MEMBERS ONLY

Bears Control The Action Despite Inability To Take Out Major Support

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, November 23, 2018

Friday's action was disappointing on a couple of different levels. First, the Friday morning attempt at a rally failed midday and sellers emerged into the close. It was somewhat similar to the action on Wednesday when the early morning gap higher...

READ MORE

MEMBERS ONLY

Friday After Thanksgiving Generally Belongs To The Bulls

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, November 21, 2018

Wall Street was mostly higher on Wednesday, although, by just about any other measure, it was a disappointing session. The early morning gap higher was essentially where the bullishness ended and there was a slow drift lower throughout the balance of the day....

READ MORE

MEMBERS ONLY

VIX Hits November High; Apparel Retailers, Railroads Crushed

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, November 20, 2018

It was another ugly day for U.S. equities as the February price support on our major indices draws closer and closer. Volatility shot higher as panicked, impulsive selling once again gripped Wall Street. Energy (XLE, -3.28%), consumer discretionary (XLY, -2.26%...

READ MORE

MEMBERS ONLY

Impulsive Selling Returns And VIX Spikes Amid Technology Assault; Futures Tanking

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, November 19, 2018

I'd like to say something good about yesterday's action on Wall Street, but I don't think there's anything to be said. Impulsive selling returned with little in the way of a bid on technology stocks...

READ MORE

MEMBERS ONLY

Small Caps Need To Hold Onto This Price Support

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Special Event

Join me and John Hopkins, President of EarningsBeats.com, after the bell today for a 4:30pm EST webinar. I'll be discussing the stocks that I believe represent the best trading opportunities of Q4. These stocks all posted better-than-expected quarterly revenues and EPS and significant accumulation...

READ MORE

MEMBERS ONLY

You Must Master These Two Things To Trade Successfully

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Trading is difficult, emotional and can be quite lonely. We have seen volatility ($VIX) shoot higher, rising from an 11.61 close on October 3rd to a high of 28.84 on October 11th. Since then, we've remained above the key 16-17 support level that typically holds during...

READ MORE

MEMBERS ONLY

History Supports Bullish Move But Earnings Last Night Could Dampen Bulls' Victory Thursday

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Reminder

I post a blog article every morning that the stock market is open in a format similar to today's article. If you haven't already subscribed (for FREE) and would like to, simply scroll to the bottom of this article and type your email address into...

READ MORE

MEMBERS ONLY

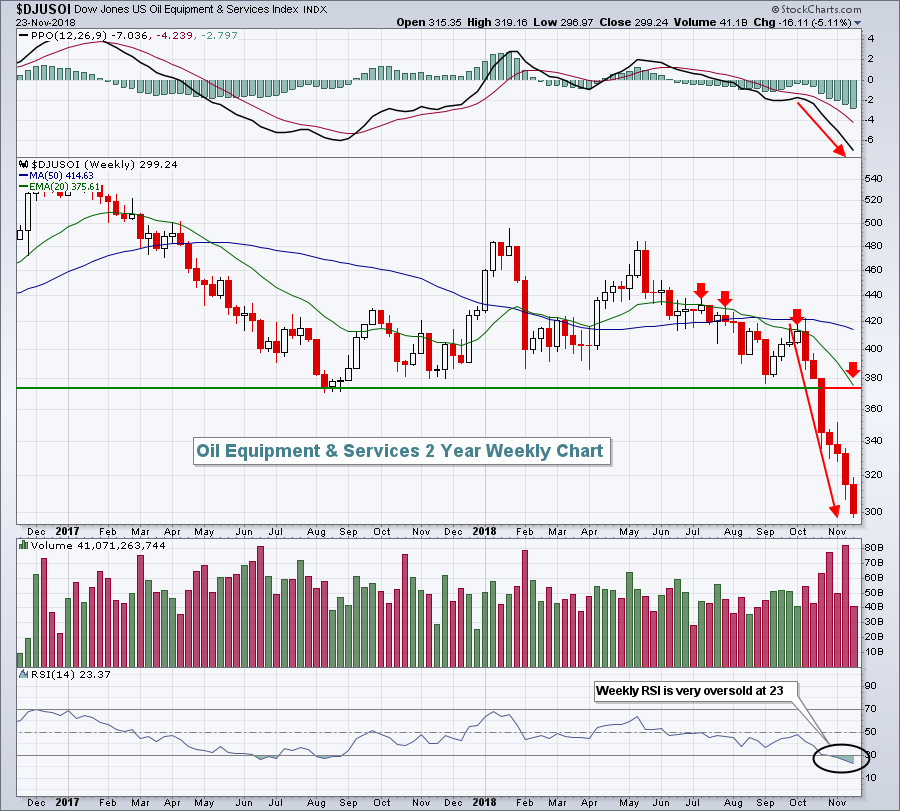

30% Gain From Here Over Next Year Possible? This Chart Says YES

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, November 14, 2018

In a rare twist, communication services (XLC, +0.49%) was the only sector to gain ground yesterday. The group has underperformed the S&P 500 badly since its July relative high with Facebook's (FB) quarterly earnings report on July 25th...

READ MORE

MEMBERS ONLY

Trade Setup - Tandem (TNDM) In Real Time

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

From a trading perspective, I wanted to give you a quick idea of what I look for in a trade. I bought Tandem Diabetes Care (TNDM) when it crossed back above 31.21 and I'll hold it unless it closes beneath 31.00 or moves intraday beneath 30....

READ MORE

MEMBERS ONLY

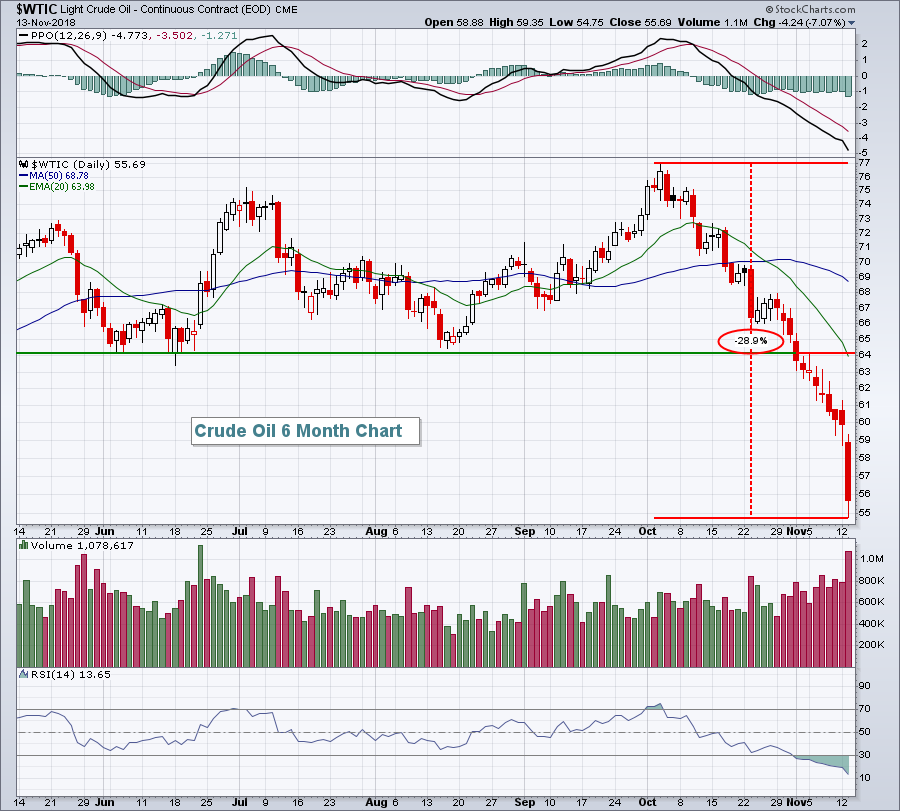

Gold Downtrend Resuming As Is S&P 500's

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, November 13, 2018

Losses weren't big on Tuesday as the Dow Jones dropped just 0.40% and was the worst performing of our major indices. But it seemed to be more of a continuation of the recent downtrend as all key areas of the...

READ MORE

MEMBERS ONLY

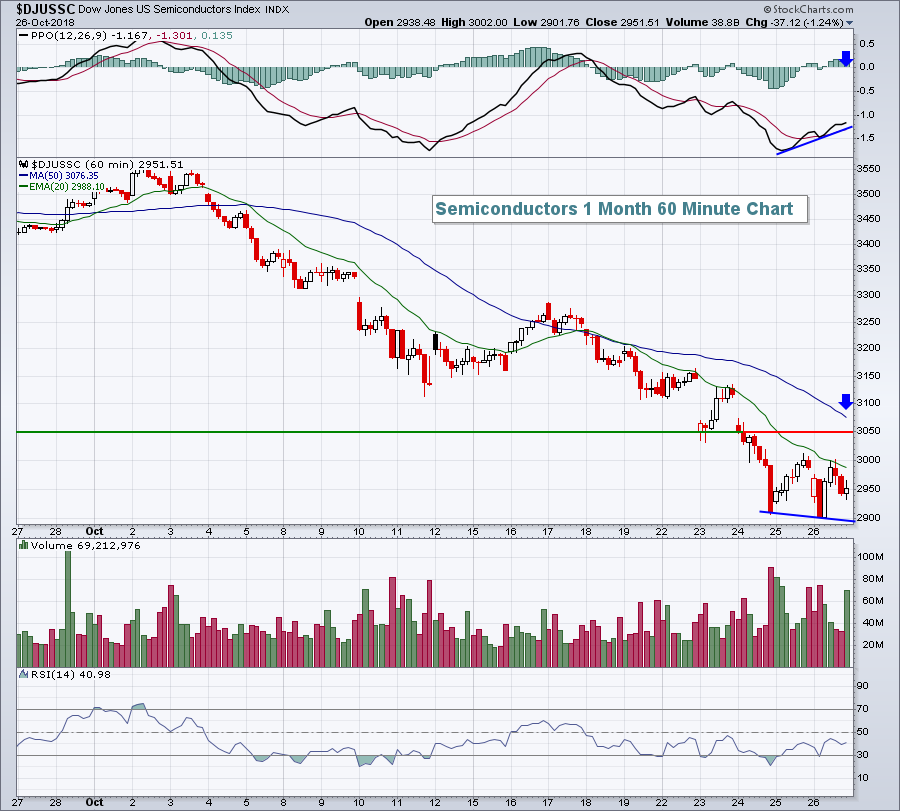

Semiconductors Are In A Bear Market, Follow This Trading Range

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, November 12, 2018

Welcome back bears. Welcome back volatility. It was another day of steep losses on Wall Street, underscoring the likely end to what the bulls were hoping was a sustainable rally back to recent highs. There was a major test last week for the...

READ MORE

MEMBERS ONLY

Are Copper Prices Signaling S&P 500 Bear Market Like In Prior Years?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, November 9, 2018

There was a return of strength in defensive sectors on Friday as consumer staples (XLP, +0.58%), utilities (XLU, +0.15%) and real estate (XLRE, +0.12%) were the only sectors to finish the session in positive territory. There was also significant relative...

READ MORE

MEMBERS ONLY

S&P 500 Hesitates At Next Key Price Resistance

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

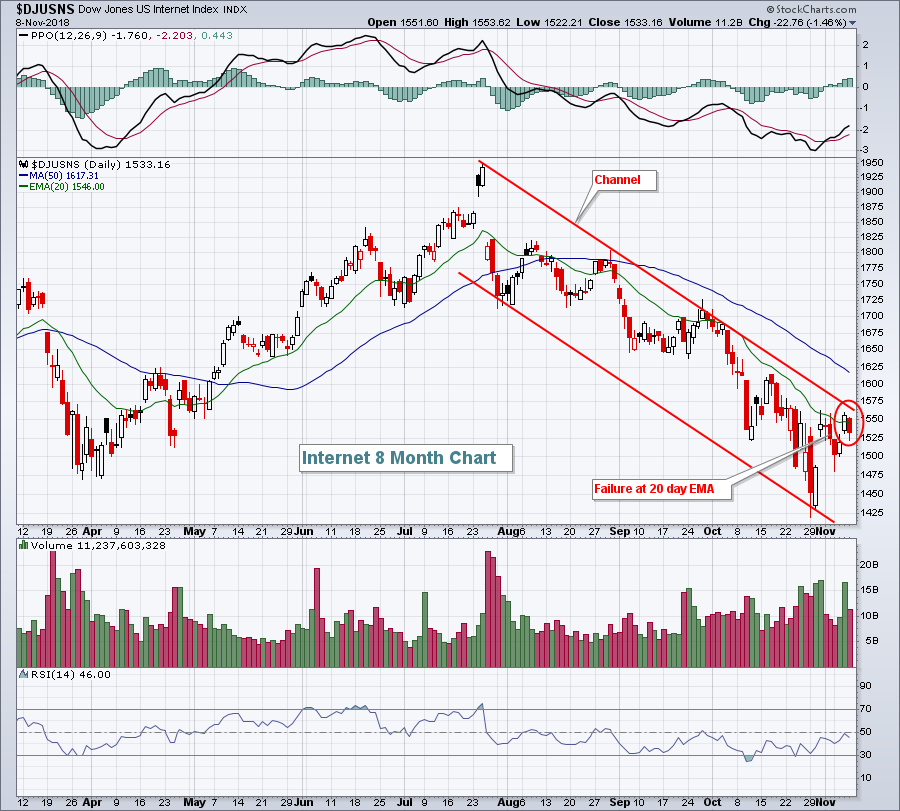

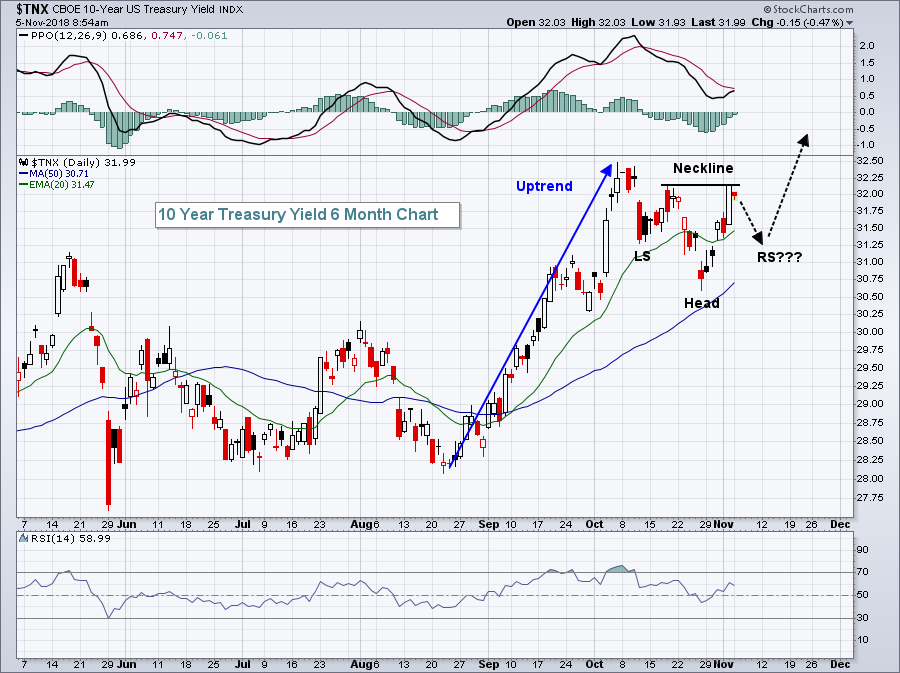

Market Recap for Thursday, November 8, 2018

Well, another Fed day has come and gone. The FOMC ended its two day meeting and left rates unchanged, as expected. It promised, however, further gradual increases. If you recall, the spike in the 10 year treasury yield ($TNX) to 3.25%, a...

READ MORE

MEMBERS ONLY

Very Bullish Sector Rotation Underscores Dow's 500 Point Gain

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, November 7, 2018

The Dow Jones surged 545 points, or 2.13%, yesterday and that index of conglomerates was a laggard. NASDAQ stocks exploded nearly 200 points higher, or 2.64%, to extend what's been a very impressive rally after October's massacre....

READ MORE

MEMBERS ONLY

Railroads Provide Us Market Clues And Right Now They're Bullish

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, November 6, 2018

All eleven sectors rose on Tuesday with materials (XLB, +1.64%) leading as the U.S. Dollar Index ($USD) closed at its lowest level in nearly two weeks. All of our major indices had similar gains, from 0.55% to 0.68%, as...

READ MORE

MEMBERS ONLY

Bulls Avert Near-Term Breakdown But Caution Prevails

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

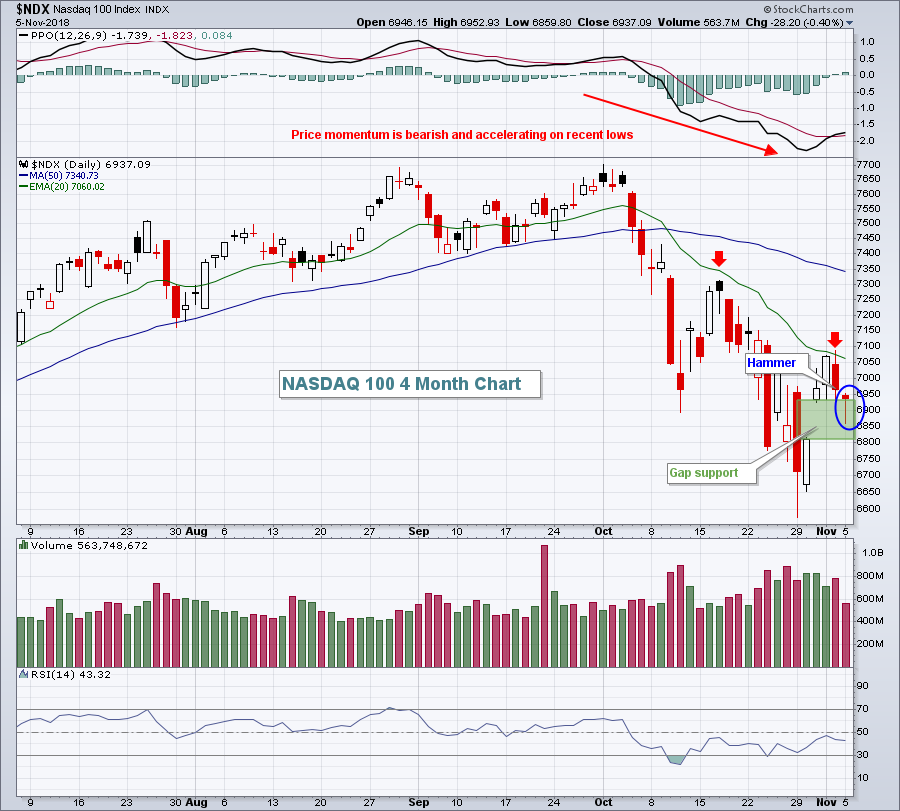

Market Recap for Monday, November 5, 2018

Bifurcated market action dominated on Monday. The Dow Jones and S&P 500 gapped higher and traded higher throughout nearly all of the session. The NASDAQ and Russell 2000, on the other hand, struggled throughout most of the day with an afternoon...

READ MORE

MEMBERS ONLY

Transports Are A Big Deal And Here's What The Chart Is Saying

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, November 2, 2018

Traders were anxiously awaiting jobs data last week. First, it was a solid ADP employment report on Wednesday morning that helped to lift U.S. equities. But the biggie was on Friday and we all held our collective breath as the numbers were...

READ MORE

MEMBERS ONLY

3 Upcoming Earnings Reports I Can't Wait To See

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I'm not a fan of buying (or short selling) stocks and holding them into quarterly earnings reports. It's simply too difficult to manage risk. Yes, there are options strategies that you can employ to reduce risk so we could debate back and forth the merits of...

READ MORE

MEMBERS ONLY

Apple (AAPL) Disappoints, But Nonfarm Payrolls Soar Past Estimates

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

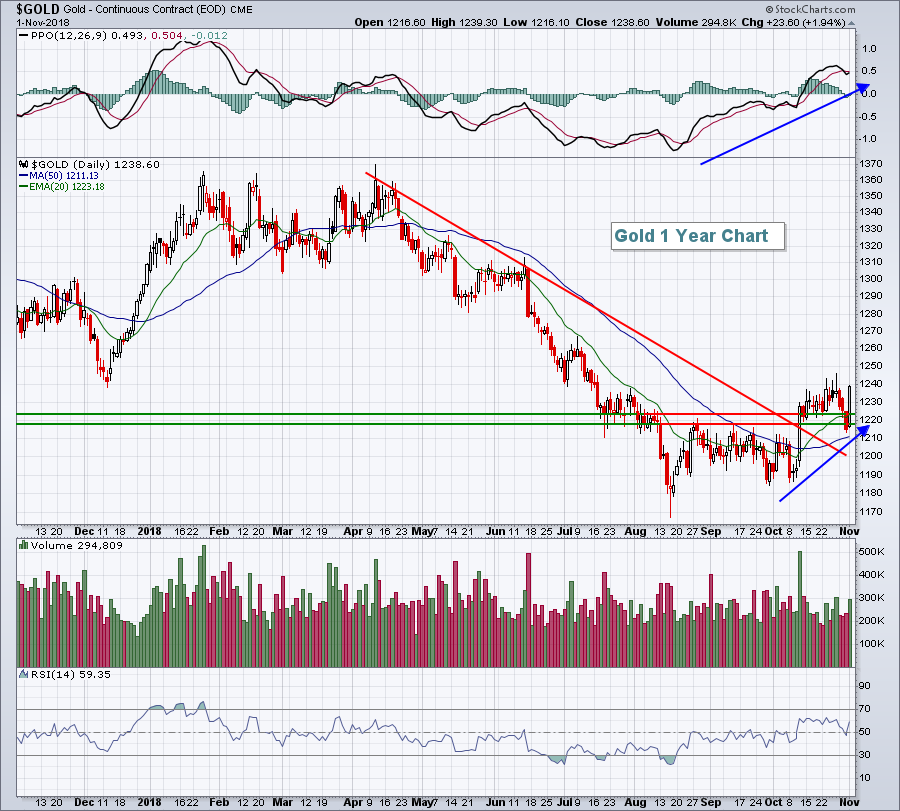

Market Recap for Thursday, November 1, 2018

The U.S. Dollar Index ($USD) absorbed its largest decline in several months and that finally triggered buying in the materials sector (XLB, +2.81%). Gold ($GOLD) was a big beneficiary for sure as it climbed nearly 2%, one of its largest advances...

READ MORE

MEMBERS ONLY

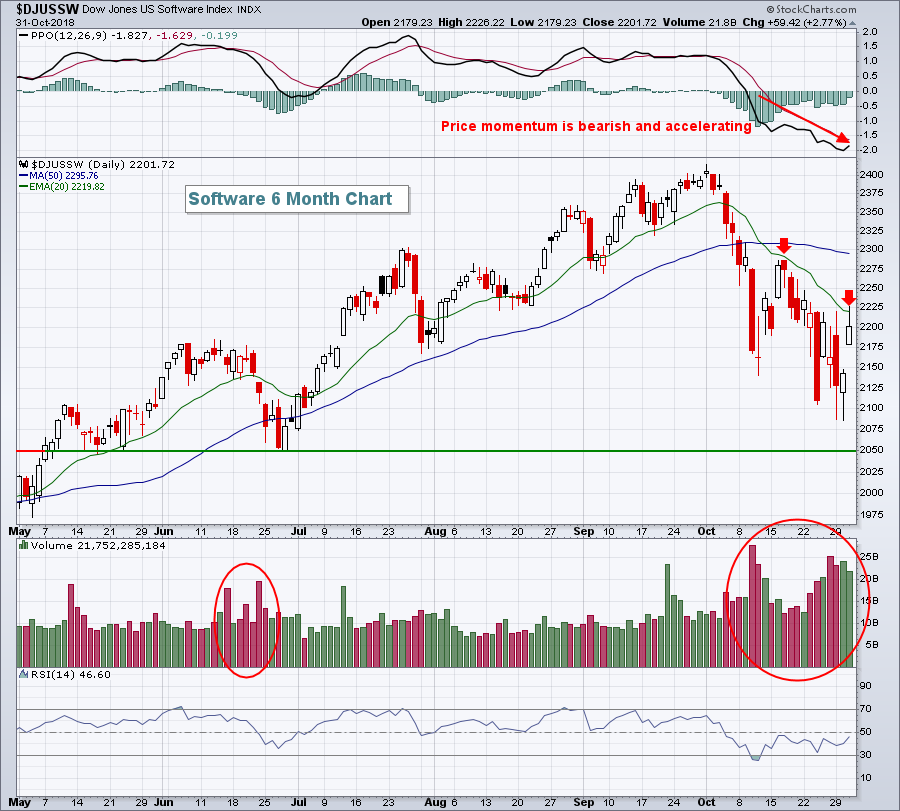

Software Hits Key Resistance....And Fails; S&P 500 Shares Similar Fate

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, October 31, 2018

Let's start with the positives from Wednesday's action. First, all of our major indices rebounded and finished higher on the session, led by the more aggressive NASDAQ and NASDAQ 100. These two indices had been crushed both on an...

READ MORE

MEMBERS ONLY

Relief Rally Begins, How Long Might This Last?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, October 30, 2018

Today's article will be limited as I'm having technical difficulties sharing charts, but I'll give you my thoughts. Yesterday's action and reversal was important as our volatility measures - VIX and VXN - are at...

READ MORE

MEMBERS ONLY

Impulsive Selling Returns, More Rotation To Defensive Areas

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, October 29, 2018

Early on Monday morning, it looked like stocks were trying to carve out a bottom, but by the afternoon, big time selling resumed and prior support levels were lost - all with rapidly rising volatility. That is a recipe for short-term stock market...

READ MORE

MEMBERS ONLY

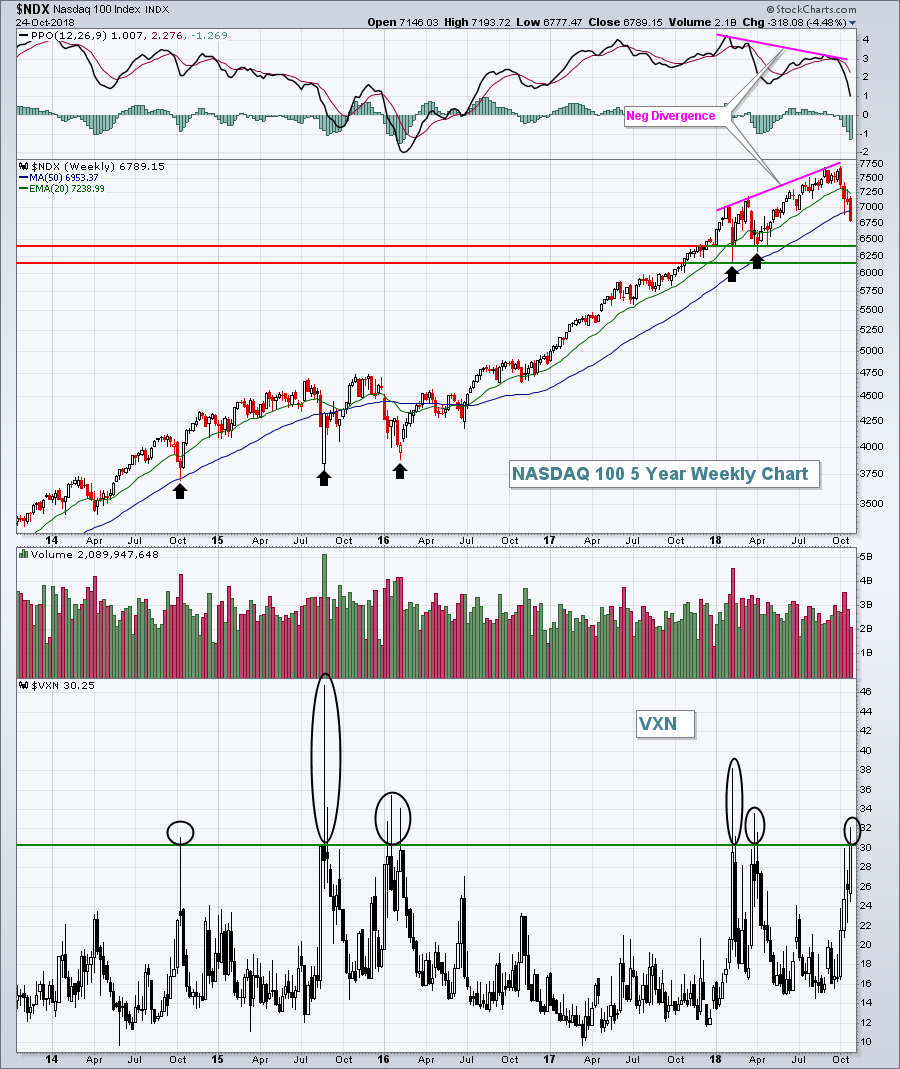

NASDAQ Volatility Measure Suggests Market Bottom

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, October 26, 2018

All of our major indices finished lower on Friday and all of our major sectors did the same. It's difficult to paint a bullish picture after such selling, but I'm going to do just that. On Friday, despite selling...

READ MORE

MEMBERS ONLY

History Says BUY NOW, But Here's When The Charts Say To Buy

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, October 25, 2018

Obviously, the numbers from Thursday tell us that we had a very strong day. But the "under the surface" signals really underscored that strength. Transports ($TRAN) gained 1.88% after nearly touching the February low. Technology (XLK, +3.44%), communication services...

READ MORE

MEMBERS ONLY

Fear Gauge Soars As Dow Jones Posts 600 Point Loss

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

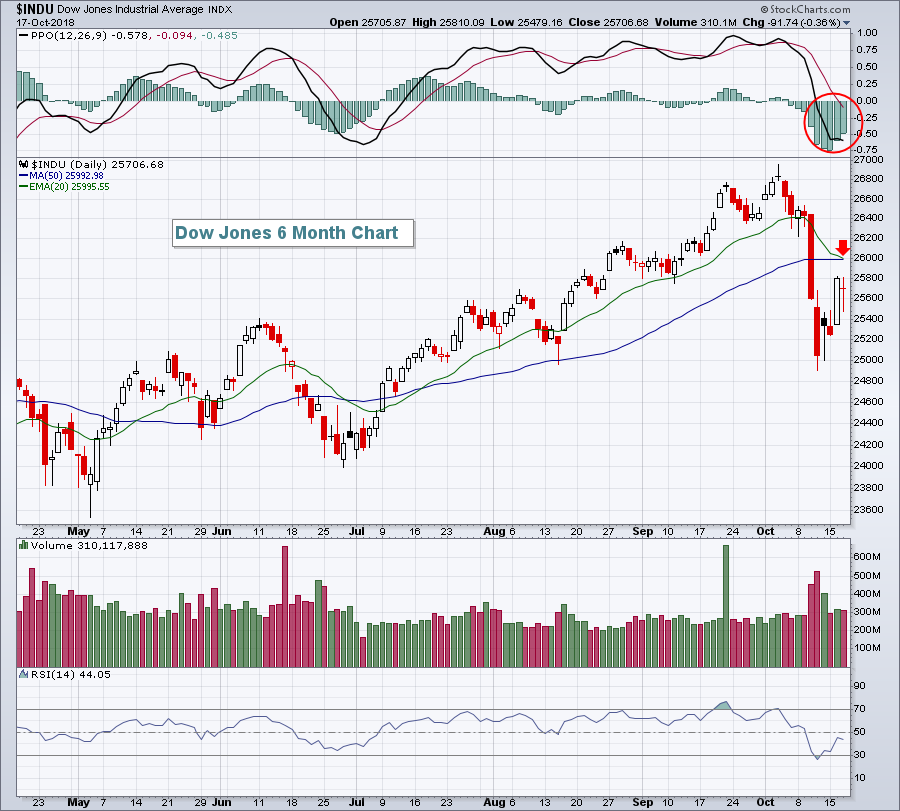

Market Recap for October 24, 2018

When the Volatility Index ($VIX, +21.83%) is elevated, like it's been throughout much of October, it should be no shock when Wall Street has a day like it did yesterday. There was a buyers strike and the Dow Jones lost 500...

READ MORE

MEMBERS ONLY

Wild Ride On Wall Street Ends With Minor Losses

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

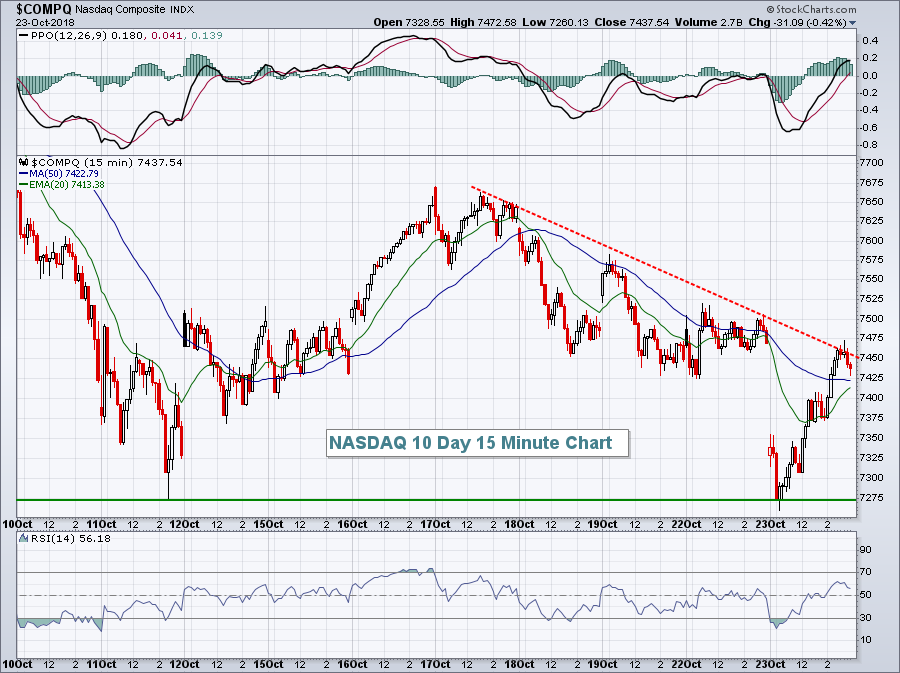

Market Recap For October 23, 2018

It was a crazy day on Wall Street which, quite honestly, we should expect with a Volatility Index ($VIX) in the 20s. Jitters in global markets saw U.S. futures plunge yesterday morning. Our major indices opened more than 2% lower and it appeared...

READ MORE

MEMBERS ONLY

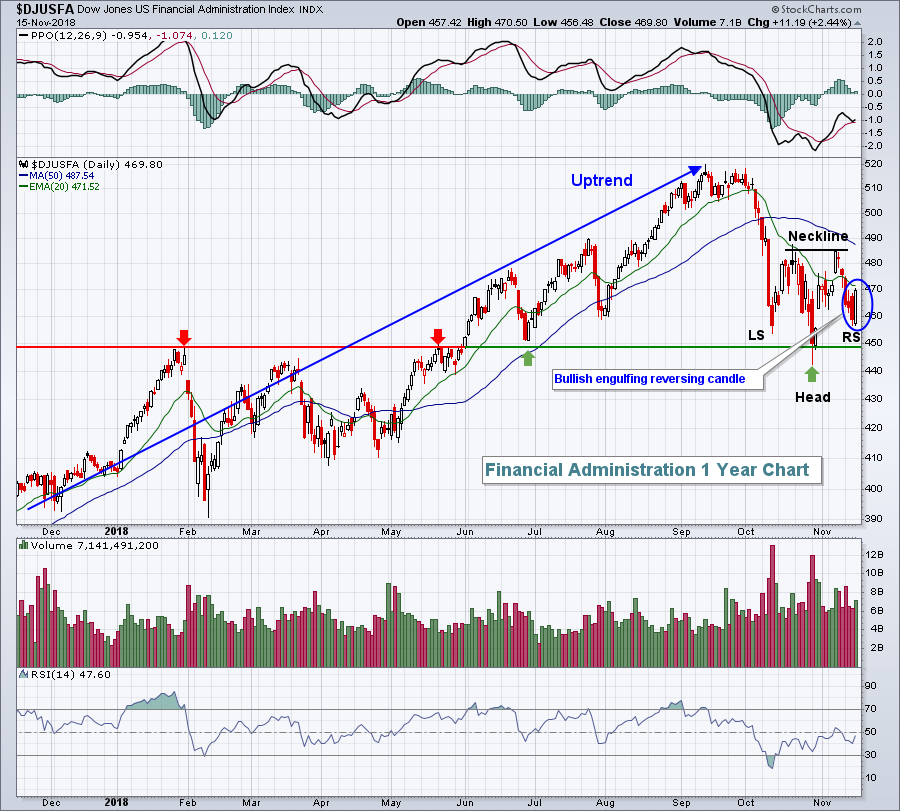

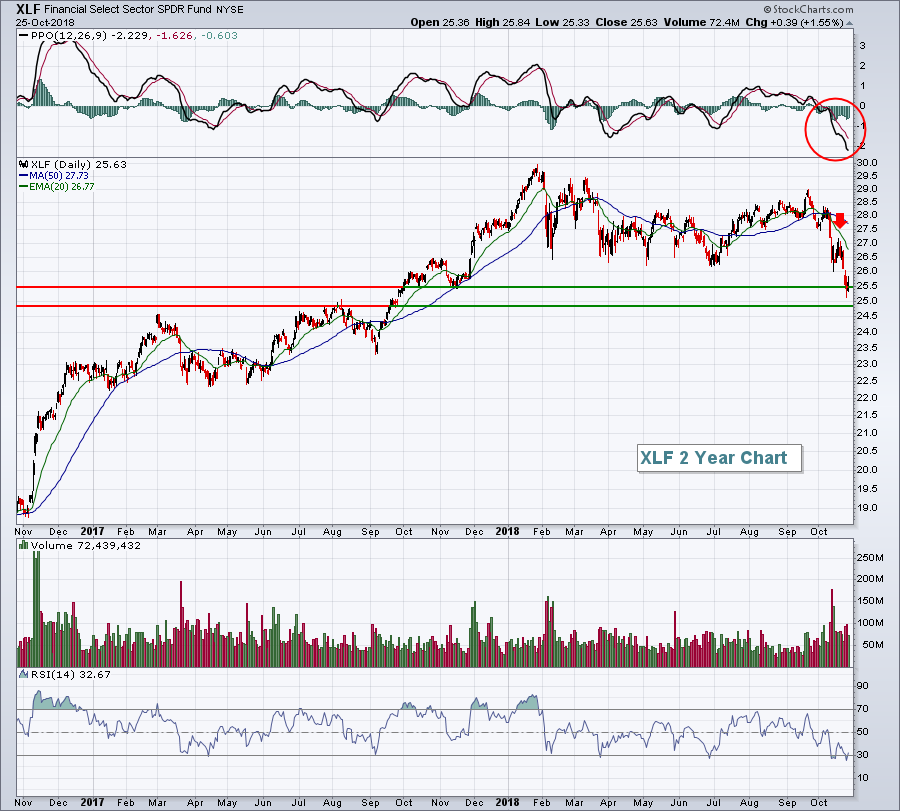

Banks, Financials Drop To 2018 Lows, Futures Tumble As Risk Grows

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Subscribe For FREE Below

If you enjoy my daily blog article that summarizes recent action, current outlook and provides a historical perspective, please subscribe below. It's 100% FREE, no strings attached, and is much appreciated. Simply scroll to the bottom of my article and type in your email...

READ MORE

MEMBERS ONLY

Here's What To Expect Going Forward And It May Not Be Pretty Short-Term

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Special Note

I will be joining John Hopkins, President of EarningsBeats.com, for a special webinar later this afternoon at 4:30pm EST. I will be discussing my trading strategy during a volatile market like the one we have now, including some tips and tricks to manage risk during these...

READ MORE

MEMBERS ONLY

Sector Relative Performance Suggesting Caution, Not Bear Market

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

There are plenty of reasons why we should be cautious given the current market environment, but I'm not in the camp that believes we've entered a bear market. It's simply too early to make that call, in my opinion. Most corrections and bear markets...

READ MORE

MEMBERS ONLY

A Consumer Discretionary Group Has Been Sending Warning Signs For Two Years

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, October 18, 2018

Impulsive selling seemed to return to Wall Street on Thursday as the Dow Jones had a couple of intraday bouts where the index declined 200-300 points in just an hour or so. That sent the Volatility Index ($VIX, +15.29%) scurrying higher once...

READ MORE

MEMBERS ONLY

Financials Continue To Bounce Off Support, Market Choppy

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, October 17, 2018

There was a lot of back and forth action in our major indices on Wednesday. For instance, in the span of just 2 1/2 hours, the Dow Jones lost more than 300 points, then recovered them all, moving slightly into positive territory....

READ MORE

MEMBERS ONLY

Dow Jones Gains Over 500 On Strong Earnings

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, October 16, 2018

Wall Street welcomed a trend day to at least temporarily pause the violent downtrend we've experienced the past couple weeks. A trend day typically starts with a gap higher and then gains are extended throughout the session. We clearly saw that...

READ MORE

MEMBERS ONLY

The Yield Spread (Curve) Is Worrisome For Banks

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

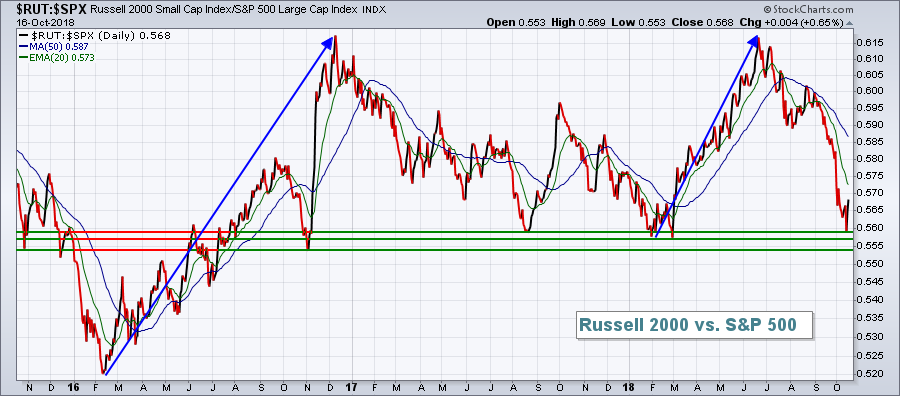

Market Recap for Monday, October 15, 2018

A late afternoon selling binge pushed our major indices into negative territory by the close, with the lone exception being the small cap Russell 2000 ($RUT), which avoided a relative breakdown vs. the benchmark S&P 500. Small caps have been languishing...

READ MORE

MEMBERS ONLY

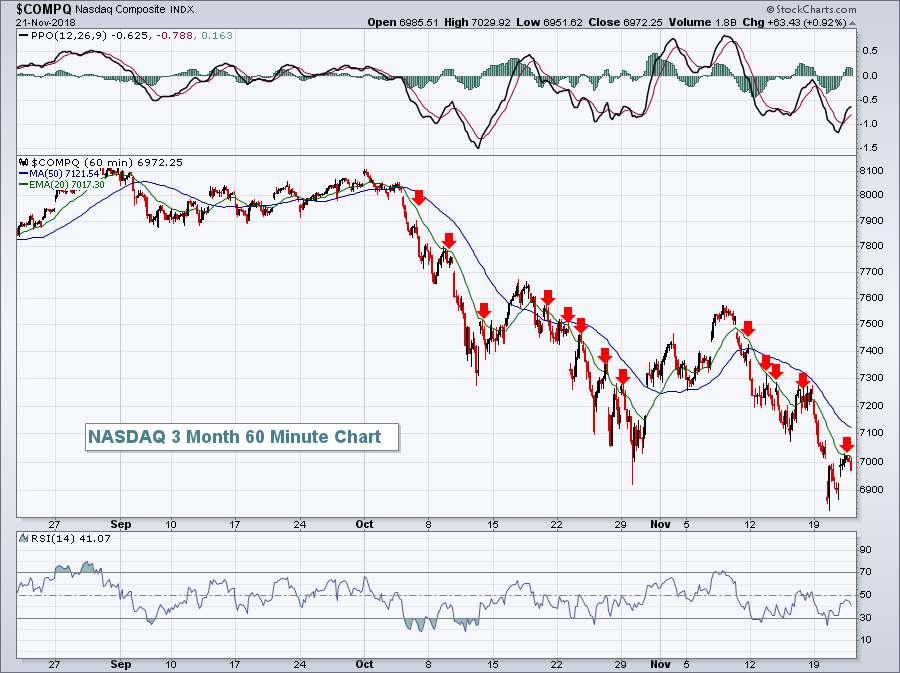

History Says To Watch Those 60 Minute Charts For Bottoming Clues

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, October 12, 2018

Finally, Wall Street saw buying pressure to end a trading session. That certainly felt great psychologically, although as I point out below, I doubt that the short-term bottom is in. It's possible, but the odds favor another short-term plunge. For now,...

READ MORE

MEMBERS ONLY

Bears Retain Grip on Wall Street as Fears Grow

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Special Note

I will be speaking to the Charlotte Chapter of the American Association of Individual Investors (AAII) tomorrow Saturday, October 13th at 10:00am EST. I plan to discuss how to evaluate the sustainability of a bull market, relative strength and gap trading strategies. The first meeting is FREE...

READ MORE

MEMBERS ONLY

VIX Surges 43% To Lead Major Selloff

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Special Note

I will be speaking to the Charlotte Chapter of the American Association of Individual Investors (AAII) this Saturday, October 13th at 10:00am EST. I plan to discuss how to evaluate the sustainability of a bull market, relative strength and gap trading strategies. The first meeting is FREE...

READ MORE

MEMBERS ONLY

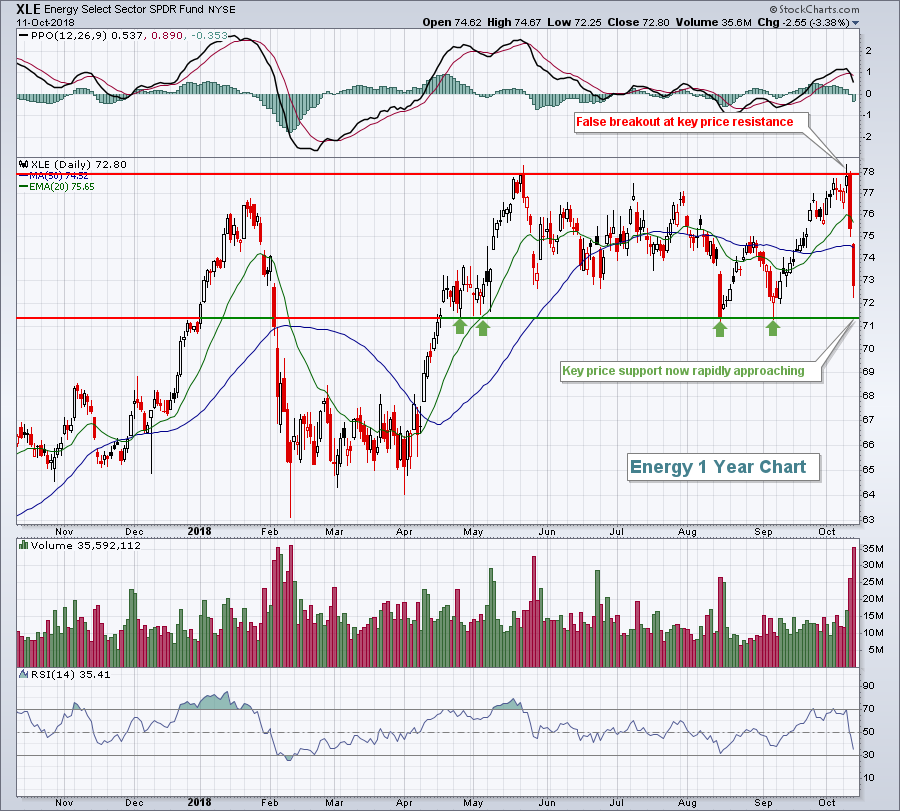

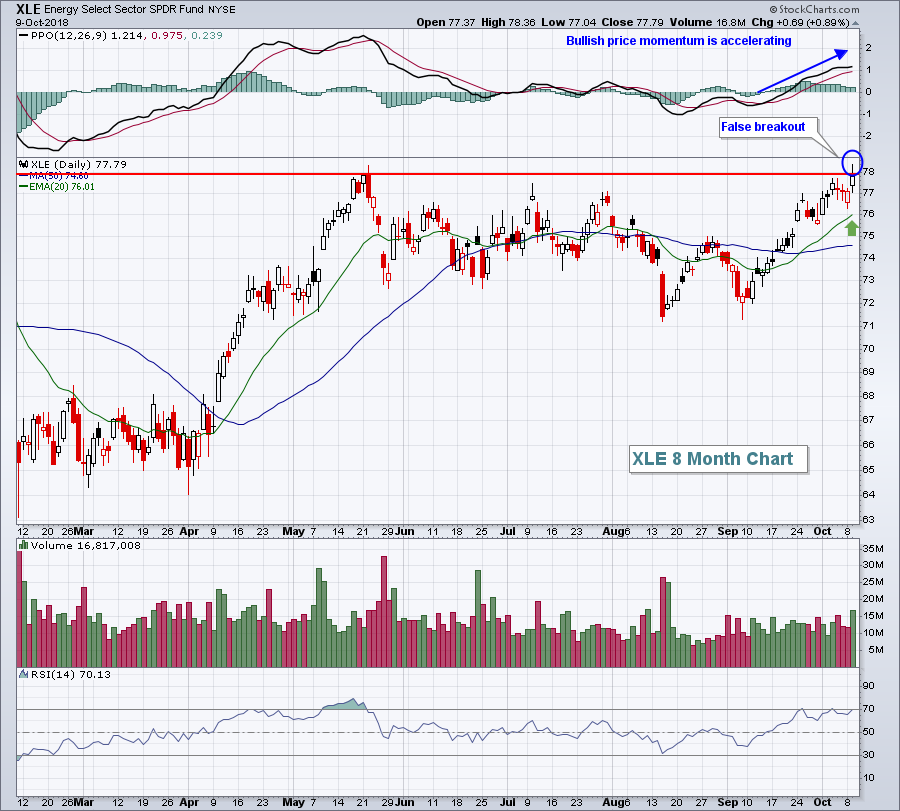

Energy Continues To Lead But Failed At Key Resistance

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Special Note

I will be speaking to the Charlotte Chapter of the American Association of Individual Investors (AAII) this Saturday, October 13th at 10:00am EST. I plan to discuss how to evaluate the sustainability of a bull market, relative strength and gap trading strategies. The first meeting is FREE...

READ MORE

MEMBERS ONLY

Consumer Staples And Real Estate Lead Rally

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, October 8, 2018

Consumer staples (XLP, +1.38%) and real estate (XLRE, +1.29%) helped to power Monday's reversal, but that was not enough to turn around the fortunes for the NASDAQ, which still dropped more than 50 points as technology (XLK, -1.13%...

READ MORE

MEMBERS ONLY

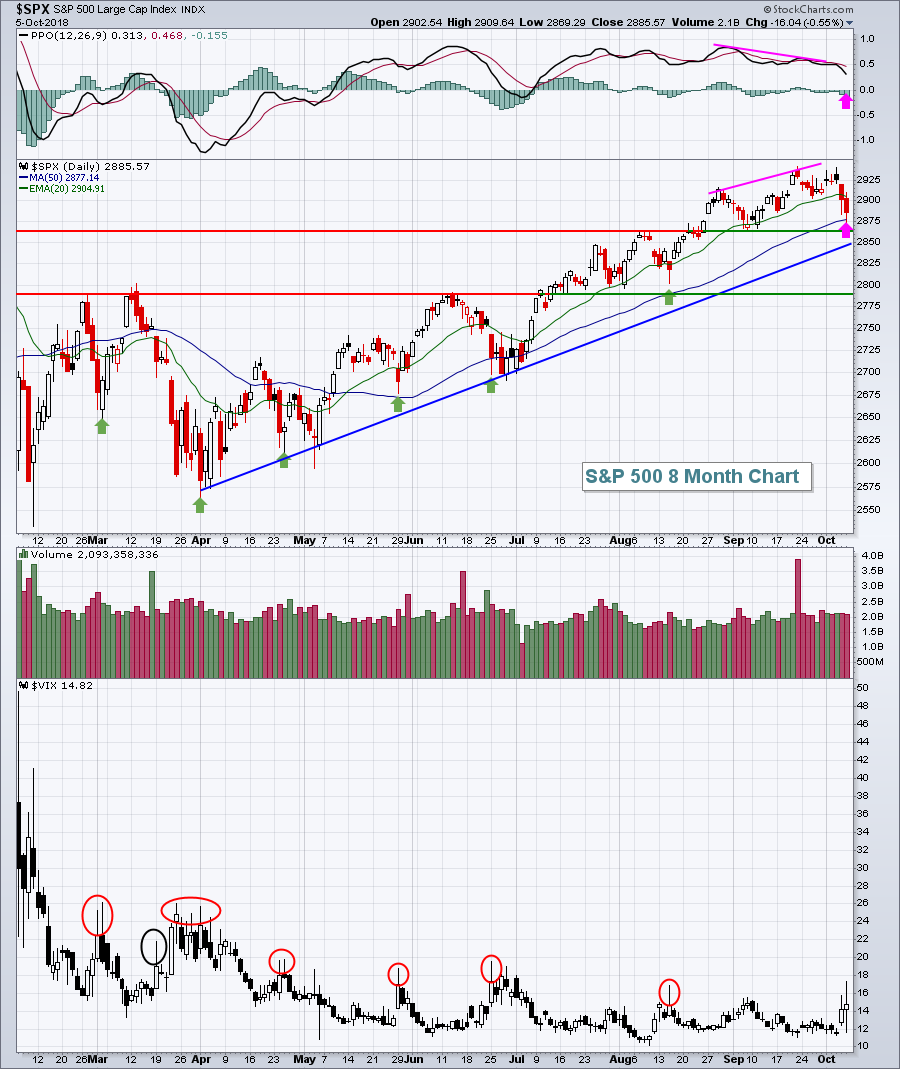

VIX Hits Highest Level In 3 Months - What That Means

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, October 5, 2018

There was good news and bad news Friday on the volatility front. The Volatility Index ($VIX) hit 17.36 intraday on Friday, the highest level of expected volatility since the late-June swoon, and it closed another 4% higher after a big spike on...

READ MORE

MEMBERS ONLY

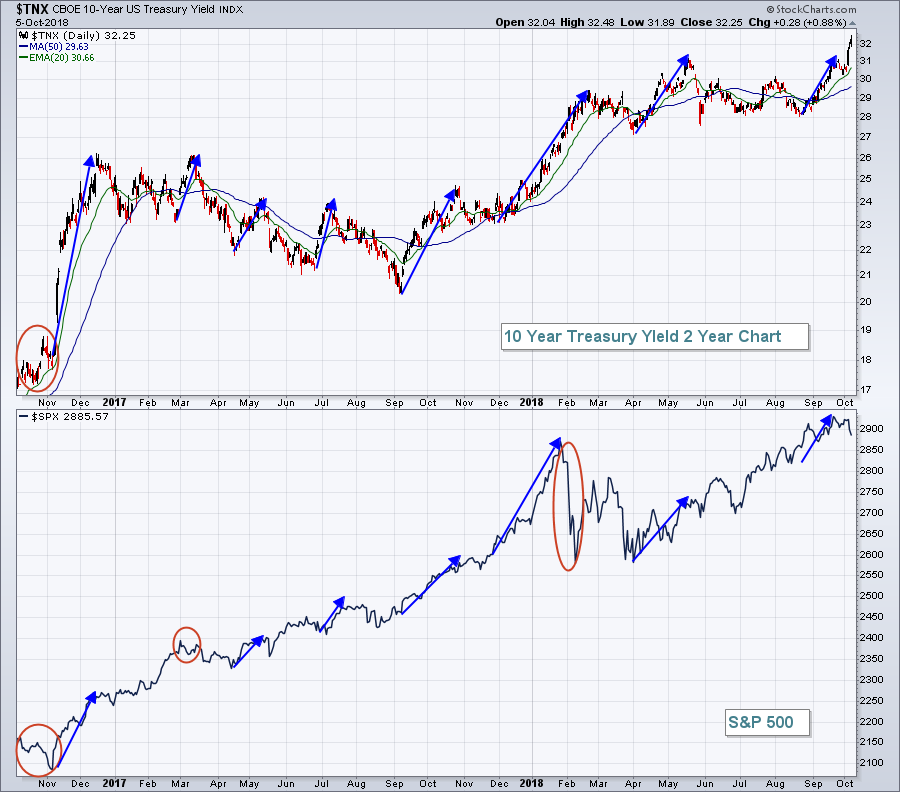

When Panicked Selling Kicks In, Look To The VIX For A Bottom Call

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

It was a brutal week for many areas of the stock market, but mostly those areas that have led the charge for so long. Stocks that for one to two years or more rarely saw a significant pullback suddenly couldn't find buyers this week. Unfortunately, that's...

READ MORE