MEMBERS ONLY

Mish's Daily: 3 Technical Lessons on Whether or Not Semiconductors Bottomed

We currently have high inflation, a rising US dollar, and massive global interest rate hikes that have hammered stocks. Investors have lost approximately $24 trillion in value destruction for 2022 already.

The good news today is that it appears a short-term bottom has been reached, and a potential rally is...

READ MORE

MEMBERS ONLY

Anticipating More Inflation

It is crucial to prepare for adjustments in Fed policy and the credit markets, and adjust your trading accordingly, given the persistence of high inflation.

As seen above, The Fed-preferred inflation gauge (core PCE) remained elevated at 4.9% in August, as data released Friday remains far above the Fed&...

READ MORE

MEMBERS ONLY

Mish's Daily: Mid-September Column Highlights

As we prepare to move into October, I wanted to take a moment to highlight some of my recent daily columns from September.

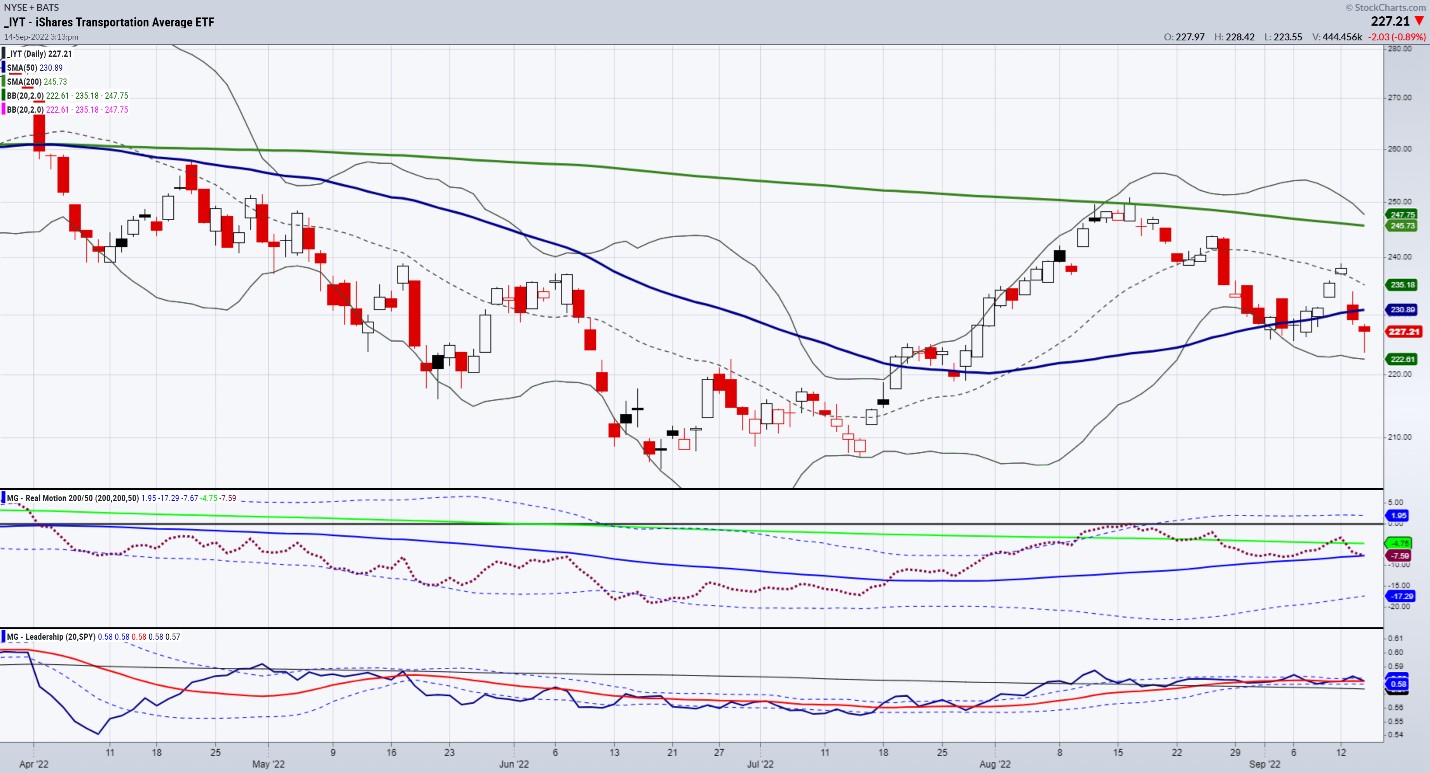

On September 13, I wrote a Daily titled "Why Higher Inflation Matters and Transportation is Key". In it, I highlighted that the transportation sector and...

READ MORE

MEMBERS ONLY

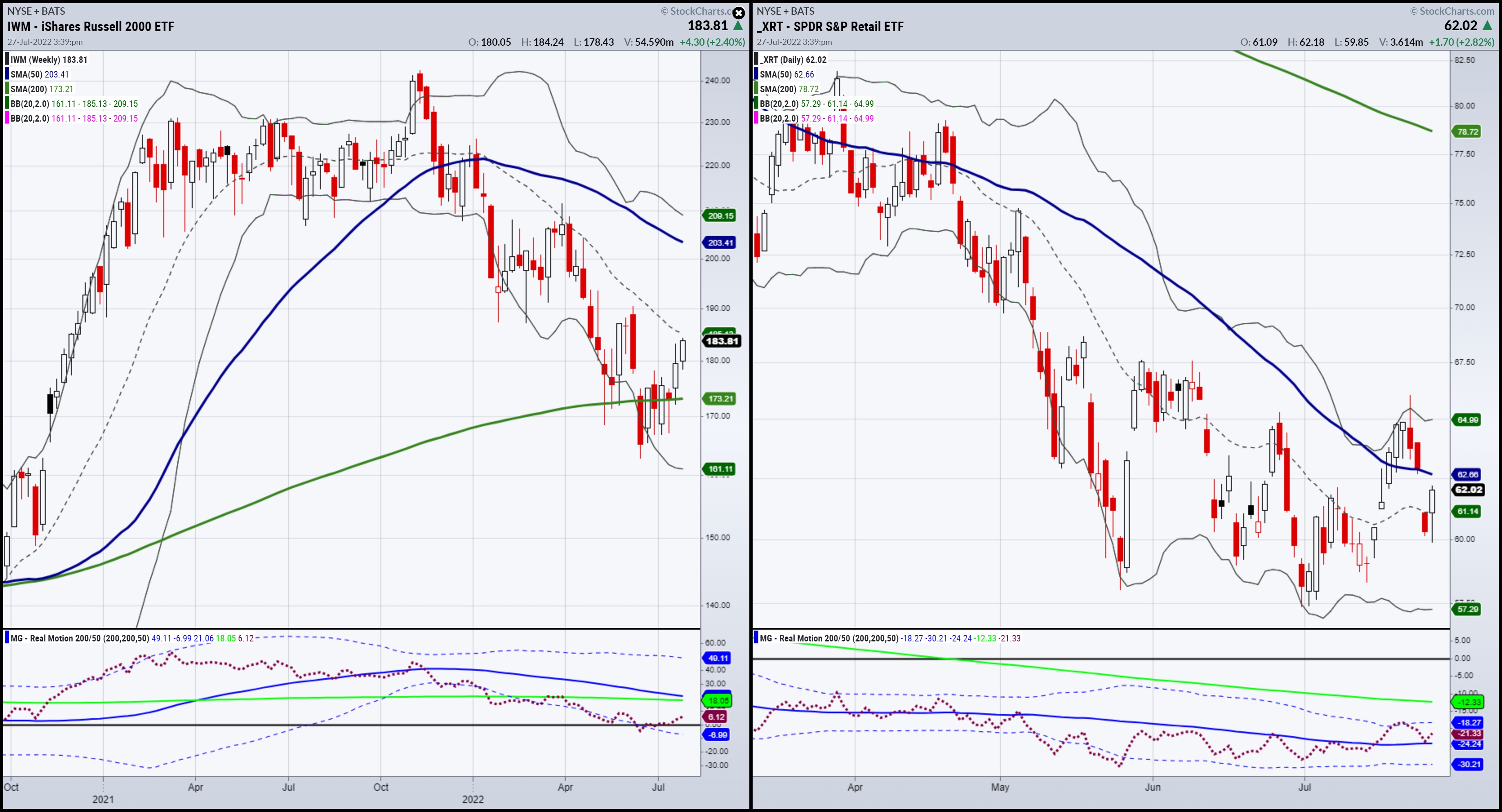

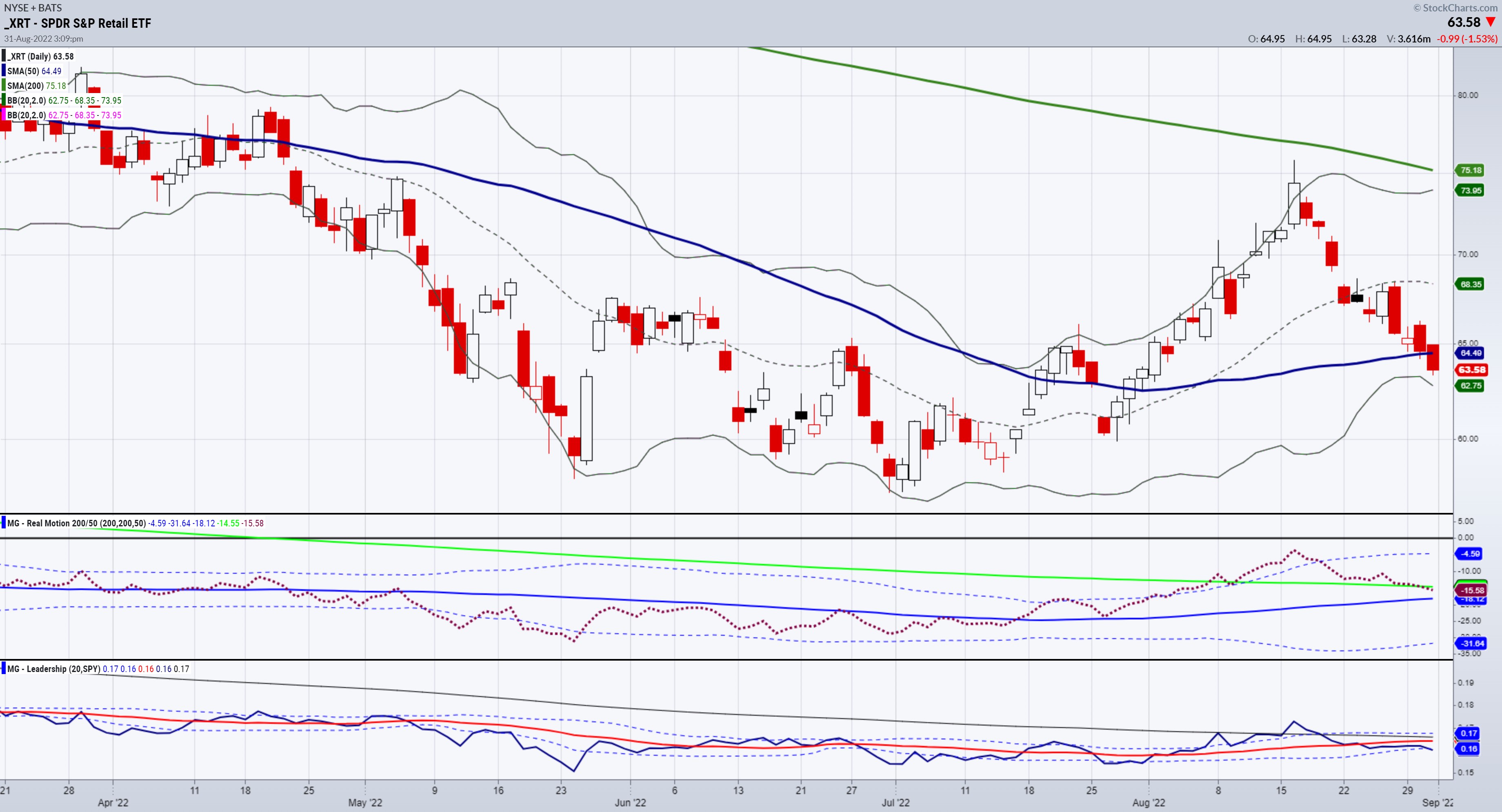

Mish's Daily: The Retail Market as a Stock and Economic Indicator

As the selloff continues, our Big View serviceRisk Gauge has been bearish for weeks, signaling risk off.Most of our portfolio strategies hold more than 50% cash, some are short, and my discretionary service is looking to deploy capital soon.

Today, we'll focus on what the retail sector,...

READ MORE

MEMBERS ONLY

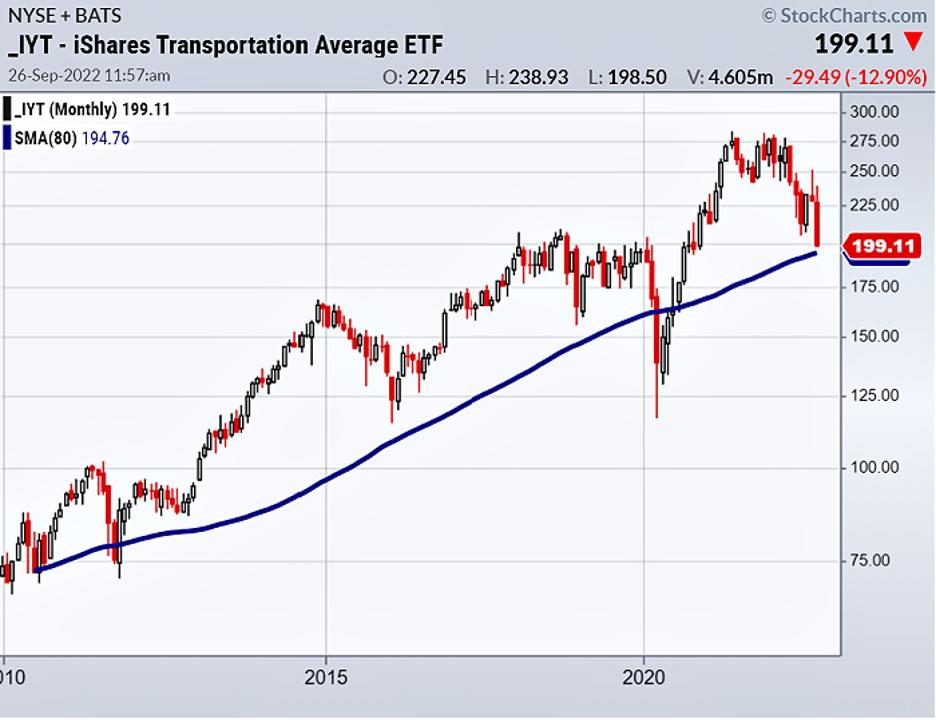

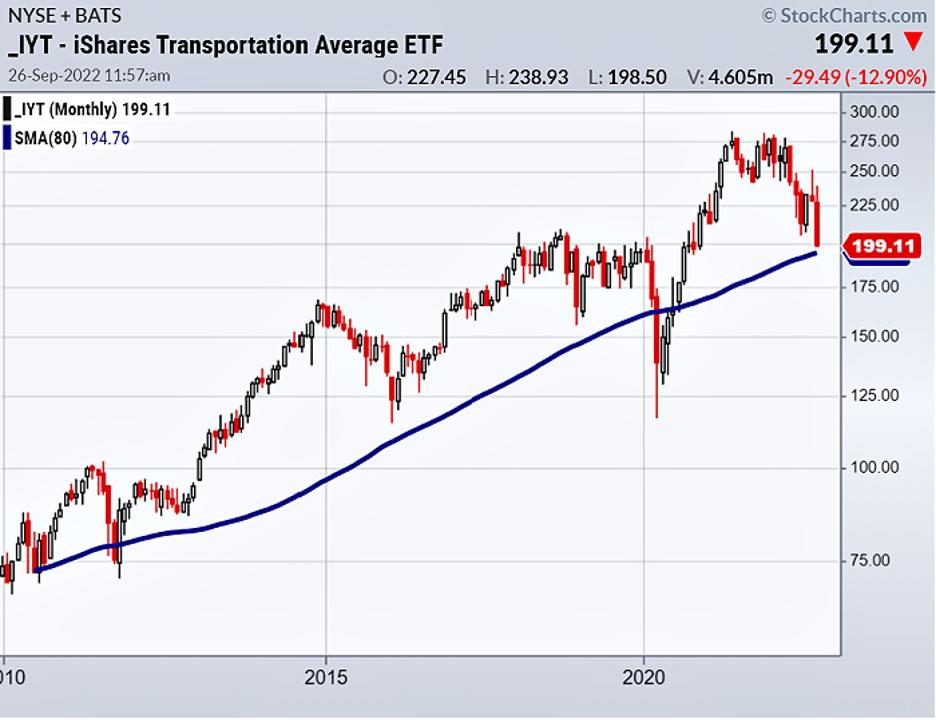

Mish's Daily: Step Back to the Monthly Chart on Transportation

Last Friday, I spoke on Women of Wall Street Twitter Spaces and Fox Business's Making Money with Charles Payne to talk about a key monthly moving average.

What makes this moving average so important right now is that three of the Economic Modern Family members are testing it....

READ MORE

MEMBERS ONLY

Weekend Daily: The Biotech Sector Should Come Back First

The market has turned for the worst in recent weeks and continues to fall in a bear market fashion.

Most of our portfolio strategies are holding more than 50% cash, some are utilizing inverse ETFs, and in my discretionary trading service, we are largely in cash. We are looking for...

READ MORE

MEMBERS ONLY

Mish's Daily: What is the Impact of the Fed Hike?

The FedEx news has caused many analysts to worry about the transportation sector and the potential ripple effects this could have on the rest of the market. As we have written before, transportation sector is seen as a barometer of economic activity. The Fed hikes and FedEx lowered profit revisions...

READ MORE

MEMBERS ONLY

Mish's Daily: Is Silver About to Outshine Gold?

With the Fed about to announce its next interest rate change, it's a good time to check out the condition of gold (GLD). After all, gold is a tried-and-true safe haven asset, and has historically been used as a hedge during times of uncertainty to protect against inflation...

READ MORE

MEMBERS ONLY

Mish's Daily: High Interest Rates, Your Portfolio and Next Steps

On Wednesday, the Federal Reserve is anticipated to raise interest rates by 75 basis points. How will the rate increase affect your portfolio? Depending on your investment holdings, the interest rate increase could have a significant impact.

Higher interest rates could also lead to a decrease in the stock market....

READ MORE

MEMBERS ONLY

Weekend Daily: Thinking Ahead for Trading Next Week

The market took another turn for the worse this past week, with four weeks in a row in the red and the DOW futures dropping, testing significant support from the summer. With the upcoming Fed meeting and higher rates coming to control inflation, we are watching a few themes.

Here...

READ MORE

MEMBERS ONLY

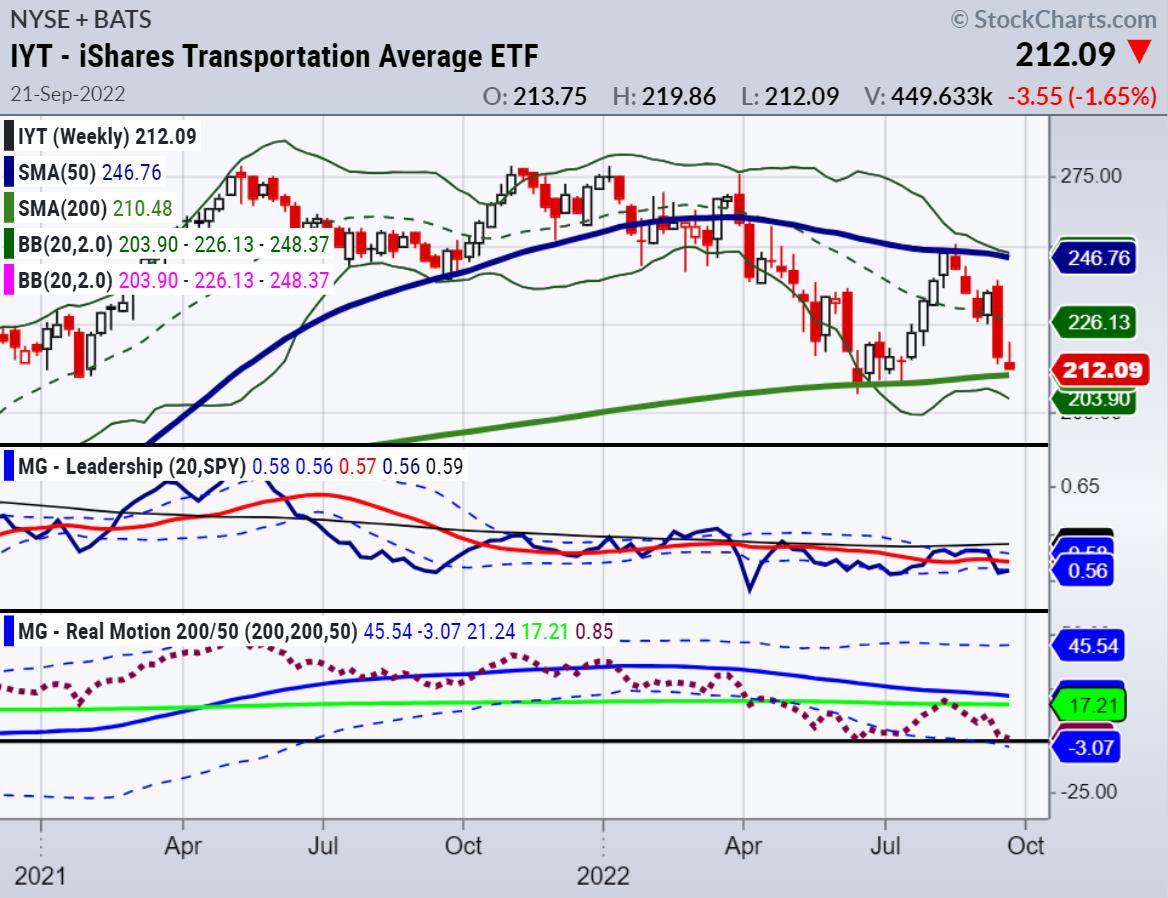

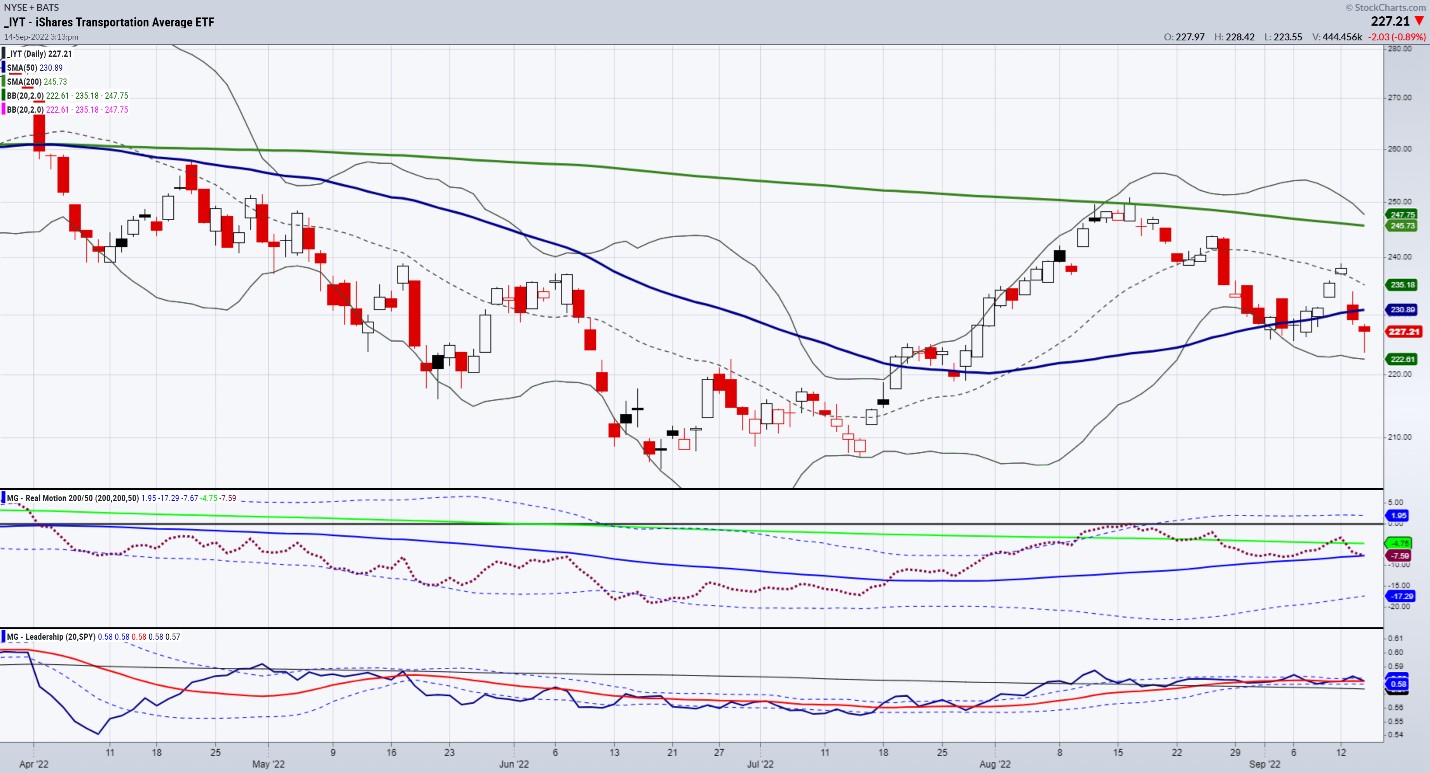

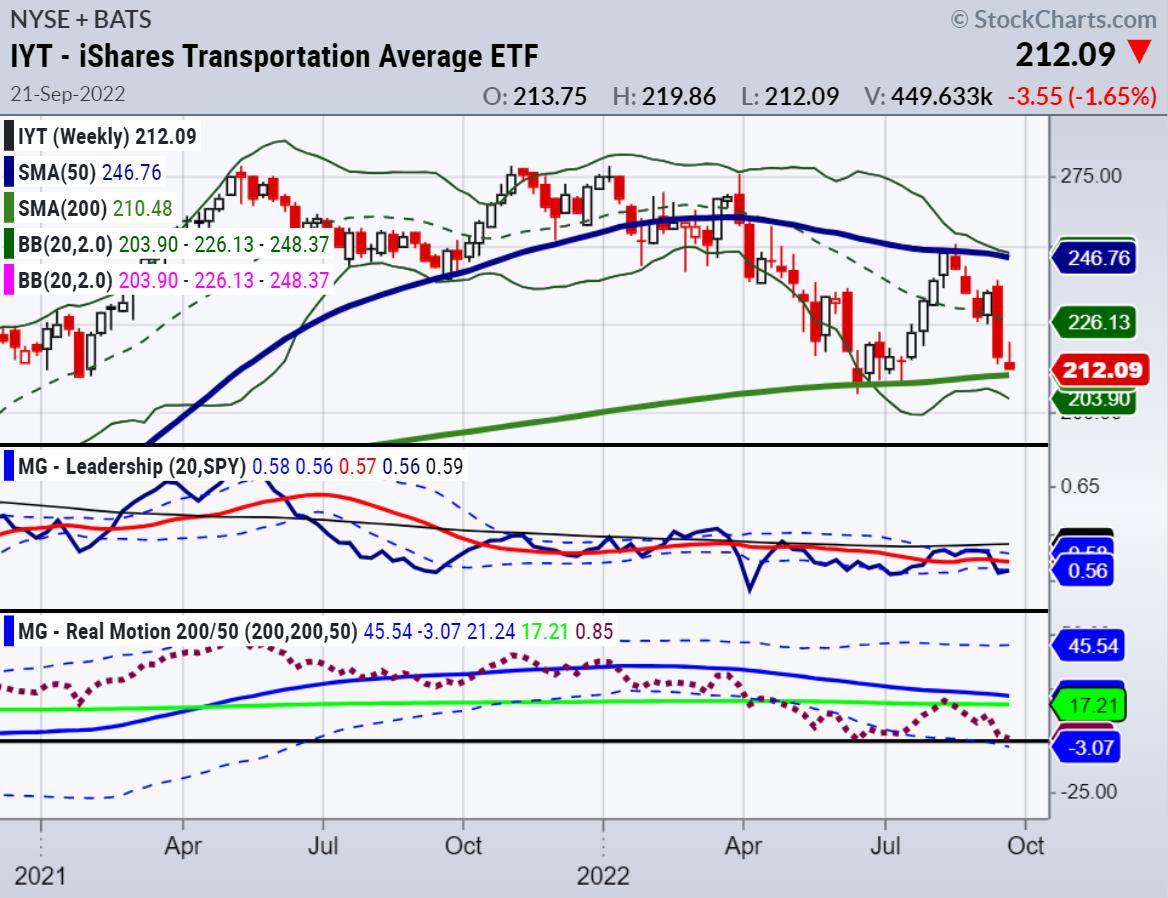

Mish's Daily: Market Stabilizes While Transports Hold Their Breath

After Tuesday's stock market rout, the outperforming sector transportation (IYT) struggled on Wednesday. Although our other indicator we have been writing about, junk bonds (JNK), led the rally in the indices, IYT did not follow.

Why?

A Western-style showdown between 60,000 rail workers, their unions and some...

READ MORE

MEMBERS ONLY

Mish's Daily: Why Higher Inflation Matters and Transportation is Key

After a higher-than-anticipated CPI report, the major market averages traded much lower. August's CPI came in increased by 20 basis points.

Fed Futures are now pricing in a 20% chance of a 100-basis point hike and an 80% chance of a 75-basis point hike. Inflation has broadened in...

READ MORE

MEMBERS ONLY

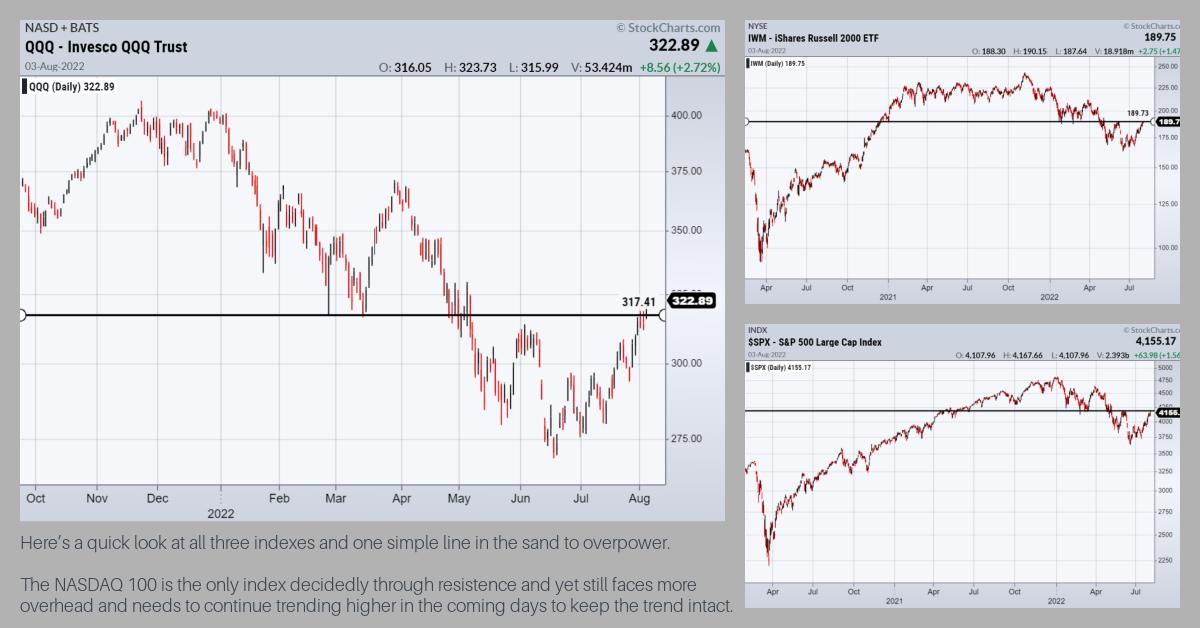

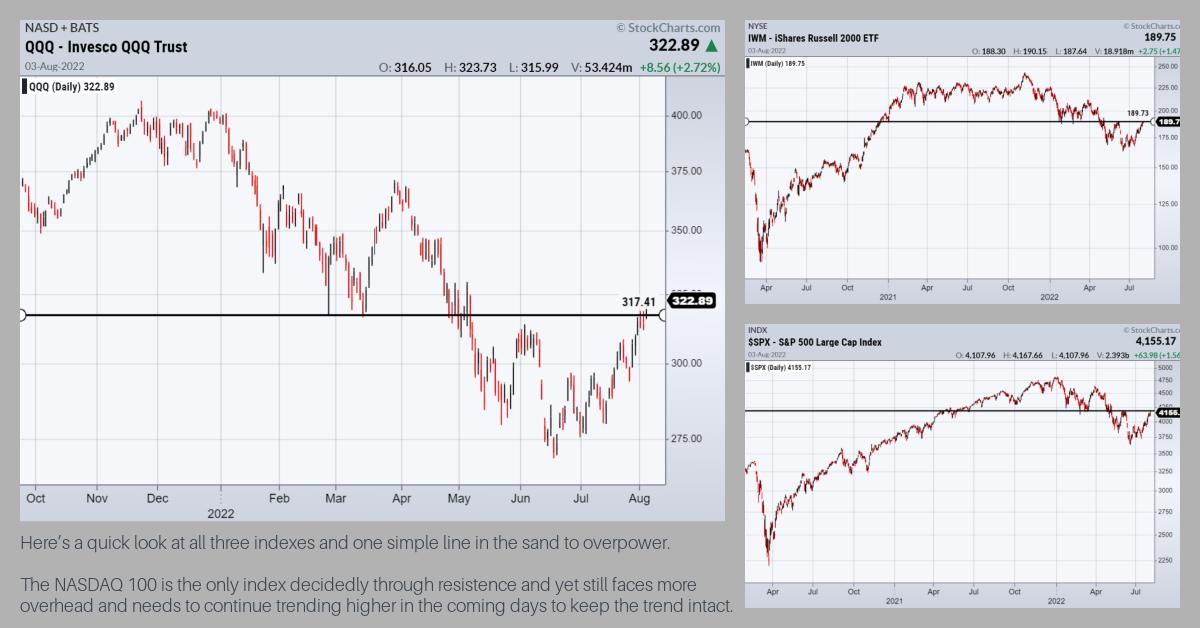

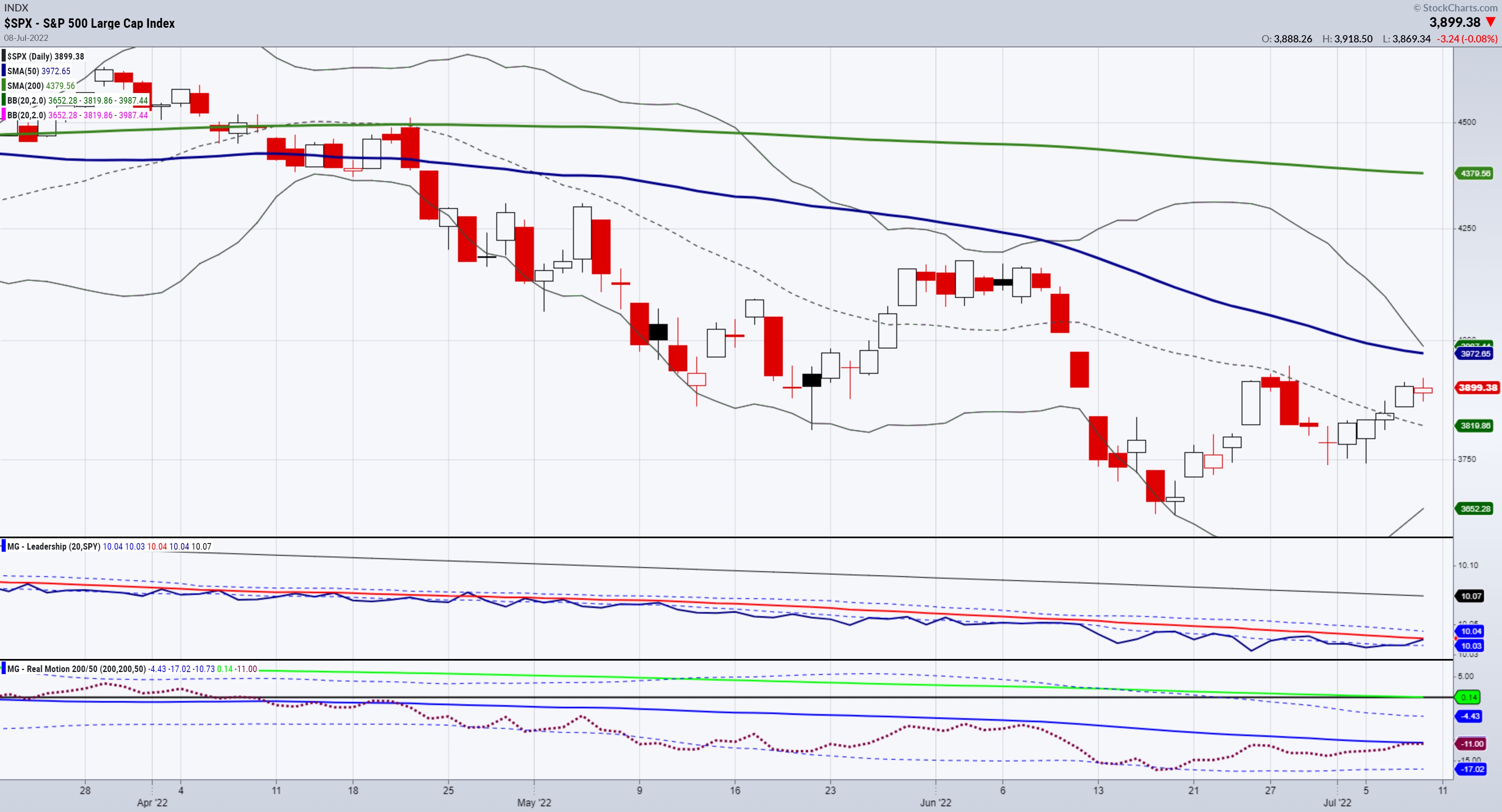

Mish's Daily: The Stock Market Bounces Amidst Strong Headwinds

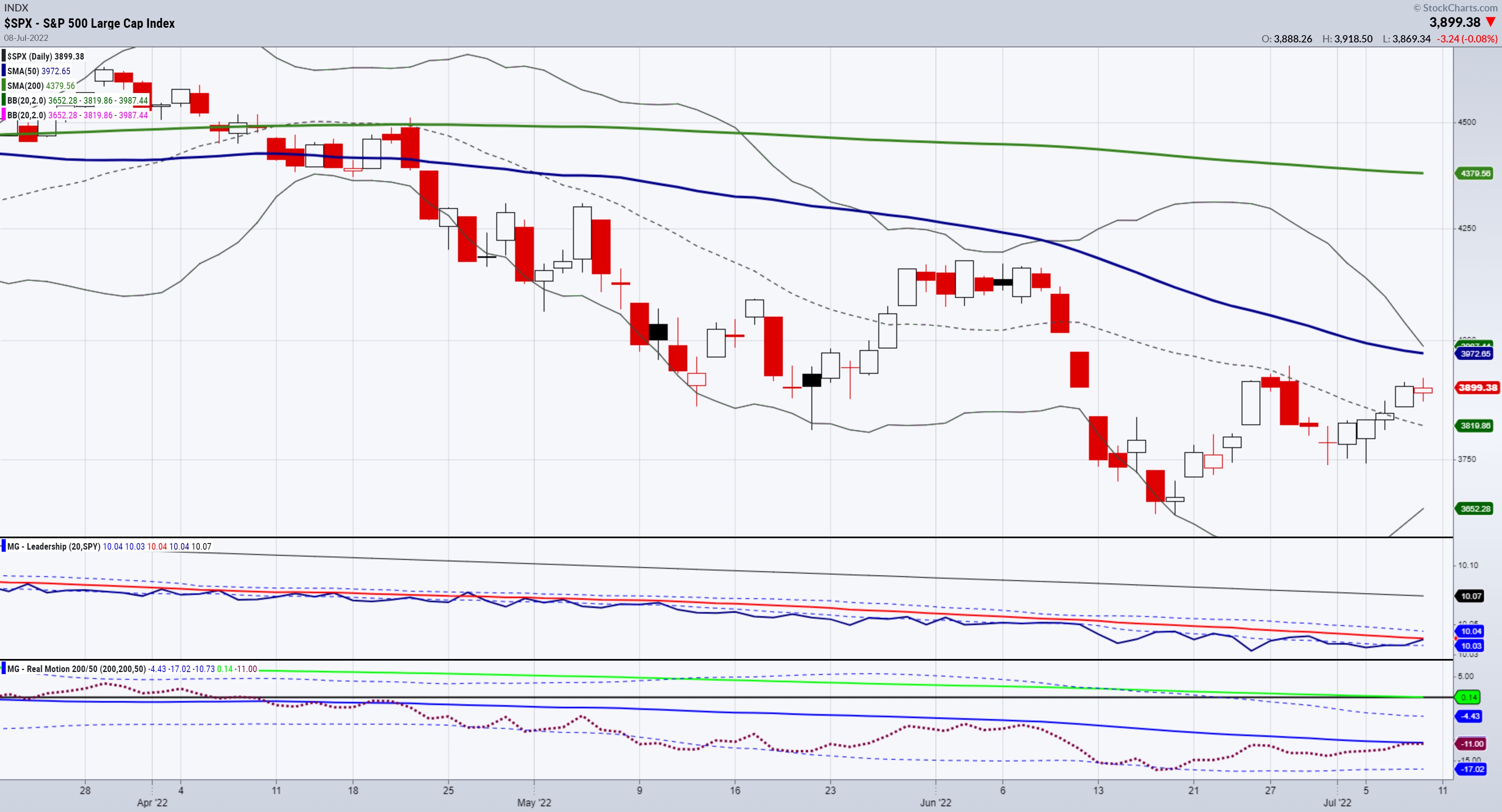

The S&P 500 was sharply oversold last week according to Our Big View weekly analysis. Hence, the market bounced and cleared the 50-day moving average in all indices.

The macro backdrop for the financial system remains the same. However, with all the headwinds, can this bounce last?

First...

READ MORE

MEMBERS ONLY

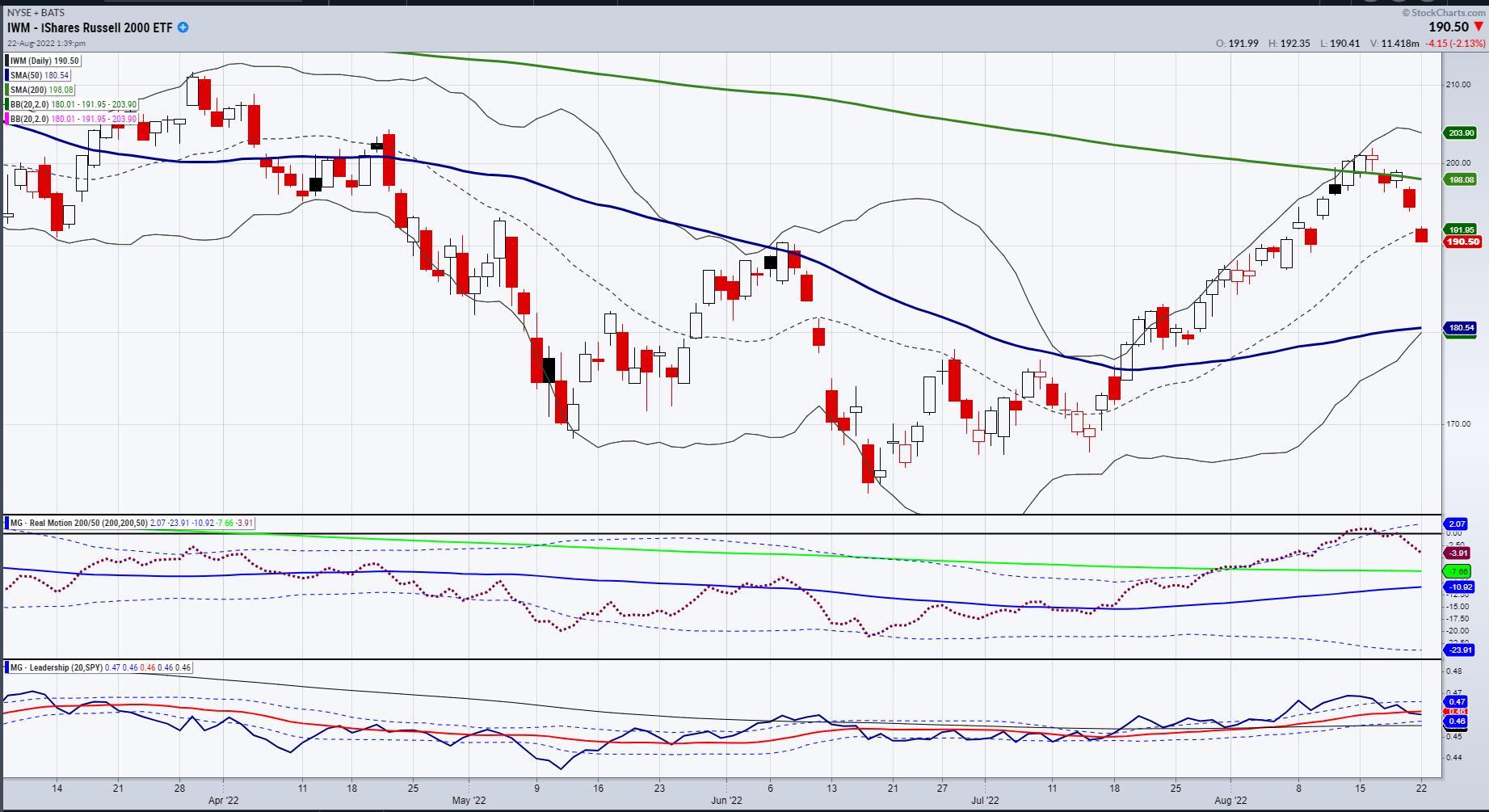

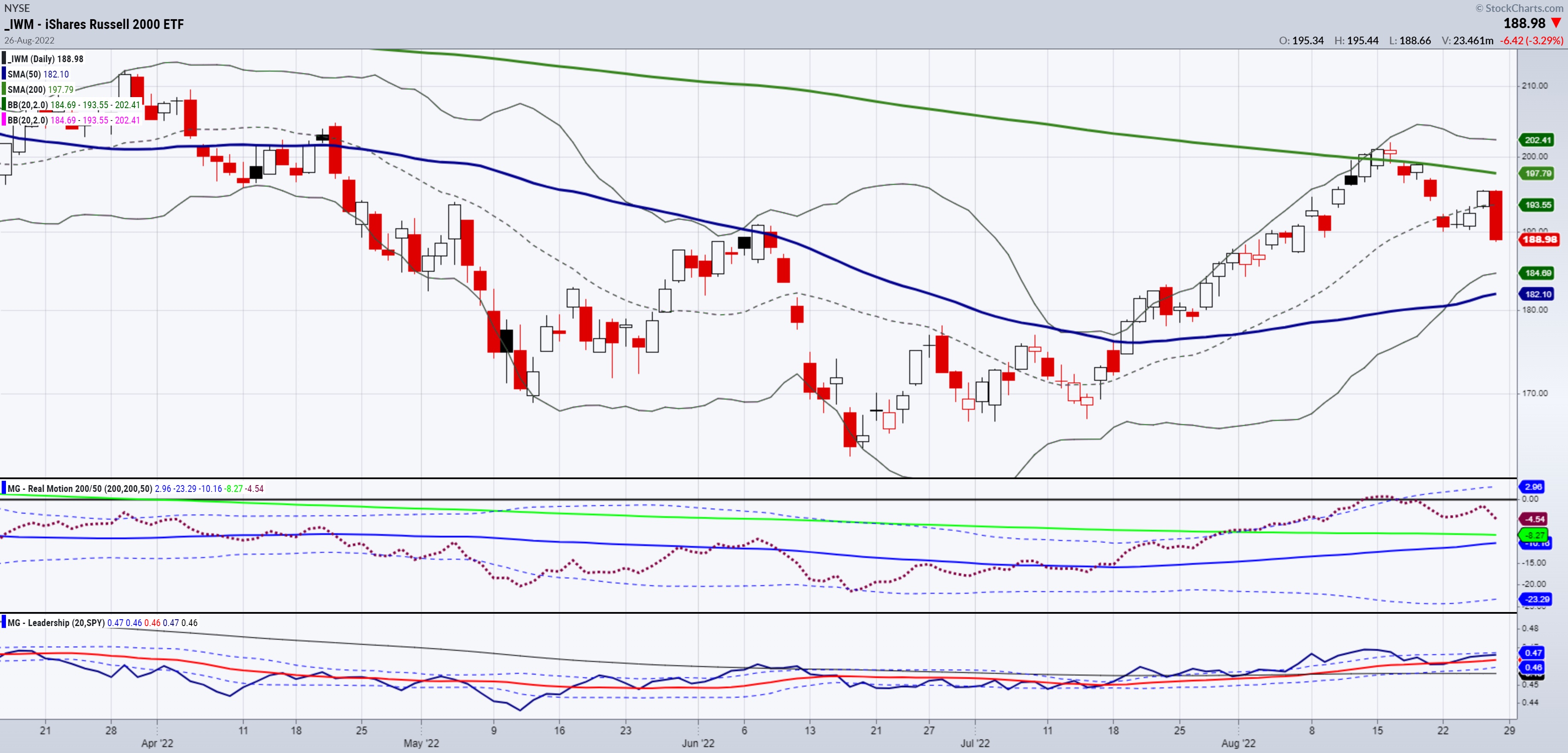

One Key Moving Average in Stocks Cleared: Now What?

Reserve Chairman Jerome Powell's speech this past week cautioned against prematurely loosening monetary policy.

Powell's speech reminds us that the Fed is focused on keeping inflation under control. Nonetheless, what we also learned this week is that technical matter. It is far more crucial to monitor...

READ MORE

MEMBERS ONLY

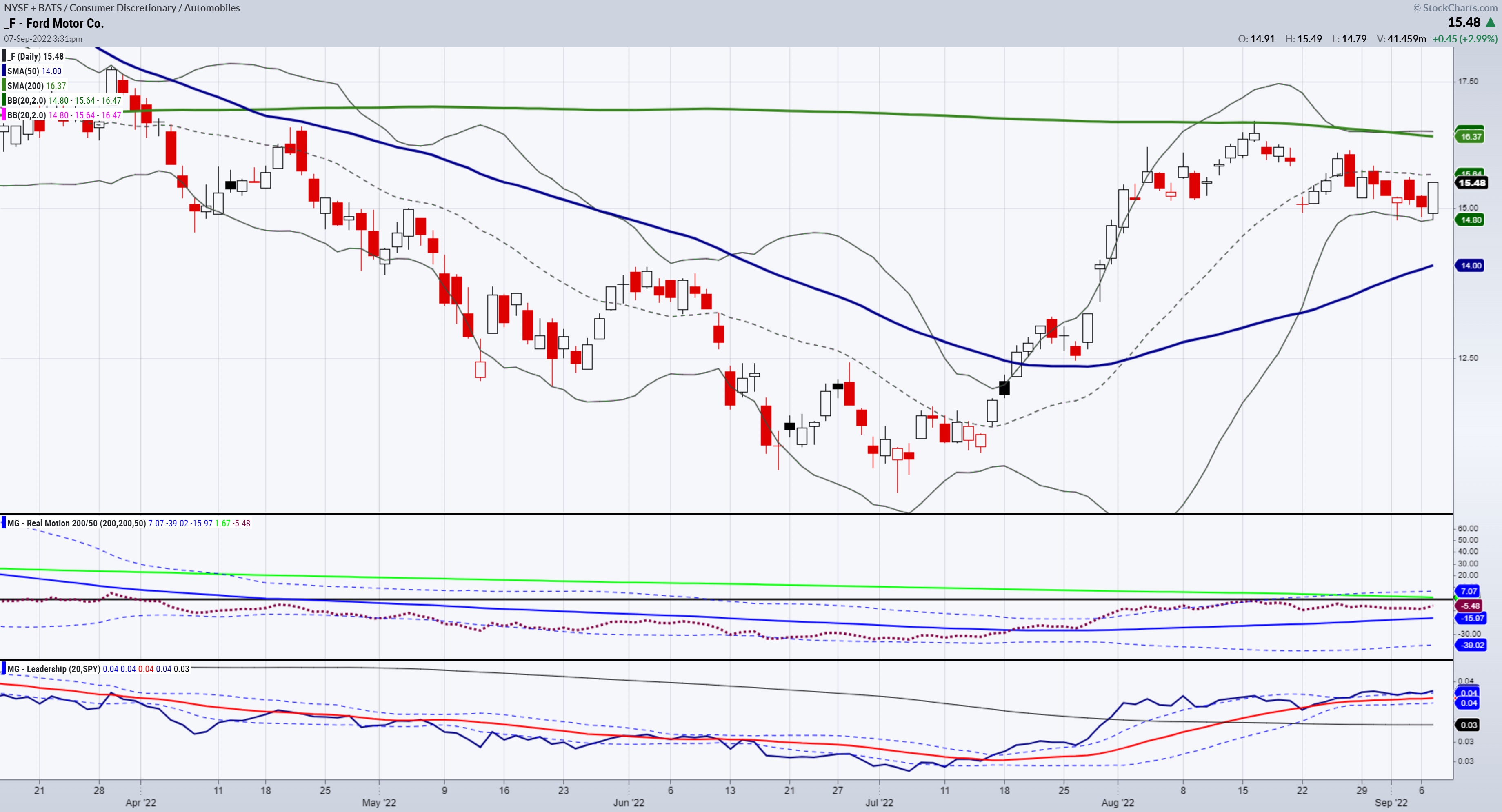

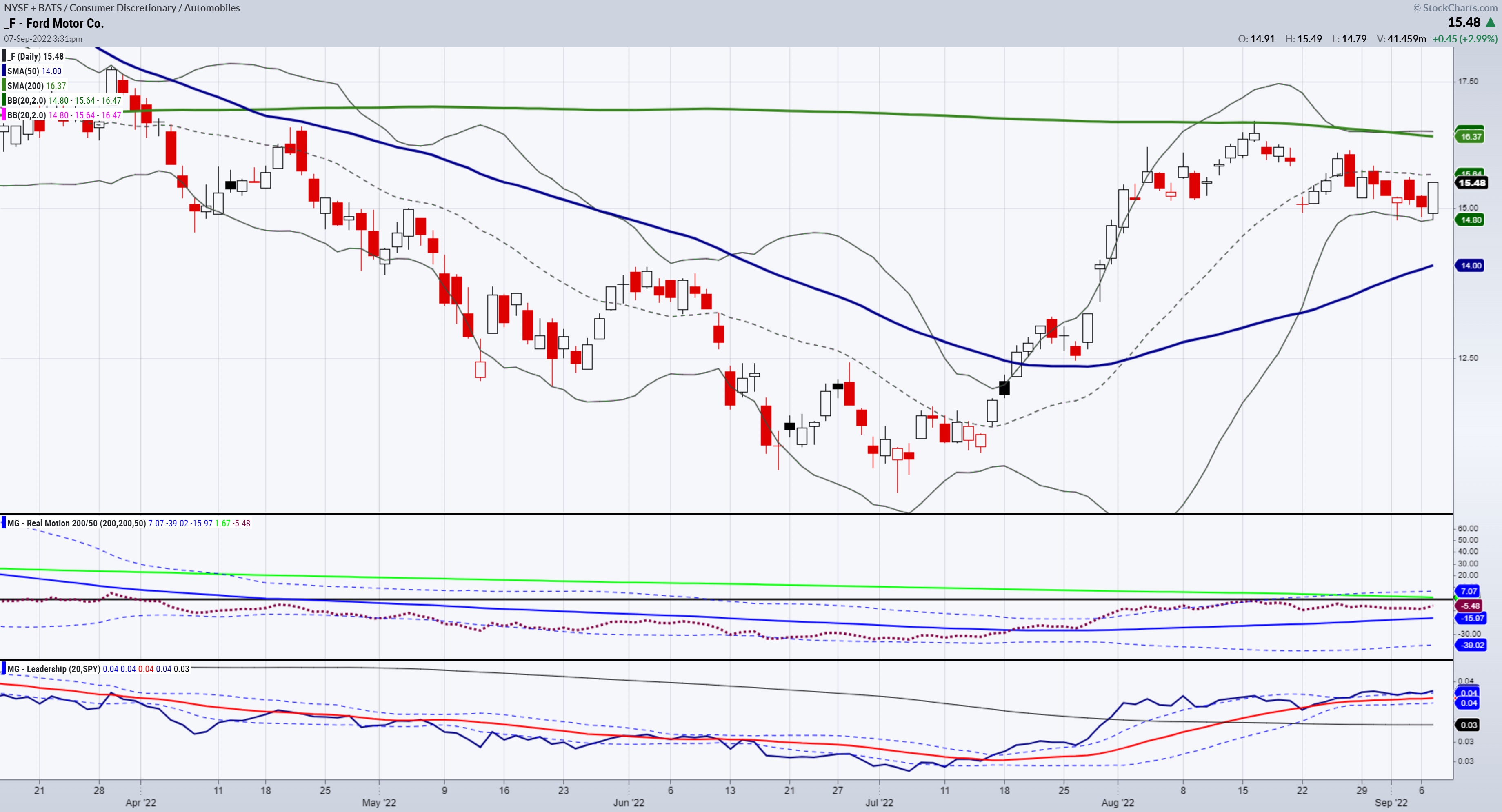

Mish's Daily: Why Ford is a Great Long-Term Investment

The Biden administration declared an intermediate target in August 2021 that 50% of all new automobiles would be electrified by 2030. This transition to lithium-ion battery power will potentially guard against climate change and counter China's aggressive push into the global EV automobile market. Electric car efforts are...

READ MORE

MEMBERS ONLY

Mish's Daily: The Economic Modern Family Reveals All for Investors

Semiconductors have been a significant drag on Wall Street. Sister Semiconductors (SMH) needs to regain her -50week moving average to really see a major technical shift in the market. She is a good barometer of the overall direction of the stock market.

The "Modern Family" comprises seven key...

READ MORE

MEMBERS ONLY

Weekend Daily: Trading Plan for the Week with the Economic Modern Family

Hello friends,

Labor Day is approaching, and the market is closed in observation, so it's time for some fantastic fun, entertainment for everyone, and relaxation.

I have been doing two videos a week along with the written commentary to introduce you to the one index and six sectors...

READ MORE

MEMBERS ONLY

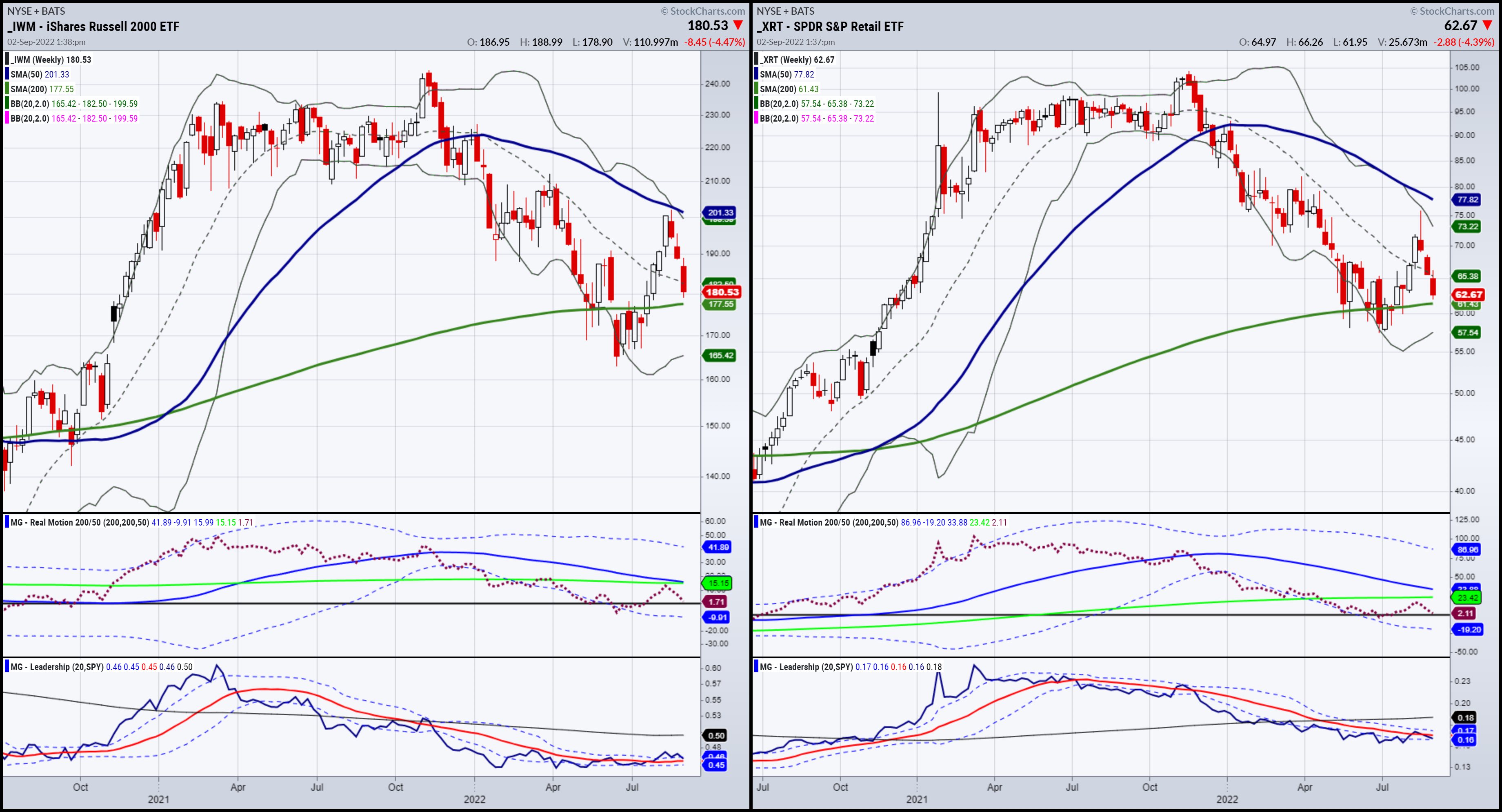

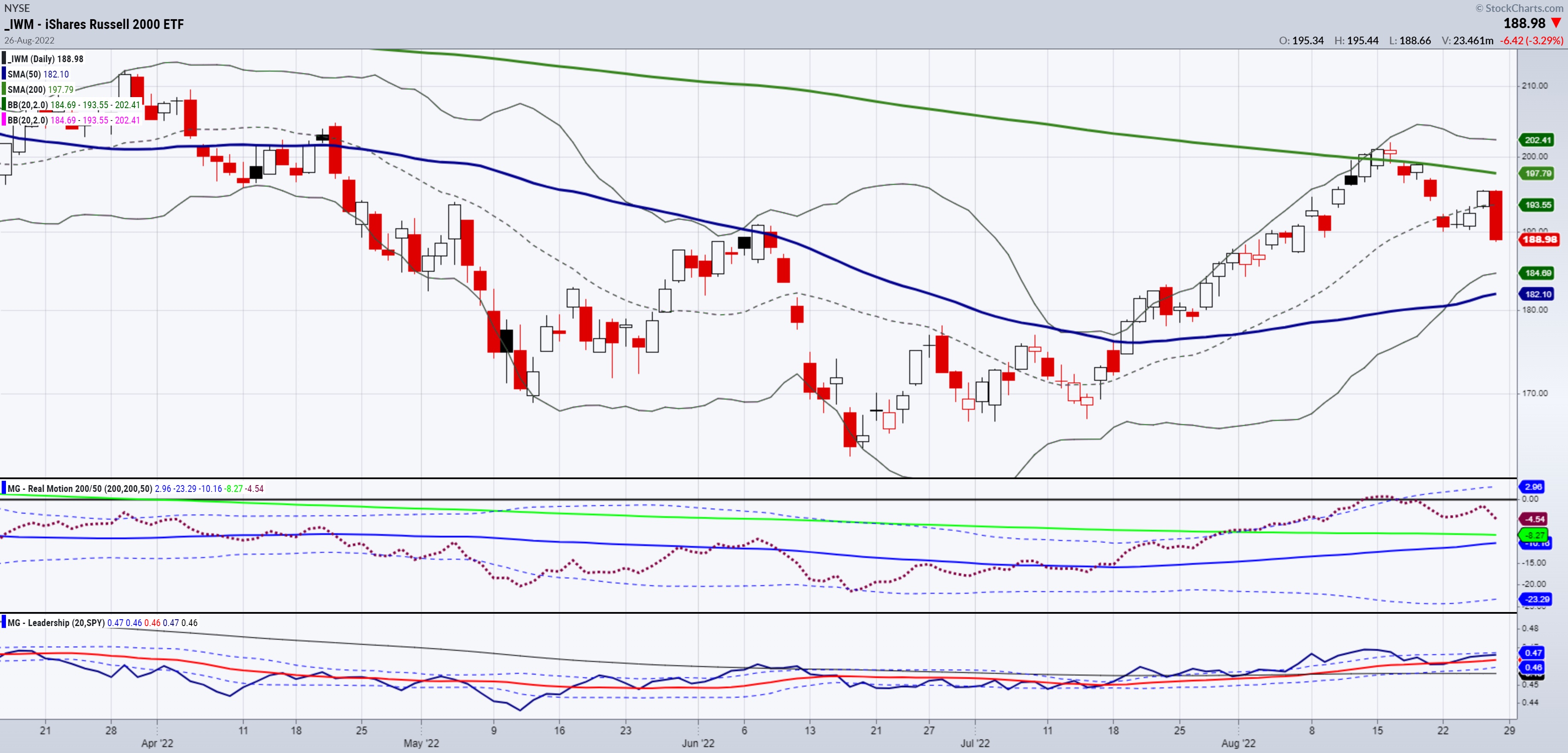

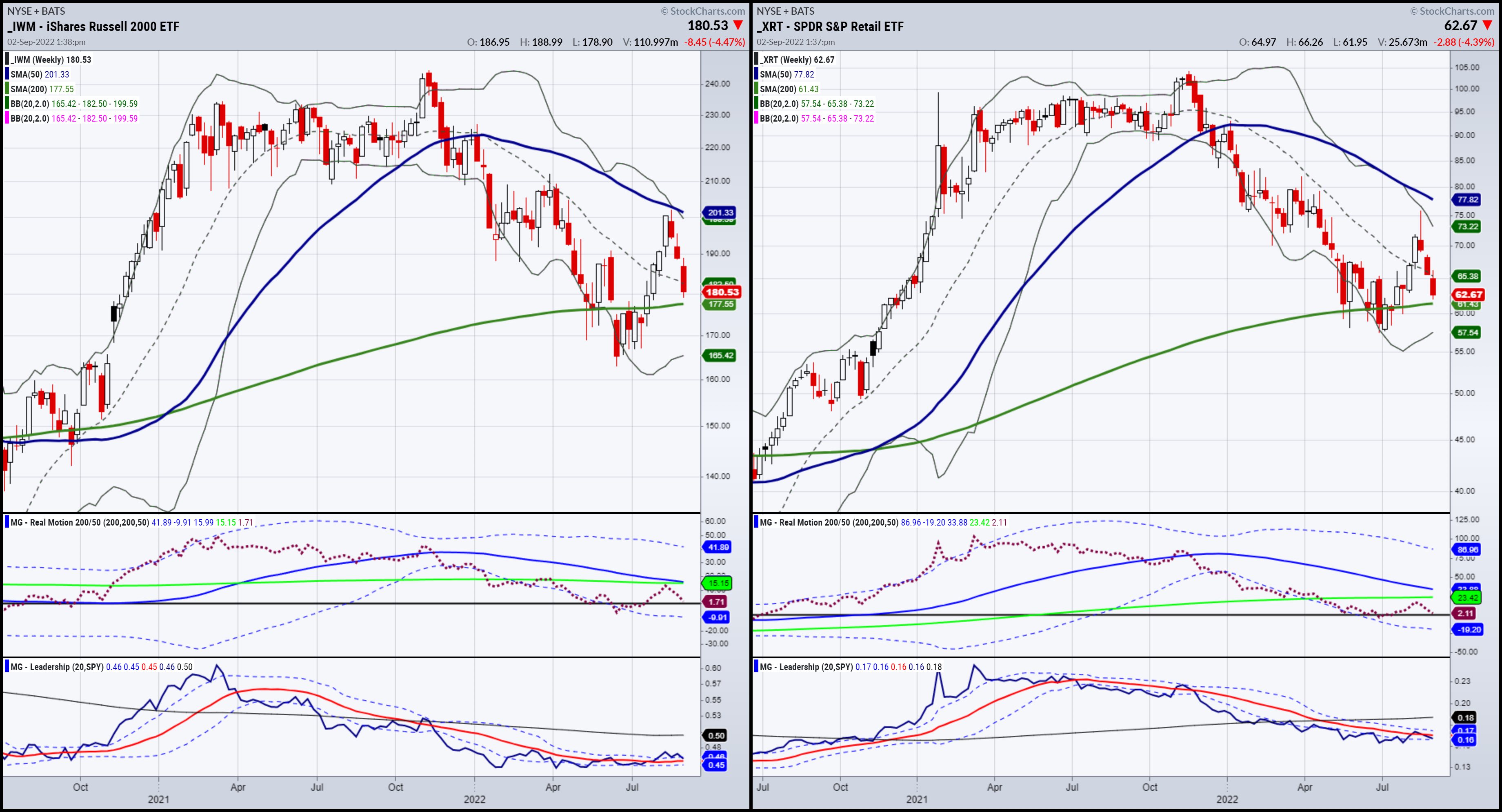

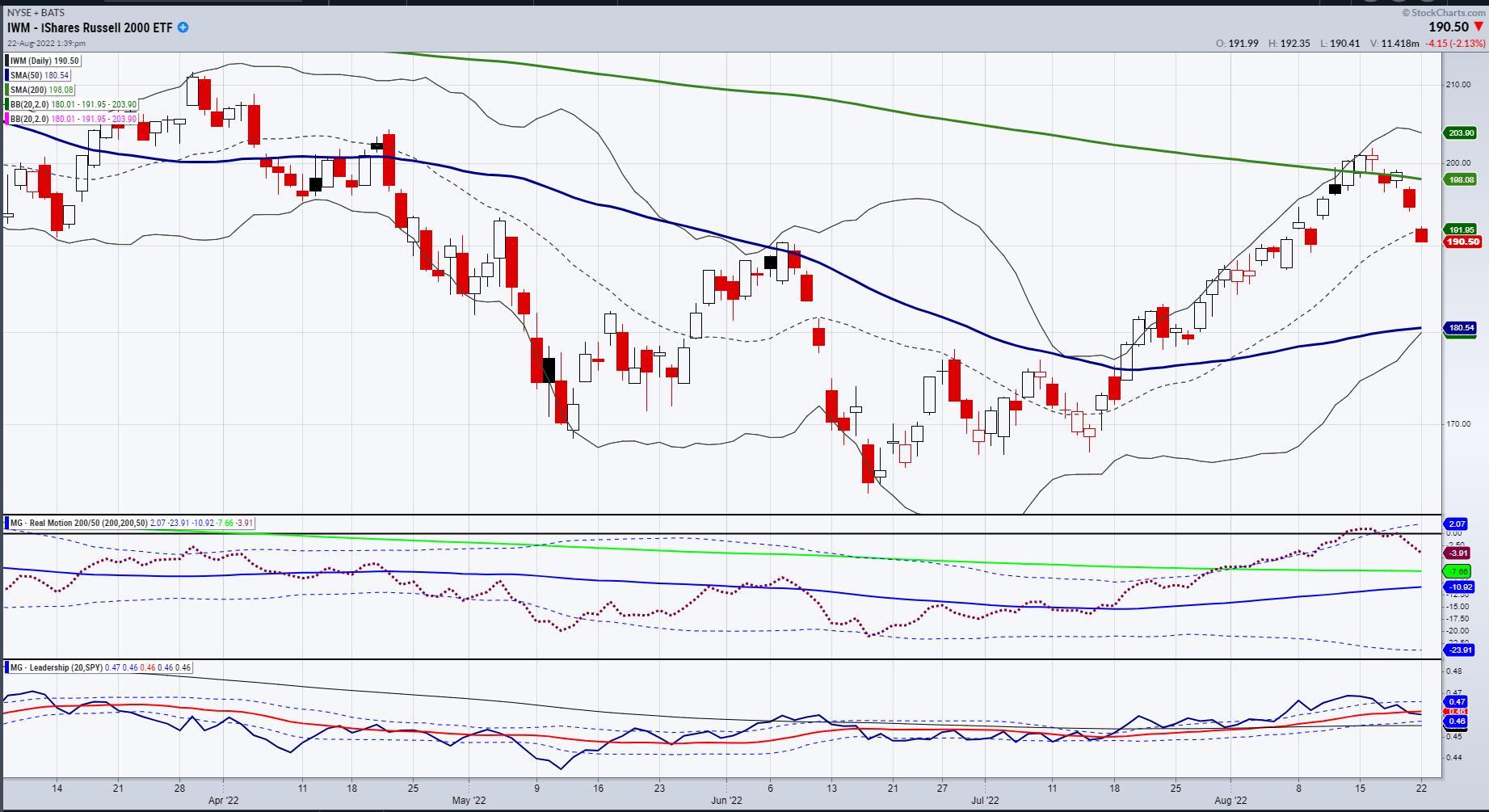

Mish's Daily Video: The Russell 2000, Retail and Transportation Tell a Story

In today's video, I'm going to introduce you to my favorite way to explain markets, price action and where the market might be headed, plus cover a few technicals with you. We will talk with three finance experts within our Modern Family to find out more....

READ MORE

MEMBERS ONLY

Mish's Daily Video: Why Watch the Transportation Sector

I have created a video recap for today's daily; the link to watch is below.

Transportation stocks are an excellent measure of industrial and manufacturing strength and supply and demand. In this video, I discuss the Transport (IYT) ETF, which is a good indicator of economic health, as...

READ MORE

MEMBERS ONLY

Powell: Inflation is Public Enemy #1 to the Stock Market

The Economic Modern Family tells us the macro story, and the charts are warning us. The indices and sectors closed the week lower and very stressed out.

The speech by Fed Chair Powell on Friday clarified what some did not want to believe, while others knew and were prepared for:...

READ MORE

MEMBERS ONLY

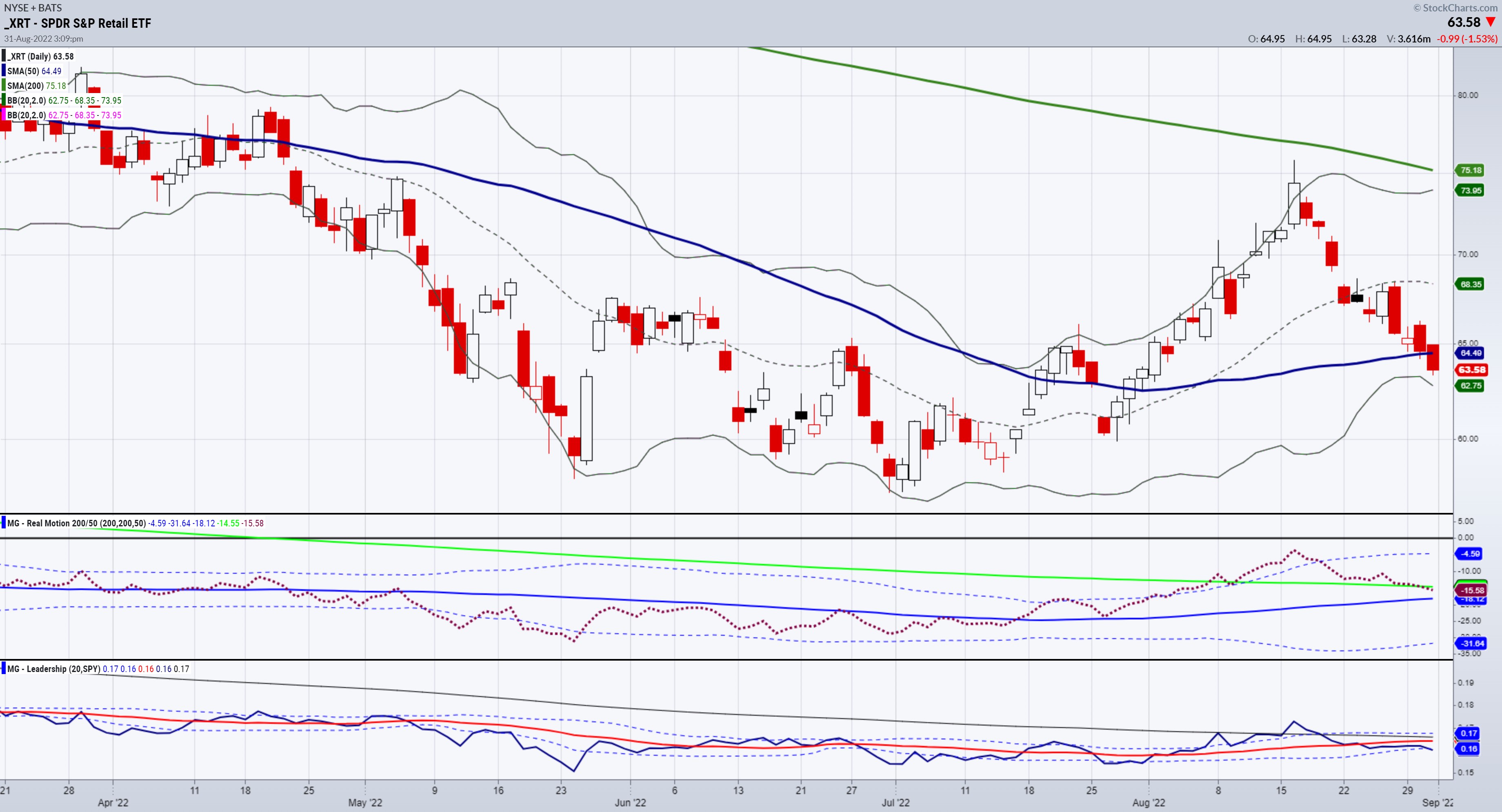

Mish's Daily Video: Granny Retail -- Can the Consumer Hang in There?

I have created another video recap for today's Daily. The link to watch is below. The focus is on our Grandma of the Economic Modern Family -- Granny Retail. I use the ETF XRT as the benchmark.

XRT is the largest retail ETF, but not the only one...

READ MORE

MEMBERS ONLY

Mish's Daily: Grain Prices Suggest Inflation Far From Peaking

The chart above is the Consumer Price Index for All Urban Consumers, and reflects that inflation is historically high. The Fed has been trying to get a handle on the inflation problem, but the graph seems to illustrate that inflation may not be contained.

The Fed has had to act....

READ MORE

MEMBERS ONLY

Mish's Daily: Granddad Russell 2000 and His Best Friend

Now that I am back from vacation, I thought we would mix it up for you all and do the Daily as a video a couple of times per week, so that I can explain the charts in more detail and speak directly to all of you. We will continue...

READ MORE

MEMBERS ONLY

Mish's Daily: Don't Get Caught In The Market's Confusion

For the moment, the stock market continues to defy the notion that inflation or slower economic growth is hurting US businesses. Corporate earnings have slightly underperformed, but the stock market has continued on a trajectory upwards since the middle of July.

Technology (XLK) was today's best performing sector,...

READ MORE

MEMBERS ONLY

Mish's Daily: Ways to Profit in a Stagflationary World

Investing in an inflationary environment can be challenging. The markets have been volatile, but stocks have trended steadily higher with corporate earnings.

In stagflation, cash and bonds are usually below the rate of inflation, while certain stocks might not fare much better. It is important to invest into assets that...

READ MORE

MEMBERS ONLY

Mish's Daily: Can Gold and Silver Hold Recent Gains?

As impressive as the global stock rally was last week, gold and silver's remarkable performance on Friday did not generate many financial headlines. Still, their one-day individual parabolic rise merits closer attention. Could this be a new trend? Or is it just a one-day wonder?

Using the Gold...

READ MORE

MEMBERS ONLY

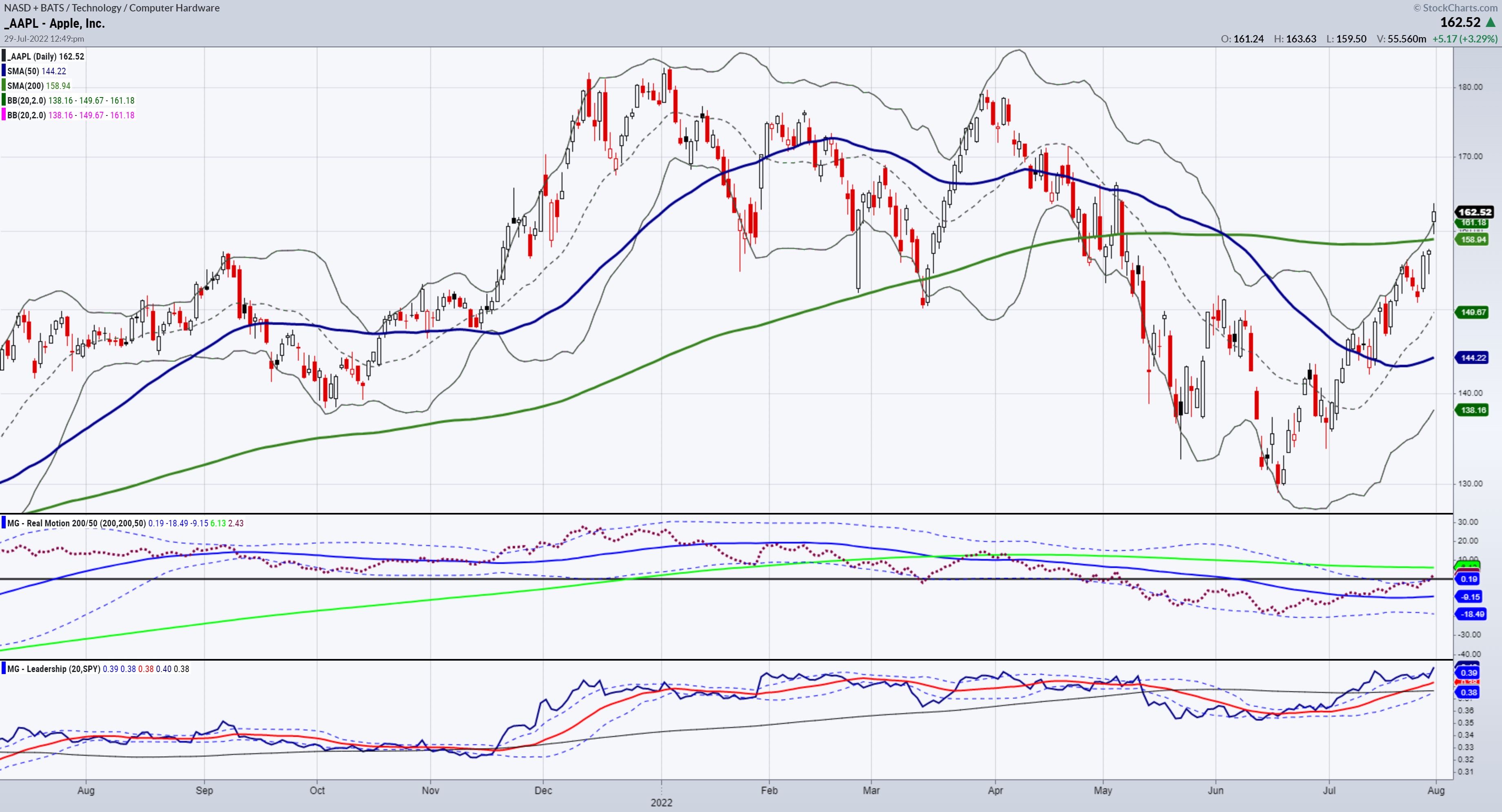

Weekend Daily: Big Tech Stock Earnings and Market Implications

The stock market rally continued to show strength into Friday, moving decisively higher on the week.

Big tech and many other sectors shrugged off a post-Fed pullback and more earlier in the week; bad earnings and poor guidance from Wal-Mart, Meta, and Qualcomm, to mention a few. With Amazon, Apple,...

READ MORE

MEMBERS ONLY

Mish's Daily: Granny Retail and Granddad Russell Dish Post-FOMC

Powell and crew raised the rates by .75 BPS in an attempt to continue the fight against inflation. He even said, "Another unusually large increase in rates could be appropriate, it depends on data." However, the market heard something different.

Sure, we rallied pre-FOMC and continued to rally...

READ MORE

MEMBERS ONLY

Mish's Daily: S&P 500 Futures Fail 4,000 as Market Downtrend Looms

The Fed has already hiked rates three times this year and is expected to hike again on Wednesday, July 27th. But with the economy showing signs of significant slowdown, there are rumors that the Fed might not hike rates as much as anticipated.

The current downtrend, which began in April,...

READ MORE

MEMBERS ONLY

Expectations, Implications and Possible Impacts on the Market

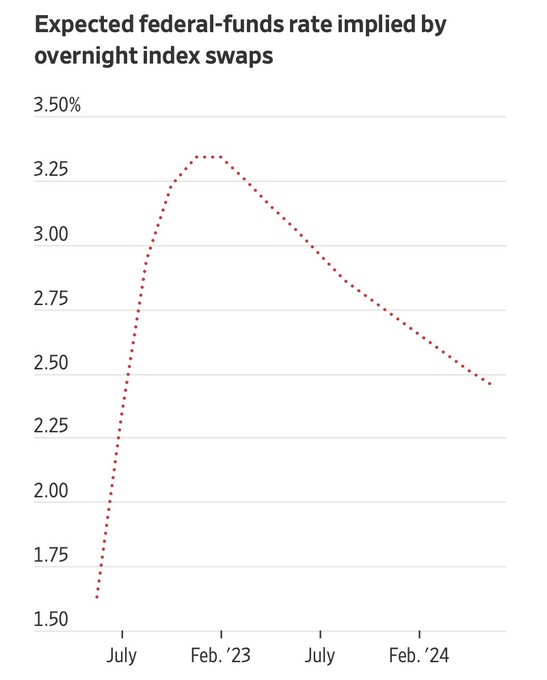

The chart posted is all about expectations.

Regardless of the talk on the new and stretched definition of recession, departing from the textbook definition, investors believe that the Fed Funds rate is close to peaking and will begin to decline into 2023 and 2024. Incidentally, I wrote a dailyon June...

READ MORE

MEMBERS ONLY

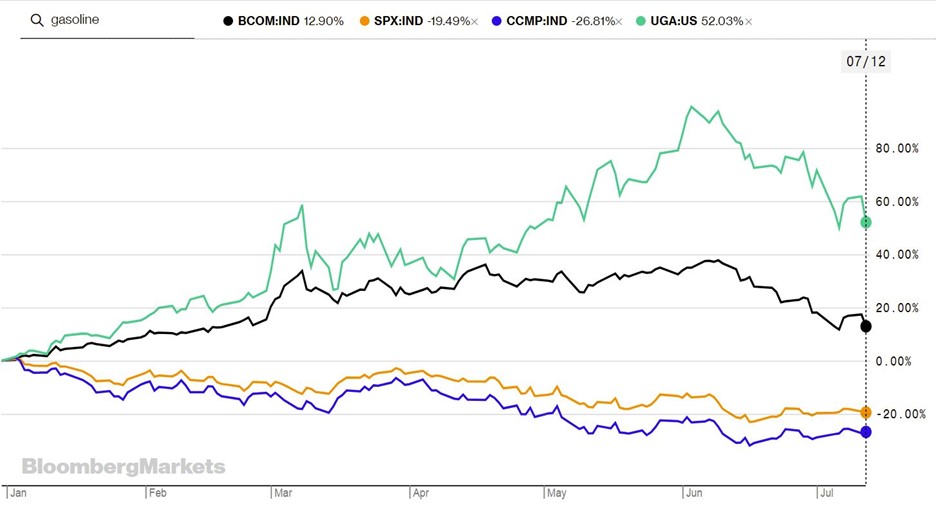

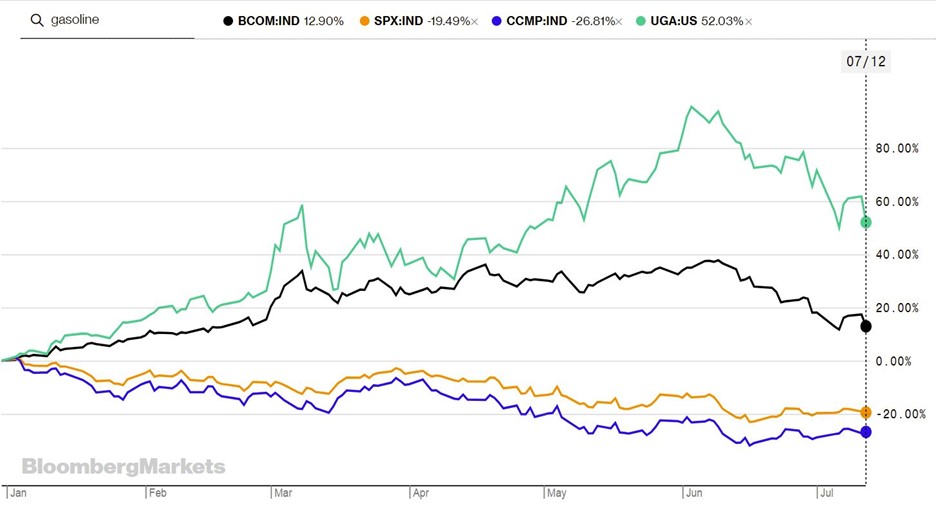

Weekend Daily: What Will Drive the Commodities Market?

Commodities across the board rallied after the Russian invasion of Ukraine and have since declined significantly.

Before the War though, commodities were already enjoying a rally due to results of the pandemic such as supply chain, low production, rising demand, high government debt and labor shortages.

The other significant factor...

READ MORE

MEMBERS ONLY

Mish's Daily: The Modern Family Will Not Let You Down

The disconnect between Fed tightening and the rebound in the tech sector leaves many investors wondering what will happen next.

The Fed is raising interest rates, which is frequently a precursor to a stock market decline, but growth stocks are rallying. The S&P 500 has regained some of...

READ MORE

MEMBERS ONLY

Mish's Daily: All About Netflix

As investors are looking at the earnings and guidance closely for the individual leading companies reporting, I thought I would highlight the leader in the multi-billion-dollar TV streaming industry.

First off, Netflix (NFLX) reported:

* Revenue: $7.97 billion, est: $8.04 billion

* EPS: $3.2, est: $2.91

The stock&...

READ MORE

MEMBERS ONLY

Mish's Daily: Things Over Paper - Why Real Assets are Best

In today's economy, investing in assets that will hold their value to or near the rate of inflation is more important than ever. These types of investments offer protection from inflation and can provide a hedge against other economic downturns.

You don't have to be a...

READ MORE

MEMBERS ONLY

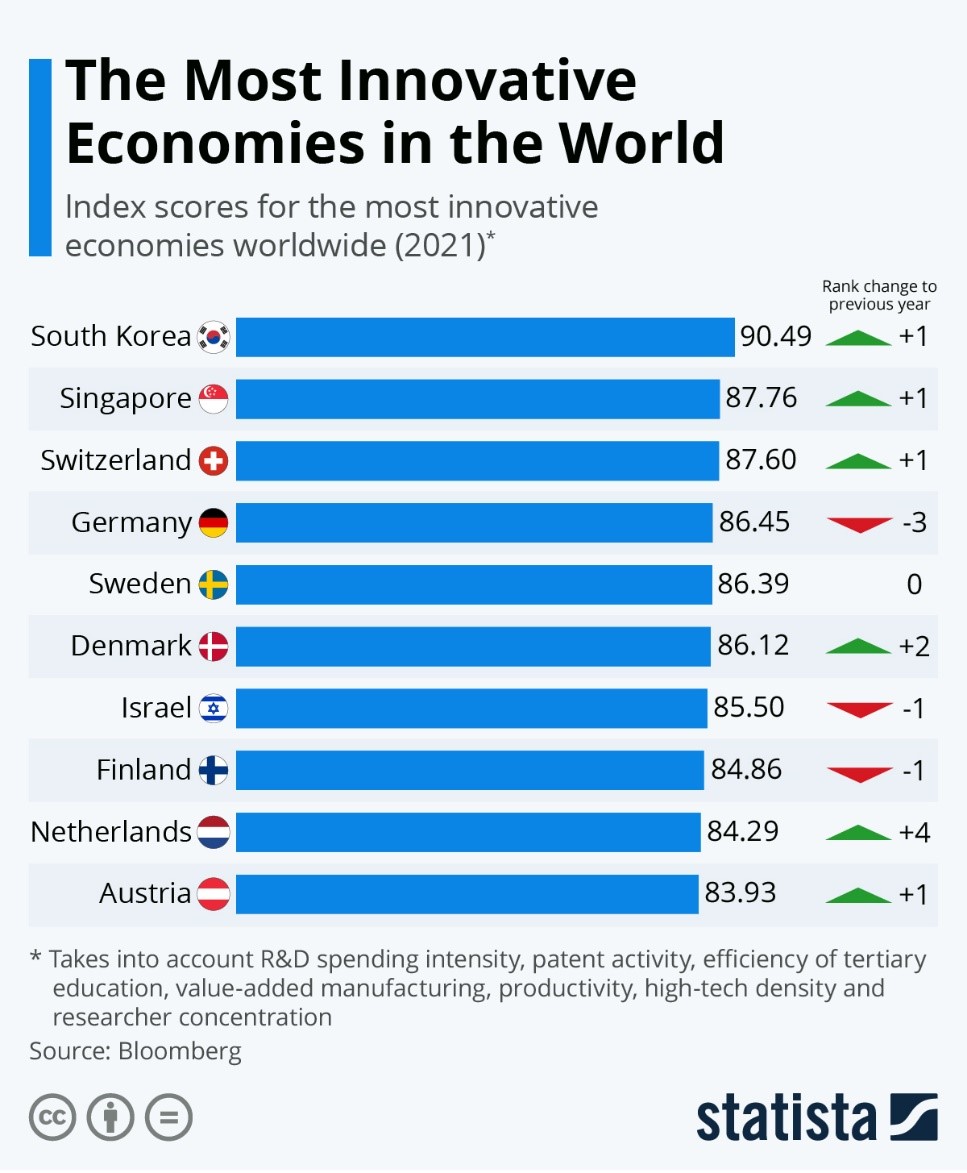

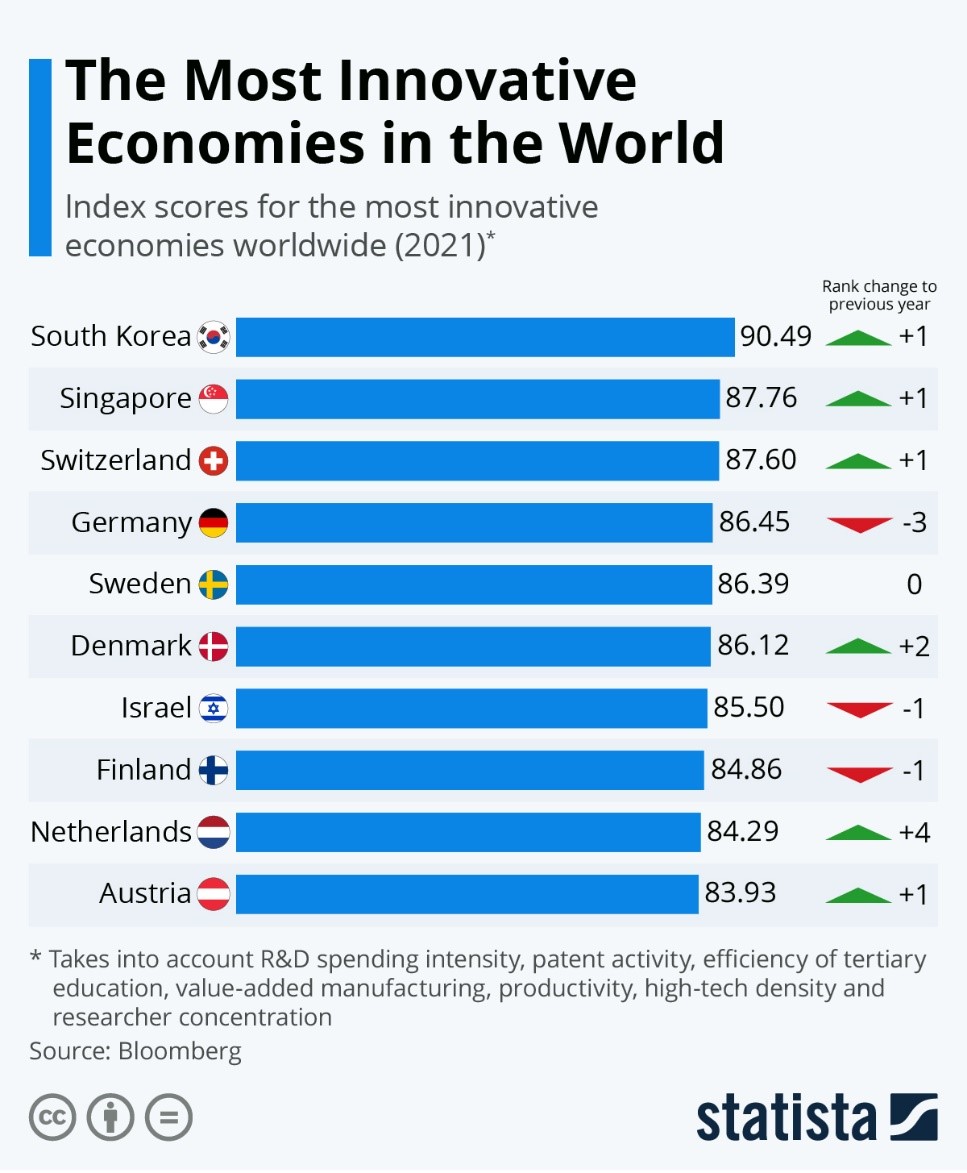

The Most Underpriced Country Fund: South Korea

Some of the most significant advancements of our day are cancer research, meat substitutes and innovative home technology.

So, which nation tops the globe in R&D, patent activity, high-tech density and all other aspects of supporting innovation? The most inventive nations are listed above from a Bloomberg report...

READ MORE

MEMBERS ONLY

Mish's Daily: USD & EUR — Is This the Dollar's Last Hurrah?

US Dollar and Euro at Parity Again

Investors are flocking to the US Dollar as Europe braces for a potential energy crisis in the Fall. The euro has been under pressure recently, with investors pulling their money out in favor of the haven currency—the Dollar.

This is the first...

READ MORE

MEMBERS ONLY

Mish's Daily: Strengthen Your Portfolio with Real Assets

As we head into the second half of the year, it's essential to keep an eye on real assets. Real asset prices provide clues to what's happening in the global economy and can provide valuable insight. If commodity prices start to fall, it could indicate that...

READ MORE

MEMBERS ONLY

Mish's Daily: What are the Corporate Bond Markets Telling Us?

The two bond ETFs we've highlighted suggest something is brewing in the corporate credit market. Keep an eye on these two corporate bonds ETFs to stay ahead of the curve in the stock market.

Maybe you've heard that the high-yield market is in trouble, but is...

READ MORE

MEMBERS ONLY

MarketGauge's Forecast: Profitable Investments During Stagflation

At MarketGauge, we believe we are in a stagflation period that could last six months to three years. Nevertheless, we continue to find profitable investments in this new regime.

Some of our forecasting can be traced directly to the war in Ukraine, so if the war ends tomorrow, our forecasts...

READ MORE

MEMBERS ONLY

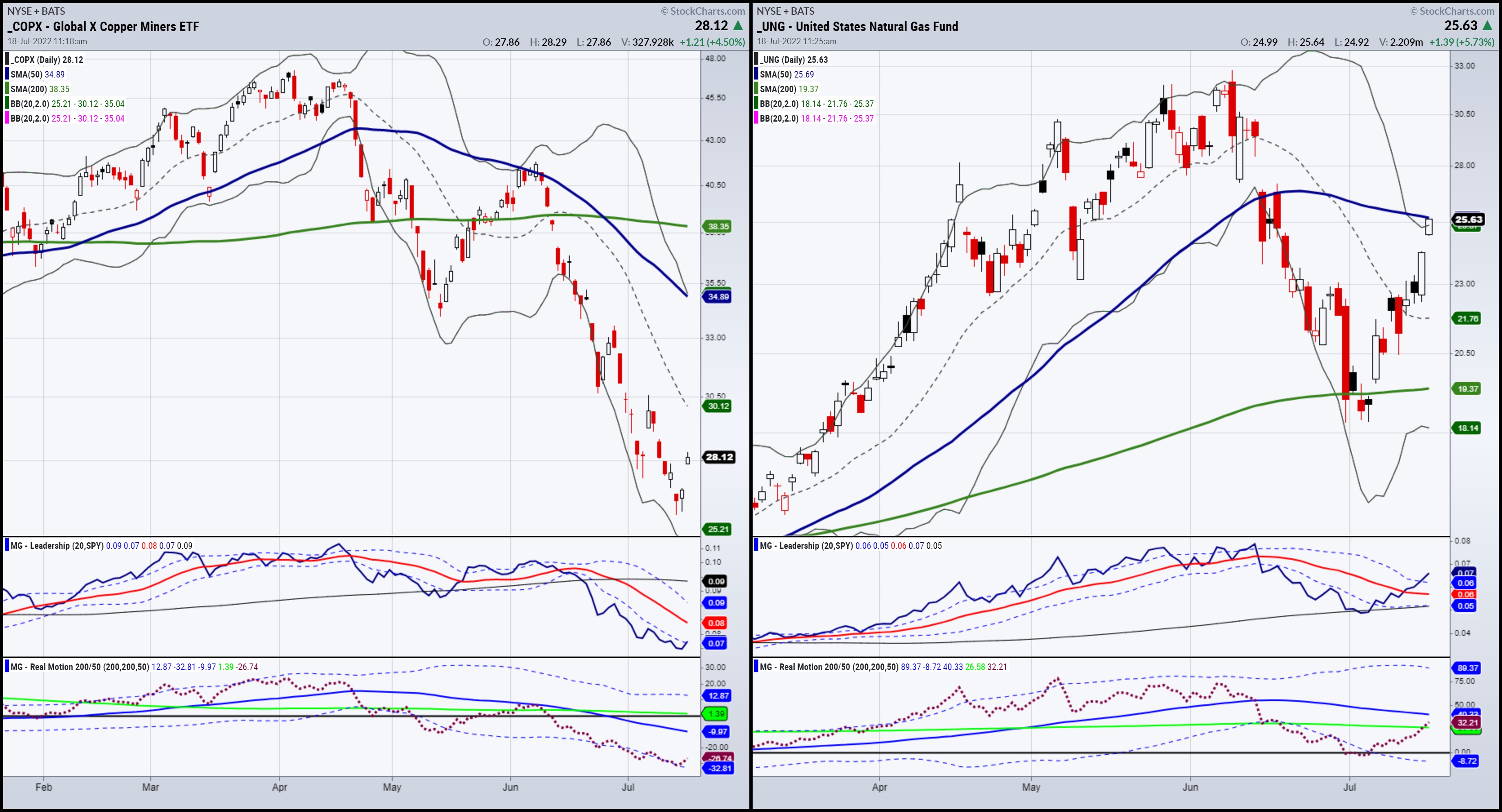

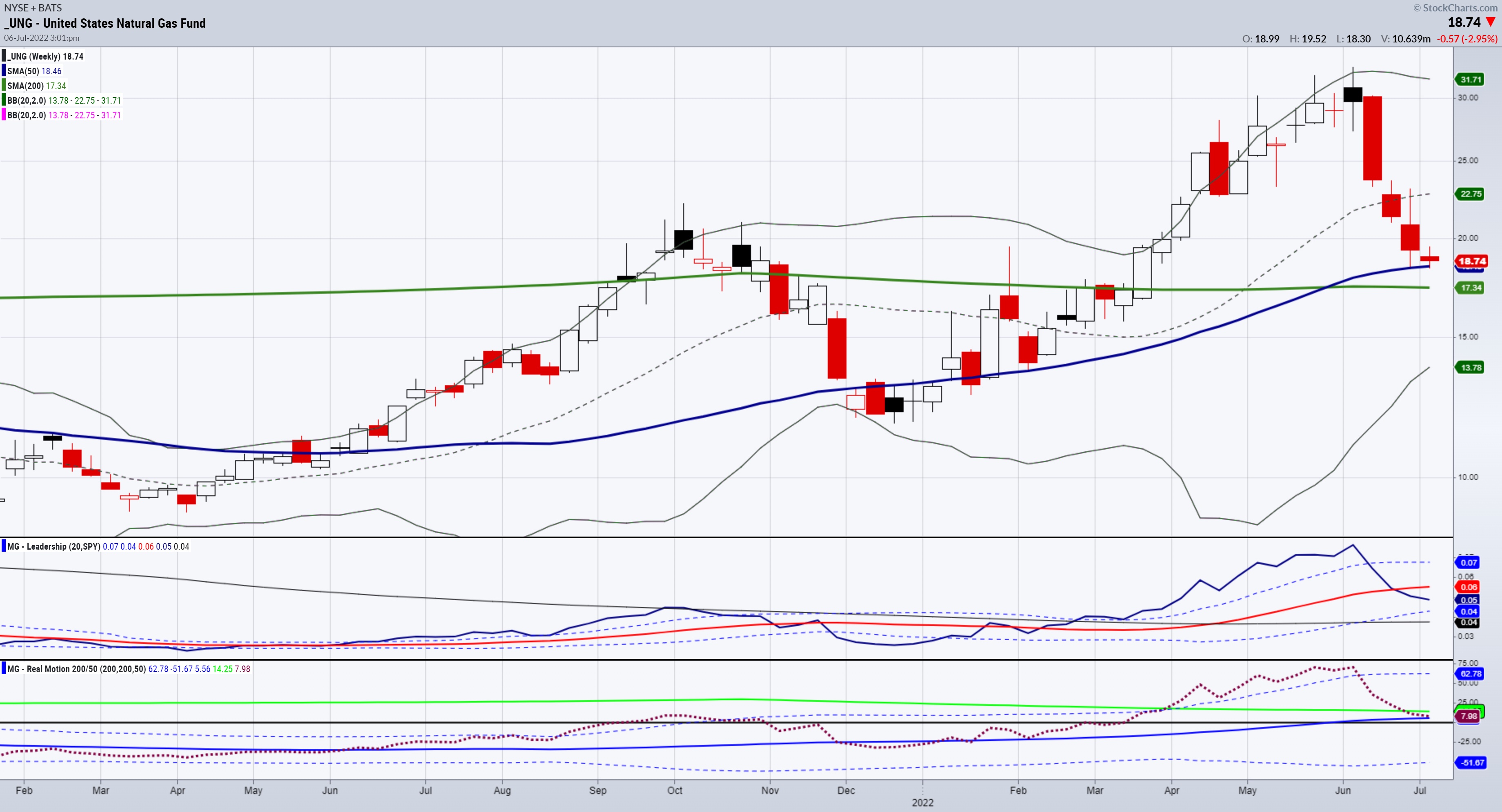

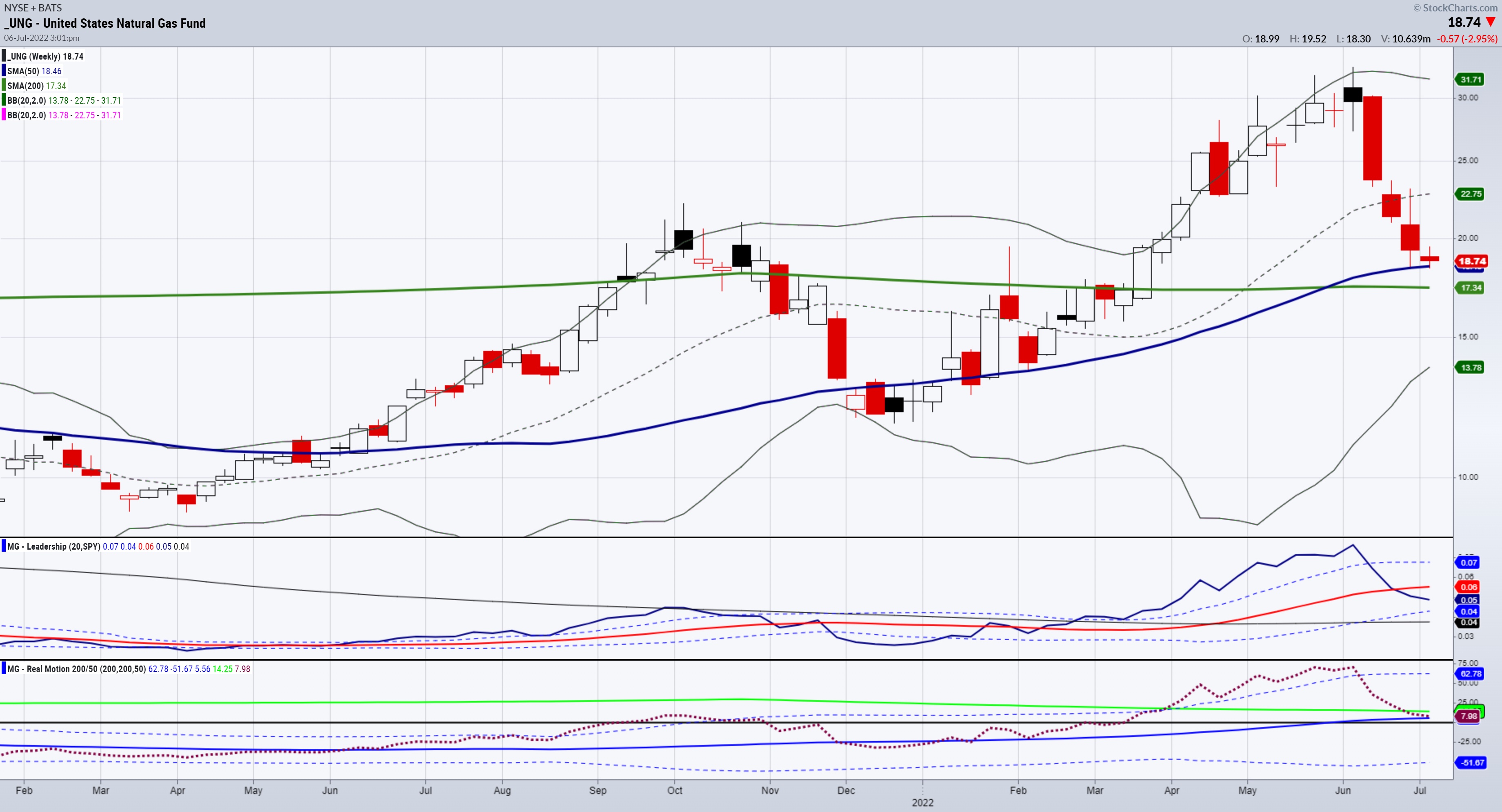

Mish's Daily: Dislocation -- Fundamentals vs. Price in Natural Gas

Global demand for natural gas continues to skyrocket in the wake of Russia's invasion of Ukraine.

Over the last year, demand for LNG has risen incredibly, as have LNG stockpiles. The United States is competing with Australia and Qatar for the world's largest exporter of natural...

READ MORE