MEMBERS ONLY

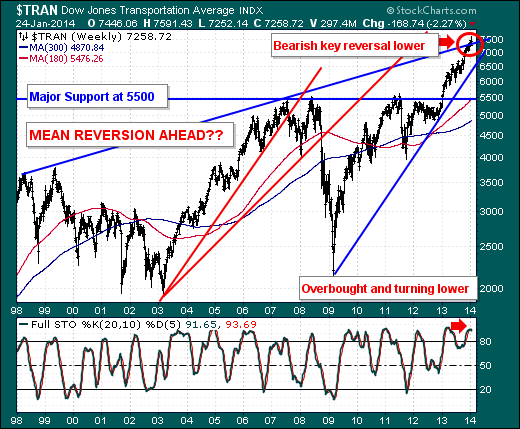

Bearish Weekly Key Reversals for US and World Indices

by Richard Rhodes,

Founder and President, Rhodes Capital Management and Rhodes Trading Group

Last week's trade was rather bearish from a technical perspective, for many of the US and world indices forged "bearish weekly key reversals" to the downside. To us, this suggests that a larger correction is underway - perhaps -10%...but perhaps a greater percentage. For now,...

READ MORE

MEMBERS ONLY

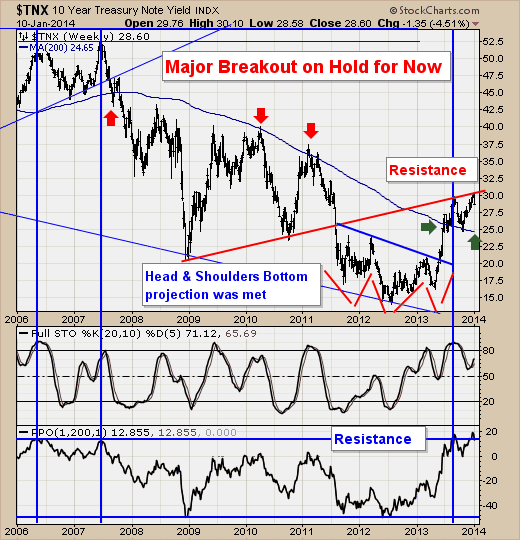

Major Breakout on Hold

by Richard Rhodes,

Founder and President, Rhodes Capital Management and Rhodes Trading Group

Friday's US Employment Situation Report was much less-than-expected at +87k. Many believe this to be an aberration given recent strong employment data, but the aberration may be a longer-than-expected aberration given 10-year note yield may be telling us that a "soft patch" is directly ahead.

Quite...

READ MORE

MEMBERS ONLY

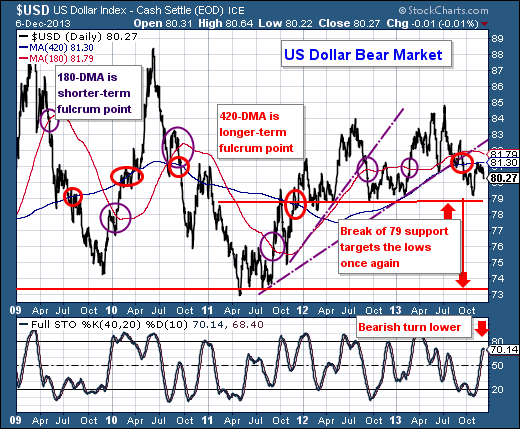

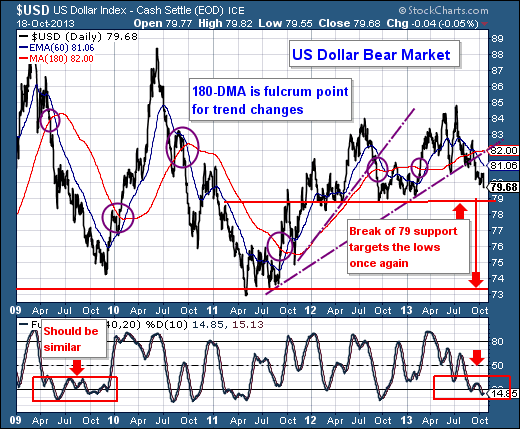

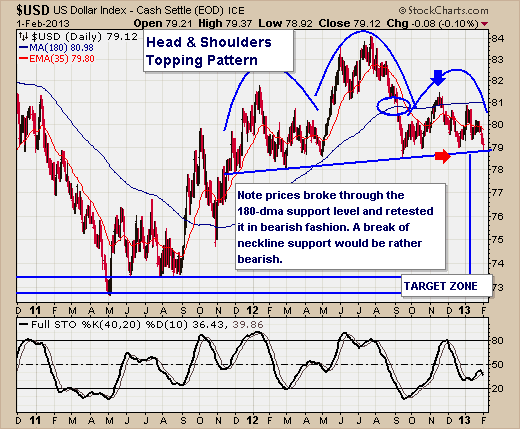

US Dollar Bear Market

by Richard Rhodes,

Founder and President, Rhodes Capital Management and Rhodes Trading Group

In the fundamental economic forum, the balance of economic data has been "positive" as of late with the exception of the housing market. And this data has engendered a belief that the Fed shall begin to

pullback on its bond-buying campaign - which shall simply be US Dollar...

READ MORE

MEMBERS ONLY

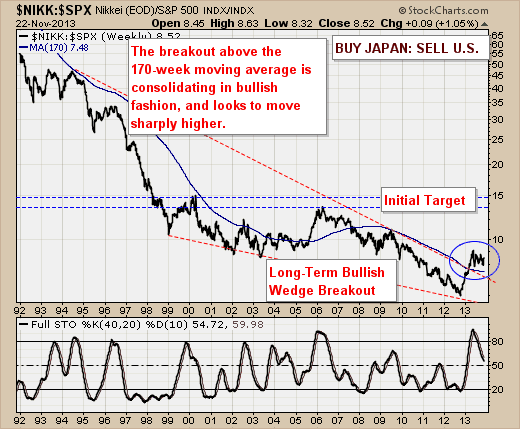

Buy Japan, Sell US

by Richard Rhodes,

Founder and President, Rhodes Capital Management and Rhodes Trading Group

With the equity markets hitting all-time highs in many cases, we think it prudent to look around the world and determine if there are any better risk-reward countries into which one can invest or park money for the long-term. To this end, we believe that the multi-decade decline of Japan&...

READ MORE

MEMBERS ONLY

Head and Shoulders for Light Crude

by Richard Rhodes,

Founder and President, Rhodes Capital Management and Rhodes Trading Group

For the past 9-weeks, Crude Oil has weakened from $112/barrel to below $95/barrel. This is a rather sharp drop indeed, but the fact of the matter is that the fundamentals are bearish Crude Oil, and so is the techncial state of prices. Moreover, the technicals could very well...

READ MORE

MEMBERS ONLY

Loss of Faith in the US Dollar

by Richard Rhodes,

Founder and President, Rhodes Capital Management and Rhodes Trading Group

The US Congress came through at the 11th hour once again as many expected they would in opening the government and raising the debt ceiling, but only for a short while really. However, the decision to "kick the can down the road" is causing the US Dollar to...

READ MORE

MEMBERS ONLY

Lower Interest Rates May Prove to be Headwind for US Dollar

by Richard Rhodes,

Founder and President, Rhodes Capital Management and Rhodes Trading Group

The capital market starting to trend once again. The 10-year note yield has risen rather swiftly in recent months, which has caused both the stock market and the US dollar to trade in a sideways movement. In each case, we believe it to be a distribution phase that will lead...

READ MORE

MEMBERS ONLY

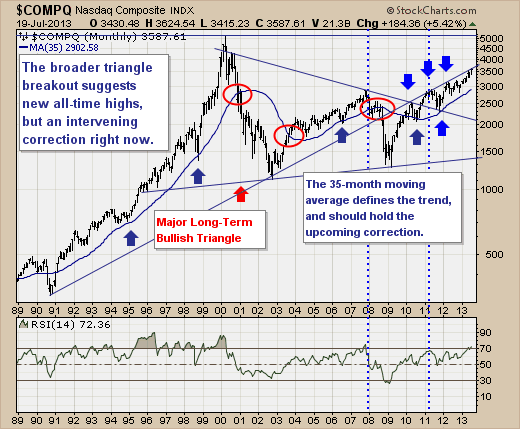

New All-Time Highs for NASDAQ Composite coming?

by Richard Rhodes,

Founder and President, Rhodes Capital Management and Rhodes Trading Group

The NASDAQ Composite is a "forgotten index", as it led the tech bubble higher into the 2000 high. Now, it is the NASDAQ 100 that garners all the attention given it consists mainly of Apple (AAPL) and Google (GOOG). But that aside, the Composite is on a bullish...

READ MORE

MEMBERS ONLY

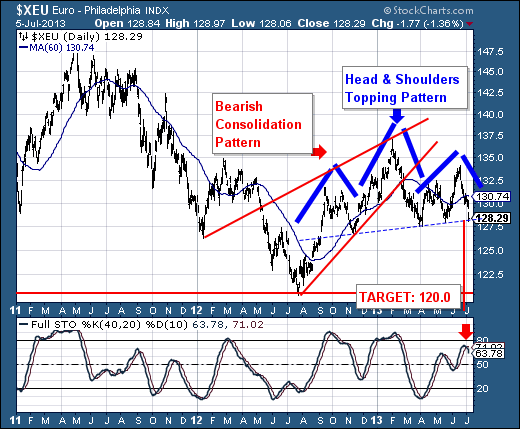

British Pound and Euro Poised for Sharp Decline

by Richard Rhodes,

Founder and President, Rhodes Capital Management and Rhodes Trading Group

This past week, the monetary policy world shook once again as the Bank of England and the European Central Bank provided the markets with "dovish" comments regarding leaving o/n funding rates low "for an extended period of time." This was clearly reminiscent of the Fed&...

READ MORE

MEMBERS ONLY

US Dollar Bear Market

by Richard Rhodes,

Founder and President, Rhodes Capital Management and Rhodes Trading Group

The US Dollar has declined rather sharply over the past 2-weeks, which given the scope of the decline - has likely pushed it into a bear market. The reasons for this could be myriad; or simply that the Fed will continue upon the bond-buying campaign far longer than the consensus...

READ MORE

MEMBERS ONLY

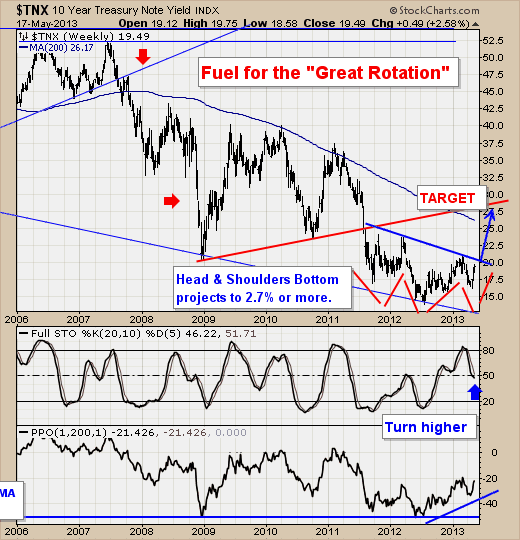

The "Great Rotation" Has Begun

by Richard Rhodes,

Founder and President, Rhodes Capital Management and Rhodes Trading Group

The Great Rotation is in its early stages. For those initiated to this concept, it is simply that rising interest rates will cause asset allocators to sell bonds and buy stocks. And we shall posit that it shall become more pronounced in the weeks and months ahead as interest rates...

READ MORE

MEMBERS ONLY

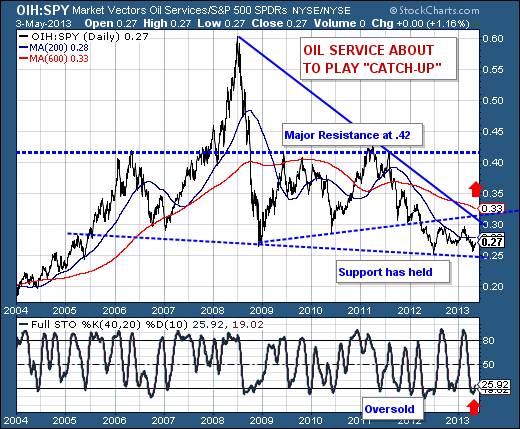

Oil Service About to Play "Catch-Up"

by Richard Rhodes,

Founder and President, Rhodes Capital Management and Rhodes Trading Group

The current S&P 500 rally to new all-time highs may very well be the beginning of a "bubble-like" move to much higher levels in the weeks and months ahead. However, make no mistake, there is a great deal of risk in being long many stocks at...

READ MORE

MEMBERS ONLY

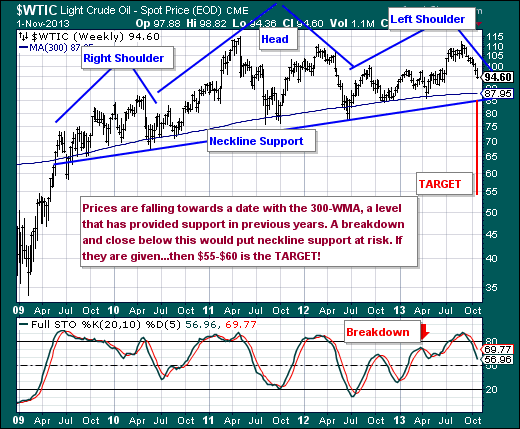

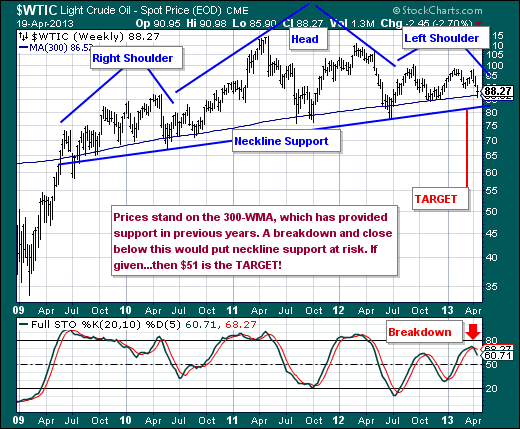

Sharp Correction Ahead for Crude Oil?

by Richard Rhodes,

Founder and President, Rhodes Capital Management and Rhodes Trading Group

Our attention has turned to the crude oil market, where a rather large "head & shoulders" top pattern is in development. The focus is upon how prices challenge and hold the 300-week moving average, and if not...whether neckline support is violated. A breakdown of these levels would...

READ MORE

MEMBERS ONLY

Made in Manhattan

by Richard Rhodes,

Founder and President, Rhodes Capital Management and Rhodes Trading Group

April has not thus far been very kind to the economic bulls. The various world and US PMI reports have been "less-than-anticipated", while employment is showing weaker-than-expected figures via the weekly jobless claims, ADP private payroll and non-farm payrolls. This economic deceleration is simply part and parcel of...

READ MORE

MEMBERS ONLY

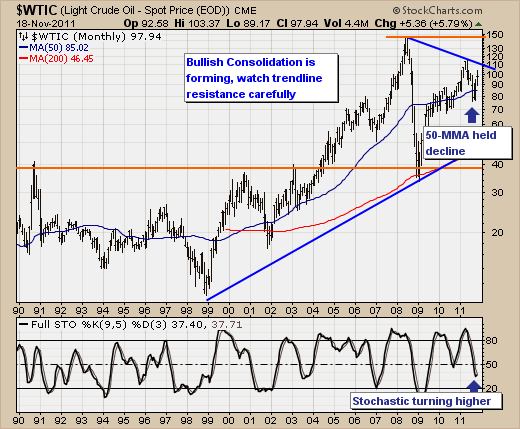

Bullish Consolidation Suggests Sharp Rise for Crude Oil

by Richard Rhodes,

Founder and President, Rhodes Capital Management and Rhodes Trading Group

The stock market's uninterrupted gains in recent months is giving rise to talk of a bubble, and perhaps this is the case within the scope of time. It is still far too soon to determine this, although further gains will cause us to consider sharply higher prices within...

READ MORE

MEMBERS ONLY

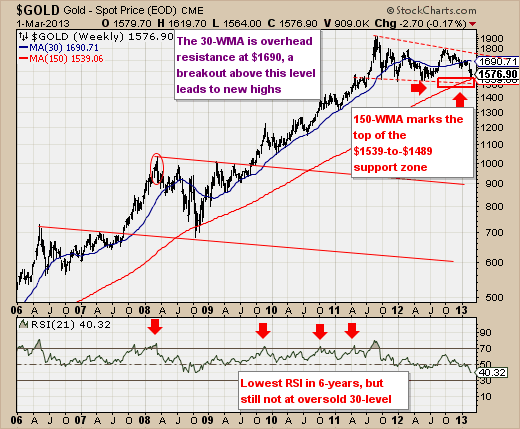

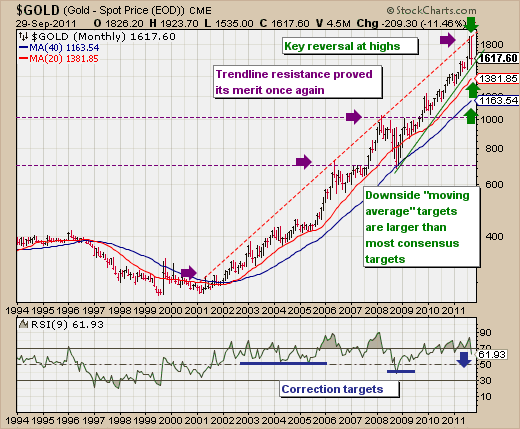

Wailing and Gnashing of Teeth in the Gold Market

by Richard Rhodes,

Founder and President, Rhodes Capital Management and Rhodes Trading Group

The past two trading weeks in the gold market has been rather dramatic: a sharp decline followed by a sharp rally and then a recent test of the lows. The end result - quite a bit of wailing and gnashing of teeth. And, we think the wailing shall become louder...

READ MORE

MEMBERS ONLY

CURRENCY WAR

by Richard Rhodes,

Founder and President, Rhodes Capital Management and Rhodes Trading Group

There has been quite a bit of banter recently about a "currency war" developing given the Japanese Yen has fallen dramatically against the USD - roughly -15% in the past 11-weeks. This is a rather major move for a currency; and it is such that it is providing...

READ MORE

MEMBERS ONLY

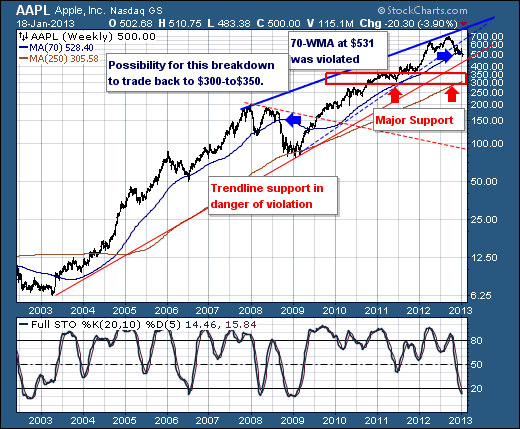

A Close-Up on AAPL

by Richard Rhodes,

Founder and President, Rhodes Capital Management and Rhodes Trading Group

Next week, the markets will be focused upon the incoming earnings reports; and in particular - Apple's (APPL) earnings after Wednesday's close. Over the past several months, AAPL has declined rather sharply off its highs around $700 down to its current trade at $500; which is...

READ MORE

MEMBERS ONLY

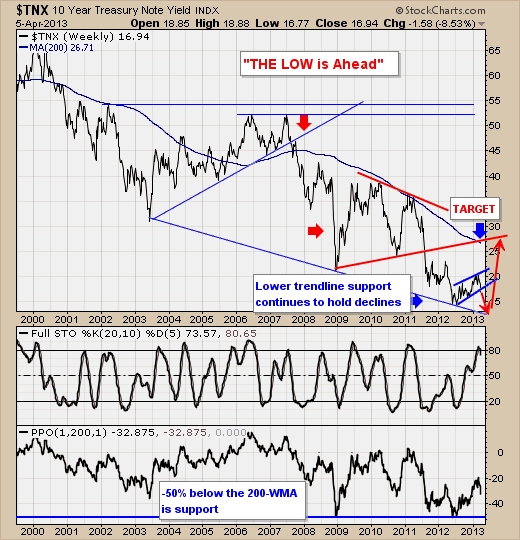

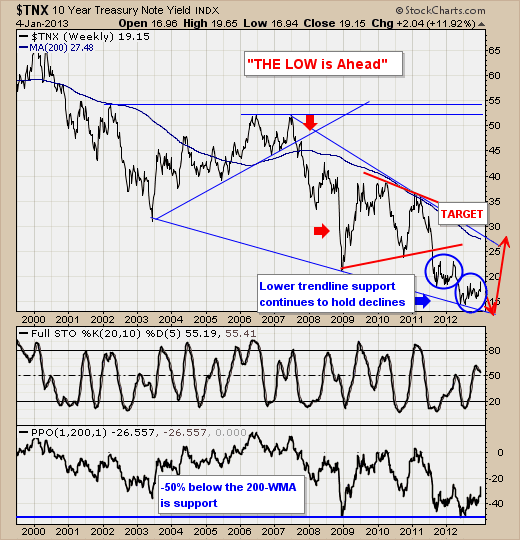

THE LOW IS AHEAD

by Richard Rhodes,

Founder and President, Rhodes Capital Management and Rhodes Trading Group

January 2013 has rolled in, with the "fiscal cliff" solved for the moment; and now there are concerns "QE-4" will end sooner rather than later...and perhaps below 2013 ends. Collectively, the passing of the fiscal cliff and the new QE-4 concerns pushed 10-year note yields...

READ MORE

MEMBERS ONLY

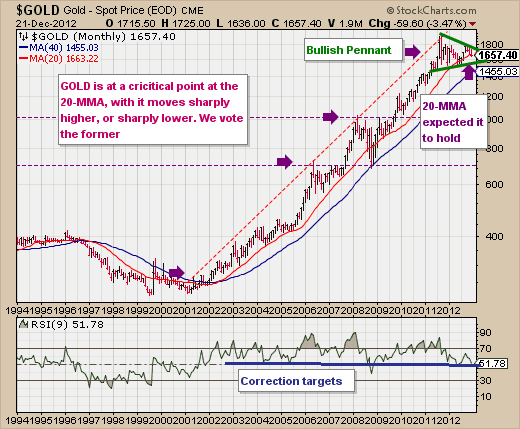

KEEPING AN EYE ON GOLD

by Richard Rhodes,

Founder and President, Rhodes Capital Management and Rhodes Trading Group

In the past several weeks, the FOMC has voted to "expand" its balance sheet until which time economic growth is strong and getting stronger ($45 billion long-term treasuries/$45 MBS). One would have reasonably thought that Gold prices ($GOLD) would have rallied rather sharply - we certainly were...

READ MORE

MEMBERS ONLY

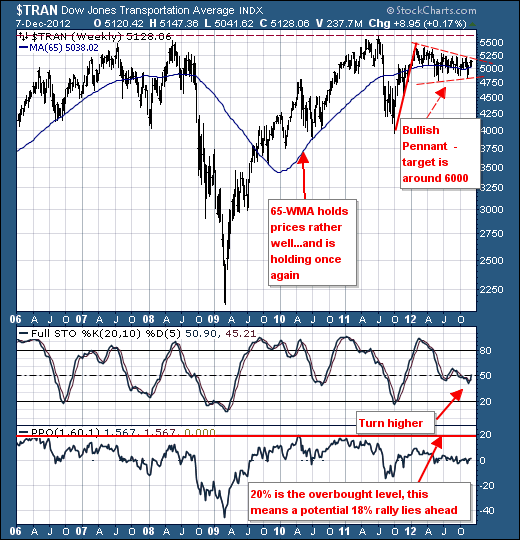

TRANSPORTATION ON THE VERGE OF BREAKOUT

by Richard Rhodes,

Founder and President, Rhodes Capital Management and Rhodes Trading Group

The Dow Jones Transportation Index ($DJT) is on the verge of a major breakout that could see prices rise by up to +20%. Quite simply, the developing bullish pennant pattern would suggest that once a breakout of trendline resistance materializes, then a measured towards the 6000 to 6200 zone becomes...

READ MORE

MEMBERS ONLY

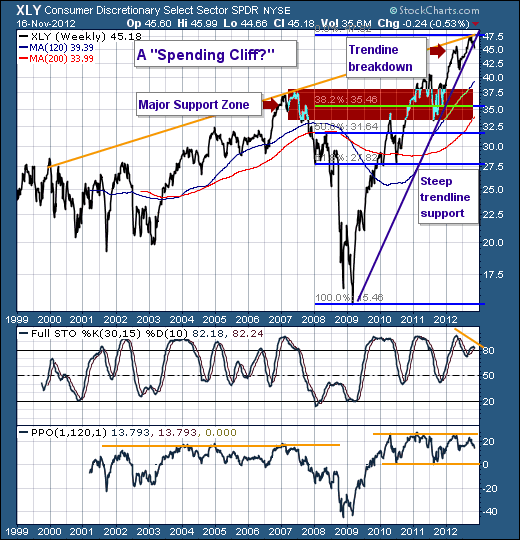

ARE CONSUMER DISCRETIONARY STOCKS ABOUT TO CLIFF DIVE?

by Richard Rhodes,

Founder and President, Rhodes Capital Management and Rhodes Trading Group

There is quite a bit of newsprint lately regarding the US "fiscal cliff"; and the impact of whether it goes through or not. Regardless or not of whether it is extended or not, we think it instructive to analyze the consumer discretionary stocks as they will be inordinately...

READ MORE

MEMBERS ONLY

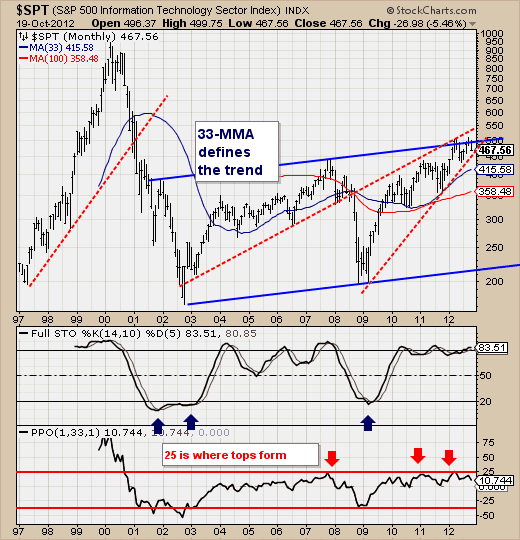

Technology Buyers Beware...

by Richard Rhodes,

Founder and President, Rhodes Capital Management and Rhodes Trading Group

Last's week's early market rally seemingly disavowed all the bad news; which is of course what this market has been doing since the summer. However, we may be premature - but we are certain the market is changing its stripes from focusing upon "benefits"...

READ MORE

MEMBERS ONLY

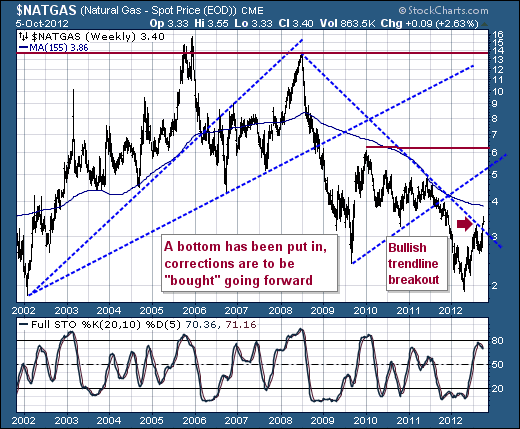

BEARS GONE, BULLS BEGIN FOR NATURAL GAS

by Richard Rhodes,

Founder and President, Rhodes Capital Management and Rhodes Trading Group

Quite simply, a bear market has ended, and a bull market has begun in the Natural Gas market. This has been quite some time in the making, for the relationship between natural gas and crude oil has been skewed for a number of years in favor of natural gas. Now,...

READ MORE

MEMBERS ONLY

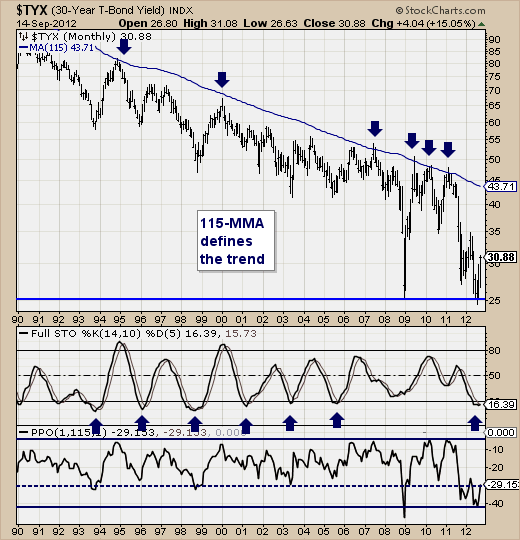

ENJOY LOW RATES WHILE THEY LAST....

by Richard Rhodes,

Founder and President, Rhodes Capital Management and Rhodes Trading Group

Well, finally the past economic/political week has passed, and we find ourselves starting down the barrel of QE-3. There is no need to go into the particulars of QE-3, but suffice to say that the Fed is buying mortgage-agency debt rather than adding to their Treasury debt holdings. This...

READ MORE

MEMBERS ONLY

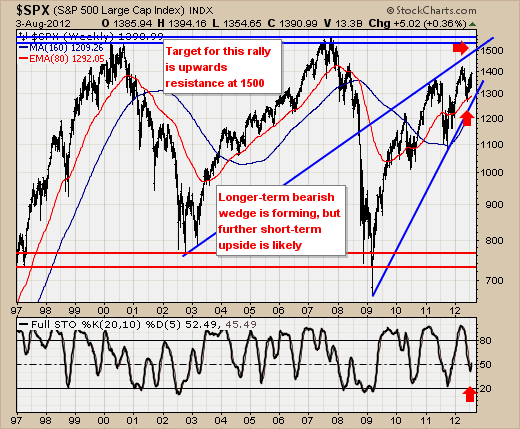

ENJOY S&P 500 RALLY WHILE IT LASTS

by Richard Rhodes,

Founder and President, Rhodes Capital Management and Rhodes Trading Group

For now, the S&P 500 is rallying in a manner that is abrupt to say the least - several days higher, then several days lower, and then repeat. This, coupled with the European fiasco has caused investor/trader sentiment to become rather archly bearish; and therefore the short-term...

READ MORE

MEMBERS ONLY

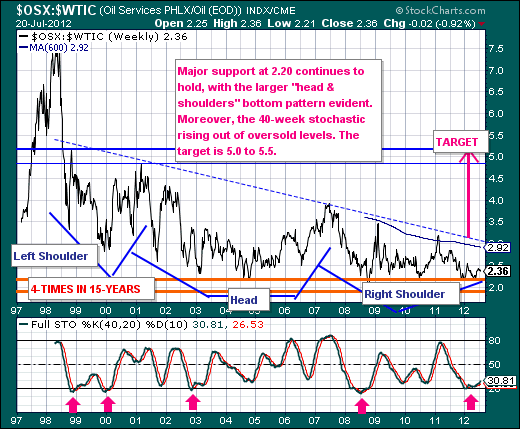

TRADING ENVIRONMENT FOR ENERGY STOCKS LOOKS GOOD

by Richard Rhodes,

Founder and President, Rhodes Capital Management and Rhodes Trading Group

The current market environment is rather difficult to be sure; but the moving of the chess pieces underneath the market surface is what interests us at present. We are focused upon the Energy Sector (XLE) in general, and the Oil Services Group (OSX) in particular. To this end, we find...

READ MORE

MEMBERS ONLY

GOLD A "CAGED" ANIMAL

by Richard Rhodes,

Founder and President, Rhodes Capital Management and Rhodes Trading Group

Gold prices are trapped we are afraid; and they are trapped between the $1584 and $1646 levels - of which the lower boundary is the 20-month moving average; while the upper boundary is the 30-week moving average. We expect Gold prices shall break higher given the bullish consolidation forming; and...

READ MORE

MEMBERS ONLY

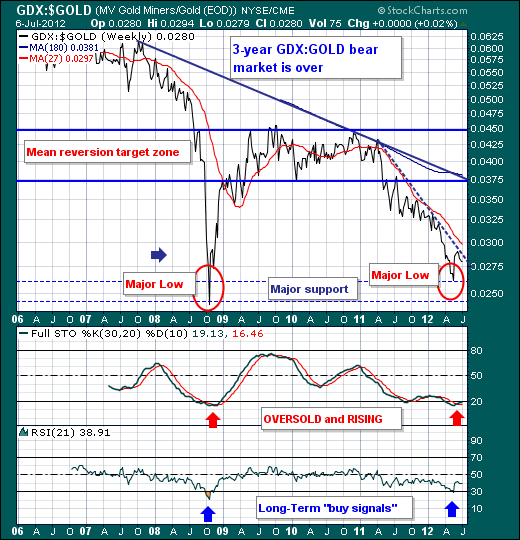

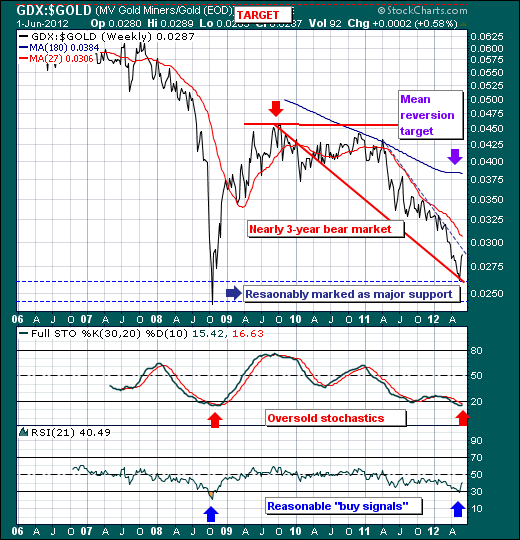

THE GOLD SHARE/GOLD FUTURES RATIO BUY SIGNAL

by Richard Rhodes,

Founder and President, Rhodes Capital Management and Rhodes Trading Group

Over the past week, we've seen gold shares gain sponsorship without the physical gold metal rising. Perhaps this was the "canary in the coal mine" as they say, but gold prices roared ahead yesterday from a low of $1545 to a high of $1632 before closing...

READ MORE

MEMBERS ONLY

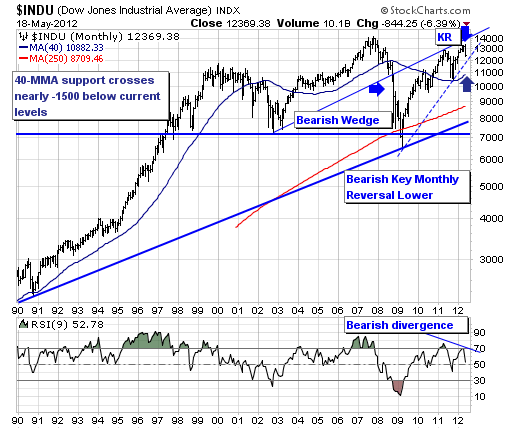

TREMENDOUS AMOUNT OF RISK IN $INDU

by Richard Rhodes,

Founder and President, Rhodes Capital Management and Rhodes Trading Group

An important tops looks to be in place in the Dow Industrials ($INDU) by month's end if the current pattern holds true to form. Quite simply, the $INDU is forming a bearish wedge pattern, of which rising trendline support looks to be violated in the months ahead. This...

READ MORE

MEMBERS ONLY

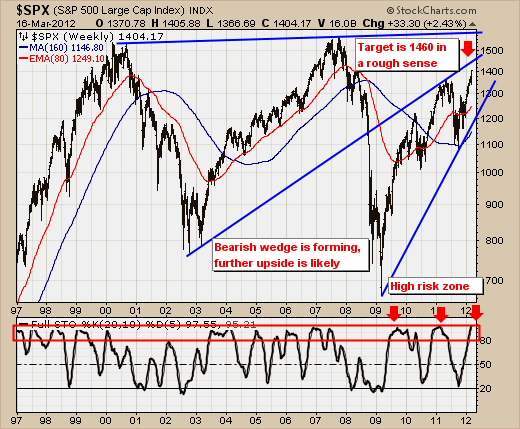

S&P 500 RALLY GETTING RISKIER BY THE WEEK

by Richard Rhodes,

Founder and President, Rhodes Capital Management and Rhodes Trading Group

The S&P 500 rally continues unabated, although it has shown some signs of wear and tear given the less-than-hoped for volume patterns as well as advance/decline patterns. However, it is clear that this type of market condition does not preclude prices from moving higher and forming major...

READ MORE

MEMBERS ONLY

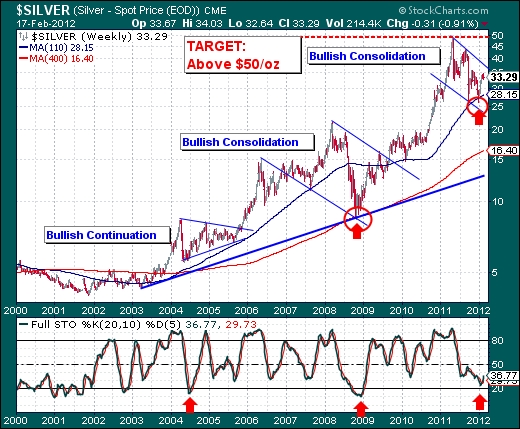

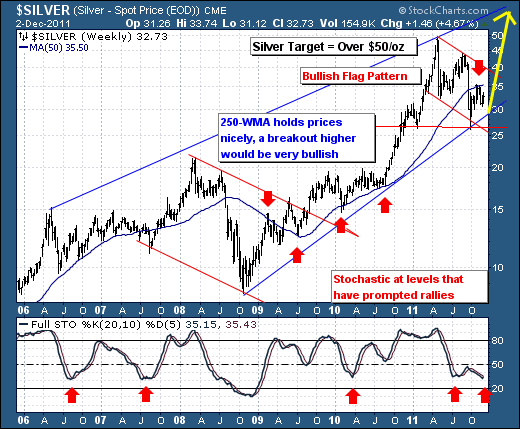

SILVER RIPE FOR TRADING AGAIN

by Richard Rhodes,

Founder and President, Rhodes Capital Management and Rhodes Trading Group

With all the press centering in upon Gold gains recently +10%, Silver has risen by +19% - thereby outperforming the yellow metal by +9%. Silver - the poor man's good; now looks rather ripe for trading once again. This is as it should be in a metals bull...

READ MORE

MEMBERS ONLY

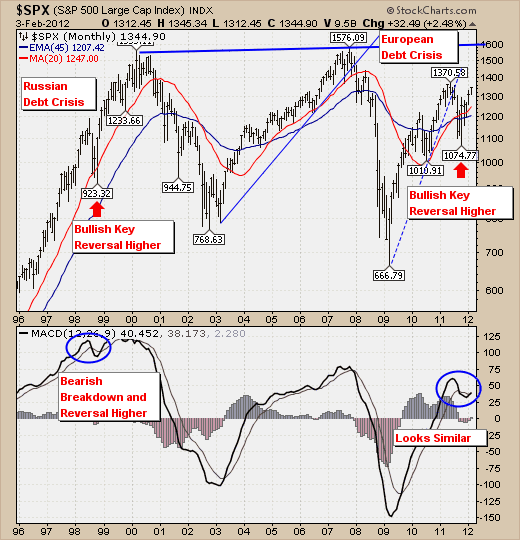

STARTING OFF WITH A BANG

by Richard Rhodes,

Founder and President, Rhodes Capital Management and Rhodes Trading Group

The 2012 trading year has begun with a "bang" to be sure. In terms of the S&P 500, we find that 16 of the 23 trading sessions have traded to the upside, with no losing session down more than -8 points or -0.6%. This is...

READ MORE

MEMBERS ONLY

METALS STILL BULLISH

by Richard Rhodes,

Founder and President, Rhodes Capital Management and Rhodes Trading Group

Since the beginning of the year, we've seen both Gold ($GOLD) and her sister metal Silver ($SILVER) rally; but we've seen Gold under-perform during this rally. This is exactly what should take place in a metals bull market. But that said, the Gold/Silver Ratio remains...

READ MORE

MEMBERS ONLY

DOWNSIDE VIOLENCE IN THE GOLD MARKET

by Richard Rhodes,

Founder and President, Rhodes Capital Management and Rhodes Trading Group

The downside violence in the Gold market as abated for the the time being given the reallocation and repositioning for the New Year. There are many the recent drop is sufficiently of the cathartic-type that will send prices to all-time highs, for we all know that "all the current...

READ MORE

MEMBERS ONLY

SILVER POISED TO OUTPERFORM AGAIN

by Richard Rhodes,

Founder and President, Rhodes Capital Management and Rhodes Trading Group

Last week, the world's stock markets cheered the coordinated central bank efforts to supply dollar liquidity to the world banking system via lower than market rates. This clearly resulted in a "risk-on" trade across the board, and we expect more to follow in the weeks ahead...

READ MORE

MEMBERS ONLY

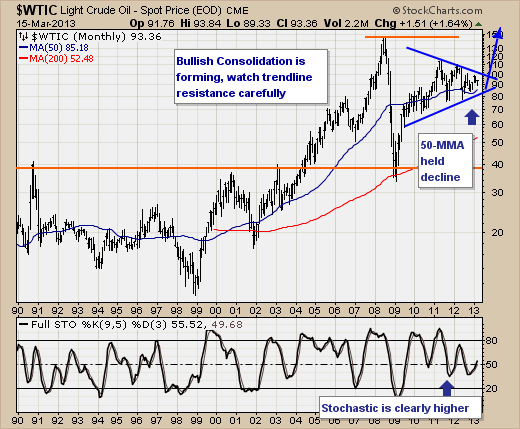

BULLISH CONSOLIDATION FOR LIGHT CRUDE

by Richard Rhodes,

Founder and President, Rhodes Capital Management and Rhodes Trading Group

Over the past three months, we've seen the West Texas Intermediate Crude Oil futures ($WTIC) rise from low of $75/barrel to a high of $102/barrel, which is a rather large move in a very short period of time in what many consider to be a modest...

READ MORE

MEMBERS ONLY

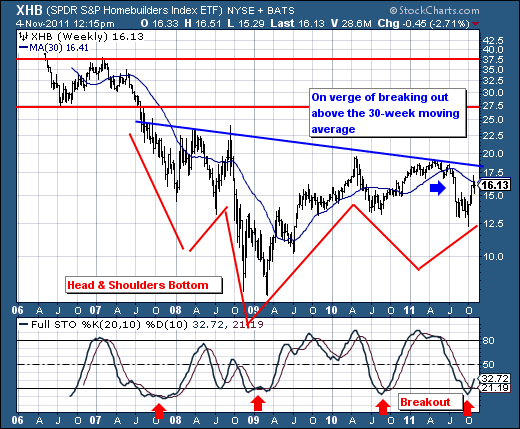

SUSTAINED RALLY IN THE FUTURE?

by Richard Rhodes,

Founder and President, Rhodes Capital Management and Rhodes Trading Group

Quite simply, the past 5-week rally has been breathtaking, but it remains to be seen whether it has "legs" of whether it does not. It is of our opinion, that it "does have legs", and it does so given the Financials (XLF) are rallying...but more...

READ MORE

MEMBERS ONLY

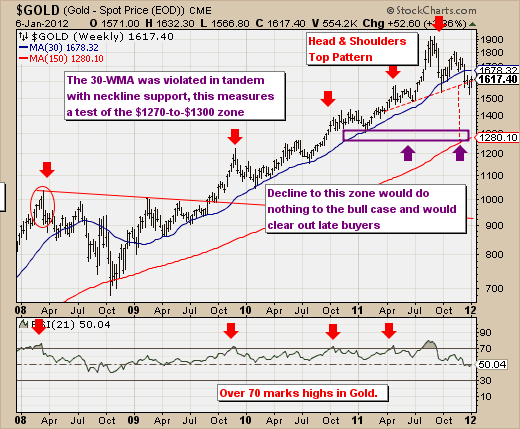

HAS GOLD REACHED ITS PEAK?

by Richard Rhodes,

Founder and President, Rhodes Capital Management and Rhodes Trading Group

The month of September has not been kind to Gold; and the question before everyone is whether or not gold has seen its highs for an intermediate period or whether a brief pause before higher highs are forged. We are of the opinion of the former rather than the latter,...

READ MORE

MEMBERS ONLY

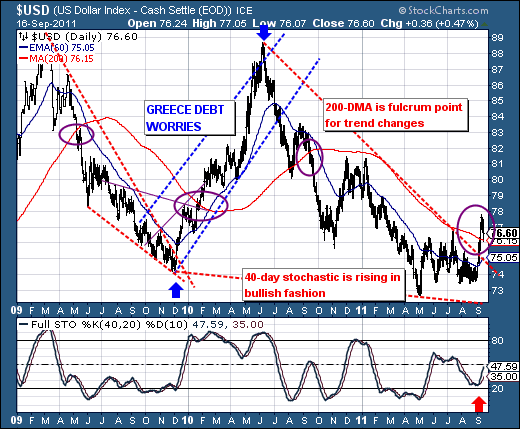

CURRENT S&P 500 RALLY IN TROUBLE?

by Richard Rhodes,

Founder and President, Rhodes Capital Management and Rhodes Trading Group

Over the past 6-weeks, we've seen the S&P 500 trade in a large sideways pattern between 1220 and 1100; we find this eerily reminiscent of a bearish pattern that will resolve itself to new lows. Certainly this is our viewpoint; and we believe the supporting technicals...

READ MORE