vs. Large Caps

In the Bible story, David and Goliath represent resilience and overcoming odds. David, a small sheepherder, places a stone in a sling to hurl at Goliath's head. David gets a clean hit and Goliath falls. David then uses Goliath's sword to kill and decapitate the giant....

READ MORE

MEMBERS ONLY

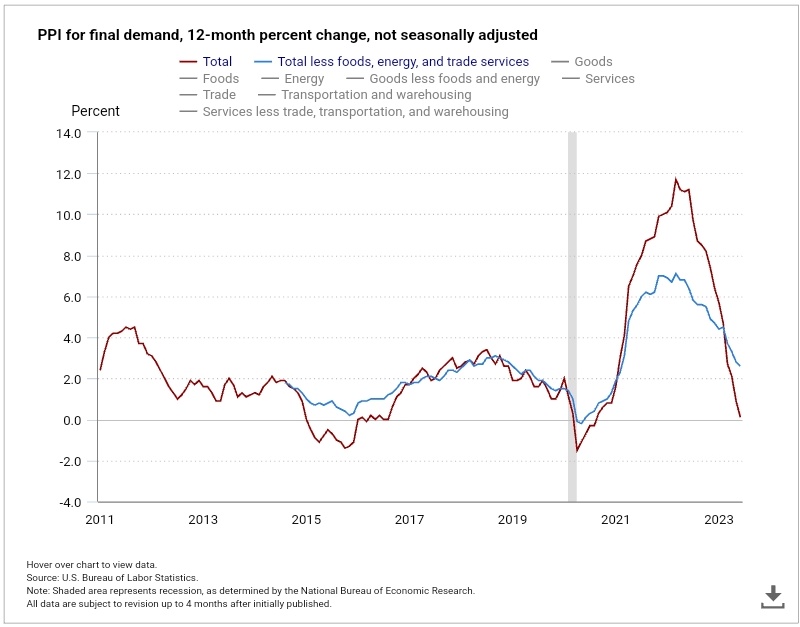

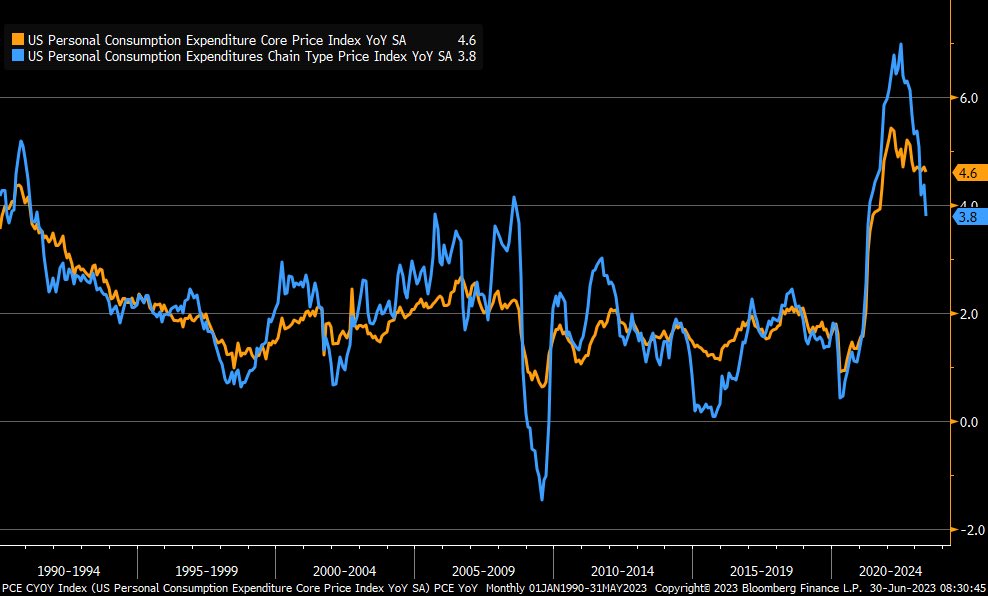

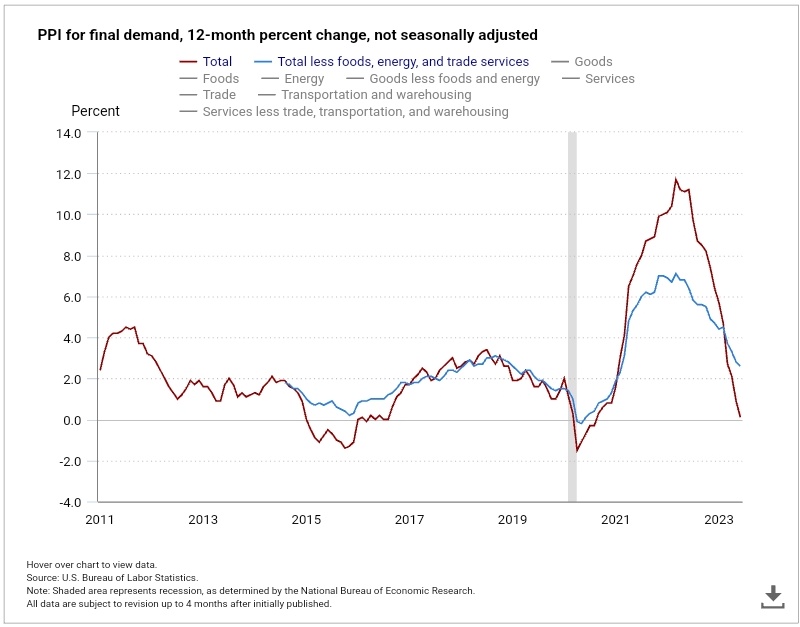

Is Inflation Permanently "Dissed"?

I wish I could say that the clearly impressive trend from peak until now in CPI and PPI is sustainable. However, I am more inclined to say "trough," with more chance of rising inflation numbers going forward rather than the chance of inflation falling further.

Here are some...

READ MORE

MEMBERS ONLY

CPI, Bonds, Inflation, Indices and Gold

For today's daily, have a listen to Mish on Real Vision with Ash Bennington as they cover:

* CPI Inflation and market reaction

* What's going on in the Russell and Nasdaq

* How the Fed will respond

* Bonds

* Metals

* Inflation

For more detailed trading information about our blended...

READ MORE

MEMBERS ONLY

Cocoa Soars: Nobody Knows the Truffles I've Seen

On the heels of the CPI report, out first thing July 12th, and because of El Niño, West Africa expects to see lower average rainfall and higher.

West Africa is the main cocoa grower. The growing season began last October and ends this September. That means already damaged cocoa crops...

READ MORE

MEMBERS ONLY

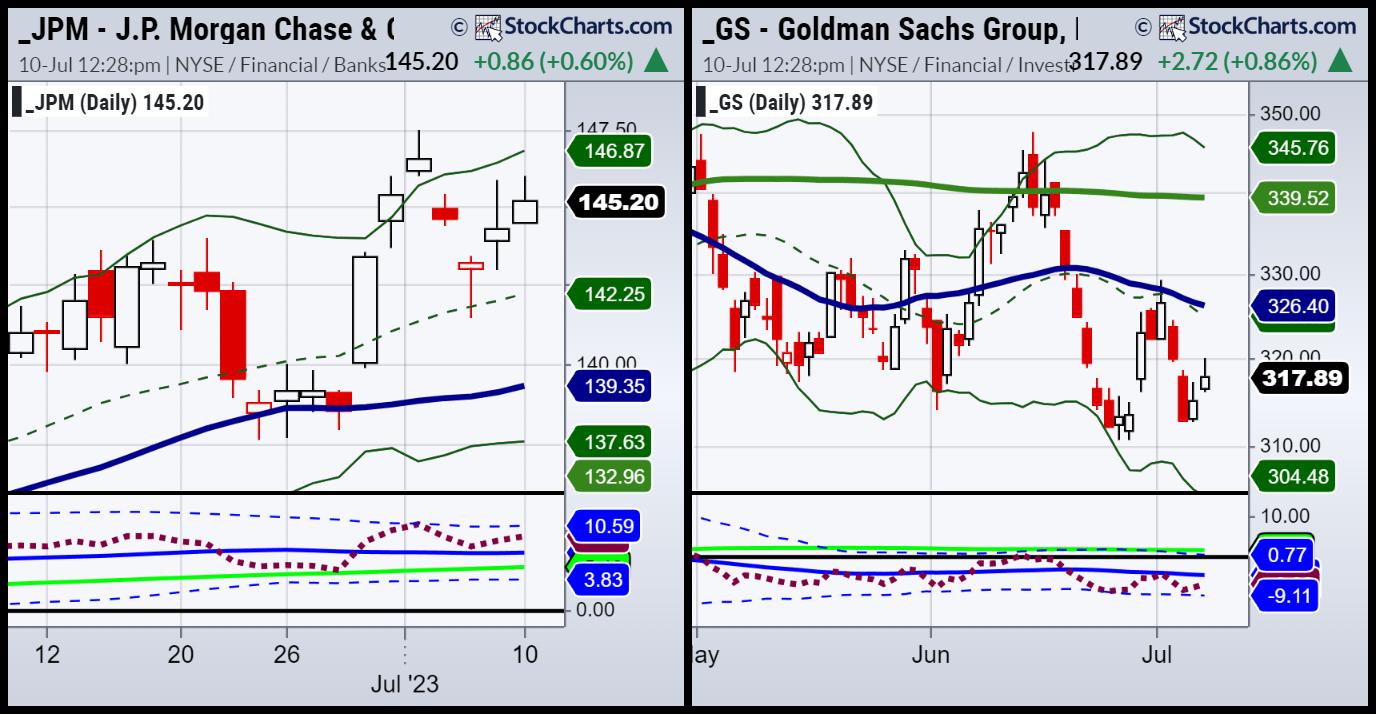

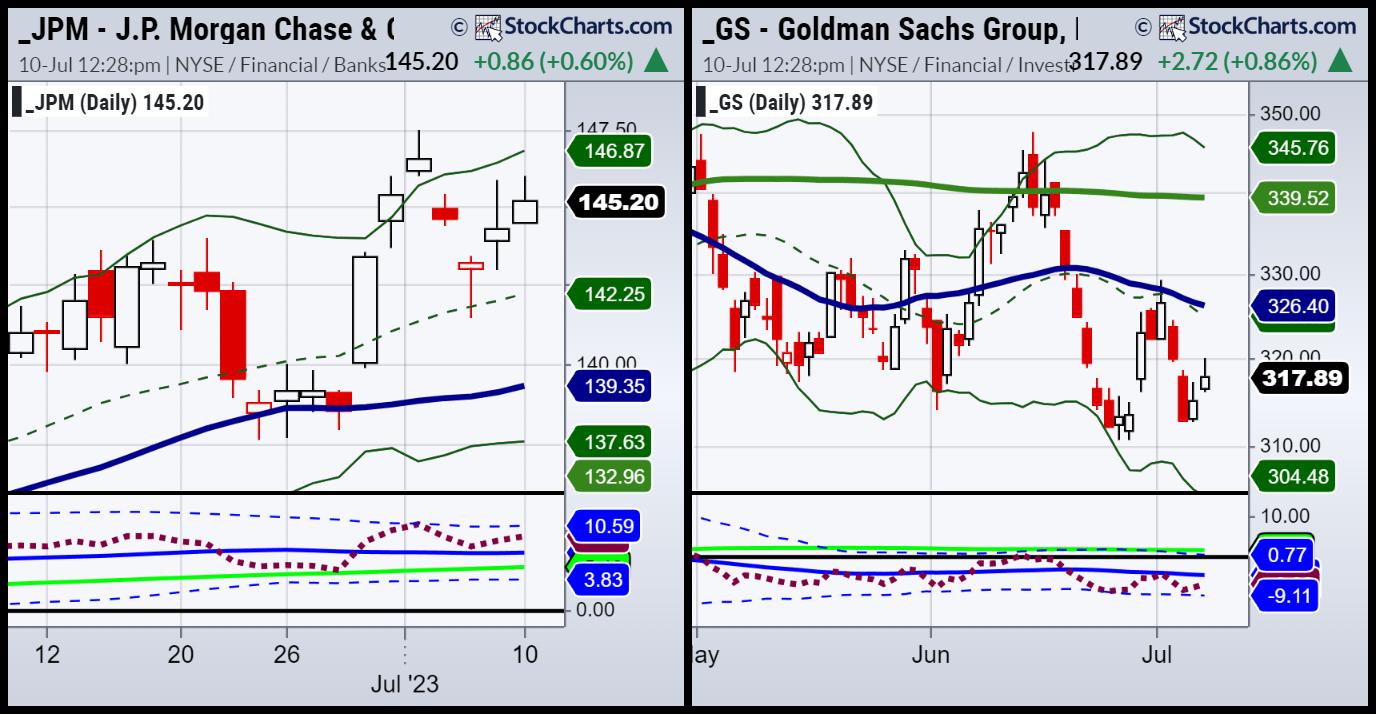

Bank Earnings: JP Morgan vs. Goldman Sachs

JP Morgan kicks off earnings season this Friday, July 14th. Goldman Sachs does not report until next week, on July 19th. That is an auspicious day for us, as the July 6-month calendar range will be established. We will be able to see how each bank and banks in general...

READ MORE

MEMBERS ONLY

Economic Modern Family--Granny Retail Takes a Bow

Sometimes, it's just that simple.

The Economic Modern Familyhas had its share of rotation.By rotation this year, we mean that, while Semiconductors wowed, Regional Banks soured. We have looked to certain members of the Family to hold their lead and wait for the other members to catch...

READ MORE

MEMBERS ONLY

Earnings, Inflation, Yield Curve & July Reset

Mish appeared on Yahoo Finance this morning with Brad Smith and Diane King Hall as a contributor/guest host.

Topics covered:

* Jobs Report

* Yield Curve and the Fed

* Tech and AI

* Earnings Season

* Inflation and impact on consumers

* Technical indicators to assess next market direction

* China

* Mother Nature

* Geopolitics and...

READ MORE

MEMBERS ONLY

Sell in July and Go Away? Calendar Range Reset

One of the most interesting things about July in the market is the biannual reset of the 6-month calendar range. Above is a chart of the NASDAQ 100, with the January 6-month calendar range drawn in. (To clarify, it is the solid green line that goes perfectly horizontal across the...

READ MORE

MEMBERS ONLY

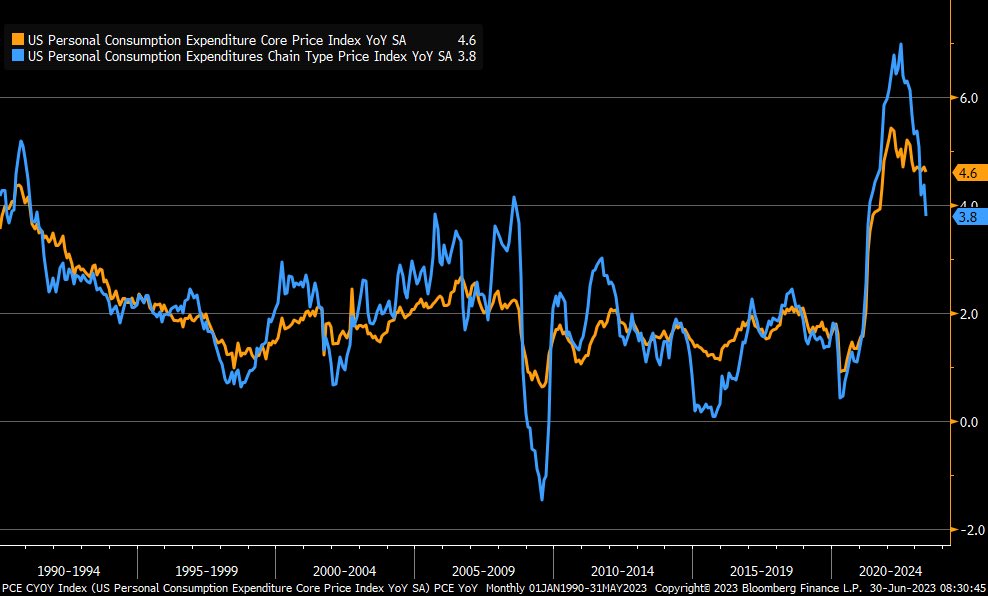

A Glimpse at the Next 6 Months in the Markets

With last week's strong economic stats and inflation basically flatlined, many believe there will be a soft landing and no recession. However, there are stats saying that, with the yield curve so inverted (most since 1983), recession can and probably will still happen.

Recession can take time to...

READ MORE

MEMBERS ONLY

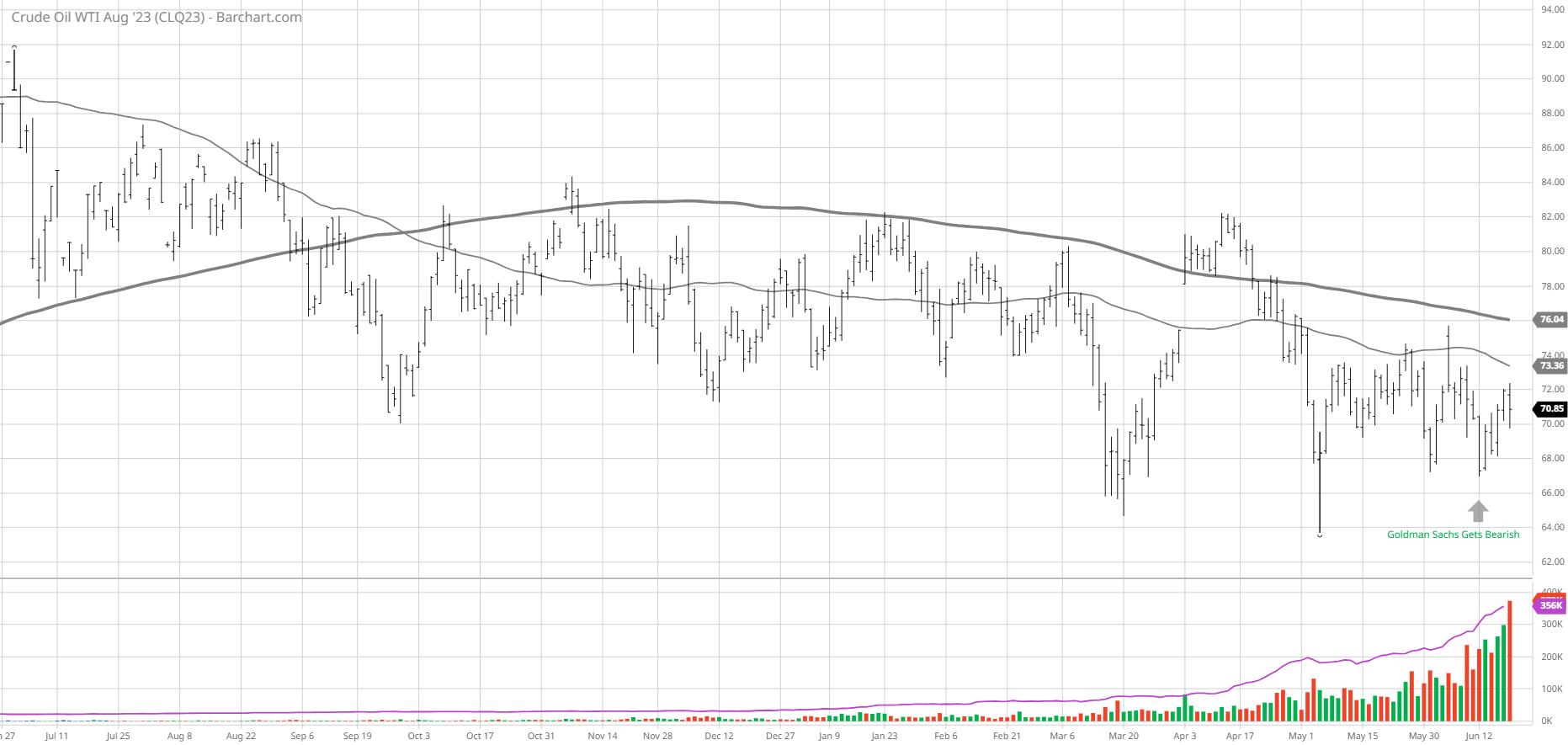

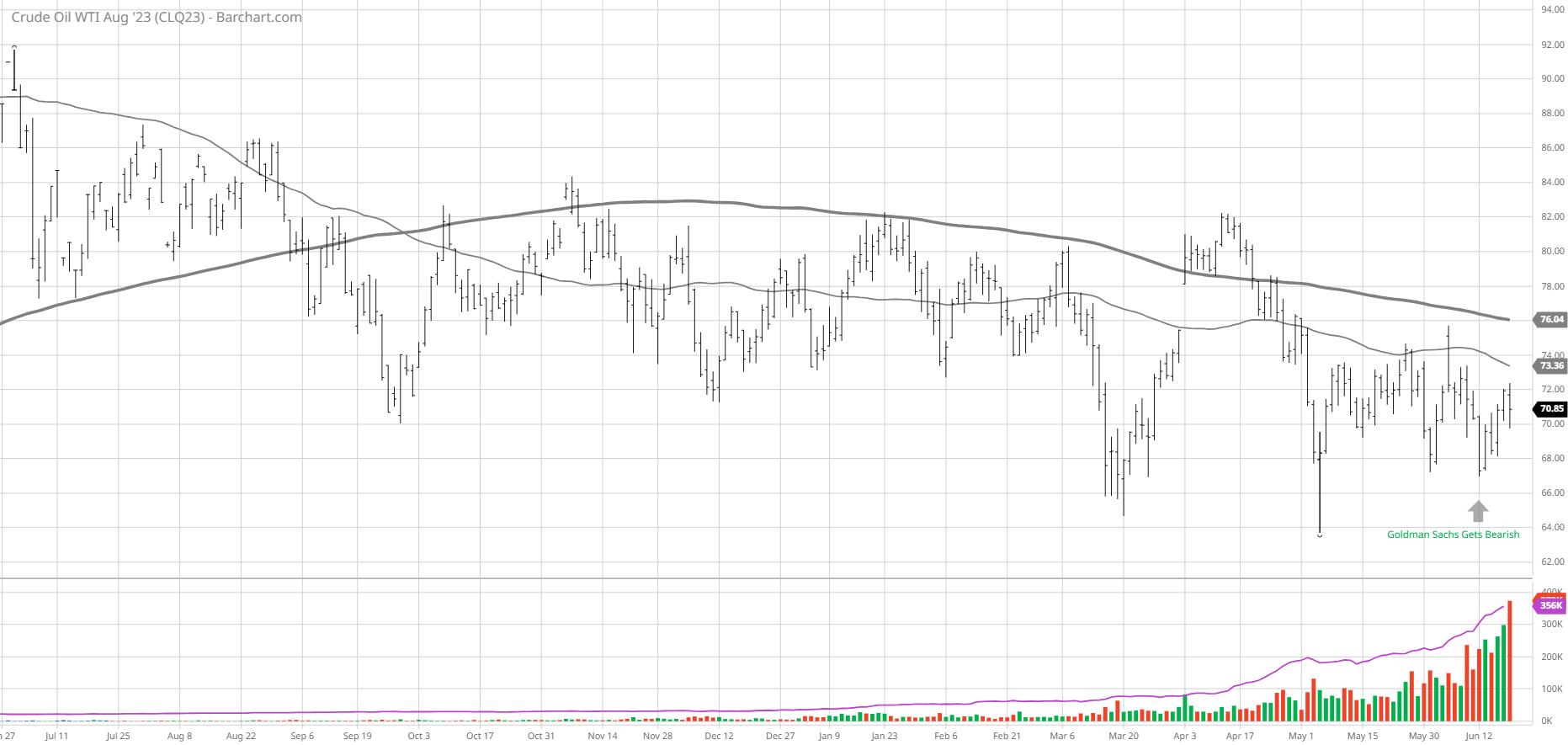

U.S. Oil Reserves Drop to 40-Year Lows

On June 12th, Goldman Sachs (GS) came out stating how bearish they are on oil. I wrote a Daily about it on June 20th.

It's not uncommon for me to stick my neck out and go against the big analysts. Heck, I have made a career out of...

READ MORE

MEMBERS ONLY

What a Healthy Correction in Energy Looks Like

An interesting article based on cycles and commodities versus stocks suggests that over the past 90 years, stocks have outperformed commodities by 4 to 1. Within those 90 years, though, there are times that commodities outperform stocks, generally for about 15 years.

The author believes that we will see such...

READ MORE

MEMBERS ONLY

Do Not Get Bearish While Transportation Leads

What we know for sure, is that the demand side of the U.S. Economy, as seen through the lens of the transportation sector, is holding up.

IYT, shown AI-generated in the image above, is the ETF for things that move and carry people and cargo via ships, planes, freight,...

READ MORE

MEMBERS ONLY

Complete Trader: Macro to Micro and Top Picks Live

Once a month, I do a coaching session for our members of the Complete Trader, a MarketGauge comprehensive product for the discretionary trader.

During the 45-minute session, I cover EVERYTHING!

1. The Economic Modern Family

2. The Indices

3. The Big View Risk Gauges

4. The Bonds

5. The Metals...

READ MORE

MEMBERS ONLY

Granny Retail a Big Barometer: Video Analysis

It was a great day to sit down and talk to Dale Pinkert of FACE Live Market Analysis & Interviews.And we covered a lot of ground.

1. BoE interest rate cut.

2. Inflation, Recession, or Stagflation?

3. Commodities -- grains, metals, industrial metals.

4. The "inside" sector...

READ MORE

MEMBERS ONLY

Is Cannabis Finally Low Enough to Go High?

On Wednesday, we began to see a separation between what Chairman of the Fed Powell said on fighting inflation and the inflation indicators themselves.

Food commodities, particularly grains, soared. Weather is the dominant factor as we head into the summer season. Happy June equinox.

Oil rallied, and we hope you...

READ MORE

MEMBERS ONLY

Bearish at the Bottom; Institutions Wrong on Oil

On June 12th, Goldman Sachs (GS) came out with this:

Goldman Sachs has slashed its forecast for oil prices by nearly 10%, citing weak demand in China and a glut of supply from sanctioned countries, including Russia.

What the big institutional analysts have done this year is get pretty much...

READ MORE

MEMBERS ONLY

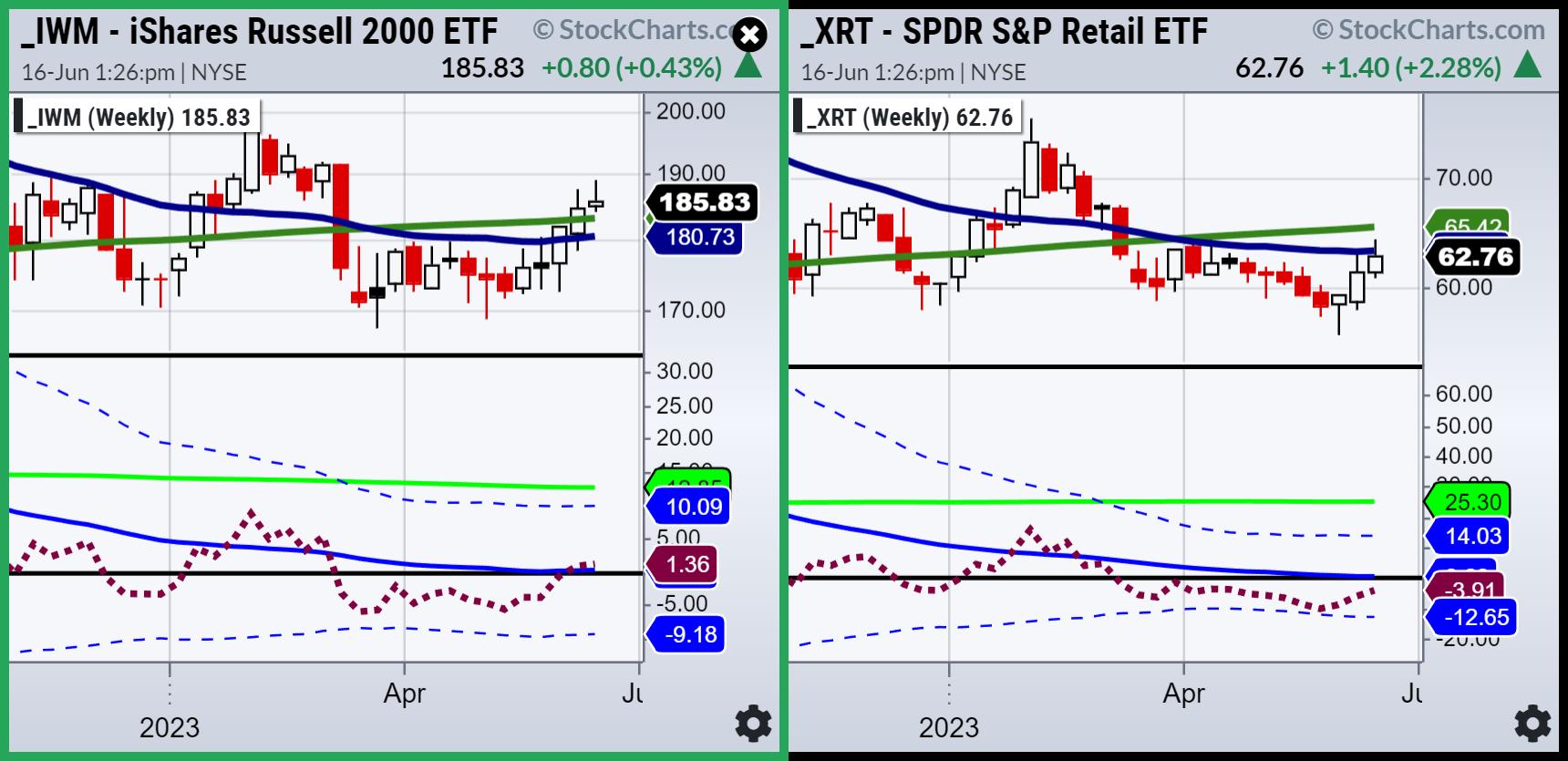

Economic Modern Family -- Let's Get Technical!

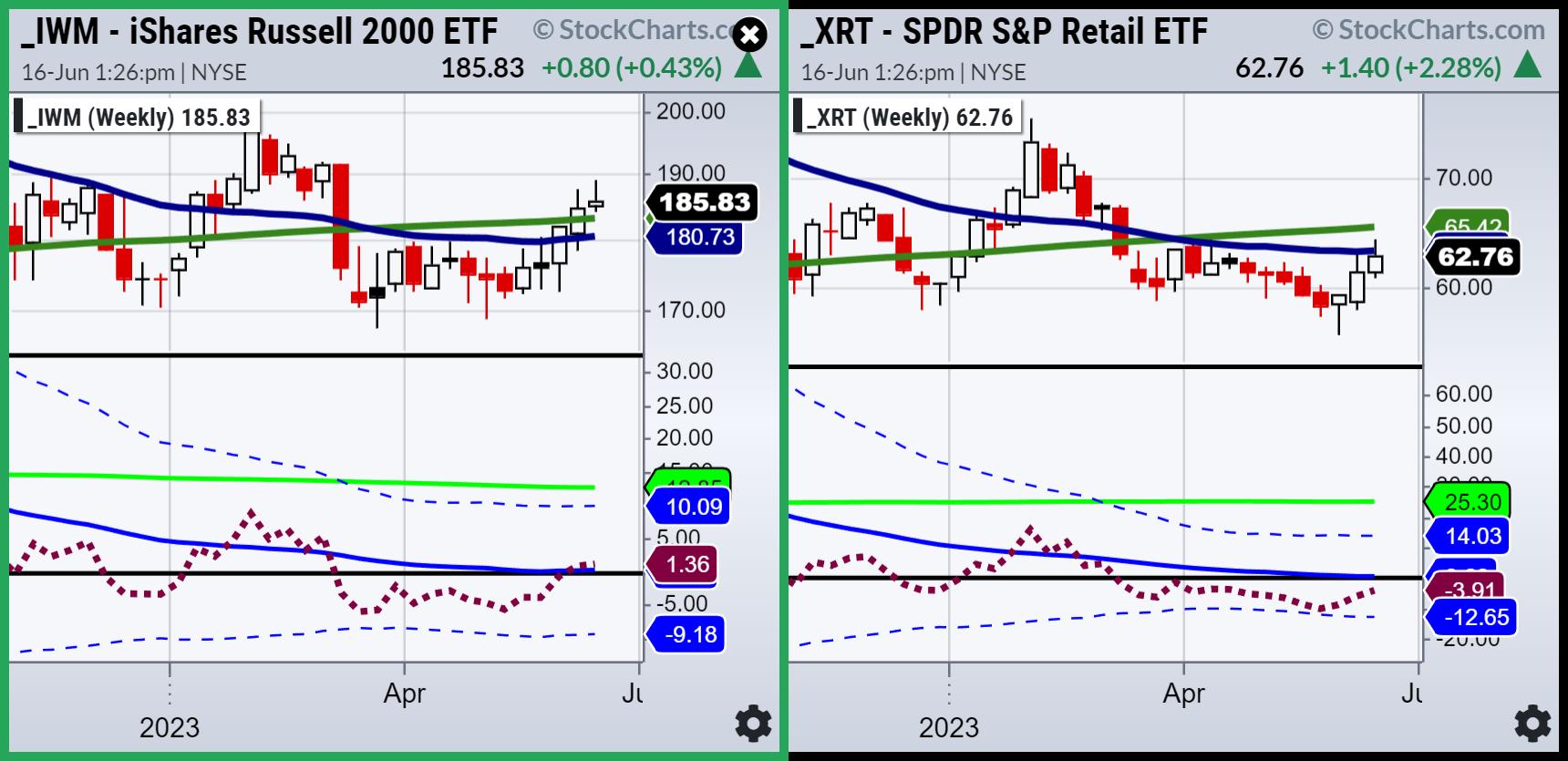

Focusing on the Economic Modern Family, the weekly charts will help us see who is doing what, why, and perhaps help us understand for how long.

Granddad and Grandma Russell and Retail are the matriarch and patriarch of the Family. IWM cleared the 50- and 200-week moving averages and is...

READ MORE

MEMBERS ONLY

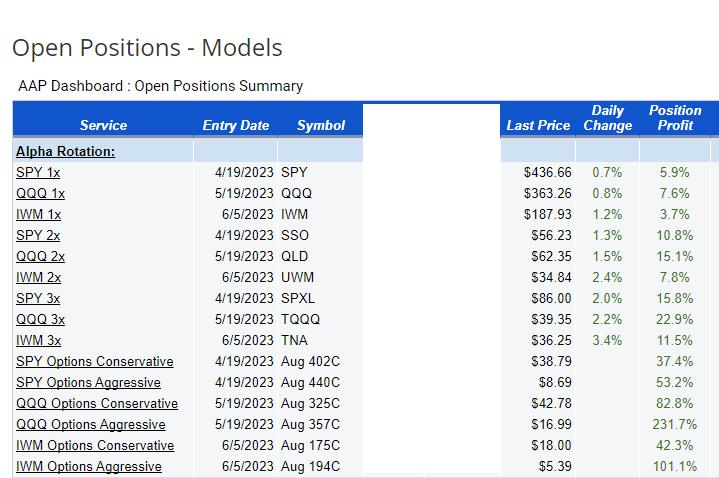

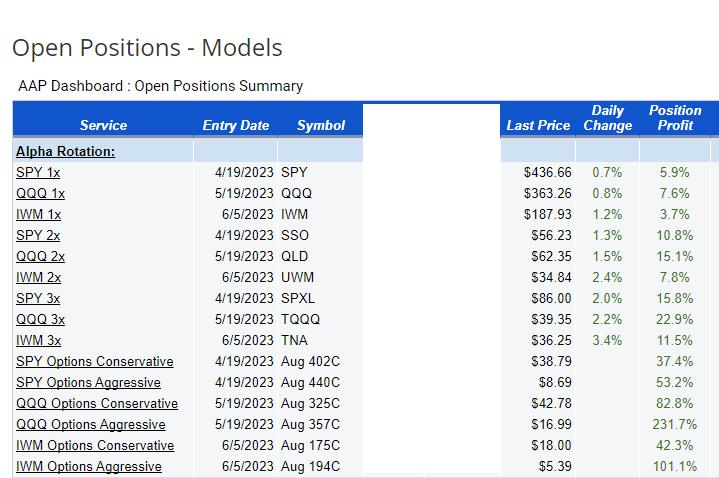

Speaking of AI -- A Look at Our Alpha Rotation

Those who read our Daily and follow us on the media know that we talk a lot about risk gauges. The big focus for me personally is the relationship between the S&P 500 and the long bonds. The other 2 I watch are the relationships between junk and...

READ MORE

MEMBERS ONLY

A Foray into Currency Pairs

Teaching an old dog new tricks means that the tricks might be new, but the notion of doing tricks is familiar.

Case in point-currencies and trading currency futures.

We have traded ETFs UUP and FXE (dollar and Euro) in the past.

And, I have been vocal through the years on...

READ MORE

MEMBERS ONLY

Fed's Victory Lap and Next Steps for the Market

What we heard from the Fed and FOMC on Wednesday:

1. Unanimous

2. Holding rates allows FOMC to assess additional data

3. Tighter credit likely to weigh on activity

4. 2023 unemployment seen at 4.1% vs. 4.5%

5. Median rate forecasts rise to 5.6% end-`23, 4....

READ MORE

MEMBERS ONLY

It's Not Just About Small Caps; Look Here Too

Last week, I was listening to an analyst talking about small caps. He basically poo-poo'd their importance and therefore influence on the overall market conditions.

Now, this is our Granddad Russell (IWM) -- the representative of stuff made in the USA.

He went on to say that IWM...

READ MORE

MEMBERS ONLY

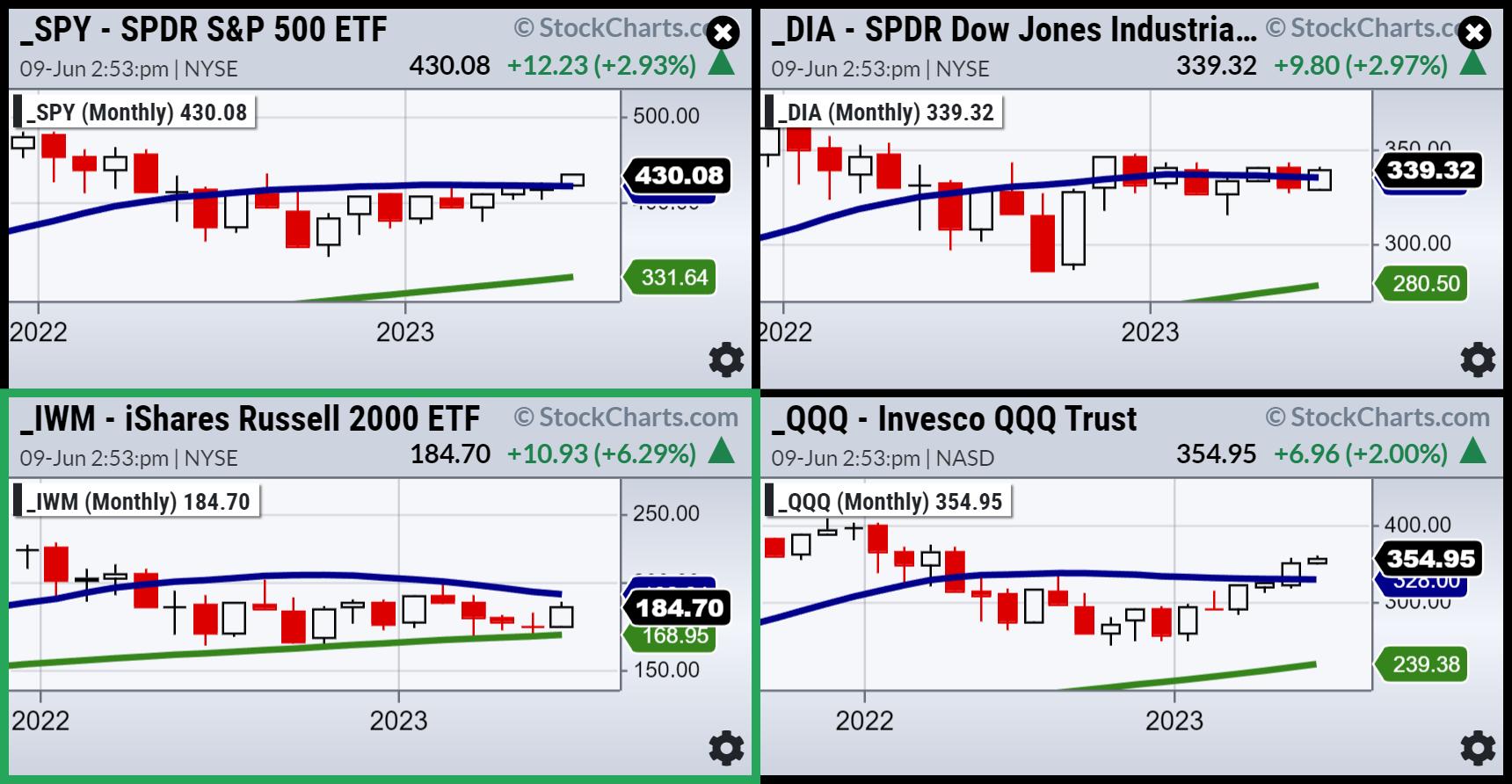

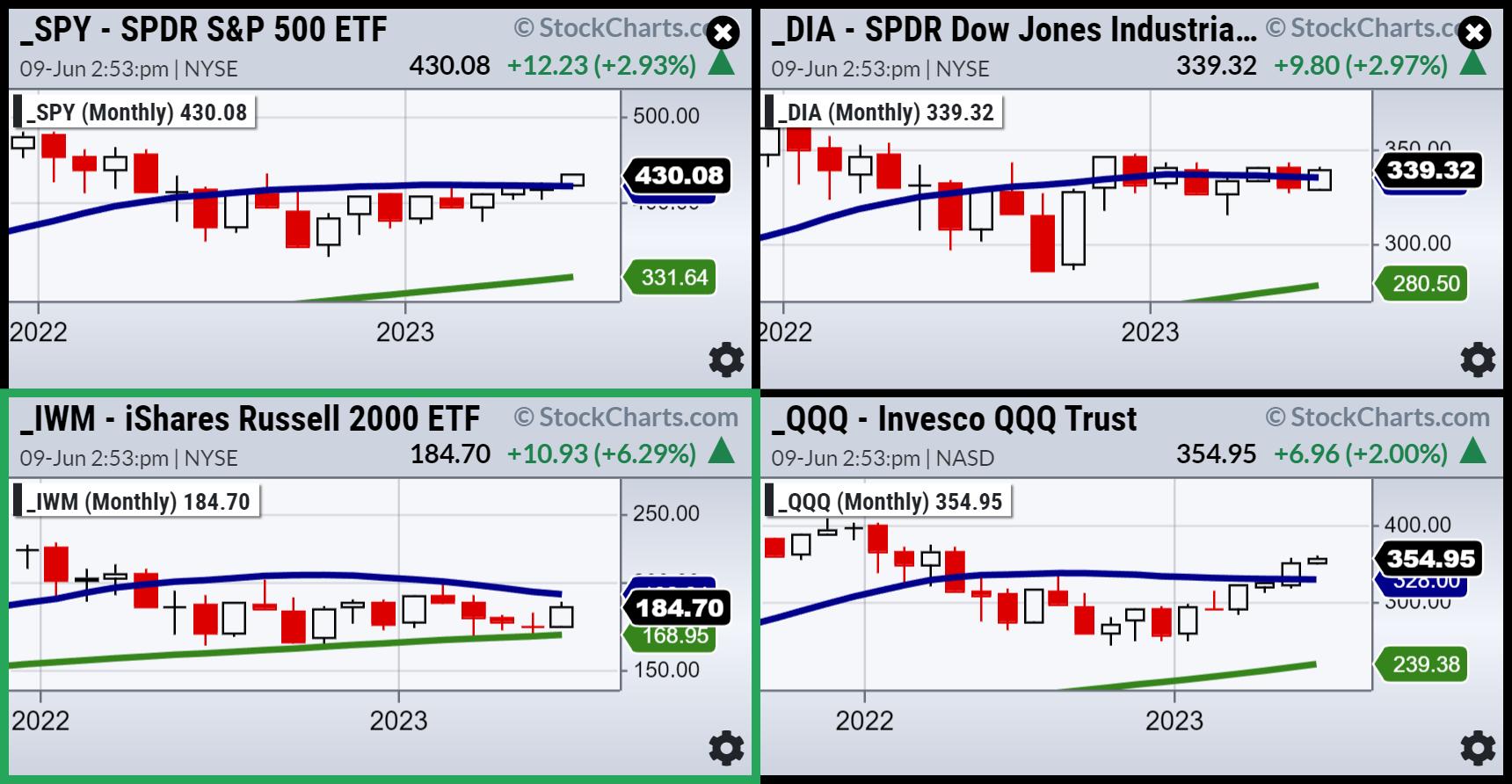

Major Investing Themes Upcoming

Looking at the monthly charts of the four major indices as we hit mid-June, all but the Russell 2000 are trading above their 23-month moving average. Thus far, this is in line with our prediction that, by the time IWM hits (if it does hit) 190-200 and the SPY hits...

READ MORE

MEMBERS ONLY

Vietnam and the U.S. Widening Trade Deficit

The US trade deficit widened to a six-month high and by the most in eight years. That means that we imported way more goods while our exports declined.

We don't like to use one economic stat as the end-all-be-all, but this strengthens our stagflation outlook. The dollar'...

READ MORE

MEMBERS ONLY

Some Trading Pairs to Think About Right Now

It's just like the entire month of May, when folks were saying "Sell in May and go away"-- but not us. We were telling you that the Big ViewRisk Gauges were all pointing to risk on.

However, before that, on March 12, 2023, we also...

READ MORE

MEMBERS ONLY

If It Weren't For These 7 Stocks...

Apple, Nvidia, Meta, Alphabet, Microsoft, Amazon, and Tesla have now been penned as the "Magnificent 7." Only around 25% of the S&P 500 stocks have outperformed the benchmark, while these stocks continue to show massive leadership.

The Nasdaq is up around 15% year-to-date, outpacing the S&...

READ MORE

MEMBERS ONLY

Soft Landing? Retail Sector Gets up and Boogies

Last week, we asked, "Can the Retail ETF XRT hold here?"

We wrote that the Consumer Sector ETF had some words for you. To summarize:

1. The test of the 80-month MA (green and price 56.24) on the last day of the month of May is mad...

READ MORE

MEMBERS ONLY

Consumer Sector ETF XRT Has Some Words for You

Tuesday's Daily was all about the metals. On Wednesday, gold, miners, and silver all rallied.

Is the bottom in on this last correction? Perhaps.

Two interesting areas to watch now are the one-year PCE rate-adjusted. And the retail sector is now on critical lows. In other words, we...

READ MORE

MEMBERS ONLY

Precious Metals and Miners Ready to Rally

In gold futures, we were looking for a correction to around $1940 an ounce.

The June contract fell to $1932. Now, it closed on the exchange at $1958. Plus, it had a new 60-day low and potential reversal pattern.

The Gold ETF (GLD) has begun this week trading inside the...

READ MORE

MEMBERS ONLY

Podcast on Macro to Micro in Markets

This past week, we have written a lot about tech (another AI-generated photo), the discordance between the small caps and large caps, rates, debt ceiling and the Fed.

For this weekend, we want to invite you to have a listen to the live coaching Mish does exclusively for our MarketGauge...

READ MORE

MEMBERS ONLY

The Elders Both Fatigue: Grandpa Russell 2000 v. Granny Retail

Above is an AI image to illustrate that while, on Monday, Granddad Russell (IWM) was offering a helping hand to his wife Granny Retail (XRT), today they both looked more vulnerable.

Just as the S&P 500 failed to clear its 23-month moving average, we are hoping that IWM...

READ MORE

MEMBERS ONLY

Battle of the Elders: Grandpa Russell 2000 v. Granny Retail

Just look at the March lows in Granddad Russell 2000 (IWM).

And now look at the March lows in Granny Retail (XRT).

So who is right?

IWM has moved up for the March lows and, to start the week, took the lead. It cleared the 50-DMA in price, and is...

READ MORE

MEMBERS ONLY

The Yin and the Yang of the Stock Market

We started out this year thinking that the economy stagnates, and inflation has a second wave or a super-cycle.

At this point, with 5 months into the year, the recent economic stats still support that our economy is contracting.

But those numbers are looking back not forward.

Risk factors which...

READ MORE

MEMBERS ONLY

Natural Gas and Oil -- Always on the Radar

This week I wrote a Daily on USO, the US Oil Fund.

Plus, I did a video for CMC Markets on those 2 commodities plus on Dollar pairs with Yen, Euro, British Pound.

I wrapped things up with a look at Lithium (another Daily this week) plus a look at...

READ MORE

MEMBERS ONLY

Analysts are Bearish While Risk-On Explodes!

The four ratio indicators track key intermarket relationships which identify risk on/off market conditions. These indicators can be used together to confirm or identify the strength of the core risk on/off indicator, which is the S&P 500 v. Utilities.

These charts come from our Big View...

READ MORE