MEMBERS ONLY

VOLATILITY HITS SUPPORT WHILE THE S&P 500 AND BANKS HIT RESISTANCE

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

High volatility is generally associated with declining equity prices. The inverse is true as a declining level of volatility emboldens the bulls. Therefore, I follow the VIX continually to get a sense of DIRECTION. Clearly, the volatility index (VIX) has been trending lower over the past few months. So it...

READ MORE

MEMBERS ONLY

2012 MARKET OUTLOOK

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I always find myself turning my attention to "next year" in the stock market as we enter the December holiday season. On many fronts, 2011 has been the most challenging year in equities that I've ever seen. Sure, the losses in 2008 and the fear that...

READ MORE

MEMBERS ONLY

DEFENSIVE SECTORS HITTING RESISTANCE BUT REMAIN RELATIVE LEADERS

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

With one week left to go, the S&P 500 was on the verge of its worst November in the last sixty years. Then the Fed and other central bankers came to the rescue of global markets last week and everything was just peachy again (sarcasm intended). November turned...

READ MORE

MEMBERS ONLY

OPTIONS MANIPULATION

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

For an options expiration week, volume was quite light. Any time volume is light, the threat of market manipulation grows. As we headed into last week, max pain suggested a potential 2.5%-3.5% move lower in equity prices, depending on the index. With hindsight now, we see the...

READ MORE

MEMBERS ONLY

FINANCIALS STILL HOLD THE KEY

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

When you review the history of the stock market, you see that financials tend to hold the key for whether a stock market advance is sustainable or not. The long-term chart below still raises questions about the sustainability of not only the October rally, but also the multi-year rally off...

READ MORE

MEMBERS ONLY

TECHNOLOGY AND CONSUMER DISCRETIONARY LEADING RALLY INTO EARNINGS

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The market has spoken. If you're looking for nice earnings surprises for the third quarter, or perhaps raised guidance on a forward-looking basis, look no further than the technology and consumer discretionary sectors. This past week, we saw a very positive earnings report from Google (GOOG), while commodity...

READ MORE

MEMBERS ONLY

WEEKLY MACDs REMAIN QUITE BEARISH

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The weekly moving average convergence divergence (MACD) has always been a favorite indicator of mine. It provides a "big picture" outlook of the market and helps me take a step back from the day to day swings of the market. With the Volatility Index (VIX) in the stratosphere...

READ MORE

MEMBERS ONLY

ANOTHER ROUND OF TARP FOR THE BELEAGUERED FINANCIALS

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I'm not buying this rally - not yet anyway. This past Sunday night, I calculated max pain for the ETFs that track our major indices. After staring at the numbers, I wondered "can they do it again"? By "they", I meant the market makers....

READ MORE

MEMBERS ONLY

MORE BEAR MARKET SIGNS EMERGE

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Wednesday at noon, the Dow Jones and NASDAQ were both testing critical resistance. Here's an excerpt from my daily Market Chatter mailed out close to noon EST on Wednesday:

"We certainly don't like the action thus far today. A rather significant reversal is possibly underway...

READ MORE

MEMBERS ONLY

IN AN EMOTIONAL MARKET, LET SENTIMENT BE YOUR GUIDE

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

If the stock market were a mental health patient, it would have been committed by now. Major trend changes are occurring at points of wild volatility and extreme fear. I've written many times in the past about my favorite sentiment indicator - the equity only put call ratio...

READ MORE

MEMBERS ONLY

DEJA VU - 2011 IS LOOKING A LOT LIKE 2004

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

If you recall, stocks were mired in an ugly bear market from 2000 through 2002. At the end of that bear market, however, the S&P 500 staged a huge advance, running specifically from 789 in March of 2003 to 1163 by March 2004. After that big climb, there...

READ MORE

MEMBERS ONLY

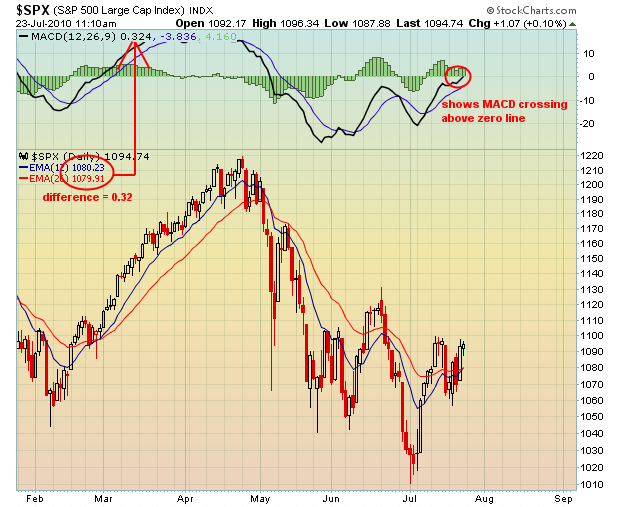

MACD DIVERGENCES

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Gerald Appel created the MACD in the late 1970s. It's a momentum oscillator that serves to gauge the strength and direction of a trend, but what I find most useful is its ability to predict a reversal. If you like to short weak stocks, I can't...

READ MORE

MEMBERS ONLY

DON'T GOT TO WAR WITH WALL STREET WITH A WATER PISTOL

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I was certainly looking for a bounce last week, but if I'm being honest, I wasn't looking for THAT kind of bounce. Our major indices all gained over 5% in just one week. That's not a bad return for a YEAR!!!

There were definitely...

READ MORE

MEMBERS ONLY

THE VIX SAYS IT ALL

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Traders are expecting the horrible market we've seen thus far in June to only get worse. The VIX is the ticker symbol for the Chicago Board Options Exchange Market Volatility Index. It measures implied volatility of S&P 500 index options, or the "expectations" of...

READ MORE

MEMBERS ONLY

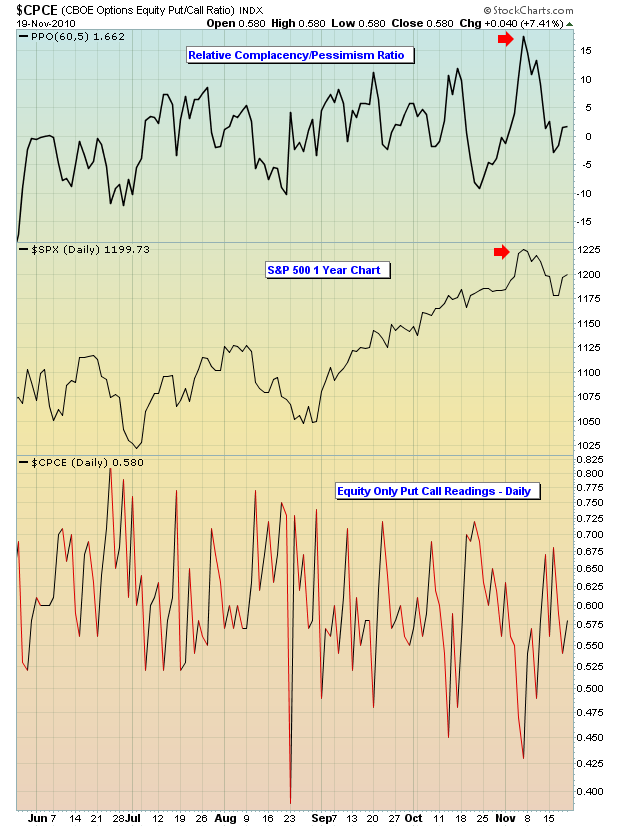

COMPLACENCY CONFIRMS A TOP

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

There are many sentiment indicators that can be followed but the two I most closely follow are the Volatility Index (VIX) and the Equity Only Put Call Ratio (EOPCR). There are sentiment gauges that tell you how investment letter newswriters "feel" about the market. Personally, I'd...

READ MORE

MEMBERS ONLY

BULLS ON THE DEFENSIVE

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

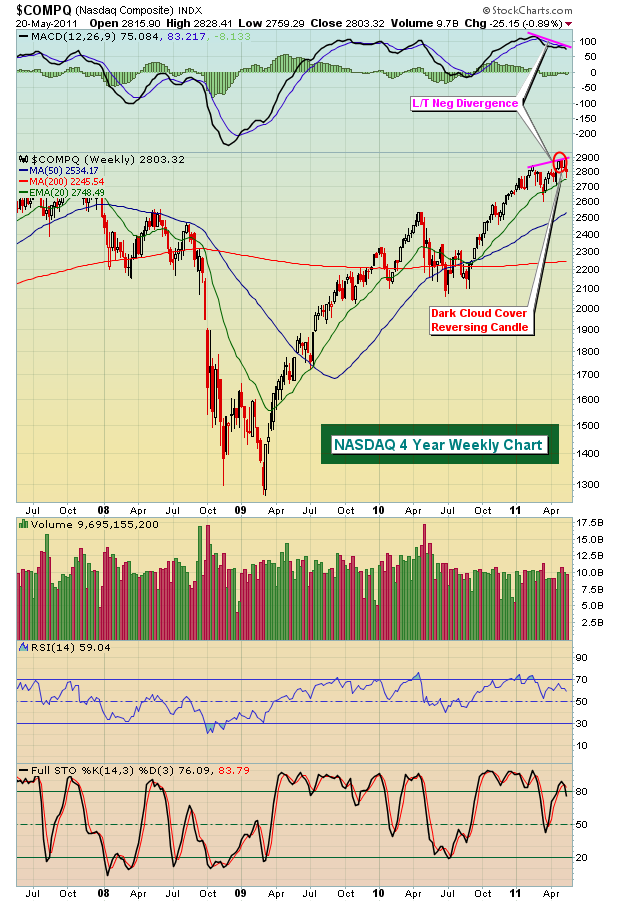

Issues are mounting and the pressure is definitely weighing on the bulls. While we haven't seen any major breakdowns to confirm several bearish signs, you should be approaching the market with caution in my opinion.

In my last article, I discussed one of the warning signs - the...

READ MORE

MEMBERS ONLY

THE TALE OF TWO MARKETS

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

It was a little more than one year ago - in April 2010 - that I began warning about a potential top approaching. We now know what happened in May and June of that year. Well, the warning signs are mounting again and, barring technical changes, we could be in...

READ MORE

MEMBERS ONLY

USING THE PPO INDICATOR

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

If you plot the Percentage Price Oscillator (PPO - 12,26,9) on an index or individual stock chart next to the MACD (12,26,9), you'll find that they appear to be identical. Let's use Wynn Resorts (WYNN) as an example. Below I show how...

READ MORE

MEMBERS ONLY

LONG-TERM TECHNICALS AND RISING PESSIMISM TRUMPS SHORT-TERM BREAKDOWN

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Let's face it. Two weeks ago, the market looked cooked. There didn't appear to be a single drop of gas left in the bulls' tank. We saw impulsive selling. The volume surged on the selling. Daily charts had already printed long-term negative divergences across our...

READ MORE

MEMBERS ONLY

DA BEARS ARE IN CHARGE!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

For the first time since August 2010, the bears are in control of the short-term action. I haven't lost sight of the intermediate- and long-term uptrends that are in place (which remain bullish), but I also am not going to ignore the clear breakdowns of the past few...

READ MORE

MEMBERS ONLY

FINALLY CONSOLIDATION!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

It's hard to believe it's been two years since that infamous 2009 March bottom. I'm going to focus on the NASDAQ for purposes of today's article. Let's take a quick look at the advance since late August 2010 to gain...

READ MORE

MEMBERS ONLY

INSURING A SOLID RETURN

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

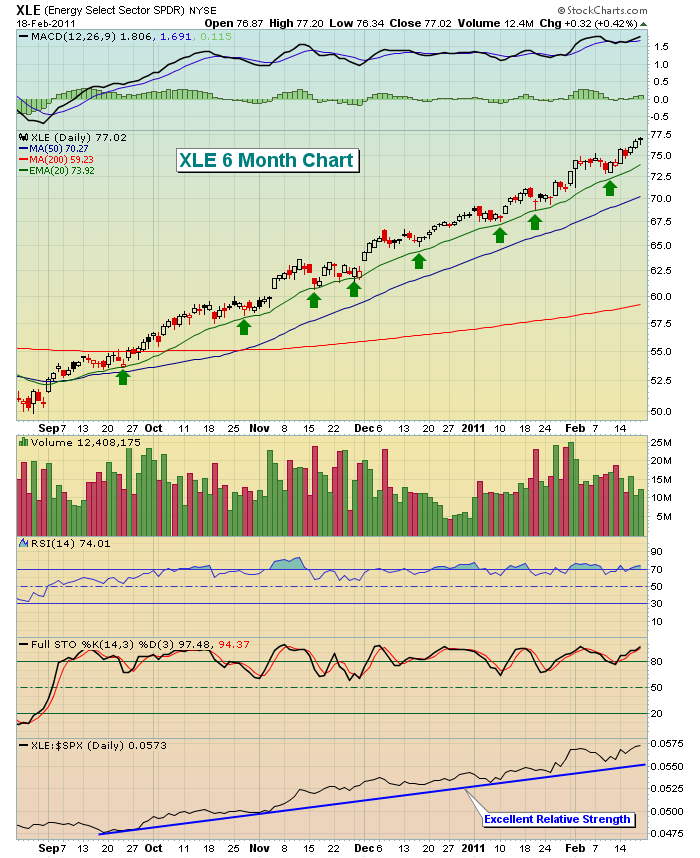

One thing that's been quite apparent to me over the past several months is that money is not leaving the equity market. When one sector or industry group sells off, the money simply rotates elsewhere. Then rinse and repeat. This is truly a trader's dream because...

READ MORE

MEMBERS ONLY

POSITION SIZING AND HIGH REWARD TO RISK SETUPS ARE CRITICAL

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Attempting to short this market prior to any significant breakdown is the equivalent of financial suicide. Taking profits occasionally, moving into cash, and awaiting entry on a new position is fine. But shorting this uptrend with hopes of a big reversal just makes no sense. Since January 27th, take a...

READ MORE

MEMBERS ONLY

TRADERS ARE ALL IN

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Complacency in the market was setting records this past week. The technicals? They look great. But can the market keep moving higher short -term when options traders are betting on it en masse? Well, maybe, but if you enter stocks on the long side at this level, please understand the...

READ MORE

MEMBERS ONLY

Financials: A Home Run, But Avoid The "Triple" Play

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Happy New Year!!!

The financial sector looks superb as we bring in a new year. I am of the opinion, at least based on current technicals, that 2011 will be a solid stock market year and financials will be a primary reason. I'm looking for solid quarterly earnings...

READ MORE

MEMBERS ONLY

TRADING RESOLUTIONS FOR 2011

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

It's hard to believe another year is coming to an end. Outside of a few scary weeks, the stock market performed well in 2010 and heads toward 2011 with a lot of bullish momentum. Complacency is a short-term issue that we dealt with last week and will continue...

READ MORE

MEMBERS ONLY

DIVERGENCES INDICATE SLOWING MOMENTUM IN LEADING SECTORS

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Complacency was the big issue for stock market bulls as we entered the second week of November. The market simply ran too far too fast and everyone began piling in on the equity calls as if the buying would never end. Well, guess what? The buying ended! The market topped...

READ MORE

MEMBERS ONLY

COMPLACENCY ONCE AGAIN MARKS TOP

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The top in April was laced with warning signs, from record complacency to negative divergences on daily and weekly MACDs to underperforming financials to overbought oscillators to oversold bonds. In particular, the negative divergence on the MACD on the weekly charts suggested the weakness was likely to last. Recently, complacency...

READ MORE

MEMBERS ONLY

MARKET GLASS HALF FULL OR HALF EMPTY?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

It's been a breathtaking move. The NASDAQ was trading near the 2100 level at the end of August. Friday it closed at 2579. That's more than a 25% move in just over two months. Of course that followed a 17% decline from April through August. The...

READ MORE

MEMBERS ONLY

A LOOK AT THE FINANCIALS

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I spend a great deal of time evaluating the financial sector because I believe it's the most influential group in terms of leading the market. Financials underperformed miserably in 2007 and 2008 and overall market performance followed suit. In 2009, financials outperformed and the market recovered a lot...

READ MORE

MEMBERS ONLY

IS THIS RALLY SUSTAINABLE?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Great question. There are as many arguments saying "no" as there are those saying "yes". Who do you believe? In August, our major indices were tumbling and it seemed like every media outlet was touting our doom and gloom. By the end of September, psychologically it...

READ MORE

MEMBERS ONLY

FINDING THE NEW EMERGING LEADERS

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Let's do a case study.

Wouldn't it be great to find the next Google (GOOG) or Apple (AAPL) in the early stages, before the meteoric rise? It's definitely possible, but it takes homework and TONS of patience. Every great long-term performer goes through similar...

READ MORE

MEMBERS ONLY

FOUR KEYS TO A CONTINUING RALLY

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Semiconductors. Financials. Small Caps. 10 Year Treasury Yields.

Take a look at the following chart as the relative performance of each of the above is plotted against the S&P 500:

These are four of the biggest reasons why the market hasn't been able to sustain a...

READ MORE

MEMBERS ONLY

S&P 500 FAIL AT CRITICAL RESISTANCE

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

With a myriad of "under the surface" problems, the S&P 500 simply ran out of gas at a very inopportune time. The bulls were on the threshold of a major breakout on the S&P 500 above its June highs near 1131. For seven consecutive...

READ MORE

MEMBERS ONLY

Making Cents in a Wacky Market

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Yep, you read the headline correctly. I want to personally congratulate you if you're able to successfully trade this market. Because it ain't easy. Friday was yet another example. Not only did the report fall well short of expectations on the July jobs, the revision to...

READ MORE

MEMBERS ONLY

UNDERSTANDING DIVERGENCE

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Divergences are among the most misused technical analysis tool anywhere, in my opinion. The first step in successful trading using divergences is understanding both their strengths and their limitations. My preference is to focus on divergences as they relate to the Moving Average Convergence Divergence (MACD). Others use divergences on...

READ MORE

MEMBERS ONLY

THE MID-YEAR UPDATE

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

In the life of a technical analyst, a month seems like a week, a week seems like a day and a day seems like minutes. Time flies and so do the charts and various technical patterns. I think it's always a good idea to periodically take a step...

READ MORE

MEMBERS ONLY

TIME FOR JUICED ETFS?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The market is at a crossroads short-term. We've been bouncing back and forth after that early May drubbing. So is the rally ending or is it just starting? Well, we can only look at the technical, sentiment and historical indicators and come up with a "highest probability&...

READ MORE

MEMBERS ONLY

Look out Below!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Technically, this hasn't been brain surgery. Our major indices broke down in early May on very heavy volume and, as technicians, we can never ignore that lethal price/volume combination. The weakness also came on the heels of some of the most extreme complacency that I've...

READ MORE

MEMBERS ONLY

THE PITFALLS OF INCREASING VOLATILITY

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Many traders look at volatility and think huge potential rewards. I look at it and think huge potential risks. I know I'm conservative, but it's two different ways of viewing the same market. I concede that if you're on the right side of each...

READ MORE