MEMBERS ONLY

Sector Spotlight: Opportunities in the Industrials Sector

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of Sector Spotlight, I put last week's rotations for asset classes and sectors into a longer-term perspective. After the break, I perform a deep dive into the industrials sector, showing some stocks with potential but also a group that, as a whole, is better off...

READ MORE

MEMBERS ONLY

DP Show: How Do Stock Splits Work?

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, Carl and Erin discuss current market conditions for the major indexes. Given Apple (AAPL) and Tesla (TSLA) are preparing for stock splits, Carl gives viewers a complete tutorial on stock splits, how they work, how they compare to dividends and more! Carl highlights Gold and...

READ MORE

MEMBERS ONLY

Take a Look at This Mega-Cap Turnaround with Your Next Cup of Joe!

by Mary Ellen McGonagle,

President, MEM Investment Research

It's been a tough period for most Restaurant stocks as lockdown initiatives have forced closures across the country. And while a select few who had digital sales systems in place before the pandemic have done just fine - think Chipotle Mexican Grill (CMG) - most others have had...

READ MORE

MEMBERS ONLY

Stocks Like Mondays

by Geoff Bysshe,

Co-founder and President, MarketGuage.com

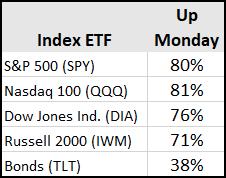

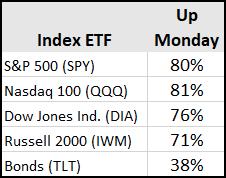

It was a quiet news day, but Mondays don't need news to go up. Today's image above represents the percentage of times that Mondays have closed higher than their Friday close since the March bottom.

It's also worth noting that not only does Monday...

READ MORE

MEMBERS ONLY

Did You Know This About XRT and TLT?

by Geoff Bysshe,

Co-founder and President, MarketGuage.com

As the S&P 500 struggles to rise a fraction of a percentage point to be able to achieve the status of reclaiming its February all-time high level...

Imagine you could go back to February 19th, 2020. The SPY has just closed at a new all-time high, and news...

READ MORE

MEMBERS ONLY

Week Ahead: These are Two Concerning Factors for NIFTY; RRG Chart Shows Dearth of Sectors in Dominant Position

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

This was a week when the markets perfectly respected the technical levels; they took a breather and ended with a minor loss. Over the past five days, the NIFTY piled up incremental gains, but the last trading day reversed all those little gains. The NIFTY oscillated in a narrow 262-point...

READ MORE

MEMBERS ONLY

Delivery Services Is Dropping This Small Cap Winner Off At Your Door

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I'm not sure if there's a hotter group right now than delivery services ($DJUSAF). Both United Parcel Service (UPS) and FedEx Corp (FDX) blew earnings right out of the park. They crushed both revenue and EPS estimates and the market has responded with institutions seemingly accumulating...

READ MORE

MEMBERS ONLY

Is It a Pullback or Something More? The Recent Selloff in Top Growth Stocks Reminds Us to Stay Sharp

by Mary Ellen McGonagle,

President, MEM Investment Research

The recent pullback in high-growth stocks has created some unique opportunities to purchase select growth names at a discount. Before considering this strategy, however, it's important to make sure that several characteristics are in place.

To begin, you'll want to reduce uncertainty by making sure the...

READ MORE

MEMBERS ONLY

Here are 3 of the Fastest-Gaining Momentum Stocks

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Over the past five months, since that March low, we've enjoyed many stocks' relentless pursuit to the upside. I know it's hard, however, to keep chasing those stocks as their prices move into what seems the stratosphere. So I set out to find stocks that...

READ MORE

MEMBERS ONLY

Will the Uptrend Continue?

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen analyzes distinct money flows into 2 areas that may signal a market shift, as well as ways you can capitalize on these moves. She also outlines how to tell if your stock is just pulling back or if...

READ MORE

MEMBERS ONLY

What Would Change My Mind on This Market

by David Keller,

President and Chief Strategist, Sierra Alpha Research

The last five months of market history are a blur for me. Back in mid-March, the S&P 500 was in free fall with no end in sight. Here we are in mid-August, and the S&P is retesting all-time highs. Trend-following is about defining the trend, recognizing...

READ MORE

MEMBERS ONLY

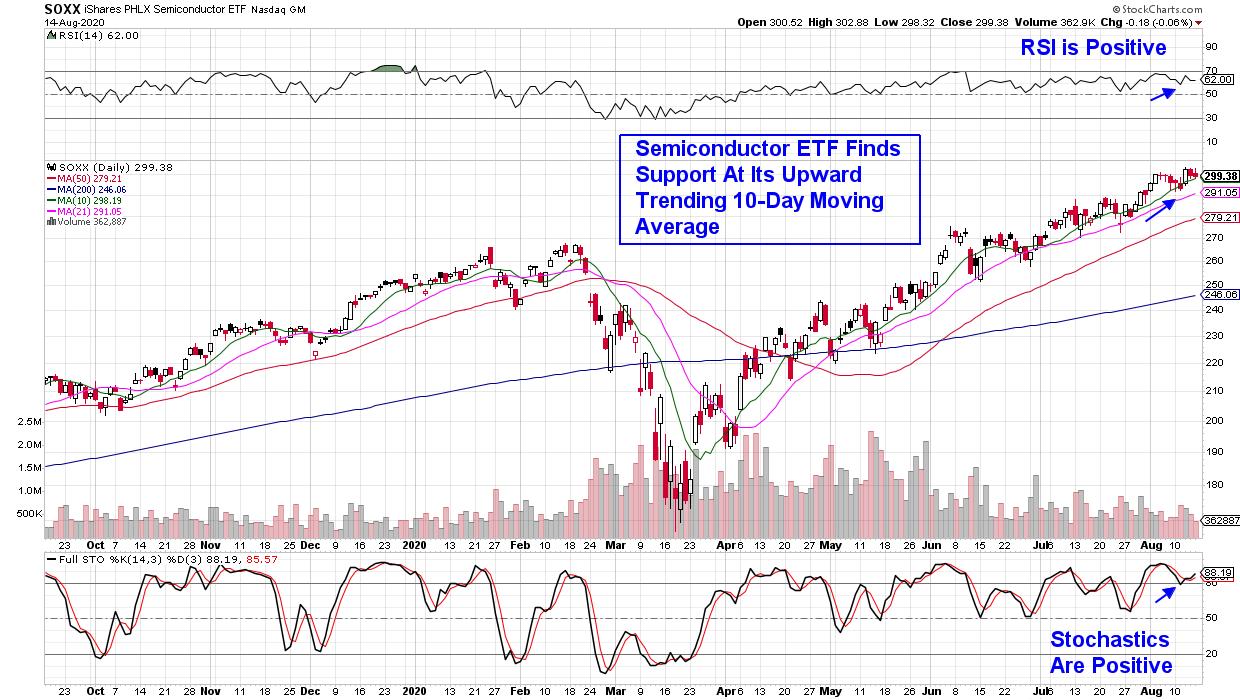

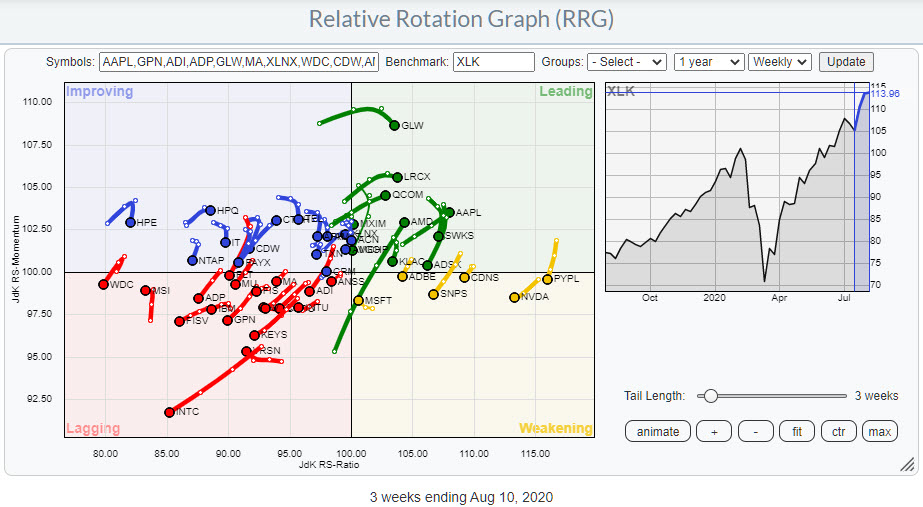

Not All Tech Stocks Look Good... But the Most Important Ones Still Do!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

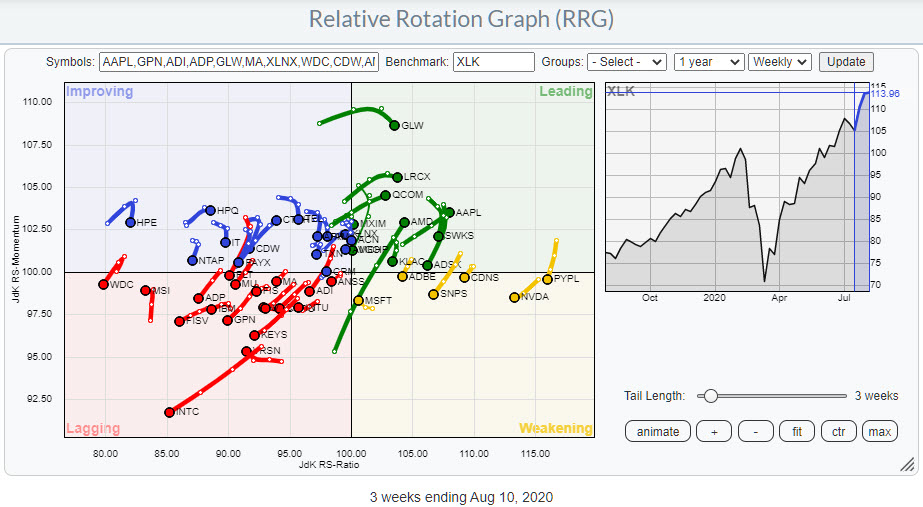

The technology sector sparks a lot of interest, and for good reason - it has turned into a safe(r) haven when things get rough in the markets, but it's also everybody's baby when the market goes up. "What could possibly go wrong?", one...

READ MORE

MEMBERS ONLY

Our Top Trade Targets Are On The Table For You To See: Don't Miss The Latest Edition Of "The Pitch"

by Grayson Roze,

Chief Strategist, StockCharts.com

Without a doubt, one of my favorite shows on StockCharts TV right now is "The Pitch", a monthly series where we assemble three different technical analysts and ask each of them to bring their five best individual ideas to the table.

With each guest pitching a narrow list...

READ MORE

MEMBERS ONLY

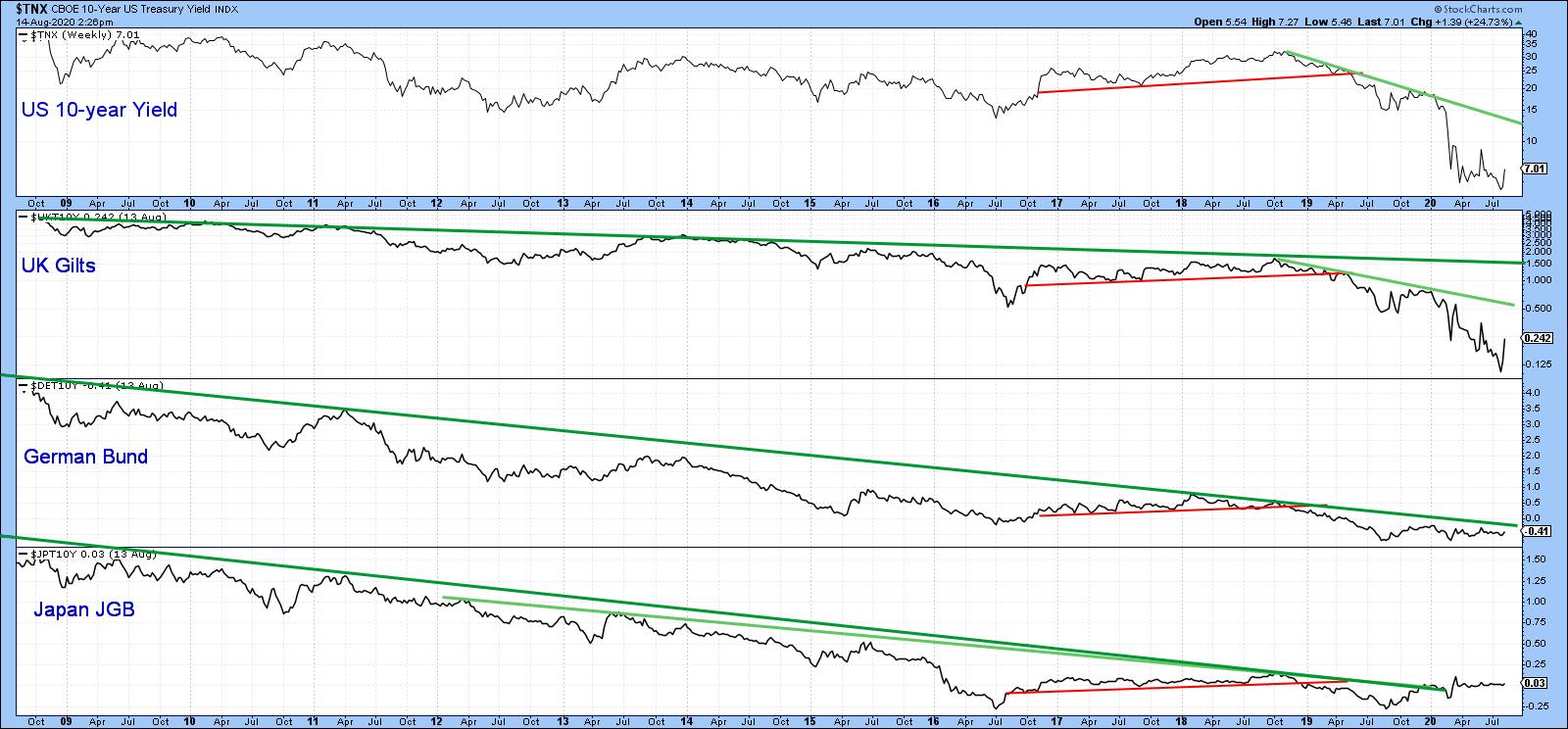

Time for a Little Firmness in Bond Yields?

by Martin Pring,

President, Pring Research

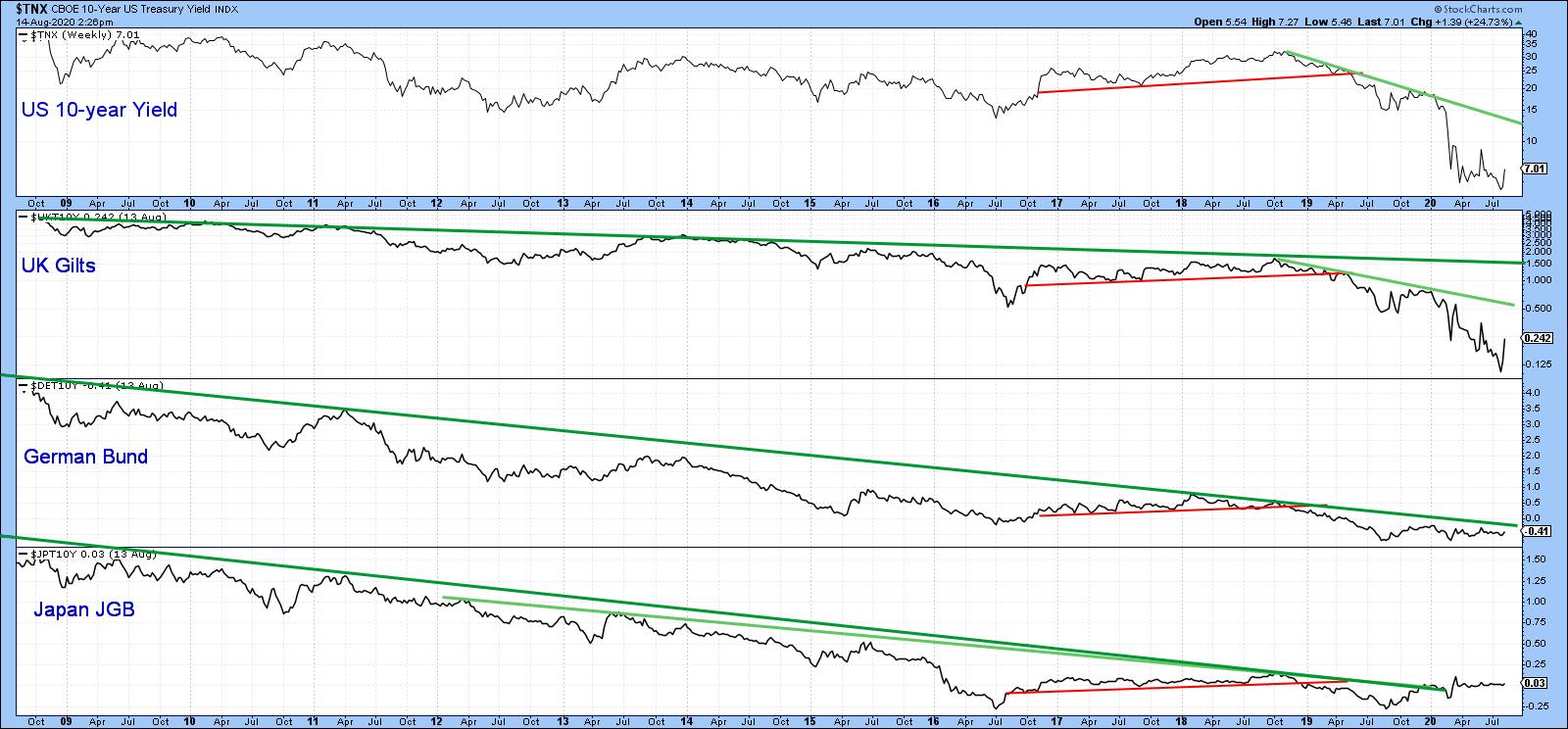

Chart 1 shows that the basic trend for bond yields around the world is still negative, as all series are in a clear-cut downtrend. The only exception is Japan, where the secular down trendline was violated earlier in the year. So far, though, the yield has only managed a sideways...

READ MORE

MEMBERS ONLY

S&P 500 TESTING ITS FEBRUARY HIGH -- USING BOLLINGER BANDS FOR GUIDANCE

by John Murphy,

Chief Technical Analyst, StockCharts.com

S&P 500 IS TESTING ITS FEBRUARY HIGH... The most important test going on at the moment is the S&P 500 challenging its February high. Its highest intra-day value shown in Chart 1 is 3393.52. The SPX closing high for February was 3386.15. Although the...

READ MORE

MEMBERS ONLY

If This Line Doesn't Hold, Stocks May Get Hit

by Geoff Bysshe,

Co-founder and President, MarketGuage.com

While the media is obsessively focused on cheering for the S&P 500 to close at a new all-time high, the bond market is quietly collapsing.

TLT broke its 50-DMA today and has now had its second worst 5-day slide since the March 2020 meltdown.

The last time bonds...

READ MORE

MEMBERS ONLY

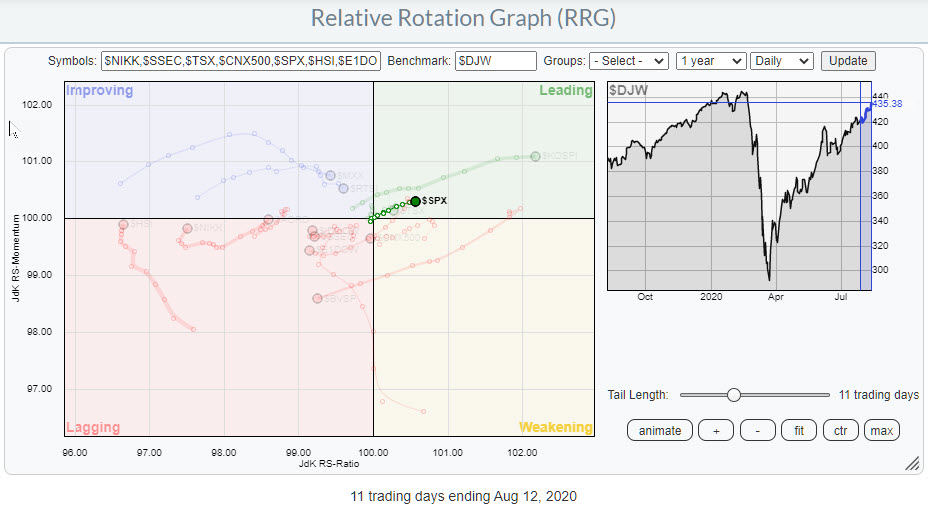

Break to New Highs in $SPX is Crucial for Leadership vs. Rest of the World

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

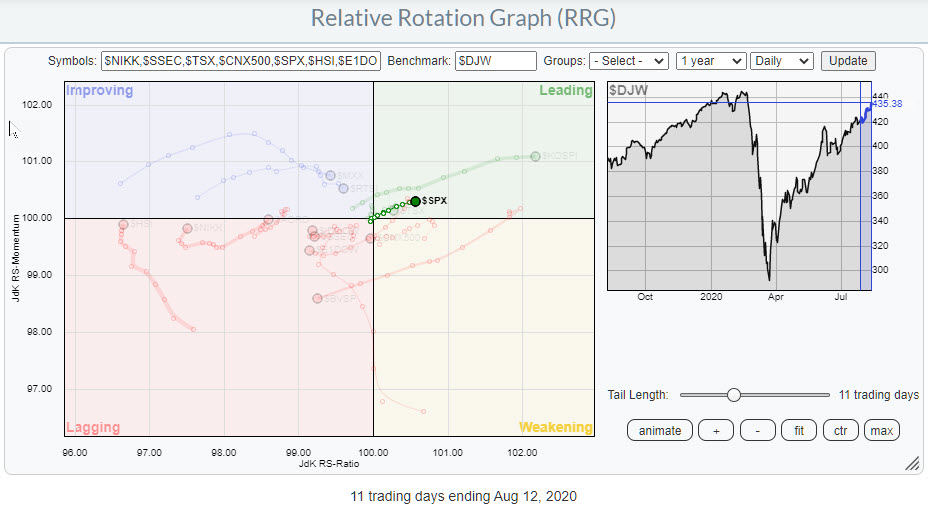

Towards the end of May, the US stock market ($SPX) started to lose relative strength vs. other major world market stock indexes.

Around that time the $SPX tail vs. $DJW, the Dow Jones Global Index, rolled over inside the leading quadrant and started to rotate into and through weakening. This...

READ MORE

MEMBERS ONLY

This Base Breakout Should Concern You

by Geoff Bysshe,

Co-founder and President, MarketGuage.com

Today's chart is one that every investor should keep an eye on (but most will not), as that double bottom base breakout pattern is in a market that has been declining for almost a decade! However, there's good reason to believe it could wake up like...

READ MORE

MEMBERS ONLY

Darvas and Breakouts

by Dave Landry,

Founder, Sentive Trading, LLC

In this edition of Trading Simplified, Dave explains Darvas and continuing his "Methodology In Action" series. He also presents examples of his "Landry Light" indicator to help qualify setups.

This video was originally broadcast on August 12th, 2020. Click anywhere on the Trading Simplified logo above...

READ MORE

MEMBERS ONLY

WEAK DOLLAR ALSO BOOSTS EMERGING MARKET ETFS -- SOUTH KOREA ETF IS BREAKING OUT -- TAIWAN IS ALREADY IN RECORD TERRITORY

by John Murphy,

Chief Technical Analyst, StockCharts.com

EMERGING MARKET ETFS ALSO BENEFIT FROM WEAKER DOLLAR... My earlier message today made the point that a weaker dollar is benefiting foreign stock ETFs that are quoted in dollars. The message showed the rising euro benefiting eurozone ETFs with Germany on the verge of a bullish breakout. The same principle...

READ MORE

MEMBERS ONLY

WEAK DOLLAR CONTINUES TO BOOST FOREIGN STOCK ETFS QUOTED IN DOLLARS -- EUROZONE ETF REACHES SIX-MONTH HIGH -- GERMANY ISHARES MAY BE BREAKING OUT -- THE NETHERLANDS ETF HITS NEW RECORD

by John Murphy,

Chief Technical Analyst, StockCharts.com

EAFE ISHARES REACH SIX-MONTH HIGH... I wrote a message three weeks ago on Wednesday, July 22 to the effect that a weaker U.S. dollar was boosting foreign stocks ETFs that are quoted in dollars. When American investors buy foreign stocks, they're also indirectly buying local currencies. So...

READ MORE

MEMBERS ONLY

A Potential Breakout from a Bollinger Band Squeeze

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

SBIN.in (State Bank Of India)

SBI.in has seen a prolonged period of low volatility over the past several weeks, which has led to contraction of the Bollinger bands. Periods of low volatility are often followed by the periods of high volatility. The probability of the sharp move in...

READ MORE

MEMBERS ONLY

Mish Warned You About Junk Bonds...

by Geoff Bysshe,

Co-founder and President, MarketGuage.com

Will today's market tremors shake the QQQ out of its solidly bullish 4-month channel?

On April 14th, the QQQ broke above its 50 DMA (blue line) and began the trend that you see above. A steady trend line with 6 points is an impressive feat. Today's...

READ MORE

MEMBERS ONLY

Time for a Little Firmness in Bond Yields?

by Martin Pring,

President, Pring Research

Chart 1 shows that the basic trend for bond yields around the world is still negative, as all series are in a clear-cut downtrend. The only exception is Japan, where the secular down trendline was violated earlier in the year. So far, though, the yield has only managed a sideways...

READ MORE

MEMBERS ONLY

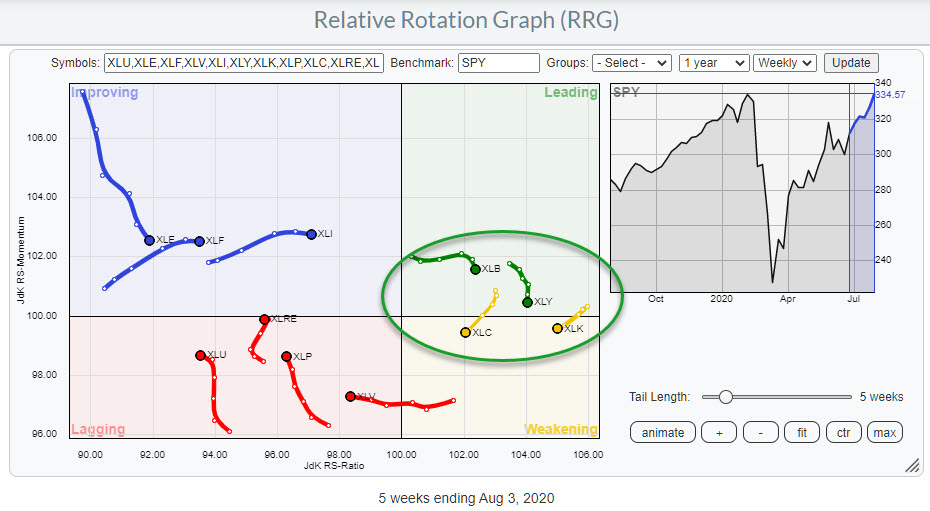

Sector Spotlight: Four Interesting Sector Rotations

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of Sector Spotlight, I look at the rotations for Asset Classes and US sectors, zooming in on the combination of weekly and daily rotations for Consumer Discretionary, Materials, Communication Services and Technology. After the break, I touch on the current positions in the long short baskets and...

READ MORE

MEMBERS ONLY

Gambling Stocks Are Looking For A WYNN-Win

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Many of the worst-hit stocks during the pandemic are leading this latest rally and, among those, are gambling stocks ($DJUSCA). The group broke out yesterday above July highs and now has its collective sight set on the June 8th closing high of 747. Wynn Resorts (WYNN), one of the bigger...

READ MORE

MEMBERS ONLY

BOUNCING BOND YIELDS BOOST BANKS AND FINANCIALS -- AND CONTRIBUTE TO PROFIT-TAKING IN GOLD

by John Murphy,

Chief Technical Analyst, StockCharts.com

GLOBAL YIELDS REBOUND... Bond yields are rebounding today. That may be partially due to an uptick in producer price inflation. Or the fact that global stocks are also rebounding which is driving some money out of bonds and into stocks. Global yields are rebounding along with stocks. Chart 1 shows...

READ MORE

MEMBERS ONLY

DP Show: Is It Time to Leave Technology Behind?

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, Carl and Erin discuss the demise of Technology and the resurgence of Industrials. Should we leave Technology behind? Negative divergences still persist on major indexes, so Erin discusses her strategy of using trailing stops to maximize profit with excellent protection when the overall market is...

READ MORE

MEMBERS ONLY

UPS vs. FedEx: It's Like Splitting Hairs

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Earlier today, I was a guest on "Your Daily 5" and I featured 5 charts that I believe we should all be focused on right now. One of the charts I discussed was the Dow Jones U.S. Delivery Services Index ($DJUSAF), which has exploded higher after two...

READ MORE

MEMBERS ONLY

DOW INDUSTRIALS EXCEED JUNE HIGH -- CATERPILLAR AND NIKE BREAK OUT -- AIRLINES LEAD TRANSPORTS HIGHER -- FEDEX HAS ANOTHER BIG DAY

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW EXCEEDS JUNE HIGH... The Dow Industrials continue to gain ground on the rest of the stock market. And is the strongest of the three major stock indexes today. Chart 1 shows the Dow Industrials trading above their June intra-day peak at 27,600. The Dow is the last of...

READ MORE

MEMBERS ONLY

ALUMINUM AND STEEL STOCKS LEAD MATERIALS HIGHER -- ALCOA AND CENTURY ALUMINUM HAVE STRONGER CHART PATTERNS -- SO DO NUCOR AND STEEL DYNAMICS

by John Murphy,

Chief Technical Analyst, StockCharts.com

ALCOA CLEARS 200-DAY LINE...CENTURY ALUMINUM LEADS... Material stocks continue to act as market leaders. Strong gold miners are a big part of that. So are copper miners. Last Wednesday' message showed the Dow Jones Nonferrous Metals Index scoring a bullish breakout along with Freeport McMoran (FCX); and Southern...

READ MORE

MEMBERS ONLY

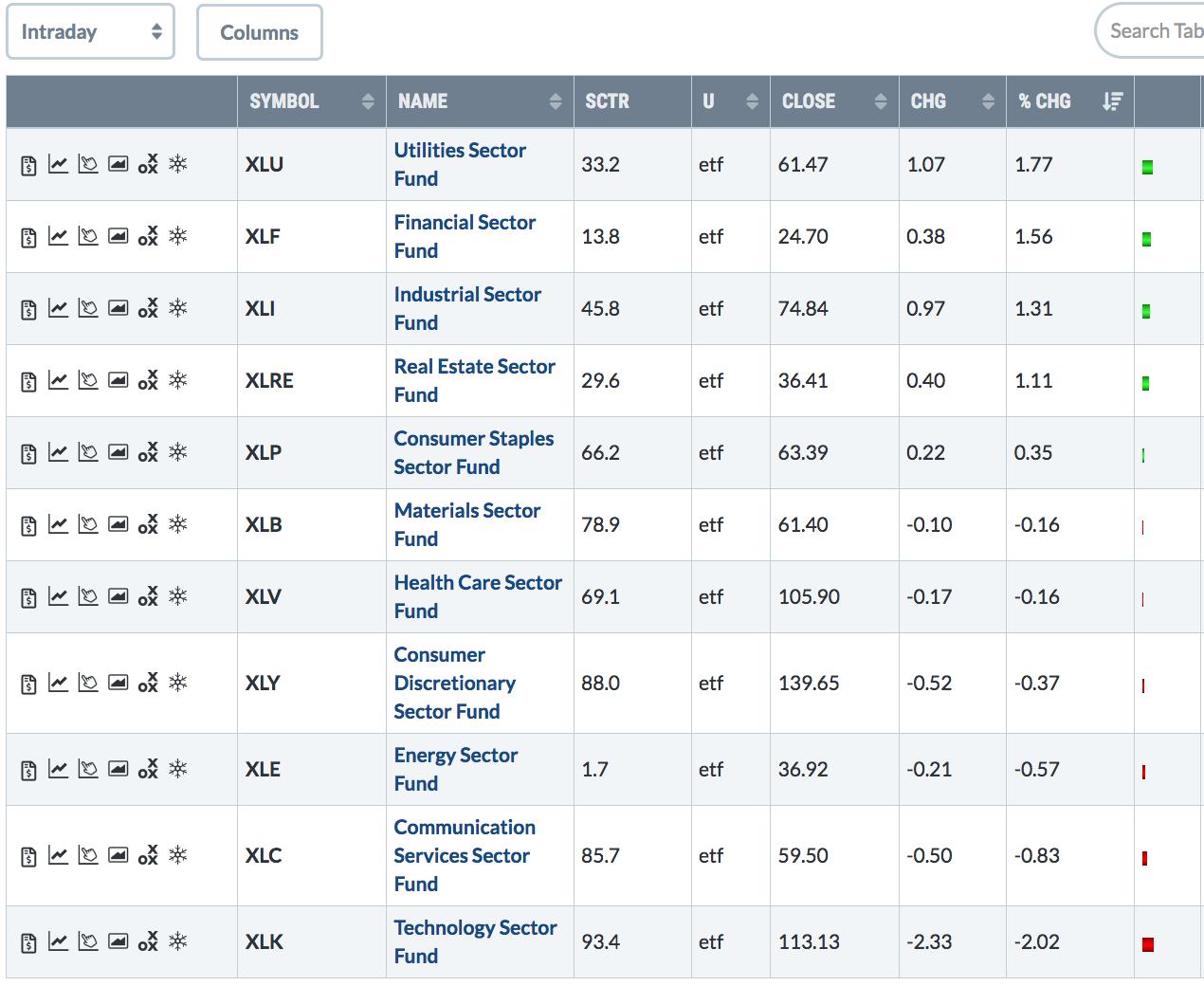

Sector Rotation From Materials and Discretionary to Tech and Communication

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

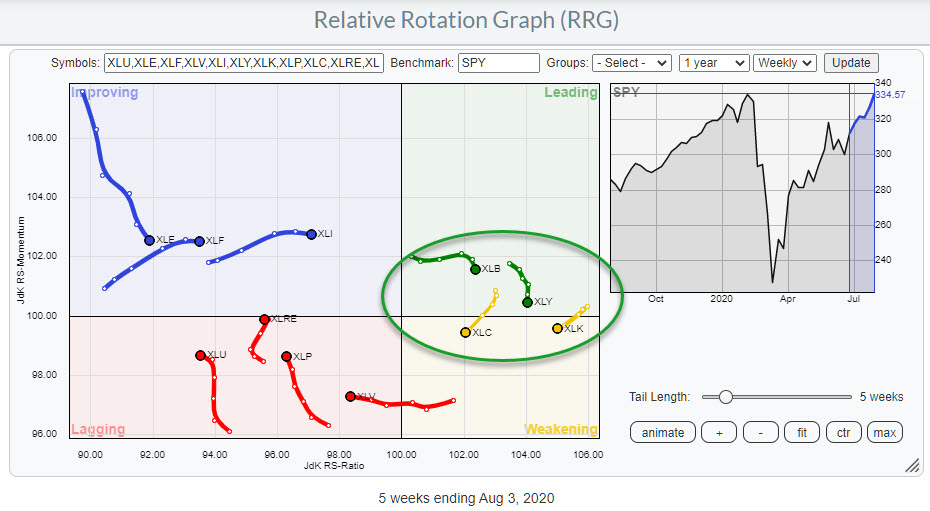

The weekly Relative Rotation Graph for US sectors shows four sectors at the right-hand side of the plot, JdK RS-Ratio > 100 and all seven other sectors at the left-hand side. This indicates that, from a relative strength perspective, the market is driven by only four sectors. But those four...

READ MORE

MEMBERS ONLY

The Aftermath of 2020: What Will It Look Like?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Somehow, we've been able to weather the storm that's called 2020. I'm speaking from a stock market perspective. The health care crisis has taken its toll and continues to take its toll and impact our everyday lives. But if you pulled up an S&...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Likely to Stay in a Range; RRG Chart Shows These Sectors Staying Resilient

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

After clocking robust gains in July, the NIFTY started off the first week of August on a positive note. Over the past five sessions, the markets traded in a 374-point range before closing the week with modest gains. The NIFTY stayed above its critical levels on both the daily and...

READ MORE

MEMBERS ONLY

Techs Retreat as Other Groups Gain

by John Murphy,

Chief Technical Analyst, StockCharts.com

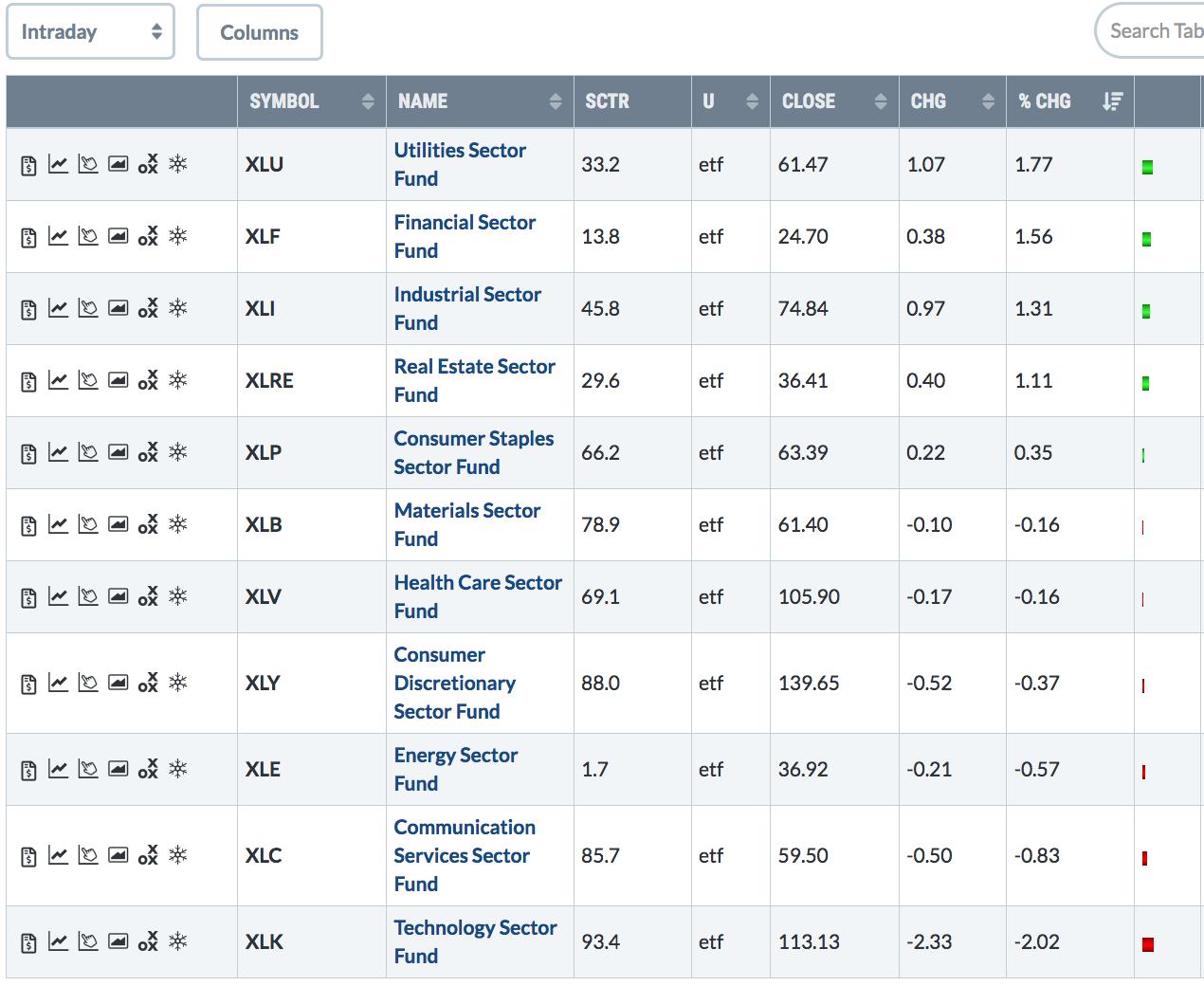

Big tech has been the main story in the market since the start of the pandemic with most of the rest of the market largely left behind. Over the past couple of weeks, however, we've started to see some money moving into weaker parts of the stock market...

READ MORE

MEMBERS ONLY

Two Industrial Sector Stocks that are Prepared to Perform!

by Erin Swenlin,

Vice President, DecisionPoint.com

On Wednesday afternoon, as I was preparing to record the DecisionPoint show, I did a scan of the sectors in preparation and the Industrial Sector SPDR (XLI) caught my eye after a nice gap up. I scanned my Tuesday DecisionPoint Diamonds and, sure enough, I had presented an Industrial stock...

READ MORE

MEMBERS ONLY

Major Market Rotation Taking Shape!

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen explores significant moves taking place in the market and reviews the best ways to play them. She also shares the 3 triggers of a highly bullish stock and where you can uncover them.

This video was originally broadcast...

READ MORE

MEMBERS ONLY

Powerhouse Stocks with Smashing Results

by John Hopkins,

President and Co-founder, EarningsBeats.com

A number of tech giants have crushed earnings expectations, something that becomes quite apparent when you look at their charts. For example, take a look at Apple (AAPL), which recently reported its numbers:

Your eyes are not deceiving you. Since the company reported its earnings on July 30, the stock...

READ MORE

MEMBERS ONLY

A Top-Down Approach To Find Market-Beating Stocks

by Grayson Roze,

Chief Strategist, StockCharts.com

Back at it this week on StockCharts TV! I had the pleasure of once again hosting "Your Daily Five" this afternoon and I gotta say – I am a HUGE fan of this format. In just about 10 minutes, we bring you a concise, action-packed daily rundown of the...

READ MORE

MEMBERS ONLY

Four Stocks Poised to Drive Healthcare Higher

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Healthcare SPDR (XLV) is one of the strongest sectors in 2020. Even though it does not sport the biggest gain, XLV recorded a new high in July and some 80% of its components are above their 200-day EMAs. The new high points to a long-term uptrend and upside leadership,...

READ MORE