MEMBERS ONLY

When Contemplating Trades, Target The Leaders

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I know I speak of relative strength frequently, but it kinda makes common sense, doesn't it? In order to establish relative strength vs. your peers and the overall market, there has to be a lot of interest. When buying clothes, do you buy what's in style...

READ MORE

MEMBERS ONLY

Earnings Gaps Provide Excellent Reward To Risk Trades

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Trading gaps from earnings is a big part of what I do. The reason is simple. When a company provides market participants new information, as a quarterly earnings report does, a new set of buyers and sellers emerge. Better-than-expected news will provide an immediate short-term boost in price, while bad...

READ MORE

MEMBERS ONLY

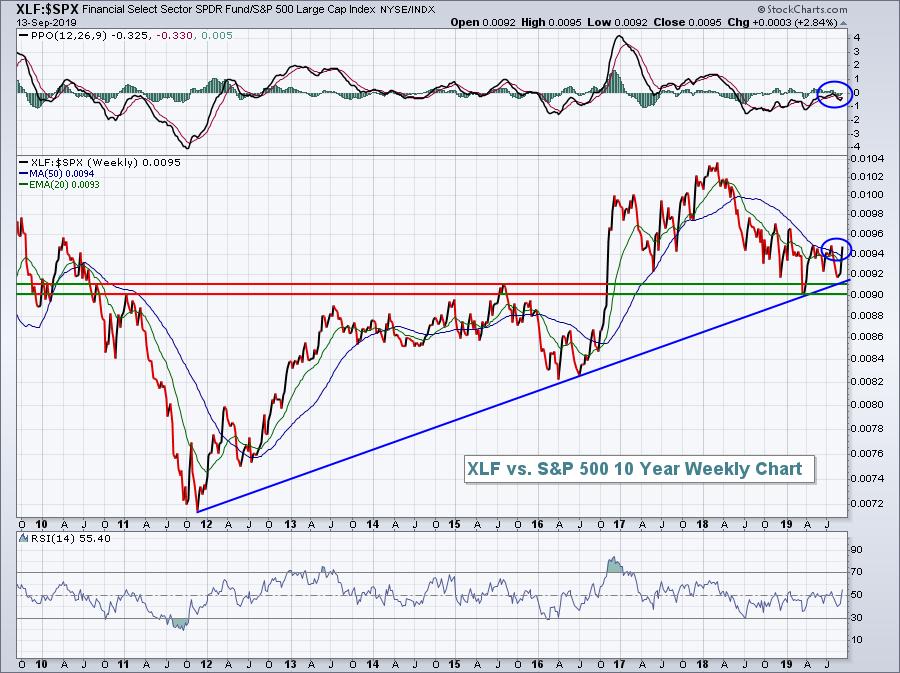

Financials Are About To Do Something They Haven't Done In Nearly 18 Months

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Financials (XLF) had been rather dormant for nearly 18 months - at least on a relative basis to the S&P 500 - but that is all about to change. While the group is certainly beginning to flex its collective muscle, the real confirming signal would likely be a...

READ MORE

MEMBERS ONLY

This Pharma Stands Above (Most Of) The Crowd

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Pharmaceuticals ($DJUSPR) have definitely been an area to avoid in 2019, which is somewhat surprising when you consider how effective many defensive areas have been this year. Still, with the S&P 500 up roughly 18% year-to-date, the DJUSPR has actually fallen 2 points from 553 to 551, clearly...

READ MORE

MEMBERS ONLY

Major Reversal In Software Offers Encouraging Sign

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I've been watching and waiting to see if software ($DJUSSW) would begin to show leadership again as we approach earnings season, which will kick off in the next few weeks. If you've owned any software stocks other than Microsoft (MSFT), then you probably know all too...

READ MORE

MEMBERS ONLY

This Mid Cap Might Be The Best Semiconductor Stock

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Semiconductors ($DJUSSC, -1.78%) had a rough session on Tuesday, but they had been on a roll since early-August, rising from 3350 to 3850, and there have been plenty of leaders to choose from. KLA Corp (KLAC), Lam Research (LRCX), Applied Materials (AMAT), and Micron Technology (MU) are certainly among...

READ MORE

MEMBERS ONLY

3 Key Industry Groups Nearing Breakouts

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The S&P 500 is slightly more than 1% away from setting a new all-time high close and there are several areas of the market I'm watching closely to evaluate leadership in the next leg of this bull market. I'm going to ignore renewable energy...

READ MORE

MEMBERS ONLY

Uncovering The Deception On Wall Street - Webinar Recording Available

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Well, I have to admit, I'm always watching this first chart. It's how consumer stocks are performing vs. one another. When consumer discretionary stocks (XLY) are outperforming consumer staples stocks (XLP) over time, I'm generally very bullish U.S. equities. Consumer spending comprises roughly...

READ MORE

MEMBERS ONLY

Friday Wasn't Selling, It Was Manipulation

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I've seen it so, so many times. The stock market is strong, trending higher and the bottom drops out. Ever heard of "buy on rumor, sell on news"? That was partly responsible for the end of week selling. The Fed's policy statement on Wednesday...

READ MORE

MEMBERS ONLY

2019 Lagging Industry Becoming Leader Again

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The aerospace industry ($DJUSAS) has recently caught fire once again and it's worth noting - not only from an absolute perspective, but also from a relative strength standpoint. Each pullback over the past 5-6 weeks has been met with buying at the 20 day EMA, a bullish development....

READ MORE

MEMBERS ONLY

Post-Fed Action Provides Us MAJOR Clues....If You Know Where To Look

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I think most technicians would agree that stock market action into the close is generally much more important than stock market action just after the open. That is magnified even further when we have a major event take place intraday. Yesterday, we had a widely anticipated Fed meeting with growing...

READ MORE

MEMBERS ONLY

Hold Your Breath, It's Fed Day!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I'm nervous. I believe the market has shown how nervous it's been as money quickly rotated from growth to value stocks ahead of today's Fed announcement. Here's a 10 year weekly look at the IWF:IWD ratio (Russell 1000 growth vs. value)...

READ MORE

MEMBERS ONLY

Crude Oil: The Long-Term View And The Fed's Role

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Crude oil ($WTIC) was certainly in the news on Monday after a drone strike crippled Saudi Arabian oil production by roughly 50%. The immediate reduction in global oil supply was felt via a 14.68% surge in price to $62.90 per barrel. Obviously, that's a one-time type...

READ MORE

MEMBERS ONLY

Is Now The Time For FedEx?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

FedEx Corp (FDX) will be reporting its latest quarterly results tomorrow after the closing bell. In late-August, FDX printed a bullish engulfing candle and it's been moving straight up ever since. It's now running into both gap and price resistance, however, so it needs a catalyst....

READ MORE

MEMBERS ONLY

When Transports And Small Caps Talk, We MUST Listen

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I've been adamant that we remain in a secular bull market, and I'm sticking to it. Yes, September scares me. The Fed petrifies me. And no more tweets, please! Oh, and let's not forget about the inverted yield curve (which isn't inverted...

READ MORE

MEMBERS ONLY

Daily Market Report - Friday, September 13, 2019

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Special Note:

On Monday, September 16th, I will officially begin writing full-time at EarningsBeats.com as its Chief Market Strategist, returning to a role that I left in March 2015 when I joined StockCharts.com as a Sr. Technical Analyst. Below is a brief example of the type of information...

READ MORE

MEMBERS ONLY

Wall Street Rallies As We Near Record Highs Once Again

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, September 12, 2019

Apparently we're back in the "feel good" portion of the trade war as President Trump announced on Thursday that there would be a tariff delay, providing a "gesture of good will". Accordingly, global markets have rallied and...

READ MORE

MEMBERS ONLY

Industrials Challenging Resistance Again; Airlines Poised Strong Q4?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, September 11, 2019

On the 18th anniversary of 9/11, it was somewhat ironic that Boeing (BA, +3.51%) led the Dow Jones back above 27,000 and within 1% of its all-time high. Apple (AAPL, +3.05%) also performed quite well, with both stocks breaking...

READ MORE

MEMBERS ONLY

Energy And Transports Benefit From Rotating Market

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, September 10, 2019

We once again finished in bifurcated fashion on Tuesday with the small cap Russell 2000 ($RUT, +1.28%) and the Dow Jones ($INDU, +0.28%) leading the action, while the S&P 500 ($SPX, +0.03%) and the NASDAQ ($COMPQ, -0.04%...

READ MORE

MEMBERS ONLY

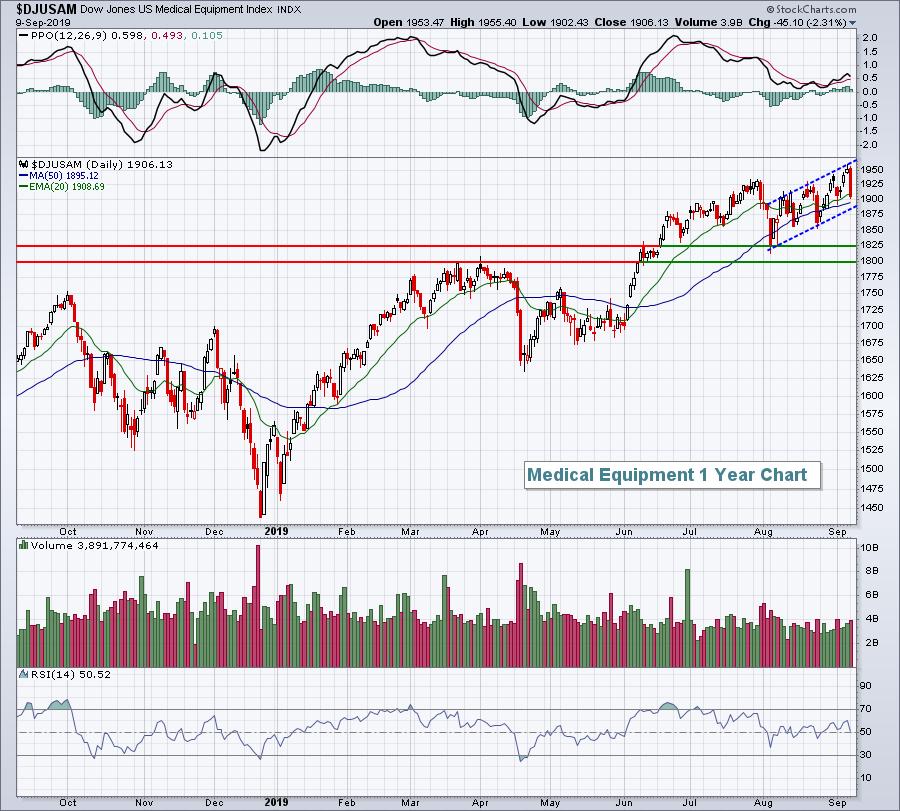

Bifurcated Action Draws Sellers In Leading Industries

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, September 9, 2019

Monday's action was odd, mixed and bifurcated. The small cap Russell 2000 ($RUT) had a very strong day, rising 1.27%, while the NASDAQ, another aggressive index, fell 0.19%. The Dow Jones finished with a slight gain, but the S&...

READ MORE

MEMBERS ONLY

My Monday Trade Setup Features A Leader In Software

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Special Event Today!

This is probably the most excited that I've been for an event ever. I honestly believe that the lineup of products and services that we've put together at EarningsBeats.com will benefit thousands of followers/subscribers across the globe. After spending 20 years...

READ MORE

MEMBERS ONLY

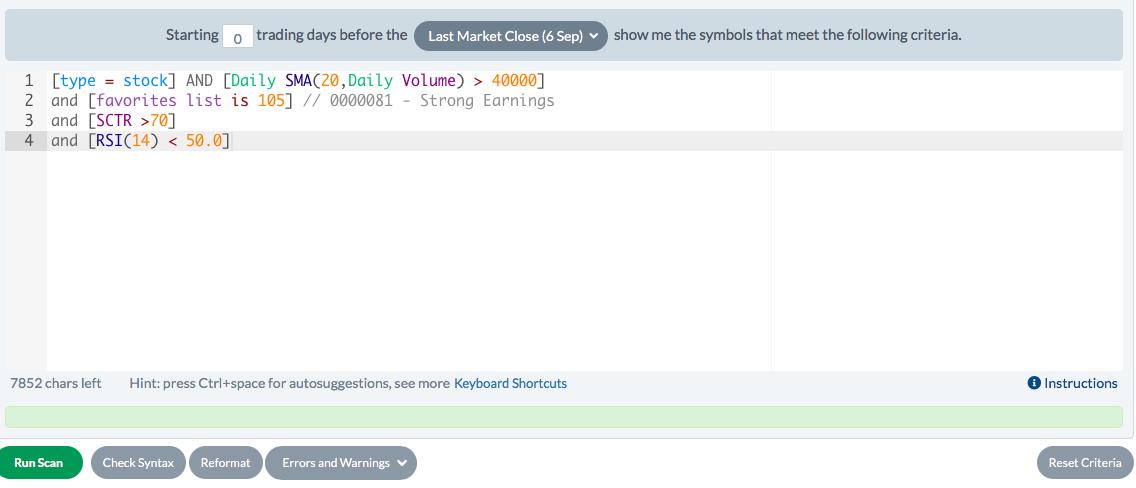

Scanning For Stocks With Strong Technicals AND Strong Fundamentals

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I maintain a "Strong Earnings ChartList", where I organize those companies who (1) beat Wall Street consensus estimates as to both revenues and earnings per share (EPS), (2) have adequate liquidity (generally trade more than 200,000 shares daily), and (3) have shown solid technical price action. The...

READ MORE

MEMBERS ONLY

Earnings Season Never Ends; These 2 Companies Prove It

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The beauty of being both a fundamentalist and a technician is that the fun never stops. Many of you may view earnings season to last from the middle of the first month of each calendar quarter (when Dow Jones component stocks and the biggest money center banks begin reporting) to...

READ MORE

MEMBERS ONLY

S&P 500 Breaks Trading Range To Upside And There Was Very Bullish Confirmation

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, September 5, 2019

U.S. indices had a strong day on Thursday, with leadership from key aggressive areas. The small cap Russell 2000 ($RUT) led the action with a solid 1.75% gain. More on the RUT in today's Current Outlook section below. The...

READ MORE

MEMBERS ONLY

Head & Shoulder Top Is Perhaps The Most Over-Hyped Technical Pattern

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, September 4, 2019

It was a solid day for U.S. equities as all of our major indices rallied, as did all 11 sectors. Communication services (XLC, +1.94%) and technology (XLK, +1.71%) were the top two performing sectors. Broadcasting & entertainment ($DJUSBC, +2.12%...

READ MORE

MEMBERS ONLY

Defensive Sectors Hold U.S. Equities Up

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, September 3, 2019

This is just a very brief market recap as I'm on jury duty this week.

New U.S. tariffs took effect this morning and it's September, so the stock market saw considerable weakness, especially at the open. Defensive sectors...

READ MORE

MEMBERS ONLY

Sneak Preview: Sector and Industry Relative Strength Analysis

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Special Note

There will be no Trading Places blog article on Tuesday, September 3rd as I've been selected for jury duty and will be out all day. I'll find out more of my schedule (for later this week) tomorrow morning and I will post articles here...

READ MORE

MEMBERS ONLY

The 3 Biggest Risks As We Enter September; The Trade War Isn't One

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Listen, the media loves to overhype the trade war. Seriously, is there anyone that isn't aware of the trade war, the tweets, the rhetoric, etc. at this point? Hasn't everyone already priced in an economic disaster because of it? Oh wait! That's right, our...

READ MORE

MEMBERS ONLY

China Blinks First, U.S. Equities Rally

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, August 29, 2019

Well, thank you China. On Thursday morning, China pledged a calmer approach to the trade war and indicated they would not retaliate for the latest tariffs imposed by the U.S. At least not now. Temporarily, that appeased traders who used the opportunity...

READ MORE

MEMBERS ONLY

Consumer Strength Is Real, PLUS A Personal Announcement

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, August 28, 2019

10 of 11 sectors advanced in a broad-based rally on Wednesday that carried the Dow Jones higher by 1%. The small cap Russell 2000, a major laggard in 2019, rose 1.15% in a rare day of outperformance. Energy (XLE, +1.43%), consumer...

READ MORE

MEMBERS ONLY

Volatility And Treasury Yields: The Two Beasts Of Burden

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, August 27, 2019

U.S. equities were strong out of the gate on Tuesday, but had little follow-through as sellers re-emerged. Early gains on our major indices quickly vanished and these key indices were left trying to minimize losses into the close. There were no significant...

READ MORE

MEMBERS ONLY

Here's The Driving Force Behind My Bullishness

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, August 26, 2019

All eleven sectors advanced on Monday as U.S. equities staged a rally following Friday's selloff. It wasn't overly impressive in my view as most of the gains came at the opening bell. There wasn't much follow...

READ MORE

MEMBERS ONLY

Trade War Escalates, Key Price Support Revisited

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, August 23, 2019

Friday was another trade war disaster. It's almost as if we're getting numb to it. Dow Jones down 600. Ho-hum. Technically, there wasn't even a short-term violation as the S&P 500 simply moved back down...

READ MORE

MEMBERS ONLY

Summing Up The Transportation Group And Its Impact

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, August 22, 2019

U.S. equities began Thursday on mostly a positive note, but reservations from Fed officials and a manufacturing report that showed weakness weighed on sentiment as stocks gave back earlier gains, finishing mixed. The Dow Jones was able to end the session in...

READ MORE

MEMBERS ONLY

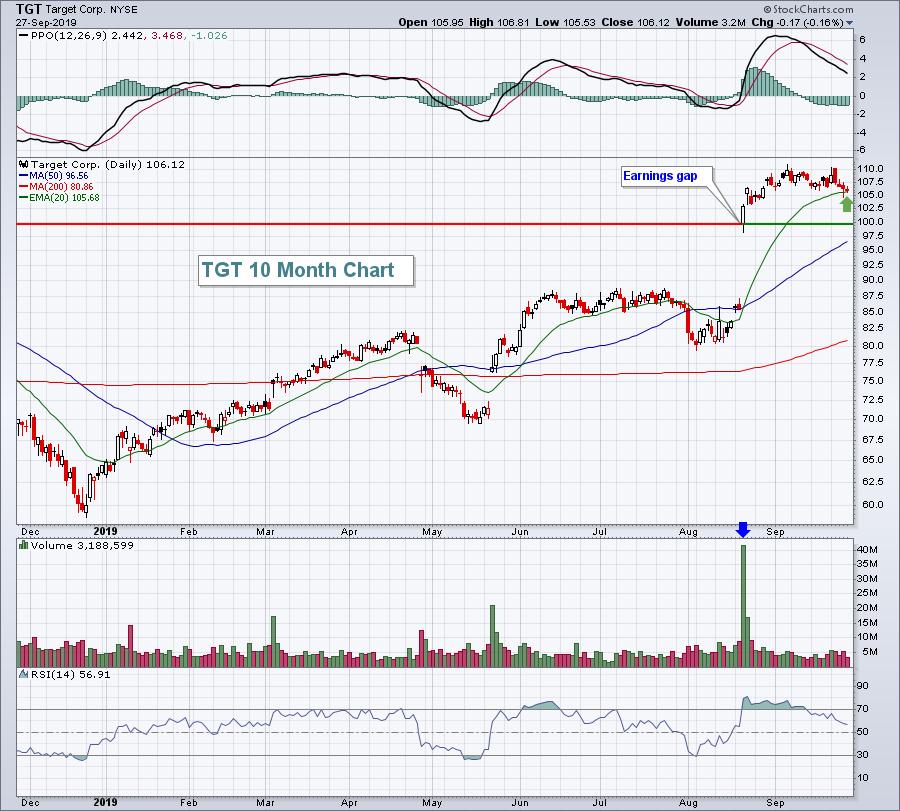

Target And Lowes Deliver The Goods; Equities Surge

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, August 21, 2019

It was a big day for broadline retail ($DJUSRB, +1.91%) and home improvement ($DJUSHI, +3.68%) as strong earnings from Target (TGT, +20.43%) and Lowes Companies (LOW, +10.35%), respectively, sent both groups higher, along with the overall market. All of...

READ MORE

MEMBERS ONLY

Tuesday's Weak Close Has Very Little Impact On Market Outlook

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, August 20, 2019

It was another day of consolidation for U.S. equities. That's not a bad thing. Let's establish a base, allowing the weak hands to get out before the next push higher. If we break those recent lows, we'...

READ MORE

MEMBERS ONLY

A Birds-Eye View Of The S&P 500 Weekly Chart; The Bulls Are In Charge

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, August 19, 2019

The S&P 500 rallied for a third consecutive day, this time rising 1.21% and closing back above its 20 day EMA for the first time in August. The other major indices also rallied, including leadership from the NASDAQ and Russell...

READ MORE

MEMBERS ONLY

A Mystery Group Emerges To Lead Friday's Stock Market Rally

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Special Event Today

Every quarter, I announce my Top 10 Stocks (equally-weighted) for my Model, Aggressive and Income portfolios. Today's the day! It all starts at 4:30pm EST. CLICK HERE for portfolio performance and registration information.

Market Recap for Friday, August 16, 2019

Industrials (XLI, +1.93%...

READ MORE

MEMBERS ONLY

The Results Are In, Here Are The Winners And Losers

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

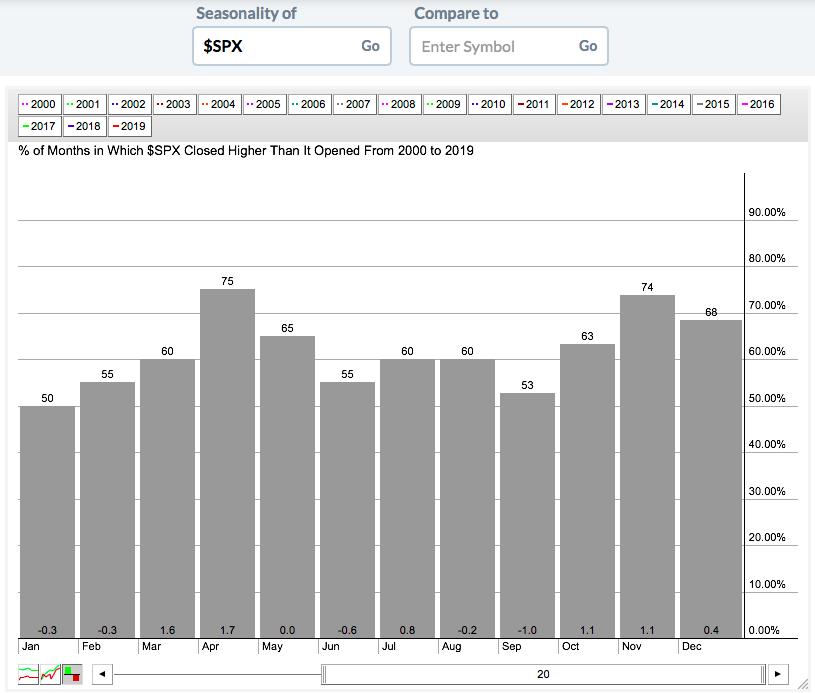

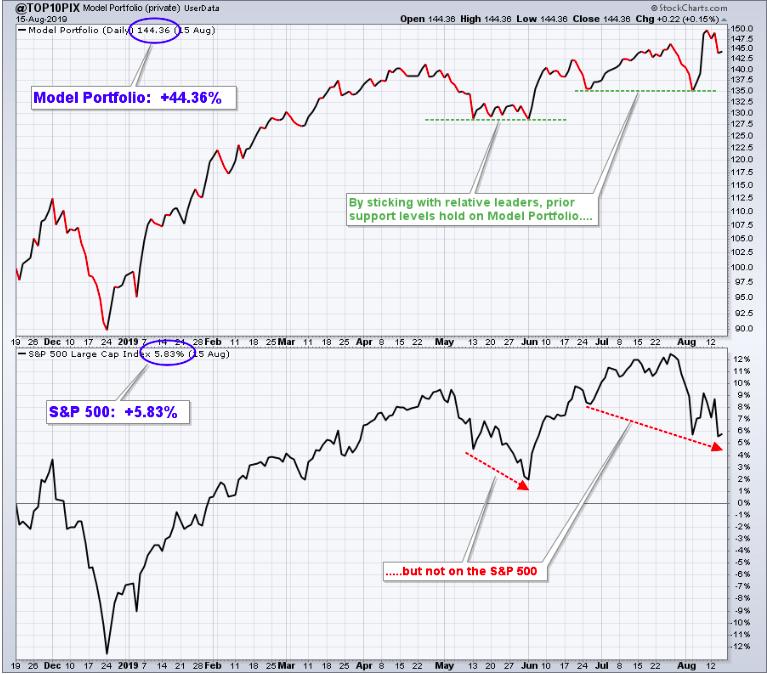

Monday will mark the end of my third quarter of performance for the Model Portfolio. I've easily surpassed the benchmark S&P 500 in each quarter and this last quarter was certainly no exception. The average return of the 10 equal-weighted stocks in this portfolio was 12....

READ MORE

MEMBERS ONLY

Returning To My Roots At EarningsBeats.com

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Wow, it's been a great ride here at StockCharts.com!

I posted essentially this same article in my Trading Places blog a week ago, but I'm not sure how many of you follow me there. I want to make sure I reach out to everyone who...

READ MORE