MEMBERS ONLY

THE BEGINNING OF A BEAR MARKET?

by Richard Rhodes,

Founder and President, Rhodes Capital Management and Rhodes Trading Group

The recent volatility is enough to make one step back, put your money aside - and reassess. In fact, this is what both institutional and individual investors have done over the past 3-weeks as money withdrawn from funds has significantly increased - even more so than at the March-2009 panic...

READ MORE

MEMBERS ONLY

THE BEAUTY LIES IN THE RELATIVE TRADE...

by Richard Rhodes,

Founder and President, Rhodes Capital Management and Rhodes Trading Group

Last week, and so far this week the stock market has traded rather dismal to be sure, with the S&P 500 trading lower in 8 of the past 9 trading sessions. However, regardless of this weakness, we've begun to see slow, but sure movements beneath the...

READ MORE

MEMBERS ONLY

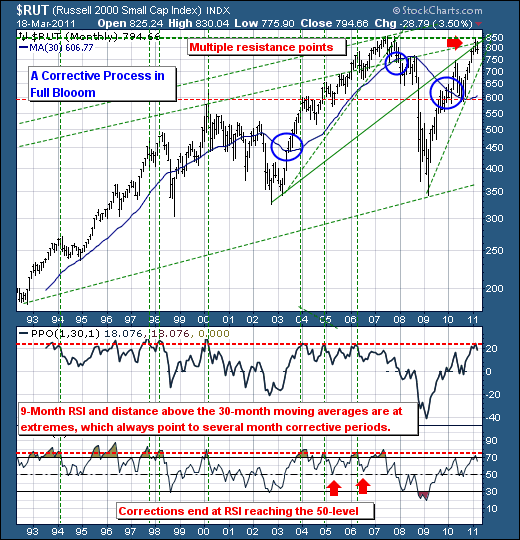

MAJOR INDICATORS FLASHING "CAUTION" FOR RUSSELL 2000

by Richard Rhodes,

Founder and President, Rhodes Capital Management and Rhodes Trading Group

At times, it is best to step back and take a longer-term viewpoint of the markets; and today we'll examine the Russell 2000 Small Caps (RUT). Quite simply, RUT has having difficulty moving past its all-time highs forged in October 2007; and in the process - have caused...

READ MORE

MEMBERS ONLY

NATURAL GAS LOOKING TO PLAY "CATCH-UP"

by Richard Rhodes,

Founder and President, Rhodes Capital Management and Rhodes Trading Group

In the past 10-months, the commodity markets have rallied rather substantially on the back of the QE-2 campaign. But, we would be remiss if we didn't point out that Natural Gas did not participate, with prices below the August levels extant when Fed Chairman Bernanke announced that QE-2...

READ MORE

MEMBERS ONLY

NYSE COMPOSITE IN CORRECTIVE MODE

by Richard Rhodes,

Founder and President, Rhodes Capital Management and Rhodes Trading Group

Since the end of April, the broader market as defined by the NYSE Composite Index has been in a corrective mode. However, the question remains as to whether this corrective process will continue in the weeks and months ahead, or will it come to a halt with the materialization of...

READ MORE

MEMBERS ONLY

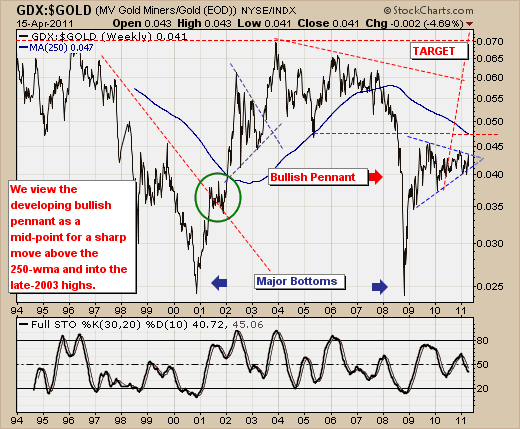

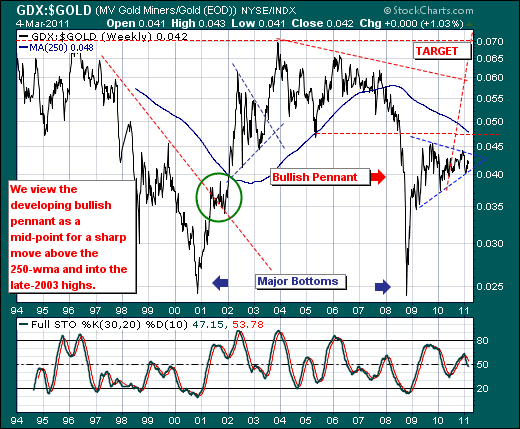

GOLD STOCKS ETF (GDX) POISED FOR SHARP MOVE UP?

by Richard Rhodes,

Founder and President, Rhodes Capital Management and Rhodes Trading Group

The recent gold price rally to new highs has paled in comparison with silver's seemingly parabolic move higher. While many "johnny come latelys" play in the silver pit, we are rather interested in the manner in which the Gold Stocks ETF (GDX) has performed relative to...

READ MORE

MEMBERS ONLY

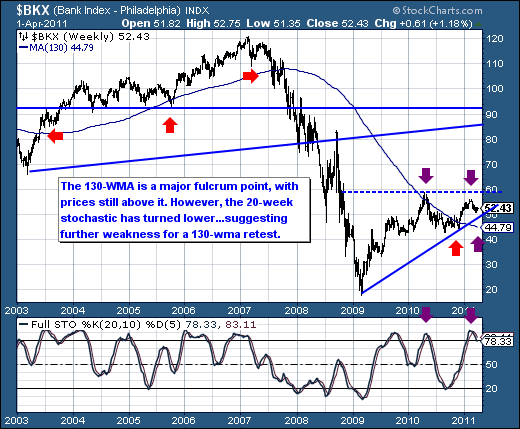

BANK INDEX - THE "CANARY IN THE COAL MINE"?

by Richard Rhodes,

Founder and President, Rhodes Capital Management and Rhodes Trading Group

Questions about regarding the quick/sharp rally off the March 16th low. They are numerous, and they consist of a number of troubling circumstances that call into question the veracity of the rally. One of the areas that is troublesome is the Banking Index ($BKX), for any rally worth its...

READ MORE

MEMBERS ONLY

CORRECTIVE PROCESS IN FULL BLOOM FOR RUSSELL 2000

by Richard Rhodes,

Founder and President, Rhodes Capital Management and Rhodes Trading Group

Over the past several weeks, we've seen the market leader Russell 2000 Small Cap Index ($RUT) falter modestly given Middle East/North Africa and Japanese concerns. Commonsensically speaking, this would have been expected, but certainly on a longer-term basis RUT was ready to decline from a technical perspective...

READ MORE

MEMBERS ONLY

SILVER AND GOLD

by Richard Rhodes,

Founder and President, Rhodes Capital Management and Rhodes Trading Group

The recent gold price rally to new highs hasn't been impressive when compared to silver's sharp rally; but then again, the race may not always go to the rabbit. And it is this thought that has prompted us to consider the horridly lagging gold stocks (GDX)...

READ MORE

MEMBERS ONLY

RICHARD ON HIATUS

by Richard Rhodes,

Founder and President, Rhodes Capital Management and Rhodes Trading Group

Richard Rhodes is on hiatus this week. His article will return in the next issue of ChartWatchers....

READ MORE

MEMBERS ONLY

EMERGING MARKETS SHOWING WEAKNESS

by Richard Rhodes,

Founder and President, Rhodes Capital Management and Rhodes Trading Group

While the US markets power towards higher highs - although in a weak manner we might add, we've begun to see outflows of funds from the Emerging Markets. Ostensibly, this is due in large part to the Egypt uprising, but there are other issues the emerging markets are...

READ MORE

MEMBERS ONLY

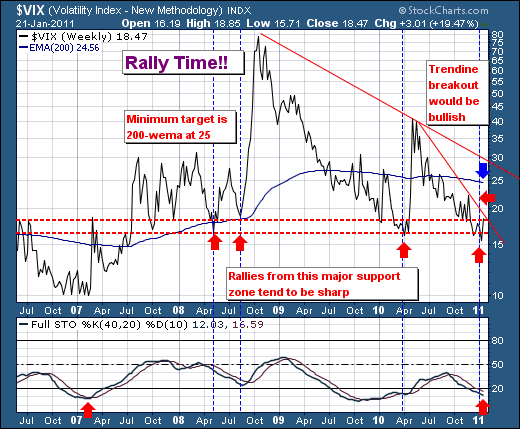

RALLY TIME!

by Richard Rhodes,

Founder and President, Rhodes Capital Management and Rhodes Trading Group

The recent rally in the broader stock market has begun to correct; and it shall likely correct for the next several weeks. We view this decline much in the same manner as the Jan-2010 to early Feb-2010 decline, which the S&P lost roughly 106 points or nearly -10%...

READ MORE

MEMBERS ONLY

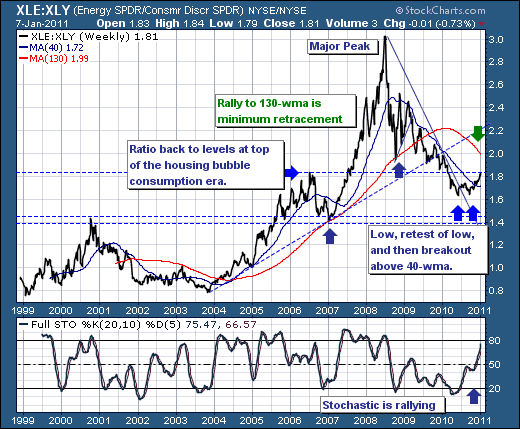

Cons. Discrectionary/Retail In Decline?

by Richard Rhodes,

Founder and President, Rhodes Capital Management and Rhodes Trading Group

As the 2011 trading year unfolds, it is rather clear that the consumer discretionary sector and retail in particular are showing a tendency towards declining rather than rallying with the overall broader market. This is change from the past 2-years, where the consumer discretionary names have out-performed rather than handily....

READ MORE

MEMBERS ONLY

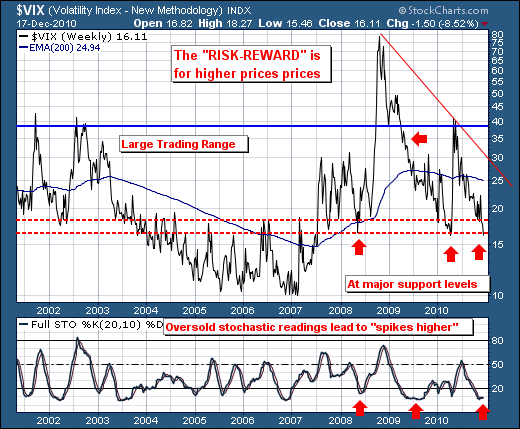

MARKET POISED TO CORRECT

by Richard Rhodes,

Founder and President, Rhodes Capital Management and Rhodes Trading Group

Happy Holidays!

The recent rally off the late-August low has begun to encounter sluggish internals, which leads one to believe that the market shall be poised correct in the weeks and perhaps even months ahead. To this end, we should note the CBOE Volatility index or VIX has moved sharply...

READ MORE

MEMBERS ONLY

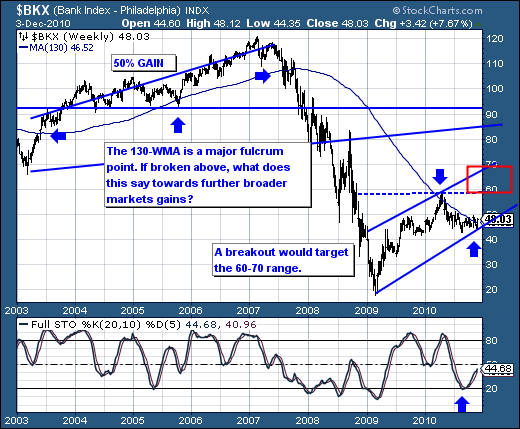

FINANCIALS AND BANKS TO BE A "SURPRISE PERFORMER"?

by Richard Rhodes,

Founder and President, Rhodes Capital Management and Rhodes Trading Group

The past several day market rally has caught many "flat-footed" to be sure as traders head into year-end. Moreover, the prospects for further gains are rather high; hence we're likely to see many traders attempt to play "catch-up". This begs the question as to...

READ MORE

MEMBERS ONLY

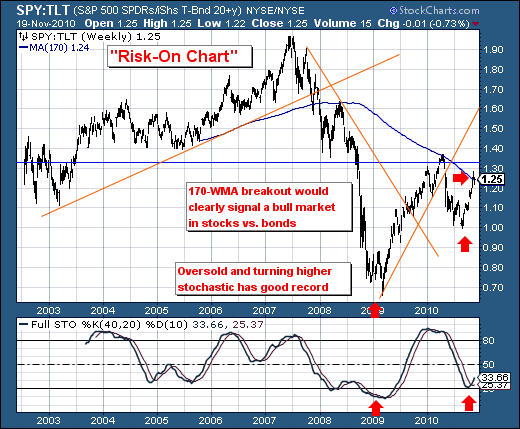

DETERMINING "RISK-ON/RISK-OFF" TRADE

by Richard Rhodes,

Founder and President, Rhodes Capital Management and Rhodes Trading Group

Happy Thanksgiving!

We view the ratio between stocks and bonds as a barometer for the "risk-on" or "risk-off" trade. Therefore, the recent upward movement in the ratio has our attention, and so too should it have our readers as it on the precipice of breaking out...

READ MORE

MEMBERS ONLY

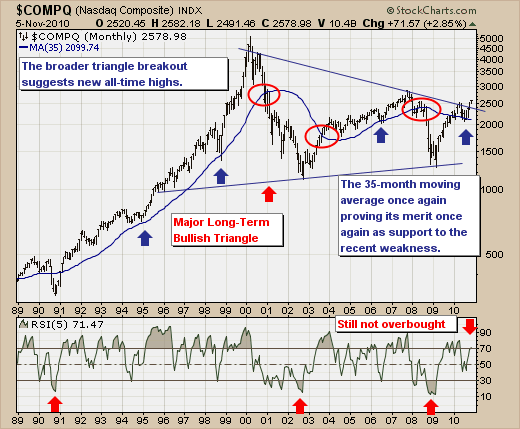

A LONGER-TERM LOOK AT THE NASDAQ COMPOSITE

by Richard Rhodes,

Founder and President, Rhodes Capital Management and Rhodes Trading Group

With the "troika" of the US mid-term elections, FOMC meeting decision on QE-2, and the US Employment Situation Report having been digested by the markets, we thought it instructive to step back and take a longer-term viewpoint of the NASDAQ Composite. Perhaps by looking at the Composite, we...

READ MORE

MEMBERS ONLY

CLOUDS ON THE HORIZON

by Richard Rhodes,

Founder and President, Rhodes Capital Management and Rhodes Trading Group

The S&P 500 rally off the late-August lows continues apace, although it would appear that it is stalling and a correction at a minimum is warranted. There are many who point to the 200-day moving average breakout and the "head & shoulders" neckline being pierced to...

READ MORE

MEMBERS ONLY

S&P 500 HEADED TO HISTORICAL OCTOBER BOTTOM?

by Richard Rhodes,

Founder and President, Rhodes Capital Management and Rhodes Trading Group

The S&P 500 is square within the September/October "historically weak" time frame, but it has been nothing short of astounding to be sure...to the upside. We've seen a rally in 10 of the past 13 days, with prices now squarely upon major...

READ MORE

MEMBERS ONLY

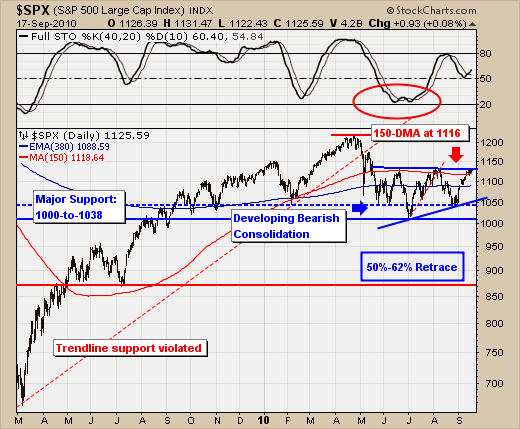

WILL EARLY SEPTEMBER RALLY HAVE STAYING POWER?

by Richard Rhodes,

Founder and President, Rhodes Capital Management and Rhodes Trading Group

The summer is coming to an end for all practical purposes, with many traders returning from their vacations to a budding sharp rally. This presents an interesting situation for traders, for the historically weakest period lies directly ahead - the September/October time frame. Hence, the question is whether last...

READ MORE

MEMBERS ONLY

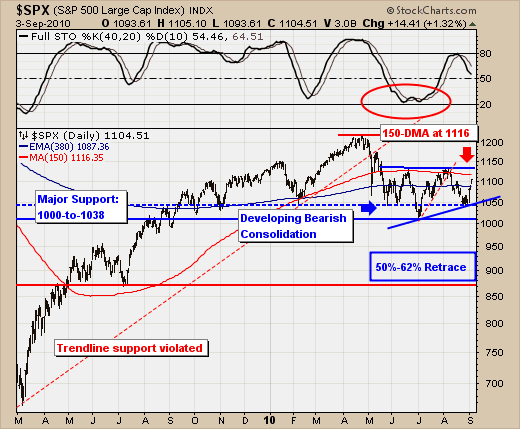

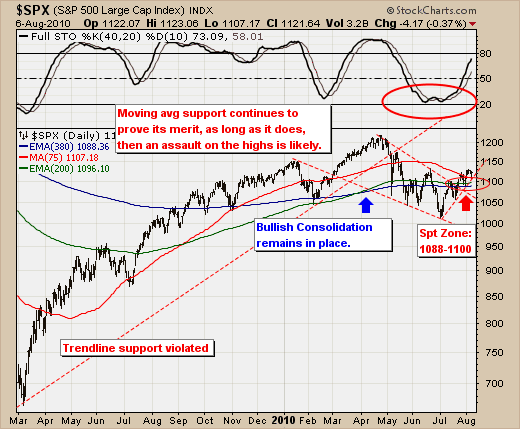

S&P 500 bullish....for the time being

by Richard Rhodes,

Founder and President, Rhodes Capital Management and Rhodes Trading Group

The rally off the July low is ongoing, and appears resilient in the face of very negative sentiment. While we want to be bearish based on a plethora of macro fundamentals, the technical viewpoint remains rather bullish for the time being. However, as we all understand - it could change...

READ MORE

MEMBERS ONLY

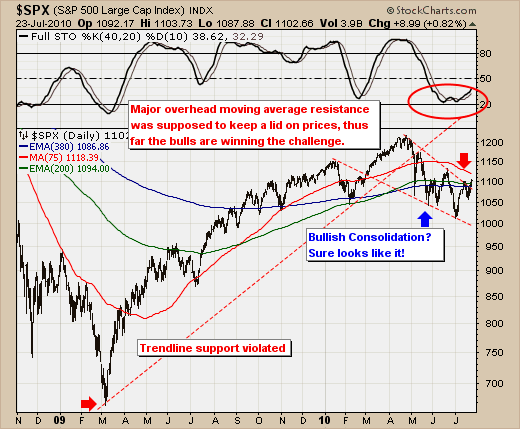

NOW THAT'S A TRADABLE RALLY!

by Richard Rhodes,

Founder and President, Rhodes Capital Management and Rhodes Trading Group

After a horrid 2nd quarter, the S&P 500 is sure making up it's losses at a rapid rate. We've been rather bearish of late given the S&P was trading below its major moving averages that delineate bull & bear markets, with the...

READ MORE

MEMBERS ONLY

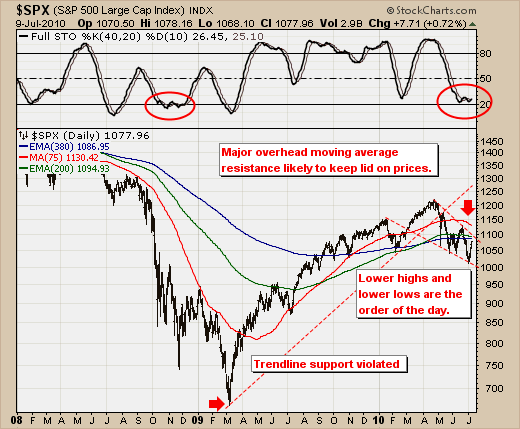

CURRENT S&P RALLY HAVE STAYING POWER?

by Richard Rhodes,

Founder and President, Rhodes Capital Management and Rhodes Trading Group

The July 4th fireworks came a bit more belatedly this year as the S&P 500 rose +4.86% in the holiday shortened week. This performance was rather impressive in terms of points and breadth, but certainly not in terms of volume. To us, this calls into question the...

READ MORE

MEMBERS ONLY

S&P 500 AT A CRITICAL JUNCTION

by Richard Rhodes,

Founder and President, Rhodes Capital Management and Rhodes Trading Group

The S&P 500 decline over the past several weeks has reached a critical junction point in the decline at the 380-day exponential moving average support level. There are several forward scenarios that can occur:

1) Prices are sufficiently oversold on a short-term basis to where the S&...

READ MORE

MEMBERS ONLY

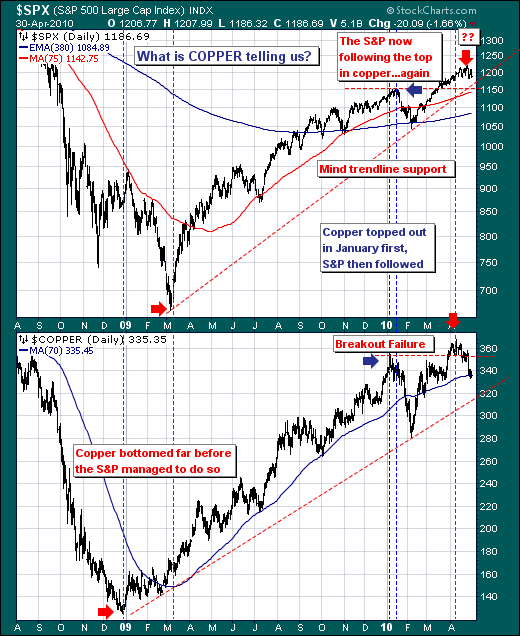

WHAT IS COPPER TELLING US?

by Richard Rhodes,

Founder and President, Rhodes Capital Management and Rhodes Trading Group

We are rather interested in the manner Copper is trading at present, for Copper has shown itself in recent months to be a leading indicator of the path of the S&P 500. Perhaps this is due to it's economic sensitivity, or perhaps it is due to...

READ MORE

MEMBERS ONLY

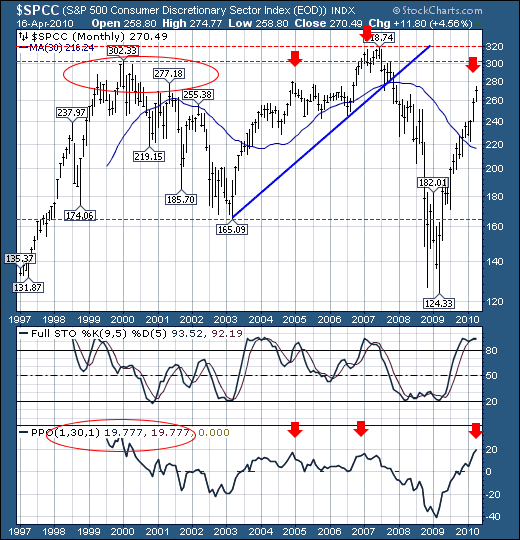

CONSUMER DISCRETIONARY STOCKS PRIMED TO LEAD

by Richard Rhodes,

Founder and President, Rhodes Capital Management and Rhodes Trading Group

Since the beginning of the year, the market "Generals" if you will have been the S&P Consumer Discretionary, S&P Financial and S&P Industrial sectors given they are the only sectors to have out-performed the S&P 500. However, there is only...

READ MORE

MEMBERS ONLY

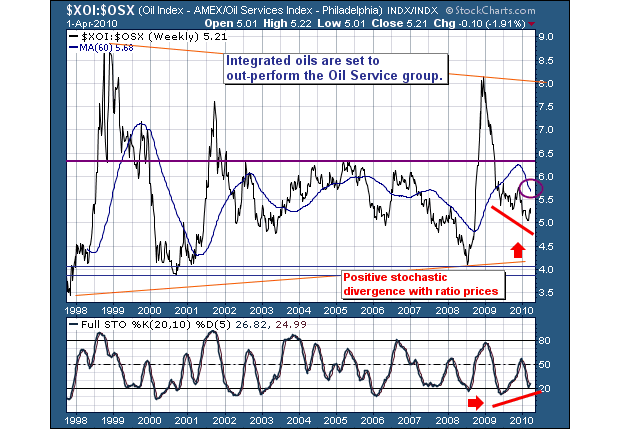

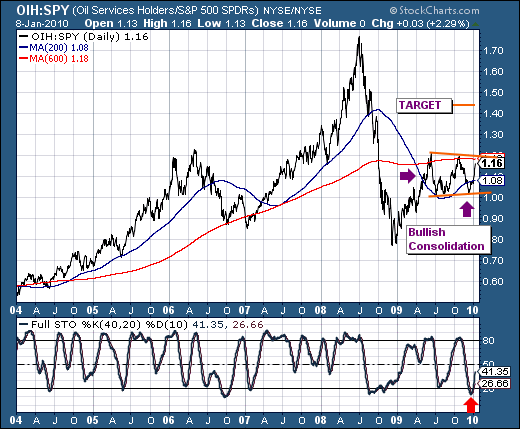

LOOKING INTO OIL SERVICES

by Richard Rhodes,

Founder and President, Rhodes Capital Management and Rhodes Trading Group

The market rally higher has taken quite a few stock groups along for the ride - most notably the Consumer Discretionary and Industrial sectors. However, we've begun to see some very small rotations out of this group, and into the Energy group. This interests us greatly, for Crude...

READ MORE

MEMBERS ONLY

IS THE S&P ON SOUND-FOOTING, OR NOT?

by Richard Rhodes,

Founder and President, Rhodes Capital Management and Rhodes Trading Group

The recent S&P rally to new reactionary highs has shown to be on rather slim-footing given that volume patterns are rather tepid. We don't disagree in the least, but the fact of the matter is that the advance/decline figures have been rather "good"...

READ MORE

MEMBERS ONLY

ON HIATUS THIS WEEK

by Richard Rhodes,

Founder and President, Rhodes Capital Management and Rhodes Trading Group

Richard will return for our next issue....

READ MORE

MEMBERS ONLY

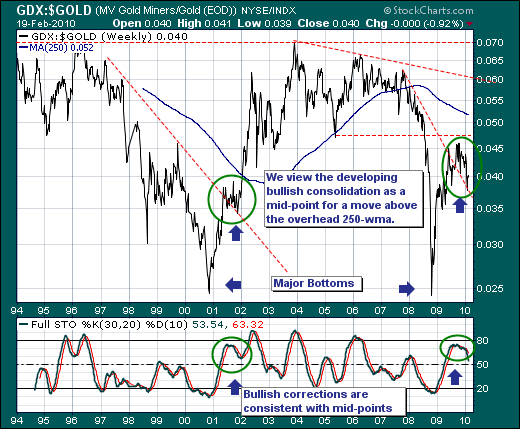

GOLD MINERS VS. GOLD FUTURES

by Richard Rhodes,

Founder and President, Rhodes Capital Management and Rhodes Trading Group

The Gold Futures ($GOLD) market has begun to capture traders' attention once again, for the developing technical patterns would suggest new highs above $1225/oz will materialize in the months ahead. Unfortunately, we haven't included a Gold Futures price here, but take our word for it: a...

READ MORE

MEMBERS ONLY

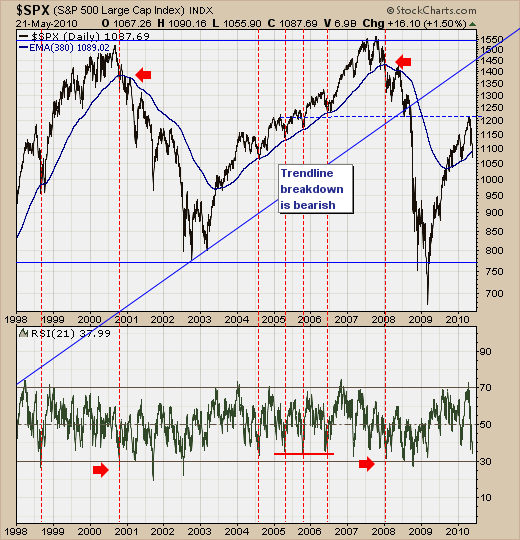

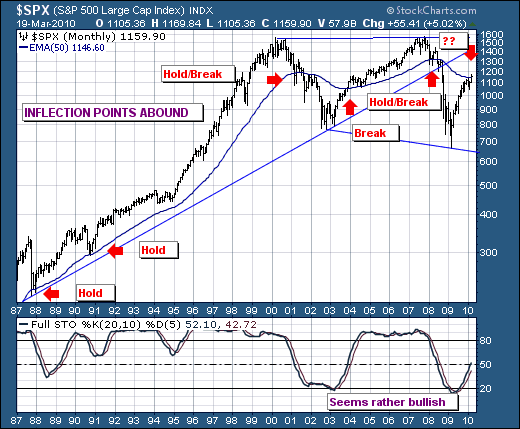

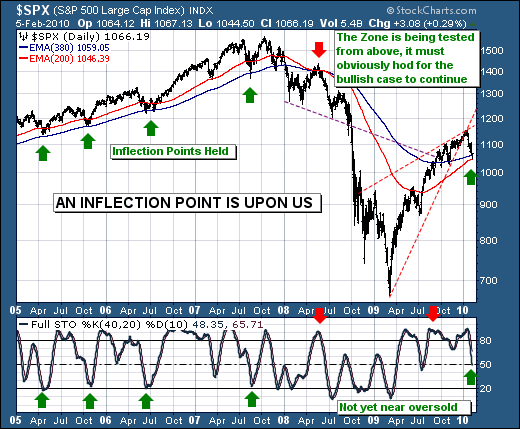

AN INFLECTION POINT IS UPON US

by Richard Rhodes,

Founder and President, Rhodes Capital Management and Rhodes Trading Group

Last week's S&P decline reached a crescendo on Friday around mid-day at 1044.50, which brings the decline to roughly 106 S&P points from the January 19th high at 1150.42. Pencil to paper, and the decline stands at -9.2%, which is just...

READ MORE

MEMBERS ONLY

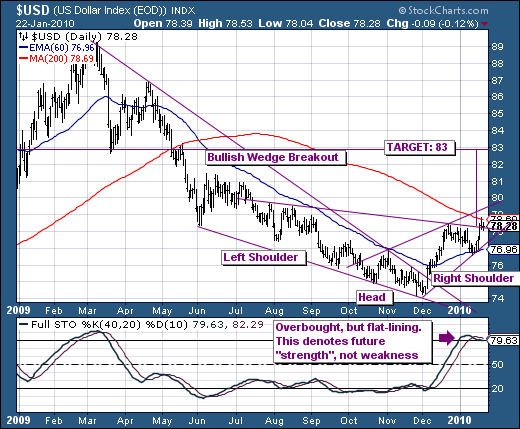

$USD INDICATING A CHANGE?

by Richard Rhodes,

Founder and President, Rhodes Capital Management and Rhodes Trading Group

The past week was punctuated with sharp stock market weakness, with many pundits believing that it is transitory and doesn't have the makings of a larger top. Quite obviously, there is nothing definitive at this juncture, but we're giving odds of over 50% that indeed a...

READ MORE

MEMBERS ONLY

ROTATION THE THEME OF 2010

by Richard Rhodes,

Founder and President, Rhodes Capital Management and Rhodes Trading Group

Rotation, rotation and more rotation. This is what 2010 will be about, with the first week of trading a very good example of what to expect. During 2009, there were only 3 S&P sectors out of 10 that out-performed the S&P 500: Consumer Discretionary, Basic Materials...

READ MORE

MEMBERS ONLY

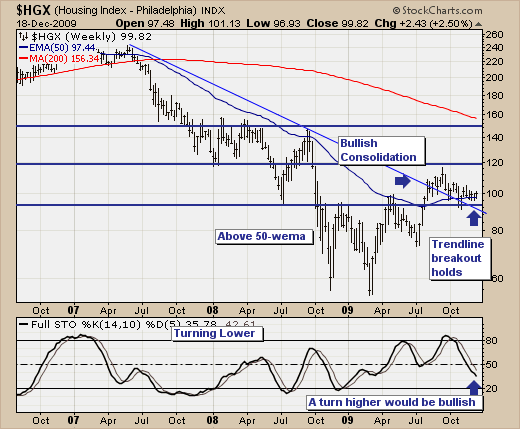

ANOTHER RALLY IN $HGX FUTURE?

by Richard Rhodes,

Founder and President, Rhodes Capital Management and Rhodes Trading Group

We'll be the first to admit that we are bearish on the housing market; and we are bullish on 10-year not yields that will ultimately have a negative impact upon mortgage rates and hence home sales. However, our fundamental backdrop really doesn't square well with our...

READ MORE

MEMBERS ONLY

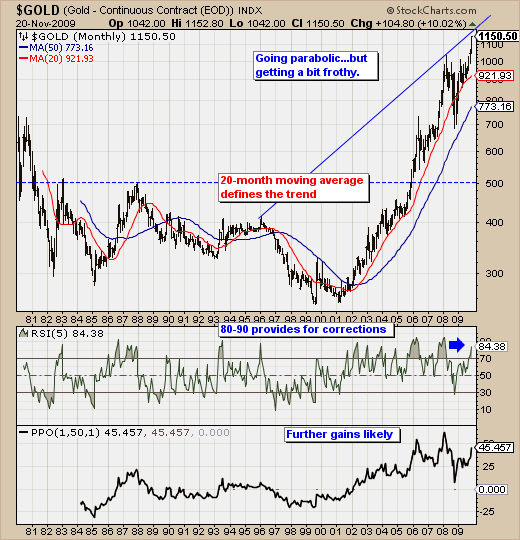

LARGER CORRECTION LOOMING FOR GOLD?

by Richard Rhodes,

Founder and President, Rhodes Capital Management and Rhodes Trading Group

Gold prices are obviously rising, and they are rising rapidly. However, given the move has begun to go parabolic in its 8-year of rally - we have to question how much higher gold prices can go in both the short and intermediate-term. To this end, the monthly charts adds some...

READ MORE

MEMBERS ONLY

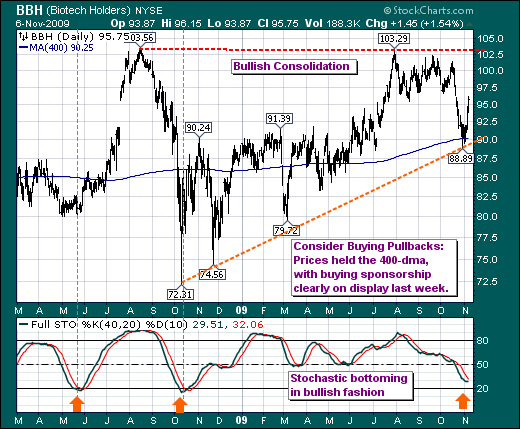

BIOTECHNOLOGY ETF FINDING SPONSORSHIP

by Richard Rhodes,

Founder and President, Rhodes Capital Management and Rhodes Trading Group

We find it rather interesting that the laggard Biotechnology group and the Biotechnology ETF (BBH) in particular have begun to find sponsorship; and it is our opinion that BBH is set to embark upon a period of both absolute and relative out-performance. Quite simply, BBH is forming a rather large...

READ MORE

MEMBERS ONLY

COMPLACENCY IN THE MARKETS

by Richard Rhodes,

Founder and President, Rhodes Capital Management and Rhodes Trading Group

Complacency, complacency and more complacency. While the media worries about a correction in the strong cyclical bull market, they should quite simply be considering whether or not the cyclical bull has indeed topped out and a cyclical bear market has begun. This is the nature of higher prices; market participants...

READ MORE

MEMBERS ONLY

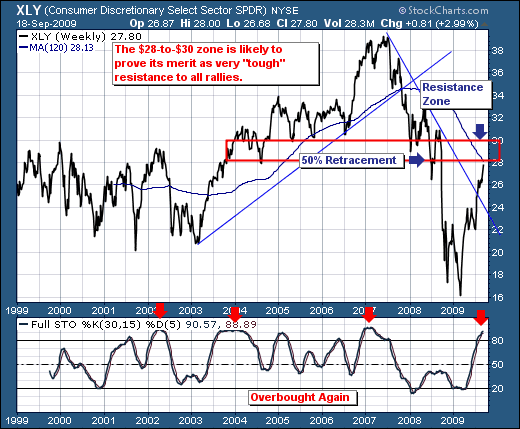

LOWER PRICES AHEAD FOR XLY?

by Richard Rhodes,

Founder and President, Rhodes Capital Management and Rhodes Trading Group

The insatiable need to own stocks has manifested itself in most S&P sectors, in which the Consumer Discretionary sector is doing far better than anyone can believe. Most, if not all of the clients we speak with on a daily basis do not understand why this is so;...

READ MORE

MEMBERS ONLY

ON HIATUS THIS WEEK

by Richard Rhodes,

Founder and President, Rhodes Capital Management and Rhodes Trading Group

Richard will return for our next issue....

READ MORE

MEMBERS ONLY

"IF THEY A YELL'IN; THEN YOU SHOULD BE SELL'IN"

by Richard Rhodes,

Founder and President, Rhodes Capital Management and Rhodes Trading Group

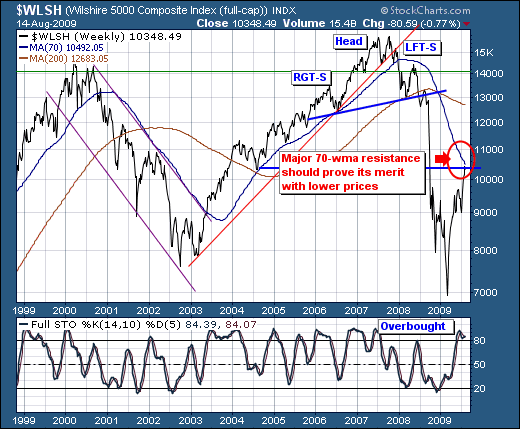

The July-August stock market rally has caught many surprised given its strength and duration; however, we are of the opinion that this "freight train" is running of out of fuel, and shall falter from roughly current levels in what may be quite a "quick and nasty"...

READ MORE