MEMBERS ONLY

Breaking the Dow(n)... in Theory

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The most widely followed Dow Jones index is the Dow Jones Industrials Average. But, in reality, this is only one of three averages that make up the Dow Jones Composite average.

The other two are the Dow Jones Transportation and the Dow Jones Utility averages.

The RRG above shows the...

READ MORE

MEMBERS ONLY

BIG TECH STOCKS ARE MAKING A COMEBACK -- QQQ IS SHOWING NEW LEADERSHIP

by John Murphy,

Chief Technical Analyst, StockCharts.com

BIT TECHS ARE DOING BETTER... The largest technology stocks have been trading sideways over the past few months while the rest of the market has been rallying. The last two days, however, are showing money starting to flow back into some of the biggest tech stocks. Chart 1 shows Apple...

READ MORE

MEMBERS ONLY

The Next Mega-Trend and What to Watch For in 2021

Wednesday's inauguration marks an interesting time for the economy.

The new administration has shown that clean energy tech is on the table as a way to push for new jobs in the industry, along with focusing on climate change policy going into the new year. The Nasdaq 100...

READ MORE

MEMBERS ONLY

Momentum Divergences in Key Market Indicators

The transportation sector (IYT) closed .36% lower Tuesday. It was the only member of the Economic Modern Family to end the day red.

On the other hand, the retail sector (XRT) ended almost a half percent higher.

Because of how retail and transportation are interconnected via supply and demand, watching...

READ MORE

MEMBERS ONLY

Sector Spotlight: Core Satellite Approach with RRG

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of StockCharts TV's Sector Spotlight, I highlight the rotations of last week and zoom in on a few sectors to put things in a slightly longer perspective. After the break, I answer two questions from the mailbag, explaining how you can find the symbols covering...

READ MORE

MEMBERS ONLY

RRG Basket Update: Swapping SEE & INTC for EWC & COST

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In today's episode of Sector Spotlight, I promised, time permitting, to have at least one change in the RRG L/S basket that I am maintaining in the show and my blogs. Obviously, time did not permit me to cover it during the show, so I am writing...

READ MORE

MEMBERS ONLY

Only a Fool Tries to Call a Correction in a Bull Market, So Here Goes!

by Martin Pring,

President, Pring Research

Last week, I recorded a 40-minute presentation with my friend Bruce Fraser on the 2021 outlook. It's currently being featured on StockCharts TVand calls for a significant extension to the bull market. We present a number of long-term charts featuring several indicators whose bullish signals have consistently been...

READ MORE

MEMBERS ONLY

Further Downside for Gold?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Back in early December, we discussed the three signals we would need to see to turn bullish on gold and gold stocks. Although the picture for gold turned more positive that month, a failure at resistance and a return below the 200-day moving average suggest further weakness may be in...

READ MORE

MEMBERS ONLY

Short-Term Manipulation Hammers Enphase Energy (ENPH) On Friday

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Follow my logic:

You expect ENPH to go higher, so you buy 10 calls at XX strike price on ENPH. The market maker that sells you those 10 contracts employs a covered call strategy and buys 1000 shares of ENPH. (This protects the market maker as ENPH's stock...

READ MORE

MEMBERS ONLY

Post-Vaccine Trading Reveals New Leadership And Further Confirms Bull Market

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

We all knew it was coming - or at least we should have. Industries that struggled throughout the pandemic and restrictions would come back to life once positive vaccine news hit and we could see the light at the end of the tunnel. But let me caution you first. They...

READ MORE

MEMBERS ONLY

A Top or a Mere Correction?

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Visual chart analysis is prone to subjectivity and biases. While we cannot completely remove subjectivity, we can approach chart analysis in a systematic fashion and increase objectivity. This commentary will show an example using the Home Construction ETF (ITB) because the ETF has traded flat since mid October. Is this...

READ MORE

MEMBERS ONLY

This Is How Market Makers Steal From Us

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

You might think the stock market is really unpredictable and, for the most part, I'd agree with you. But when we get to options expiration week, there is a consistent theme that emerges nearly every month. The market makers are looking to steal you blind. Once per month,...

READ MORE

MEMBERS ONLY

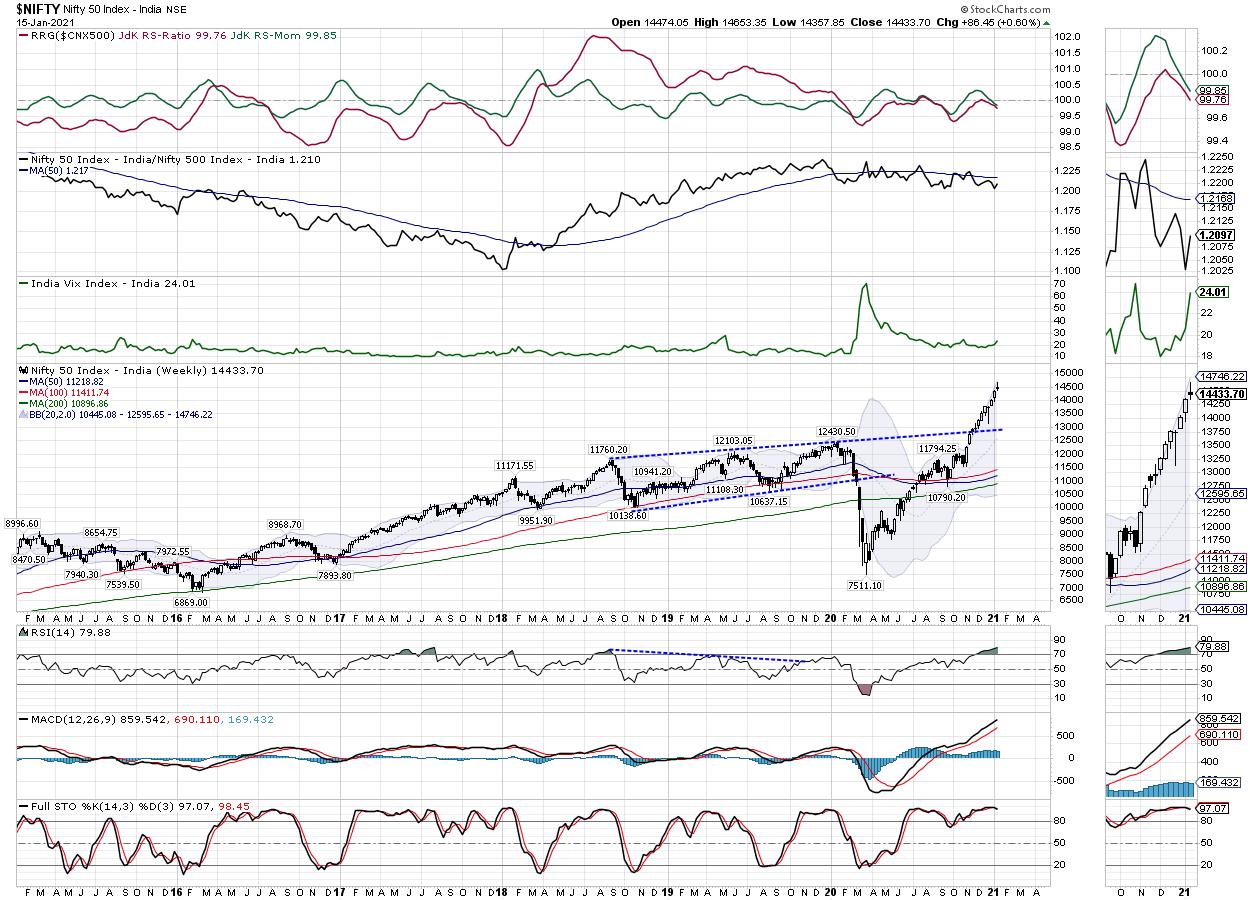

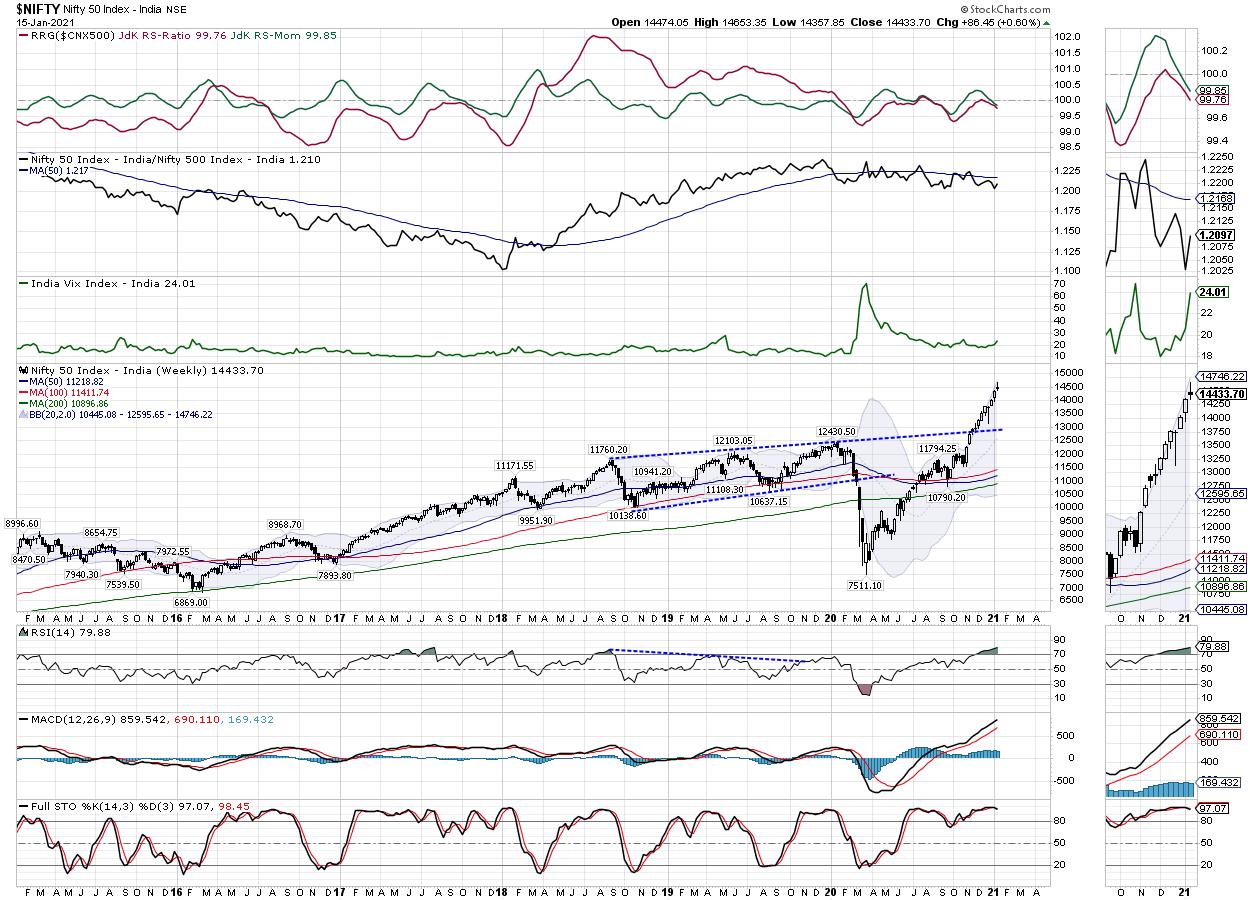

Week Ahead: NIFTY Eyes Some More Consolidation; RRG Chart Suggests This Group Likely Ending Relative Underperformance

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Although the Indian equity markets extended their weekly gains, they showed the first signs of impending broad consolidation, spending much of the last three days correcting from the higher levels. The start to the week was buoyant; however, after marking the week's high at 14653, the NIFTY continued...

READ MORE

MEMBERS ONLY

Ways To Uncover Stocks Poised For Explosive Moves!

by Mary Ellen McGonagle,

President, MEM Investment Research

It was another winning week for most of the stocks from my bi-weekly MEM Edge Report. In fact, over 74% of the Suggested Holdings from this report outperformed the broader markets, some doing so by a very wide margin.

Today, I'm going to share with you some of...

READ MORE

MEMBERS ONLY

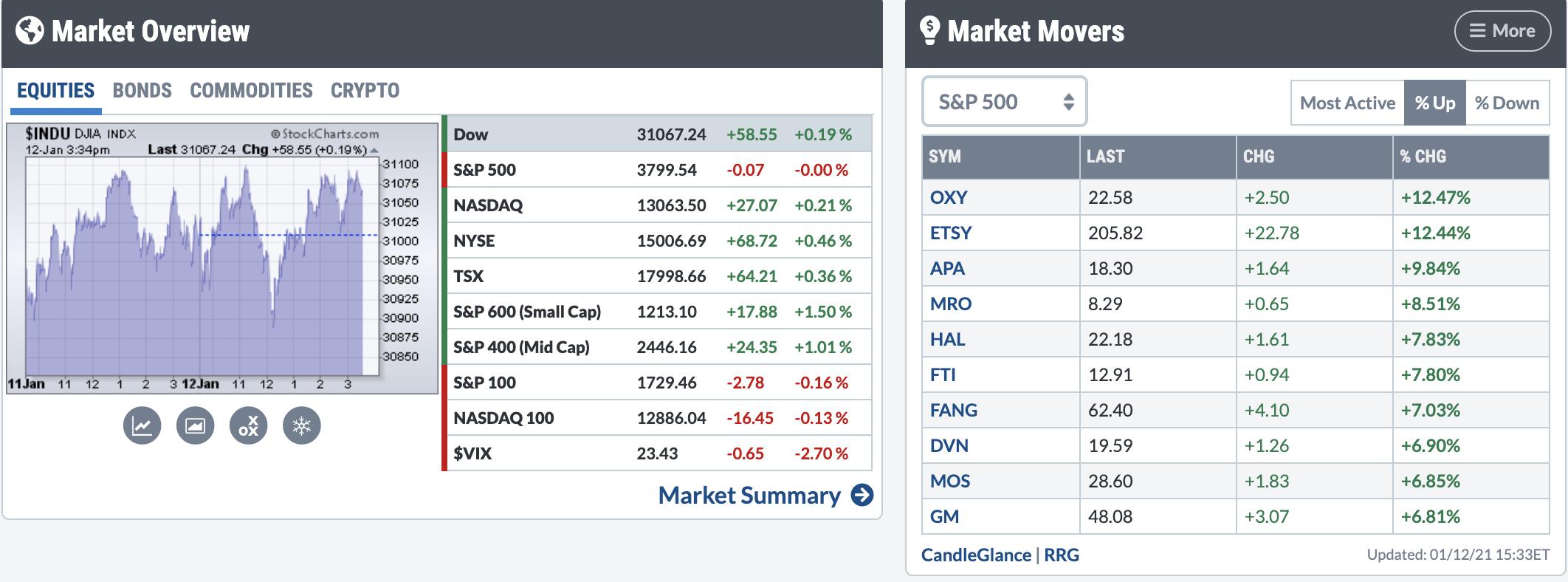

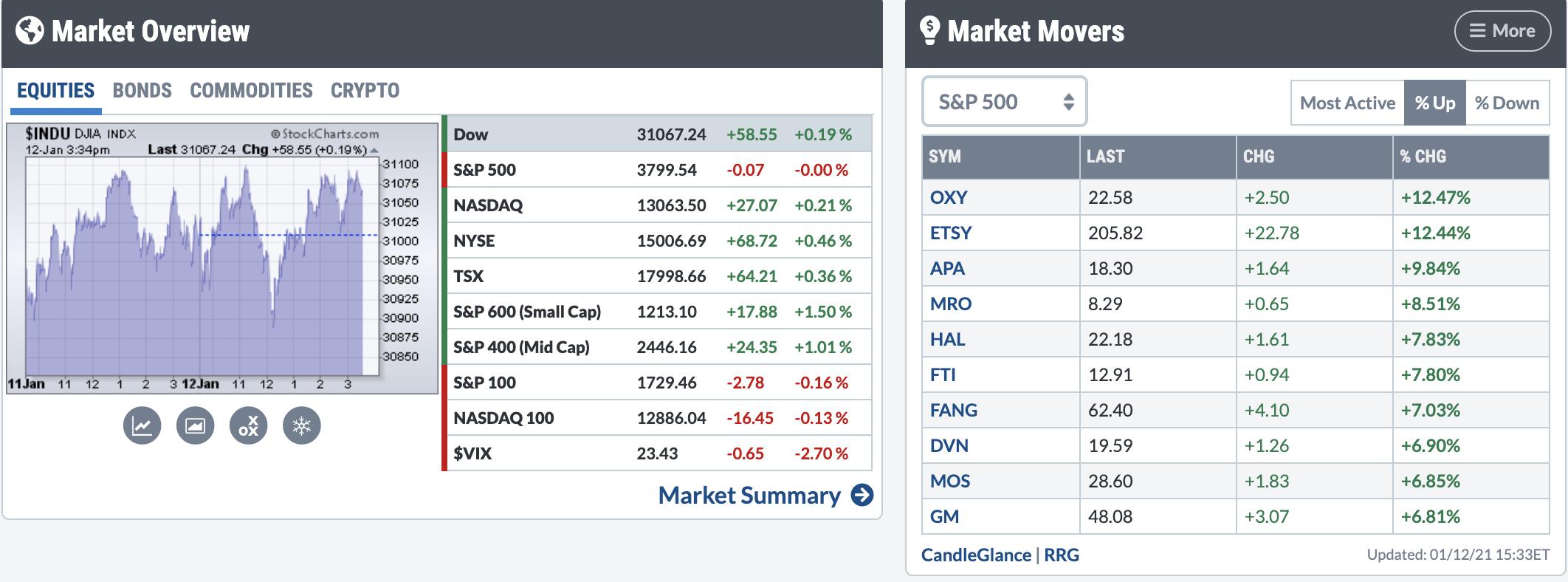

Looking Back While the Market Drives Forward

On Friday, three of the major indices gapped lower, ultimately closing negative for the week. The Russell 2000, although down on Friday, closed up on the week.

With the media pointing to a slew of reasons for the price drop, like negative bank earnings, slow vaccination rates, fall in retail...

READ MORE

MEMBERS ONLY

Don't Miss These Stimulus Stock Plays!

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen shares 2 groups that are turning after Biden's stimulus plan was released. She also reviews how to successfully trade stocks going into earnings season, as well as 1 major pocket of strength and how to capitalize....

READ MORE

MEMBERS ONLY

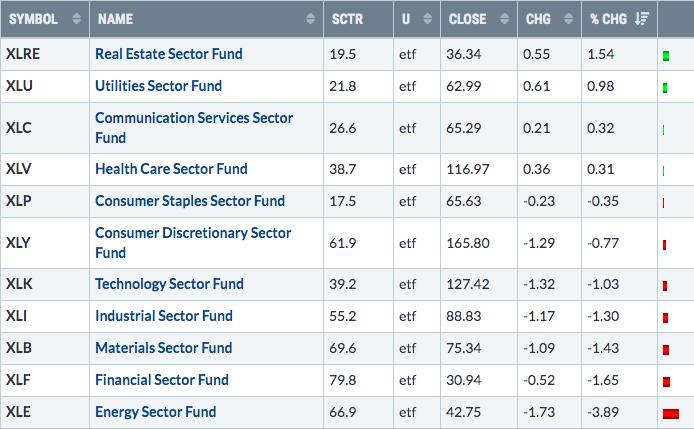

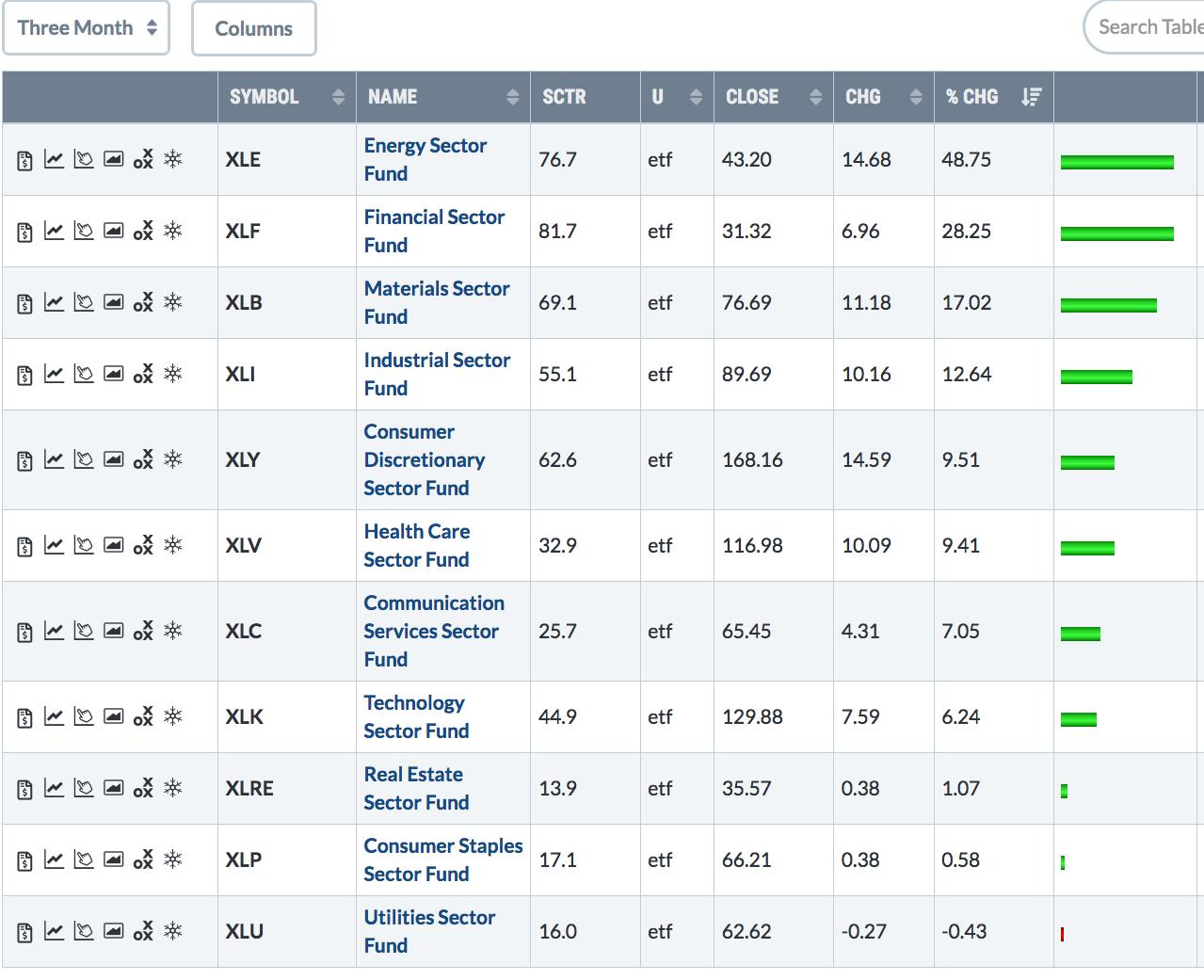

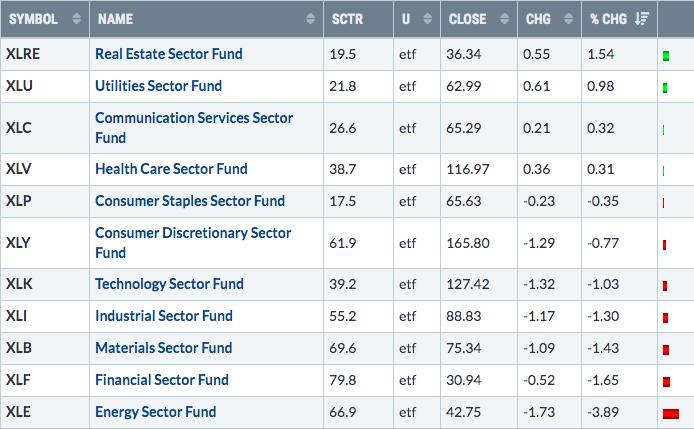

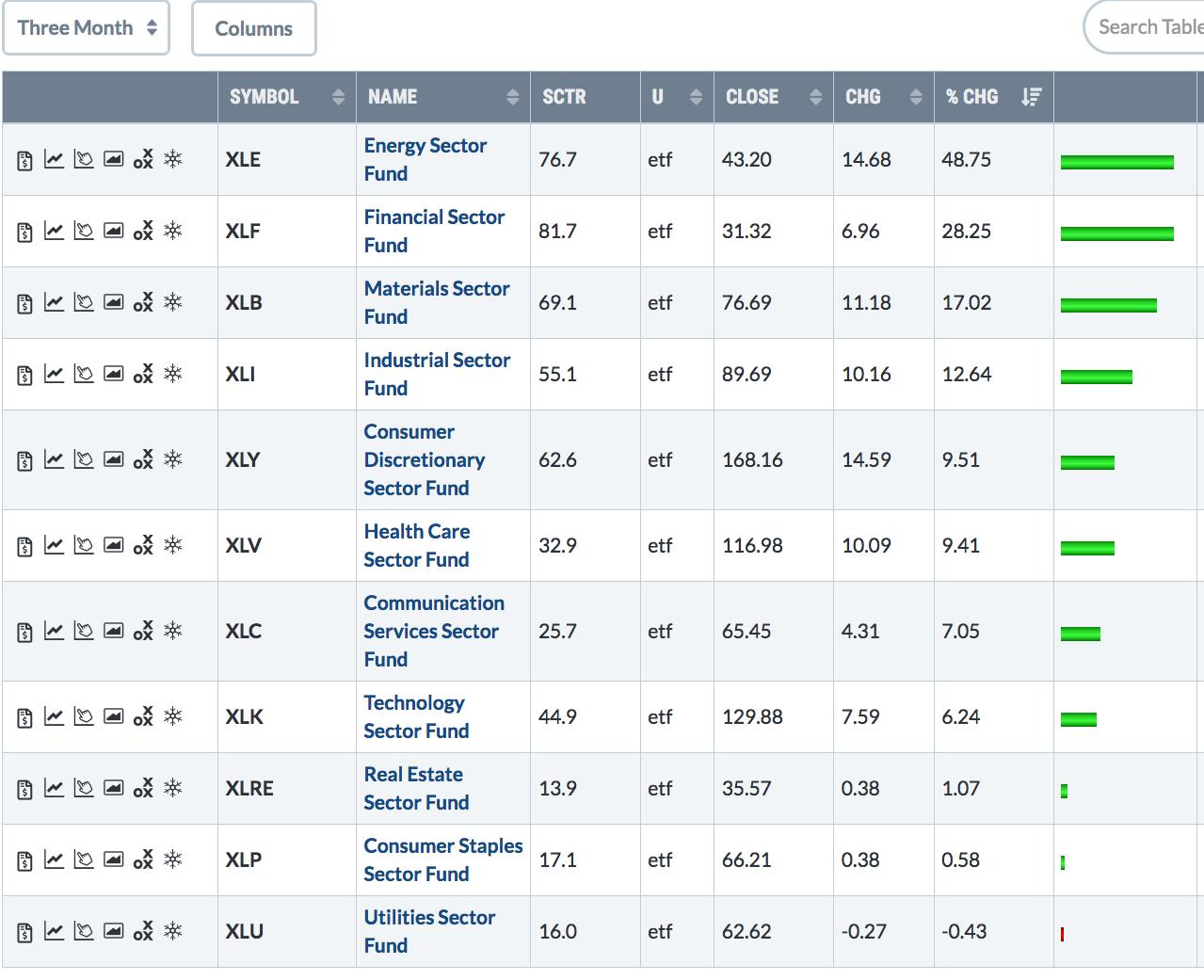

A Three-Month Look at Sector Leadership Shows More Optimism

by John Murphy,

Chief Technical Analyst, StockCharts.com

The last three months have seen rising stock prices. What's especially encouraging is which sectors have led the market higher. Chart 1 plots the sector performance over those three months. The top five sectors have been energy, financials, materials, industrials, and consumer cyclicals. All five are economically-sensitive stock...

READ MORE

MEMBERS ONLY

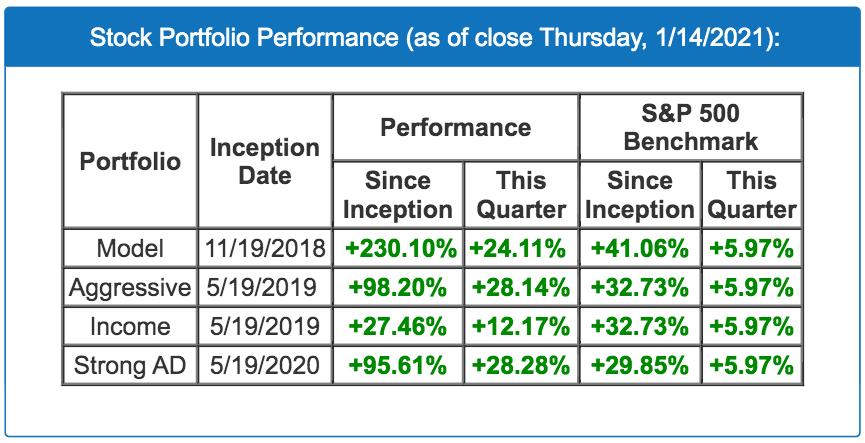

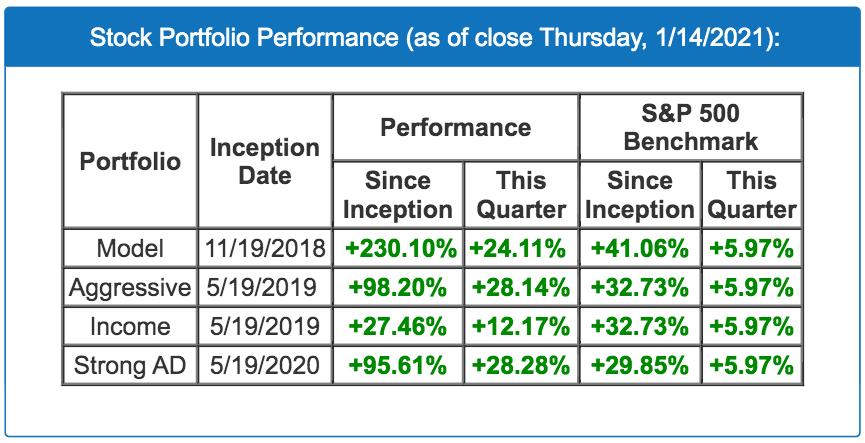

My Stock-Picking Secrets To Beat The Benchmark S&P 500

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

All of the stocks and ETFs in our 5 current portfolios are "drafted" in real time during our members-only events that we hold quarterly. I don't Monday Morning quarterback; I listen to what Wall Street is saying and stick with the themes that are driving big...

READ MORE

MEMBERS ONLY

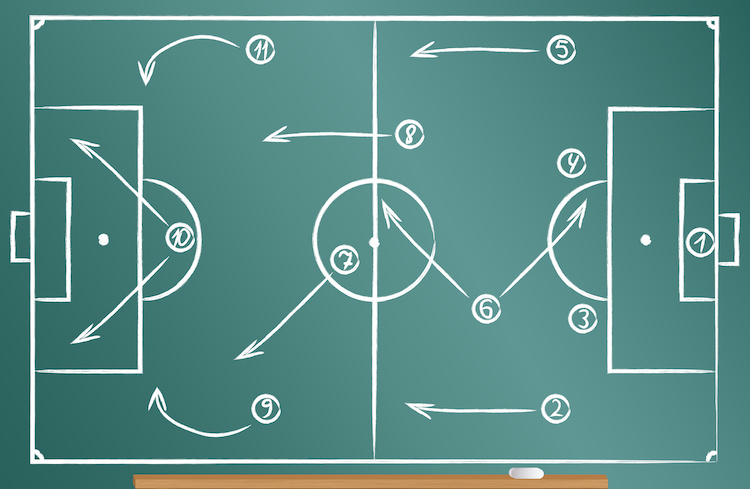

How To Draft Stocks With A Profitable "Personality" And Build A Winning Portfolio

by Gatis Roze,

Author, "Tensile Trading"

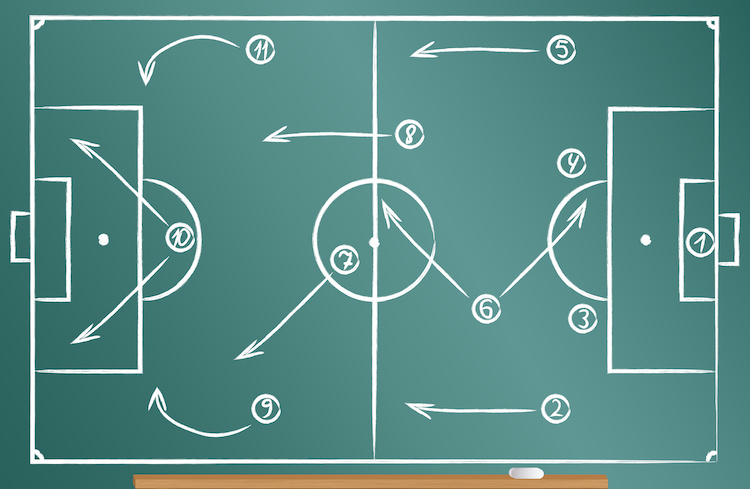

FACT: If you investigate the skill sets of the top tier General Managers of your favorite pro sports league, you'll recognize uncanny parallels to the top tier traders described in the Market Wizard books. This is not a coincidence.

Some 20 years ago, I discovered a breakthrough that...

READ MORE

MEMBERS ONLY

Gold Hints at Further Downside

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Back in early December, we discussed the three signals we would need to see to turn bullish on gold and gold stocks. Although the picture for gold turned more positive that month, a failure at resistance and a return below the 200-day moving average suggest further weakness may be in...

READ MORE

MEMBERS ONLY

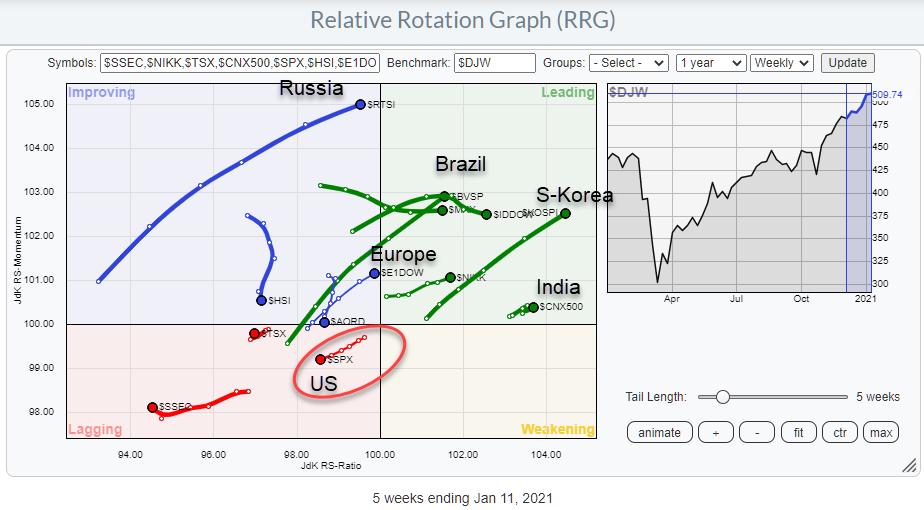

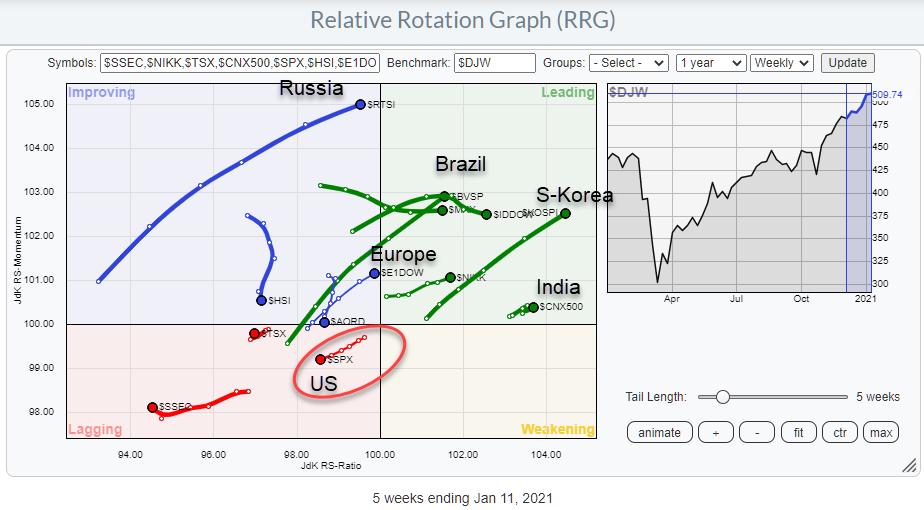

The World is Outperforming the US

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Relative Rotation Graphs, or RRGs, can help you get a better view of the big picture.

One of the RRGs I often use to get a handle on international developments on stock markets around the world is to pull up the Relative Rotation Graph for international stock market indexes, as...

READ MORE

MEMBERS ONLY

Chartwise Women: Explosive Healthcare Stocks!

by Mary Ellen McGonagle,

President, MEM Investment Research

by Erin Swenlin,

Vice President, DecisionPoint.com

In this week's edition of Chartwise Women, Erin and Mary Ellen show ways to boost your portfolio by taking advantage of the many strong outperformers in the Healthcare sector. They then take a deep dive into the sector and their favorite industry groups, looking at the best vaccine...

READ MORE

MEMBERS ONLY

Brazil is Beating the US! (and We're Not Talking About Soccer...)

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

One of the Relative Rotation Graphs that I like to keep an eye, in order to monitor the bigger picture, is the RRG that shows the rotations for international stock market indexes against the DJ Global index, as shown above.

What we see here is a cluster of markets inside...

READ MORE

MEMBERS ONLY

A THREE-MONTH LOOK AT SECTOR LEADERSHIP SHOWS MORE OPTIMISM -- RISING COMMODITY PRICES AND RISING BOND YIELDS HAVE ALSO PLAYED A ROLE

by John Murphy,

Chief Technical Analyst, StockCharts.com

ECONOMICALLY-SENSTIVE GROUPS HAVE BEEN MARKET LEADERS...The last three months have seen rising stock prices. What's especially encouraging is which sectors have led the market higher. Chart 1 plots the sector performance over those three months. The top five sectors have been energy, financials, materials, industrials, and consumer...

READ MORE

MEMBERS ONLY

ECONOMICALLY-SENSITIVE TRANSPORTS HIT NEW HIGHS -- WHILE DEFENSIVE UTILITIES LAG BEHIND -- BITCOIN REBOUNDS

by John Murphy,

Chief Technical Analyst, StockCharts.com

TRANSPORTS HIT NEW RECORD... It's usually a good sign to see more economically-sensitive groups hitting new highs, while more defensive groups are lagging behind. Two examples of that are seen by comparing the transportation stocks and utilities. Chart 1 shows the Dow Transports hitting a new record again...

READ MORE

MEMBERS ONLY

The Market and Media Paint 2 Different Pictures

The market digests its recent highs amidst a rush of politically-charged news as more riots and a second impeachment dominate headlines.

We believe the market is more focused on the economic plans of the incoming administration and not as much on the politics at hand. The marijuana industry can attest...

READ MORE

MEMBERS ONLY

If I Can Do It, So Can You!

by Dave Landry,

Founder, Sentive Trading, LLC

In this edition of Trading Simplified, Dave shows many recent trades that have turned into big winners (and a few that have the potential to become big winners down the line). These were all found using simple patterns discussed in previous shows. Further, all of the stocks were discussed before...

READ MORE

MEMBERS ONLY

GRAIN MARKETS REACH MULTI-YEAR HIGHS -- CRB INDEX TESTS TRENDLINE RESISTANCE -- A LONGER-TERM LOOK AT COMMODITY PRICES

by John Murphy,

Chief Technical Analyst, StockCharts.com

GRAIN MARKETS ARE IN NEW UPTRENDS... Higher commodity markets are starting to attract more attention because of the potential for higher inflation. Past messages have written about new uptrends in energy markets or industrial commodities like copper. Some of the biggest gains, however, are being seen in agricultural markets, and...

READ MORE

MEMBERS ONLY

Handle is Complete, Time For AAPL To Run?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I wrote about a pending short-term correction in AAPL shares a couple weeks ago right here in the DITC blog. My article, "Apple (AAPL) Prints Reversing Candle, Short-Term Selling Possible", illustrated the reversing dark cloud cover candle that had taken place at key price resistance established at the...

READ MORE

MEMBERS ONLY

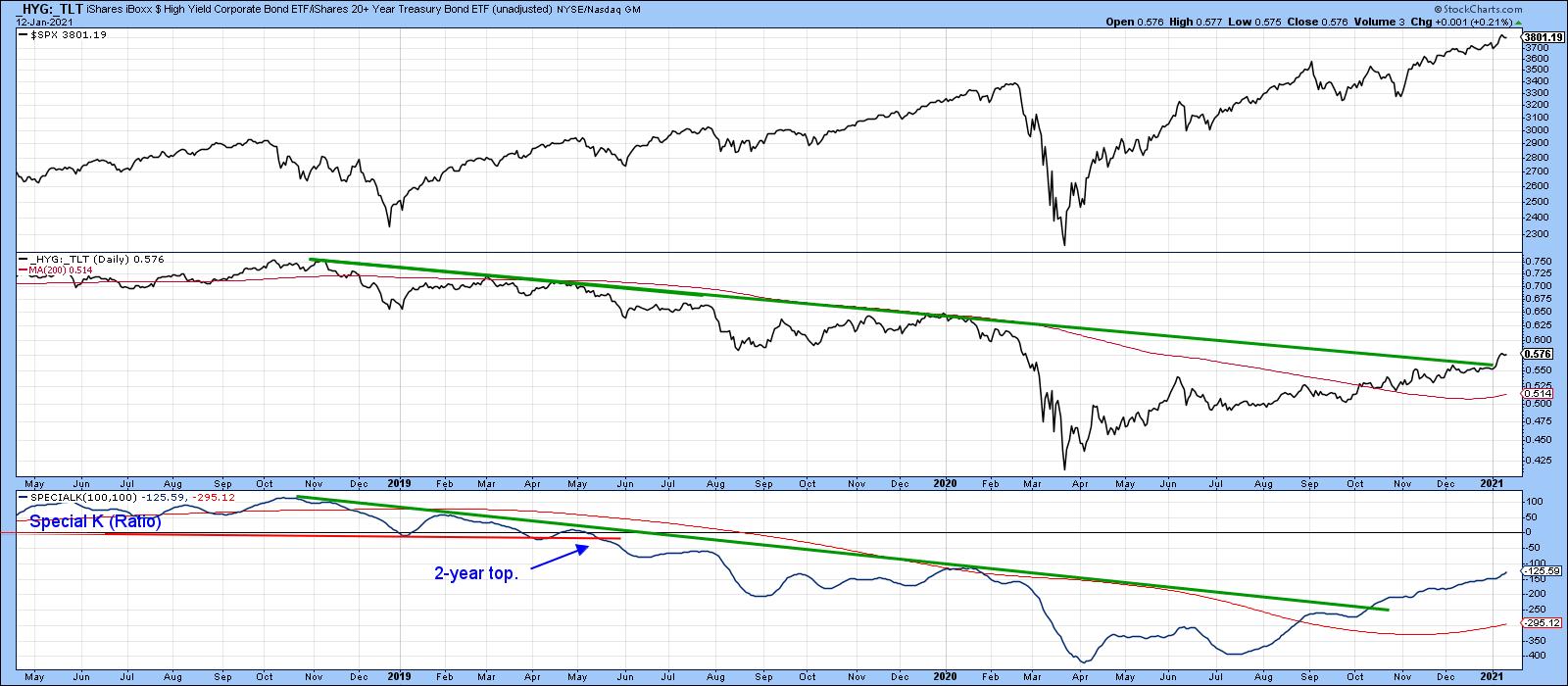

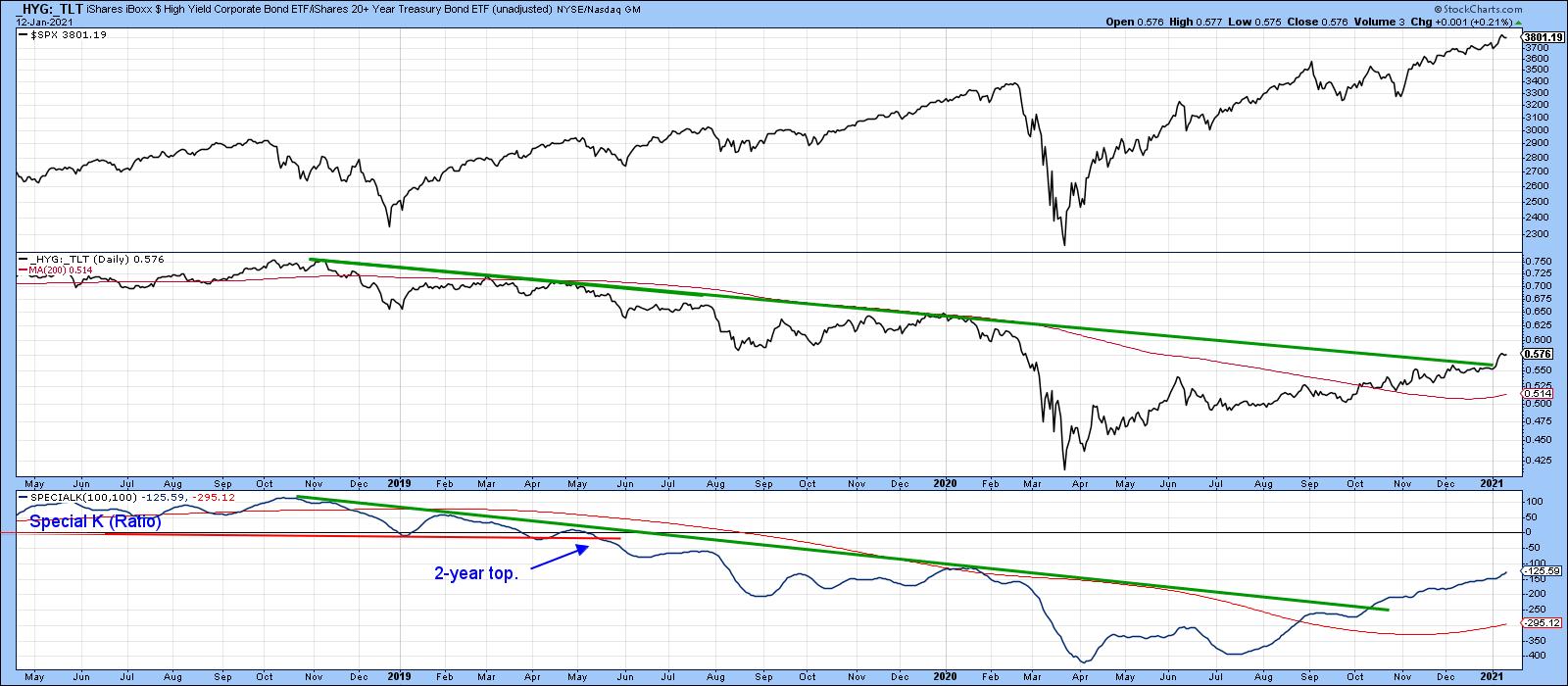

Green Light Still Flashing for Higher Bond Yields, Stock & Commodity Prices

by Martin Pring,

President, Pring Research

Back in early November, I wrote an article entitled,Confidence is Breaking Out all Over, Which is Bullish for Stocks/Commodities and Bond Yields, where I examined several intermarket relationships that monitor confidence. Since then, all three markets have rallied, but a further review of some of these relationships presents...

READ MORE

MEMBERS ONLY

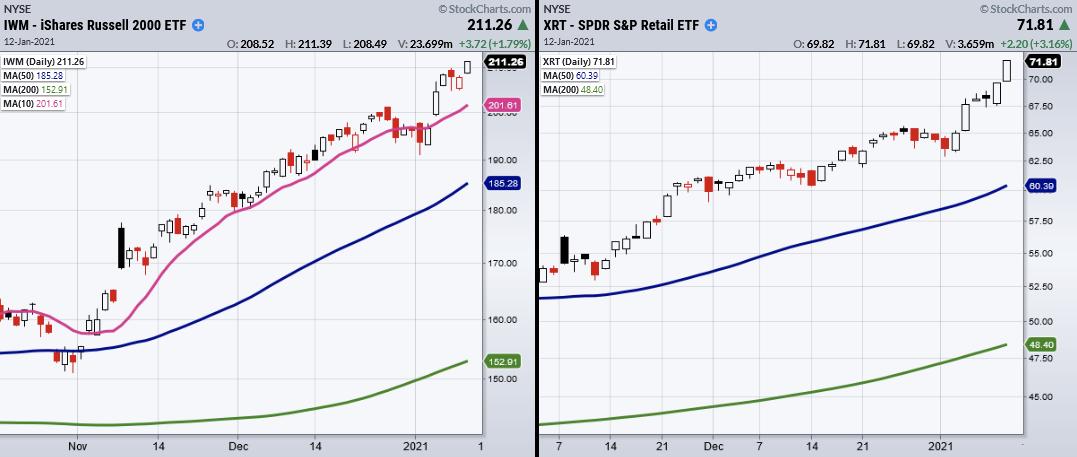

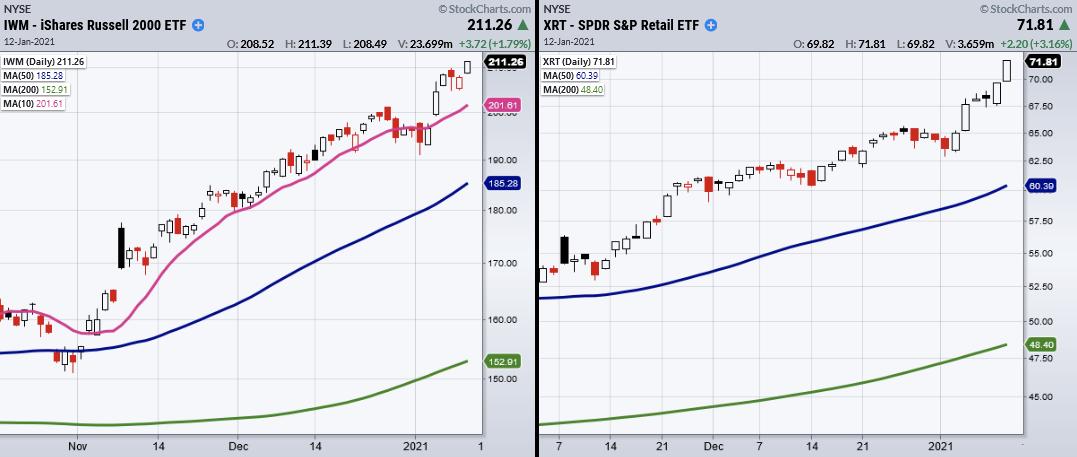

The Market's Power Couple

Grandad Russell 2000 (IWM) and Granny Retail (XRT) make the Perfect Power Couple.

The Russell 2000 (IWM) followed his wife (XRT) Retail, to new highs today while major indices sit under their recent highs. Granny's enthusiasm has not only encouraged Grandad to get back up since his recent...

READ MORE

MEMBERS ONLY

Power Charting TV: Big Investment Themes for 2021

by Bruce Fraser,

Industry-leading "Wyckoffian"

On January 4th BOK Financial (BOKF), PacWest Bancorp (PACW) and super regional bank SVB Financial (SIVB) all received analyst upgrades. BOKF and PACW were increased to ‘Overweight' status. The Financial sector (XLF) and bank industry groups are in constructive uptrends. Using Wyckoff Methodology technique can we confirm the timeliness...

READ MORE

MEMBERS ONLY

Sector Spotlight: Energy & Financials Beating SPY

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of StockCharts TV's Sector Spotlight, I talk you through the recent rotations in asset classes and US sectors, then look at growth vs value rotation, as well as the rotation of the US vis-a-vis international stock markets. After the break, I dive into the current...

READ MORE

MEMBERS ONLY

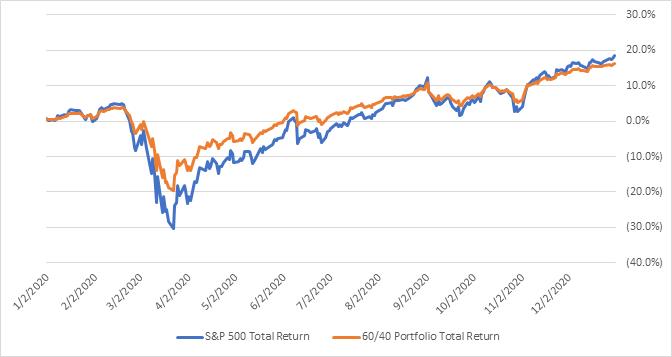

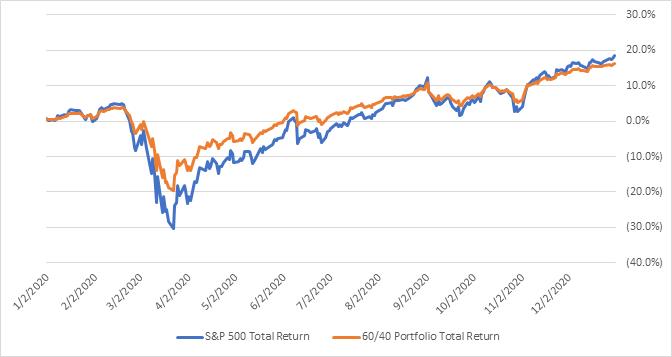

Long Days, Short Years

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

With another year in the books, we think it is a good time to provide an update on our rules-based trend following strategies, and why we think they are a better approach to investing. Let's start with a 2020 market recap.

A passive buy & hold investor in...

READ MORE

MEMBERS ONLY

ENERGY ETFS NEAR UPSIDE BREAKOUTS -- OIH HAS ALREADY CLEARED ITS JUNE HIGH -- RISING ENERGY SHARES ARE PART OF THE REFLATION TRADE

by John Murphy,

Chief Technical Analyst, StockCharts.com

ENERGY ETFS CONTINUE CLIMBING... Energy stocks continue to show new market leadership. That leadership is reflected in two energy ETFs that may be nearing some upside breakouts, and one having already achieved one. Chart 1 shows the Energy Sector SPDR (XLE) trading at the highest level in more than six...

READ MORE

MEMBERS ONLY

S&P 500 Earnings 2020 Q3: The Most Overvalued Market Ever?

by Carl Swenlin,

President and Founder, DecisionPoint.com

On an almost daily basis we hear experts on the subject complaining that this the most overvalued market ever. While our chart doesn't quite confirm that claim, we would agree that it could easily be true using a different methodology. And there is no question that the market...

READ MORE

MEMBERS ONLY

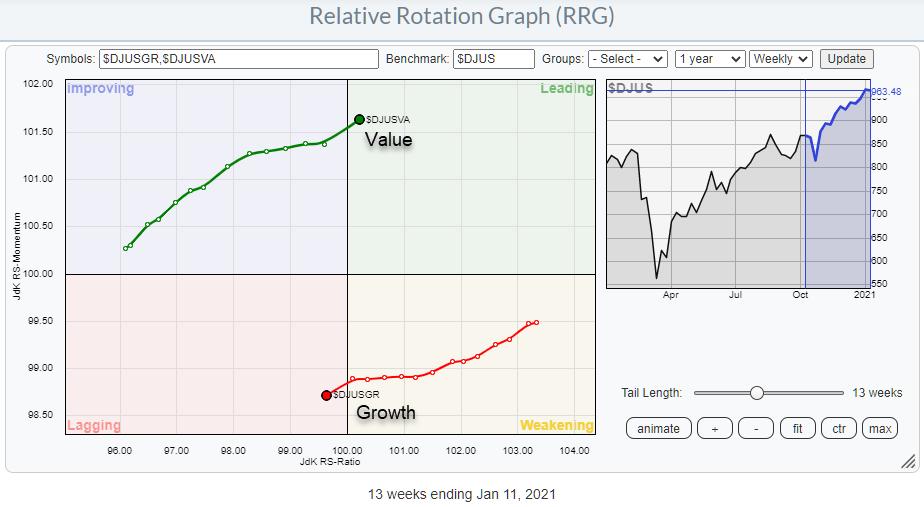

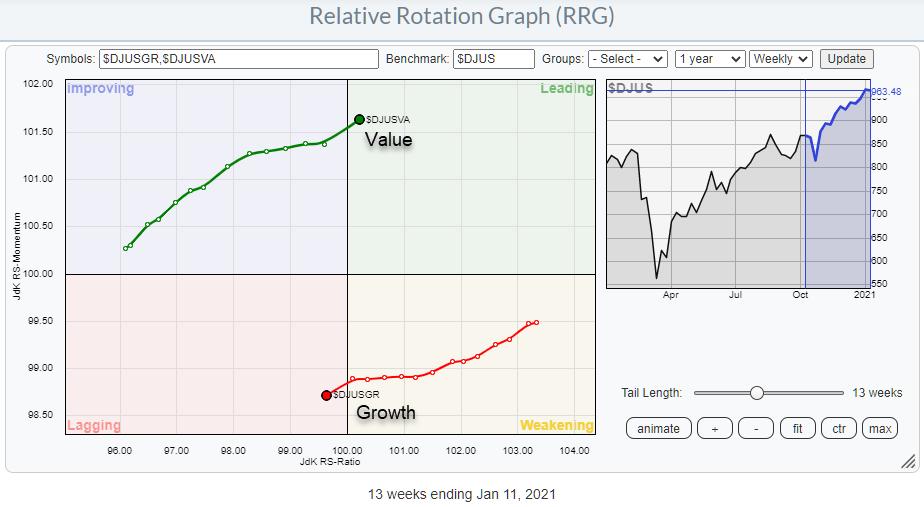

Value Starts to Accelerate Away from Growth

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

This week, the tails for Growth and Value are crossing over. Value is moving into the leading quadrant while Growth crosses from weakening into lagging.

This rotation has been going on for quite some time already and was picked up by the RRG Lines and the rotation of the tails...

READ MORE

MEMBERS ONLY

Here's The One Thing You Need To Worry About Right Now

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Any time that it behooves market makers to direct prices lower, I get nervous. So that means I get nervous as we approach the 3rd Friday of every calendar month (monthly options expiration day), especially if we've seen a nice advance leading up to it. If you'...

READ MORE

MEMBERS ONLY

DP TV: Bullish Bias Returns

by Erin Swenlin,

Vice President, DecisionPoint.com

In this episode of DecisionPoint, Erin flies solo, bringing quite a few trading ideas into the show. As far as the market overall, the bullish bias has returned. What does that mean for Gold, Silver and the Gold Miners? Reviewing sector rotation, it is clear that defensive sectors of the...

READ MORE

MEMBERS ONLY

Where Have All the Silver Bulls Gone?

A week or so ago, silver was all the rage. The talk ranged from an inflation indicator, to the industrial usage to the outperformance to gold as key.

Then, last Friday, silver (and gold) tanked. Silver breached the 50-DMA but closed above it. Monday, it also declined, but not only...

READ MORE