MEMBERS ONLY

Mish's Daily: The Battle Against Inflation May Have Only Just Begun

The Federal Reserve hiked interest rates by 50 basis points, as the market was expecting. Major U.S. indices turned red on the news with a modest day of losses. The SPDR Dow Jones Industrial Average ETF (DIA) closed in negative territory, but stayed above its 50- and 200-day moving...

READ MORE

MEMBERS ONLY

Mish's Daily: Grandpa Russell Might Be Running Into Trouble

While we follow the Fed announcement tomorrow, we'll closely watch Grandpa Russell's (IWM) reaction.

As the patriarch in charge of Mish's Modern Family, it's a good idea to meticulously monitor Grandpa Russell's pricing daily and weekly. IWM is also the...

READ MORE

MEMBERS ONLY

Mish's Daily: How to Trade a Golden Cross in a Bear Market

Investors will watch closely tomorrow, as the Consumer Price Index (CPI) print is released, and Wednesday, when the Fed announces its latest rate hike. The expectation is for CPI to be lower and for the Fed to raise interest rates a half-percentage point.

The Dow Jones Industrial Average (represented above...

READ MORE

MEMBERS ONLY

Weekend Daily: Mish's Modern Economic Family -- A Blueprint for Trading like a Pro

Looking at Modern Economic Family member charts and connecting the different members shows a unique market vantage point.

The Modern Family has continued to serve as a reliable indicator for market direction through the years. The Family gives you an overall gauge of how aggressive or conservative you can be...

READ MORE

MEMBERS ONLY

Mish's Daily: Small Caps vs. Large Caps -- Who Is Leading?

Clearly, large-cap stocks have been leading, with the Dow Jones Industrial Average ($INDU) down the least year-to-date. Yet, even though the selling pressure has been constant, trading volume has been anemic.

The iShares Russell 200 ETF (IWM) normally trades approximately 27 million shares on average daily and traded approximately 17...

READ MORE

MEMBERS ONLY

Mish's Daily: Real Motion Trading -- Forecasting Reversal Patterns

The S&P 500, Dow Jones Industrial Average, and Nasdaq all traded lower on Tuesday. Despite the intense two days of selling, we have yet to see any technical criteria suggesting a crash is imminent. Our Real Motion Trading Indicator above displays downward moderated momentum and forecasted a stalled...

READ MORE

MEMBERS ONLY

Mish's Daily: This Commodity Will Sweeten Your Returns

If you're looking to invest in a commodity with high trading potential, sugar has seen significant price fluctuations in recent years.

Sugar prices have been rising due to increased demand in countries like China and India, which is likely to continue. Many factors affect the global sugar market,...

READ MORE

MEMBERS ONLY

Weekend Daily: Is Now a Good Time to Buy Silver or Gold?

While investor sentiment continues to be tugged and pulled, precious metals continue climbing.

The iShares Silver Trust (SLV) is forecast to lead gold prices higher. We like both the yellow metal and white metal. We are long in both and have taken profits along the way.

Silver ended the week...

READ MORE

MEMBERS ONLY

Mish's Daily: The Next Stop on This Fierce Bear Market Rally: A Global Recession?

Determining whether we are in a risk-on or risk-off climate is challenging, especially after a fantastic day of gains in every major U.S. index.

We should be in a risk-on environment. The Chinese stock market even rose, with technology and electric vehicles leading, as investors hoped for a more...

READ MORE

MEMBERS ONLY

Mish's Daily: Will the Dow Jones Continue Higher? Will the Nasdaq Follow?

It's been a volatile few weeks in the markets, and it can be hard to tell if we're currently in a risk-on or risk-off environment. Have we seen the market lows for 2022, or will the market reverse lower before the end of the year?

The...

READ MORE

MEMBERS ONLY

Mish's Daily: Critical Intersections for Small Caps, Retail, Semis, and Long Bonds

The overall market is at a crucial intersection.

Let's take a deeper look at a few Modern Family members, focusing on semiconductors (SMH), long bonds (TLT), small caps (IWM), and retail (XRT). These sectors will be crucial to determining the market's trajectory for the rest of...

READ MORE

MEMBERS ONLY

What to Expect from Granny Retail This Holiday Weekend

As the Thanksgiving holiday shopping weekend is here, we will be looking at Granny Retail XRT (SPDR S&P Retail ETF).

Investors and retailers are closely monitoring consumption over the holiday weekend. The National Retail Federation estimates that 166.3 million Americans will shop through Cyber Monday, up by...

READ MORE

MEMBERS ONLY

Big View Analytics: Consumer Discretionary vs. Consumer Staples

As the Thanksgiving holiday shopping season approaches, let's look at our Big View leading sector exchange-traded funds (ETFs) and the current tug-of-war between Consumer Discretionary (XLY) and Consumer Staples (XLP).

The chart displays the price spread between Consumer Discretionary (XLY) over Consumer Staples (XLP). Consumer Staples leads as...

READ MORE

MEMBERS ONLY

The Dow Jones Leads as Investors Prepare for Thanksgiving

The market had a relatively quiet day as investors look to the Thanksgiving holiday. Stocks did end lower on Monday, with the QQQs declining 1.1%. DIA lost 0.06% today. As seen in the chart above, starting from October 11, 2022, the Dow Jones (represented by DIA) outperformed the...

READ MORE

MEMBERS ONLY

The Risk On/Risk Off Gauge Just Flashed Red

It can take time to determine what financial news to trust and who to follow, with many conflicting market opinions and a 24-hour-driven news culture.That's one reason we use a rules-based methodology and quant modeling, combined with our proprietary trading indicators to help us make informed decisions...

READ MORE

MEMBERS ONLY

Learn What's Driving Retail Sales Growth

Today, the Commerce Department's retail sales report showed solid consumer spending. Yet robust retail sales data failed to boost the market.

Consumption accounts for approximately 70% of our economy. SPDR S&P Retail ETF (XRT), or Granny Retail, is a large, diversified ETF representing broad market consumption....

READ MORE

MEMBERS ONLY

This Semiconductor ETF Might Signal a Chip Recovery

Semiconductors are an essential part of our daily lives, a geopolitical football of national security interests, and chips are increasingly in demand.

Meet Sister Semiconductor (SMH), also known in trading circles as the VanEck Semiconductor ETF (SMH). SMH potentially indicates new leadership in the beaten-down tech industry.

Today, institutional investment...

READ MORE

MEMBERS ONLY

U.S. Inflation to Remain a Pain in Granny Retail's Side

The retail sector soared after the CPI report last week, as represented above by Granny Retail, the lead shopper of Mish's Modern Family, SPDR S&P Retail ETF (XRT).

The latest Consumer Price Index (CPI) reading came in at 7.7% versus 7.9% showing 0.20%...

READ MORE

MEMBERS ONLY

All Indices Improved Their Market Phases This Week

The mid-terms are now somewhat behind us, and this week we saw the FTX crypto exchange file Chapter 11. Some investors worry that there might be more domino effects in the institutional crypto space. It is worth keeping an eye on.

Concerning the market, the mild CPI inflation numbers caused...

READ MORE

MEMBERS ONLY

What Investment Theme Will Lead the Market in 2023?

Market leaders are constantly evolving and staying up to date on the newest trends, and macro events can be challenging. Looking back at previous decades of market leadership provides insight into how market leaders change over time, and the impressive cumulative returns indicate potential future market leadership gains.

It may...

READ MORE

MEMBERS ONLY

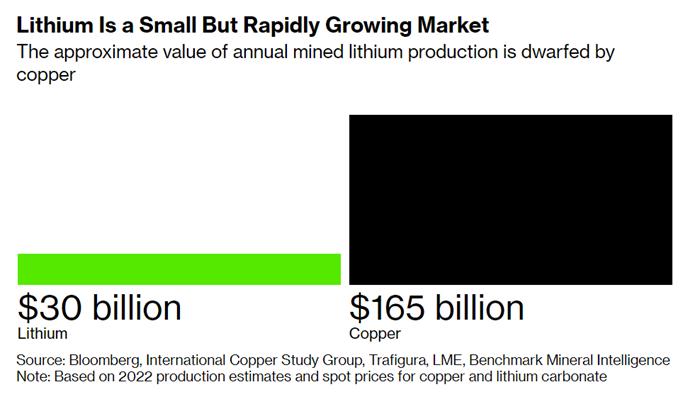

Mish's Daily: Lithium -- The Electrification of Transportation

The race to secure lithium supplies is on.

While lithium demand multiplies, geopolitical concerns between China and the West have made securing a reliable supply of lithium more difficult. Lithium is becoming one of the world's most-sought commodities, yet the annual amount globally is still tiny. Battery makers...

READ MORE

MEMBERS ONLY

Midterm Election Results: Why Should the Stock Market Care?

Conventional wisdom is that the Democrats will retain the Senate and lose the House, but there's a chance the Republicans could easily sweep both chambers. With the midterm elections tomorrow, it's still too early to call the outcome of many of the races, and we may...

READ MORE

MEMBERS ONLY

Weekend Daily: Has "Dr. Copper" Signaled a New Round of Inflation?

As we await the midterm elections next week, there was massive speculation about China loosening COVID-19 restrictions.

Additionally, with a lack of global copper inventories, metals and miners erupted on Friday. Global X Copper Miners (COPX) found significant support twice at the 200-week moving average. COPX sold off at critical...

READ MORE

MEMBERS ONLY

Fed Hikes Interest Rates, Hurts Consumers and Hits Granny Retail

The Fed has never raised the target interest rate four times in a row, with a 75 basis point each time – till today. They still need to beat inflation.

Today, they harmed retail stocks, hurt consumers, and decreased real estate values.

Granny Retail was gaining strength and displaying demonstrated Triple...

READ MORE

MEMBERS ONLY

Look Who's Leading Now

Since the market's dramatic intraday reversal at the lows of the year on Oct. 13, the equity indexes have rallied in the face of headwinds from rising interest rates, lowered earnings expectations, big high-profile earnings misses, and the uncertainty of tomorrow's Fed announcement.

This may be...

READ MORE

MEMBERS ONLY

Markets are Shifting; Should Your Trading Strategy Shift Too?

Mish is at the Money Show, so I (Wade Dawson) am filling in for two days till she returns, and I already managed to miss her daily publishing deadline.

Sorry folks. I am posting this late or early now, but all of you are included, and all of you have...

READ MORE

MEMBERS ONLY

Weekend Daily: Can Investors Trust This Rally?

GDP data painted a somewhat roseate picture for the US economy this week. Yet inflation is still rising.

The PCE price index climbed by 0.3% in a month and was up 6.2% from the prior year. Still very far from the Fed's 2% inflation target. Consumer...

READ MORE

MEMBERS ONLY

Mish's Daily: Granddad Russell 2000 Leads This Stock Market Rally

This week, it is crucial for traders to maintain the overall macro firmly in their vision.

We are keeping an eye on the indices, currency movements, the PCE print, and the GDP statistics. We also closely follow the small caps this week, the Russell 2000 (IWM), and the patriarch of...

READ MORE

MEMBERS ONLY

Will Regional Banks Finally Begin to Shine?

This week is a big week for earnings.

Furthermore, PCE and GDP prints will also be closely watched.

This week will be important in determining the tone leading to the Fed meeting next week and the midterm elections on November 8.

As many investors will be watching tech earnings, many...

READ MORE

MEMBERS ONLY

Weekend Daily: The Perfect Storm - U.S. Dollar, Inflation and Precious Metals

According to recent PPI and CPI prints, inflation has plateaued. Some analysts will argue that inflation has hit its zenith. However, what if one of the next catalysts to even higher inflation is spurred by the potential and recent peak in the U.S. dollar?

Looking at the price chart...

READ MORE

MEMBERS ONLY

Mish's Daily: Russell 2000 -- How Money is Made and Lost in Small Caps

The Grandaddy Russell 2000 rallied close to its 200-week moving average (topic of our previous article) yesterday. On Wednesday, with rising yields once again, Gramps retreated.

In a bullish scenario, IWM continues to consolidate and rally in the coming days and weeks, eventually breaking through the 200-week moving average and...

READ MORE

MEMBERS ONLY

Mish's Daily: The Four Indices -- Where Each Are in a 4-Year Cycle

The 200-week moving average (about 4 years), represented on the charts as a green line, is starting to look like one of the more important and pivotal chart points.

There is very little written about the 200-WMA. But only once, in 2007, did the SPY break its 200-WMA, for a...

READ MORE

MEMBERS ONLY

Mish's Daily: 4 Indicators and The "Bear Market" Rally

The 200-week moving average or about 4-years, represented on the charts as a green line, is starting to look like one of the more important and pivotal chart points.

Although there is very little written about the 200-WMA, only in 2007 did the SPY break its 200-WMA for a period...

READ MORE

MEMBERS ONLY

Weekend Daily: Precarious Action in the Bonds and Stock Market

It was a wild ride on Wall Street this week, with stocks swinging wildly in both directions before closing overall a little lower for the week. The CPI data indicates inflation is entrenched in the economy, squeezing household real income, and is a significant concern for businesses.

This year also...

READ MORE

MEMBERS ONLY

Mish's Daily: Taking the Temperature of the Economic Modern Family

One of the most important first steps towards trading success is to tilt your trading towards trending sectors that display strength and avoid market weakness. A very helpful tool for understanding the underlying forces driving trends is Mish's Modern Economic Family, a simplified economic market model. The Family...

READ MORE

MEMBERS ONLY

Mish's Daily: Analyzing Two Stocks in the Grocery Space

With the potential of a full recession looming in the coming quarters, investors are looking for defensive plays, such as dividend-paying stocks and businesses more resilient in economic downturns.

Looking at Tuesday's market close, XRT, a.k.a. Granny Retail, was up 1.1%, along with Costco (1....

READ MORE

MEMBERS ONLY

Mish's Daily: The Convergence of Market Headwinds and Mid-Term Elections

The S&P 500, represented by the SPY, has generally stayed above the 200-week moving average long-term. It is a good line in the sand to use as a guide for potential market crashes. Bear market declines are primarily responsible for the few occasions when the SPY dipped to...

READ MORE

MEMBERS ONLY

Weekend Daily: Don't Be Afraid of the Fed; The Modern Family Will Guide You

Wall Street sold off dramatically on Friday after the jobs report. While the economy is stagnating, many investors are concerned that the Fed will raise rates too quickly, pushing the U.S. economy into a deep recession.

It is good to stay current on the unemployment rate and Fed policy....

READ MORE

MEMBERS ONLY

Mish's Daily: The Battle of Supply and Demand, Oil, Gold and the Market

As predicted, and as we wrote about yesterday, oil prices continued to climb in anticipation of an OPEC+ production cut. Reports confirmed today that OPEC+ will cut production by 2 million barrels a day.

The Strategic Petroleum Reserve (SPR), which the Biden administration has tapped to ease gas prices, has...

READ MORE

MEMBERS ONLY

Mish's Daily: Gasoline Prices Matter to the Stock Market

It's no secret that gas prices significantly impact the economy, discretionary spending and stock market prices. Gas prices were at record highs following an incredible run-up over the summer and have declined steadily until recently, as represented by the United States Gasoline Fund (UGA). Treasury yields have fallen,...

READ MORE