MEMBERS ONLY

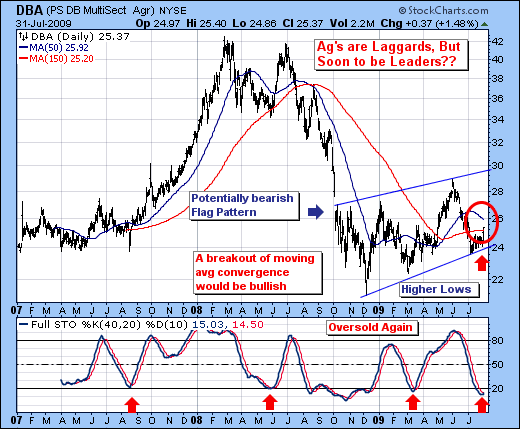

COMMODITY SECTOR PICKING UP

by Richard Rhodes,

Founder and President, Rhodes Capital Management and Rhodes Trading Group

On Thursday and Friday of last week, we saw the US dollar resume its downtrend, and the commodity sector begin to pick up participation as a result. This is likely to continue into the future as the US dollar is destined for lower lows; thus we are quite interested in...

READ MORE

MEMBERS ONLY

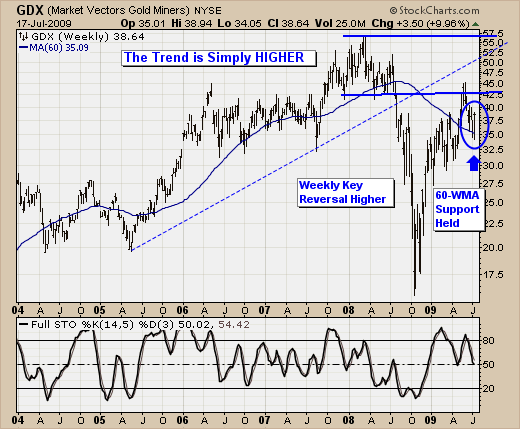

Riding Out the Summer Doldrums

by Richard Rhodes,

Founder and President, Rhodes Capital Management and Rhodes Trading Group

As the summer doldrums set in, we've seen quite a bit of back and forth in the various capital markets, with prices not moving far from where they were just 2-months prior. However, last week was important for the Gold Miners (GDX) we believe, for a very simple,...

READ MORE

MEMBERS ONLY

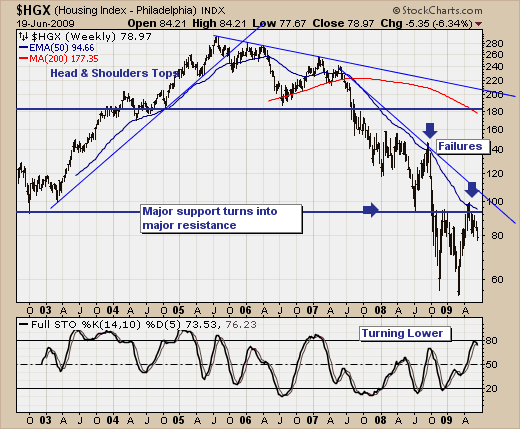

NOT MUCH TO LIKE ABOUT HOUSING...

by Richard Rhodes,

Founder and President, Rhodes Capital Management and Rhodes Trading Group

As the "green shootists" shout from the rooftops about the bottoming of the US and world economy; we think a technical and the Housing Index ($HGX) in particular offer keen insight as to whether one component of what led the US into the housing & credit market bubble....

READ MORE

MEMBERS ONLY

DRUGS & HEALTHCARE POISED TO OUTPERFORM

by Richard Rhodes,

Founder and President, Rhodes Capital Management and Rhodes Trading Group

As the current rally perpetuates beyond what reasonable technicians would have thought at this point - the buying surge has now surpassed 57 trading sessions, it would appear traders are searching rather intently for those "laggard" groups or stocks to provide them with enhanced risk-reward benefits. This is...

READ MORE

MEMBERS ONLY

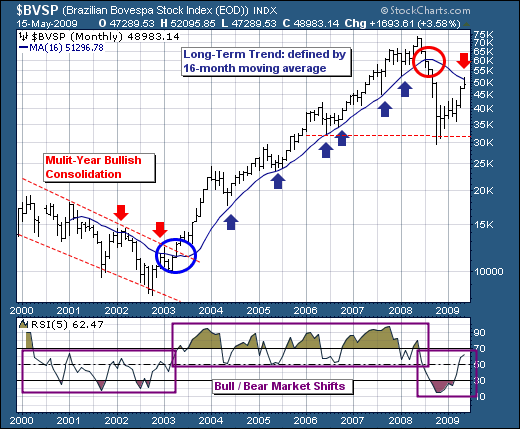

EMERGING MARKETS TAKING THE LEAD

by Richard Rhodes,

Founder and President, Rhodes Capital Management and Rhodes Trading Group

As the markets have rallied off the March 9th bottom, we find it rather interesting that the Emerging Markets have taken a lead role and have outperformed rather handily. The growing consensus believes that when the worlds' stock markets do bottom, then the Emerging Markets will take the role...

READ MORE

MEMBERS ONLY

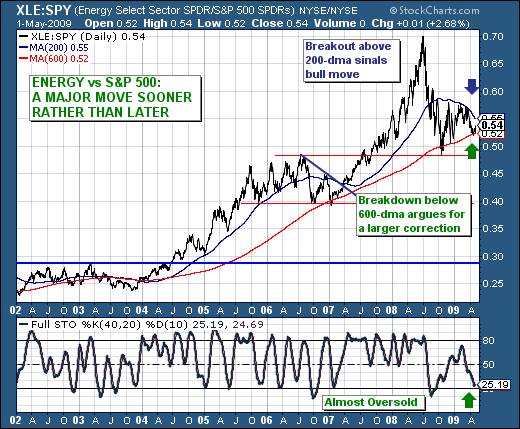

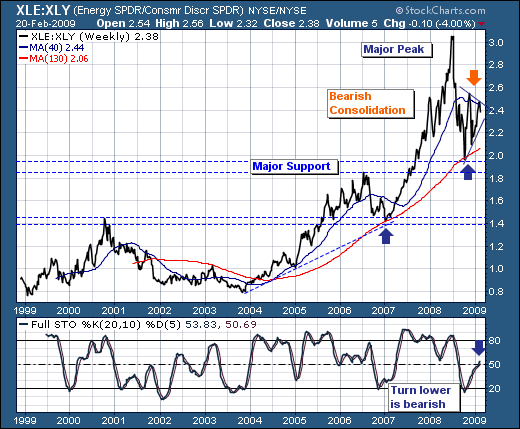

ENERGY vs S&P 500: A MAJOR MOVE SOONER RATHER THAN LATER

by Richard Rhodes,

Founder and President, Rhodes Capital Management and Rhodes Trading Group

The past several trading sessions have shown an increased propensity for traders to "allocate or rotate" funds into commodity and natural resource stocks. Those gains were no starker than during Friday's trading session, when the S&P Energy Sector (XLE) was higher by +3.23%...

READ MORE

MEMBERS ONLY

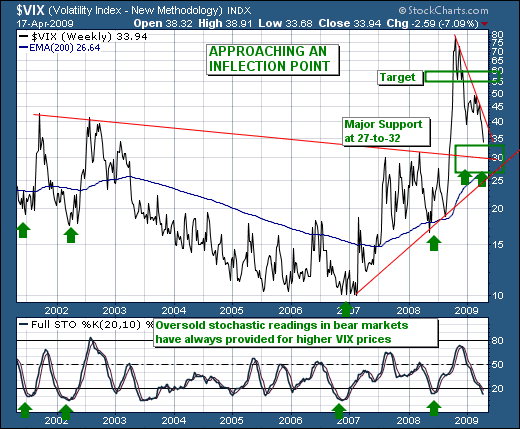

LUCKY #7

by Richard Rhodes,

Founder and President, Rhodes Capital Management and Rhodes Trading Group

The various US market averages have seen six straight weeks of rally, and one must wonder is "lucky #7" is in the offing. We don't know honestly; however, there are signs the rally off the March 9th low is becoming "long in the tooth"...

READ MORE

MEMBERS ONLY

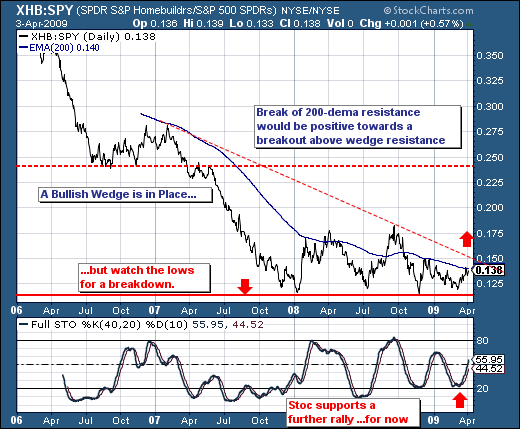

LOOKING AT HOMEBUILDERS

by Richard Rhodes,

Founder and President, Rhodes Capital Management and Rhodes Trading Group

As the market continues it counter-trend bullish rally, we find is more than interesting that the Homebuilders haven't yet taken a leadership role. We would posit that given it was the Homebuilders that was the "canary in the coal mine" for the sharp broader market decline,...

READ MORE

MEMBERS ONLY

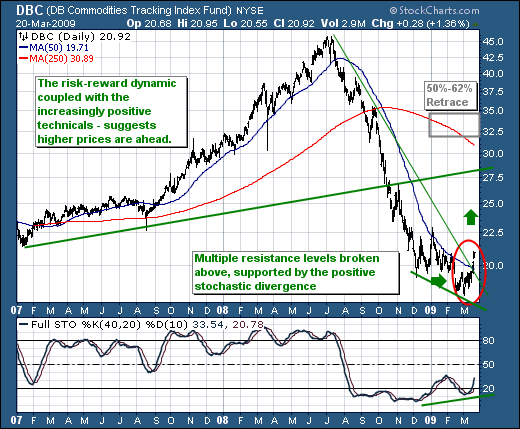

FOCUSING ENERGY ON COMMODITIES

by Richard Rhodes,

Founder and President, Rhodes Capital Management and Rhodes Trading Group

The FOMC has now become very serious to put an end to the financial crisis. To put it simply, Wednesday's FOMC announcement that they plan to roll the printing presses in order to buy $200 billion in longer-dated treasury paper is certainly a "positive." This will...

READ MORE

MEMBERS ONLY

LOOKING TOWARDS SECTOR ROTATION

by Richard Rhodes,

Founder and President, Rhodes Capital Management and Rhodes Trading Group

This year has seen the S&P decline by -24.3%; with the building crescendo of "fear" likely to provide for a bottom that can be traded sooner rather than later. We're looking towards sector rotation to play a large part in our trading strategy;...

READ MORE

MEMBERS ONLY

BE PREPARED

by Richard Rhodes,

Founder and President, Rhodes Capital Management and Rhodes Trading Group

In our last commentary, we noted that the S&P Energy ETF (XLE) was in the process of forming a bearish consolidation that argues for sharply lower prices. And since then, prices have consolidated further, but

are now poised to breakdown below trendline support and the October-2008 lows. However,...

READ MORE

MEMBERS ONLY

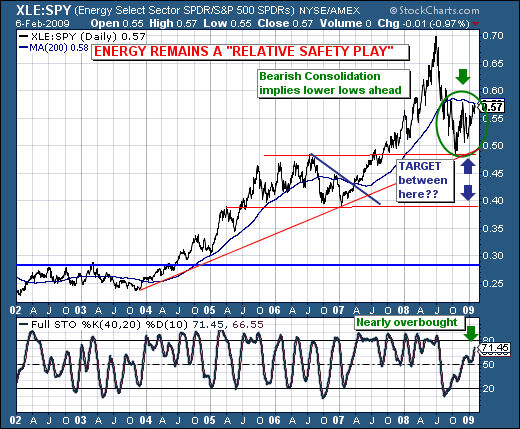

FOCUSING ON THE ENERGY SECTOR

by Richard Rhodes,

Founder and President, Rhodes Capital Management and Rhodes Trading Group

Our focus today is upon the Energy Sector (XLE) and its relative valuation to the S&P 500 Spyders (SPY). Given the current bear market, we've found recently that market participants are once again willing

to return aggressively to what they know worked rather well in the...

READ MORE