MEMBERS ONLY

Time For Earnings Season

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

As a trader, this is my favorite time of each quarter. I love it when earnings begin to roll out because the increased volatility generally sets up excellent trading opportunities. In early April, I wrote about the strong earnings report that Nike (NKE) enjoyed in March and I highlighted a...

READ MORE

MEMBERS ONLY

Bernanke Throws Wall Street A Curveball

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Federal Reserve Chairman Ben Bernanke has had several mandates since the financial crisis began several years ago. One was to keep interest rates extraordinarily low for an extended period of time. Check. Another was to make the Fed more transparent. This one was humming along just fine....until Wednesday'...

READ MORE

MEMBERS ONLY

Financials Suggesting This Bull Market Is FAR From Over

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The past 5-6 weeks have not been overly kind to the bulls. In fact, since topping at 1709.67 at the close on August 2nd, the S&P 500 has lost more than 50 points or roughly 3%. Many are calling for the end of the four and a...

READ MORE

MEMBERS ONLY

Software Stocks Lagging

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Most areas of the stock market have enjoyed the past few months, especially since the lows of June 24th. Don't count software as one of those groups, however. At first glance, this might seem like an area of the market to avoid because of poor relative strength over...

READ MORE

MEMBERS ONLY

Transports Lagging Amid Signs of Slowing Momentum

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Transportation stocks helped lead the market rally from October 2012 through March 2013, but since that time it's been a struggle on a relative basis. Check out this relative chart:

Relative support resides near the 3.80 level in the chart above - a relative close beneath this...

READ MORE

MEMBERS ONLY

S&P 500 Warning Signs Emerging for Summer - Again

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

In the very near-term, it's difficult to predict which way the S&P 500 is heading. Recently, we saw the Volatility Index ($VIX) spike to nearly 22 and the multi-month uptrend line on the S&P 500 was violated. Take a quick look:

The biggest technical...

READ MORE

MEMBERS ONLY

Is this a VIX Top and a Market Bottom?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Volatility plays a role in any market environment, but I always look to key areas of resistance on the VIX to help identify tradable bottoms on the S&P 500. In my last article on June 1st, I suggested that the 18-19 resistance on the VIX could prove to...

READ MORE

MEMBERS ONLY

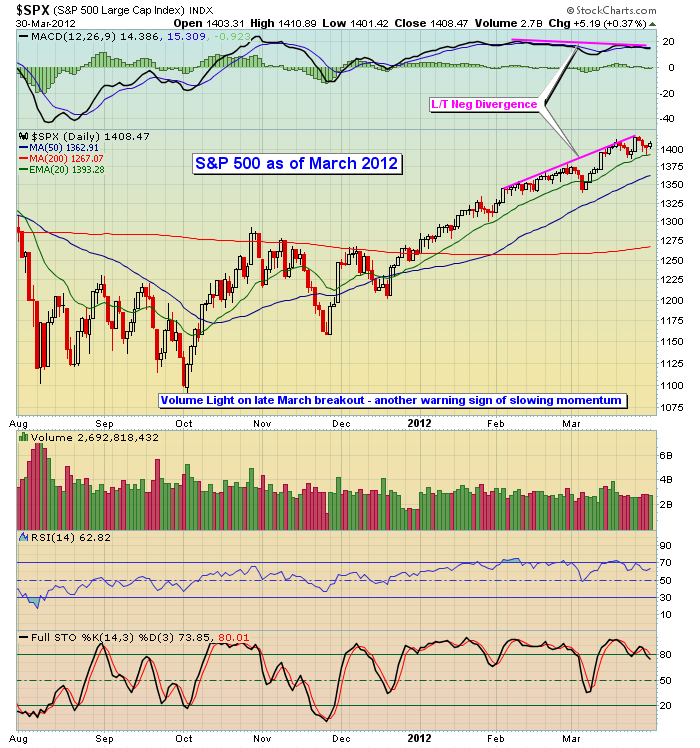

Slowing Momentum Could Pose a Threat to this Rally

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

That's the bad news. The good news is that momentum issues are more of a short-term nature than a long-term one. Still, as traders, we need to respect them just the same.

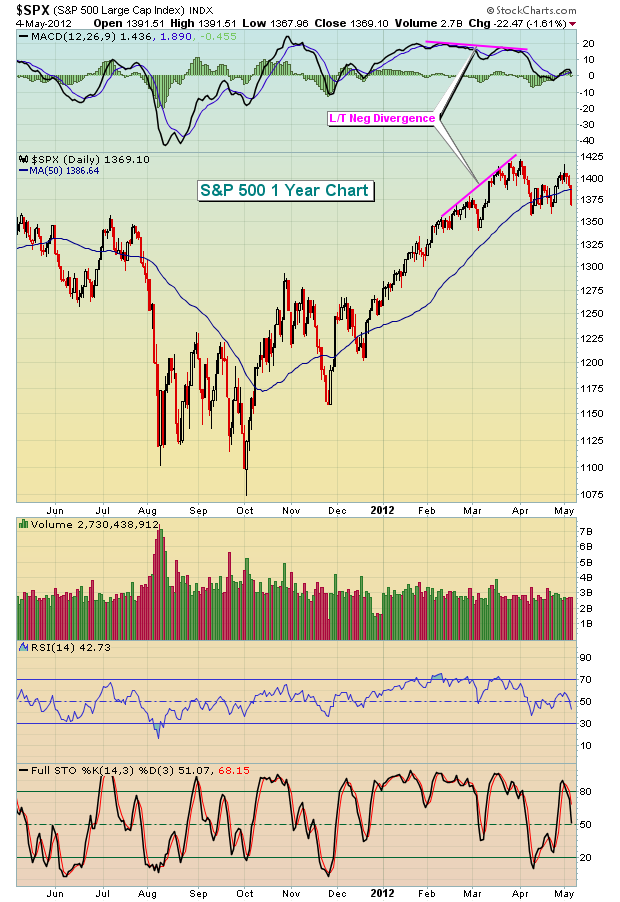

First, let's take a look at the benchmark S&P 500 index on...

READ MORE

MEMBERS ONLY

Technology Turning a Corner

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

So much for "Go away in May"!

I've written in the past that this is VERY misleading information that's routinely provided to the investing public. For example, the month of May is one of the best months of the year to invest in small...

READ MORE

MEMBERS ONLY

Earnings Really Do Matter

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Every quarter, my goal is to identify the absolute best stocks that I can find from both a technical and fundamental standpoint. I am a firm believer that stocks beating expectations, raising guidance, trading extraordinarily high amounts of volume and printing bullish candlesticks have much better odds of trading higher...

READ MORE

MEMBERS ONLY

VIX Soars But Remains Postured in Downtrend

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

At its highest level last week (Thursday afternoon), the VIX was up 50% from its prior Friday close. That's a HUGE spike in volatility.

Volatility, as measured by the CBOE Volatility Index (VIX), provides us a gauge of fear in the stock market. The VIX measures the market&...

READ MORE

MEMBERS ONLY

Earnings Season Brings New Opportunities

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

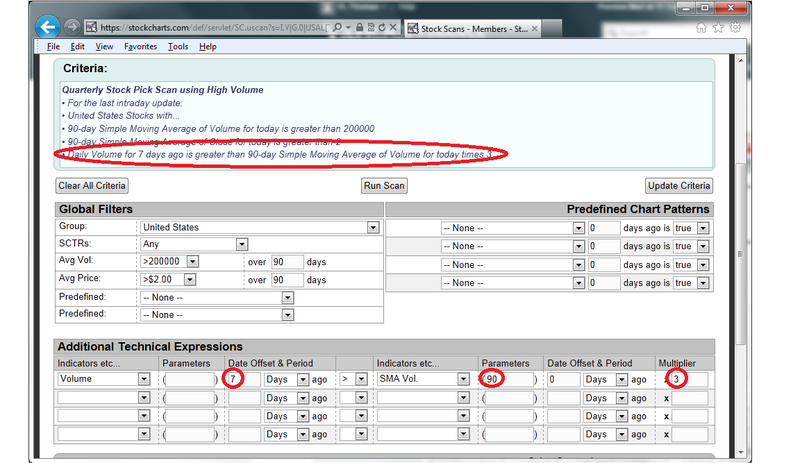

This is my favorite time of the quarter. Being a "technifundamentalist", I like finding companies that look solid both technically and fundamentally and concentrate my trading efforts there. For me, it all begins with volume. If a company reports earnings and receives a ho-hum response in terms of...

READ MORE

MEMBERS ONLY

The MACD Reset

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

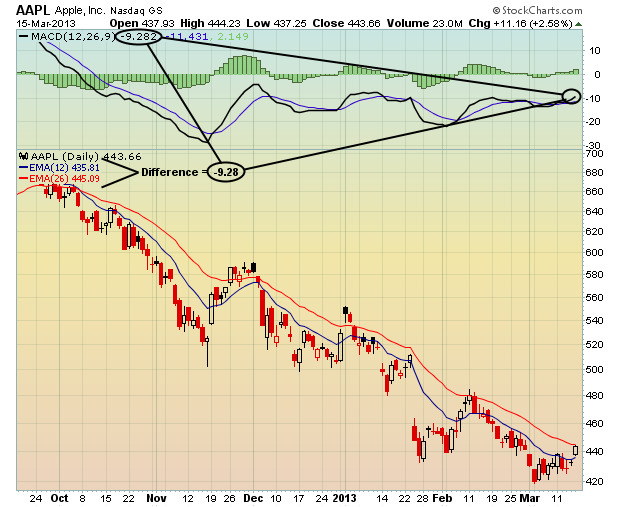

Personally, I love the MACD. It's one of my favorite technical tools when trading. It's not perfect - nothing is - but it does provide us a snapshot of momentum of a stock or index. The MACD is nothing more than the difference between two exponential...

READ MORE

MEMBERS ONLY

DEFENSIVE SECTORS SHOWING RELATIVE STRENGTH

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

In my last article, I laid out several arguments why it would make sense to be more cautious as you approach the stock market. I'm bullish for the balance of 2013 - at least as of now - but the short-term has definitely turned more dicey. One of...

READ MORE

MEMBERS ONLY

Six Important Short-Term Warning Signs for This Market

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I remain bullish for 2013 and believe we could see 1700-1800 on the S&P 500 before the year is over. But I can't deny the short-term warning signs that are showing up everywhere. Let's take the issues one at a time.

1. Historical Tailwinds...

READ MORE

MEMBERS ONLY

ENERGY'S RALLYING, WHAT'S NEXT?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Energy apparently has more fuel in the tank. After underperforming the past couple years, it has rocketed higher to start 2013 and was the leading sector during what was a VERY solid January. As a student of history, that January strength bodes well for the stock market during the balance...

READ MORE

MEMBERS ONLY

The Best Sector for 2013

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Technicals do change and I reserve the right to change my opinion as price action evolves, but the energy sector looks like THE ONE for 2013. I remain bullish the stock market overall so I expect most sectors will perform well in 2013. Keep in mind that money rotates from...

READ MORE

MEMBERS ONLY

GAUGING THE JANUARY EFFECT

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Happy New Year!!! Here's to good health and good fortune in 2013!

Now is the time when market pundits give their predictions for the stock market for the upcoming year. While it might be entertaining to try to figure out where the S&P 500 might finish...

READ MORE

MEMBERS ONLY

SMALL CAPS LEADING THE DECEMBER CHARGE - AGAIN

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

To historians, this doesn't come as a surprise. Since 1987, the Russell 2000 has produced annualized returns during the month of December of 43.38%. April is the next best month for small caps with its annualized return of 21.84%, a very distant second. Over the past...

READ MORE

MEMBERS ONLY

HOMEBUILDERS SEEING CRACKS IN THE FOUNDATION

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Homebuilders have been a leading industry group throughout the S&P 500 rally off the 2009 lows. This strength has been particularly obvious over the past year. Looking strictly at a shorter-term chart, technical indicators couldn't look much better. Check it out:

While homebuilders did fall below...

READ MORE

MEMBERS ONLY

SHORT-TERM "TECHNICAL CLIFF"

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

All the recent talk has centered around the effect of a potential fiscal cliff. While we may or may not be subject to a fiscal cliff, each and every one of us has been subject to the recent technical cliff, especially the one since election day. Things have gone from...

READ MORE

MEMBERS ONLY

IS IT TIME TO RE-ENTER GOLD?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

One month ago, I discussed the increased risk of holding gold as key price resistance was being tested with a long-term negative divergence on the MACD present. That was a sign of slowing momentum and that, combined with price resistance, simply tells us to grab profits and respect the resistance...

READ MORE

MEMBERS ONLY

Financials and Technology Stocks Diverging

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

October has been a very strange month thus far. While most of our sectors are trading close to the flat line for the month, financials and technology are heading in opposite directions. I can't recall a two week period where the returns of these two influential sectors diverged...

READ MORE

MEMBERS ONLY

FOURTH QUARTER OUTLOOK

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

To be honest, I'm not a big fan of providing outlooks too far into the future because prices change continually. As a technician, I realize charts can change daily. Therefore, I have to be willing to change my thinking on a dime and, if you're managing...

READ MORE

MEMBERS ONLY

QE3 SENDS SHORTS SCURRYING

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Living in the Washington DC area, I'm not sure which was more exciting - QE3 or RG3!

The market was set up for higher prices as traders anticipated more quantitative easing. Fed Chairman Bernanke did not disappoint. By providing a third round of quantatative easing, the Fed aims...

READ MORE

MEMBERS ONLY

THE GOLD RUSH IS ON

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Before I take a look at the bigger picture, there were a couple rather bullish signs on the one year chart for gold the past few weeks. Take a look:

After testing descending triangle support (you'll see that in the 5 year chart below) in mid-May, gold began...

READ MORE

MEMBERS ONLY

COMBINING FUNDAMENTALS AND TECHNICALS TO PRODUCE SUPERIOR RESULTS

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

First, let me say that it was AWESOME meeting so many of you at Chartcon 2012 in Seattle last week. It was also great to finally meet several of the co-authors of ChartWatchers. I've been to a LOT of trading conferences and this one surpassed all of the...

READ MORE

MEMBERS ONLY

AGGRESSIVE INDICES AND SECTORS FLASHING A WARNING?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Any time the S&P 500 moves to fresh new highs, I try to determine the likelihood that the move is a sustainable one. Traders need to be in the right mindset to carry prices further. They need to be aggressive in terms of where they place their trading...

READ MORE

MEMBERS ONLY

DIVERGENCES PROVIDE ADVANCED WARNINGS

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I know many traders view the MACD to be a lagging indicator and technically it is. After all, the calculation of the MACD uses historical price data so how could it not be a lagging indicator? Well, I can only tell you that I use the MACD for advanced calls...

READ MORE

MEMBERS ONLY

CRUDE OIL SIGNALS POTENTIAL BOTTOM

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Reasonably bullish signs have emerged, the latest being that crude oil prices (finally!) found support at 2 year lows near $76-$77 per barrel. Not only was price support tested, but slowing momentum was obvious in the form of a long-term positive divergence. It's always nice to see...

READ MORE

MEMBERS ONLY

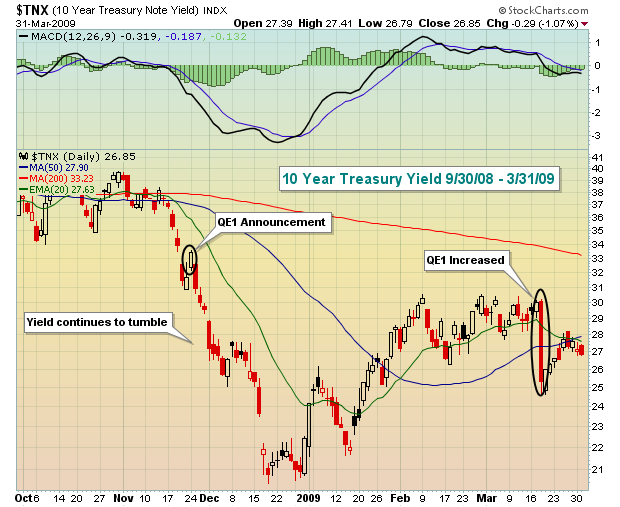

BOND TRADERS GET IT RIGHT - AGAIN!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

All traders must decide whether to invest their dollars aggressively or conservatively. It's a basic principle, yet following the flow of such dollars can provide us valuable clues about the likely direction of the stock market. For me, it's a simple case of tracking the 10...

READ MORE

MEMBERS ONLY

MOMENTUM IS CREATING OPPORTUNITIES - ON THE BEARISH SIDE

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The long-term negative divergences that printed in February and March provided us clues that we'd at least see some near-term trepidation and possibly something much worse. Well, the "much worse" has arrived. There is no technical sign - bullish or bearish - that ever provides us...

READ MORE

MEMBERS ONLY

TIME TO CHERRY PICK

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Everything seemed perfectly aligned for the bulls. In March, slowing momentum on the bulls' side was a growing concern, but the consolidation that took place in the latter part of March and throughout April relieved that concern, so technically it appeared the bulls might resume control of the action....

READ MORE

MEMBERS ONLY

MARKET MAKERS SCORE AN EMPTY NET GOAL

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Once a month, the stock market provides us a unique opportunity. In basketball terms, it's like the market makers have the ball with time running out in the quarter - or the game - and they nearly always bury that critical three-pointer. For those more predisposed to hockey,...

READ MORE

MEMBERS ONLY

SPRING INTO SMALL CAPS

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I'm not quite sure why, but there definitely is a positive bias towards small cap stocks as we approach the Spring season. April and May are the 2nd and 3rd best calendar months in terms of annualized returns on the Russell 2000. Only December boasts a better monthly...

READ MORE

MEMBERS ONLY

COMMON MACD MISCONCEPTIONS

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

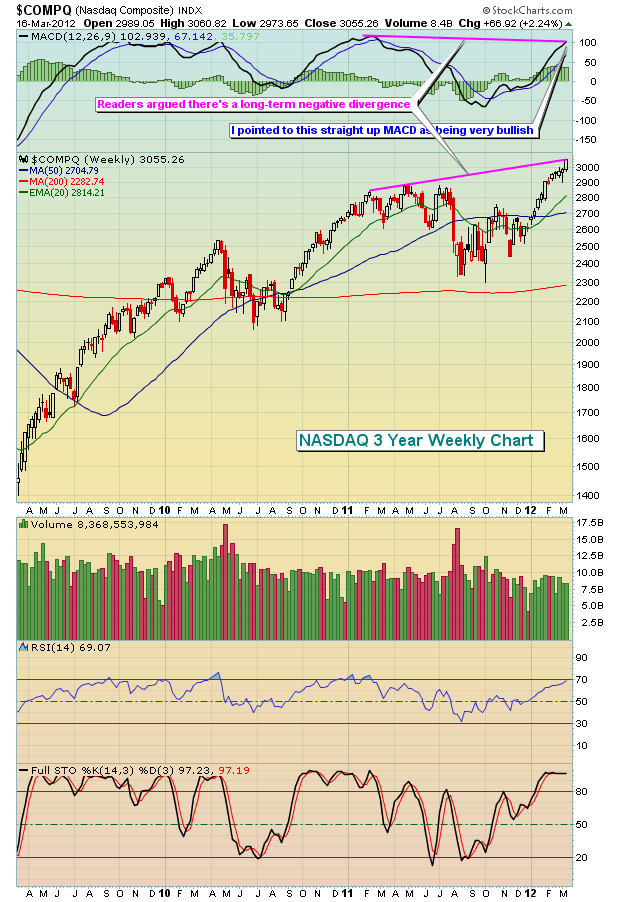

In my last article, I featured a weekly NASDAQ chart and pointed out that the MACD was coming up off the centerline and pointing higher. I indicated this was a very bullish signal for the intermediate- to longer-term and supported my belief that equity prices would continue to rise in...

READ MORE

MEMBERS ONLY

BANKING ON A STRONG 2012

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

In earlier articles, I wrote about key upcoming resistance on banks and the "January Effect". Very strong performance in January suggests that equities will continue to rally throughout 2012. If the recent performance in the banking industry is any indication, consider it confirmation.

If you study history, you&...

READ MORE

MEMBERS ONLY

THE BULLISH MOVE IN GOLD ISN'T OVER

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

It takes time and patience for continuation patterns to play out. Many traders grow frustrated, especially after the stealth move higher ends because of the time involved for continuation patterns to form. The current bull market in gold has lasted more than a decade and there are few technical signs...

READ MORE

MEMBERS ONLY

THE JANUARY EFFECT

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Two weeks ago, I wrote that equities were very overbought and quite complacent. While we didn't see any selling of substance, the market did struggle to move up - that is, until Friday's Nonfarm Payrolls hit the wires. What a blowout number it was!

Let'...

READ MORE

MEMBERS ONLY

COMPLACENCY SCREAMS "GET OUT" SHORT-TERM

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

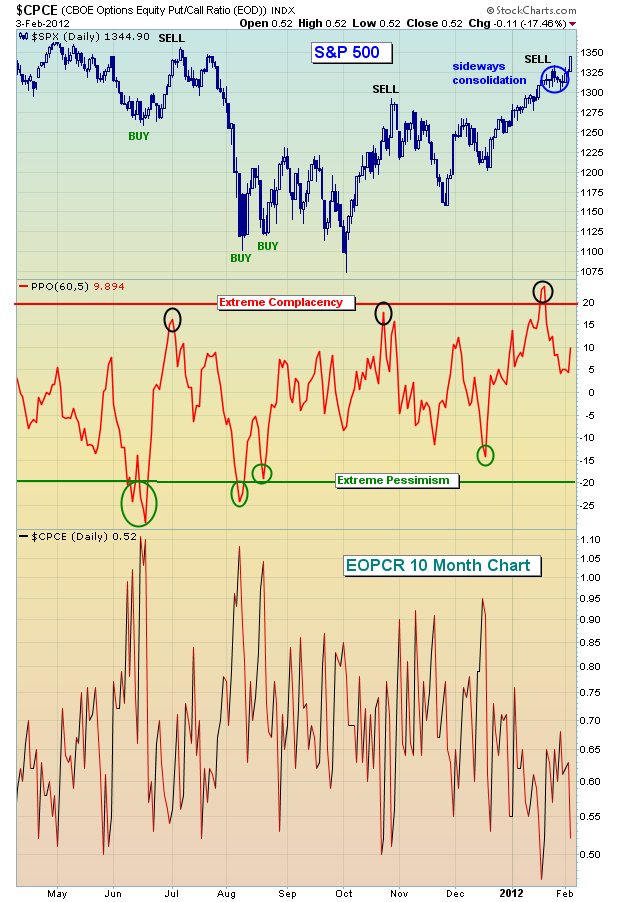

Ok, I'll admit I'm being a little dramatic. But everyone should know how I feel about my favorite sentiment indicator - Relative Complacency/Pessimism. One month ago as the market was dropping, I wrote about how relative pessimism was building and how that could limit the...

READ MORE