MEMBERS ONLY

Is the Economic Modern Family Ready to Howl?

This past week, our Daily content proved itself invaluable. We directed our readers to look at buying Natural Gas, Crude Oil, Steel, Aluminum, Corn, Sugar, and NASDAQ. Now, we would like to turn our attention to the Economic Modern Family.

On Tuesday, March 7, there will be perfect alignment of...

READ MORE

MEMBERS ONLY

Bullish Reversals

Those of you who read our Daily are by now, learning about the value of our scanning tools, quants and the Complete Trader.What we are trying to accomplish is to show not only how best to use the product, but how to focus on key patterns, especially those that...

READ MORE

MEMBERS ONLY

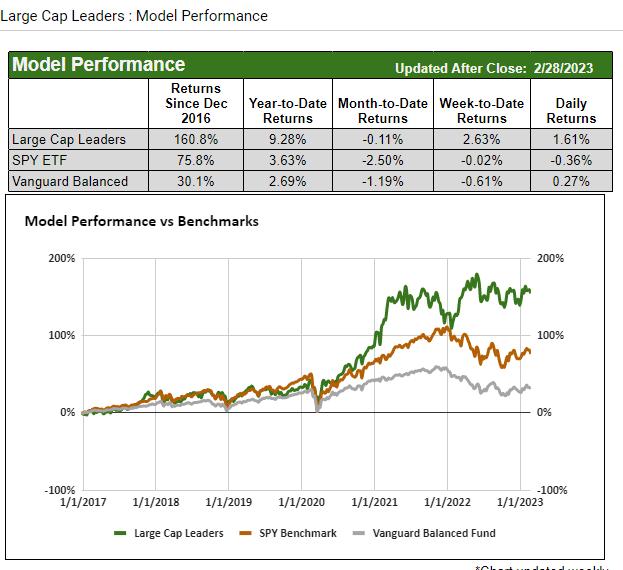

Industrial Metals Outperforming the S&P 500

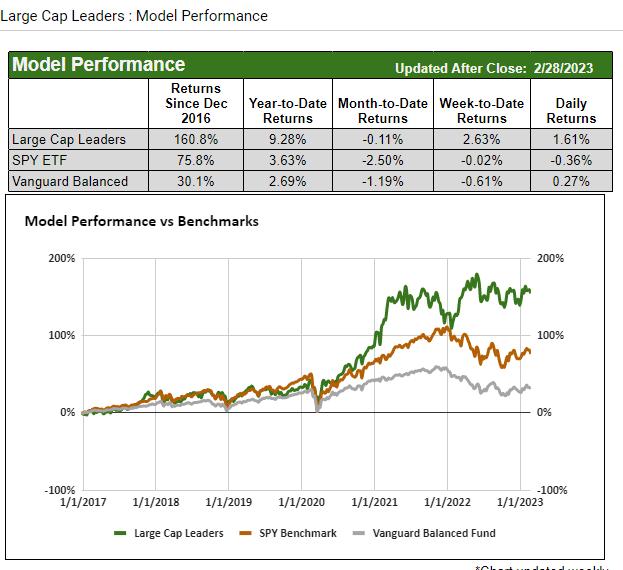

Why are Large Cap Leadersleading?

While the major indices still try to sort out the next interest rate direction, soft, hard or no landing, and/or if inflation has peaked, a few stocks have dominated. Companies like Steel Dynamics (both holdings in the quant model) are in the manufacturing and...

READ MORE

MEMBERS ONLY

NASDAQ New High/New Low Ratio and Risk

Stuck is a word we have used a lot lately.

Some common synonyms for stuck are jammed, trapped, put, pushed, and caught.

Nasdaq is stuck, jammed, or whichever word one wishes to use. And that's price. Traders are also trapped and caught, considering that the market breadth is...

READ MORE

MEMBERS ONLY

Century Aluminum Pops Up as Bullish

The week is starting out exactly how we expect.

* The SPY and indices stuck in the trading range within a trading range.

* The latest economic data weak, hence causing buyers to return to the market, figuring bad news is good news.

* Four of the 6 Economic Modern Family members in...

READ MORE

MEMBERS ONLY

Oil, Energy, and Related Stocks of Interest

After the CORE PCE numbers came out on Friday, the market had the expected reaction of selling off in anticipation of a more aggressive Fed.

We find the reaction less than surprising. But what we do find more surprising is that the metals sank along with equities, although gold fell...

READ MORE

MEMBERS ONLY

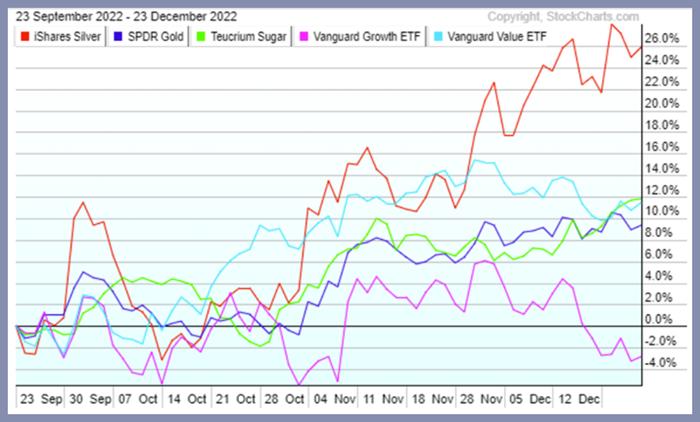

Sugar Prices Soar -- What Could It Mean?

What if sugar futures are really onto something?

What if they are relaying food shortages? More social disruption? The Start of Russian hoarding? Which leads to Geopolitical hell? And all the inflation theories that could still develop are staring us right in the face?

In the face of a rising...

READ MORE

MEMBERS ONLY

"No Landing"—Sugarcoated Words for Stagflation?

The above chart is from our MarketGauge product called Big View.

Risk Sentiment

Coming into the FOMC, the sentiment for risk is neutral. A week ago sentiment was 100% bullish. A month ago, it was neutral leaning towards bearish. Amazingly, the sentiment and the persistent trading range in the S&...

READ MORE

MEMBERS ONLY

Classic Short Setup in Tech

Akamai Technologies (AKAM) is a cloud computing company in the tech sector that deals with online security. Up until mid-2022, the trend was up.

Then, with the hawkish Fed, the trend changed, with AKAM eventually breaking the 23-month or two-year business cycle in May 2022. It just goes to show...

READ MORE

MEMBERS ONLY

Comparing Gold to the S&P 500

This coming week is a big one. We have FOMC on tap, with some Fed members calling for .50 bps rate hike on the heels of the hot Producer Price Index and inflation. We have Gross Domestic Product on the heels of a strong retail sales number, and record amount...

READ MORE

MEMBERS ONLY

Is the Whole Country Buying Teslas and Eating at Wingstop?

Wednesday morning brought some love to the US economy. The January retail sales rose 3% month/month vs. +2% estimated.

The breakdown fascinates.

With food inflation where it is, and egg prices the big headline, the leader for today's number is FOOD, particularly eating out. At the bottom...

READ MORE

MEMBERS ONLY

CPI Excludes Food: Have You Seen the ETF DBA?

Maybe it's just Valentine's Day, so the food and commodities market sees a push to chocolates, flowers, and fine dining.

And maybe not.

The consumer price index (CPI) came out with an unexpected rise... but goods remained softer. Services, on the other hand, rose. However, the...

READ MORE

MEMBERS ONLY

Economic Modern Family: More to Prove to Traders

All in all, the key sectors (retail, transportation) have more to prove, especially by clearing the 23-month moving average or 2-year business cycle. This is a significant level, as these sectors proved recession was held off when they both held the 80-month moving average or their 6-7 year business cycle...

READ MORE

MEMBERS ONLY

SOTU's Not-so-Subtle Implications for the Market

This is not meant to be political. As we have written many times, politics and investing should not be in the same sentence.

With that said, during this past week's State of the Union Address, we were keenly listening for comments on our macro themes (as reported in...

READ MORE

MEMBERS ONLY

2-Year Business Cycles Matter in Commodities

This week, we have featured the 23-month moving average, or two-year business cycle, and its significance to the indices.

In particular, when speaking about the S&P 500 index, we wrote:

* There was a bullish run in 2021 based on easy money.

* Inflation ran hotter than most expected.

* The...

READ MORE

MEMBERS ONLY

2-Year Business Cycles Matter in This Market

Some of you might have already heard us speak about the monthly moving averages or have read our commentary about their significance.

On Monday, we asked, "What if the trading range top at 4200 we have been calling for in the S&P 500 turns out to be....

READ MORE

MEMBERS ONLY

Price Reversals from Recent Highs in Stocks

What if the trading range top at 4200 we have been calling for in the S&P 500 turns out to be... the top?

Certainly, we can make a case for it given higher yields, strong dollar, geopolitical stress, debt issues, government spending, and no real proof we have...

READ MORE

MEMBERS ONLY

Stock Market Stuck with a Plethora of Mixed Signals

If you are having a hard time figuring out the market's next moves, start by thinking about trading range. The 2023 Outlook spells out reasons for a 1000-point trading range potential in the SPY from 3200-4200. We are adding that the NASDAQ 100, through QQQ, can head to...

READ MORE

MEMBERS ONLY

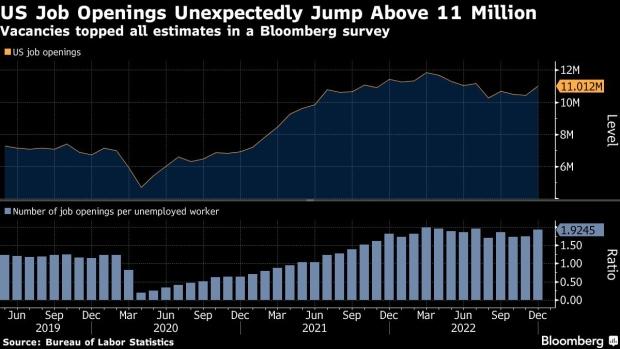

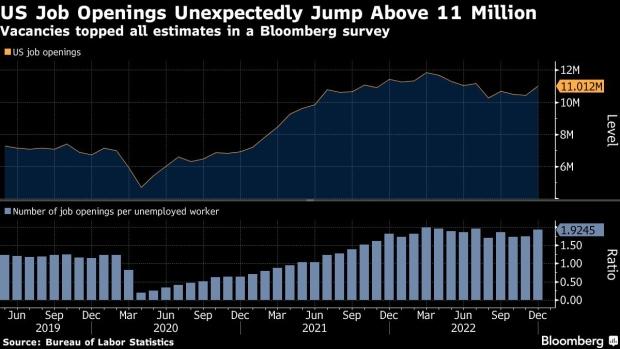

The Labor Market and the Stock Market

By the time you read this, the buzz of what the Fed did and Powell's presser will be over... at least for the day.

We will not repeat the obvious.

What we are way more focused on is the underlying reasons that the Fed, unless they are willing...

READ MORE

MEMBERS ONLY

What Are the Equity Market's Positive Signs?

On Monday, the Daily covered some of the warning signs, particularly in the Regional Banks and Transportation sectors. We ended the Daily by writing this: "Transportation and Regional Banks make up nearly 1/3 of the Economic Modern Family."

On their weakness: "Of course, the week is...

READ MORE

MEMBERS ONLY

What Are the Equity Market's Warning Signs?

Nearly every member of Mish's Modern Familyimproved last week, with the Russell 2000 (IWM), Transportation (IYT), Semiconductors (SMH), and Retail (XRT) all putting in Golden Crosses on their daily charts.

Except for Regional Banks (KRE).

Risk off or on during this data-heavy week? Clearly, the performance of MarketGauge&...

READ MORE

MEMBERS ONLY

Inflation, What Inflation?

We typically have a song or two in our heads. After all, watching ticks is musical and has a lot of different beats.

And typically, those songs turn into parodies.

For this past week, the first song was sealed in our brains after Tesla's extraordinary run. And then...

READ MORE

MEMBERS ONLY

Are You Invested in Precious Metals Yet?

I started out this year saying that, to date, gold has been sold on strength and bought on weakness. And the day strength is bought is the day we see a much bigger rally.

A Few Gold Headlines

* Gold prices hit record high in Japan

* China steps up gold imports...

READ MORE

MEMBERS ONLY

Stock Price Divergence and Potential Signs of Risk!

We cannot begin the Daily without a mention of the glitch in the NYSE right out of the gate Tuesday morning. A wild stock-price swing occurred at the open and 84 stocks suddenly plunged or spiked, causing volatility triggers and trading halts. The event is now under investigation.

The chart...

READ MORE

MEMBERS ONLY

Momentum vs. Price: Is the Stock Market Rally Over?

Last week was the reset of the January six-month calendar range. For the S&P 500 index, that range sits at 3770-4000.23.

In our 2023 Outlook, the prediction we made for the yearly range is much wider, or between 3200-4200. That is based on the position of two...

READ MORE

MEMBERS ONLY

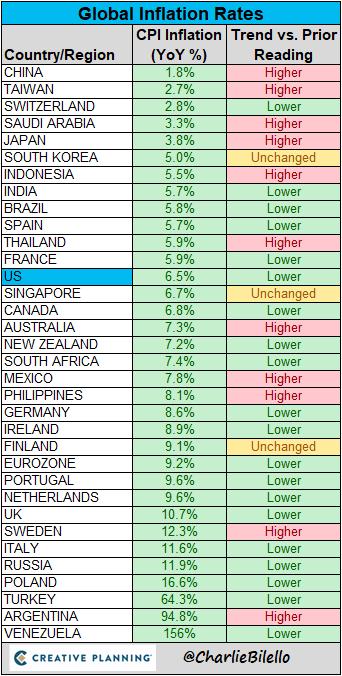

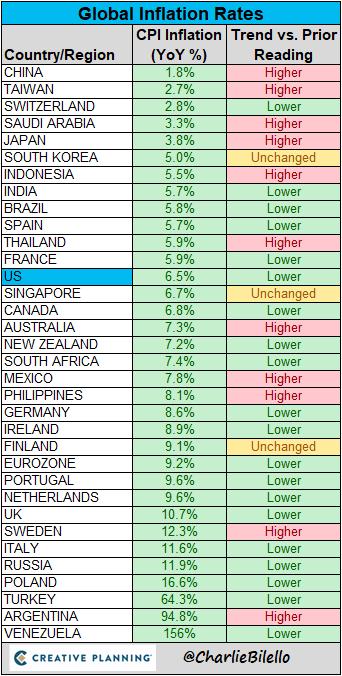

Has Inflation Cooled or Not?

This past week, I got to talk a lot about inflation, something many have thrown in the towel about. But not us!

In particular, I sat down with Charles Payne during his show Making Money with Charles Payne on Fox Business. He prepared a list of questions for me.

Charles:...

READ MORE

MEMBERS ONLY

Mish's Daily: Should the Market Worry About Regional Banks Sector?

KRE Regional Banks is a member of my Economic Modern Family. With bank earnings in gear, this ETF measures the smaller banks--the ones where people living in more rural communities and smaller cities often go to borrow and save money.

Here is a passage from March 22, 2022:

"We...

READ MORE

MEMBERS ONLY

Mish's Daily: Sugar Futures and Social/Economic Impact to Stocks

The price of sugar is exposed to many global and national influences. These include government tariffs, costs of production, climate change, and geopolitical instability. These demand and supply factors all influence movement within the market.

Most sugar production occurs in a few countries across the world. The top producing countries...

READ MORE

MEMBERS ONLY

Weekend Daily: Stock Market Outlook: New Year, New Calendar Range

Welcome to the new year and the new January reset!

The January 6-month calendar range could be even more influential than usual. Let me explain before showing you the S&P 500 (SPY) price chart...

After the first 10-trading days in January, a range is established. That range becomes...

READ MORE

MEMBERS ONLY

Mish's Daily: Ahead of CPI Inflation, The Market Rose in Expectation

You don't want to miss Mish's 2023 Market Outlook, E-available now!

Ahead of Thursday's CPI inflation print, the stock market rose on Wednesday, extending previous gains for the week. The stakes for the Fed-critical report are high, since most investors expect a lower CPI...

READ MORE

MEMBERS ONLY

Mish's Daily: The Shiller Ratio is Telling Us There is More to Come

You don't want to miss Mish's 2023 Market Outlook, E-available now!

As earnings season kicks off, the market is primed to witness some surprising turns in the coming days, weeks, and months ahead. Powell's speech today kept investors thinking about future interest rate hikes...

READ MORE

MEMBERS ONLY

Mish's Daily: The Spot Where the US Dollar Still Stands

You don't want to miss Mish's 2023 Market Outlook, E-available now!

Despite the debate about the strength or weakness of the US Dollar, it will remain one of the most important currencies in the world for decades, and will continue to cause trouble for some. Still,...

READ MORE

MEMBERS ONLY

Weekend Daily: Gold is the Featured Pick of 2023

You don't want to miss Mish's 2023 Market Outlook, E-available now!

From page 55 of How to Grow Your Wealth in 2023:

"Overall, the gold futures have the lion's share of our interest, (as referenced earlier in this Outlook). We wrote about the...

READ MORE

MEMBERS ONLY

How to Grow Your Wealth in 2023

Investors and traders should utilize sensible trading strategies, intelligent portfolio management, and vigilant risk governance to stay ahead in today's fast-paced, liquid markets. In this article, renowned and legendary trader Michele Schneider outlines 10 themes that are likely to shape and drive the markets in 2023 and into...

READ MORE

MEMBERS ONLY

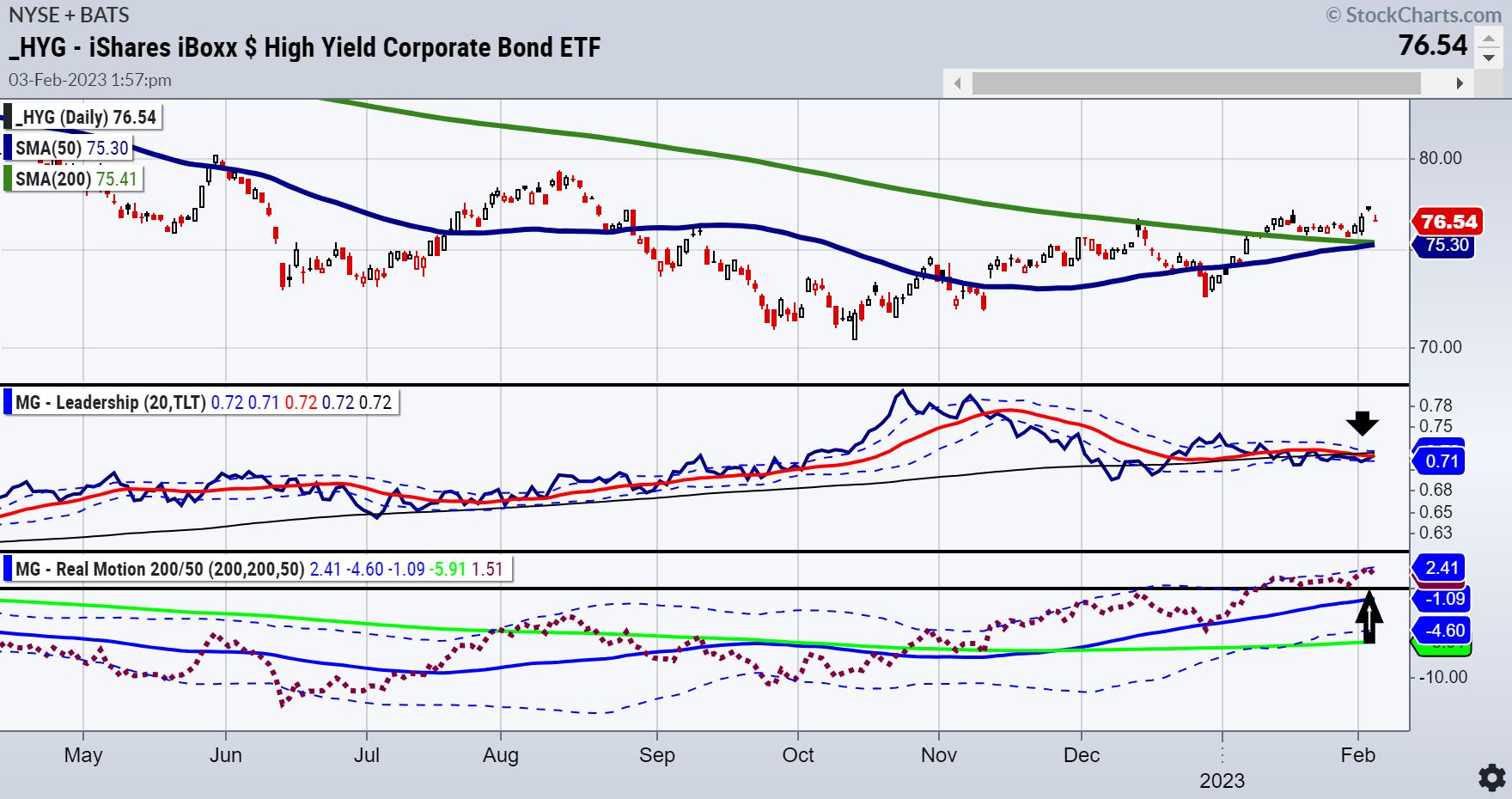

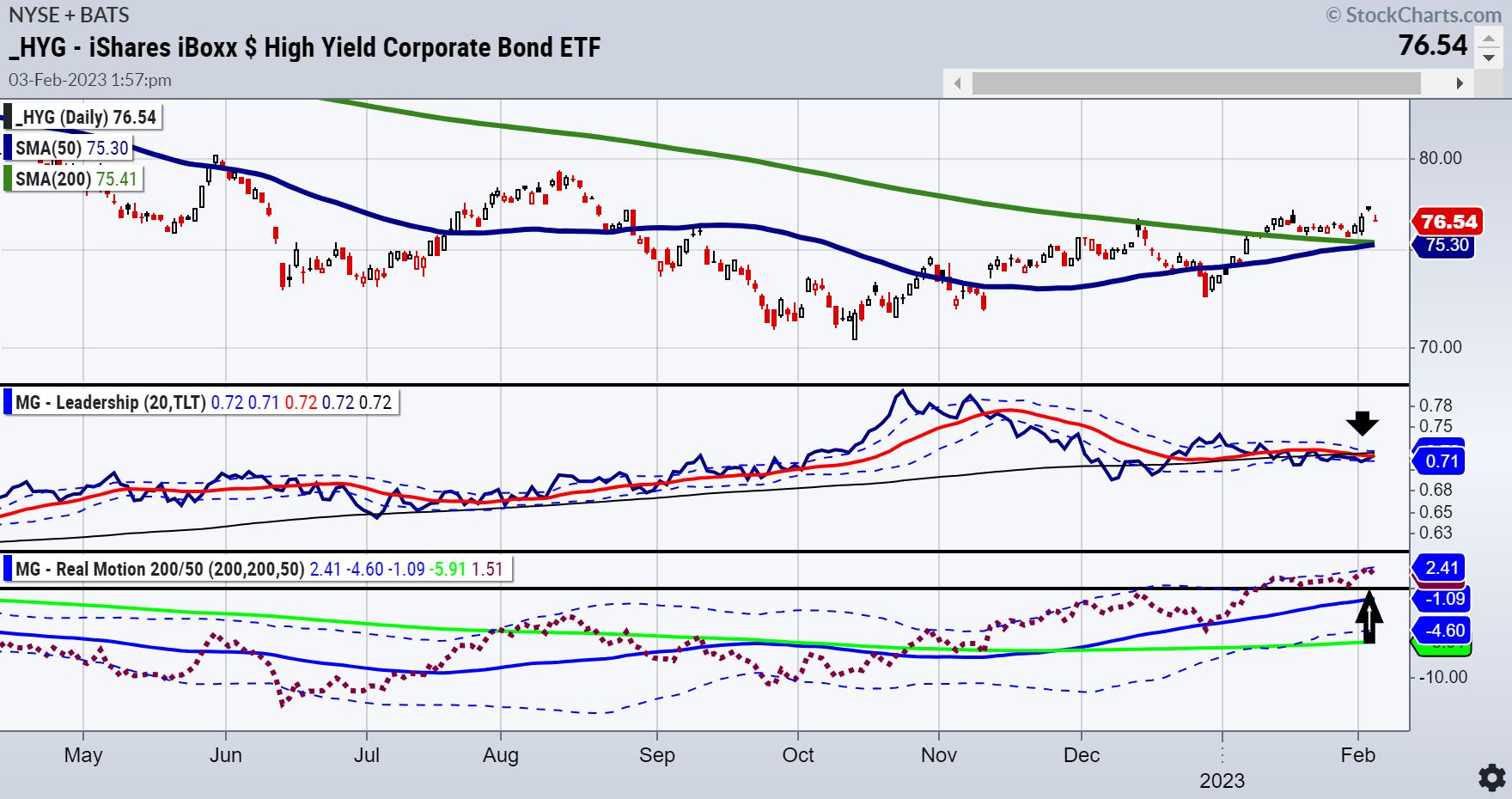

Mish's Daily: The New Year Could Be All About Junk Bonds

Now that we are one day into the new year, there are two pieces of advice to give you.

1. Learn a strategy and then become a specialist in that strategy. As an example, you could use phases. And once you understand the phases on a daily and weekly timeframe,...

READ MORE

MEMBERS ONLY

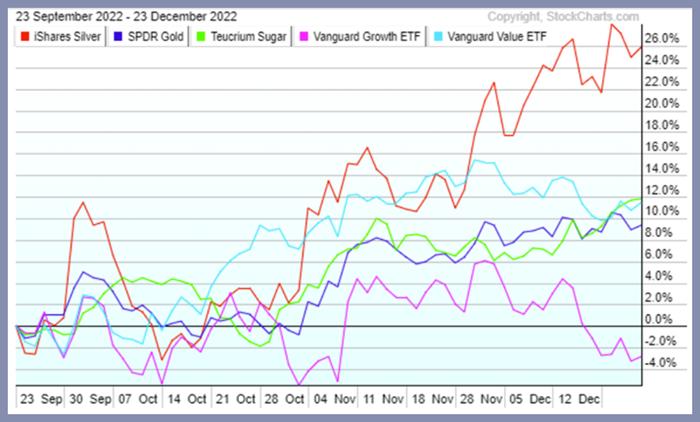

Weekend Daily: Tips for Trading Profitably in a Bear Market

Many investors have had a rough year.

2022 has been characterized by turbulence in financial markets. The Nasdaq Composite, S&P 500 Index, and Russell 2000 are all in bear market territory, while the Dow Jones is the only U.S. index down less than 10% YTD. The performance...

READ MORE

MEMBERS ONLY

Mish's Daily: Sister Semiconductors—A Gauge of High-Tech Industries

Even the biggest Grinches on Wall Street might need to rethink their outlook for the final trading days of 2023, as U.S. stocks rallied on surprising consumer confidence numbers and strong earnings from Nike (NKE) and FedEx (FDX). This is cause for some holiday cheer, signaling that good financial...

READ MORE

MEMBERS ONLY

Mish's Daily: Don't Miss Out on the Next Gold Rush

Gold always has been and will always be a controversial asset within investment circles. Its proponents can't agree on why it deserves a place in portfolios or how much to allocate to gold in various risk-based portfolio models.

But gold can be used as insurance against macroeconomic tail...

READ MORE

MEMBERS ONLY

Mish's Daily: Is the Santa Claus Rally Over?

Bond prices plummeted, yields increased, and U.S. indexes fell again Monday.

The major U.S. indexes have fallen for the past two weeks, and, on Monday, most markets closed near their lows. The S&P 500 Index, represented by the SPDR S&P 500 ETF (SPY) above,...

READ MORE

MEMBERS ONLY

Weekend Daily: Wall Street Banks Favored Over Main Street's Regional Banks

The SPDR S&P Regional Banking ETF (KRE) is a key member of Mish's Modern Family. Why? Because KRE measures the health the U.S. financial system and the overall economic activity of rural America.

Regional banks have performed relatively well compared to larger, more prominent banking...

READ MORE