MEMBERS ONLY

NASDAQ 100 Trio Report Blowout Results, Technology Looking To Extend Rally

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, April 26, 2018

Two familiar areas - technology (XLK, +1.82%) and consumer discretionary (XLY, +1.62%) - saw money rotate their way on Thursday, with especially strong action in both internets ($DJUSNS, +4.11%) and semiconductors ($DJUSSC, +2.35%) leading the technology space. Discretionary stocks...

READ MORE

MEMBERS ONLY

Will Today's Earnings-Related Gap Higher Break Through Key Resistance?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, April 25, 2018

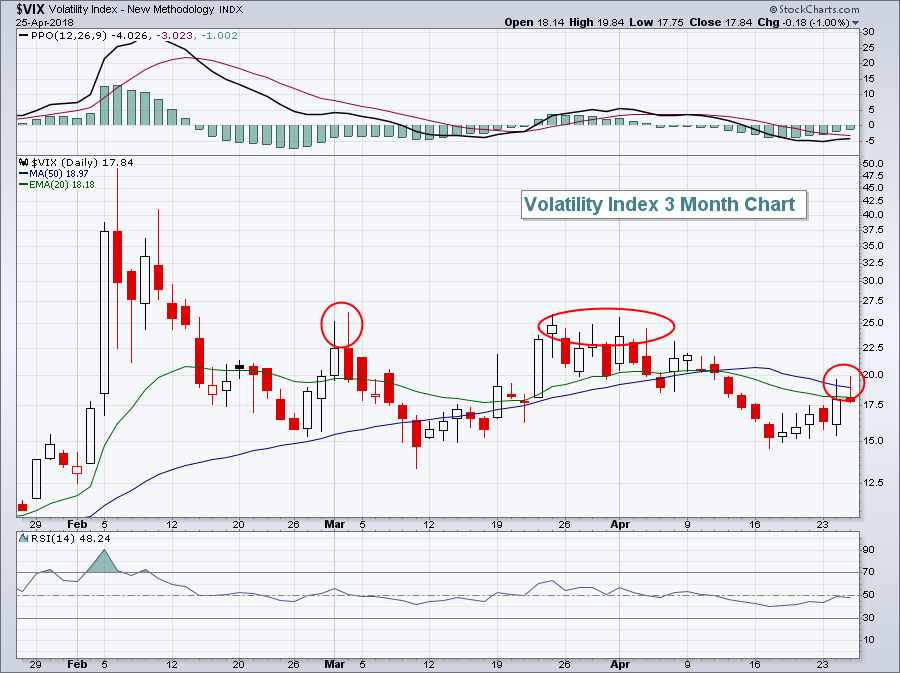

Wall Street was able to find equity buyers yesterday, despite the 10 year treasury yield's ($TNX) first close above 3.00% since 2014. The Volatility Index ($VIX) settled back down after approaching 20 for the second consecutive day. It has closed...

READ MORE

MEMBERS ONLY

The Bears Are Making A Run For The Roses

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, April 24, 2018

Pre-market action on Tuesday was solid and that's just about where the bullishness ended. With the Kentucky Derby just around the corner, let me summarize Tuesday's action from the opening bell in different fashion: "And they're...

READ MORE

MEMBERS ONLY

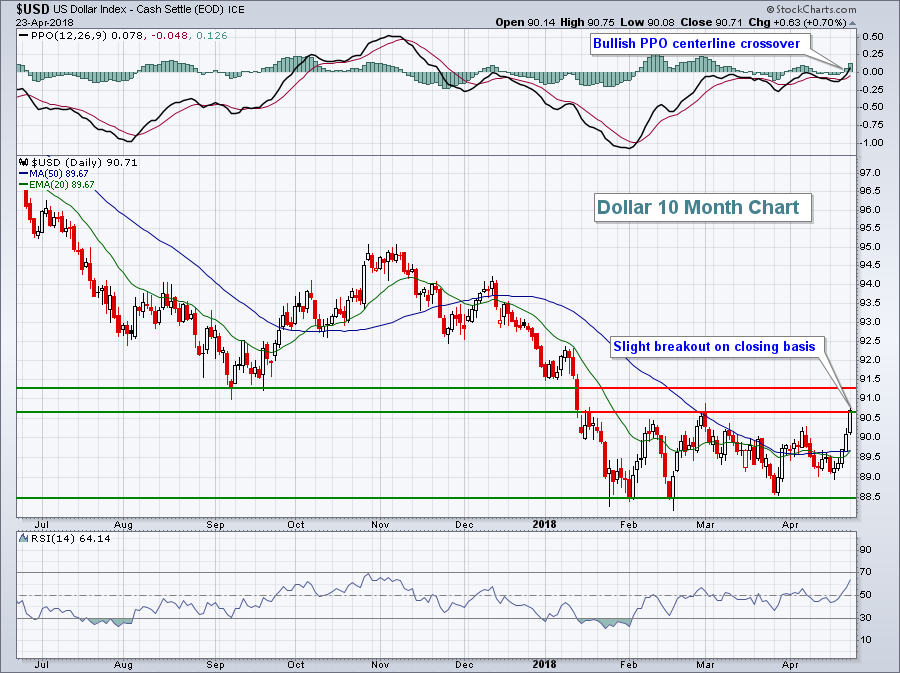

Dollar Makes Major Breakout; What That Means For Investment Allocation

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for April 23, 2018

A significant bullish breakout in the U.S. Dollar ($USD) occurred on Monday and the push higher is likely to just be beginning. Before I look at possible ramifications, let's look at the chart itself:

Monday's close was the USD&...

READ MORE

MEMBERS ONLY

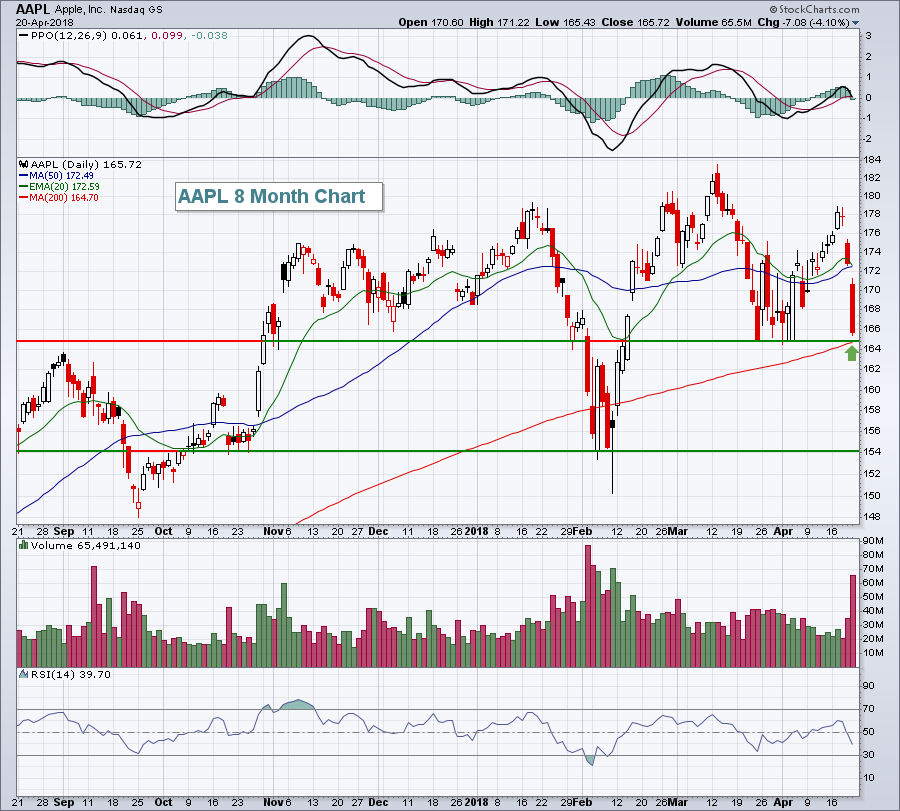

Two Bad Apples Don't Spoil The Whole Market Bunch

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, April 20, 2018

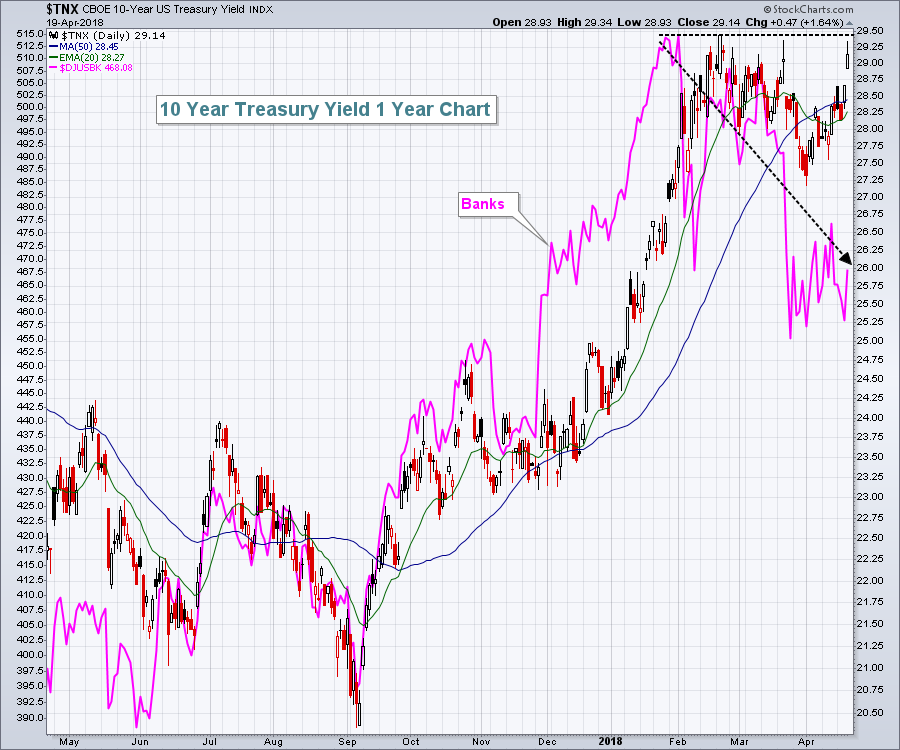

The big news on Friday was the bond market. The 10 year treasury yield ($TNX) closed just a tad above 2.95% and that was the highest close since late-2013/early-2014. The TNX has climbed another couple basis points in early action this...

READ MORE

MEMBERS ONLY

Go Away In May? Not If You Own This NASDAQ 100 Stock

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

One of the most over used cliches in the stock market, in my opinion, is "go away in May". First of all, it's simply bad investment advice. Since 1950 on the S&P 500, the May 1st to July 17th period has produced annualized returns...

READ MORE

MEMBERS ONLY

Treasury Yields Spike; TNX Threatens 4+ Year High, Banks Soar

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, April 19, 2018

The U.S. stock market has been solid throughout April thus far, so seeing a Thursday drop of 0.57% and 0.78% on the S&P 500 and NASDAQ, respectively, shouldn't be too alarming. And it wasn't....

READ MORE

MEMBERS ONLY

Bifurcated Action Doesn't Hold Back Transports, Renewable Energy

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, April 18, 2018

Our major indices showed signs of tiring on Wednesday as its seasonal pre-earnings run from April 1st to April 18th concluded. Five sectors managed to finish in positive territory, including the red-hot energy sector (XLE, +1.57%) and industrials (XLI, +1.04%). The...

READ MORE

MEMBERS ONLY

Twitter Leads Internet Group Higher; Netflix Soars On Earnings Beat

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, April 17, 2018

Futures were solid heading into Tuesday's pre-market action as Netflix reported stellar Q1 results after the closing bell on Monday. Then, on Tuesday morning, home construction ($DJUSHB) received great news as both March housing starts and building permits easily exceeded expectations....

READ MORE

MEMBERS ONLY

Falling VIX Aiding Stocks; Watch This Resistance Zone On S&P 500

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, April 16, 2018

Utilities (XLU, +1.37%) and materials (XLB, +1.34%) led rather odd market behavior on Monday. The good news is that all nine sectors finished higher. The bad news is that our most aggressive sectors struggled on a relative basis. Financials (XLF, +0....

READ MORE

MEMBERS ONLY

Energy Now Sports The Highest SCTR Among Sectors

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, April 13, 2018

U.S. stocks fell on Friday the 13th, but managed to cut intraday losses in half (or more) during the final 45 minutes of the session. Most of our major indices lost roughly 0.50%, except for the benchmark S&P 500,...

READ MORE

MEMBERS ONLY

CNBC Won't Tell You When The Market Is Topping, But This Chart Will

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Note

I write an article here in this blog each and every morning that the stock market is open. It's typically published during pre-market action, between 8:30am-9:00am EST. I've been doing it since September 2015 and I do my best to keep you up-to-date...

READ MORE

MEMBERS ONLY

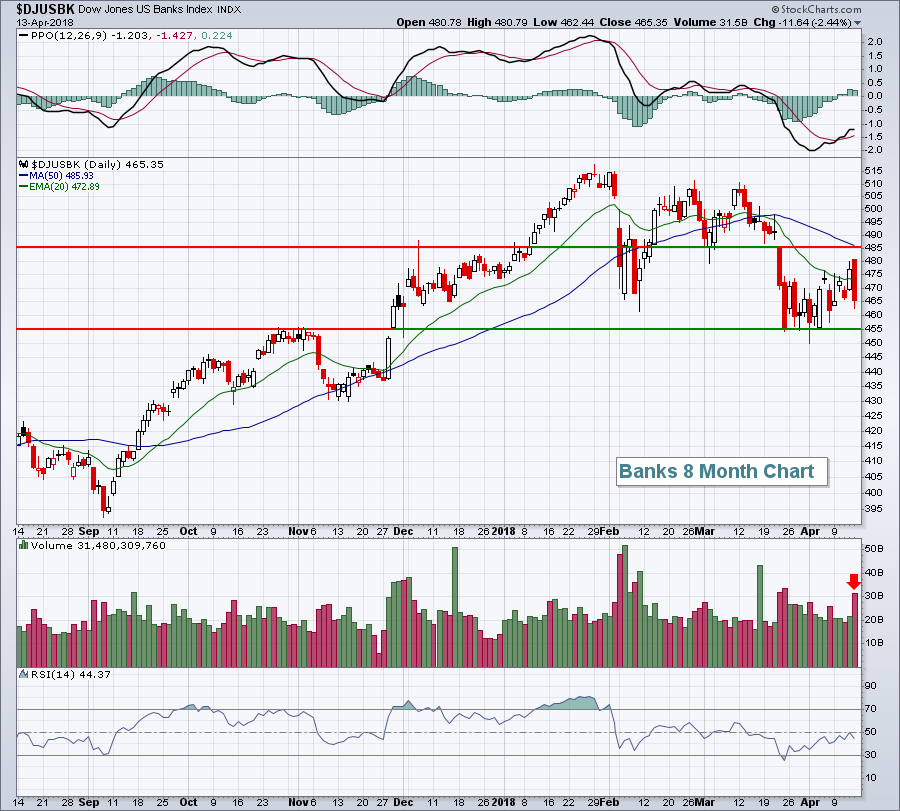

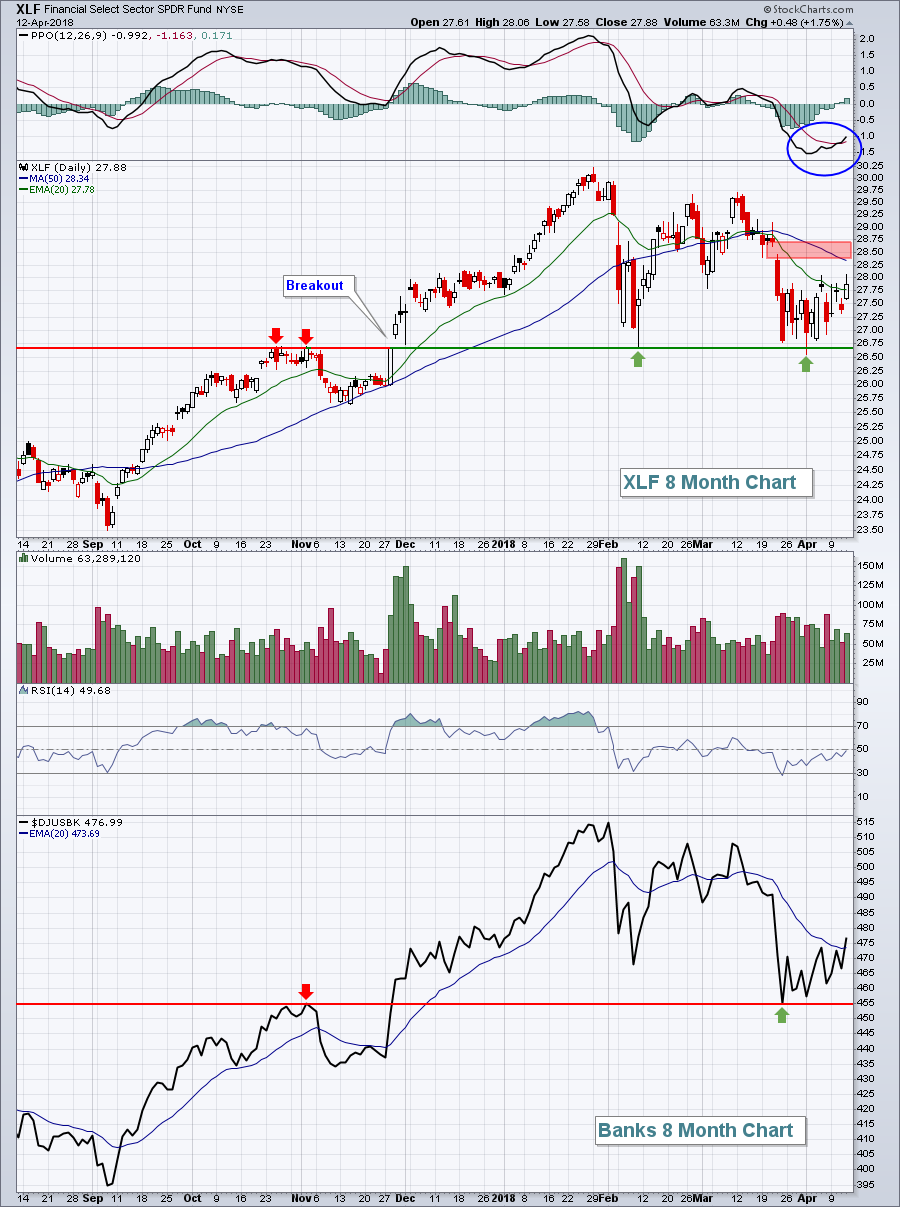

One Day Ahead Of 4 HUGE Bank Earnings Reports, Let's Delve Into The Group

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, April 11, 2018

Well, the S&P 500 tried to clear its 20 day EMA again. And it failed....again. That marks the 5th consecutive day of failed 20 day EMA breakouts. Given that futures are higher this morning, this benchmark index appears headed for...

READ MORE

MEMBERS ONLY

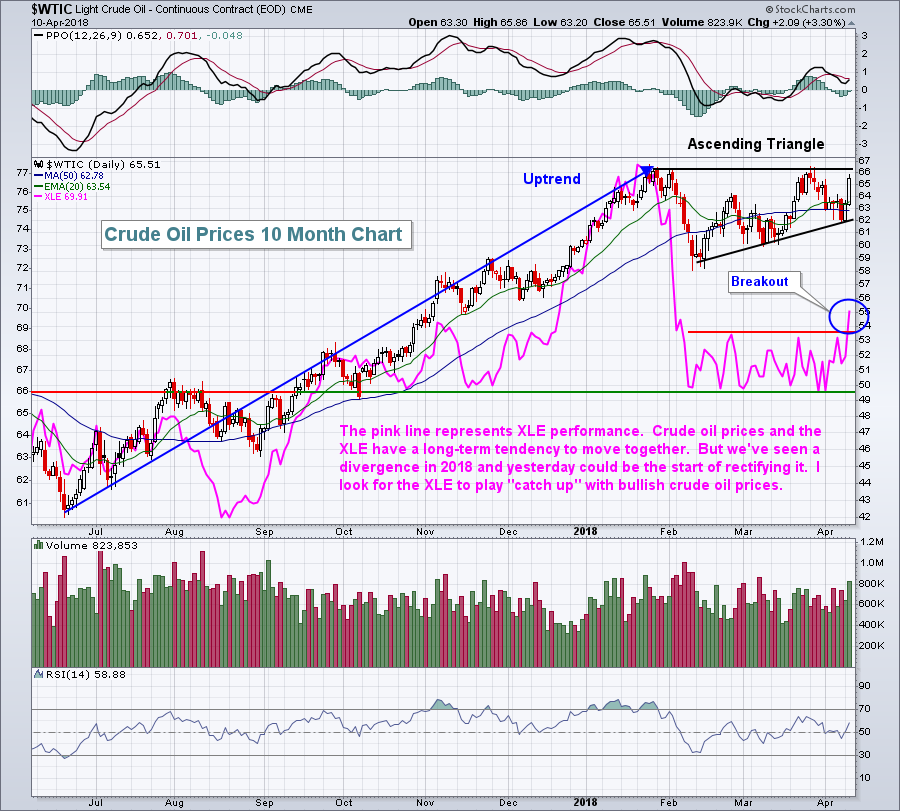

Energy Finally Breaks Out, Fuels S&P 500 Advance

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, April 10, 2018

It seems like forever, but the energy sector ETF (XLE, +3.31%) finally did it - it closed above 69.00! Can we please say goodbye to the 66-69 trading range? I didn't realize this until yesterday, but the XLE'...

READ MORE

MEMBERS ONLY

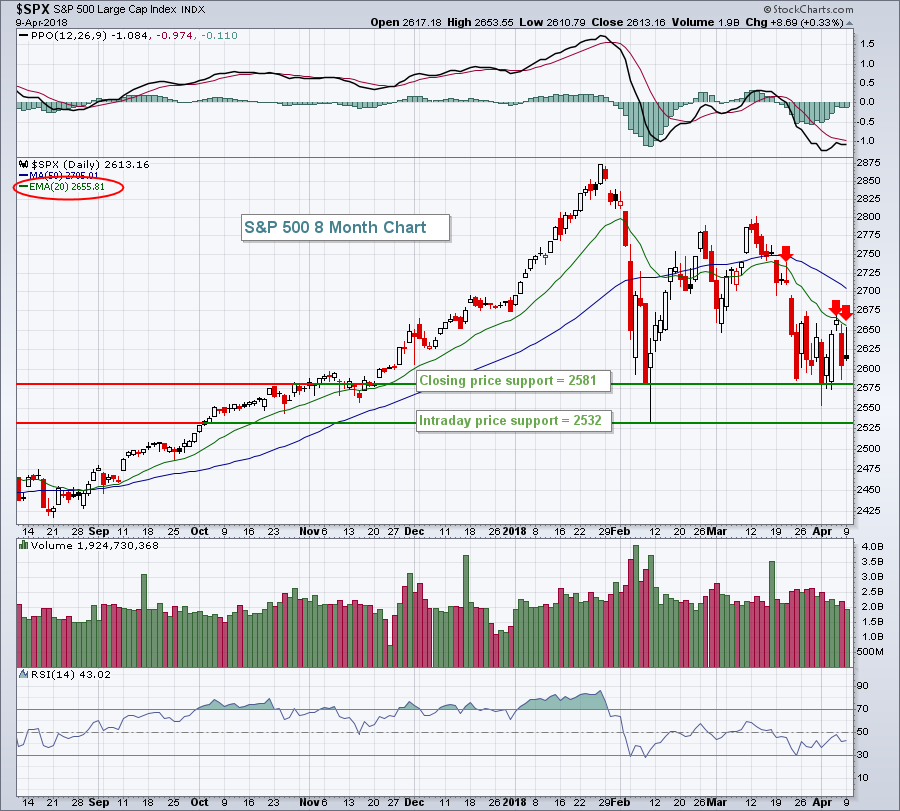

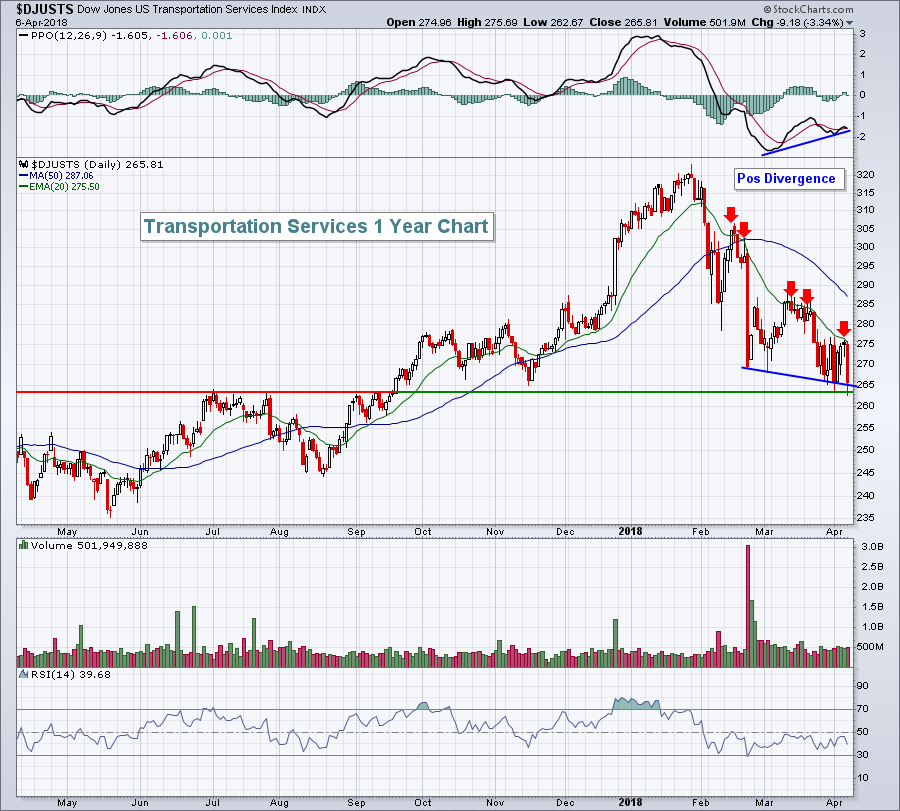

Here's A Beaten Down Industry Group Where I'd Look For A 6-7% Rebound

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, April 9, 2018

Once again, Monday was the tale of two markets. The first half of the day was quite bullish, but it was all for naught as sellers stampeded the bulls in the afternoon session. Our major indices finished with across-the-board gains so if you...

READ MORE

MEMBERS ONLY

Despite Friday's Selloff, My Most Reliable Signal Remains Bullish

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, April 6, 2018

All nine sectors fell on Friday as the Dow Jones tumbled 572 points amid more threats of China tariffs by the White House. China has promised further retaliation if the U.S. remains adamant about imposing tariffs on China imports. This rhetoric back...

READ MORE

MEMBERS ONLY

Identifying Solid Reward To Risk Trades For A Big Pre-Earnings Advance

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The start of every quarter represents a big opportunity to me and the reason is simple. Historically, the odds favor a bullish move into earnings season. Before we consider which individual stocks might be poised for a solid advance, let's take a look at history and the Volatility...

READ MORE

MEMBERS ONLY

I Cannot Own Commodities And Here's Why

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, April 5, 2018

The latest recovery attempt continued into Thursday of this week, but weak futures this morning will provide yet one more obstacle for the bulls to overcome. I'll talk more about that in the Pre-Market Action section below.

In the meantime, eight...

READ MORE

MEMBERS ONLY

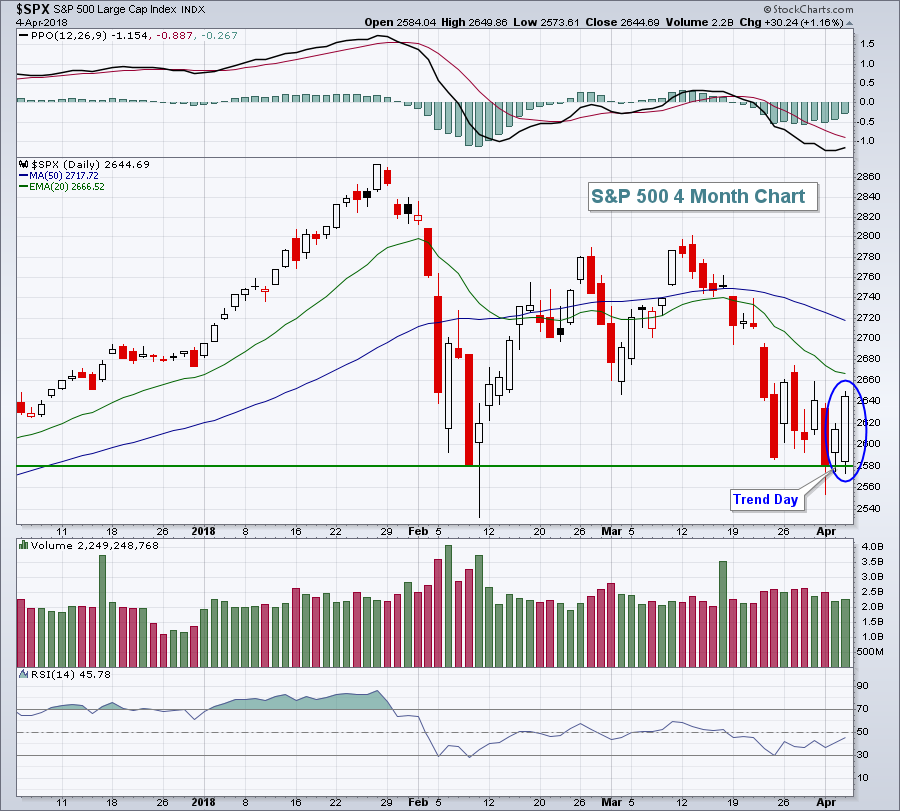

Consumer Discretionary Leads And Remains On A Very Bullish Track

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, April 4, 2018

Welcome back consumer stocks! One day certainly doesn't make a fresh new trend, but it's been awhile since consumer stocks led a rally. Consumer discretionary (XLY, +1.84%) and consumer staples (XLP, +1.56%) were atop the sector leaderboard...

READ MORE

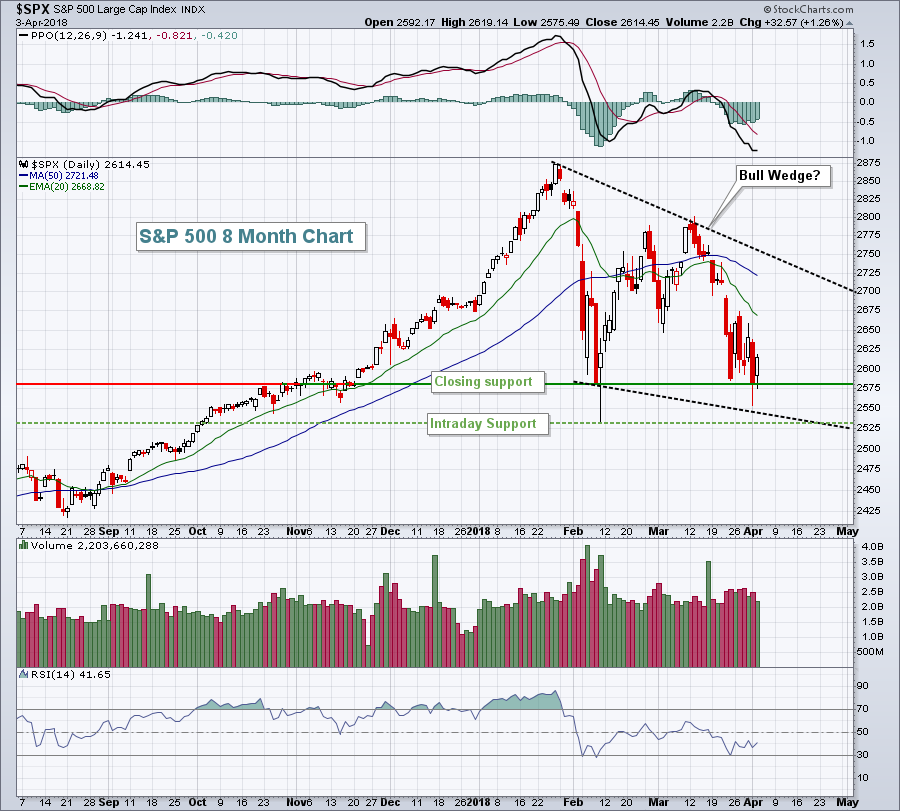

MEMBERS ONLY

A Volatility War Has Been Declared

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Special Note

I typically post a blog article every day that the U.S. stock market is open. If you'd like to receive my blog articles as soon as they're published, you can subscribe (for FREE) by scrolling to the bottom of this article, typing your...

READ MORE

MEMBERS ONLY

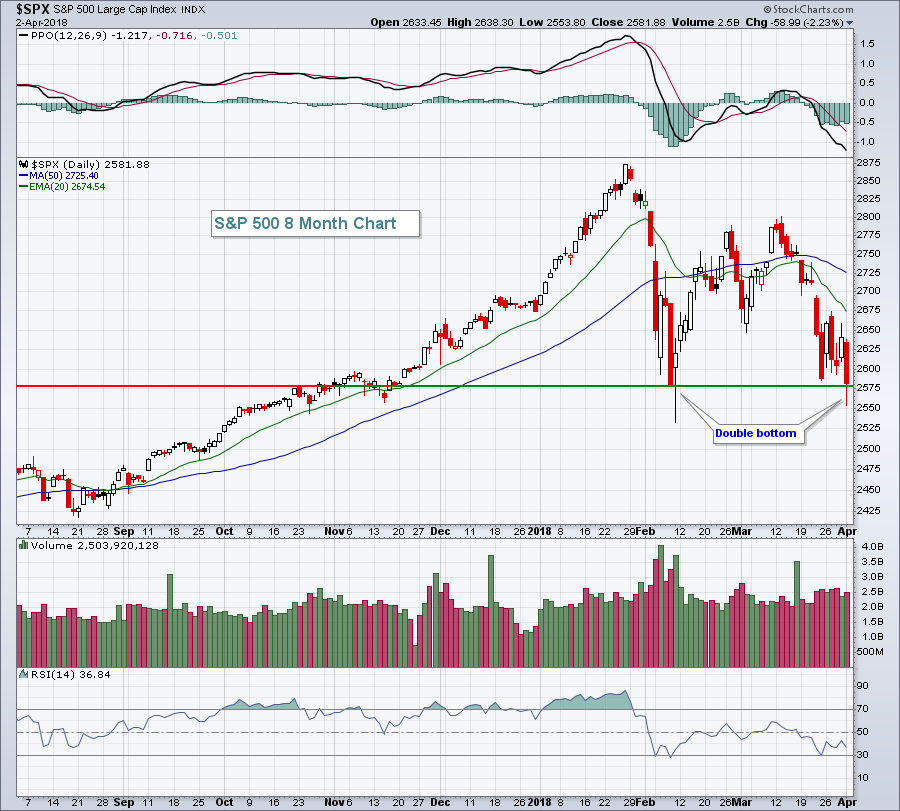

U.S. Stocks Slide As S&P 500 Prints Double Bottom

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, April 2, 2018

It was a big down day on Wall Street with eight of nine sectors down 2% or more. Only the defensive utilities (XLU, -0.77%) were able to minimize its losses, with the more aggressive consumer discretionary (XLY, -2.82%) and technology (XLK,...

READ MORE

MEMBERS ONLY

Energy Bounces Off Of Rock Solid Support......Again

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, March 29, 2018

The energy ETF (XLE, +2.11%) surged off of key price support at 66.00 and there's reason to believe that this rally could last a bit longer. Crude oil prices ($WTIC) outperformed the XLE during the month of March and...

READ MORE

MEMBERS ONLY

Wednesday's Reversal In NASDAQ 100 Volatility Gauge Could Signal End Of Selling

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, March 28, 2018

The U.S. stock market settled down on Wednesday and that could be very good news for the bulls. High volatility ($VIX) has stunned equity traders the past two months after a 15 month period of little volatility. But on Wednesday, the VIX...

READ MORE

MEMBERS ONLY

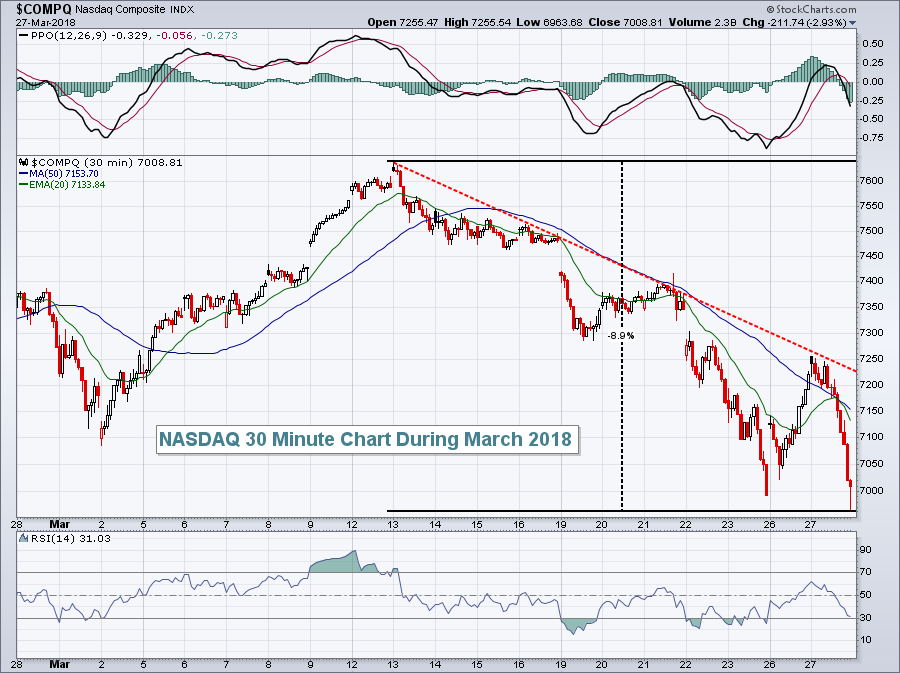

FAANG Stocks Slammed, NASDAQ Plummets

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, March 27, 2018

I've discussed since early February the difficulty in trading a market with an elevated Volatility Index ($VIX). While returns can be awesome when you make great calls, the opposite is true when your timing is less than perfect. Here's...

READ MORE

MEMBERS ONLY

Technology And Financials Bounce Back Strongly, U.S. Equities Surge

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, March 26, 2018

It was an impressive rally on Wall Street on Monday. All nine sectors advanced at least 1%. The four aggressive sectors - technology (XLK, +3.80%), financials (XLF, +3.24%), consumer discretionary (XLY, +2.95%) and industrials (XLI, +2.42%) - were the...

READ MORE

MEMBERS ONLY

Very Weak Financials Drive Dow Jones To Lowest Close in 2018

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, March 23, 2018

All of our major indices tumbled on Friday, but none are struggling quite the same as the Dow Jones, which fell another 425 points on Friday to close at its lowest level since November 2017. There are likely three reasons for this relative...

READ MORE

MEMBERS ONLY

Trade War Fears Send U.S. Stocks Reeling

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, March 22, 2018

Let me start today's article by saying that the stock market loathes uncertainty. Traders love boring small gains day after day with subtle, anticipated pullbacks to key moving averages or short-term price support levels. You can always tell when the stock...

READ MORE

MEMBERS ONLY

Fed Raises Quarter Point, Energy Soars

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, March 21, 2018

It was a volatile session on Wednesday, particularly after 2pm EST when the FOMC policy statement was released. In Fed Chairman Jerome Powell's first meeting as Fed Chief, the Fed raised the benchmark funds rate a quarter point from 1.50%...

READ MORE

MEMBERS ONLY

I'm Betting On The Gambling Stocks This Spring

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, March 20, 2018

There weren't huge gains on Tuesday, but given how poorly Monday went, I'd say yesterday was a very solid day. On Monday, we saw the Volatility Index ($VIX) spike more than 20% back above 19 as fear ramped up....

READ MORE

MEMBERS ONLY

Facebook Shares Crater Amid Controversy; Leads Another Big Selloff

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, March 19, 2018

Ok, let's start with the obvious. It was an ugly day for U.S. equities. The Dow Jones, S&P 500, NASDAQ and Russell 2000 fell 1.35%, 1.42%, 1.84% and 0.98%, respectively. The Volatility Index ($VIX)...

READ MORE

MEMBERS ONLY

Energy And Utilities Fuel Dow Jones Rise

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, March 16, 2018

There was an industry-wide rally in energy stocks (XLE, +0.89%) on Friday and utilities (XLU, +0.88%) also performed well. The latter looks much better technically, however, as it has broken above its 50 day SMA. There's still much work...

READ MORE

MEMBERS ONLY

Here Are Two Seasonal Winners In The NASDAQ 100 For April And May

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The NASDAQ Composite and NASDAQ 100 became the first two key indices to break to fresh all-time highs and their 2018 relative strength can be underscored by this chart:

The NASDAQ 100 is seeing money rotate its way in 2018 so it's prudent to focus on this index...

READ MORE

MEMBERS ONLY

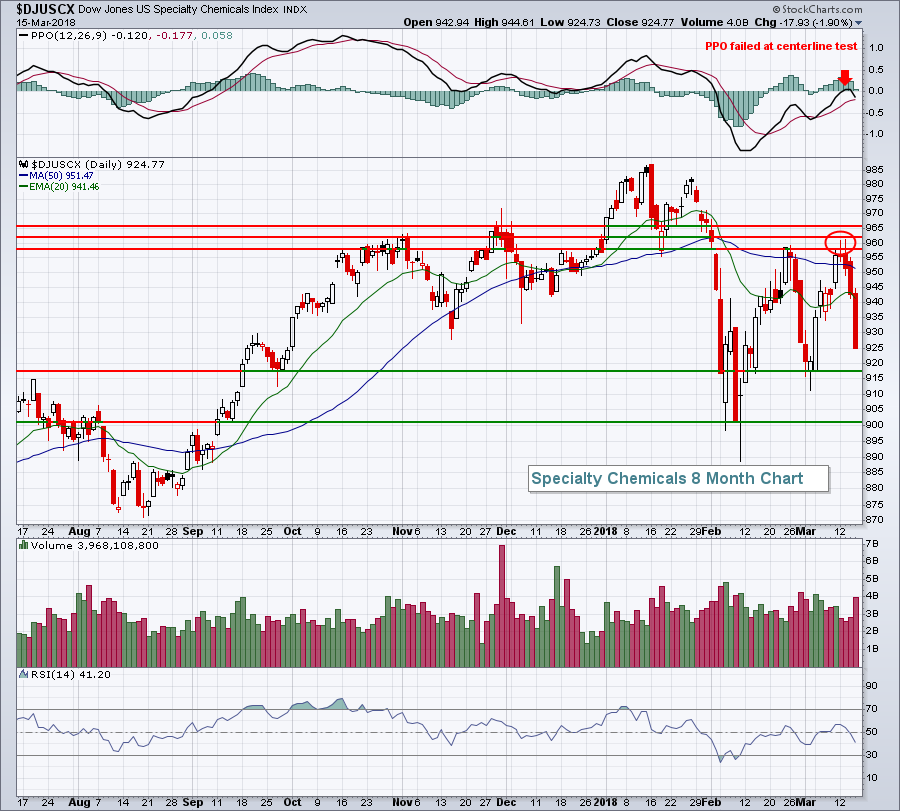

Several Technical Signs Pointing To A Surge In The US Dollar

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, March 15, 2018

It was just another day of bifurcated action on Wall Street. But this time it featured a strengthening Dow Jones. The Dow gained 0.47%, while the S&P 500, NASDAQ and Russell 2000 fell 0.08%, 0.20% and 0.49%...

READ MORE

MEMBERS ONLY

The Dollar's January Bottom Is Spooking Stocks In This Major Index

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, March 14, 2018

The U.S. stock market continued its bifurcated ways on Wednesday. While all of our major indices declined, it was not across-the-board selling. The Dow Jones (-1.00%) saw the brunt of the selling, while the NASDAQ Composite (-0.19%) outperformed by a...

READ MORE

MEMBERS ONLY

Internet, Technology Stocks Lead Southbound Train

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, March 13, 2018

It appears to be a case of "too much of a good thing". Technology stocks (XLK, -1.15%) retreated off of a 60 minute negative divergence and that reverberated throughout most parts of the NASDAQ (-1.02%), which led our major...

READ MORE

MEMBERS ONLY

Tesla, Autos Gain Traction As NASDAQ Records 2nd Straight Record

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, March 12, 2018

While we saw bifurcated action on Monday, it was still mostly bullish action. For starters, the more aggressive NASDAQ (+0.36%) and Russell 2000 (+0.25%) finished in positive territory while the safer indices - Dow Jones (-0.62%) and S&P...

READ MORE

MEMBERS ONLY

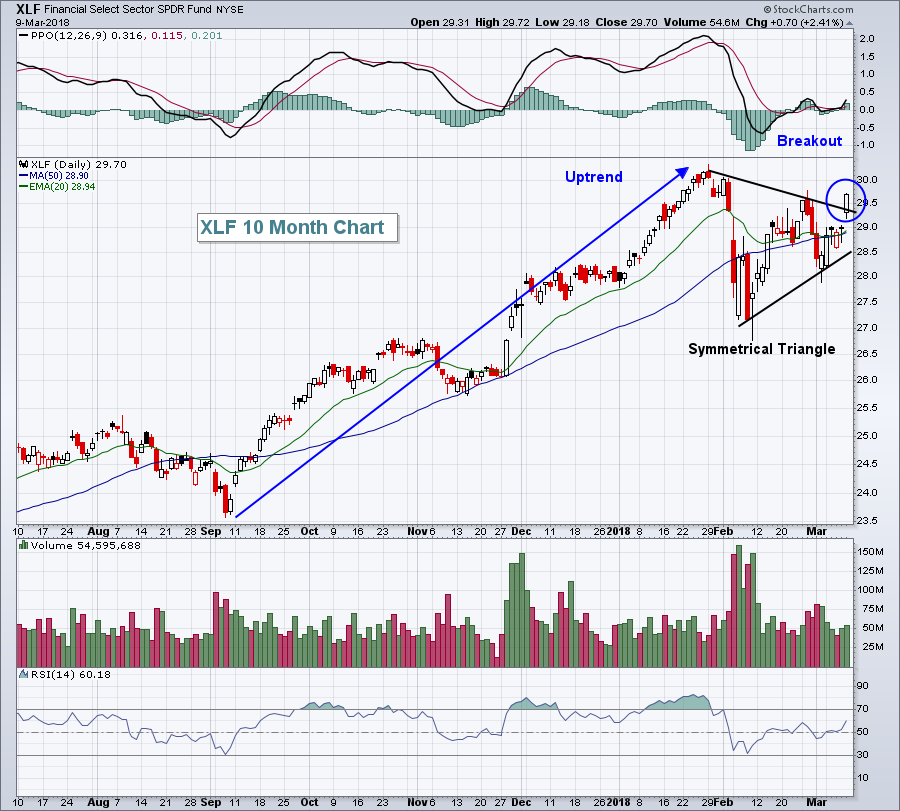

Huge Jobs Report Sends NASDAQ To All-Time Highs

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, March 9, 2018

The U.S. stock market was back to its old bull market tricks on Friday as the NASDAQ powered 133 points higher (+1.79%) to close at 7560.81 - its highest ever - and end its correction that began with the high...

READ MORE

MEMBERS ONLY

Defensive Stocks Lead Thursday's Rally; Warning Sign?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, March 8, 2018

It's never a great signal to see the stock market rally and the three defensive sectors - consumer staples (XLP, +0.91%), utilities (XLU, +0.74%) and healthcare (XLV, +0.67%) - sit atop the sector leaderboard. But we also shouldn&...

READ MORE

MEMBERS ONLY

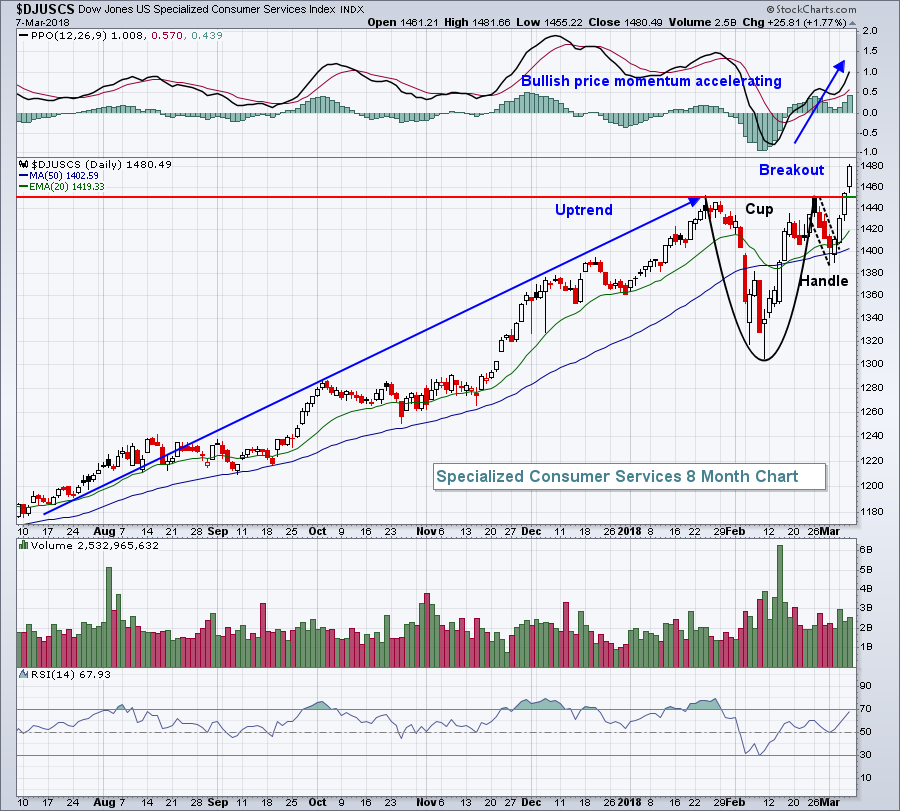

Railroads Hold One Of The Bull Market Keys

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, March 7, 2018

It was a day of bifurcation, but it was good bifurcation - if that makes any sense. When the stock market jury is split as we saw on Wednesday, I prefer that our aggressive market areas perform well and defensive areas lag. Well,...

READ MORE

MEMBERS ONLY

Retail Regaining Strength And In The Middle Of Its Seasonal Sweet Spot

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, March 6, 2018

Materials (XLB, +1.10%) and consumer discretionary (XLY, +0.69%) led a modest stock market rally here in the U.S. on Tuesday. The small cap Russell 2000 gained more than 1% to once again outperform its larger cap counterparts. The NASDAQ also...

READ MORE