MEMBERS ONLY

What to Make of the Small-Cap Rally: A Closer Look at IJR and IWM

Small-cap stocks are showing signs of strength. Investors should keep an eye on the performance of IWM and IJR, two small-cap ETFs, to determine if the small-cap rally has legs....

READ MORE

MEMBERS ONLY

StockCharts Insider: Should You Start with a Blank Chart or Pre-Loaded Indicators?

by Karl Montevirgen,

The StockCharts Insider

Before We Dive In…

Should I start with a blank chart or one pre-loaded with indicators? It’s a good question. There are pros and cons to both, and it depends on what you’re trying to do. In this quick post, I’ll break everything down so that you...

READ MORE

MEMBERS ONLY

This Week’s Stock Market Winners — And What’s Driving Them

by Mary Ellen McGonagle,

President, MEM Investment Research

Join Mary Ellen as she breaks down the latest market trends! The highlight of the show is a deep dive into the consumer discretionary sector, where Mary Ellen analyzes leading industry groups like homebuilders, apparel, and specialty retail, and explains why this sector continues to show relative strength. She shares...

READ MORE

MEMBERS ONLY

US Dollar at a Crossroads, Gold Primed for Action: Macro Moves to Watch

With high-impact US data and geopolitical risks on tap this week, traders must assess the US dollar. Here are some outcomes that could surface in the dollar and gold....

READ MORE

MEMBERS ONLY

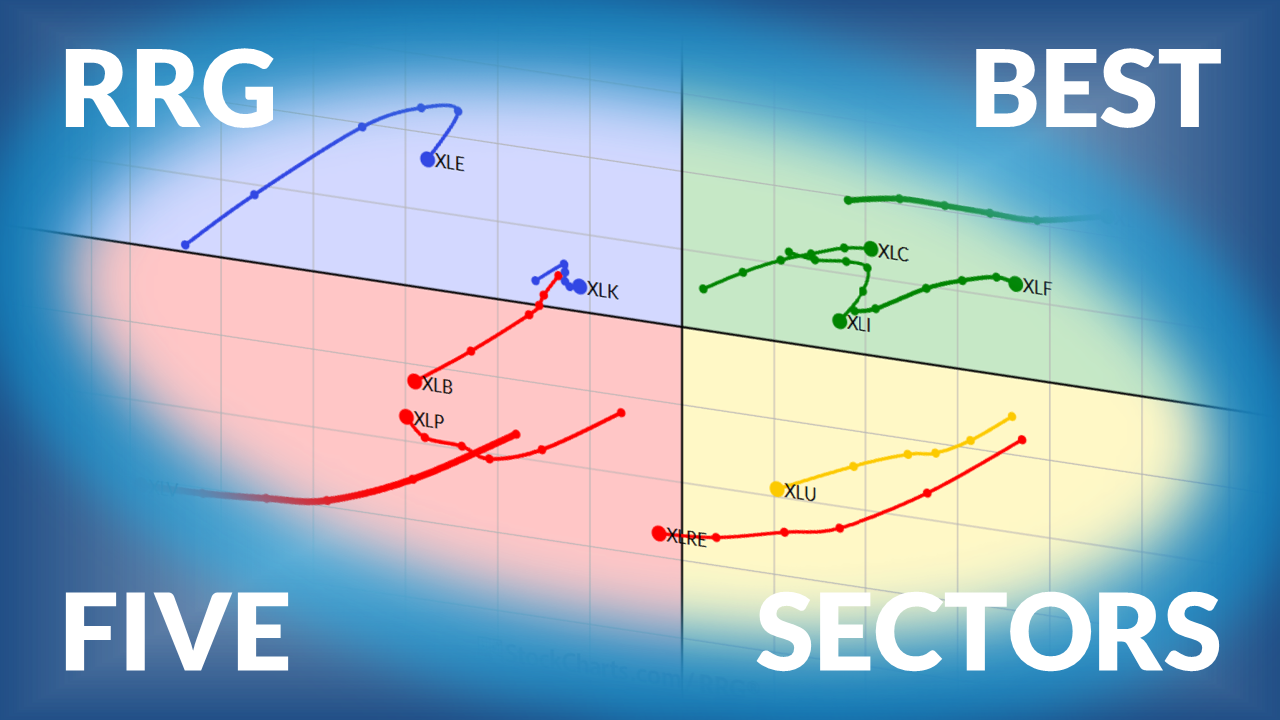

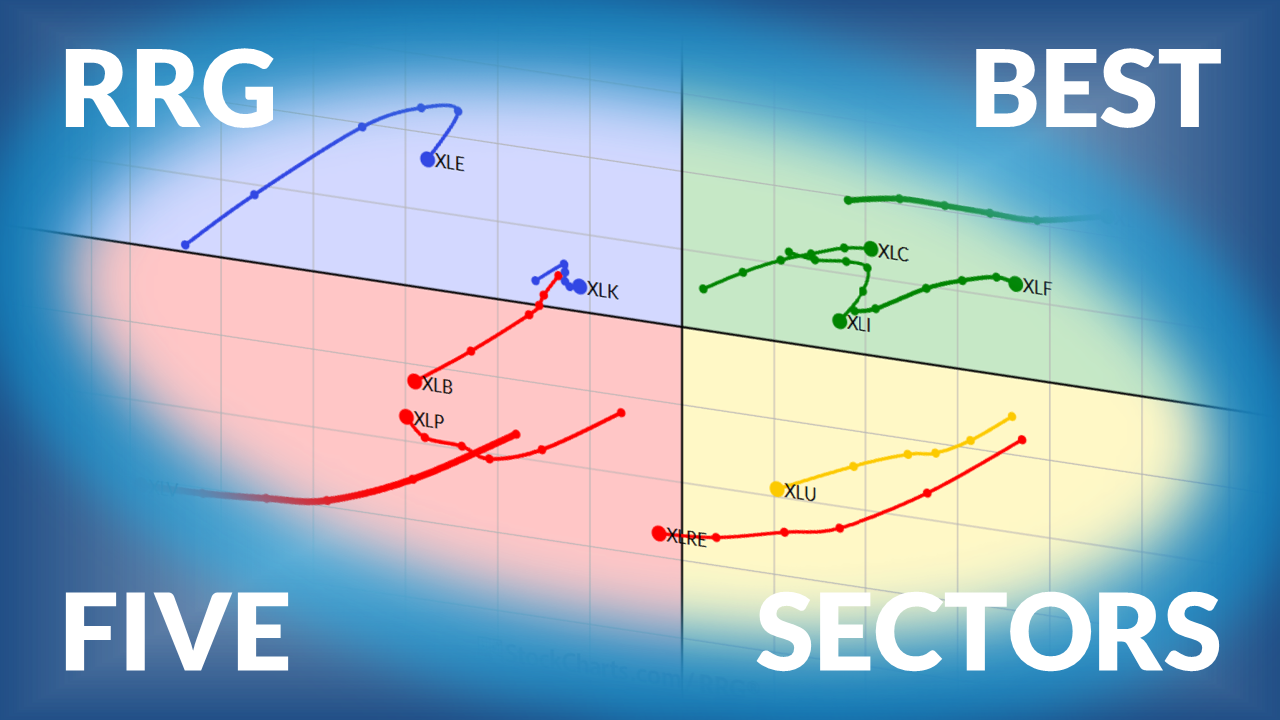

The Best Five Sectors, #31

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Julius presents his weekly update on US sector rotation based on Relative Rotation Graphs....

READ MORE

MEMBERS ONLY

Week Ahead: Keeping Head Above This Level Crucial for Nifty To Avoid Slipping Into Prolonged Weakness

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Nifty logs its sixth week of losses, hovering below key resistance. Traders remain cautious amid potential downside risks. ...

READ MORE

MEMBERS ONLY

Three Key Macro Charts I’m Watching on Vacation

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Here are the key levels to watch in the S&P 500 as well as META, MSFT, and AAPL. As long as the index and stocks hold above key support levels, the uptrend in stocks is in good shape. ...

READ MORE

MEMBERS ONLY

StockCharts Insider: ‘My Chart Just Froze.’ Is It You… Or Us?

by Karl Montevirgen,

The StockCharts Insider

We’ve all been there: You're in the middle of analyzing a chart when suddenly everything freezes, and real-time data stops flowing. And now you’re wondering—is it my computer, my Wi-Fi, or... my charting service?

Check the New System Status Page When Things Go Weird

The...

READ MORE

MEMBERS ONLY

Charts Don’t Lie: The Secret Weapon Behind This Week’s Picks

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

It's the Clash of the Chart Titans — Who Wins?

Buckle up, folks. This week, we’re bringing you not one, but two "Top 10 Stocks" videos. That means double the picks, double the fun!

So, who’s the victor in this high-stakes stock showdown? Spoiler: It’...

READ MORE

MEMBERS ONLY

Friday Chart Fix: 2024 vs. 2025, Commodities with a Dash of Crypto, Moment of Truth for IWM, The Tesla Squeeze

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Here's a deep dive into the differences between the 2024 bull market and 2025 bull run, small-cap performance, the price action in Bitcoin and gold, and the Bollinger Band squeeze in Tesla's stock price....

READ MORE

MEMBERS ONLY

Apple's Strongest 2-Day ROC Since April: Breakout or Bull Trap?

Apple (AAPL) jumps on tariff relief headlines. See the ROC thrust, 200-day moving average test, gap levels at $213/$203, and targets to $237-$250....

READ MORE

MEMBERS ONLY

Smart Investors are Watching These Chart Signals: Here's Why

by Frank Cappelleri,

Founder & President, CappThesis, LLC

Discover what Bollinger Bands and RSI are signaling for the S&P 500. Learn how low volatility and key momentum indicators could point to the next market breakout....

READ MORE

MEMBERS ONLY

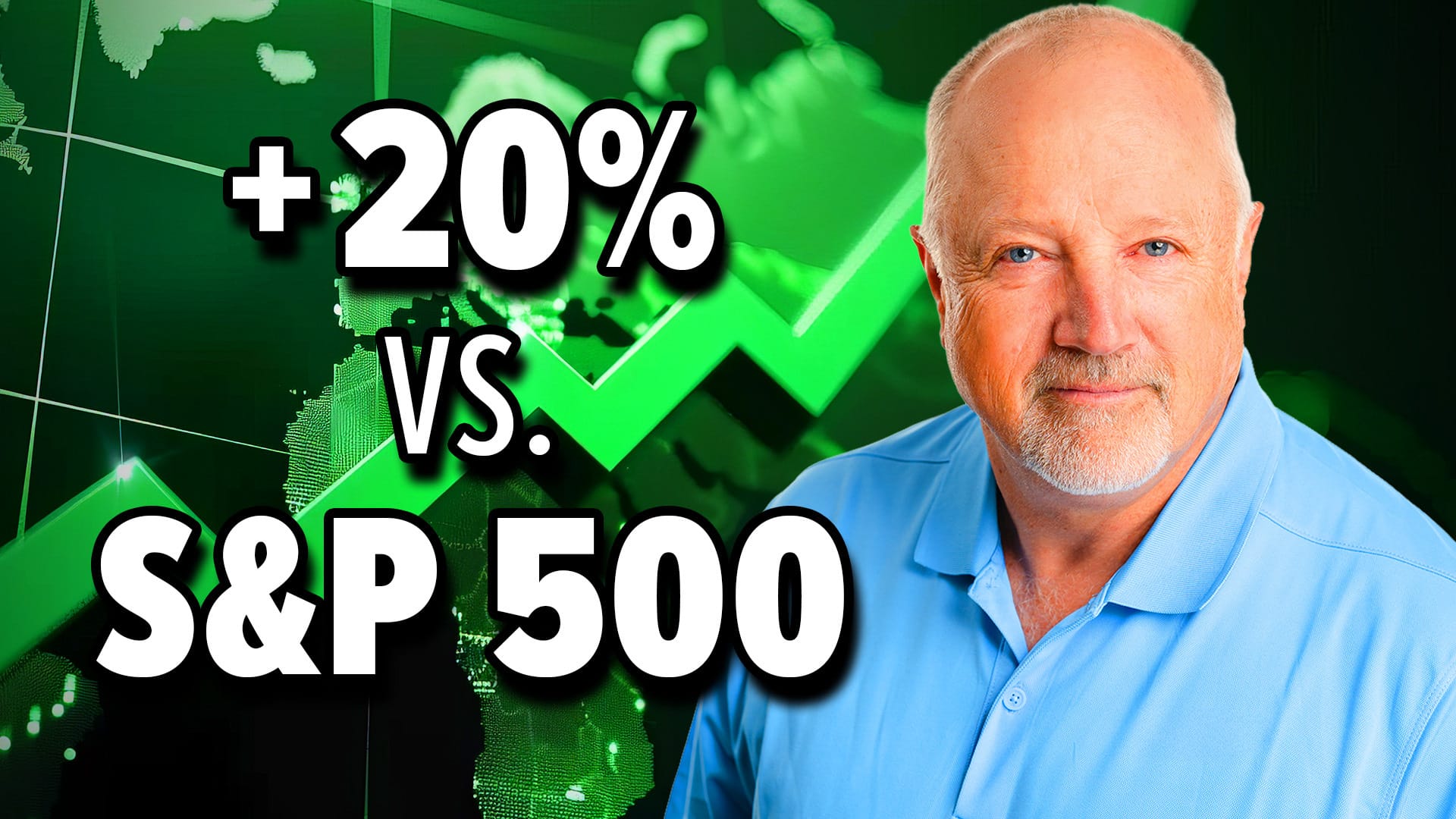

How We Beat the S&P 500 by 20% This Quarter!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Tom breaks down how his model portfolios have consistently outperformed the S&P 500 — including a 24.5% return for the aggressive portfolio over the past quarter, against the S&P 500’s 5%. He covers market signals following the Fed’s recent rate decision, explains why Wall...

READ MORE

MEMBERS ONLY

StockCharts Insider: How to Use the New StockCharts Search Tool Like a Pro

by Karl Montevirgen,

The StockCharts Insider

Before We Dive In…

Sure, it’s a search tool, but what matters is how you use it. StockCharts’ new search digs deep into the archive and pulls up the most relevant content. I’ll show you how I optimize its use to find indicators, tutorials, market analysis, and explainers...

READ MORE

MEMBERS ONLY

The Good, the Bad, and the Sideways

by David Keller,

President and Chief Strategist, Sierra Alpha Research

As U.S. equity indexes hit new highs, not all stocks are keeping pace. Explore these three stocks that are at key technical junctures with charts that highlight trend shifts, risk levels, and actionable signals....

READ MORE

MEMBERS ONLY

My Go-To ADX Scan for Finding Breakout Stocks

by Joe Rabil,

President, Rabil Stock Research

Joe shares his go-to ADX stock scan! Follow along as Joe uses the StockCharts platform to uncover strong long-term uptrends paired with low short-term momentum — the kind of setup that often precedes powerful breakouts. He walks through his “Strong Monthly / Low Weekly” scan criteria, explains how to apply it across...

READ MORE

MEMBERS ONLY

Narrow Leadership Is a Concern, but the Bear Signal Has Yet To Trigger: Here's What To Watch

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

New highs show narrow leadership in the S&P 500, yet new highs are outpacing new lows. Will the leadership broaden? Watch these indicators....

READ MORE

MEMBERS ONLY

Top 10 Charts to Watch August 2025!

by Grayson Roze,

Chief Strategist, StockCharts.com

Join Grayson Roze as he reveals his top 10 stock charts to watch this month including SFM, BSX, AFRM and SYF. From breakout strategies to moving average setups, he walks through technical analysis techniques using relative strength, momentum, and trend-following indicators. Viewers will also gain insight into key market trends...

READ MORE

MEMBERS ONLY

Top 10 Stock Charts for August 2025 You Need to Watch Now

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Join Dave as he shares ten actionable stock charts for August 2025 that he’s watching closely. From breakout setups to key reversals, David highlights tickers like Tesla, Meta, Caterpillar, Motorola, and Newmont Mining that show compelling technical patterns. He also walks through how to manage the full trading process...

READ MORE

MEMBERS ONLY

Markets Drop! But These Stocks Are Still Leading

by Mary Ellen McGonagle,

President, MEM Investment Research

Mary Ellen McGonagle breaks down this week’s market volatility and what it means for investors. She explains how inflation and employment data triggered technical breakdowns in key indexes, and discusses why volatility, relative strength, and leadership stocks (including MPWR, TER, and Cadence Design) should remain on your radar. Mary...

READ MORE

MEMBERS ONLY

Last Week’s Market Action Showed Signs of Exhaustion, Especially In This One Key Stock

by Martin Pring,

President, Pring Research

Explore how recent bearish weekly patterns in the S&P 500, Nasdaq, and Microsoft could signal an intermediate-term trend reversal. Learn why confirmation is key in technical analysis....

READ MORE

MEMBERS ONLY

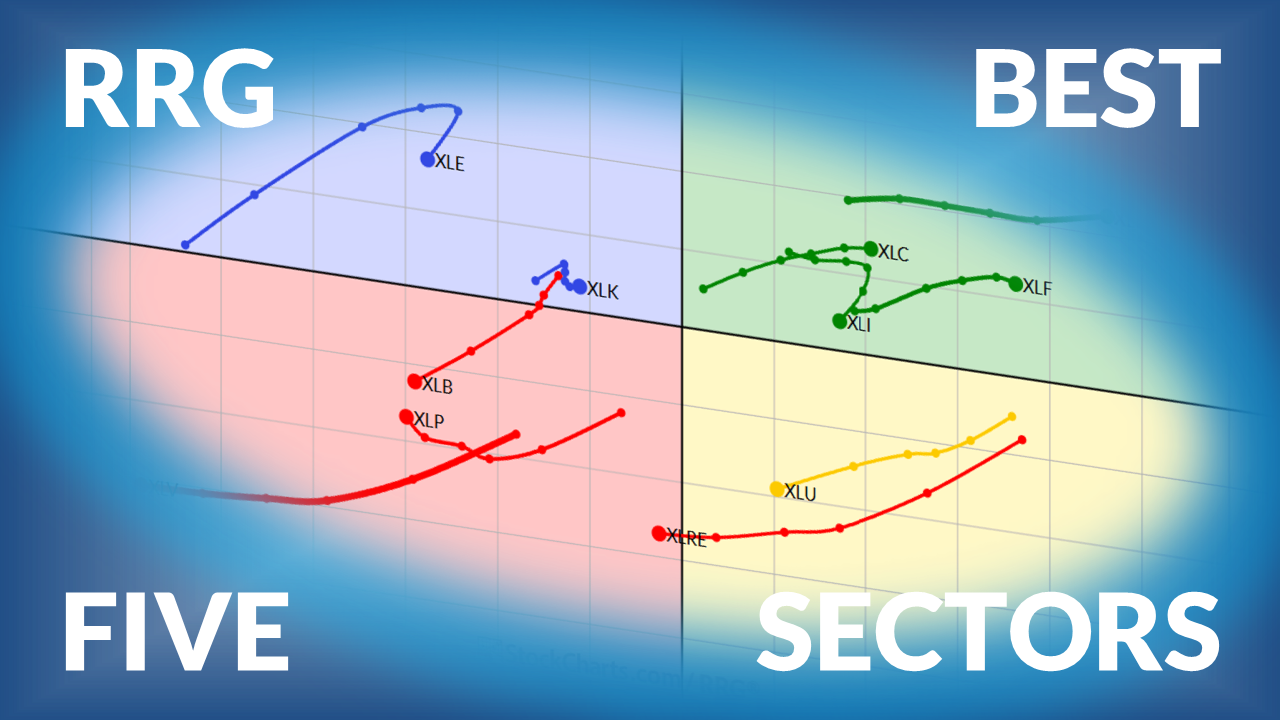

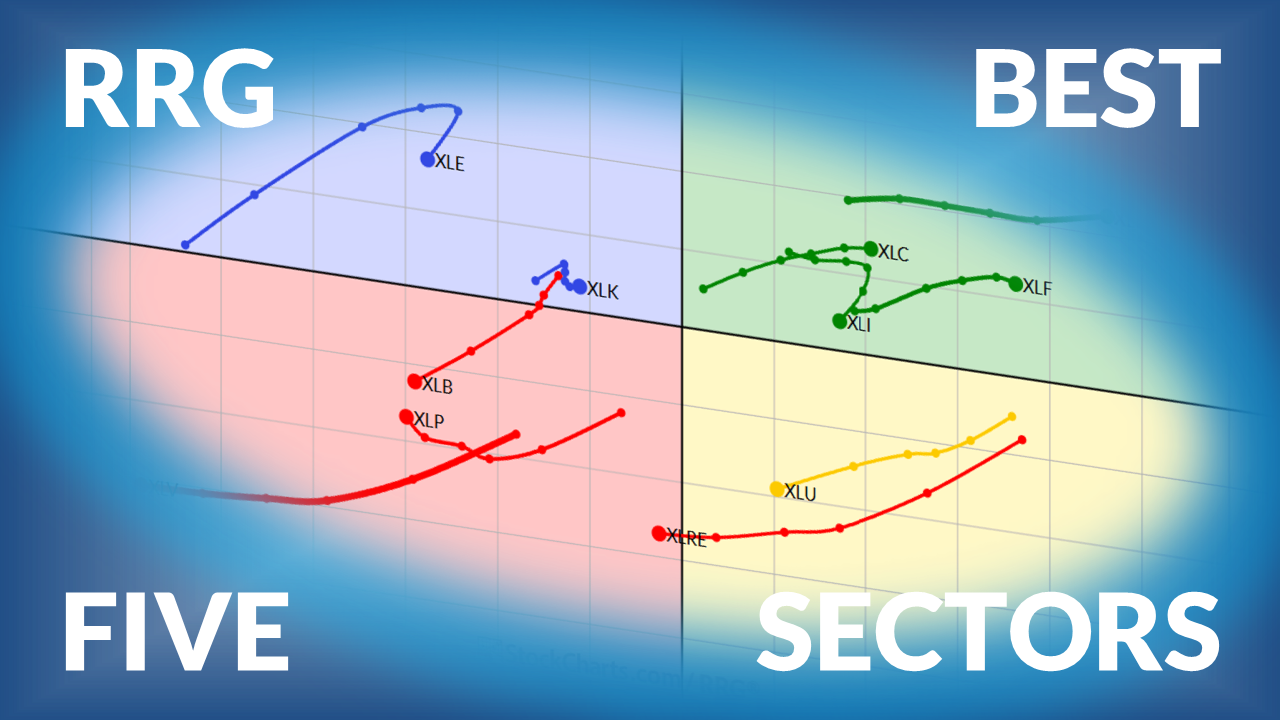

The Best Five Sectors, #30

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Julius presents his weekly update on US sector rotation rankings using Relative Rotation Graphs (RRG)....

READ MORE

MEMBERS ONLY

Warning Signs in the Charts: How to Survive a Late-Summer Shakeout

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The stock market rally may be hitting a wall as volatility spikes and bearish signals emerge. Discover key technical warnings, seasonal trends, and how traders and investors should prepare for a choppy August–September....

READ MORE

MEMBERS ONLY

Week Ahead: Nifty Tests Key Support Levels—May Weaken If Levels Violated

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The Nifty closed the week lower, trading within a narrow range. Volatility also rose. Monitor short-term support levels as we head into next week. Discover which sectors are leading and which are lagging....

READ MORE

MEMBERS ONLY

August Pullback: Déjà Vu or Opportunity in Disguise?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

Well, we got our seasonally strong July, but now, like clockwork, August has arrived, and the market sells off. It eerily echoes last August’s decline. Back then, the stock market sold off the week of August 5 on a weak jobs report, came close to its 40-week moving average,...

READ MORE

MEMBERS ONLY

Why Daily vs. Weekly RRGs Matter in Portfolio Construction

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Relative Rotation Graphs can be rendered in similar intervals as regular bar- or candlestick charts. This article explains the differences between weekly and daily RRGs....

READ MORE

MEMBERS ONLY

What Happens to Bitcoin Should QQQ Correct?

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stock market correction risks are rising as key indicators flash warnings. Discover sector correlations with SPY, potential safe havens, and how Bitcoin's surge aligns with QQQ in this data-driven analysis....

READ MORE

MEMBERS ONLY

StockCharts Insider: What Kind of Chart Analyst Are You?

by Karl Montevirgen,

The StockCharts Insider

What are the different ways you can use technical analysis in your trading? And which is the best one for you? Today's Insider Tip: Know your charting "style" and focus on its strengths....

READ MORE

MEMBERS ONLY

Thursday's Stock Market Dive: Noise or a Warning? Let the Charts Decide

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

Was Thursday's market dip a warning sign or just noise? Explore market trends, sentiment, and sector rotation, and learn how the StockCharts Market Summary page can help you stay one step ahead....

READ MORE

MEMBERS ONLY

Meta, Microsoft Blow Past Earnings — Are These Stock Next?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Tom recaps a pivotal week for the markets, as the Fed holds rates steady despite signs of softening economic growth. Tom breaks down the rare dissent among Fed governors, the market’s sharp reaction during Jerome Powell’s press conference, and the technical fallout across major indexes, especially small caps...

READ MORE

MEMBERS ONLY

3 Types of Breakouts To Upgrade Your Portfolio

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Use this StockCharts scan to identify three categories of stocks and ETFs that are making new three-month highs....

READ MORE

MEMBERS ONLY

Avoid This Common RSI Mistake (And What to Do Instead)

by Joe Rabil,

President, Rabil Stock Research

Master RSI strategies with Joe! Follow along as Joe shares his refined method using dual timeframes and a two-RSI approach; see how he uses RSI-20 as a trend filter and RSI-5 as an entry signal to avoid common mistakes and enhance trading precision. Joe breaks down real chart examples on...

READ MORE

MEMBERS ONLY

Catch Big Moves Early With This Breakout Scan!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Follow along as Dave shares the one stock scan he runs every week to uncover potential breakout candidates. He explains the three types of chart setups that frequently appear, each with their own trading implications, and walks through how he structures trades according to type. He also illustrates how to...

READ MORE

MEMBERS ONLY

RRG Reveals the Next Big Sector Moves!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this video, Julius breaks down current market trends using Relative Rotation Graphs (RRG). He examines weekly and daily asset class rotations, highlighting key developments in stocks, commodities, bonds, the U.S. dollar, and crypto. From there, Julius analyzes sector momentum shifts, including technology, energy, and real estate, and explains...

READ MORE

MEMBERS ONLY

StockCharts Insider: Your Streetwise Guide Through the StockCharts Universe

by Karl Montevirgen,

The StockCharts Insider

Kicking off his new column, Karl Montevirgen introduces you to "The StockCharts Insider," your new guide to the ins and outs of StockCharts....

READ MORE

MEMBERS ONLY

Is It Time to Take Another Look at China?

by Martin Pring,

President, Pring Research

Here's an analysis of the recent bullish developments in the Shanghai Stock Exchange Composite Index and liquid Chinese ETFs. ...

READ MORE

MEMBERS ONLY

Before You Cast Away, Hook the Market's Key Trends on StockCharts

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

Check these must-see StockCharts signals before you cast off for the summer and see whether August's market currents say "stay the course" or "make adjustments."...

READ MORE

MEMBERS ONLY

These Breakout Stocks Are Leading the Market Right Now

by Mary Ellen McGonagle,

President, MEM Investment Research

Markets hit another all-time high as rotation accelerates into biotech, software, and alt-energy names. Follow along as Mary Ellen breaks down the top-performing sectors and ETFs, including key breakouts in Bloom Energy, DoorDash, and Deckers. She also highlights meme stocks' action, examines what international leadership in countries like Spain...

READ MORE

MEMBERS ONLY

Is It Time For a Comeback? 3 Stocks That Might Be Turning a Corner

by Jay Woods,

Chief Global Strategist, Freedom Capital Markets

Explore technical turnaround setups for UPS stock, UNH stock price trends, and why MRK stock may offer the best risk/reward for investors this earnings season....

READ MORE