MEMBERS ONLY

Is it Time to Pull the Plug on the Gold Bull Market?

by Martin Pring,

President, Pring Research

Since its intraday high (set in August), the price of the SPDR Gold Trust, the GLD, has fallen close to 15%. That's not enough to qualify for a bear market under the media's arbitrary and totally useless 20% standard. However, it is enough for bulls like...

READ MORE

MEMBERS ONLY

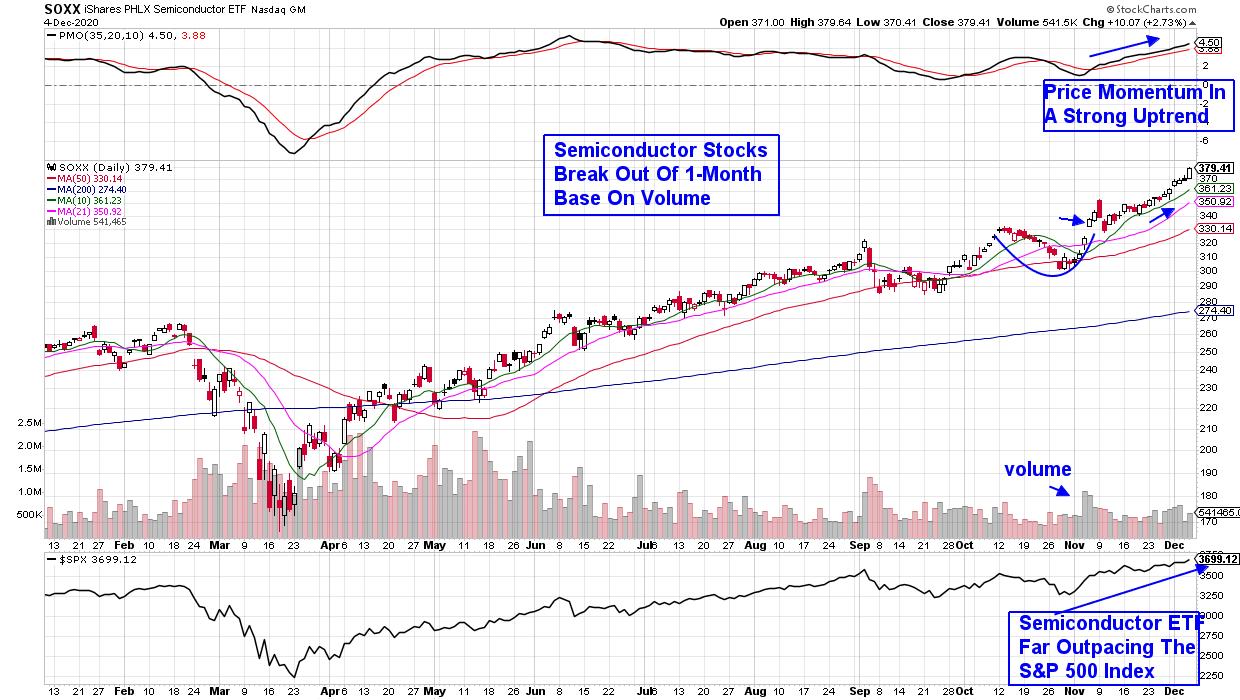

These 3 Steps Will Put You In Front Of Big, Winning Stocks

by Mary Ellen McGonagle,

President, MEM Investment Research

For many investors, uncovering that best-of-breed stock that goes on to far outpace its peers can be elusive. With the tools I'm going to share with you today, you can get started setting up a system that's designed to locate and help you trade that next...

READ MORE

MEMBERS ONLY

Is There a Future for Oil and Gas Exploration?

In the past couple of weeks, we've talked about the rise of oil and gas exploration (XOP).

On Friday, XOP closed with just under an 8% gain for the day. Its recent break over the 200-day moving average gave a good area to risk from. Even with its...

READ MORE

MEMBERS ONLY

These Areas of the Market are Just Getting Started!

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews where the momentum is in the markets and how you can capitalize with specific stocks, as well as screening techniques to uncover top candidates. She also shares names that gapped up on earnings this week and how...

READ MORE

MEMBERS ONLY

Three Tells for a Bottom in Gold Stocks

by David Keller,

President and Chief Strategist, Sierra Alpha Research

As much as people speak of gold's value as a safe haven, its performance in 2020 has done much to dispel that investment thesis. Recent months have seen gold and gold stocks underperforming the S&P 500. Is the pattern of new highs for stocks and new...

READ MORE

MEMBERS ONLY

(When) Will we See $40k in Bitcoin?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Bitcoin and, more broadly, cryptocurrencies, are back to the forefront of financial markets. A lot of new participants are entering the crypto-space and they are all looking to get a piece of the bitcoin-pie.

So what can we learn from the Bitcoin chart when we want to get an idea...

READ MORE

MEMBERS ONLY

FALLING DOLLAR IS BOOSTING COMMODITY PRICES -- MOST COMMODITY GROUPS ARE RISING -- COPPER HITS SEVEN YEAR HIGH -- WHILE GOLD RETREATS

by John Murphy,

Chief Technical Analyst, StockCharts.com

FALLING DOLLAR BOOSTS COMMODITY PRICES...One of the side-effects of a falling dollar is usually rising commodity prices. That's partly because global commodities are priced in dollars. And our first chart reflects their inverse relationship. Chart 1 shows the Invesco DB Commodity Index (DBC) in a rising trend...

READ MORE

MEMBERS ONLY

TEN-YEAR TREASURY YIELD NEAR 1% MARK... STOCK INDEXES ARE HITTING NEW RECORDS -- FINANCIAL SPDR HITS NEW RECOVERY HIGH

by John Murphy,

Chief Technical Analyst, StockCharts.com

TEN-YEAR TREASURY YIELD NEARS 1%... Treasury bond yields continue to climb and are hitting new recovery highs. Chart 1 shows the 10-Year Treasury Yield trading rising 5 basis points today to .96%. It also touched the highest level since March. That's obviously bad for Treasury bond prices which...

READ MORE

MEMBERS ONLY

Chartwise Women: Is the Santa Claus Rally Real?

by Mary Ellen McGonagle,

President, MEM Investment Research

by Erin Swenlin,

Vice President, DecisionPoint.com

In this week's edition of Chartwise Women, Erin and Mary Ellen are in the holiday spirit today as they talk about whether Santa Claus is fact or fiction. Oops, that should be Santa Claus RALLY! They look at seasonality to show you when is the best time to...

READ MORE

MEMBERS ONLY

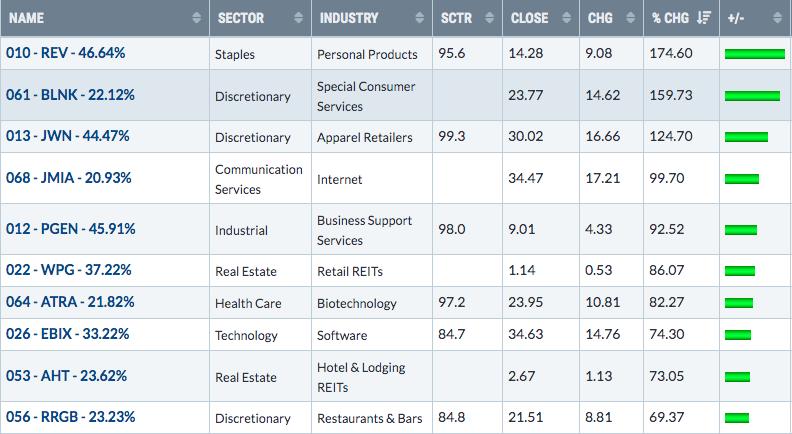

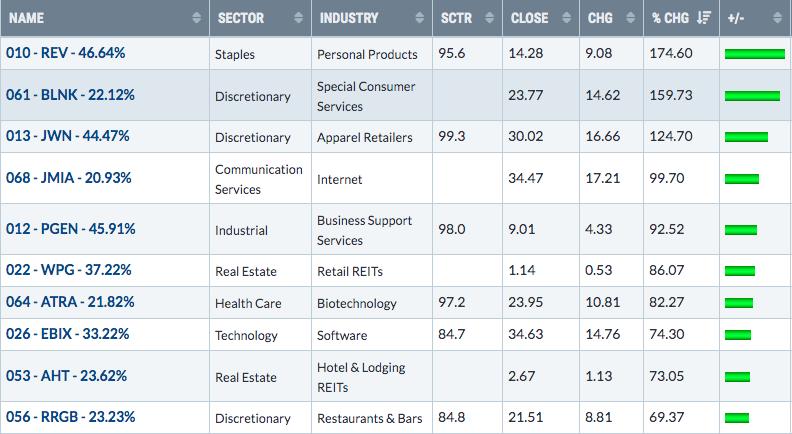

Short Squeezes Are Crippling Those On The Bearish Side

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

This has been the quarter for short squeezes. It's been crazy. The beauty from the long side is that once these stocks make breakouts, the pressure builds on short sellers to cover their positions. Unfortunately, many have the same emotional connection to their bearish bets that many long...

READ MORE

MEMBERS ONLY

Is it Time to Pull the Plug on the Gold Bull Market?

by Martin Pring,

President, Pring Research

Since its intraday high (set in August), the price of the SPDR Gold Trust, the GLD, has fallen close to 15%. That's not enough to qualify for a bear market under the media's arbitrary and totally useless 20% standard. However, it is enough for bulls like...

READ MORE

MEMBERS ONLY

AIRLINE ETF TURNS UP -- AIRLINE LEADERS ARE DELTA, ALASKA AIR, AND SOUTHWEST -- BOEING HAS A BREAKOUT DAY

by John Murphy,

Chief Technical Analyst, StockCharts.com

AIRLINE ETF CLEARS JUNE HIGH... Airline stocks continue to gain more altitude and show stronger chart patterns. Chart 1 shows the US Global Jets ETF (JETS) surging to the highest level since the spring. The upper box shows its relative strength ratio rising to the highest level since June. A...

READ MORE

MEMBERS ONLY

What's with Gold?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Relative Rotation Graph for Commodities shows the tail for precious metals deep inside the lagging quadrant and recently bending towards the left again after a few weeks of picking up relative momentum. This makes precious metals the weakest group in the universe.

Watching such a rotation on the tail...

READ MORE

MEMBERS ONLY

Is Junk Worth More than Gold?

In Santa Fe, New Mexico, we awoke with freezing temperatures and fresh snow.

This week, the state lifted the current lockdown, with restaurants now being able to serve at 25% occupancy outdoors. I can hardly wait to sit outside on a windy winter day!

The blatant disconnect between state orders...

READ MORE

MEMBERS ONLY

Trend Following at its Finest

by Dave Landry,

Founder, Sentive Trading, LLC

In this edition of Trading Simplified, Dave shows viewers how following a simple trend following methodology can pay off nicely. He also presents Mystery Charts examines the "what, when, where, how and what" of trading.

This video was originally broadcast on December 2nd, 2020. Click anywhere on the...

READ MORE

MEMBERS ONLY

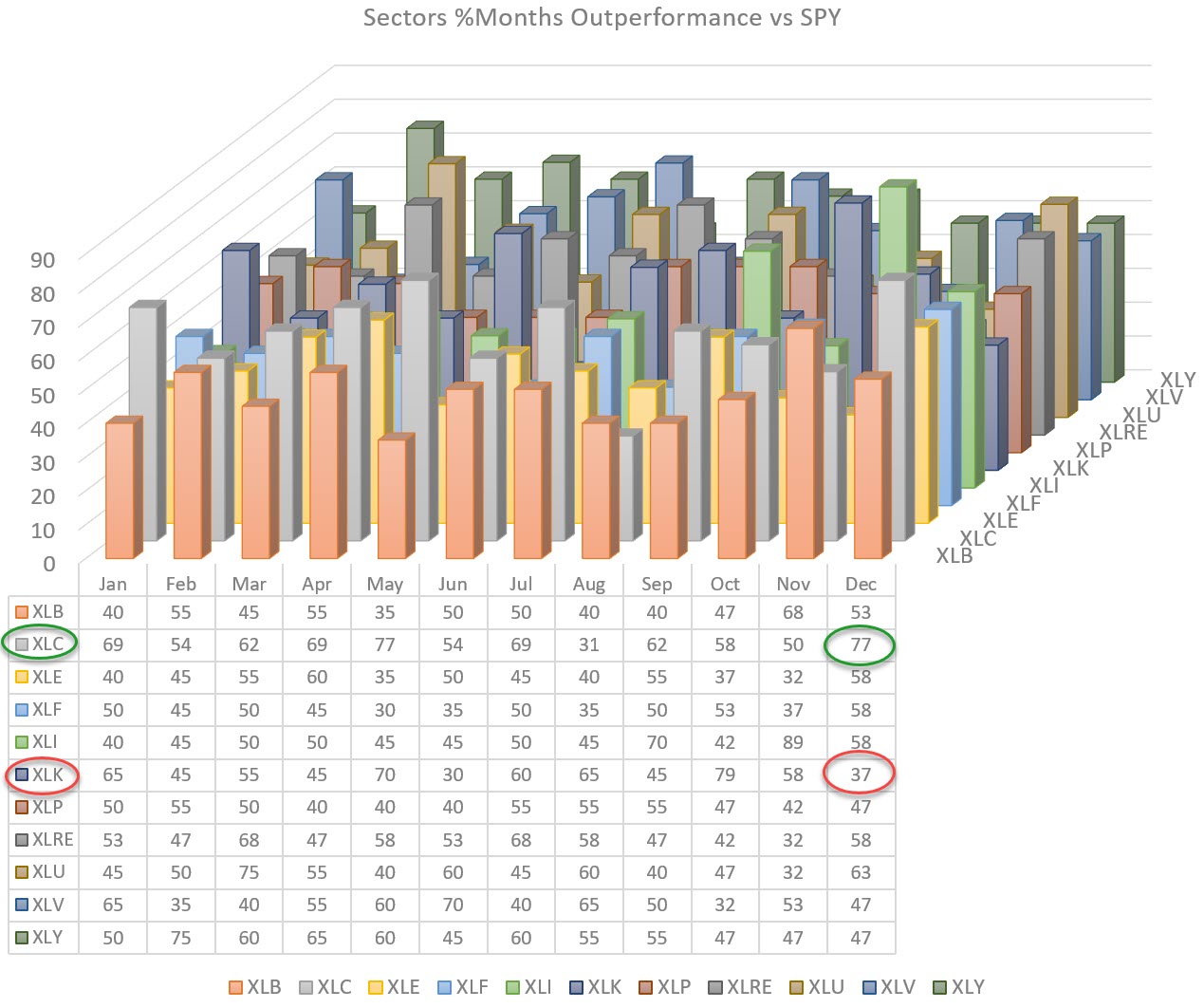

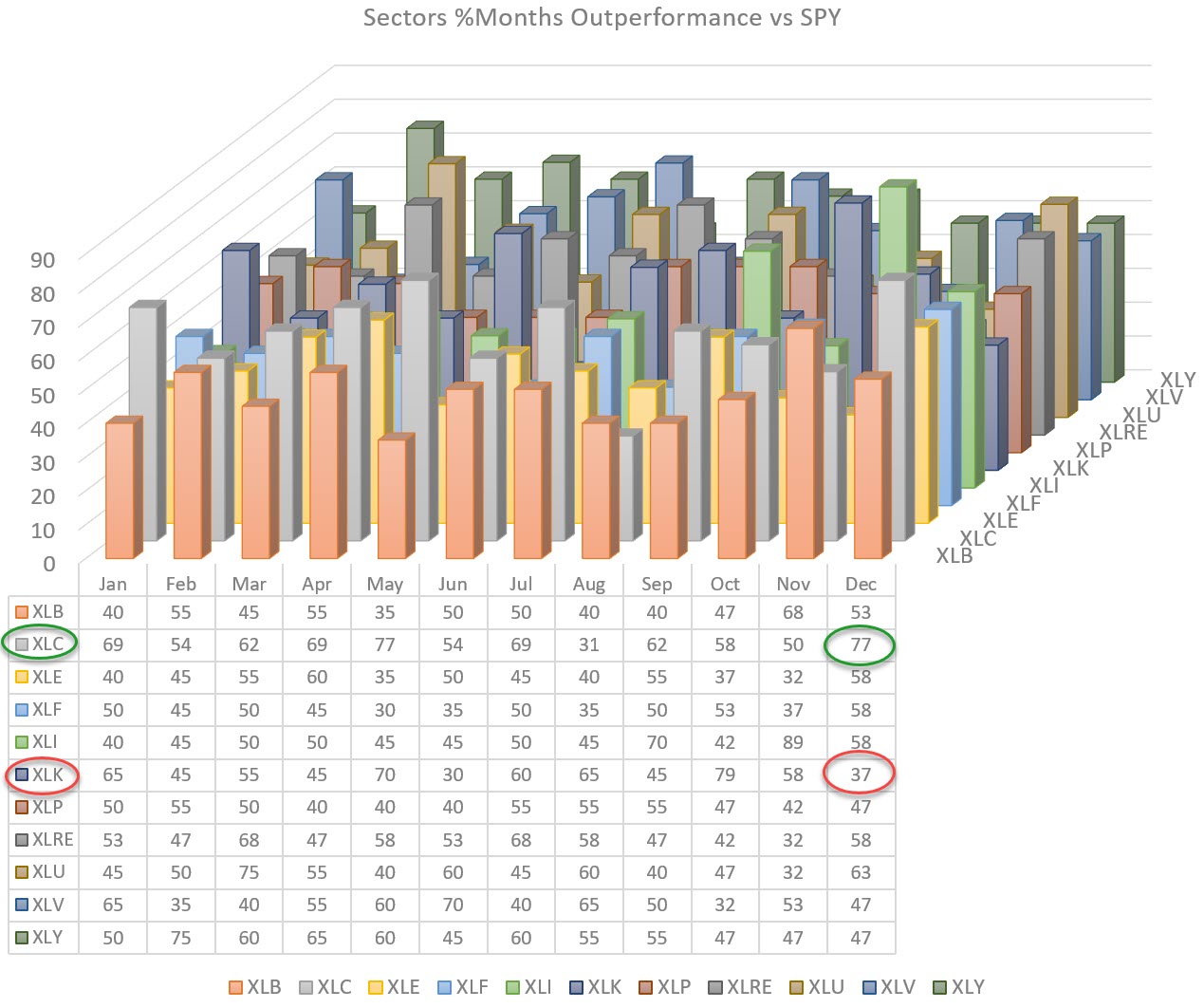

Sector Spotlight: Strong Performance for XLC in December

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of Sector Spotlight, I kick off by walking viewers through last week's performances and rotations on the Relative Rotation Graphs for Asset Classes and US sectors. After the break, I put these rotations in a bigger perspective and bring in seasonality for the month of...

READ MORE

MEMBERS ONLY

Can Tech and Biotech Continue to Break New Highs?

Those of you who are new to the Daily have probably noticed the references to the Economic Modern Family.

Mish developed one index and five sectors as the nucleus of the Family to help you and herself see the real economy, as portrayed through a combination of cyclicals and non...

READ MORE

MEMBERS ONLY

NASDAQ 100 HITS NEW RECORD -- A NUMBER OF ITS LARGEST STOCKS ARE IN CONSOLIDATION PATTERNS -- APPLE HITS SEVEN-WEEK HIGH -- MICROSFT, AMAZON, AND FACEBOOK MAY BE IN TRIANGULAR FORMATIONS

by John Murphy,

Chief Technical Analyst, StockCharts.com

NASDAQ 100 HITS NEW RECORD...With the Dow and S&P 500 reaching new records, the tech-dominated Nasdaq market has been lagging behind. Not anymore. Chart 1 shows the Invesco QQQ Trust trading in record territory today. It's also the strongest of the major U.S. stock...

READ MORE

MEMBERS ONLY

Seasonality Points to a Strong Month of December for XLC

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The chart above shows the seasonality for all US sectors relative to the S&P 500 index. The numbers in the table are the percentages of time in history (20 years when available) where a sector outperformed the S&P.

For the coming month of December, two sectors...

READ MORE

MEMBERS ONLY

DP TV: Monthly Charts Go Final! + Extended Cyber Monday Deal

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

With today being the final day of the month, DecisionPoint "books" the current signals from the monthly charts. In this episode, Carl discusses the importance of monthly PMO direction changes, as many times the crossover signals arrive late. Today, there were TWO monthly PMO direction changes of special...

READ MORE

MEMBERS ONLY

The Economic Modern Family Makes Way for Crypto

Today, Bitcoin (BTC) passed its record high as certain members of the Economic Moderns Family digest their recent gains.

Cryptocurrency as an alternative currency has pushed for widespread acceptance since the launch of the first Bitcoin in 2009. Even more so, it has become a movement for investors who see...

READ MORE

MEMBERS ONLY

Save 20% with Cyber Monday at DP! - "Diamond of the Week" Ready for Entry

by Erin Swenlin,

Vice President, DecisionPoint.com

I wanted to make sure all of our subscribers to the DecisionPoint Blog on StockCharts know about our Cyber Monday Special and I want to share the "Diamond of the Week" as soon as possible. I presented it on today's DecisionPoint Show that will air later...

READ MORE

MEMBERS ONLY

Cyber Monday Special and Consumer Discretionary Breadth Hits an Extreme

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Consumer Discretionary SPDR (XLY) is leading the charge with the most stocks trading above their 200-day EMAs. The table below shows the percentage of stocks above their 200-day EMAs for three indexes and the eleven sectors. This indicator is above 98% for XLY and above 90% for four other...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Hangs Just Above this Important Pattern Resistance Level; RRG Chart shows These Sectors Doing Well

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The equity markets are presently dealing with one of their most important pattern resistances over the previous days. In the previous note, we had mentioned the importance of this pattern resistance line; it was also mentioned that, unless the zone of 12960-13000 is taken out comprehensively, we may not see...

READ MORE

MEMBERS ONLY

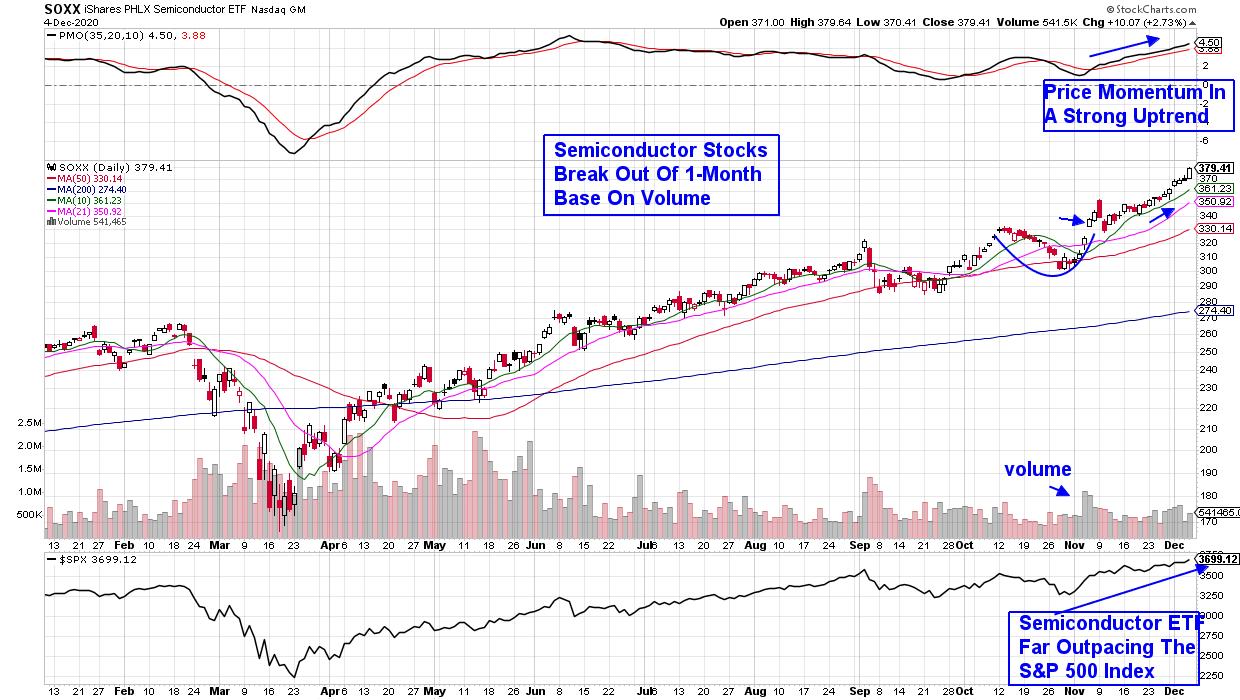

A Look Back At The Clues Of This Pandemic Rally And Why We're Just Getting Started

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Global markets are rallying as more and more analysts look beyond the devastation caused by the 100-year pandemic and see a very bright economic outlook. Pent up demand, combined with historically-low interest rates will likely prove to be very bullish in the end. I continue to believe that we'...

READ MORE

MEMBERS ONLY

Strong Seasonality Combined With a Breakout Can Prove to be Quite Profitable

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

A month ago, we provided our EarningsBeats.com members a list of 20 companies that have historically performed well in the month of November. One of the stocks was TransDigm Group (TDG), and it only takes a quick glance at the seasonality chart to see why it was featured at...

READ MORE

MEMBERS ONLY

Foreign Stock ETFs are Hitting New Records

by John Murphy,

Chief Technical Analyst, StockCharts.com

The decline in the U.S. dollar continues. Chart 1 shows the Invesco US Dollar Index (UUP) dropping to the lowest level in two years. Previous messages have described some of the intermarket side-effects of a weaker greenback. One of them is that it's usually good for foreign...

READ MORE

MEMBERS ONLY

How to Uncover & Successfully Trade Winning Stocks

by Mary Ellen McGonagle,

President, MEM Investment Research

In this special workshop episode of StockCharts TV'sThe MEM Edge, Mary Ellen shares the common characteristics of stocks that far outpace the broader markets. She also presents ways that you can screen for these big winners.

This video was originally recorded in mid-November and broadcast on November 27th,...

READ MORE

MEMBERS ONLY

Bullish Setups in Two Boring Tech ETFs

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Boring and lagging ETFs turned into exciting leaders in November as we saw breakouts in the Regional Bank ETF (KRE) and REIT ETF (IYR). The breakouts are bullish and IYR has a short-term bullish continuation pattern working, but we should not forget about the prior leaders and ETFs with real...

READ MORE

MEMBERS ONLY

S&P is Starting to Drag Against the World; Who's Going to Benefit?

by Martin Pring,

President, Pring Research

Last September, I pointed out herethat the ratio between the S&P Composite and the MSCI World Stock ETF (SPY/ACWI) had reached a critical juncture and needed an immediate rally in order to avoid an important sell signal. That point has been flagged with the green arrow. As...

READ MORE

MEMBERS ONLY

FALLING DOLLAR HELPS BOOST FOREIGN STOCKS -- FOREIGN STOCK ETFS ARE HITTING NEW RECORDS

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOLLAR DROPS TO TWO-YEAR LOW... The decline in the U.S. dollar continues. Chart 1 shows the Invesco US Dollar Index (UUP) dropping to the lowest level in two years. Previous messages have described some of the intermarket side-effects of a weaker greenback. One of them is that it'...

READ MORE

MEMBERS ONLY

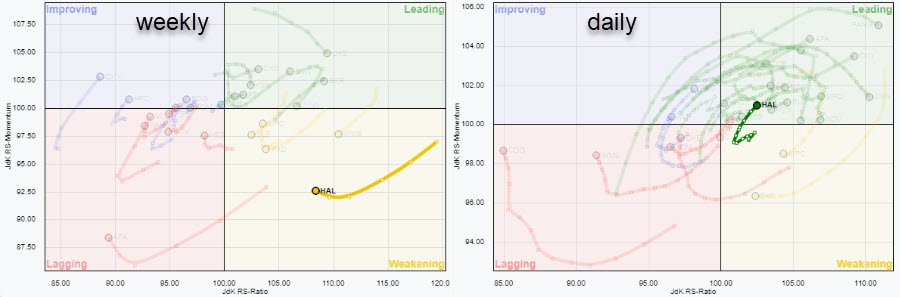

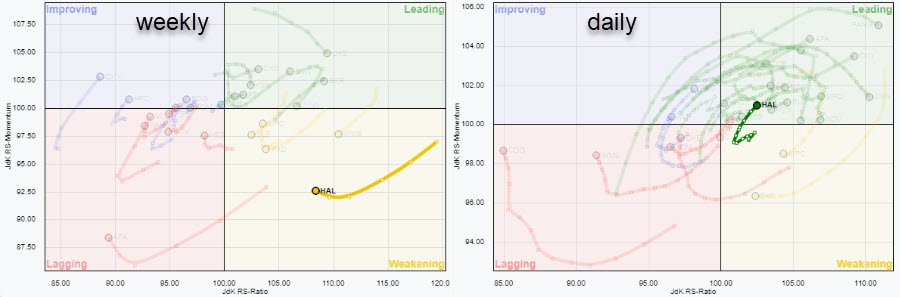

RRG is Picking Up Turnaround in HAL

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

With returns in the Energy sector flying off the charts, I want to track developments in individual stocks within the sector closely. This is particularly true because the rotation of the sector on the weekly Relative Rotation Graph is still not very strong.

The weekly tail on XLE is shown...

READ MORE

MEMBERS ONLY

Chartwise Women: Bringing Women to the Table

by Mary Ellen McGonagle,

President, MEM Investment Research

by Erin Swenlin,

Vice President, DecisionPoint.com

In this archived edition of Chartwise Women, Mary Ellen and Erin examine the topic of bringing women into the investing arena using a preview of their MoneyShow presentation. Mary Ellen discusses the dangers that can come from waiting to begin investing and Erin looks at some case studies.

This video...

READ MORE

MEMBERS ONLY

Current Rotation Leading to Massive Short Squeeze Trades

by John Hopkins,

President and Co-founder, EarningsBeats.com

The market rotation of late has resulted in some explosive moves in some "forgotten stocks." This has been particularly true of those stocks that have a high percentage of shares short.

As an example, take a look at the two charts below. Both of these stocks are on...

READ MORE

MEMBERS ONLY

Keeping You on the Right Side of the Market - Thanks Economic Modern Family!

As we head into the Thanksgiving holiday here in the U.S., we cannot help but think how grateful we are in the midst of so much stress.

For starters, we are grateful to you - our folks who publish and post our daily, plus our readers, members, followers and...

READ MORE

MEMBERS ONLY

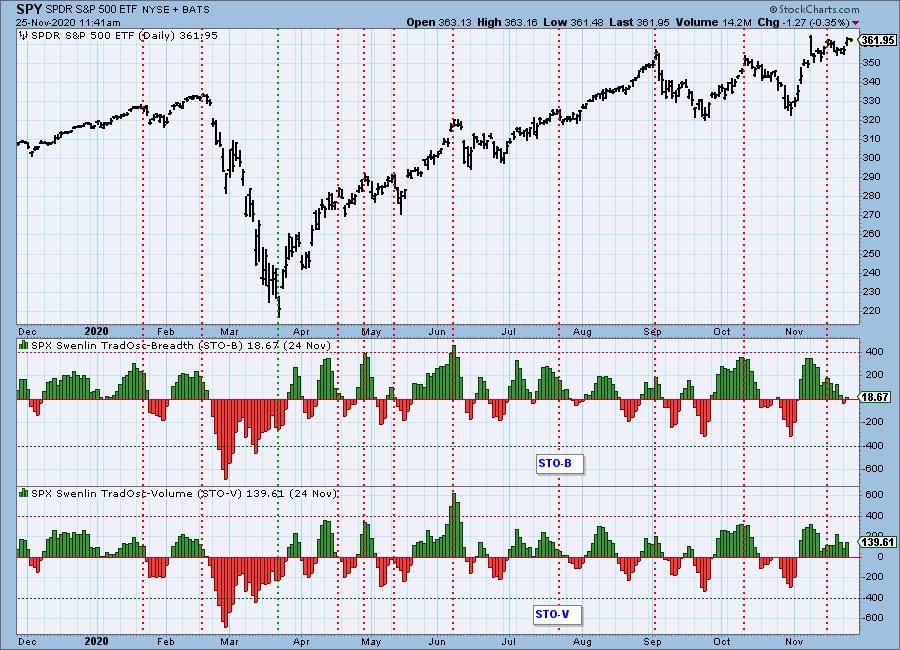

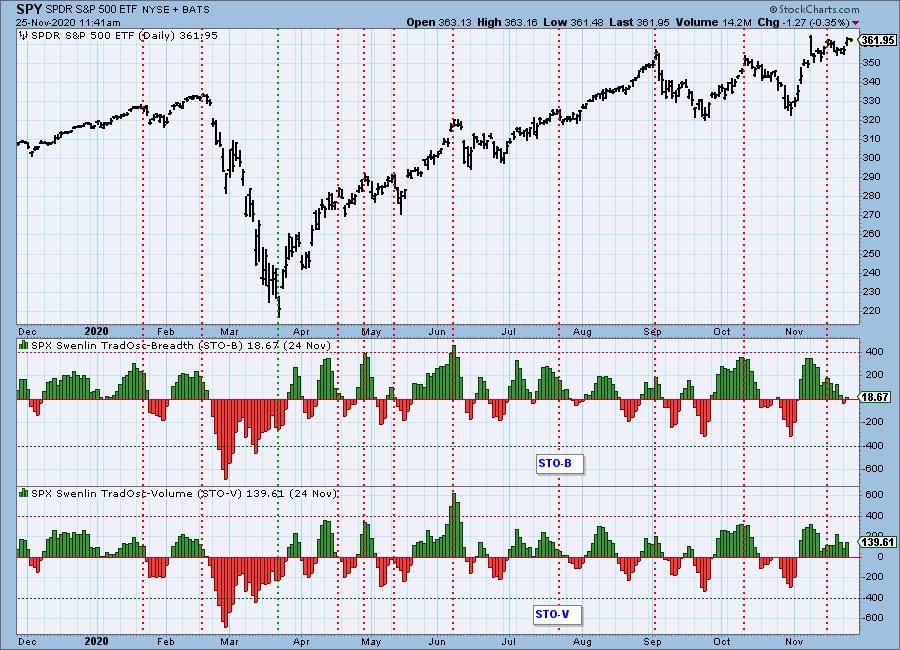

Assessing Market Bias

by Carl Swenlin,

President and Founder, DecisionPoint.com

We have all heard that "a rising tide raises all boats," and at DecisionPoint.com we have come to think of the direction of the market tide as being a bias that can benefit or work against our trading positions. As regular market participants, we may have a...

READ MORE

MEMBERS ONLY

Sector Spotlight: Equal Weight vs. Cap Weight Rotations

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of Sector Spotlight, I walk viewers through the current state of asset class and sector rotations. After that, I zoom in, using the Relative Rotation Graphs of Equal weight and Cap weighted sectors side by side in order to spot differences or anomalies that can help us...

READ MORE

MEMBERS ONLY

Who is Guarding the Market's Galaxy?

Since the pandemic, the market has risen on stimulus. Then, the market bulls turned to vaccine news and hopes for a quick and effective release. Most recently, the market has a new guardian - a transition team taking shape with the market's favorite dove Janet Yellen as Treasury...

READ MORE

MEMBERS ONLY

Financial Stocks Showing Strength on Relative Rotation Graph as Dow Hits 30k

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Financial sector has been picking up a lot of relative strength recently.

On the Relative Rotation Graph for US sectors (against SPY), XLF is on a rotation trail through the improving quadrant and closing in on a cross over into the leading quadrant. Where JdK RS-Momentum was slightly lower...

READ MORE

MEMBERS ONLY

DOW HITS 30,000 -- ENERGY AND FINANCIALS LEAD MARKET HIGHER -- BANK INDEX ACHIEVES BULLISH BREAKOUT -- SMALL CAPS SHOW NEW LEADERSHIP -- ANOTHER ENERGY ETF IS RISING

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW REACHES 30K... Chart 1 shows the Dow Industrials hitting 30,000 and setting a new record. The S&P 500 isn't far behind. Chart 2 shows the S&P 500 in a coiling pattern which also favors higher prices. The Nasdaq is lagging behind but...

READ MORE