MEMBERS ONLY

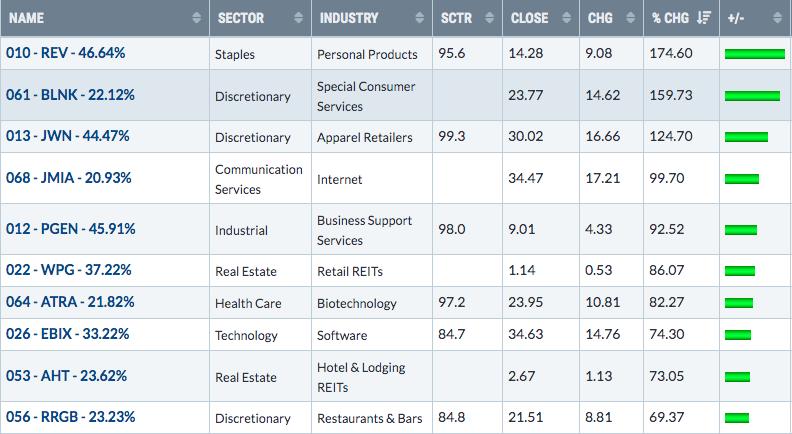

Post-Vaccine Trading Reveals New Leadership And Further Confirms Bull Market

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

We all knew it was coming - or at least we should have. Industries that struggled throughout the pandemic and restrictions would come back to life once positive vaccine news hit and we could see the light at the end of the tunnel. But let me caution you first. They...

READ MORE

MEMBERS ONLY

This Is How Market Makers Steal From Us

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

You might think the stock market is really unpredictable and, for the most part, I'd agree with you. But when we get to options expiration week, there is a consistent theme that emerges nearly every month. The market makers are looking to steal you blind. Once per month,...

READ MORE

MEMBERS ONLY

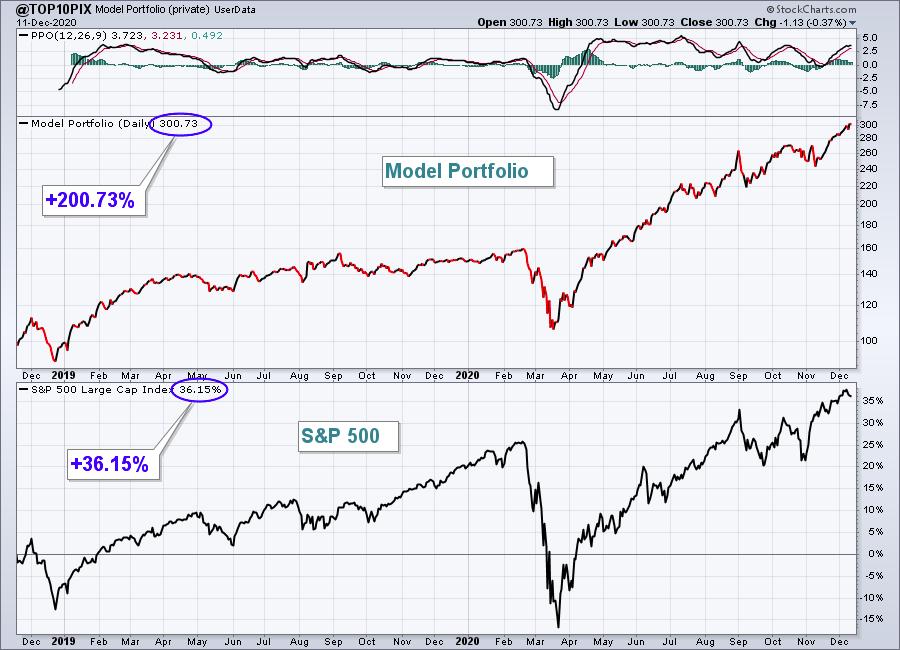

My Stock-Picking Secrets To Beat The Benchmark S&P 500

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

All of the stocks and ETFs in our 5 current portfolios are "drafted" in real time during our members-only events that we hold quarterly. I don't Monday Morning quarterback; I listen to what Wall Street is saying and stick with the themes that are driving big...

READ MORE

MEMBERS ONLY

Handle is Complete, Time For AAPL To Run?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

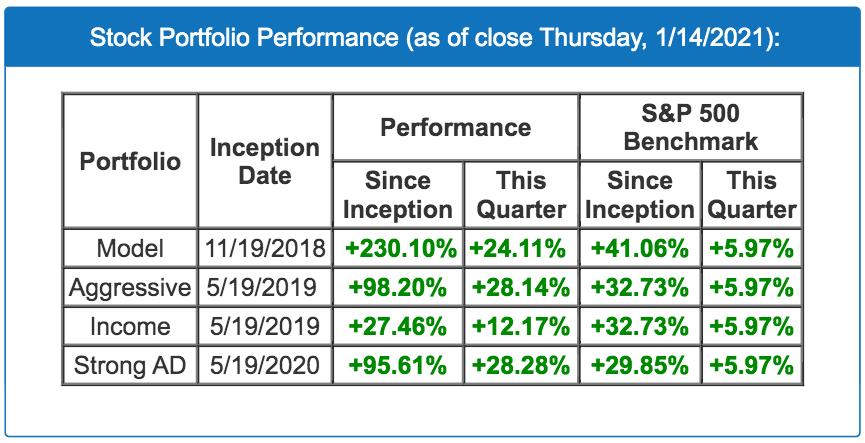

I wrote about a pending short-term correction in AAPL shares a couple weeks ago right here in the DITC blog. My article, "Apple (AAPL) Prints Reversing Candle, Short-Term Selling Possible", illustrated the reversing dark cloud cover candle that had taken place at key price resistance established at the...

READ MORE

MEMBERS ONLY

Here's The One Thing You Need To Worry About Right Now

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Any time that it behooves market makers to direct prices lower, I get nervous. So that means I get nervous as we approach the 3rd Friday of every calendar month (monthly options expiration day), especially if we've seen a nice advance leading up to it. If you'...

READ MORE

MEMBERS ONLY

Searching For The Next Solar ETF And FREE Event This Morning

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Whether you're investing in individual stocks or ETFs, finding that next BIG winner makes a huge difference in your absolute results and your relative results vs. a benchmark like the S&P 500. At EarningsBeats.com, we spend a great deal of time researching stocks and reviewing...

READ MORE

MEMBERS ONLY

One Obstacle Every Investor Must Overcome To Enjoy Stock Market Success

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The demon lies within. Listen, I know because I've had to overcome this demon. Stock market success - true, sound, market-beating success - didn't occur until I realized one thing. The stock market, collectively, is smarter than me. When I began constructing our stock portfolios at...

READ MORE

MEMBERS ONLY

Massive Short Squeeze Taking Place In This Computer Hardware Stock Today

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Imagine you're in a crowded theater, there's one small exit in the lower corner and someone yells, "FIRE!" Or perhaps you're the bottom grain of sand in an hourglass. That's what many of the short sellers likely feel like today...

READ MORE

MEMBERS ONLY

5 Things to Know About This Secular Bull Market

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Happy New Year!

Many market pundits view every year in the stock market exactly the same. I do not. I believe there are "big picture" headwinds and tailwinds that impact the stock market in much the same way as currents impact fish attempting to swim upstream vs. downstream....

READ MORE

MEMBERS ONLY

Apple (AAPL) Prints Reversing Candle, Short-Term Selling Possible

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Candlestick charting can be very useful if you're a short-term trader, especially when you see a reversing candle at key price support or resistance. Yesterday, we saw a dark cloud cover candle form on more-than-average volume, suggesting to me that AAPL may have topped near-term. Make no mistake,...

READ MORE

MEMBERS ONLY

Is Amazon Finally Ready To Launch PLUS My Favorite Stock For 2021

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Consolidation requires patience and anyone that's owned AMZN during the 4th quarter knows what I'm talking about. Since September 30th, the S&P 500 has gained more than 10%, while AMZN has flat-lined. Many will view this relative weakness as a signal to avoid AMZN...

READ MORE

MEMBERS ONLY

ETF Investors: Make This Your #1 New Years Resolution

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

When I speak to anyone about ETFs, the conversation nearly always revolves around performance. I'm not saying that performance isn't important. Ultimately, it's what we all look at. But I'm surprised that many ETF investors have no plan. They hear about this...

READ MORE

MEMBERS ONLY

Here's Why I'd Be Buying an Overbought Market

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Since the March lows, the NASDAQ has seen its RSI approach or pierce the overbought 70 level on 11 different occasions. The only meaningful correction that's taken place on any of those 11 occurrences, though, has been the September selling. Historically, September is a poor month, so we...

READ MORE

MEMBERS ONLY

We Have a New Software Leader and It's Exploding!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

We combine fundamentals and technicals at EarningsBeats.com to deliver market-beating returns. While past results can never guarantee future results, our strategy has a documented record of crushing the S&P 500, not just beating it. Our approach is undeniably simple: find companies that are (1) underpromising and overdelivering,...

READ MORE

MEMBERS ONLY

U.S. Stocks Just Received Yet Another Bullish Signal

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I love to see a leading industry group go through a lengthy consolidation period on both an absolute and relative basis....and then break out. There haven't been too many groups that have consistently performed better than software ($DJUSSW) over the past several years. Here's a...

READ MORE

MEMBERS ONLY

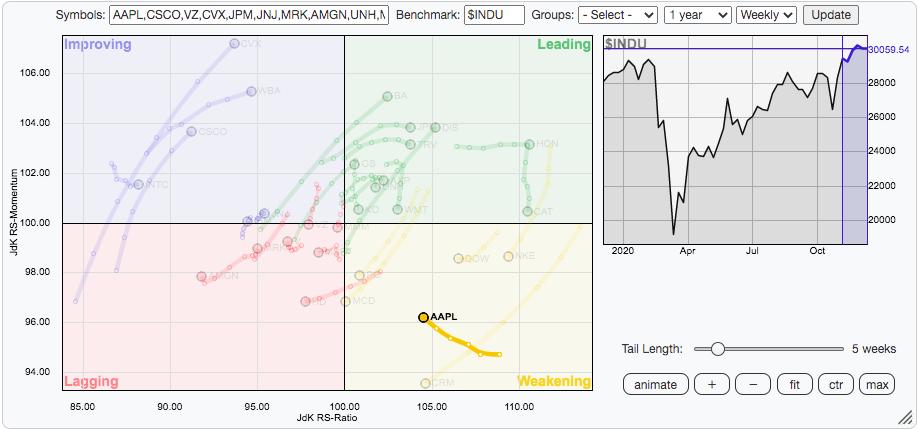

AAPL Is Strengthening Again - Check Out These RRGs

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Yesterday, in my Daily Market Report to members, I pointed out three of the Dow Jones component stocks that were showing leadership, or in Apple's (AAPL) case, a return to leadership. While it isn't very apparent on AAPL's own price relative chart vs. its...

READ MORE

MEMBERS ONLY

Investment Professionals: Sharpe Ratios Don't Get Any Better Than This

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

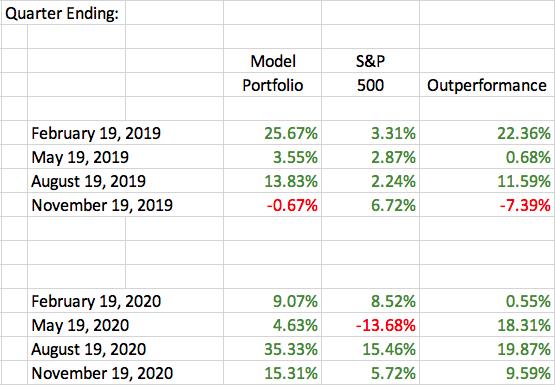

We now have 2 years under our belt at EarningsBeats.com with respect to our flagship Model Portfolio and the results have been stunning - quite honestly better than I could have ever predicted or imagined. We had to suffer through a 20%+ drawdown in Q4 2018 (trade war), just...

READ MORE

MEMBERS ONLY

The Big Winner Leading Our Model Portfolio Higher

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Since we announced our latest portfolio "draft" selections, one Model Portfolio stock - Tesla (TSLA) - has been flying. Even after some recent profit-taking, TSLA was higher by 25.6% from our November 19th selection to Thursday's close. Out of our 10 equal-weighted stocks in our...

READ MORE

MEMBERS ONLY

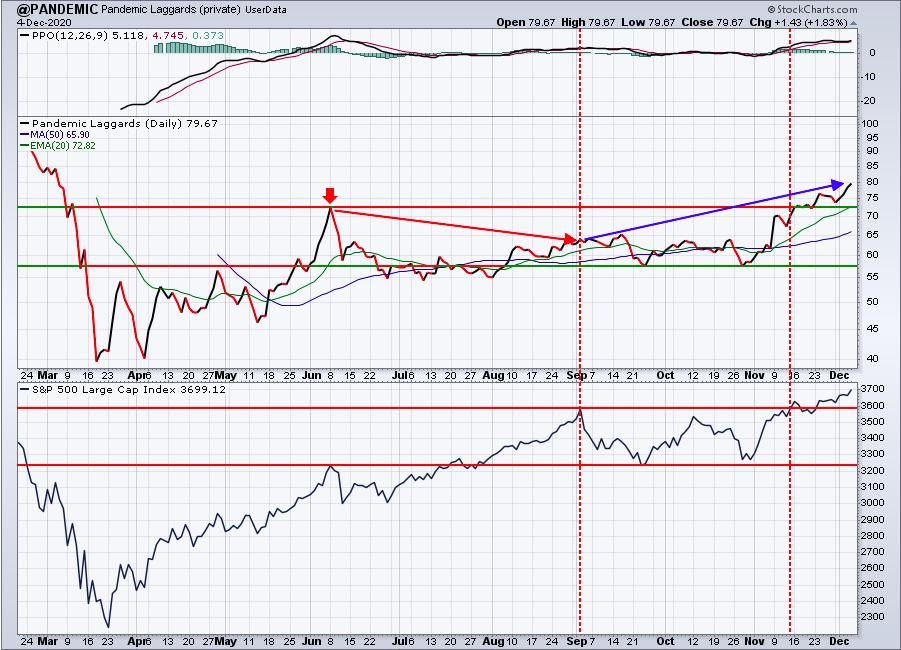

9 of 10 Industries In My Pandemic Index Have Broken Out

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

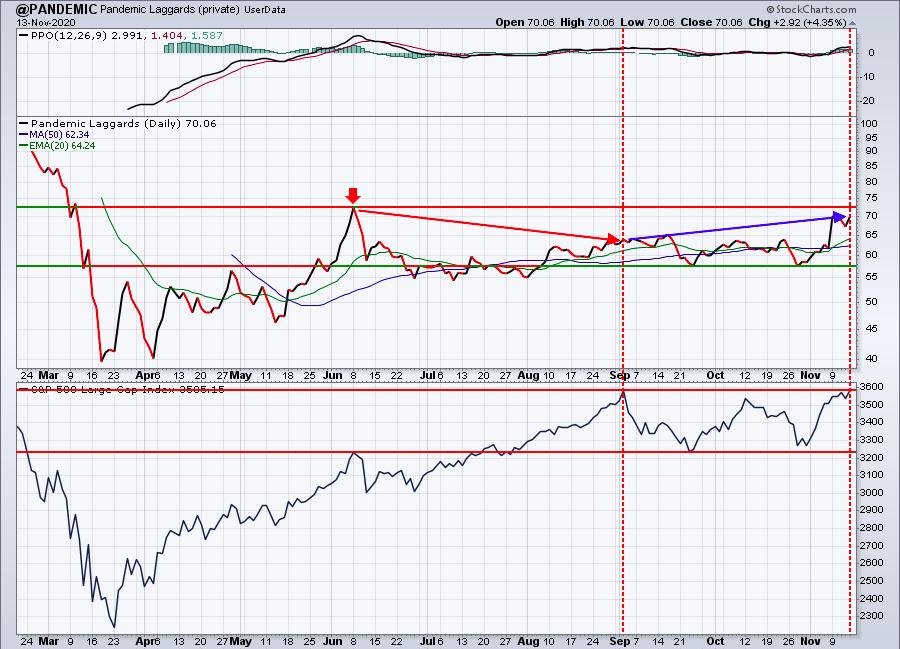

I developed my Pandemic Index several months ago to track the progress of the 10 worst performing industry groups during the onset of COVID-19. It's an equal-weighted index of those 10 industries and I track it using StockCharts.com's User-Defined Index tool. Here's how...

READ MORE

MEMBERS ONLY

A December Seasonal Powerhouse Is Exploding Higher

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

We prepared a list of the 20 best stocks to own in December and sent it to our EarningsBeats.com members one week ago. The TOP-RATED stock on our list was Western Digital (WDC), which has advanced in 70% of Decembers this century and has produced an average return of...

READ MORE

MEMBERS ONLY

2 Intermarket Relationships are Providing MASSIVE Buy Signals

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I always credit John Murphy for all of my work regarding intermarket relationships. He's inspired me in a number of ways and I continue to look for relationships that can better increase my odds of calling the stock market correctly. The great thing about these relationships is that...

READ MORE

MEMBERS ONLY

Short Squeezes Are Crippling Those On The Bearish Side

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

This has been the quarter for short squeezes. It's been crazy. The beauty from the long side is that once these stocks make breakouts, the pressure builds on short sellers to cover their positions. Unfortunately, many have the same emotional connection to their bearish bets that many long...

READ MORE

MEMBERS ONLY

A Look Back At The Clues Of This Pandemic Rally And Why We're Just Getting Started

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Global markets are rallying as more and more analysts look beyond the devastation caused by the 100-year pandemic and see a very bright economic outlook. Pent up demand, combined with historically-low interest rates will likely prove to be very bullish in the end. I continue to believe that we'...

READ MORE

MEMBERS ONLY

Strong Seasonality Combined With a Breakout Can Prove to be Quite Profitable

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

A month ago, we provided our EarningsBeats.com members a list of 20 companies that have historically performed well in the month of November. One of the stocks was TransDigm Group (TDG), and it only takes a quick glance at the seasonality chart to see why it was featured at...

READ MORE

MEMBERS ONLY

We Now Have Confirmation That It's Full Speed Ahead for this Secular Bull Market

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I'm going to keep this article short and sweet. We're going higher.

If you're still convinced that the U.S. stock market is staring at a doom-and-gloom environment, I don't know what to say. Several months ago, I created a User-Defined Index,...

READ MORE

MEMBERS ONLY

We Have The #1 Draft Pick (And Picks 2 Through 10) Once Again And We're Going To Make It Count!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Every 3 months, on February 19th, May 19th, August 19th, and November 19th, we host our own version of a "Draft Party". It's the most exciting day of the quarter for us at EarningsBeats.com. The anticipation has been building for weeks, and for good reason....

READ MORE

MEMBERS ONLY

A Very Strong Stock in an Industry Just Breaking Out and Showing Leadership

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Later tonight and tomorrow, I'll be evaluating literally thousands of stocks in determining which 10 equal-weighted stocks I'll include in each of our 4 portfolios at EarningsBeats.com. Our track record is sparkling and you can view our portfolio results HERE.

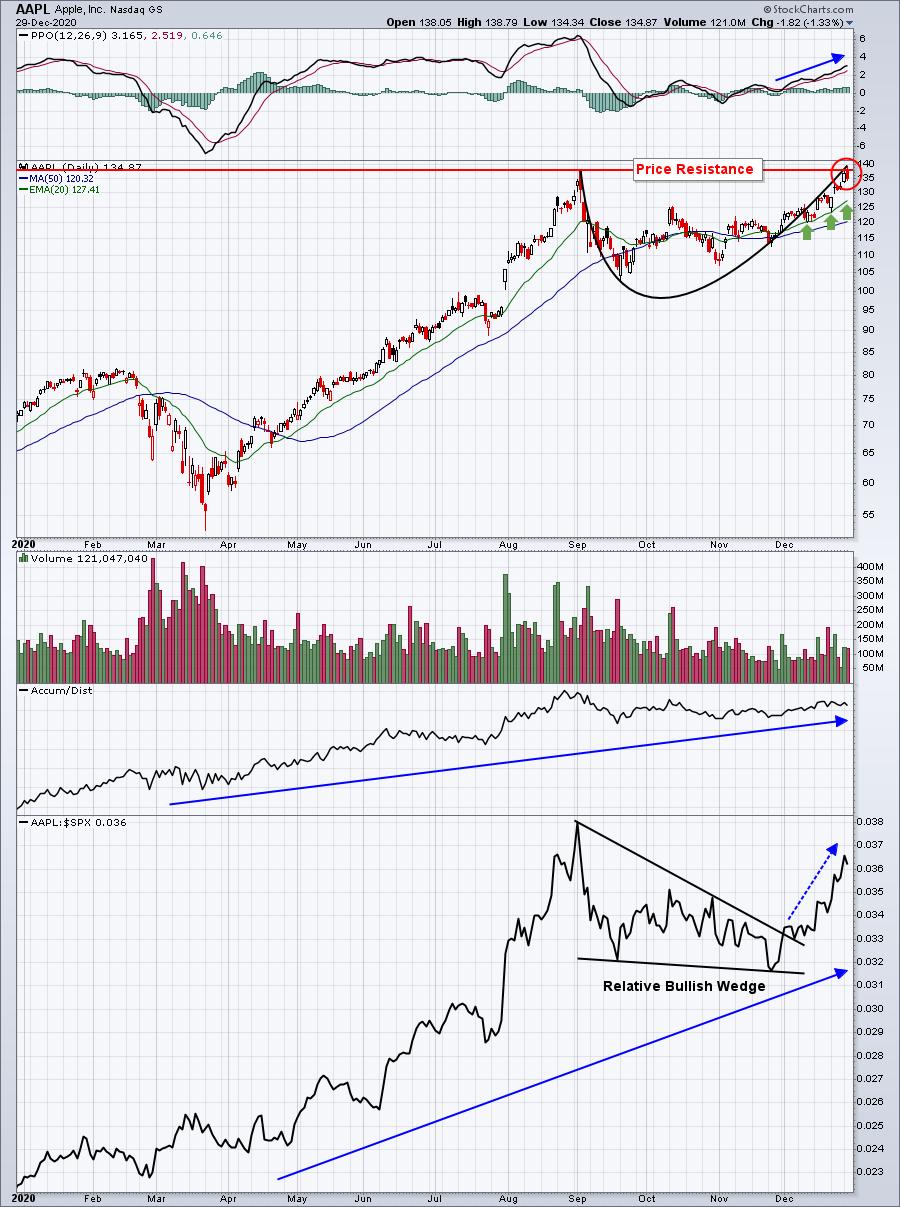

I start with sectors. I&...

READ MORE

MEMBERS ONLY

Pandemic Index: Recent Relative Strength Means We Should Start Looking At Different Industries

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Ever since the worst industry groups in March and April revealed themselves, I've been tracking what I refer to as my Pandemic Index. It's an equal-weighted index of the 10 worst performing industry groups during the pandemic's first few months. A key resistance level...

READ MORE

MEMBERS ONLY

Sector And Industry Rotation Is The Most Important Factor In Outperforming The S&P 500.....And It's Changing

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

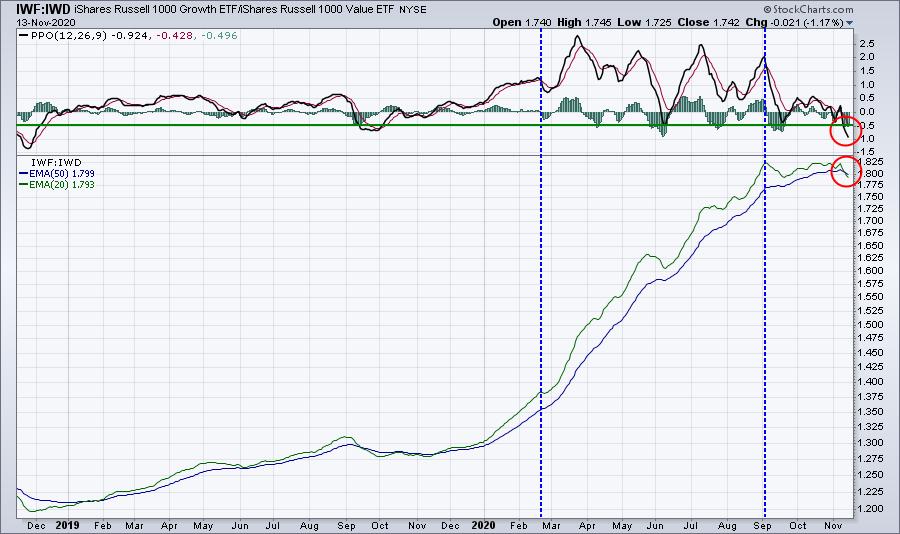

During the initial stages of the pandemic in March and April, it became quite clear to me that companies with a strong online brand and presence were set to outperform the broad S&P 500 index. The accumulation/distribution line (AD line) pointed us towards those companies that were...

READ MORE

MEMBERS ONLY

Is The NASDAQ 100 Trending Higher Again? Watch These Two Charts

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

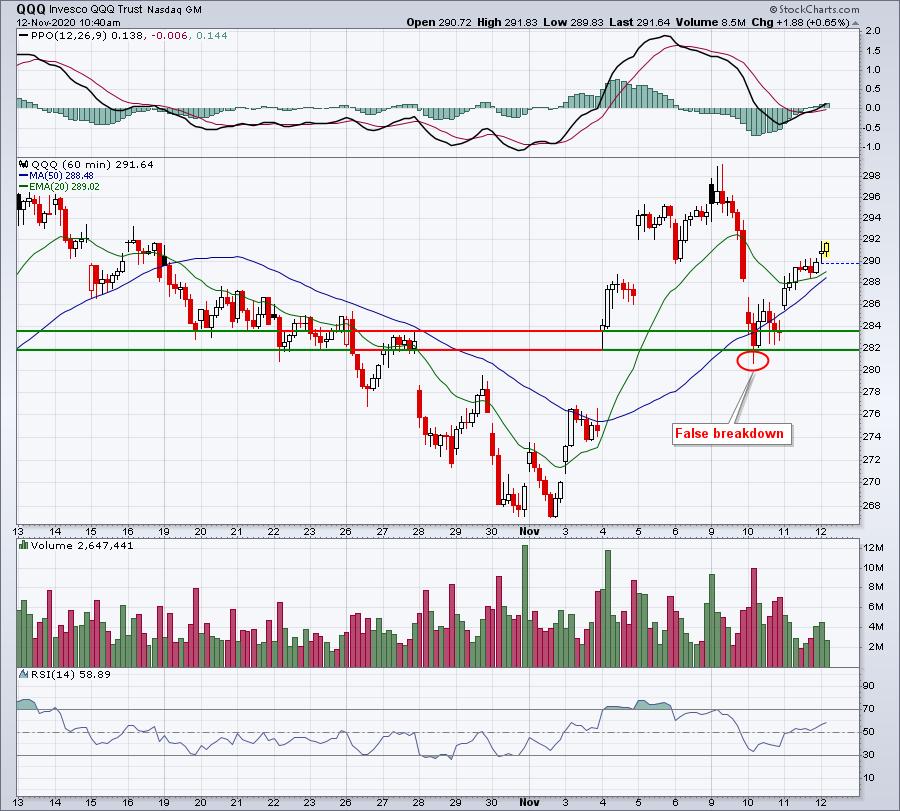

We have seen tremendous leadership from the NASDAQ 100 ($NDX) throughout 2020 and the COVID-19 pandemic. Many growth-oriented component stocks have done exceptionally well as they've adjusted to this "stay-at-home" and "social distancing" environment. But is this a paradigm shift that continues into 2021?...

READ MORE

MEMBERS ONLY

Here Are The 39 Stocks In Our 4 Portfolios That Have Enabled Us To Crush The S&P 500 This Quarter

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Special Note

This is a weekly portfolio report that I send to our EarningsBeats.com members every Sunday. It's designed to provide a summary of our portfolio performance over the past week, highlighting the stocks that have led our portfolios higher (or lower). From our website, here'...

READ MORE

MEMBERS ONLY

Portfolios Break To New Record Highs; 4 Portfolio Stocks Likely To Remain For Next Quarter

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

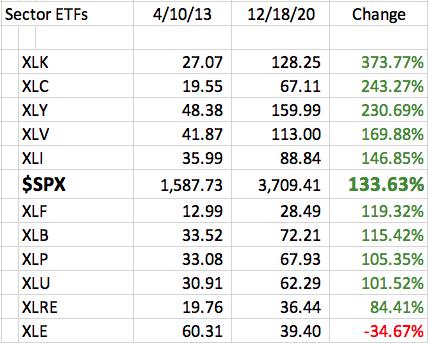

Portfolios Update

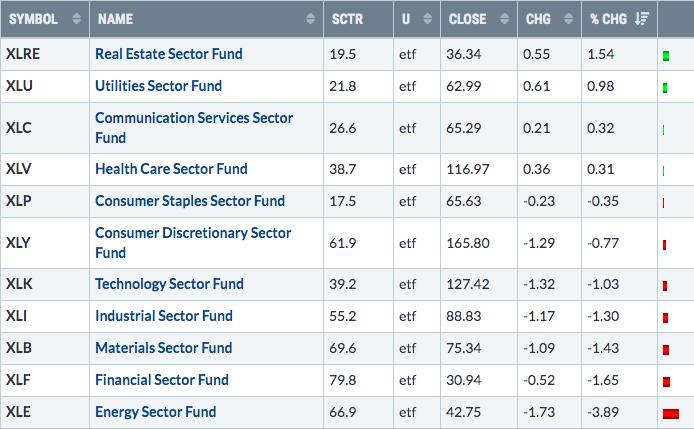

4 of our 5 portfolios - Model, Aggressive, Strong AD, and Model ETF - all exceeded their prior closing highs on Friday. The Strong AD Portfolio soared more than 18% last week, absolutely crushing the S&P 500. Here's a quick summary of our portfolios:...

READ MORE

MEMBERS ONLY

Here's My Strategic Approach to Outperforming the S&P 500 - It Works in Any Market

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Let me preface my article by saying that I'm very bullish. I mean, like, extremely bullish. No, really, I'm talking CRAZY bullish. Historically, we've just entered a period, October 27th close through January 18th close, where the S&P 500 has gained ground...

READ MORE

MEMBERS ONLY

Earnings And The Fed: They Drive The Market, Not The Virus

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

When valuing a company, the two key variables are earnings (and earnings growth) and interest rates. I believe we're in a secular bull market because earnings growth is expanding, along with our economy, and the Fed has said historically-low interest rates will remain that way at least into...

READ MORE

MEMBERS ONLY

Here's A Sector And A Stock That You Don't Want To Ignore In November

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I have a huge preference for owning companies that are leaders within their industry and the industry itself is a leader. So it's very hard for me to argue against a company like Deere & Company (DE), which has been showing leadership attributes among commercial vehicles & trucks...

READ MORE

MEMBERS ONLY

When This Index Breaks Out, Wall Street Will Be Declaring The End Of The Pandemic

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I've created 5 User-Defined Indexes (UDI) here at StockCharts.com. I use these UDIs to track our four equal-weighted portfolios - Model, Aggressive, Income, and Strong AD - and one other pandemic-related index. Our flagship Model portfolio handled yesterday's selling pretty well and currently stands with...

READ MORE

MEMBERS ONLY

Watch S&P 500 Support on This Short-Term Hourly Chart

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I expect that we'll bounce sooner rather than later, but a key short-term test is underway right now. I'm watching 3425 on the S&P 500 ($SPX) and 11600 on the NASDAQ 100 ($NDX). Both support levels are currently lost. A weak finish today would...

READ MORE

MEMBERS ONLY

This Technology Group Has Finally Become A Leader, Plus Two Stocks To Benefit

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

For the past few years, I've written countless articles on semiconductors ($DJUSSC), software ($DJUSSW), and computer hardware ($DJUSCR) as these three industry groups have led a powerful charge in technology. But other industry groups in this sector have failed to participate to the same degree (or even close...

READ MORE

MEMBERS ONLY

4 Earnings Reports You Need To Be Watching

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Earnings is what we do at EarningsBeats.com. While a lot of traders are hoping, perhaps gambling, that companies they own come through with great results, we're doing our homework to prepare for our next Top 10 Stocks webinar on November 19th. That's when we'...

READ MORE

MEMBERS ONLY

Align Technology (ALGN) Absolutely Crushes Revenue And EPS Estimates!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

'Tis the season to look for blowout earnings reports and Align Technology (ALGN) delivered one last night. Wow! Check out ALGN's actual revenues and EPS vs. Wall Street consensus estimates:

Revenues: $734.1 million (actual) vs. $531.9 million (estimate)

EPS: $2.25 (actual) vs. $.59 (estimate)...

READ MORE