MEMBERS ONLY

Where Does the Economic Modern Family Look Next?

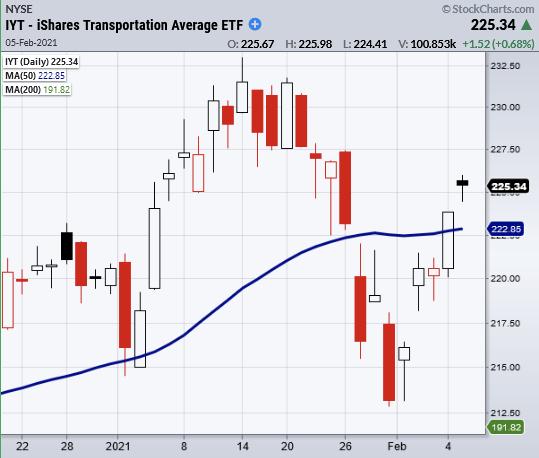

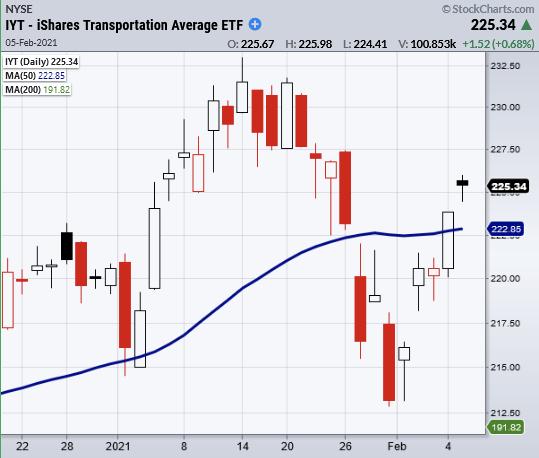

The Economic Modern Family members are all in a bullish phase, with transportation (IYT) leading the charge. A rundown of each member shows Russell 2000 (IWM) putting in some consolidation over Monday's low of 223.40.

Watching IWM instead of larger indices, like the S&P 500,...

READ MORE

MEMBERS ONLY

Get Big Gains with Gaps Up!

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen examines how to trade stocks that bullishly gap up and go on to greater heights. She also shares newer areas of the market that are just getting started, while also highlighting strong groups and stocks that will continue...

READ MORE

MEMBERS ONLY

You Profit By Respecting The Sacred Trinity Of The Stock Market

by Gatis Roze,

Author, "Tensile Trading"

If you can embrace this metaphor, consistent profits are achievable. Think of the stock market as a mythical beast that feeds on truths but its behavior is driven by rumors and beliefs. To tame this creature, your suit of armor must be woven with the finest cloth of emotional control....

READ MORE

MEMBERS ONLY

Earnings are Driving the Market, But There are Two Road Blocks Ahead

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The quarterly earnings that have poured out are utterly amazing. We're not just talking slight beats; Corporate America is CRUSHING it and the pent up demand hasn't even kicked in yet. In the meantime, the Fed is content to sit idly by with interest rates hovering...

READ MORE

MEMBERS ONLY

BOND YIELDS CONTINUE TO CLIMB -- THAT'S HELPING BANK STOCKS

by John Murphy,

Chief Technical Analyst, StockCharts.com

TEN-YEAR YIELD EXTENDS UPTREND... The uptrend in bond yields is continuing. The daily bars in Chart 1 show the 10-Year Treasury yield touching a new recovery high in today's trading. That puts the TNX at the highest level since last March. The horizontal line in Chart 2 shows...

READ MORE

MEMBERS ONLY

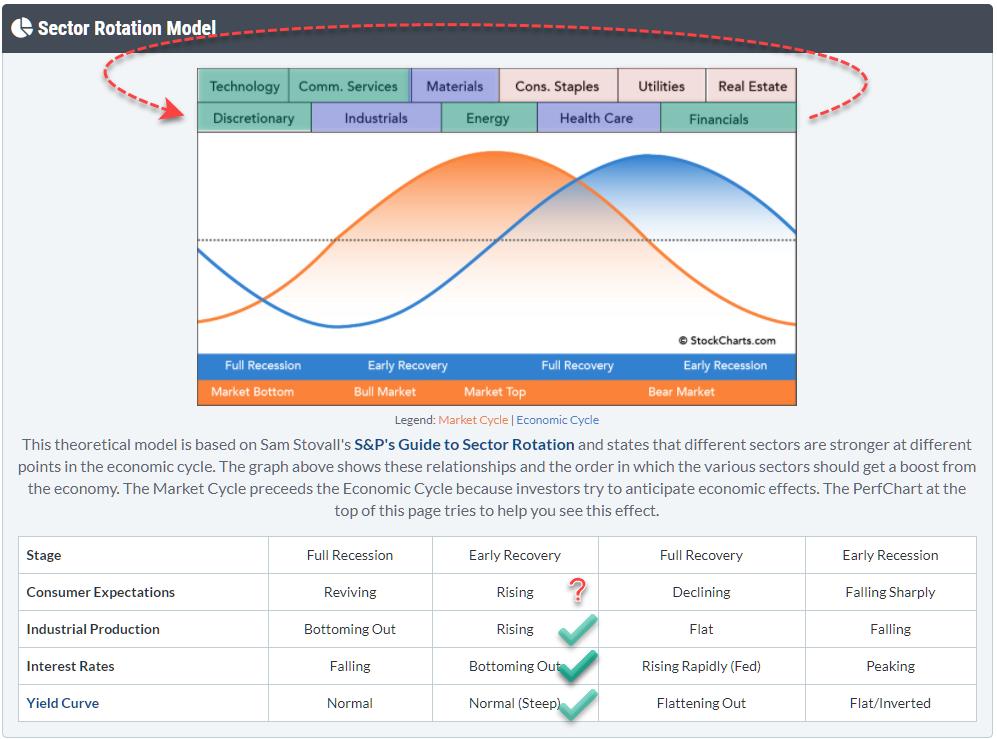

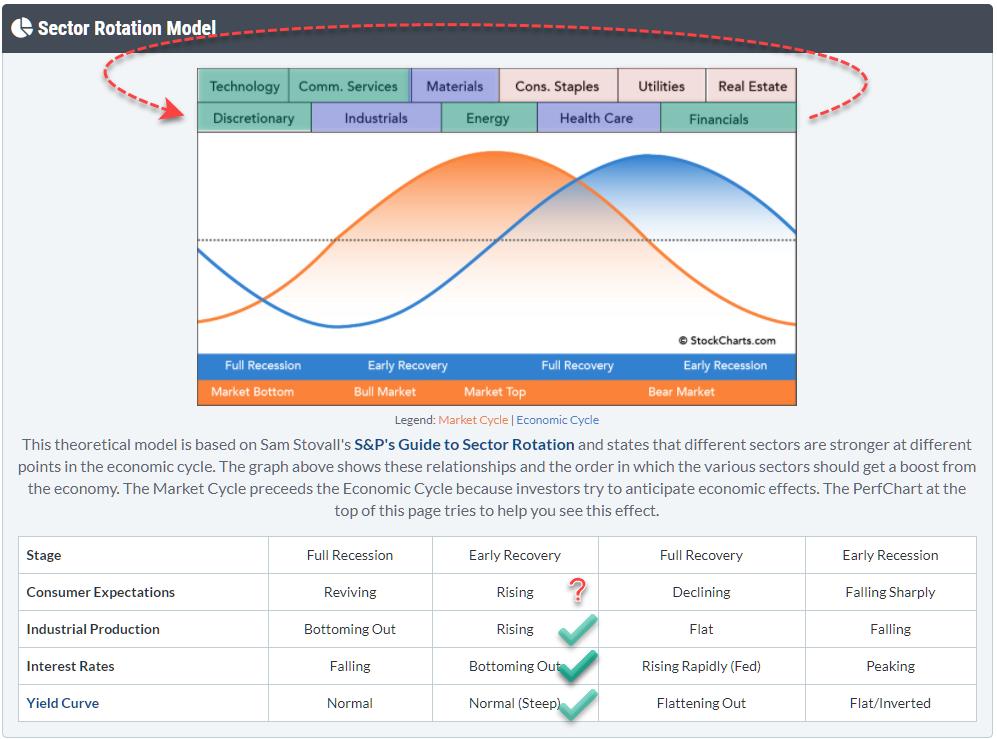

Sector Rotation Model Suggests Bull Market in Stocks Ongoing

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

From time to time, I like to check the macro environment and try to see if I can find meaningful clues to draw conclusions from generally accepted theories/models. The Sector Rotation Model (From Sam Stovall's guide to sector rotation) is one of those models that I like...

READ MORE

MEMBERS ONLY

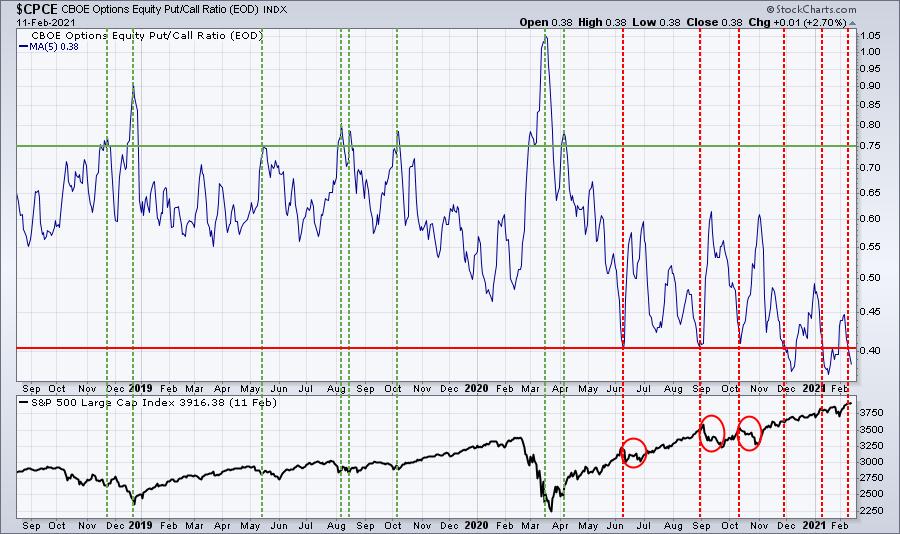

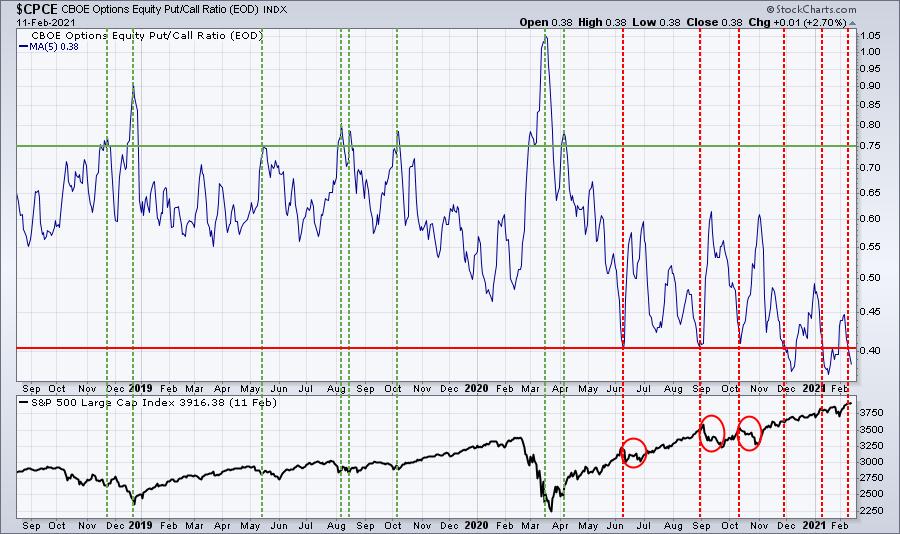

Chartwise Women: Is the Market Hot or Cold?

by Mary Ellen McGonagle,

President, MEM Investment Research

by Erin Swenlin,

Vice President, DecisionPoint.com

In this week's edition of Chartwise Women, Erin and Mary Ellen share their analysis techniques on how they determine whether the market or sector or industry group is "hot" or "cold." Erin discusses how she measures "participation" in a market move to...

READ MORE

MEMBERS ONLY

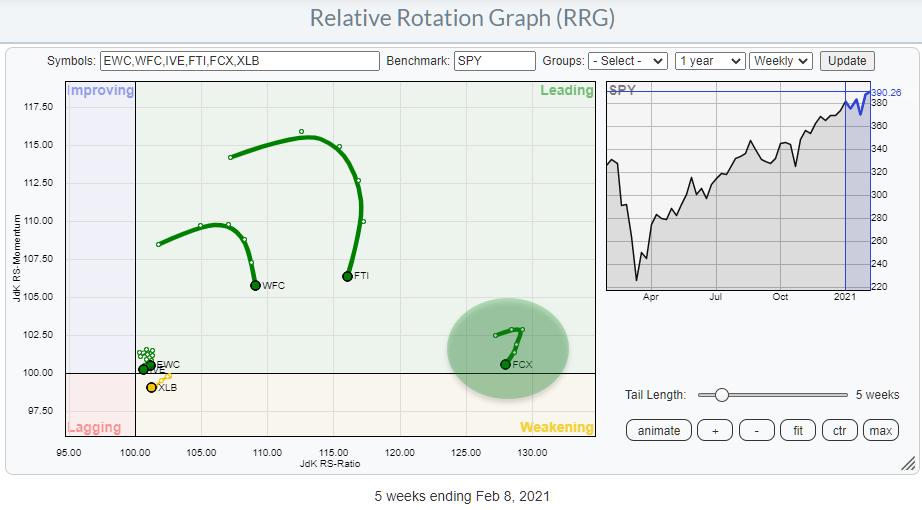

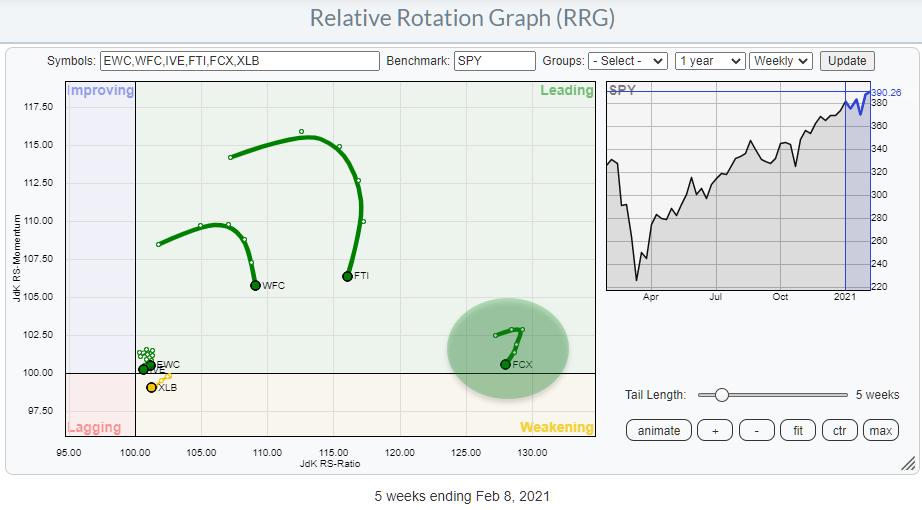

These Two Relationships Point to Ongoing Strength for Stocks

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The RRG above shows the rotations for two relationships that can help you get a handle for the market as a whole:

* Growth vs Value: Generally, when growth stocks are doing well and outperforming value, that is good for the market - whereas, vice versa, when value stocks are outperforming...

READ MORE

MEMBERS ONLY

Plan Your Trade and Trade Your Plan

With crazy market volatility and wide price swings, having a trading plan couldn't be more important for a day like Wednesday.

At around 10:20 ET, the market began to sell off rapidly, turning into a large drop. Though the market rebounded, such large price swings could have...

READ MORE

MEMBERS ONLY

COMMODITY PRICES CONTINUE TO RISE WHICH SUGGESTS MORE INFLATION -- RISING COMMODITIES ARE BOOSTING BOND YIELDS AND THE YIELD CURVE

by John Murphy,

Chief Technical Analyst, StockCharts.com

CRB INDEX BREAKS TRENDLINE RESISTANCE... The current rally in commodity markets is attracting a lot of attention. Not just because commodities represent an asset class that's been attracting a lot of money over the last year. But also because of their intermarket implications. Stronger commodity markets are usually...

READ MORE

MEMBERS ONLY

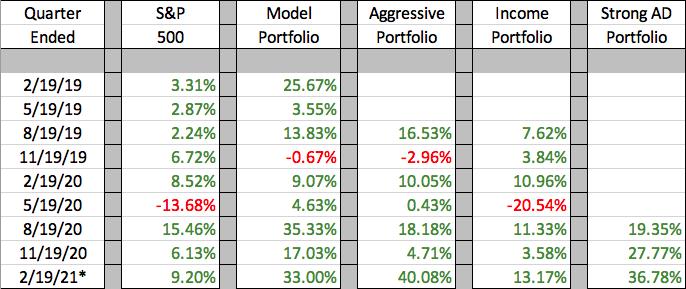

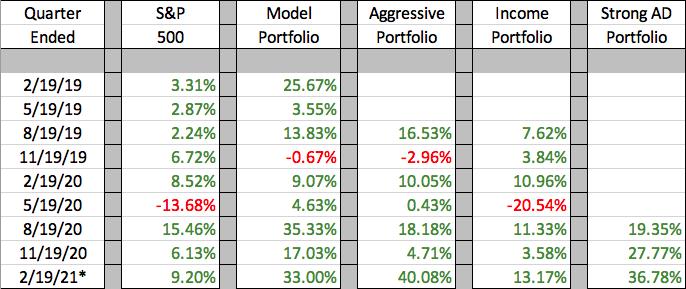

Here Are All Of Our Portfolio Stocks And ETFs Powering Our Performance

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

It's hard to believe, but our 9th quarter of Model Portfolio performance is nearing an end. Barring a last minute collapse, we will outperform the S&P 500 for the 8th time in those 9 quarters. I'm proud of the performance of all of our...

READ MORE

MEMBERS ONLY

Sector Spotlight: Three Sectors That Will Drive SPY Higher

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of StockCharts TV's Sector Spotlight, I walk you through the current rotations in asset classes and US sectors using Relative Rotation Graphs. On the weekly RRG for sectors, I note three that are rotating back into the leading quadrant. And when these sectors are outperforming,...

READ MORE

MEMBERS ONLY

Does the Real Estate Sector Have Hidden Growth Potential?

The Real Estate sector (IYR) has cleared an important price level at $88.76 or the high of 11/9/2020. The real estate recovery has been slow compared to the rest of the market, which is more like a roller coaster ride at this point. However, IYR has put...

READ MORE

MEMBERS ONLY

Rebalancing a Portfolio is Important

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Good money management can help you a great deal in managing portfolios. Rebalancing is a very important part of that discipline. In this article, I am reviewing the current RRG Long/Short basket, replacing XLB and FTI with EBAY and MSFT while at the same time bringing all positions back...

READ MORE

MEMBERS ONLY

Are You Ready For Another Short Squeeze Play?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I know the Gamestop (GME) craze has slowed down considerably, but short squeezes will always be in play. When a stock's float has been heavily borrowed against and borrowed shares sold, those short sellers must buy those borrowed shares back at some point down the road. And when...

READ MORE

MEMBERS ONLY

DP TV: Power ETFs Pack a Punch

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, Carl and Erin cover a wide range of subjects today, from current market conditions and the VIX to Bitcoin and Tesla (TSLA) to Natural Gas (UNG) and a Sector review. Carl discusses a group of funds that have weathered most storms and are poised to...

READ MORE

MEMBERS ONLY

Oil on the Move - Good Thing or Slippery Slope?

Oil (USO) has blasted off with the rest of the market in the last 5 trading days. And that is after it cleared the key 50-week moving average 4 weeks ago. This bodes well for the market and economy for now, as oil signifies a economic recovery is on the...

READ MORE

MEMBERS ONLY

Using Short-Term Momentum to Define the Primary Trend Direction of Stocks, Bonds and the Dollar

by Martin Pring,

President, Pring Research

They say that a rising tide lifts all boats, and so it is with freely traded markets. In the boating world, you can spot a rising tide with a steadily rising boat, but, with markets, the simplest approach is to observe a series of rising peaks and troughs. However, there...

READ MORE

MEMBERS ONLY

ENERGY SPDR NEARS TEST OF JUNE HIGH -- A NUMBER OF INDIVIDUAL STOCKS ARE ALSO TESTING THAT CHART BARRIER -- CRUDE OIL PRICES CONTINUE TO CLIMB

by John Murphy,

Chief Technical Analyst, StockCharts.com

ENERGY SPDR NEARS TEST OF JUNE HIGH...Energy stocks continue to show both absolute and relative strength. They're leading the market higher today, and have been the market's strongest sector over the last three months. And they're approaching an important test. The daily bars...

READ MORE

MEMBERS ONLY

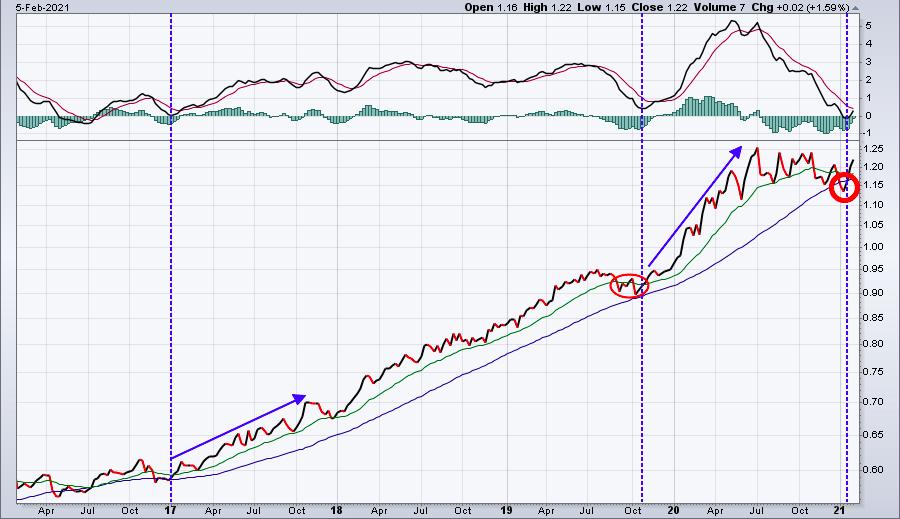

Earnings Season Is Lighting A Fire Under This Industry Group

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

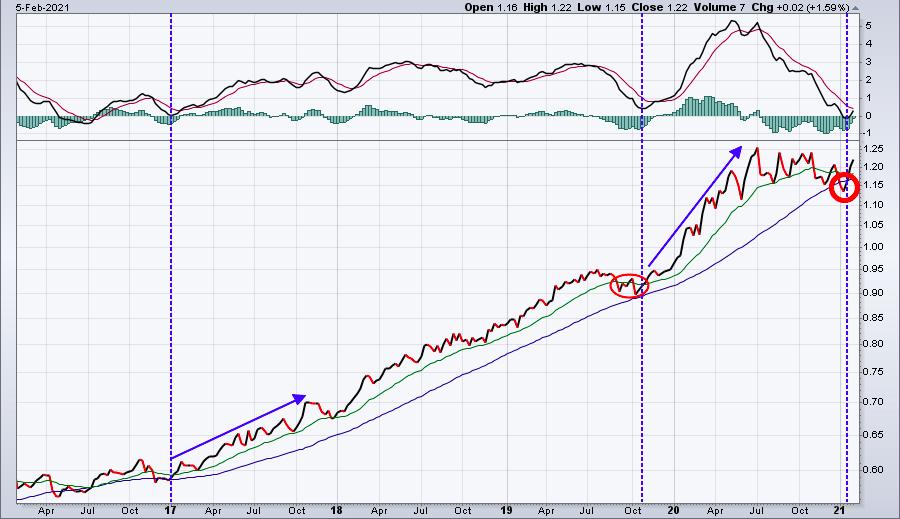

I want you to look at a 5-year relative chart without titles and, before you look below the chart, see if you can name the industry group that's been responsible for this amazing long-term relative strength:

The relative price action (vs. the S&P 500) has remained...

READ MORE

MEMBERS ONLY

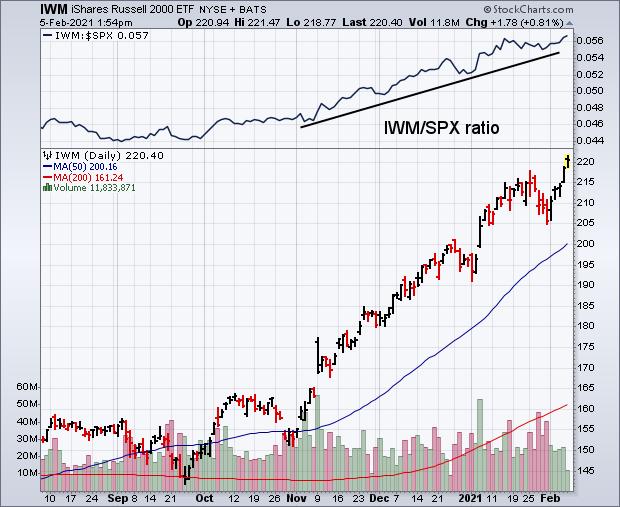

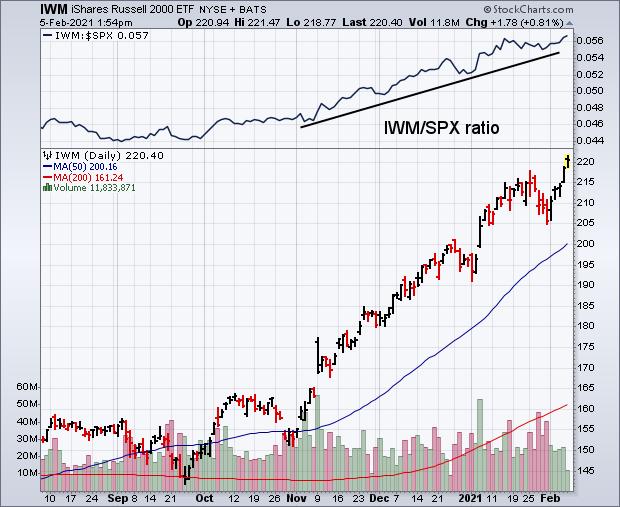

Russell 2000 Hits New Record as Small Cap Leadership Continues

by John Murphy,

Chief Technical Analyst, StockCharts.com

Stocks are ending the week on a firm note with the S&P 500 and Nasdaq trading in record territory. The Dow isn't far behind. Small cap stocks, however, continue to lead the market higher. The daily bars in Chart 1 show the Russell 2000 iShares (IWM)...

READ MORE

MEMBERS ONLY

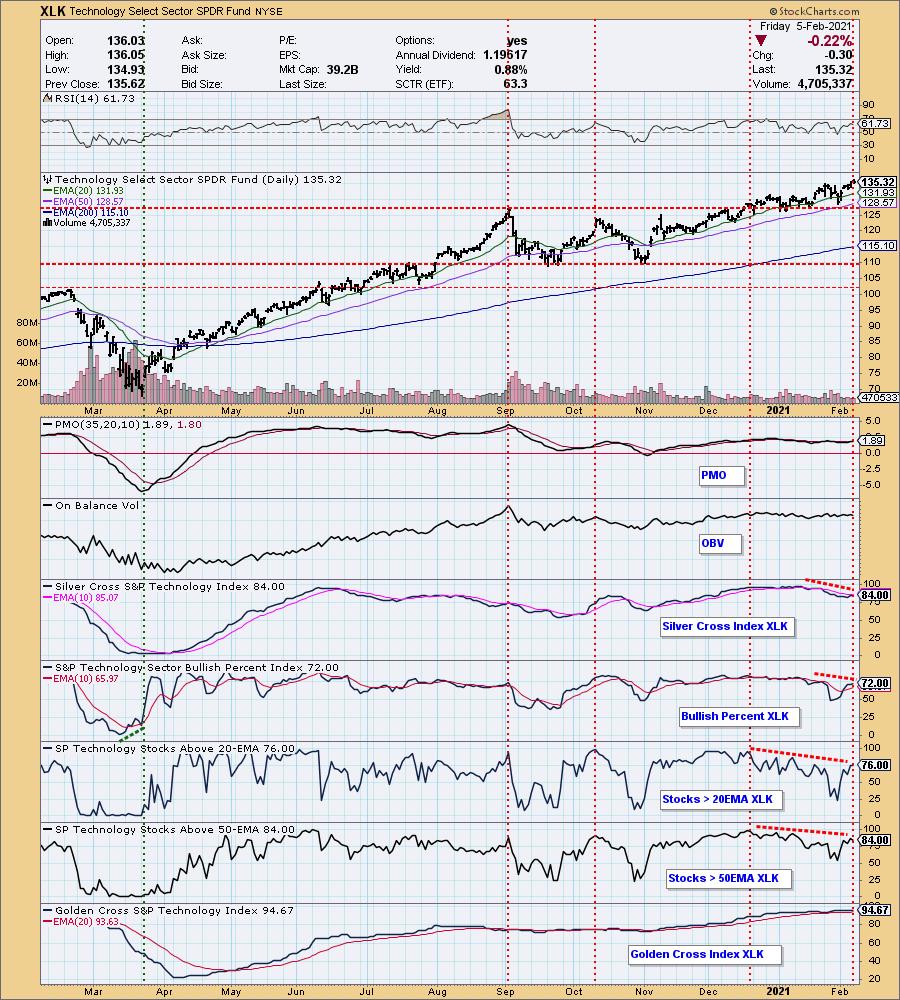

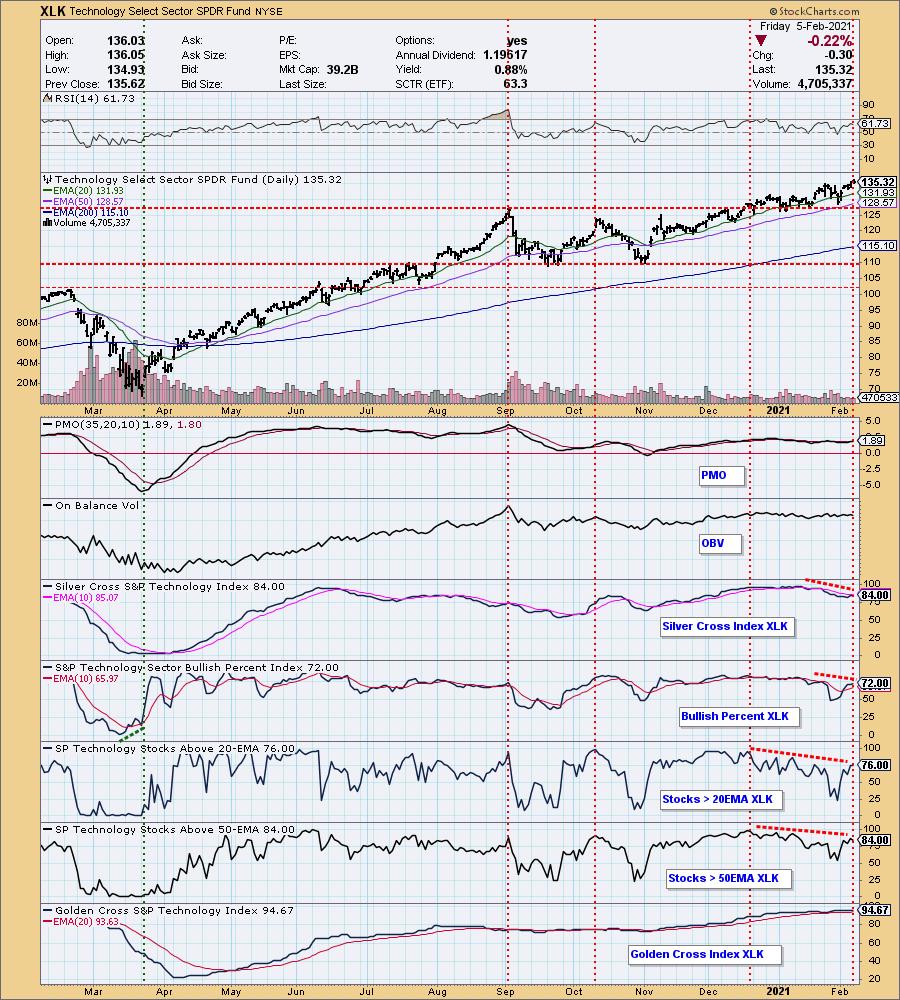

A Tale of Two Sectors: Technology and Materials

by Erin Swenlin,

Vice President, DecisionPoint.com

Today, I will weave a technical analysis tale of two sectors--one of the popular star that is beginning to lose its shine, the other about a possible Cinderella story sector.

The popular star and doted-upon sector is Technology (XLK). It gets most of the love because, let's face...

READ MORE

MEMBERS ONLY

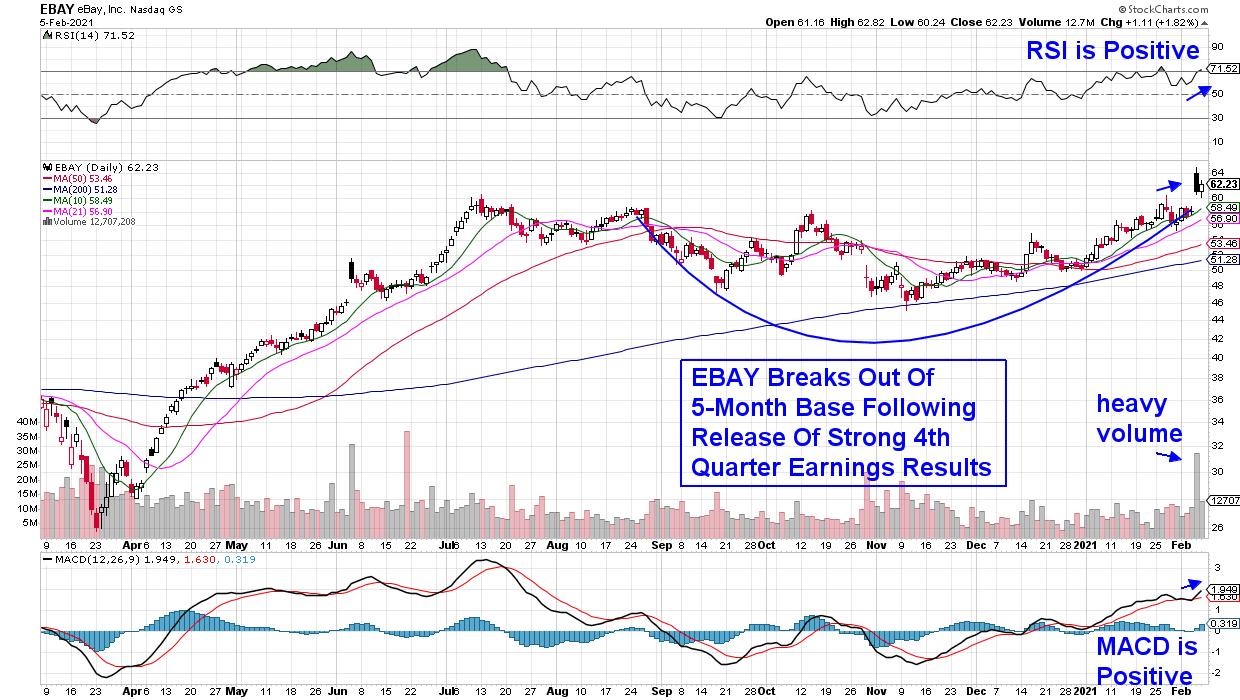

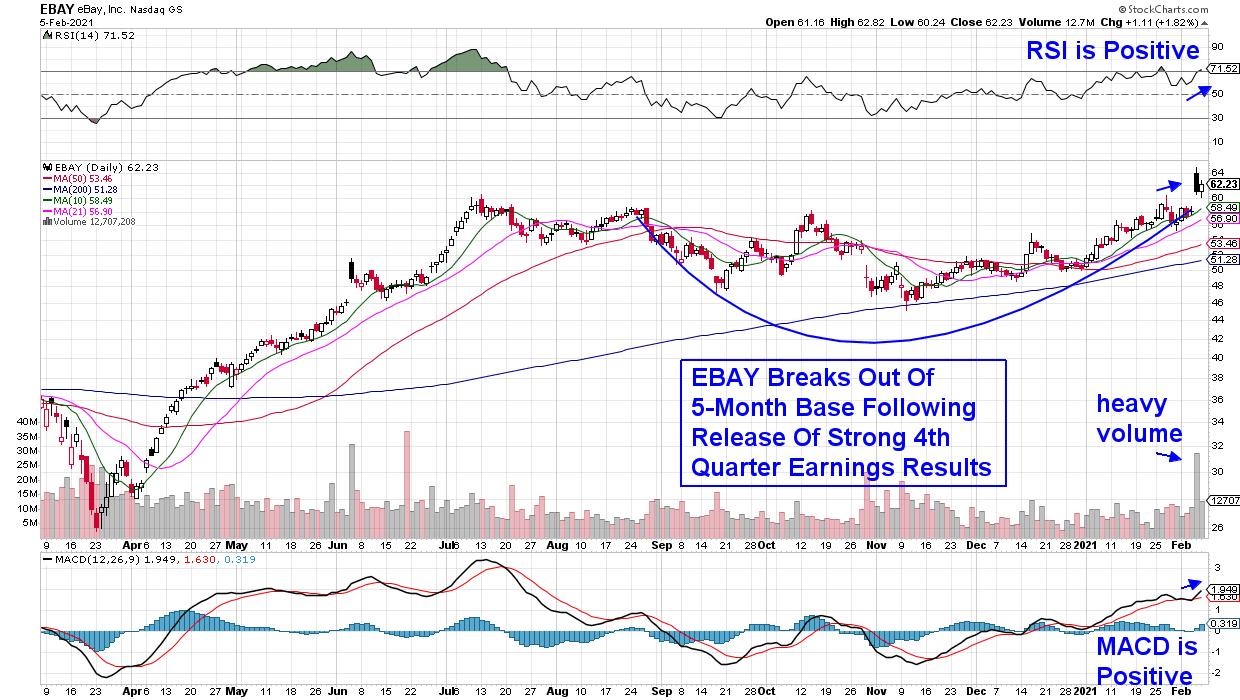

This Stock Is Exhibiting Winning Characteristics!

by Mary Ellen McGonagle,

President, MEM Investment Research

With earnings season in full swing, this is the best time to be on the lookout for the next set of winning stocks.

A lengthy study conducted by Bill O'Neil uncovered the fact that strong earnings are the number one driver of stocks that go on to experience...

READ MORE

MEMBERS ONLY

GME, GME and... GME

by John Hopkins,

President and Co-founder, EarningsBeats.com

While the overall market was working its way to new highs, the entire investing world (and many who had never been involved in the market before) was tuning in daily to see what the price of Gamestop (GME) was. A stock that was trading at just over $19 a share...

READ MORE

MEMBERS ONLY

Catch These Base Breakouts!

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen shares what areas of the market are poised to continue higher, as well as individual stocks. She also reviews sector rotation, plus the best practices after your stock gaps up in price.

This video was originally recorded on...

READ MORE

MEMBERS ONLY

Transportation Sector Must Hold its Bullish Phase

The transportation sector (IYT) has entered back into a bullish phase. (A bullish phase is when the price is over the 50-day moving average, and the 50-DMA is over the 200-DMA.) IYT is now back in line with the rest of its Economic Family members who, as a whole, give...

READ MORE

MEMBERS ONLY

RUSSELL 2000 HITS NEW RECORD AS SMALL CAP LEADERSHIP CONTINUES -- SMALL CAP LEADERSHIP IS THE STRONGEST IN DECADE -- RISING BOND YIELDS HELP SMALL CAPS

by John Murphy,

Chief Technical Analyst, StockCharts.com

RUSSELL 2000 ISHARES HIT NEW RECORD... Stocks are ending the week on a firm note with the S&P 500 and Nasdaq trading in record territory. The Dow isn't far behind. Small cap stocks, however, continue to lead the market higher. The daily bars in Chart 1...

READ MORE

MEMBERS ONLY

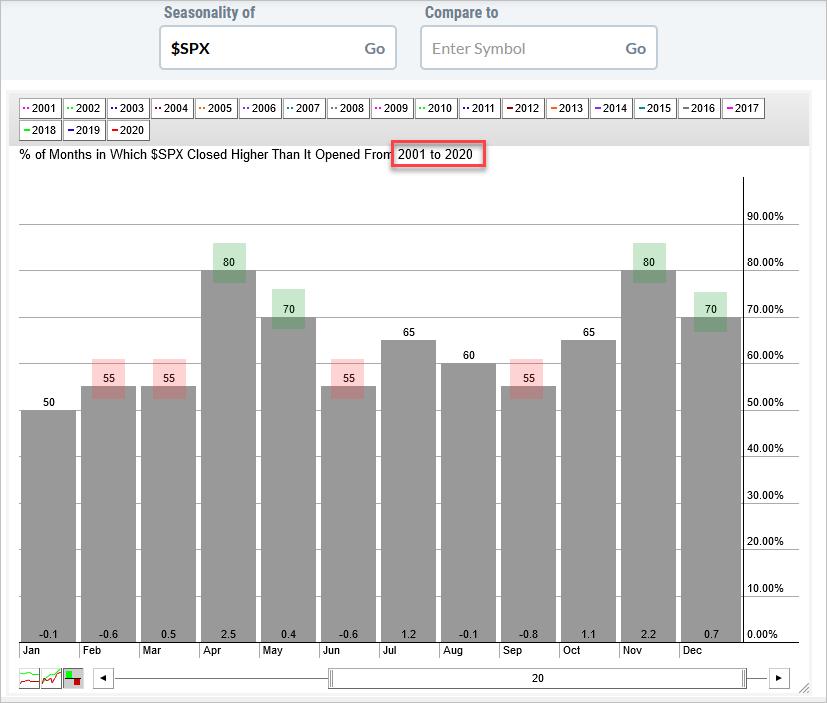

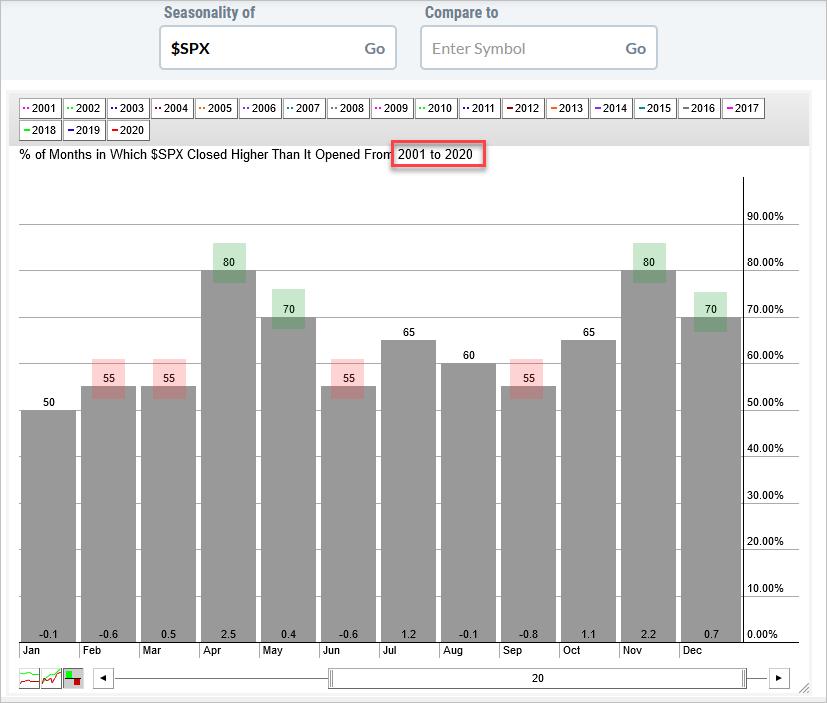

Seasonality Looks Weak, but Price Action is Strong

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The seasonal patterns over the next two months are not very strong, but price action is strong with the S&P 500 hitting a new high. Price action is more important than the seasonal pattern because profits and losses are driven by price changes, not seasonal tendencies. Seasonality becomes...

READ MORE

MEMBERS ONLY

Chartwise Women: Bolster Your Profits with ETFs!

by Mary Ellen McGonagle,

President, MEM Investment Research

by Erin Swenlin,

Vice President, DecisionPoint.com

Robotics, Cannabis, Clean Air - These are all themes that are taking the markets by storm. In this week's edition of Chartwise Women, Mary Ellen and Erin share ways you can participate in the uptrends without the volatility. Plus, they also reveal their favorite ETFs right now.

This...

READ MORE

MEMBERS ONLY

EBAY Popping to New High and Unlocking More Upside Potential

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

One of my routines to gauge the current market action is to start at the StockCharts.com Dashboard and take a look at the Market Movers - Most Active for the S&P 500. The link at the bottom left of that widget allows me to open up the...

READ MORE

MEMBERS ONLY

The Most Efficient Way To Track Earnings Reports Every Day

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Recently, we introduced a newer, very organized way of viewing earnings results at EarningsBeats.com. We call it our Upcoming Earnings ChartList, which our entire community can download into their own StockCharts.com account, assuming that you are either an Extra or Pro members. Others can still view the ChartLists,...

READ MORE

MEMBERS ONLY

Does Big Tech Have Limited Upside?

With positive earnings out for big tech companies, should investors' appetites grow for companies like Google (GOOGL), Microsoft (MSFT) and Amazon (AMZN)? Or should they look for more potential elsewhere?

This can be a very loaded question, as many people have favored these companies for a long time.

As...

READ MORE

MEMBERS ONLY

TAKING ANOTHER LOOK AT BITCOIN

by John Murphy,

Chief Technical Analyst, StockCharts.com

BITCOIN BOUNCES OFF ITS 50-DAY AVERAGE... A couple of recent messages took a look at Bitcoin as it underwent a downside correction. We'll take another look today. The main message is that it's starting to look stronger. Chart 1 shows Bitcoin in what looks like a...

READ MORE

MEMBERS ONLY

Sector Spotlight: Stealth Rotation for Healthcare

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of StockCharts TV's Sector Spotlight, I attack the monthly charts to monitor the long-term trends that are in play. With this knowledge, I then build this into a "view" using the investment pyramid that covers the market from asset classes all the way...

READ MORE

MEMBERS ONLY

What is Your Risk/Reward Plan?

"How much are you risking?" This is a key question to ask when making a trade and might even be the most important one to ask, as lately, the market's high volatility has created huge price swings.

Take the Retail Sector, (XRT) for example. In just...

READ MORE

MEMBERS ONLY

US Stocks are Lagging the World, and a Clear Preference for Short-Dated Bonds

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In today's episode of Sector Spotlight, I cover, or at least try to, the complete investment landscape from asset allocation, all the way down to stocks at sector level.

With the monthly bars for January just completed, I stuck to my guns, looking at the long-term trends on...

READ MORE

MEMBERS ONLY

Natural Gas (UNG) Coming to Life

by Carl Swenlin,

President and Founder, DecisionPoint.com

I have been watching the Natural Gas ETF (UNG) as a potential trading vehicle for about a year. My attention is focused on the long side, but opportunities of that nature have been limited. There was a rally of +65% last summer, but that reversed in August, going into a...

READ MORE

MEMBERS ONLY

Key Interasset Relationships are Bullish for Stocks and Commodities but Bearish for Bonds

by Martin Pring,

President, Pring Research

The business cycle approximates 41-months between the low points of slowdowns or recessions. For the record, a slowdown develops when the growth path of the economy declines, but not sufficiently to result in an actual recession, when economic momentum goes negative. The important point to bear in mind is that...

READ MORE

MEMBERS ONLY

GAMESTOP AND AMC GAP LOWER -- SO DOES SILVER AND ITS MINERS -- DOW REGAINS 50-DAY LINE

by John Murphy,

Chief Technical Analyst, StockCharts.com

GAMESTOP AND AMC GAP SHARPLY LOWER... The recent short-squeeze mania may have finally run its course. Charts 1 and 2 show GameStop And AMC gapping sharply lower today. Other stocks caught up in the short squeeze are trading sharply lower as well. To the extent that last week's...

READ MORE

MEMBERS ONLY

Short Stoppers: From GameStop to Silver

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, Carl begins with the topic of the GameStop (GME) short kill, coining the phrase "Short Stoppers" - and news suggests that the Short Stoppers are moving their interest to Silver. Carl looks at the Silver chart and discusses the implications. Erin takes a...

READ MORE