MEMBERS ONLY

The Ultimate Test For The Bears Is Here

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, January 17, 2019

Word that the U.S. would ease Chinese tariffs as negotiations wear on helped to reduce stock market stress and resulted in an intraday surge in U.S. equity prices on Thursday afternoon. Quick profit taking followed, but strength resumed into the close...

READ MORE

MEMBERS ONLY

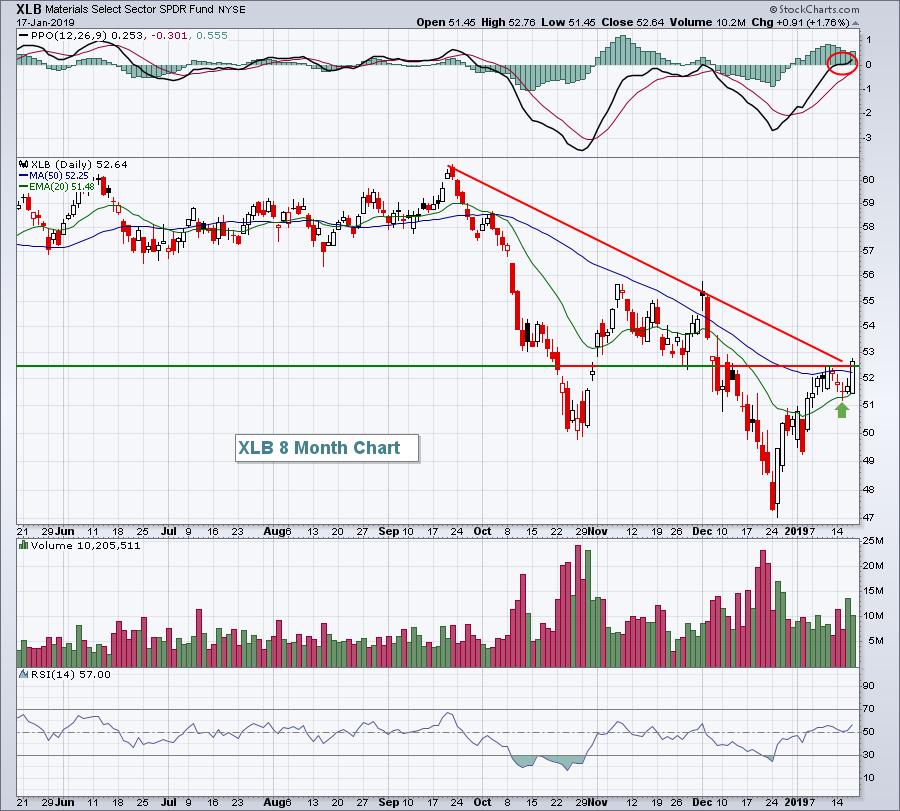

Solid Earnings Lift Financials, Wall Street

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, January 16, 2019

Late-day selling cut into some of Wall Street's gains, but the bear market rally continued. It's left many wondering whether we're still in a bear market. The technical answer to that question is yes, we're...

READ MORE

MEMBERS ONLY

10 S&P 500 Stocks That Seasonally Outperform From February Through April

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, January 15, 2019

We saw an across-the-board advance led by healthcare (XLV, +1.80%), communication services (XLC, +1.66%) and technology (XLK, +1.51%). All of our major indices jumped as NASDAQ shares soared by 1.71%. The S&P 500 rose 1.07%. After...

READ MORE

MEMBERS ONLY

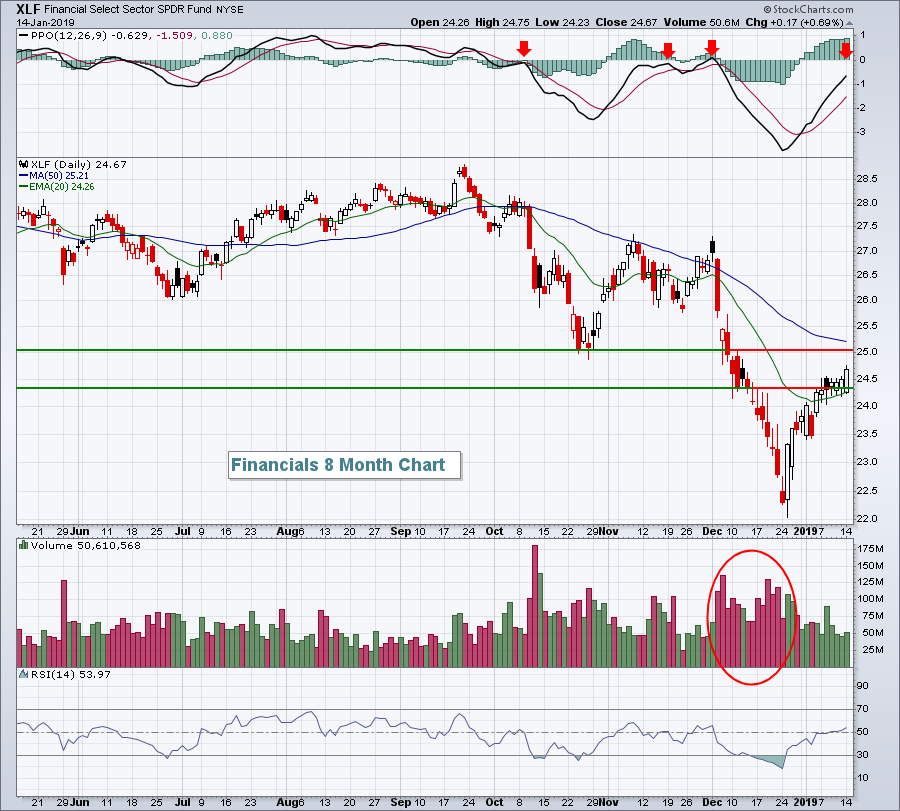

Banks Rally On Citigroup's Results, But Likely To Struggle Today With JP Morgan's

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, January 14, 2019

The losses on Monday were not huge, but there did seem to be selling in most areas of the market. 10 of 11 sectors finished lower as financials (XLF, +0.69%) was the only sector to finish in positive territory. That sector'...

READ MORE

MEMBERS ONLY

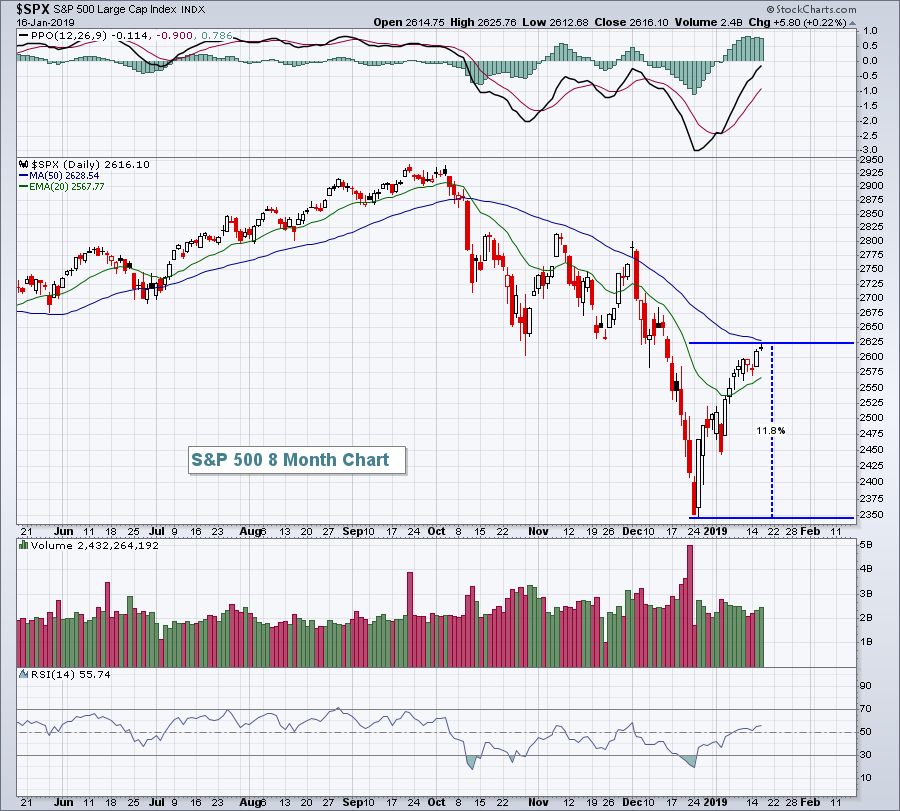

Will Earnings Sustain The Current Rally? Probably Not

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, January 11, 2019

Healthcare (XLV, +0.33%) and consumer staples (XLP, +0.29%) paced a bifurcated market on Friday as the Russell 2000 eked out a 2 point gain. Despite rallying most of the session after a poor start, the Dow Jones, S&P 500...

READ MORE

MEMBERS ONLY

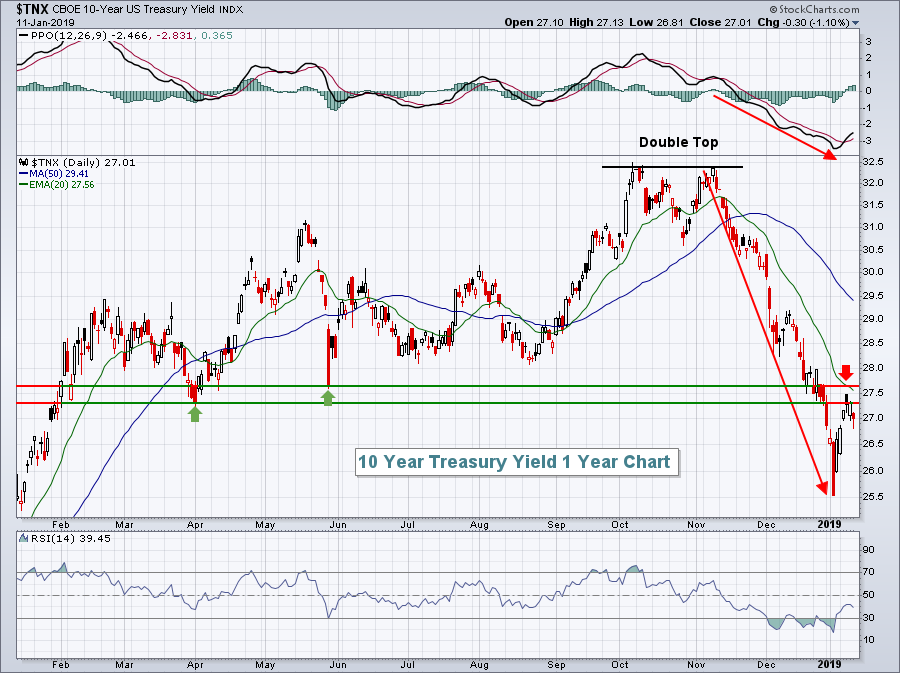

Correlation Suggests That We Monitor Treasury Yields Closely

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, January 10, 2019

There was both good and bad action on Thursday. Yes, the bulls should be excited as a short-term price and trendline breakdown did not result in panic or a Volatility Index ($VIX) that surged. Also, all of our major indices remained above their...

READ MORE

MEMBERS ONLY

Crude Oil Surges, Energy Paces Wall Street Advance; Negative Divergences Loom

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, January 9, 2019

Crude oil ($WTIC, +5.18%) continued rolling higher on Wednesday, buoyed at least in part from its positive divergence. Recently, I discussed the likelihood that crude oil prices would move back into the $50-$54 per barrel range and you can see from...

READ MORE

MEMBERS ONLY

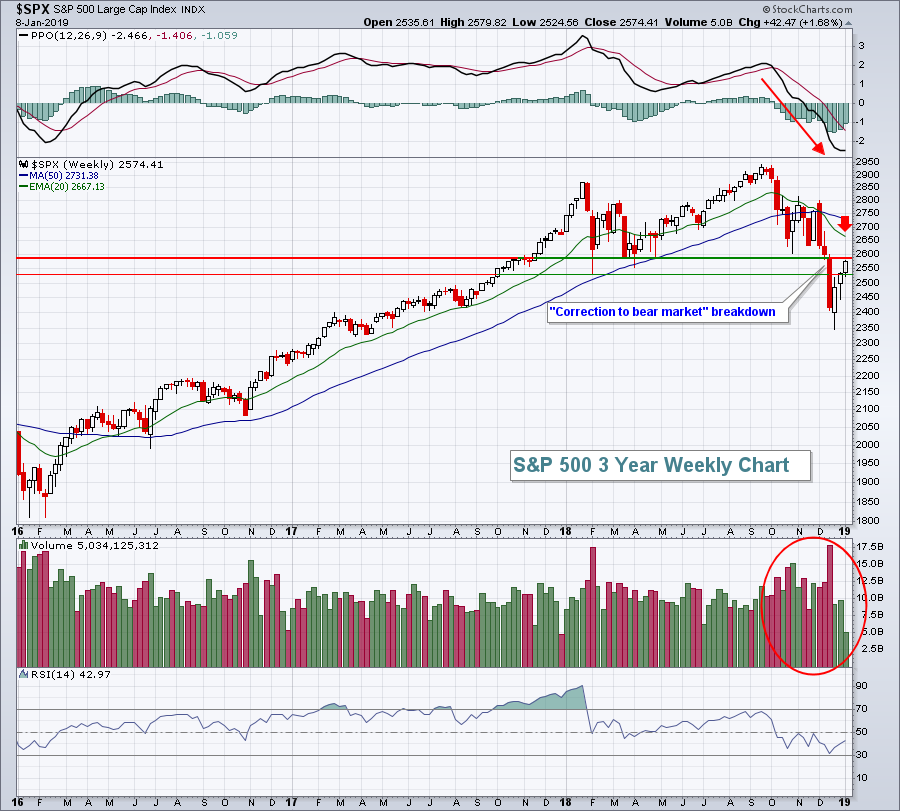

Bear Market Rally Likely Nearing Its End

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, January 8, 2019

It was another broad-based rally on Wall Street with 10 of 11 sectors finishing higher. Small caps powered ahead 1.53% to lead the action, but the Dow Jones, S&P 500 and NASDAQ gained 1.09%, 0.97% and 1.08%...

READ MORE

MEMBERS ONLY

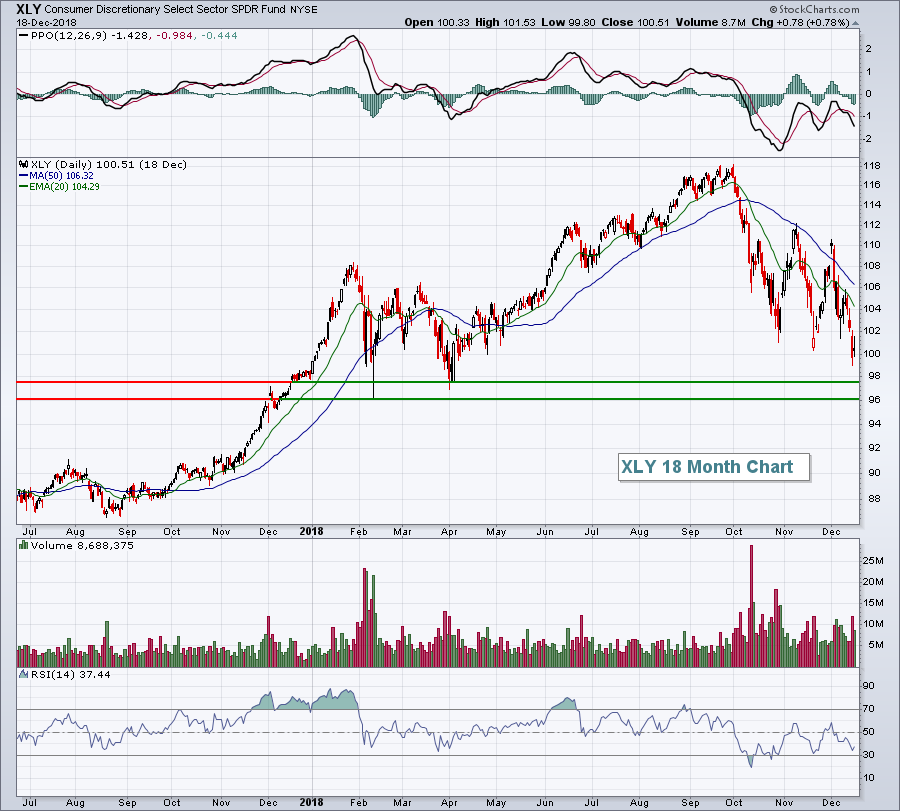

Consumer Discretionary Makes Relative Breakout, Poised To Lead In 2019

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, January 7, 2019

Crude oil prices ($WTIC, +1.17%) rallied on Monday, helping energy (XLE, +1.49%) continue its recent surge, but the day clearly belonged to consumer discretionary stocks (XLY, +2.26%) as retail (XRT, +3.10%) and home construction ($DJUSHB, +2.43%) were among...

READ MORE

MEMBERS ONLY

One Industry Group Has Quietly Been "Building" Relative Strength

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, January 4, 2019

Friday was a HUGE day for the bulls as nonfarm payrolls came in well ahead of expectations (312,000 vs 180,000), which in no way reflects what the stock market has been saying since Q4 2018 began - that we were heading...

READ MORE

MEMBERS ONLY

2019 Stock Market Forecast And My Report Card For 2018 Forecast

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Before I look ahead to what we might expect in 2019, let me rewind for a bit and check out last year's forecast. Here's a recap, summarizing a few of my "expectations". I've graded my predictions with a slight curve. Feel free...

READ MORE

MEMBERS ONLY

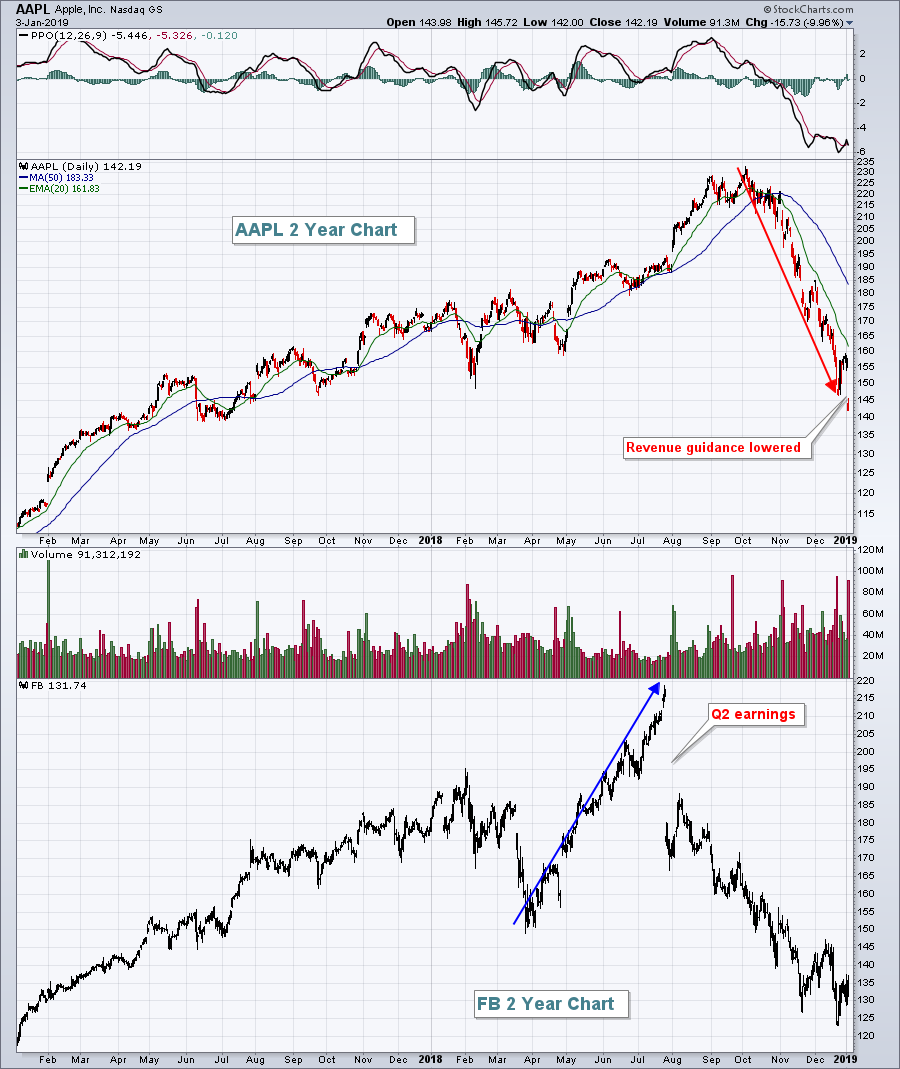

Apple's (AAPL) Guidance Wasn't As Shocking As Facebook's (FB)

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, January 3, 2019

Just about every market-related discussion since Wednesday's close has centered around Apple (AAPL, -9.96%)....and for good reason. AAPL is a U.S. stock market icon. Some might argue it is THE icon. When they lowered their revenue guidance substantially...

READ MORE

MEMBERS ONLY

Just Two Days After The Ball Drops, The Bomb Drops

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, January 2, 2019

On a day filled with hope, as traders rang in the new year on Wall Street, the biggest news came after the market closed as Apple (AAPL) warned regarding its upcoming quarter. During the trading day, we saw resiliency for one of the...

READ MORE

MEMBERS ONLY

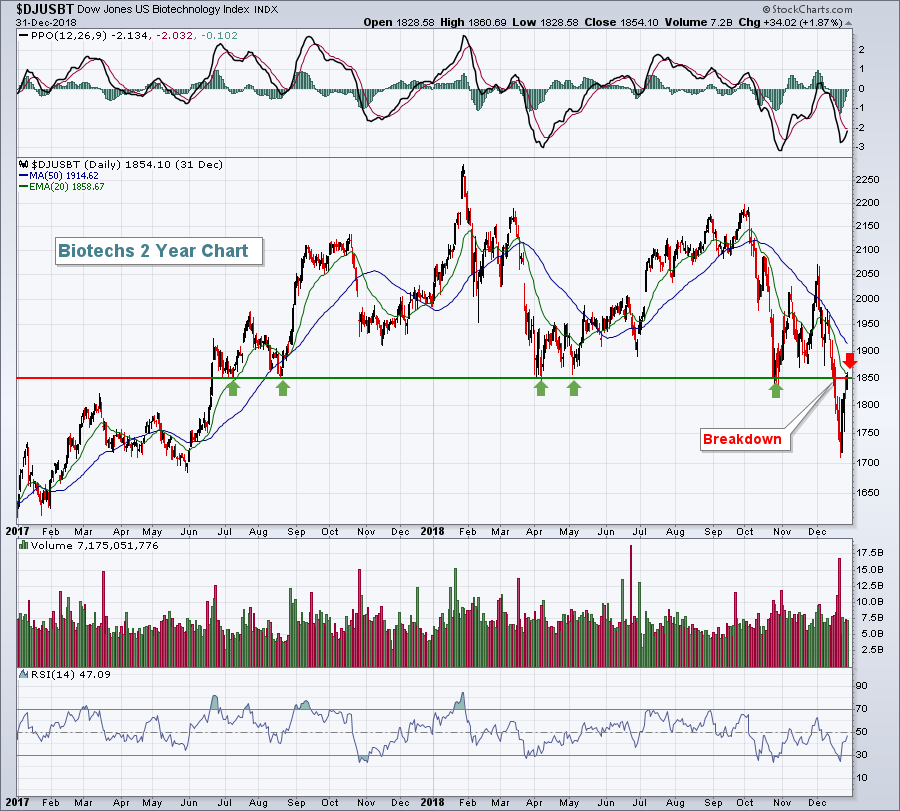

2019 Will Be A Cyclical Bear Market Within A Secular Bull Market

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, December 31, 2018

December 2018 was a rough month to end a very difficult Q4. It was very unusual in terms of historical perspective as we're accustomed to seeing mostly solid action in early December followed by a Santa Claus rally into year end....

READ MORE

MEMBERS ONLY

Utilities Is The Lone Bullish Sector As We Move Into 2019

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, December 28, 2018

Let's start with the bright spots from Friday's market action. The more aggressive NASDAQ and Russell 2000 ended the session in positive territory, gaining 0.08% and 0.46%, respectively. They both closed higher for the third consecutive day...

READ MORE

MEMBERS ONLY

Afternoon Strength Lifts Wall Street For 2nd Consecutive Session

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, December 27, 2018

The final two hours on Wall Street yesterday was quite the finish. After languishing deep in red territory throughout much of the session, the bulls took complete charge into the close. The Dow Jones, down more than 600 points just past 2pm EST,...

READ MORE

MEMBERS ONLY

Support Has Been Established, Now How High Might We Bounce?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, December 26, 2018

After gapping higher on Wednesday, our major indices retreated initially to lose all of its opening gains. The Dow Jones traded approximately 300 points higher right out of the gates, but within 90 minutes had lost those gains and was down 80 points....

READ MORE

MEMBERS ONLY

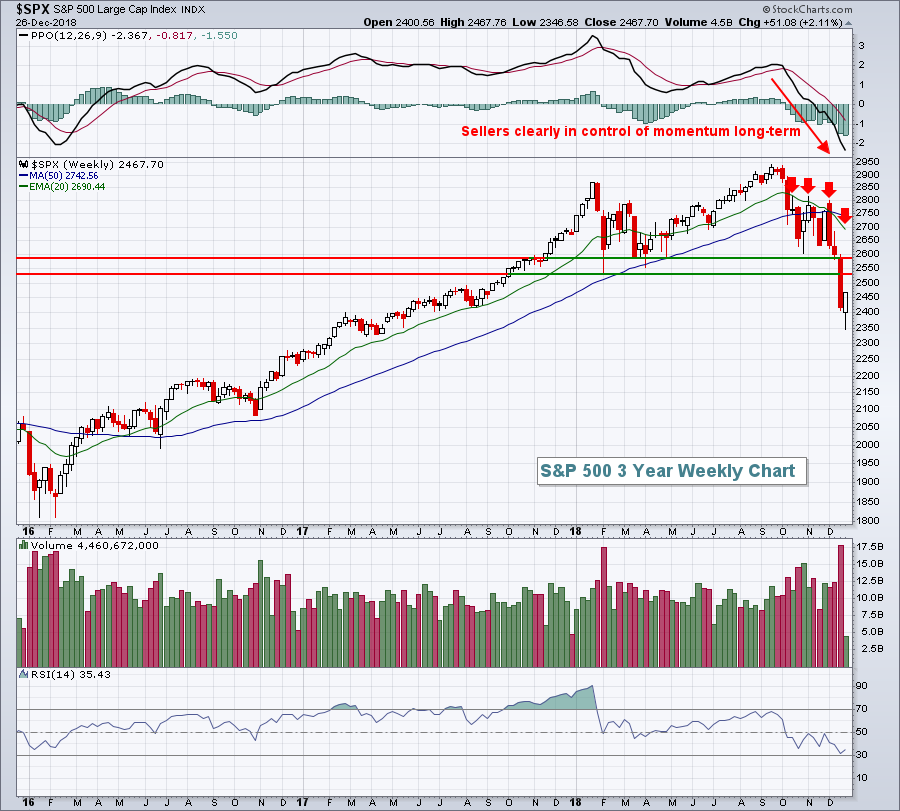

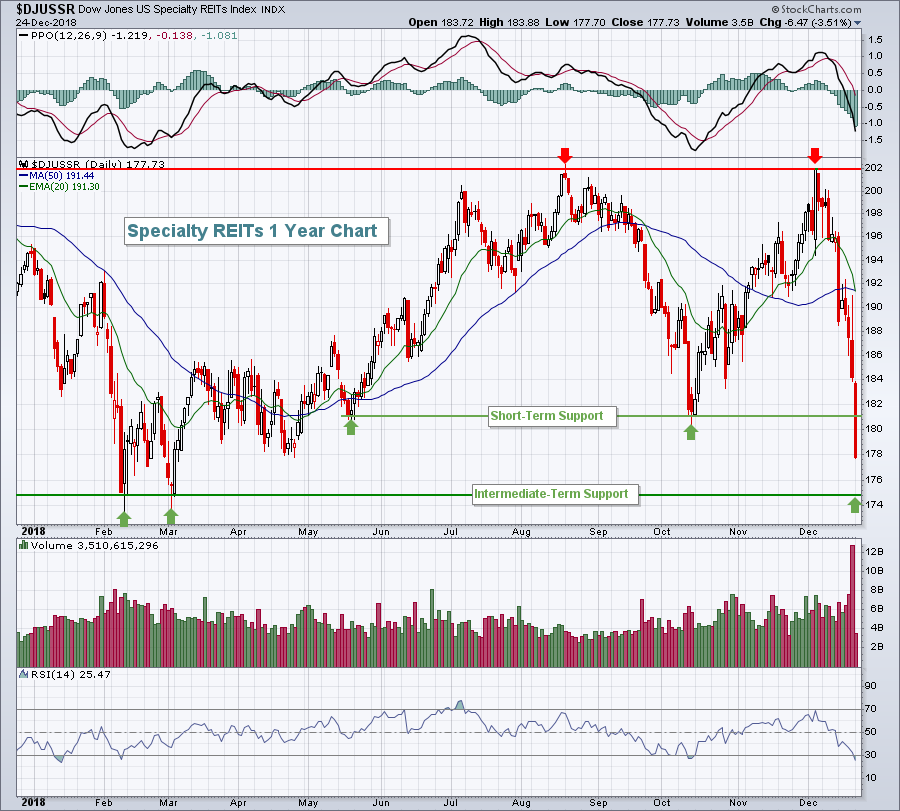

We're Nearing Our First Major Bear Market Bottom

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, December 24, 2018

It was an abbreviated session on Monday, but the losses were not abbreviated. The Dow Jones lost another 653 points, or 2.91%, while the S&P 500, NASDAQ and Russell 2000 posted losses of 2.71%, 2.21% and 1.95%...

READ MORE

MEMBERS ONLY

"How The Grinch Stole Christmas" Featuring Jerome Powell

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, December 21, 2018

Growth stocks remain under significant pressure as the stock market is quickly repricing them based on bear market rules. While I believe the sudden drop in so many critical areas simultaneously told us of the impending S&P 500 breakdown and ensuing...

READ MORE

MEMBERS ONLY

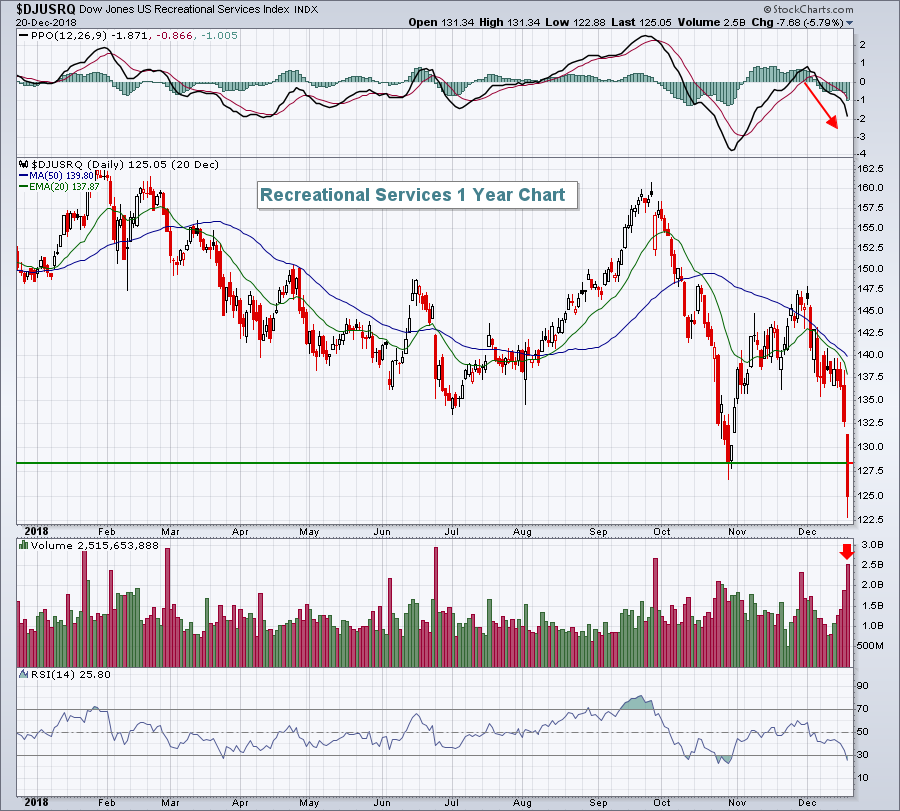

We're Looking At A Category 3 Stock Market Hurricane Making Landfall

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, December 20, 2018

If you haven't noticed, I use a lot of weather analogies in describing the stock market. It's by design as forecasting the stock market has a lot of similarities to forecasting the weather. Meteorologists are often scrutinized as weather...

READ MORE

MEMBERS ONLY

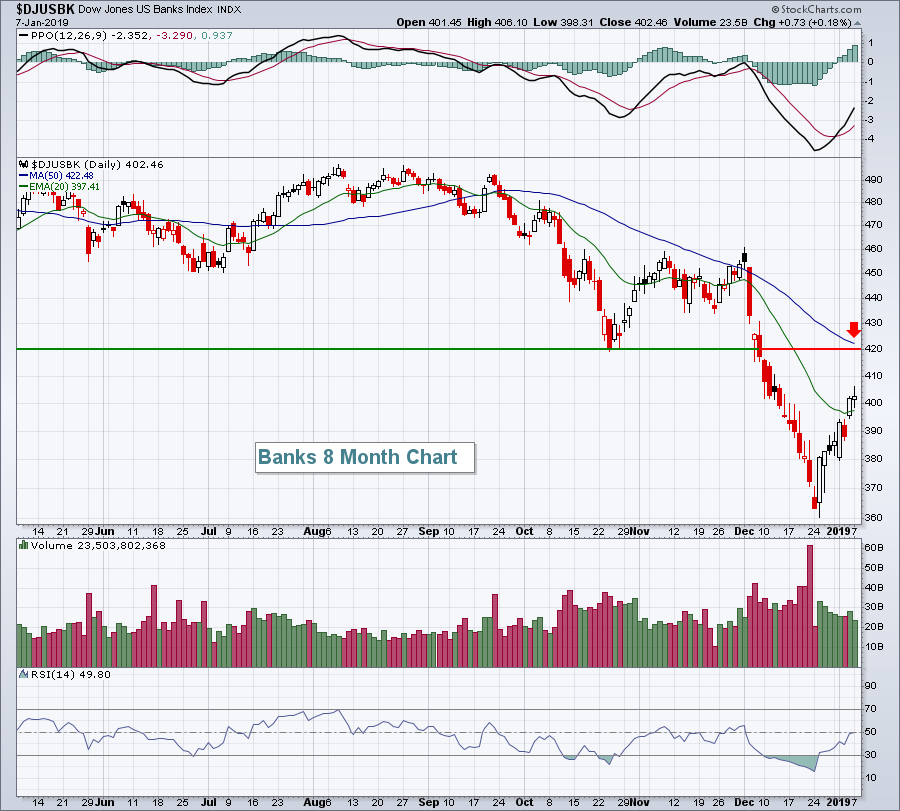

Fed Hikes, Promises More In 2019; Banks In Big Trouble

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, December 19, 2018

This was a Fed day that could have lasting damaging effects. Fed Chair Jerome Powell and his band of cronies decided to ignore the one piece of data that's probably the best leading indicator - the U.S. stock market. The...

READ MORE

MEMBERS ONLY

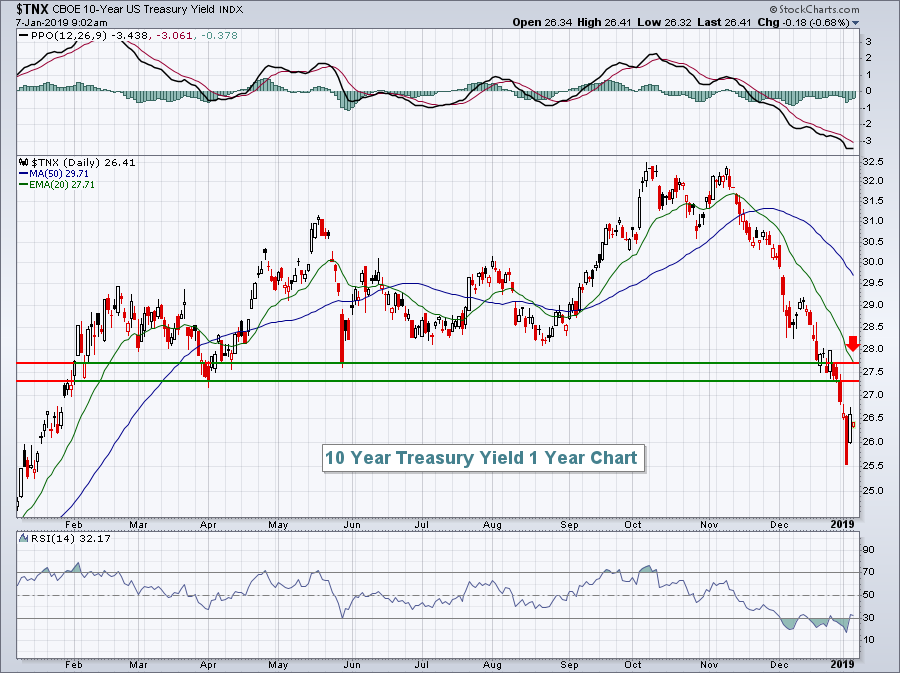

On Fed Day, The Treasury Market Is Painting A Bearish Picture

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Special Event

At 4:30pm EST today, I'll be joining John Hopkins, President of EarningsBeats.com, for a special "2019 Stock Market Outlook" webinar. It's a FREE event where I'll be discussing likely market direction in 2019 and areas of the market...

READ MORE

MEMBERS ONLY

It Was Just Another Manic Monday

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

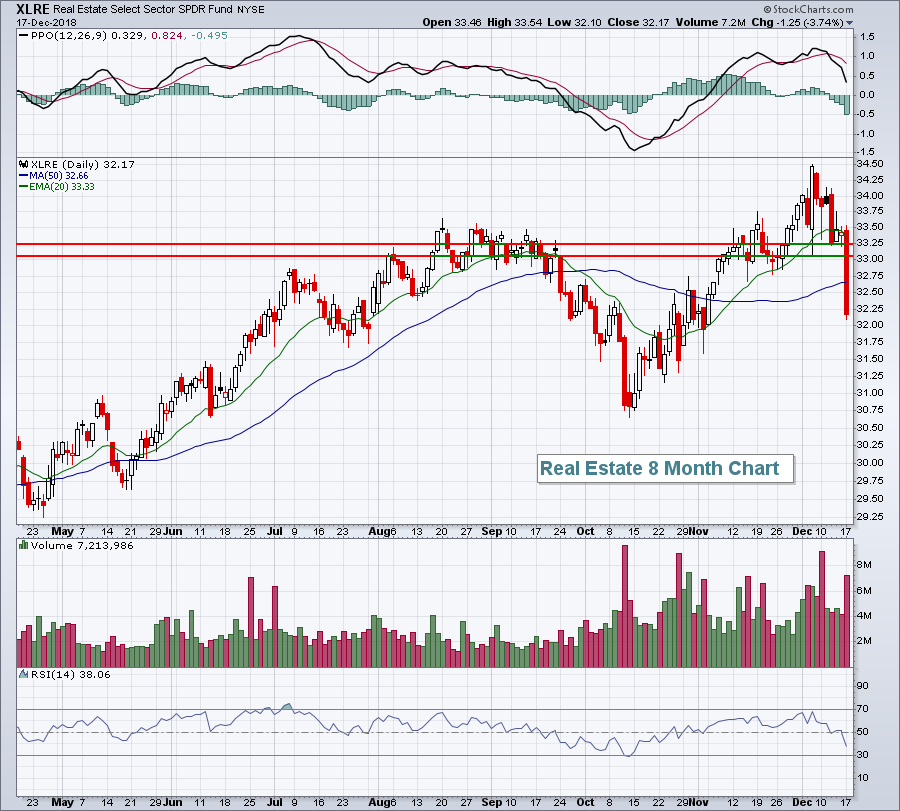

Market Recap for Monday, December 17, 2018

Every component stock in the Dow Jones Industrial Average fell on Monday as the index dropped another 500 points. The S&P 500 lost major closing price support at 2581, crude oil ($WTIC) threatened to break below $50 per barrel, small caps...

READ MORE

MEMBERS ONLY

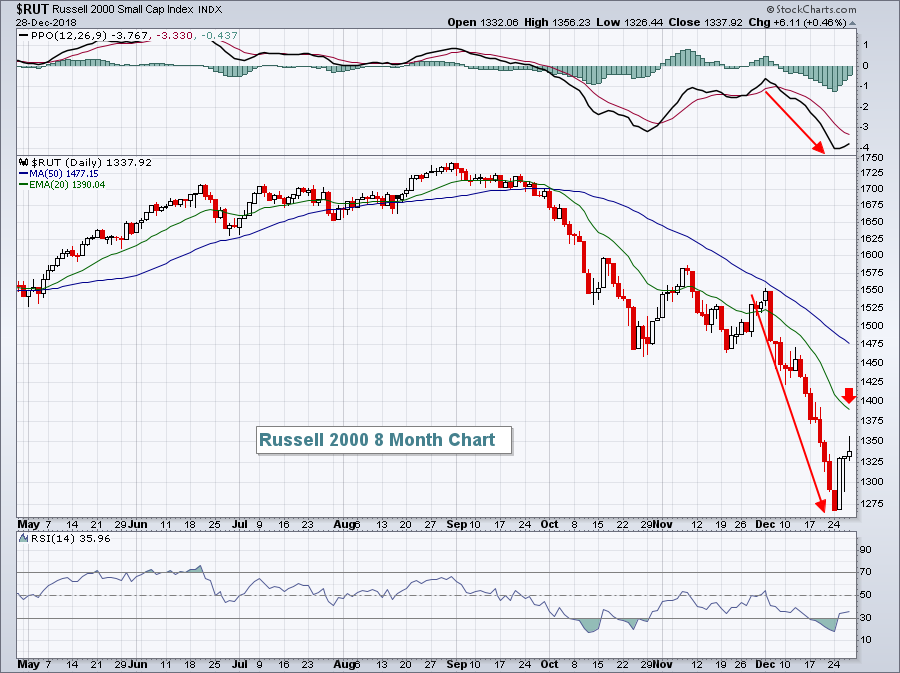

S&P 500 Nearing Significant Breakdown, Bull Market Running Out Of Steam

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, December 14, 2018

The U.S. stock market suffered another big blow to its current 9+ year bull market on Friday. Culprits for the selling included Johnson & Johnson (JNJ, -10.30%) in the healthcare space (XLV, -3.37%), easily the worst performing sector, Adobe Systems...

READ MORE

MEMBERS ONLY

Want To Know The Difference Between A Correction And A Bear Market?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Not a whole lot.

I guess there are three primary differences. First, there's the percentage drop as corrections are generally considered to see a drop of less than 20%, while bear markets tend to see declines well in excess of 20%. Second, a bear market tends to last...

READ MORE

MEMBERS ONLY

Here's A Bear Market Chart You Can't Afford To Miss!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

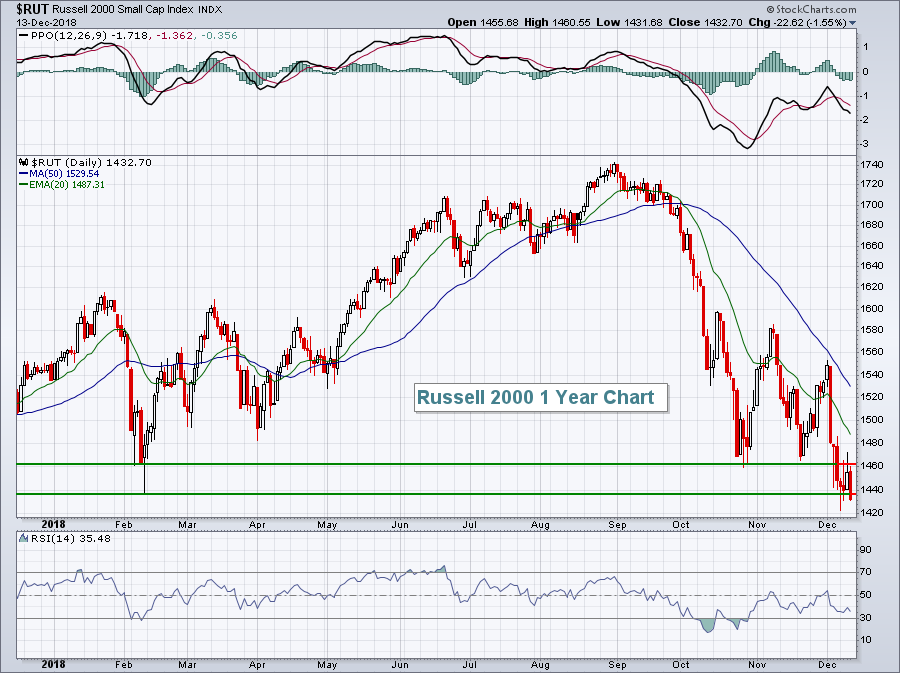

Market Recap for Thursday, December 13, 2018

The U.S. stock market attempted to stage rallies on Thursday, initially in the morning session and then again in the final hour. But astute technicians that follow more than the headline Dow Jones and S&P 500 numbers realized it was...

READ MORE

MEMBERS ONLY

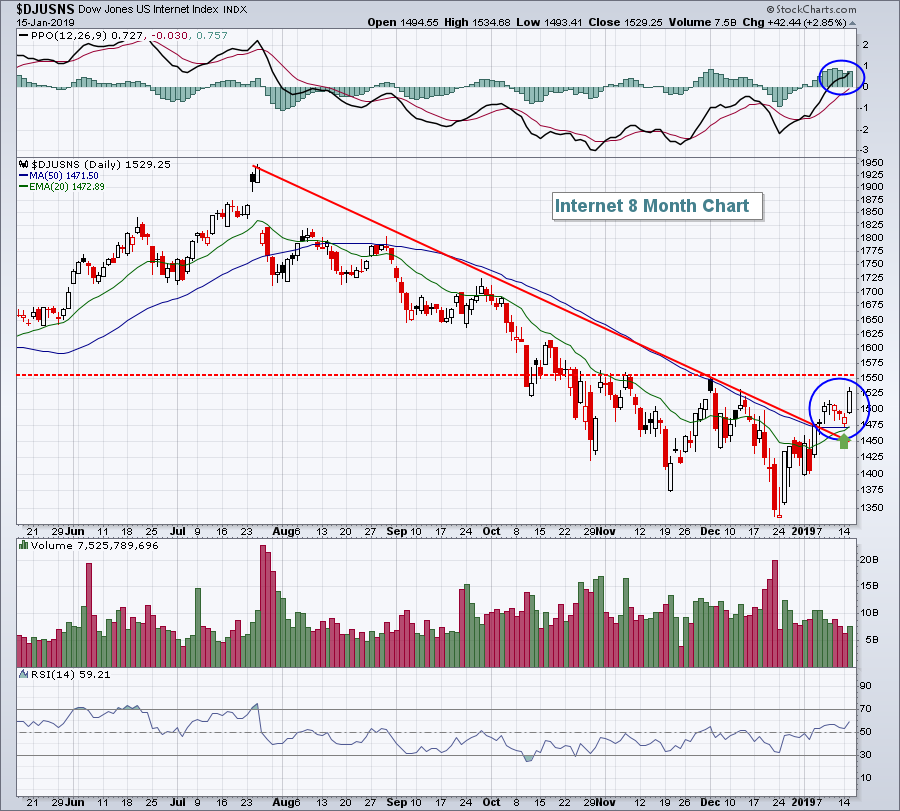

A Great Day Turns Good With Afternoon Selling; Internet Stocks Bottoming?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, December 12, 2018

The opening gap higher on Wednesday added to the recent stock market advance and the bulls stretched those early morning gains into the afternoon session. But much of those intraday profits faded as the session wore on and an across-the-board advance really didn&...

READ MORE

MEMBERS ONLY

Early Gains Wiped Out As U.S. Equities Finish In Bifurcated Fashion

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, December 11, 2018

Volatile action on Tuesday resulted in a bifurcated market. The NASDAQ managed to cling to gains at the close, while the Dow Jones, S&P 500 and Russell 2000 saw early morning gains turn into losses by the close. Leadership came mostly...

READ MORE

MEMBERS ONLY

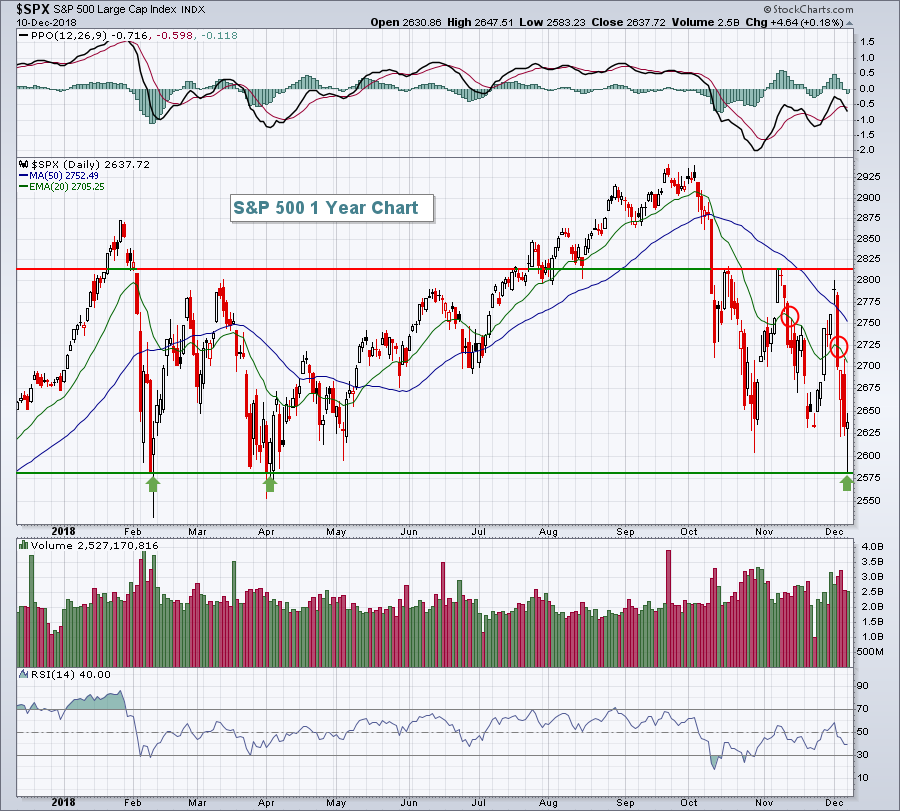

S&P 500 Touches MAJOR Price Support; One Ingredient Missing For Bear Market

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, December 10, 2018

Yesterday was significant for one very important technical development. The February 2018 low close of 2582 was within a whisker on Monday as the S&P 500 hit an intraday low of 2583 before rallying strongly. Technology (XLK, +1.38%) led the...

READ MORE

MEMBERS ONLY

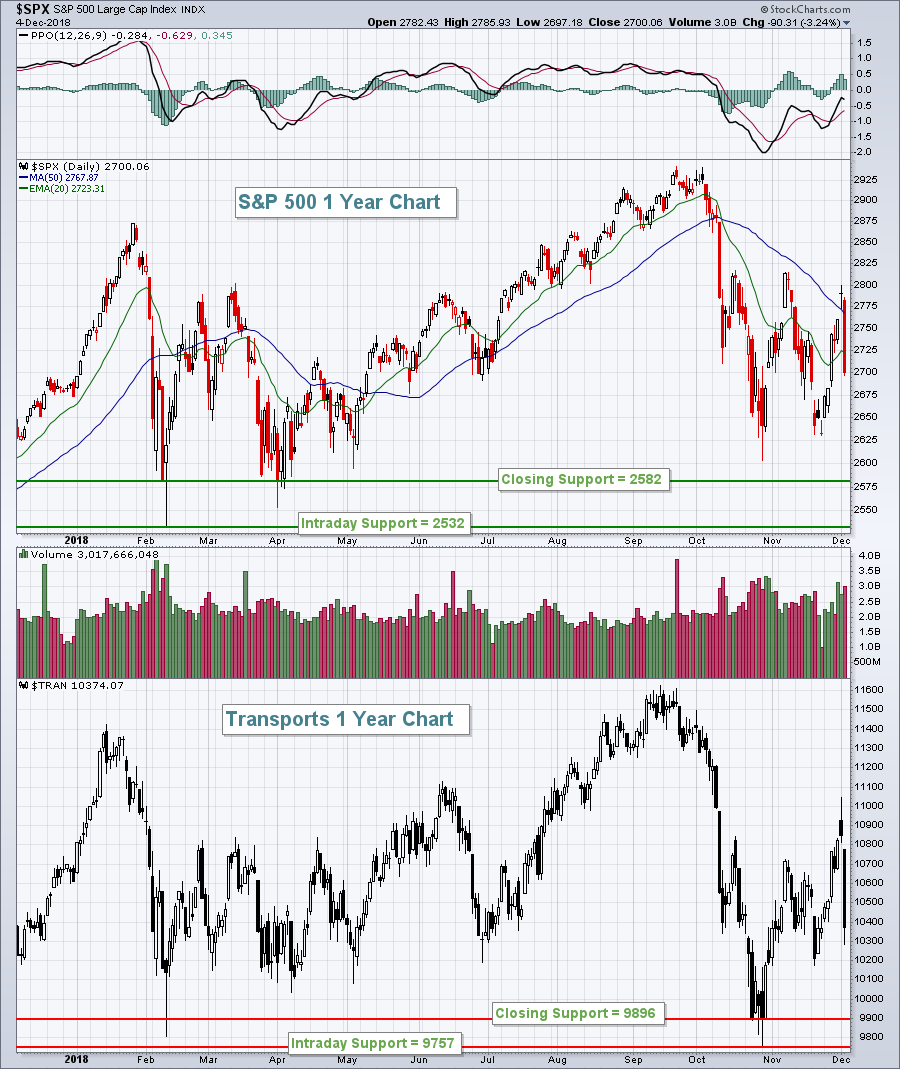

Falling Transports Lead To Further Losses On Wall Street

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, December 7, 2018

Friday marked the end of a rough day and a rough week for U.S. equities. Strength was found in utilities (XLU, +0.37%), the only sector to end in positive territory to close out the week. Gold miners ($DJUSPM, +2.36%) and...

READ MORE

MEMBERS ONLY

Big Recovery Temporarily Halts Slide; Nonfarm Payrolls Weak

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

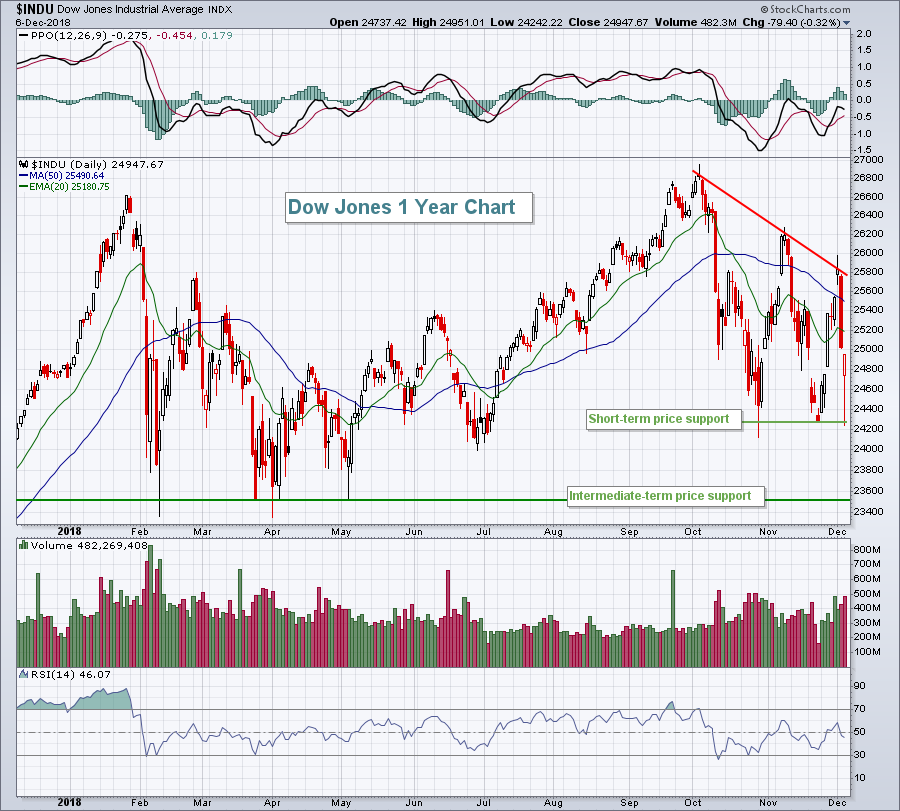

Market Recap for Thursday, December 6, 2018

The Dow Jones and S&P 500 were both on a crash course for key February price support until buyers re-emerged just past 11am EST. At the low yesterday, the Dow Jones was down nearly 800 points and it had tumbled more...

READ MORE

MEMBERS ONLY

U.S. Stock Futures Plummeting; Caution Is The Word

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, December 5, 2018

The U.S. stock market was closed.

Pre-Market Action

U.S. futures look set to continue Tuesday's rout. The 10 year treasury yield ($TNX) is lower by 3 basis points to 2.89% as money seeks out safety in the defensive...

READ MORE

MEMBERS ONLY

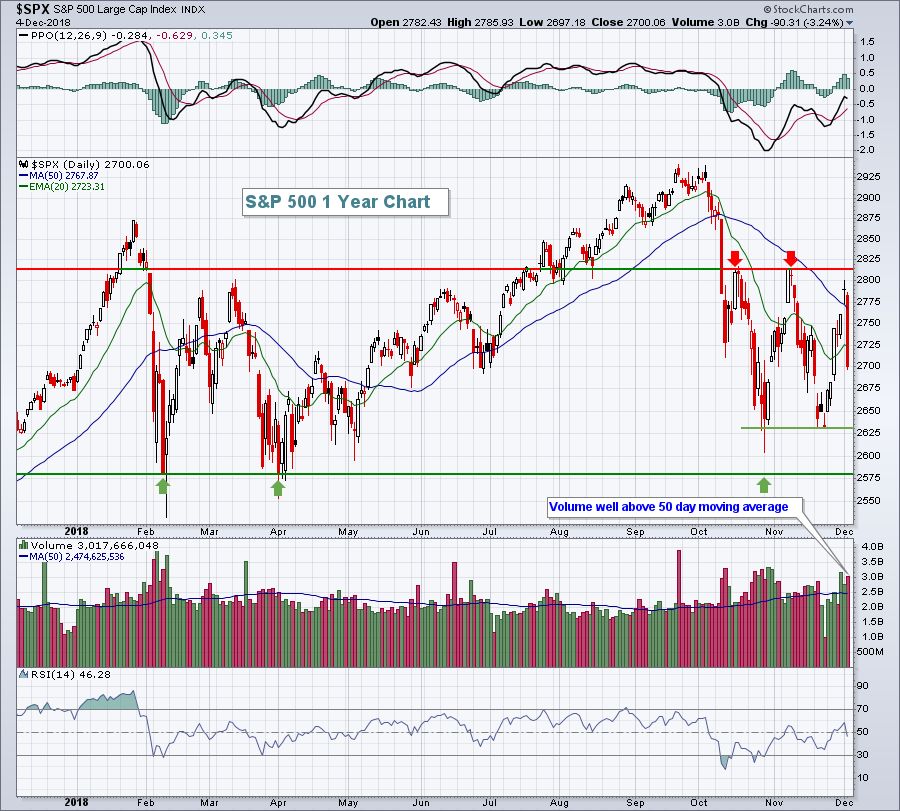

Impulsive Selling Dominates, Dow Jones Drops 800....What Does It Mean?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, December 4, 2018

Don't be swayed by market commentary that discusses lack of volume yesterday as a positive. First of all, the Dow Jones fell 800 points. 800!!! And that's somehow a positive? We lost 20 hour EMA support on the intraday...

READ MORE

MEMBERS ONLY

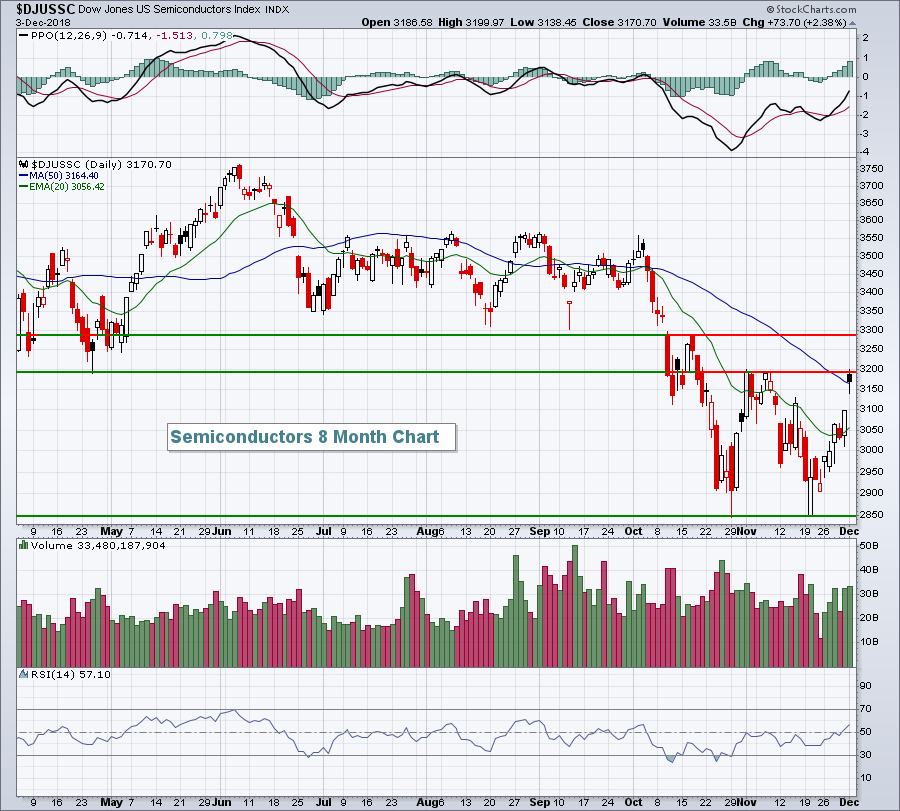

As We Head Into Winter, We Should Buy.....Home Construction Stocks?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, December 3, 2018

Global stocks were buoyed on Monday by the United States and China agreeing to delay further tariffs for 90 days to provide the two countries an opportunity to work through its trade differences. Obviously, nothing has been resolved and it simply pushes back...

READ MORE

MEMBERS ONLY

Here's A Bear Market Signal That's Yet To Turn Bearish

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, November 30, 2018

Friday's strength capped off a very solid week for the bulls, one in which the Dow Jones gained more than 1250 points. Strength was found everywhere although healthcare (XLV, +2.03%) and utilities (XLU, +1.48%) were the big winners to...

READ MORE

MEMBERS ONLY

Combining Strong Technicals And Fundamentals To Wildly Outperform The S&P 500

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Everybody wants the secret formula. You know, the one where you never lose money. Well, I haven't found THAT one yet, but trading companies that have recently beaten Wall Street revenue and EPS estimates is a fairly solid runner-up strategy. A company that produces results in excess of...

READ MORE

MEMBERS ONLY

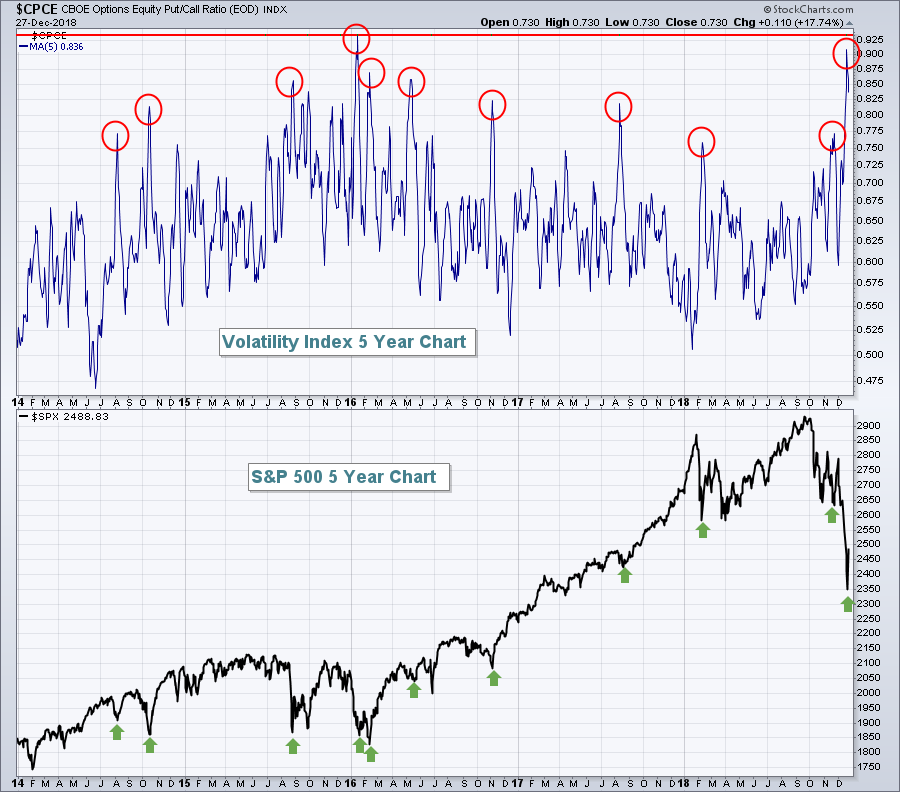

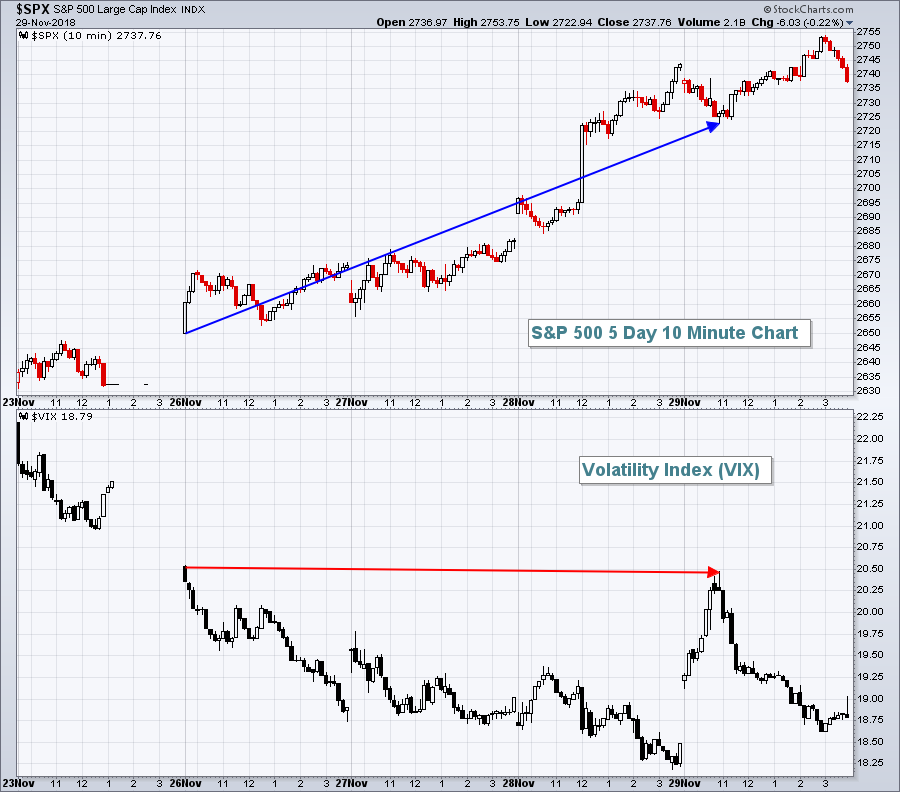

Volatility Index Suggests That Impulsive Selling Could Return

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, November 29, 2018

Before I discuss strength and weakness from the mixed action on Thursday, let me first say that the Volatility Index ($VIX) remains one of my biggest fears about the current state of the market. In the morning yesterday, the VIX touched its high...

READ MORE

MEMBERS ONLY

U.S. Equities Rally Big Time, But I Remain Very Cautious

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

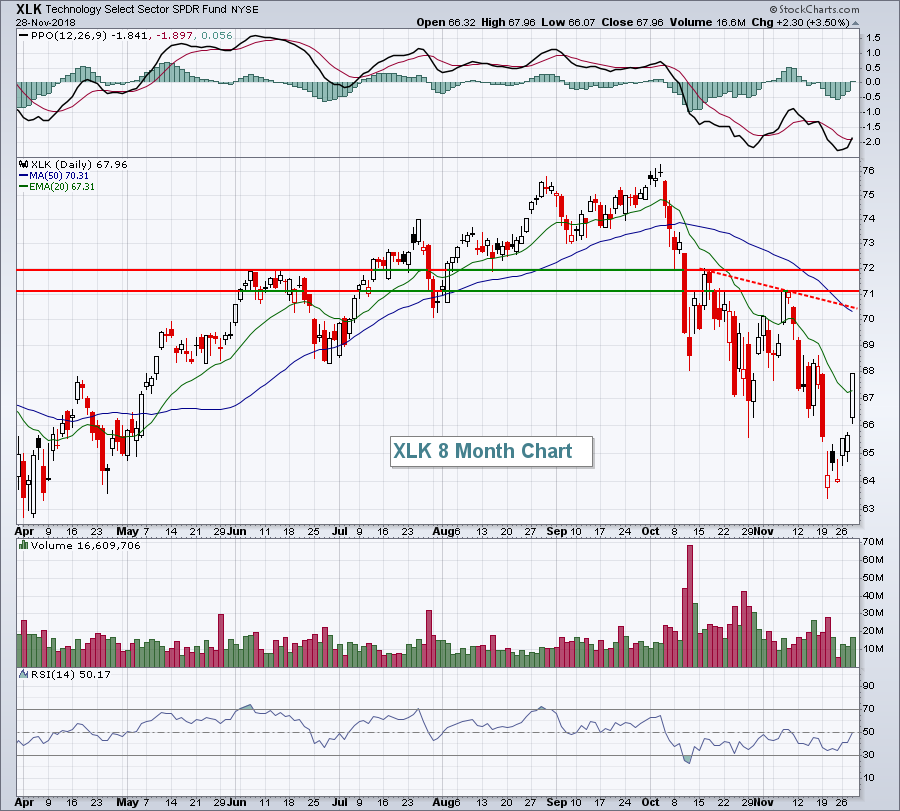

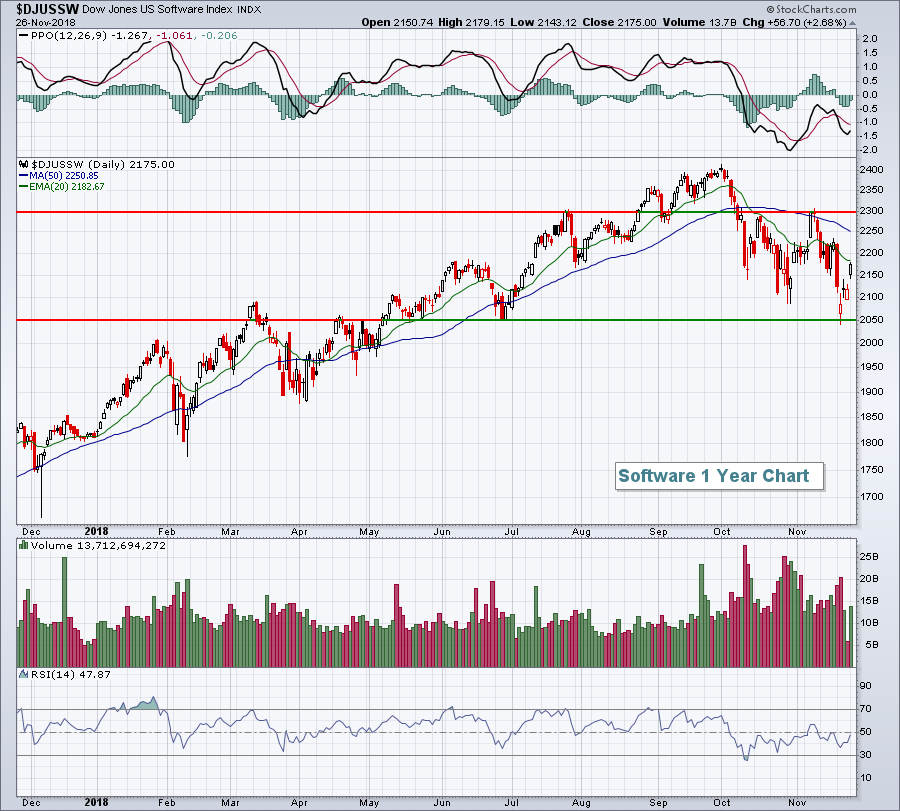

Market Recap for Wednesday, November 28, 2018

Wall Street finally (!) had a day where the bulls could smile at 4pm EST. It was a trend day where the buying begins early and continues throughout the trading day. These days tend to be very bullish, although there is still plenty to...

READ MORE

MEMBERS ONLY

Here's What's Wrong With Commodities....And Are Renewable Energy Stocks Finally Bottoming?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, November 27, 2018

One highlight from Tuesday's action is that the U.S. Dollar ($USD, +0.31%) remains in favor as it nears yet another breakout. This is important on a number of fronts, especially with respect to gold ($GOLD, -0.74%). There'...

READ MORE

MEMBERS ONLY

Home Construction Has Bottomed And Here's An Unrelated Stock To Bolster Your Holidays

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, November 26, 2018

Yesterday marked the first day in quite awhile where we saw all of our major indices higher, along with all of our sectors. All eleven sectors gained ground, even the defensive sectors - though they lagged badly on a relative basis. Leading the...

READ MORE