MEMBERS ONLY

PLUG in Your Batteries

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Earlier this week, I was preparing for my participation in a new episode of The Pitch. Unfortunately, that show got canceled as our host, Dave Keller, got sick with a cold.

One of the stocks I was going to pitch is PLUG. I ran into this company while working my...

READ MORE

MEMBERS ONLY

Are Dip Buyers Ready for Thursday?

Over the past month, the four major indices have rallied to new highs. As seen in the above charts, this is our first pullback since the market cleared key resistance. Although the media has focused on rising inflation as a leading factor for investor worries, we can also learn a...

READ MORE

MEMBERS ONLY

Would You Rather Profit or Pontificate?

by Dave Landry,

Founder, Sentive Trading, LLC

In this edition of Trading Simplified, Dave talks about his methodology in action regarding "Where the Money Is", with a mystery chart follow up and a new mystery chart. He also covers where the money is in crypto and talks money management.

This video was originally broadcast on...

READ MORE

MEMBERS ONLY

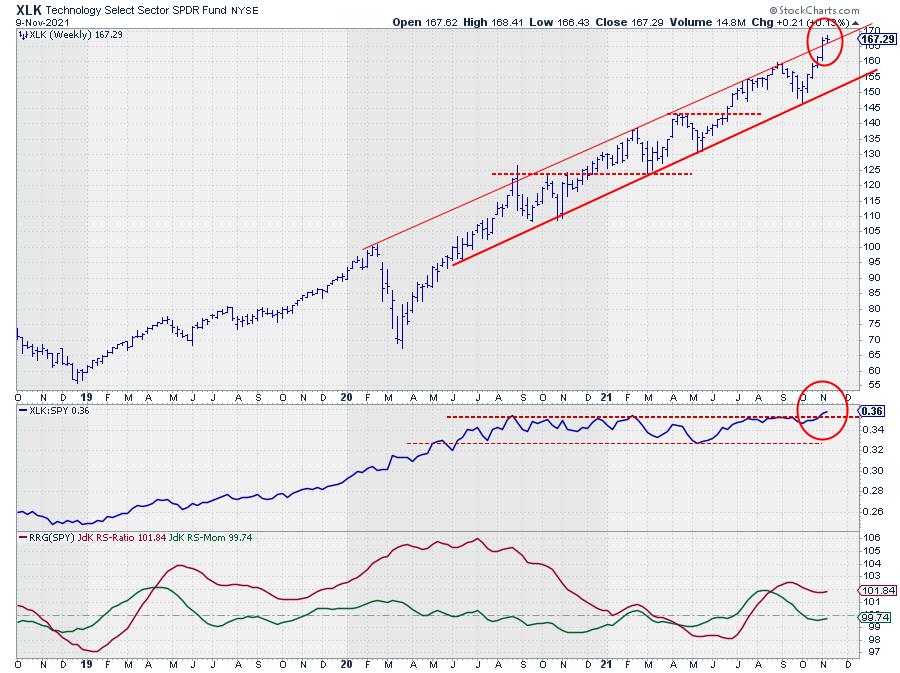

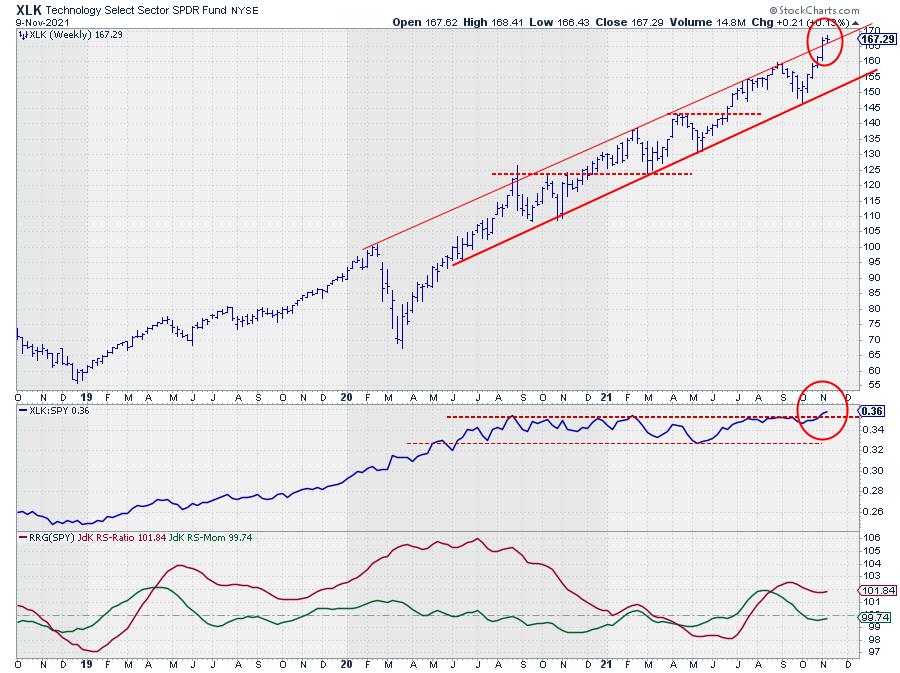

"Finally...." Tech is Breaking Out!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

This may seem an odd title because, you might say, "tech broke out ages ago." While that is true with regard to price, it certainly was not the case for relative strength.

The (raw) RS-Line peaked back in August 2020 and has moved sideways in a narrow range...

READ MORE

MEMBERS ONLY

Inflationary Trades Ripe and Ready

On Monday, we talked about watching High Yield Corporate Bonds (JNK) and 20+ Year Treasury bonds (TLT) ETF as risk-on or off indicator. With risky JNK moving lower and TLT pushing higher, this gave us more caution for trading on Tuesday.

It turns out being cautious was the right side...

READ MORE

MEMBERS ONLY

Watch the Metal; It May Soon be Time to Pedal

by Martin Pring,

President, Pring Research

The gold price zig-zagged its way down between August of last year and April of this one. Since then, it's really been in a trading range and now looks poised to break out. Whether it will or not is another question that only the market can decide.

I&...

READ MORE

MEMBERS ONLY

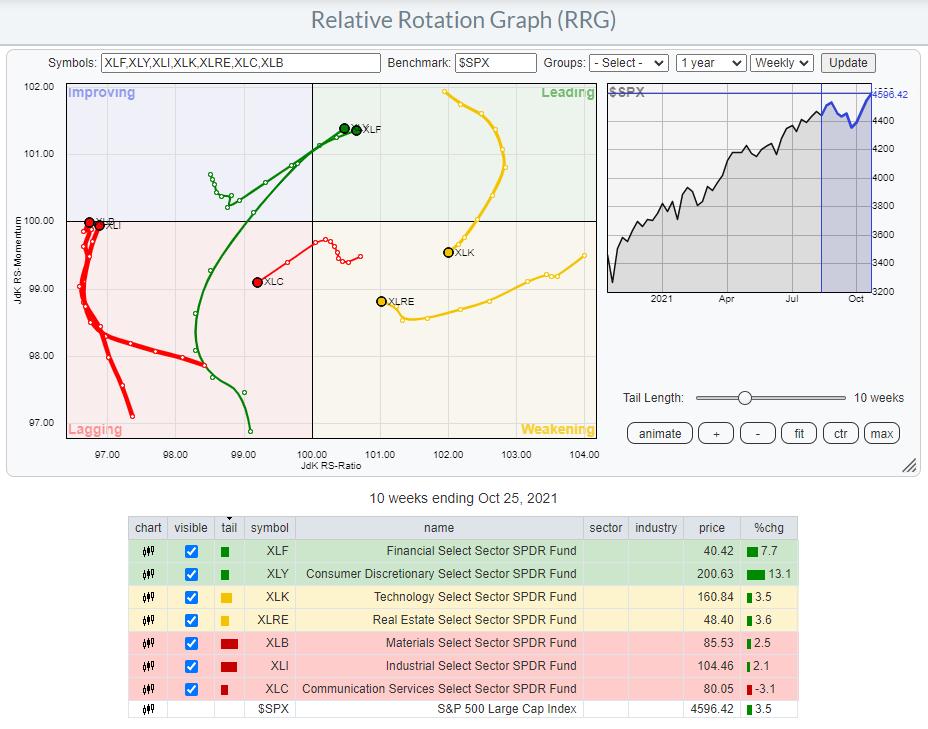

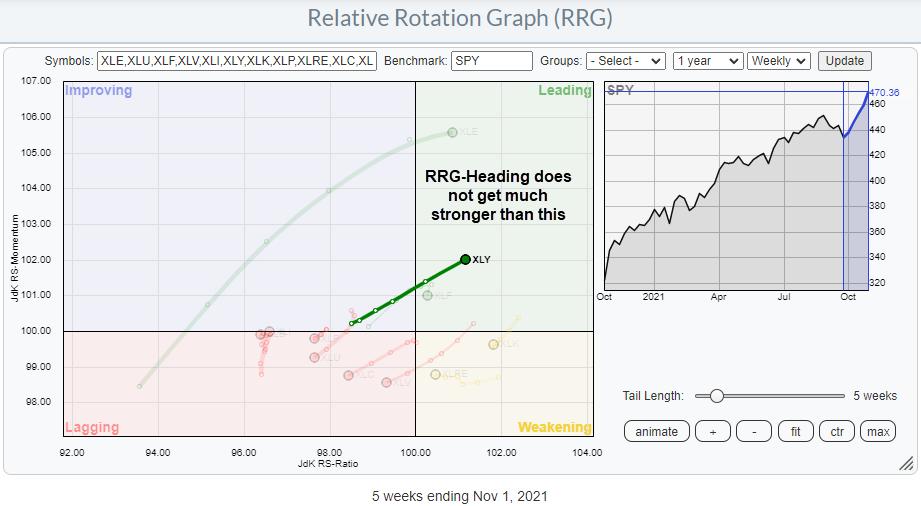

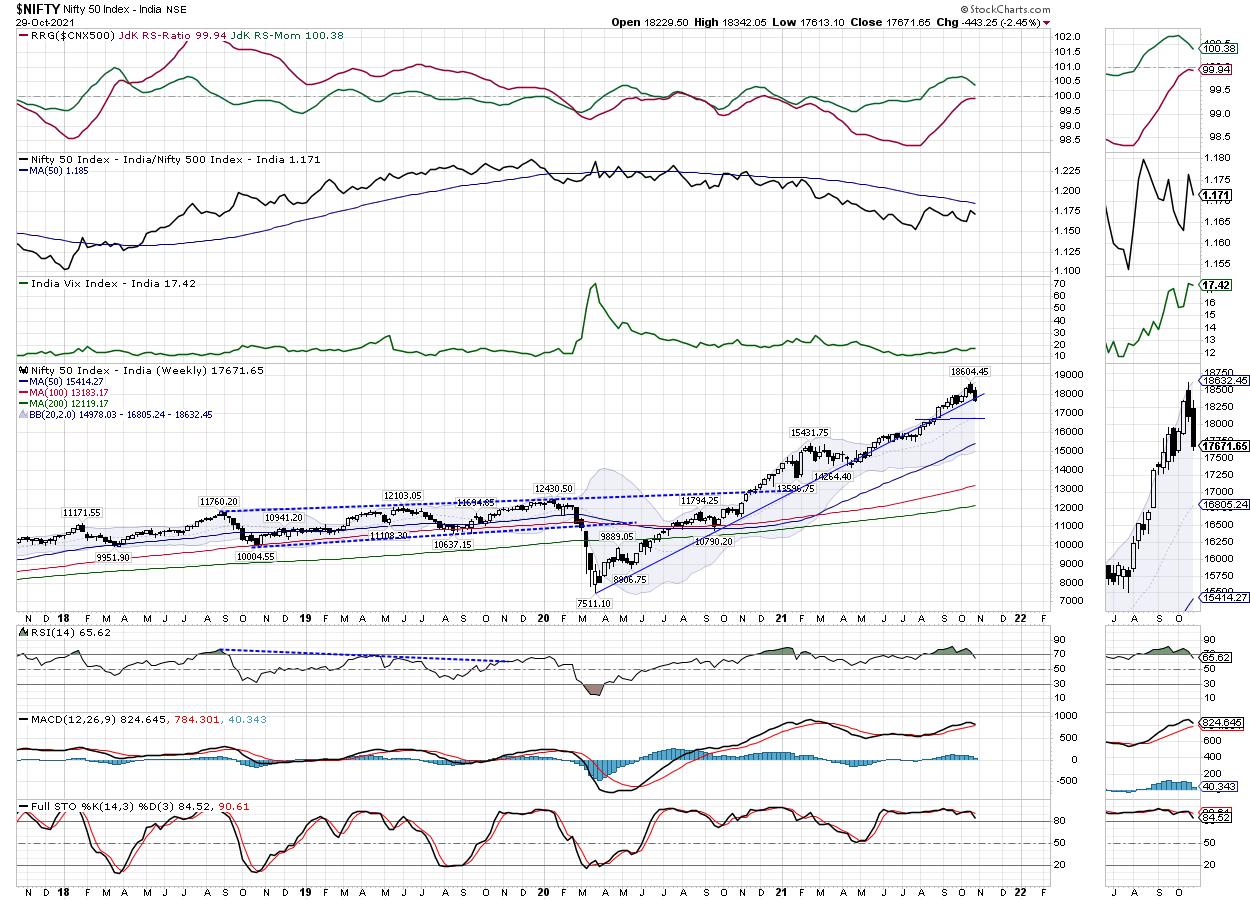

Sector Spotlight: 3 Levels of Sector Rotation on RRG

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this edition of StockCharts TV's Sector Spotlight, I discuss the current rotations in asset classes and sectors and bring the daily rotations into a longer-term perspective on the weekly Relative Rotation Graphs. Then, in the second half, I extend the use of the break down into Cyclical,...

READ MORE

MEMBERS ONLY

DP TV: Materials Breakout! Bullish ETFs/Stocks!

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

On this episode of DecisionPoint, Carl enlightens us on the current market conditions and zeros in on Bitcoin, Gold, Oil and Bonds. Tesla (TSLA) and Nvidia (NVDA) were in the news so Carl gives us his take. The Materials sector (XLB) broke out above resistance and has brought plenty of...

READ MORE

MEMBERS ONLY

Is The Stock Market Looking to Consolidate Near Highs?

Inflation pressures take the media's focus this week. Nevertheless, we must remember the news does not always align with market price.

With that said, prices are holding near highs in the major indices. This is a positive sign as investors are looking for a continuation in trend or...

READ MORE

MEMBERS ONLY

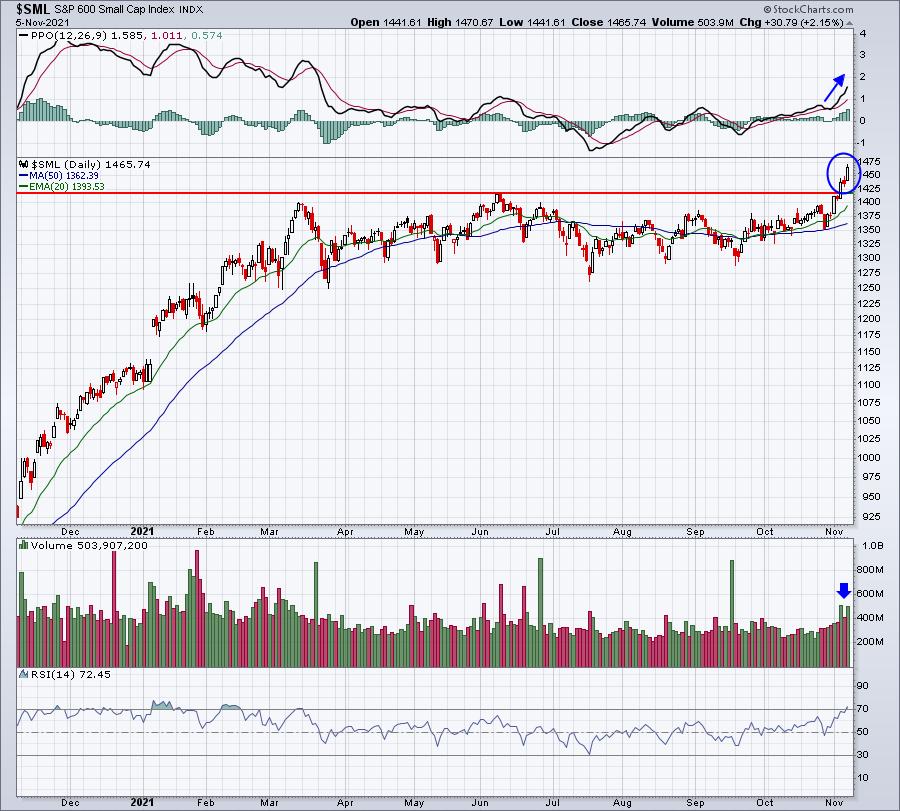

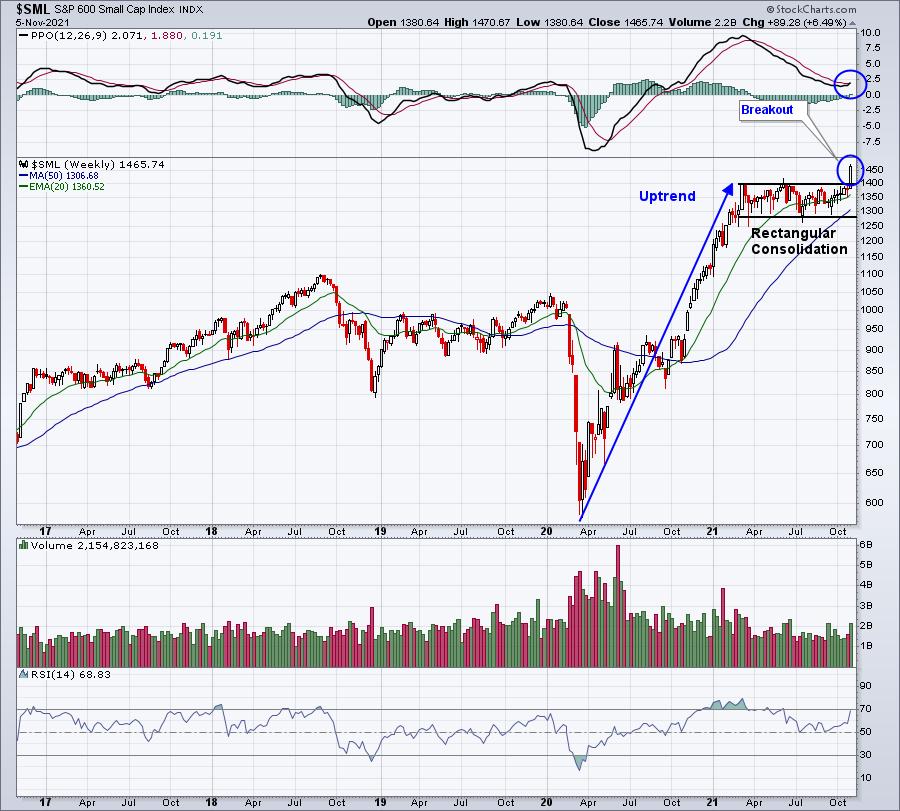

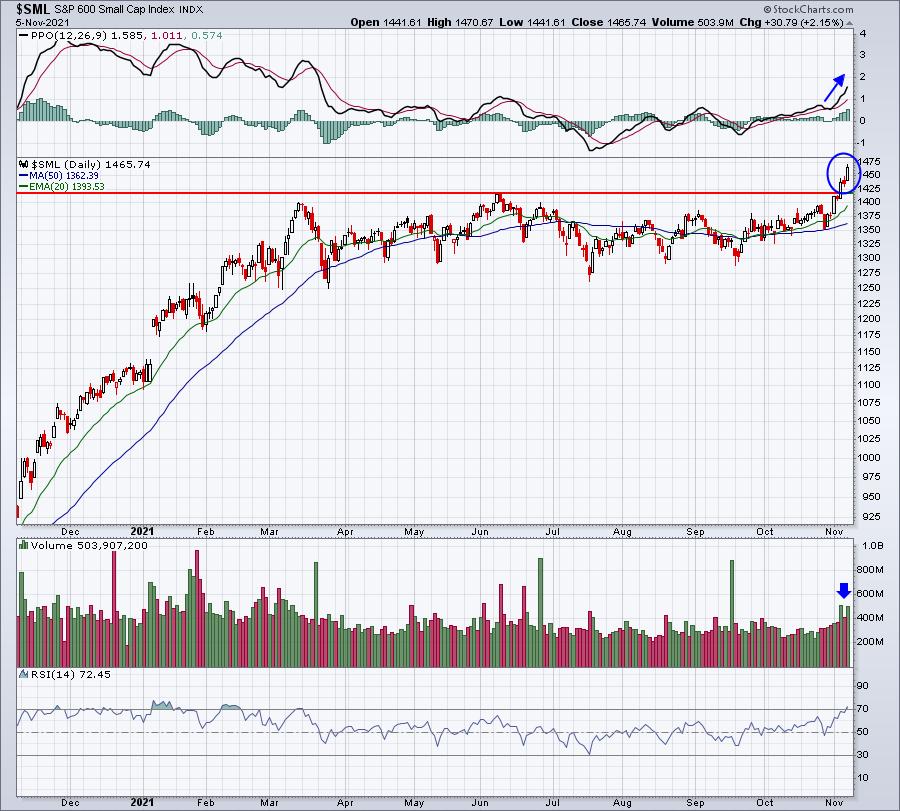

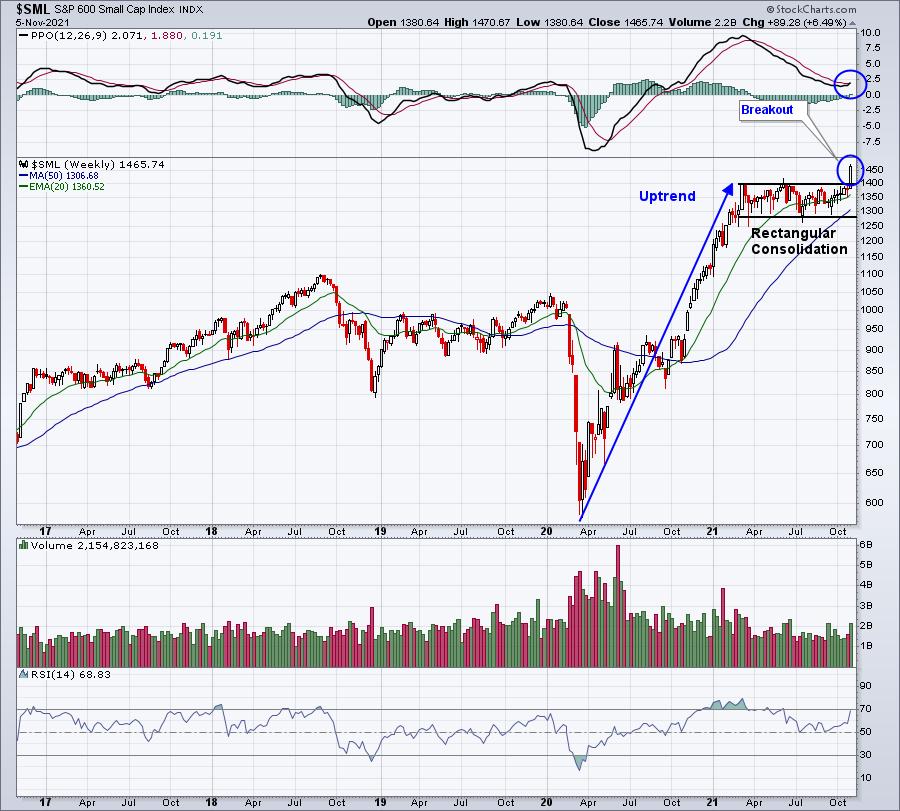

Small Caps Broke Out, But Which Small Caps Should We Consider?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

For me, the breakout in a particular area triggers a series of questions in order to find the best trading opportunities. Last week, small caps finally joined the U.S. equities party in all-time high territory. The chart breakout is simply the first step in my research:

This provides us...

READ MORE

MEMBERS ONLY

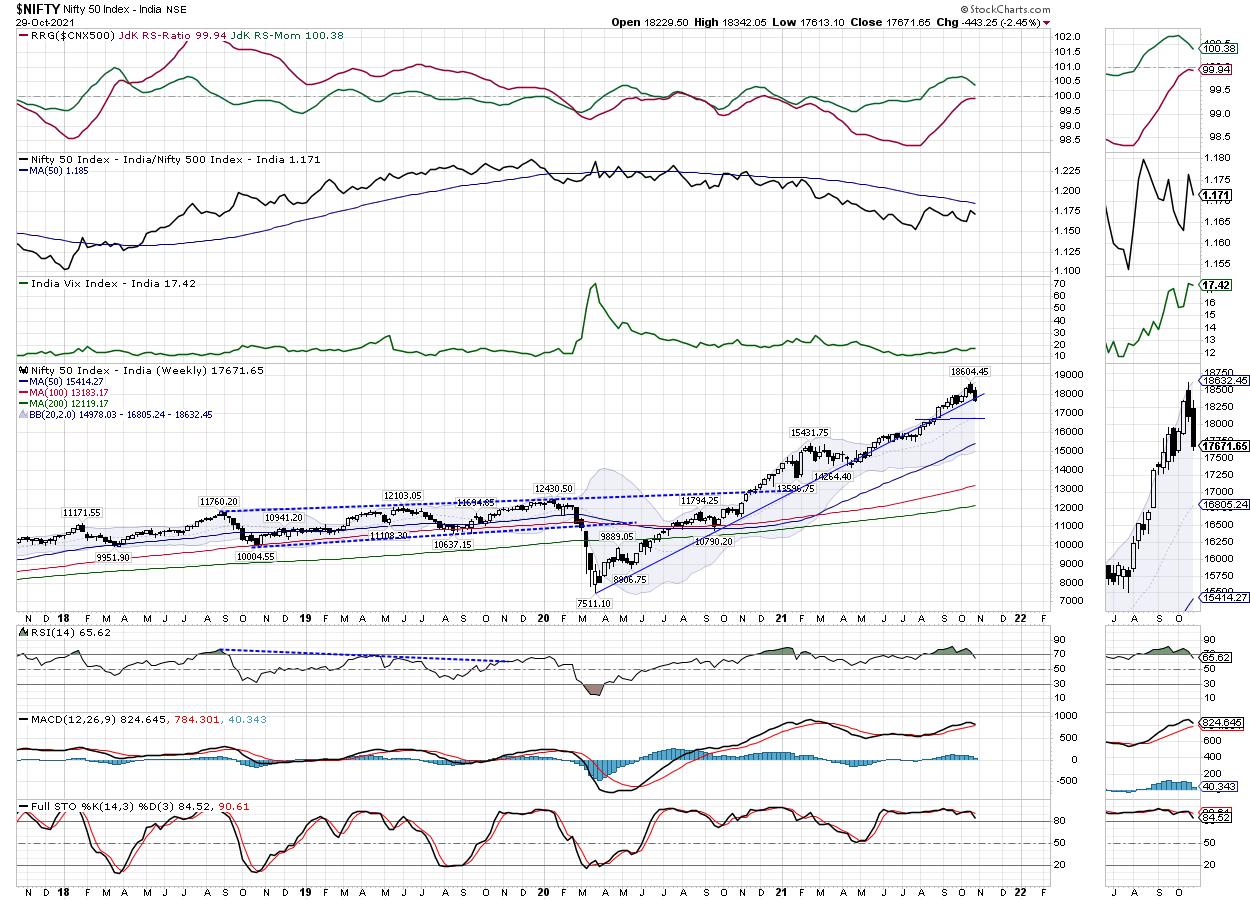

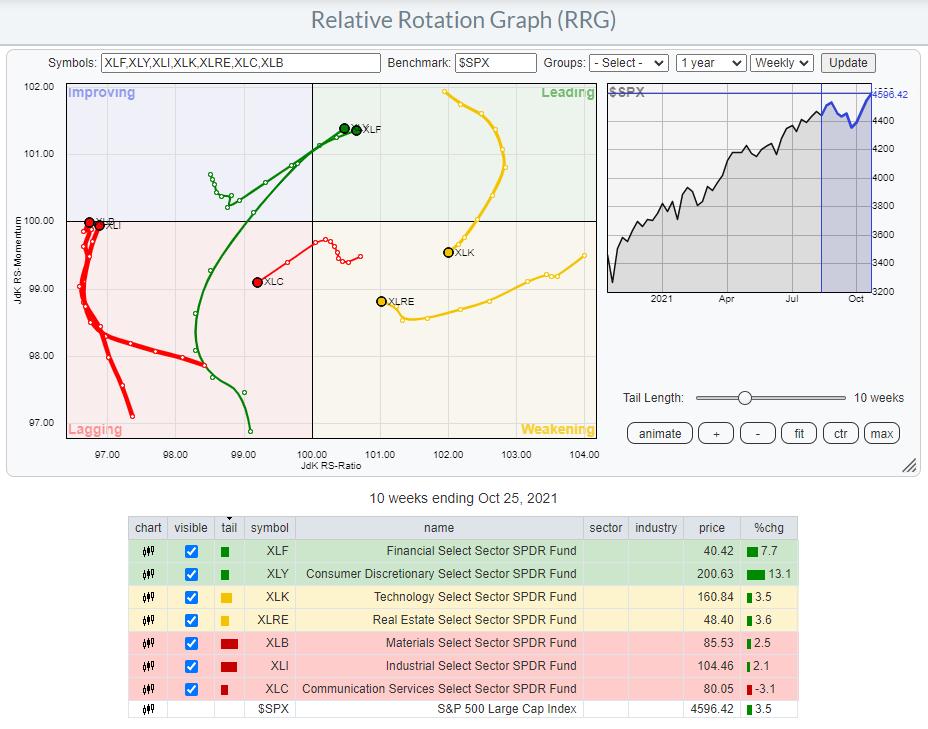

Week Ahead: NIFTY May Inch Higher If This Level is Taken Out; RRG Chart Shows MidCaps Rolling Inside Leading Quadrant

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In a three-day trading week truncated by festivities, the Indian equity markets attempted to stabilize on the expected lines. The market rebounded from near the 50-DMA levels and also took support on an 18-month long upward rising trend line on the weekly charts. The NIFTY stayed in a narrower 315-point...

READ MORE

MEMBERS ONLY

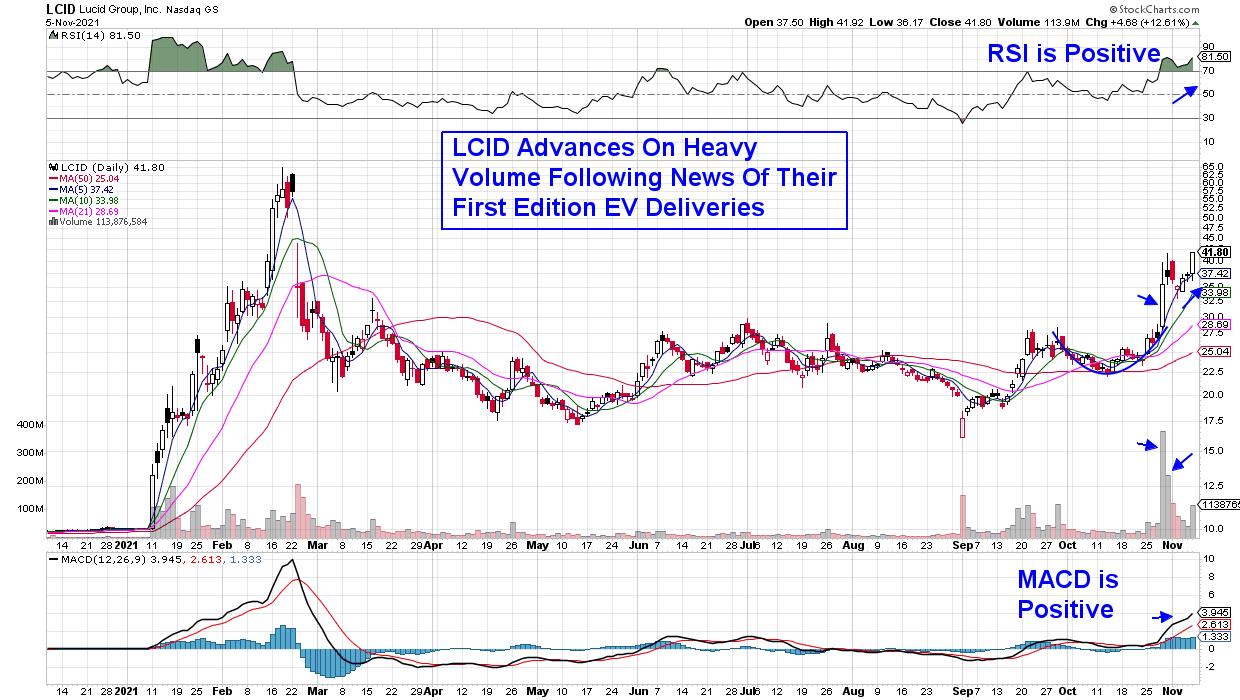

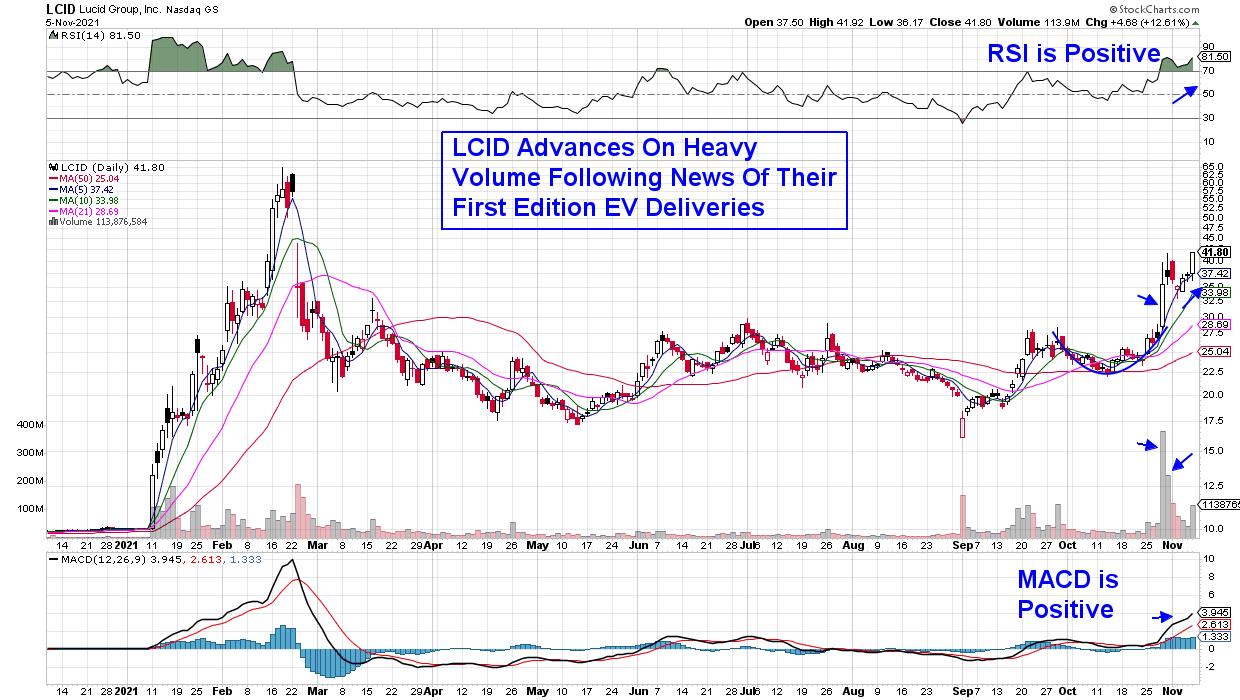

Ford vs Ferrari — The EV Race is Real and These Stocks are Set to Benefit

by Mary Ellen McGonagle,

President, MEM Investment Research

The Consumer Discretionary sector hit another new high in price last week. While Leisure and Entertainment stocks rallied on Friday's news of Pfizer (PFE)'s highly effective Covid pill, the recent rally in Discretionary stocks has been all about Automobile stocks and, in particular, companies that are...

READ MORE

MEMBERS ONLY

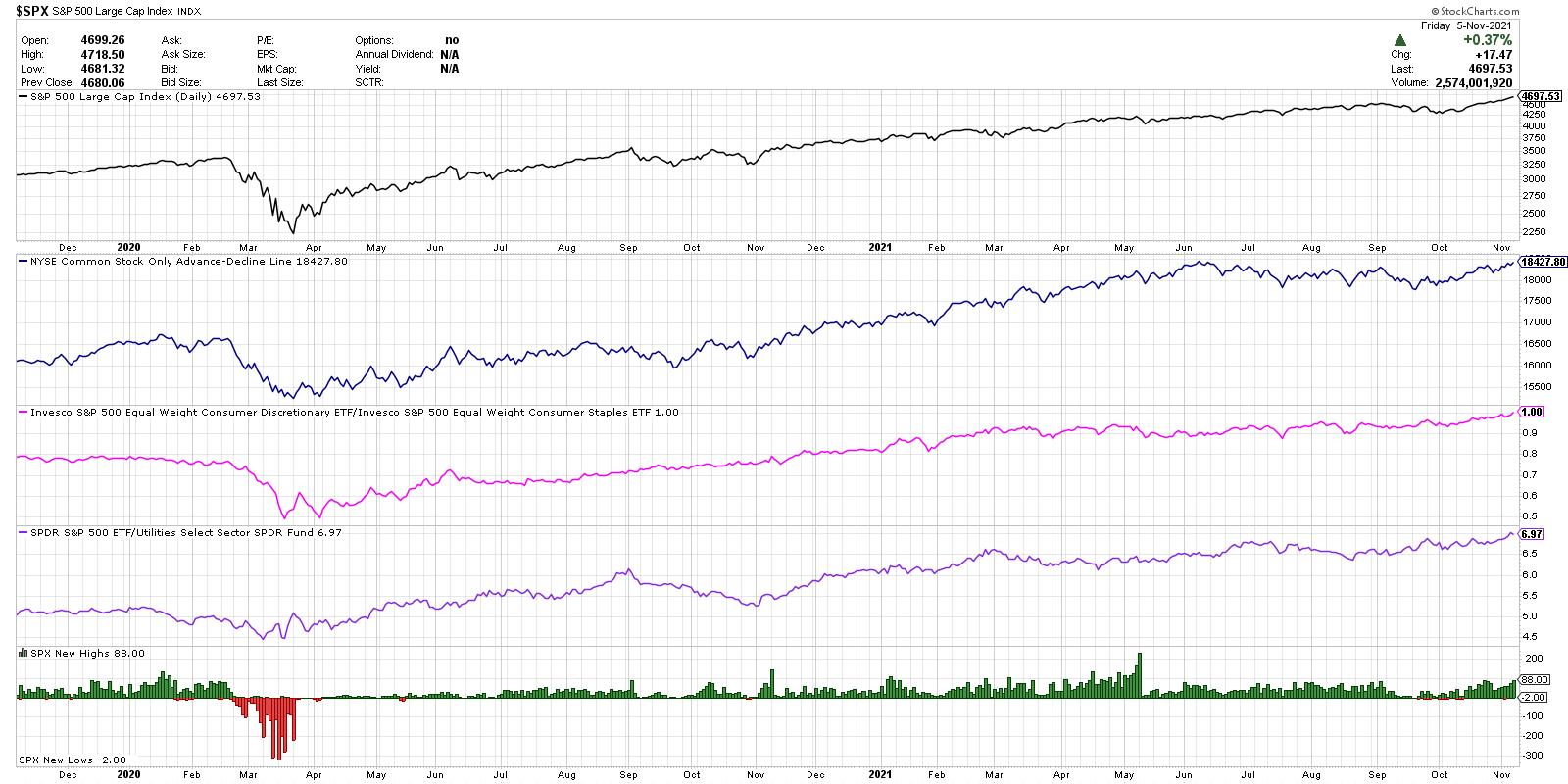

When is the S&P 500 No Longer Bullish?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

One of the best parts of hosting The Final Bar on StockCharts TVis the opportunity to compare notes with some of the top technical analysts and traders in the markets.In my recent discussions, we've discussed new highs for the S&P 500, Nasdaq, Russell 2000, Dow...

READ MORE

MEMBERS ONLY

3 Major Leadership Changes in November

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Like most technicians, I take a "top down" approach when it comes to my trading strategy. I start with the overall market, which, I believe, continues to be insanely bullish. My two biggest worries in the market have been alleviated as both small-cap stocks ($SML) and transportation stocks...

READ MORE

MEMBERS ONLY

Stealth Stocks Exploding After Earnings

by Mary Ellen McGonagle,

President, MEM Investment Research

On this episode StockCharts TV'sThe MEM Edge, Mary Ellen reveals what's driving moves into the biggest gainers after earnings, as well as names poised to rally after their upcoming reports. She also highlights areas that have further upside following today's positive COVID pill news....

READ MORE

MEMBERS ONLY

First People Buy Cars, Then They Need Parts (and Tires)

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

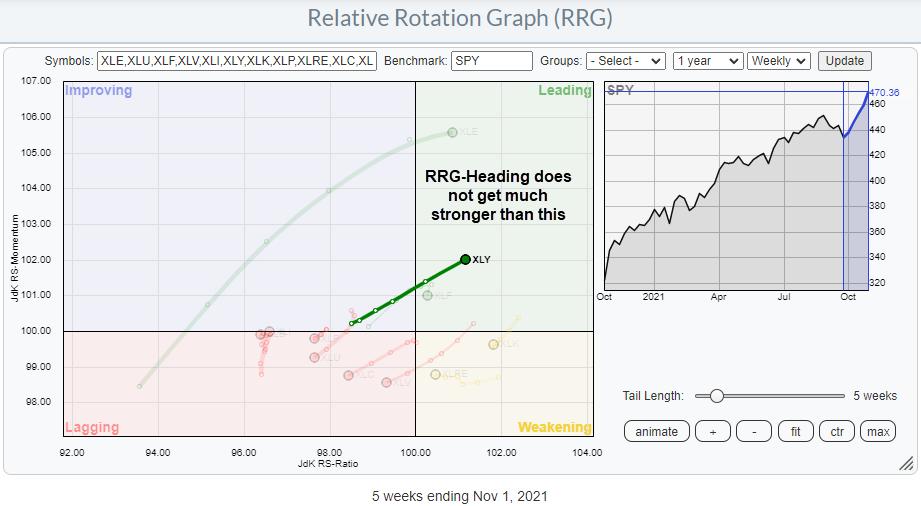

One of the (if not THE) most promising tails on the Relative Rotation Graph for US sectors is on XLY, the Consumer Discretionary sector. Over the last five weeks, the tail on XLY shows an almost straight line into the leading quadrant while gaining on both axes. Things do not...

READ MORE

MEMBERS ONLY

These 7 Symbols Give a Complete Market Picture

Mish's Economic Modern Family consists of 5 key sectors, one major index and Bitcoin. Bring them all together and you have an easy and quick way to look at the market, grasp overall trends and see where potential pressure is leaning. Each symbol is meant to display a...

READ MORE

MEMBERS ONLY

AIRLINES LEAD INDUSTRIAL SPDR TO A NEW RECORD -- DELTA AND UAL LEAD AIRLINES

by John Murphy,

Chief Technical Analyst, StockCharts.com

INDUSTRIAL SPDR HITS NEW RECORD... A strong jobs report has boosted major stock indexes into record territory with most sectors also rising. Industrials are one of the day's strongest sectors. Chart 1 shows the Industrial Sector SPDR (XLI) moving into record territory today. It's being led...

READ MORE

MEMBERS ONLY

Trend-Following: The Good, the Bad and the Ugly

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

We have all heard of trend-following and many us employ trend indicators in our strategies. But how do these indicators actually perform over an extended period of time and in varying market conditions? Let's look at an example.

The chart below shows Alphabet (GOOGL) with two trend indicators:...

READ MORE

MEMBERS ONLY

Let Me Show You Why Relative Strength Is So Important

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

If you're not already familiar with relative strength, then I have to ask why not? Yes, absolute price action is extremely important, but so is relative strength. I'm going to give you a perfect example of why you need to be aware of relative strength. Texas...

READ MORE

MEMBERS ONLY

Chartwise Women: Follow Where the Money Flows!

by Mary Ellen McGonagle,

President, MEM Investment Research

by Erin Swenlin,

Vice President, DecisionPoint.com

On this week's edition of Chartwise Women, Mary Ellen and Erin share how you can get in front of where the strength is in the market through "Sector Rotation". The two share how you can "put your money on the right horse in the race....

READ MORE

MEMBERS ONLY

How the ADX and DI Lines Work Together

by Joe Rabil,

President, Rabil Stock Research

In this week's edition of Stock Talk with Joe Rabil, Joe Rabil explains the relationship between the 2 DI lines and the ADX line. He discusses how they show phases of expansion and contraction. He then analyzes all the viewer stock requests that came through this week, including...

READ MORE

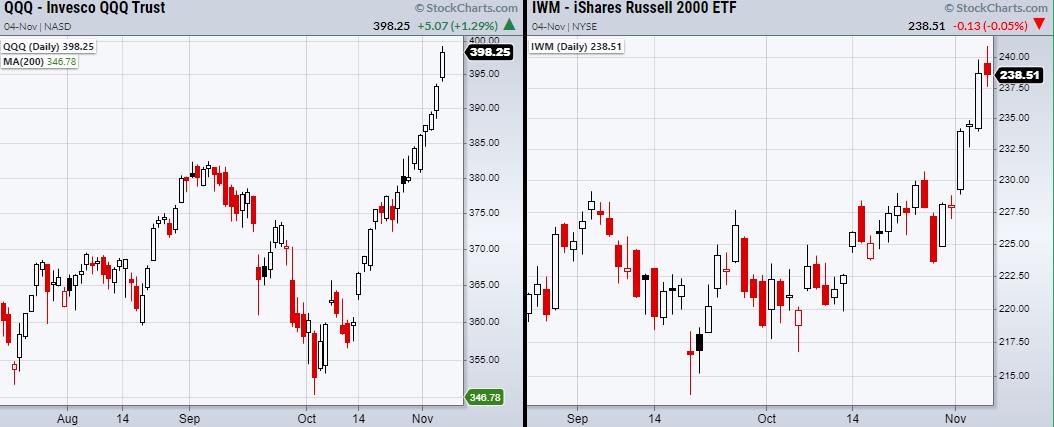

MEMBERS ONLY

How to Improve Your Profit-Taking Rules

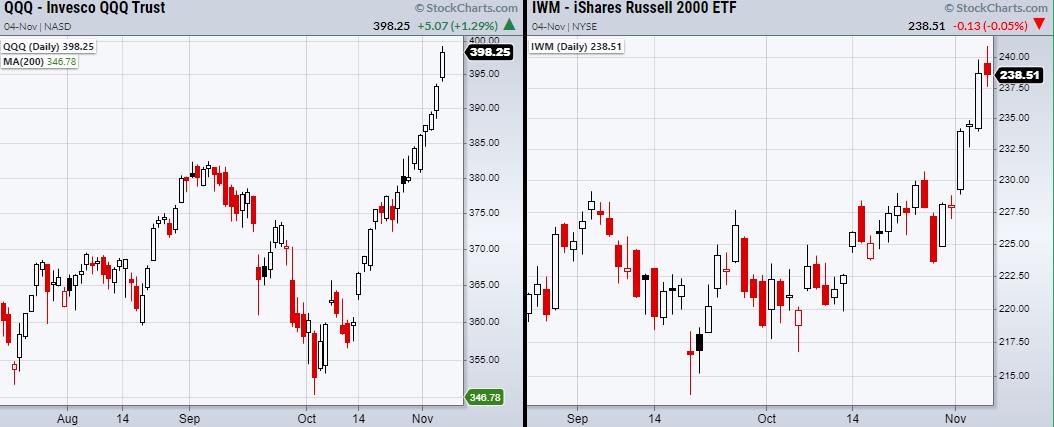

The S&P 500 (SPY) and the Nasdaq 100 (QQQ) both sit at highs, while the small-cap Russell 2000 (IWM) digests its recent breakout.

Triggered from Wednesday's bullish Fed meeting, the overall market has made a huge push Thursday. While many traders are loading up on positions,...

READ MORE

MEMBERS ONLY

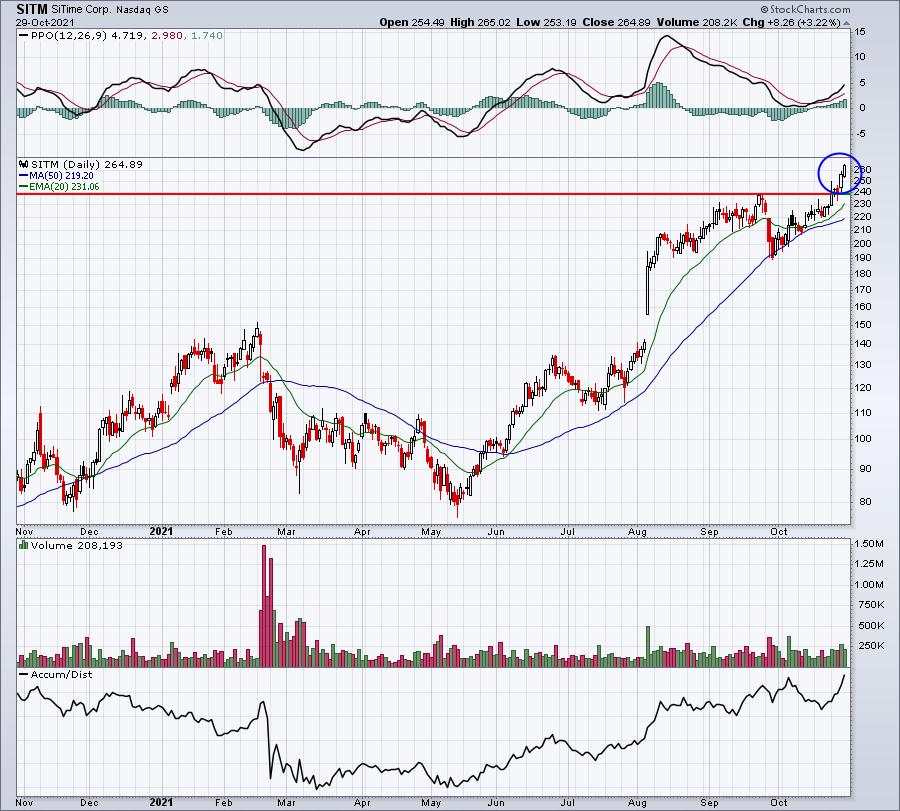

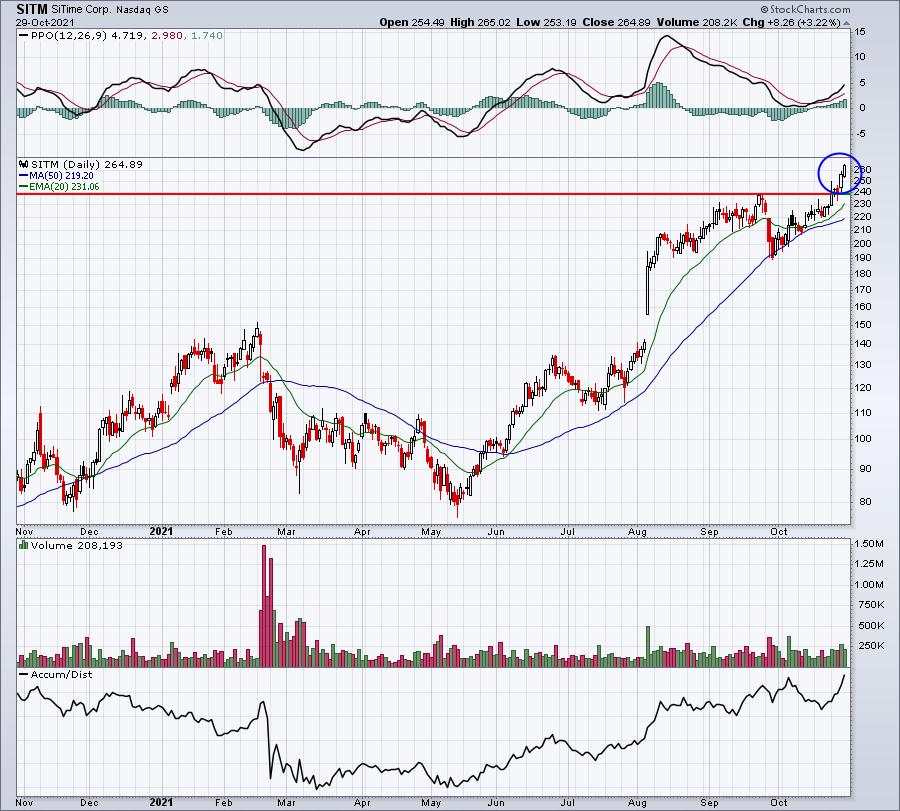

Semiconductors are Flying - Here's a Major Breakout

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

My favorite breakout is one that occurs after a lengthy basing period. Stocks that go through these frustrating periods can be quite rewarding when they finally make the breakout. And when those breakouts occur in an industry group that Wall Street loves, well, even better!

Currently, there aren't...

READ MORE

MEMBERS ONLY

Major Indices Create Important New Support Levels

The Fed has announced it will continue with its tapering plan. However, the Fed will decrease bond-buying by 10 billion per month, instead of the previously stated 15 billion. As of now, the program is set to buy 120 billion in bonds per month. This dovish sign creates an easier...

READ MORE

MEMBERS ONLY

We Might be in the Right Place at the Right Time

by Dave Landry,

Founder, Sentive Trading, LLC

In this edition of Trading Simplified, after a follow up on mystery charts, Dave continues his discussion on inefficient markets and how being in the right place at the right time can get you major gains. However, for this to work, you first need the ability to recognize it and...

READ MORE

MEMBERS ONLY

The Key Ingredient In Short Squeezes Is Triggering Again

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Have you ever heard a meteorologist describe the odds of a tornado touching down? They usually start by outlining the "conditions necessary" for a tornado. Early in the day, or possibly even the prior day, the meteorologist will say something like "this area has a 30% chance...

READ MORE

MEMBERS ONLY

The S&P is at New Highs: Now What, Especially for Small Caps?

by Martin Pring,

President, Pring Research

The major averages have recently been scoring new highs for the year, strongly hinting that the post-May correction has run its course. So where do we go from here? Is the market overbought and likely to digest recent gains, or is a rally into the bullish year-end period a better...

READ MORE

MEMBERS ONLY

Sector Spotlight: Bullish New Highs on Monthly Charts

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this edition of StockCharts TV's Sector Spotlight, being the first Tuesday of the month, I take on the completed monthly charts for October. I kicks off the show with a look back at last week's rotations on the Relative Rotation Graphs for Asset Classes and...

READ MORE

MEMBERS ONLY

DP TV: Is Natural Gas Prepping for a Reversal?

by Carl Swenlin,

President and Founder, DecisionPoint.com

by Erin Swenlin,

Vice President, DecisionPoint.com

On this episode of DecisionPoint, Carl and Erin give you the scoop on where the SPY might be headed based on exclusive DecisionPoint indicators. Carl also reviews Gold Miners and Bitcoin, as well as Gold, Dollar, Crude and Bonds. Erin queues up the sector CandleGlance to search for strength and...

READ MORE

MEMBERS ONLY

Why You Should Be Watching Junk Bonds (JNK) This Week

This Tuesday and Wednesday, the Federal Reserve policy meeting will be held. Investors are expecting to hear a tapering announcement involving the monthly bond-buying program. This is the same program that has given the market its bullish gusto and is closely tied to the overall economic recovery throughout the pandemic....

READ MORE

MEMBERS ONLY

One Candle Can Light Up A Chart

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I occasionally refer to myself as a Technifundahistorian, because I believe in technicals, fundamentals, and history. I practiced in public accounting in 20 years, so I cannot ignore those basics. Earnings matter. And beating earnings estimates and raising future guidance REALLY matters. That's why we regularly update our...

READ MORE

MEMBERS ONLY

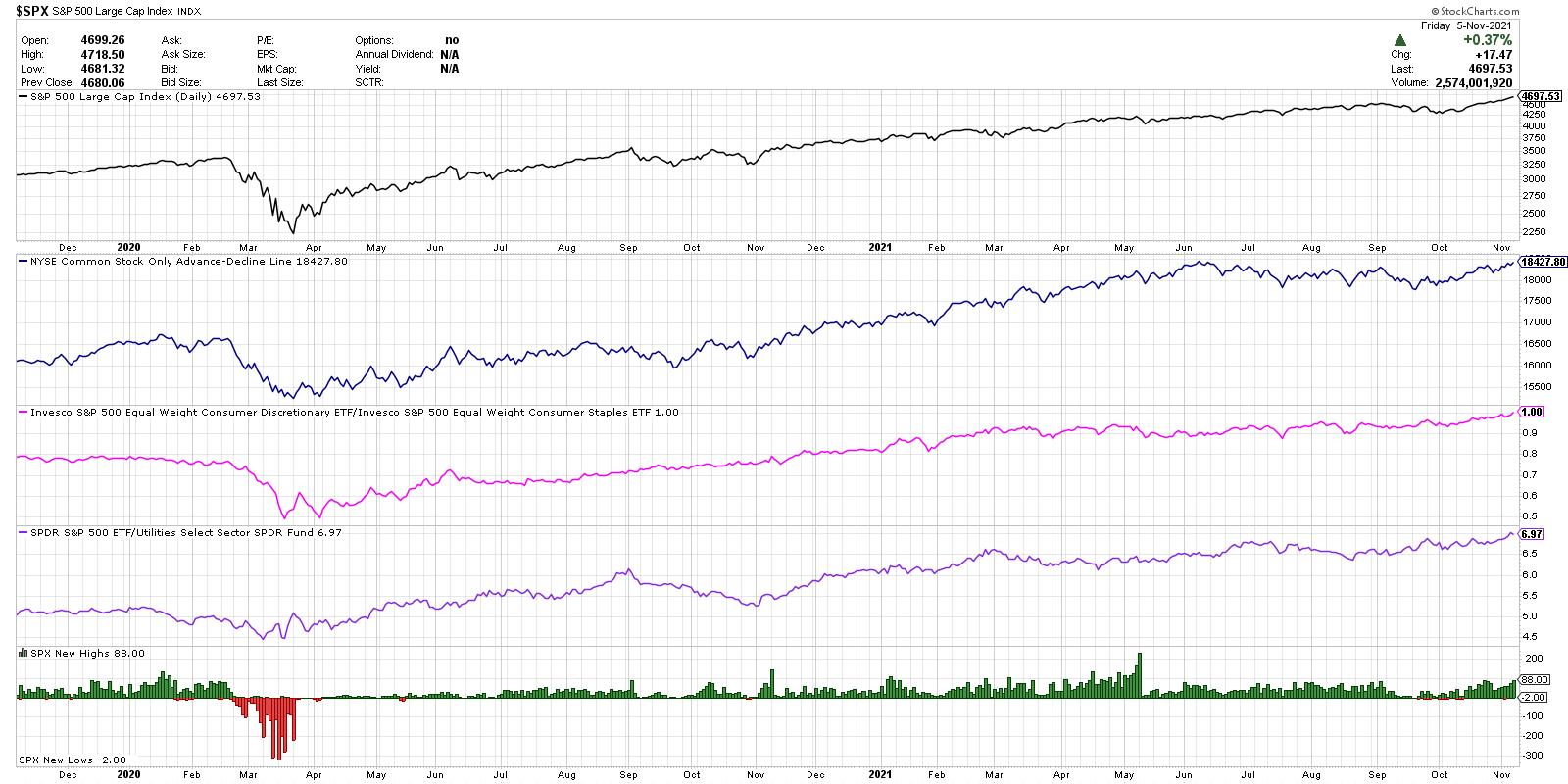

Offensive / Defensive Rotations & BETA Suggest More Upside For S&P 500

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Offensive vs Defensive sector rotation always is a theme in stock markets. Sometimes a little more on the forefront, sometimes a bit more on the background. Sometimes we can read very clear messages from certain rotations, sometimes a little less.

At the moment, I believe, the offensive/defensive rotation is...

READ MORE

MEMBERS ONLY

Week Ahead: Truncated Week May See NIFTY Trying to Stabilize; RRG Chart Shows Broader Markets May Do Well

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In the week before this one, the markets had shown the first signs of some fatigue, as it had ended on a negative note leading to a dark cloud formation on the candles. Over the past five days, the Indian equity market extended its correction; it went on to test...

READ MORE

MEMBERS ONLY

Which Stocks Are Under Heavy Accumulation? Here Are Two To Consider

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Where should you invest your hard-earned money? That's a question that we ask ourselves quite frequently. And I don't know that there's an easy answer to this question. I like to see where Wall Street is investing its money and then make a decision...

READ MORE

MEMBERS ONLY

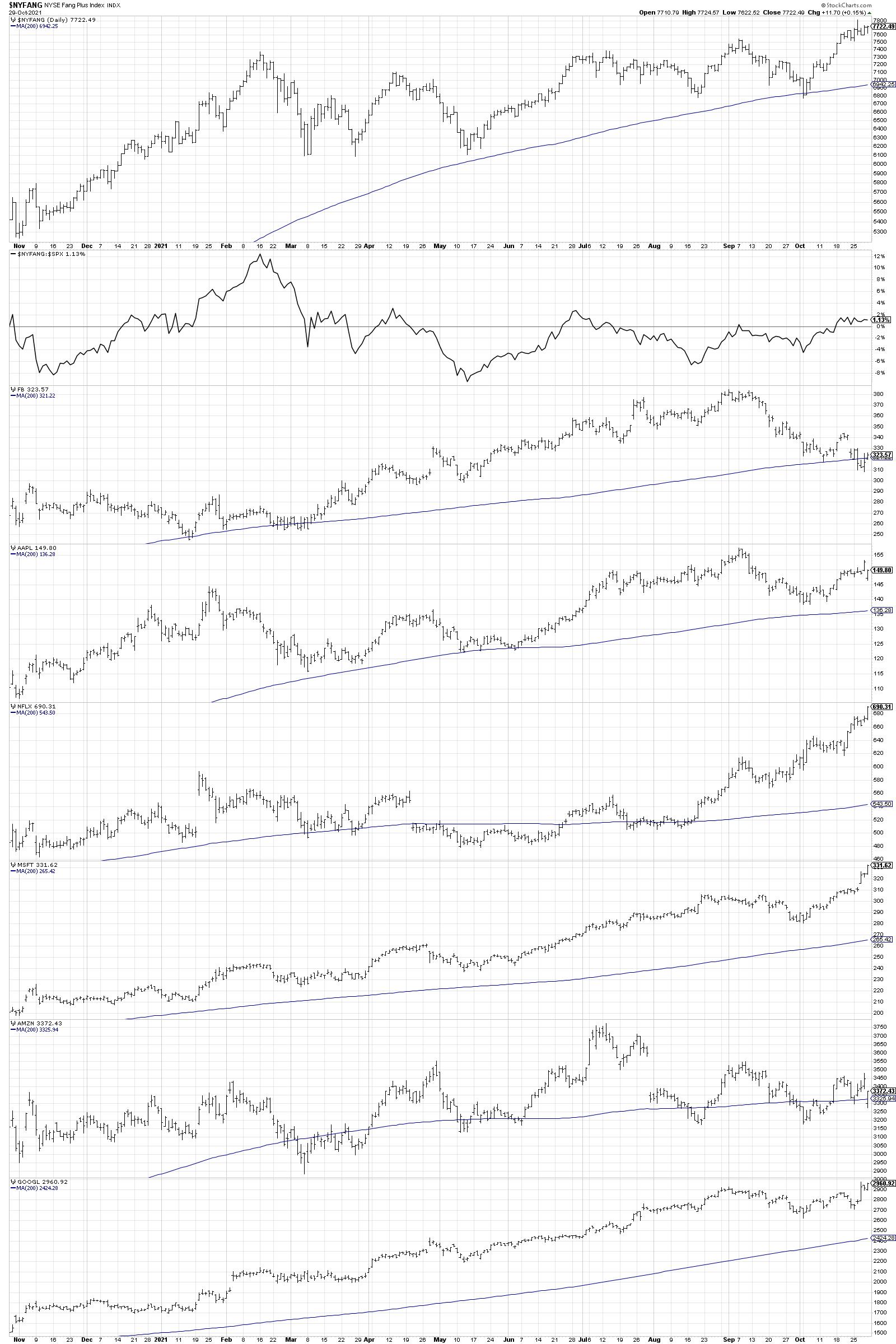

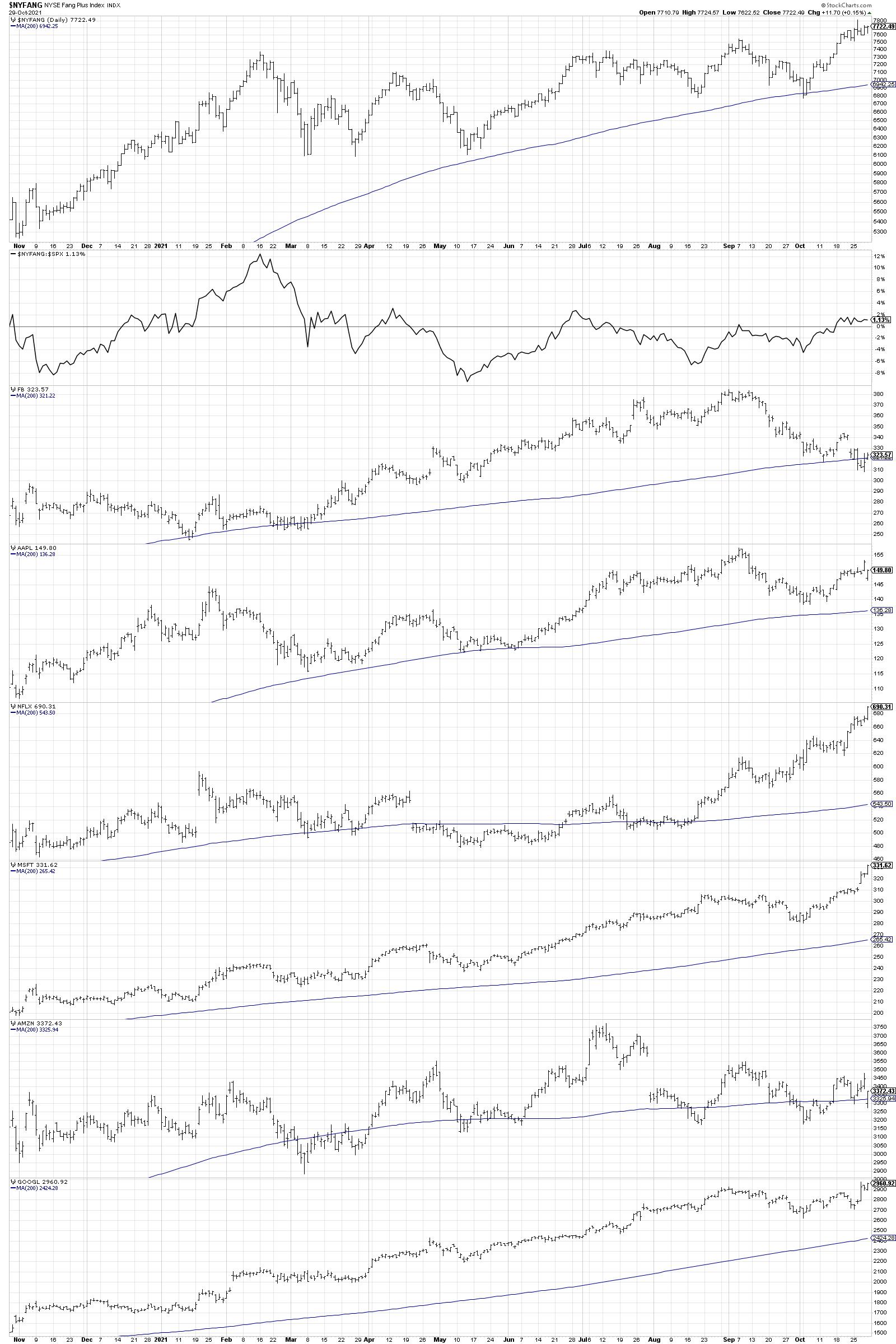

The Best FANMAG Stock Through Year End

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Investors often think of the FAANG stocks as one basket of names. Either the mega cap tech and communication trade is working, or it isn't. But, as a review of the charts will reveal, these stocks can actually be differentiated using their price and relative profiles.

So which...

READ MORE

MEMBERS ONLY

A Key Technical Indicator That Could Make You Money

by John Hopkins,

President and Co-founder, EarningsBeats.com

Like many traders, I have a few "go to" technical indicators I rely on when making trading decisions. One that I have found to be extremely useful over the years is the Relative Strength Index, better known as the "RSI".

Investopedia says, "The Relative Strength...

READ MORE

MEMBERS ONLY

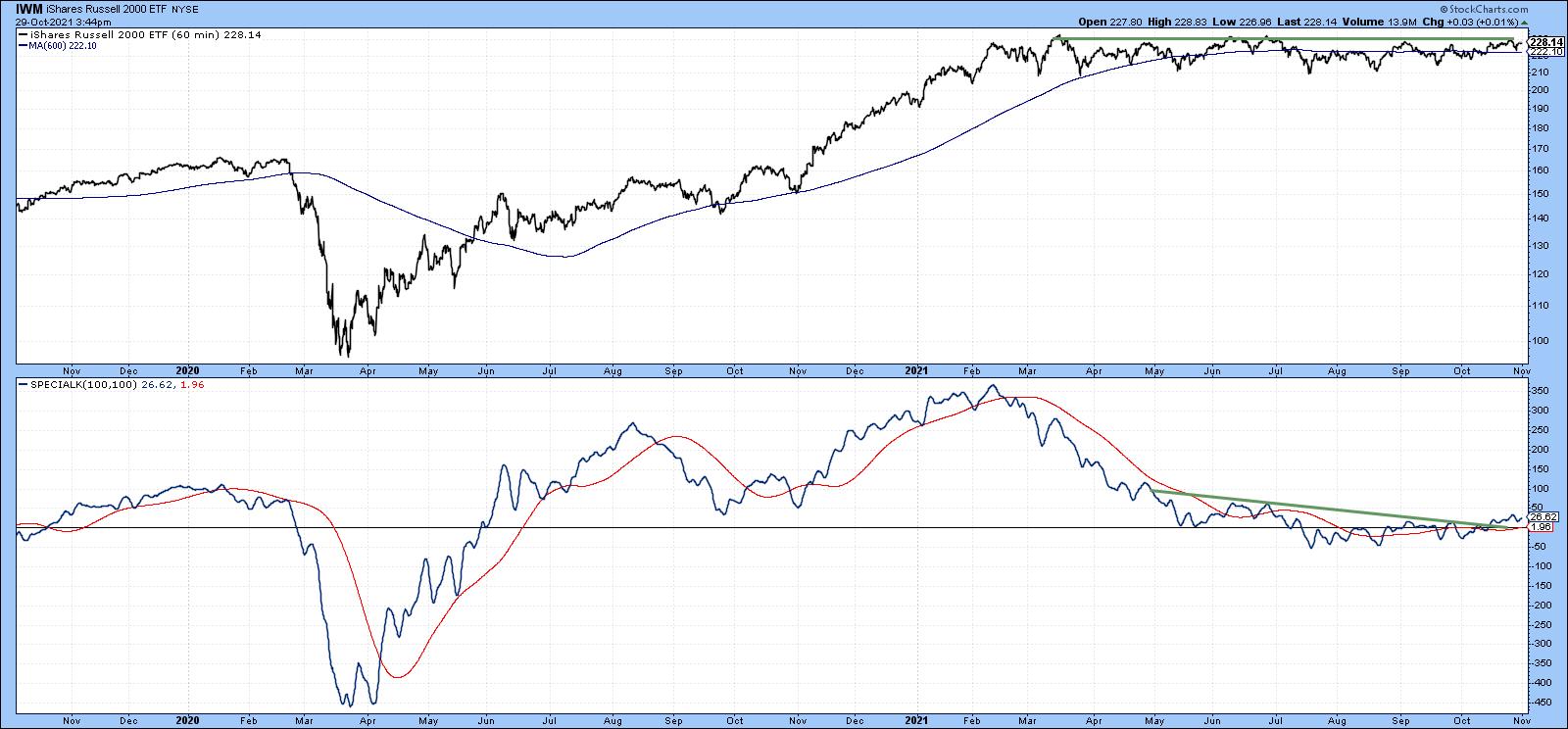

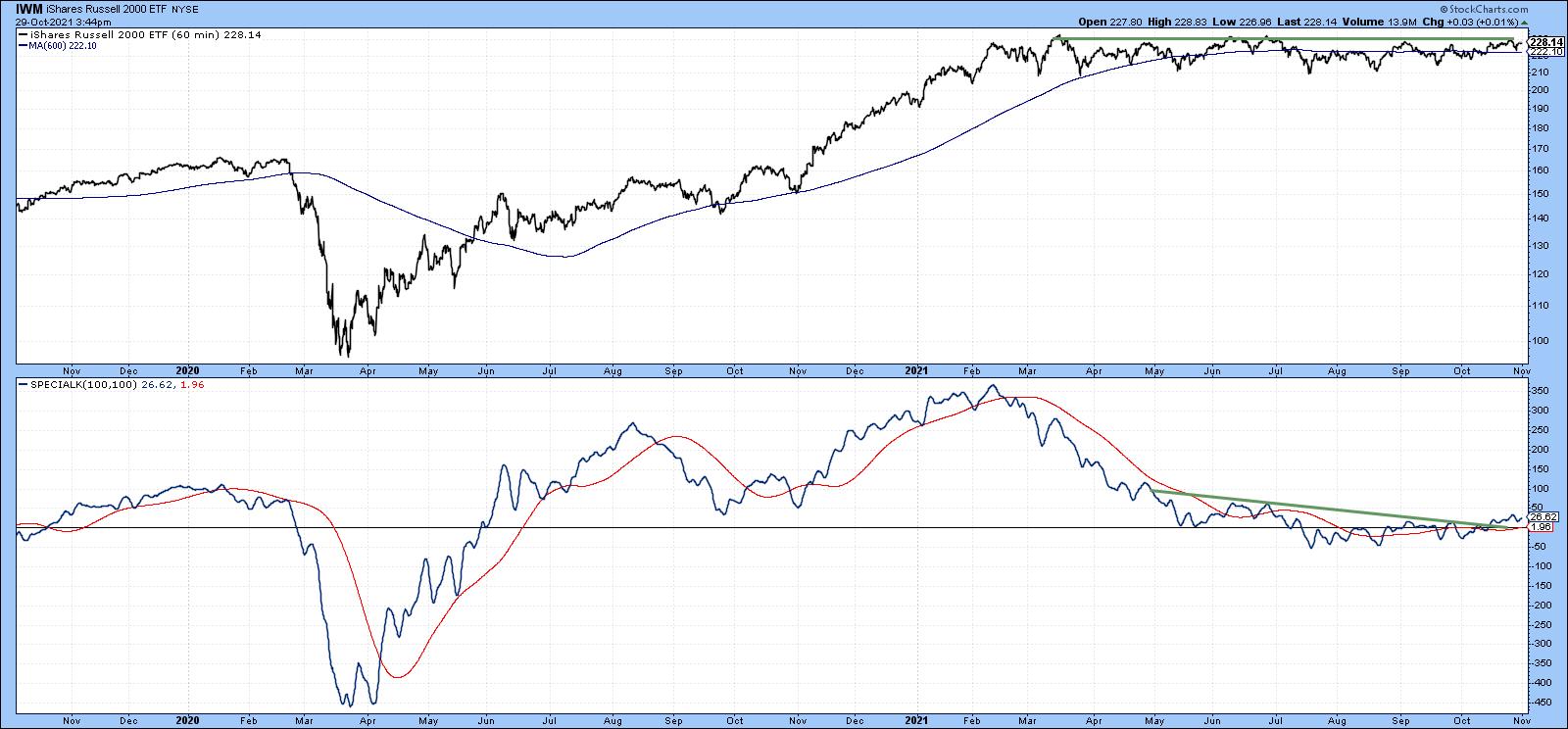

Identifying Intermediate Buying Opportunities with the Hourly Special

by Martin Pring,

President, Pring Research

Sometimes, when I mess around with the charts, I discover an entirely new approach that I had not thought of before. Last week saw one of those breakthrough moments when, for the first time ever, I applied the Special K to hourly charts and came up with some interesting results....

READ MORE

MEMBERS ONLY

Former Leadership Group Turning Bullish

by Mary Ellen McGonagle,

President, MEM Investment Research

On this episode StockCharts TV'sThe MEM Edge, Mary Ellen reviews a former leadership area of the market that turned bullish last week, as well as positive stocks in the group. She also shares names you may want to put on your watch list as we move further into...

READ MORE

MEMBERS ONLY

The Major Stock Indices Must Hold These Key Support Levels

Next week, investors are expecting the Fed to announce a reduction in the monthly bond-buying program. Jerome Powell, the Fed chair, has previously stated that he's looking to keep the original tapering schedule. This means there should not be any surprises investors need to worry about.

At least...

READ MORE