MEMBERS ONLY

Technical and Fundamental Analysis on Lithium

Most associate lithium with EV usage.

The largest holding in the Global X Lithium ETF (LIT) basket is Albemarle Corp. (ALB). The US-based company isn't purely a lithium business. It also produces chemicals related to petroleum refining and consumer electronics. Interestingly, Tesla (TSLA) is a holding in LIT...

READ MORE

MEMBERS ONLY

Technical and Fundamental Analysis on US Oil Fund

USO, the US Oil Fund ETF, invests primarily in futures contracts for light, sweet crude oil, other types of crude oil, diesel-heating oil, gasoline, natural gas, and other petroleum-based fuels. Essentially, the top 6 holdings are crude oil futures from May to August--which, like futures, will continue to roll out...

READ MORE

MEMBERS ONLY

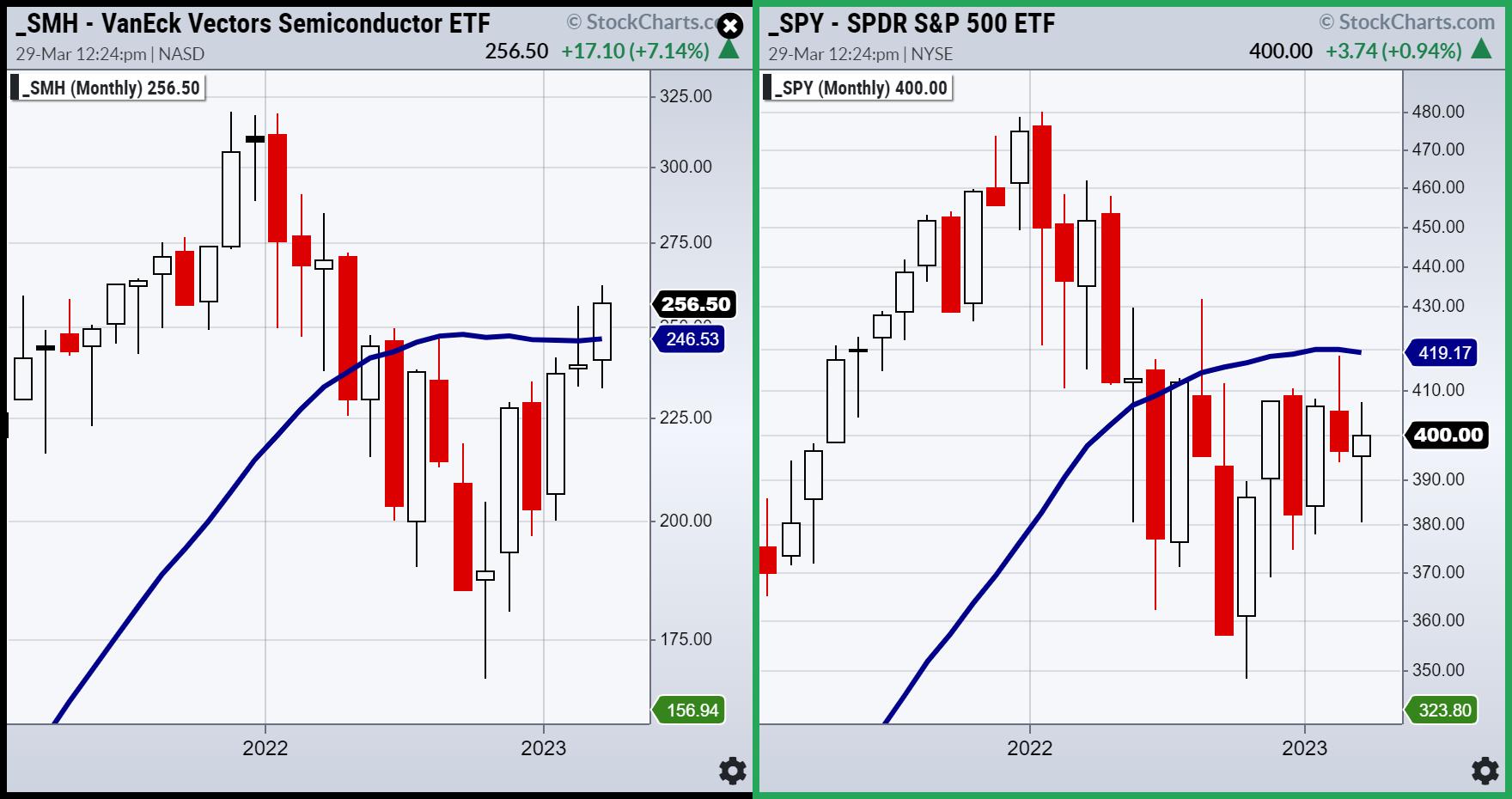

Is "Wonder Woman" Semiconductors Immortal?

Sister Semiconductors is a character and leading sector in the Economic Modern Family.We use the ETF SMH to represent her contribution to the market, family, and economy.

The cartoon you see reflects some of her Wonder Woman-like superpowers as I created the image from AI. Yes, AI. Cool, huh?...

READ MORE

MEMBERS ONLY

Currencies, Metals and Soft Commodities

Today, I am including a clip that covers currency pairs and several commodities.

The four-chart screen is a daily screenshot of gold (GLD), sugar (continuous contract), the US dollar to the Euro (USDEUR) and platinum continuous contract (PLAT). Gold is falling from its recent highs. Sugar has run into some...

READ MORE

MEMBERS ONLY

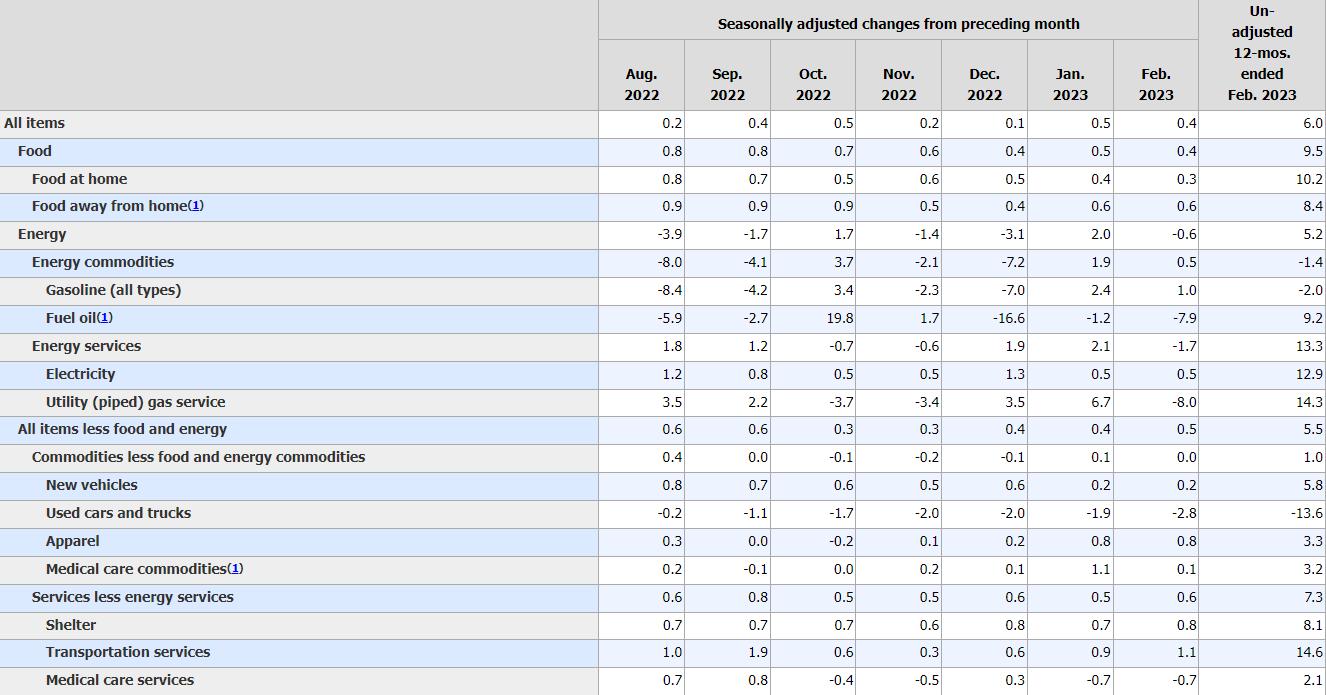

Fresh Macroeconomic Look after CPI

I was honored to spend time on Making Money with Charles Payne, which airs on Fox Business, and give a brief glimpse into why I'm not as bearish right now based on the macro. (link below)

My macro take based on business cycles and zooming out on the...

READ MORE

MEMBERS ONLY

Stock Picks from the 2023 Market Outlook

The Market Outlook for 2023was written in December 2022.

I have a designated radar screen for all the predictions and stock picks. The picks especially remain a focus for short-term and longer-term trades, depending on market conditions. In December, I wrote, "This stock, Tetra Tech (TTEK) made our radar...

READ MORE

MEMBERS ONLY

Daily Briefing Notes for the Market

I am back from 2 weeks of whirlwind travel and presenting at both the Money Show in Las Vegas and Charting Forward at StockCharts.com. I thank Geoff Bysshe, the President of MarketGauge.com for filling in for me.

After the market has absorbed bank crises, debt ceiling talk, the...

READ MORE

MEMBERS ONLY

The Next Leading Indicator

Today's daily features two videos that Mish recorded in the studio at StockCharts.com HQ!

The first video is Mish's appearance on today's episode of Your Daily Five.In this video, Mish explains why Grandma Retail (XRT) may become our new leading indicator. In...

READ MORE

MEMBERS ONLY

Now That "Stagflation" Has Gone Mainstream

Below is just one of several headlines about stagflation we have seen this week.

From April 27, 2023, TheStreet.com:

"Stagflation Risks In Focus As U.S. Economy Slows, But Inflation Stays High"

"The coveted soft landingis looking increasingly difficult to achieve and we are now getting...

READ MORE

MEMBERS ONLY

What Can We Expect from Stagflation?

The PCE rises (although far from the 8% peak). The GDP falls (is contraction of the economy over?). Meanwhile, stagflation persists along with the trading ranges in indices and many sectors. Plus, the theory we have been expounding on (a 2-year business cycle within a longer 6–8-year business cycle)...

READ MORE

MEMBERS ONLY

Gaining an Edge in a Tough Trading Year

On Thursday morning, April 20th, I began the day with the crew at the Benzinga PreMarket Prep show. We (Joel and Mitch) covered a lot, but the focus remains this persistent, rangebound market.

I've used many different moving averages consistently through the years. This year, the monthly moving...

READ MORE

MEMBERS ONLY

Banks, Well, Are They in the Bank??

Regional Banks (KRE) made a comeback during the session. The price pierced the 44 resistance level and closed above the last 18 trading day's range.

On March 6th, over a month ago, I wrote a Daily called "Retail and Regional Banks Will Call the Shots". At...

READ MORE

MEMBERS ONLY

Tesla Reports April 19: What To Look For

After recent price cuts and low expectations of only $0.85 per share or a 20% drop since a year ago, many eyes will watch Tesla (TSLA) after the close.

Tesla, always controversial, can either beat those low expectations and provide a low-risk buy opportunity against major moving averages,

Or...

READ MORE

MEMBERS ONLY

Is the Transportation Sector Starting to Lead?

Over the weekend, we covered the weekly charts of the Economic Modern Family. And...

Given that yields begin this week higher.

Given that earnings season kicks into gear with banks, the weakest sector so far, surviving.

Given that the seasonality of April point bullish for the S&P 500....

READ MORE

MEMBERS ONLY

The Economic Modern Family & the MOST IMPORTANT Data Ever

Admittedly, numbers are sexy.

Think about how much focus all the economic stats that came out this past week got on all media. Each one was the defining one for the markets and economy, according to the talking heads.

CPI and PPI softer? That's it, inflation is over....

READ MORE

MEMBERS ONLY

Oil, Chips and 4 Indices

For today, please enjoy a video taking you through the ever important energy and chips sectors along with the 23-month moving averages in the 4 indices.

For more detailed trading information about our blended models, tools and trader education courses, contact Rob Quinn, our Chief Strategy Consultant, to learn more....

READ MORE

MEMBERS ONLY

Bullish Compression in Consumer Staples

The Complete Trader, which we have featured in previous Dailys, is one of my favorite go-tos for trading ideas.

The columns help determine the trade setup. For example, an "Inside Day" that is also in a bullish stock phase. Also a narrow range that shows a narrower trading...

READ MORE

MEMBERS ONLY

Junk Bonds: Best Equity Predictor

Junk bonds are high-risk, high-yield bonds issued by companies with lower credit ratings. These bonds are also known as speculative-grade bonds or high-yield bonds, as they offer a higher rate of return than investment-grade bonds, but come with a higher risk of default. Companies that issue junk bonds have lower...

READ MORE

MEMBERS ONLY

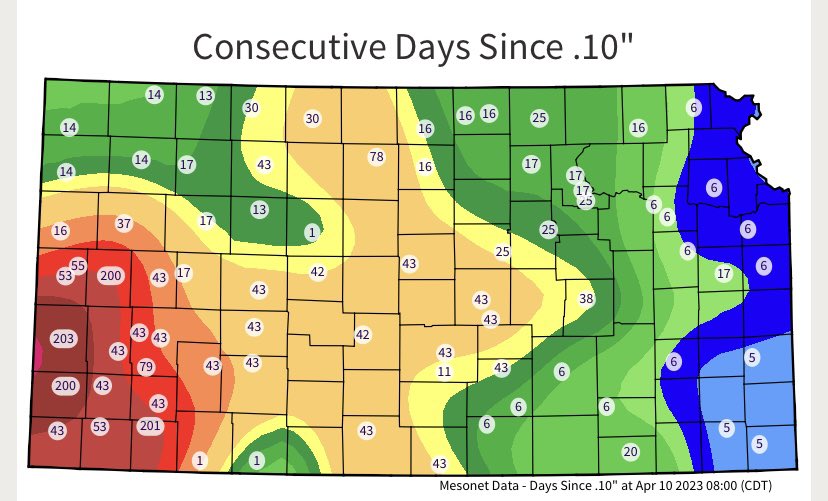

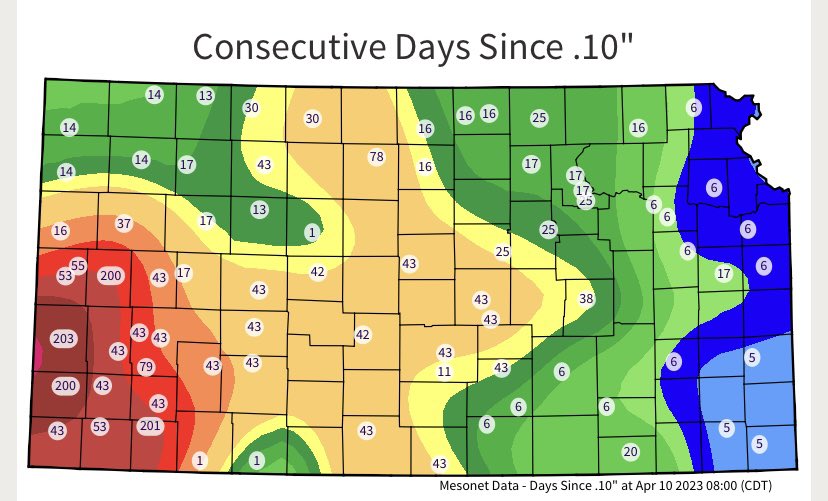

Drought in Key Regions for Major U.S. Crops

The chart shows how many days have passed since any significant rain in the major crop growing regions in the U.S.

Initial yield estimates for this year's U.S. winter wheat crop have been hammered by persistent drought. 12 Southwest Kansas counties dominate the area of drought....

READ MORE

MEMBERS ONLY

The Stock Market in 2023 is Like Picasso's Cubist Period

Pablo Picasso is known as the father of cubist painting. He and others used geometric shapes and patterns to represent a specific form. Cubism, in Picasso's mind, was created to emphasize the different ways of seeing the world around us. Picasso painted cubes and shapes using the concept...

READ MORE

MEMBERS ONLY

Bonds, Eurodollar, Metals, Oil, and a Pick

In the last few Daily blogs, we have covered a lot, from the silver to gold ratio, to long bonds, to the Euro vs. the dollar. And that's not all!

We have looked at the 23-month moving average and how that has been an incredibly reliable indicator to...

READ MORE

MEMBERS ONLY

When Uncle Utilities (XLU) Shows Up Drunk

Gosh, it's been a minute since we have looked at Utilities.

With rising interest rates, in March 2023, utilities fell near the October 2022 lows. Currently, XLU is changing phases from Bearish to Recuperation.

In my book, Plant Your Money Tree: A Guide to Growing Your Wealth,I...

READ MORE

MEMBERS ONLY

The 4 Indices -- More to Prove in 2nd Quarter

Since the first quarter ended with very few instruments above the 23-month, we thought we would start the 2nd quarter by examining where the 4 indices are.

Over the weekend, the Market Outlookreminded us that "we would likely see a rangebound market, along with stagflation. With positive back-to-back quarterly...

READ MORE

MEMBERS ONLY

1st Quarter -- QE Boosts Commodities and Stocks

Partial Look at the Models and Positions

On Friday, I was part of the Festival of Learning, sponsored by Real Vision, to help new and experienced traders.The topics that came up were in line with what everyone who trades wants more insights on:

* FOMO

* Position Sizing

* Risk Management

* Entries...

READ MORE

MEMBERS ONLY

The 23-Month Moving Average "Tell" for 1st Quarter

We have written lots of Dailys, not to mention talked a lot in media, about the significance of the 23-month moving average. Here are some past comments:

What has happened in the last 2 years? A bullish run in 2021 based on easy money. Inflation running hotter than most expected....

READ MORE

MEMBERS ONLY

Why Buy DBA: Agricultural Fund ETF?

Last week, I tweeted:

I believe the #commodities prices in food softs $DBA have bottomed. $GLD-well those who know me-that I pointed out bottomed months ago. $SLV now outperforming. That tells you something. Maybe even #oil. Get ready for the Commodities Super Cycle.

If you are not following me @marketminute...

READ MORE

MEMBERS ONLY

Keeping Up with 3 Key Ratios in a Trading Range

Friday:

Monday:

Over the weekend, our Daily covered 3 key ratios to help decipher the market action and the prevailing macro theme for the economy.

We started with the one between long bonds (TLT) and the S&P 500 (SPY).

All last week, long bonds outperformed the SPY with...

READ MORE

MEMBERS ONLY

Art and Science: 3 Key Ratios in the Markets

One of the best questions I got asked this week was "How can you be long gold and long semiconductors at the same time?" And I have a simple answer for that.

We love to take a position based on the macro, which is why gold has been...

READ MORE

MEMBERS ONLY

Two Big Signs of Stagflation

The Federal Reserve raised rates by 25 basis points. The decision was unanimous. The terminal rate projection is unchanged at 5.1%.

The FOMC statement modifies guidance: "The committee anticipates that some additional policy firming may be appropriate."

My first tweet @marketminute this morning before the market opened:...

READ MORE

MEMBERS ONLY

The Market's Contagious Buzz: What About the China/Russian Brah-Fest?

The market buzz can be quite contagious.

* "Market didn't collapse on the bank news-must be bullish."

* "Yellen will save the day buy making sure depositors are safe."

* Yellen herself: "We have an economy that is performing very well."

And, of course, we...

READ MORE

MEMBERS ONLY

Where is the Market Finding Joy?

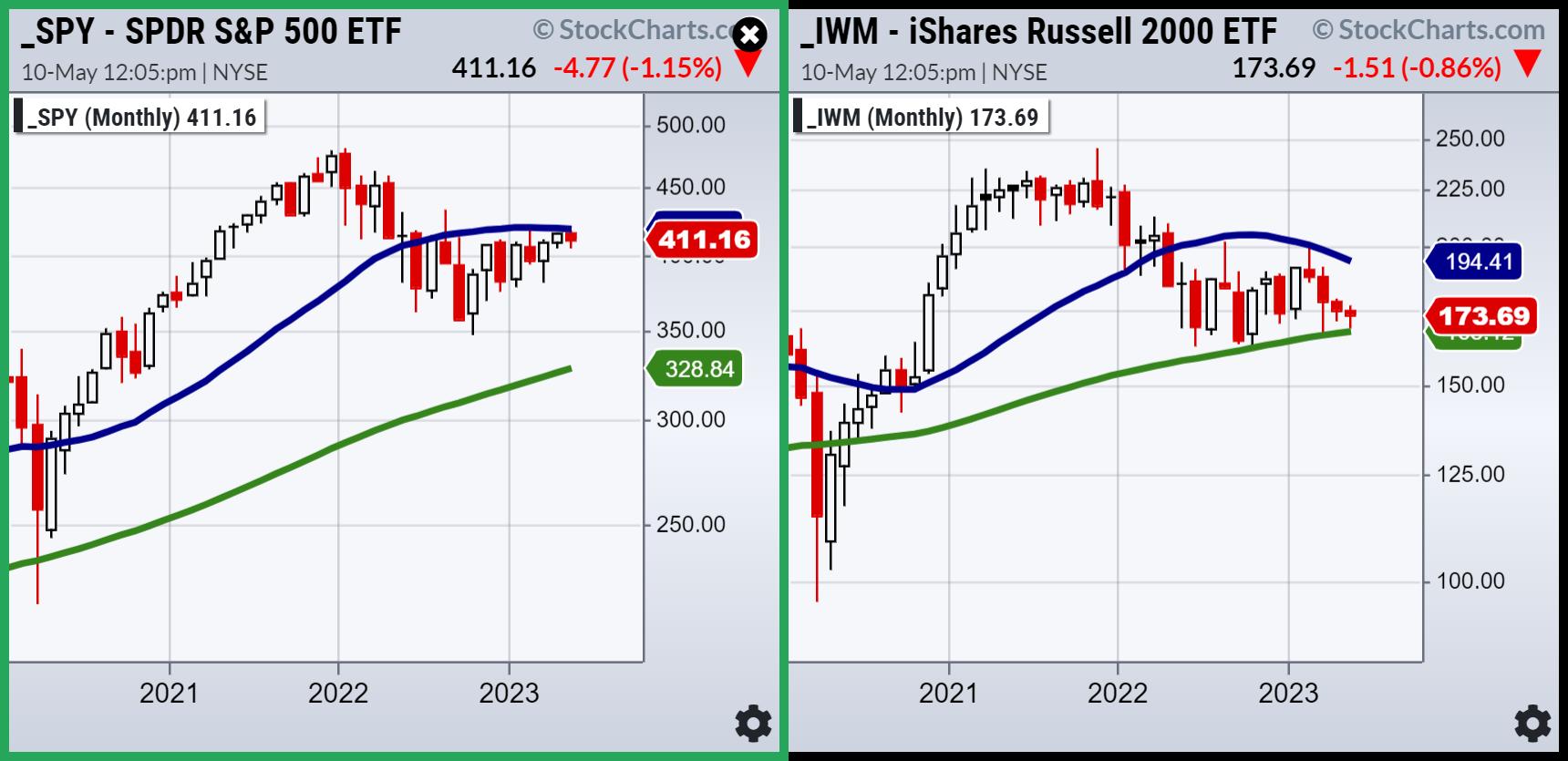

Where is the market finding joy? Is it here, in the Russell 2000 (IWM)? Let's check out the weekly chart.

The 50-week moving average just crossed below the 200-week moving average. That is bearish. The Leadership Indicators shows IWM well underperforming the SPY; also bearish. The Real Motion...

READ MORE

MEMBERS ONLY

CHAOS-Insert Any Headline Here-BUY #GOLD

When we wrote How to Grow Your Wealth in 2023,we began with

* Chaos

* Trying to Fit a Square Peg into a Round Hole

* Looking for Inflation in All the Wrong Places

Could we have known at the time what headlines would emerge? No. Yet what was obvious is that...

READ MORE

MEMBERS ONLY

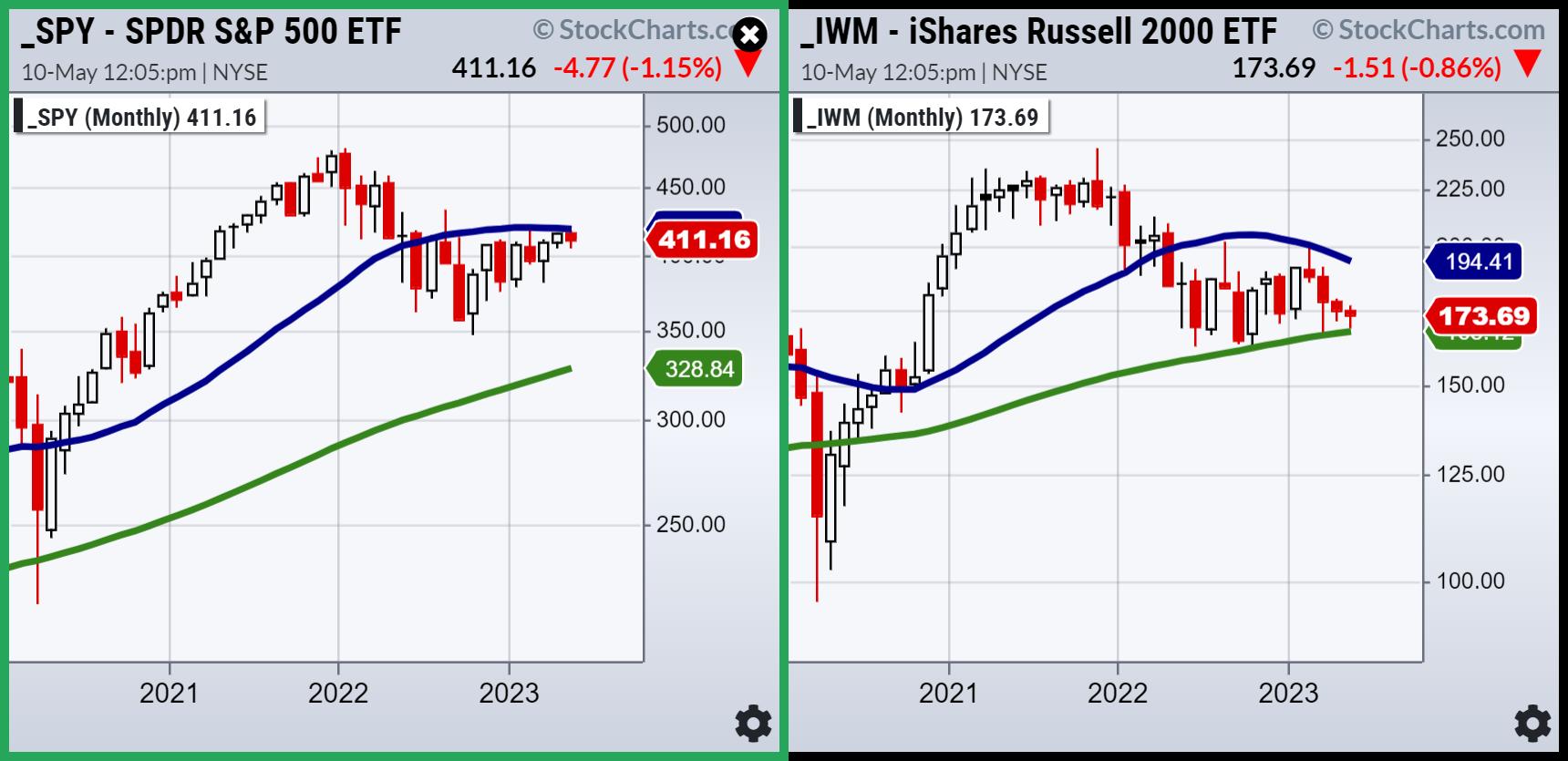

Small Caps and Semis -- Their 2- and 7-Year Business Cycles

In our book How to Grow Your Wealth in 2023,we featured our projections for the Economic Modern Family.

To begin with the Granddad of the Family -- Russell 2000 (IWM) -- in December 2022, we wrote this:

"The Russell 2000 IWM is the granddad of the Family. Hence,...

READ MORE

MEMBERS ONLY

Silver, Gold, and Miners

Folks are calling the FED opening swap lines on the entire US Banking deposit base to the tune of $17.6 trillion as QE infinity. Moody's cut its outlook on the banking system to negative, saying that it is a rapidly deteriorating operating environment. The market though, generally...

READ MORE

MEMBERS ONLY

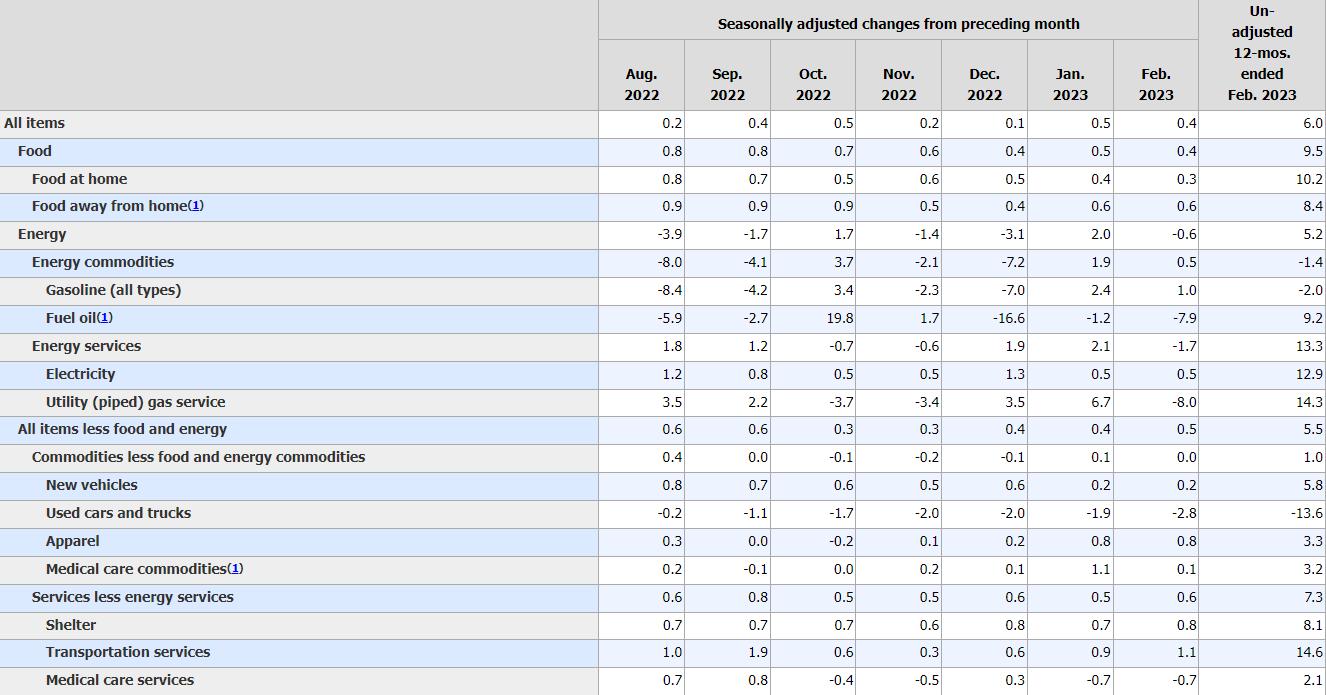

Get Ready for the Consumer Price Index!

Given the recent liquidity crisis in the banking sector, Tuesday morning's CPI number could be an important driver in the Federal Reserve's next move on March 22nd.

As per the report, How to Grow Your Wealth in 2023, "The Federal Reserve is overly optimistic about...

READ MORE

MEMBERS ONLY

Long Bonds: Island Bottom and the Signal of Chaos

On March 7th, we asked "Will the Market Internals Turn More Bearish"?

While we focused mainly on Jerome Powell's testimony, when he said "if the totality of the data were to indicate that faster tightening is warranted, we would be prepared to increase the pace...

READ MORE

MEMBERS ONLY

Regional Banks: From March 6 to March 9

We could call this "3 Days to All Hell broke loose."

We could call this "We told you so."

We could call this, "Welcome to the incredible forecasting of the Economic Modern Family."

We could call this, "Hello delusional semiconductors."

Whatever you...

READ MORE

MEMBERS ONLY

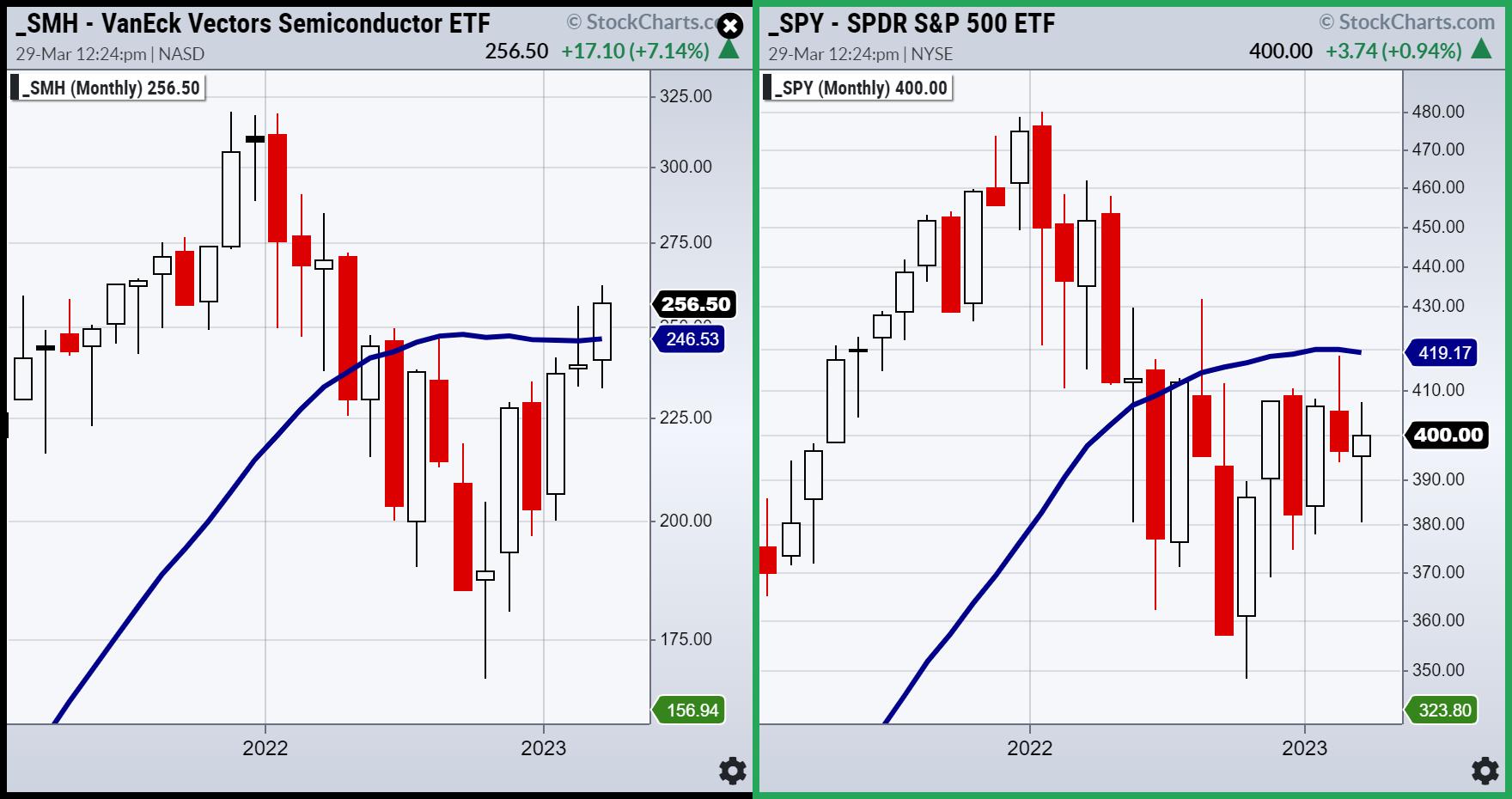

How Long Can Semiconductors Lead the Market?

With Jerome Powell so data-dependent, as he stated on his second and last day of testimony, it seems pretty obvious where most of the growth and labor strength is coming from.

This isn't the first time we have seen semiconductors lead the market, and we can say that...

READ MORE

MEMBERS ONLY

Will the Market Internals Turn More Bearish?

Jerome Powell brought reality to the market.

"The latest economic data have come in stronger than expected, which suggests that the ultimate level of interest rates is likely to be higher than previously anticipated," Powell told the Senate Banking Committee in prepared remarks. "If the totality of...

READ MORE

MEMBERS ONLY

Retail and Regional Banks Will Call the Shots

The 23-month moving average or a two-year business cycle is particularly important this year after a big up then down year-looms large.

Looking at Granny Retail, that business cycle not only leaves investors with the trading range resistance, it also shows how the Retail sector could be a harbinger of...

READ MORE