MEMBERS ONLY

A New Round of Crypto Strength Seems to be Around the Corner!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The interest in Bitcoin or, more generally, cryptocurrencies comes and goes, and the moves are highly volatile from time to time. Nevertheless, this investment space is becoming more and more mainstream and, no matter what your personal opinion is, it is more and more a force to be reckoned with....

READ MORE

MEMBERS ONLY

Two Trade Ideas Along with Key Levels for the Stock Market to Hold

Although we've had a choppy week in the market, key areas held in the major indices, showing upside potential for Monday. Currently, the main support levels are near the 50-day moving average (blue line) in the Dow Jones (DIA), Russell 2000 (IWM), Nasdaq 100 (QQQ) and the S&...

READ MORE

MEMBERS ONLY

How I Combat Disinformation And Prevent It From Corrupting My Portfolio With 5 Essential Tools

by Gatis Roze,

Author, "Tensile Trading"

Recently, academic researchers have proven and quantified the impact of fake news and how it sways stock prices to the tune of approximately 7% with small-caps, 5% with mid-caps and somewhat less with large-caps. Disinformation and propaganda is all around us. As investors, we must be attuned to how these...

READ MORE

MEMBERS ONLY

Uptrend or Pullback?

by TG Watkins,

Director of Stocks, Simpler Trading

In this week's edition of Moxie Indicator Minutes, TG lays out examples of how the market may move after the pullback he is expecting. Then, he will explain what an up trend might look like, even though it may be into resistance vs. a pullback that finds no...

READ MORE

MEMBERS ONLY

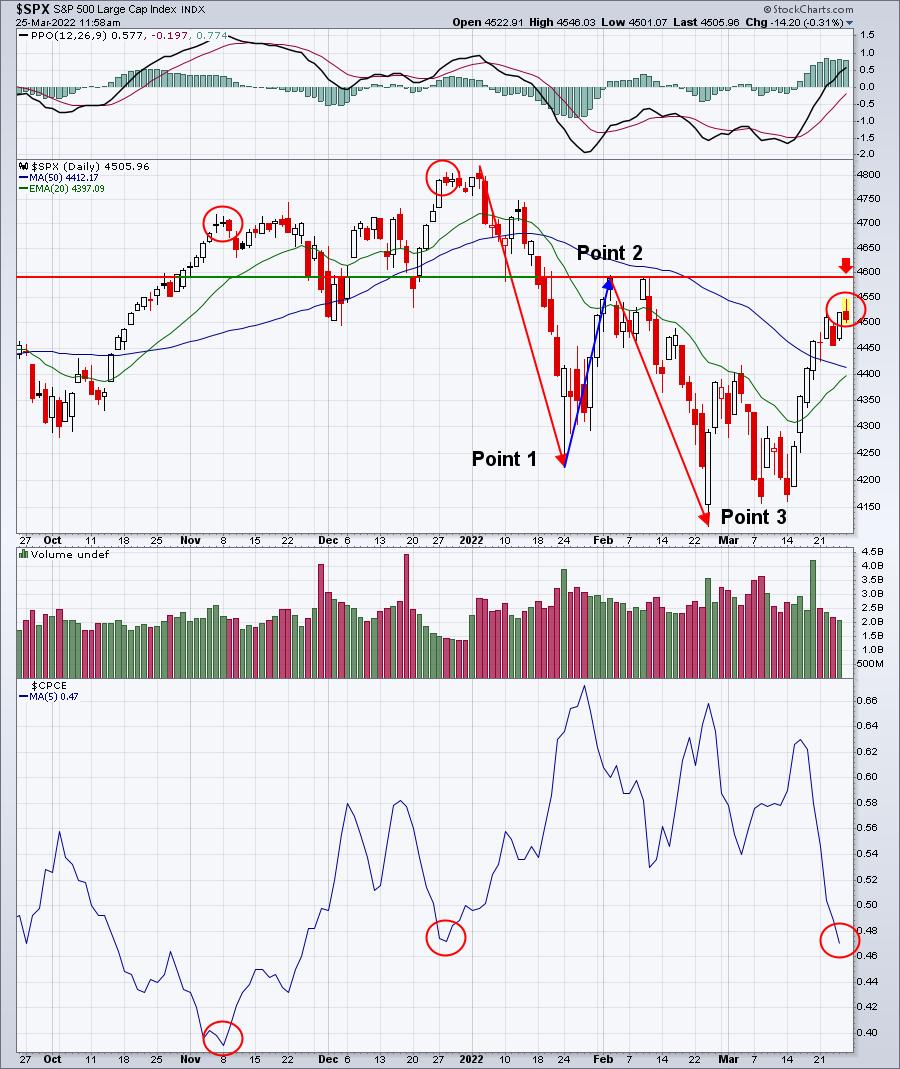

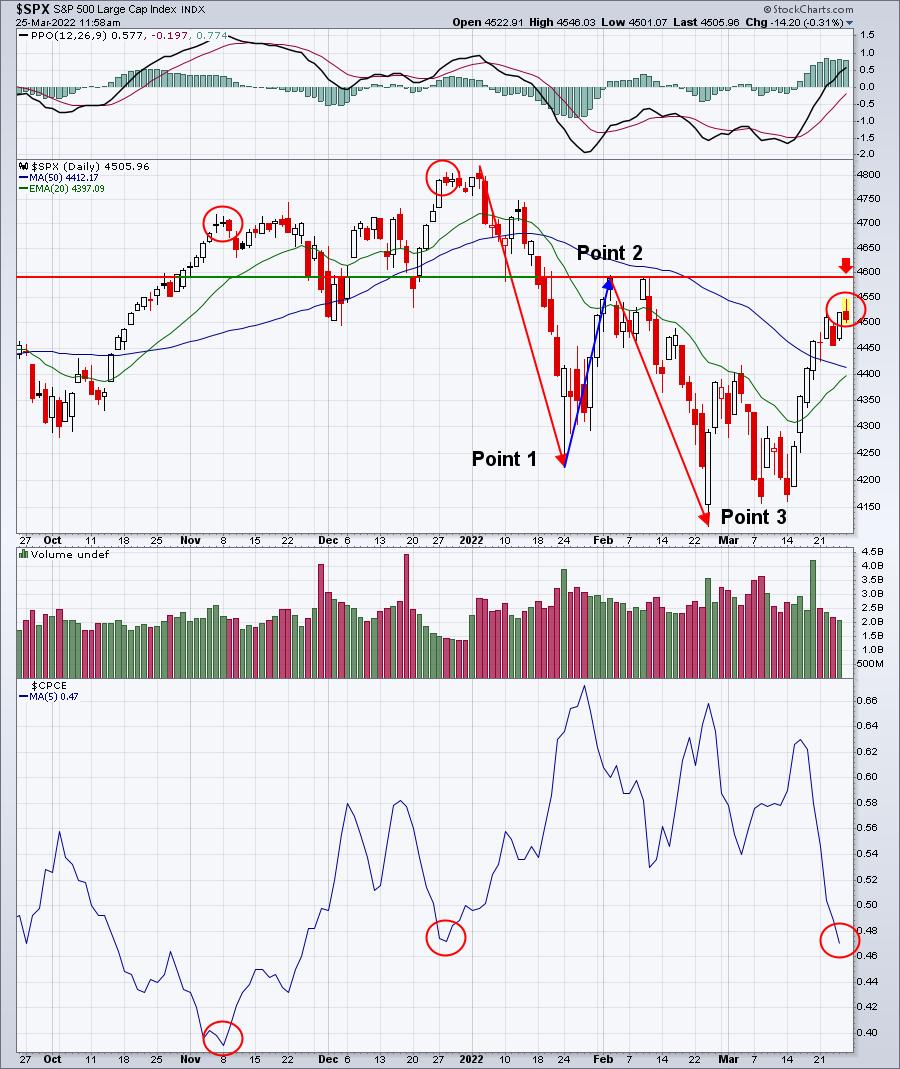

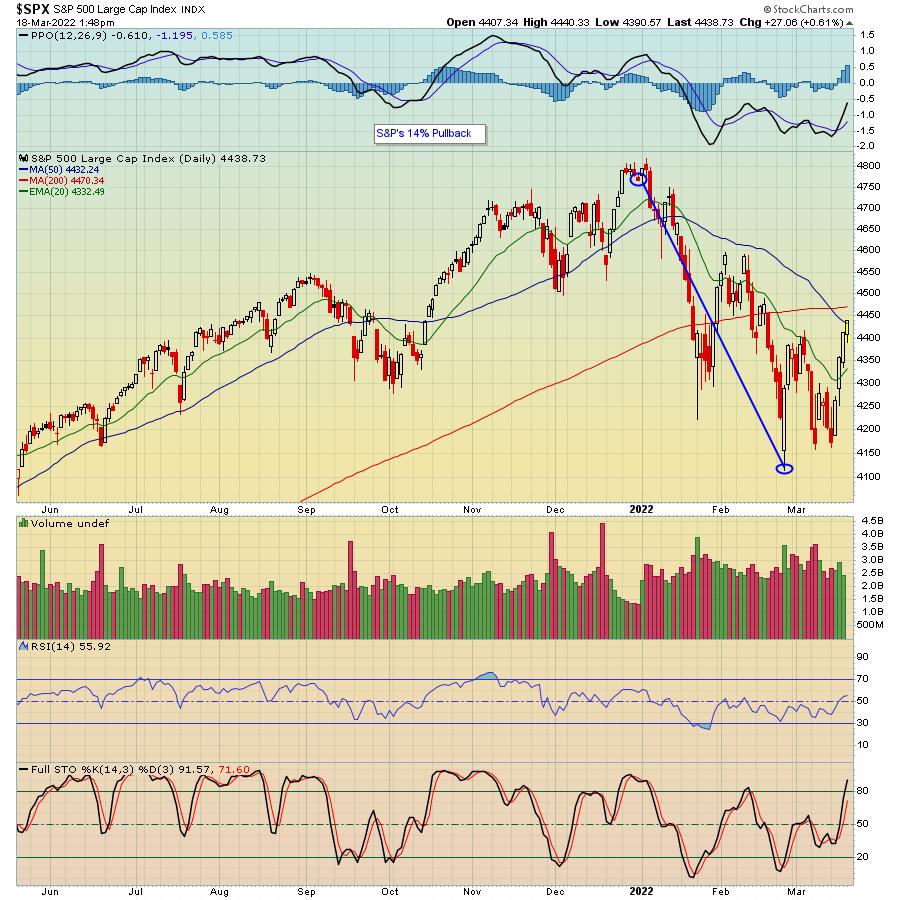

Is this Bear Market Rally Ending? These 2 Charts Will Tell Us

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Rallies and selloffs can be so crazy during volatile periods, and 2022 definitely qualifies as volatile. The Volatility Index ($VIX) has now been elevated and above 20 every single day since January 18th. That's roughly 9 weeks. It comes after a year in which the VIX has bottomed...

READ MORE

MEMBERS ONLY

Chartwise Women: Women of Finance - A Discussion with Linda Raschke and Danielle Shay

by Mary Ellen McGonagle,

President, MEM Investment Research

by Erin Swenlin,

Vice President, DecisionPoint.com

Join Mary Ellen and Erin as they wrap up Women's History Month with an all-women discussion panel featuring Linda Raschke (LBRGroup, LLC) and Danielle Shay (Simpler Trading). For this final episode of Chartwise Women, these top female analysts will discuss their own histories with market analysis, including how...

READ MORE

MEMBERS ONLY

GoNoGo TV: Risk On, But What Has Changed?

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

The market rally over the last 10 days has been impressive. A huge relief to investor portfolios beaten down in 2022 YTD. In this week's edition of the GoNoGo Charts show, the question Alex and Tyler seek to answer is whether or not the safe haven trading was...

READ MORE

MEMBERS ONLY

Improve Timing on Your Fundamental Picks

by Joe Rabil,

President, Rabil Stock Research

In this week's edition of Stock Talk with Joe Rabil, Joe uses his 30 years of experience to show how to use technicals to improve your timing on a stock you like fundamentally. He gives a strategy for how to buy good weakness. He also shows what to...

READ MORE

MEMBERS ONLY

Can Silver (SLV) Follow Meme Stocks Higher?

Though it's easy to forget about meme stocks, as they've been out of focus for a while, the big two have made a comeback over their 50-day moving average.

GameStop (GME) and AMC Theatres (AMC), as seen in the above chart, cleared their 50-DMA on Tuesday...

READ MORE

MEMBERS ONLY

Bear Market Breakout?

by Carl Swenlin,

President and Founder, DecisionPoint.com

At DecisionPoint.com we have been operating on the assumption that we are in a bear market. We won't know for sure until the market declines 20% or more, but that seems a bit late to begin responding to what appears to be bear market action.

The market...

READ MORE

MEMBERS ONLY

Are Cryptos Rising from the Dead?

by Dave Landry,

Founder, Sentive Trading, LLC

On this week's edition of Trading Simplified, Dave presents his Mystery Charts with a new chart and a reveal. Alongside this discussion is his explanation of "Methodology In Action." He then covers the topic of Profit-Centers and, finally, "Crypto Corner!" Are cryptos rising from...

READ MORE

MEMBERS ONLY

FAANG Stocks Rebound, But Is The Bottom In?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

We've seen a tremendous rally over the past week or so across most U.S. equities, but the FAANG stocks tend to garner the most attention. These large cap growth names help to carry our major indices either higher or lower, because of their huge market caps. They...

READ MORE

MEMBERS ONLY

Mish's Economic Modern Family Needs to Clear Resistance

We have and continue to use Mish's Economic Modern Family to successfully navigate through the pandemic and now, in 2022, we use its insights to guide us through a year that has three main overhead pressures: geopolitical stress from the current Russian/Ukraine war, inflation and, finally, rising...

READ MORE

MEMBERS ONLY

Three Intermarket Relationships that are Forecasting Higher Stocks and Yields

by Martin Pring,

President, Pring Research

Changing relationships between differing asset classes and markets do not speak that often. When they do, strong evidence that important changes may be afoot is often provided. One of the characteristics that has caught my attention since the beginning of the year is that, on one side, stocks been reacting...

READ MORE

MEMBERS ONLY

DP TV: Carl Explains Unadjusted Data Charts

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

On this episode of DecisionPoint, Carl opens the show with a look at the Chevron (CVX) chart he discussed last week. He realized an error in his analysis and decided to give us some instruction on how to use unadjusted data on StockCharts.com. He talks about the implications of...

READ MORE

MEMBERS ONLY

Mish: The Best Potential Trade Setup Looking Ahead - FXE Euro Trust

As Forrest typically writes the Daily commentary, and quite well I might add, today please consider me a guest host to my own blog. As such, I want to wrote about a setup that is not quite ready, but one that should be kept on your radar.

The Euro is...

READ MORE

MEMBERS ONLY

Week Ahead: Strong Start to NIFTY Expected, But Consolidation Looks Imminent; RRG Chart Shows Defensive Play Likely

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In the week before this one, looking at the quantum of the fresh short positions in the system, a strong possibility of the short-covering led rally was expected. The previous week saw a strong rally, obviously fueled by short-covering, which led to weekly gains of 385.10 points after a...

READ MORE

MEMBERS ONLY

WHY do Most Investors do so Poorly?

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

There are a number of companies that track performance for various asset classes, including the performance of investors. Table A, from J.P. Morgan, shows the Average Investor's 20-year annualized returns of only 2.3%. I have reproduced the small print below the table because it explains the...

READ MORE

MEMBERS ONLY

PULLBACK IN OIL CONTRIBUTES TO STOCK RALLY -- BUT HAWKISH FED MAY LIMIT UPSIDE POTENTIAL

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCKS HAVE VERY STRONG WEEK... Major U.S. stock indexes registered their strongest week since November 2020. And they also broke through some initial resistance levels. The week's strong action signals that stocks have put in a short-term bottom and may continue to gain some ground. Their longer-range...

READ MORE

MEMBERS ONLY

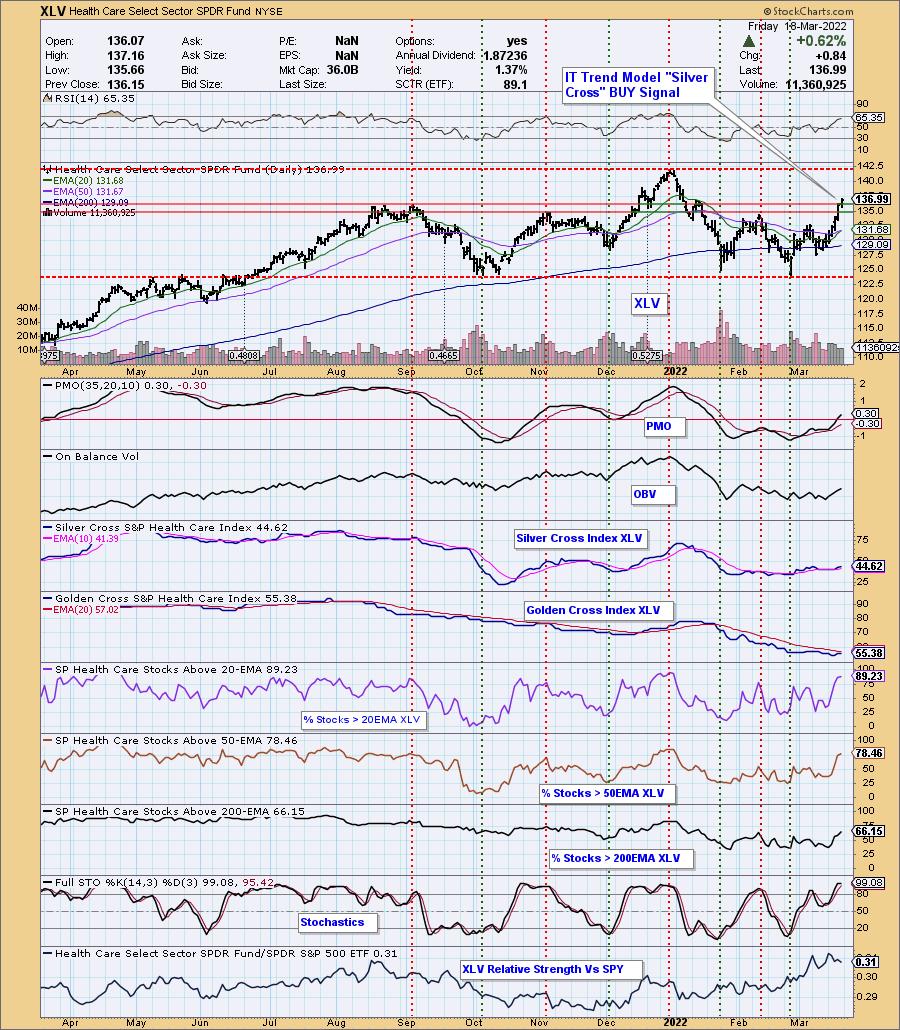

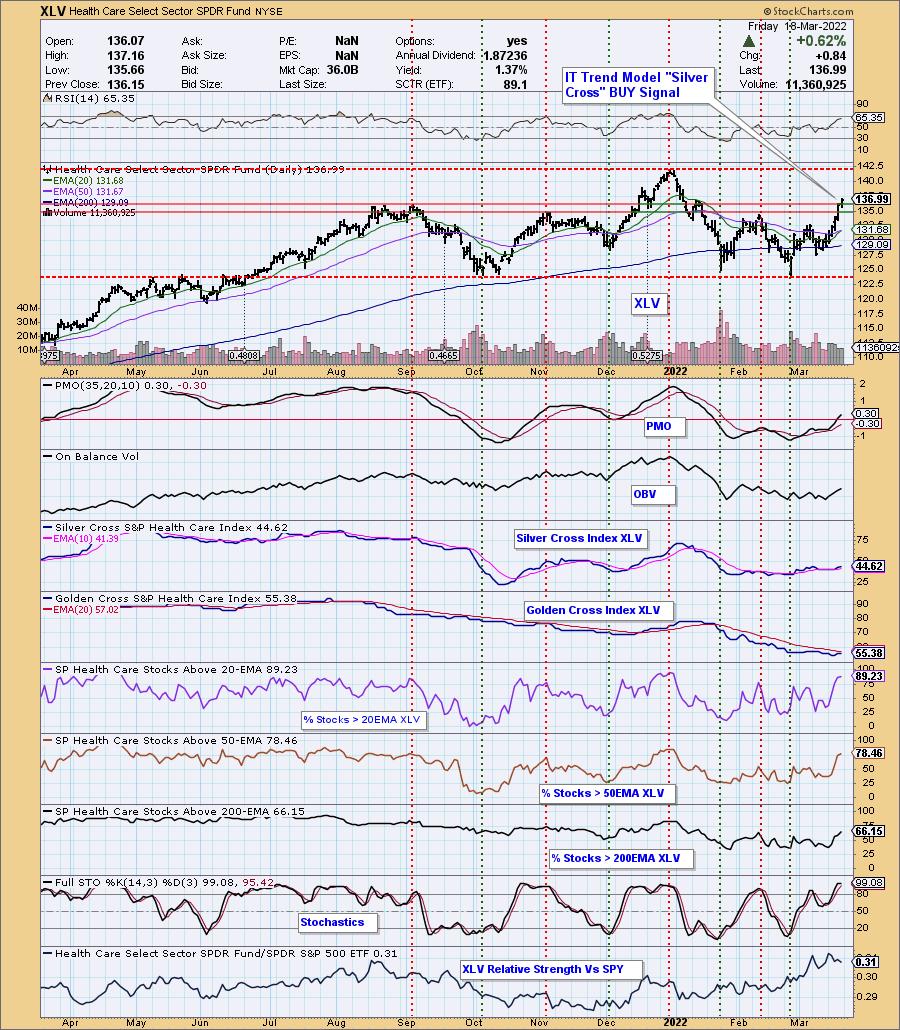

Sector Watch? Healthcare Triggers an IT Trend Model "Silver Cross" BUY Signal

by Erin Swenlin,

Vice President, DecisionPoint.com

The Health Care sector (XLV) broke out from a strong resistance zone today. Better yet, we saw an IT Trend Model "Silver Cross" BUY signal as the 20-day EMA crossed above the 50-day EMA. There is a lot going for this sector right now; the RSI is positive...

READ MORE

MEMBERS ONLY

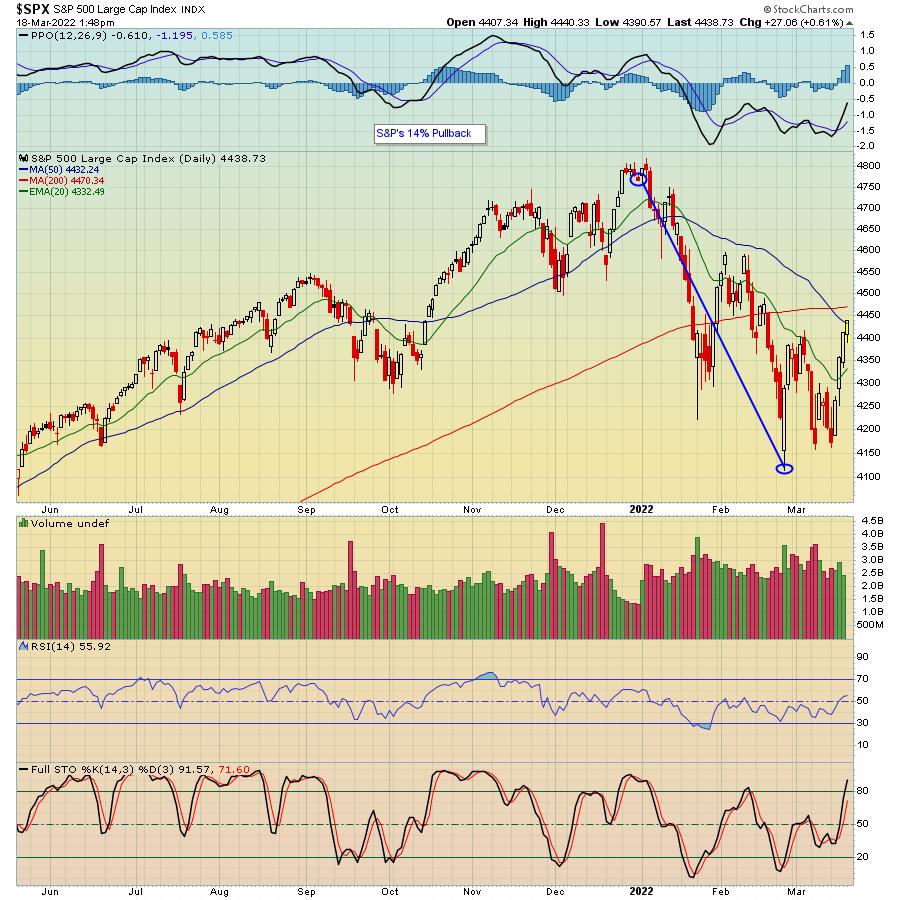

New Bullish Uptrend in the Market

by Mary Ellen McGonagle,

President, MEM Investment Research

On this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews the downtrend reversal in the markets and highlights which areas are best positioned to trade higher. She also reviews the top way to hedge against rising inflation.

This video was originally recorded on March 18, 2022. Click...

READ MORE

MEMBERS ONLY

The 50-Day Moving Average Must Hold in the Major Indices

After the quarter-percent rate increase, the market continues to rally off recent lows. Now, all the major indices besides the Nasdaq 100 (QQQ) have cleared resistance from their 50-day moving average as seen in the above chart. So far, the Russell 2000 (IWM) is leading the way with a second...

READ MORE

MEMBERS ONLY

Preserving Capital in a Challenging Environment

by John Hopkins,

President and Co-founder, EarningsBeats.com

Back on December 31, 2021, our Chief Market Strategist Tom Bowley penned a ChartWatchers article titled "It Could be a Very Rough Start to 2022". Boy, was he right! In fact, look at the two charts below, showing the performance of both the S&P and NASDAQ...

READ MORE

MEMBERS ONLY

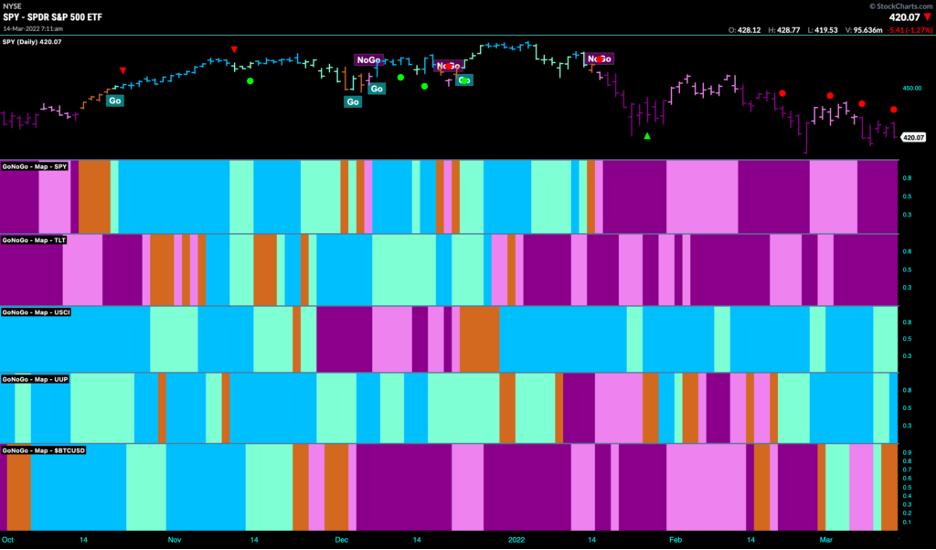

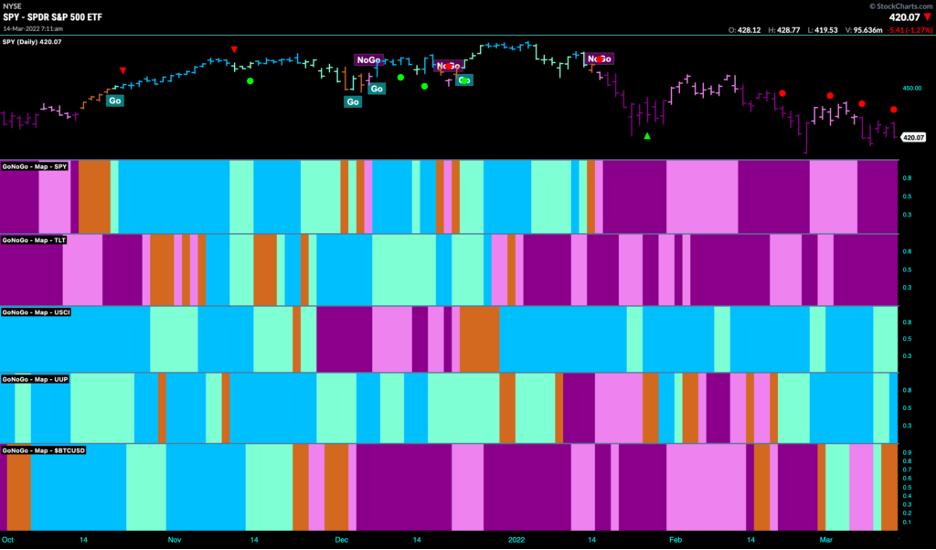

Going, Going, Gone: End of Week Themes with GoNoGo Charts

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

As the week ends, let's look at some of the thematic charts from a GoNoGo perspective.

Below is the GoNoGo Chart of $SPY. We have seen a strong rally that started on Wednesday as prices have climbed higher. We were watching the zero line on the oscillator closely...

READ MORE

MEMBERS ONLY

SPY Gets its Biggest Surge since November 2020. Is it Enough?

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The S&P 500 SPDR (SPY) surged 5.77% from Tuesday to Thursday and this was the biggest 3-day surge since the 6.07% advance on November 5th, 2020. This early November surge led to a breakout and the advance extended until January 2022. The current surge also shows...

READ MORE

MEMBERS ONLY

Chartwise Women: The Importance of Historical Precedent

by Mary Ellen McGonagle,

President, MEM Investment Research

by Erin Swenlin,

Vice President, DecisionPoint.com

On this week's edition of Chartwise Women, Erin and Mary Ellen continue Women's History Month with a discussion of the importance of knowing your history! Historical precedence, your own investing history, knowing the history of the markets as a whole -- all of it will help...

READ MORE

MEMBERS ONLY

GoNoGo TV: Downside on Multiple Timeframe Perspectives

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

It is no mystery that US equity indices are chopping around volatile swings each and every day. The trend conditions remain "NoGo" as markets deliver continued lower highs and lower lows. The weight of the evidence remains to the downside on daily and weekly timeframes. However, Wednesday delivered...

READ MORE

MEMBERS ONLY

Avoid This Trap When Buying Weakness

by Joe Rabil,

President, Rabil Stock Research

In this week's edition of Stock Talk with Joe Rabil, Joe explains the difference between "Good" weakness and "Bad" weakness. This is a key for traders interested in buying pullbacks. He discusses what he uses to determine the tradeable trend and how to distinguish...

READ MORE

MEMBERS ONLY

Rates Increase and Transportation (IYT) Clears Its Major Moving Averages

On Wednesday, the market rallied into the Fed's rate announcement, showing speculator's optimism given the current downward trend. It also helped that, on Monday, the Nasdaq 100 (QQQ) held key support at $318, sparking a rally on Tuesday.

Now, with a rate increase of 0.25%...

READ MORE

MEMBERS ONLY

Don't Let the Market Beat You

by Dave Landry,

Founder, Sentive Trading, LLC

On this week's edition of Trading Simplified, Dave continues his discussion about not only surviving, but prospering during a bear market. Paying attention to the signs and signals, as well as understanding the trends, will help you stay ahead of the curve. He then discusses his mystery charts...

READ MORE

MEMBERS ONLY

Materials are Creeping Up, While PKG Breaks Higher

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The materials sector has recently started to pick up relative strength again following a loss of relative momentum while inside the leading quadrant. The RRG above, with the XLB tail highlighted, is a nice example of how RRG-Velocity, which measures the week-to-week distances on the tail, started to shrink before...

READ MORE

MEMBERS ONLY

The Two Directions for the S&P 500

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Jesse Livermore famously said, "There is a time to go long, time to go short and time to go fishing."

On a Fed meeting day, I often find that it's one of those "fishing" days. Plenty of speculators will try and game this meeting...

READ MORE

MEMBERS ONLY

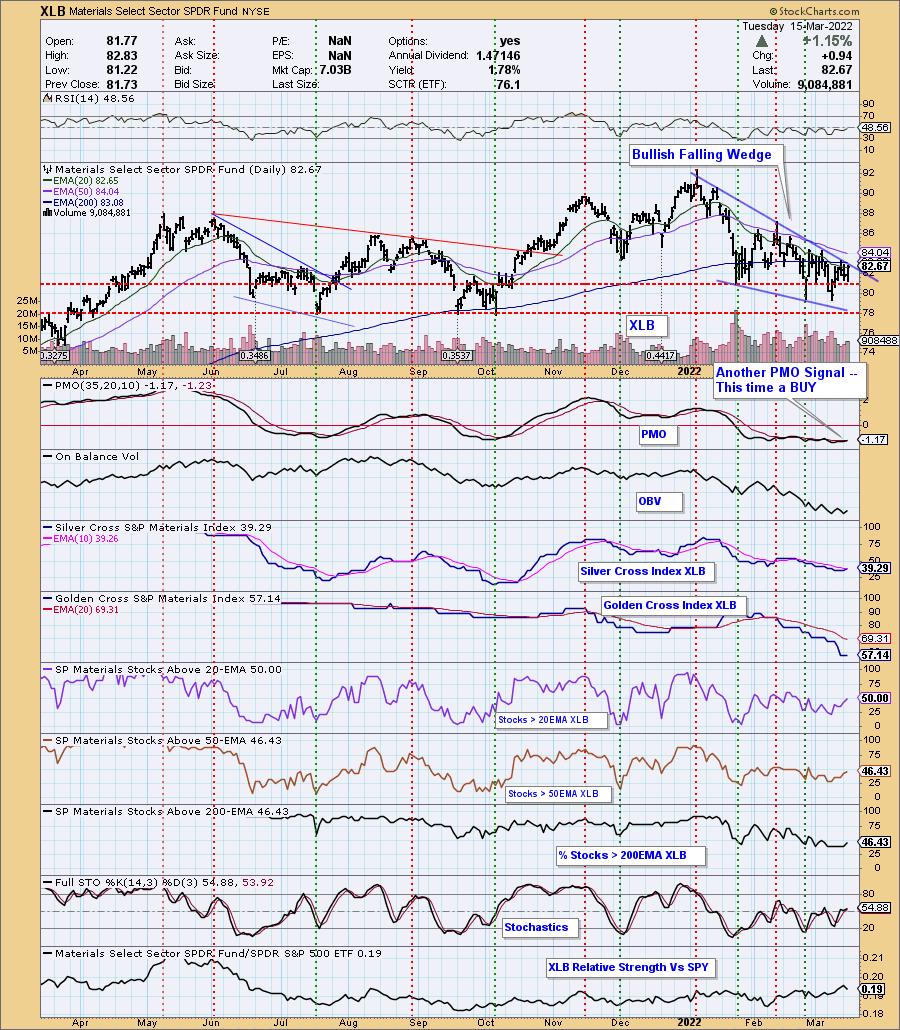

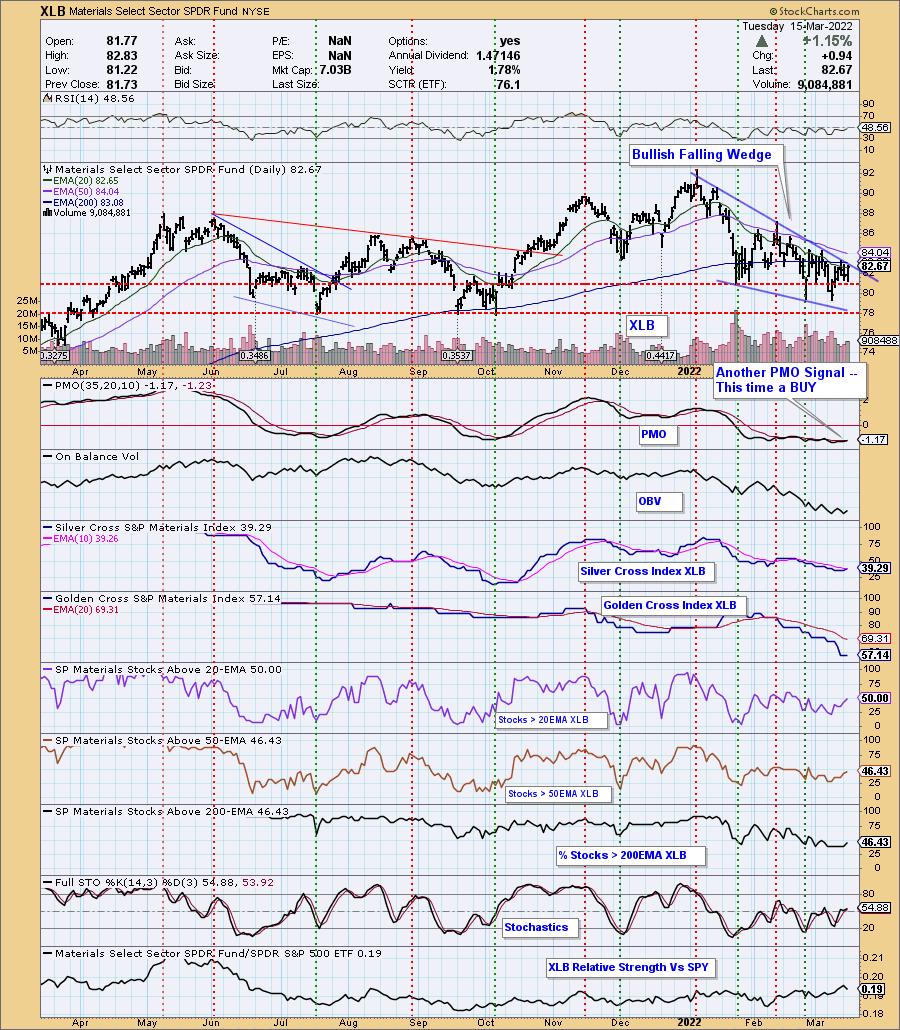

Whipsaw Price Momentum Oscillator (PMO) BUY Signal on Materials (XLB)

by Erin Swenlin,

Vice President, DecisionPoint.com

I have alerts set up to tell me when the eleven S&P sectors have Price Momentum Oscillator (PMO) crossovers to the upside or the downside. Materials (XLB) have been popping out PMO crossover signals for over a month. Do we trust this BUY signal right now? Maybe.

There...

READ MORE

MEMBERS ONLY

Sector Spotlight: It's Not Over Yet for Slumping SPY!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of StockCharts TV's Sector Spotlight, I address last week's rotations for asset classes and sectors. After that, I look deeper into the current structure of the S&P 500 chart in combination with the RSI and discuss the interpretation of the current...

READ MORE

MEMBERS ONLY

Flight Path: S&P Sinks Toward Prior Lows; Materials Not Miserable

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

Good morning and welcome to this week's Flight Path. Let's take a look at the below GoNoGo Asset Map for this week. The top panel shows that the trend in U.S. equities has remained a "NoGo" and strengthened this week on purple bars....

READ MORE

MEMBERS ONLY

DP TV: Where's the Strength? Hot Industry Groups!

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

On this episode of DecisionPoint, Carl opens the show with his "Grab Bag" and a deep dive into the Technology sector. How far could Apple (AAPL) fall? Carl gives us his take on options expiration and reviews DecisionPoint indicators. Erin walks viewers through the short and intermediate-term Relative...

READ MORE

MEMBERS ONLY

Don't Be Surprised if the NASDAQ Jumps from Here

by Martin Pring,

President, Pring Research

I've been bearish on the NASDAQ -- or, more specifically, on its relative action against the S&P Composite -- for about a year. Now that the financial press has announced that the Index, by virtue of passing the somehow magic -20% level, has "entered bear...

READ MORE

MEMBERS ONLY

Reaching the Breaking Point in the Nasdaq 100 (QQQ)

The overall trend in the major indices is downward. Though we've had small rallies, our last jump in price was minor and right into resistance. Specifically looking at the QQQs, we have reached a key support level in which many traders are watching for a price break. However,...

READ MORE

MEMBERS ONLY

Growth Stocks Remain Under Big Pressure, But Get Ready To Buy Soon

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The prospects of surging inflation and higher interest rates hinder the performance of growth stocks in a big way. Remember, their valuations are highly dependent on future promises of earnings and earnings growth. Inflation and higher rates eat away at that future growth. And a recession changes the picture completely...

READ MORE

MEMBERS ONLY

Looking Under The Hood of EarningsBeats.com -

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The storm clouds rolled in during the month of December. That was our early warning sign that 2022 would likely be a very rough year. If you haven't been reading my articles over the past few months, I'd highly recommend that you at least go back...

READ MORE