MEMBERS ONLY

EXTREME SENTIMENT VARIATIONS DRIVING VOLATILITY

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Global stock markets have been quite volatile of late and significant gap ups and gap downs are becoming the norm. While trading gaps may seem impossible at times, there is good news technically from the market selloff that resulted from the debt crisis in Europe. In recent articles, I'...

READ MORE

MEMBERS ONLY

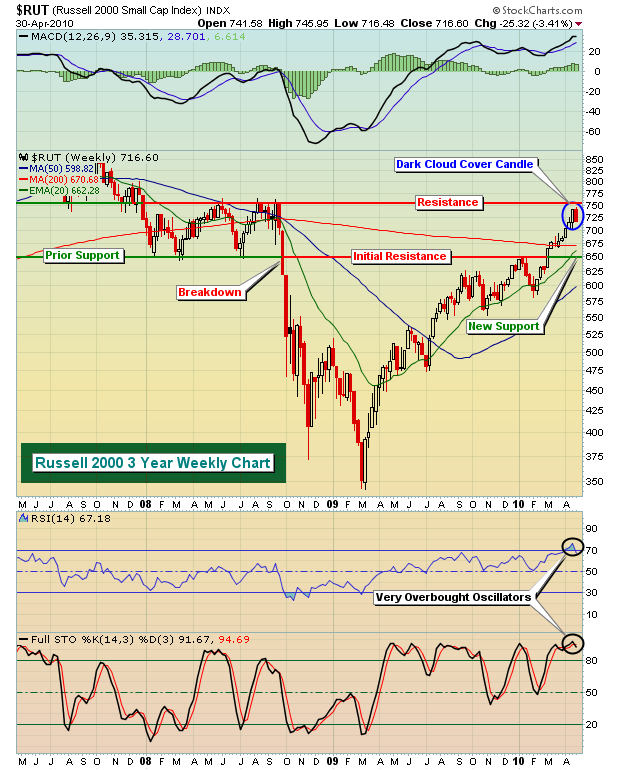

NASDAQ AND RUSSELL 2000 CONFIRM BEARISH SIGNS

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

In my last article I suggested the financials were topping and that would make any further advance in the market difficult. Well this past week the action on the NASDAQ and Russell 2000, home of the high beta stocks, confirmed the bearish action. We've seen several warning signs...

READ MORE

MEMBERS ONLY

FINANCIALS TOPPING?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

In my first article of 2010, I indicated that financials would need to lead on a relative basis in order for us to see strength in overall equity prices this year. Until late last week, financials have performed very well on a relative basis. Take a look visually at what...

READ MORE

MEMBERS ONLY

INDUSTRIALS LEADING THE CHARGE

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

If you're looking for sector leadership in 2010, look no further than the industrials. While other sectors have performed admirably, especially financials and consumer discretionary, none top the 13.13% year-to-date gain that industrials are sporting. Compare that return to the paltry 0.57% gain in technology. Because...

READ MORE

MEMBERS ONLY

THE POWER OF THE REVERSING CANDLE

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Candlesticks and candlestick patterns are the foundation to trading in my view. I use them on every charting timeframe, whether it's a one minute, hourly, daily, weekly or monthly chart. If you're a daytrader or swing trader, trading without the knowledge of reversing candlesticks is doing...

READ MORE

MEMBERS ONLY

SECTOR ROTATION CONTINUES

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Happy Anniversary! It was one year ago, on March 6, 2009, that the S&P 500 made that unforgettable 666 low, completing an amazing drop from above 1300 in August 2008. That represented nearly a 50% decline in the market capitalization of 500 of the largest U.S. companies...

READ MORE

MEMBERS ONLY

TRANSPORTATION STOCKS LAGGING - MORE TURBULENCE AHEAD?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

History is a valuable tool in the stock market as we witness cycles repeating themselves all the time. Our major indices and the various sectors and industries rotate back and forth as our economy moves from strength to weakness and back to strength again. Certain sectors perform better during strong...

READ MORE

MEMBERS ONLY

WHO DAT GONNA GET DEM BEARS?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Relax Chicago. You're not in the Super Bowl this year. I'm just applying a little Super Bowl-mania to the current state of the stock market. The bears are calling the plays.

From a sentiment and technical perspective, this market is really making sense right now. The...

READ MORE

MEMBERS ONLY

IT ALL COMES DOWN TO DEFENSE

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Ask any NFL coach and he'll tell you unequivocably that defense wins championships. If you're looking for market-beating returns, then you'd better improve your defense first, then your offense. Plain and simple, Invested Central did everything possible to prepare defensively for last week'...

READ MORE

MEMBERS ONLY

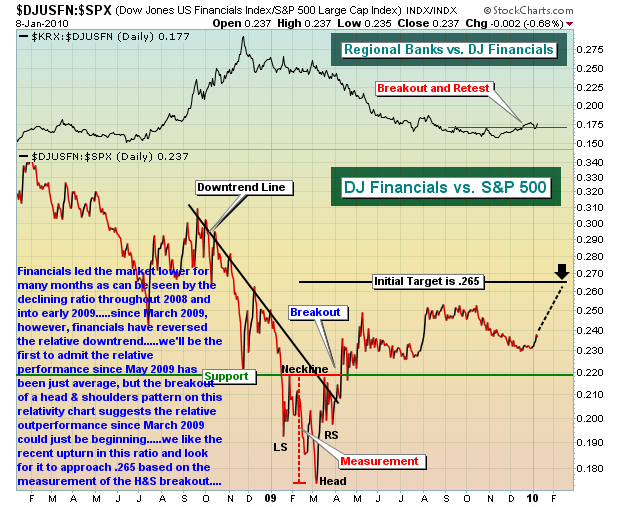

RELATIVE STRENGTH RETURNING TO FINANCIALS

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Happy New Year!!!!

It's been awhile since I've spoken about the financials in a positive light. As sector rotation continues though, it appears as if the financials may get their turn after all. I've been watching bank after bank, financial after financial, either moving...

READ MORE

MEMBERS ONLY

Natural Gas Rising, Gold Falling

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

In my last article I wrote about the recent disconnect between crude oil and oil services stocks. On a relative basis, oil services stocks had severely underperformed the S&P 500 from mid-October to early December despite crude oil prices trading flat to slightly lower. Since that article, oil...

READ MORE

MEMBERS ONLY

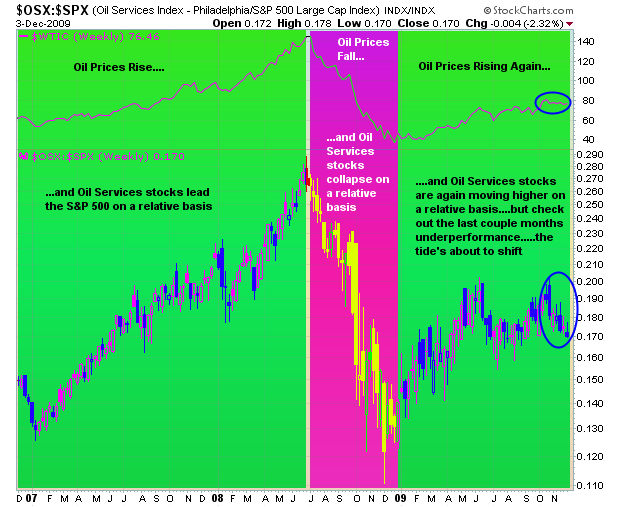

Oil Services Ready to Run?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

When I see a relationship in the market that tends to hold true over time, it always peaks my interest when the market varies from that "norm". That seems to be the case right now with oil services stocks. Generally speaking, when oil prices rise, money flows to...

READ MORE

MEMBERS ONLY

Gold and Silver Bull Market Rages On

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

While there are lots of questions surrounding the sustainability of the stock market advance, there seems to be little resistance ahead for commodities, specifically gold and silver. The U.S. dollar is the primary variable. As you can see from the charts below, gold and silver seem to have no...

READ MORE

MEMBERS ONLY

VOLUME TRENDS REVERSE; H&S PATTERNS EMERGE

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

In my latest article on October 18, I provided a very cautious tone but noted that volume trends remained strong - good news for the bulls! Well, short-term volume trends now have turned negative, though the really key long-term price support levels remain intact. A couple damaging technical developments make...

READ MORE

MEMBERS ONLY

SAFETY FIRST

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

It's very easy to get caught up in the euphoria of this market run. I'd be careful to do that. Invested Central turned from aggressively optimistic to cautiously bullish in early May and we've maintained that more cautious stance since. Call us conservative if...

READ MORE

MEMBERS ONLY

Major Indices Hit Major Resistance and Fail

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I've cautioned recently about the risks of being long in the market. There were too many warning signs. Yes, the market could have kept its head down and pushed to higher levels. But that wouldn't have been the healthy way to extend the recent uptrend. Many...

READ MORE

MEMBERS ONLY

Getting out of the "Zone"

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Autozone (AZO) is setting up rather bearishly in a bear flag formation. Divergences on the MACD within the retail space are weak at best and AZO has been a relative underperformer with its MACD unable to climb above the centerline, one of the few stocks having that difficulty. Watch the...

READ MORE

MEMBERS ONLY

As Risks Rise, Discipline and Stock Selection are Critical

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

In a perfect world, we'd all invest every dime in winning stocks each and every trading day. Unfortunately, I haven't seen that kind of trading world yet. So as we approach each day, we must assess the risks in the market and determine an appropriate trading...

READ MORE

MEMBERS ONLY

Identifying the Cup with Handle Formation

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The cup with handle formation is a powerful continuation pattern. A prior uptrend must exist in order to rely on the cup with handle pattern. Below are two examples of cup with handle patterns that show the cup formation and the powerful breakout moves. In the case of ADSK, we&...

READ MORE

MEMBERS ONLY

CHINA MAY HOLD SOME CLUES

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

China's Shanghai Composite index is swinging wildly in both directions, reminiscent of the 1999-2002 moves by the NASDAQ. From a long-term perspective, you can clearly see that trends in both directions have been exaggerated. Any time that we've seen impulsive moves in one direction or the...

READ MORE

MEMBERS ONLY

Intel's Raised Guidance Lifts Semiconductors to Key Resistance

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Once the SOX broke below the March and July lows of 2008, a new low close of 312 was established in mid-Sept 2008. After a move higher to quickly retest the earlier breakdown area, the SOX fell precipitously into late 2008. After months of trending higher, the SOX had climbed...

READ MORE

MEMBERS ONLY

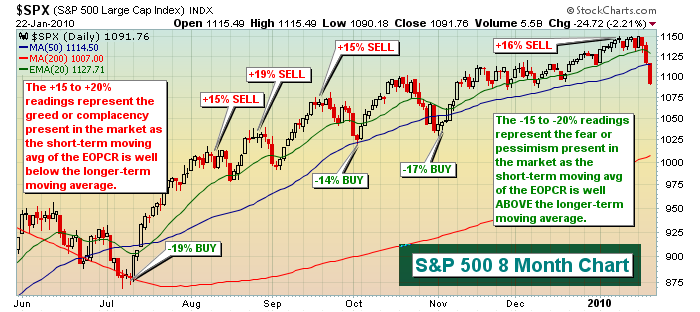

CAUTION IS ADVISED NEAR-TERM

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Two weeks ago, I pointed out what appeared to be the early stages of a new trend of outperformance by the financials and suggested they might be primed for a move higher to rescue the stumbling stock market. Right on cue, money rotated back into financials and we saw the...

READ MORE

MEMBERS ONLY

FINANCIALS TO THE RESCUE?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

During the initial phase of the market recovery, from the March lows to the early May highs, financials were a primary driver of the move. Since that time, financials have lagged badly as sector rotation has caused money to flee to other, better-performing sectors over the last 8 weeks or...

READ MORE

MEMBERS ONLY

Semiconductors Continue As Relative Leaders

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

This first chart really says it all:

Semiconductors are trying to break out on a relative basis. They're trying to do it at a time when the major indices are attempting breakouts of their own. A combination of a relative price breakout in semiconductors while at the same...

READ MORE

MEMBERS ONLY

CORRECTIVE MOVE OR SIGNIFICANT DOWNTREND?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I believe it's the former. Thursday's selloff after the June Employment report was a bit scary, particularly if you're only looking at the magnitude of the point losses. But, in my opinion, no key support levels have been violated. That means the beginning of...

READ MORE

MEMBERS ONLY

Watching for Tech Leadership

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The tech-laden NASDAQ 100 showed considerable relative strength prior to the market bottom in March 2009. Should the NDX:SPX relative ratio break above 1.625, I believe it could lead to additional market strength.

-Tom Bowley

Join Tom and the Invested Central Team at www.investedcentral.com. Invested Central...

READ MORE

MEMBERS ONLY

GOLD SETTING UP FOR MOVE HIGHER

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

There are lots of questions in the market regarding possible inflation, deflation, and general market weakness. One way to hedge against all three is to play gold. Below is a long-term weekly chart that shows gold in a very bullish inverse head & shoulders continuation pattern. The current pattern is...

READ MORE

MEMBERS ONLY

Semiconductors Leading The Charge

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The semiconductor group has been very influential during the recent rally. In fact, the SOX has been outperforming the S&P 500 since late in 2008. A key relative resistance area has been approached, however. Whether the market can sustain a move higher could hinge significantly on how semiconductors...

READ MORE

MEMBERS ONLY

TIME TO TURN CAUTIOUS

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I've been bullish for several weeks now, but the tide is changing. We are running out of historical bullish periods until later in 2009. We have a few periods that are a bit more optimistic, but by and large the stock market remains either neutral or bearish through...

READ MORE

MEMBERS ONLY

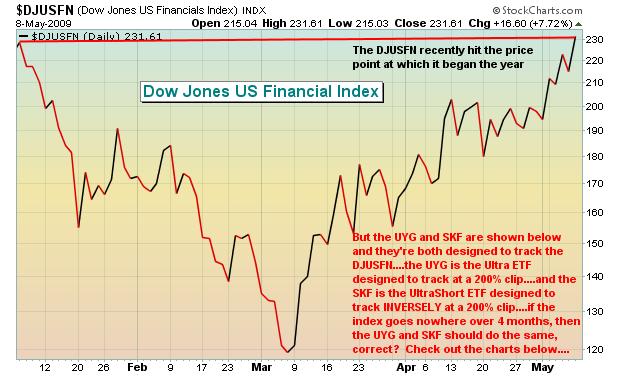

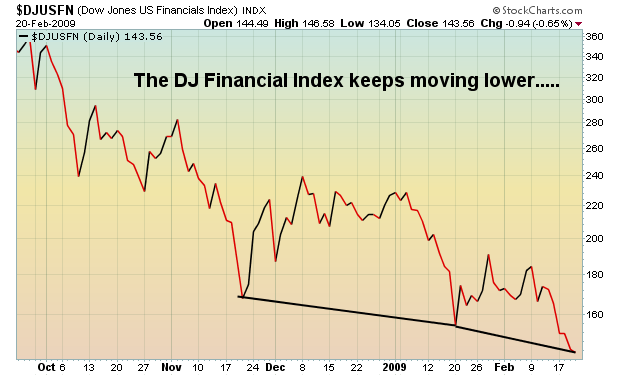

ANOTHER LOOK AT JUICED ETFS

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

In February, I wrote an article discussing the fact that juiced ETFs (ETFs designed to double or inversely double the returns of an underlying index) do not perform as you might expect. There was a huge response to this article and mostly positive feedback. There are plenty of reasons why...

READ MORE

MEMBERS ONLY

GO AWAY IN MAY? REALLY?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Ok, I understand the logic - partially. In order of S&P 500 calendar month performance since 1950, May ranks 8th out of 12 and June ranks 10th out of 12. However, both have produced positive annualized returns and in this period of very low interest rates, does it...

READ MORE

MEMBERS ONLY

DIFFERENT STRATEGIES FOR DIFFERENT MARKETS

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

In my last article, I noted that I was "undeniably bullish". I can tell you that nothing occurred these last two weeks to change my mind. More and more corroborating technicals have lined up to suggest this current rally has legs. Perhaps the most important of them all...

READ MORE

MEMBERS ONLY

UNDERLYING BULLISH SIGNALS STRENGTHENING

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I am undeniably bullish right now. My only question at this point is whether this is a very significant bear market rally or the early legs of a new bull market. Believe it or not, I think it's the latter. As pointed out in my last article, this...

READ MORE

MEMBERS ONLY

LIGHT AT THE END OF THE TUNNEL?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The market performance the last two weeks was very impressive. Was it simply a sequel to the bounces we saw in October and November? That is certainly a possibility, but we saw a few sparks in this rally. For instance, the volume that exploded in financials must be respected. Perhaps...

READ MORE

MEMBERS ONLY

WHERE'S THE FEAR?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Significant market bottoms generally share many key characteristics. I like to see a spike in volume to get that last wave of selling in place. During this "panicked" phase, it's also important to see pessimism rise to a relative level where we can be fairly confident...

READ MORE

MEMBERS ONLY

JUICING UP YOUR RETURNS

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I receive a lot of questions regarding the "ultra" shares and "ultrashort" shares and how to effectively trade them. In particular, there are always questions asking why those "juiced" ETF returns don't correspond to the indices they're supposed to track...

READ MORE

MEMBERS ONLY

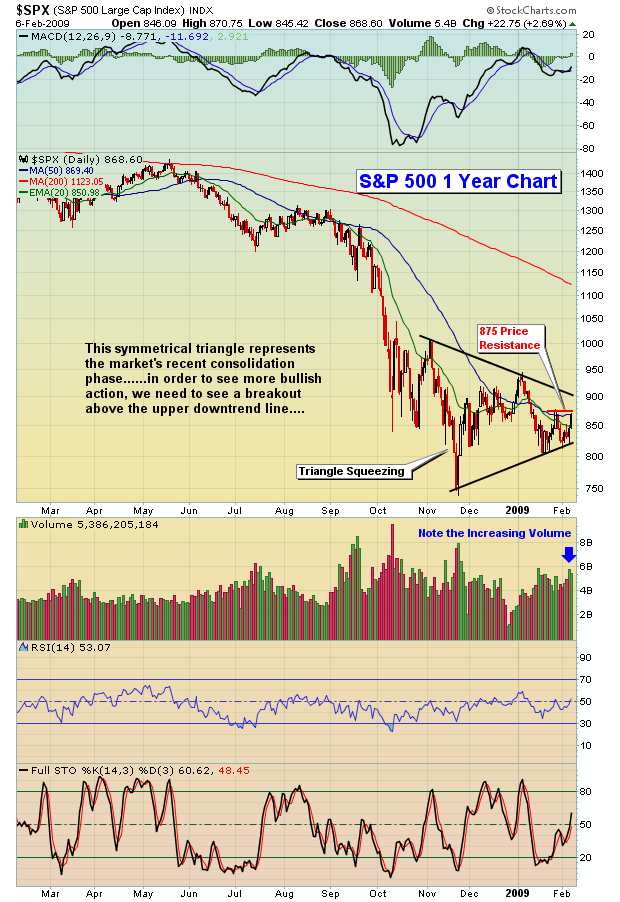

BERMUDA TRIANGLE - WALL STREET STYLE

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

We've seen this all before. The sure-fire short setups get waxed as trendline support holds. Then the bulls grow confident as the market soars only to get turned back by trendline resistance. The cycle continues to repeat itself until we get resolution. If you time your entries perfectly,...

READ MORE