MEMBERS ONLY

Healthcare Strengthening With Medical Supplies And Pharmas Following Biotechs Lead

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Special Announcement

Tomorrow's StockCharts Outlook Webinar with Greg Schnell and me will be held at 11am EST. Please join us by registering HERE.

Market Recap for Thursday, September 7, 2017

Thursday's action was just further confirmation of a strengthening healthcare group (XLV, +1.11%). The group...

READ MORE

MEMBERS ONLY

Gambling Index Prints Reversing Shooting Star Candle

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Over the past six months, the Dow Jones U.S. Gambling Index ($DJUSCA) has gained 27.35% to lead all consumer discretionary groups. In fact, renewable energy ($DWCREE) is the only industry group among all sectors to outperform gambling stocks. But the short-term outlook for gamble stocks changed on Thursday...

READ MORE

MEMBERS ONLY

Energy Rolling Higher, But Will It Last?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, September 6, 2017

Energy (XLE, +1.63%) has been the clear leader for the U.S. stock market the past week or so, but I'm not a fan just yet of the recent bounce continuing and morphing into an uptrend. Keep in mind that...

READ MORE

MEMBERS ONLY

Financial Stocks Tumble Ahead Of Hurricane Irma

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, September 5, 2017

Hurricane Irma may still be well out in the Atlantic Ocean, but its bearish winds are being felt on the shores of Wall Street already. Irma is a monster and is now regarded as the most powerful Atlantic storm ever recorded and it&...

READ MORE

MEMBERS ONLY

Semiconductors Fail At Key Resistance, Cause NASDAQ To Fail

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, September 1, 2017

The latest government nonfarm payrolls report came and went. The number was a bit disappointing, but the U.S. stock market handled it quite well and the bond market surprisingly sold off. Normally, you'd see traders move into bonds on weak...

READ MORE

MEMBERS ONLY

Trade Strength; Here Are The Best Industry Groups In The Aggressive Sectors

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

One of my trading strategies is to trade the best stocks in the best industries at the best price. Sounds easy enough, right? But what does this mean exactly? Well, first I take a top down approach and review every industry group within each aggressive sector - technology, industrials, financials...

READ MORE

MEMBERS ONLY

NASDAQ 100 Closes At All-Time High....Are We Bullish Or Bearish? That Depends On The Chart

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Special Note

Today marks my 2 year anniversary of writing daily articles here in Trading Places. It's spanned some 500 articles. I love what I do and am completely blessed to be able to write about something I'm very passionate about. I'd like to...

READ MORE

MEMBERS ONLY

Auto Parts Getting Its Engine Revving; Approaching MAJOR Breakout

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I have to admit I love breakouts of long-term basing patterns and the Dow Jones U.S. Auto Parts Index ($DJUSAP) is currently in the midst of the mother of all basing patterns. Dating back to 2014, we've seen a number of price resistance tests that all finished...

READ MORE

MEMBERS ONLY

Biotechs And Semiconductors Lead The NASDAQ Charge

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, August 30, 2017

The U.S. stock market benefited from a lot of the new and a little of the old on Wednesday as the Dow Jones U.S. Biotechnology Index ($DJUSBT) and the Dow Jones U.S. Semiconductors Index ($DJUSSC) posted solid gains to help...

READ MORE

MEMBERS ONLY

Are We Trending Or Trendless? Watch Small Caps For Clues

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, August 29, 2017

At Tuesday's open, North Korea and its missile test were the talk of Wall Street. By the close, traders ignored the rising tensions and instead focused on the recent better-than-expected quarterly earnings and the low interest rate environment. U.S. equities...

READ MORE

MEMBERS ONLY

Biotechs Surge To Lead The NASDAQ Higher

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, August 28, 2017

The U.S. market was able to rally a bit in afternoon trading on Monday and most of our major indices finished in positive territory - the Dow Jones was the lone exception as that index of 30 conglomerates fell 5 points. Sectors...

READ MORE

MEMBERS ONLY

Down Channels Are Firmly Established As We Approach September

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, August 25, 2017

Selling in the final hour on Friday contributed to bifurcated action where the NASDAQ tumbled into negative territory while the Dow Jones, S&P 500 and Russell 2000 all managed to hang onto meager gains. Our major indices remain in a downtrend...

READ MORE

MEMBERS ONLY

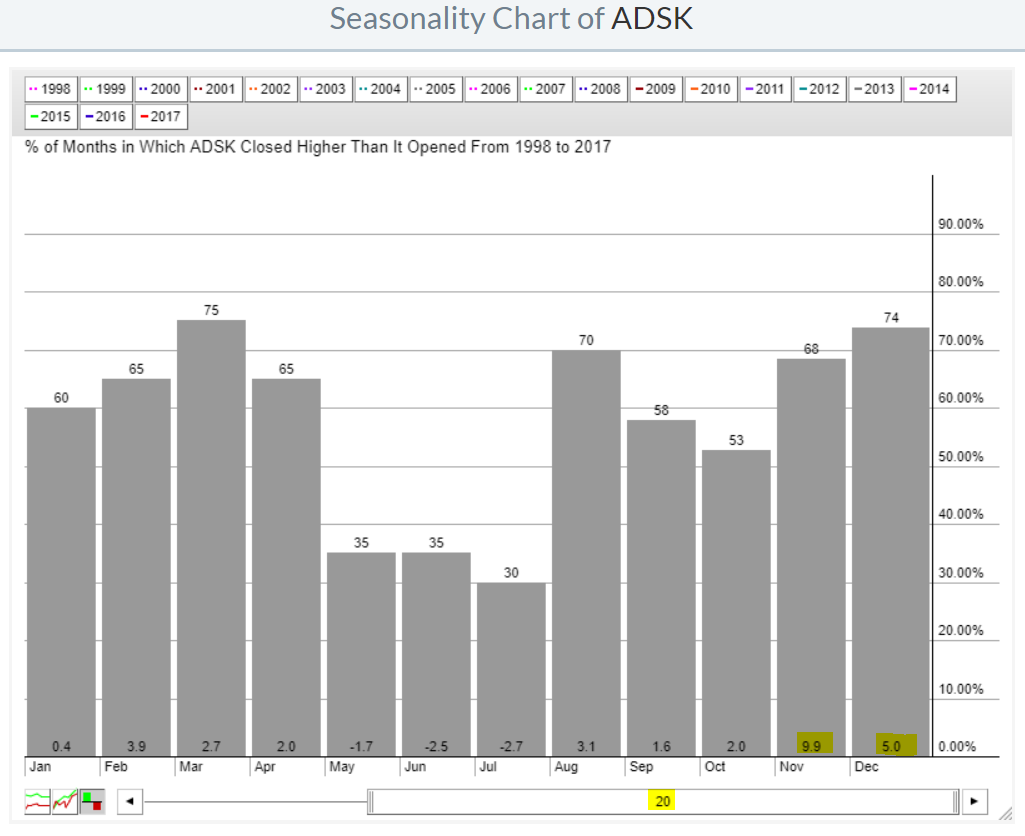

Autodesk (ADSK) Sends Buy Signal Technically, Fundamentally, And Seasonally

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

It's rare when stocks line up bullishly from a technical perspective, in addition to both fundamental and seasonal perspectives as well. But that's exactly what I see when looking at Autodesk (ADSK). Let's start with fundamentals. ADSK just reported its latest quarterly earnings and...

READ MORE

MEMBERS ONLY

Food And Broadline Retailers Crushed By Amazon.....Again

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Reminder

You can subscribe to my blog by scrolling to the bottom of the article, typing in your email address and clicking the green "Notify Me!" button. Once subscribed, my articles will be sent directly to your email as soon as Trading Places articles are published. Thanks!

Market...

READ MORE

MEMBERS ONLY

Amazon To Cut Prices At Whole Foods, Prints Hammer On Support

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

It was another round of selling for Whole Food Markets' (WFM) competitors as Amazon.com (AMZN) made headlines by announcing that prices would be cut at WFM stores. That spooked the likes of Costco (COST), Wal-Mart (WMT) and Target (TGT) as all three saw drops on very heavy volume....

READ MORE

MEMBERS ONLY

Oil Exploration & Production Stocks Rebound But Key Resistance Approaching

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, August 23, 2017

Industrials (XLI, -0.94%) and consumer discretionary (XLY, -0.85%) led a move lower in U.S. stocks on Wednesday as we approach the gathering of global central bankers in Jackson Hole over the next few days. Energy (XLE, +0.43%) managed to...

READ MORE

MEMBERS ONLY

Combine Technicals And Seasonality And You Get? A Buy Signal On ULTA

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, August 22, 2017

All nine sectors advanced on Tuesday to lead a broad-based advance on Wall Street. The NASDAQ and Russell 2000 were the top performing indices, but the S&P 500 also saw a gain of nearly 1% and the Dow Jones bounced nearly...

READ MORE

MEMBERS ONLY

Technology Still Looks Most Vulnerable While Healthcare Remains Strong

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, August 21, 2017

Healthcare (XLV, +0.45%) led the market's advance on Monday's total solar eclipse day as money rotated into more defensive areas of the market. Utilities (XLU, +0.37%) and consumer staples (XLP, +0.36%) also benefited and this move...

READ MORE

MEMBERS ONLY

Gold Tops 1300 And Reverses; Equities Close Out Rough Week

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, August 21, 2017

Late day selling killed the market's earlier attempt to rebound from Thursday's heavy losses. A market that finishes multiple days in a row weak is a market that requires a renewed buying effort. While we could see that at...

READ MORE

MEMBERS ONLY

AMC Might Entertain The Bulls This Week

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I'm mostly a short-term momentum trader that likes to follow the big picture trend. But it's hard to ignore stocks after they've been bludgeoned for a potential quick bounce, especially when you see a reversing candle on heavy volume. Enter AMC Entertainment Holdings (AMC)...

READ MORE

MEMBERS ONLY

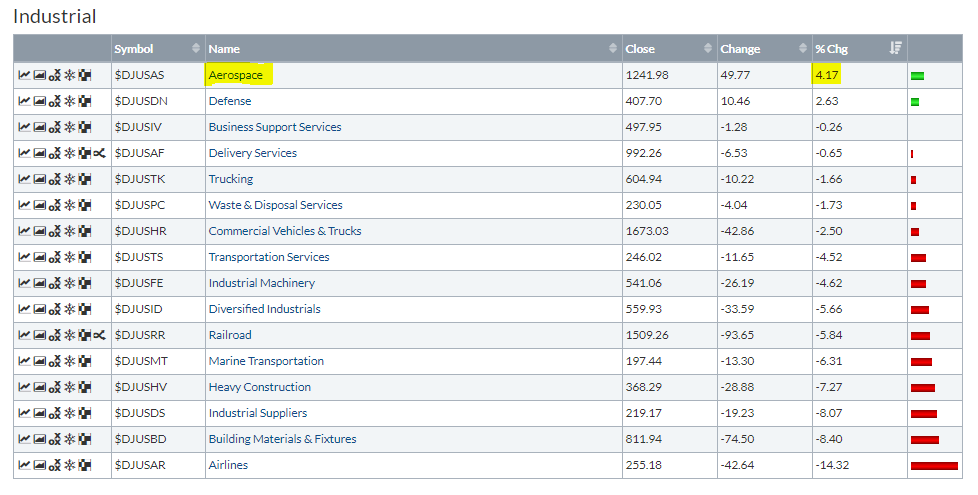

Aerospace Has Been Strong, But It's Relative Strength Momentum Is Weakening

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Bull markets are fueled by sector and industry group rotation. Throughout the bull market since 2009, we've seen each of the key aggressive sectors take their turn leading on a relative basis. Within each sector, we also see relative leadership and weakness among industry groups. For example, over...

READ MORE

MEMBERS ONLY

Fear Escalates; Gold Nears Major Breakout

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, August 17, 2017

For now it's just a short-term issue, but money is rotating to defensive areas and fear is rising. The Volatility Index ($VIX) jumped over 32% yesterday to close at its 5th highest level of 2017. The highest close of 16.04...

READ MORE

MEMBERS ONLY

Internet Stocks Weekly Losing Streak Nearing Bull Market Record

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Unless there's a reversal on Friday, the Dow Jones U.S. Internet Index ($DJUSNS) will close lower for the fourth consecutive week, equaling its longest losing streak since the DJUSNS bottomed in late 2008. There's a decent chance a new record could be set next week...

READ MORE

MEMBERS ONLY

NASDAQ 100 Again Gets Turned Back At Key Resistance

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, August 16, 2017

All of our major indices finished higher on Wednesday and seven of our nine sectors finished higher as well. The primary laggard on the session? Energy (XLE, -0.96%). Go figure. A significant reason for the XLE's renewed relative weakness has...

READ MORE

MEMBERS ONLY

Strong Retail Sales Leads To.....Awful Performance By Retailers. Huh?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, August 15, 2017

July retail sales doubled expectations (+0.6% actual vs +0.3% consensus estimate) and we saw the kind of reaction in the bond market that we'd expect with treasury prices tumbling and treasury yields spiking. But what happened to retail stocks?...

READ MORE

MEMBERS ONLY

Monday Was A Bullish Kind Of Rebound

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, August 14, 2017

When the stock market goes up, I want to see money rotate towards aggressive areas and we definitely saw that on Monday. Technology (XLK, +1.59%), financials (XLF, +1.37%) and industrials (XLI, +1.05%) were the three big winners on the session...

READ MORE

MEMBERS ONLY

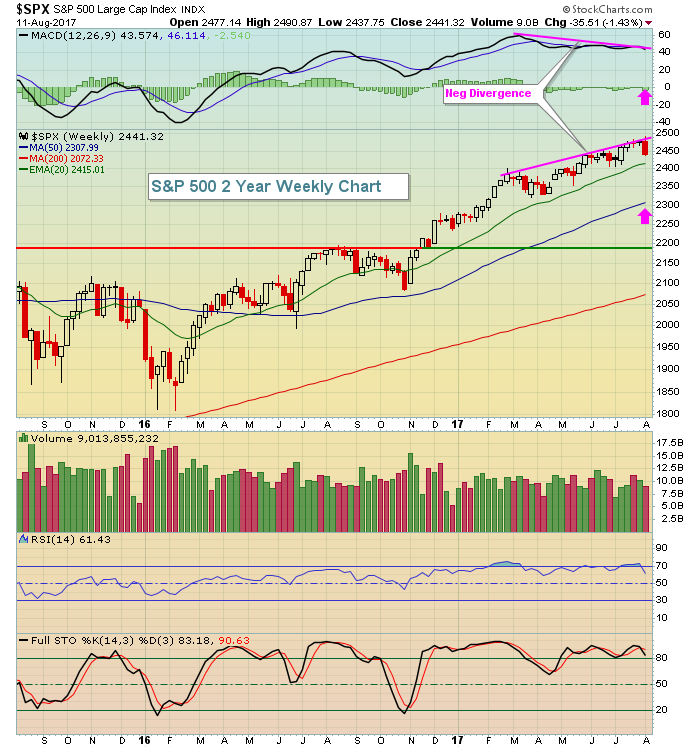

Evaluating The Technical Damage Inflicted On The S&P 500

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, August 11, 2017

Here's a fact: The benchmark S&P 500, along with all the major U.S. indices, had a rough week last week. Traders aren't used to weekly declines of more than 1%, yet that's exactly what...

READ MORE

MEMBERS ONLY

Small Caps Break Down; Where's Support?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The Russell 2000 fell for the third consecutive week and its 2.70% loss last week fell below its rising 20 week EMA for only the second time in 2017. It was a significant violation and now this index is staring at key price and moving average support in the...

READ MORE

MEMBERS ONLY

Key Support Levels Lost, Futures Weak; How Low Do We Go?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, August 10, 2017

Technology (XLK, -1.97%) and financials (XLF, -1.78) led a steep selloff in equities on Thursday. It wasn't the worst day of the year for the NASDAQ, but it was pretty close. That aggressive index lost both its 20 day...

READ MORE

MEMBERS ONLY

NetEase.com Getting Crushed After Earnings; The Bad News? The Selling Isn't Over

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

After the bell on Wednesday, NetEase.com (NTES) was hammered as its Earnings Per Share (EPS) of $3.86 fell short of Wall Street consensus estimates of $4.07. While that was bad enough from a fundamental perspective, the technical conditions had already begun to deteriorate in the form of...

READ MORE

MEMBERS ONLY

Stocks Recover After Early Drop; Futures Weak Again

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, August 9, 2017

U.S. equities were under early fire on Wednesday, but there was a steady recovery throughout the balance of the day with little technical damage done by session end. The Russell 2000 was one exception, however, as that aggressive small cap index closed...

READ MORE

MEMBERS ONLY

Brace Yourselves, The Summertime Doldrums Have Arrived

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Reminder

If you'd like to receive my blog article each trading day, just as it's published, be sure to scroll down to the bottom of this article, type in your e-mail address and click the "Notify Me" button. It's FREE and you...

READ MORE

MEMBERS ONLY

Leadership Returns To NASDAQ 100; Watch This Key Resistance

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, August 7, 2017

There's nothing wrong with the Dow Jones moving to all-time highs for the ninth consecutive trading session. However, higher prices on the more aggressive NASDAQ and Russell 2000 show traders' appetite for riskier investments and it's that risk...

READ MORE

MEMBERS ONLY

Solid Jobs And Treasury Selling Lifts U.S. Equities

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Special Note

I will be joining John Hopkins, President of EarningsBeats.com, for a special earnings-related webinar that begins at 4:15pm this afternoon, just after the market closes. I'll be providing several of my favorite stocks from the current parade of earnings so please join me and...

READ MORE

MEMBERS ONLY

Ferrari Flying But Does It Need A Pit Stop?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Fresh off yet another stellar quarterly earnings report, Ferrari's (RACE) stock price has hit the accelerator once again. Its ascent truly has been remarkable as RACE has gone from 31 to 111 in 3.2 seconds. Okay, the stock price hasn't really moved that fast, but...

READ MORE

MEMBERS ONLY

Searching For More Summertime Breakouts

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

A month ago, I posted an article looking at 3 NASDAQ 100 stocks that were looking to make technically significant breakouts. Sirius XM Holdings (SIRI) had a cup in play that, if broken, would measure to 5.90, or nearly 8%. It broke out on heavy volume and hit a...

READ MORE

MEMBERS ONLY

August Means Road Construction Ahead For Truckers; July Jobs Report On Deck

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, August 3, 2017

The Dow Jones was once again able to eke out a meager 9 point gain to establish yet another record closing high, but other indices were unable to keep up. The more aggressive Russell 2000 and NASDAQ fell by 0.54% and 0....

READ MORE

MEMBERS ONLY

Here's A High Reward To Risk Biotech Play

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

First, please understand that any time you trade a small biotech company, there are considerable risks attached. These types of stocks are certainly not for everyone. One size does not fit all. However, if you enjoy taking higher risk in an attempt to score high returns quickly, then take a...

READ MORE

MEMBERS ONLY

Consumer Relationship Still Pointing To Higher Prices

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, August 2, 2017

The action on Wednesday was quite boring once again, despite hundreds of companies reporting their quarterly results. The Dow Jones jumped another 52 points to a fresh record high - which it's been seeing daily - and it pierced 22000 for...

READ MORE

MEMBERS ONLY

It's Make Or Break Time For The Dollar And Gold

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, August 1, 2017

It was a rather boring day on Wall Street Tuesday, albeit a bullish one, as all of our major indices finished the day higher. Both the S&P 500 and NASDAQ tight-roped along key support/resistance levels as you can see below:...

READ MORE