MEMBERS ONLY

Is the Current Market Rally Sustainable?

This past week, dip buyers saved the market from breaking lower.

The Retail (XRT) and Regional Banking (KRE) sectors have cleared back over resistance from their 50-day moving averages, followed by the Biotech (IBB) clearing back over its 200-DMA. However, the small-cap Russell 2000 (IWM) and Semiconductors (SMH) are still...

READ MORE

MEMBERS ONLY

A Tech ETF Forming A Short-term Bullish Pattern within a Bigger Bullish Pattern

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Cybersecurity ETF (CIBR) was hit with the rest of the tech sector over the last few weeks, but it held the March lows and is on my radar as a possible triangle forms over the last few months. In particular, I am watching the downswing within this triangle for...

READ MORE

MEMBERS ONLY

Chartwise Women Archives: Are Your Stocks Headed Lower?

by Mary Ellen McGonagle,

President, MEM Investment Research

by Erin Swenlin,

Vice President, DecisionPoint.com

In this restored archive edition of Chartwise Women, Mary Ellen and Erin review ways to tell if it's time to sell your stock or if it's time to buy the dip. (The charts are old, but can still illustrate valuable trading lessons.)

This video was originally...

READ MORE

MEMBERS ONLY

An 18-Year Living Investment Experiment And Its Most Impactful Conclusions

by Gatis Roze,

Author, "Tensile Trading"

Last month, Grayson and I had the pleasure of Zooming online to a combined audience of both the Los Angeles and San Diego chapters of the AAII. Our investment talk to this significant group of investors was presented in three distinct pods of investment strategy and money management topics. It...

READ MORE

MEMBERS ONLY

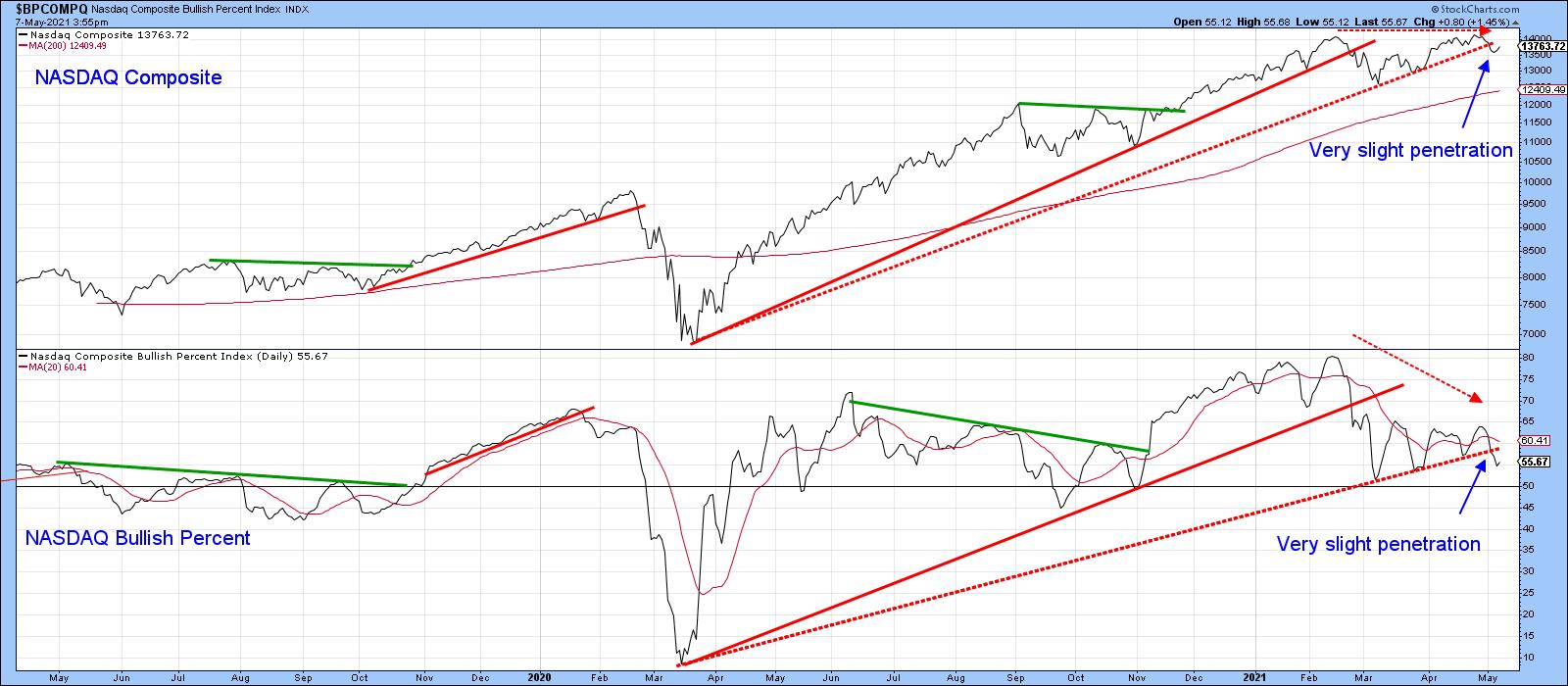

THE NASDAQ SHOWS RELATIVE WEAKNESS AND MAY HOLD KEY TO MARKET DIRECTION -- S&P 500 BOUNCES OFF 50-DAY LINE

by John Murphy,

Chief Technical Analyst, StockCharts.com

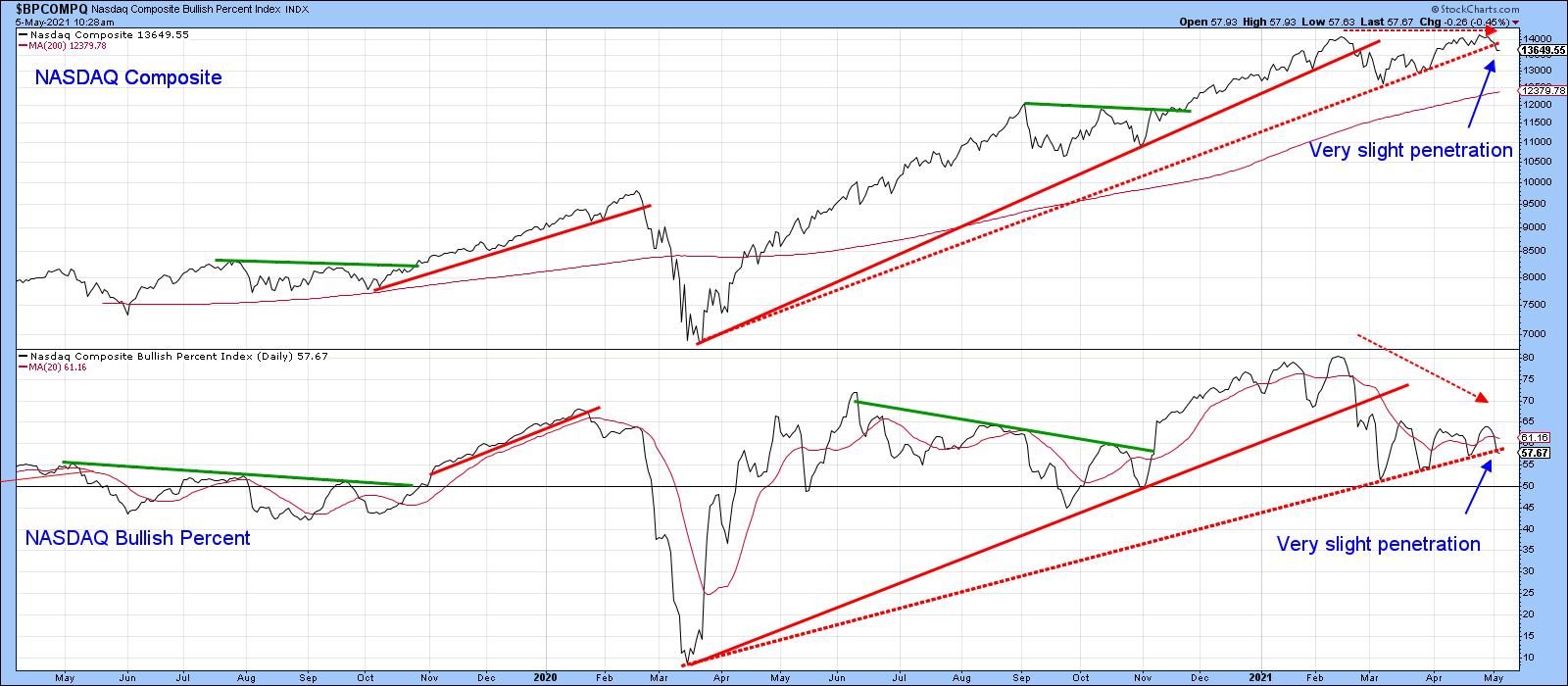

THE NASDAQ REMAINS IN SHORT-TERM DOWNTREND... The tech-dominated Nasdaq market continues to show relative weakness. Chart 1 shows the Nasdaq Composite trading well below its 50-day average and in a short-term downtrend. Prices are attempting a rebound today from yesterday's heavy selling. If that low doesn't...

READ MORE

MEMBERS ONLY

DP TV: Market Climax Analysis

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, Carl and Erin cover a variety of topics. Carl opens the show with his "grab bag" of news items and follows up with his unique view of the markets in general. Both discuss Gold Miners (GDX) and Natural Gas (UNG). Erin finishes up...

READ MORE

MEMBERS ONLY

The Power of the Plug-In

by Dave Landry,

Founder, Sentive Trading, LLC

In this edition of Trading Simplified, Dave discusses market timing, staying on the right side of the trend, setups, and volatility using his Trading Simplified Plugin.

This video was originally broadcast on May 12th, 2021. Click anywhere on the Trading Simplified logo above to watch on our dedicated show page,...

READ MORE

MEMBERS ONLY

Caution All Around with Transportation Market's Last Hope

On Wednesday, the market continued the prior days' sell-off. This has placed the overall market trend in a pivotal area as more sectors begin to look weak.

This can be seen in Mish's Economic Modern Family, which consists of one index and 5 important sectors. Currently, the...

READ MORE

MEMBERS ONLY

SPIKE IN APRIL INFLATION AND RISING BOND YIELDS PUSH STOCKS LOWER

by John Murphy,

Chief Technical Analyst, StockCharts.com

INFLATION SPIKE BOOSTS BOND YIELDS... A spike in April CPI and its inflationary implications is boosting bond yields and hurting stock prices. Chart 1 shows the 10-Year Treasury yield jumping nearly 6 basis points today to 1.68% and close to exceeding its late April peak. That's having...

READ MORE

MEMBERS ONLY

Why Big Tech is Tuesday's Main Focus

On Tuesday, the Nasdaq 100 (QQQ), Russell 2000 (IWM) and S&P 500 (SPY) gapped lower, followed by a rally.

One of the most important indices to gap lower was the teach-heavy index QQQ. This is important because big tech companies were the first to lead the rally created...

READ MORE

MEMBERS ONLY

Monday's Falling Dominos May Be Enough to Tip the Short-term Trend to the Downside

by Martin Pring,

President, Pring Research

Many internal short-term indicators are overextended and starting to look vulnerable, but need some kind of a push to tip the near-term technical balance to the bearish side. That push may have been delivered with Monday's action, as several indexes gave the appearance of some selected short-term buyer...

READ MORE

MEMBERS ONLY

DOW AND S&P OPEN SHARPLY LOWER BUT REMAIN ABOVE SHORT-TERM SUPPORT -- THE NASDAQ 100 RECOVERS FROM EARLY LOSS

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW NEARS SHORT-TERM SUPPORT... The Dow gapped sharply lower today and inflicted some short-term chart damage. Chart 1 shows its 14-day RSI backing off from overbought territory near 70; the red arrow shows its daily MACD lines forming a lower high than in April which shows some loss of upside...

READ MORE

MEMBERS ONLY

Sector Spotlight: It's Not Good Under the Hood

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this edition of StockCharts TV's Sector Spotlight, I kicksoff the show with an overview of last week's rotation in asset classes, immediately blending them with a longer term picture using the weekly RRGs and price charts. After that, the focus is on stock sectors, starting...

READ MORE

MEMBERS ONLY

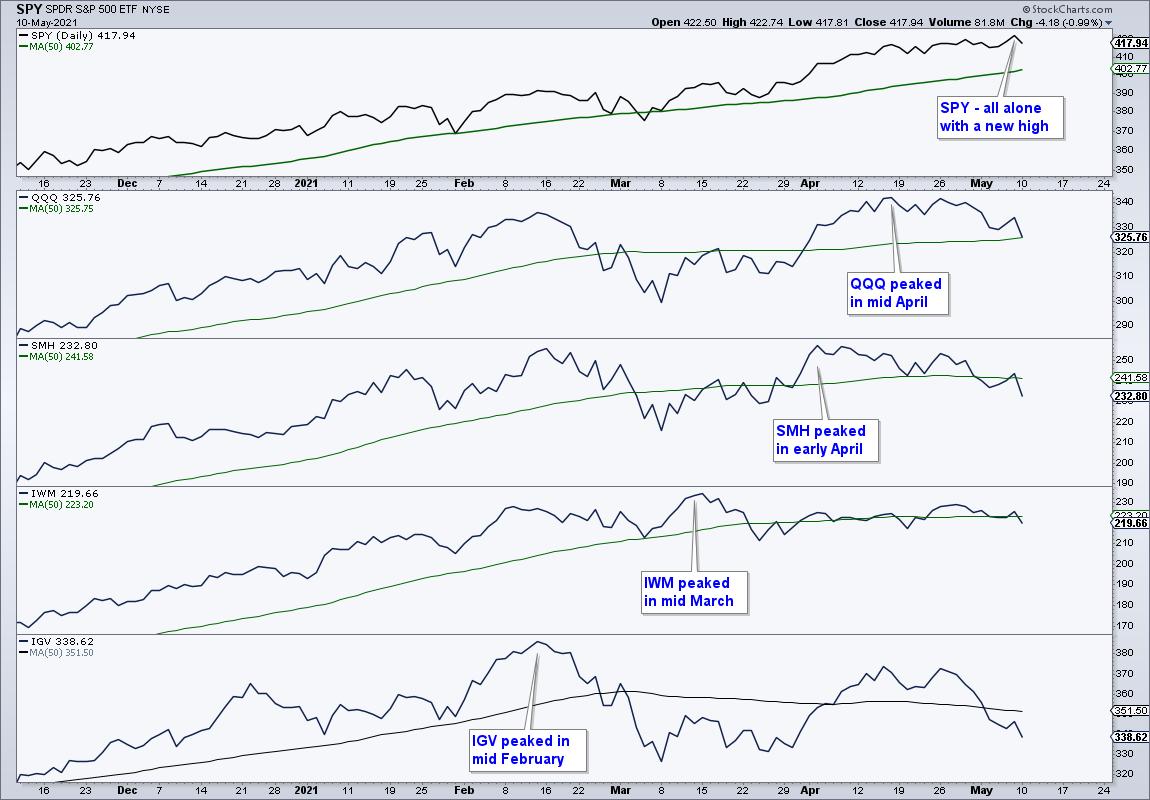

Non-confirmations show Creeping Correction that Could Expand

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

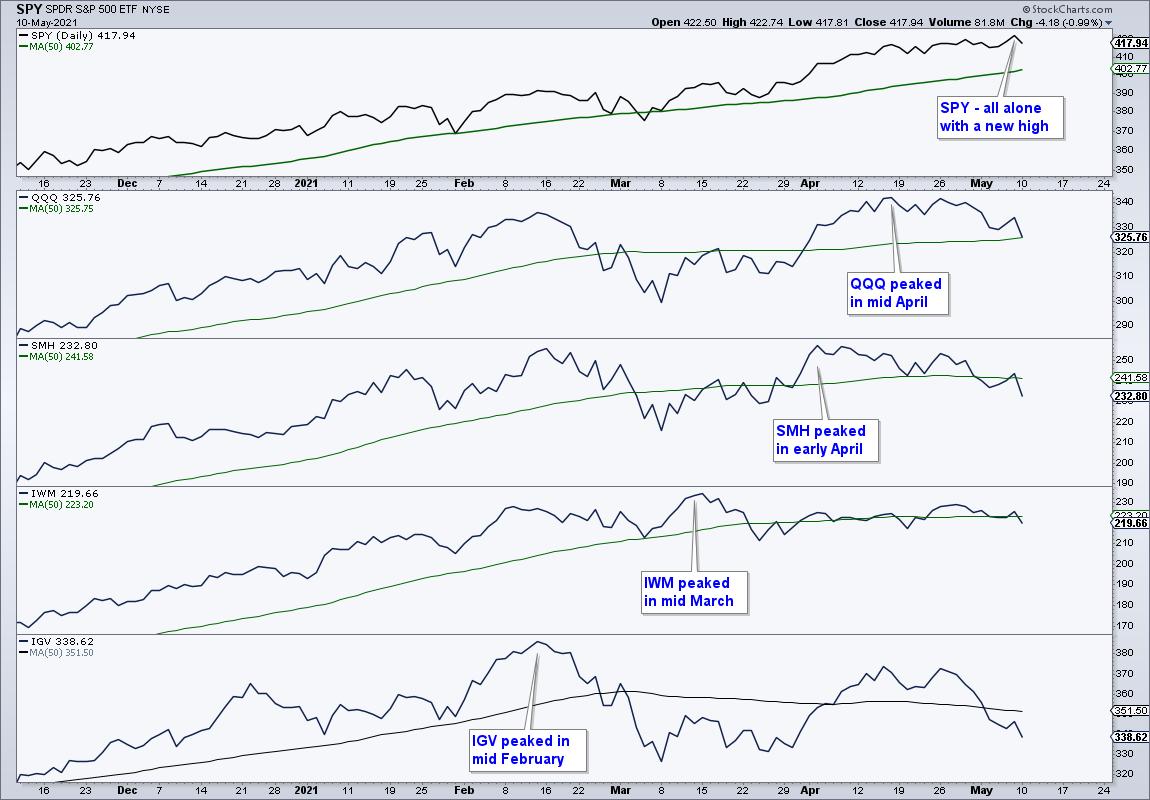

The S&P 500 SPDR hit a new high last week, but it was alone at the top because several other major index ETFs did not confirm. In fact, these non-confirmations have been building since March as fewer groups participated. Of note, several tech-related ETFs peaked in mid February,...

READ MORE

MEMBERS ONLY

What a Weakening Dollar Could Mean for the Market

The Russell 2000 (IWM) and the Nasdaq 100 (QQQ) both broke their 50-day moving averages. Meanwhile, Transportation (IYT) printed another new all-time high. This shows the market's current indecision and choppy nature.

The market's uncertainty may be related to inflation, which is set to increase beyond...

READ MORE

MEMBERS ONLY

KRE Breakout Holds and Bodes well for Small-caps

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Regional Bank ETF pattern over the last few months is similar to that of the S&P SmallCap 600 SPDR and Russell 2000 ETF. This is not surprising because the financial services sector accounts for 17.8% of IJR and 16.34% of IWM, and is the second...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Within the Falling Channel; RRG Chart Show These Two Defensive Sectors Rolling Over to Improving Quadrant

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In a week that remained technically important, the markets pulled up from the lows that were marked in two previous weeks. The NIFTY saw a narrower trading range than the week prior. The index oscillated in a 446-point range over the past five sessions and remained largely trending on the...

READ MORE

MEMBERS ONLY

And The Most Accumulated Industry During Earnings Season Is.....

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

So let me set the stage. At EarningsBeats.com, we're tracking every earnings reaction for companies with $1 billion or more in market capitalization. Through yesterday's close (May 7th), we've now reviewed about 1600 earnings reactions. We've studied them by sector and...

READ MORE

MEMBERS ONLY

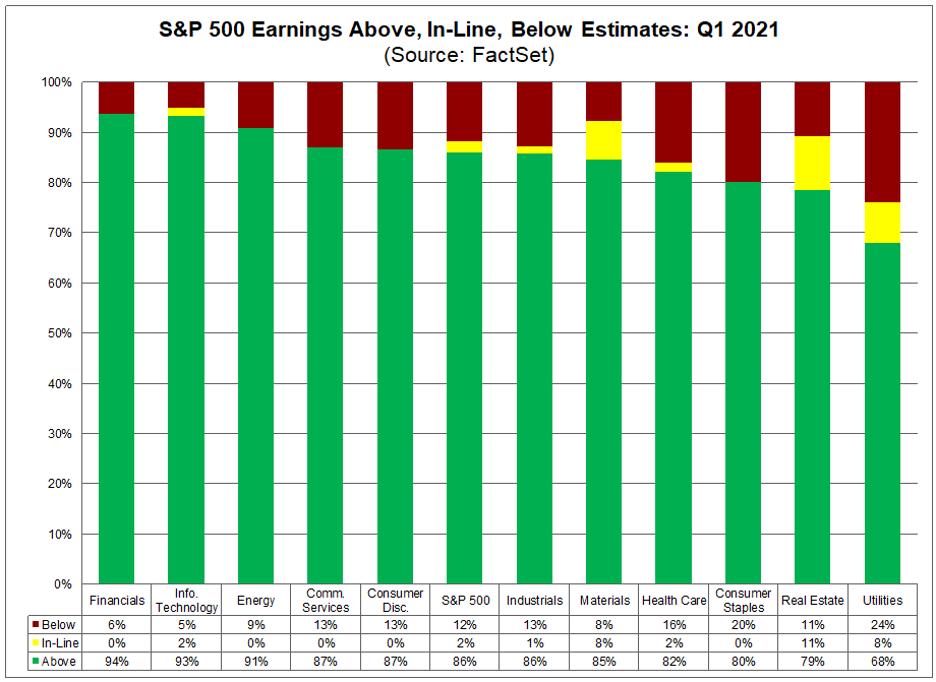

Base Breakouts Abound Amid Record First Quarter Earnings Season

by Mary Ellen McGonagle,

President, MEM Investment Research

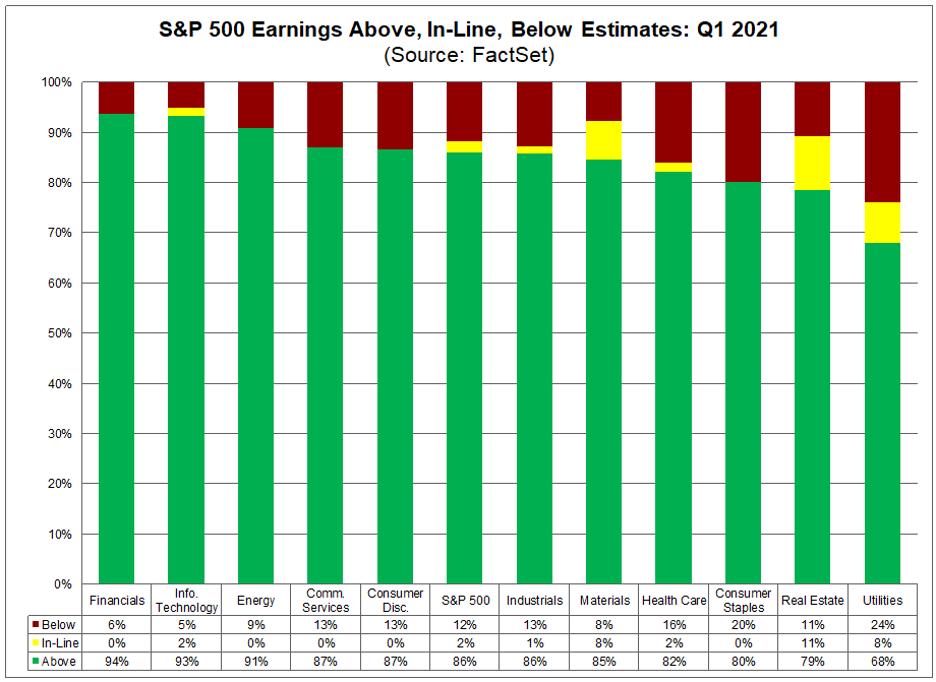

The S&P 500 is reporting the highest year-over-year earnings growth since the markets were emerging from the '08-'09 recession. In fact, over 85% of corporations are reporting first quarter results that are well above their estimates.

The chart below shows the percent of companies reporting...

READ MORE

MEMBERS ONLY

One Industry That's Failed Miserably During Earnings Season

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I could provide a solid list of earnings season failure nominees like semiconductors ($DJUSSC), software ($DJUSSW) and medical equipment ($DJUSAM). However, I'm going to give the award to gambling ($DJUSCA). Since the big banks kicked off earnings season on April 14th, we've seen 8 gambling stocks...

READ MORE

MEMBERS ONLY

Putting Forward a Candidate to Take Over Tech Leadership

by Martin Pring,

President, Pring Research

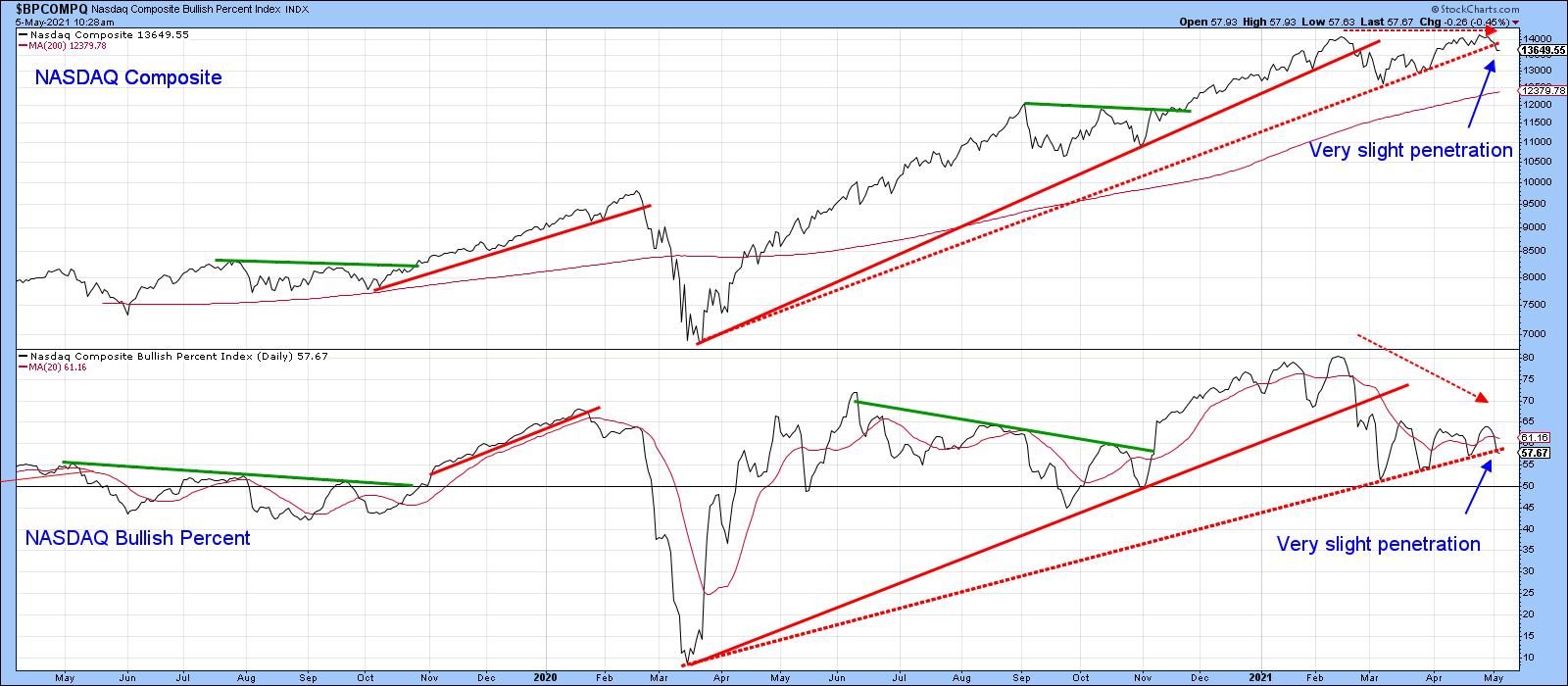

A couple of weeks ago, I posted an articlequestioning whether the tech-dominated NASDAQ still had the mojo to lead the market higher. At the time, many sub-surface indicators, such as breadth, volume and relative action, looked weak. Several charts indicated that many of them had experienced multiple negative divergences, but...

READ MORE

MEMBERS ONLY

New Leadership Areas into Year-End

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews top areas that are poised to outperform the markets into the remainder of this year. She also shares ways to uncover stocks in these new groups. The impact of earnings upgrades are also discussed, as well as...

READ MORE

MEMBERS ONLY

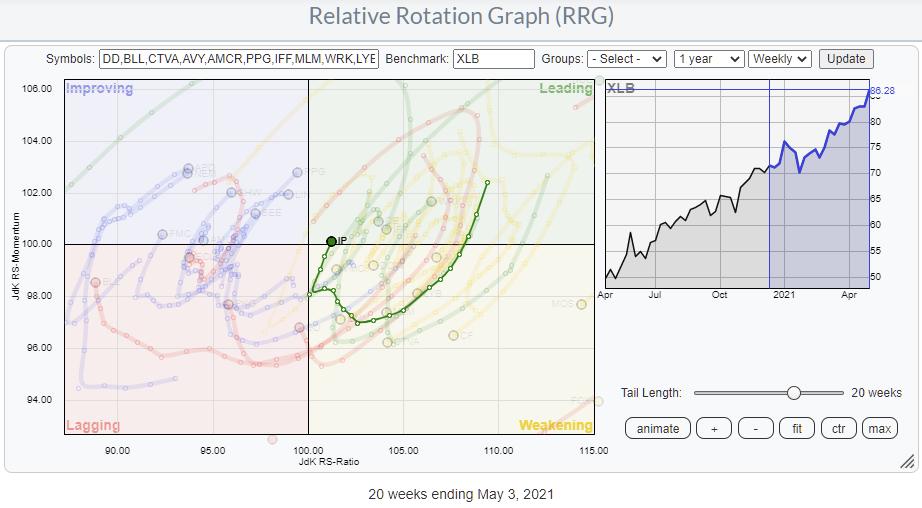

RRG Tails Have a Story to Tell

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

One of the main characteristics of a Relative Rotation Graph is the "tail," which shows us the sector's trajectory through recent history.

Tails illustrate how the security ended up in the position where it currently is, helping us to view current rotations and create a big...

READ MORE

MEMBERS ONLY

Weekly Market Recap Based on 5 Key Sectors and 1 Index

On Friday, non-farm payrolls were announced, with a disappointing 266,000 jobs created compared to the roughly 1 million that economists had predicted. However, the gap in expectations did not result in a market selloff. This could be showing that investors are giving more weight to the Fed's...

READ MORE

MEMBERS ONLY

ECONOMICALLY-SENSITIVE STOCKS HAVE BEEN OUTPERFORMING TECHNOLOGY -- STOCKS RALLY TODAY ON WEAK JOBS REPORT -- NASDAQ 100 BOUNCES OFF CHART SUPPORT -- BOND YIELDS RECOVER FROM MORNING DECLINE

by John Murphy,

Chief Technical Analyst, StockCharts.com

TECHNOLOGY HAS BEEN A MARKET LAGGARD... With the economy showing signs of strength, money has been rotating into more economically-sensitive sectors at the expense of technology stocks. The table in Chart 1 shows materials, energy, and financials being the three strongest sectors over the last month, while technology has been...

READ MORE

MEMBERS ONLY

Chartwise Women: Don't Get Married to Your Stock!

by Mary Ellen McGonagle,

President, MEM Investment Research

by Erin Swenlin,

Vice President, DecisionPoint.com

In this week's edition of Chartwise Women, Erin and Mary Ellen discuss stocks and their "personalities." Stock personalities come in the form of seasonality, sector, industry group, support and relative strength. Watch as Mary Ellen and Erin help you find dreamy "dates" for your...

READ MORE

MEMBERS ONLY

While Everything is Going Digital, This Stock is Breaking Higher

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

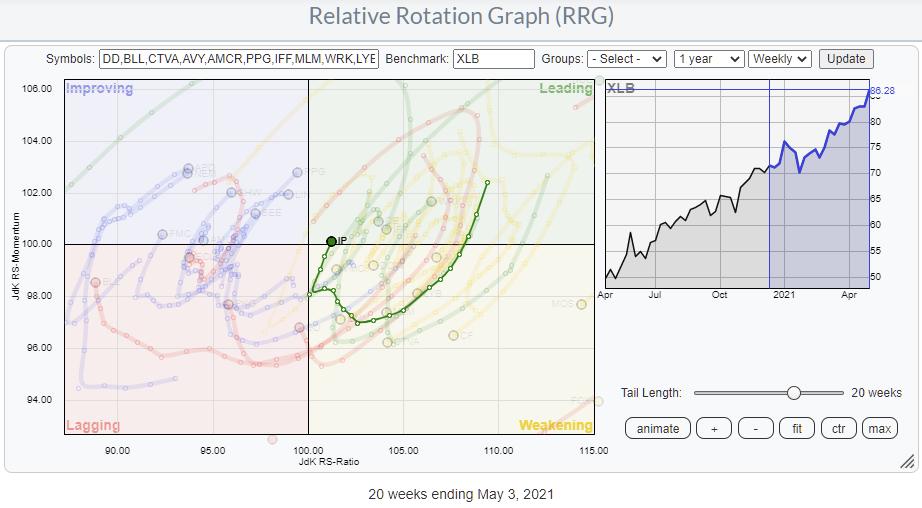

The Relative Rotation Graph for sectors shows XLB, the Materials sector, powering into the leading quadrant.

The RRG at the top of the article shows the rotations of the individual stocks in the Industrials sector, with the tail for IP highlighted. After entering the leading quadrant in October, IP traveled...

READ MORE

MEMBERS ONLY

Europe is Ready to Turn Around a Long Period of Underperformance

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

From time to time, I keep an eye on the Relative Rotation Graph showing the rotations of various world markets against the DJ Global Index. The tail on Europe ($E1DOW) has just crossed into the leading quadrant after a quick improving-lagging-improving rotation, setting it up for a powerful rotation into...

READ MORE

MEMBERS ONLY

Which Commodities are the Safest Play to Combat Inflation?

Recently, there has been a surge of articles pertaining to rising inflation, as the Federal Government plans to add more debt with upcoming spending from the infrastructure bill and another stimulus package. Inflation has also become an increasingly touchy topic.

On Wednesday, Janet Yellen (Treasury Secretary) backtracked her recent comments...

READ MORE

MEMBERS ONLY

How to Hunt and Trade Alt-Coins

by Dave Landry,

Founder, Sentive Trading, LLC

In this edition of Trading Simplified, Dave focuses on Profit Centers, what they are, and their dangers and pitfalls. He combines this lesson with one for hunting and trading hot Alt-Coins! Learn more about Landry Light Pullbacks, profit centers, and more in this new episode!

This video was originally broadcast...

READ MORE

MEMBERS ONLY

Power Charting TV: Inflation Nation

by Bruce Fraser,

Industry-leading "Wyckoffian"

Materials prices are screaming higher and higher and this is emphasizing to investors that inflation is surging. Eventually raw and intermediate materials price increases work their way into the Consumer Price Index (C.P.I.) trend. The Federal Reserve acknowledged as much last week, using the term ‘frothy' to...

READ MORE

MEMBERS ONLY

Putting Forward a Candidate to Take Over from Tech Leadership

by Martin Pring,

President, Pring Research

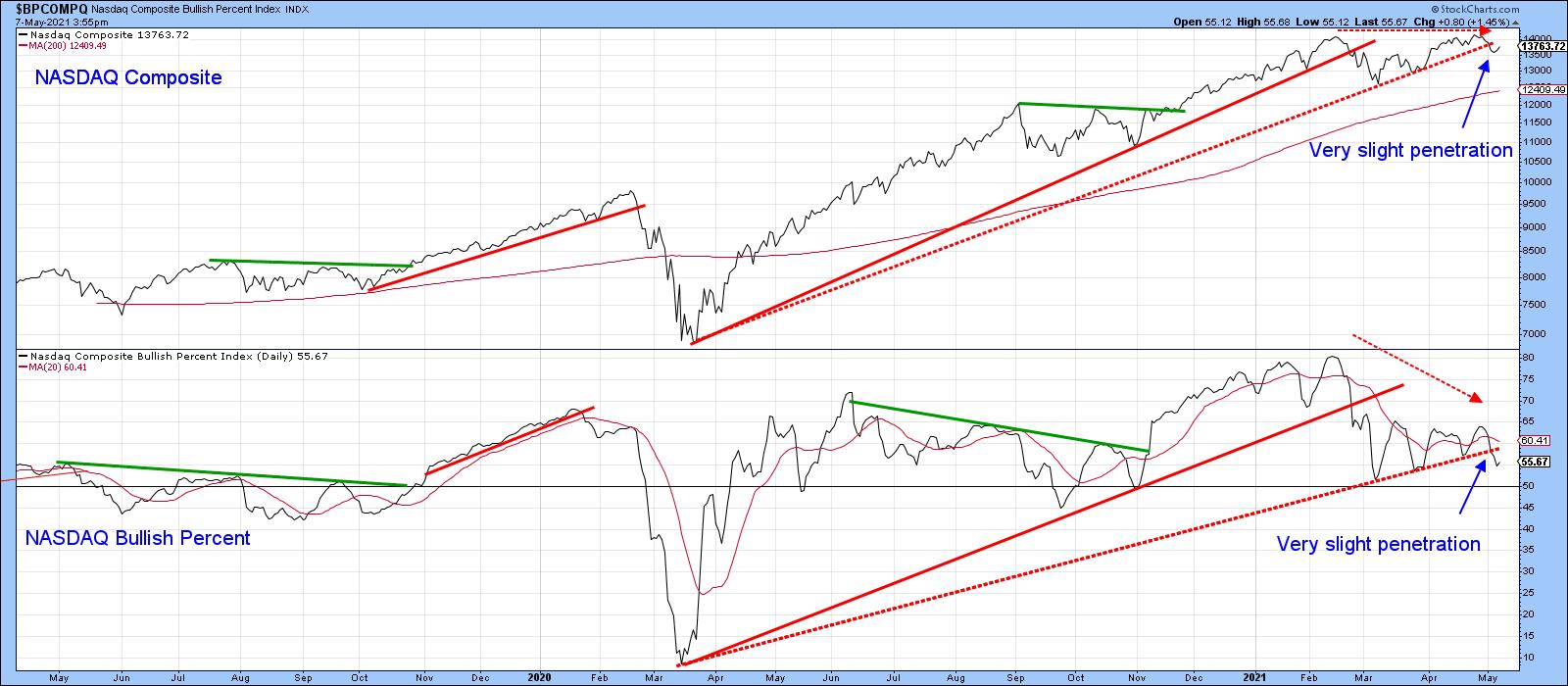

A couple of weeks ago, I posted an article questioning whether the tech-dominated NASDAQ still had the mojo to lead the market higher. At the time, many sub-surface indicators, such as breadth, volume and relative action, looked weak. Several charts indicated that many of them had experienced multiple negative divergences,...

READ MORE

MEMBERS ONLY

ARK Innovation ETF (ARKK) Reaches Important Support Level

by Erin Swenlin,

Vice President, DecisionPoint.com

This is an excerpt from today's subscriber-only DecisionPoint Alert report:

The family of ARK funds have received quite a bit of attention lately. In particular, the ARK Innovation ETF (ARKK) managed by phenom Cathie Wood, has been in the news for months. The fund is in what she...

READ MORE

MEMBERS ONLY

Can the Nasdaq 100 (QQQ) Hold its Main Support Area?

On Tuesday, Janet Yellen commented that "[i]t may be that interest rates will have to rise somewhat to make sure that our economy doesn't overheat." The market was already trending lower on the day after its recent teetering around new high territory. Clearly, Yellen did...

READ MORE

MEMBERS ONLY

Sector Spotlight: Short-Term Weakness Ahead

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this edition of StockCharts TV's Sector Spotlight, I start the month with an overview of rotations in asset classes and sectors last week using Relative Rotation Graphs. The main theme remains intact; the stock market is in a long-term uptrend and stocks continue to outperform bonds. However,...

READ MORE

MEMBERS ONLY

TECH STOCKS LEAD MARKET LOWER -- TECH SPDR TESTS ITS 50-DAY AVERAGE -- SEMICONDUCTORS LOSE 50-DAY SUPPORT

by John Murphy,

Chief Technical Analyst, StockCharts.com

NASDAQ BACKS OFF FROM PREVIOUS HIGH... Chart 1 shows the recent rally in the Nasdaq Composite meeting new selling near its mid-February peak which was the first warning that its uptrend might be losing upside momentum (red line). Today's lower gap confirms the idea that a short-term top...

READ MORE

MEMBERS ONLY

Retail and Transportation Attempt to Lead the Market Higher

On Monday, the transportation sector (IYT) closed the day +1.4%, along with the Retail sector (XRT) also performing well, up +2.11%. These two sectors are currently attempting to lead the market higher, but are having trouble getting other members of the Economic Modern Family to join in.

The...

READ MORE

MEMBERS ONLY

DP TV: New Market Sell Signals

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, Carl starts off by discussing outrageous market valuations and giving his thoughts on Gold and Gold Miners, as well as the Dollar, Treasury Yields, Crude Oil and the Bonds. Erin alerts viewers to new Price Momentum Oscillator (PMO) SELL signals on three major indexes. There...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Has a Challenging Phase To Navigate; RRG Points at Likely Relative Underperformance From These Sectors

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In a week where the trading range remained wider than usual, the Indian equities took a serious cut on the Friday's session; however, they managed to close the week on a positive note. In the previous weekly note, it was mentioned that the NIFTY was trading inside the...

READ MORE

MEMBERS ONLY

Is This A "Sell On News" Top? Five Warning Signs

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

It very well could be. In my Daily Market Report (DMR) to EarningsBeats.com members on Thursday, I discussed this very possibility. I do not believe we're at any MAJOR top, but our major indices have had a significant "pre-earnings" run higher since late March and...

READ MORE