MEMBERS ONLY

The Self-Fulfilling Prophecy

It's interesting how news affects the market. The negative information, paired with human emotion, sends the market frantically lower.

It is also interesting to watch how it creates a self-fulfilling prophecy. When people hear negative news, a common thought is "My goodness, I must sell before everyone...

READ MORE

MEMBERS ONLY

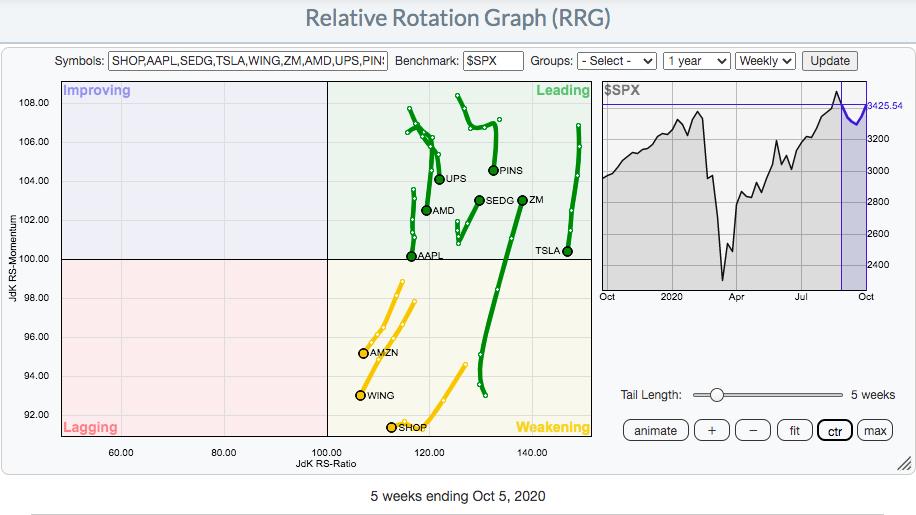

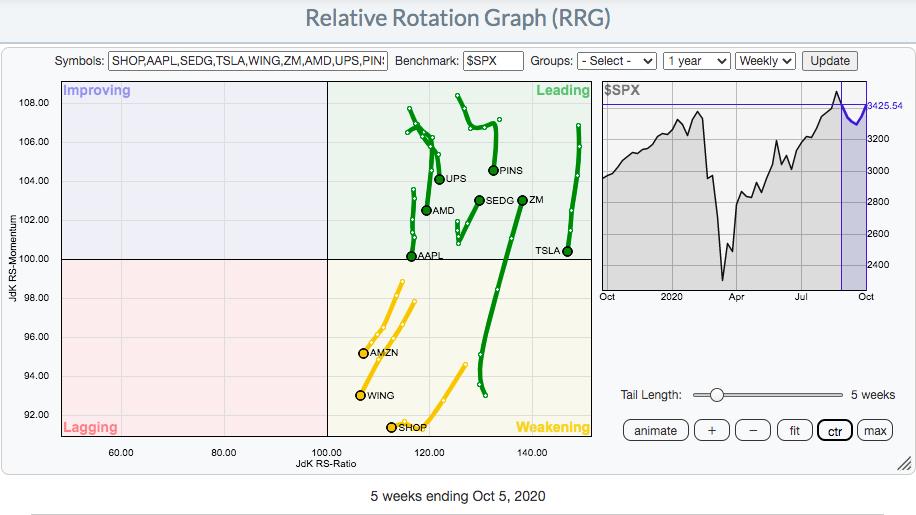

My 10 Favorite Stocks On An RRG Chart

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

A week ago, I published an article here in the Don't Ignore This Chart blog highlighting two renewable energy stocks ($DWCREE) - SEDG and ENPH. Both have gained in the 25%-30% range in one week. It illustrates how trading leading stocks in leading industry groups can pay...

READ MORE

MEMBERS ONLY

TRANSPORTS REACH NEW RECORD -- INDUSTRIAL SPDR NEARS UPSIDE BREAKOUT -- STOCKS REGAIN UPSIDE MOMENTUM

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW TRANPORTS EXCEED 2018 HIGH... Transportation stocks are once again trying for a new record. The weekly bars in Chart 1 show the Dow Transports trying to close decisively above their 2018 high. The transports are being led higher today by airlines and delivery stocks. But rails and trucking stocks...

READ MORE

MEMBERS ONLY

Should You Time the Market?

by Dave Landry,

Founder, Sentive Trading, LLC

In this edition of Trading Simplified, Dave is here to discuss "How Important Is Market Timing?" now that the market has gotten a little "iffy." As Dave puts it, market timing is less about beating the market and more about not letting the market beat you....

READ MORE

MEMBERS ONLY

DP ALERT: Trick or Tweet?

by Erin Swenlin,

Vice President, DecisionPoint.com

(This is a complimentary issue of today's subscriber-only DP Alert report. Get this report every business day on DecisionPoint.com!)

Everything was running smoothly as the market broke above the previous week's trading range. And then...bah bah baaaaah... stimulus talks not only stalled, but were...

READ MORE

MEMBERS ONLY

What Do the Technicals Show Us?

These past weeks, we've talked about the market's hopes of a quick stimulus package.

Today showed how easily the market can flip when stimulus hope fades. It also shows that the market can trade higher on expectations, even though it really didn't know what...

READ MORE

MEMBERS ONLY

DELAY IN STIMULUS TALKS SINKS STOCKS -- TEN SECTORS LOSE GROUND -- BOND YIELDS ALSO DROP

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCKS SELL OFF IN AFTERNOON TRADING... Stocks fell this afternoon after a presidential tweet pushed stimulus talks until after the November election. The three charts below show major stock indexes reversing lower from chart resistance formed a couple of weeks ago. Ten of eleven sectors also ended the day in...

READ MORE

MEMBERS ONLY

BANKS AND FINANCIALS HAVE A STRONG DAY -- RUSSELL 2000 ISHARES HIT 7-MONTH HIGHS

by John Murphy,

Chief Technical Analyst, StockCharts.com

FINANCIAL SPDR TRIES TO CLEAR 200-DAY LINE... Higher bond yields and a steeper yield curve usually benefit financial stocks and banks in particular. Which helps explain why financials are starting to attract new buying. Chart 1 shows the Financial SPDR (XLF) trading above its 200-day moving average today for the...

READ MORE

MEMBERS ONLY

Are We Seeing Significant Rotation? Check Out These 3 Industry Groups

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The secular bull market is alive and well and the list of industry groups in breakout mode is growing. In addition, there are a few on the cusp of a breakout that bear watching. When a group breaks out, money flows to that area, creating tons of trading/investing opportunities....

READ MORE

MEMBERS ONLY

Biggest Movers in the Modern Family

If the market could talk, it might say that the Economic Modern Family is happy. Perhaps happier than they have been in a long time.

Starting Friday, Forrest and I pointed out that the Russell 2000, Transportation and Retail all closed green in the face of the news on Trump...

READ MORE

MEMBERS ONLY

DP Show: Stalking Energy Stocks - Options Mania

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, Carl and Erin give us the current market conditions to prepare you for the week ahead. Both discuss what "climax analysis" is all about. Monitoring climactic readings in breadth and the VIX can give you strong clues as to market action in the...

READ MORE

MEMBERS ONLY

BOND YIELDS TOUCH FOUR-MONTH HIGH - THAT'S HELPING FINANCIAL SHARES -- AND VALUE CYCLICAL STOCKS IN GENERAL -- SMALL CAPS SHOW SOME LEADERSHIP

by John Murphy,

Chief Technical Analyst, StockCharts.com

BOND YIELDS TOUCH FOUR-MONTH HIGH... Treasury bond yields continue their rise that started a week ago. And they're overcoming some resistance levels. Chart 1 shows the 30-Year Treasury Yield rising above its late August high to reach the highest level since June. It's also testing its...

READ MORE

MEMBERS ONLY

Time to Enjoy the Hospitality Of This Stock for the Medium Term

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The Indian Hotels Company Ltd (INDHOTEL.IN)

This hospitality stock has formed its bottom in June and is in the process of confirming it by moving past the crucial 200-DMA, to which it has presently resisted. If this level is taken out, we may see this stock extending its gains...

READ MORE

MEMBERS ONLY

Is This Sector Set to End its Underperformance?

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Nifty Financial Services Index ($CNXFIN)

The NIFTY Financial Services sector seem to have ended its short-term underperformance. The Index has broken out from a falling channel and has formed a gap, which indicates greater push to the upside.

The RSI has marked a fresh 14-period high, which is bullish. It...

READ MORE

MEMBERS ONLY

STOCKS END VOLATILE FRIDAY IN THE RED -- BUT GAIN ON THE WEEK -- TECH STOCKS WEAKENED ON FRIDAY WHILE CYCLICAL SECTORS GAINED -- REITS AND UTILITIES LED WEEK'S GAINS -- BOND YIELDS ALSO ROSE

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCKS END VOLATILE FRIDAY LOWER... Stocks opened sharply lower on Friday on news that President Trump and the First Lady had tested positive for the coronavirus. Then news of some possible fiscal stimulus helped them make back some of their earlier losses. By the end of the day, however, all...

READ MORE

MEMBERS ONLY

How Can We Tell When The Pandemic-Stricken Groups Begin To Lead?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

That's a really good question and one that I'm researching. My view has been (and remains) that the stock market is in a multi-decade secular bull market, one that will carry us into the 2030s. There will be cyclical bear markets along the way, similar to...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY May Try to Push Higher Amid Increased Volatility; RRG Chart Says These Sectors May Start Making Moves

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The week before this one was quite eventful, as the NIFTY tested all its crucial supports on the daily and weekly charts. The past week saw the NIFTY respecting few crucial support levels on the higher timeframe charts and showing a technical pullback. The four-day trading week showed the headline...

READ MORE

MEMBERS ONLY

The Gold Bull Market is Likely to Extend Once the Correction Runs its Course

by Martin Pring,

President, Pring Research

Coppock Indicator Using Quarterly Data is Bullish

Long-term Charts show that gold is in a firm uptrend. Take Chart 1, for instance; it tracks the price of the yellow metal on a quarterly basis using a quarterly measure of the Coppock Curve, a momentum indicator originally devised by Edmund Coppock....

READ MORE

MEMBERS ONLY

Here are the 2 Stocks Leading Our Powerful Portfolios

by John Hopkins,

President and Co-founder, EarningsBeats.com

It's very true at the moment that this is a "stock pickers" market, meaning it really makes a big difference which individual stocks you are trading unless you focus more on ETFs. For example, as you can see below, one of the stocks in our "...

READ MORE

MEMBERS ONLY

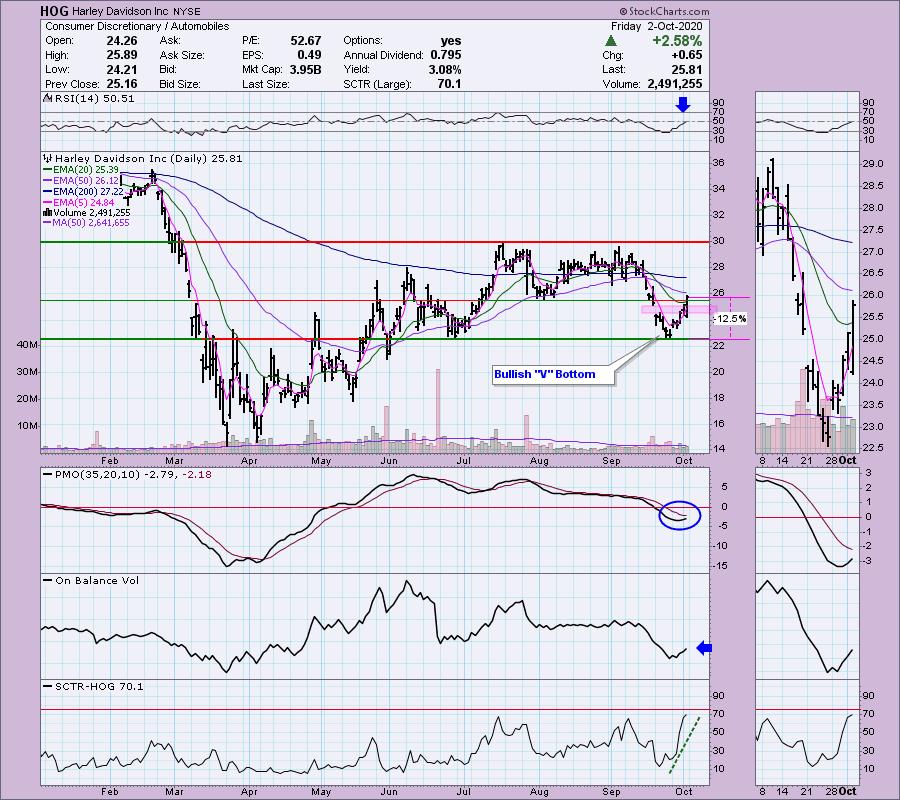

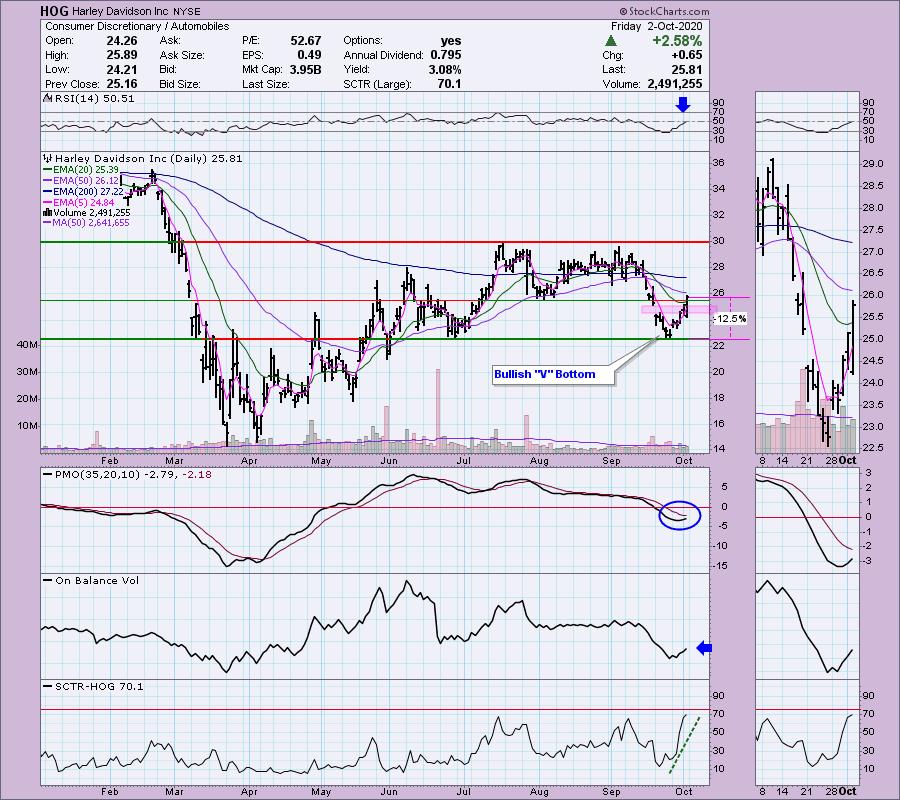

Going "Hog Wild"! & Free DP Trading Room with Julius de Kempenaer

by Erin Swenlin,

Vice President, DecisionPoint.com

While I love bacon, I did not intentionally pick another "pig"-themed headline (referring to my article on the "pig's ear" chart pattern at this link). For this morning's DecisionPoint "Diamond Mine" trading room (for Diamonds subscribers only), I ran...

READ MORE

MEMBERS ONLY

Making Better Trades with Market Timing

Our president and first lady contracted COVID. That yielded a morning gap down, followed by a rally; that rally was partially based on hope for the stimulus.

These are some of the biggest thoughts on trader's minds as of Friday. And, of course, on everyone's mind...

READ MORE

MEMBERS ONLY

Bullish Breakouts as Nasdaq Holds Support

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews stocks breaking out of bases in stronger areas of the market while also uncovering top candidates in newer areas of the market. She also shares what to be on the lookout for in a failed base breakout....

READ MORE

MEMBERS ONLY

Mind the Gap in SPY

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The S&P 500 SPDR (SPY) gapped up on Monday and broke out of a classic correction pattern. The breakout is bullish, but the coast is not entirely clear. Here's what to watch going forward.

First, the long-term trend is up as SPY hit a new high...

READ MORE

MEMBERS ONLY

Chartwise Women: Which Stocks Did Best in Q3?

by Mary Ellen McGonagle,

President, MEM Investment Research

by Erin Swenlin,

Vice President, DecisionPoint.com

"And the winner is..." In this week's edition of Chartwise Women, Erin and Mary Ellen host a 3rd Quarter Stock Market Awards Show! See not only the best performers in categories like Best Technology Stock, Best Growth Stock and Best in Show, but also the granddaddy...

READ MORE

MEMBERS ONLY

How to React to a Choppy Market

We've recently talked about higher volatility in the market with the election date closing in. In these past couple of weeks, we've seen the market jump around quite a bit. We're in a choppy market environment, and while three of the 4 major indices...

READ MORE

MEMBERS ONLY

The Gold Bull Market is Likely to Extend Once the Correction Runs its Course

by Martin Pring,

President, Pring Research

* Coppock Indicator Using Quarterly Data is Bullish

* Monthly-Based Gold Model is a Long Way from a Sell Signal

* Inflation-Adjusted Gold at Mega Resistance

* When Will the Correction Have Run its Course?

Coppock Indicator Using Quarterly Data is Bullish

Long-term Charts show that gold is in a firm uptrend. Take Chart...

READ MORE

MEMBERS ONLY

The Next Market Low and Election Rally

by Larry Williams,

Veteran Investor and Author

On this special episode of Real Trading with Larry Williams, Larry is back to give a follow-up on his last special regarding Chinese stocks, with an aside for Korea. He then discusses the "Uncle Sam" index and his exclusive ACP Plug-In indicators, followed by an overview of who...

READ MORE

MEMBERS ONLY

Ever Wondered How To Create A User-Defined Index (UDI) At StockCharts.com?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Well, I plan to host a free webinar on Saturday to demonstrate how we use this cool StockCharts.com feature to track our portfolios at EarningsBeats.com. In the StockCharts.com "Support Center", you'll find many examples of why you might want to consider using a...

READ MORE

MEMBERS ONLY

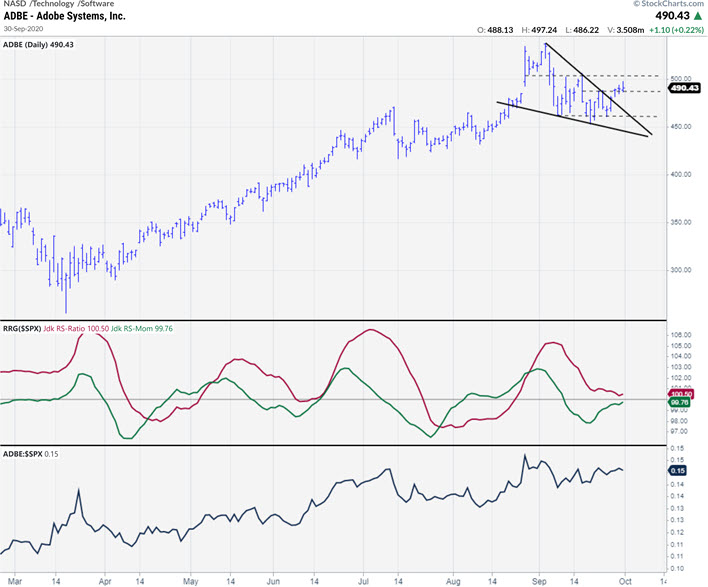

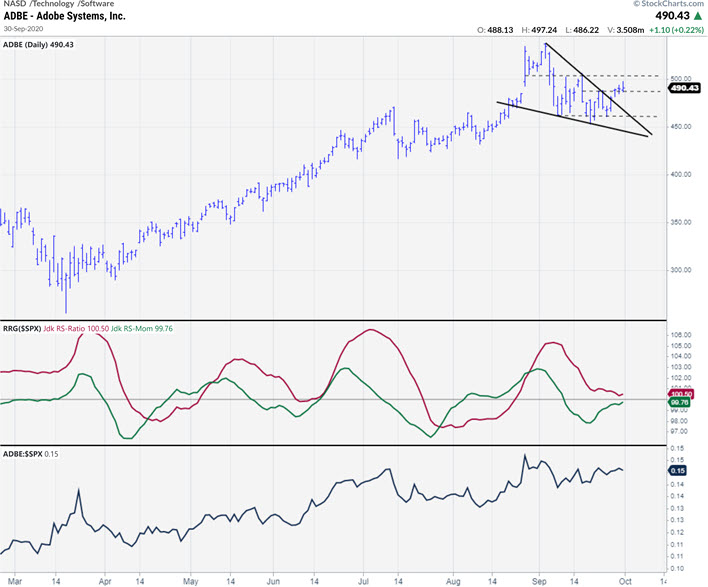

ADBE Setting Up For a New Rally

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The chart above shows the daily price bars for ADBE, in combination with the RRG-Lines and raw Relative Strength.

There are two reasons to use this chart today. The first is to make sure all of you are aware of the rapid further development of the new ACP platform here...

READ MORE

MEMBERS ONLY

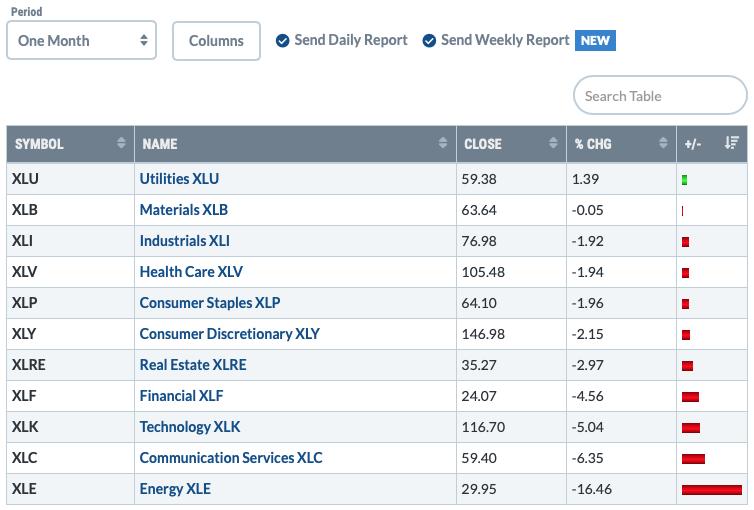

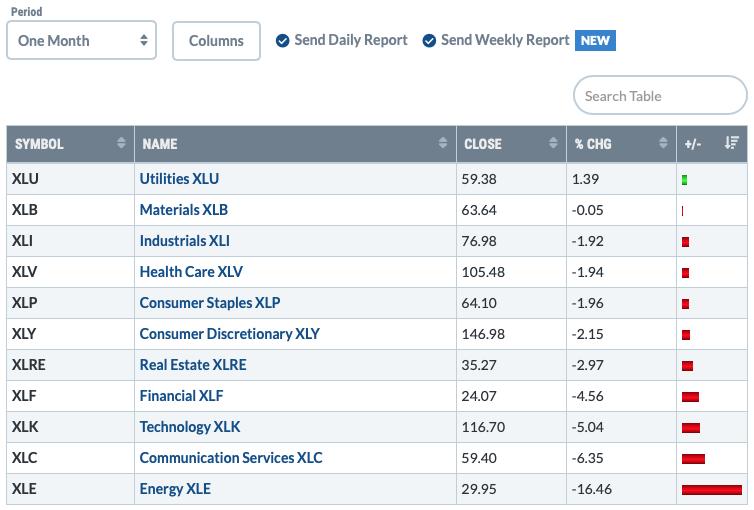

Utilities Were the Only Sector to Close Higher This Month?

by Erin Swenlin,

Vice President, DecisionPoint.com

(This is an excerpt from today's member only DecisionPoint Alert on DecisionPoint.com)

The Utilities SPDR (XLU) is the only sector that is up over the past month. Yes! It surprised me too, but you can see the graphic below! Yet today, we have an IT Trend Model...

READ MORE

MEMBERS ONLY

Time to Keep an Eye on Homebuilders

It's time to start watching the homebuilding sector. We can look at this using the symbol XHB, which is an ETF based off the SPY.

The reason that homebuilders are interesting right now is because they have been outperforming all the other sectors in the US economy based...

READ MORE

MEMBERS ONLY

Learning From Your Trading Mistakes

by Dave Landry,

Founder, Sentive Trading, LLC

In this edition of Trading Simplified, Dave discusses a recent mistake that cost him thousands in profits. More importantly, he presents simple steps that you can take to avoid making these types of costly mistakes. Afterwards, Dave continues his discussion of showing the methodology in action with recent examples. Finally,...

READ MORE

MEMBERS ONLY

STOCKS HAVE ANOTHER STRONG DAY -- BOND YIELDS ARE ALSO CLIMBING

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCKS INDEXES GAIN MORE GROUND... Stocks are building on their earlier gains from Monday and are trading above their 50-day lines as shown on the three following charts. Chart 1 shows that the next test of overhead resistance for the Dow Industrials could come at at 28,400 which was...

READ MORE

MEMBERS ONLY

Solar Edge (SEDG) and Enphase Energy (ENPH) Break Out, Lead Renewables

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Leading stocks in leading industry groups.

If you've struggled with your investments, read that line over and over again. Investing in leaders will change your returns and likely alter your opinion about your chances to outperform the overall market. Our Model Portfolio has now returned +148.21% in...

READ MORE

MEMBERS ONLY

Q4 Holds Big Challenges, Are You Ready For Them?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

We held a "Market Vision 2020" event at EarningsBeats.com back on January 5th and were joined by several long-time StockCharts.com contributors, including John Murphy. I credit John for a lot of my intermarket relationship knowledge as his work over the years truly inspired me to learn...

READ MORE

MEMBERS ONLY

Formerly Leading Stocks Exhibiting Downtrend Reversals

by Mary Ellen McGonagle,

President, MEM Investment Research

The Nasdaq Composite broke back above its key 50-day moving average on Monday and after today's action, the RSI and MACD are now in positive positions.

A number of underlying stocks from this Tech-heavy index are also exhibiting bullish downtrend reversals and below is a chart of online...

READ MORE

MEMBERS ONLY

Sector Spotlight: Tech & Comm Rally Into October

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of Sector Spotlight, with September drawing to an end, I dive into the monthly seasonality, finding some very interesting seasonal patterns for Technology and Communication Services on the one hand and Energy and Health Care on the other. History suggests a 2% out-performance for Technology in October,...

READ MORE

MEMBERS ONLY

The Benefits of a Consistent Imperfect Routine

by David Keller,

President and Chief Strategist, Sierra Alpha Research

A consistent imperfect routine is way better than an inconsistent perfect routine.

When I've worked with investors that are new to technical analysis, I often find that they spend too much time trying to perfect their analytical approach on a particular chart, and way too little time determining...

READ MORE

MEMBERS ONLY

DP Show: Bullish Falling Wedges Everywhere!

by Erin Swenlin,

Vice President, DecisionPoint.com

In this episode of DecisionPoint, Erin, flying solo today, reviews Carl's ChartList of the "S&P 10" which includes the FAANG stocks and other large-cap names that sway the S&P 500. Those charts are FULL of bullish falling wedges! Erin covers the implications...

READ MORE

MEMBERS ONLY

Risk vs. Reward and The Never-Ending Battle

Today's large gap up in the indices can pose some great morning questions. The biggest one being, should I buy the gap, or should I wait to see where things go?

You don't want to chase the market, but you don't want to miss...

READ MORE