MEMBERS ONLY

Consumer Staples Next To Bounce Off Support? A Look At Coca Cola

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, September 7, 2016

Consumer staples (XLP, -0.87%) had a rough Wednesday while most other sectors finished just above or below the breakeven level for the day. Of the 10 industry groups that make up consumer staples, only drug retailers ($DJUSRD) finished higher - fractionally so....

READ MORE

MEMBERS ONLY

Energy Rebounds Strongly, Led By Red Hot Pipelines

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, September 6, 2016

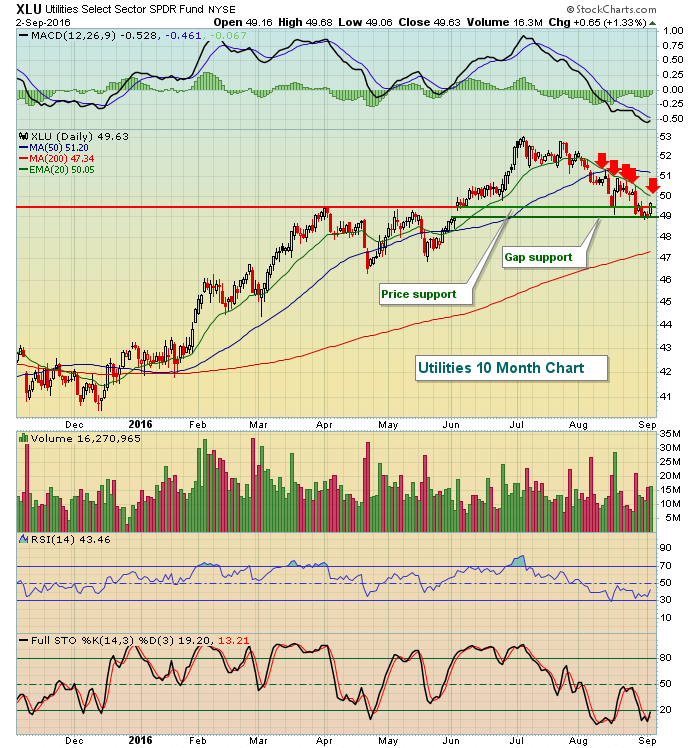

Energy (XLE, +1.51%) was the clear leader on Tuesday, resuming their leadership role in 2016. Utilities (XLU, +1.09%) also continued its recent climb off price support near 49.00, actually closing above its declining 20 day EMA for the first time...

READ MORE

MEMBERS ONLY

Treasury Market Brushes Off Disappointing Jobs, Utilities Lead

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Special Webinar Scheduling Note

Because of the holiday-shortened trading week, please be sure to check out the webinar calendar on the home page. Monday's Bowley Briefing and Trading Places LIVE were cancelled due to the Labor Day holiday here in the U.S., but webinars are a "...

READ MORE

MEMBERS ONLY

This Homebuilder Is Testing Major Gap Support

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

One of my favorite trades is looking for a bounce off of gap support. Many times, the top of gap support will provide great support and the stock will never "fill" the entire gap back to the prior close. PulteGroup (PHM) lost the top of its gap support...

READ MORE

MEMBERS ONLY

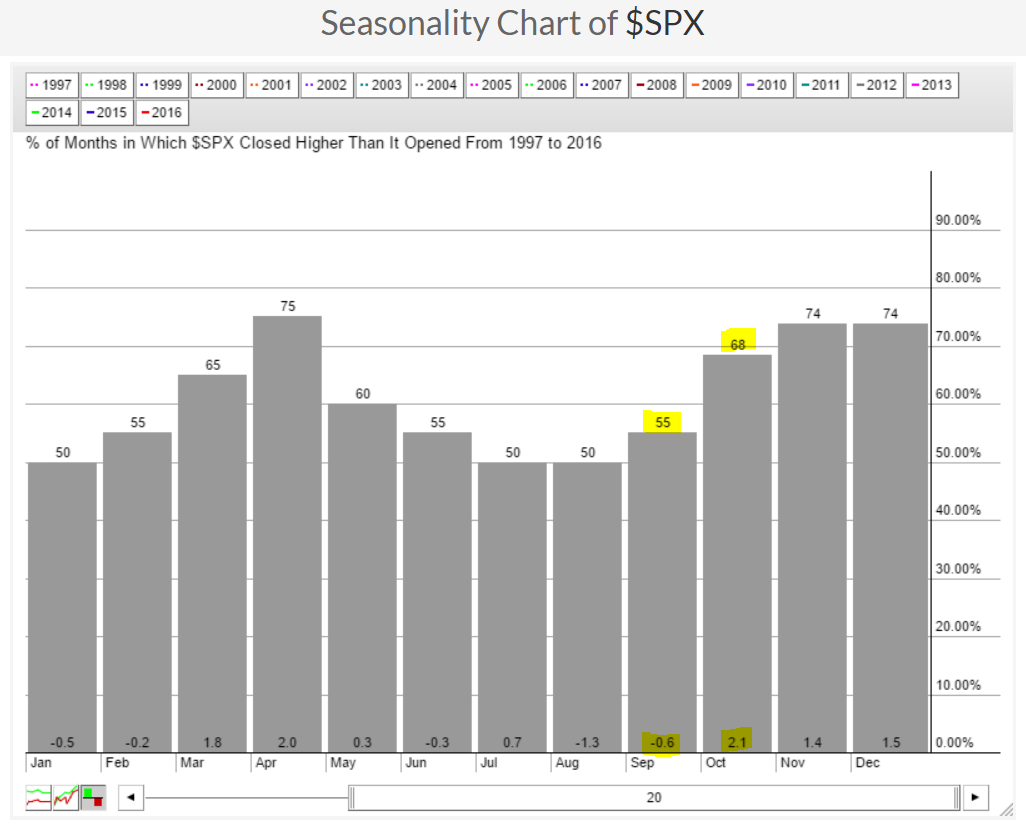

What Can We Expect From September (Besides ChartCon)

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

First, I'd like to invite everyone to join us via the internet for ChartCon 2016. It's only three weeks away and everyone here is growing very excited for this one-of-a-kind event. There will be tons of technically-oriented presentations from leading technical experts. You don't...

READ MORE

MEMBERS ONLY

Support Holds With All Eyes On Disappointing Jobs This Morning

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, September 1, 2016

Key support levels were tested - and held once again - at 2160 and 5190 on the S&P 500 and the NASDAQ, respectively. We're not going any higher, but we're not breaking down either. The S&...

READ MORE

MEMBERS ONLY

Haliburton Weakness Setting Up Strong Reward To Risk Trade

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Haliburton (HAL) had risen close to 70% from its February low to its early June high, but since that time has simply consolidated those gains. Over the past two weeks, HAL has declined close to 10% and is nearing a very important short-term price support level. The closer it gets...

READ MORE

MEMBERS ONLY

Energy And Materials Suffering From Rising Dollar

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, August 31, 2016

Higher treasury yields in August are impacting more than just a few interest-sensitive equity groups. It's also been driving the U.S. dollar higher. A higher dollar can also affect equities in various ways. Yesterday was a prime example as energy...

READ MORE

MEMBERS ONLY

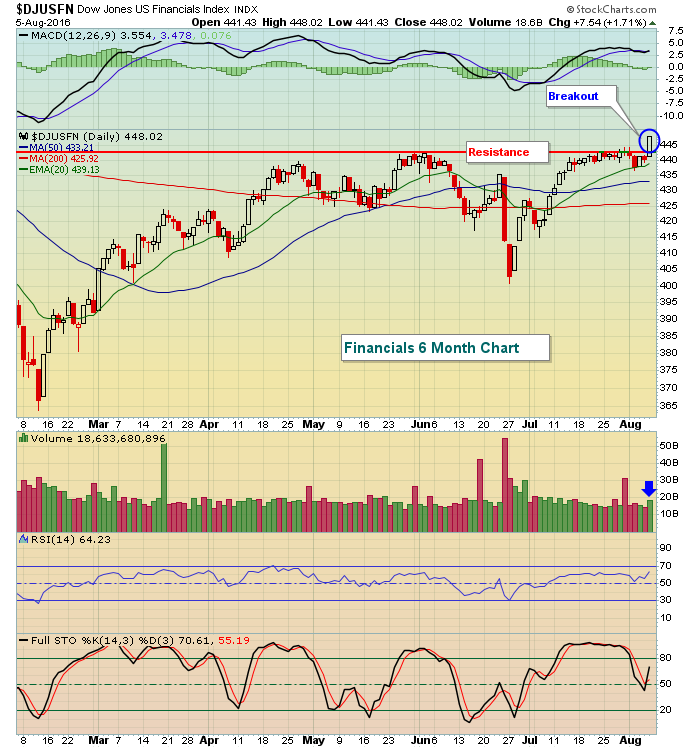

Prospects Of Higher Rates Aiding Financials

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

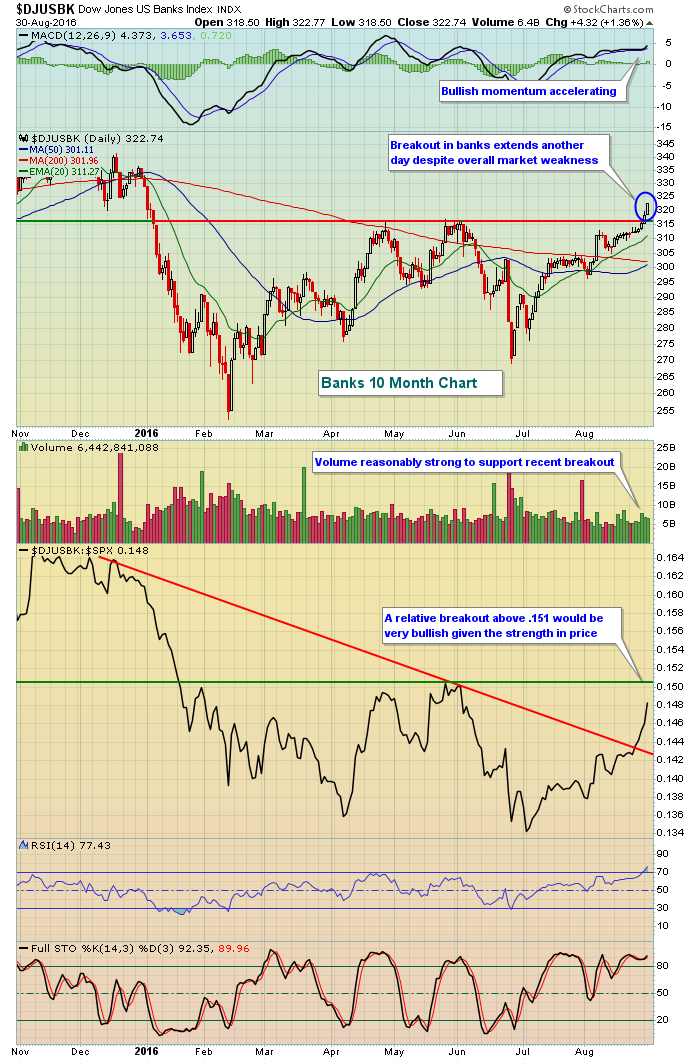

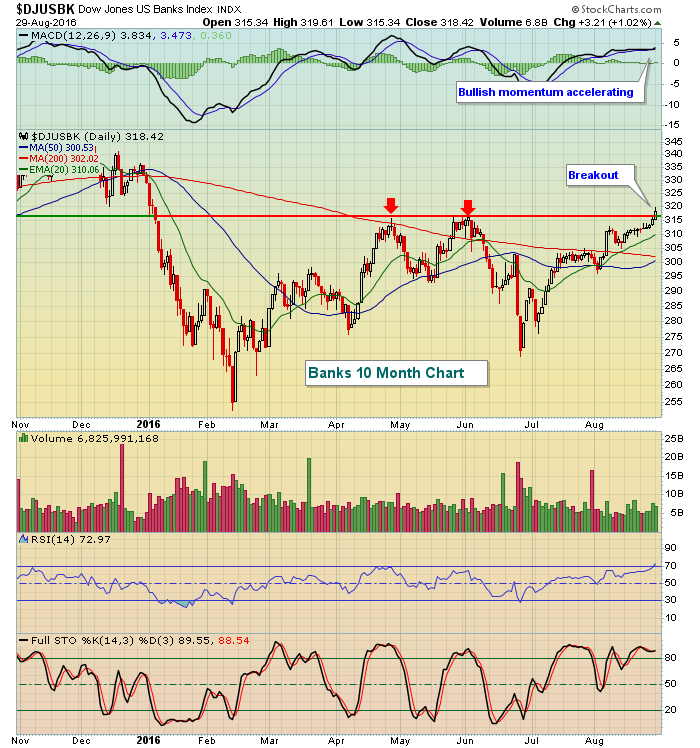

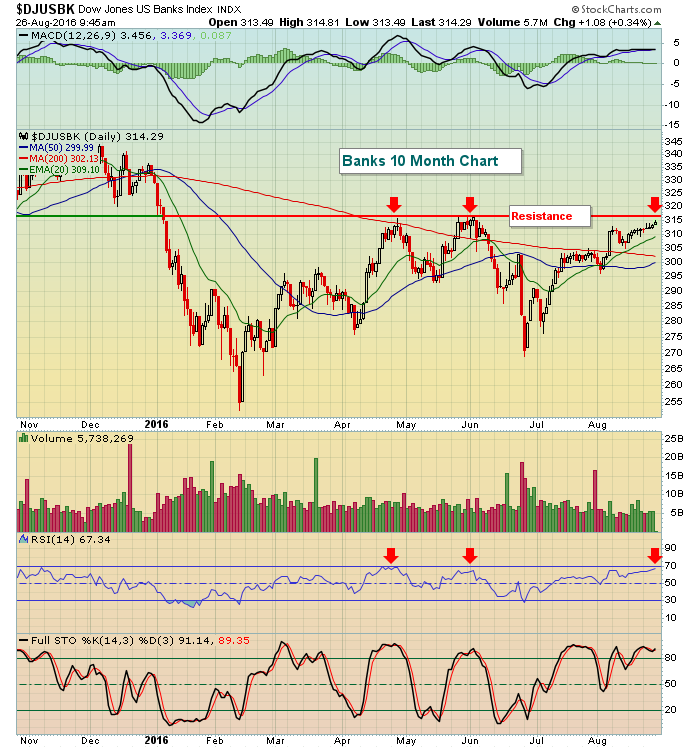

Market Recap for Tuesday, August 30, 2016

Eight of nine sectors fell on Tuesday, with financials (XLF, +0.90%) the lone gaining sector. This behavior seems to be setting the stage for a Fed rate hike, probably sooner rather than later. Banks ($DJUSBK) continue to lead the recent action and...

READ MORE

MEMBERS ONLY

Defense Stocks Ready To Fire Back?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for August 29, 2016

It was a strong, wide participation kind of day for U.S. equities on Monday as August 2016 nears a close. Stocks continue to battle through various sorts of difficulty, including negative divergences, slowing volume, seasonal headwinds, questionable relative ratios (offense vs. defense ratios)...

READ MORE

MEMBERS ONLY

10 Year Treasury Yield Surges To 2 Month High

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Special NOTE

Please check out the Historical Tendencies section below for important seasonal information as we approach the bearish month of September. There are a couple of important links - one to join me for my webinar today at 1pm and also one to join us at StockCharts.com for...

READ MORE

MEMBERS ONLY

Nautilus Does Some Heavy Lifting On Friday

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Nautilus (NLS) officially became a technical heavyweight on Friday as its stock price soared through price resistance to a fresh new 52 week high, bouncing bullishly off its rising 20 day EMA in the process. Volume supported its first very bullish gap in early August and it once again confirmed...

READ MORE

MEMBERS ONLY

S&P 500 Hadn't Done This In Two Months

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, August 25, 2016

For the first time since late June, the S&P 500 closed beneath its 20 day EMA. We've seen plenty of closes near its 20 day EMA, but yesterday marked the first one beneath. Normally that's a pretty...

READ MORE

MEMBERS ONLY

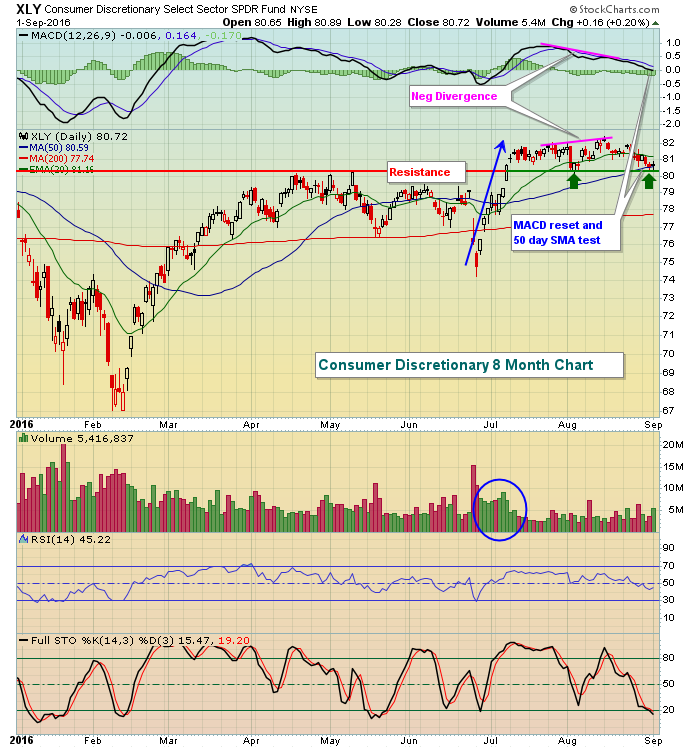

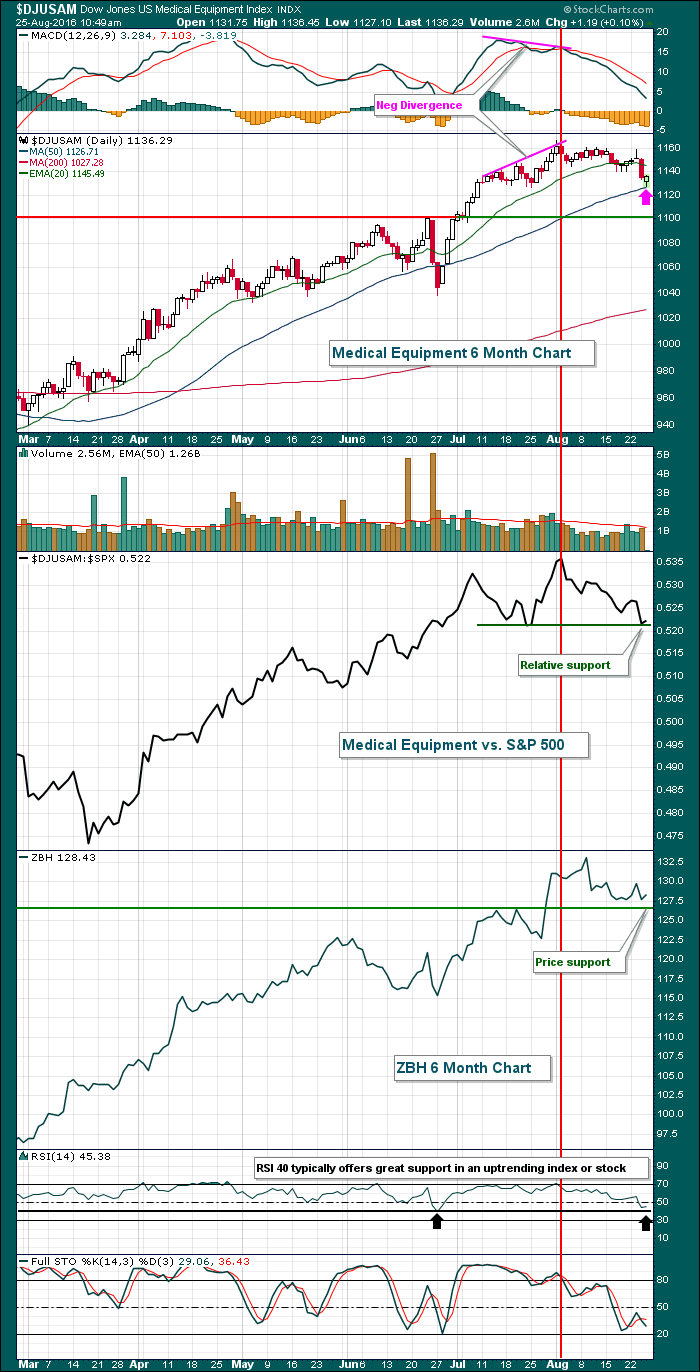

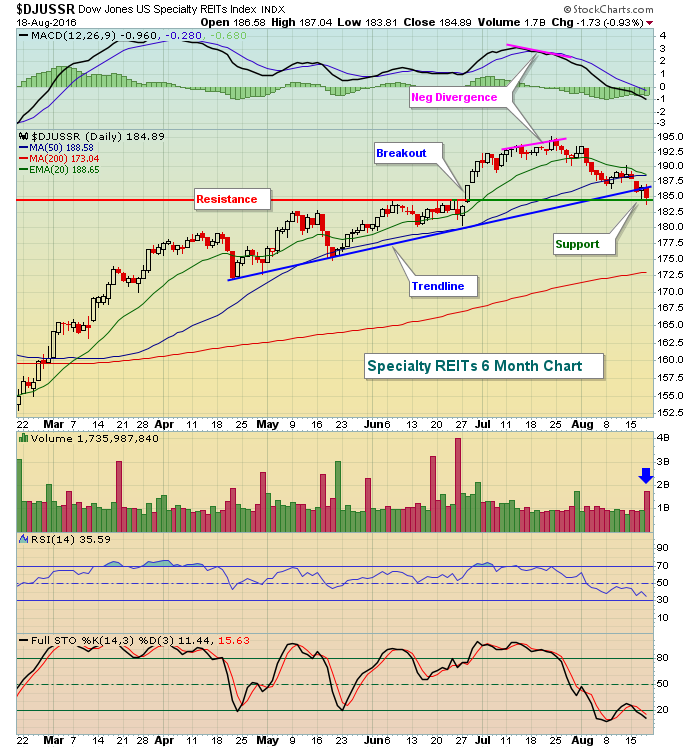

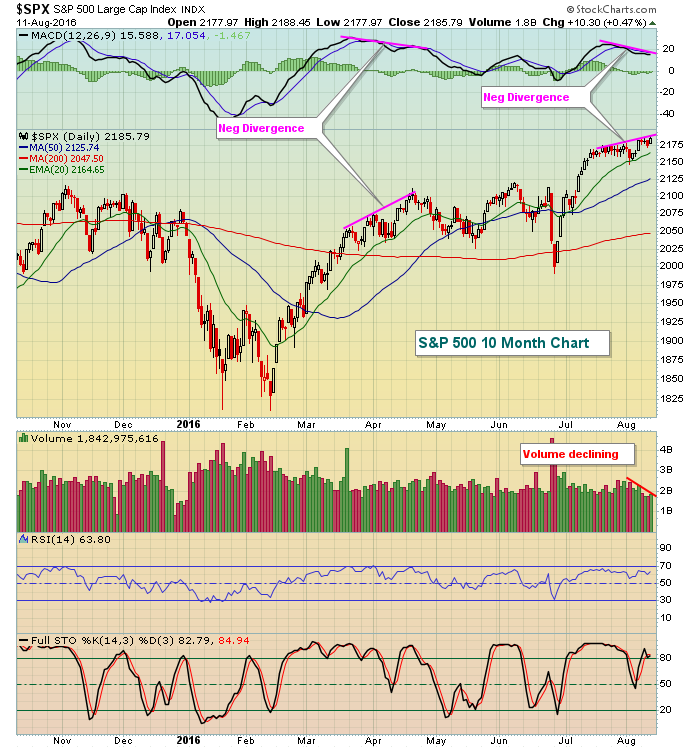

Slowing Momentum And Negative Divergences Are Wreaking Havoc On Equities

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The U.S. stock market has been suffering from a series of negative divergences that have run rampant throughout many sectors and industry groups. As one weakening group sells off, money rotates to another strengthening group. We have not been seeing wide participation moves to the upside. The sector performance...

READ MORE

MEMBERS ONLY

Rough Day For Healthcare As Biotechs Fail At Resistance

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, August 24, 2016

Healthcare (XLV, -1.57%) was one of two sectors losing more than 1% on Wednesday as the Dow Jones U.S. Biotechnology Index ($DJUSBT) fell 2.46%. There were many losers in the biotech space, but Amgen's loss of its rising...

READ MORE

MEMBERS ONLY

Dollar Remains Under Pressure, Lifting Materials And Energy

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, August 23, 2016

While U.S. equities continue to waver, albeit in a slow northerly fashion, they're not the only asset groups trying to figure out which direction they want to ultimately go. Yesterday, I discussed the 10 year treasury yield ($TNX) struggling to...

READ MORE

MEMBERS ONLY

Bifurcated Market Signals Little About The Short-Term

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, August 22, 2016

Monday was another boring day with most of the action slanting to the negative side, but it was nothing terrible. In fact, both the NASDAQ and Russell 2000 managed to finish the session with small gains while the Dow Jones and S&...

READ MORE

MEMBERS ONLY

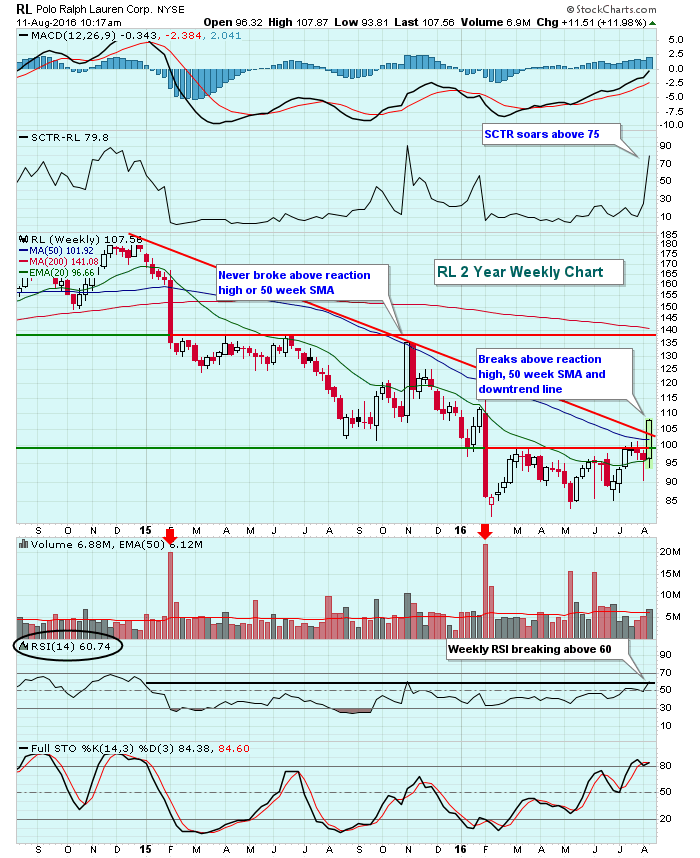

If The Shoe Fits, Then Buy It

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, August 19, 2016

Stocks ended last week on a negative note with each of our major indices finishing in negative territory. Losses were very minor on the more aggressive NASDAQ and Russell 2000, however, and three sectors - materials (XLB, +0.14%), technology (XLK, +0.06%...

READ MORE

MEMBERS ONLY

Merck Breaks To An All-Time High

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

One company's failure can be another company's catalyst. Take for instance Merck & Co (MRK), who on Friday, August 5th surged to an all-time high after Bristol Myers (BMY) had a failed clinical trial of its lung cancer drug. BMY had clearly been outperforming MRK for...

READ MORE

MEMBERS ONLY

Rebound In Crude Oil Prices Trigger Big Gains In Energy

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

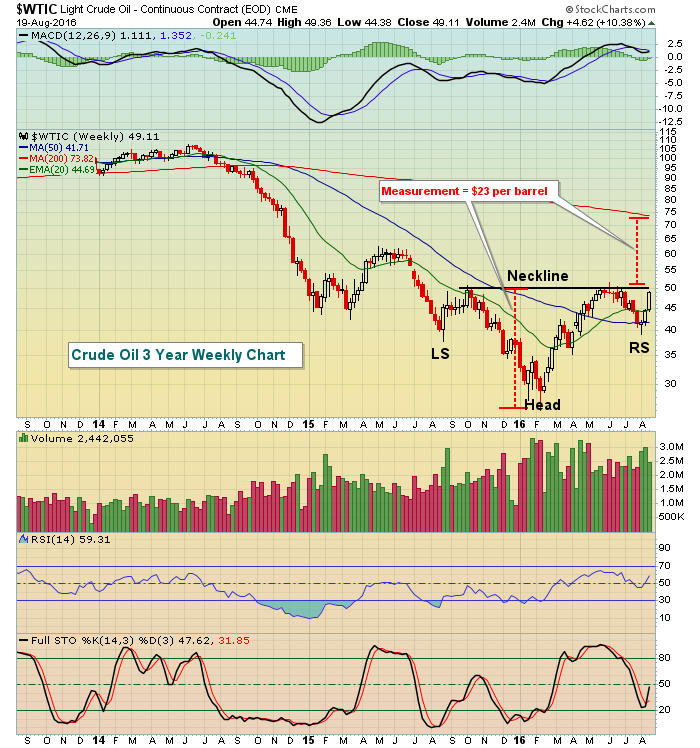

The bottoming formation in crude oil ($WTIC) continues to take shape and the beneficiary clearly has been the energy ETF (XLE). Since dipping below $40 per barrel to begin August, the WTIC has rallied more than 20% in the past three weeks and is now nearing $50 per barrel. A...

READ MORE

MEMBERS ONLY

Energy Makes Huge Breakout As Crude Oil Jumps Again

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, August 18, 2016

Energy (XLE, +2.06%) led the action on Thursday and helped turn the stock market around after it briefly turned negative at mid-day. Utilities (XLU, +1.23%) and materials (XLB, +0.64%) also performed well, but the remaining six sectors fluctuated near the...

READ MORE

MEMBERS ONLY

Will The Real Twitter Please Stand Up?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

There aren't too many stocks under the same scrutiny as Twitter (TWTR) and expectations range from wildly bullish to wildly bearish. So what is a trader to do? Well, I'd ignore all the news headlines, which lately have gone full circle from potential buyout rumors to...

READ MORE

MEMBERS ONLY

Afternoon Rally Erases Early Losses

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, August 17, 2016

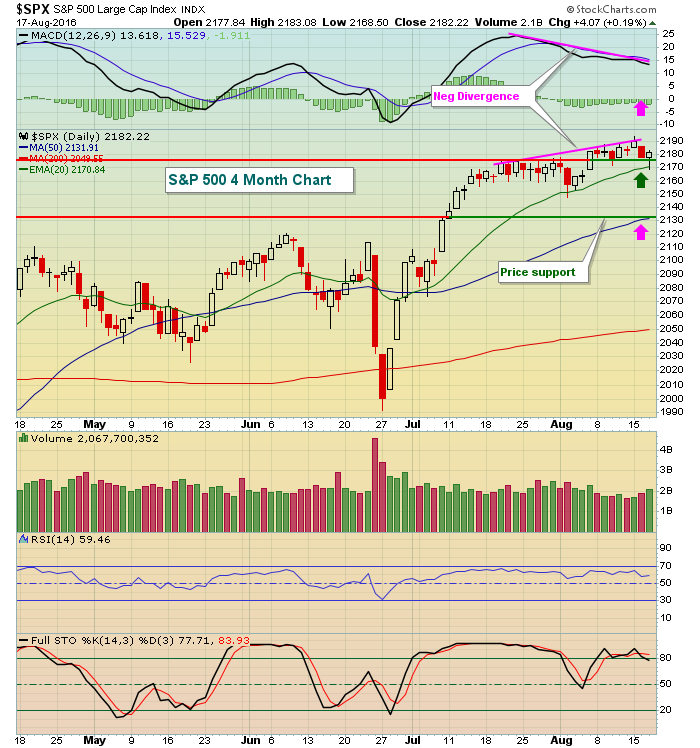

The Tuesday selling continued into early Wednesday, but initial support held in the support zone that was highlighted yesterday. 2170-2175 was the support zone and the S&P 500's intraday low was 2168 late Wednesday morning before the buyers returned...

READ MORE

MEMBERS ONLY

U.S. Stocks Weaken, Watch This Support Level

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

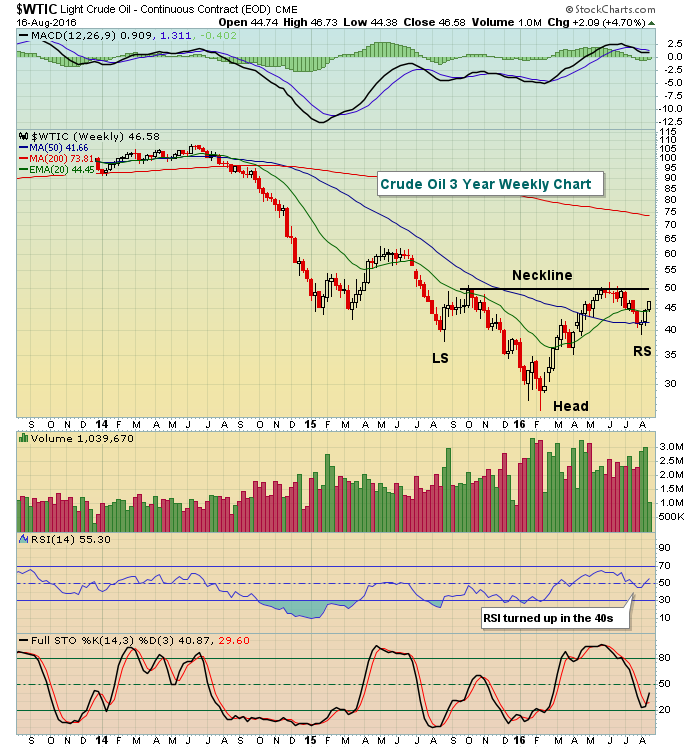

Market Recap for Tuesday, August 16, 2016

Eight of nine sectors fell on Tuesday with energy (XLE, +0.16%) the lone sector that managed to finish in positive territory. That was attributable to a continuing rise in crude oil prices ($WTIC) that has taken black gold from $39 per barrel...

READ MORE

MEMBERS ONLY

Small Caps Lead Broad-Based Rally

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, August 15, 2016

The Russell 2000 index surged nearly 1%, more than three times the percentage gain seen on the S&P 500 as small caps were once again held in favor by traders. The outperformance by small caps has been continuing since the S&...

READ MORE

MEMBERS ONLY

Bifurcated Action Stifles The Bulls On Friday

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, August 12, 2016

It was another day of indecision - but within the confines of a continuing uptrend. The NASDAQ and Russell 2000 eked out gains while both the Dow Jones and S&P 500 suffered fractional losses. Negative divergences are now present on the...

READ MORE

MEMBERS ONLY

Here's A Trucker Looking For Gap Support

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

YRC Worldwide (YRCW) recently posted quarterly results that blew away Wall Street consensus estimates with EPS reported at $.83. The estimate was for just $.51. That news was well received by traders as YRCW gapped up and opened at 10.98 on July 29th and never looked back. After becoming...

READ MORE

MEMBERS ONLY

Big Rise In Crude Oil Extends S&P 500 Rally

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, August 11, 2016

Crude oil surged more than 6% yesterday and energy (XLE, +1.47%) led yet another S&P 500 rally with that benchmark index finishing at a record high. Initial price support at 2175 held before the bulls were back on the attack....

READ MORE

MEMBERS ONLY

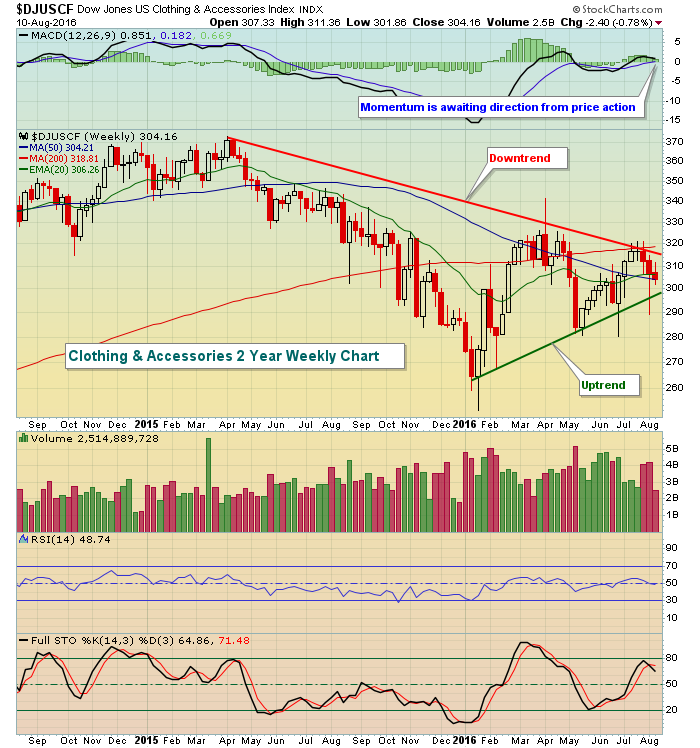

This Clothing Retailer Has Your Back

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The Dow Jones U.S. Clothing Accessories Index ($DJUSCF) has been challenged technically with a long-term downtrend and a short-term uptrend currently in play. It'll be interesting to see which way this index breaks, but if the overall market holds any clue, then the DJUSCF will likely break...

READ MORE

MEMBERS ONLY

Should We Shop For Retail Stocks?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, August 10, 2016

U.S. stocks fell across all of our major indices on Wednesday (gasp!). Don't worry, it wasn't anything of technical significance. As I highlighted in the Current Outlook section below, the S&P 500 still remains poised for...

READ MORE

MEMBERS ONLY

Consumer Staples Lead With Weak Volume

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, August 9, 2016

It was another day of watching paint dry as the Dow Jones, S&P 500, NASDAQ and Russell 2000 gained 0.02%, 0.10%, 0.24% and 0.11%, respectively. The Dow Jones traded in a 70 point range and a final...

READ MORE

MEMBERS ONLY

Where's The Summer Weakness?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, August 8, 2016

It's summer time in the stock market, but you wouldn't know it by the action since June 27th. There's no doubt the rally has been strong, but most of the gains have occurred during the more bullish...

READ MORE

MEMBERS ONLY

Jobs Beat And Strength In Financials Lead Friday Rally

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, August 8, 2016

Friday was a very solid day for the bulls and not just because the S&P 500 closed at all-time highs again. The part I liked the most was the leadership of the financial sector (XLF, +1.91%). The strength was apparent...

READ MORE

MEMBERS ONLY

Strength In Technology Shares Continuing To Fuel This Rally

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

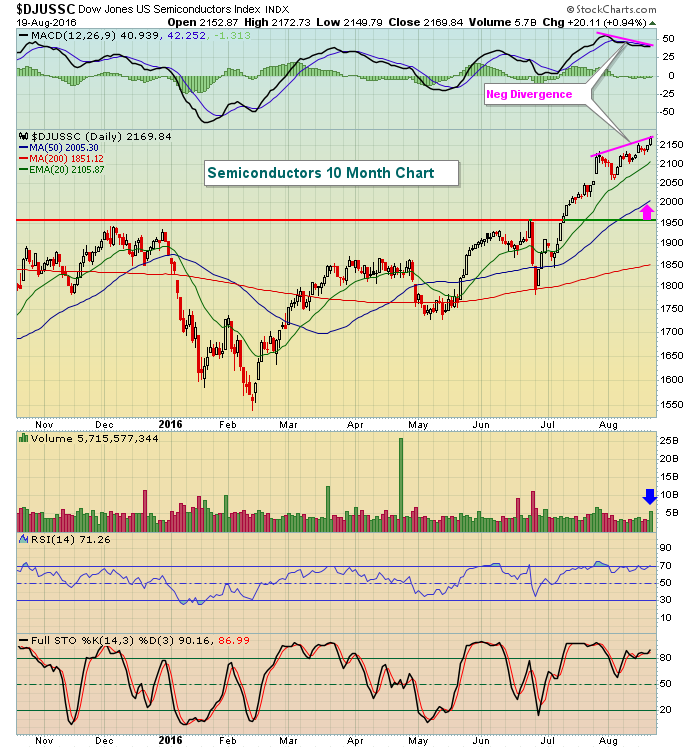

Market Recap for Thursday, August 4, 2016

Technology (XLK, +0.54%) has been the leading sector over nearly every short-term performance measure. Industry groups like internet ($DJUSNS), software ($DJUSSW), semiconductors ($DJUSSC) and electronic equipment ($DJUSAI) have all broken out and are performing exceptionally well vs. the S&P 500....

READ MORE

MEMBERS ONLY

Dun & Bradstreet Breaks Out of Consolidation To Lead Publishers

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The Dow Jones U.S. Publishers Index ($DJUSPB) has broken a downtrend on its weekly chart and Dun & Bradstreet (DNB) is one of the best looking companies within this index. DNB posted revenues and EPS that bested Wall Street consensus estimates on Monday after the bell, then proceeded to...

READ MORE

MEMBERS ONLY

Small Caps, Energy And Financials Lead Rally

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

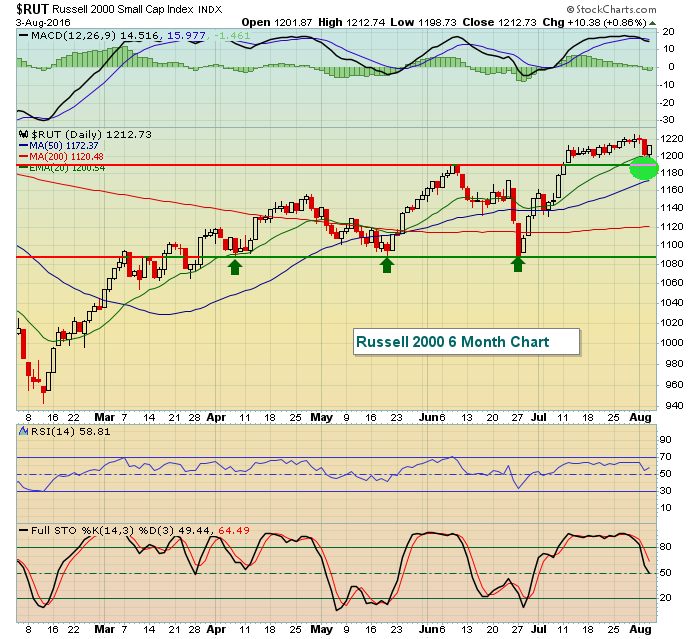

Market Recap for Wednesday, August 3, 2016

Strength returned in most areas of U.S. equities on Wednesday, but the gains were more pronounced in the Russell 2000, which rose 0.86%. Among the six sectors in positive territory, none was stronger than energy (XLE, +1.93%) where rebounding crude...

READ MORE

MEMBERS ONLY

S&P 500 Bounces Off First Key Short-Term Support

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

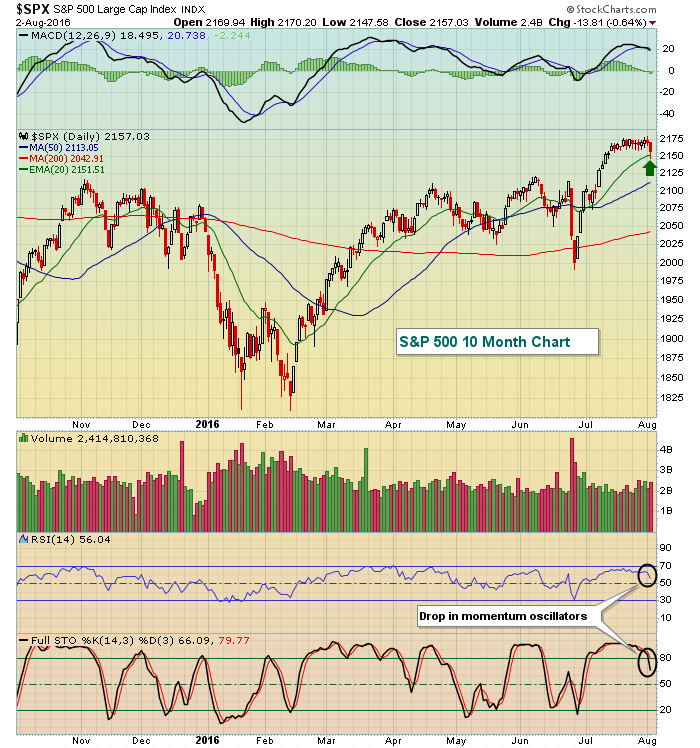

Market Recap for Tuesday, August 2, 2016

There was no bifurcated action on Tuesday. There were no major indices threatening breakouts and eight of the nine sectors fell. Finally, the NASDAQ and Russell 2000 saw some much-needed profit taking after a long steady advance off their late-June lows. The S&...

READ MORE

MEMBERS ONLY

Biotechs Surge Through Resistance To Lead NASDAQ

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, August 1, 2016

Monday marked another day of mixed action. The NASDAQ continues to power forward, leading the action. Since July 14th, the NASDAQ has advanced more than 150 points or roughly 3%. During that same time frame, the S&P 500 has barely budged,...

READ MORE

MEMBERS ONLY

Bull Market Escapes July With Barely A Scratch

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

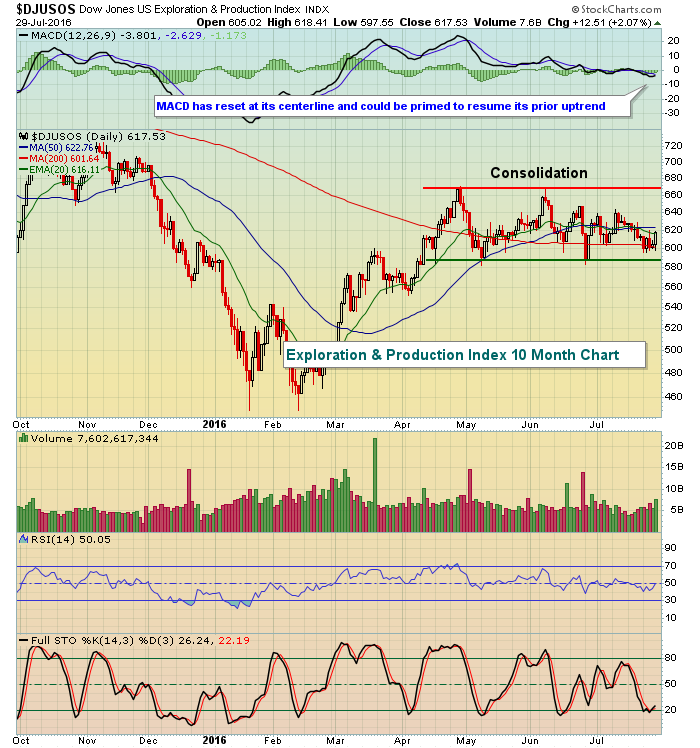

Market Recap for Friday, July 29, 2016

Friday's end of month action was bifurcated with the Dow Jones lagging and posting a 0.13% decline. The other three major indices did manage to finish in positive territory with sectors finishing in that same bifurcated fashion. Energy (XLE, +1....

READ MORE

MEMBERS ONLY

Q2 GDP Is Out And Falls Waaaay Short

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, July 28, 2016

The action on Thursday was different than what we've seen recently as investor focus seemed to turn to safety ahead of the GDP report and after the FOMC announcement on Wednesday. Consumer staples (XLP, +0.44%) and utilities (XLU, +0.39%...

READ MORE