MEMBERS ONLY

Three Key Charts for Falling Rates

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In terms of key developments this week, I would argue that the ten-year Treasury yield breaking below 1.5% was perhaps the most significant. On The Final Bar this week, we've talked about the $140 level on the long bond ETF ($TLT) and how this rotation higher in...

READ MORE

MEMBERS ONLY

Where Are We Now, What's Next?

by Larry Williams,

Veteran Investor and Author

In this special presentation, Larry shares his views about what is coming for stocks, gold, crude oil and bonds. He provides some of his secrets of cycles and fundamentals, with an alert on what you need to be following going forward. As an added bonus, Larry highlights a specific trade...

READ MORE

MEMBERS ONLY

Very Bullish Pattern Setting Up for This Leading Semiconductor Stock

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Leading stocks go through consolidation periods where weak hands forego their shares as impatience takes over. It's never fun to watch the stock market break to new highs while your stock(s) consolidate and fail to gain ground. A trained technical eye, however, needs to recognize continuation patterns...

READ MORE

MEMBERS ONLY

Chartwise Women: Hot IPOs and Short Squeezes

by Mary Ellen McGonagle,

President, MEM Investment Research

by Erin Swenlin,

Vice President, DecisionPoint.com

In this week's edition of Chartwise Women, Mary Ellen and Erin dive into the world of Initial Public Offerings (IPOs) and look at stocks with high short interest. They explain how to find these stocks and share their favorites, including a spotlight on Biotechs!

This video was originally...

READ MORE

MEMBERS ONLY

Sector Spotlight: Putting Rotation into Perspective

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this edition of StockCharts TV's Sector Spotlight, I make up for last week's brief coverage of recent rotations in asset classes and sectors by spending half of today's show examining recent rotations on the daily Relative Rotation Graphs. I put things into longer-term...

READ MORE

MEMBERS ONLY

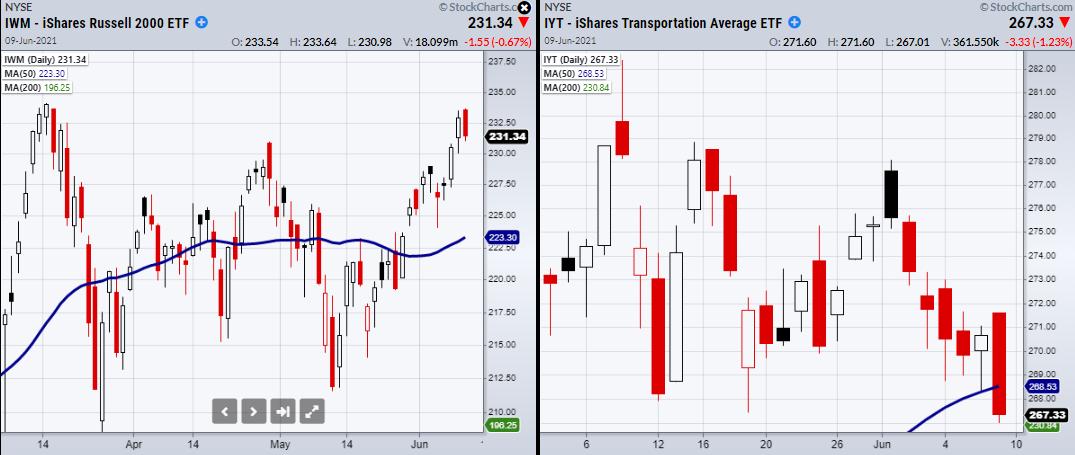

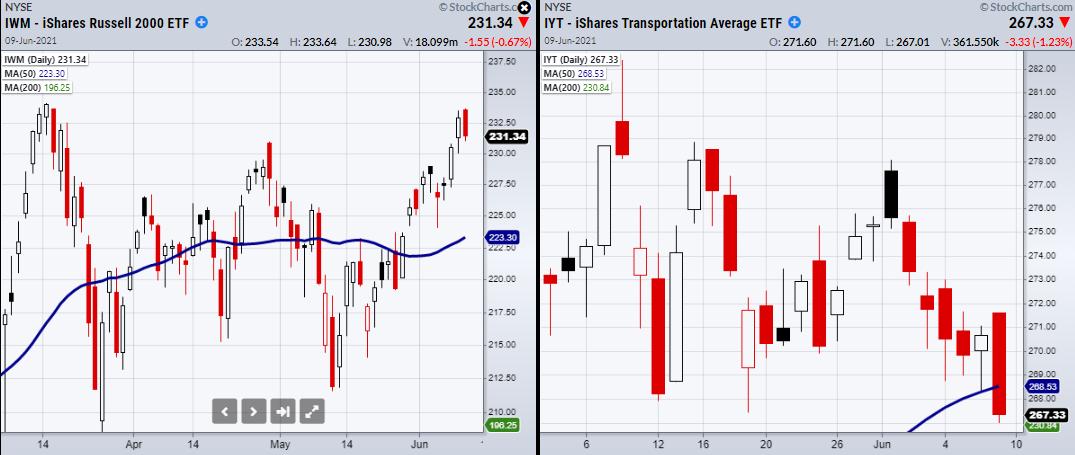

Is the Transportation Sector (IYT) Stifling a Major Market Breakout?

The S&P 500 (SPY) and the Small-caps Russell 2000 (IWM) linger near all-time highs. This looks like a great setup for a rally past resistance and into higher territory. However, there are two potential problems to consider.

The first is the Transportation sector (IYT), which has broken its...

READ MORE

MEMBERS ONLY

How to Think Like a Trader

by Dave Landry,

Founder, Sentive Trading, LLC

In this edition of Trading Simplified, Dave explains that trading success is more about attitude than aptitude. How you think is crucial; if you want to succeed at trading, then think like a trader. Dave also went on to continue to show his methodology in action and why you need...

READ MORE

MEMBERS ONLY

Why Transportation (IYT) Must Hold Over $268

The transportation sector (IYT) bounced off $268, closing +.32% on the day. This was a pivotal level to hold and becomes more important when compared to the rest of Mish's Economic Modern Family. Besides IYT, the Family consists of Retail (XRT) Regional Banking (KRE), Biotech (IBB), Semiconductors (SMH)...

READ MORE

MEMBERS ONLY

Oil May Be on the Verge of a Major Breakout

by Martin Pring,

President, Pring Research

Last week, I featured three energy-related ETFs as part of an article on the bond market, as they had just broken out on a short-term basis. Chart 1 shows that those breakouts have held so far. This week, though, I'd like to take a deeper dive into the...

READ MORE

MEMBERS ONLY

Recap of Long/Short Baskets, adding CRM (+) and SWKS (-)

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In today's episode of Sector Spotlight, I did a full review of all stocks that we are monitoring in the RRG L/S baskets. Both baskets (Long and Short) with the stocks on watch are shown in the RRGs above; the members of the Long basket are on...

READ MORE

MEMBERS ONLY

DP TV: Negative Divergences Take Center Stage

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, Carl gives us the market review and points out numerous negative divergences that are finding their way back onto the indicator charts. He and Erin discuss how to use "cardinal highs" and "cardinal lows" to easily see negative and positive divergences....

READ MORE

MEMBERS ONLY

Small-Cap Growth Stocks

"A small-cap is generally a company with a market capitalization of between $300 million and $2 billion. The advantage of investing in small-cap stocks is the opportunity to beat institutional investors through growth opportunities. Small-cap stocks have historically outperformed large-cap stocks but have also been more volatile and riskier...

READ MORE

MEMBERS ONLY

5G Takes the Lead - Tune into the Trading Room

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The 5G Next Generation ETF (FIVG) is taking the lead within the tech space as it breaks out of a bullish continuation pattern. FIVG is leading because it recorded a new high here in early June. Not very many tech-related ETFs hit new highs here in early June and this...

READ MORE

MEMBERS ONLY

Anticipating Where Money May Rotate Next and a Strong Trading Candidate

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Catching an industry group as it bottoms and begins to lead the market can be very profitable. We're seeing tons of rotation in the stock market, which is the biggest reason why selling doesn't last long. Money comes out of one group and then rotates into...

READ MORE

MEMBERS ONLY

Week Ahead: Buoyant NIFTY Has These Things to Guard Against; RRG Chart Shows Mixed Sectoral Setup

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

For the third week in a row, the Indian equity markets continued with their up move. The week that went by saw the NIFTY50 index scaling a fresh high and also ending at its new lifetime high point. The Indian headline index is now placed in uncharted territory. The NIFTY...

READ MORE

MEMBERS ONLY

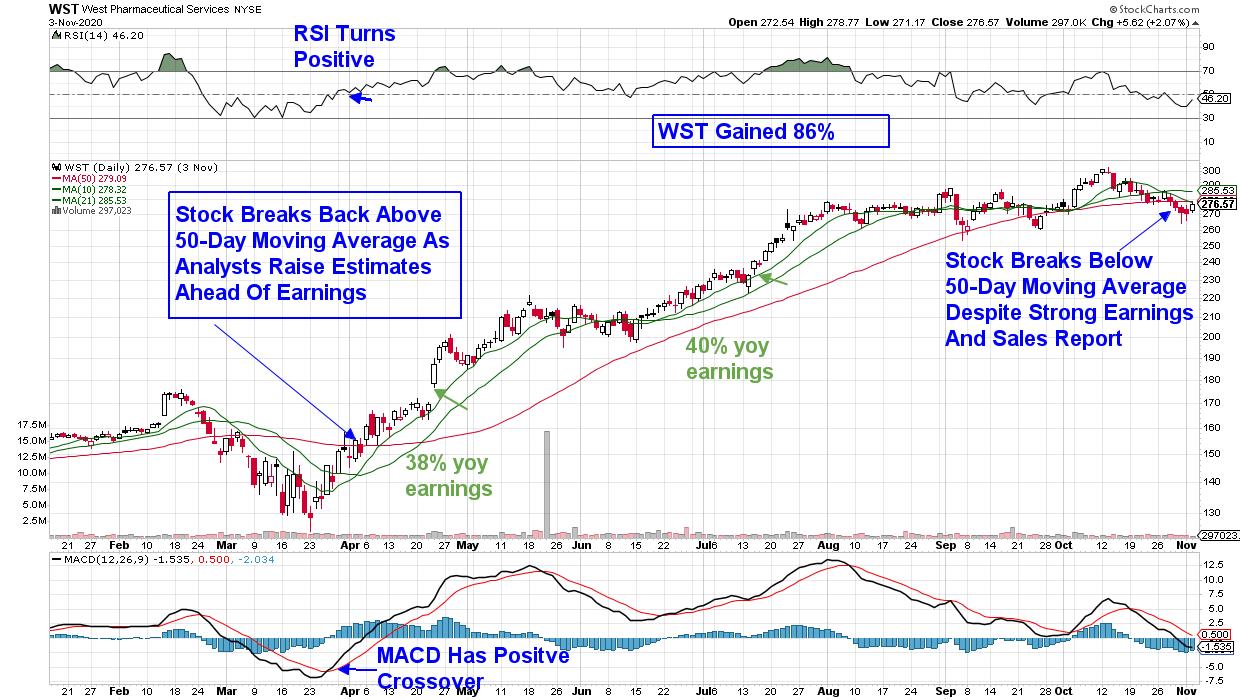

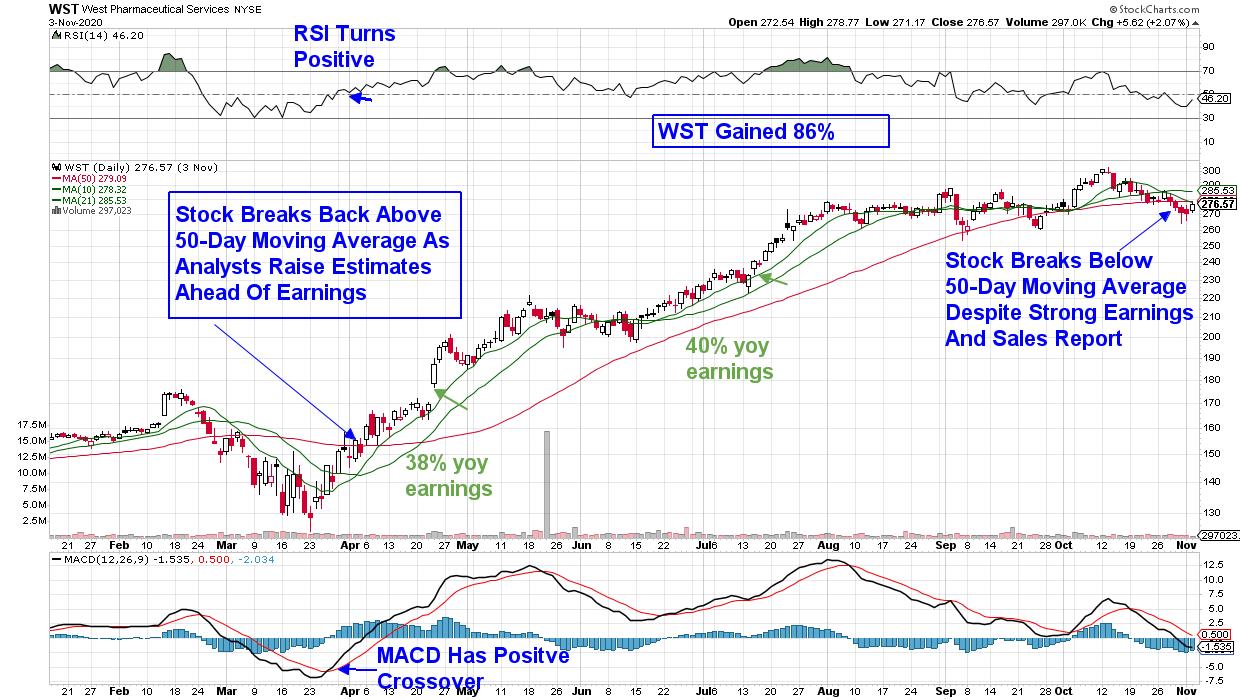

Fallen Angels Beginning to Reverse - Here's What to Be on the Lookout For

by Mary Ellen McGonagle,

President, MEM Investment Research

A number of winning stocks that performed well last year and into the first quarter of this year have seen dramatic drops in price. A decline in high-multiple growth stocks amid increasing interest rates was one reason, while a shift away from lockdown stocks caused other areas to drop.

I&...

READ MORE

MEMBERS ONLY

Introducing the FAME Stocks

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In John Murphy's classic text Technical Analysis of the Financial Markets, he explains that one of the three basic assumptions of technical analysis is that prices move in trends.For anyone that has looked at charts for any amount of time, this seems like an obvious truism. The...

READ MORE

MEMBERS ONLY

This Group is On Fire!

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reveals an area of the market that's benefiting from a shift in government spending. She also reviews how to identify uptrends vs. downtrends in well-known stocks.

This video was originally recorded on June 4th, 2021. Click...

READ MORE

MEMBERS ONLY

DP ALERT WEEKLY WRAP: SPX and OEX Generate IT PMO SELL Signals

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

This is a copy of the "subscriber-only" DecisionPoint Weekly Wrap. It is posted each Friday for our subscribers and wraps up the week by analyzing daily and weekly charts. For more information on subscribing, click here.

Intermediate-Term Price Momentum Oscillator (PMO) signals are determined by weekly PMO crossovers....

READ MORE

MEMBERS ONLY

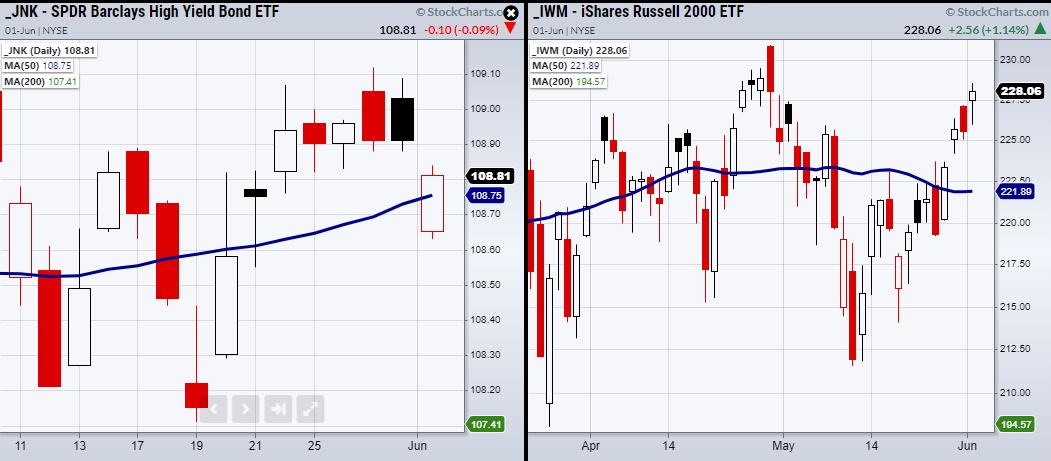

Can the Small-Cap Index and the Transportation Sector Hold Key Support?

For the small-cap Russell 2000 (IWM), $226.69 is an important level to hold, as it shows the index can sustain itself over its main consolidation range dating back to early April. On the other hand, the Transportation sector (IYT), along with Retail (XRT), are not far from their 50-day...

READ MORE

MEMBERS ONLY

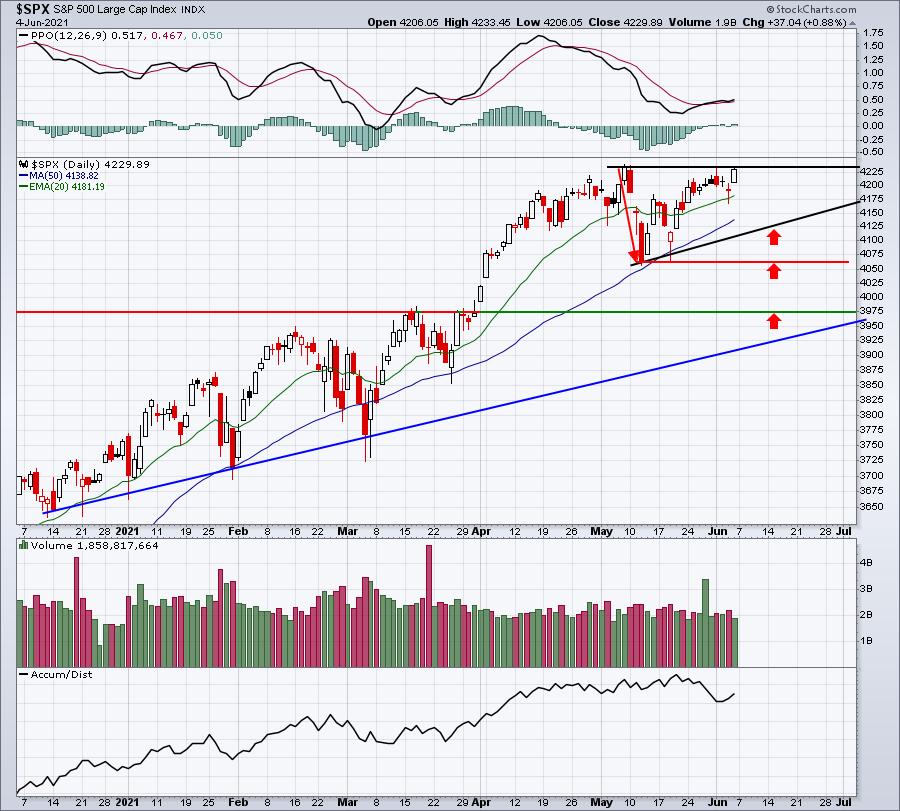

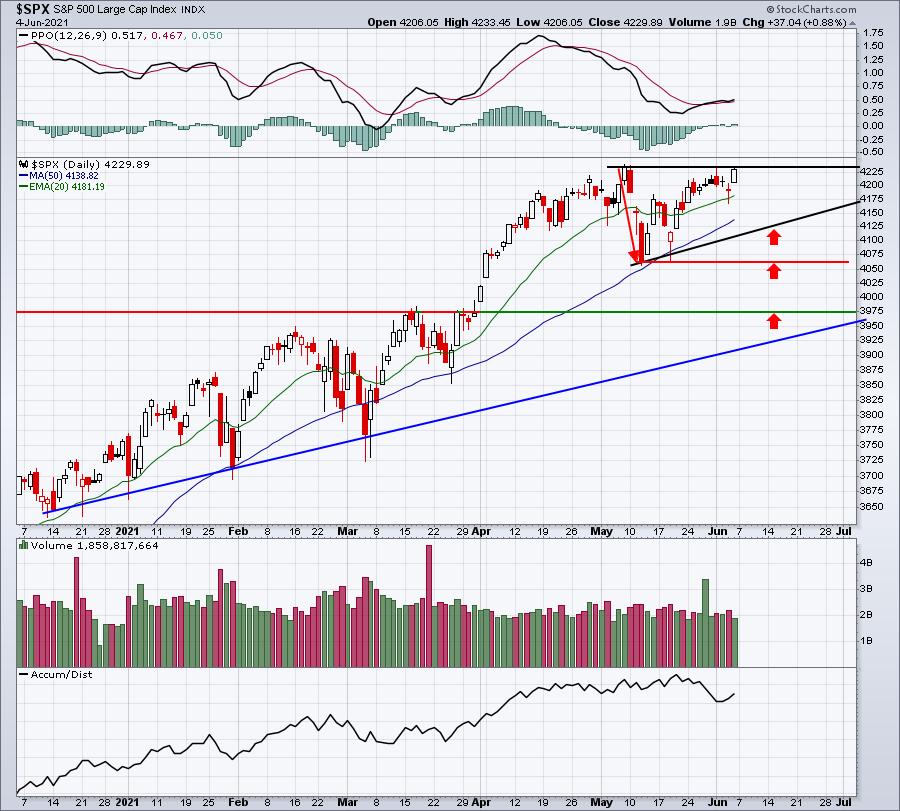

Looking Ahead: Expect Selling Next Week For One Primary Reason

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The S&P 500 reached a high on Friday of 4233.45, narrowly eclipsing the all-time high close of 4232.60 from May 7th. Unfortunately for the bulls, selling in the final few minutes ruined the breakout attempt. This false breakout, ever so slight, could be quite ominous for...

READ MORE

MEMBERS ONLY

The Big Turnaround in Commodities Continues, Favoring Energy and Agricultural

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The improvement of commodities started already back in early 2020. Looking at long-term (monthly) charts, that rally seems like one straight move higher.

This chart shows $GNX and GSG stacked on top of each other. ($GNX is the S&P GSCI Commodity Index and GSG is the iShares S&...

READ MORE

MEMBERS ONLY

TECH AND NASDAQ LEAD MARKET HIGHER -- SEMICONDUCTERS LEAD XLK HIGHER -- SMALL CAPS MAY BE TRIANGULATING -- BITCOIN MEETS 40K RESISTANCE

by John Murphy,

Chief Technical Analyst, StockCharts.com

NASDAQ LEADS MARKET HIGHER... Stocks are reacting positively to this morning's job report which came in weaker than expected but showed job growth during May. Bond yields weakened on the report which may be helping to boost stocks, and technology stocks in particular. Chart 1 shows the Invesco...

READ MORE

MEMBERS ONLY

Chartwise Women: High-Yielders Breaking Out!

by Mary Ellen McGonagle,

President, MEM Investment Research

by Erin Swenlin,

Vice President, DecisionPoint.com

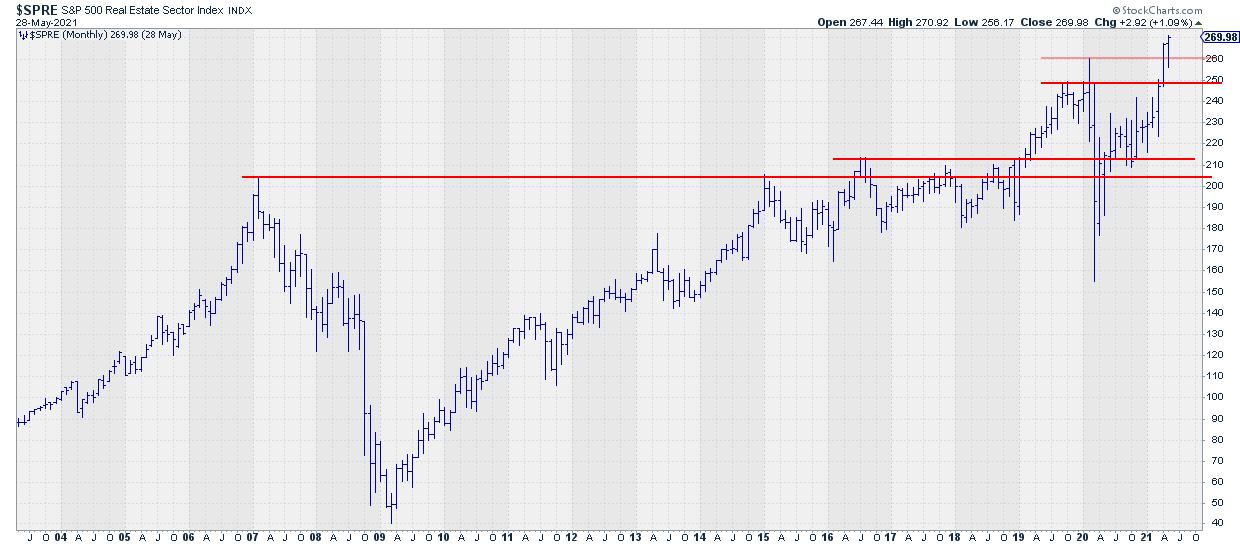

In this week's edition of Chartwise Women, Erin and Mary Ellen discuss the concept of "high-yield" stocks/ETFs. With inflation fears edging in, high-yield stocks are in favor. Not only that, but high-yield energy and real estate stocks are breaking out and are poised to move...

READ MORE

MEMBERS ONLY

This Health Care Provider is Ready to Pop

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this week's episode of Sector Spotlight, I discussed the outlook for the Health Care sector based on the current alignment of the rotation on the Relative Rotation Graph and the seasonal expectation for the sector. Over the last 20 years, the Health Care sector outperformed the S&...

READ MORE

MEMBERS ONLY

Bonds at the Crossroad as Energy Breaks to the Upside

by Martin Pring,

President, Pring Research

The Dilemma Between the Long and Short-Ends

Last March, I wrote an articleopining that, while the primary trend was positive, the idea of rising bond yields may have been become too popular for the time being. In the intervening 2 ½-months, yields at the long end have backed off a...

READ MORE

MEMBERS ONLY

How to Use Simple Risk Control for Stocks Like AMC

Once a stock goes flying, it seems as though everyone wants a piece of the action.

Of course, it might be fun to be a part of a big move, but it can also be extremely dangerous to take a trade in something going parabolic. However, if you are late...

READ MORE

MEMBERS ONLY

Sector Spotlight: It's Healthcare Season

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this edition of StockCharts TV's Sector Spotlight, for the first Tuesday of the month, I combine the usual look at long-term trends on the monthly charts with the seasonal expectations along with current rotations as they are visible on the Relative Rotation Graph for US sectors. For...

READ MORE

MEMBERS ONLY

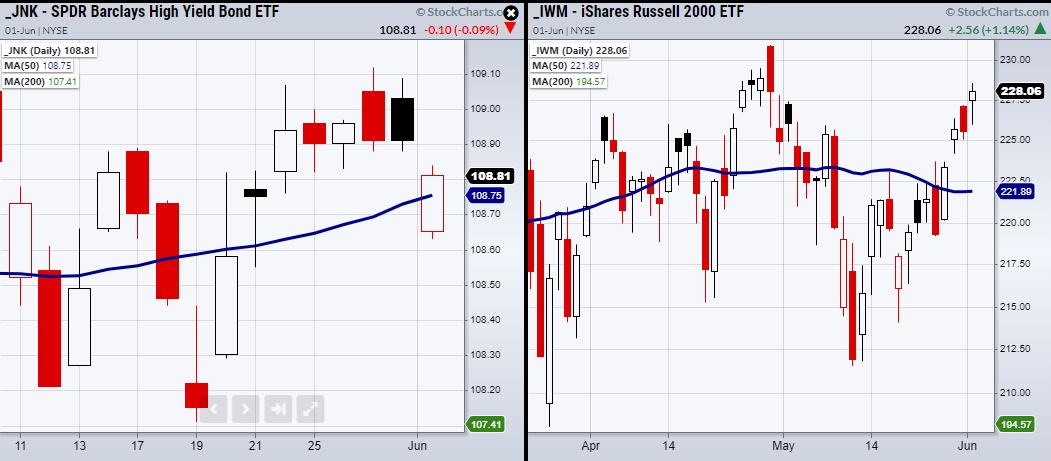

Can JNK and IWM Hold Their Key Price Levels?

On Tuesday, the Russell 2000 (IWM) closed over its pivotal price area of $226.69 from April 6th. Now it needs to hold over this price level as new support. However, the other major indices, including the S&P 500 (SPY) and Dow Jones (DIA), closed almost unchanged from...

READ MORE

MEMBERS ONLY

Looking Ahead: What Might June Have in Store?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

There are two sides to every coin. Similarly, I can look at the market from an optimistic or pessimistic perspective. Each provides different answers as we look into June 2021.

The Bullish View

The first reason to be bullish is as simple as it gets. We're in a...

READ MORE

MEMBERS ONLY

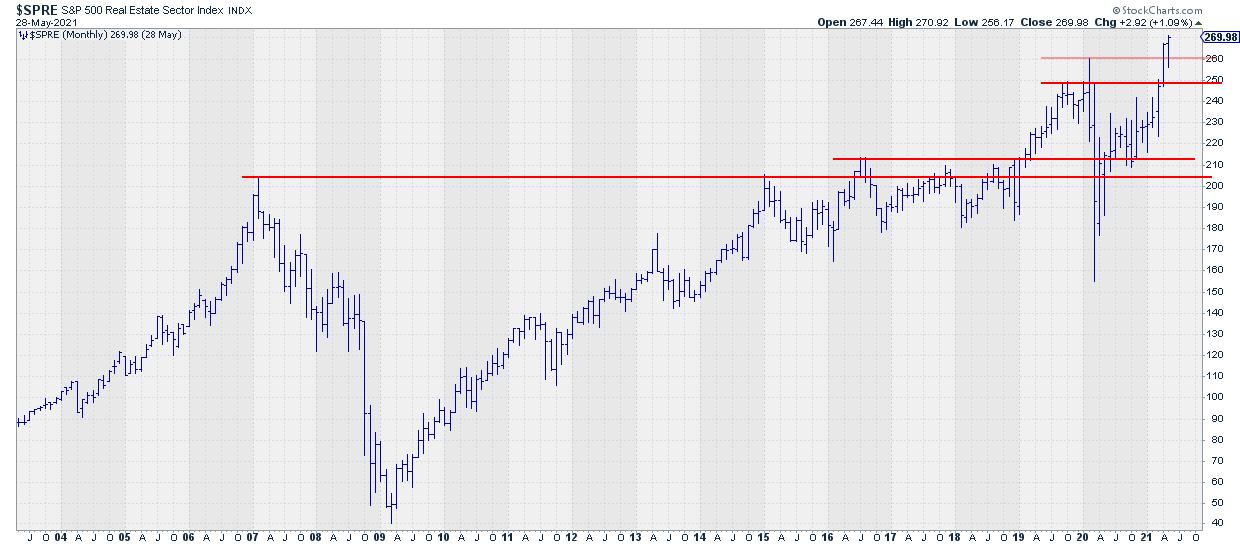

Specialty REITs are Surfacing Inside a Strong Real-Estate Sector

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Going over the monthly charts, I noticed the confirmation of the upward break visible at the end of April. During May, that upward break managed to hold up above the breakout level, record a new high during the month and close the month at a new closing high.

These are...

READ MORE

MEMBERS ONLY

Change the Range When the Trend Ends

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I'm a momentum trader, so I look for consistent uptrending patterns before I commit capital. As I've said many times before, I'm most comfortable trading leading stocks in leading industry groups. These are the stocks that Wall Street favors and, in my opinion, offer...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Stays Buoyant; Keeping Eye on Volatility Important Because of This

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The past week remained a trending one, as the NIFTY attempted to break out of the channel and, in the process, tested and marked a new lifetime high on the last trading day of the week. The trading range during the week remained narrower; the index moved in a 324-point...

READ MORE

MEMBERS ONLY

Has The Technology Run Ended?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I suppose the answer really depends on your level of expectation and your time frame. If you're looking for technology to outperform the benchmark S&P 500 over the next few months the way it did throughout much of 2020, then you'll likely be quite...

READ MORE

MEMBERS ONLY

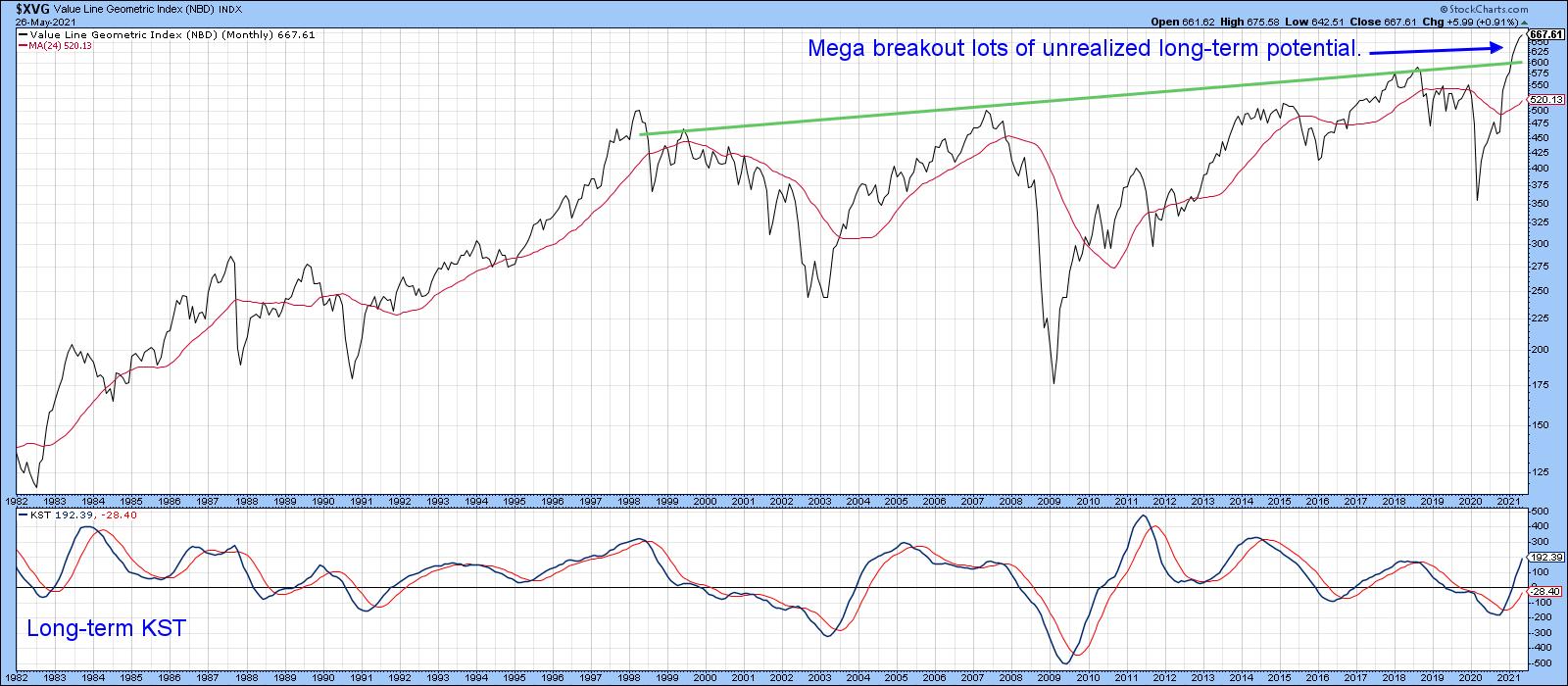

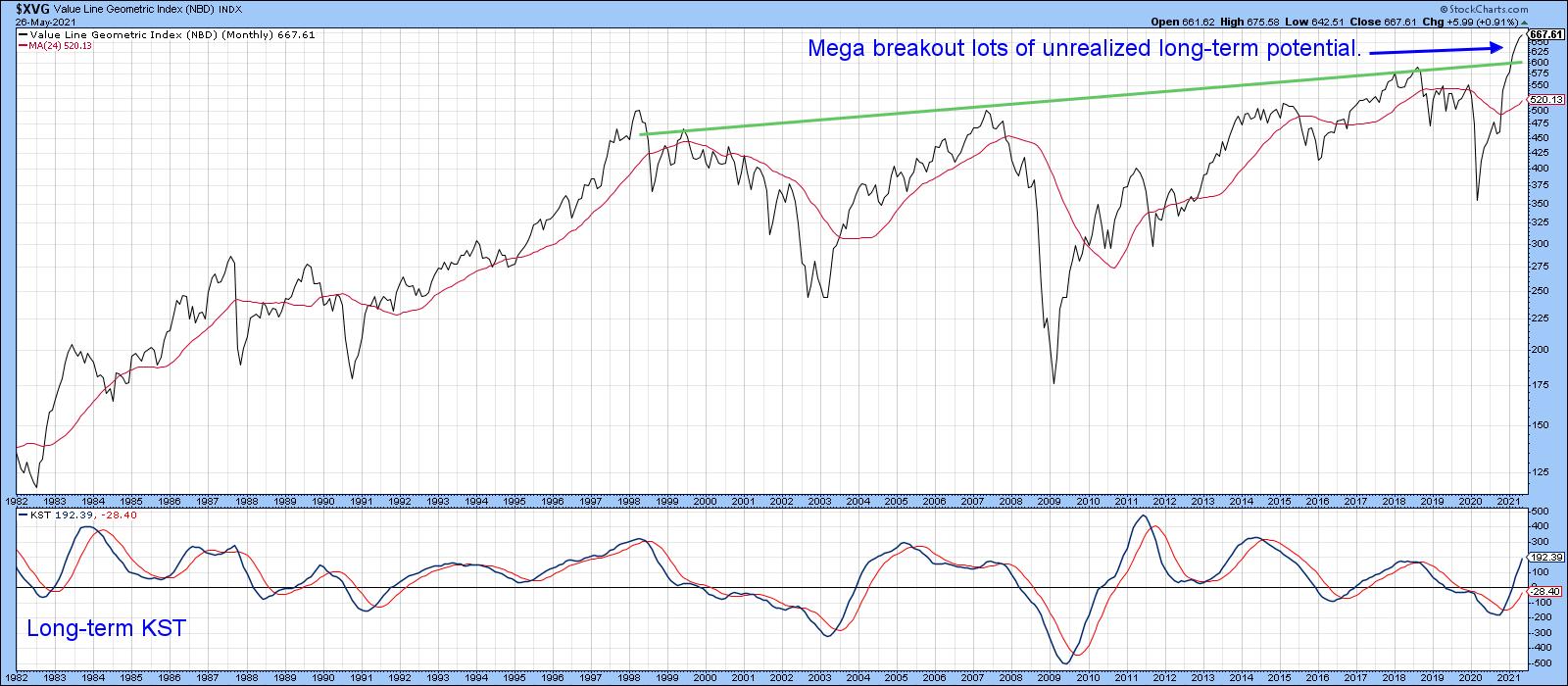

I Don't Know If the Correction Will Extend, But Here are Five Charts I'm Watching

by Martin Pring,

President, Pring Research

The Big Picture

Before we get into the subject of corrections, it's important to make sure that we do not lose focus on the big picture. For instance, take Chart 1, which features the Value Line Geometric Average. It reflects the performance of the average stock, as opposed...

READ MORE

MEMBERS ONLY

Shorts Get Cooked Again!

by John Hopkins,

President and Co-founder, EarningsBeats.com

The Reddit crowd was at it again this past week as they mounted a full-out assault on short sellers, with some stocks making meteoric rises. The biggest example was AMC Entertainment (AMC), which tripled - repeat; tripled - over a one week period, rising from just over $12 to almost...

READ MORE

MEMBERS ONLY

Cannabis Stocks Going Higher - Opportunities Abound

by Erin Swenlin,

Vice President, DecisionPoint.com

On Tuesday, I let DecisionPoint Diamonds subscribers know that weed stocks were the place to be. While this area can be speculative in nature, there are some strong winds at the back of these stocks. Technically, these charts look fantastic, but there is also news on the marijuana front.

A...

READ MORE

MEMBERS ONLY

Is Your Stock a Leadership Name?

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reveals key characteristics that your stock is poised to far outperform its peers. She also reveals stocks that are re-emerging after lengthy downtrends, as well as top Small Caps that have regained momentum.

This video was originally recorded...

READ MORE

MEMBERS ONLY

Cybersecurity - An Ever-Evolving Megatrend

The Biden administration is looking to increase spending on cybersecurity with the next round of stimulus. This comes after an increase in cyber-attacks across the world, which has targeted government agencies and groups. For the U.S, one of the most recent attack was a ransomware attack on the Colonial...

READ MORE

MEMBERS ONLY

CARZ Revs its Engine (while it Still Can)

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Some of the old Ford and GM cars can still rev their engines, but the sound of a revving engine could go the way of the dodo with EVs. Perhaps, I should say that the Global Auto ETF (CARZ) price chart is revving its engine and poised for a breakout....

READ MORE