MEMBERS ONLY

2021 Q3 Earnings Perspective

by Carl Swenlin,

President and Founder, DecisionPoint.com

The following chart shows us the normal value range of the S&P 500 Index, indicating where the S&P 500 would have to be in order to have an overvalued P/E of 20 (red line), a fairly valued P/E of 15 (blue line), or an...

READ MORE

MEMBERS ONLY

What Do Staples, Energy and Financials Have in Common?

by Martin Pring,

President, Pring Research

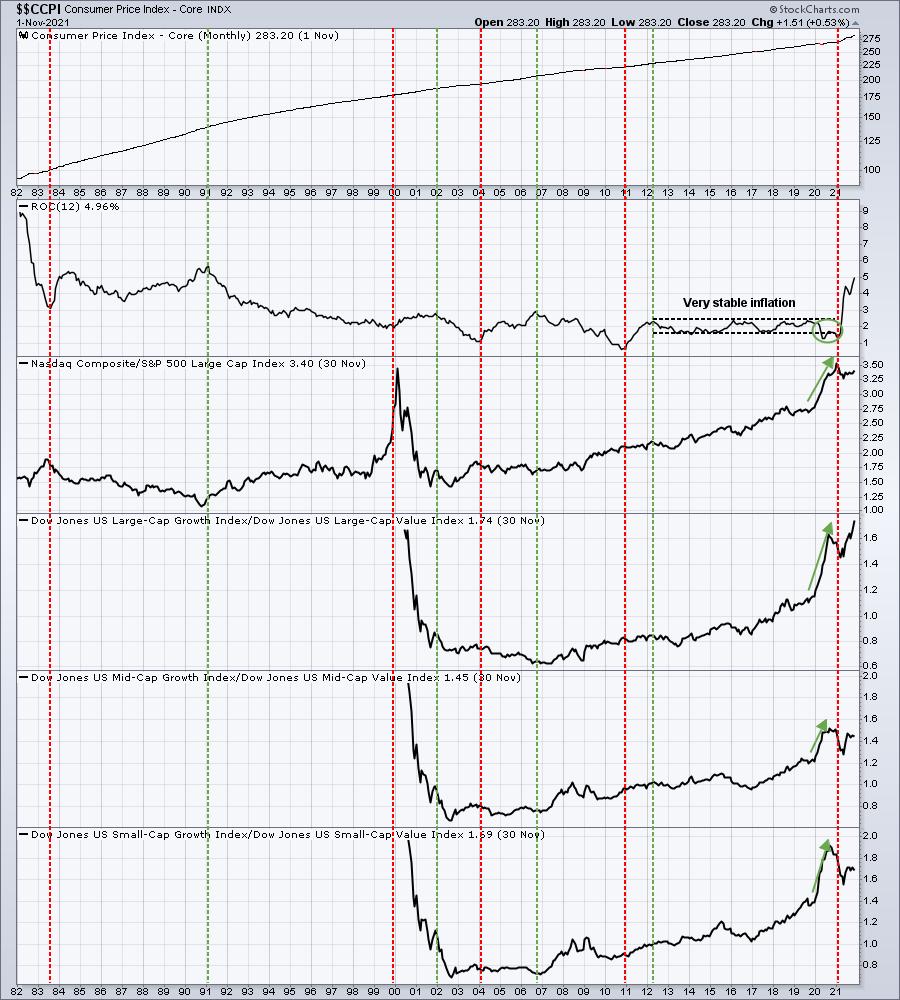

Technology outperformed throughout the second decade of this century, but the times they are a-changin', as it is clear that this sector has lost enough mojo in the last year to indicate that a basic transformation in market leadership is underway. Just to be clear, I am not saying...

READ MORE

MEMBERS ONLY

Why is SPX 4550 So Important?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

So far in 2022, we've seen elevated volatility, yet another test of the 50-day moving averagefor the S&P 500, and renewed strength incyclical sectors over growth. If you were looking for a nice break after the uncertainty of 2021, I'm sure you are quite...

READ MORE

MEMBERS ONLY

Sector Spotlight: Tech & Discretionary Push S&P to Support

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of StockCharts TV's Sector Spotlight, I cover the rotations for asset classes, sectors and crypto. The break below support of GOVT gets attention while the recent sector rotation out of Consumer Discretionary and Technology pushed the S&P 500 to the lower boundary of...

READ MORE

MEMBERS ONLY

DP TV: Six Important Stocks in Bear Market

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

On this episode of DecisionPoint, Carl takes the reins and leads our discussion, examining how the trading environment has changed over the years and what that means for today's markets. He analyzes the top 10 market cap stocks in the S&P 500 or the "S&...

READ MORE

MEMBERS ONLY

Could Greece (GREK) be Waking Up?

Last week, Mish released her yearly outlook report,with dozens of ideas on trends and trades going into the new year.Greece ETF (GREK) is one of those picks.

While the major indices were selling off Monday, GREK held near an important breakout area. Though Mish has called GREK the...

READ MORE

MEMBERS ONLY

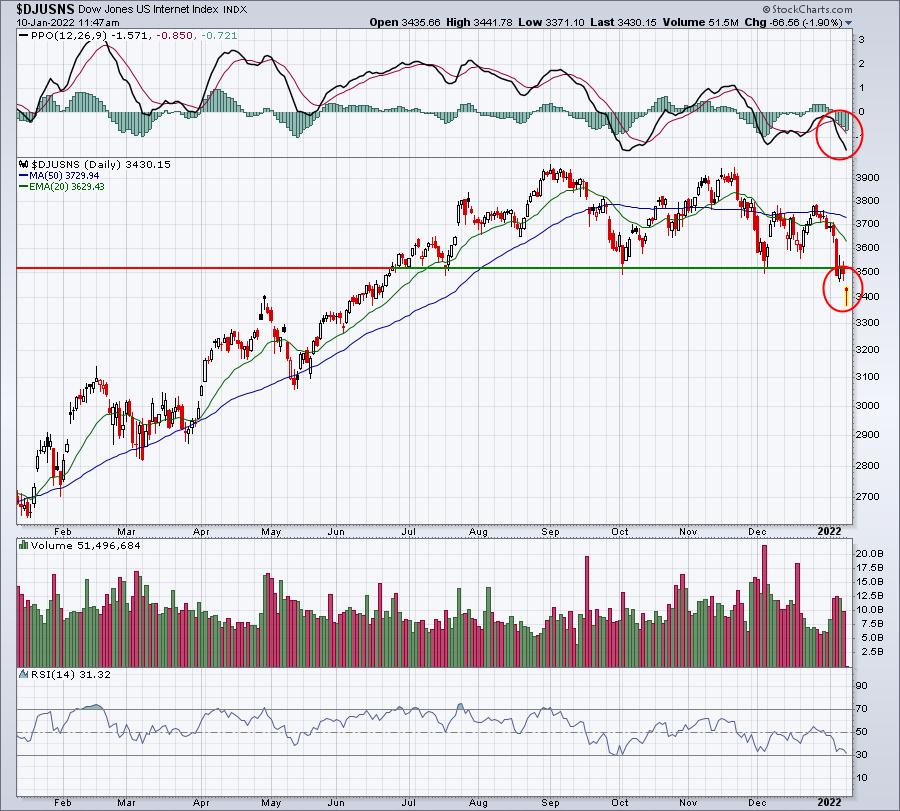

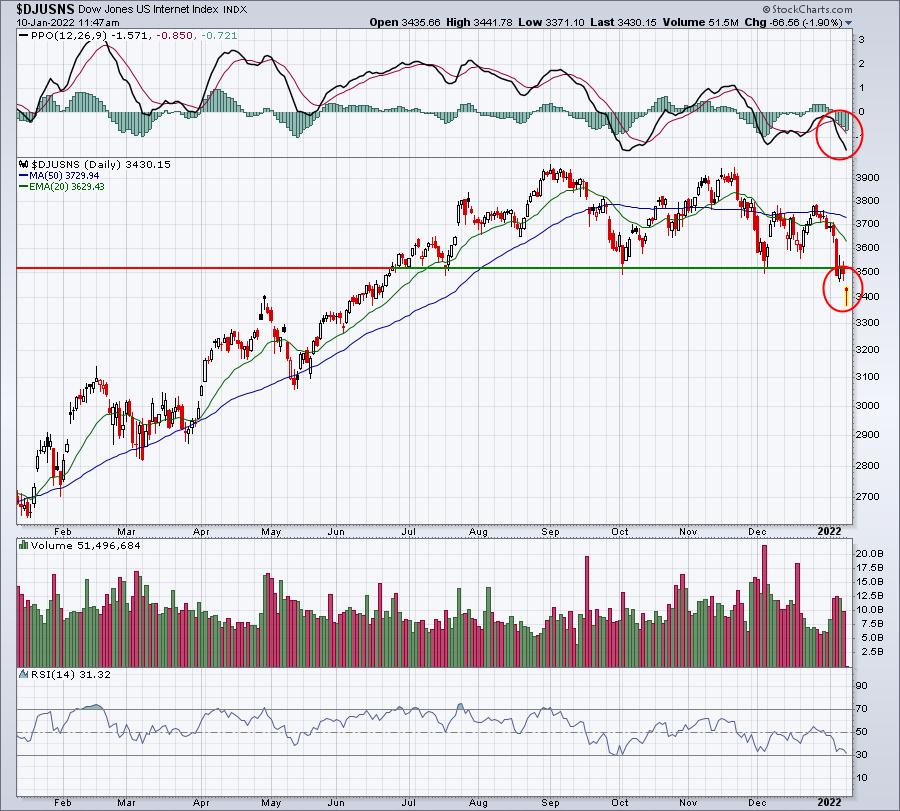

Internet And Semiconductors Are Among Today's Casualties

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I've been discussing warning signs for the past several weeks, even talking about that nasty (gulp!) cyclical bear market possibility. These are what I refer to as "storm clouds on the horizon." Well, it's starting to rain pretty hard, so make sure you have...

READ MORE

MEMBERS ONLY

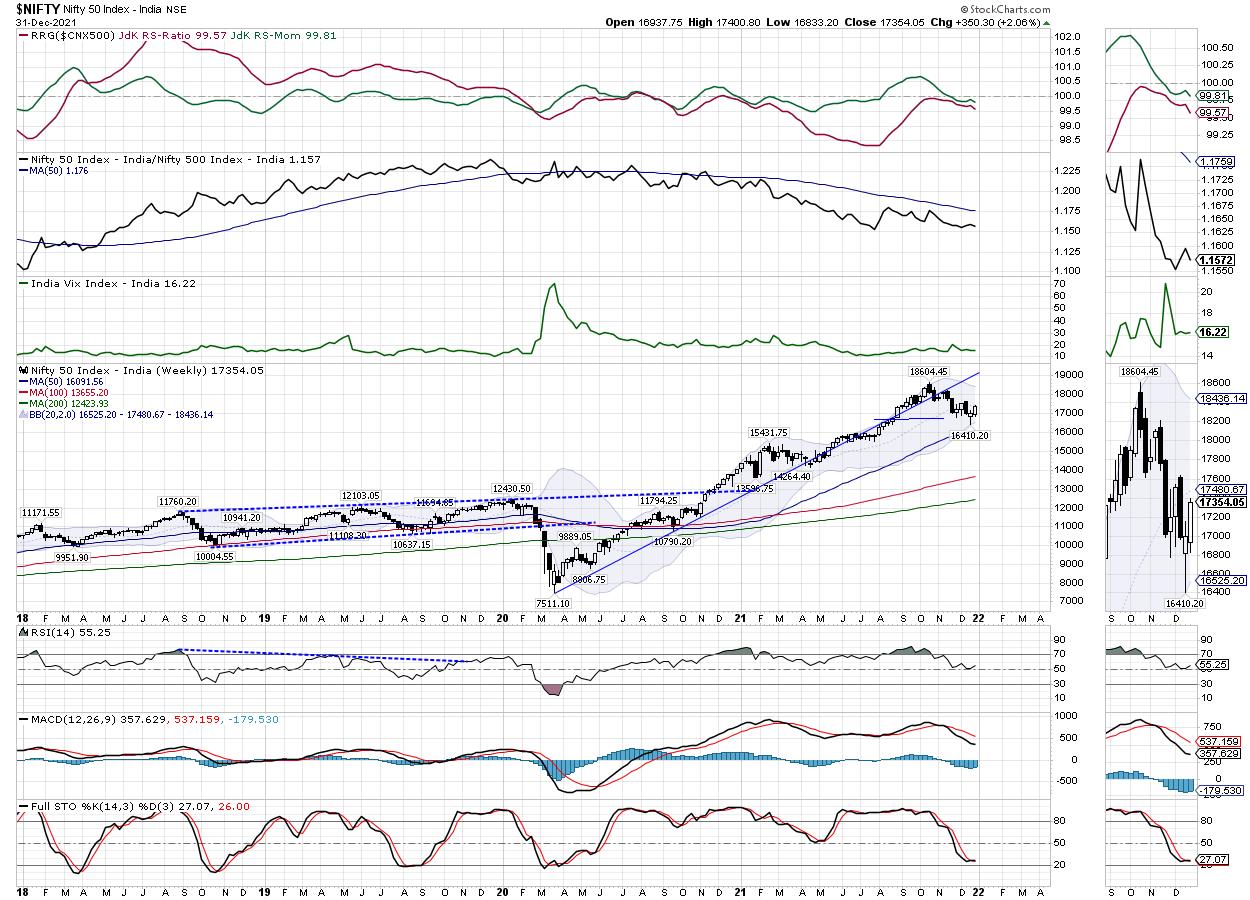

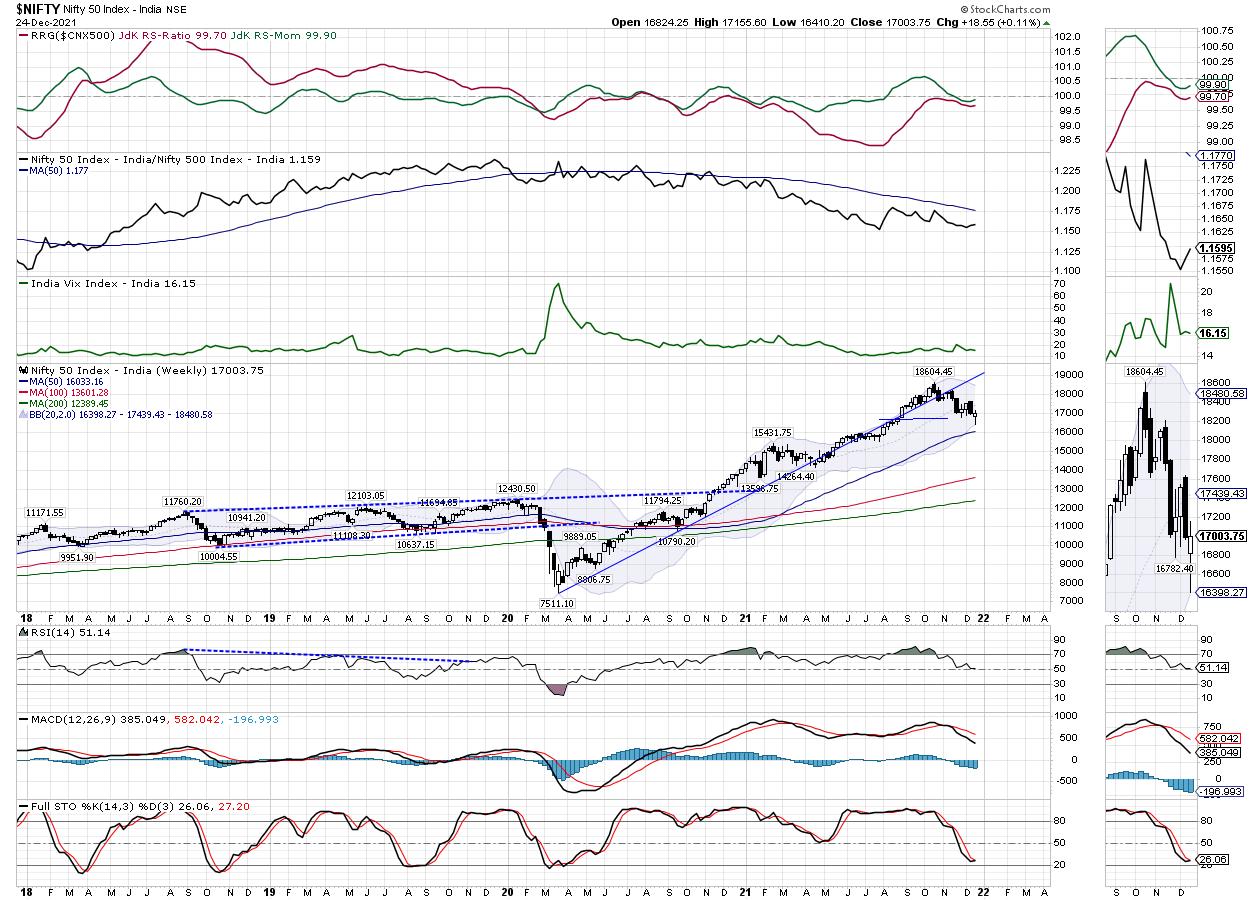

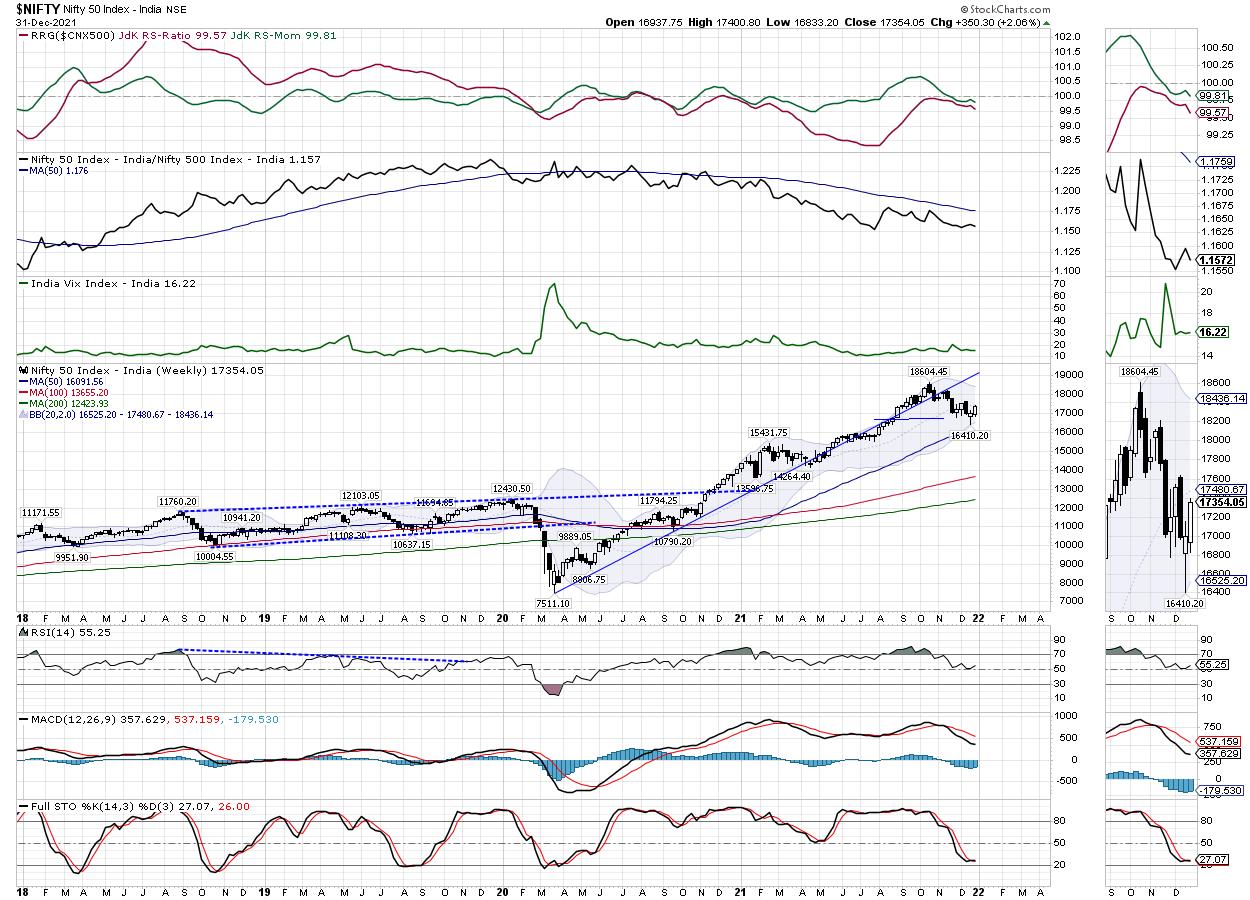

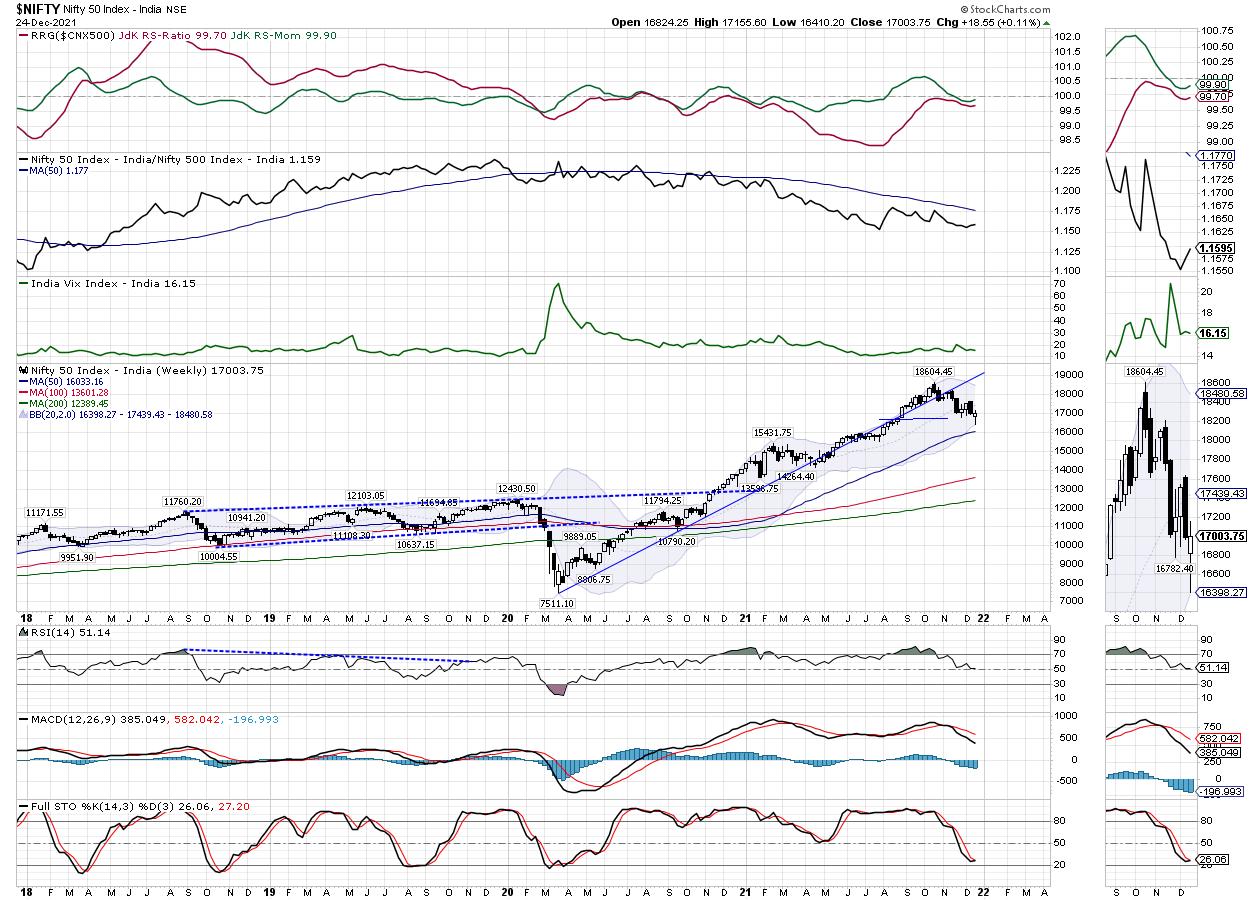

Week Ahead: NIFTY Likely to Stay Capped Until Below This Level; Pharma, Metals and IT to Relatively Outperform

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The Indian equity markets extended their up move for this week as well and ended with gains. The NIFTY gained for the first three trading sessions, then consolidated in the last two sessions of the week. The market continued to display its internal strength and looks forward to defending its...

READ MORE

MEMBERS ONLY

New Year, New Market Dynamics!

by Mary Ellen McGonagle,

President, MEM Investment Research

On this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews the sharp rotation taking place while also highlighting stocks in these newly strong sectors. The impact of earnings upgrades and reports is also highlighted as we head into Q4 earnings season.

This video was originally recorded on...

READ MORE

MEMBERS ONLY

Will the Nasdaq 100 (QQQ) Hold Key Support?

This week has been a wild ride from new highs, followed by a quick pullback towards support in certain indices. High Yield Corporate Debt ETF (JNK), which we use as a risk-on or -off indicator, has broken under minor support from $107.33. To make things even more confusing, the...

READ MORE

MEMBERS ONLY

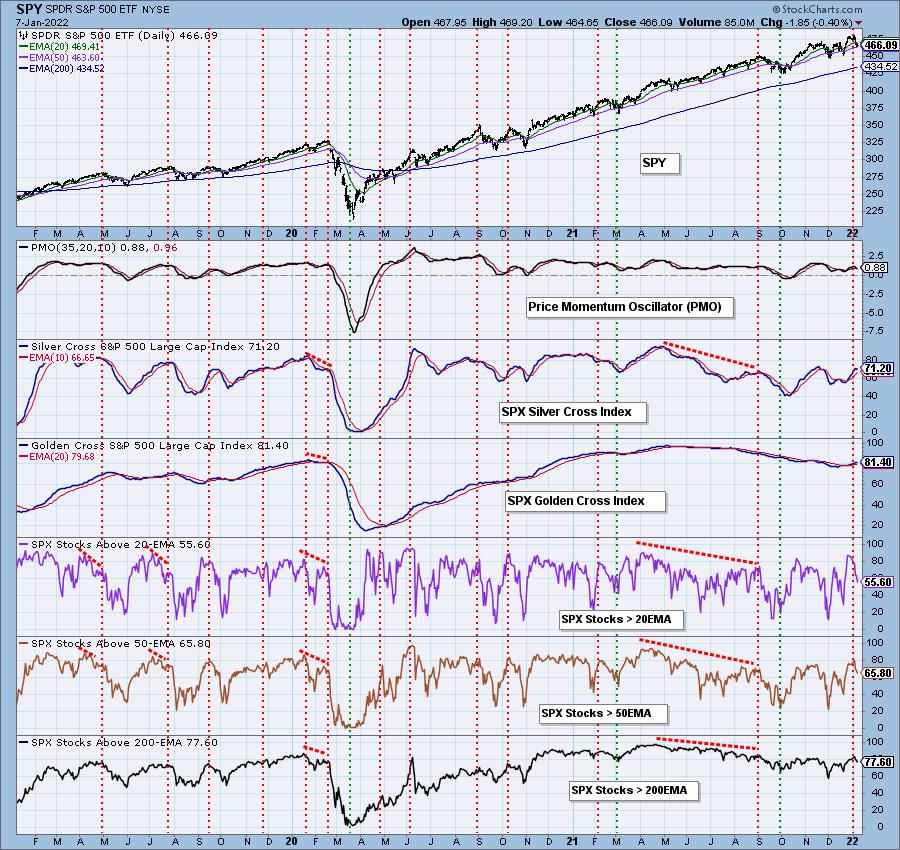

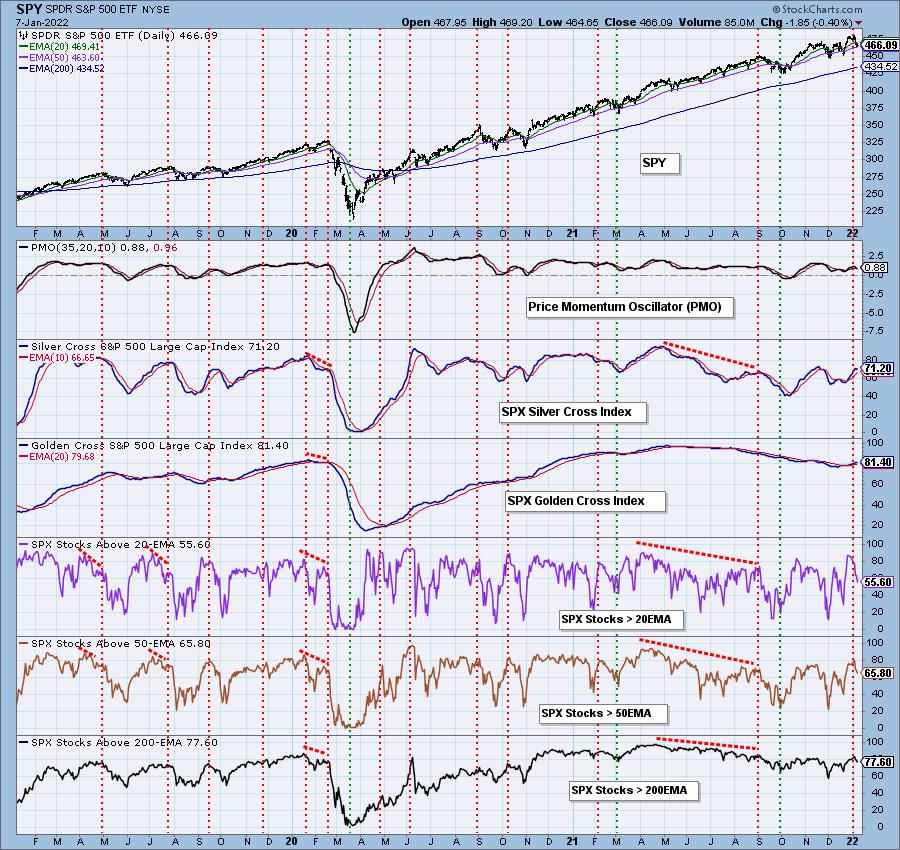

Broad Market Bias Assessment

by Erin Swenlin,

Vice President, DecisionPoint.com

Included in our DP Alert daily report is a section on "Bias Assessment". We've found that, by analyzing the Golden/Silver Cross Indexes (GCI/SCI) along with Participation of Stocks > 20/50/200-day EMAs, we can determine the market bias in all three timeframes.

The...

READ MORE

MEMBERS ONLY

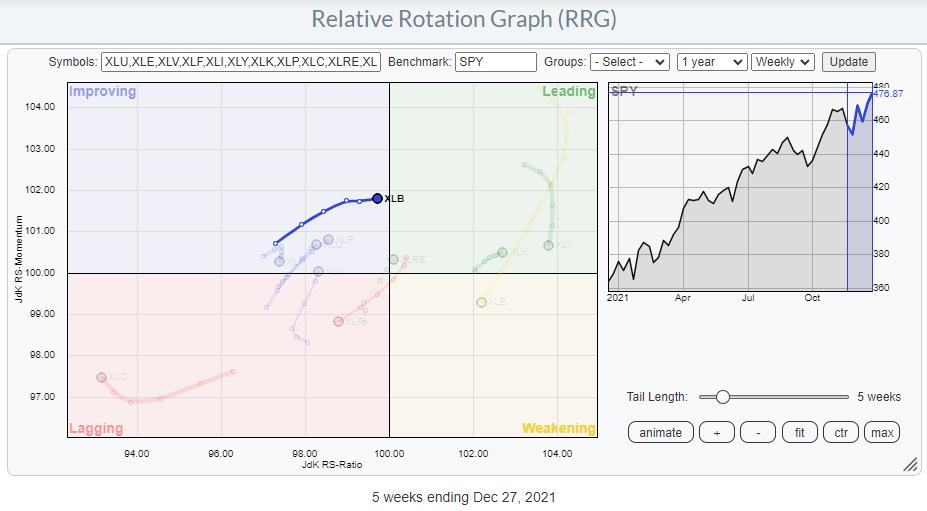

Strong Rotation for Defensive Sectors is Keeping S&P Under Pressure

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

One of the more prominent rotations on the (weekly) Relative Rotation Graph for sectors is the strength displayed by the defensive sectors.

In the RRG above, I have marked an oval around Staples, Utilities and Health Care. These are the three "defensive sectors" in the universe and they...

READ MORE

MEMBERS ONLY

A Look into the Future: 2022 Forecast

by Larry Williams,

Veteran Investor and Author

Larry presents his predictions for the markets in 2022 in this new StockCharts TV special. Can the future really be known? In general, Larry thinks so. But, as he always says, trust but verify, and the proof is in the pudding. Larry looks back at his previous presentations and forecasts...

READ MORE

MEMBERS ONLY

The Effects of Interest Rates

by TG Watkins,

Director of Stocks, Simpler Trading

In this week's edition of Moxie Indicator Minutes, TG answers the question: "How much does the market not like interest rate hikes?" The market is being very difficult and moving into more defensive areas. Then, TG moves on to technology, a sector that typically doesn'...

READ MORE

MEMBERS ONLY

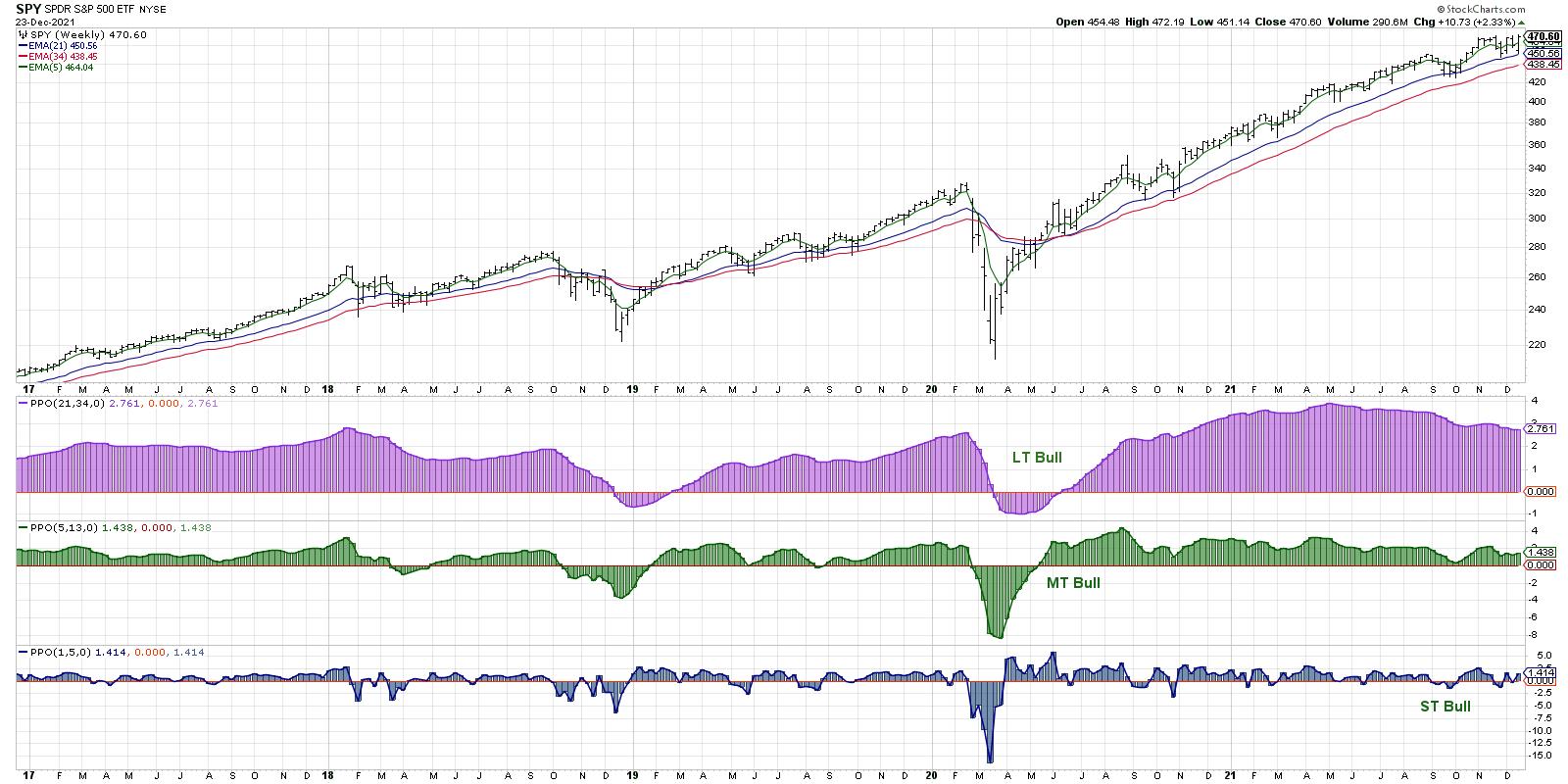

Realistic Expectations for Setups and Signals

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Setting expectations is part of a strategy and this includes expectations for the number of signals we can expect in any given year. Signal frequency, of course, depends on your strategy and timeframe. Short-term mean-reversion strategies generate more signals than swing strategies and swing strategies generate more signals than long-term...

READ MORE

MEMBERS ONLY

Apple (AAPL) Could Be on the Verge of Tumbling, Putting the Entire Stock Market at Risk

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

We're about to find out.

I liken the current stock market environment to stepping into The Twilight Zone or the Great Unknown. This post-pandemic market has been brutal in terms of rotation. Most growth stocks have tumbled amid the inflation and interest rate uncertainty; unfortunately, the inflation news...

READ MORE

MEMBERS ONLY

GoNoGo Flight Path

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

In the first-ever edition of the GoNoGo Charts show, Alex and Tyler wrap up the 2021 markets, then dive into the charts as the new year begins. Starting with the S&P, they move through small-caps, growth, value and healthcare.

This video was originally broadcast on January 6, 2022....

READ MORE

MEMBERS ONLY

My Favorite ADX Screen

by Joe Rabil,

President, Rabil Stock Research

In this week's edition of Stock Talk with Joe Rabil, Joe discusses his favorite ADX screen. He explains the settings he uses and why and then shows a few examples of what the screen can find. He then analyzes the stock requests that came through in multiple timeframes,...

READ MORE

MEMBERS ONLY

BOND YIELDS RISE ON MORE HAWKISH FED -- TECH STOCKS LEAD NASDAQ LOWER -- ENERGY AND FINANCIAL STOCKS SHOW LEADERSHIP

by John Murphy,

Chief Technical Analyst, StockCharts.com

FED MINUTES PUSH STOCKS LOWER... The release of Fed minutes yesterday from its December meeting reflected a more hawkish tone which pushed stocks lower and interest rates higher. The Nasdaq took the biggest hit owing to a big drop in technology shares which are the most vulnerable to rising rates....

READ MORE

MEMBERS ONLY

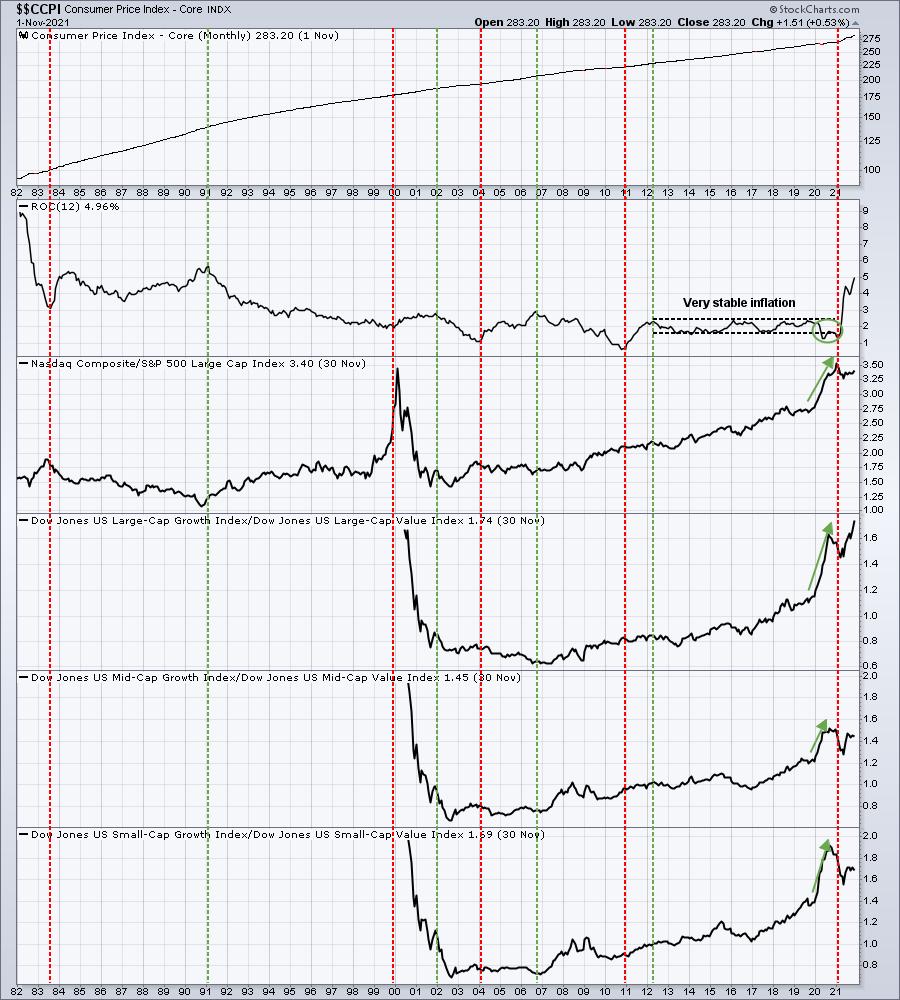

The Fed Confirms They Were Wrong About Inflation

Earlier this week, Mish released her annual report for the year ahead, titled "2022 Trends, Themes, and Trades to Watch".Today, the market showed why she has inflation as one of her 8 important themes.

On Thursday (Jan. 6th), Mish will be hosting a special webinarabout how her...

READ MORE

MEMBERS ONLY

22 Trading Resolutions for 2022, Part 1

by Dave Landry,

Founder, Sentive Trading, LLC

Happy New Year from Trading Simplified! Are you going to fall into the same old bad trading behaviors, or are you going to become the trader you were meant to be in 2022? In this edition of the series, Dave follows up his methodology in action with a new mystery...

READ MORE

MEMBERS ONLY

Yields Breaking or About to Break Out All Over

by Martin Pring,

President, Pring Research

I had thought that rates would moderate a little at the beginning of 2022, as the economic growth rate slowed due to COVID and other factors. Not so, as yields across the spectrum have resumed their bull market rally in anticipation of higher inflation and a less accommodative central bank....

READ MORE

MEMBERS ONLY

What are Tuesdays Market Outliers Telling Us?

On Monday, we talked about the potential for the market to get stuck in rangebound trading if pivotal price levels were not cleared in the major indices. That uncertainty carries into Tuesday, as the major indexes besides the Dow Jones (DIA) are struggling or making little to no change. This...

READ MORE

MEMBERS ONLY

Sector Spotlight: Yield Curve Supports Further Strength for Stocks

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On the first 2022 edition of StockCharts TV's Sector Spotlight, I look back at rotations that happened over the holiday period and then address the monthly charts that completed in December. The long-term trend in the yield curve shows a rapid flattening in December and, historically, that seems...

READ MORE

MEMBERS ONLY

The Great Divide Presents Big Problems....and a Wild Prediction for Apple (AAPL)

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Today is just the latest example of the massive divide taking place in U.S. equities right now. There was major rotation throughout 2021 and we're seeing more of the same here in early 2022. Unfortunately, the rotation is not favoring the growth stocks that have powered the...

READ MORE

MEMBERS ONLY

DP TV: Participation Sickly Across the Board

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

On this episode of DecisionPoint, after reviewing the current market conditions and price charts, Carl shares a new spreadsheet summary that displays the Silver Cross Index (SCI) and Golden Cross Index (GCI) percentages for all of the sectors and major markets. He discusses the underlying fissures in the foundation. Erin...

READ MORE

MEMBERS ONLY

Can the Major Indices Avoid Rangebound Trading?

After a roller coaster start to a new year with major indices having a choppy Monday morning, each has closed positive showing traders optimism for the beginning of 2022.

However, the major indices including the S&P 500 (SPY), Nasdaq 100 (QQQ), Russell 2000 (IWM), and the Dow Jones...

READ MORE

MEMBERS ONLY

Week Ahead: Coming Days May See NIFTY Consolidating with Positive Bias; These Sectors May Do Relatively Better

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Except for some intermittent consolidation, the previous five trading days largely saw the markets advancing and extending their technical pullbacks on the anticipated lines. As mentioned in the previous technical note, the high Put OI at 17000 stayed constant, which lent support to the markets all through the previous week....

READ MORE

MEMBERS ONLY

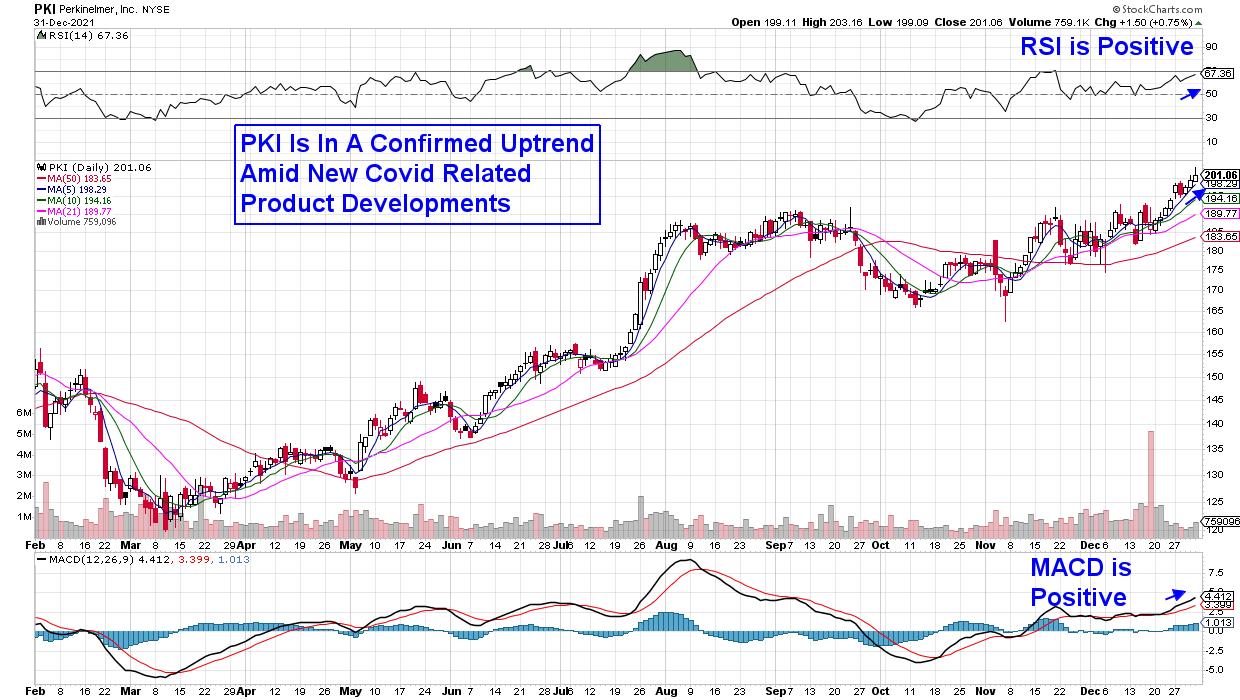

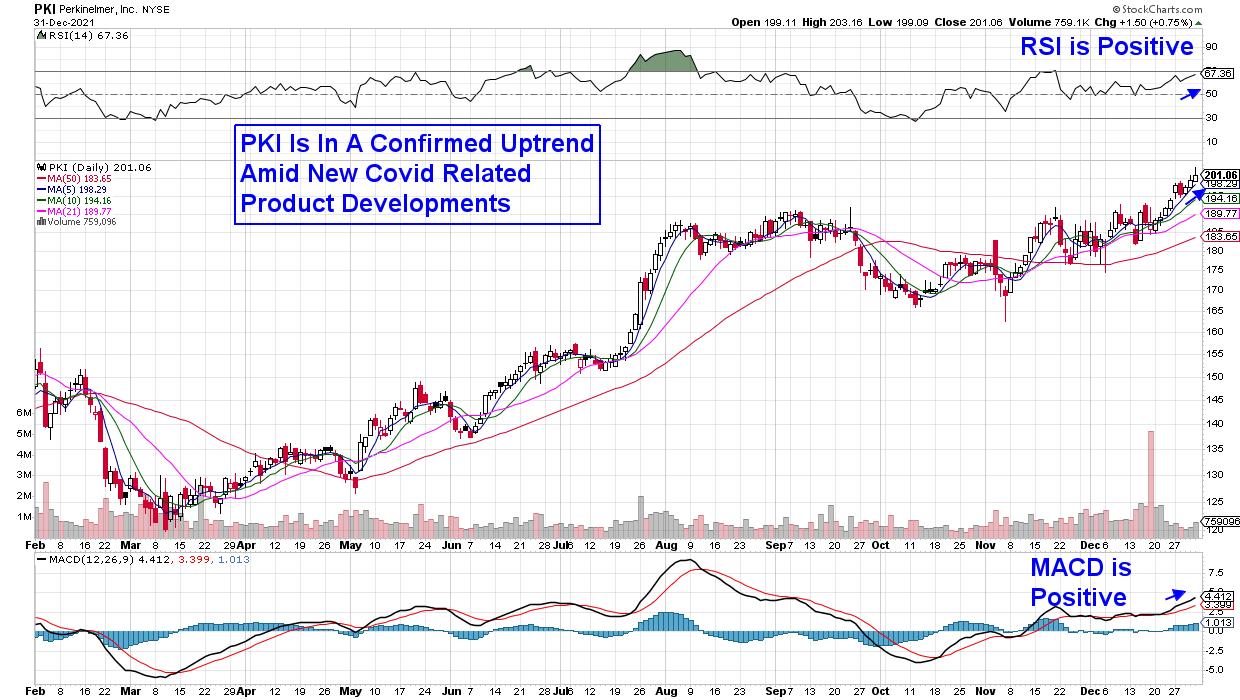

Three Stocks to Watch as We Head into the New Year

by Mary Ellen McGonagle,

President, MEM Investment Research

While it was a banner year for the markets, 2021 ended with a whimper as uncertainty surrounding the impact of a surge in Omicron cases, coupled with inflation fears and a monetary policy shift, pushed defensive stocks higher. Though this month's move into risk-off areas such as REITs,...

READ MORE

MEMBERS ONLY

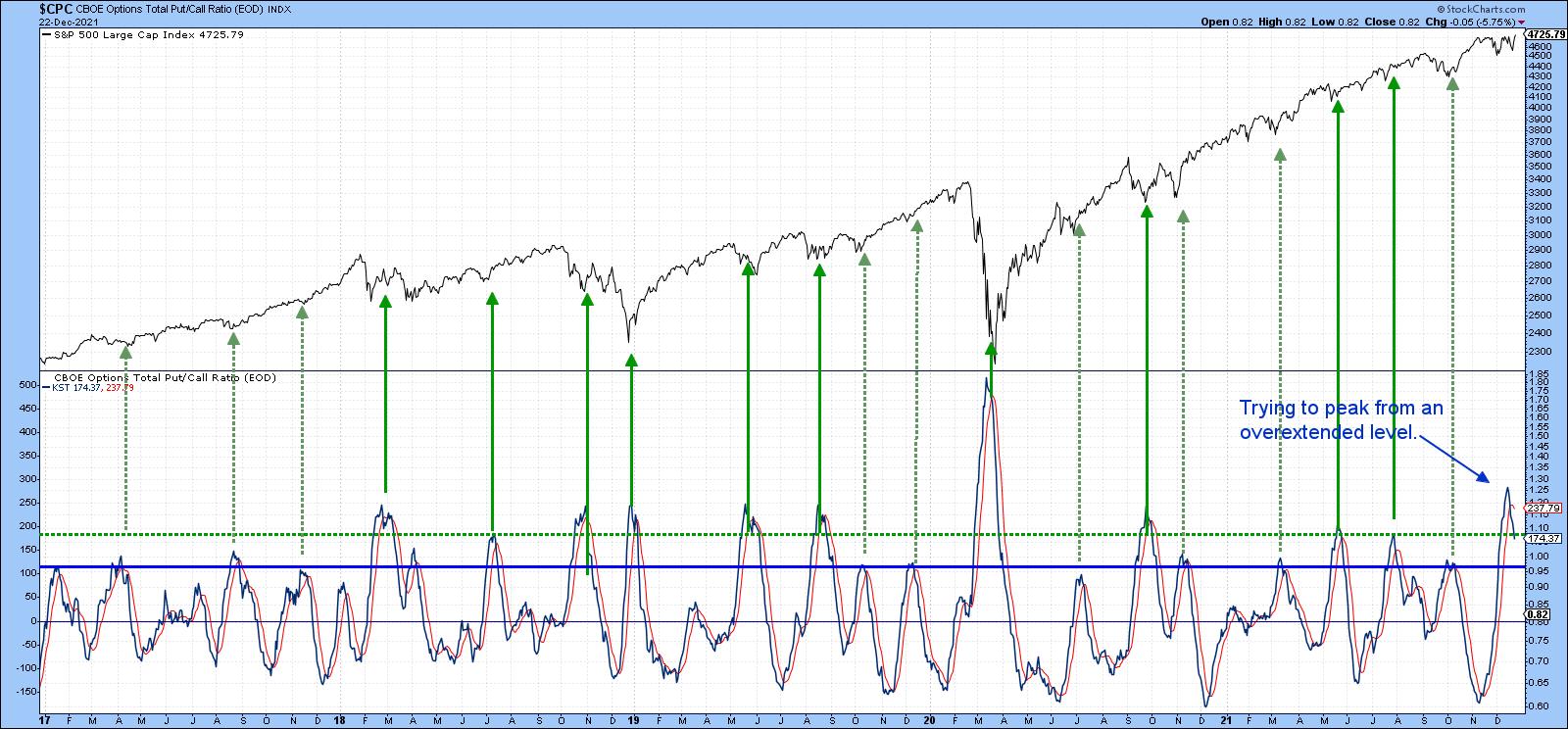

It Could Be a Very Rough Start to 2022

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

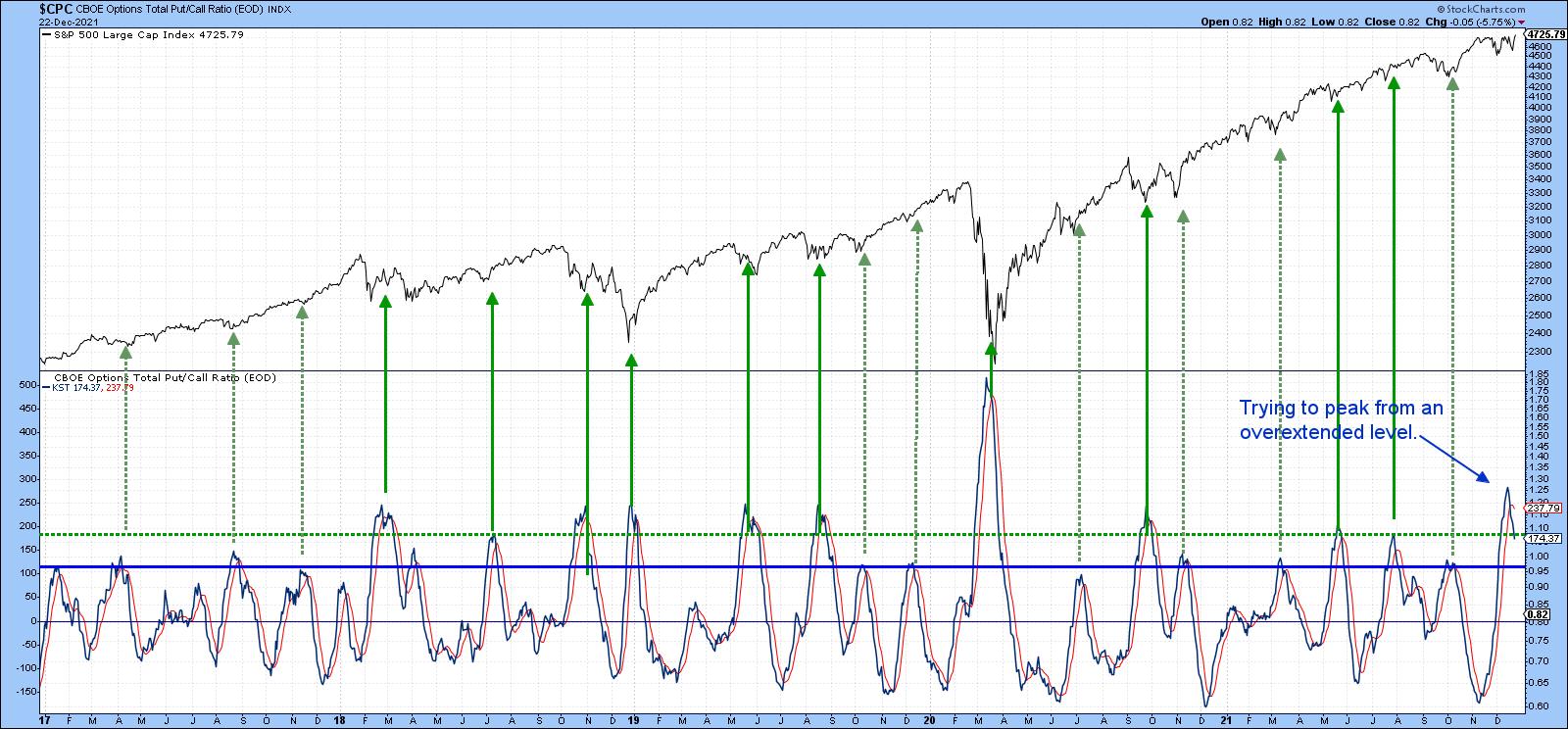

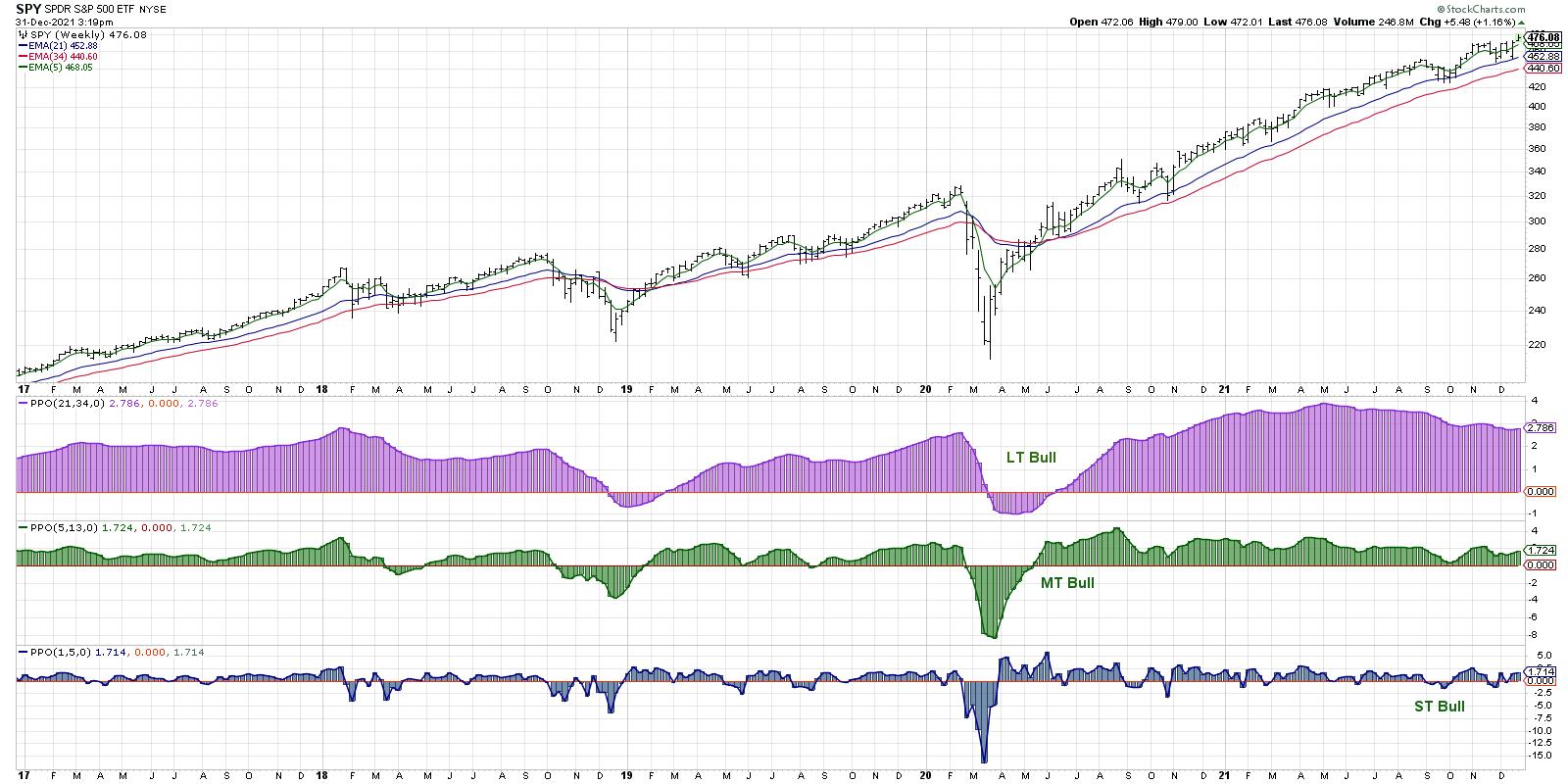

When it comes to stock market performance, it's not always about reality. Many times, perceived problems can be a bigger problem than actual problems. As we wrap up 2021 and head into 2022, there's really no denying that inflation is a problem at both the consumer...

READ MORE

MEMBERS ONLY

Ten Questions to Ask Yourself at Year-End

by David Keller,

President and Chief Strategist, Sierra Alpha Research

The week between Christmas and New Year's is a special week for me. I actually call it "Power Week", and it is basically a week-long process of taking a step back from the "flickering ticks" of day-to-day life to focus on the long-term.

Part...

READ MORE

MEMBERS ONLY

Ready for New RRG Rotations into 2022

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Here we are, on the last day of the year, writing my last ChartWatchers newsletter contribution for 2021.

By the time you are reading this, it will be 2022. So let me kick off by...

wishing you a very happy and above all healthy new year!!

Given the situation the...

READ MORE

MEMBERS ONLY

Learn the Key Details About MACD & ADX

by Joe Rabil,

President, Rabil Stock Research

In this week's special edition of Stock Talk with Joe Rabil, Joe discusses MACD and ADX in detail, defining how they are calculated and why there may be some lag in them when volatility increases. He spends time showing the specifics in the DI line calculation and how...

READ MORE

MEMBERS ONLY

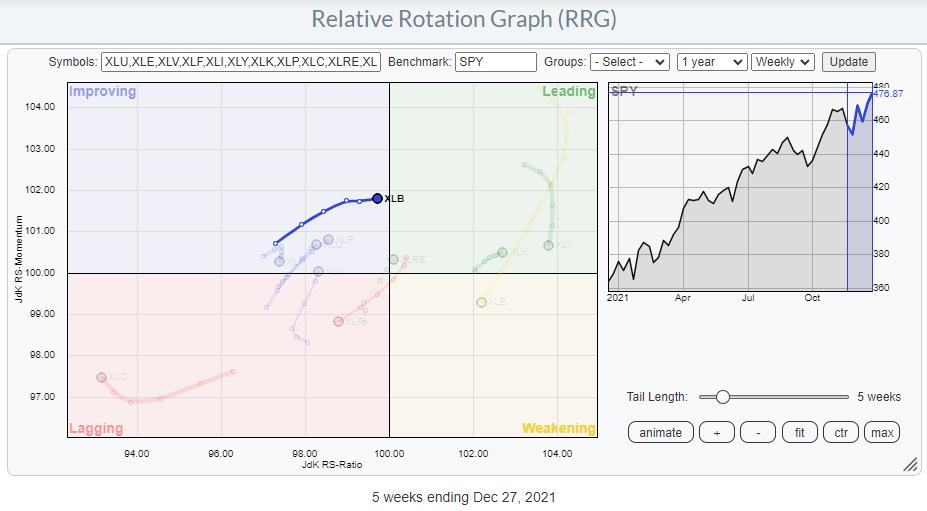

Three Groups to Watch Inside the Materials Sector

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Over the past several weeks, the materials sector has continued to improve very gradually and is now on the verge of crossing over into the leading quadrant.

The bottoming process of relative strength against SPY is still ongoing and has been picked up by the RRG-Lines, which are both rising....

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Placed at Key Juncture; RRG Chart Shows Likely Outperformance from These Pockets

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Over the past five days, the Indian equity markets struggled to maintain their closing levels from the previous week. The beginning of the week was on a steeply negative note; the following four trading days after that were spent recouping from those lower levels. This ensured that, despite decent pullbacks,...

READ MORE

MEMBERS ONLY

Two Intermarket Relationships Worth Monitoring for Early 2022

by Martin Pring,

President, Pring Research

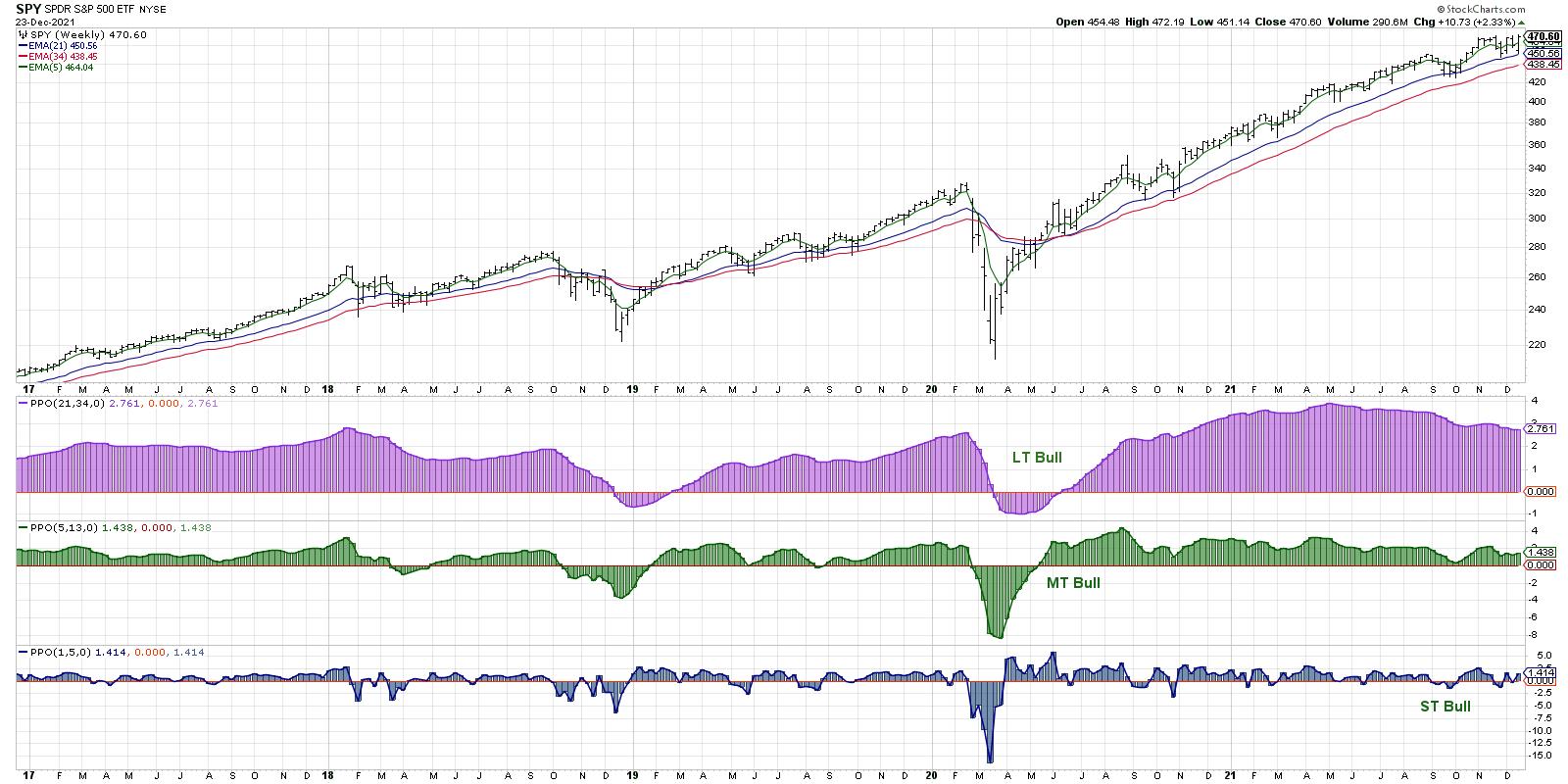

Last week, I pointed out three charts that had triggered bullish signals and suggested that these characteristics were strong enough to power the market higher. Prices immediately sold off, but have subsequently rebounded. Since those charts are still positive, I am sticking to the higher market over the next 2-4...

READ MORE

MEMBERS ONLY

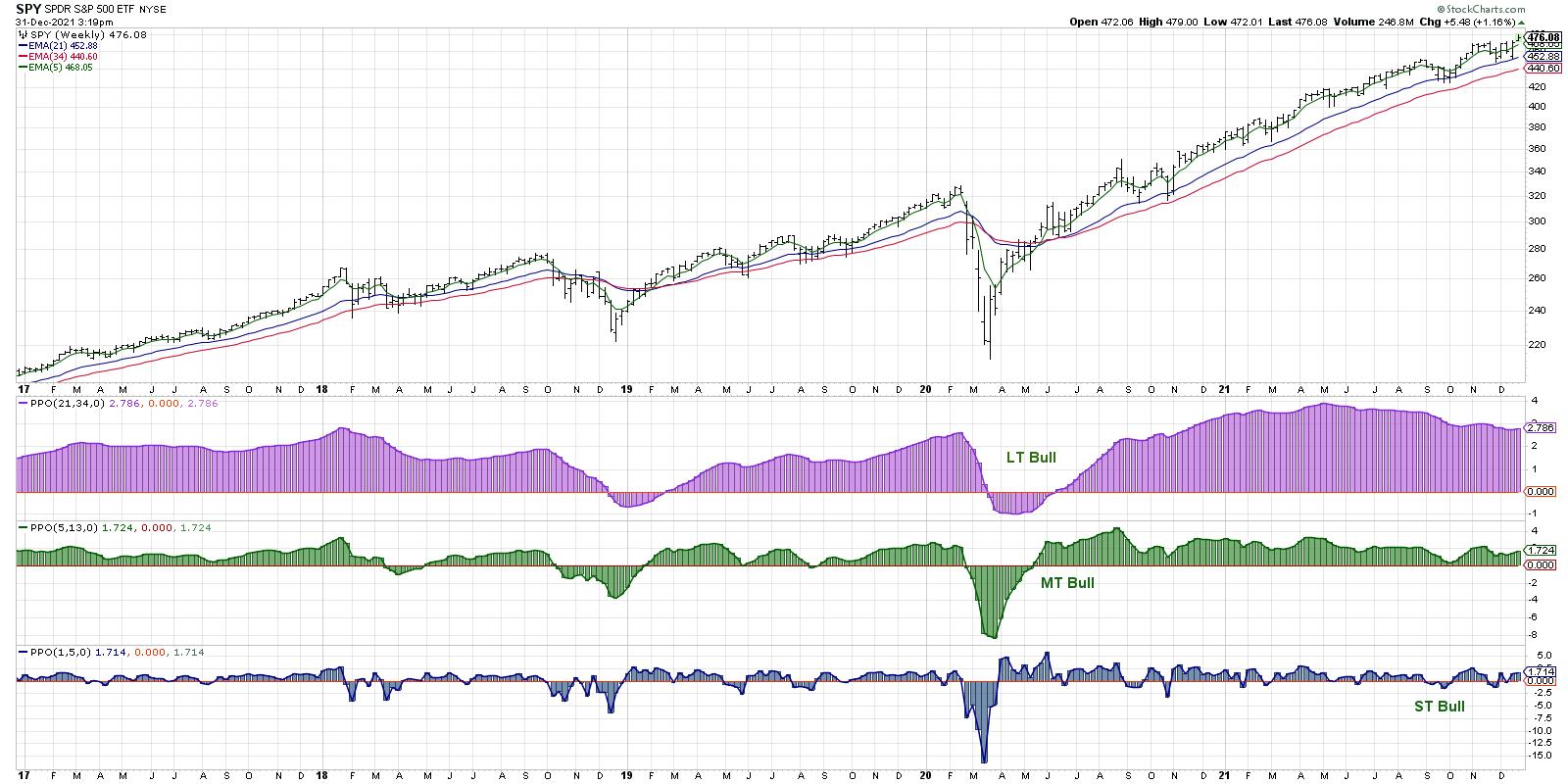

Theme of 2021? Market Resilience. Theme for 2022? TBD

by John Hopkins,

President and Co-founder, EarningsBeats.com

When the S&P hit a record high on November 22, then proceeded to fall over 5% in just over a week, a lot of pundits declared the market was dead. The S&P had simply risen too much for the year and fallen below key technical levels,...

READ MORE

MEMBERS ONLY

Sorry, But I Don't Believe in This Santa Claus Rally

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

It might take more than Old Saint Nick to sustain this current stock market rally. I'm not a believer this year. It reminds me of that catchy holiday tune:

"StockCharts is making a chart and I've checked it twice, gonna find out that Wall Street&...

READ MORE

MEMBERS ONLY

Networking Leads and this Stock Could be Next

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Networking ETF (IGN) is leading the market with a solid uptrend and a new high this week. Diving into the group, I found a stock that recently broke out and formed a short-term bullish continuation pattern. The stock is also in an uptrend and I expect a breakout to...

READ MORE

MEMBERS ONLY

Top Five Charts of 2021

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Try to summarize 2021 in one word.

"Rotational."

"Uncertain."

"Volatile."

Perhaps all of the above?

This year has been all about leadership rotation, with growth names, value stocks and even defensive sectors all spending some time as the strongest performers in a given month....

READ MORE