MEMBERS ONLY

How Does A SCTR Score Go From 50 To 95 In A Month? Here's The Only Company To Do It

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

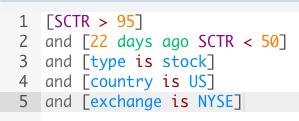

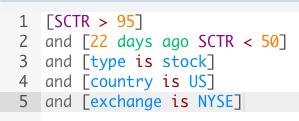

I ran a very simple scan, searching for companies that have been able to make the almost impossible jump in SCTR score from less than 50 to greater than 95 in just one month (22 trading days). Here's the scan I ran:

There were 2 results:

Eaton Vance...

READ MORE

MEMBERS ONLY

Trying to Outperform the S&P 500? You Gotta Pick the Right TEAM

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

There's not much I'd rather see than a heavy volume breakout in a consolidating stock within a strong industry. Enter Atlassian Corp (TEAM). Some traders let their guard down when a stock consolidates, and it's easy to do because consolidation normally leads to relative...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY to Stay Largely Rangebound; RRG Charts Show No Improvement in This Group

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The market action in this week fared precisely on the anticipated lines. In the previous weekly outlook, we had mentioned the markets were firmly placed but, at the same time, staying overstretched on the short-term charts. It was also mentioned that any up moves will face stiff resistance at higher...

READ MORE

MEMBERS ONLY

Don't Look Now, But We're Seeing a New Leading Industry Group Emerging

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Those who follow me know that I'm constantly monitoring the current leaders and watching for new leadership. It's one piece of technical analysis that helps in selecting our portfolio stocks. The best way to beat the benchmark S&P 500 is to follow the strength...

READ MORE

MEMBERS ONLY

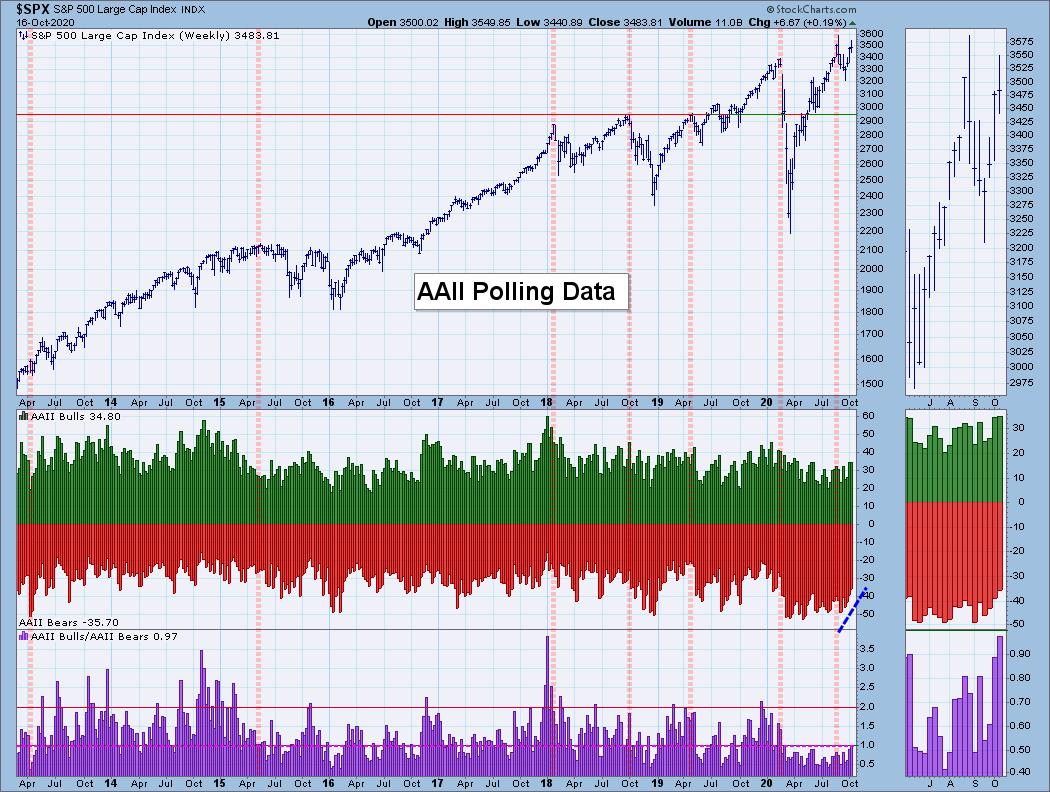

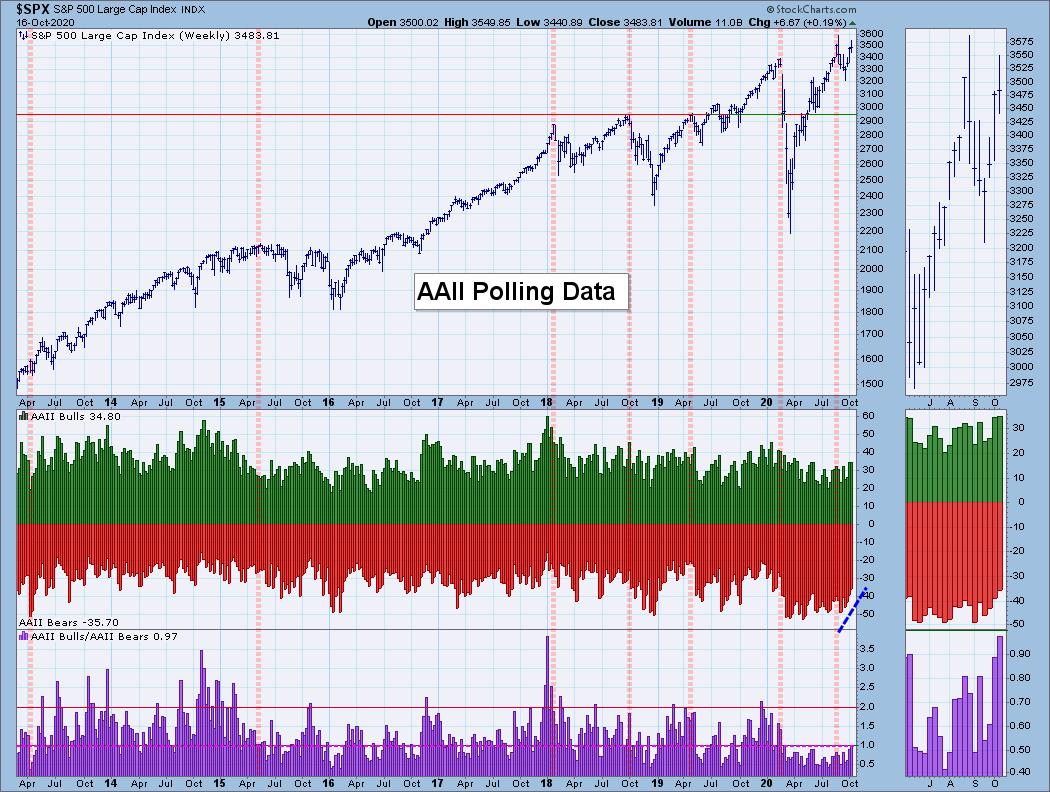

Are Market Participants Really Bearish Right Now? Nope

by Erin Swenlin,

Vice President, DecisionPoint.com

I have heard rumblings of market participants beginning to "feel" bearish about the market as it pulled back this past week. That information can not only be gleaned from business news channels, but can also be pulled from polling data. Below is the American Association of Individual Investors&...

READ MORE

MEMBERS ONLY

Healthcare Providers Lead XLV Higher

by John Murphy,

Chief Technical Analyst, StockCharts.com

Healthcare stocks are leading the market higher for a change. The daily bars in Chart 1 show the Health Care SPDR (XLV) nearing a test of its recent highs after finding support near its 50-day moving average. The solid line overlaid on the chart plots a relative strength ratio for...

READ MORE

MEMBERS ONLY

Where is Current Market Leadership?

by Mary Ellen McGonagle,

President, MEM Investment Research

Strength abounds! In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews where the strength is in the markets and what to look for going forward. She also highlights the explosive moves in Small-Cap stocks and what signals point to further upside in select names. Finally, she...

READ MORE

MEMBERS ONLY

Who Rocks? The Economic Modern Family - That's Who!

In spite of no passing stimulus, mixed economic data, rising COVID cases and a wild pre-election season, for the first time since we can remember, the Economic Family is brushing off most of the negativity.

For years, we would report on the health of the family with words like "...

READ MORE

MEMBERS ONLY

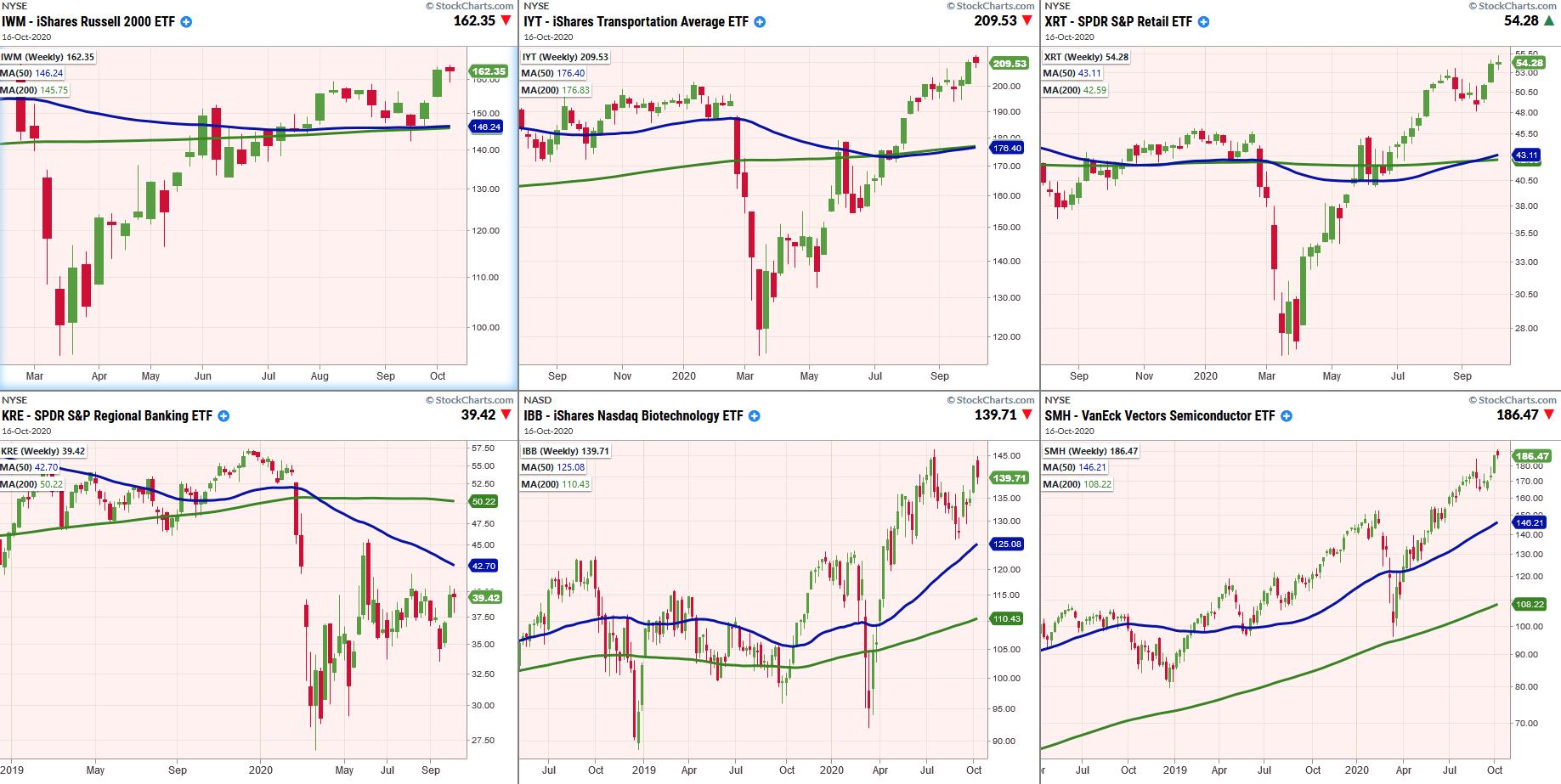

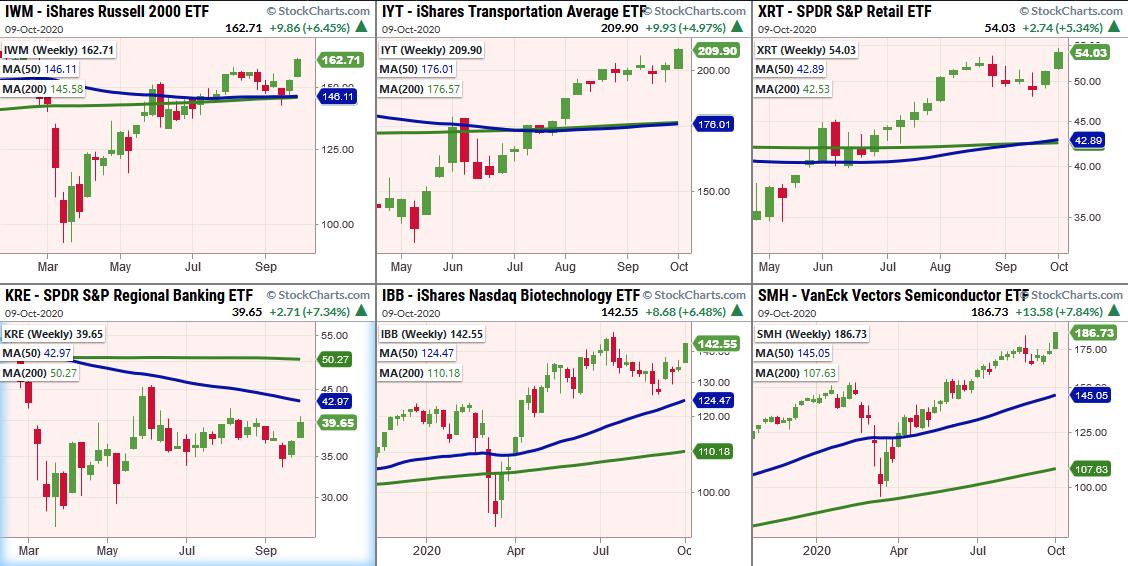

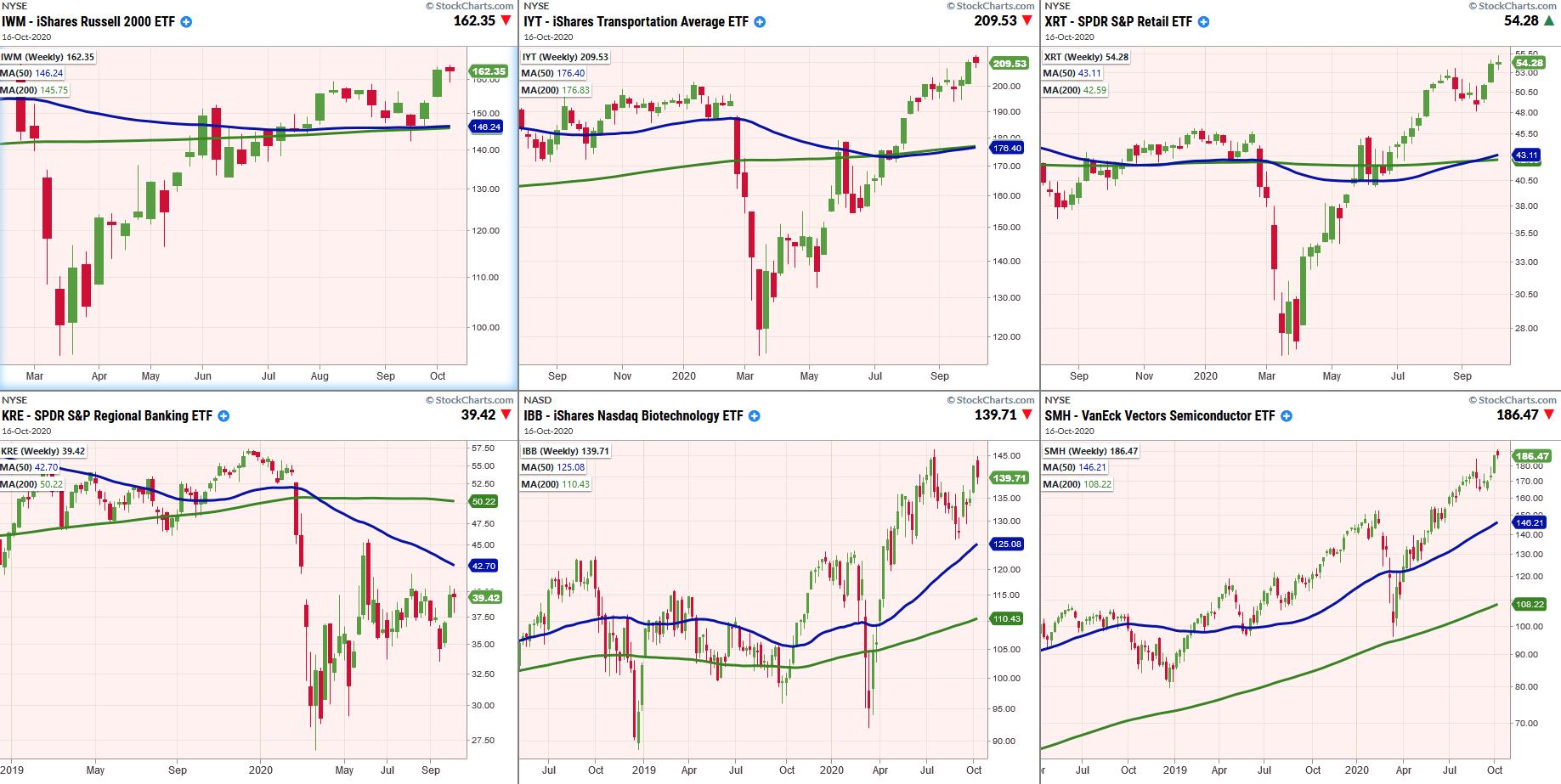

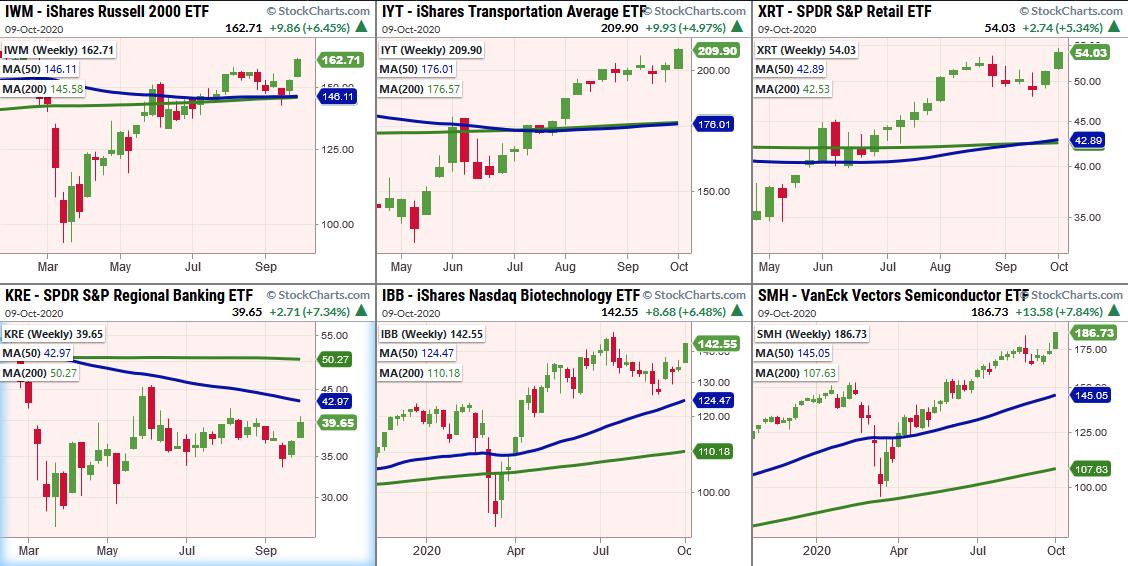

Small-Caps Take the Lead: Can They Hold It?

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Russell 2000 ETF (IWM) rose from the ashes in late September and surged above its summer highs with a double-digit advance. This is quite amazing considering that IWM closed below its 200-day SMA on 24-Sept and was seriously lagging less than a month ago. IWM is leading over the...

READ MORE

MEMBERS ONLY

HEALTHCARE PROVIDERS LEAD XLV HIGHER -- MOLINA, HUMANA, AND UNITEDHEALTH HIT NEW RECORDS -- ANTHEM MAY BE NEXT

by John Murphy,

Chief Technical Analyst, StockCharts.com

HEALTH CARE SPDR IS STARTING TO SHOW SOME LEADERSHIP... Healthcare stocks are leading the market higher for a change. The daily bars in Chart 1 show the Health Care SPDR (XLV) nearing a test of its recent highs after finding support near its 50-day moving average. The solid line overlaid...

READ MORE

MEMBERS ONLY

Chartwise Women: Sentiment - Harnessing Market Fear

by Mary Ellen McGonagle,

President, MEM Investment Research

by Erin Swenlin,

Vice President, DecisionPoint.com

"How do you feel about that?" In this week's edition of Chartwise Women, Erin and Mary Ellen talk about sentiment and its uncanny ability to mark reversal points. Going beyond merely a definition, Mary Ellen walks us through sentiment prior to presidential election of 2016. Erin...

READ MORE

MEMBERS ONLY

MARKET BREADTH SHOWS IMPROVEMENT -- BANKS CONTINUE TO HOLD FINANCIALS BACK -- WHILE ASSET MANAGERS HAVE TURNED UP -- INCLUDING BLACKROCK, T. ROWE PRICE, AND INVESCO

by John Murphy,

Chief Technical Analyst, StockCharts.com

% OF STOCKS ABOVE MOVING AVERAGES GAIN... Various measures of market breadth have improved over the last month. Chart 1 shows the S&P 500 percent of stocks above their 50-day moving average rising from an oversold low of 25% during September to 78% this week. That's a...

READ MORE

MEMBERS ONLY

When Will the Financial Sector Stop Riding the Bear?

The banking sector has been put through the ringer since the March selloff. While the market has rallied since then, KRE (Regional Bank ETF) still looks in need of help.

One thing to note is that JPMorgan and Goldman Sachs reported Q3 earnings stronger than expectations. While JPM and GS...

READ MORE

MEMBERS ONLY

More Ways to Time the Markets

by Dave Landry,

Founder, Sentive Trading, LLC

It's Dave's 50th episode! In this edition of Trading Simplified, Dave discusses his experiences in following trends and fighting them. He also continues discussions that were brought up on his prior show. Watch to see some mystery charts, more statistics talk and a look at defining...

READ MORE

MEMBERS ONLY

Auto Strength Resuming, These Two Leaders Breaking Out

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

At EarningsBeats.com, we like to line our portfolios with leaders, and I believe the following chart of autos ($DJUSAU) qualifies as leadership:

We're seeing weakness today in our major indices, but not in autos. Two leaders in this space currently reside in our portfolios and are helping...

READ MORE

MEMBERS ONLY

Evaluating The Likelihood Of An Earnings Beat, PLUS One Company That's Benefiting From The Pandemic

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

If there's one thing we do really well at EarningsBeats.com, it's evaluate earnings reports and the stock market's reaction to them. I'd even take it one step further. I believe we anticipate upcoming earnings very well. There's a lot...

READ MORE

MEMBERS ONLY

The Key to Your Success

I have been trading for many years. However, since I began working with MarketGauge, I have become a much better trader. The major reason, besides the awesome teachers (Mish, Keith, Geoff and James) is that they have taught me to think in terms of a rule-based trading system.

In today&...

READ MORE

MEMBERS ONLY

Sector Spotlight: RRG L/S Basket Update

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of Sector Spotlight, I cover rotational developments over the last two weeks for asset classes and sectors. After that, I take a look at the current positions in the Long/Short basket, which is up well over 10% since March.

This video was originally broadcast on October...

READ MORE

MEMBERS ONLY

Be VERY Careful If You're Trading Peloton (PTON)

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Listen, I'm a big fan of PTON. It was one of my 5 stock picks from StockCharts TV's "The Pitch", which aired on April 1st of this year. It traded at near 27 at the time. Yesterday, PTON closed above 127. That's...

READ MORE

MEMBERS ONLY

TREASURY ETF TESTS 200-DAY AVERAGE -- CORPORATE BONDS ARE HOLDING UP BETTER -- HIGH YIELD BOND ETF HITS NEW HIGH

by John Murphy,

Chief Technical Analyst, StockCharts.com

20+ YEAR TREASURY ISHARES TEST 200-DAY AVERAGE... The recent rise in Treasury bond yields has pushed bond prices lower. And especially bonds with longer maturities. Chart 1 shows the 20+Year Treasury Bond ETF (TLT) falling to the lowest level since June. More importantly, the TLT is bouncing today after...

READ MORE

MEMBERS ONLY

DP Show: 2020 Q2 Earnings Revealed!

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

The market has been running higher and higher and, in this episode of DecisionPoint, Carl and Erin break down the implications of the current vertical rally in technology and the accelerated rising trend for the SPX. Swenlin Trading Oscillators (STOs) could be revealing important information regarding the stamina of the...

READ MORE

MEMBERS ONLY

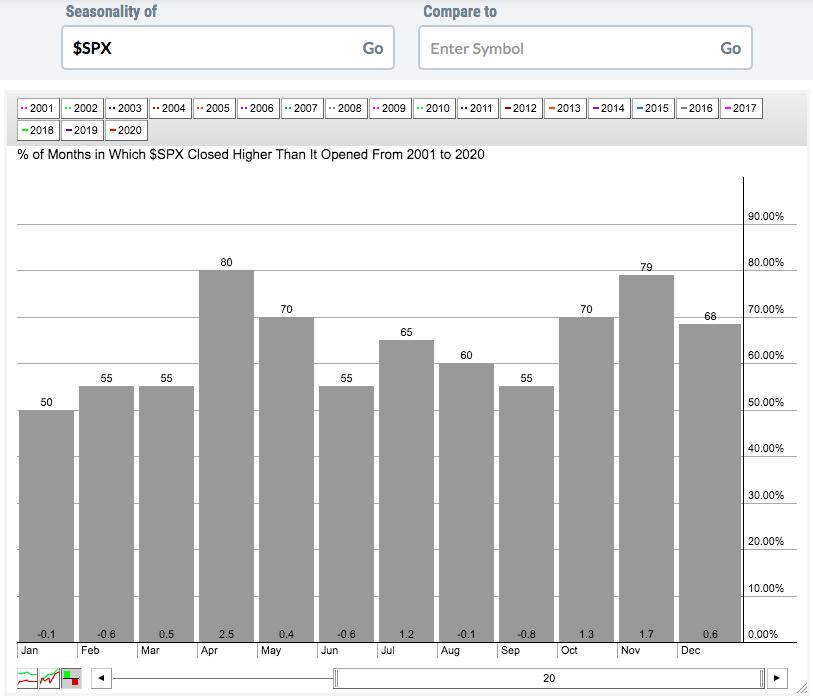

The Market Runs Rich

The market begins to show some overexuberance as we head into earning season and the election date closes in.

Amazon (AMZN)'s Prime Day and an Apple (AAPL) event are scheduled this week, with other companies, like Target (TGT) and Walmart (WMT) joining in with their own sale events...

READ MORE

MEMBERS ONLY

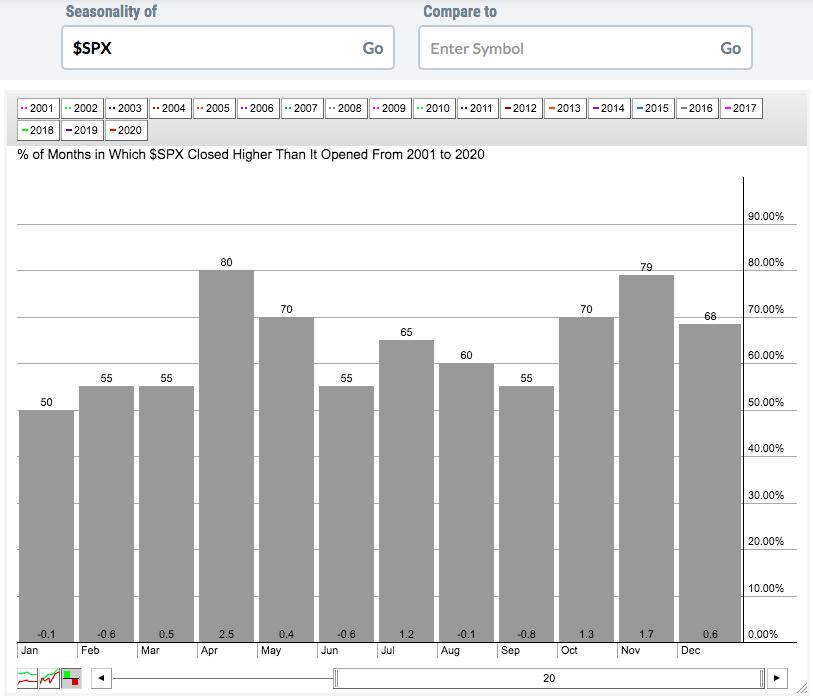

Short-Term Indicators Argue for an Extension to the Recent Rally

by Martin Pring,

President, Pring Research

Last week, I pointed out that the long-term KST for the ratio between stocks and bonds was close to a buy signal, and that all such signals in the last 30-years had been followed by substantial advances in equity prices (Chart 1). We still don't have a signal...

READ MORE

MEMBERS ONLY

S&P 500 Earnings 2020 Q2: Market Still Extremely Overvalued

by Carl Swenlin,

President and Founder, DecisionPoint.com

As a new earnings season begins, let's look at the finalized results of the last earnings period. The S&P 500 earnings results for 2020 Q2, based upon GAAP earnings (Generally Accepted Accounting Principals), show that the S&P 500 is, as usual, far above the...

READ MORE

MEMBERS ONLY

Finding The Right ETFs To Manage Risk And Beat The S&P 500

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Starting today at 4:30pm ET, EarningsBeats.com is excited to unveil a Sneak Preview of its latest product, the Model ETF Portfolio. The concept is rather simple. We plan to do the research to provide our members with a Strong ETF ChartList, highlighting the best performing ETFs from a...

READ MORE

MEMBERS ONLY

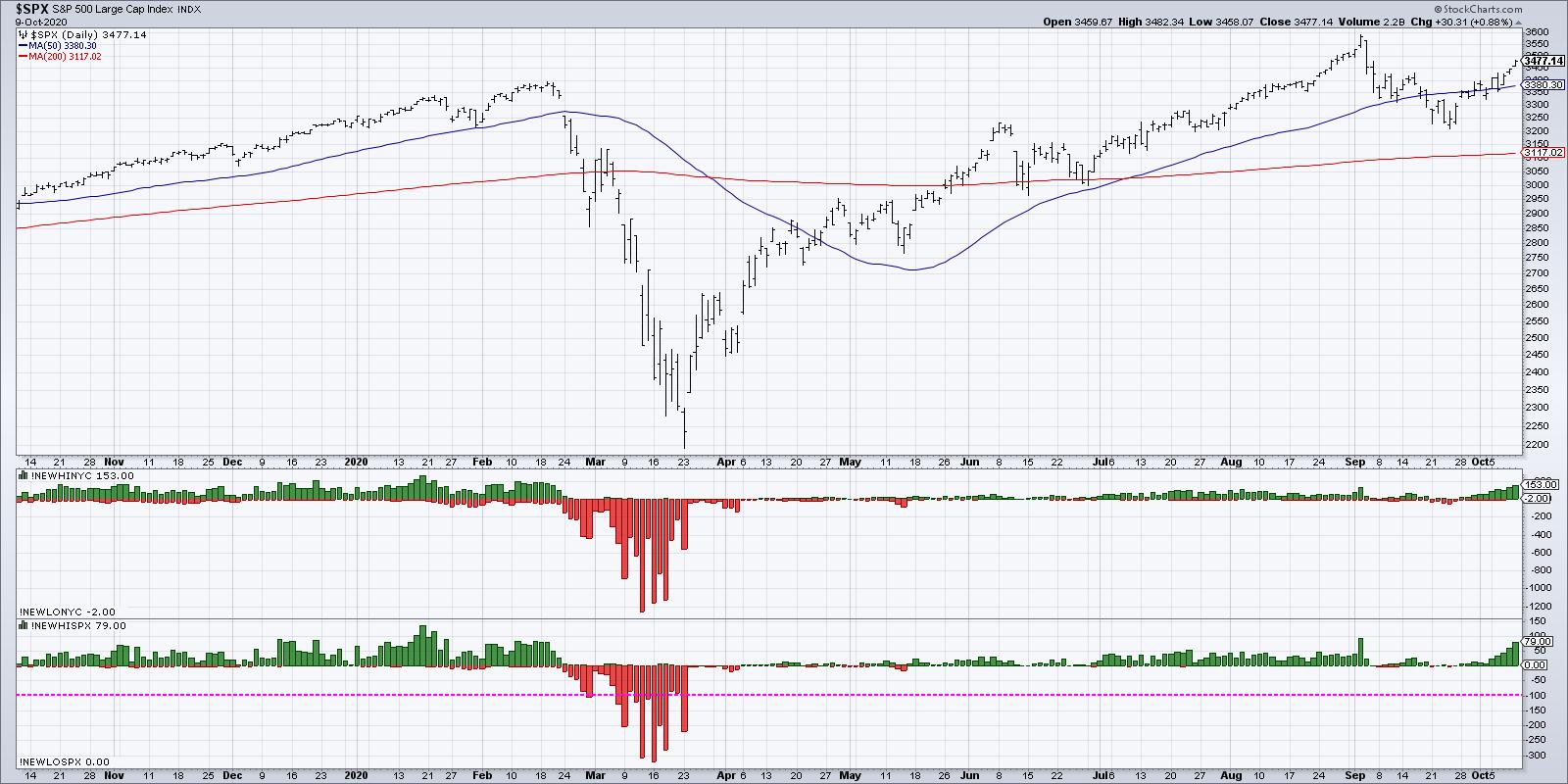

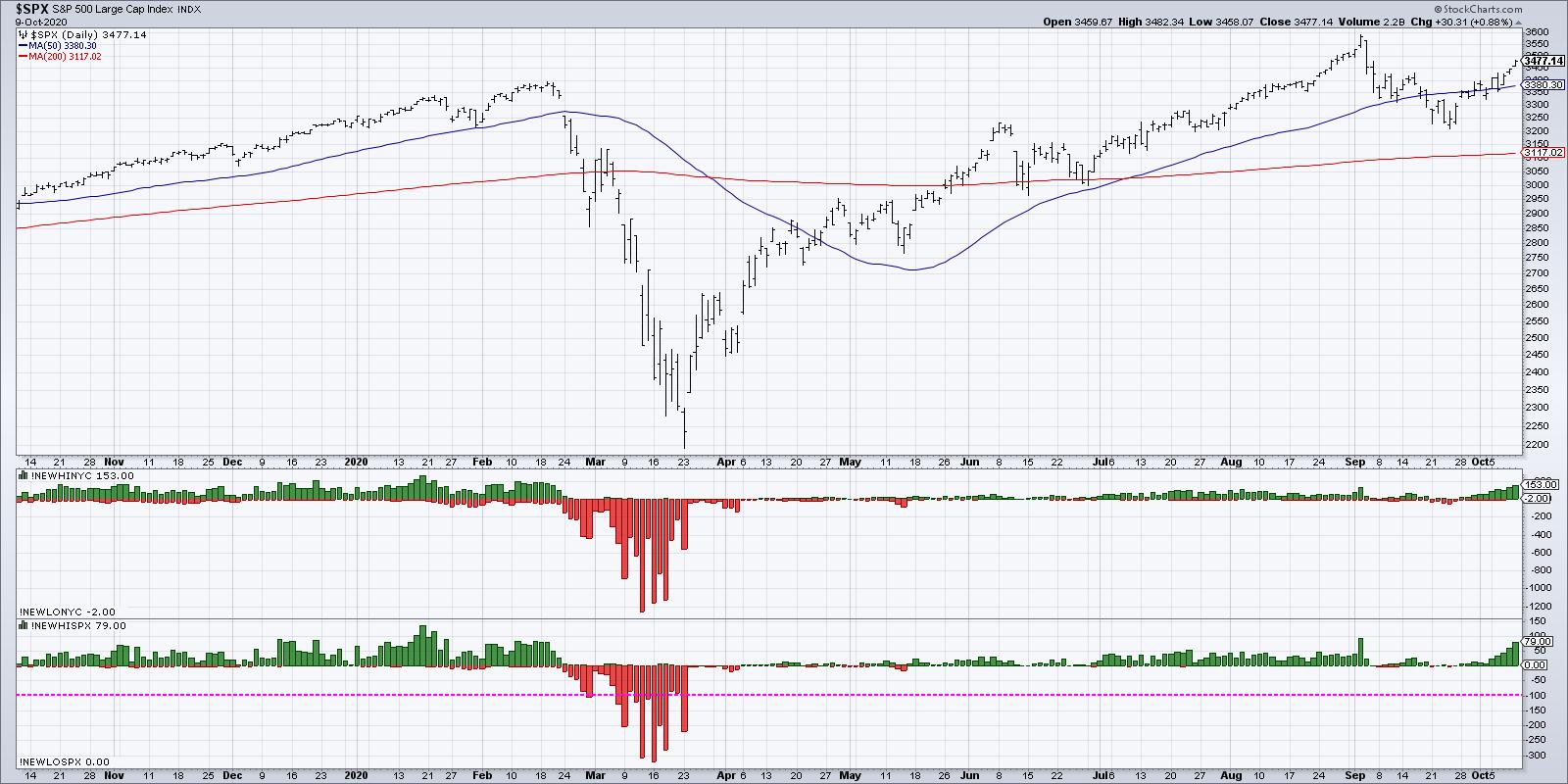

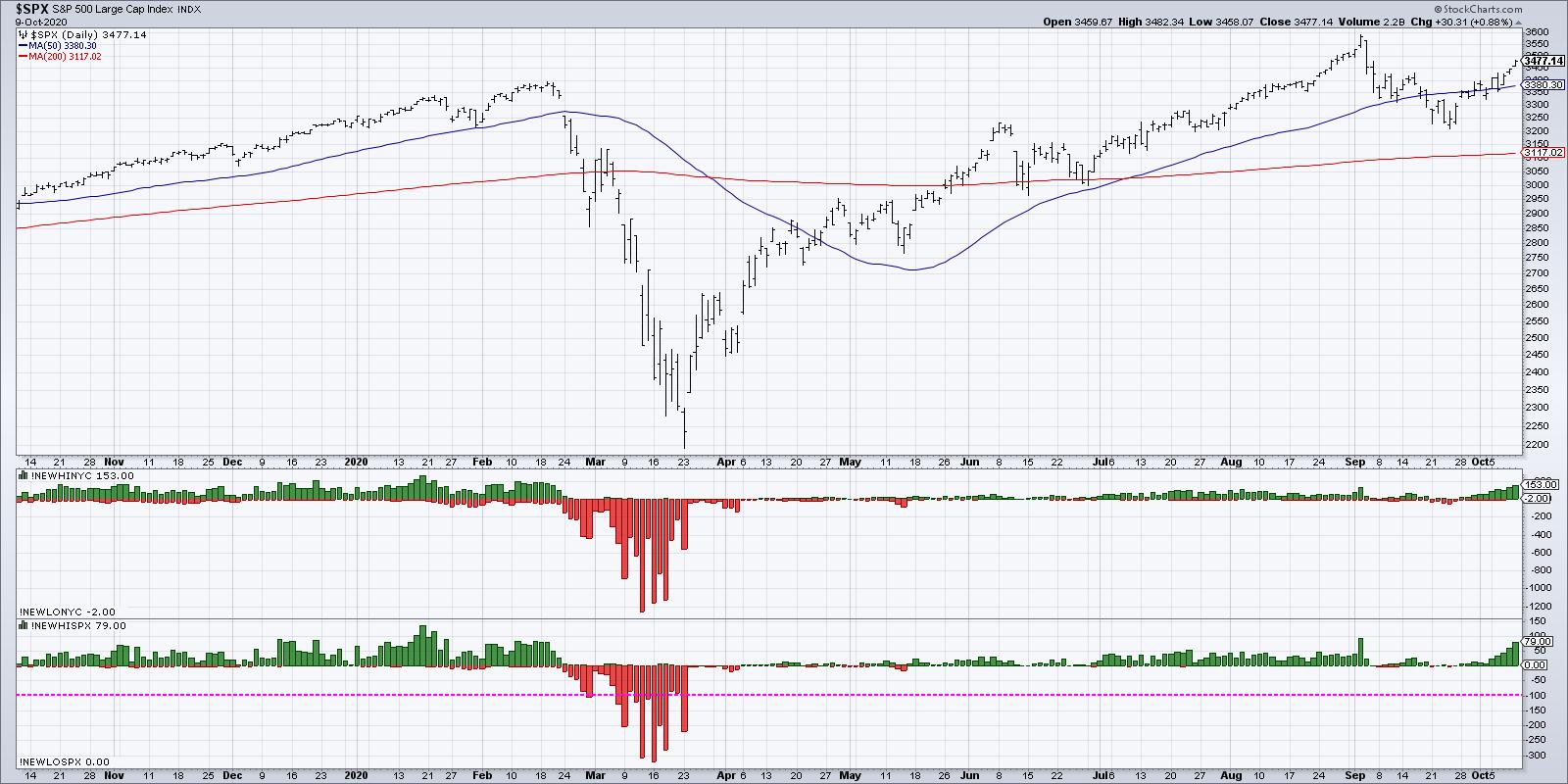

Expanding New Highs are Bullish

by David Keller,

President and Chief Strategist, Sierra Alpha Research

I would currently describe myself as a "cautious bull," in that I recognize that the market is trending higher, I'm prepared to follow that trend as long as it continues, and I'm always looking for some signs of potential weakness and/or exhaustion.

Over...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY at Crucial Resistance Zone; RRG Chart Suggests Staying Highly Sector-Specific

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The week that went by remained firmly on the expected lines. In the previous weekly note, we had mentioned that the markets may push themselves higher amid increased volatility. The NIFTY indeed closed higher following a strong move, while the volatility also spiked. The financial stocks were expected to perform...

READ MORE

MEMBERS ONLY

Bullish Breadth Thrusts in 5 of the 6 Big Sectors

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There are 11 sectors in the S&P 500, but the big six are the only ones we need to be concerned with when making a broad market assessment. The big six account for a whopping 82.5% of the S&P 500, which leaves the other 5...

READ MORE

MEMBERS ONLY

It's Baaaackkkkk! Top 5 Stocks For Q4 2020

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Back on April 1st, in the midst of the COVID-19 pandemic, the initial episode of The Pitch was aired on StockCharts TV. Grayson Roze, VP of Operations here at StockCharts.com, Mary Ellen McGonagle, President of MEM Research, and I joined host David Keller and provided our Top 5 stocks...

READ MORE

MEMBERS ONLY

These Leading Growth Stocks Just Reversed Their Downtrends

by Mary Ellen McGonagle,

President, MEM Investment Research

The Nasdaq has been in recovery mode over the past 3 weeks after a September rout that left many high-growth Tech stocks underwater. Leading stock Apple (AAPL) was down over 25% from its peak and the stock is still trying to get up off the mat.

Not all recently hit...

READ MORE

MEMBERS ONLY

Bullish Expansion of New Highs

by David Keller,

President and Chief Strategist, Sierra Alpha Research

I would currently describe myself as a "cautious bull," in that I recognize that the market is trending higher, I'm prepared to follow that trend as long as it continues, and I'm always looking for some signs of potential weakness and/or exhaustion.

Over...

READ MORE

MEMBERS ONLY

Reliable Long-Term Ratio May Be About to Trigger its Seventh Buy Signal for Stocks Since 1995

by Martin Pring,

President, Pring Research

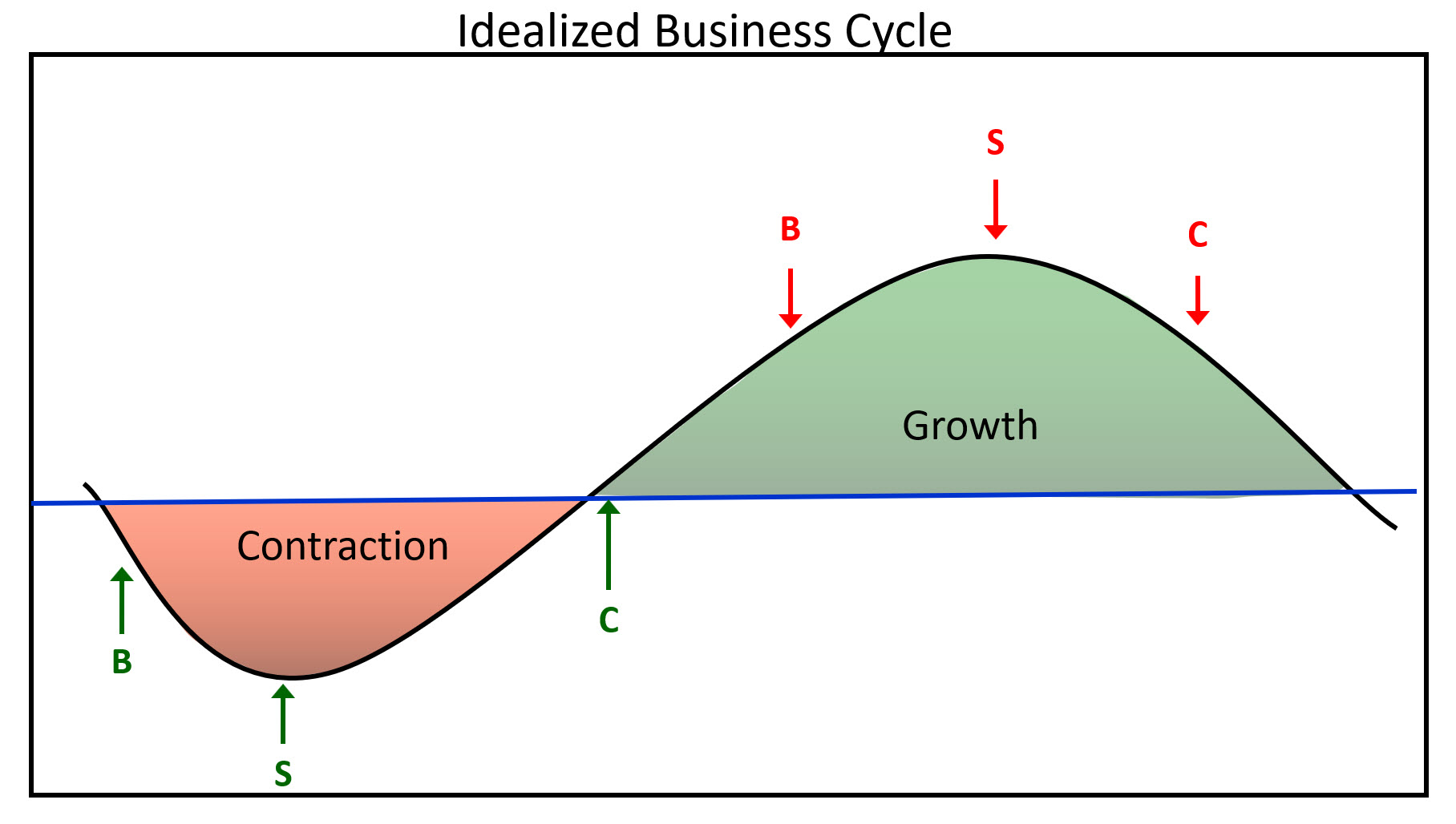

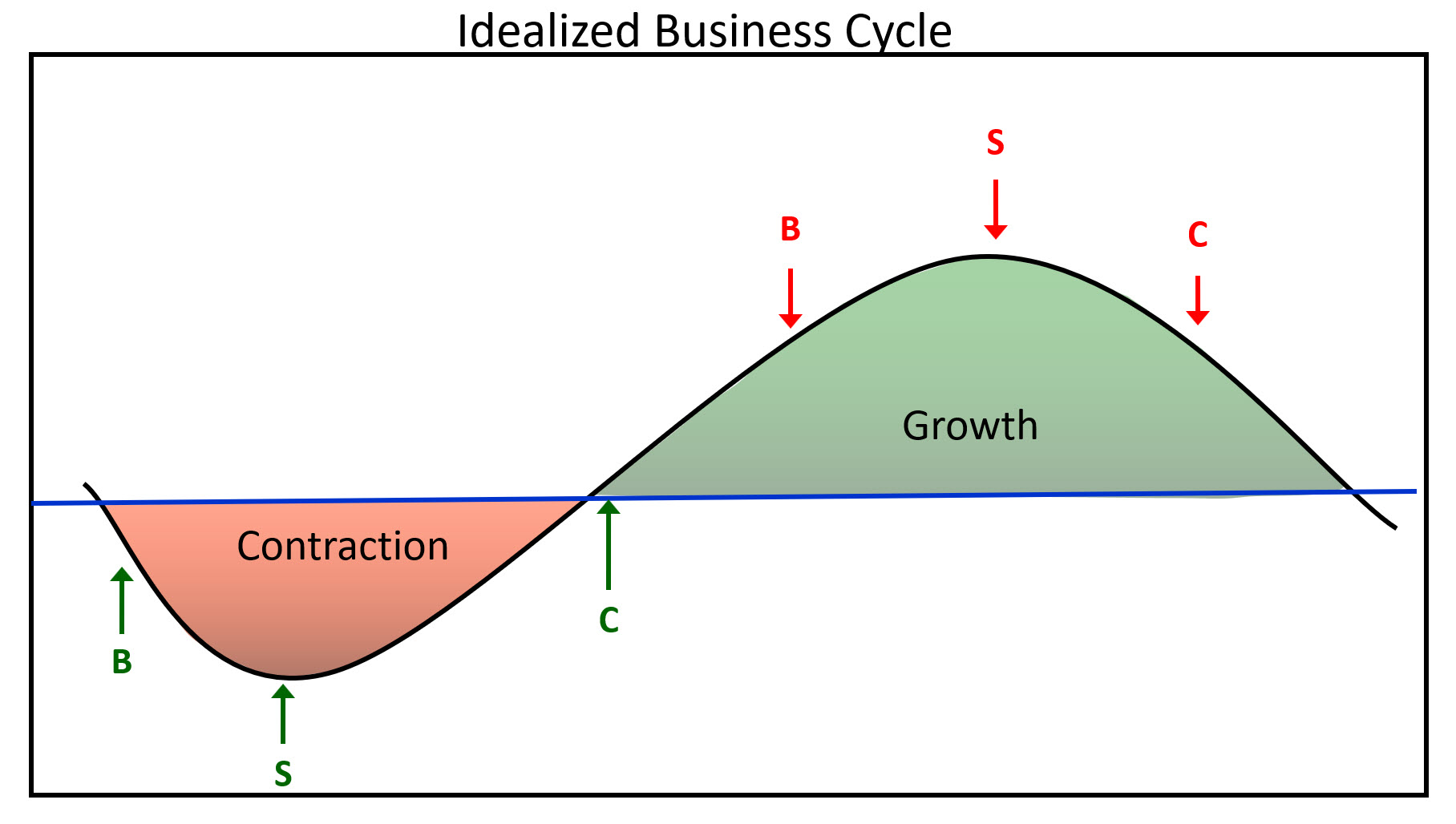

Sometimes, it's a good idea to approach likely market action not so much from an analysis of the market itself, but substituting intermarket or inter-asset relationships to accomplish the same objective. It is a fact that each business cycle goes through a set series of chronological sequences. We...

READ MORE

MEMBERS ONLY

Happy Days for the Economic Modern Family

Friday showed us that, even with the insecurity of the stimulus package passing and tension from job loss, the Modern Family was still able to close strong for the week.

Grandpa Russell (IWM), which has been in a consolidation period for the last 6 weeks, has closed over resistance at...

READ MORE

MEMBERS ONLY

Downtrend Reversals as Market Broadens Out

by Mary Ellen McGonagle,

President, MEM Investment Research

Strength abounds! In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews former leading stocks that have broken back above resistance. She also shares a stealth election play as well as stocks further along in their bid to break out of sound bases.

This video was originally...

READ MORE

MEMBERS ONLY

FALLING DOLLAR BOOSTS METAL PRICES -- GOLD AND SILVER PRICES RISE -- COPPER PRICES NEAR TWO-YEAR HIGH ALONG WITH ITS MINERS -- RISING STOCKS WEAKEN THE DOLLAR

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOLLAR INDEX FALLS BELOW 50-DAY LINE...The dollar is under selling pressure. Part of the reason why may be rising stock prices. The dollar has been moving inversely to stocks over past few months (more on that shortly). It rallied during September when stocks were selling off. And has weakened...

READ MORE

MEMBERS ONLY

Ready For a Melt UP? Bears, It's Checkmate!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I remain firmly in the secular bull market theory camp. We're going higher. Forget about politics, civil unrest, the virus, the deficit, the economy, blah, blah, blah. Money flow, the Fed and historically-low interest rates will fuel higher prices. While each of those is extremely important in the...

READ MORE

MEMBERS ONLY

Transportation Stocks Are Confirming More Bullish Action Ahead

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

It's generally a very good sign to see transportation stocks ($TRAN) breaking to new highs. Currently, the TRAN is at an all-time high and all signs are pointing to continuing strength, as far as I can tell. Transports do well when our economy is strong or when it&...

READ MORE

MEMBERS ONLY

Chartwise Women: Bullish Setups in Small-Caps!

by Mary Ellen McGonagle,

President, MEM Investment Research

by Erin Swenlin,

Vice President, DecisionPoint.com

Enjoy the little things! In this week's edition of Chartwise Women, Mary Ellen and Erin share the best ways to capitalize on the powerful move into small-cap stocks. They also break down the highest-concentrated area of winners, as well as how to screen for top candidates now.

This...

READ MORE

MEMBERS ONLY

S&P VALUE INDEX IS GAINING GROUND -- IT'S GETTING A LOT OF HELP FROM STONGER FINANCIALS AND INDUSTRIALS -- SMALL CAP RALLY CONTINUES

by John Murphy,

Chief Technical Analyst, StockCharts.com

S&P VALUE IS GAINING GROUND... Value stocks are continuing to fuel much of the stock market's recent gains. Chart 1 shows the S&P 500 Value iShares (IVE) rising this week to the highest level in a month. And it's been rising faster...

READ MORE

MEMBERS ONLY

Reliable Long-Term Ratio May Be About to Trigger its Seventh Buy Signal for Stocks Since 1995

by Martin Pring,

President, Pring Research

Sometimes, it's a good idea to approach likely market action not so much from an analysis of the market itself, but substituting intermarket or interasset relationships to accomplish the same objective. It is a fact that each business cycle goes through a set series of chronological sequences. We...

READ MORE