MEMBERS ONLY

This Is How You Hammer Out A Bottom

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Children's Place (PLCE) printed a reversing hammer on Friday just after touching gap support at 70.51. This comes off a lengthy downtrend that began in mid-April after a negative divergence had developed. Take a look at the technical picture on a daily chart first:

Adding further bullishness...

READ MORE

MEMBERS ONLY

Energy Resting At Key Pivot Area

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

2016 has been a very good year thus far for the energy sector (XLE) as it's gained 17.51% in just the last three months alone. Unlike many of the other sectors that have been battling slowing momentum in the form of negative divergences, momentum remains very strong...

READ MORE

MEMBERS ONLY

REITs Break Out, Biotechs Break Down

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, May 5, 2016

The energy sector (XLE) was back on top on Thursday, once again leading the market. The XLE gained .82% as four sectors advanced while five declined. Consumer discretionary (XLY) was the weakest link, dropping .64%. Apparel retailers ($DJUSRA) fell 3.0%, led by...

READ MORE

MEMBERS ONLY

Which Way Is The Market Heading? Ask Apple

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Apple (AAPL) is the most influential stock considering all its branches and its psychological effect, not to mention its $510 billion market cap. But all is not well technically for AAPL and we're going to soon find out if it can hold support and resume its uptrend or...

READ MORE

MEMBERS ONLY

When Does Rising Volatility Become A Major Concern?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, May 4, 2016

Wednesday's theme was defense. In many sports circles, defense wins championships. That's not the case with the stock market. Strong "defense" here means skepticism, fear and generally a downtrending stock market. So I'm not a...

READ MORE

MEMBERS ONLY

Gold Strengthening As Dollar Faces Major Test Of Support

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, May 3, 2016

Energy (XLE) was hit hard on Tuesday as all nine sectors retreated. But the XLE's drop of 2.36% was notable as it nears a key short-term price support level and its rising 20 day EMA, both generally strong areas during...

READ MORE

MEMBERS ONLY

Consumer Stocks Lead U.S. Equities Higher

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, May 2, 2016

Consumer discretionary (XLY) and consumer staples (XLP) were the sector leaders on Monday as they posted gains of 1.40% and 1.15%, respectively. But like so many areas of the market, even sizable gains and market leadership come with warning signs and...

READ MORE

MEMBERS ONLY

Is It Time To Sell In May And Go Away?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, April 29, 2016

The U.S. stock market suffered further damage on Friday as all of our major indices ended lower. There were a few bright spots despite the NASDAQ losing more than its fair share and closing at its lowest level in more than a...

READ MORE

MEMBERS ONLY

It's Not Wise To Chase Gaps

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

You have to keep in mind that when everyone wants to buy a stock (or sell a stock), it's the market makers job to provide liquidity and take the other side of the trade. That's why so often we see stocks gap higher or lower from...

READ MORE

MEMBERS ONLY

Dow Drops 200 Points; U.S. Futures Lower

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, April 28, 2016

U.S. indices tumbled on Thursday, the day after central bankers temporarily closed the candy store. Neither the Federal Reserve here in the U.S. nor Bank of Japan offered up any stimulus that traders could wrap their arms around and amid signs...

READ MORE

MEMBERS ONLY

This Small Technology Company Is Drifting Back To Support

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

When a stock breaks out to fresh highs with light volume, a negative divergence and overbought oscillators, you need to be on high alert for a period of selling. That's exactly the signal that ORBCOMM (ORBC) provided astute traders as we entered April. Since that time ORBC has...

READ MORE

MEMBERS ONLY

Energy And Utilities Lead Market After FedSpeak

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, April 27, 2016

Well another FOMC meeting has come and gone. Not much has changed really. The Fed still seems adamant about raising rates, but they're not sure as to the timing. The next meeting in June is a real possibility, but they'...

READ MORE

MEMBERS ONLY

Apple Crushed After Earnings, NASDAQ Futures Tank

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, April 26, 2016

April has not been kind to technology stocks (XLK). We've seen several key earnings disappointments from the group, including Microsoft (MSFT), Alphabet (GOOGL) and Apple (AAPL), and investors in those three are not happy. We've seen bifurcated action throughout...

READ MORE

MEMBERS ONLY

Crude Oil Hasn't Done This In Nearly Two Years

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for April 25, 2016

Energy (XLE) was very weak on Monday, losing 1.12% to finish 9th out of 9 sectors. Technically, the sector is still very strong and has essentially "reset" its hourly MACD to centerline support. A negative divergence on the hourly chart suggested...

READ MORE

MEMBERS ONLY

Stock Market Bulls: "Let's Have A Toast"

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, April 22, 2016

The technology world (-1.74%) was rocked on Friday with disappointing earnings announcements from a host of NASDAQ names, particularly a couple large technology companies. Microsoft (MSFT) stumbled badly, losing 7.17% after posting EPS that fell slightly below expectations. Revenue guidance in...

READ MORE

MEMBERS ONLY

Helix Energy Breaks Out, SCTR Surges Above 90

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Energy stocks have been strengthening throughout 2016 and Helix Energy Solutions (HLX) is a small $900 million market cap company that just broke out his past week. Its SCTR rank has quickly soared to above 90 after recently printing SCTR readings in the single digits for several months. Check out...

READ MORE

MEMBERS ONLY

Market Bifurcation Intensifies As Utilities Fall Beneath Key Moving Average

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, April 21, 2016

The Dow Jones dropped 114 points on Thursday, marking only the fourth time in the past two months it's lost more than 100 points during a session. The climb has been steady with few declines of any magnitude as energy (XLE)...

READ MORE

MEMBERS ONLY

Energy And Banks Lead Continuing Stock Market Parade

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, April 20, 2016

Energy (XLE) once again found itself on top of the relative leaderboard in terms of sector performance. The XLE gained .90% on Wednesday. Oil equipment and services ($DJUSOI) gained over 1% and broke to fresh highs. Here's an update on that...

READ MORE

MEMBERS ONLY

U.S. Stocks Dodge Bullets, Edge Closer To Record Highs

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, April 19, 2016

Nothing seems to be able to slow down this market freight train. Not disappointing housing data. Not a continuing rush into treasuries. Not weak guidance from IBM and Netflix (NFLX). Not negative divergences across multiple time frames. Literally nothing. Yes, the market did...

READ MORE

MEMBERS ONLY

Dow Hits 18000; IBM, Netflix Weighs

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, April 18, 2016

All nine sectors rallied on Monday to support the Dow Jones' breakout above the psychological 18000 barrier. Energy (XLE) and consumer discretionary (XLY) led the broad-based rally with gains of 1.65% and .94%, respectively. Healthcare (XLV) tacked on a .93% gain....

READ MORE

MEMBERS ONLY

Dow Jones Nears 18000 Resistance With Negative Divergence

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, April 15, 2016

The last significant top on the Dow Jones occurred on November 3rd when it posted an intraday high of 17978 and closed at 17918. The action late last week challenged those two levels when the Dow Jones hit an intraday high of 17962...

READ MORE

MEMBERS ONLY

Slowing Momentum WAS A Problem For This Insurer

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Negative divergences that appear on daily charts tend to take a couple weeks to play out before we see momentum potentially resume back to the upside. That seems to be where Progressive Corp (PGR) currently stands. On PGR's most recent price high, its MACD did not follow suit,...

READ MORE

MEMBERS ONLY

Where Should We Look For May Strength?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Based on April performance alone over the past 20 years, the best industry groups to invest in have been the following:

$DJUSHL (Hotels & Lodging REITs) +12.4%

$DJUSAU (Automobiles) +10.3%

$DJUSRL (Retail REITs) +9.7%

$DJUSES (Real Estate Services) +8.9%

$DJUSTR (Tires) +7.9%

All five of...

READ MORE

MEMBERS ONLY

Top Three Reasons Why We're Not Breaking Out

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, April 14, 2016

Energy (XLE) and financials (XLF) led the market action on Thursday, although our major indices were bifurcated with slight gains in the Dow Jones and S&P 500 and minor losses on the more aggressive NASDAQ and Russell 2000.

Crude oil ($WTIC)...

READ MORE

MEMBERS ONLY

Banks Ignore Earnings Shortfall, Challenge Price Resistance

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The Dow Jones U.S. Banks Index ($DJUSBK) soared on Wednesday after JP Morgan Chase (JPM) delivered better than expected quarterly earnings results. The strength in JPM sent the DJUSBK to the doorstep of a significant price breakout above 300. However, Bank of America (BAC), PNC Bank (PNC) and Wells...

READ MORE

MEMBERS ONLY

U.S. Equities Surge On Increasing Volume

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, April 13, 2016

Wednesday was arguably the best trading day of 2016 for U.S. equities. Volume increased to nearly 2 billion shares on the NASDAQ and the four offensive sectors - financials, industrials, consumer discretionary and technology - led the rally with gains of 2....

READ MORE

MEMBERS ONLY

Energy Helps S&P 500 Hold Key Moving Average

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, April 12, 2016

Just before Tuesday's open, the International Monetary Fund (IMF) lowered its forecast for world economic growth. Then shortly after the open, all of our major indices lost recent price support and rising 20 day EMA support. Short-term prospects were worsening and...

READ MORE

MEMBERS ONLY

Dollar Reaches Six Month Low, Lifts Commodities

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, April 11, 2016

It was a disappointing day on Wall Street Monday as nice early gains vanished by the close with all of our major indices at the door step of 20 day EMA support. The Dow Jones was higher by 155 points 30 minutes into...

READ MORE

MEMBERS ONLY

Energy Rebounds To Lead U.S. Equities On Friday

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, April 8, 2016

Our major indices gave up a big chunk of their earlier gains on Friday, but did manage to finish in positive territory. Crude oil ($WTIC) topped off a superb week (+8.27%) by rising 5.68% on Friday alone. The WTIC is now...

READ MORE

MEMBERS ONLY

Asset Managers Failing At Price Resistance And Rolling Over

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Last week was horrible for financial stocks as the XLF tumbled 2.86%. Investment services ($DJUSSB) and asset managers ($DJUSAG) were at the bottom of the heap with losses of 6.00% and 3.94%, respectively. The losses were technically damaging for both industry groups as both now appear to...

READ MORE

MEMBERS ONLY

The Key Short-Term Test Has Begun

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, April 7, 2016

It was a rough day yesterday. All of our major indices were down. All nine sectors were lower. Unless you were trading gambling stocks or mining for gold, you probably saw red numbers. The selling was truly across the board. But there was...

READ MORE

MEMBERS ONLY

This Food Company Serving Up A Cup With Handle

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Kraft Heinz Co (KHC) has been uptrending for several years. On its high in August, however, a negative divergence appeared on its weekly chart and, as a result, KHC sideways consolidated for the past 8 months. The good news is that it appears to be consolidating in a bullish cup...

READ MORE

MEMBERS ONLY

The Direction Of Treasury Yields Remains A Major Concern

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, April 6, 2016

Healthcare (XLV) and energy (XLE) had huge days on Wednesday as our major indices rose throughout the day and finished on its high. Strength was seen across nearly every sector with only the defensive utilities down slightly. The best performing aggressive sector -...

READ MORE

MEMBERS ONLY

Harley Davidson (HOG) Goes Off Road

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

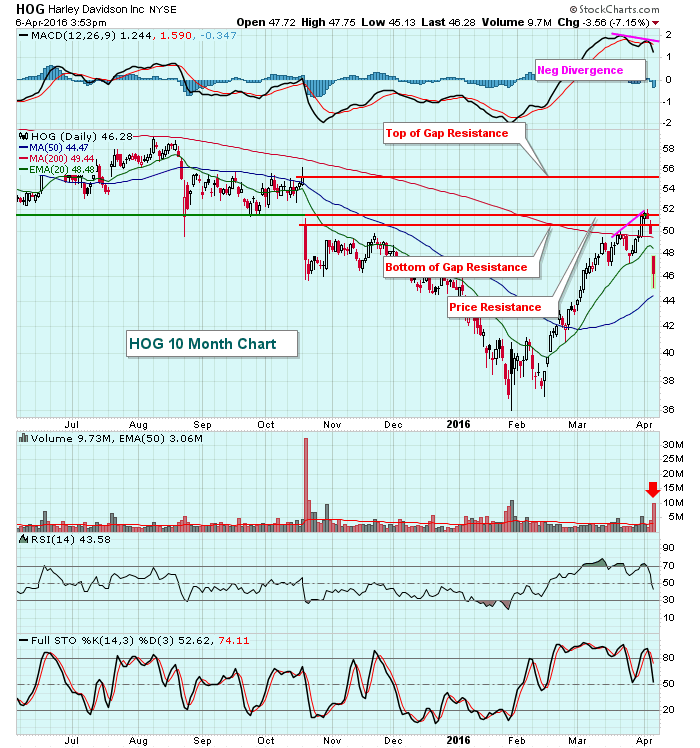

Volume is triple its normal daily volume and Harley Davidson (HOG) is down more than 7% today, but technical analysis flashed many warning signs on both the daily and weekly charts. First, let's look at the daily chart where price and gap resistance and a negative divergence all...

READ MORE

MEMBERS ONLY

German Shares Suggesting Caution In U.S.

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, April 5, 2016

U.S. equities had a rough day from the opening bell on Tuesday. The Dow Jones fell more than 100 points in a session for the first time in nearly a month as the rally off the February 11th bottom has continued to...

READ MORE

MEMBERS ONLY

U.S. Futures Sink Amid Signs of Slowing Momentum

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, April 4, 2016

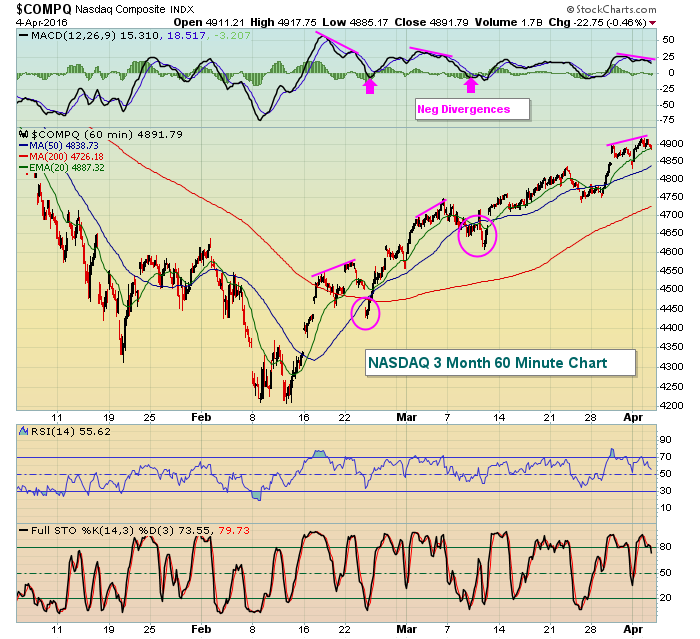

During my Monday webinar (CLICK HERE for recording), I highlighted a few red flags regarding a possible short-term market downturn. Among those were negative divergences across our major indices. The Moving Average Convergence Divergence (MACD) is a momentum oscillator designed to track price...

READ MORE

MEMBERS ONLY

Traders Show Appetite For Food Products Friday

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, April 1, 2016

The market rally continues. While the majority of money seems to be flowing toward defense, which isn't a great sign of strength nor one of sustainability, it's difficult to argue with day after day of gains. So caution makes...

READ MORE

MEMBERS ONLY

April Is A Good Prescription For Pharmaceuticals

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

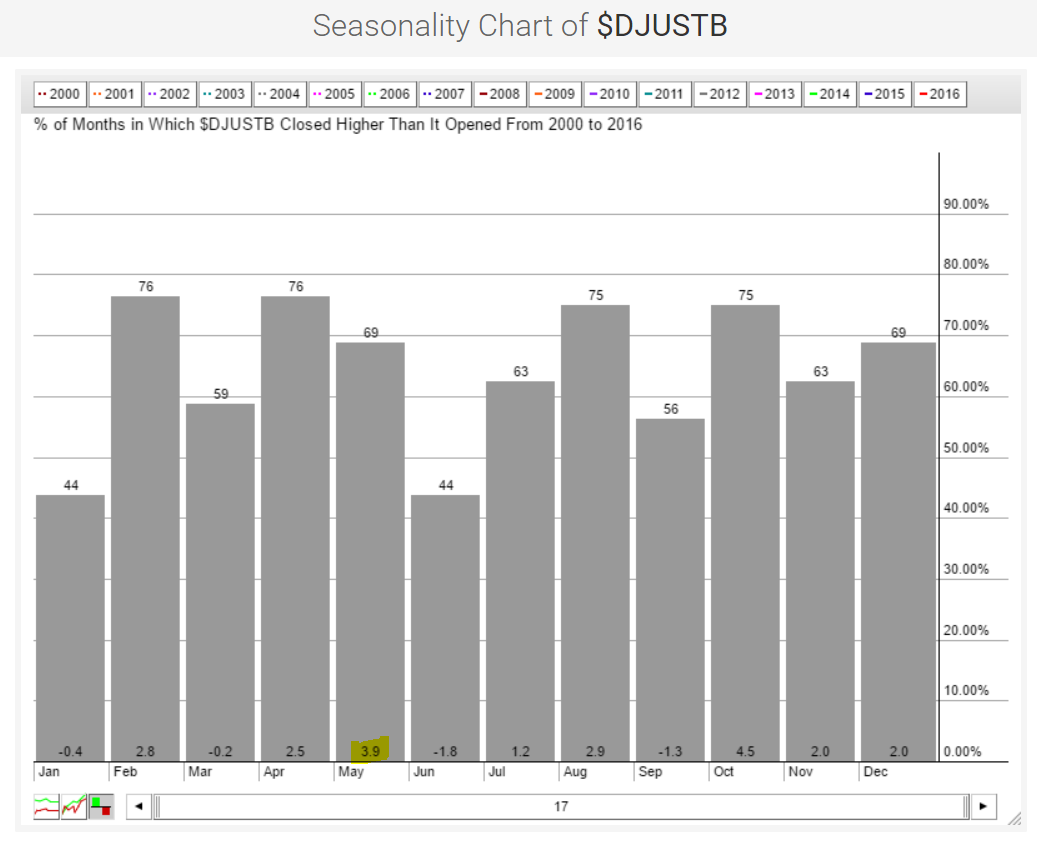

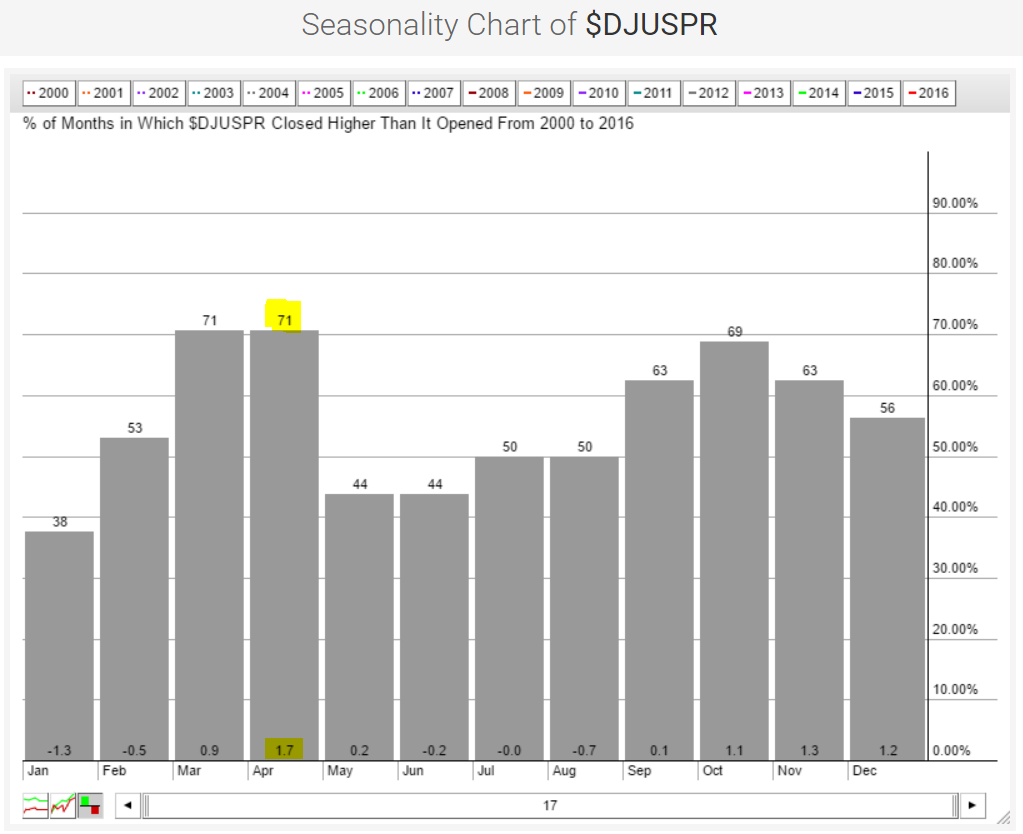

The seasonality tool here at StockCharts.com provides an easy way to review historical results for indices, sectors, industry groups and individual stocks. I looked at financials and healthcare industry groups as these two sectors have performed the worst over the past three months. Perhaps seasonal strength can provide a...

READ MORE

MEMBERS ONLY

March Rotation Doesn't Support Rally

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

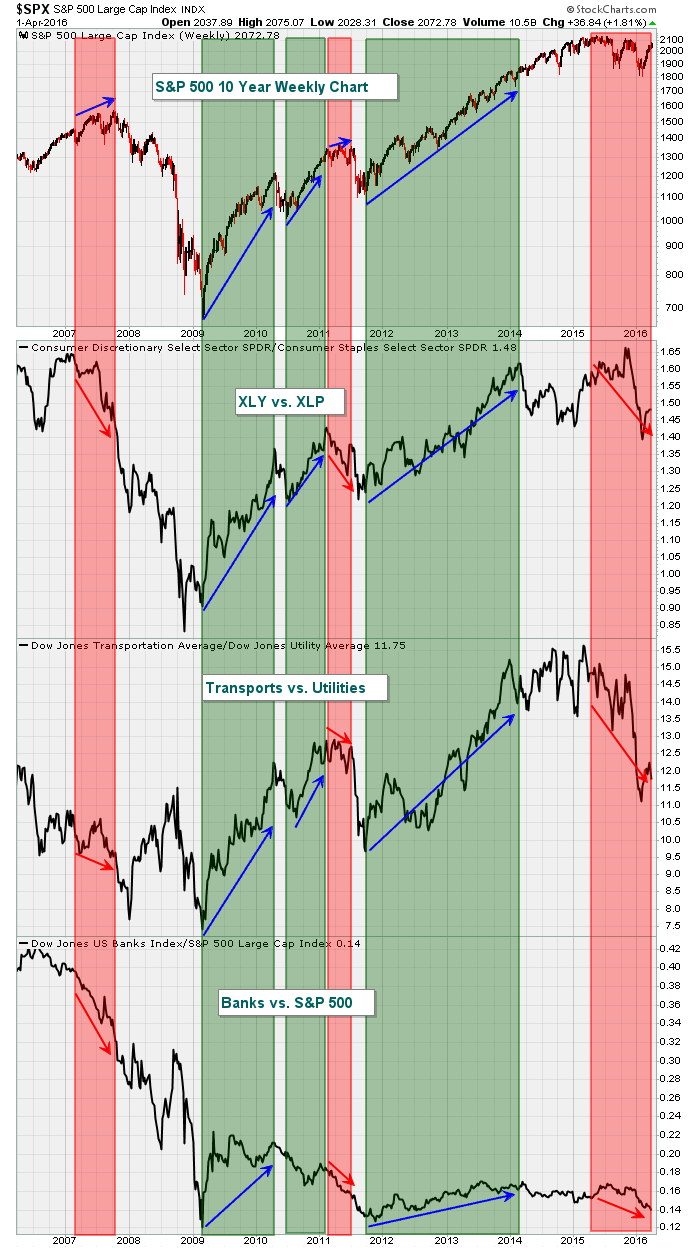

In order to determine the sustainability of market rallies, following the rotation between certain sectors or indices can be quite helpful. The chart below shows red shaded areas to highlight warning signs that appeared at the end of the prior bull market in 2007 and also warned of the 2011...

READ MORE

MEMBERS ONLY

Jobs Report Shows Slight Beat; Where Do We Go From Here?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, March 31, 2016

Utilities (XLU) were the only sector to finish in positive territory on Thursday, rising .59%. The remaining eight sectors fell, led by materials' (XLB) .84% decline. While the loss on Thursday was a problem for the materials bulls, weakness in the U....

READ MORE