MEMBERS ONLY

Typical Climax Aftermath

by Carl Swenlin,

President and Founder, DecisionPoint.com

At DecisionPoint.com we watch for what we call "climax days." These are days when large price moves are accompanied by spikes in New Highs or New Lows, Net Advances minus Declines, Net Advancing Volume minus Declining Volume, and SPX Total Volume.

There are two kinds of climaxes:...

READ MORE

MEMBERS ONLY

Forget about AAPL! What is Happening Under the Hood of Rotation Out of Technology?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The flow of money out of the Technology sector is clearly visible on the Relative Rotation Graph for US sectors, and it is an observation that has made by many market commentators recently. What I want to do in this article is look under the hood of the technology sector...

READ MORE

MEMBERS ONLY

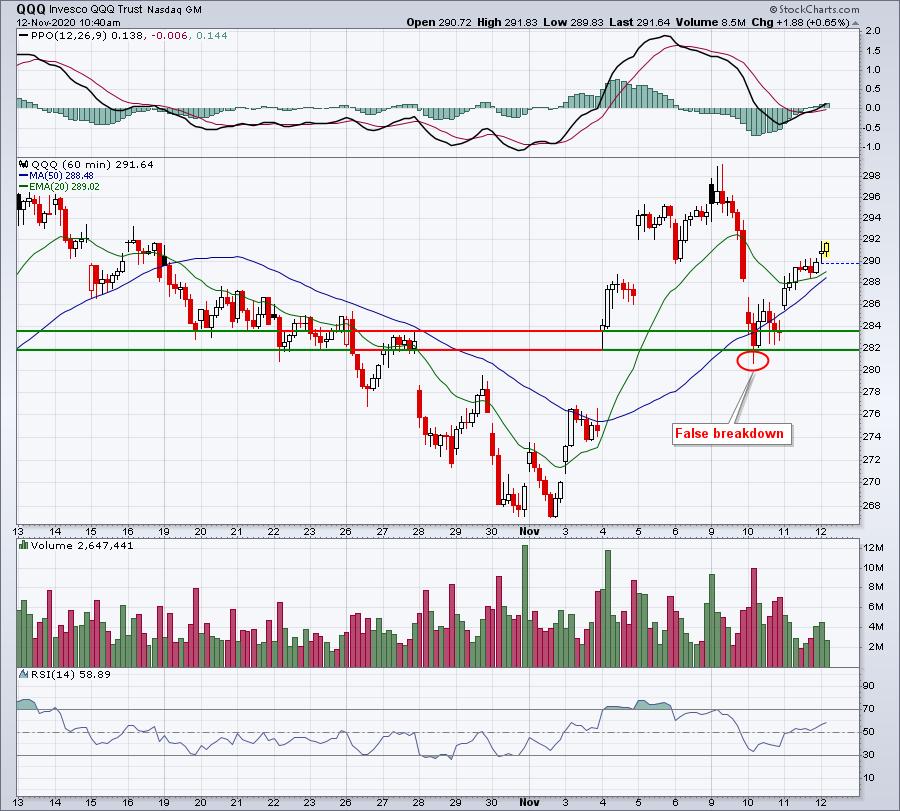

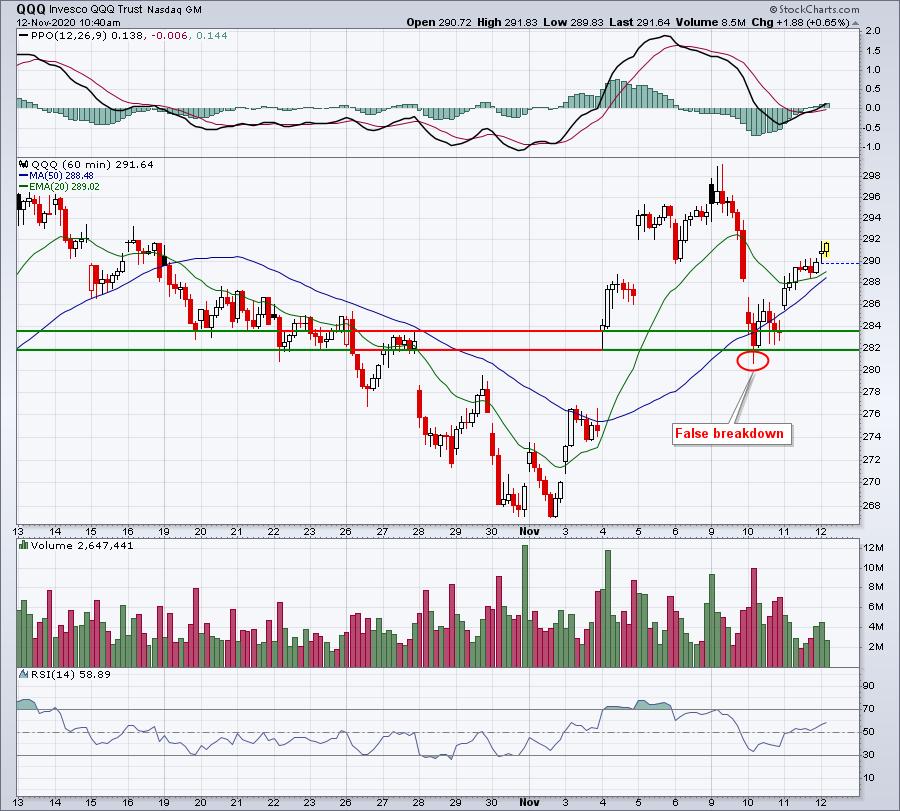

Is The NASDAQ 100 Trending Higher Again? Watch These Two Charts

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

We have seen tremendous leadership from the NASDAQ 100 ($NDX) throughout 2020 and the COVID-19 pandemic. Many growth-oriented component stocks have done exceptionally well as they've adjusted to this "stay-at-home" and "social distancing" environment. But is this a paradigm shift that continues into 2021?...

READ MORE

MEMBERS ONLY

Will Regional Banking Continue to Grow as the Market Holds?

Yesterday, we looked at the Economic Modern Family as either hiding or holding their ground.

Today's price action shows that, at least for now, we are holding, as the Russell 2000 (IWM), Transportation (IYT), Regional Banks (KRE), Biotech (IBB), and Semiconductors (SMH) are currently trading inside the range...

READ MORE

MEMBERS ONLY

Trading in a Word

by Dave Landry,

Founder, Sentive Trading, LLC

Trading all boils down to one word. "Accept" this and you're on your way to success. In this edition of Trading Simplified, Dave explains the notion of acceptance as it relates to trading on a neurological and psychological standpoint, and reiterates the key point of "...

READ MORE

MEMBERS ONLY

Confidence is Breaking Out all Over, Which is Bullish for Stocks/Commodities and Bond Yields

by Martin Pring,

President, Pring Research

Pfizer (PFE)'s announcement about a vaccine may have triggered a sharp rally on Monday, but its real effect was to boost confidence, which improved the status of a lot of different relationships that I follow, portending further gains for stocks and commodities down the road.

Swings in sentiment...

READ MORE

MEMBERS ONLY

Sector Spotlight: Sector Rotation After the Election

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of Sector Spotlight, I look at asset class and sector rotation after last week's elections and try to digest the impact for various sectors. I analyze both the daily and weekly RRGs and find that, for some sectors, the different timeframes send contradicting messages. After...

READ MORE

MEMBERS ONLY

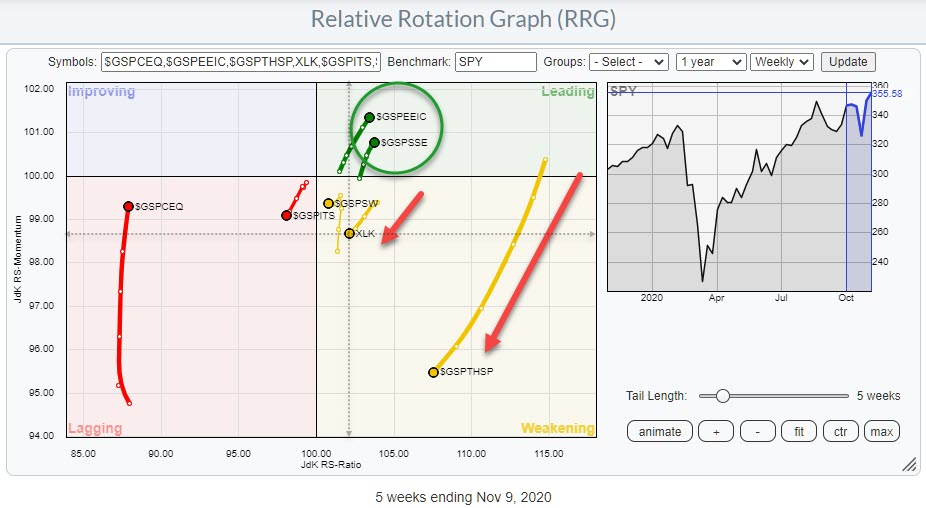

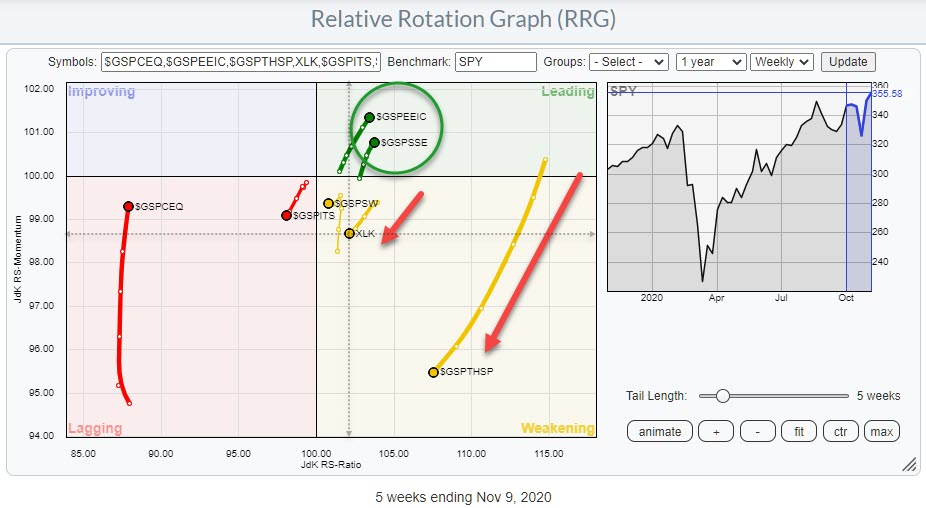

Sector Rotation Shows Money Flowing Out of Technology, Communications and Discretionary

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Relative Rotation Graph for US sectors shows an ongoing rotation out of the three strongest performers in 2020 so far.

Technology is inside the weakening quadrant, following a long rotation through leading, and has started to accelerate towards lagging. Consumer Discretionary is trailing slightly behind the rotation of XLK...

READ MORE

MEMBERS ONLY

ROTATION OUT OF GROWTH AND INTO VALUE STOCKS CONTINUES -- VALUE ISHARES SURGE TO EIGHT-MONTH HIGH WHILE GROWTH ISHARES BACK OFF

by John Murphy,

Chief Technical Analyst, StockCharts.com

ROTATION INTO VALUE CONTINUES... Yesterday's positive vaccine news contributed to a rotation into economically-sensitive value stocks at the expense of technology driven growth stocks. That rotation was accompanied by a jump in bond yields which touched an eight-month high. Signs of that rotation can be seen again today....

READ MORE

MEMBERS ONLY

DP TV: Big Rally, Big Bust

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

It was a climactic day, but does it have the gas to inspire a follow-up rally this week? In this episode of DecisionPoint, Carl looks at Gold and Gold Miners to see if today's damage will weigh heavy on the week. Carl also walks through the sectors and...

READ MORE

MEMBERS ONLY

Market Euphoria with a Touch of Reality

Today, the market gapped up as news of Pfizer (PFE)'s Covid vaccine being 90% effective was released.

Last week, we talked about the Economic Modern Family's uncertainty over the election and potential gridlock over a Republican senate. The uncertainty looks to have followed into Monday, as...

READ MORE

MEMBERS ONLY

POSITIVE VACCINE NEWS PUSHES STOCKS SHARPLY HIGHER -- BOND YIELDS SURGE AS WELL -- GOLD TUMBLES

by John Murphy,

Chief Technical Analyst, StockCharts.com

POSITIVE VACCINE NEWS CAUSES STOCKS TO SOAR...News of a vaccine with a 90% success rate caused stocks to soar today with the Dow and S&P 500 setting new records. The Nasdaq and so-called "stay at home" stocks are lagging behind or losing ground. Today'...

READ MORE

MEMBERS ONLY

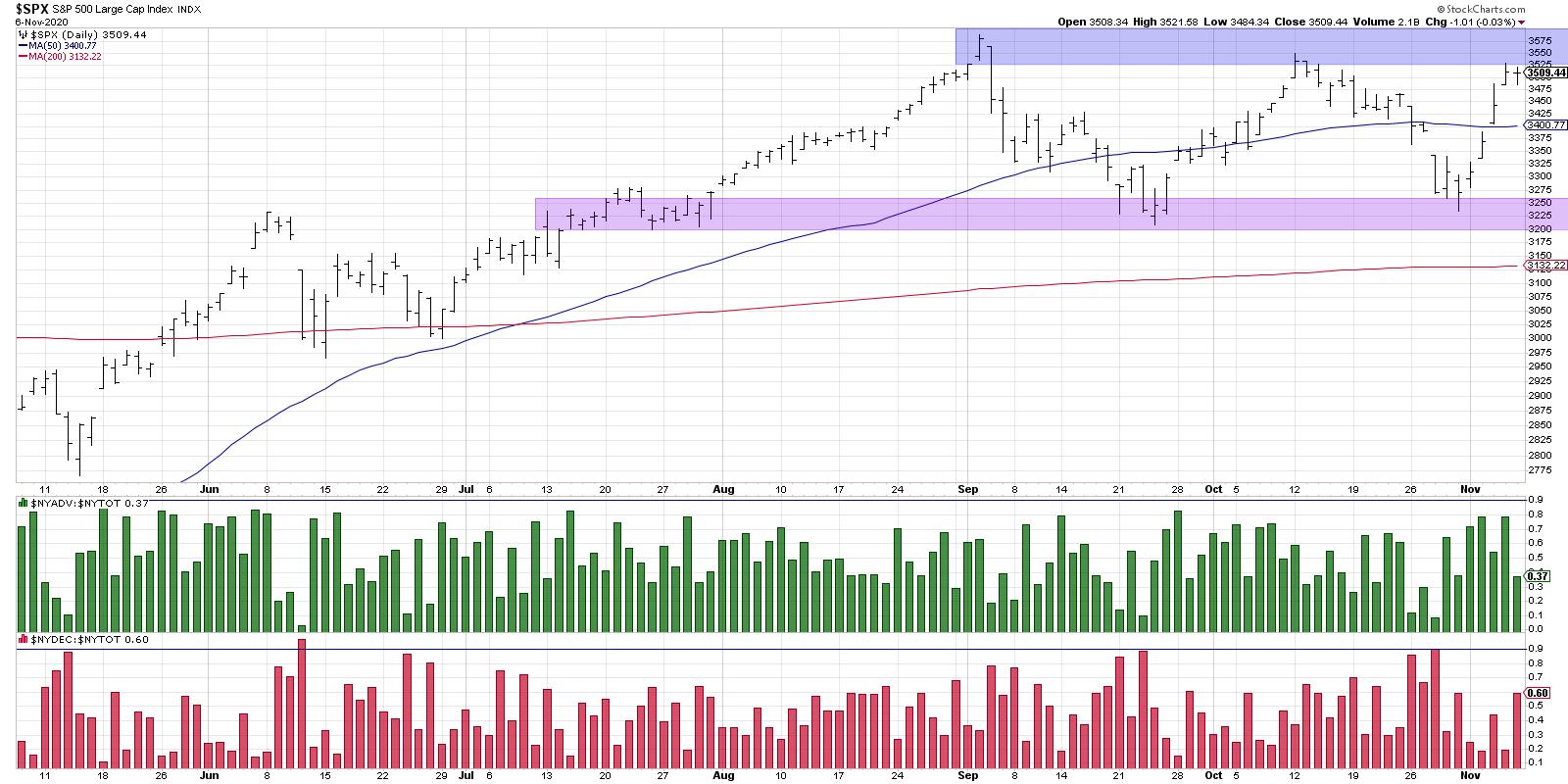

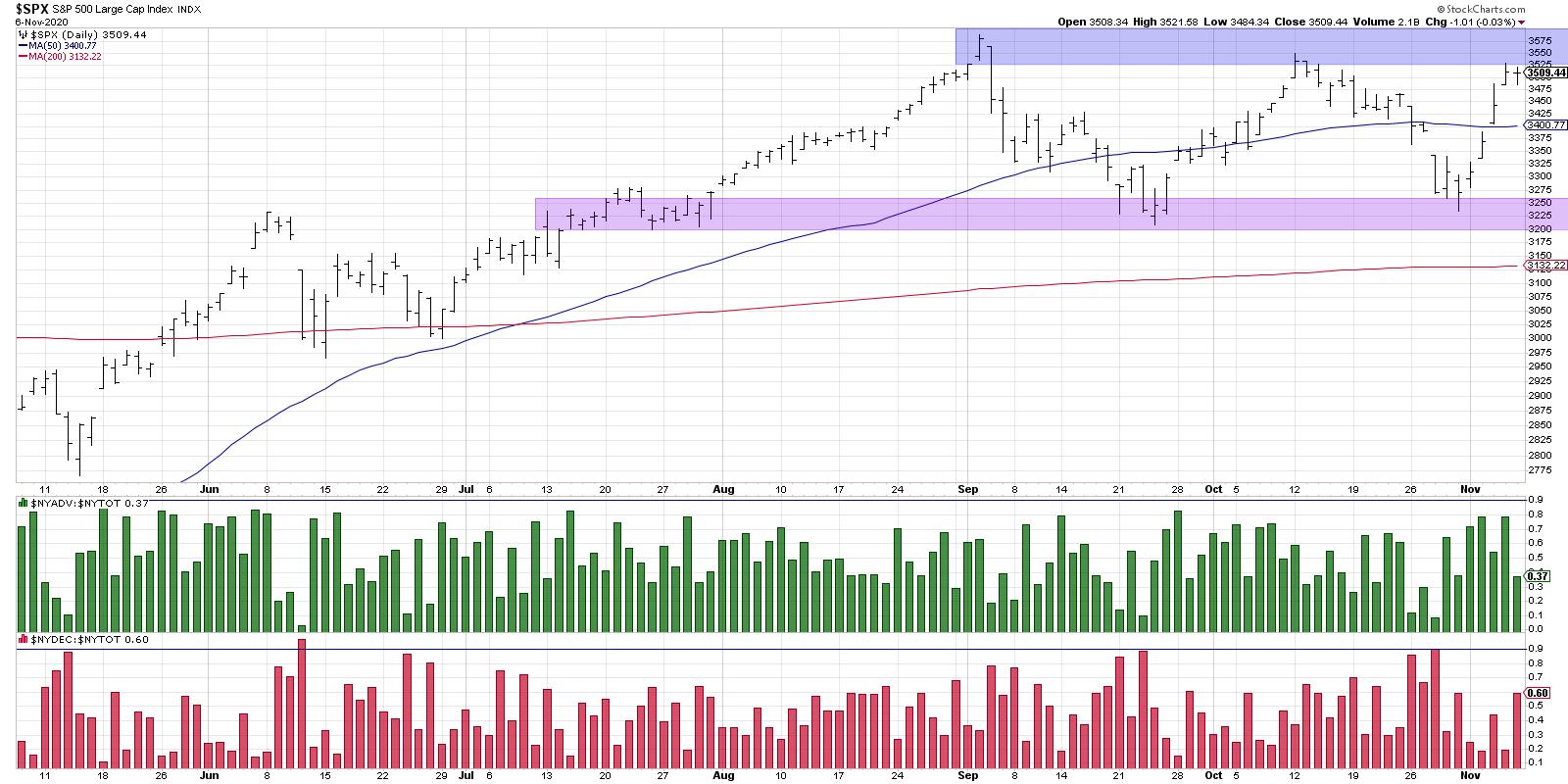

Improving New Highs Would Validate Further Upside

by David Keller,

President and Chief Strategist, Sierra Alpha Research

The S&P 500 wrapped a rather volatile week by settling in at the upper end of the 3200-3600 range. One key breadth indicator shows clear similarities to the bull run in early October, and also provides a prescription for bulls looking for validation of further upside.

*** This article...

READ MORE

MEMBERS ONLY

Two ETFs with Market Leading Charts and Fast Growing Industries

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

New highs and a fast growing industry group make for a powerful combination. Today's article and video (below) will focus on two ETFs that capture two fast growing industries, video gaming and esports. We will show why these two ETFs are leading, why a consolidation within an uptrend...

READ MORE

MEMBERS ONLY

Here Are The 39 Stocks In Our 4 Portfolios That Have Enabled Us To Crush The S&P 500 This Quarter

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Special Note

This is a weekly portfolio report that I send to our EarningsBeats.com members every Sunday. It's designed to provide a summary of our portfolio performance over the past week, highlighting the stocks that have led our portfolios higher (or lower). From our website, here'...

READ MORE

MEMBERS ONLY

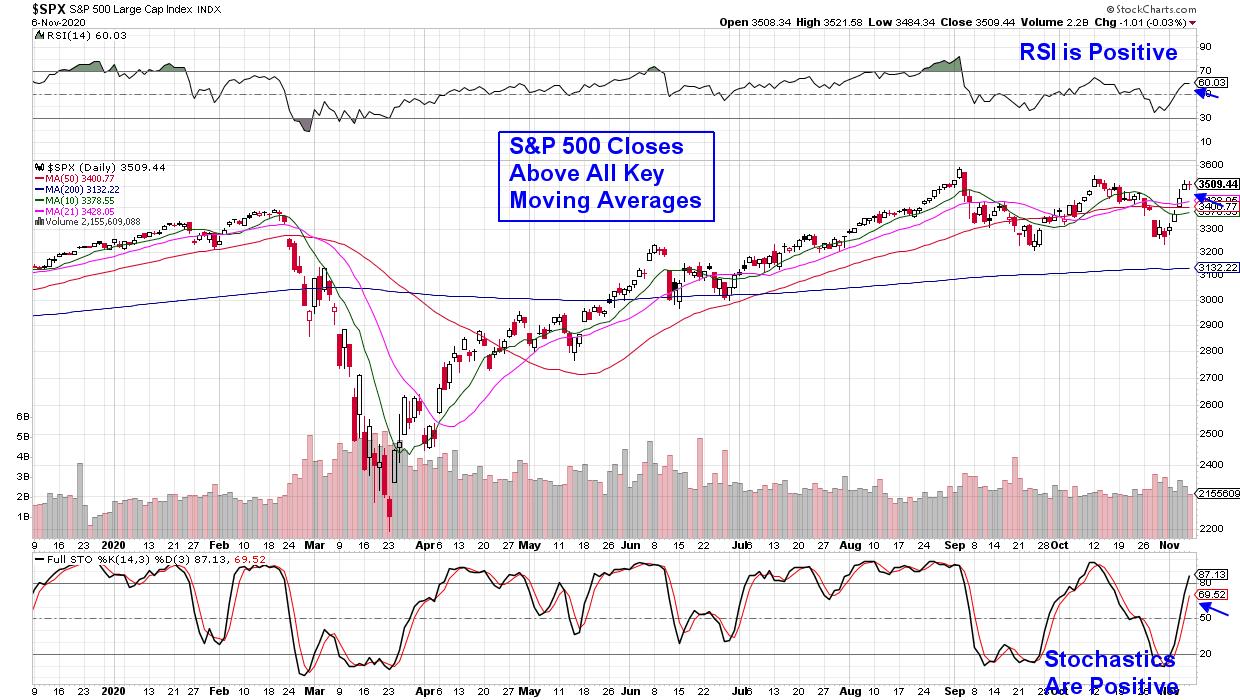

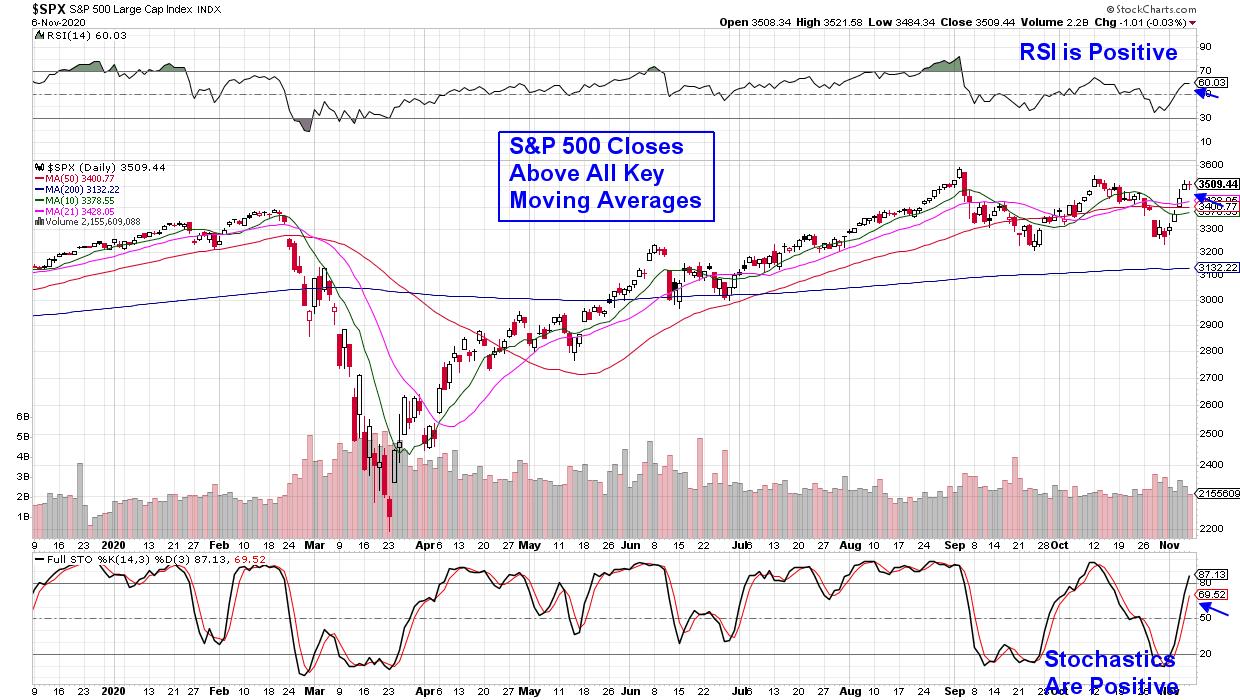

STOCKS HAD A STRONG WEEK WHILE THE DOLLAR DROPPED -- TECHNOLOGY AND HEALTHCARE WERE THE WEEK'S TOP GAINERS -- BUT ALL SECTORS GAINED GROUND

by John Murphy,

Chief Technical Analyst, StockCharts.com

GLOBAL STOCKS HAD A STRONG WEEK... Stocks had one of the strongest weeks in months as election results appear to be leaning in the direction of a more divided government. That might reduce chances for higher taxes and more regulations. Major stock indexes ended the week within striking distance of...

READ MORE

MEMBERS ONLY

Portfolios Break To New Record Highs; 4 Portfolio Stocks Likely To Remain For Next Quarter

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Portfolios Update

4 of our 5 portfolios - Model, Aggressive, Strong AD, and Model ETF - all exceeded their prior closing highs on Friday. The Strong AD Portfolio soared more than 18% last week, absolutely crushing the S&P 500. Here's a quick summary of our portfolios:...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Likely to Consolidate at Higher Levels; RRG Chart Point Towards These Sectoral Shifts

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In a week that saw wide-ranging moves and a rally that was fueled by US elections, the Indian equities went on to end on a strong note. The week's trading range not only wide that of 723 points, but the previous days also saw volatility declining to a...

READ MORE

MEMBERS ONLY

Emerging Markets Achieve Bullish Breakout

by John Murphy,

Chief Technical Analyst, StockCharts.com

The U.S. dollar continues to weaken against both developed and emerging market currencies. Chart 1 shows the Invesco Dollar Bullish Fund (UUP) nearing a test of its yearly low. A drop below that level would put the dollar at the lowest level since early 2018. One of the factors...

READ MORE

MEMBERS ONLY

Two Ways to Play the Current Bullish Uptrend

by Mary Ellen McGonagle,

President, MEM Investment Research

The markets posted their biggest weekly percentage gains since April as investors set their sights on a Biden win with a Republican-dominated U.S. Senate. This creates a gridlock in Washington and, as the CIO of Bank of America (BAC) puts it: "Gridlock = Goldilocks." A Republican-held Senate will...

READ MORE

MEMBERS ONLY

NEW! Streamline Your Charting Experience By Setting Your "Default" Charting Tool Across StockCharts

by Grayson Roze,

Chief Strategist, StockCharts.com

Well folks, we're all seeing stars this week.

And no, not because of that mind-bending +9.67% gain the Technology sector printed this week (although wowza, what a move). We're seeing stars because of a handy new site setting that just rolled out across StockCharts!

Now,...

READ MORE

MEMBERS ONLY

Bulls Need More New Highs

by David Keller,

President and Chief Strategist, Sierra Alpha Research

The S&P 500 wrapped a rather volatile week by settling in at the upper end of the 3200-3600 range. One key breadth indicator shows clear similarities to the bull run in early October, and also provides a prescription for bulls looking for validation of further upside.

Breadth equals...

READ MORE

MEMBERS ONLY

Did We Already See "The Dip" or Is There Risk Ahead?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Every first Tuesday of the month in Sector Spotlight, I go over the completed monthly charts for the prior month.

Sometime mid-2019, when there was a lot of discussion on the yield curve being inverted, I started to include a long-term chart of the yield-curve in my monthly overviews. And,...

READ MORE

MEMBERS ONLY

Preparing for the Next Leg Up!

by Mary Ellen McGonagle,

President, MEM Investment Research

Mary Ellen shares the best areas to put new money to work in this episode of StockCharts TV'sThe MEM Edge. She also reviews bullish stocks poised to trade higher after posting strong earnings with base breakouts, as well as stocks that gapped up and signals that will alert...

READ MORE

MEMBERS ONLY

Does the Economic Modern Family Stand Divided?

The Economic Modern Family is holding onto the uncertainty of the election, with potential gridlock if Biden is elected and the Senate majority stays republican. As such, certain sectors of the modern family did very well, while others not so much.

Anticipating that taxes will not increase and interest rates...

READ MORE

MEMBERS ONLY

EMERGING MARKETS ACHIEVE BULLISH BREAKOUT -- THEY'RE GETTING A LOT OF HELP FROM A WEAKER DOLLAR

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOLLAR NEARS YEARLY LOW... The U.S. dollar continues to weaken against both developed and emerging market currencies. Chart 1 shows the Invesco Dollar Bullish Fund (UUP) nearing a test of its yearly low. A drop below that level would put the dollar at the lowest level since early 2018....

READ MORE

MEMBERS ONLY

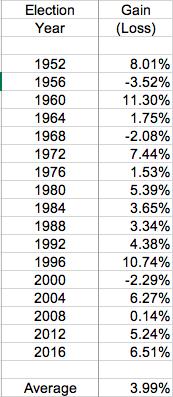

Here's My Strategic Approach to Outperforming the S&P 500 - It Works in Any Market

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

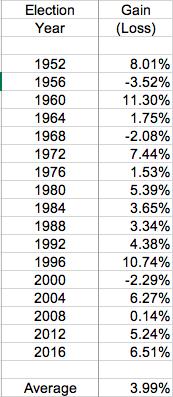

Let me preface my article by saying that I'm very bullish. I mean, like, extremely bullish. No, really, I'm talking CRAZY bullish. Historically, we've just entered a period, October 27th close through January 18th close, where the S&P 500 has gained ground...

READ MORE

MEMBERS ONLY

This Energy Stock Has Started to Improve!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Last Tuesday 11/3, Election Day, I joined Dave Keller on The Final Bar. Most likely because all potential US-based guests were busy doing something else ;)

Dave and I talked about the Stock/Bond rotation going into the elections and how that lined up with the 2016 elections. We also...

READ MORE

MEMBERS ONLY

Chartwise Women: Best Candidates for Market Reversal

by Mary Ellen McGonagle,

President, MEM Investment Research

by Erin Swenlin,

Vice President, DecisionPoint.com

In this week's edition of Chartwise Women, Mary Ellen and Erin reveal their top picks following last week's sharp pullback. They also outline signals that will tell you if your stock is poised to trade much higher. Top pet-related stocks are discussed after they shared news...

READ MORE

MEMBERS ONLY

WEAKER DOLLAR AND LOWER YIELDS BOOST GOLD AND ITS MINERS -- NEWMONT HAS ALREADY TURNED UP -- WEAKER DOLLAR MAY ALSO BE BOOSTING MATERIALS STOCKS

by John Murphy,

Chief Technical Analyst, StockCharts.com

GOLD ASSETS TURN UP... While global stocks are having another strong day, precious metals are starting to perk up as well. Chart 1 shows the Gold SPDR (GLD) jumping today to the highest level in nearly two months. Gold has been in a downside correction since early August, but remains...

READ MORE

MEMBERS ONLY

Stop Guessing and Start Assessing

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

As of this writing, Tuesday's Presidential Election is still undecided, but one thing that seems abundantly clear to us, and should to you as well, is that people are not good at forecasting, predicting, or guessing reliably about the future. This clearly applies to politics, but also to...

READ MORE

MEMBERS ONLY

Earnings And The Fed: They Drive The Market, Not The Virus

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

When valuing a company, the two key variables are earnings (and earnings growth) and interest rates. I believe we're in a secular bull market because earnings growth is expanding, along with our economy, and the Fed has said historically-low interest rates will remain that way at least into...

READ MORE

MEMBERS ONLY

Chinese ETFs Break to the Upside

by Martin Pring,

President, Pring Research

They say that the Chinese economy has emerged from the pandemic quicker than the rest of the world. Recent action by Chinese ETFs certainly underscores such a possibility, as many have broken out from multi-week consolidation patterns. I last wrote about Chinese ETFs back in July,when we considered a...

READ MORE

MEMBERS ONLY

Are Media Companies the Real Winners of This Election?

Media companies stand to gain a large amount of income from this election, as both candidates have spent over $90 million in ads and that is just on Facebook (FB) alone.

Since 2018, Facebook has brought in more than $2.2 billion from political advertising. TV ads run in support...

READ MORE

MEMBERS ONLY

DROP IN BOND YIELDS MAY BE BOOSTING TECHNOLOGY SHARES

by John Murphy,

Chief Technical Analyst, StockCharts.com

DROP IN BOND YIELDS CASTS DOUBT ON STIMULUS SPENDING...After rising over the last two months, bond yields fell sharply today. The 10-Year Treasury yield on Tuesday reached the highest level since early June on expectations for more stimulus spending and the resulting need to finance that spending by selling...

READ MORE

MEMBERS ONLY

What You Need to Know Now

by Dave Landry,

Founder, Sentive Trading, LLC

In this edition of Trading Simplified, Dave continues to show his methodology in action, with a focus on positioning for greatness - creating "free" positions with longer-term potential. He then discusses signals that you need to be watching in the overall market both now and in the future....

READ MORE

MEMBERS ONLY

TECH-DRIVEN NASDAQ MARKET LEADS STRONG STOCK RALLY -- HEALTHCARE SPDR HITS NEW RECORD -- SO DO HEALTH INSURERS

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCKS HAVE ANOTHER STRONG DAY... Major stock indexes are trading sharply higher as we await the results of the presidential election. Increased expectations for a divided government may be helping fuel today's strong stock reaction. The three charts below show the three major stock indexes rising above their...

READ MORE

MEMBERS ONLY

Sector Spotlight: Yield Curve Steepening Accelerates

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of Sector Spotlight, as it is the first Tuesday of the new month, I take a look at the monthly charts for asset classes and US sectors. Most of the (strong) monthly trends are still intact. The long-term chart of the 10-2 yield curve, in combination with...

READ MORE

MEMBERS ONLY

Monthly Charts, Bars or Lines?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On the first Tuesday of every month, I have a segment in Sector Spotlight in which I look at the completed monthly charts for the previous month. It forces me to sit down and look at the market from a longer-term perspective and make up my mind about trends that...

READ MORE

MEMBERS ONLY

STOCKS HAVING A STRONG ELECTION DAY -- ALL SECTORS ARE IN THE BLACK -- BANKS AND FINANCIALS LEAD ON HIGHER TREASURY YIELDS

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCK INDEXES ARE HAVING A STRONG ELECTION DAY... Stocks are rallying for the second day in a row after finding support near their September lows. Chart 1 shows the Dow Industrials bouncing impressively off their 200-day moving average. Chart 2 shows the S&P 500 also rallying for the...

READ MORE