MEMBERS ONLY

Thinking Like a Trader, Part 3

by Dave Landry,

Founder, Sentive Trading, LLC

In this edition of Trading Simplified, Dave continues his discussion on "Thinking Like a Trader," focusing on seeing what's there vs. what you want to see. Be right by ceasing to be wrong, and do the right thing instead trying to look smart.

This video was...

READ MORE

MEMBERS ONLY

Bitcoin Pulls Back Over Its Pivotal 30k Price Level

Tuesday morning's trading session continued a large sell-off in Bitcoin, which recently lingered near 41k in the prior weeks before selling off to roughly 29k. However, dip buyers that have been waiting for the chance to scoop up the largest-cap cryptocurrency under 30k were finally given one. Or...

READ MORE

MEMBERS ONLY

Bitcoin Bounces Off Important Support

by Carl Swenlin,

President and Founder, DecisionPoint.com

On the Bitcoin chart, an important support line at about 30,000 provides the base for a large rounded top. A rounded top is considered to be bearish, with the expectation that, if the support fails, much lower prices are likely. As to how much lower, let's look...

READ MORE

MEMBERS ONLY

Sector Spotlight: SPX on the Edge

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this edition of StockCharts TV's Sector Spotlight, after spending almost an entire show on a question from the mailbag last week, I shift gears again and highlight the most important rotations in asset classes and sectors. In the asset class segment, I look closely at the stock/...

READ MORE

MEMBERS ONLY

DP TV: Short-Term Buying Initiation!

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, Carl discusses last Friday's "selling exhaustion" and today's new "upside initiation climax." Carl also reviews the DecisionPoint indicators and gives you his outlook on Gold, Gold Miners, the Dollar, Crude Oil, Bitcoin, Bonds and the 10-Year Treasury...

READ MORE

MEMBERS ONLY

How to Effectively Use a Moving Average Confirmation Rule

On Friday, the major indices, including the small-cap Russell 2000 (IWM) and S&P 500 (SPY) closed underneath their 50-day moving average. However, on Monday, both reversed and ended the day above their 50-DMA. With Friday's weak price action, any bearish traders who decided to short these...

READ MORE

MEMBERS ONLY

Downside Participation Expands - Here's How to Measure and the Key Levels to Watch

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

SPY experienced its biggest weekly decline (-2.2%) since late February and the nine-week Rate-of-Change turned negative for the first time since late October. The ETF also closed below its 10-day SMA for the first time since late January. Normally, a close or dip below the 10-week SMA signals a...

READ MORE

MEMBERS ONLY

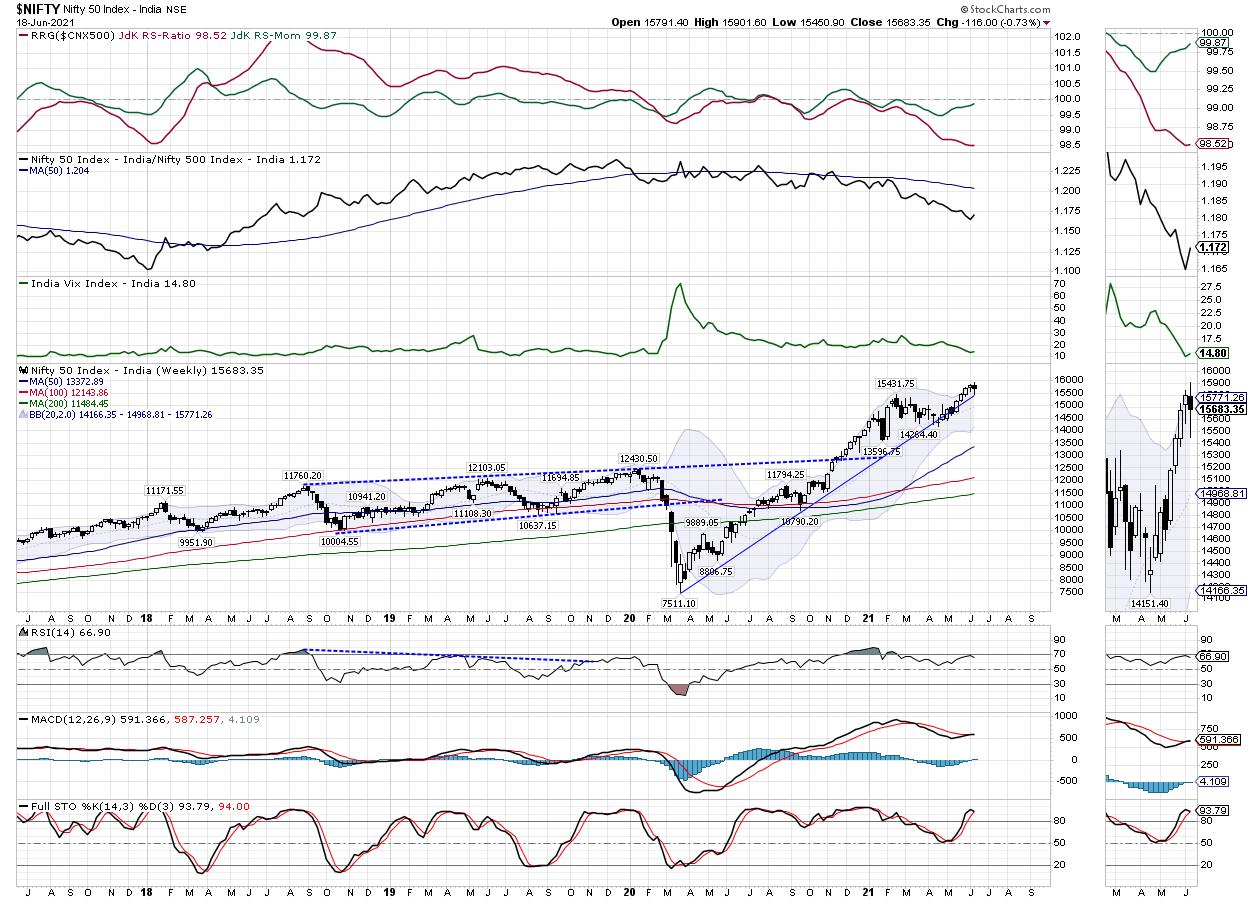

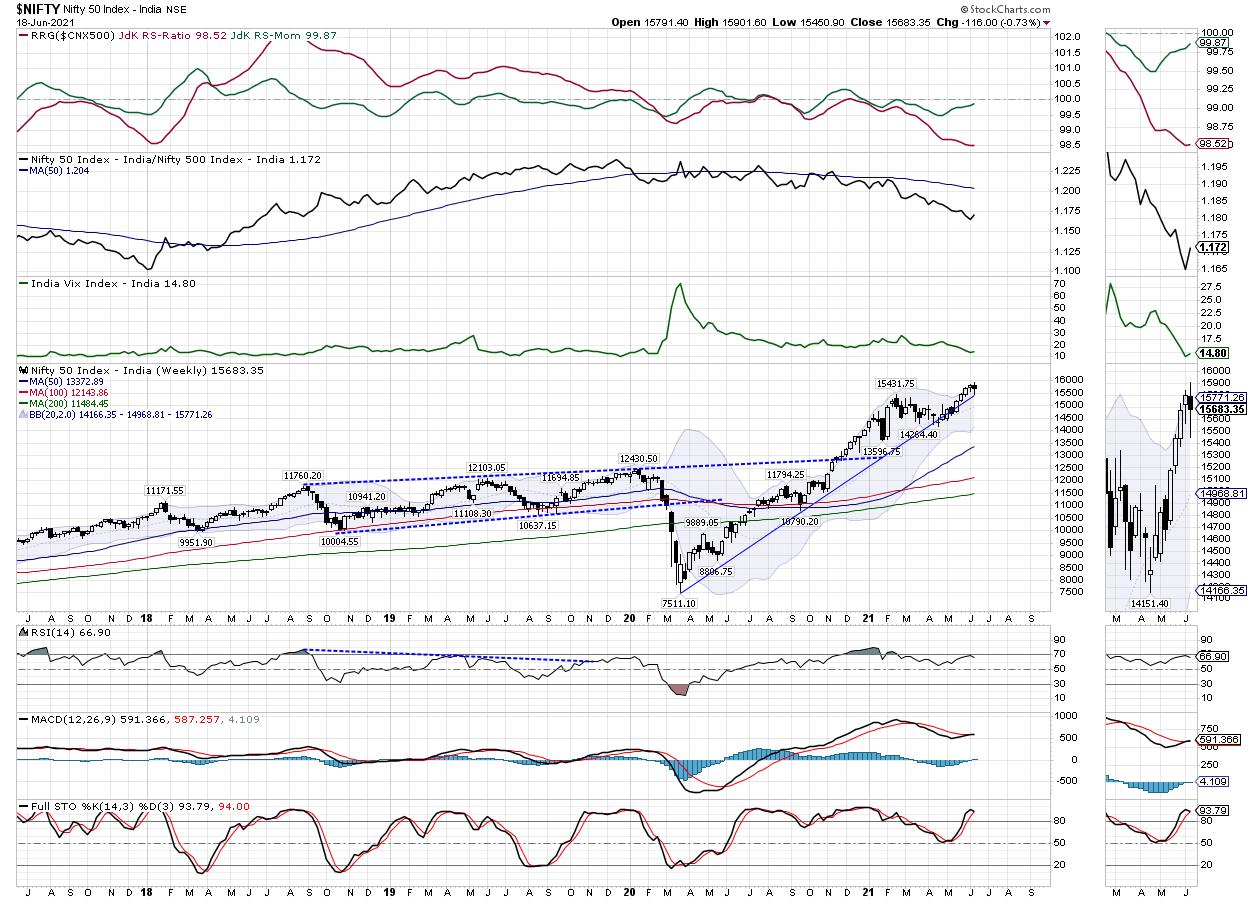

Week Ahead: Technical Structure Shows NIFTY's Upside Capped Near This Point; RRG Chart Continues Throwing Mixed Cues

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The Indian equity markets took a breather in the week gone by as they halted four consecutive weeks of gains. Over the past month, the NIFTY had piled up 1121.55 points of gains. However, over the past five days, the NIFTY retraced after marking its fresh lifetime high at...

READ MORE

MEMBERS ONLY

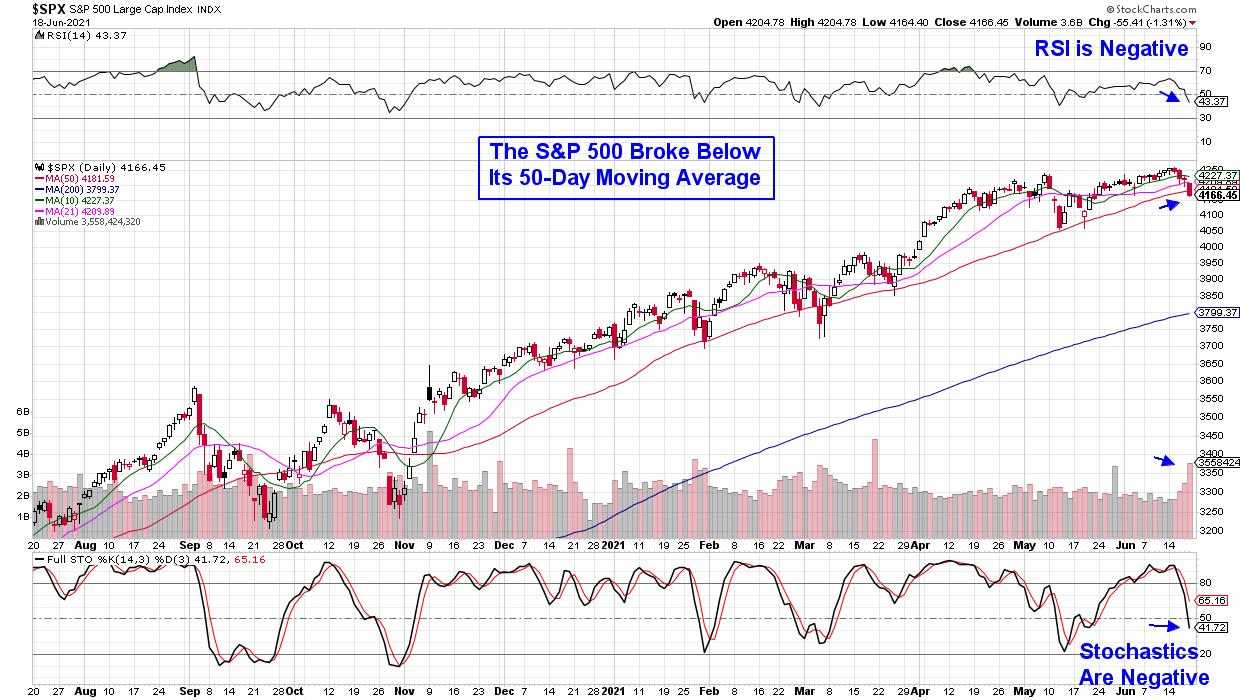

The Rotation is Real - Here's One Area That Stands to Shine

by Mary Ellen McGonagle,

President, MEM Investment Research

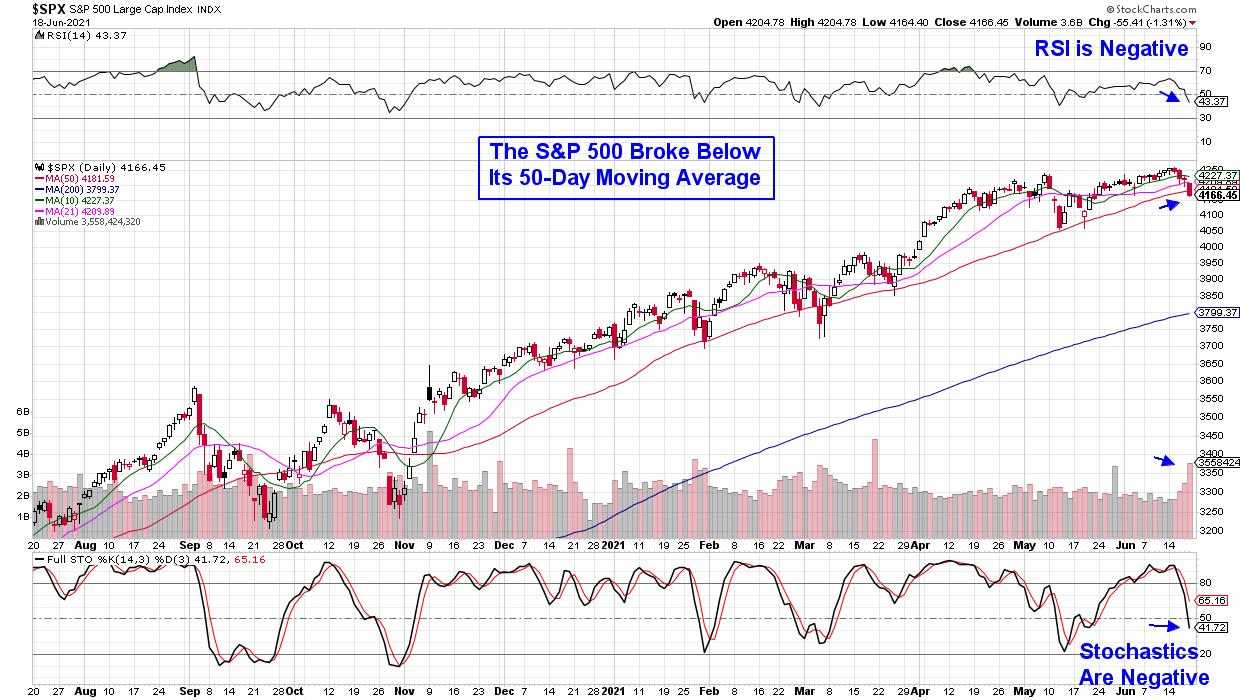

The U.S. markets ended the week in the red, with the S&P 500 breaking below its key area of support today on heavy volume. Already under pressure following Wednesday's hawkish comments from the Federal Reserve, the markets took a tumble today after Fed official James...

READ MORE

MEMBERS ONLY

How To Rank, Rate And Grade The Stocks In Your Watchlist

by Gatis Roze,

Author, "Tensile Trading"

We chartists are a dedicated lot, but at the risk of alienating my fellow technicians, we are sometimes too myopically focused just on charts at the expense of profits and have been known to succumb to something I'll label "The Shiny Chart Syndrome". This blog is...

READ MORE

MEMBERS ONLY

These Two Growth Stocks are Likely Pausing Before a Big Run Ahead

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

One of our key ChartLists at EarningsBeats.com is our Raised Guidance ChartList. As the name implies, it tracks companies that raised their revenue and/or EPS expectations at some point over the last 90 days. Many times, once a stock raises guidance, profit-taking kicks in, traders grow impatient and...

READ MORE

MEMBERS ONLY

Can Positive Short & Intermediate Indicators for the Dollar Tip Long-Term Balance to the Bullish Side?

by Martin Pring,

President, Pring Research

Chart 1 shows that, since 2015, the Dollar Index has been in a narrowing trading range bounded by two converging trendlines. That period has also embraced the end part of the 2011-2016 bull market, a mini-bear and bull market and the current bear. I use the term "bear"...

READ MORE

MEMBERS ONLY

Is Stagflation Creeping Up?

After Wednesday's Fed announcement, the stock market has been sitting in an uneasy state. The U.S Dollar (UUP) has not only firmed, but pushed over resistance from its 200-day moving average at 24.69, confirming an accumulation phase. Additionally, the 20+ year treasury bond ETF (TLT) has...

READ MORE

MEMBERS ONLY

Four Lessons From Four Charts in My Office

by David Keller,

President and Chief Strategist, Sierra Alpha Research

I have four paper charts hanging in my office. I use these as the background for most of my videos, and you can usually see one in the background when we shoot The Final Barevery afternoon.

I was recently asked why these four charts were worthy of display -- and...

READ MORE

MEMBERS ONLY

DOW BREAKS SHORT-TERM SUPPORT -- FLATTENING YIELD CURVE HURTS FINANCIALS

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW UNDERCUTS ITS MAY LOW... Some hawkish comments on interest rates by a member of the Fed this morning is taking a negative toll on stocks. The Dow is under the most pressure. Chart 1 shows the Dow Industrials trading below its May low to the lowest level in nearly...

READ MORE

MEMBERS ONLY

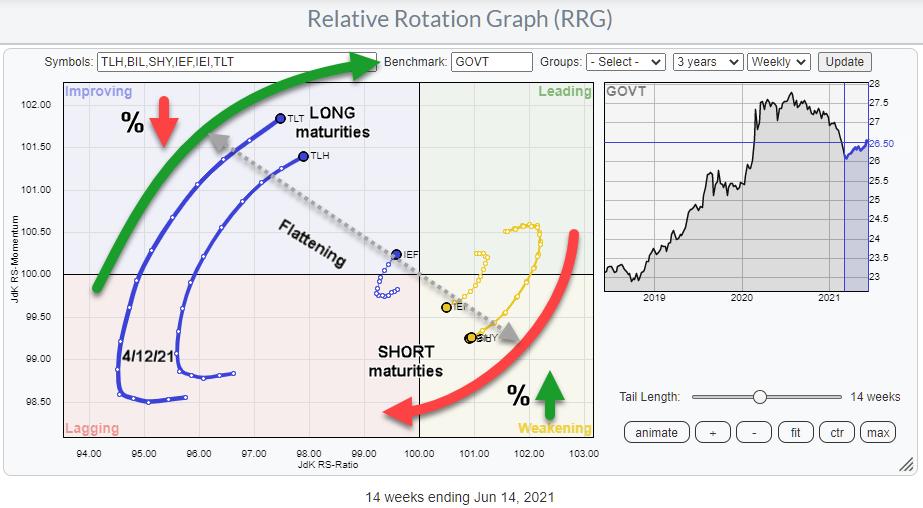

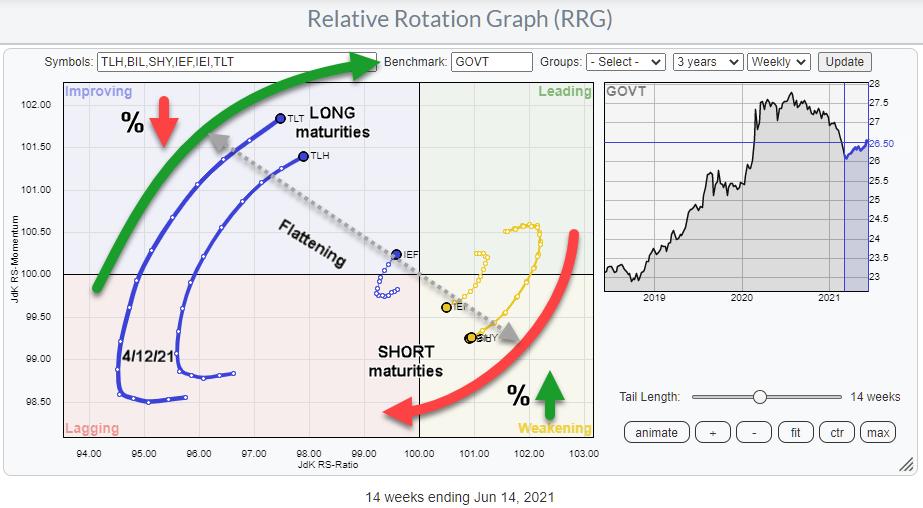

Is The Bond Market Sending Us Warning Signals?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

There's been a lot of talk and articles on rates, rising yields, and rate hikes lately. That seems like a good moment for a reminder of the fact that Relative Rotation Graphs can also be very well used to visualize the (relative) movement of yields for various maturities....

READ MORE

MEMBERS ONLY

Chartwise Women: Navigating These Choppy Markets

by Mary Ellen McGonagle,

President, MEM Investment Research

by Erin Swenlin,

Vice President, DecisionPoint.com

In this week's edition of Chartwise Women, Erin and Mary Ellen focus on determining the market tides and how to find and follow the treasure map and charts. Watch them uncover the sectors, industry groups and stocks that should "weather the storm" and guide you to...

READ MORE

MEMBERS ONLY

Let's Get it Started!

by Joe Rabil,

President, Rabil Stock Research

In this inaugural edition of Stock Talk with Joe Rabil, Joe gives his background of 30 years and insights into his approach to the market. He gives a quick introduction to his history, format for future shows, and use of technical analysis. He provides his preferred setup in StockChartsACP and...

READ MORE

MEMBERS ONLY

RISING DOLLAR PUNISHES GOLD -- SO DOES THE PROSPECT FOR HIGHER RATES

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOLLAR JUMPS ON FED MESSAGE... The Fed's more hawkish tone yesterday set off a number of intermarket reactions. Stocks sold off (although not by that much), and bond yields rose. Prospects for higher rates in the U.S. also had a positive impact on the dollar. Chart 1...

READ MORE

MEMBERS ONLY

Cactus, Not The Plant, Is Breaking Out.

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In yesterday's article in the RRG blog, I highlighted the Oil&Equipment Services industry as potentially interesting.

Using the scan-manager to find the members of this industry gives 78 matching results.

[group is OilEquipmentServices]

One thing that we need to take into account when using the scan-manager...

READ MORE

MEMBERS ONLY

The Fed Has Spoken; What Did Wall Street Hear?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The latest FOMC meeting has come and gone. Fed Chair Jay Powell capped it off by recognizing that inflation was hotter than expected and even signaling that the Fed is ready to hike rates by the end of 2023, stepping up its earlier April guidance of "no rates hikes...

READ MORE

MEMBERS ONLY

Can the Economic Modern Family Hold its Current Price Range?

After the FOMC minutes were released on Wednesday, the market responded with a sharp selloff. The Feds' underestimation of rising inflation pushed them to consider scheduling rate increases in 2023. While 2023 is still far in the future, the market responded with choppy price action.

This could be taken...

READ MORE

MEMBERS ONLY

Financials and Energy Sectors Are (Re-)Gaining Strength -- Which Industries to Watch?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Relative Rotation Graph for US sectors shows interesting rotations on the tails of the Financials and the Energy sectors. These two sectors are inside the weakening quadrant on the RRG, but ranking highest on the JdK RS-Ratio scale.

Both sectors completed a first stint through the leading quadrant, entering...

READ MORE

MEMBERS ONLY

Thinking Like a Trader, Part 2

by Dave Landry,

Founder, Sentive Trading, LLC

In this edition of Trading Simplified, Dave continues his discussion on the fact that successful trading is more about attitude and less about aptitude. If you want to succeed at trading, then think like a trader. Dave also goes on to continue to show his methodology in action.

This video...

READ MORE

MEMBERS ONLY

The Hidden Opportunity in Soft Commodities

On Monday, we talked about transitory inflation and decided that, if general demand for goods was to continue with such strength, one of the best places to keep an eye on for investing opportunities could be in soft commodities. Not only must people eat, but, as travel picks up its...

READ MORE

MEMBERS ONLY

Can Positive Short & Intermediate Indicators for the Dollar Tip Long-Term Balance to the Bullish Side?

by Martin Pring,

President, Pring Research

Chart 1 shows that, since 2015, the Dollar Index has been in a narrowing trading range bounded by two converging trendlines. That period has also embraced the end part of the 2011-2016 bull market, a mini bear and bull market and the current bear. I use the term "bear&...

READ MORE

MEMBERS ONLY

Sector Spotlight: Does RRG Really Matter?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this edition of StockCharts TV's Sector Spotlight, I address an email I received from a user with the subject line "Does RRG Really Matter?" At first glance, one could think a lot of things about such a subject line. However, it appeared to be a...

READ MORE

MEMBERS ONLY

It's Options Expiration Week, Be Careful With This Semiconductor

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Listen, NVDA has been one of the strongest market performers in 2021 and I believe there's a very good chance it goes much higher. But if I wanted to buy it, I'd likely wait a week or so. There are never any guarantees, but the number...

READ MORE

MEMBERS ONLY

DP TV: Timing Entries with the PMO

by Erin Swenlin,

Vice President, DecisionPoint.com

In this episode of DecisionPoint, Erin (flying solo) starts with the DecisionPoint market overview, drilling down and uncovering three sectors that are showing new strength. She demonstrates how to find the strong industry groups within, then gives us five stocks to watch that should take advantage of that strength. Timing...

READ MORE

MEMBERS ONLY

What is the Deal with Transitory Inflation?

The Federal Reserve has called inflation transitory as they look for the economy to continue to recover and for more people to enter the workforce. The Fed could be expecting inflation to settle down, not only from people returning to work but also with a decrease in programs, including the...

READ MORE

MEMBERS ONLY

QQQ HITS NEW RECORD WITH TECHNOLOGY IN THE LEAD -- APPLE AND AMAZON TURN UP

by John Murphy,

Chief Technical Analyst, StockCharts.com

NASDAQ 100 HITS NEW RECORD... Chart 1 shows the Invesco QQQ Trust closing above its April high to achieve a new record. Technology was the day's strongest sector. Chart 2 shows the Technology SPDR (XLK) nearing a test of its April high. Semiconductors had another strong day as...

READ MORE

MEMBERS ONLY

Rally Is Being Undermined

by Carl Swenlin,

President and Founder, DecisionPoint.com

Most people are familiar with the Golden Cross, which is when the 50EMA of a price index crosses up through the 200EMA. The Golden Cross has positive long-term implications, but to address the intermediate-term I chose the 20EMA and 50EMA and thought it appropriate to call an upside crossover a...

READ MORE

MEMBERS ONLY

Weekend Recap: Inflation Soars But Who Cares?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

In The News

It was a light week for headlines as there wasn't much in the way of either economic or earnings news. Thursday did provide us our next glimpse into the inflation story as May CPI jumped 0.6%, ahead of the 0.4% expectation. That left...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Has High Call Writing at These Levels; RRG Chart Continues Offering Mixed Cues

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

While trading on a narrower range, the NIFTY continued its up move and ended on a positive note for the fourth consecutive week. The NIFTY went on to mark its incremental fresh lifetime high as it continued trending higher on reduced and decelerating momentum. The trading range remained narrower at...

READ MORE

MEMBERS ONLY

"Diamonds in the Rough" - Last Week's Darlings and Dud

by Erin Swenlin,

Vice President, DecisionPoint.com

Each week in my DecisionPoint Diamonds reports, I give readers 10+ stock picks to consider. This week, we had 11 picks. I look for stocks that are beginning to show positive momentum, bullish chart patterns, breakouts and improving relative strength among not only the SPX, but also against its industry...

READ MORE

MEMBERS ONLY

Uptrend in NASDAQ Continues!

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews why the Nasdaq outperformed last week and how you can capitalize. She also looks at best practices for buying stocks on their pullback, as well as a review of the best looking names from Robinhood's...

READ MORE

MEMBERS ONLY

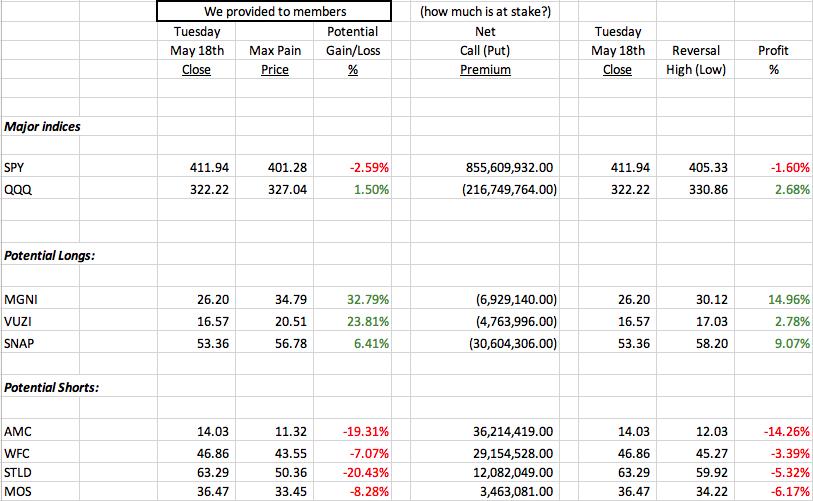

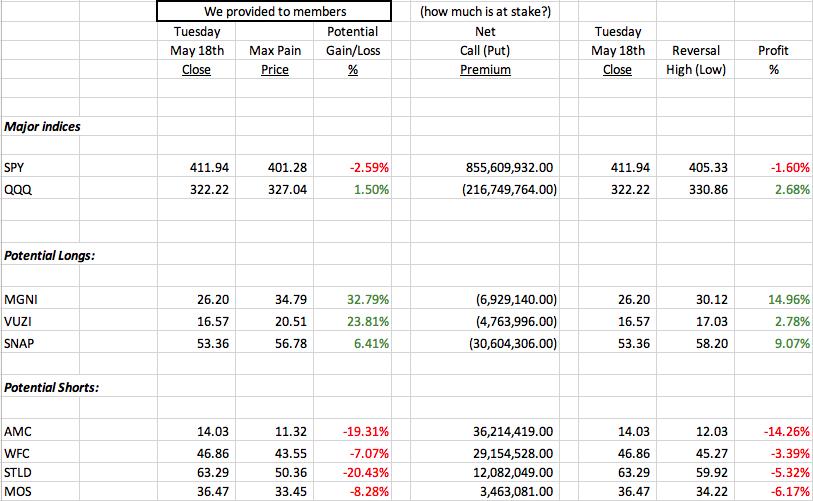

How To Avoid Option-Related Manipulation This Week

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Friday, June 18th is the next monthly options expiration day and, if it's like recent option-expiration Fridays, then get ready for crazy reversals. To best illustrate how the madness around options expiration works, we'll review past results.

Before I do that, let me explain that I...

READ MORE

MEMBERS ONLY

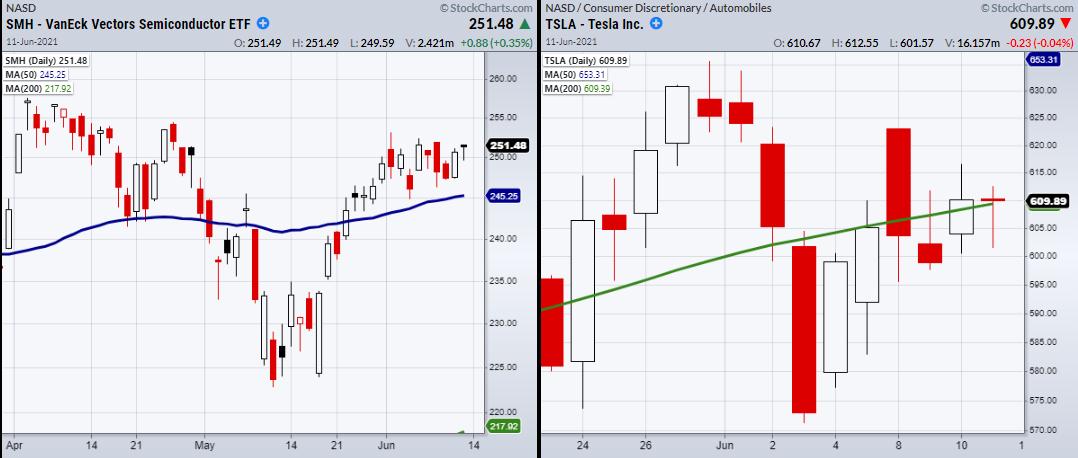

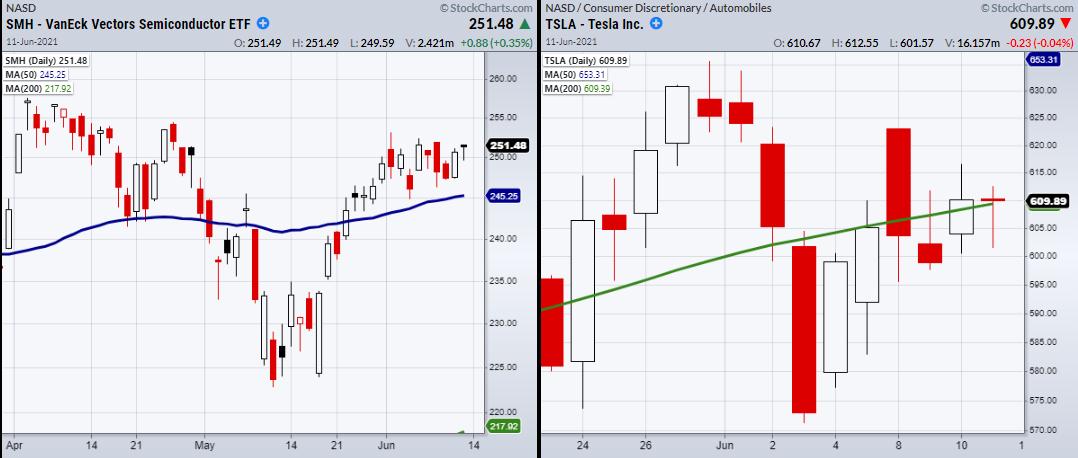

Will the Semiconductors Sector (SMH) Lead the EV Market Higher?

It is well known that supply chain disruptions in Taiwan and other leading countries, which produce semi-chips for computers/Electric Vehicles, have been struggling to keep up with demand. Therefore, if the EV space is looking to extend higher, it will need semiconductor supply companies to step up its game....

READ MORE

MEMBERS ONLY

Momentum Turns Up as Utes Form Bullish Pattern

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Utilities SPDR is lagging the broader market over the last eight weeks, but a close look at price action reveals an uptrend, a bullish continuation pattern and an uptick in short-term momentum. Let's investigate.

First and foremost, the long-term trend is up for the Utilities SPDR (XLU)...

READ MORE

MEMBERS ONLY

Three Key Charts for Falling Rates

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In terms of key developments this week, I would argue that the ten-year Treasury yield breaking below 1.5% was perhaps the most significant. On The Final Bar this week, we've talked about the $140 level on the long bond ETF ($TLT) and how this rotation higher in...

READ MORE