MEMBERS ONLY

Exploration and Production Index ($DJUSOS) Bottoming?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

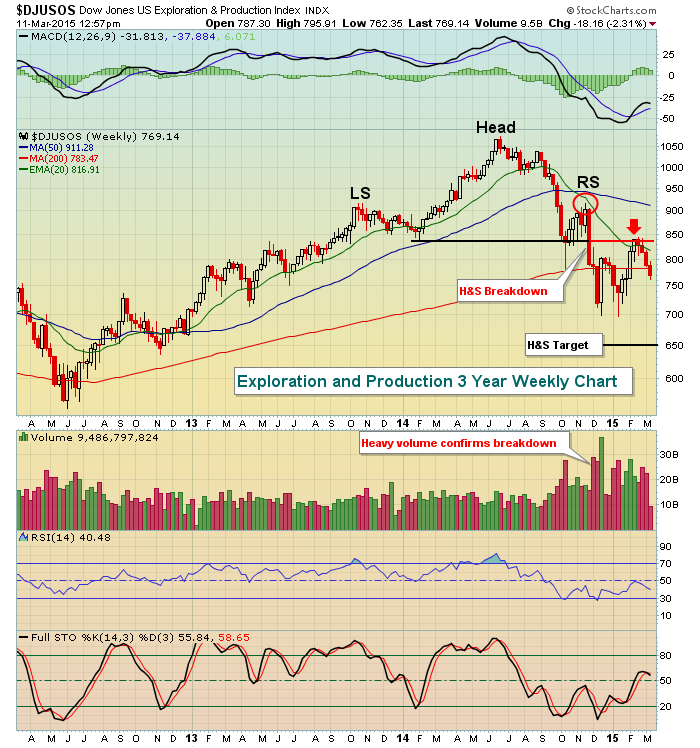

While most of the U.S. stock market enjoys quite a bull market dating back to March 2009, that's not the case currently for exploration and production stocks ($DJUSOS) - at least not in the near- to intermediate-term. A topping head & shoulders pattern confirmed in late November...

READ MORE

MEMBERS ONLY

Cisco Systems (CSCO) Tests 14 Year High

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Since the tech bubble popped in the early 2000s, CSCO has slowly risen from the ashes. It fell a remarkable 90% from its high in 2000 to its low in late 2002. Keep in mind, however, that it made a parabolic move higher prior to this drop. 2000 started a...

READ MORE

MEMBERS ONLY

KLA-Tencor (KLAC) Testing Key Support Zone

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Semiconductors ($DJUSSC) are one of the worst areas of the market today and have been one of the worst areas of technology over the past week. KLA-Tencor (KLAC) has hit a key area of support, however, and certainly presents a much better reward to risk opportunity. 60.53 represents gap...

READ MORE

MEMBERS ONLY

Internet Stocks Showing Renewed Relative Strength

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

When we look back at last week's action, a few things stand out to me. First, the aggressive sectors - financials, consumer discretionary, technology and industrials - held up quite well on a relative basis. That should be seen as a positive. The worst performing group was utilities,...

READ MORE

MEMBERS ONLY

Cardtronics (CATM) Fills Earnings Gap

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Cardtronics (CATM) reported stellar quarterly results on February 4th after the close, beating Wall Street estimates with respect to both revenues ($283.9 million actual vs. $270.6 million estimate) and EPS ($.64 actual vs. $.57 estimate). At the open on February 5th, CATM gapped higher to 40.00 from...

READ MORE

MEMBERS ONLY

Welcome to Trading Places!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Hello! I'm Tom. Welcome to my new blog - "Trading Places with Tom Bowley."

First off, I'd like to thank you for stopping by. I'm thrilled to be writing blogs and hosting webinars exclusively at StockCharts.com while doing so among the...

READ MORE

MEMBERS ONLY

BABA: Breaking Down or Reversing With Positive Divergence?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

On Monday, BABA closed at 84.00, its lowest close since its IPO in September. However, that close was very close to support and BABA is currently oversold with its RSI below 30 and its stochastic reading at 11. Note there's a long-term positive divergence that's...

READ MORE

MEMBERS ONLY

Defensive Stocks Lagging Although One Group Poised For Rebound

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

We've seen a very nice rally in U.S. equities during February, erasing all of January's losses with most of our major indices now breaking out to all-time highs. The NASDAQ has been leading the charge and that indicates that we're in a "...

READ MORE

MEMBERS ONLY

Consumer Discretionary Stocks Fuel Rally

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

There's been much said and written about rapidly-declining crude oil prices ($WTIC). But one thing makes perfect sense to me. When American consumers save TONS of money when filling up at the pump, they tend to spend it elsewhere. It's simply what we like to do...

READ MORE

MEMBERS ONLY

Key Tests Approaching in Technology

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The nearly six year bull market lives on, but the bulls have been taking several body blows of late. Whether this bull market continues could depend on a couple of key industry groups within the technology space.

First, let's take a look at computer hardware ($DJUSCR). This is...

READ MORE

MEMBERS ONLY

Industrial Machinery Index Seems Poised for 2015 Rally

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

It's easy to follow the crowd and buy what keeps going higher. But generally larger gains can be found in healthy areas of the market where we've seen months of consolidation, awaiting that next breakout. As an example, it wasn't that long ago that...

READ MORE

MEMBERS ONLY

Business Support Services Index Breaks Out After Long Base

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Stock market action played out the past two weeks almost perfectly according to historical plan. In my last article, I discussed the bearish tendencies of equities from December 7th through December 15th and the S&P 500 promptly lost 85 points, or more than 4% during this period in...

READ MORE

MEMBERS ONLY

Small Caps Ready to Make a December Run?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

As a student of stock market history, I'm often astonished by historical facts about market performance. December is generally a very solid month for equities and no index benefits more from this seasonal bullishness than the Russell 2000. Since 1987, the Russell 2000 has risen 24 of 27...

READ MORE

MEMBERS ONLY

Earnings Season Delivers

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

If ever the bulls needed to see some stellar earnings results and/or positive forward guidance, it was about one month ago. From the late September high of 2019 to the mid-October low of 1821, the S&P 500 fell nearly 10% just as earnings season kicked off. During...

READ MORE

MEMBERS ONLY

Is The Latest Breakout A Trick or Treat?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

First, let me say Happy Halloween to all! It's an exciting time for many, but especially the children. I know our neighborhood is always buzzing with kids anticipating the sugarfest! :-)

Unfortunately, the stock market bears were SPOOKED on Halloween this year. I've said for months...

READ MORE

MEMBERS ONLY

Weakness Confirms Earlier Bearish Signals

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

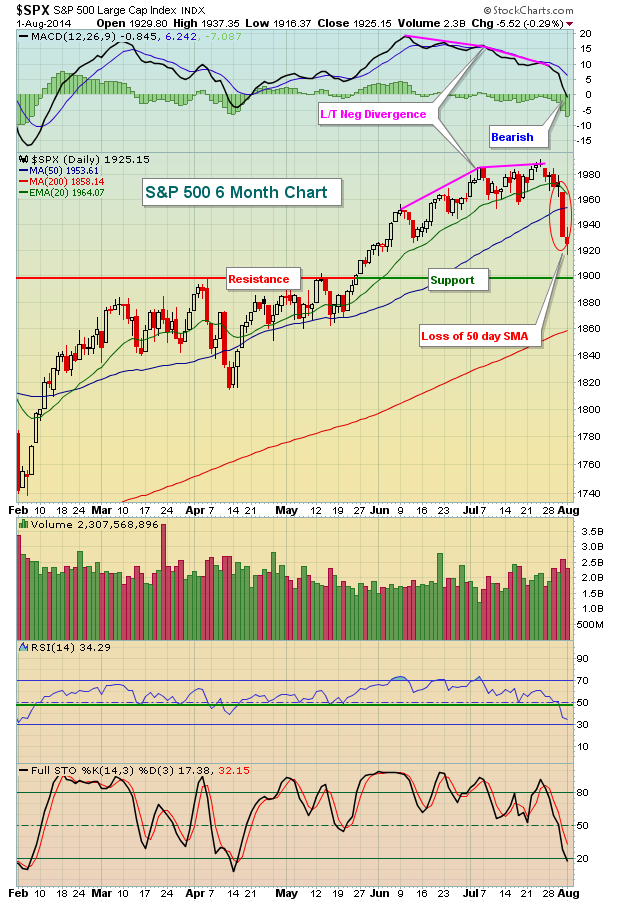

Make no mistake about it, volume has exploded and stock prices have fallen and lost key support levels. That combination is bearish in and of itself. But the part that really bothers me is that intermarket warning signs have been flashing for months so this high volume market drop confirms...

READ MORE

MEMBERS ONLY

Next Up: Earnings Season

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The Fed is winding down its asset purchase program and the historically weak month of September is now behind us. So what's in store next? Earnings season. The stock market sends us signals all the time and given the recent performance of certain sectors and industry groups, we...

READ MORE

MEMBERS ONLY

Remodeling Your Portfolio With Home Improvement Stocks

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

You should know by now that I'm a HUGE fan of the Moving Average Convergence Divergence (MACD) indicator. Other than the combination of price/volume and the use of candlesticks, it's probably my "go-to" indicator. As a case study for this weekend, let'...

READ MORE

MEMBERS ONLY

Trading Gaps

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Identifying a tradable gap can be quite profitable, but also frustrating at times. Awful news hits the wires and a stock gaps lower. The immediate question becomes "Should I sell at the open?" Well, conventional wisdom may suggest that you sell and your emotions may suggest it as...

READ MORE

MEMBERS ONLY

Price Support Holds After Momentum Slows

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

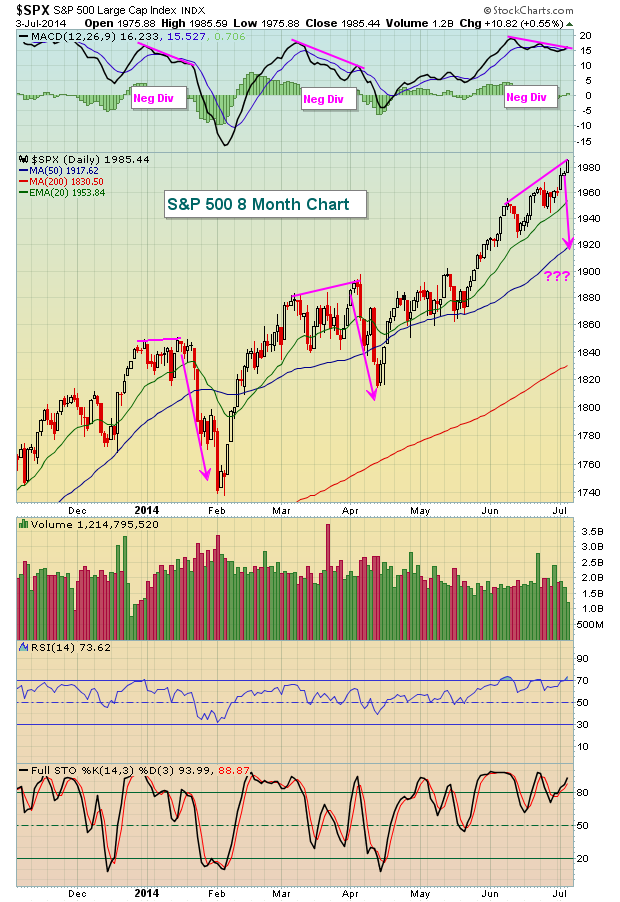

The NASDAQ has been powering forward off the mid-April lows and one big reason has been the semiconductor industry. The Philadelphia Semiconductor index ($SOX) rose 15% in just a seven week period from May 15th through July 3rd. From there, a severe long-term negative divergence printed and that suggested that...

READ MORE

MEMBERS ONLY

Homebuilders Lead Bear Attack on S&P 500

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Warning signs have piled up for months, but there have been few breakdowns to confirm all of these bearish signals. That changed last week as volume surged leading to breakdowns across many of our major indices, sectors and industry groups. One obvious problem was the S&P 500'...

READ MORE

MEMBERS ONLY

Mortgage Finance At Major Support

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Financial stocks have lagged throughout 2014 and are showing signs of slowing momentum. That's keeping hope alive for the bears. The XLF (ETF tracking financial stocks) has a clear long-term negative divergence in play on its MACD as you can see from the chart below:

Most of the...

READ MORE

MEMBERS ONLY

Assessing The First Half of 2014

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

It's been quite confusing for several reasons, a few of which are discussed below.

Historically, the S&P 500 nearly always struggles during the balance of a calendar year in which January performance is weak. In January 2014, the S&P 500 fell 3.56%, ranking...

READ MORE

MEMBERS ONLY

Industrial Suppliers Waiting Their Turn?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The Dow Jones US Industrial Suppliers Index ($DJUSDS) experienced a HUGE bull market run off the 2009 lows through mid-2013, quadrupling in value during the period. Momentum on the weekly chart turned negative, as evidenced by the long-term negative divergence on its MACD. As a result, this index has gone...

READ MORE

MEMBERS ONLY

Small Caps Rebound After Holding Major Support

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

In my last article, I posted a chart of the Russell 2000, identifying a potentially bearish head & shoulders pattern. This pattern, however, requires a high volume breakdown to confirm the likelihood of future weakness. That breakdown never occurred and small cap bulls used historical bullish tendencies from late May...

READ MORE

MEMBERS ONLY

Small Caps: Turn Around Approaching?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I've been very cautious about the stock market throughout most of 2014. There are warning signs galore. But the Russell 2000 has been hit particularly hard year-to-date, dropping approximately 10% from the high set in early March. That was the time when money began rotating away from many...

READ MORE

MEMBERS ONLY

Cyclicals Not Worth The Gamble

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

In 2013, market participants couldn't get enough of cyclicals, or consumer discretionary stocks. The XLY (ETF that tracks consumer discretionary) rose more than 40% in 2013 to lead all sectors on a relative basis. But things have changed in 2014, with many of the strong industry groups in...

READ MORE

MEMBERS ONLY

Rising Volatility and Bearish Technical Patterns a Double Negative

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Last week's gains may have been more about options expiration and an oversold bounce than anything else. I have my eyes set squarely on the NASDAQ right now, waiting either for a resumption of the five year bull market or a breakdown of its current head & shoulders...

READ MORE

MEMBERS ONLY

Warning Signs Piling Up

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

In earlier 2014 articles, I've discussed warning signs that emerged from Volatility indices, behavior in the treasury market, relative weakness of banks and relative strength of defensive areas of the market like utilities and REITs. In addition, the S&P 500 has shown a propensity to struggle...

READ MORE

MEMBERS ONLY

March Madness Underway

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Nope, I'm not referring to college basketball. Instead, it's this wacky stock market. In my last article, I discussed several reasons why the 2014 advance is on shaky ground. Since then, we've seen increased volatility and lots of whipsaw action. Earlier in March, our...

READ MORE

MEMBERS ONLY

Pardon The Interruption

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Make no mistake about it, I prefer to be bullish. History supports this notion because the stock market has always tended to move higher more than it moves lower. Dating back to 1950, the S&P 500 has moved higher over 53% of trading days. Did you know that...

READ MORE

MEMBERS ONLY

Mixed Signals Abound

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Just two weeks ago, the stock market seemed on the verge of its first correction in a long time - all within the confines of a long-term bull market that began in March 2009. Then came the breakdown I was looking for to confirm it. Check out the head &...

READ MORE

MEMBERS ONLY

Financials and Treasury Yields Offering Bears Some Motivation

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Signs of a sustainable bull market rally include strong relative performance from financial stocks, especially banks, and rising treasury yields that result from rotation away from treasuries. Both of these areas of the market are flashing warning signs right now, although technical breakdowns to confirm the weakness have not yet...

READ MORE

MEMBERS ONLY

January Reflecting a Neutral to Bearish 2014 Forecast

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

This bull market has been humming along since March 2009, but we cannot ignore the storm clouds building on the horizon. The technical conditions have slowly deteriorated with the highly influential banking industry ($DJUSBK) reversing hard last week with a long-term negative divergence present on its weekly chart. Those weekly...

READ MORE

MEMBERS ONLY

Sizing Up Earnings Season

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

It's my favorite time of the quarter - as a trader. I approach it like an offensive or defensive coordinator on one of the NFL playoff teams this weekend. I study recent history to find strengths and weaknesses of the market and then I anticipate "plays"...

READ MORE

MEMBERS ONLY

Consumer Stocks Saying This Bull Market Is Sustainable

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

It's quite easy to look at the S&P 500 and see if it's rallying or not. But not every rally is created equal. Many rallies carry significant warning signs that should have you running for cover. Others simply invite you to jump on the...

READ MORE

MEMBERS ONLY

Don't Forget Historical Tendencies

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

When I map out my trading strategies, I consider fundamentals, especially quarterly earnings reports, but I FOCUS on technical indicators. The study of price action helps to determine future price action, but note that it doesn't guarantee it. The basic premise of trading is to set up the...

READ MORE

MEMBERS ONLY

Banks Surge As Bull Market Rages On

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I rarely question a market move to the upside when banks are leading the charge. And if you're wondering how the banks performed last week as the S&P 500 broke to a fresh all-time high, check out the Dow Jones US Bank Index chart:

Banks consolidated...

READ MORE

MEMBERS ONLY

Warning Signs or Another Seasonal Rally Opportunity?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I've maintained a bullish stance throughout this bull market, but I have to admit I'm beginning to get a little nervous. As a stock market historian, it's difficult for me to think bearish thoughts as we enter November because November, December and January are...

READ MORE

MEMBERS ONLY

Gaps Created By Earnings Surprises

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I've mentioned it before, but I'll say it again. I LOVE trading stocks (in bull markets) that gap higher on better-than-expected revenues and earnings and very strong volume as it's a sign of great management execution and investor accumulation. That combination is difficult to...

READ MORE