MEMBERS ONLY

Gold Jumps As U.S. Stocks Take A Breather

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Note

I'll be out for personal reasons on Wednesday so I'll not likely be able to post a blog article Wednesday morning. Also, the Bowley Briefing webinar, scheduled for Wednesday at noon EST, has been cancelled as well. I should be back in full swing Thursday....

READ MORE

MEMBERS ONLY

Friday's Action Follows History, Ends Higher

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, November 25, 2016

It was a shortened trading session on Friday, but that didn't stop the bulls. Our major indices all gapped higher and finished there as well. There was little volatility during the day as the S&P 500 spent most of...

READ MORE

MEMBERS ONLY

Ignore Renewable Energy Stocks Until This Happens

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Renewable energy ($DWCREE) has been among the worst areas of the stock market to invest since topping over two years ago. There could be reason for hope, however, as rising crude oil prices ($WTIC) could trigger interest in the group again. There's a potential bottoming reverse head &...

READ MORE

MEMBERS ONLY

Dow Jones Tops 19000, S&P 500 Rolls Through 2200

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Due to the Thanksgiving holiday, my article will be abbreviated today. I hope everyone is able to enjoy the long weekend with family and friends. I'll be back on Monday with my regular Trading Places blog article.

Market Recap for Wednesday, November 23, 2016

It was another record...

READ MORE

MEMBERS ONLY

Give American Express Some Credit

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

After a double top and nearly two years of downtrending price, American Express (AXP) has finally turned the corner and its stock price is rising. Based on improving volume trends, strengthening momentum, and a hot financial sector, I look for the recent price strength to continue. Check out the AXP...

READ MORE

MEMBERS ONLY

Small Caps Lead Another Surge, Bull Rages On

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, November 22, 2016

You can't keep the bulls down right now, it's that simple. Yesterday, leadership turned to consumer discretionary (XLY, +1.19%) and materials (XLB, +0.61%) as small caps led a surge that took all of our major indices to...

READ MORE

MEMBERS ONLY

S&P 500 Hits All-Time High, NASDAQ Rolls, Energy Breaks Out

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

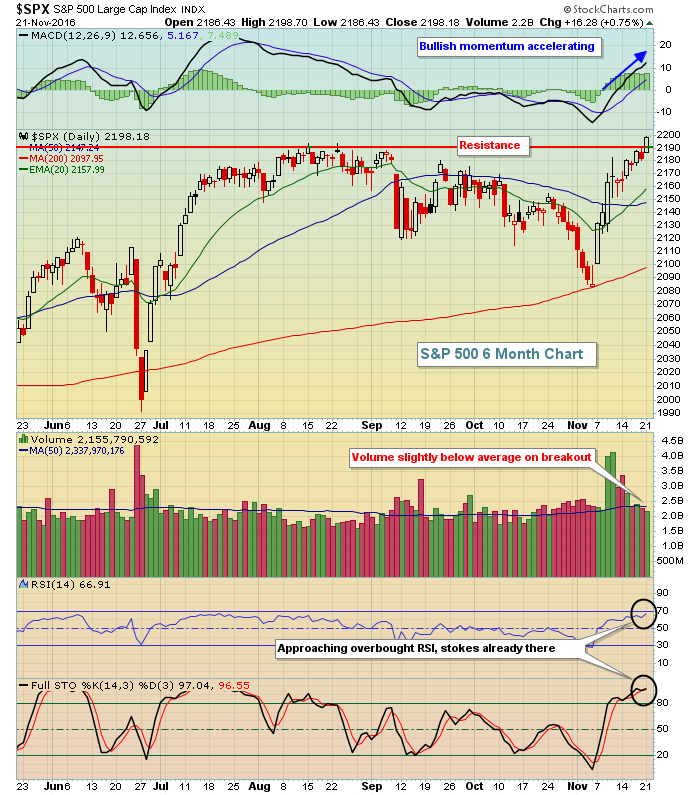

Market Recap for Monday, November 21, 2016

It took months, but the S&P 500 finally did what bulls had been hoping for - it closed at an all-time high, breaking above the previous record of 2190. If there was one negative, it was that volume finished below its...

READ MORE

MEMBERS ONLY

S&P 500 On Brink Of Milestone Breakout

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, November 18, 2016

Friday was mostly a day of profit taking - nothing horrible but down nonetheless. Energy (XLE, +0.41%) was able to avoid the downdraft and financials (XLF, +0.00%) broke even, but the other seven sectors finished down, led by healthcare (XLV, -1....

READ MORE

MEMBERS ONLY

There's Only One Thing That Slows Starbucks

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

One of the best stock market stories of this century has been the remarkable growth of Starbucks (SBUX) and over the past five years, I can only point to one thing that slows the price appreciation. Coffee prices. That seems simple enough to understand, but the chart below brings it...

READ MORE

MEMBERS ONLY

Small Caps Flying High, Now Feeling Historical Tailwinds

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The Russell 2000 is a small cap index and it had been lagging for quite awhile....until 2016. This year the Russell 2000 is wildly outperforming the S&P 500 and now we're heading into December, its most bullish calendar month of the year by far. Since...

READ MORE

MEMBERS ONLY

This Ag Stock Appears To Be Bottoming

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

It's been downhill for a long time for CF Industries (CF), but finally its downtrend was broken and volume has been pouring into the stock at these lower prices. CF's short-term strength has taken it to a 50 week SMA test for the first time since...

READ MORE

MEMBERS ONLY

Home Construction Stocks Surge, Look To Move Higher

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, November 17, 2016

U.S. stocks posted gains once again on Thursday, this time with the benchmark S&P 500 closing within a whisker of an all-time high. Strength came from all the right areas too with financials (XLF, +1.37%), consumer discretionary (XLY, +1....

READ MORE

MEMBERS ONLY

Apple Establishes Inverse Right Shoulder, Leads Tech Higher

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, November 16, 2016

Computer hardware ($DJUSCR) led a tech-fueled rally on Wednesday that resulted in bifurcated action in our major indices. The NASDAQ finished with a nice 0.36% gain while the Russell 2000 was flat and the Dow Jones and S&P 500 ended...

READ MORE

MEMBERS ONLY

Energy And Internet Stocks Fuel Latest Rally

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, November 15, 2016

In my blog article yesterday morning, I pointed out that both crude oil ($WTIC) and internet stocks ($DJUSNS) hit significant price support. In the case of the WTIC, there was a big reversal in place that suggested we'd see continuing strength...

READ MORE

MEMBERS ONLY

Dollar's Rise Crushing Gold And Silver

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, November 14, 2016

The dollar shot higher on Monday as treasury yields continue to soar. This combination has set the stage for a major rally in financial stocks (XLF) and they have not disappointed. Also, all the selling that's taken place in bonds have...

READ MORE

MEMBERS ONLY

Small Caps Explode Higher To Lead Friday Rally

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, November 11, 2016

Friday may not have seemed like a particularly bullish day as the Dow Jones gained just 39 points and the S&P 500 even lost a few points. But check out the Russell 2000's 2.46% gain! Historically, the Russell...

READ MORE

MEMBERS ONLY

Don't Take This Stock For Granite

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

President-elect Trump has suggested that his presidency will focus on infrastructure and, as a result, heavy construction ($DJUSHV) finished last week higher by 12.36% to lead all industrial groups. While there are plenty of quality companies to choose from, Granite Construction (GVA) surged 23.80% to follow many small...

READ MORE

MEMBERS ONLY

Traders Log Another Gain, Should We Trust This Rally?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, November 11, 2016

First let me say a heartfelt thank you to all our veterans today for your service - past, present and future. Please thank those that protected or protect our freedoms every day.

Financials (XLF, +3.69%) and industrials (XLI, +2.13%) once again...

READ MORE

MEMBERS ONLY

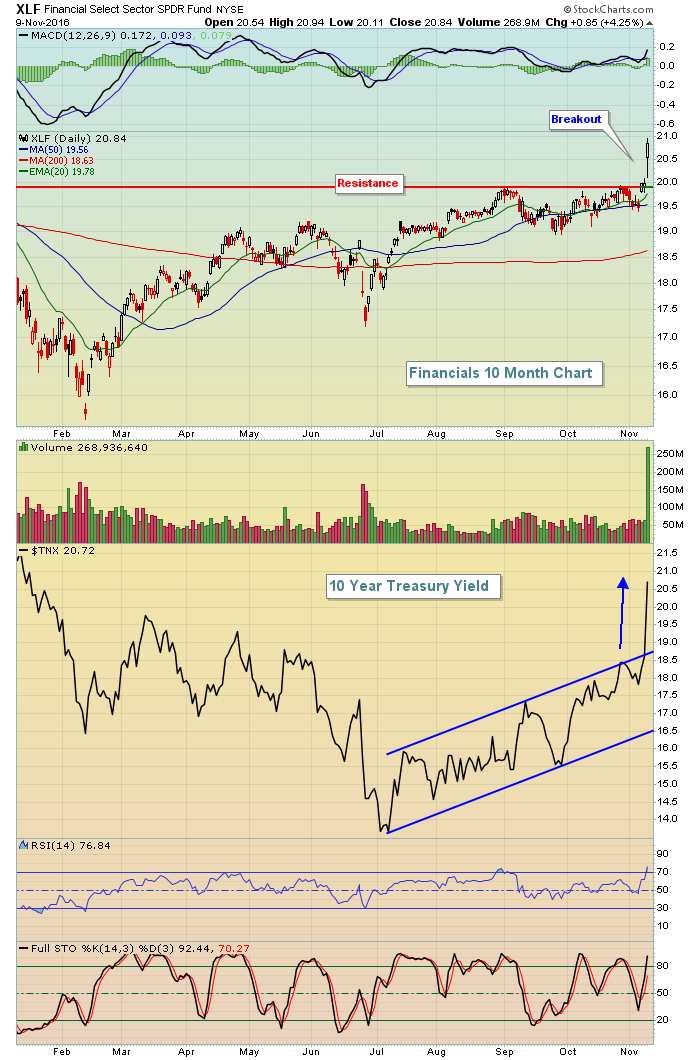

Surging Treasury Yields Paving The Way For Financials

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Over the past two trading sessions, treasuries are being sold hand over fist with corresponding yields soaring. Financials have exploded higher on this development. This is simply a continuation of what we've seen since the Brexit-related lows in June. Those higher yields will add profits to the bottom...

READ MORE

MEMBERS ONLY

Global Markets Cheering U.S. Election Results

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

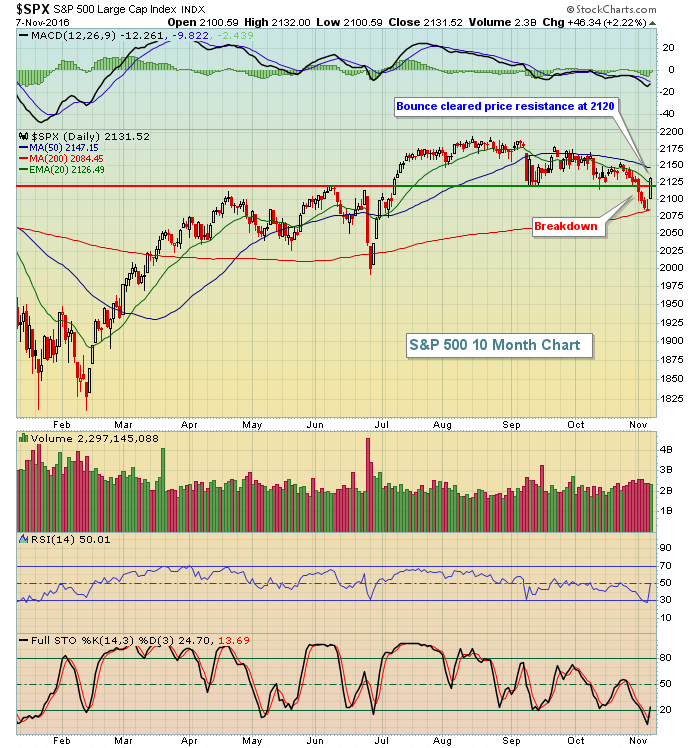

Market Recap for Wednesday, November 9, 2016

Talk about your fickle traders. A little more than 24 hours ago with traders around the globe wrestling with an unexpected Presidential victory by Donald Trump, equities sold off hard. The Dow Jones futures were down 800 points at its low. Japan'...

READ MORE

MEMBERS ONLY

Trump Wins Presidency, Global Stocks Sell Off

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

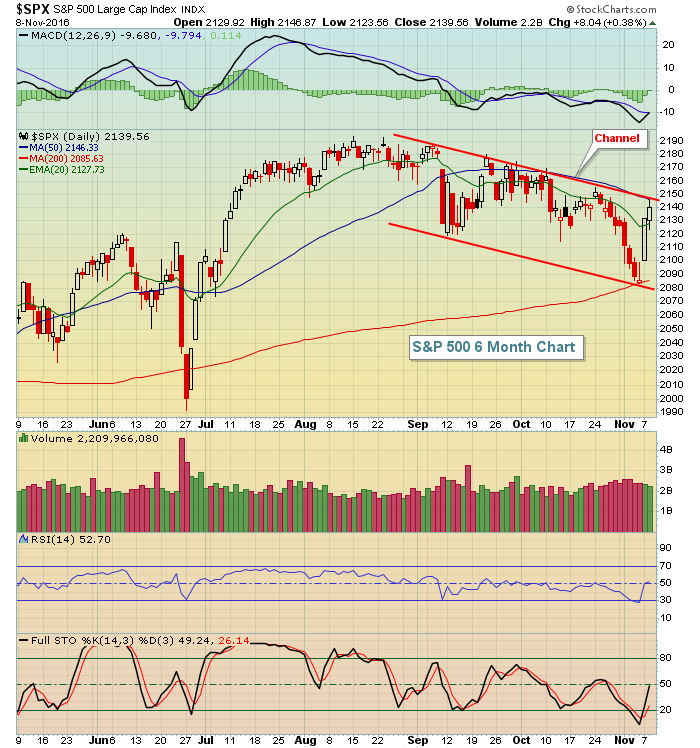

Market Recap for Tuesday, November 8, 2016

The U.S. stock market paused on Tuesday, awaiting results from the U.S. Presidential election. All nine sectors did manage to finish in positive territory but gains were fairly minimal. The NASDAQ outperformed, rising 0.53% but on just 1.7 billion...

READ MORE

MEMBERS ONLY

Biotechs Explode Higher But Squeezing In Narrowing Range

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, November 7, 2016

After nine consecutive losing sessions on the benchmark S&P 500, the bulls needed some relief and they woke up to it on Monday. U.S. futures were soaring and looking to erase several days of losses at the opening bell. While...

READ MORE

MEMBERS ONLY

S&P 500 Losing Streak Hits Nine; Futures Soaring

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, November 4, 2016

Friday was a rough day for market bulls, especially when you consider how our major indices finished out the week. The S&P 500 was solidly higher at 2pm EST on Friday.....but the last two hours wiped out all gains and...

READ MORE

MEMBERS ONLY

Are Shareholders Withdrawing From PayPal?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The past two weeks have not been kind to PayPal (PYPL) as the online payment enabler has dropped roughly 10% since reporting stellar quarterly results and witnessing a breakout to its post-IPO all-time high. PYPL beat estimates on both revenue (slightly) and EPS (.29 vs .27) and the company was...

READ MORE

MEMBERS ONLY

Now The Bear Market Concerns Begin

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The "under the surface" signals have been quite bearish for the past 1-2 years. Money has rotated away from aggressive areas and I've discussed it here and my Trading Places blog quite often. But it was very difficult to think bearish thoughts as long as the...

READ MORE

MEMBERS ONLY

FireEye Printing Bullish Candle On Weekly Chart At Support

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

FireEye (FEYE) hasn't had much to brag about since June 2015, but for those traders with high risk tolerance levels, FEYE could provide very nice returns from its current price level. The cyber security company reported better than expected revenues and EPS after the close on Thursday and...

READ MORE

MEMBERS ONLY

S&P 500 Drops For 8th Straight Session, Jobs Fall Short

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

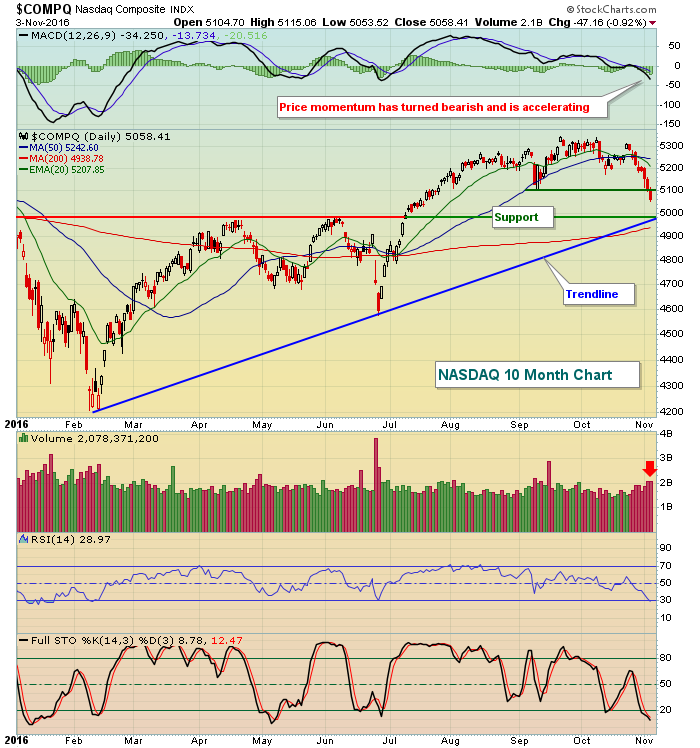

Market Recap for Thursday, November 3, 2016

Outside of option expiration days, the NASDAQ's volume the past two days is the highest consecutive day volume level since the post-Brexit results in late June. And there are two further signs that suggest to me the selling hasn't...

READ MORE

MEMBERS ONLY

Fed Leaves Rates Unchanged, S&P 500 Remains Below Support

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, November 2, 2016

Traders waited nervously for the FOMC announcement at 2pm EST yesterday and given the recent S&P 500 breakdown beneath 2120 and the elevated volatility index ($VIX), they had reason to do so. I felt the market environment was such that we...

READ MORE

MEMBERS ONLY

S&P 500 Loses Key Support, What You Need To Know

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

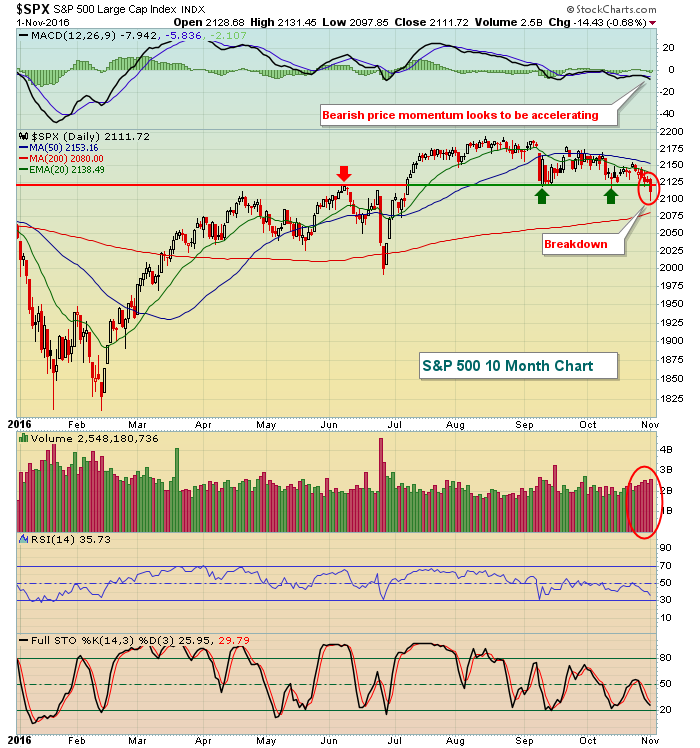

Market Recap for Monday, November 1, 2016

A couple reminders before we get into the action. First, today's webinar will be very interesting given the breakdown on the S&P 500 and Russell 2000 yesterday. It's 30 minutes of charts, key technical levels and market...

READ MORE

MEMBERS ONLY

Utilities Keep S&P 500 Afloat But How Much Longer?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, October 31, 2016

The S&P 500 only finished down 0.26 points on the day Monday, but it felt a lot worse, mostly because that benchmark index finished very close to its low of the day and only 6 points from MAJOR short- to...

READ MORE

MEMBERS ONLY

Market Deciding If Earnings Are Trick Or Treat

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, October 28, 2016

Happy Halloween! Earnings season is well underway and it's clear that certain areas of the market are gaining momentum as a result. Those that benefit from higher interest rates are doing particularly well - both fundamentally and technically. Look no further...

READ MORE

MEMBERS ONLY

Charter Hits Price Support, Bounces

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

There are basic technical analysis 101 principles and perhaps none more significant than the premise of price support and price resistance. During an uptrend, think of support and resistance as you would traveling higher in an elevator in an office building. The ceiling (resistance) on the first level becomes the...

READ MORE

MEMBERS ONLY

Key Support Holds As U.S. Stocks Enter Best Time Of Year

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, October 27, 2016

All of our major indices were fractionally lower to end the historically bearish October 22nd-27th period. Treasury yields were on the rise as the 10 year treasury yield ($TNX) broke above 1.80% to continue its recent uptrend. Selling in treasuries sent the...

READ MORE

MEMBERS ONLY

Russell 2000 On Verge Of Breakdown But.....

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Small cap stocks tumbled today, losing 1.23% and far exceeding losses incurred on the other major indices. Since Monday's close, the Russell 2000 has dropped approximately 3% while the benchmark S&P 500 has retreated less than 1%. One hallmark of a bull market is the...

READ MORE

MEMBERS ONLY

Bifurcated Market Shows Traders Lack Of Commitment

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, October 26, 2016

The Dow Jones finished in positive territory yesterday while the S&P 500, NASDAQ and Russell 2000 all declined. It was a particularly rough day for the Russell 2000, which fell 0.93%. The bifurcation was also seen throughout our sectors as...

READ MORE

MEMBERS ONLY

Discretionary Stocks Lead S&P 500 Lower; Home Depot Breaks Down

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, October 25, 2016

If you own consumer discretionary (XLY, -1.17%) stocks, you probably weren't too happy with your performance on Tuesday. 22 of 23 industry groups within the discretionary sector fell with only travel & tourism ($DJUSTT) escaping the bears' wrath. Media...

READ MORE

MEMBERS ONLY

Earnings Season Picking Up Steam, Apple On Deck

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, October 24, 2016

Technology (XLK, +0.97%) led the U.S. stock market advance on Monday as mobile telecommunications ($DJUSWC) and software ($DJUSSW) were the primary reasons for the bulls' assault to open what normally is a very bearish week historically. Technically, however, price action...

READ MORE

MEMBERS ONLY

U.S. Futures Strong Despite Most Historically Bearish Week Ahead

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, October 21, 2016

Consumer stocks were back in charge on Friday as discretionary (XLY, +0.80%) and staples (XLP, +0.54%) were the best and second best performing sectors. Restaurants & bars ($DJUSRU) were among discretionary leaders and just in time too. The DJUSRU had fallen...

READ MORE

MEMBERS ONLY

Will The Bull Market Resume? Watch This Chart

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

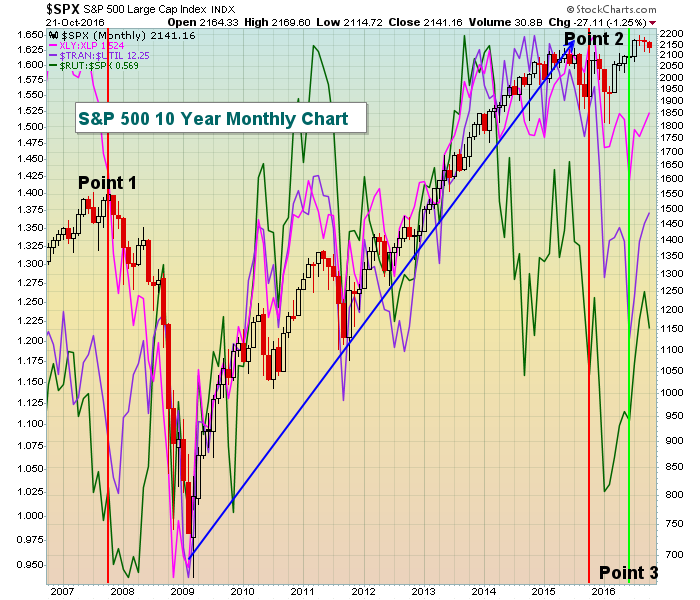

There are fundamental, technical and historical factors that drive U.S. equity prices. Earnings and interest rates have very clear fundamental impacts. The Fed has done everything in their power to keep interest rates at historically low levels in an attempt to promote growth. We could debate back and forth...

READ MORE

MEMBERS ONLY

Technology And Industrials Drive S&P 500 Lower But Remain Technically Sound

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

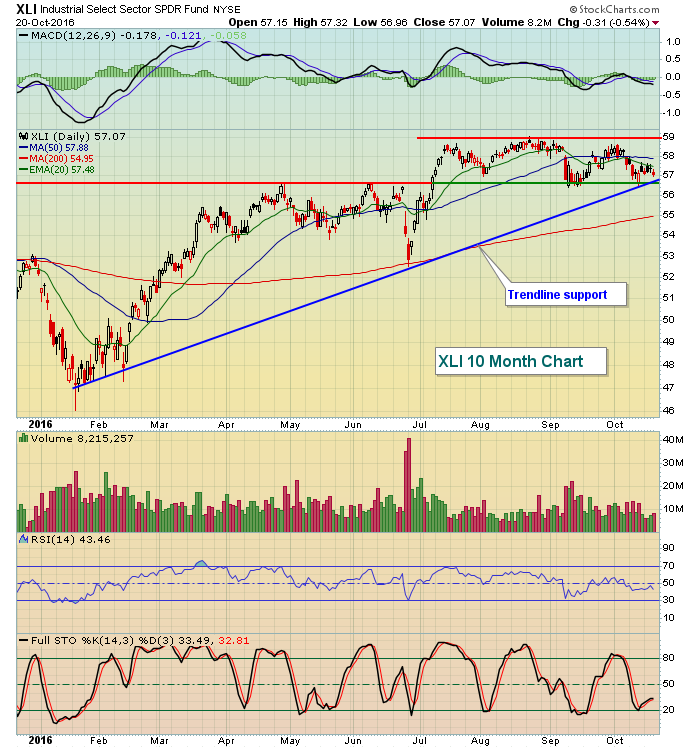

Market Recap for Thursday, October 20, 2016

Industrials (XLI, -0.54%) and technology (XLK, -0.46%) were the two weakest sectors on Thursday and this bull-bear battle continues for yet another day with apparently no end in sight. The only sector to finish in positive territory was healthcare (XLV, +0....

READ MORE